Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SEALED AIR CORP/DE | d134397d8k.htm |

| EX-99.1 - EX-99.1 - SEALED AIR CORP/DE | d134397dex991.htm |

| Exhibit 99.2

|

Exhibit 99.2

Fourth Quarter & Year-End 2015

February 10, 2016

Earnings Conference Call Supplement (Unaudited Results)

Jerome A. Peribere – President & CEO Carol P. Lowe – Senior Vice President & CFO

|

|

Safe Harbor and Regulation G Statement

This presentation contains “forward-looking statements” within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 concerning our business, consolidated financial condition and results of operations. Forward-looking statements are subject to risks and uncertainties, many of which are outside our control, which could cause actual results to differ materially from these statements. Therefore, you should not rely on any of these forward-looking statements. Forward-looking statements can be identified by such words as “anticipates,” “believes,” “plan,” “assumes,” “could,” “should,” “estimates,” “expects,” “intends,” “potential,” “seek,” “predict,” “may,” “will” and similar references to future periods. All statements other than statements of historical facts included in this press release regarding our strategies, prospects, financial condition, operations, costs, plans and objectives are forward-looking statements. Examples of forward-looking statements include, among others, statements we make regarding expected future operating results, expectations regarding the results of restructuring and other programs, anticipated levels of capital expenditures and expectations of the effect on our financial condition of claims, litigation, environmental costs, contingent liabilities and governmental and regulatory investigations and proceedings. The following are important factors that we believe could cause actual results to differ materially from those in our forward-looking statements: the tax benefits associated with the Settlement agreement (as defined in our 2015 Annual Report on Form 10-K), global economic and political conditions, changes in our credit ratings, changes in raw material pricing and availability, changes in energy costs, competitive conditions, success of our restructuring activities, currency translation and devaluation effects, the success of our financial growth, profitability, cash generation and manufacturing strategies and our cost reduction and productivity efforts, the effects of animal and food-related health issues, pandemics, consumer preferences, environmental matters, regulatory actions and legal matters, and the other information referenced in the “Risk Factors” section appearing in our most recent Annual Report on Form 10-K, as filed with the Securities and Exchange Commission, and as revised and updated by our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Any forward-looking statement made by us is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

Our management uses non-U.S. GAAP financial measures to evaluate the Company’s performance, which exclude items we consider unusual or special items. We believe the use of such financial measures and information may be useful to investors. We believe that the use of non-U.S. GAAP measures helps investors to gain a better understanding of core operating results and future prospects, consistent with how management measures and forecasts the Company’s performance, especially when comparing such results to previous periods or forecasts. Please see Sealed Air’s February 10, 2016 earnings press release for important information about the use of non-U.S. GAAP financial measures relevant to this presentation, including applicable reconciliations to U.S. GAAP financial measures. Information reconciling forward-looking non-U.S. GAAP measures to U.S. GAAP measures is not available without unreasonable effort.

Website Information

We routinely post important information for investors on our website, www.sealedair.com, in the “Investor Relations” section. We use this website as a means of disclosing material, non-public information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor the Investor Relations section of our website, in addition to following our press releases, SEC filings, public conference calls, presentations and webcasts. The information contained on, or that may be accessed through, our website is not incorporated by reference into, and is not a part of, this document.

2

|

|

FOURTH QUARTER & YEAR-END 2015

Key Takeaways

FOURTH QUARTER 2015

Delivered 2% organic sales growth with favorable price/mix of 1.6%.

Despite $30 million of unfavorable currency, Adjusted EBITDA was $282 million, or

16.1% of net sales, a 180 basis points margin improvement compared to last year.

YEAR-END 2015

Delivered 3% organic sales growth with favorable price/mix of 2.3%.

Adjusted EBITDA of $1.17 billion, or 16.7% of net sales, increased 19% on an organic

basis with margin expansion across all divisions.

Generated $595 million of Free Cash Flow, net of $184 million in capex and $98 million

in cash restructuring payments.

Business Highlights

Repurchased 16.1 million shares for $802 million in 2015.

$884 million remaining on share repurchase program.

Product Care substantially completed rationalization efforts in Latin America; North

America efforts on track to be completed in H1 2016.

Provided 2016 outlook for Net Sales, Adjusted EBITDA, Adjusted EPS and Free Cash

Flow.

Reported U.S. GAAP Measures, Continuing Operations

Q4-15 Net Sales: $1.75B; Operating Profit: $196.6M; Net Income: $123.5M 2015 Net Sales: $7.03B; Operating Profit: $763.4M; Net Income: $335.4M Q4-14 Net Sales: $1.97B; Operating Profit: $143.7M; Net Income: $66.3M 2014 Net Sales: $7.75B; Operating Profit: $653.6M; Net Income: $258.1M

3

|

|

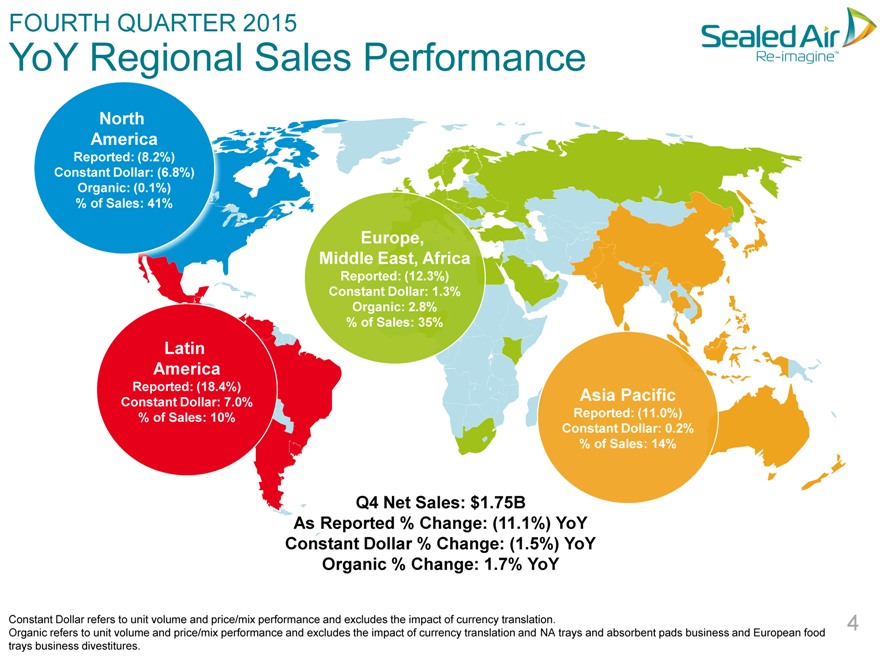

FOURTH QUARTER 2015 YoY Regional Sales Performance North America Reported: (8.2%) Constant Dollar: (6.8%) Organic: (0.1%) % of Sales: 41% Europe, Middle East, Africa Reported: (12.3%) Constant Dollar: 1.3% Organic: 2.8% % of Sales: 35% Latin America Reported: (18.4%) Constant Dollar: 7.0% Asia Pacific % of Sales: 10% Reported: (11.0%) Constant Dollar: 0.2% % of Sales: 14% Q4 Net Sales: $1.75B As Reported % Change: (11.1%) YoY Constant Dollar % Change: (1.5%) YoY Organic % Change: 1.7% YoY Constant Dollar refers to unit volume and price/mix performance and excludes the impact of currency translation. 1 Organic refers to unit volume and price/mix performance and excludes the impact of currency translation and NA trays and absorbent pads business and European food trays business divestitures.

|

|

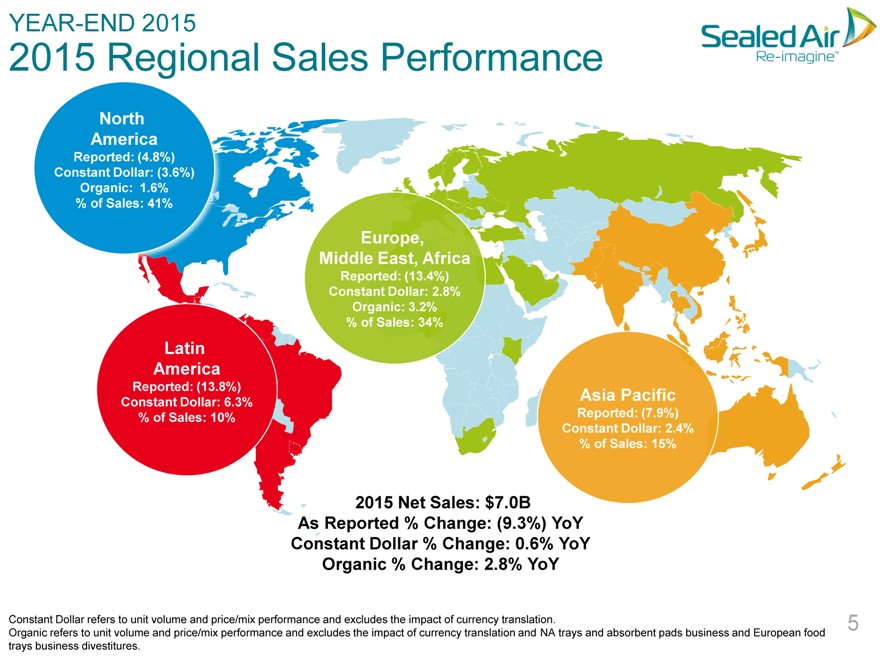

YEAR-END 2015 2015 Regional Sales Performance North America Reported: (4.8%) Constant Dollar: (3.6%) Organic: 1.6% % of Sales: 41% Europe, Middle East, Africa Reported: (13.4%) Constant Dollar: 2.8% Organic: 3.2% % of Sales: 34% Latin America Reported: (13.8%) Constant Dollar: 6.3% Asia Pacific % of Sales: 10% Reported: (7.9%) Constant Dollar: 2.4% % of Sales: 15% 2015 Net Sales: $7.0B As Reported % Change: (9.3%) YoY Constant Dollar % Change: 0.6% YoY Organic % Change: 2.8% YoY Constant Dollar refers to unit volume and price/mix performance and excludes the impact of currency translation. 2 Organic refers to unit volume and price/mix performance and excludes the impact of currency translation and NA trays and absorbent pads business and European food trays business divestitures.

|

|

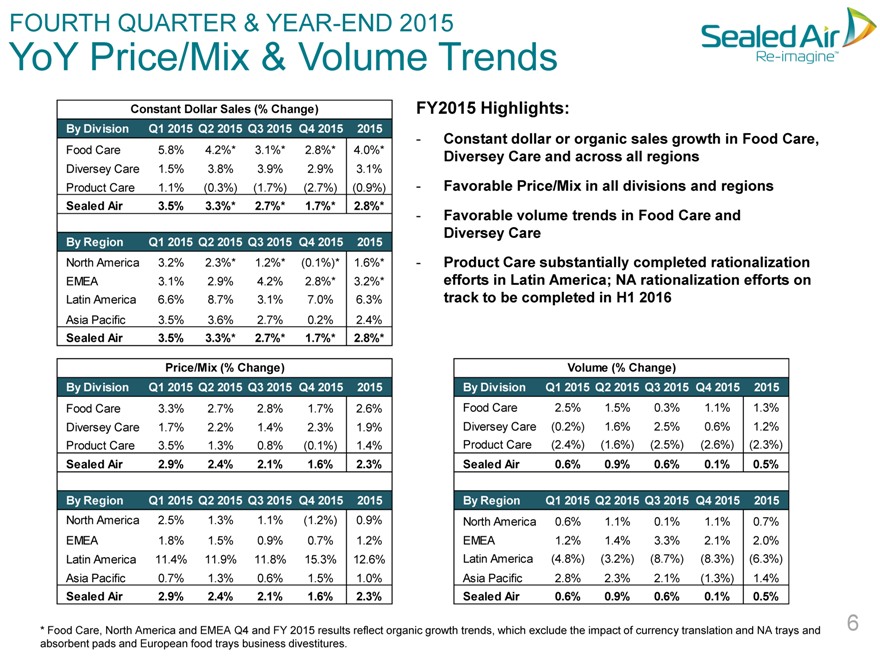

FOURTH QUARTER & YEAR-END 2015

YoY Price/Mix & Volume Trends

Constant Dollar Sales (% Change)

By Division Q1 2015 Q2 2015 Q3 2015 Q4 2015 2015

Food Care 5.8% 4.2%* 3.1%* 2.8%* 4.0%*

Diversey Care 1.5% 3.8% 3.9% 2.9% 3.1%

Product Care 1.1%(0.3%)(1.7%)(2.7%)(0.9%)

Sealed Air 3.5% 3.3%* 2.7%* 1.7%* 2.8%*

By Region Q1 2015 Q2 2015 Q3 2015 Q4 2015 2015

North America 3.2% 2.3%* 1.2%*(0.1%)* 1.6%*

EMEA 3.1% 2.9% 4.2% 2.8%* 3.2%*

Latin America 6.6% 8.7% 3.1% 7.0% 6.3%

Asia Pacific 3.5% 3.6% 2.7% 0.2% 2.4%

Sealed Air 3.5% 3.3%* 2.7%* 1.7%* 2.8%*

Price/Mix (% Change)

By Division Q1 2015 Q2 2015 Q3 2015 Q4 2015 2015

Food Care 3.3% 2.7% 2.8% 1.7% 2.6%

Diversey Care 1.7% 2.2% 1.4% 2.3% 1.9%

Product Care 3.5% 1.3% 0.8%(0.1%) 1.4%

Sealed Air 2.9% 2.4% 2.1% 1.6% 2.3%

By Region Q1 2015 Q2 2015 Q3 2015 Q4 2015 2015

North America 2.5% 1.3% 1.1%(1.2%) 0.9%

EMEA 1.8% 1.5% 0.9% 0.7% 1.2%

Latin America 11.4% 11.9% 11.8% 15.3% 12.6%

Asia Pacific 0.7% 1.3% 0.6% 1.5% 1.0%

Sealed Air 2.9% 2.4% 2.1% 1.6% 2.3%

FY2015 Highlights:

- Constant dollar or organic sales growth in Food Care, Diversey Care and across all regions

- Favorable Price/Mix in all divisions and regions

- Favorable volume trends in Food Care and Diversey Care

- Product Care completed rationalization efforts in Latin America; NA rationalization efforts on track to be completed in H1 2016

Volume (% Change)

By Division Q1 2015 Q2 2015 Q3 2015 Q4 2015 2015

Food Care 2.5% 1.5% 0.3% 1.1% 1.3%

Diversey Care(0.2%) 1.6% 2.5% 0.6% 1.2%

Product Care(2.4%)(1.6%)(2.5%)(2.6%)(2.3%)

Sealed Air 0.6% 0.9% 0.6% 0.1% 0.5%

By Region Q1 2015 Q2 2015 Q3 2015 Q4 2015 2015

North America 0.6% 1.1% 0.1% 1.1% 0.7%

EMEA 1.2% 1.4% 3.3% 2.1% 2.0%

Latin America(4.8%)(3.2%)(8.7%)(8.3%)(6.3%)

Asia Pacific 2.8% 2.3% 2.1%(1.3%) 1.4%

Sealed Air 0.6% 0.9% 0.6% 0.1% 0.5%

* Food Care, North America and EMEA Q4 and FY 2015 results reflect organic growth trends, which exclude the impact of currency translation and NA trays and absorbent pads and European food trays business divestitures.

6

|

|

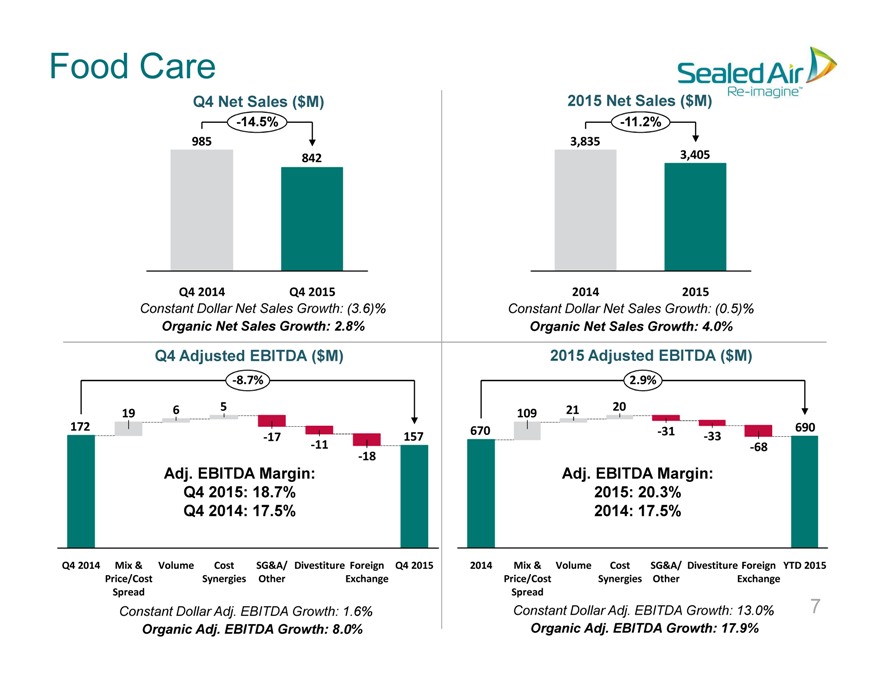

Food Care

Q4 Net Sales ($M)

-14.5%

985

842

Q4 2014

Q4 2015

Constant Dollar Net Sales Growth: (3.6)%

Organic Net Sales Growth: 2.8%

2015 Net Sales ($M)

-11.2%

3,835

3,405

2014

2015

Constant Dollar Net Sales Growth: (0.5)%

Organic Net Sales Growth: 4.0%

Q4 Adjusted EBITDA ($M)

-8.7%

19

| 6 |

|

| 5 |

|

172

-17

157

-11

-18

Adj. EBITDA Margin:

Q4 2015: 18.7%

Q4 2014: 17.5%

Q4 2014

Mix &

Volume

Cost

SG&A/ Divestiture Foreign

Q4 2015

Price/Cost

Synergies Other

Exchange

Spread

Constant Dollar Adj. EBITDA Growth: 1.6%

Organic Adj. EBITDA Growth: 8.0%

2015 Adjusted EBITDA ($M)

2.9%

109

21

20

670

-31

690

-33

-68

Adj. EBITDA Margin:

2015: 20.3%

2014: 17.5%

2014

Mix &

Volume

Cost

SG&A/ Divestiture Foreign YTD 2015

Price/Cost

Synergies Other

Exchange

Spread

Constant Dollar Adj. EBITDA Growth: 13.0%

Organic Adj. EBITDA Growth: 17.9%

| 7 |

|

|

|

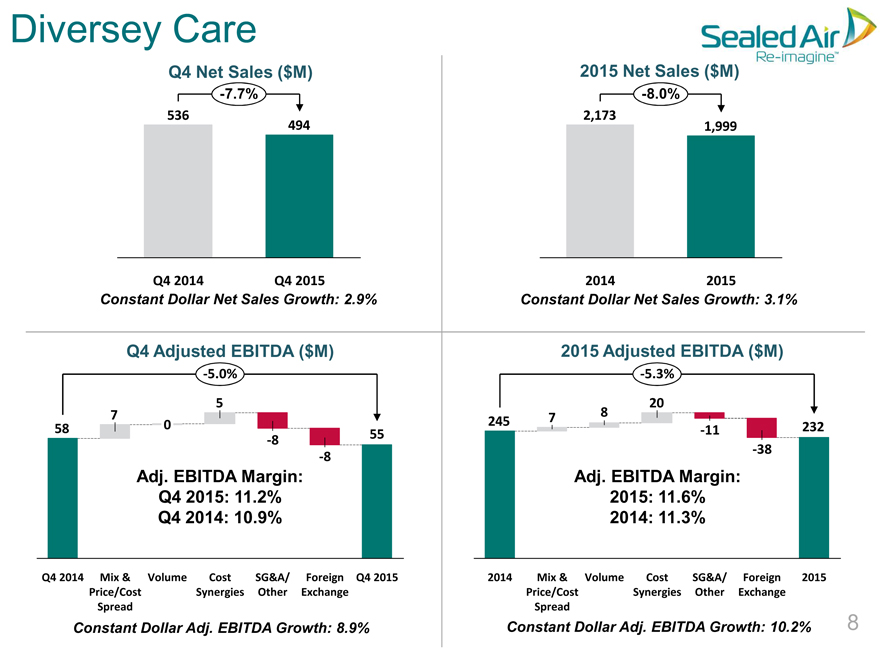

Diversey Care

Q4 Net Sales ($M)

-7.7%

536

494

Q4 2014 Q4 2015

Constant Dollar Net Sales Growth: 2.9%

2015 Net Sales ($M)

-8.0%

2,173

1,999

2014 2015

Constant Dollar Net Sales Growth: 3.1%

Q4 Adjusted EBITDA ($M)

-5.0%

| 5 |

|

| 7 |

|

| 58 |

|

0 |

-8 55

-8

Adj. EBITDA Margin:

Q4 2015: 11.2%

Q4 2014: 10.9%

Q4 2014 Mix & Volume Cost SG&A/ Foreign Q4 2015

Price/Cost Synergies Other Exchange

Spread

Constant Dollar Adj. EBITDA Growth: 8.9%

2015 Adjusted EBITDA ($M)

-5.3%

| 20 |

|

245 7 8

-11 232

-38

Adj. EBITDA Margin:

2015: 11.6%

2014: 11.3%

2014 Mix & Volume Cost SG&A/ Foreign 2015

Price/Cost Synergies Other Exchange

Spread

Constant Dollar Adj. EBITDA Growth: 10.2%

| 8 |

|

|

|

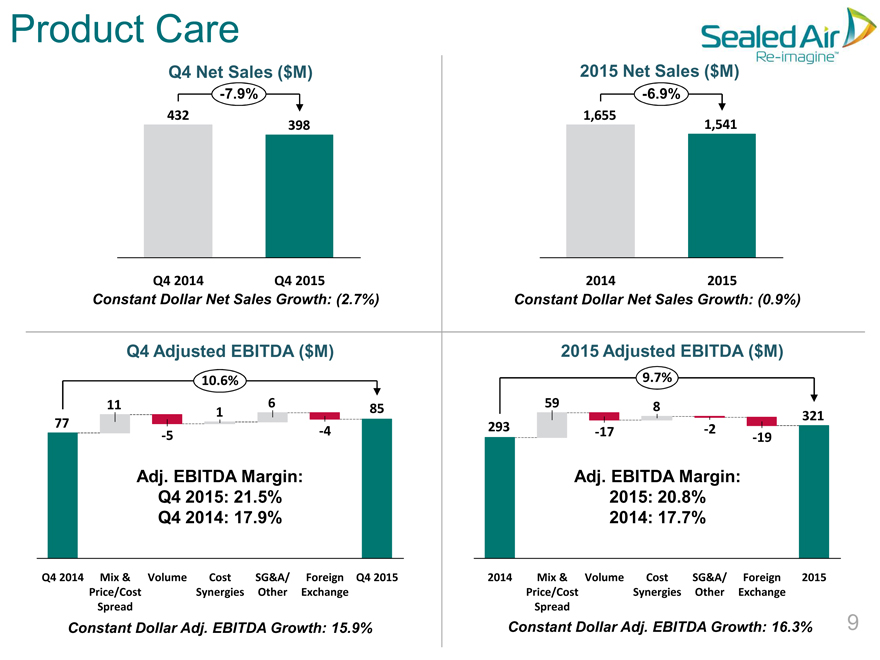

Product Care

Q4 Net Sales ($M)

-7.9%

432

398

Q4 2014 Q4 2015

Constant Dollar Net Sales Growth: (2.7%)

2015 Net Sales ($M)

-6.9%

1,655

1,541

2014 2015

Constant Dollar Net Sales Growth: (0.9%)

Q4 Adjusted EBITDA ($M)

10.6%

11 1 6 85

77

-5 -4

Adj. EBITDA Margin:

Q4 2015: 21.5%

Q4 2014: 17.9%

Q4 2014 Mix & Volume Cost SG&A/ Foreign Q4 2015

Price/Cost Synergies Other Exchange

Spread

Constant Dollar Adj. EBITDA Growth: 15.9%

2015 Adjusted EBITDA ($M)

9.7%

59 8

321

293 -17 -2 -19

Adj. EBITDA Margin:

2015: 20.8%

2014: 17.7%

2014 Mix & Volume Cost SG&A/ Foreign 2015

Price/Cost Synergies Other Exchange

Spread

Constant Dollar Adj. EBITDA Growth: 16.3%

9

|

|

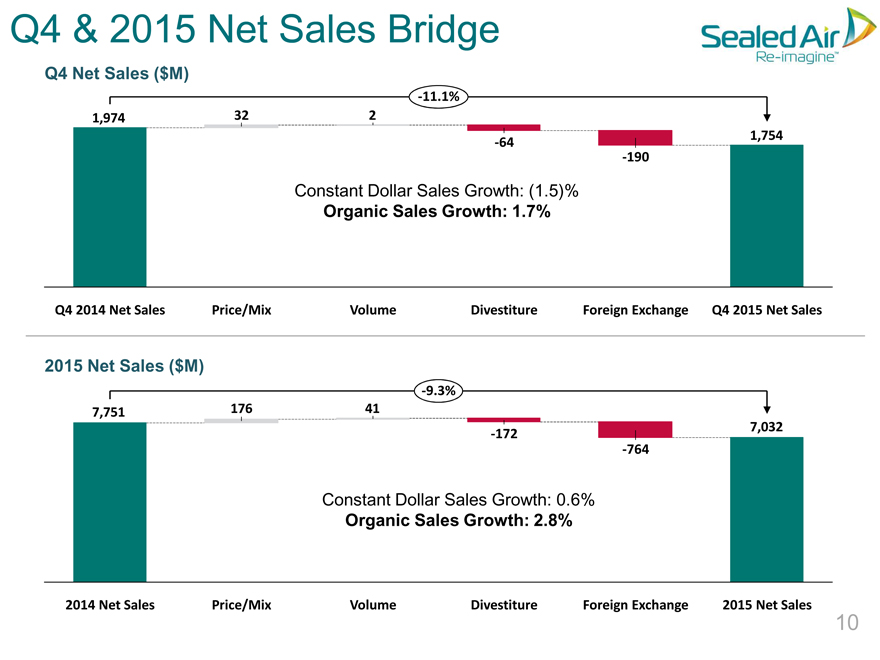

Q4 & 2015 Net Sales Bridge

Q4 Net Sales ($M)

-11.1%

1,974 32 2

-64 1,754

-190

Constant Dollar Sales Growth: (1.5)%

Organic Sales Growth: 1.7%

Q4 2014 Net Sales Price/Mix Volume Divestiture Foreign Exchange Q4 2015 Net Sales

2015 Net Sales ($M)

-9.3%

7,751 176 41

-172 7,032

-764

Constant Dollar Sales Growth: 0.6%

Organic Sales Growth: 2.8%

2014 Net Sales Price/Mix Volume Divestiture Foreign Exchange 2015 Net Sales

10

|

|

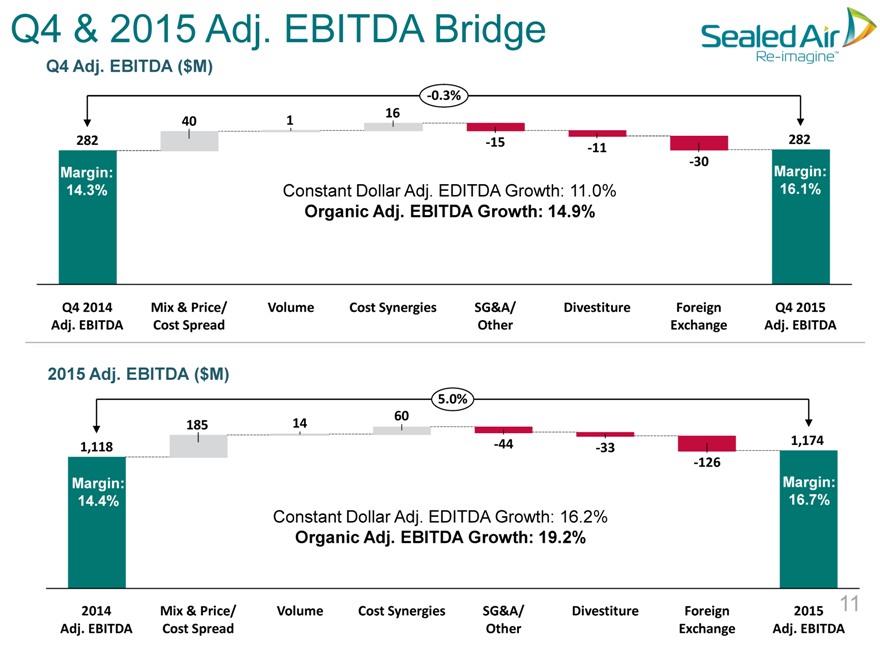

Q4 & 2015 Adj. EBITDA Bridge

Q4 Adj. EBITDA ($M)

-0.3%

40 1 16

282 -15 282

-11

-30

Margin: Margin:

14.3% Constant Dollar Adj. EDITDA Growth: 11.0% 16.1%

Organic Adj. EBITDA Growth: 14.9%

Q4 2014 Mix & Price/ Volume Cost Synergies SG&A/ Divestiture Foreign Q4 2015

Adj. EBITDA Cost Spread Other Exchange Adj. EBITDA

2015 Adj. EBITDA ($M)

5.0%

185 14 60

1,118 -44 -33 1,174

-126

Margin: Margin:

14.4% 16.7%

Constant Dollar Adj. EDITDA Growth: 16.2%

Organic Adj. EBITDA Growth: 19.2%

2014 Mix & Price/ Volume Cost Synergies SG&A/ Divestiture Foreign 2015

Adj. EBITDA Cost Spread Other Exchange Adj. EBITDA

11

|

|

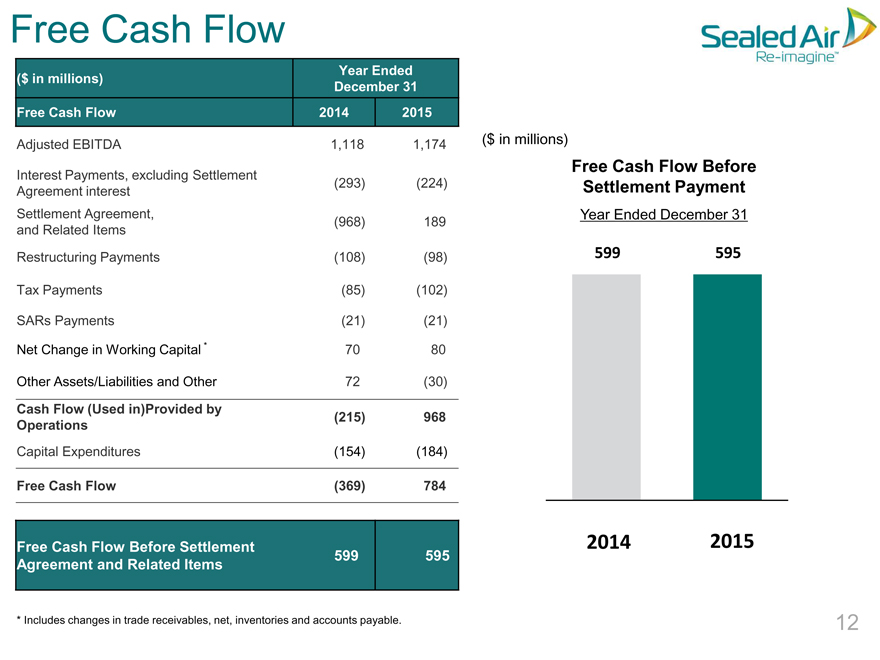

Free Cash Flow

Year Ended

($ in millions)

December 31

Free Cash Flow 2014 2015

Adjusted EBITDA 1,118 1,174

Interest Payments, excluding Settlement

(293)(224)

Agreement interest

Settlement Agreement,

(968) 189

and Related Items

Restructuring Payments(108)(98)

Tax Payments(85)(102)

SARs Payments(21)(21)

Net Change in Working Capital * 70 80

Other Assets/Liabilities and Other 72(30)

Cash Flow (Used in)Provided by

(215) 968

Operations

Capital Expenditures(154)(184)

Free Cash Flow(369) 784

Free Cash Flow Before Settlement

599 595

Agreement and Related Items

* Includes changes in trade receivables, net, inventories and accounts payable.

($ in millions)

Free Cash Flow Before

Settlement Payment

Year Ended December 31

599 595

2014 2015

12

|

|

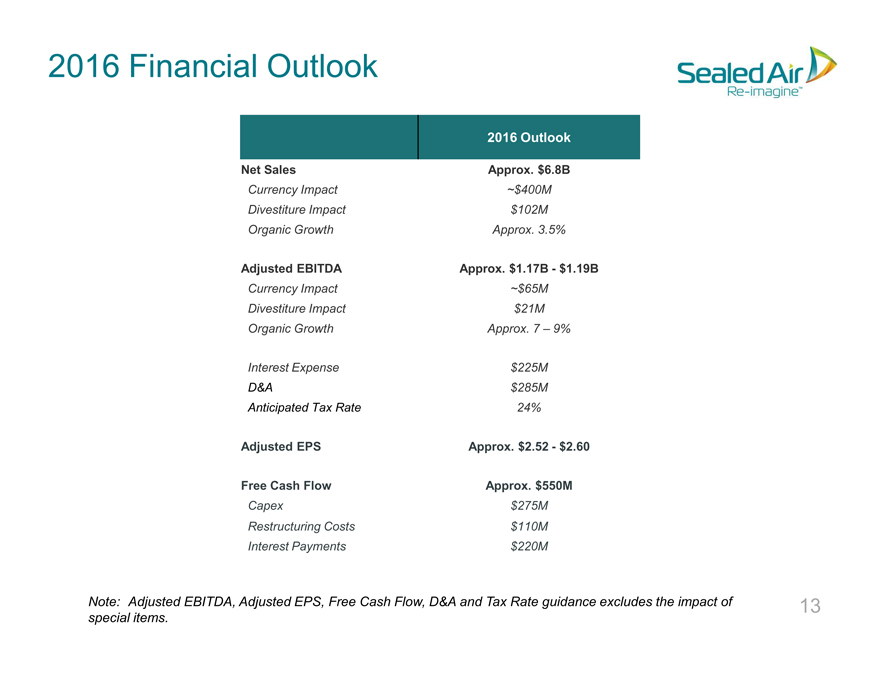

2016 Financial Outlook

2016 Outlook

Net Sales Approx. $6.8B

Currency Impact ~$400M

Divestiture Impact $102M

Organic Growth Approx. 3.5%

Adjusted EBITDA Approx. $1.17B - $1.19B

Currency Impact ~$65M

Divestiture Impact $21M

Organic Growth Approx. 7 – 9%

Interest Expense $225M

D&A $285M

Anticipated Tax Rate 24%

Adjusted EPS Approx. $2.52 - $2.60

Free Cash Flow Approx. $550M

Capex $275M

Restructuring Costs $110M

Interest Payments $220M

Note: Adjusted EBITDA, Adjusted EPS, Free Cash Flow, D&A and Tax Rate guidance excludes the impact of 13 special items.

|

|

Q&A

Earnings Conference Call Fourth Quarter & Year-End 2015