Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATE PURSUANT - Rosewood Resources, Inc. | rosewood_ex321.htm |

| EX-31.1 - CERTIFICATION - Rosewood Resources, Inc. | rosewood_ex311.htm |

| EX-32.2 - CERTIFICATE PURSUANT - Rosewood Resources, Inc. | rosewood_ex322.htm |

| EX-31.2 - CERTIFICATION - Rosewood Resources, Inc. | rosewood_ex312.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended October 31, 2015 ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from ____________ to ____________

x

COMMISSION FILE NUMBER 333-199690

ROSEWOOD RESOURCES, INC. |

(Exact name of registrant as specified in its charter) |

NEVADA |

| 61-1733971 |

State or other jurisdiction of |

| (I.R.S. Employer |

|

|

|

8 Dorset Place, 65 Dorset Road, Parkwood, Johannesburg South Africa |

| 2193 |

(Address of principal executive offices) |

| (Zip Code) |

Registrant's telephone number, including area code (416) 819-3795

Securities registered pursuant to Section 12(b) of the Act: NONE.

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.001 Par Value Per Share.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. ¨Yes xNo

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨Yes xNo

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files. x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ¨ |

Non-accelerated filer | ¨ | Smaller reporting company | x |

(Do not check if a smaller reporting company) |

|

| |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). x Yes ¨ No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter: $50,000 based on the registered resale of securities on Form S-1/A effective April 20, 2015 at a price of $0.002 per share.

Indicate the number of shares outstanding of each of the registrant's classes of common stock, as of the latest practicable date. As of December 31, 2015, the Registrant had 90,000,000 shares of common stock outstanding.

ROSEWOOD RESOURCES, INC.

ANNUAL REPORT ON FORM 10-K FOR THE YEAR ENDED OCTOBER 31, 2015

TABLE OF CONTENTS

|

|

|

| PAGE |

|

|

|

|

|

|

|

PART 1 |

|

|

| ||

|

|

|

|

| |

ITEM 1 | BUSINESS |

|

| 3 |

|

|

|

|

|

| |

ITEM 1A | RISK FACTORS |

|

| 7 |

|

|

|

|

|

| |

ITEM 2 | PROPERTIES |

|

| 8 |

|

|

|

|

|

| |

ITEM 3 | LEGAL PROCEEDINGS |

|

| 17 |

|

|

|

|

|

| |

ITEM 4 | MINE SAFETY DISCLOSURE |

|

| 17 |

|

|

|

|

|

| |

PART II |

|

|

| ||

|

|

|

|

| |

ITEM 5 | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

|

| 18 |

|

|

|

|

|

| |

ITEM 6 | RECENT SALES OF UNREGISTERED SECURITIES |

|

| 21 |

|

|

|

|

|

| |

ITEM 7 | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA. |

|

| 21 |

|

|

|

|

|

| |

ITEM 8 | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

|

| 33 |

|

|

|

|

|

| |

ITEM 9 | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

|

| 37 |

|

|

|

|

|

| |

ITEM 9A | CONTROLS AND PROCEDURES. |

|

| 37 |

|

|

|

|

|

| |

ITEM 9B | OTHER INFORMATION. |

|

| 39 |

|

|

|

|

|

| |

PART III |

|

|

| ||

|

|

|

|

| |

ITEM 10 | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

|

| 40 |

|

|

|

|

|

| |

ITEM 11 | EXECUTIVE COMPENSATION |

|

| 44 |

|

|

|

|

|

| |

ITEM 12 | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS. |

|

| 45 |

|

|

|

|

|

| |

ITEM 13 | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, DIRECTOR INDEPENDENCE |

|

| 51 |

|

|

|

|

|

| |

ITEM 14 | PRINCIPAL ACCOUNTING FEES AND SERVICES |

|

| 51 |

|

|

|

|

|

| |

ITEM 15 | EXHIBITS, FINANCIAL STATEMENT SCHEDULES |

|

| 52 |

|

|

|

|

|

| |

SIGNATURES. |

|

| 53 |

| |

| 2 |

PART I

This Form 10-K, particularly in the sections titled "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Business," contains forward-looking statements that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this Form 10-K, including statements regarding our future financial condition, business strategy and plans and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "believe," "may," "might," "objective," "estimate," "continue," "anticipate," "intend," "should," "plan," "expect," "predict," "potential," or the negative of these terms or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements are subject to a number of risks, uncertainties.

These risks are not exhaustive. Other sections of this Form 10-K may include additional factors that could adversely impact our business and financial performance. These statements reflect our current views with respect to future events and are based on assumptions and subject to risk and uncertainties. Moreover, we operate in a very competitive and rapidly-changing environment. New risk factors emerge from time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither we nor any other person assume responsibility for the accuracy and completeness of the forward-looking statements. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this Form 10-K to conform these statements to actual results or to changes in our expectations.

As used in this Annual Report, the terms "we," "us," "our," "Rosewood," and the "Company" means Rosewood Resources, Inc., unless otherwise indicated. All dollar amounts in this Annual Report are expressed in U.S. dollars, unless otherwise indicated.

ITEM 1. BUSINESS.

Overview of Our Business

We were incorporated on June 17, 2013 pursuant to the laws of the State of Nevada.

We are an Emerging Growth Company as defined in the Jumpstart Our Business Startups Act.

We shall continue to be deemed an emerging growth company until the earliest of-

(A) the last day of the fiscal year of the issuer during which it had total annual gross revenues of $1,000,000,000 (as such amount is indexed for inflation every 5 years by the Commission to reflect the change in the Consumer Price Index for All Urban Consumers published by the Bureau of Labor Statistics, setting the threshold to the nearest 1,000,000) or more;

(B) the last day of the fiscal year of the issuer following the fifth anniversary of the date of the first sale of common equity securities of the issuer pursuant to an effective registration statement under this title;

(C) the date on which such issuer has, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or

(D) the date on which such issuer is deemed to be a 'large accelerated filer', as defined in section 240.12b-2 of title 17, Code of Federal Regulations, or any successor thereto.

3

As an emerging growth company we are exempt from Section 404(b) of Sarbanes Oxley. Section 404(a) requires Issuers to publish information in their annual reports concerning the scope and adequacy of the internal control structure and procedures for financial reporting. This statement shall also assess the effectiveness of such internal controls and procedures.

Section 404(b) requires that the registered accounting firm shall, in the same report, attest to and report on the assessment on the effectiveness of the internal control structure and procedures for financial reporting.

As an emerging growth company we are exempt from Section 14A(a) and (b) of the Securities Exchange Act of 1934 which require the shareholder approval of executive compensation and golden parachutes.

We have irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the Act.

We are an exploration stage company engaged in the acquisition and exploration of mineral properties. We have a 51% option interest in a mineral property that we call the "Knott Lake" consisting of a single patented mining claim (MR6061) in Cairo Township located about 1.3 km northeast of the community of Matachewan in northeast Ontario. Our plan is to implement our exploration program as set forth under the Option Agreement dated September 11, 2013 whereby we incurred exploration expenses in the first year of $20,000, additional exploration expenses on the second anniversary of $35,000 and on the third anniversary an additional $50,000 as well as a cash payment of $25,000 to earn our 51% interest in the property. A description of the Knott Lake is provided under the heading "Properties" below.

We have not earned any revenues to date. We do not anticipate earning revenues until such time as we enter into commercial production of the Knott Lake. We are presently in the exploration stage of our business and we can provide no assurance that commercially viable mineral deposits exist on the Knott Lake, or that, if such deposits are discovered, we will be able to enter into further substantial exploration or development programs. Further exploration is required to determine the economic and legal feasibility of the Knott Lake.

Government Regulations

We will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in the Province of Ontario, Canada. The main agency that governs the exploration of minerals in Ontario is the Ministry of Northern Development and Mines ("NDM"). The NDM manages the development of Ontario's mineral resources, and implements policies and programs respecting their development while protecting the environment. In addition, the NDM regulates and inspects the exploration and mineral production industries in Ontario to protect workers, the public and the environment.

The material legislation applicable to us is the Mining Act (Ontario), which governs the procedures involved in the location, recording and maintenance of mineral titles in Ontario. The Mining Act also governs the issuance of leases which are long term entitlements to minerals.

All mineral exploration activities carried out on a mineral claim or mining lease in Ontario must be in compliance with the Mining Act. The Mining Act applies to all mines during exploration, development, construction, production, closure, reclamation and abandonment. It outlines the powers of the NDM, to inspect mines, the procedures for obtaining permits to commence work in, on or about a mine and other procedures to be observed at a mine. Additionally, various provincial statutes contain standards for employment, occupational health and safety, accident investigation, work place conditions, protective equipment, training programs, and site supervision.

| 4 |

We will not be required to obtain a permit for geochemical and/or geophysical exploration work carried out on our property. In the event that we wish to conduct drilling on the property, we will be required to file a permit application with the NDM. As of the date of this prospectus, we have not applied for such a permit.

The Mining Act also provides that a company planning to mine a property must submit a detailed "Closure Plan" must be submitted to the NDM for development activities. A closure plan outlines how the affected land will be rehabilitated and the costs associated with doing so. A closure plan must be developed and acknowledged by the NDM before mine development can begin.

Additional approvals and authorizations may be required from other government agencies, depending upon the nature and scope of the proposed exploration program. If the exploration activities require the falling of timber, then either a free use permit or a license to cut must be issued by the Ministry of Natural Resources and Forestry. Items such as waste approvals may be required from the Ministry of Environment and Climate Change if the proposed exploration activities are significantly large enough to warrant them. Waste approvals refer to the disposal of rock materials removed from the earth which must be reclaimed. An environmental impact statement may be required.

In order to maintain our mineral claims in good standing, we must complete exploration work on the mineral claims and file confirmation of the completion of work on the mineral claims with the applicable mining recording office of the NDM. In Ontario, the recorded holder of a mineral claim is required to perform a minimum amount of exploration work on a claim. We will be required to complete assessment work equal to CAD $400 per unit by the second anniversary and CAD $400 per unit for each year thereafter. There is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration program. The completion of mineral exploration work in any year will extend the existence of our mineral claims for one additional year. If we fail to complete the minimum required amount of exploration work, then our mineral claims will lapse, and we will lose all interest that we have in our mineral claims.

Environmental Regulations

We will have to sustain the cost of reclamation and environmental remediation for all exploration work undertaken. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to its natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy, any environmental damage caused. The amount of these costs is not known at this time as we do not know the extent of the exploration program that will be undertaken beyond completion of the recommended work program. Because there is presently no information on the size, tenor, or quality of any resource or reserve at this time, it is impossible to assess the impact of any capital expenditures on earnings, our competitive position or us in the event that a potentially economic deposit is discovered.

The recommended program of exploration over the three year period should have no environmental impact and therefore no cost to the Company due to basically the ground, trees, shrubs and streams will not be disturbed in any way since the main focus is on obtaining mineral samples and undertaking line definition by flagging the trees to create strength lines on the property in order to perform Induced Polarization surveys on these grid lines.

Prior to undertaking mineral exploration activities, we must make application for a permit, if we anticipate disturbing land. A permit is issued after review of a complete and satisfactory application. We do not anticipate any difficulties in obtaining a permit, if needed. If we enter the production phase, the cost of complying with permit and regulatory environment laws will be greater because the impact on the project area is greater. Permits and regulations will control all aspects of the production program if the project continues to that stage. Examples of regulatory requirements include:

| (i) | Water discharge will have to meet drinking water standards; | |

|

|

|

| (ii) | Dust generation will have to be minimal or otherwise re-mediated; | |

|

|

|

| (iii) | Dumping of material on the surface will have to be re-contoured and re-vegetated with natural vegetation; | |

|

|

|

| (iv) | An assessment of all material to be left on the surface will need to be environmentally benign; | |

|

|

|

| (v) | Ground water will have to be monitored for any potential contaminants; | |

|

|

|

| (vi) | The socio-economic impact of the project will have to be evaluated and if deemed negative, will have to be re-mediated; and | |

|

|

|

| (vii) | There will have to be an impact report of the work on the local fauna and flora including a study of potentially endangered species. |

| 5 |

Competition

We are an exploration stage company and will have to compete with other mineral resource exploration companies for funds to finance our exploration activities and if require to acquire other mineral properties. Unfortunately many of the exploration companies in Canada have more money, more qualified personnel and greater knowledge of the mining industry in Ontario than we do. They are able to spend considerable more money and attract more qualified staff than we can. This being the case they can acquire mineral properties with more potential and thereby attract more potential investors. There are only a limited number of investors who are willing to invest in a start-up exploration stage company. This being the case it will have an effect on our ability to raise funds for the exploration of the Knott Lake. In addition, we might be restricted from obtaining equipment for our exploration work due to the other companies having the financial capabilities of acquiring better and more sophisticated equipment which we might not be able to afford.

Employees

As of the date of this Form 10-K, we have no employees other than our two executive officers and directors. We have engaged the services of Douglas Turnbull, Professional Geologist, to assist the Board of Directors in analyzing the results on the Knott Lake property. In this regard the Company has entered into a Consulting Contract whereby starting September 15, 2014 Mr. Turnbull will be paid $1,000 for a maximum of twenty four months. The Directors can terminate this contract at any time.

Research and Development Expenditures

We have not incurred any research expenditures since our incorporation.

Patents and Trademarks

We do not own, either legally or beneficially, any patent or trademark.

MILESTONES

IMPLEMENTED

As at December 31, 2015, the Company has implemented certain milestones in its development as are noted below.

| 1. | The incorporation of the Company in the State of Nevada and the appointment of officers and directors to undertake the development of the Company. The cost of incorporation was $789 with additional charges after the first year of $764 for the annual filing of the Officers, Directors, etc. with the Secretary of State of Nevada. | |

| 2. | The directors identified a mineral claim located near the community of Matachewqan in northeast Ontario, Canada called the Knott Lake Property and entered into a Option Agreement with Gordon Davidson whereby by completing work on the claim over a three year period and an additional one-time payment at the end three years of $25,000 the Company would have 100% of the rights to the minerals on the claim. To date, the Company has undertaken Year 1 and Year 2 exploration program on the Knott Lake Property in the total amount of $55,000. |

| 6 |

|

| The exploration work undertaken in Year 1 comprised geological mapping to identify outcrops and old trenches previously dug in the middle of the last century. In addition, geological sampling comprising mainly sample of basal till from the old trenches and surrounding areas were taken and sent to a recognized assay laboratory for screening for gold. This was at a cost of $20,000. |

|

|

|

|

| In Year 2 an exploration program was undertaken by Canadian Exploration Services Ltd. wherein they undertook an Induced Polarization surrey over a large section of Knott Lake Property. On the basis of the results of this exploration program management will be undertaking the exploration work required in Year 3 during the summer of 2015. The cost of Year 2 exploration program was $35,000. |

|

|

|

| 3. | Additional exploration expenses incurred to date amounted to $2,625 representing independent analysis of the geological results for Year 1 and fees paid to an independent geologist as per the Company's contractual obligation. | |

| 4. | The preparation and filing of a registration statement with the SEC at a cost of approximately $20,000. |

TO BE IMPLETMENTED

The following represents certain milestone the Company intends to implement in the future.

| 1. | In the summer of 2016 the Company will undertake Year 3 exploration program on the Knott Gold Property which will entail further work on anomaly D, which under Year 2 exploration program showed strong chargeability anomaly with a correlating low resistivity anomaly. These chargeability anomalies might be related to gold mineralization but extensive work will have to be performed to verity where there is gold mineralization present. The cost of Year 3 exploration program is estimated at $50,000. | |

| 2. | Now that the Company's registration statement is effective, the Company will make an application to the OTC Bulletin Board ("OTCBB") to be quoted thereon. There is the chance that the Company's shares might never be quoted and our investors will lose eventually their entire investment. There is no cost associated with a marker maker filing an application with FINRA to obtain a quotation on the OTCBB. Nevertheless, there is a cost in applying for a DTC registration, which the Company wants to obtain, and this is estimated at between $12,000 to $15,000. | |

| 3. | Now that the Company's registration statement is effective it is required to file Form 10-Ks on an annual basis and Form 10-Qs on a quarterly basis. The cost for preparing these forms, either being examined or reviewed by the Company' s independent accountants, will be approximately $10,000 on an annual basis. |

ITEM 1A. RISK FACTORS.

We are a smaller reporting company as defined by Rule 12b-2 of the Securities Act of 1934 and are not required to provide the information under this item.

| 7 |

ITEM 2. PROPERTIES.

On September 11, 2013, the Company entered into an Option Agreement ("Option") with Gordon Davidson ("Optionor") whereby the Company was granted an exclusive option to acquire a fifty-one percent (51%) undivided interest in and to the Knott Lake Property ("Property") consisting of a single patented mining claim (MR6061) in Cario Township located about 1.3 km northeast of the community of Matachewan in northeast Ontario, Canada.

In order to exercise the Option, the Company will be required to:

| (a) | incur Exploration Expenditures of $20,000 on or before the first anniversary date of the Option (Paid); | |

| (b) | incur additional Exploration Expenditures of $35,000 on or before the second anniversary date of the Option; and | |

| (c) | incur additional Exploration Expenditures of $50,000, and grant a cash payment of $25,000 on or before the third anniversary date to this Option. |

If and when the Option has been exercised an undivided fifty-one percent (51%) right, title and interest in and to the Property shall vest in the Company free and clear of all charges, encumbrances and claims.

Upon the Company being deemed to have earned a fifty-one percent (51%) interest in the Property, the Company and the Optionor shall participate in a joint venture (the "Joint Venture") for the purpose of further exploration and development work on the Property and if warranted, the operation of one or more mines on the Property.

The participating interests of the parties at the time of the Joint Venture is formed shall be:

The Company |

|

| 51 | % |

|

|

|

|

|

The Optionor |

|

| 49 | % |

Each party shall be responsible for payment of its proportional share (based on its participating interest) of the operating and capital costs of the Joint Venture's operations, including reclamation and remediation obligations and any security required thereof. The Optionor shall retain a 2% Net Smelter Royalty in future production from the Property regardless of its participating interest in the Joint Venture.

Upon formation of the Joint Venture, a Management Committee, formed by members from each party and holding voting rights in accordance with each party's participating interest, shall be established which shall make all decisions, on a simple majority vote, which are required to be made by the Joint Venture parties with respect to the Joint Venture's operation. The Management Committee shall have the authority to establish its own rules on how meetings of the Management Committee shall be called and conducted.

The Manager shall be subject to the direction and control of the Management Committee. The Company shall have the right to be the Manager of the Joint Venture and to manage and operate the exploration, feasibility study, mine development and mining phases of the project during the term of the Joint Venture.

The Manager shall propose the work programs and budgets following the formation of the Joint Venture in accordance with the instructions of the Management Committee. Each party shall have sixty (60) days from the date of receipt of a program to notify the Manager as to whether it will participate at its interest level or whether it will not participate. The participating interest of a party which elects not to participate shall be proportionately diluted in accordance with the dilution formula set out below. A party which fails to so notify the Manager within the time required shall be deemed to have elected to participate in a work program and be diluted as aforesaid may only be exercised prior to a production decisions. A party which elects not to participate in a program shall not be subject to dilution to the extent that the expenditures under such program exceed one hundred fifteen percent (115%) of the budget for such program.

| 8 |

The dilution formula shall be as follows:

percentage participating interest of party Y = (A+B) x 100

C

Where:

A = deemed expenditures of party Y

B = actual expenditures of party Y

C = total expenditures (deemed and actual) of all parties

Deemed expenditures are assigned a value based on work done by the Company in order to earn its participating interest. Thus, the deemed expenditures for the parties shall be as follows:

If the participating interest of parties are: |

| Their deemed expenditures upon formation of the Joint Venture shall be: |

| |

|

|

| ||

The Company - 51% |

| $ | 105,000 |

|

The Optionor - 49% |

| $ | 100,882 |

|

For the purpose of calculating B and C above, actual expenditures are those expenditures made by a party after formation of the Joint Venture, provided that such actual expenditures shall exclude costs made or incurred and included in Exploration Expenditures prior to the day that the Management Committee gives notice to the parties of the formation of the Joint Venture but paid subsequent to formation of the Joint Venture.

Any Exploration Expenditures made or incurred by the Company in excess of the Exploration Expenditures required to earn its interest in the Property shall be credited to the Company's contribution to the first work program after formation of the Joint Venture and shall not automatically dilute the participating interest of the Optionor on formation.

The Option shall terminate:

| (a) | upon the Company failing to incur or make any expenditures which must be incurred in exercise of the Option; or | |

| (b) | at any other time, by the Company giving notice of such termination to Optionor. |

Knott Lake Property

The Knott Lake property consists of a single patented mining claim (MR6061) approximately 7.61 hectors in Cairo Township located about 1.3 km northeast of the community of Matachewan in northeast Ontario. This property is of interest due to its proximity to the recently re-activated Young Davidson gold mine owned by Aurico Gold. Prior to the work described below, no exploration activity has been carried out on the Knott Lake property since the 1930's. The exploration work completed in October 2013 consisted of soil sampling and basal till sampling in addition to geological mapping. The results indicated that soils and basal tills within this property are anomalously enriched in gold when compared to surrounding properties. These geochemical anomalies are spatially associated with the contact between Temiskaming Group sediments and Larder Lake Group volcanics which is considered to be a favorable setting for gold mineralization. In addition, a review of assessment data from surrounding properties indicates that IP chargeability anomalies traverse the property, and they appear to reflect splays off the Cadillac-Larder Lake Break.

| 9 |

The exploration work was carried out in 2013 on the Knott Lake property. This work was carried out under the terms of an option agreement between Gordon Davidson, the holder of the Knott Lake, and Rosewood Resources Inc, who is earning an interest in this property by funding exploration costs. The field program was carried out between October 1 and 4, 2013 by Cove Exploration Services Ltd on behalf of Rosewood Resources Inc.

Property Description and Location

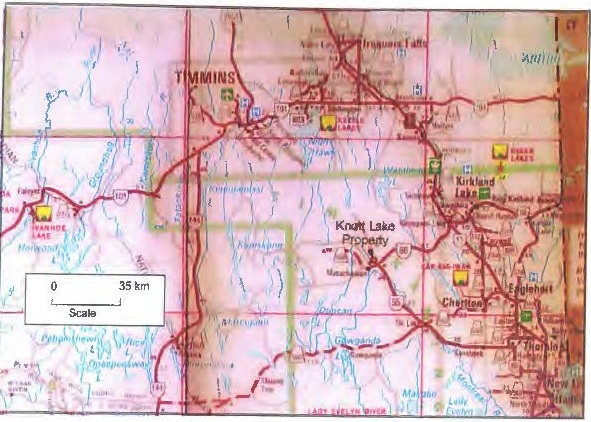

The Knott Lake property consists of a single patented mining claim (MR6061) in Cairo Township located about 1.3 km northeast of the community of Matachewan, and 50 km southwest of Kirkland Lake in northeast Ontario - refer to map below. Access to the property is via a good quality bush road leading from highway 66, and the property boundary is only 600 meters from the highway. The area within this claim is high and dry with no swamps, and forest cover consists of a mixture of poplar, birch and jack pine. Since this property is a patented claim, there are no assessment requirements. There are only modest annual tax payments payable to the Township of Matachewan for property taxes, and to the Ontario Ministry of Northern Development and Mines for sub-surface rights.

| 10 |

MAP OF ONTARIO WHERE KNOTT LAKE PROPERTY IS LOCATED

Historical Work

No historical exploration has been carried out on the Knott Lake property since the 1930's when this claim was optioned to Matachewan Hub Pioneer Mines Ltd. At that time, a trench was excavated, and a shaft and crosscut was constructed adjacent to the trench within the Knott Lake property claim. According to the engineer's report at the time, a trench on or near to MR6061 intersected carbonated schist carrying numerous stringers of honey-combed quartz. Panning of this rusty material near bedrock invariably gave several colors in the pan. No assays from this trench are reported. A two-compartment shaft 7' X 11' was sunk to a depth of 50 feet and timbered. A crosscut was then driven 45 feet to the south.

There has been substantial exploration work carried out over the past few decades on claims surrounding the Knott Lake property, and much of this data is publically available as assessment reports.

| 11 |

Geological Setting and Mineralization

Regional Geology

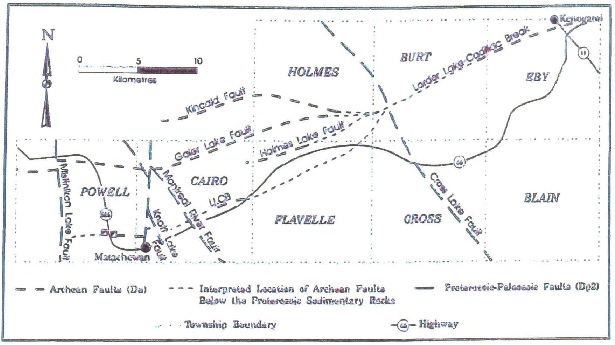

The Knott Lake property is situated in the southwestern Abitibi Greenstone belt of the Superior Province. The volcanic strata of the Matachewan area have been assigned to the Larder Lake and Kinojevis Groups. The Larder Lake Group of volcanic rocks consists of mainly pillowed and massive basalt flows with less common komatiitic flows. Komatiite is a type of ultramafic mantle-derived volcanic rock. It has low silicon, potassium and aluminium, and high to extremely high magnesium content. True komatiites are very rare and essentially restricted to rocks of Archean age (3.8 to 2.8 billion years ago). The Kinojevis Group of volcanic rocks are pillowed and massive basalts, mafic to intermediate tuffs, and cherty tuffaceous units. The volcanic rocks are overlain, in places conformably, by a narrow belt of conglomerate, arkose, greywacke and quartzite that are characteristic of the Timiskaming GroupA summary geological map of the Matachewan area is shown below.

The Matachewan area borders the northwest margin of the Round Lake Batholith, and is on the south limb of a major synclinorium, the axis of which trends westerly approximately 11 kilometres north of the area. The dominant feature is the Cairo stock, a large (13x8 km) syenite intrusion centred mainly in the eastern half of the area. The Cairo stock and related dikes and plugs of trachytic syenite and syenite porphyry intruded an isoclinally folded and greenschist facies metamorphosed sequence of Archean volcanic and sedimentary rocks. Syenitic intrusives seem to preferentially intrude Timiskaming sediments or the contact between the sediments and the volcanics.

It is the contact zones of the more southerly sedimentary sequence with the underlying volcanics, in association with syenite intrusions, which has formed the focal point for the known gold mines in the area. This contact zone is typically sheared and strongly altered.

| 12 |

Diabase dikes of the Matachewan swarm intrude all the above Archean volcanics and sediments, and are post-ore.

In the southwestern and southeastern parts of the Matachewan area, early Proterozoic glaciogenic sedimentary rocks of the Gowganda Formation, unconformably overlie the Archean rocks and the diabase dikes. Regionally, the Proterozoic sedimentary rocks strike north-northeast and dip gently, usually less than 20 degrees.

A number of major faults traverse the Matachewan area, notably the northeast-trending Cadillac-Larder Lake Break (CLLB) and the northwest-trending Montreal Fault. Numerous other northerly trending faults (including the Knott Lake Fault that lies beneath Knott Lake) are known in the Matachewan area, many of which are filled by diabase dikes. The CLLB and related faults i.e. Galer Lake Fault, Kincaid Fault, Holmes Lake Fault, as shown below, are composite structures. The CLLB has apparently had a long history of re-activation as Gowganda Formation sediments frequently show steep dips where they overlie this fault.

Property Geology

Virtually the entire claim is underlain by Archean metasediments and metavolcanics; the contact with Proterozoic sediments closely follows the southern claim line. Basalts of the Larder Lake Group have been mapped in the southwestern corner of the Knott Lake property; however this lithology is believed to be more extensive than this based on outcrops examined in this field program. Most of the property is underlain by Timiskaming metasediments, which in the area of interest, fine northwards. Conglomerates at the base of the Timiskaming grade upwards into greywacke, sandstone and siltstone. Small bosses of syenite have been mapped immediately to the north and west of the property. In the Matachewan area, the Cadillac-Larder Lake Break is masked by Gowganda Formation, which is interpreted to be about one km south of the property boundary.

| 13 |

Gold Mineralization

The gold mines of the Matachewan camp are located near the highly deformed contact between the Timiskaming Group sedimentary rocks and the Larder Lake Group volcanic rocks. Significantly, this contact is in close proximity to the westward extension of the Larder Lake-Cadillac Break. Irregular syenite bodies have intruded the supracrustal rocks, parallel to the strata and the structural fabric, along and near the sediment-volcanic contact. Syenite is much more abundant within the Timiskaming Group than within the volcanic rocks. The main syenite body localized along the Timiskaming - Larder Lake Group contact in the camp, which is the main ore host.

Two types of epigenetic gold mineralization are found in the Matachewan camp:

| 1) | syenite-hosted ore, which comprised most of the ore from the MCM and all of the ore extracted from the YDM as well as 85% of camp production, and, | |

|

|

|

| 2) | green carbonate (volcanic hosted) ore, while subordinate in tonnage, was higher grade. |

All of the ore bodies plunge steeply to the southwest, parallel to the mineral/extension/intersection lineation developed within the deformed volcanic and sedimentary rocks.

Green carbonate ore bodies were irregular and had limited vertical extents although low grade mineralization extends down-plunge from the ore bodies. Gold was directly associated with east- to northeast-trending, shallow, north-dipping (5° -20 °) extension fractures within carbonatized, pyritized and commonly brecciated volcanic rocks. The altered ultramafic volcanic units (fuchsitic schists or green carbonate zones) on the MCM are generally weakly anomalous in gold.

Gold within the main syenite body is directly associated with the following features:

| 1) | a characteristic brick-red, hematitic "phase" of the syenite; | |

|

|

|

| 2) | zones of intense quartz-carbonate veining and fracturing, with 2-5% disseminated pyrite; | |

|

|

|

| 3) | zones of "necking" within the syenite. |

This association of gold with zones in which the syenite has been thinned is illustrated in plan, long section and cross-section. Reverse motion along the Cadillac-Larder Lake Break resulted in fracturing of the more competent syenite body, especially along its margins. Flat extension veins opened due to the same vertical extension which caused the formation of "necks" within the syenite body as it was being boudinaged vertically on a large scale. Extensive fracturing occurred in the "necks" as the syenite was being extended at these sites. Auriferous hydrothermal fluids flowing along the LLCB precipitated gold along with pyrite, hematite, chalcopyrite and the other associated minerals within the fractures produced during tectonism.

Exploration

Geological Mapping

Approximately half a day was spent locating and identifying outcrops and old trenches within and adjacent to MR6061. It is believed that the trench referred to in the 1930's reports has been located, although it is now masked by overburden and completely overgrown. It is approximately 180m long, 1-2m deep and about 2m wide. No direct evidence of the original shaft was found, although widened sections in the old trench could have accommodated such a shaft. No outcrop was observed in this trench, although time spent stripping vegetation and thin overburden would likely expose bedrock.

Outcrop exposure is moderate to good along the shoreline of Knott Lake, and sporadic outcrops are exposed for about 200 meters on a trend of 045o from the shore of the lake. Most of the outcrops near the lakeshore are massive fine grained basalts. However, most of the outcrops observed on the property away from Knott Lake were composed of clastic metasediments of the Timiskaming Group. These sediments are generally fine to medium grained sandstones and greywackes that frequently show strong carbonitization. Quartz carbonate veins at least 0.6m wide were noted associated with strong shearing and disseminated pyrite in some outcrops, and a grab samples from veined outcrops yielded a maximum of 4 ppb Au. Shearing and veining appeared to be oriented at about 050o with a steep dip.

Somewhat surprisingly, the contact between the volcanics and the sediments appears to have a NW to NNW orientation, which is perpendicular to measured foliation measurements of about 245o. It is also interesting to note that this contact appears to closely follow the trace of the old trench.

| 14 |

Geochemical Sampling

The prime method for assessing the potential for hosting a gold deposit on the Knott Lake property in this field program was till sampling. The usefulness of counting gold grains in basal till as an effective tool in gold exploration and the use of this method has resulted in discoveries of several significant blind gold deposits in the Abitibi Belt. Samples each consisting of a minimum of 12 kg of basal till are examined under a binocular microscope, and individual gold grains are identified and described. Gold grains that are either pristine or modified are considered to have a proximal source (i.e. less than 1 km).

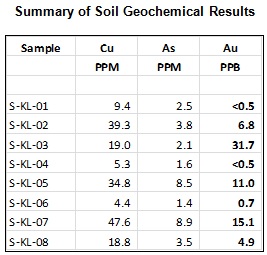

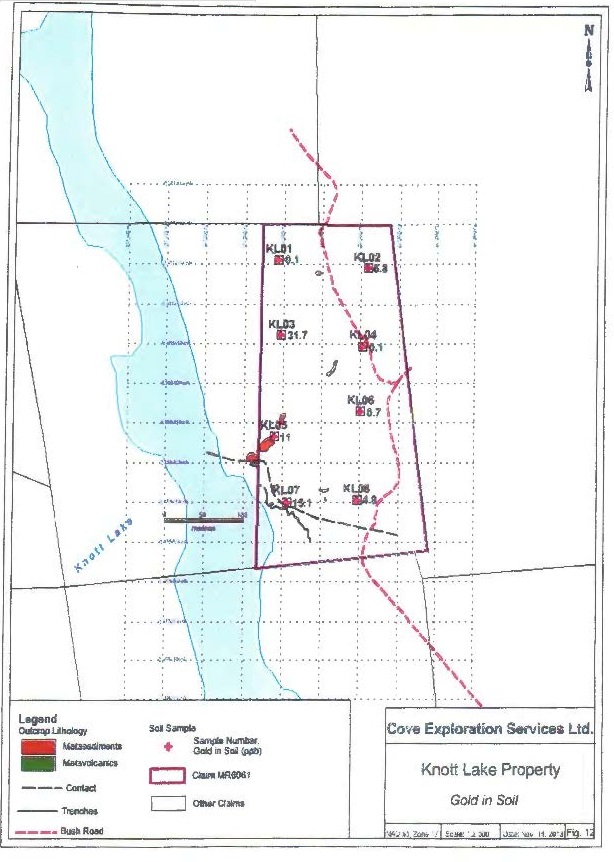

A total of 8 sample sites covered the entire Knott Lake property on a 100m X 100m spacing as shown in the map below. Positioning was achieved with hand-held GPS giving a station accuracy of +/- 3m. Pits were dug to depths of 0.75 to 1.1m in order to determine the suitability of the glacial drift as a sampling medium. The till in this property is a medium brown in color, and has a sandy texture with moderate silt content, and no clay. It is believed that the overburden here is comprised of basal till although the sandy texture and lack of clay indicates that this till may have been slightly reworked. In addition, in two of these sample sites, bedrock was encountered at the bottom of these pits. Basal till samples were collected from these pits, and samples ranged from 13 to 18 kg each. These samples were screened in order to remove clasts greater than 1 cm in diameter; these clasts were retained. These till samples were submitted to Overburden Drilling Management (ODM) in Ottawa for gold grain counting and description. The important results are summarized in the chart below. These results indicate that gold grain contents in several of the samples are anomalously enriched when compared to WMC's historical results on nearby claims.

In addition, conventional soil samples from the C horizon were collected from each of these same sample sites at a depth of approximately 50 cm. These samples were submitted to Acme Analytical for gold analyses with ICP-MS with an Aqua Regia leach as well as multi-element ICP analyses.

The results show the gold, copper and arsenic contents of the samples, and the gold results are plotted on the map below. Copper is commonly associated with gold mineralization at the Young Davidson, and arsenic is frequently a pathfinder for Archean lode gold deposits.

| 15 |

| 16 |

Interpretation and Conclusions

The most critical results of the 2013 field program in addition to geophysical and geochemical highlights compiled from assessment files are shown in the map above.

ITEM 3. LEGAL PROCEEDINGS.

We are not currently a party to any legal proceedings. There are no material proceedings to which our executive officers and directors are a party adverse to us or has a material interest adverse to us. There are no legal actions, either pending or believed by management to happen, to which the Company is aware.

We are required by Section 78.090 of the Nevada Revised Statutes (the "NRS") to maintain a registered agent in the State of Nevada. Our registered agent for this purpose is American Corporate Enterprise, Inc. of 123 W. Nye Lane, Suite 129, Carson City, NV 89706. All legal process and any demand or notice authorized by law to be served upon us may be served upon our registered agent in the State of Nevada in the manner provided in NRS 14.020(2).

ITEM 4. MINE SAFETY DISCLOSURES.

Not Applicable.

| 17 |

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.Holders of Our Common Stock

As of the date of this Form 10-K, we have one (1) registered stockholder.

No Public Market for Common Stock

There is currently no public market for our common stock. We anticipate making an application for quotation of our common stock on the OTCBB upon:

| (i) | the effectiveness of the registration statement; and | |

| (ii) | our obtaining a sufficient number of stockholders to enable our common stock to become quoted on the OTCBB. |

We cannot provide any assurance that our common shares will ever be quoted on the OTCBB or any other quotation system.

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the Nasdaq system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or quotation system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that:

(a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading;

(b) contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of Securities laws;

(c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price;

(d) contains a toll-free telephone number for inquiries on disciplinary actions;

(e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and

(f) contains such other information and is in such form, including language, type, size and format, as the SEC shall require by rule or regulation.

| 18 |

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with:

(a) bid and offer quotations for the penny stock;

(b) the compensation of the broker-dealer and its salesperson in the transaction;

(c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and

(d) monthly account statements showing the market value of each penny stock held in the customer's account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a suitably written statement.

These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our stock if it becomes subject to these penny stock rules. Therefore, if our common stock becomes subject to the penny stock rules, stockholders may have difficulty selling those securities.

Outstanding Options, Warrants or Convertible Securities

As of the date of this Form 10-K, we do not have any outstanding options, warrants to purchase our common stock or securities convertible into shares of our common stock.

Rule 144 Shares

In general, under Rule 144, a person who is not an affiliate of a company and who is not deemed to have been an affiliate of a company at any time during the three months preceding a sale and who has beneficially owned shares of a company's common stock for at least six months would be entitled to sell them without restriction, subject to the continued availability of current public information about the company (which current public information requirement is eliminated after a one-year holding period). In addition, a person, who is an affiliate and beneficially owned shares of a company's common stock for at least six months, will be entitled to sell within any three month period a number of shares that does not exceed the greater of:

| 1. | One percent of the number of shares of the company's common stock then outstanding; or |

| 2. | The average weekly trading volume of the company's common stock during the four calendar weeks preceding the filing of a notice on form 144 with respect to the sale. |

| 19 |

However, at this time, we may be deemed a company that has either no or nominal operations and no or nominal assets (a "shell company"). In particular, Rule 144 is not available for securities initially issued by a shell company, whether reporting or non-reporting, or a company that was at any time previously a shell company, unless the company:

· | has ceased to be a shell company; |

|

|

· | is subject to the Exchange Act reporting obligations; |

|

|

· | has filed all required Exchange Act reports during the preceding twelve months; and |

|

|

· | at least one year has elapsed from the time the company filed with the SEC current Form 10 type information reflecting its status as an entity that is not a shell company. |

As a result, our sole shareholder, being an affiliate, and any other person initially issued shares of our common stock, excluding those shares registered in this prospectus, is not entitled to sell such shares until the Shell Company Conditions have been satisfied. Upon satisfaction of the Shell Company Conditions, such sales by our sole shareholder and director would be limited by the manner of sale provisions and notice requirements and to the availability of current public information about us as set forth above.

Registration Rights

We have not granted registration rights to Ms. Lediga or to any other persons.

We filed a Registration Statement on Form 8-A with the SEC concurrently with, or immediately following, the effectiveness of our Registration Statement on Form S-1. The filing of the Registration Statement on Form 8-A caused us to become a reporting company with the SEC under the Exchange Act concurrently with the effectiveness of the Registration Statement on Form S-1. We must be a reporting company under the Exchange Act in order for our common stock to be eligible for quotation on the OTCBB.

We believe that the development of a public market for our common stock will make an investment in our common stock more attractive to future investors. In the near future, in order for us to continue with our exploration program on the Knott Lake, we may need to raise additional capital. We believe that obtaining reporting company status under the Exchange Act and quotation on the OTCBB should increase our ability to raise these additional funds from investors.

DIVIDENDS

Rosewood's Articles of Incorporation or Bylaws do not restrict it from declaring dividends. Nevertheless, the Nevada Revised Statutes, however, do prohibit us from declaring dividends where, after giving effect to the distribution of the dividend:

| 1. | We would not be able to pay our debts as they become due in the usual course of business; or |

| 2. | Our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of stockholders who have preferential rights superior to those receiving the distribution. |

| 20 |

Rosewood has not declared any dividends since its inception and does not conceive that it will be declaring any dividends in the near future. Management was to retain any excess funds in the Company for working capital and for further exploration on a future mineral claim.

Stock Options, Warrants and Rights

Rosewood does not have any outstanding stock options, warrants, rights or any other instrument which will allow the holders to convert into common shares of our Company.

ITEM 6. RECENT SALES OF UNREGISTERED SECURITIES

None.

ITEM 7. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

Financial Statements

| 1. | Financial statements |

| (a) | Report of Independent Registered Public Accounting Firm; | |

| (b) | Balance Sheets as at October 31, 2015 and 2014; | |

| (c) | Statements of Operations for the years ended October 31, 2015 and 2014; | |

| (d) | Statements of Changes In Stockholder's (Deficit) Equity to October 31, 2015; | |

| (e) | Statements of Cash Flows for the years ended October 31, 2015 and 2014; and | |

| (f) | Notes to Financial Statements. |

| 21 |

STEVENSON & COMPANY CPAS LLC

A PCAOB Registered Accounting Firm | 12421 N Florida Ave. Suite .113 |

|

|

| {813)443-0619 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors and Stockholders

Rosewood Resources, Inc.

We have audited the accompanying balance sheet of Rosewood Resources, Inc. as of October 31, 2015 and 2014 and the related statements of operations, changes in stockholder's equity (deficit), and cash flows for the years ended October 31, 2015 and 2014. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Rosewood Resources, Inc. as of October 31, 2015 and 2014, and the results of its operations and its cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As shown in the accompanying financial statements, the Company has significant net losses and cash flow deficiencies. Those conditions raise substantial doubt about the Company's ability to continue as a going concern. Management's plans regarding those matters are described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Stevenson & Company CPAS LLC

Stevenson & Company CPAS LLC

Tampa, Florida

February 5, 2016

| 22 |

ROSEWOOD RESOURCES, INC.

BALANCE SHEETS

| October 31, 2015 |

|

| October 31, 2014 |

| |||

|

|

|

|

|

| |||

Assets |

|

|

|

|

|

| ||

|

|

|

|

|

| |||

Cash |

| $ | 37,410 |

|

| $ | 64,204 |

|

|

|

|

|

|

|

|

| |

Total Assets |

| $ | 37,410 |

|

| $ | 64,204 |

|

|

|

|

|

|

|

|

| |

Liabilities and Stockholder's (Deficit) Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

| $ | 19,103 |

|

| $ | 11,445 |

|

Due to related parties |

|

| 51,380 |

|

|

| 50,857 |

|

|

|

|

|

|

|

|

| |

Total current liabilities |

|

| 70,483 |

|

|

| 62,302 |

|

|

|

|

|

|

|

|

| |

Stockholder's (Deficit) Equity: |

|

|

|

|

|

|

|

|

Common stock 650,000,000 common stock authorized, $0.001 par value; 90,000,000 common shares issued and Outstanding |

|

| 90,000 |

|

|

| 90,000 |

|

Deficit accumulated |

|

| (123,073 | ) |

|

| (88,098 | ) |

|

|

|

|

|

|

|

| |

Total stockholder's (deficit) equity |

|

| (33,073 | ) |

|

| 1,902 |

|

|

|

|

|

|

|

|

| |

Total Liabilities and Stockholder's (deficit) equity |

| $ | 37,410 |

|

| $ | 64,204 |

|

The accompanying notes are an integral part of these financial statements.

| 23 |

ROSEWOOD RESOURCES, INC.

Statements of Operations

| For the year ended October 31, |

|

| For the year ended October 31, |

| |||

|

|

|

|

|

| |||

Revenue |

| $ | - |

|

| $ | - |

|

|

|

|

|

|

|

|

| |

Expenses |

|

|

|

|

|

|

|

|

Exploration costs |

|

| 13,373 |

|

|

| 37,100 |

|

General and Administrative expenses |

|

| 21,602 |

|

|

| 29,203 |

|

|

|

|

|

|

|

|

| |

Total expenses |

|

| 34,975 |

|

|

| 66,303 |

|

|

|

|

|

|

|

|

| |

Loss from operations |

| $ | 34,975 |

|

| $ | 66,303 |

|

|

|

|

|

|

|

|

| |

Net loss per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic and diluted |

| $ | (0.00 | ) |

| $ | (0.00 | ) |

|

|

|

|

|

|

|

| |

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic and diluted |

|

| 90,000,000 |

|

|

| 90,000,000 |

|

The accompanying notes are an integral part of these financial statements.

| 24 |

ROSEWOOD RESOURCES INC.

Statements of Changing to Stockholder's (Deficit) Equity

| Common Shares |

|

| Stock Amount |

|

| Accumulated Deficit |

|

| Total |

| |||||

|

|

|

|

|

|

|

|

|

|

|

| |||||

Balance as at October 31, 2013 |

|

| 90,000,000 |

|

|

| 90,000 |

|

|

| (21,795 | ) |

|

| 68,205 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net loss for the year ended October 31, 2014 |

|

| - |

|

|

| - |

|

|

| (66,303 | ) |

|

| (66,303 | ) |

Balance as at October 31, 2014 |

|

| 90,000,000 |

|

|

| 90,000 |

|

|

| (88,098 | ) |

|

| 1,902 |

|

Net loss for the year ended October 31, 2015 |

|

| - |

|

|

| - |

|

|

| (34,975 | ) |

|

| (34,975 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Balance as at October 31, 2015 |

|

| 90,000,000 |

|

| $ | 90,000 |

|

| $ | (123,073 | ) |

| $ | (33,073 | ) |

The accompanying notes are an integral part of these financial statements.

| 25 |

ROSEWOOD RESOURCES, INC.

Statements of Cash Flows

|

| For the year ended October 31, 2015 |

|

| For the year ended October 31, 2014 |

| |||

|

|

|

|

|

|

| |||

Operating Activities |

|

|

|

|

|

|

| ||

|

|

|

|

|

|

| |||

Net loss |

|

| $ | (34,975 | ) |

| $ | (66,303 | ) |

|

|

|

|

|

|

|

|

| |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

-Accountspayable |

|

|

| 7,658 |

|

|

| 11,445 |

|

|

|

|

|

|

|

|

|

|

|

Net cash used in operating activities |

|

|

| (27,317 | ) |

|

| (54,858 | ) |

|

|

|

|

|

|

|

|

|

|

Cash Flows From Investing Activities: |

|

|

| - |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

Net cash used in investing activities |

|

|

| - |

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

Financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from advances from a related party |

|

|

| 523 |

|

|

| 50,608 |

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by financing activities |

|

|

| 523 |

|

|

| 50,608 |

|

|

|

|

|

|

|

|

|

|

|

Net (decrease) increase in cash |

|

|

| (26,794 | ) |

|

| (4,250 | ) |

|

|

|

|

|

|

|

|

|

|

Cash, beginning of period |

|

|

| 64,204 |

|

|

| 68,454 |

|

|

|

|

|

|

|

|

|

|

|

Cash, end of period |

|

| $ | 37,410 |

|

| $ | 64,204 |

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosure of cash flow information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid for income taxes |

|

| $ | - |

|

| $ | - |

|

Cash paid for interest |

|

| $ | - |

|

| $ | - |

|

The accompanying notes are an integral part of these financial statements.

| 26 |

ROSEWOOD RESOURCES, INC.

Notes to the Financial Statements

October 31, 2015

1. Basis of presentation and Going Concern

The accompanying financial statements of Rosewood Resources, Inc. ("Rosewood" or "the Company") have been prepared in accordance with generally accepted accounting principles in the United States for period ended October 31, 2015. Rosewood was incorporated under the laws of the State of Nevada on June 17, 2013.

The Company was organized for the purpose of acquiring and developing mineral properties. At the report date mineral claims, with unknown reserves, had been acquired. The Company has not established the existence of a commercially minable ore deposit and therefore is considered an exploration stage company.

These financial statements have been prepared in accordance with generally accepted accounting principles applicable to a going concern, which assumes that the Company will be able to meet its obligations and continue its operations for its next fiscal year. Realization values may be substantially different from carrying values as shown and these financial statements do not give effect to adjustments that would be necessary to the carrying values and classification of assets and liabilities should the Company be unable to continue as a going concern. At October 31, 2015, the Company had not yet achieved profitable operations, had accumulated losses of $123,073 since its inception, had a negative working capital position of $33,073, and expects to incur further losses in the development of its business, all of which raises substantial doubt about the Company's ability to continue as a going concern. The Company's ability to continue as a going concern is dependent upon its ability to generate future profitable operations and/or to obtain the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they come due.

The Company expects to continue to incur substantial losses as it executes its business plan of mining its interest in a mineral property and does not expect to attain profitability in the near future. Since its inception, the Company has funded operations through the issuance of shares to one of its officer and director and from advance made by the other director for certain office expenses. The Company's future operations are dependent upon external funding and its ability to execute its business plan in mining its interest in a mineral property, realizing sales from its mining activities and controlling expenses. Management believes that sufficient funding may be available from additional borrowings and private placements to meet its business objectives including anticipated cash needs for working capital, for a reasonable period of time. However, there can be no assurance that the Company will be able to obtain sufficient funds to continue the exploration of its mineral property, or if obtained, upon terms favorable to the Company.

2. Summary of Significant Accounting Policies

Accounting Method

The Company's financial statements are presented in United States dollars and are prepared using the accrual method of accounting which conforms to generally accepted accounting principles in the United States of America ("US GAAP").

| 27 |

ROSEWOOD RESOURCES, INC.

Notes to the Financial Statements

October 31, 2015

2. Summary of Significant Accounting Policies - Continued

Basic and Diluted Net Income Per Share

Basic net income per share amounts are computed based on the weighted average number of shares actually outstanding. Diluted net income per share amounts are computed using the weighted average number of common and common equivalent shares outstanding as if shares had been issued on the

exercise of the common share rights unless the exercise becomes anti-dilutive and then the basic and diluted per share amounts are the same.

Income Taxes

Income taxes are provided in accordance with Codification topic 740, "Income Taxes", which requires an asset and liability approach for the financial accounting and reporting of income taxes. Current income tax expense (benefit) is the amount of income taxes expected to be payable (receivable) for the current year. A deferred tax asset and/or liability is computed for both the expected future impact of differences between the financial statement and tax bases of assets and liabilities and for the expected future tax benefit to be derived from tax loss and tax credit carry forwards. Deferred income tax expense is generally the net change during the year in the deferred income tax asset and liability. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be "more likely than not" realized in future tax returns. Tax rate changes and changes in tax laws are reflected in income in the period such changes are enacted.

Period Ended |

| Estimated NOL Carry-Forward |

|

| NOL Expires |

| Estimated Tax Benefit from NOL |

|

| Valuation Allowance |

|

| Net Tax |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

2013 |

| $ | 21,795 |

|

| 2033 |

| $ | 6,539 |

|

| $ | (6,539 | ) |

|

| - |

|

2014 |

|

| 66,303 |

|

| 2034 |

|

| 19,890 |

|

|

| (19,890 | ) |

|

| - |

|

2015 |

|

| 34,975 |

|

| 2035 |

|

| 10,493 |

|

|

| (10,493 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| $ | 123,073 |

|

|

|

| $ | 36,922 |

|

| $ | (36,922 | ) |

| $ | - |

| |

On October 31, 2015 the Company had a net operating loss carry forward of $123,073 for income tax purposes. The tax benefit of approximately $36,922 from the loss carry forward has been fully offset by a valuation allowance. The Company has three open tax years for federal income tax purposes.

Due to the Company's net loss position from inception on June 17, 2013 to October 31, 2015, there was no provision for income taxes recorded. As a result of the Company's losses to date, there exists doubt as to the ultimate realization of the deferred tax assets. Accordingly, a valuation allowance equal to the total deferred tax assets has been recorded at October 31, 2015.

| 28 |

ROSEWOOD RESOURCES, INC.

Notes to the Financial Statements

October 31, 2015

2. Summary of Significant Accounting Policies - Continued

Long-lived Assets

Long-Lived assets, such as property and equipment, mineral properties, and purchased intangibles with finite lives (subject to amortization), are evaluated for impairment whenever events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable in accordance with Codification topic 360 "Property, Plant, and Equipment". Circumstances which could trigger a review include, but are not limited to: significant decreases in the market price of the asset; significant adverse changes in the business climate or legal factors; accumulation of costs significantly in excess of the amount originally expected for the acquisition or construction of the asset; current period cash flow or operating losses combined with a history of losses or a forecast of continuing losses associated with the use of the asset; and current expectation that the asset will more likely than not be sold or disposed significantly before the end of its estimated useful life.

Recoverability of assets is measured by a comparison of the carrying amount of an asset to estimated undiscounted future cash flows expected to be generated by an asset. If the carrying amount of an asset exceeds its estimated future cash flows, an impairment charge is recognized as the amount by which the carrying amount exceeds the estimated fair value of the asset. The estimated fair value is determined using a discounted cash flow analysis. Any impairment in value is recognized as an expense in the period when the impairment occurs.

Foreign Currency Translations

The books of the Company are maintained in United States dollars and this is the Company's functional and reporting currency. Transactions denominated in other than the United States dollar are translated as follows with the related transaction gains and losses being recorded in the Statement of Operations:

Monetary items are recorded at the rate of exchange prevailing as at the balance sheet date;

Non-Monetary items including equity are recorded at the historical rate of exchange; and

Revenues and expenses are recorded at the period average in which the transaction occurred.

Revenue Recognition

Revenue from the sale of minerals will be recognized when a contract is in place and minerals are delivered to the customer.

Mineral claim acquisition and exploration costs

The cost of acquiring mineral properties or claims is initially capitalized and then tested for recoverability whenever events or changes in circumstances indicate that its carrying amount may not be recoverable. Mineral exploration costs are expensed as incurred.

Advertising and Market Development

The company expenses advertising and market development costs as incurred.

| 29 |

ROSEWOOD RESOURCES, INC.

Notes to the Financial Statements

October 31, 2015

2. Summary of Significant Accounting Policies - continued

Fair Value of Financial Instruments

Codification topic 825, "Financial Instruments", requires disclosure of fair value information about financial instruments when it is practicable to estimate that value. The carrying amounts of the Company's financial instruments as of October 31, 2015 approximate their respective fair values because of the short-term nature of these instruments.

Estimates and Assumptions

Management uses estimates and assumptions in preparing financial statements in accordance with general accepted accounting principles. Those estimates and assumptions affect the reported amounts of the assets and liabilities, the disclosure of contingent assets and liabilities, and the reported revenues and expenses. Actual results could vary from the estimates that were assumed in preparing these financial statements.

Statement of Cash Flows

For the purposes of the statement of cash flows, the Company considers all highly liquid investments with a maturity of three months or less to be cash equivalents.

Recent Accounting Pronouncements