Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Argo Group International Holdings, Ltd. | d136559d8k.htm |

4Q 2015 Investor Presentation February 2016 Exhibit 99.1

Forward-Looking Statements This presentation contains “forward-looking statements” which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The forward-looking statements are based on the Company's current expectations and beliefs concerning future developments and their potential effects on the Company. There can be no assurance that actual developments will be those anticipated by the Company. Actual results may differ materially from those projected as a result of significant risks and uncertainties, including non-receipt of the expected payments, changes in interest rates, effect of the performance of financial markets on investment income and fair values of investments, development of claims and the effect on loss reserves, accuracy in projecting loss reserves, the impact of competition and pricing environments, changes in the demand for the Company's products, the effect of general economic conditions, adverse state and federal legislation, regulations and regulatory investigations into industry practices, developments relating to existing agreements, heightened competition, changes in pricing environments, and changes in asset valuations. The Company undertakes no obligation to publicly update any forward-looking statements as a result of events or developments subsequent to the presentation. .

Argo Group at a Glance

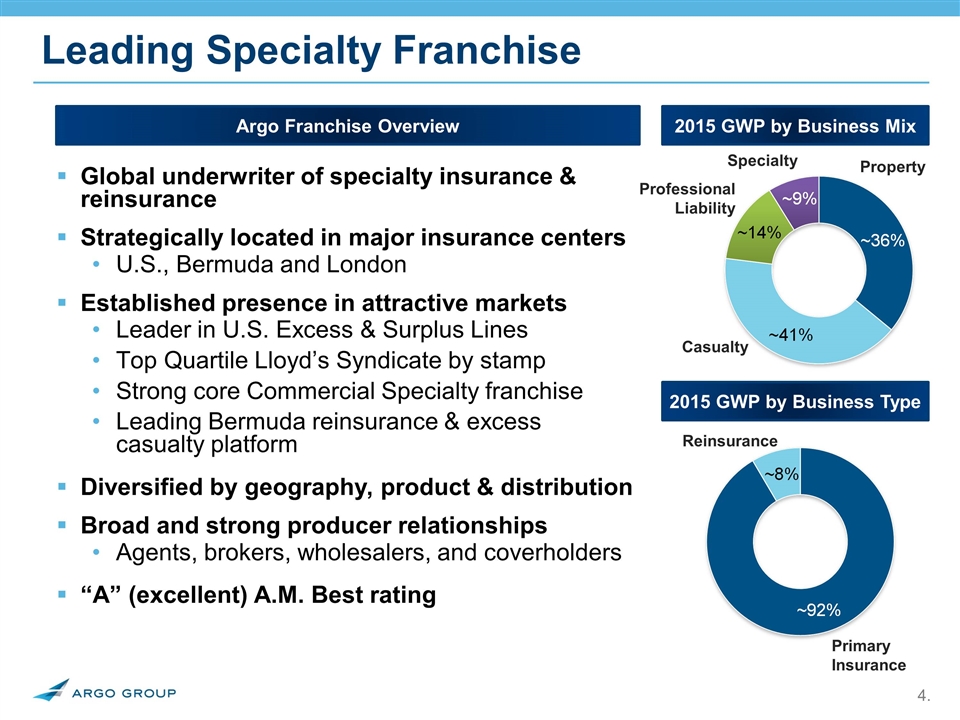

Leading Specialty Franchise Global underwriter of specialty insurance & reinsurance Strategically located in major insurance centers U.S., Bermuda and London Established presence in attractive markets Leader in U.S. Excess & Surplus Lines Top Quartile Lloyd’s Syndicate by stamp Strong core Commercial Specialty franchise Leading Bermuda reinsurance & excess casualty platform Diversified by geography, product & distribution Broad and strong producer relationships Agents, brokers, wholesalers, and coverholders “A” (excellent) A.M. Best rating Primary Insurance Reinsurance Property Casualty 2015 GWP by Business Type 2015 GWP by Business Mix Argo Franchise Overview Specialty Professional Liability

Maximize Shareholder Value through growth in Book Value per Share Sustainable competitive advantage Niche markets Underwriting expertise Superior customer service Product innovation Profitable organic & strategic growth Profitable through cycles Key underwriters/teams Deals that meet stringent criteria Deep, tenured management team Active capital management Strategy Aligned Toward Shareholder Value

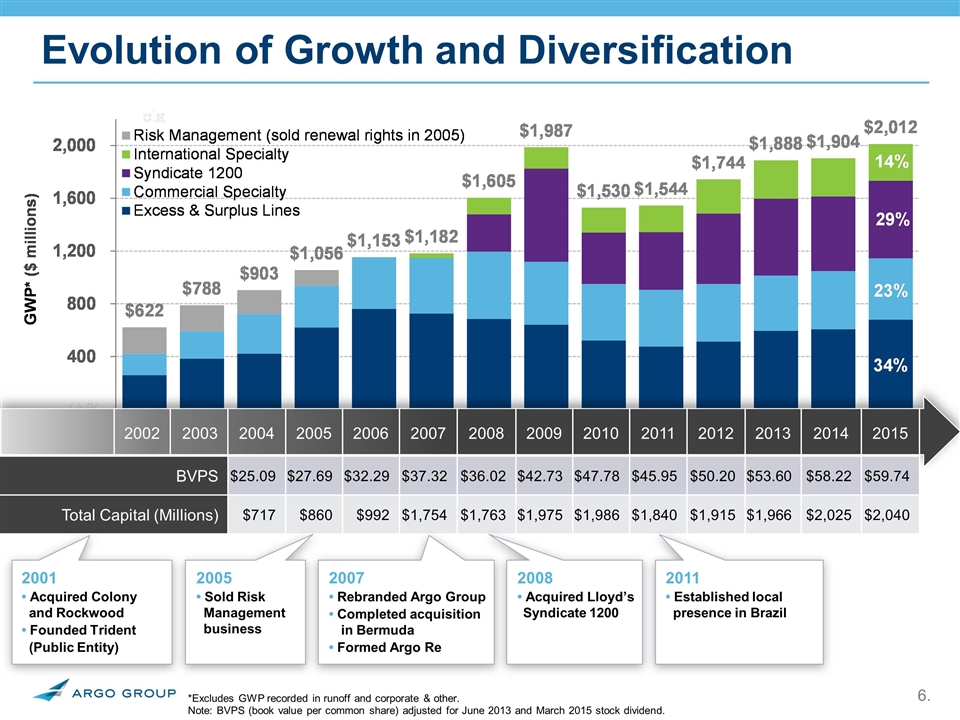

*Excludes GWP recorded in runoff and corporate & other. Note: BVPS (book value per common share) adjusted for June 2013 and March 2015 stock dividend. Evolution of Growth and Diversification $23.03 $501.1M $30.36 $716.8M $992.0M $54.85 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 BVPS $25.09 $27.69 $32.29 $37.32 $36.02 $42.73 $47.78 $45.95 $50.20 $53.60 $58.22 $59.74 Total Capital (Millions) $717 $860 $992 $1,754 $1,763 $1,975 $1,986 $1,840 $1,915 $1,966 $2,025 $2,040 2001 • Acquired Colony and Rockwood • Founded Trident (Public Entity) 2005 • Sold Risk Management business 2007 • Rebranded Argo Group • Completed acquisition in Bermuda • Formed Argo Re 2008 • Acquired Lloyd’s Syndicate 1200 2011 • Established local presence in Brazil

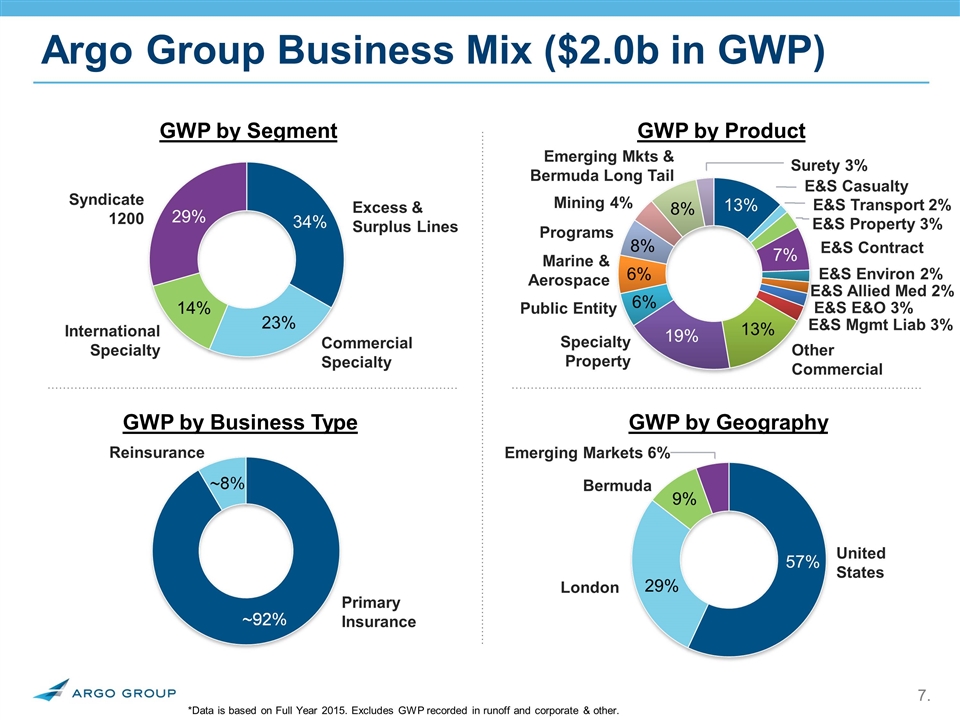

Argo Group Business Mix ($2.0b in GWP) GWP by Segment Excess & Surplus Lines Commercial Specialty Syndicate 1200 International Specialty 29% 14% 34% GWP by Geography United States London Bermuda 23% Emerging Markets 6% 57% 9% 29% GWP by Business Type Primary Insurance Reinsurance *Data is based on Full Year 2015. Excludes GWP recorded in runoff and corporate & other. GWP by Product 13% Other Commercial Specialty Property Public Entity 19% 6% 6% Marine & Aerospace Surety 3% Programs Mining 4% Emerging Mkts & Bermuda Long Tail 8% 13% 7% 8% E&S Transport 2% E&S Property 3% E&S Contract E&S Environ 2% E&S Casualty E&S Allied Med 2% E&S E&O 3% E&S Mgmt Liab 3%

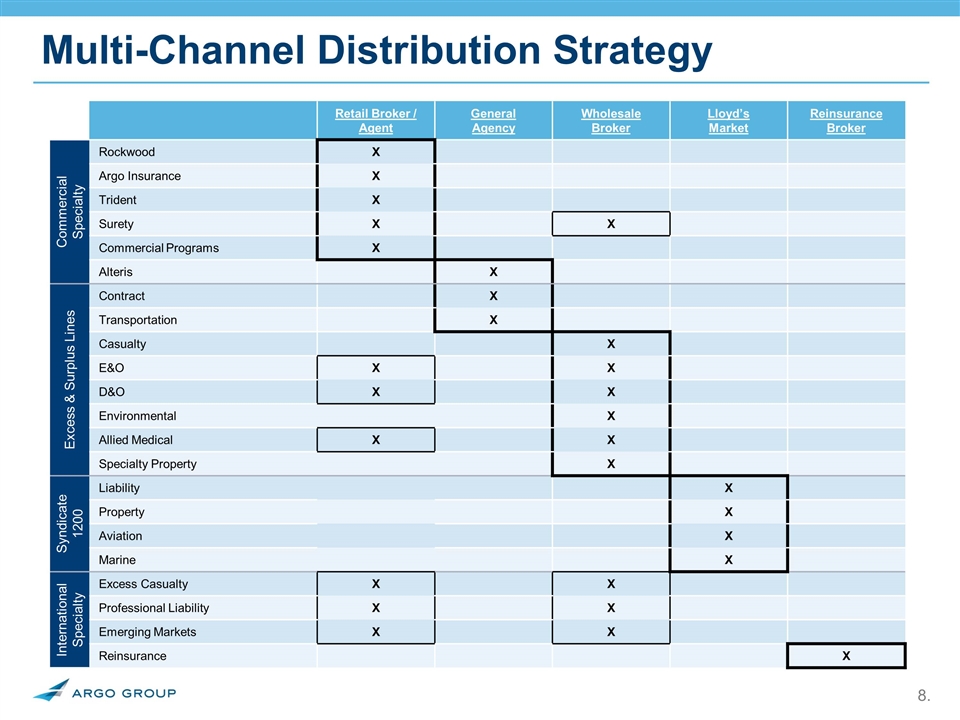

Multi-Channel Distribution Strategy Retail Broker / Agent General Agency Wholesale Broker Lloyd’s Market Reinsurance Broker Commercial Specialty Rockwood X Argo Insurance X Trident X Surety X X Commercial Programs X Alteris X Excess & Surplus Lines Contract X Transportation X Casualty X E&O X X D&O X X Environmental X Allied Medical X X Specialty Property X Syndicate 1200 Liability X Property X Aviation X Marine X International Specialty Excess Casualty X X Professional Liability X X Emerging Markets X X Reinsurance X

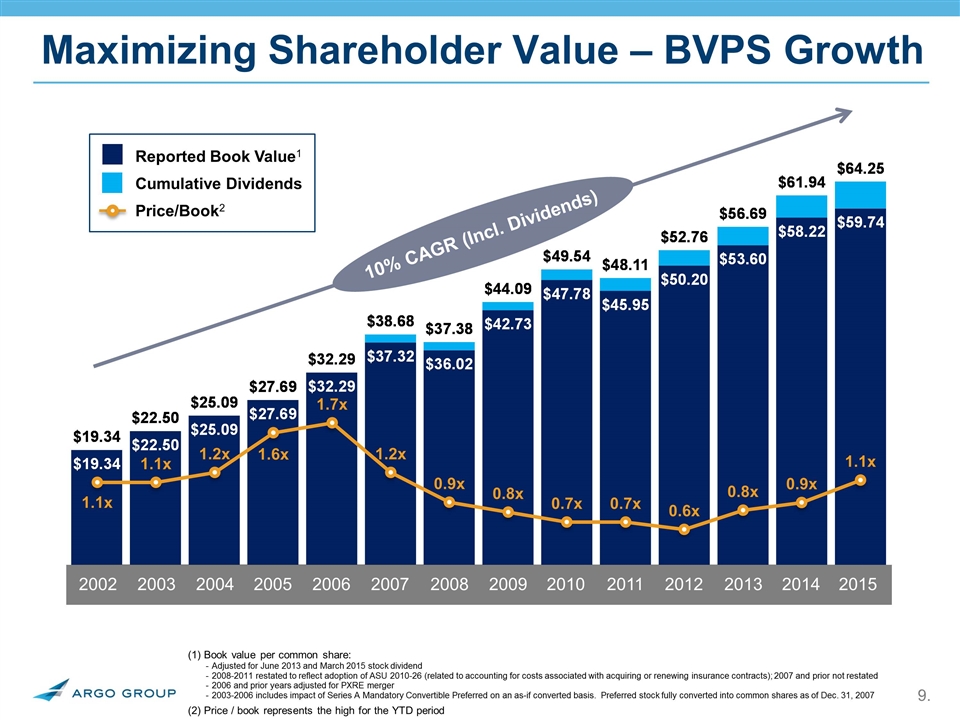

(1) Book value per common share: Adjusted for June 2013 and March 2015 stock dividend 2008-2011 restated to reflect adoption of ASU 2010-26 (related to accounting for costs associated with acquiring or renewing insurance contracts); 2007 and prior not restated 2006 and prior years adjusted for PXRE merger 2003-2006 includes impact of Series A Mandatory Convertible Preferred on an as-if converted basis. Preferred stock fully converted into common shares as of Dec. 31, 2007 (2) Price / book represents the high for the YTD period Maximizing Shareholder Value – BVPS Growth 10% CAGR (Incl. Dividends) 2002 Reported Book Value1 Cumulative Dividends Price/Book2 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2015 2014

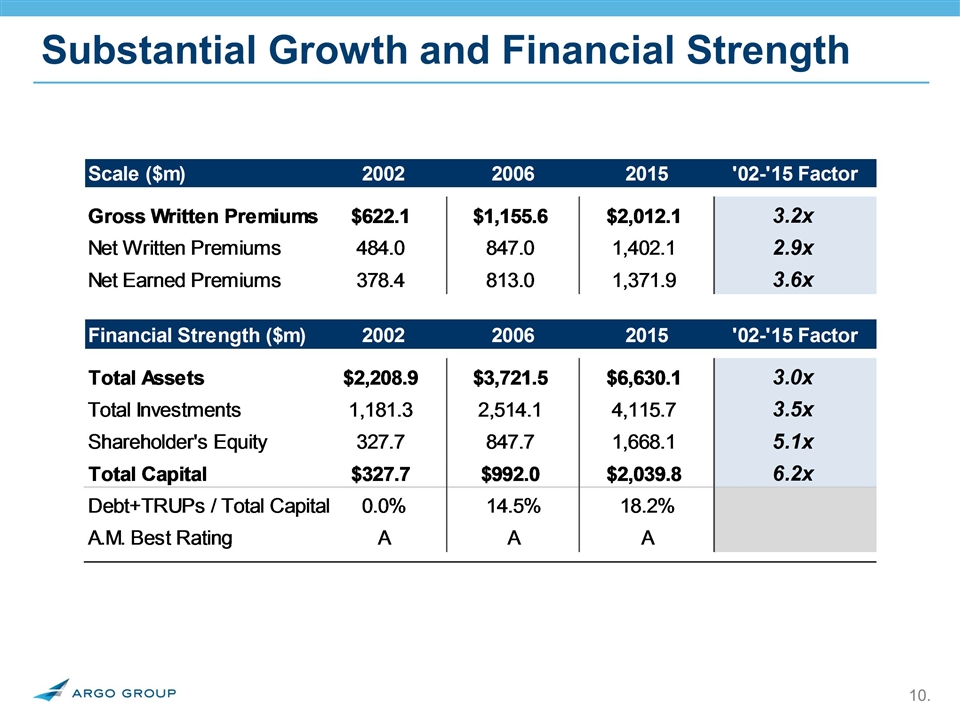

Substantial Growth and Financial Strength

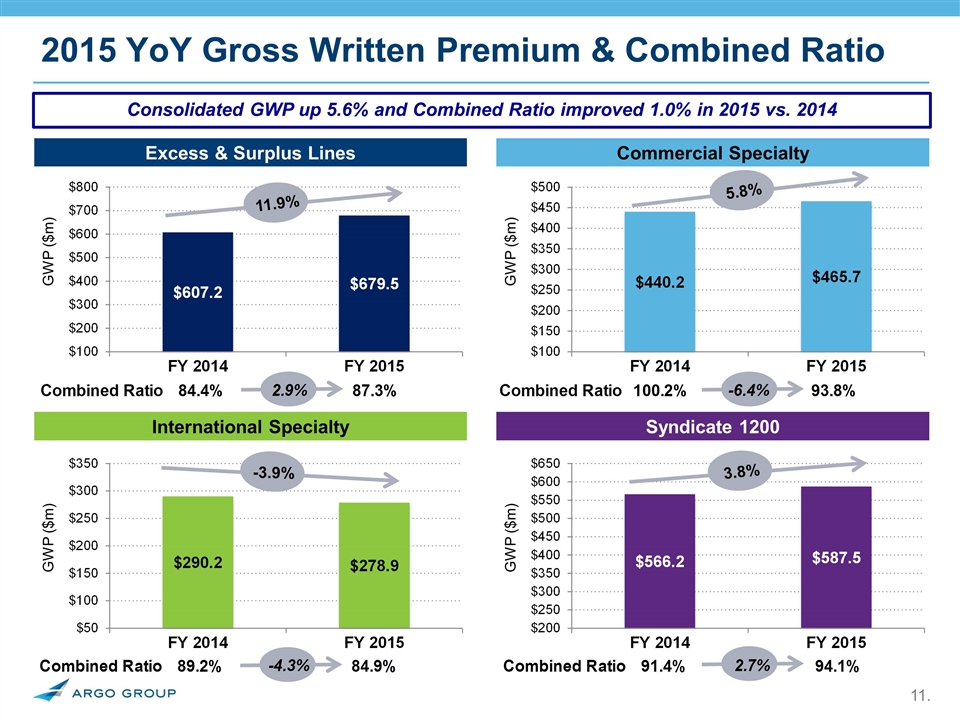

2015 YoY Gross Written Premium & Combined Ratio GWP ($m) GWP ($m) GWP ($m) GWP ($m) 11.9% 3.8% Consolidated GWP up 5.6% and Combined Ratio improved 1.0% in 2015 vs. 2014 Excess & Surplus Lines Commercial Specialty International Specialty Syndicate 1200 -3.9% 5.8%

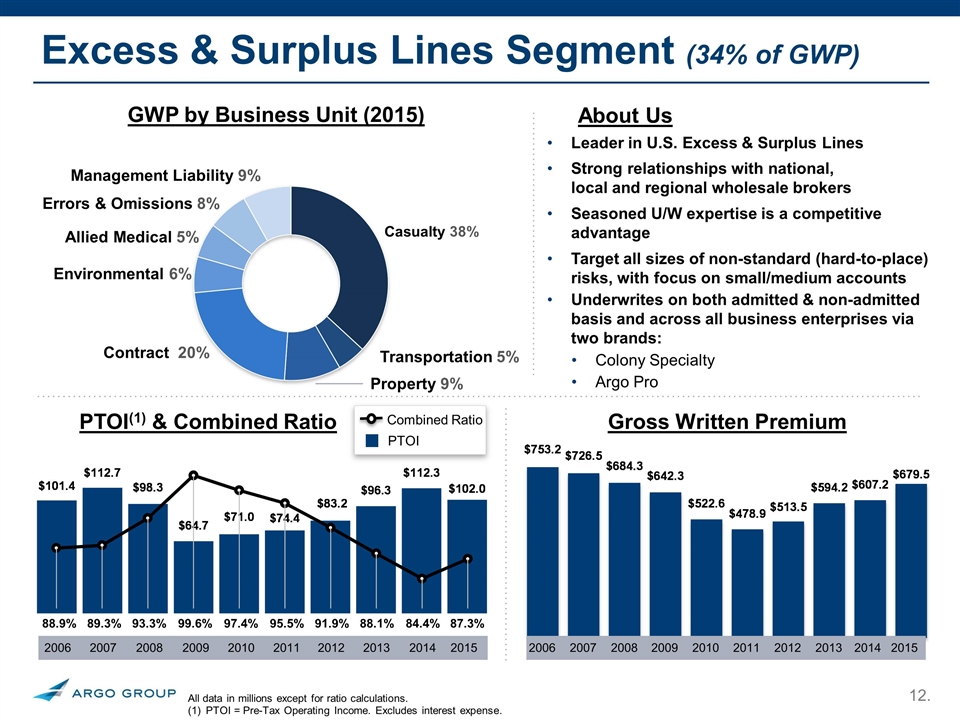

Excess & Surplus Lines Segment (34% of GWP) 88.9% 89.3% 99.6% 97.4% 95.5% 91.9% 93.3% 84.4% 88.1% About Us Leader in U.S. Excess & Surplus Lines Strong relationships with national, local and regional wholesale brokers Seasoned U/W expertise is a competitive advantage Target all sizes of non-standard (hard-to-place) risks, with focus on small/medium accounts Underwrites on both admitted & non-admitted basis and across all business enterprises via two brands: Colony Specialty Argo Pro GWP by Business Unit (2015) Casualty 38% Transportation 5% Environmental 6% Allied Medical 5% Management Liability 9% Property 9% Contract 20% Errors & Omissions 8% Combined Ratio PTOI Gross Written Premium PTOI(1) & Combined Ratio 2006 2014 2011 2010 2009 2008 2012 2007 2013 2015 All data in millions except for ratio calculations. PTOI = Pre-Tax Operating Income. Excludes interest expense. 87.3% 2013 2011 2010 2009 2008 2006 2012 2007 2015 2014

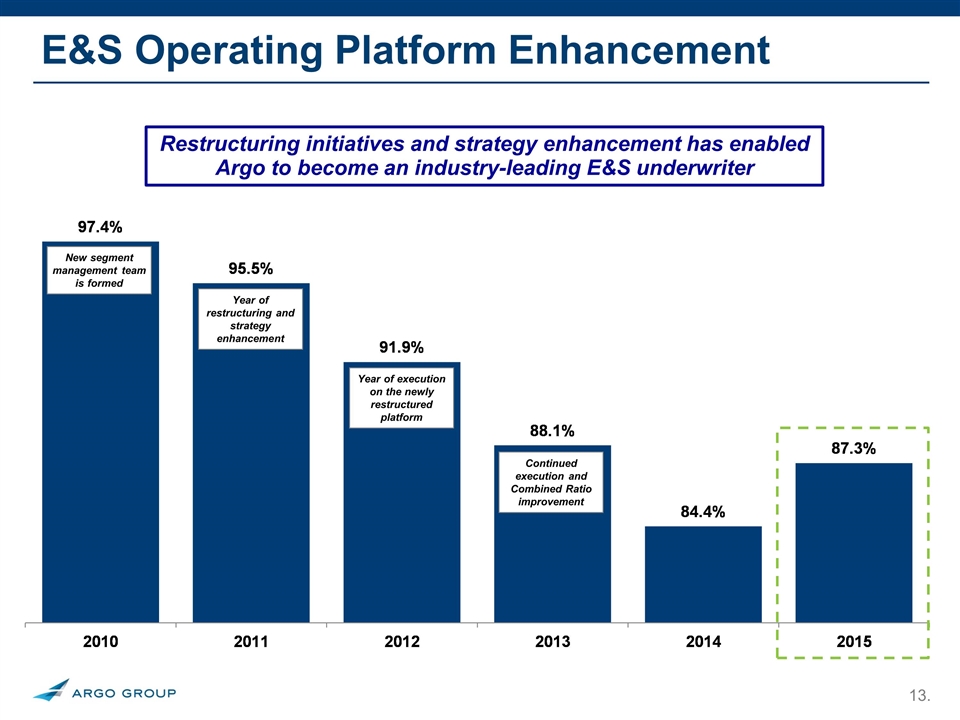

New segment management team is formed Year of restructuring and strategy enhancement Year of execution on the newly restructured platform Continued execution and Combined Ratio improvement Restructuring initiatives and strategy enhancement has enabled Argo to become an industry-leading E&S underwriter E&S Operating Platform Enhancement

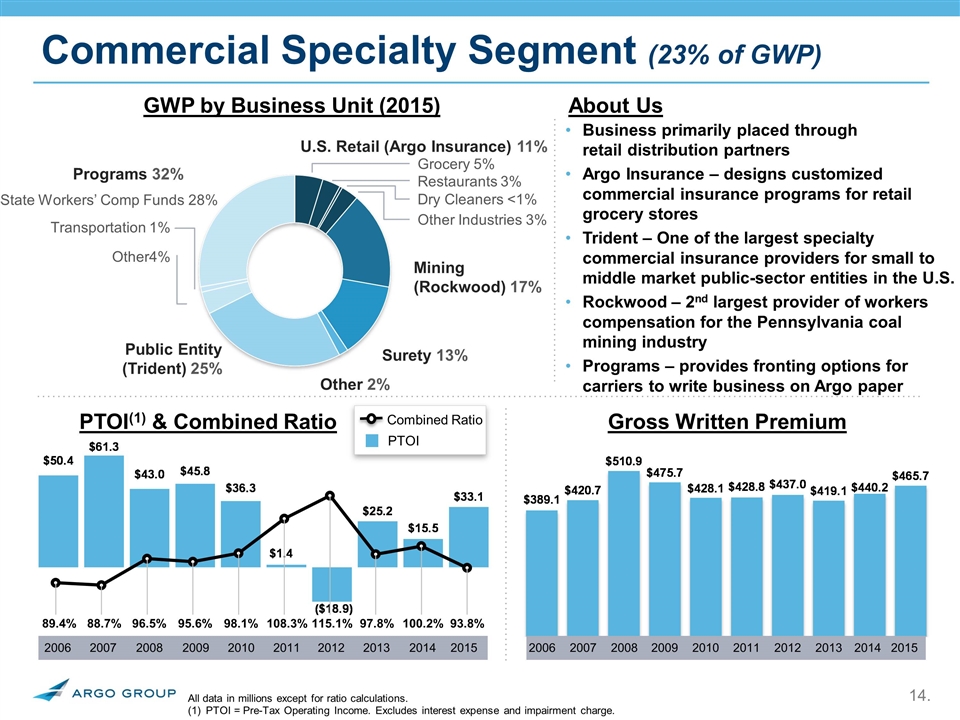

Commercial Specialty Segment (23% of GWP) About Us Business primarily placed through retail distribution partners Argo Insurance – designs customized commercial insurance programs for retail grocery stores Trident – One of the largest specialty commercial insurance providers for small to middle market public-sector entities in the U.S. Rockwood – 2nd largest provider of workers compensation for the Pennsylvania coal mining industry Programs – provides fronting options for carriers to write business on Argo paper GWP by Business Unit (2015) U.S. Retail (Argo Insurance) 11% Restaurants 3% Grocery 5% Dry Cleaners <1% Other Industries 3% Public Entity (Trident) 25% Surety 13% Mining (Rockwood) 17% Other 2% Programs 32% Transportation 1% State Workers’ Comp Funds 28% Combined Ratio PTOI Gross Written Premium PTOI(1) & Combined Ratio All data in millions except for ratio calculations. PTOI = Pre-Tax Operating Income. Excludes interest expense and impairment charge. 2006 2014 2011 2010 2009 2008 2012 2007 2013 2015 2013 2011 2010 2009 2008 2006 2012 2007 2015 2014 89.4% 88.7% 95.6% 98.1% 108.3% 115.1% 96.5% 100.2% 97.8% 93.8% Other4%

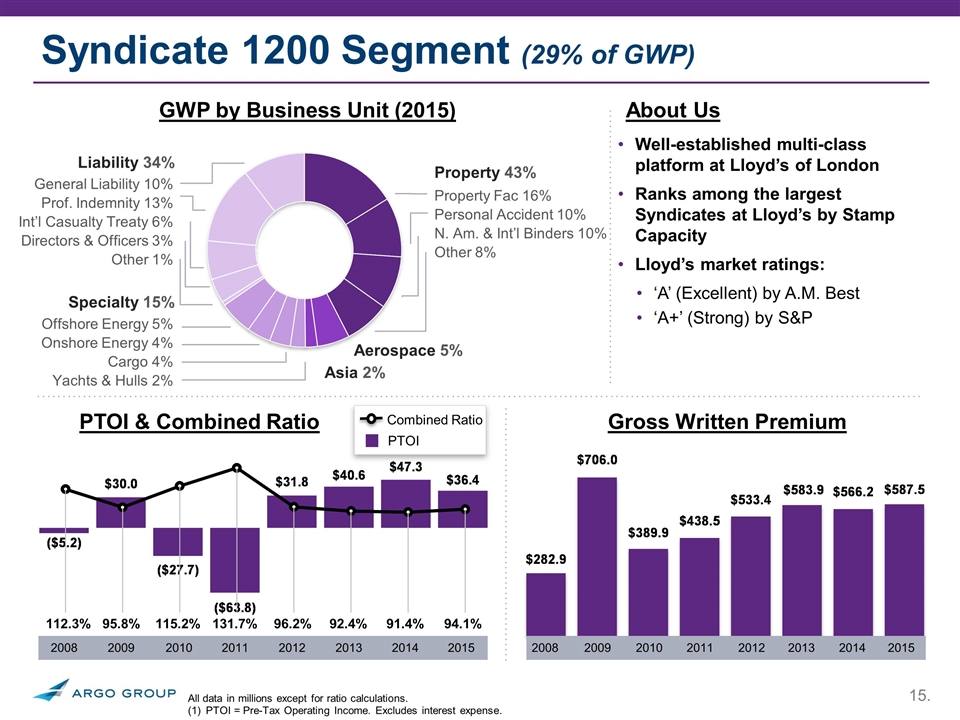

131.7% 115.2% Syndicate 1200 Segment (29% of GWP) General Liability 10% Prof. Indemnity 13% Int’l Casualty Treaty 6% Directors & Officers 3% Other 1% About Us Well-established multi-class platform at Lloyd’s of London Ranks among the largest Syndicates at Lloyd’s by Stamp Capacity Lloyd’s market ratings: ‘A’ (Excellent) by A.M. Best ‘A+’ (Strong) by S&P GWP by Business Unit (2015) Property 43% Liability 34% Specialty 15% Asia 2% Property Fac 16% Personal Accident 10% N. Am. & Int’l Binders 10% Other 8% 95.8% 112.3% 96.2% 92.4% Offshore Energy 5% Onshore Energy 4% Cargo 4% Yachts & Hulls 2% 91.4% Combined Ratio PTOI Gross Written Premium PTOI & Combined Ratio 2013 2011 2010 2009 2008 2012 2014 2015 2013 2011 2010 2009 2008 2012 2014 2015 All data in millions except for ratio calculations. PTOI = Pre-Tax Operating Income. Excludes interest expense. 94.1% Aerospace 5%

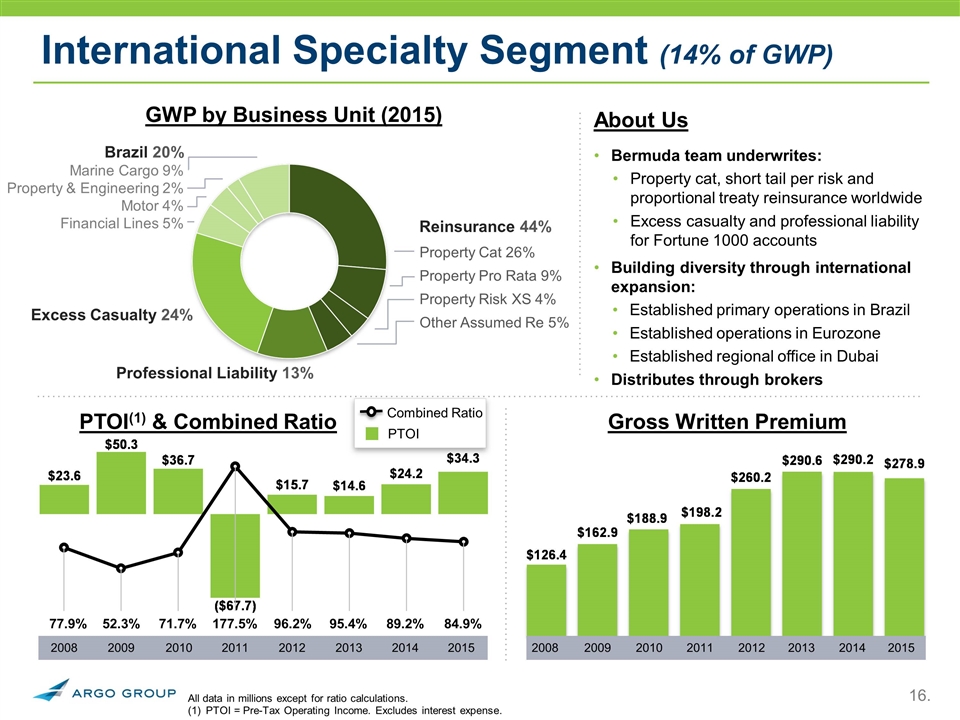

International Specialty Segment (14% of GWP) About Us Bermuda team underwrites: Property cat, short tail per risk and proportional treaty reinsurance worldwide Excess casualty and professional liability for Fortune 1000 accounts Building diversity through international expansion: Established primary operations in Brazil Established operations in Eurozone Established regional office in Dubai Distributes through brokers GWP by Business Unit (2015) Excess Casualty 24% Professional Liability 13% Brazil 20% Marine Cargo 9% Property & Engineering 2% Motor 4% Financial Lines 5% Reinsurance 44% Other Assumed Re 5% Property Risk XS 4% Property Pro Rata 9% Property Cat 26% Combined Ratio PTOI Gross Written Premium PTOI(1) & Combined Ratio All data in millions except for ratio calculations. PTOI = Pre-Tax Operating Income. Excludes interest expense. 2013 2011 2010 2009 2008 2012 2014 2015 177.5% 71.7% 52.3% 77.9% 96.2% 95.4% 89.2% 84.9% 2013 2011 2010 2009 2008 2012 2014 2015

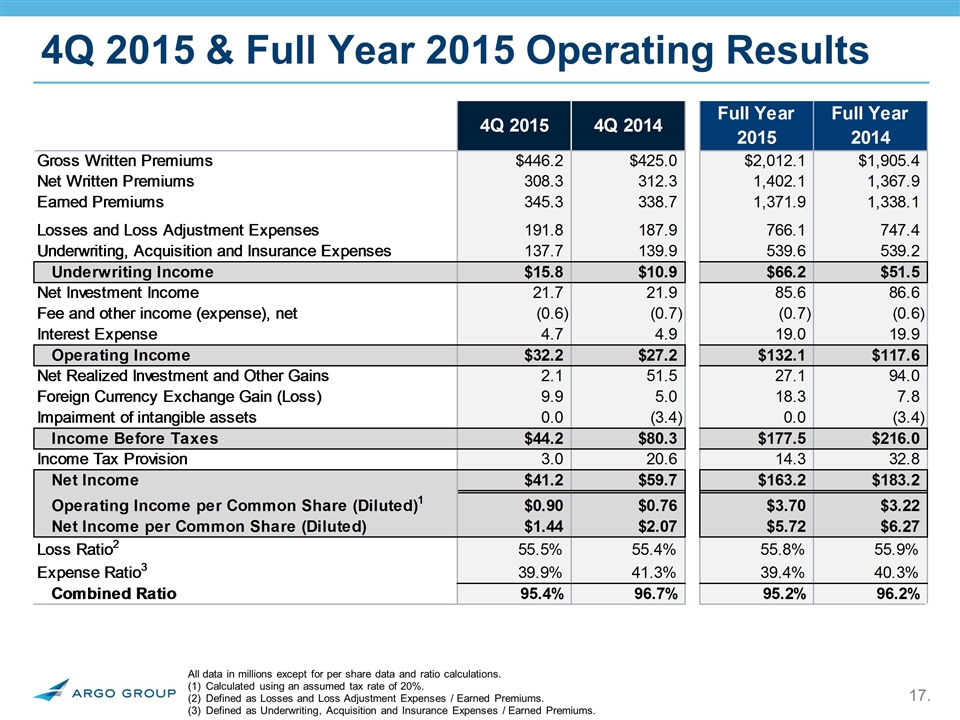

All data in millions except for per share data and ratio calculations. Calculated using an assumed tax rate of 20%. Defined as Losses and Loss Adjustment Expenses / Earned Premiums. Defined as Underwriting, Acquisition and Insurance Expenses / Earned Premiums. 4Q 2015 & Full Year 2015 Operating Results

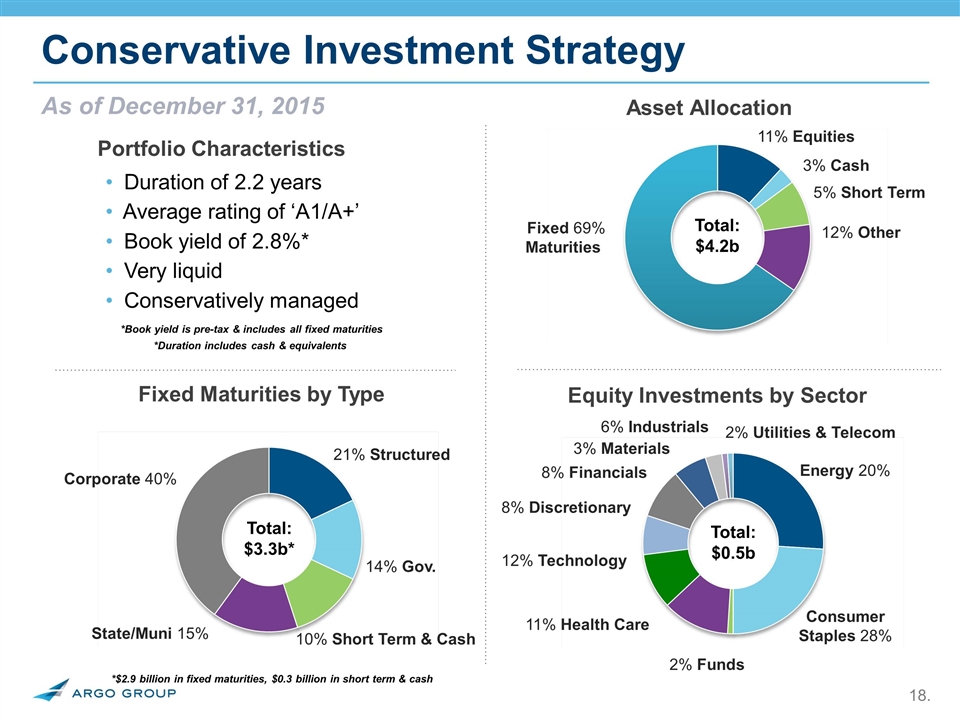

As of December 31, 2015 Conservative Investment Strategy 17% 17% . 17% Duration of 2.2 years Average rating of ‘A1/A+’ Book yield of 2.8%* Very liquid Conservatively managed Portfolio Characteristics *Book yield is pre-tax & includes all fixed maturities . Equity Investments by Sector 11% Health Care Energy 20% 8% Financials 6% Industrials 12% Technology 2% Funds 3% Materials 8% Discretionary Consumer Staples 28% Total: $0.5b Fixed Maturities by Type 10% Short Term & Cash Corporate 40%. 14% Gov. 21% Structured State/Muni 15%. Total: $3.3b* *$2.9 billion in fixed maturities, $0.3 billion in short term & cash 2% Utilities & Telecom Asset Allocation 12% Other Fixed 69% Maturities. 5% Short Term 11% Equities Total: $4.2b *Duration includes cash & equivalents 3% Cash

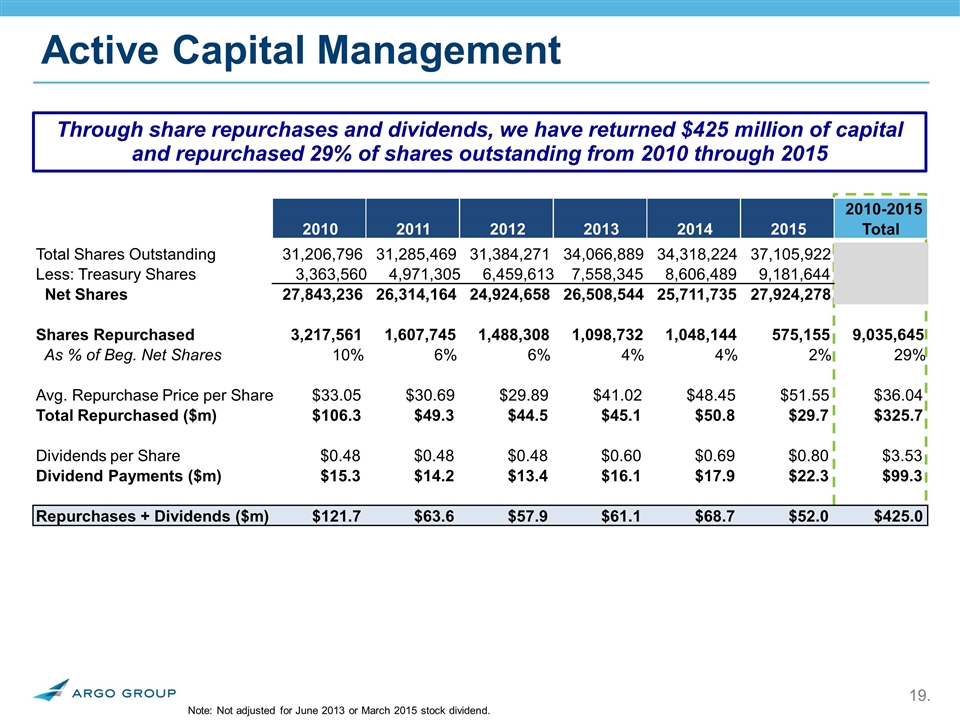

Note: Not adjusted for June 2013 or March 2015 stock dividend. Active Capital Management Through share repurchases and dividends, we have returned $425 million of capital and repurchased 29% of shares outstanding from 2010 through 2015 2010-2015 2010 2011 2012 2013 2014 2015 Total Total Shares Outstanding 31,206,796 31,285,469 31,384,271 34,066,889 34,318,224 37,105,922 Less: Treasury Shares 3,363,560 4,971,305 6,459,613 7,558,345 8,606,489 9,181,644 Net Shares 27,843,236 26,314,164 24,924,658 26,508,544 25,711,735 27,924,278 Shares Repurchased 3,217,561 1,607,745 1,488,308 1,098,732 1,048,144 575,155 9,035,645 As % of Beg. Net Shares 10% 6% 6% 4% 4% 2% 29% Avg. Repurchase Price per Share $33.05 $30.69 $29.89 $41.02 $48.45 $51.55 $36.04 Total Repurchased ($m) $106.3 $49.3 $44.5 $45.1 $50.8 $29.7 $325.7 Dividends per Share $0.48 $0.48 $0.48 $0.60 $0.69 $0.80 $3.53 Dividend Payments ($m) $15.3 $14.2 $13.4 $16.1 $17.9 $22.3 $99.3 Repurchases + Dividends ($m) $121.7 $63.6 $57.9 $61.1 $68.7 $52.0 $425.0

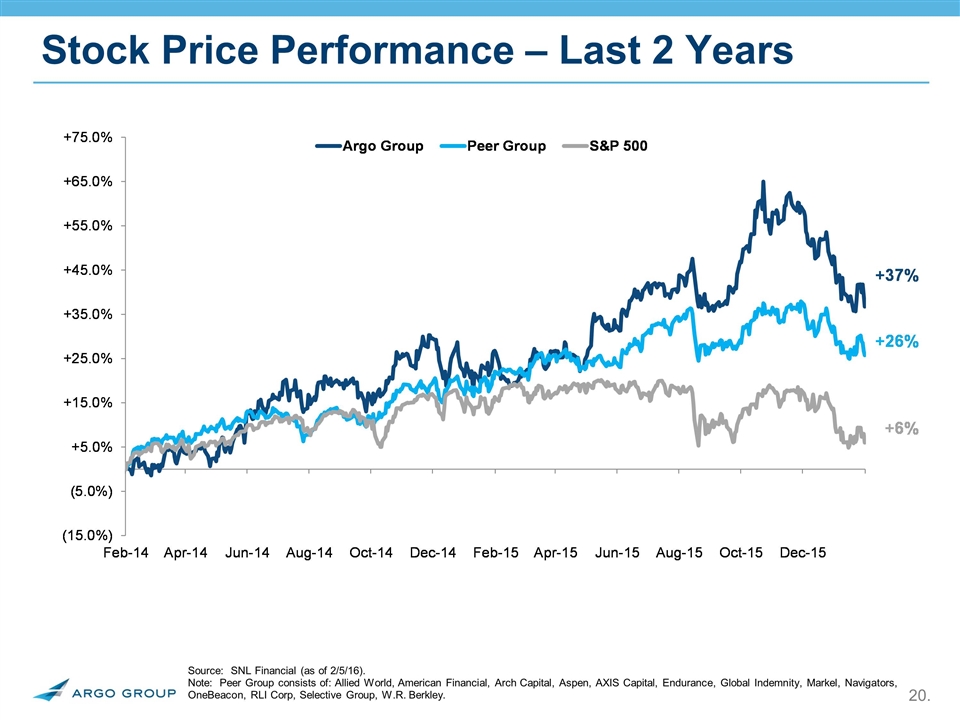

Stock Price Performance – Last 2 Years Source: SNL Financial (as of 2/5/16). Note: Peer Group consists of: Allied World, American Financial, Arch Capital, Aspen, AXIS Capital, Endurance, Global Indemnity, Markel, Navigators, OneBeacon, RLI Corp, Selective Group, W.R. Berkley.

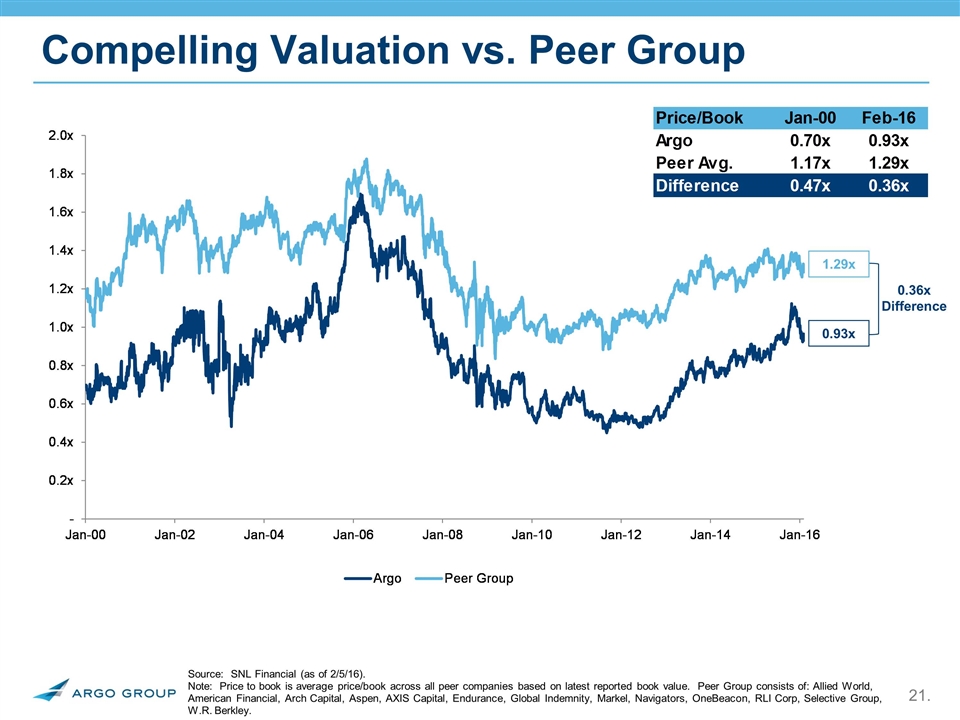

Compelling Valuation vs. Peer Group Source: SNL Financial (as of 2/5/16). Note: Price to book is average price/book across all peer companies based on latest reported book value. Peer Group consists of: Allied World, American Financial, Arch Capital, Aspen, AXIS Capital, Endurance, Global Indemnity, Markel, Navigators, OneBeacon, RLI Corp, Selective Group, W.R. Berkley. 0.93x 1.29x 0.36x Difference

We believe that Argo Group has potential to generate substantial value for new and existing investors Operations Well Positioned for Value Creation in 2016 and Beyond Moderate financial leverage Strong balance sheet with adequate reserves and excellent asset quality Capital Significant changes to premium composition completed Results of re-underwriting efforts emerging in financials Continue to employ and attract some of the best talent in the industry Incremental yield improvements can have a favorable impact on ROE Valuation Compelling investment case Stock trading at a discount to peers Upside potential as past and ongoing efforts continue