Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DOMINION ENERGY, INC | d131314d8k.htm |

| EX-99.1 - EX-99.1 - DOMINION ENERGY, INC | d131314dex991.htm |

| EX-99.2 - EX-99.2 - DOMINION ENERGY, INC | d131314dex992.htm |

| EX-99.4 - EX-99.4 - DOMINION ENERGY, INC | d131314dex994.htm |

| EX-99.5 - EX-99.5 - DOMINION ENERGY, INC | d131314dex995.htm |

Excerpt from Combination with Questar and 2015 Earnings & 2016 Guidance February 1, 2016 Exhibit 99.3

Today’s Agenda Transaction Overview and Strategic Rationale Combined Company Profile and Financial Outlook 2015 Earnings Results and 2016 Guidance Q&A 2/1/2016 Operating and Regulatory Review and Growth Project Update

Important Note to Investors This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 regarding Dominion and Dominion Midstream. The statements relate to, among other things, expectations, estimates and projections concerning the business and operations of Dominion and Dominion Midstream. We have used the words "anticipate", "believe", "could", "estimate", "expect", "intend", "may", "plan", “outlook”, "predict", "project", “should”, “strategy”, “target”, "will“, “potential” and similar terms and phrases to identify forward-looking statements in this presentation. As outlined in our SEC filings, factors that could cause actual results to differ include, but are not limited to: unusual weather conditions and their effect on energy sales to customers and energy commodity prices; extreme weather events and other natural disasters; federal, state and local legislative and regulatory developments; changes to federal, state and local environmental laws and regulations, including proposed carbon regulations; cost of environmental compliance; changes in enforcement practices of regulators relating to environmental standards and litigation exposure for remedial activities; capital market conditions, including the availability of credit and the ability to obtain financing on reasonable terms; fluctuations in interest rates; changes in rating agency requirements or credit ratings and their effect on availability and cost of capital; impacts of acquisitions, divestitures, transfers of assets by Dominion to joint ventures or to Dominion Midstream, and retirements of assets based on asset portfolio reviews; the expected timing and likelihood of completion of the proposed acquisition of Questar, including the ability to obtain the requisite approvals of Questar’s shareholders and timing, receipt and terms and conditions of required regulatory approvals; receipt of approvals for, and timing of, closing dates for other acquisitions; the execution of Dominion Midstream’s growth strategy; changes in demand for Dominion’s services; additional competition in Dominion’s industries; changes to regulated rates collected by Dominion; changes in operating, maintenance and construction costs; timing and receipt of regulatory approvals necessary for planned construction or expansion projects and compliance with conditions associated with such regulatory approvals; the inability to complete planned construction projects within time frames initially anticipated; and the ability of Dominion Midstream to negotiate, obtain necessary approvals and consummate acquisitions from Dominion and third-parties, and the impacts of such acquisitions. Other risk factors are detailed from time to time in Dominion’s and Dominion Midstream’s quarterly reports on Form 10-Q or most recent annual report on Form 10-K filed with the Securities and Exchange Commission. The information in this presentation was prepared as of February 1, 2016. Dominion and Dominion Midstream undertake no obligation to update any forward-looking information statement to reflect developments after the statement is made. Projections or forecasts shown in this document are based on the assumptions listed in this document and are subject to change at any time. In addition, certain information presented in this document incorporates planned capital expenditures reviewed and endorsed by Dominion’s Board of Directors in late 2015. Dominion undertakes no obligation to update such planned expenditures to reflect plan or project-specific developments, including regulatory developments, or other updates until the following annual update for the plans. Actual capital expenditures may be subject to regulatory and/or Board of Directors’ approval and may vary from these estimates. This presentation shall not constitute an offer to sell or the solicitation of an offer to buy securities. Any offers, solicitations or offers to buy, or any sales of securities will be made in accordance with the requirements of the Securities Act of 1933, as amended. This presentation has been prepared primarily for security analysts and investors in the hope that it will serve as a convenient and useful reference document. The format of this document may change in the future as we continue to try to meet the needs of security analysts and investors. This document is not intended for use in connection with any sale, offer to sell, or solicitation of any offer to buy securities. This presentation includes various estimates of EBITDA which is a non-GAAP financial measure. Please see the fourth quarter 2015 Dominion Midstream Press Release for a reconciliation to GAAP. Please continue to regularly check Dominion’s website at www.dom.com/investors and Dominion Midstream’s website at www.dommidstream.com/investors. 2/1/2016

Important Note to Investors Cont.’d Additional information and where to find it This communication may be deemed to be solicitation material in respect of the merger Questar into Dominion. In connection with the merger, Questar intends to file relevant materials with the SEC, including a proxy statement in preliminary and definitive form. INVESTORS OF QUESTAR ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT QUESTAR AND THE MERGER. Investors may obtain a free copy of these materials (when they are available) and other documents filed by Questar with the SEC at the SEC’s website at www.sec.gov, at Questar’s website at www.questar.com or by sending a written request to Questar at Questar Corporation, Corporate Secretary, 333 South State St., P.O. Box 45433, Salt Lake City, UT 84145-0433. Security holders may also read and copy any reports, statements and other information filed by Questar with the SEC, at the SEC public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 or visit the SEC’s website for further information on its public reference room. Participants in the solicitation Dominion, Questar and certain of their respective directors, executive officers and other persons may be deemed to be participants in the solicitation of proxies in respect of the transaction. Information regarding Dominion’s directors and executive officers is available in Dominion’s proxy statement filed with the SEC on March 23, 2015 in connection with its 2015 annual meeting of stockholders, and information regarding Questar’s directors and executive officers is available in Questar’s proxy statement filed with the SEC on April 17, 2015 in connection with its 2015 annual meeting of shareholders. Other information regarding persons who may be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials to be filed with the SEC when they become available. 2/1/2016

Transaction Overview and Strategic Rationale Tom Farrell 2/1/2016

Transaction Overview Dominion Resources and Questar Corporation (NYSE: STR) to combine in a $4.4 billion equity value transaction Consideration of $25 per share in cash represents a ~30% premium to Questar shareholders based on 20-trading day volume-weighted average price $6.0 billion enterprise value transaction Includes the assumption of ~$1.6 billion of debt Anticipated closing by year end 2016 Subject to customary regulatory approvals, Questar shareholder approval, and clearance under Hart-Scott-Rodino 2/1/2016 Please refer to page 3 for risks and uncertainties related to projections and forward looking statements.

Strategic Rationale Well-aligned with Dominion and Dominion Midstream’s strategic focus ~70% of Questar’s current EBITDA is MLP-eligible (~$425 million) Combination of integrated natural gas asset profiles with extensive supply, transportation, storage and distribution experience Enhanced scale and diversification into constructive regulatory jurisdictions Favorable business and regulatory climate in UT, WY and ID Positions Dominion to take advantage of growing need for gas generation to meet carbon and renewable targets Conservative financing plan 2/1/2016

Strategic Rationale Complementary cultures of commitment to communities and employees Well-managed operations Conduct business with integrity and honesty Provide safe and reliable service Excellent business risk profile Gas utility: Low risk margins through constructive regulation Gas pipeline: Long-term contract profile with credit-worthy counterparties Regulated gas supply: Regulated-cost of service model for 35 years 2/1/2016 (Cont.’d)

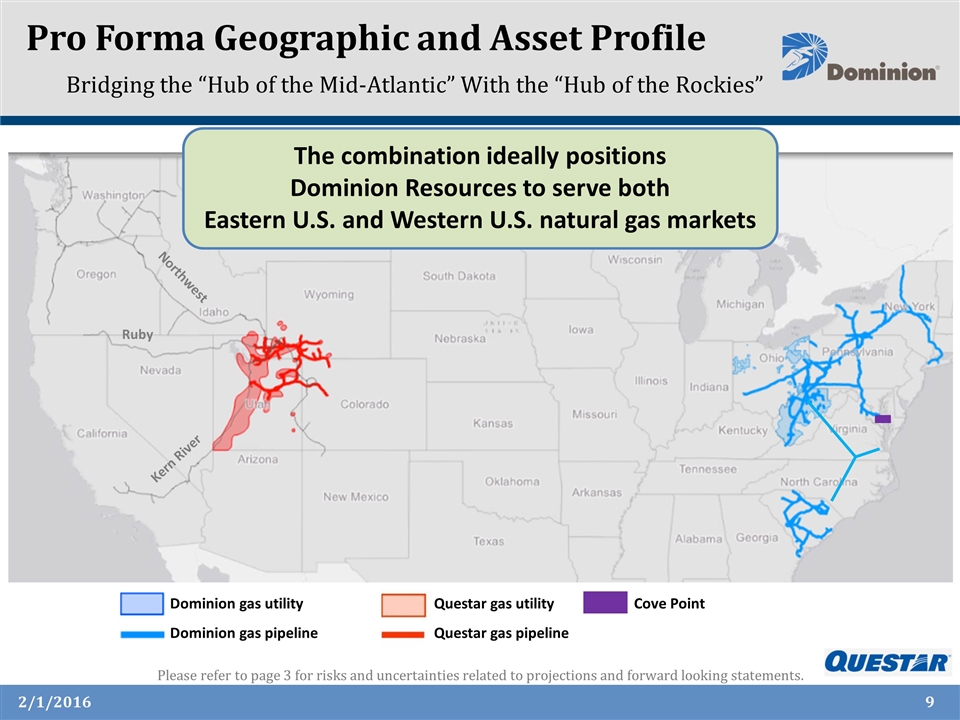

Pro Forma Geographic and Asset Profile Bridging the “Hub of the Mid-Atlantic” With the “Hub of the Rockies” The combination ideally positions Dominion Resources to serve both Eastern U.S. and Western U.S. natural gas markets 2/1/2016 Please refer to page 3 for risks and uncertainties related to projections and forward looking statements. Questar gas pipeline Dominion gas utility Dominion gas pipeline Questar gas utility Cove Point Northwest Ruby Kern River

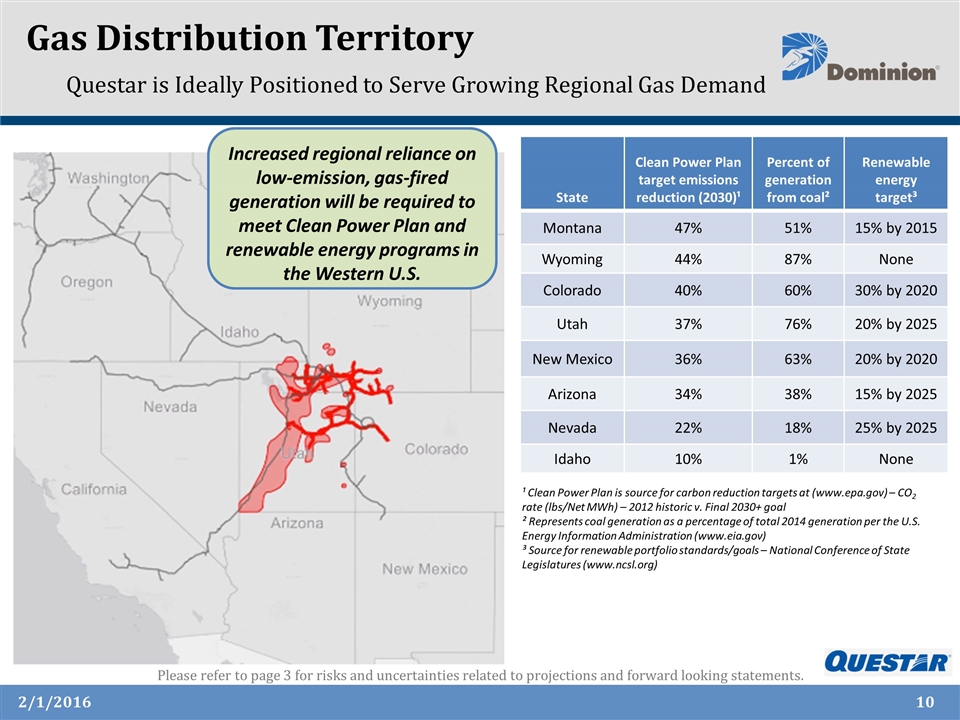

Gas Distribution Territory Questar is Ideally Positioned to Serve Growing Regional Gas Demand 2/1/2016 Please refer to page 3 for risks and uncertainties related to projections and forward looking statements. ¹ Clean Power Plan is source for carbon reduction targets at (www.epa.gov) – CO2 rate (lbs/Net MWh) – 2012 historic v. Final 2030+ goal ² Represents coal generation as a percentage of total 2014 generation per the U.S. Energy Information Administration (www.eia.gov) ³ Source for renewable portfolio standards/goals – National Conference of State Legislatures (www.ncsl.org) State Clean Power Plan target emissions reduction (2030)¹ Percent of generation from coal² Renewable energy target³ Montana 47% 51% 15% by 2015 Wyoming 44% 87% None Colorado 40% 60% 30% by 2020 Utah 37% 76% 20% by 2025 New Mexico 36% 63% 20% by 2020 Arizona 34% 38% 15% by 2025 Nevada 22% 18% 25% by 2025 Idaho 10% 1% None Increased regional reliance on low-emission, gas-fired generation will be required to meet Clean Power Plan and renewable energy programs in the Western U.S.

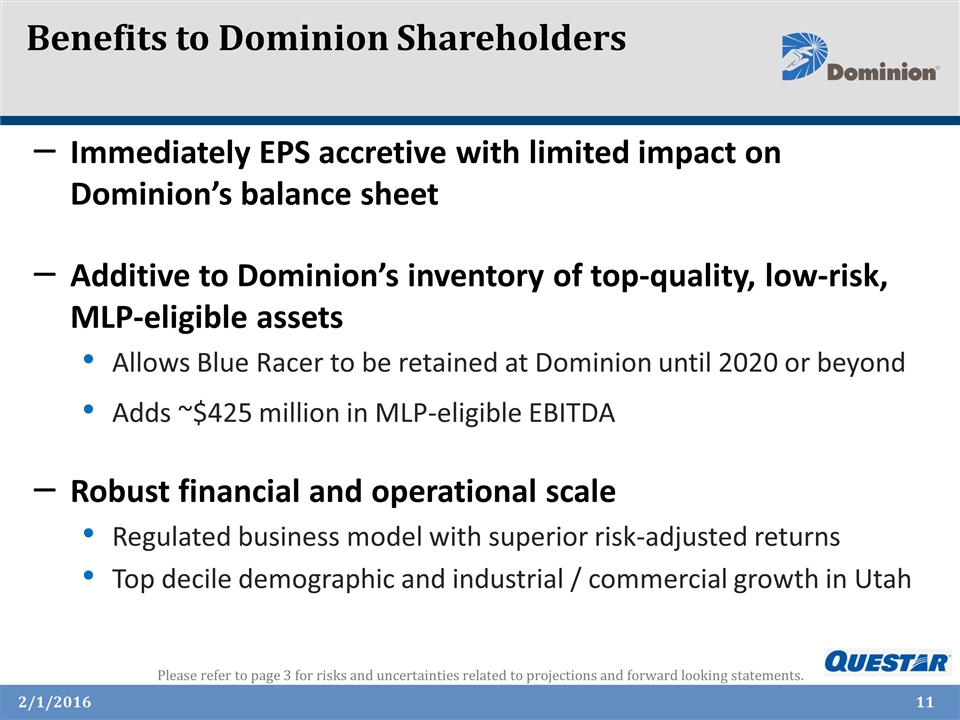

Benefits to Dominion Shareholders Immediately EPS accretive with limited impact on Dominion’s balance sheet Additive to Dominion’s inventory of top-quality, low-risk, MLP-eligible assets Allows Blue Racer to be retained at Dominion until 2020 or beyond Adds ~$425 million in MLP-eligible EBITDA Robust financial and operational scale Regulated business model with superior risk-adjusted returns Top decile demographic and industrial / commercial growth in Utah 2/1/2016

Combined Company Profile and Financial Outlook Mark McGettrick 2/1/2016

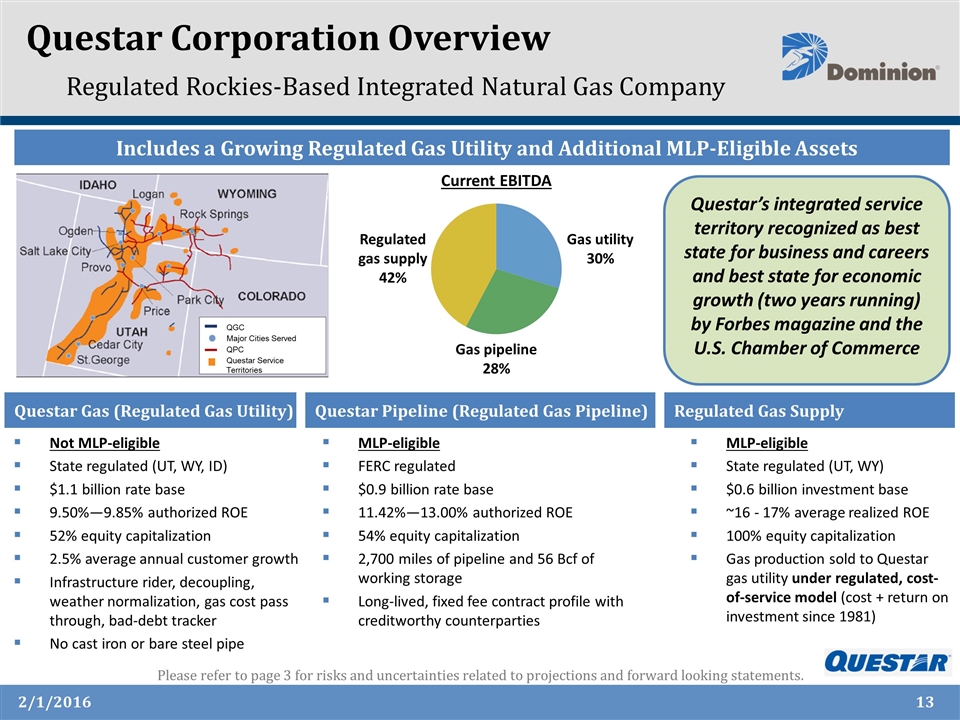

Questar Corporation Overview Regulated Rockies-Based Integrated Natural Gas Company Includes a Growing Regulated Gas Utility and Additional MLP-Eligible Assets Questar Gas (Regulated Gas Utility) Questar Pipeline (Regulated Gas Pipeline) State-regulated LDC 95% State regulated 86% Please refer to page 3 for risks and uncertainties related to projections and forward looking statements. Not MLP-eligible State regulated (UT, WY, ID) $1.1 billion rate base 9.50%—9.85% authorized ROE 52% equity capitalization 2.5% average annual customer growth Infrastructure rider, decoupling, weather normalization, gas cost pass through, bad-debt tracker No cast iron or bare steel pipe MLP-eligible FERC regulated $0.9 billion rate base 11.42%—13.00% authorized ROE 54% equity capitalization 2,700 miles of pipeline and 56 Bcf of working storage Long-lived, fixed fee contract profile with creditworthy counterparties MLP-eligible State regulated (UT, WY) $0.6 billion investment base ~16 - 17% average realized ROE 100% equity capitalization Gas production sold to Questar gas utility under regulated, cost-of-service model (cost + return on investment since 1981) Regulated Gas Supply Current EBITDA Gas pipeline 28% Gas utility 30% Regulated gas supply 42% 2/1/2016 Questar’s integrated service territory recognized as best state for business and careers and best state for economic growth (two years running) by Forbes magazine and the U.S. Chamber of Commerce QGC Major Cities Served QPC Questar Service Territories

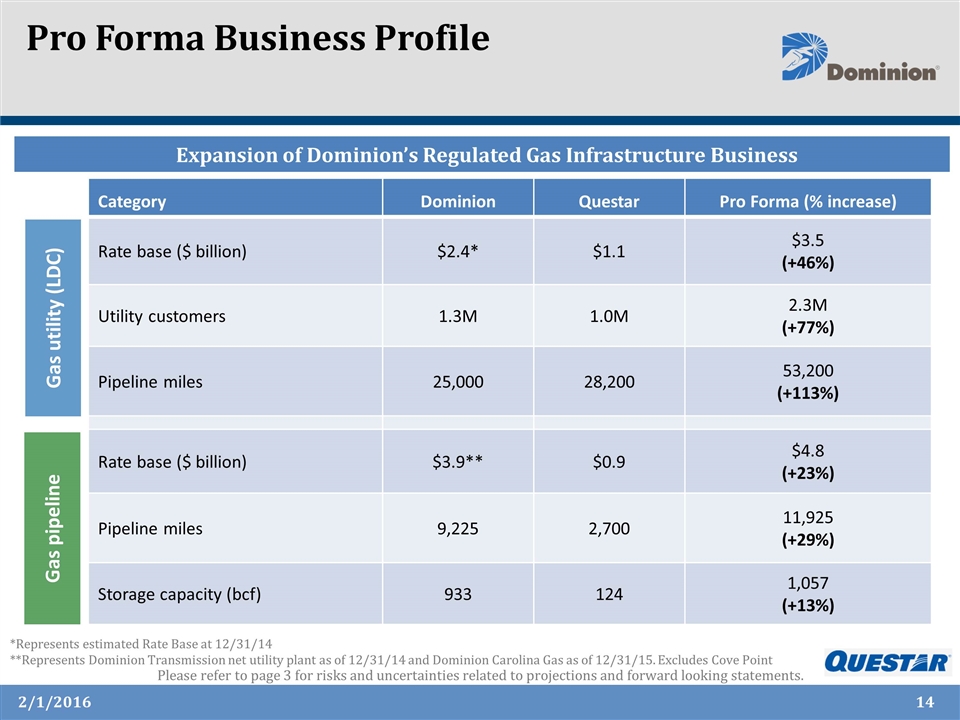

Pro Forma Business Profile 63% 6% 58% 13% 2/1/2016 Please refer to page 3 for risks and uncertainties related to projections and forward looking statements. 63% 6% 10% 56% 14% 9% Expansion of Dominion’s Regulated Gas Infrastructure Business *Represents estimated Rate Base at 12/31/14 **Represents Dominion Transmission net utility plant as of 12/31/14 and Dominion Carolina Gas as of 12/31/15. Excludes Cove Point Category Dominion Questar Pro Forma (% increase) Rate base ($ billion) $2.4* $1.1 $3.5 (+46%) Utility customers 1.3M 1.0M 2.3M (+77%) Pipeline miles 25,000 28,200 53,200 (+113%) Rate base ($ billion) $3.9** $0.9 $4.8 (+23%) Pipeline miles 9,225 2,700 11,925 (+29%) Storage capacity (bcf) 933 124 1,057 (+13%) Gas utility (LDC) Gas pipeline

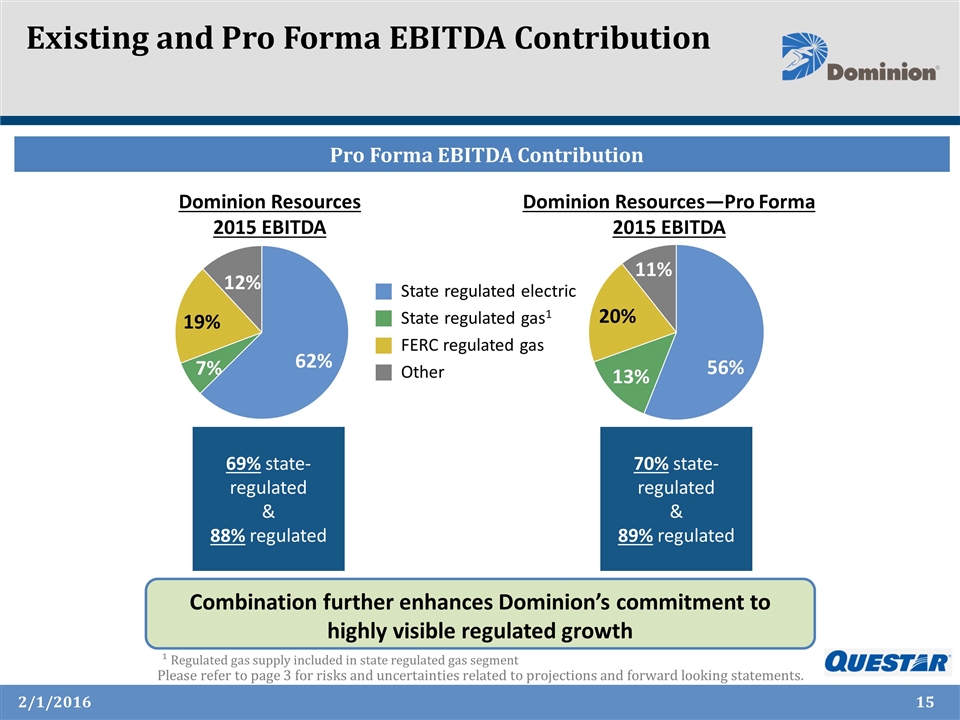

Existing and Pro Forma EBITDA Contribution 63% 6% 58% 13% Combination further enhances Dominion’s commitment to highly visible regulated growth 2/1/2016 Please refer to page 3 for risks and uncertainties related to projections and forward looking statements. Dominion Resources 2015 EBITDA State regulated electric State regulated gas1 FERC regulated gas Other Dominion Resources—Pro Forma 2015 EBITDA 56% 14% 9% 69% state-regulated & 88% regulated 70% state-regulated & 89% regulated Pro Forma EBITDA Contribution ¹ Regulated gas supply included in state regulated gas segment

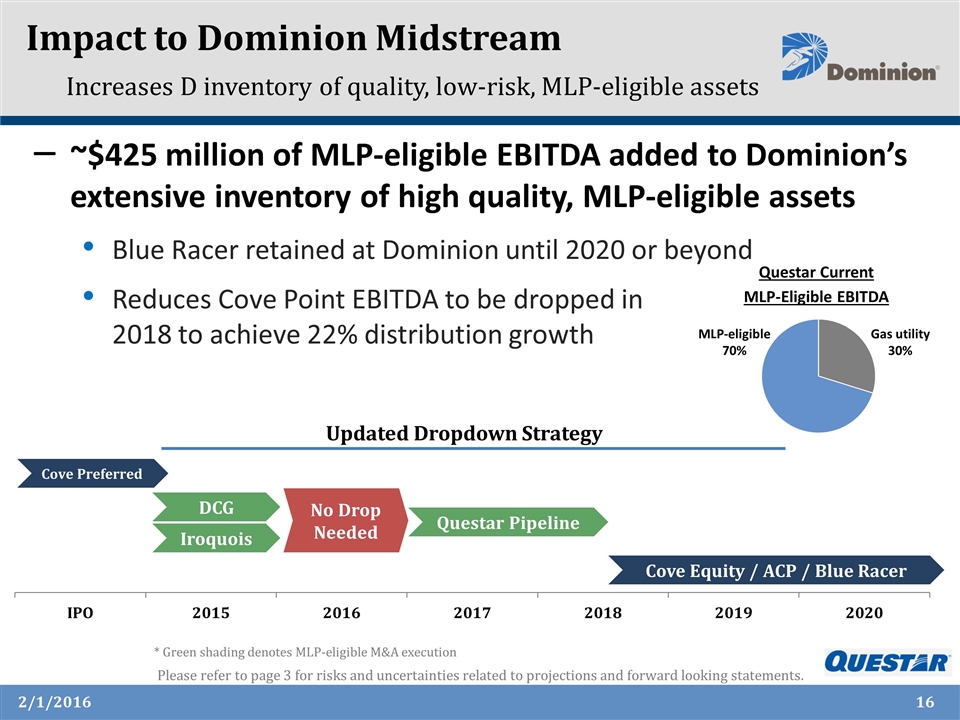

Impact to Dominion Midstream Increases D inventory of quality, low-risk, MLP-eligible assets ~$425 million of MLP-eligible EBITDA added to Dominion’s extensive inventory of high quality, MLP-eligible assets Blue Racer retained at Dominion until 2020 or beyond Updated Dropdown Strategy DCG Cove Preferred Cove Equity / ACP / Blue Racer Questar Pipeline * Green shading denotes MLP-eligible M&A execution 2/1/2016 Questar Current MLP-Eligible EBITDA Gas utility 30% MLP-eligible 70% Reduces Cove Point EBITDA to be dropped in 2018 to achieve 22% distribution growth Iroquois No Drop Needed

Financing and Financial Impact 2/1/2016 Prudently financed in line with our previously stated credit ratings targets D Equity D Mandatory Convertibles Accretive to Dominion EPS Supportive of 2017 earnings per share growth rate and allows Dominion to achieve or exceed the top end of our expected 2018 growth rate D Debt DM Equity

Concluding Remarks Tom Farrell 2/1/2016 Questar will be a premium-quality addition to Dominion and Dominion Midstream’s portfolio Consistent with strategic focus on core energy infrastructure Additive to Dominion’s significant inventory of top-quality, low-risk, MLP-eligible assets Enhances the regulated and predictable nature of Dominion natural gas infrastructure operations and cash flows Enhances scale and diversification into premium regulatory jurisdictions Please refer to page 3 for risks and uncertainties related to projections and forward looking statements.

2/1/2016