Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ALLIANCE DATA SYSTEMS CORP | form_8k.htm |

©2016 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | January 28, 2016 Alliance Data NYSE: ADS 2015 ResultsJanuary 28, 2016 Exhibit 99.1

©2016 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | January 28, 2016 Agenda Speakers: Ed Heffernan President and CEO Charles Horn EVP and CFO Fourth Quarter and 2015 Consolidated ResultsSegment Results2015 Wrap-up2016 Guidance 1

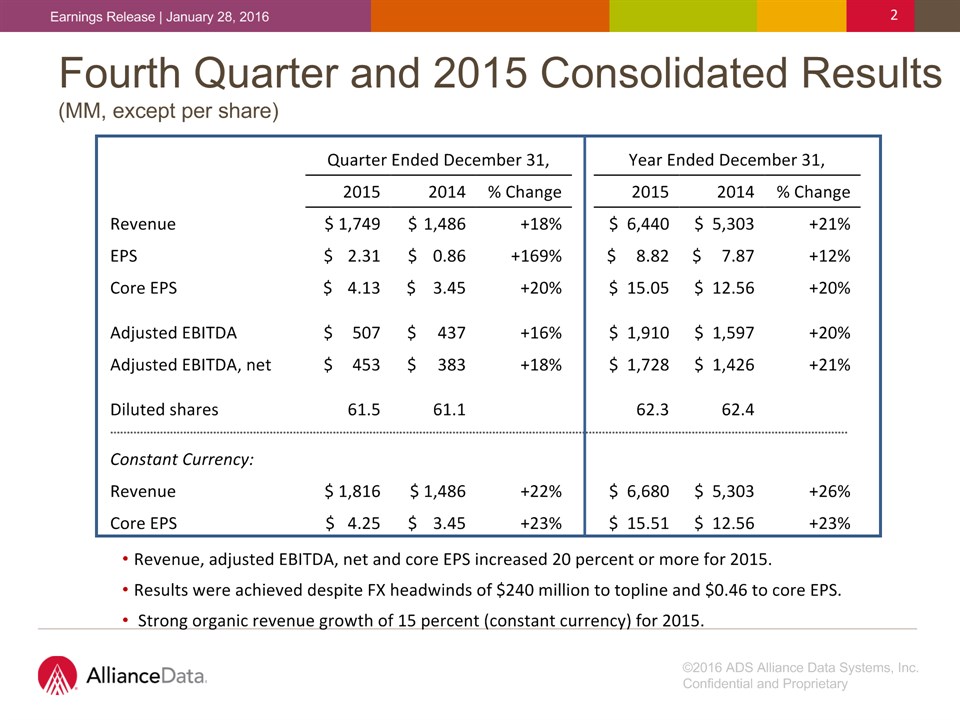

©2016 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | January 28, 2016 Fourth Quarter and 2015 Consolidated Results(MM, except per share) Quarter Ended December 31, Quarter Ended December 31, Quarter Ended December 31, Year Ended December 31, Year Ended December 31, Year Ended December 31, 2015 2014 % Change 2015 2014 % Change Revenue $ 1,749 $ 1,486 +18% $ 6,440 $ 5,303 +21% EPS $ 2.31 $ 0.86 +169% $ 8.82 $ 7.87 +12% Core EPS $ 4.13 $ 3.45 +20% $ 15.05 $ 12.56 +20% Adjusted EBITDA $ 507 $ 437 +16% $ 1,910 $ 1,597 +20% Adjusted EBITDA, net $ 453 $ 383 +18% $ 1,728 $ 1,426 +21% Diluted shares 61.5 61.1 62.3 62.4 ****************************************************************************************************************************************************************************************************************************** ****************************************************************************************************************************************************************************************************************************** ****************************************************************************************************************************************************************************************************************************** ****************************************************************************************************************************************************************************************************************************** ****************************************************************************************************************************************************************************************************************************** ****************************************************************************************************************************************************************************************************************************** ****************************************************************************************************************************************************************************************************************************** ****************************************************************************************************************************************************************************************************************************** Constant Currency: Revenue $ 1,816 $ 1,486 +22% $ 6,680 $ 5,303 +26% Core EPS $ 4.25 $ 3.45 +23% $ 15.51 $ 12.56 +23% Revenue, adjusted EBITDA, net and core EPS increased 20 percent or more for 2015.Results were achieved despite FX headwinds of $240 million to topline and $0.46 to core EPS. Strong organic revenue growth of 15 percent (constant currency) for 2015. 2

©2016 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | January 28, 2016 LoyaltyOne® (MM) 4 percent issuance growth in Canada despite difficult macro environment for 2015. $45 million in North America backlog for BrandLoyalty. Quarter Ended December 31, Quarter Ended December 31, Quarter Ended December 31, Year Ended December 31, Year Ended December 31, Year Ended December 31, 2015 2014 % Change 2015 2014 % Change Revenue $ 364 $ 398 -9% $ 1,353 $ 1,407 -4% Adjusted EBITDA 86 115 -25% 302 351 -14% Non-controlling interest -13 -19 -31 -43 Adjusted EBITDA, net $ 73 $ 96 -23% $ 271 $ 308 -12% Adjusted EBITDA % 24% 29% -5% 22% 25% -3% Constant Currency Revenue $ 421 $ 398 +6% $ 1,587 $ 1,407 +13% Adjusted EBITDA $ 99 $ 115 -13% $ 352 $ 351 -% Average CDN FX rate 0.75 0.88 -15% 0.78 0.91 -14% Average Euro FX rate 1.09 1.25 -13% 1.11 1.33 -17% 3

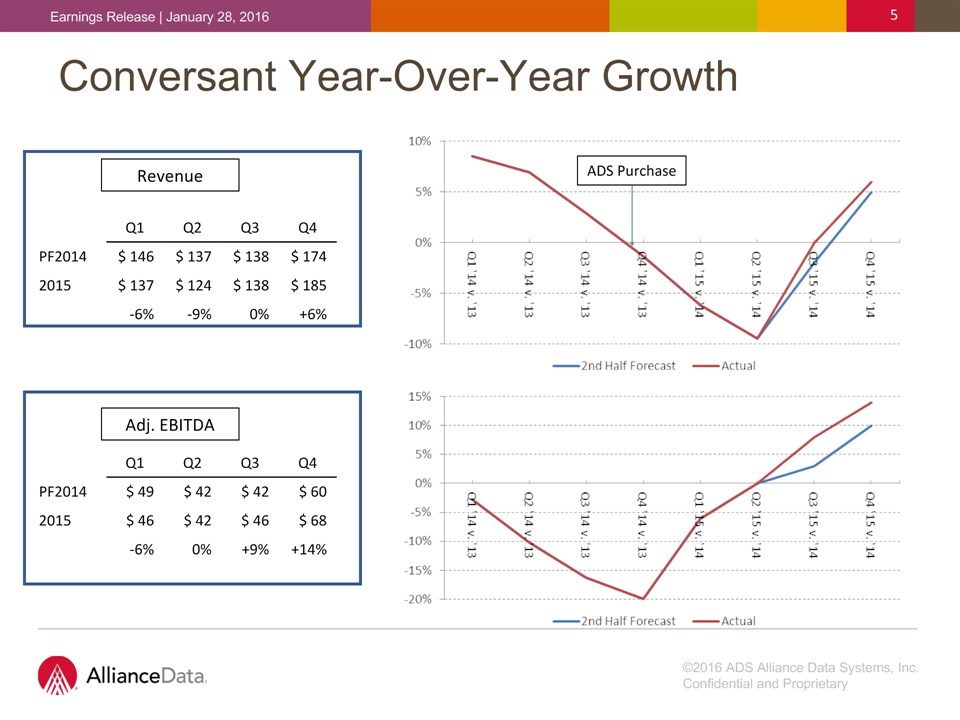

©2016 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | January 28, 2016 Epsilon® (MM) Organic revenue and adjusted EBITDA increased 7 percent and 5 percent, respectively, for 4th quarter. Organic topline growth accelerated as year progressed from 4 percent in Q2 to 5 percent in Q3 to 7 percent in Q4. Conversant revenue turned from pro-forma declines of -6 percent in Q1 and -9 percent in Q2 to flat in Q3 and growth of 6 percent for Q4.Similar to the revenue trend, Conversant’s adjusted EBITDA moved from a pro-forma decline of -6 percent in Q1 to flat in Q2 to growth of 9 percent in Q3 and 14 percent in Q4.Record backlog over $90 million for Conversant at year-end. Quarter Ended December 31, Quarter Ended December 31, Quarter Ended December 31, Year Ended December 31, Year Ended December 31, Year Ended December 31, 2015 2014 % Change 2015 2014 % Change Revenue $ 608 $ 440 +38% $ 2,141 $ 1,522 +41% Adjusted EBITDA $ 157 $ 102 +54% $ 508 $ 309 +64% Adjusted EBITDA % 26% 23% +3% 24% 20% +4% 4

©2016 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | January 28, 2016 Conversant Year-Over-Year Growth Revenue Adj. EBITDA ADS Purchase 5 Q1 Q2 Q3 Q4 PF2014 $ 146 $ 137 $ 138 $ 174 2015 $ 137 $ 124 $ 138 $ 185 -6% -9% 0% +6% Q1 Q2 Q3 Q4 PF2014 $ 49 $ 42 $ 42 $ 60 2015 $ 46 $ 42 $ 46 $ 68 -6% 0% +9% +14%

©2016 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | January 28, 2016 Card Services (MM) Quarter Ended December 31, Quarter Ended December 31, Quarter Ended December 31, Year Ended December 31, Year Ended December 31, Year Ended December 31, 2015 2014 % Change 2015 2014 % Change Revenue $ 785 $ 654 +20% $ 2,974 $ 2,395 +24% Operating expenses* 291 264 +10% 1,086 920 +18% Provision for loan losses 206 143 +44% 668 425 +57% Funding costs 42 35 +20% 151 129 +17% Adjusted EBITDA, net $ 246 $ 212 +16% $ 1,069 $ 921 +16% Adjusted EBITDA, net % 31% 33% -2% 36% 38% -2% 6 Continued strong growth in revenue and adjusted EBITDA, net.Core spending (pre-2012 programs) remains strong, up 11 percent for the 4th quarter.Estimated tender share gains of ~200 basis points for the 4th quarter. Operating efficiencies mitigated gross yield compression during the 4th quarter.Provision build is due to strong card receivables growth coupled with an increase in loss rates. * Excludes regulatory settlement charges.

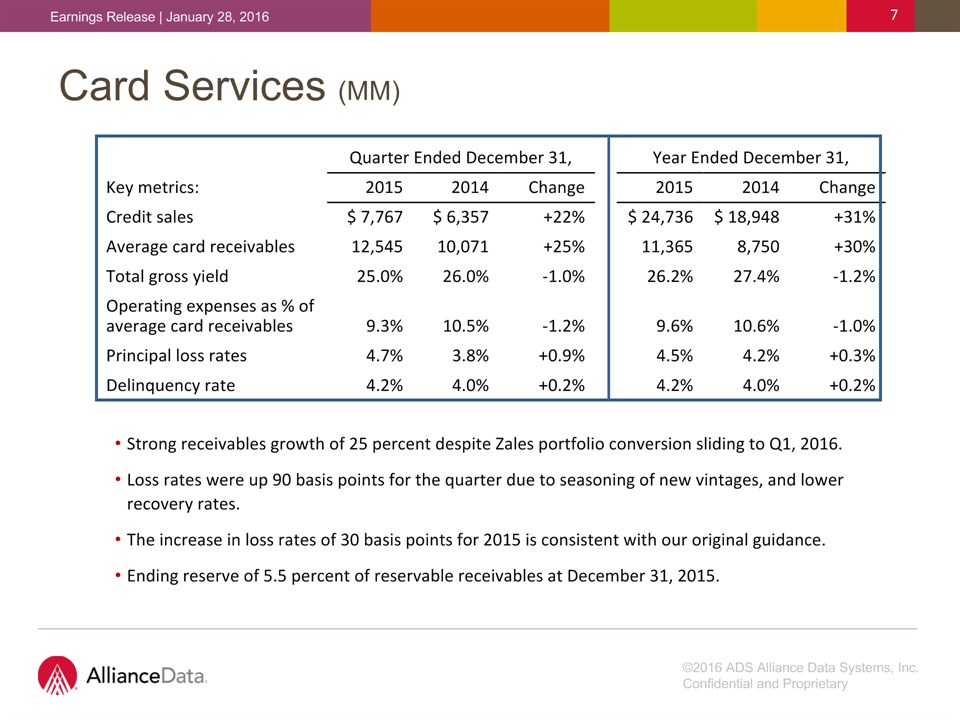

©2016 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | January 28, 2016 Card Services (MM) Strong receivables growth of 25 percent despite Zales portfolio conversion sliding to Q1, 2016.Loss rates were up 90 basis points for the quarter due to seasoning of new vintages, and lower recovery rates. The increase in loss rates of 30 basis points for 2015 is consistent with our original guidance. Ending reserve of 5.5 percent of reservable receivables at December 31, 2015. Quarter Ended December 31, Quarter Ended December 31, Quarter Ended December 31, Year Ended December 31, Year Ended December 31, Year Ended December 31, Key metrics: 2015 2014 Change 2015 2014 Change Credit sales $ 7,767 $ 6,357 +22% $ 24,736 $ 18,948 +31% Average card receivables 12,545 10,071 +25% 11,365 8,750 +30% Total gross yield 25.0% 26.0% -1.0% 26.2% 27.4% -1.2% Operating expenses as % of average card receivables 9.3% 10.5% -1.2% 9.6% 10.6% -1.0% Principal loss rates 4.7% 3.8% +0.9% 4.5% 4.2% +0.3% Delinquency rate 4.2% 4.0% +0.2% 4.2% 4.0% +0.2% 7

©2016 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | January 28, 2016 2015 Wrap-up (+) AIR MILES®: key metric, AIR MILES issued, up 4 percent.(-) AIR MILES: constant currency revenue up 1 percent, adjusted EBITDA down 6 percent.(+) BrandLoyalty: constant currency revenue up 31 percent, adjusted EBITDA up 15 percent.(+) BrandLoyalty: successful launch in North America (Canada). (+/-) Brazil (Dotz): membership up 20 percent to 17.5 million aided by Rio launch; substantial FX headwinds (BRL/USD down 33 percent).(+) Organic top and bottom-line growth of 5 percent.(+) Organic top-line growth accelerated as year progressed.(+) Opening of India office should facilitate revenue growth to EBITDA flow-thru in 2016.(-) Conversant: full year financial performance soft.(+) Conversant: momentum very strong.(+) Credit sales up 31 percent, average card receivables up 30 percent, revenue up 24 percent and adjusted EBITDA, net up 16 percent. A tremendous year. (+) Over 150 basis point pickup in tender share.(+) Another $2 billion vintage of new clients signed. (+) Principal loss rates seasoned as expected; consistent with mid-4 percent original guidance. 8 ®

©2016 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | January 28, 2016 (+) Revenue, adjusted EBITDA, net and core EPS all up +20 percent for the year.(+) Organic top-line growth of 11 percent or 4x GDP (15 percent on a constant currency basis).(-) FX: reduced revenue by $240 million and core EPS by $0.46 for year.(+) Strong momentum going into 2016. 2015 Wrap-up 9

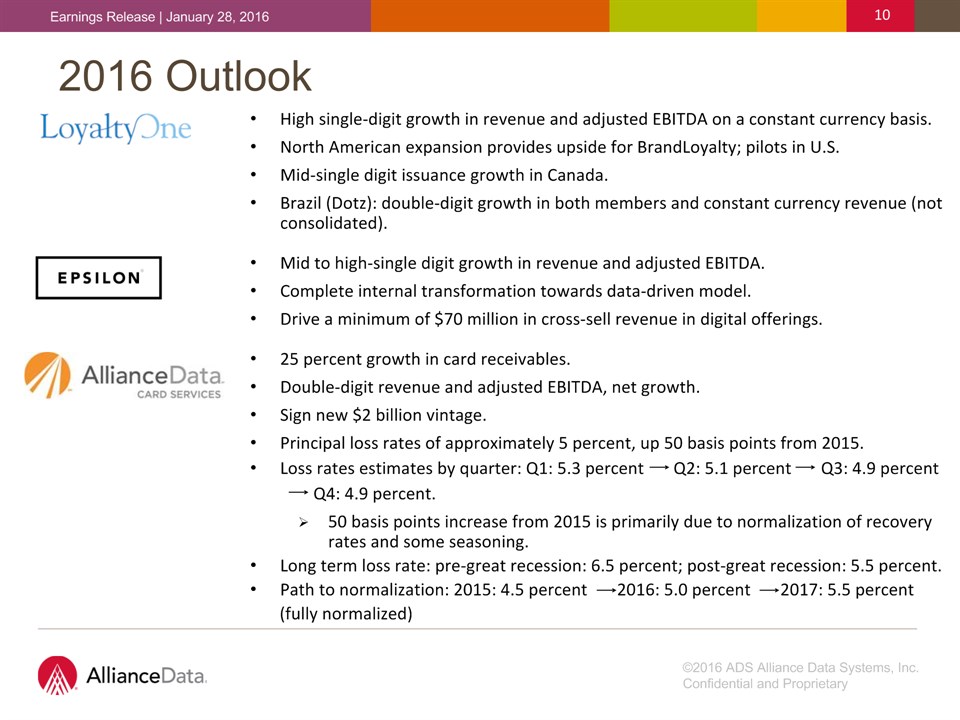

©2016 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | January 28, 2016 2016 Outlook High single-digit growth in revenue and adjusted EBITDA on a constant currency basis.North American expansion provides upside for BrandLoyalty; pilots in U.S.Mid-single digit issuance growth in Canada.Brazil (Dotz): double-digit growth in both members and constant currency revenue (not consolidated).Mid to high-single digit growth in revenue and adjusted EBITDA. Complete internal transformation towards data-driven model.Drive a minimum of $70 million in cross-sell revenue in digital offerings.25 percent growth in card receivables.Double-digit revenue and adjusted EBITDA, net growth.Sign new $2 billion vintage. Principal loss rates of approximately 5 percent, up 50 basis points from 2015. Loss rates estimates by quarter: Q1: 5.3 percent Q2: 5.1 percent Q3: 4.9 percent Q4: 4.9 percent.50 basis points increase from 2015 is primarily due to normalization of recovery rates and some seasoning.Long term loss rate: pre-great recession: 6.5 percent; post-great recession: 5.5 percent.Path to normalization: 2015: 4.5 percent 2016: 5.0 percent 2017: 5.5 percent (fully normalized) 10

©2016 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | January 28, 2016 2016 Guidance($MM, except per share) 2015 2016 ’16 / ’15 Increase Actual Constant Currency Revenue $ 6,440 $ 7,200 +12% Core EPS $ 15.05 $ 17.00 +13% Diluted shares outstanding 62.3 61 - 62 CDN$ 0.78 Euro 1.11 11 Double-digit revenue and core EPS growth.Organic revenue growth above 3x GDP target.~ $1.4 billion in free cash flow.FX headwinds to continue, but at lower levels than 2015.

©2016 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | January 28, 2016 Q & A

©2016 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | January 28, 2016 Forward-Looking StatementsThis presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements give our expectations or forecasts of future events and can generally be identified by the use of words such as “believe,” “expect,” “anticipate,” “estimate,” “intend,” “project,” “plan,” “likely,” “may,” “should” or other words or phrases of similar import. Similarly, statements that describe our business strategy, outlook, objectives, plans, intentions or goals also are forward-looking statements. Examples of forward-looking statements include, but are not limited to, statements we make regarding our expected operating results, future economic conditions including currency exchange rates, and the guidance we give with respect to our anticipated financial performance. We believe that our expectations are based on reasonable assumptions. Forward-looking statements, however, are subject to a number of risks and uncertainties that could cause actual results to differ materially from the projections, anticipated results or other expectations expressed in this release, and no assurances can be given that our expectations will prove to have been correct. These risks and uncertainties include, but are not limited to, factors set forth in the Risk Factors section in our Annual Report on Form 10-K for the most recently ended fiscal year, which may be updated in Item 1A of, or elsewhere in, our Quarterly Reports on Form 10-Q filed for periods subsequent to such Form 10-K. Our forward-looking statements speak only as of the date made, and we undertake no obligation, other than as required by applicable law, to update or revise any forward-looking statements, whether as a result of new information, subsequent events, anticipated or unanticipated circumstances or otherwise.

©2016 ADS Alliance Data Systems, Inc. Confidential and Proprietary Earnings Release | January 28, 2016 Financial Measures In addition to the results presented in accordance with generally accepted accounting principles, or GAAP, the Company may present financial measures that are non-GAAP measures, such as constant currency financial measures, adjusted EBITDA, adjusted EBITDA margin, adjusted EBITDA, net of funding costs and non-controlling interest, core earnings and core earnings per diluted share (core EPS). The Company believes that these non-GAAP financial measures, viewed in addition to and not in lieu of the Company’s reported GAAP results, provide useful information to investors regarding the Company’s performance and overall results of operations. These metrics are an integral part of the Company’s internal reporting to measure the performance of reportable segments and the overall effectiveness of senior management. Reconciliations to comparable GAAP financial measures are available in the accompanying schedules and on the Company’s website. The financial measures presented are consistent with the Company’s historical financial reporting practices. Core earnings and core earnings per diluted share represent performance measures and are not intended to represent liquidity measures. The non-GAAP financial measures presented herein may not be comparable to similarly titled measures presented by other companies, and are not identical to corresponding measures used in other various agreements or public filings.