Attached files

| file | filename |

|---|---|

| 8-K - 8-K / 425 - Leidos Holdings, Inc. | d92386d8k.htm |

| EX-99.1 - EX-99.1 - Leidos Holdings, Inc. | d92386dex991.htm |

©

Leidos. All rights reserved. Leidos + Lockheed Martin’s

Information Systems & Global

Solutions Business A New Leader in US Government IT Services January 26, 2016 Exhibit 99.2 |

Cautionary Statement Regarding Forward Looking Statements The forward looking statements contained in this document involve risks and uncertainties that may affect Leidos Holdings, Inc.’s (“Leidos”) operations, markets, products, services, prices and other factors as discussed in filings with the Securities and Exchange Commission (the “SEC”). These risks and uncertainties include, but are not limited to, economic, competitive, legal, governmental and technological factors. Accordingly, there is no assurance that the expectations of Leidos will be realized. This document also contains statements about the proposed business combination transaction between Leidos and Lockheed Martin Corporation (“Lockheed Martin”), in which Lockheed Martin will separate a substantial portion of its government information technology infrastructure services business and its technical services business, which have been realigned in the Information Systems & Global Solutions (IS&GS) business segment, and combine this business with Leidos in a Reverse Morris Trust transaction (the “Transaction”). Many factors could cause actual results to differ materially from these forward-looking statements with respect to the Transaction, including risks relating to the completion of the transaction on anticipated terms and timing, including obtaining stockholder and regulatory approvals, anticipated tax treatment, the dependency of any split-off transaction on market conditions and the value to be received in any split-off transaction, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the new combined company’s operations, Leidos’ ability to integrate the businesses successfully and to achieve anticipated synergies, and the risk that disruptions from the Transaction will harm Leidos’ business. While the list of factors presented here is considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Leidos’ consolidated financial condition, results of operations or liquidity. For a discussion identifying additional important factors that could cause actual results to vary materially from those anticipated in the forward-looking statements, see Leidos’ filings with the SEC, including “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” in Leidos’ annual report on Form 10-K for the year ended January 30, 2015, and in its quarterly reports on Form 10-Q which are available at http://www.Leidos.com and at the SEC’s web site at http://www.sec.gov. Leidos assumes no obligation to provide revisions or updates to any forward-looking statements should circumstances change, except as otherwise required by securities and other applicable laws. Additional Information and Where to Find It In connection with the proposed transaction, Abacus Innovations Corporation, a wholly-owned subsidiary of Lockheed Martin created for the Transaction (“Spinco”), will file with the SEC a registration statement on Form S-4/S-1 containing a prospectus and Leidos will file with the SEC a proxy statement on Schedule 14A and a registration statement on Form S-4 containing a prospectus. INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ THE REGISTRATION STATEMENTS/PROSPECTUSES AND PROXY STATEMENT WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PARTIES AND THE PROPOSED TRANSACTION. Investors and security holders may obtain a free copy of the prospectuses and proxy statement (when available) and other documents filed with the SEC by Lockheed Martin, Spinco and Leidos at the SEC’s web site at http://www.sec.gov. Free copies of these documents, once available, and each of the companies’ other filings with the SEC, may also be obtained from Leidos’ web site at http://www.Leidos.com. This communication is not a solicitation of a proxy from any investor or security holder. However, Leidos, Lockheed Martin, and certain of their respective directors, executive officers and other members of management and employees, may be deemed to be participants in the solicitation of proxies from stockholders of Leidos in respect of the proposed transaction under the rules of the SEC. Information regarding Leidos’ directors and executive officers is available in Leidos’ 2014 Annual Report on Form 10-K filed with the SEC on March 25, 2015, and in its definitive proxy statement for its annual meeting of stockholders filed on April 17, 2015. Information regarding Lockheed Martin’s directors and executive officers is available in Lockheed Martin’s 2014 Annual Report on Form 10-K filed with the SEC on February 9, 2015, and in its definitive proxy statement for its annual meeting of stockholders filed on March 13, 2015. These documents can be obtained free of charge from the sources indicated above. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the registration statements, prospectuses and proxy statement and other relevant materials to be filed with the SEC when they become available. This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Legal Disclosures

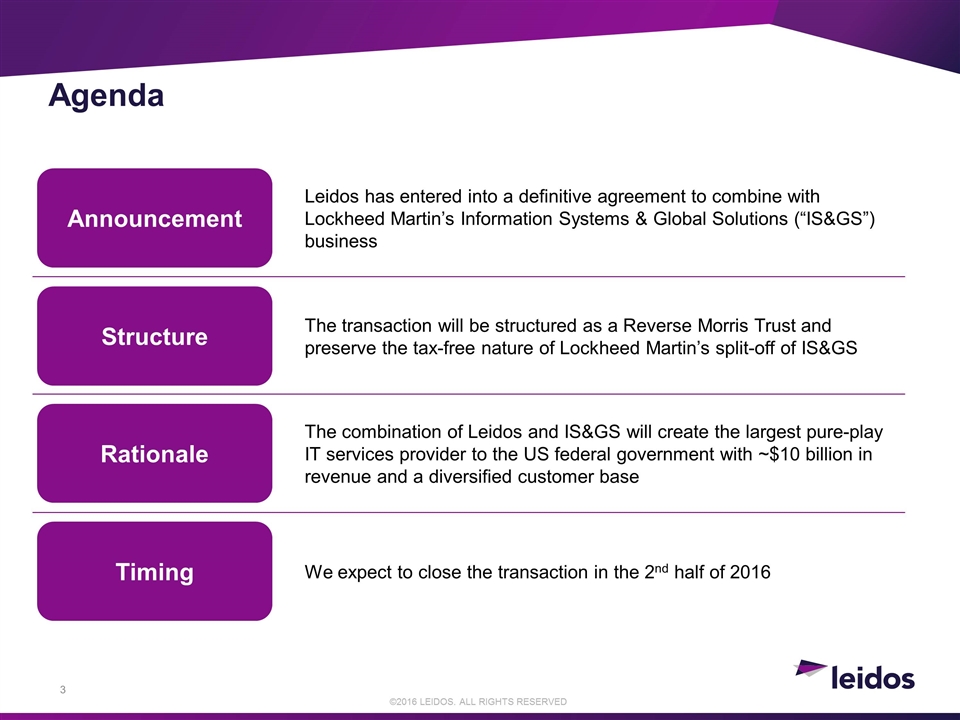

Agenda Announcement Leidos has entered into a definitive agreement to combine with Lockheed Martin’s Information Systems & Global Solutions (“IS&GS”) business Structure The transaction will be structured as a Reverse Morris Trust and preserve the tax-free nature of Lockheed Martin’s split-off of IS&GS Rationale The combination of Leidos and IS&GS will create the largest pure-play IT services provider to the US federal government with ~$10 billion in revenue and a diversified customer base Timing We expect to close the transaction in the 2nd half of 2016

Marillyn Hewson Chairman, President, and CEO Lockheed Martin Roger Krone Chairman and CEO Leidos Jim Reagan CFO Leidos Management Presenters

Leidos and Lockheed Martin have entered into an agreement whereby Leidos will combine with Lockheed Martin’s IS&GS business, valued at approximately $5 billion, in a Reverse Morris Trust transaction, expected to be tax-free Key Benefits Creates ~$10B revenue industry leader in government services Complementary organizations: customers, capabilities, culture Cost & revenue synergies Leidos and IS&GS: A Powerful Combination

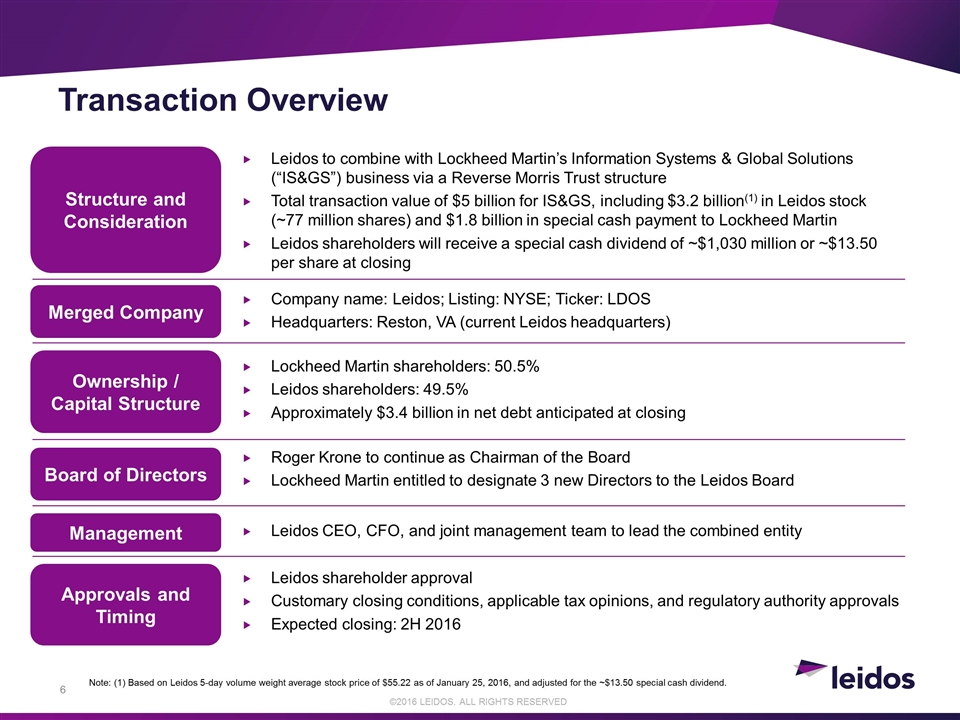

Structure and Consideration Approvals and Timing Leidos to combine with Lockheed Martin’s Information Systems & Global Solutions (“IS&GS”) business via a Reverse Morris Trust structure Total transaction value of $5 billion for IS&GS, including $3.2 billion(1) in Leidos stock (~77 million shares) and $1.8 billion in special cash payment to Lockheed Martin Leidos shareholders will receive a special cash dividend of ~$1,030 million or ~$13.50 per share at closing Roger Krone to continue as Chairman of the Board Lockheed Martin entitled to designate 3 new Directors to the Leidos Board Leidos shareholder approval Customary closing conditions, applicable tax opinions, and regulatory authority approvals Expected closing: 2H 2016 Ownership / Capital Structure Lockheed Martin shareholders: 50.5% Leidos shareholders: 49.5% Approximately $3.4 billion in net debt anticipated at closing Management Leidos CEO, CFO, and joint management team to lead the combined entity Merged Company Company name: Leidos; Listing: NYSE; Ticker: LDOS Headquarters: Reston, VA (current Leidos headquarters) Transaction Overview Note: (1) Based on Leidos 5-day volume weight average stock price of $55.22 as of January 25, 2016, and adjusted for the ~$13.50 special cash dividend. Board of Directors

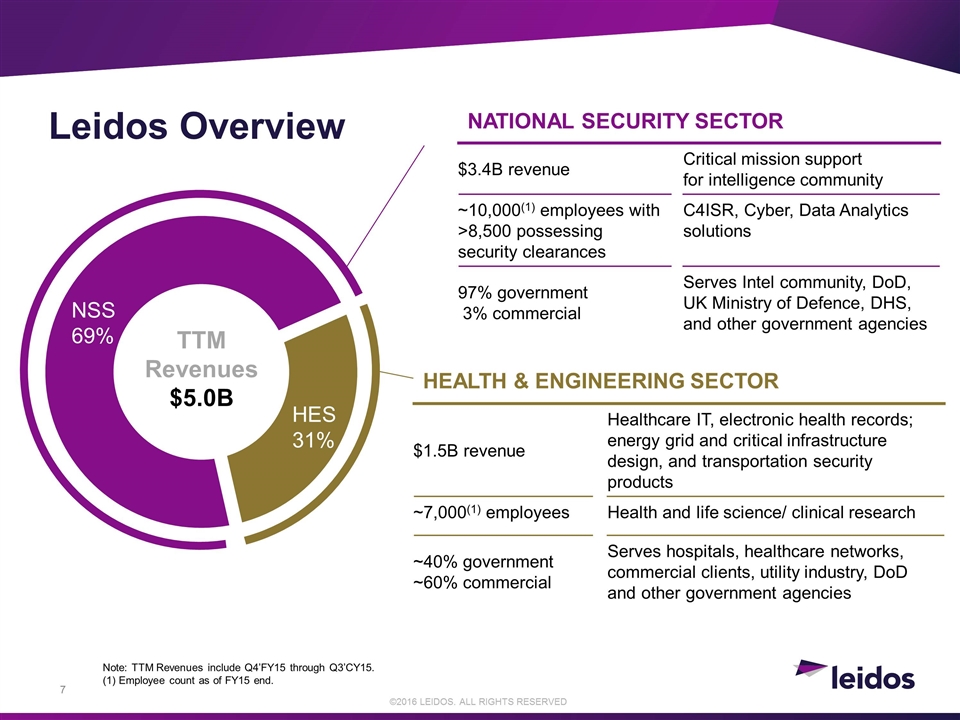

Leidos Overview NATIONAL SECURITY SECTOR HEALTH & ENGINEERING SECTOR $3.4B revenue Critical mission support for intelligence community ~10,000(1) employees with >8,500 possessing security clearances C4ISR, Cyber, Data Analytics solutions 97% government 3% commercial Serves Intel community, DoD, UK Ministry of Defence, DHS, and other government agencies $1.5B revenue Healthcare IT, electronic health records; energy grid and critical infrastructure design, and transportation security products ~7,000(1) employees Health and life science/ clinical research ~40% government ~60% commercial Serves hospitals, healthcare networks, commercial clients, utility industry, DoD and other government agencies Note: TTM Revenues include Q4’FY15 through Q3’CY15. (1) Employee count as of FY15 end. TTM Revenues $5.0B

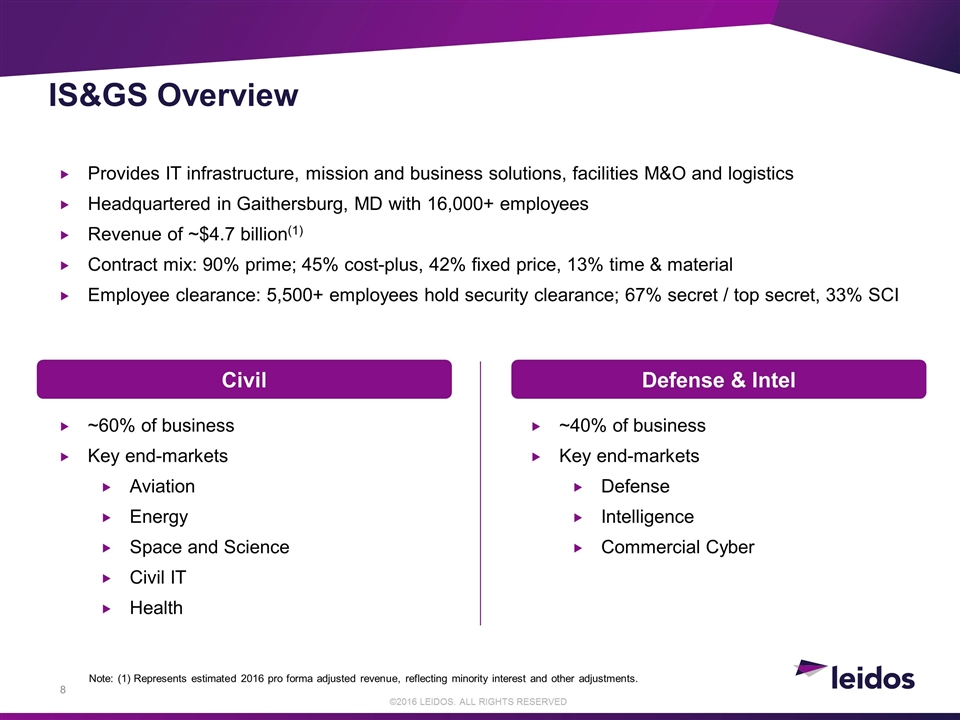

IS&GS Overview Civil Defense & Intel Provides IT infrastructure, mission and business solutions, facilities M&O and logistics Headquartered in Gaithersburg, MD with 16,000+ employees Revenue of ~$4.7 billion(1) Contract mix: 90% prime; 45% cost-plus, 42% fixed price, 13% time & material Employee clearance: 5,500+ employees hold security clearance; 67% secret / top secret, 33% SCI ~60% of business Key end-markets Aviation Energy Space and Science Civil IT Health ~40% of business Key end-markets Defense Intelligence Commercial Cyber Note: (1) Represents estimated 2016 pro forma adjusted revenue, reflecting minority interest and other adjustments.

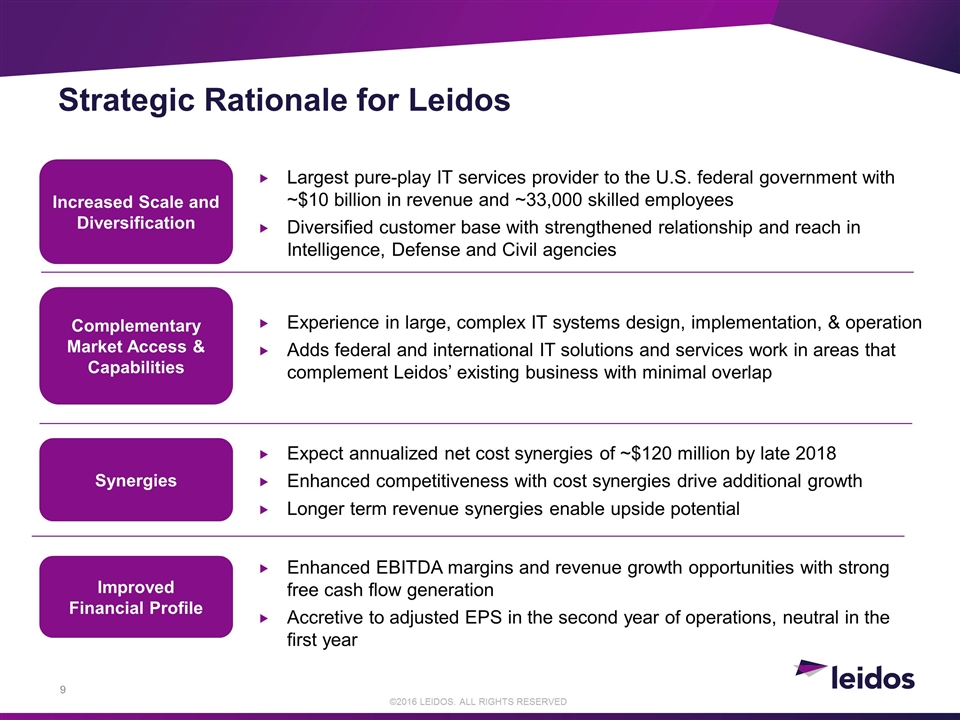

Strategic Rationale for Leidos Increased Scale and Diversification Largest pure-play IT services provider to the U.S. federal government with ~$10 billion in revenue and ~33,000 skilled employees Diversified customer base with strengthened relationship and reach in Intelligence, Defense and Civil agencies Complementary Market Access & Capabilities Experience in large, complex IT systems design, implementation, & operation Adds federal and international IT solutions and services work in areas that complement Leidos’ existing business with minimal overlap Synergies Expect annualized net cost synergies of ~$120 million by late 2018 Enhanced competitiveness with cost synergies drive additional growth Longer term revenue synergies enable upside potential Improved Financial Profile Enhanced EBITDA margins and revenue growth opportunities with strong free cash flow generation Accretive to adjusted EPS in the second year of operations, neutral in the first year

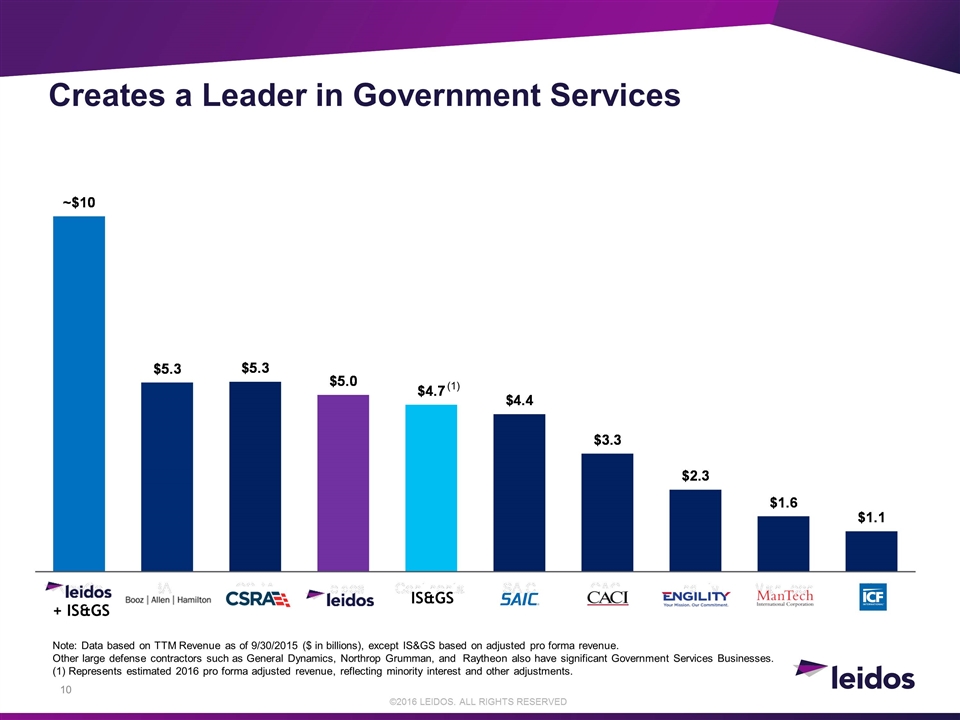

Creates a Leader in Government Services Note: Data based on TTM Revenue as of 9/30/2015 ($ in billions), except IS&GS based on adjusted pro forma revenue. Other large defense contractors such as General Dynamics, Northrop Grumman, and Raytheon also have significant Government Services Businesses. (1) Represents estimated 2016 pro forma adjusted revenue, reflecting minority interest and other adjustments. IS&GS + IS&GS Source: Company filings. (1)

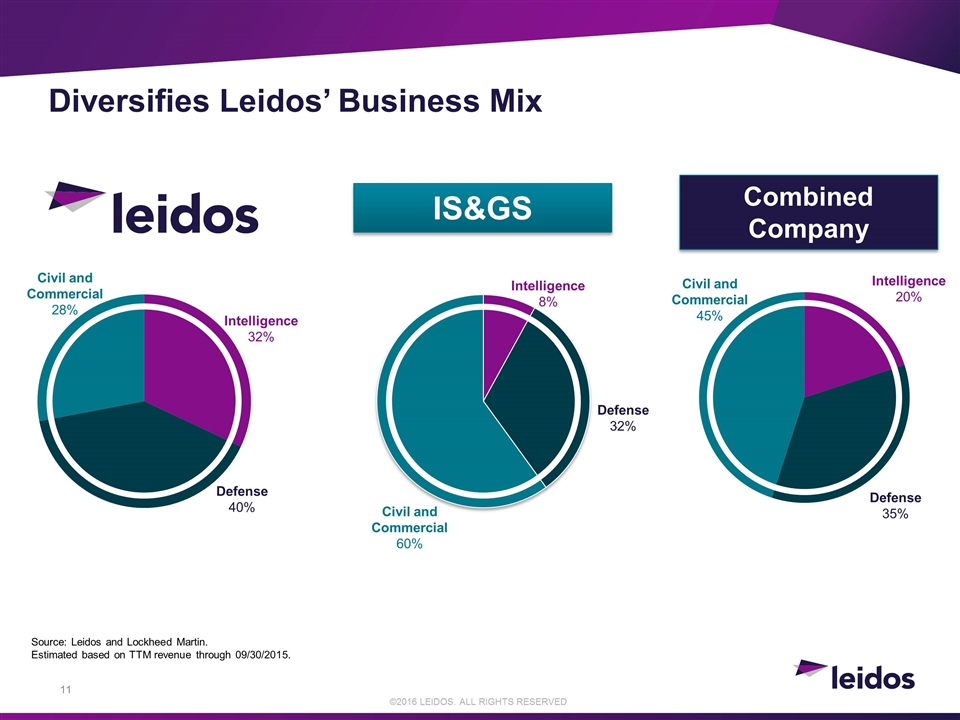

Diversifies Leidos’ Business Mix Source: Leidos and Lockheed Martin. Estimated based on TTM revenue through 09/30/2015. IS&GS Combined Company Civil and Commercial 60% Defense 32% Intelligence 8% Civil and Commercial 45% Defense 35% Intelligence 20% Civil and Commercial 28% Defense 40% Intelligence 32%

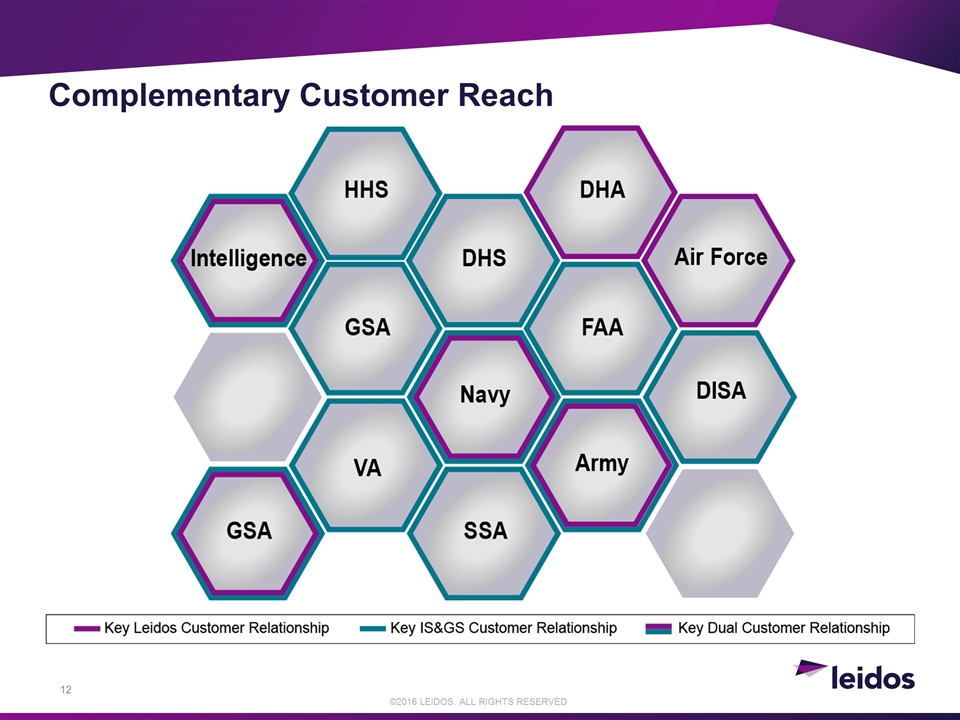

Complementary Customer Reach

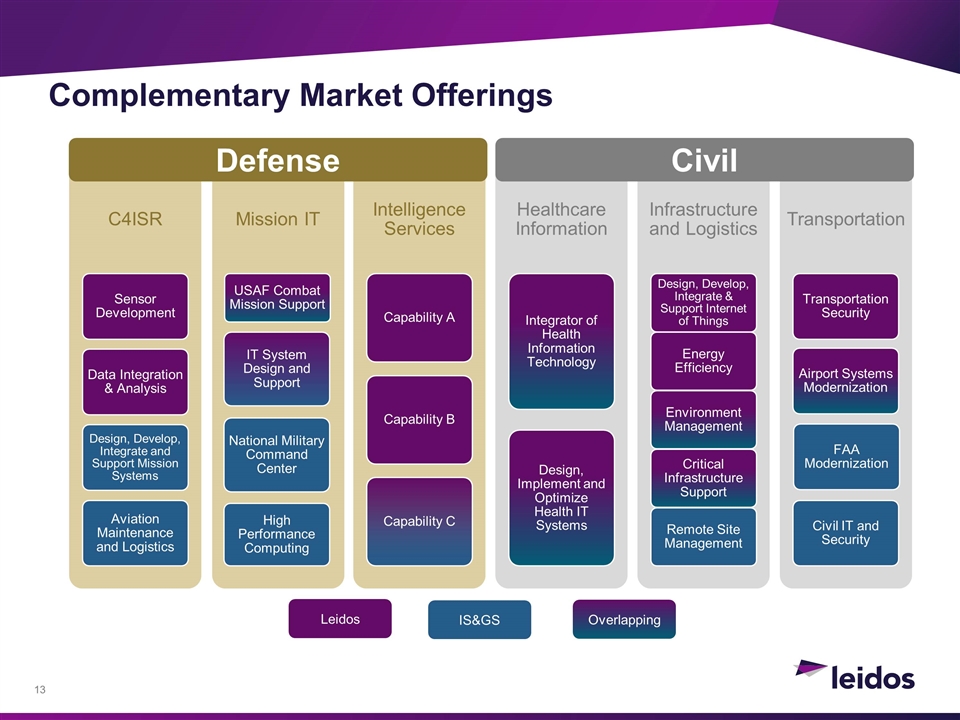

Complementary Market Offerings Leidos IS&GS Overlapping Defense Civil C4ISR Sensor Development Data Integration & Analysis Mission IT USAF Combat Mission Support Healthcare Information Transportation Transportation Security Design, Develop, Integrate and Support Mission Systems Aviation Maintenance and Logistics High Performance Computing National Military Command Center Intelligence Services Capability A Capability B Capability C Integrator of Health Information Technology Design, Implement and Optimize Health IT Systems Infrastructure and Logistics Design, Develop, Integrate & Support Internet of Things Energy Efficiency Environment Management Critical Infrastructure Support Remote Site Management FAA Modernization Airport Systems Modernization Civil IT and Security IT System Design and Support

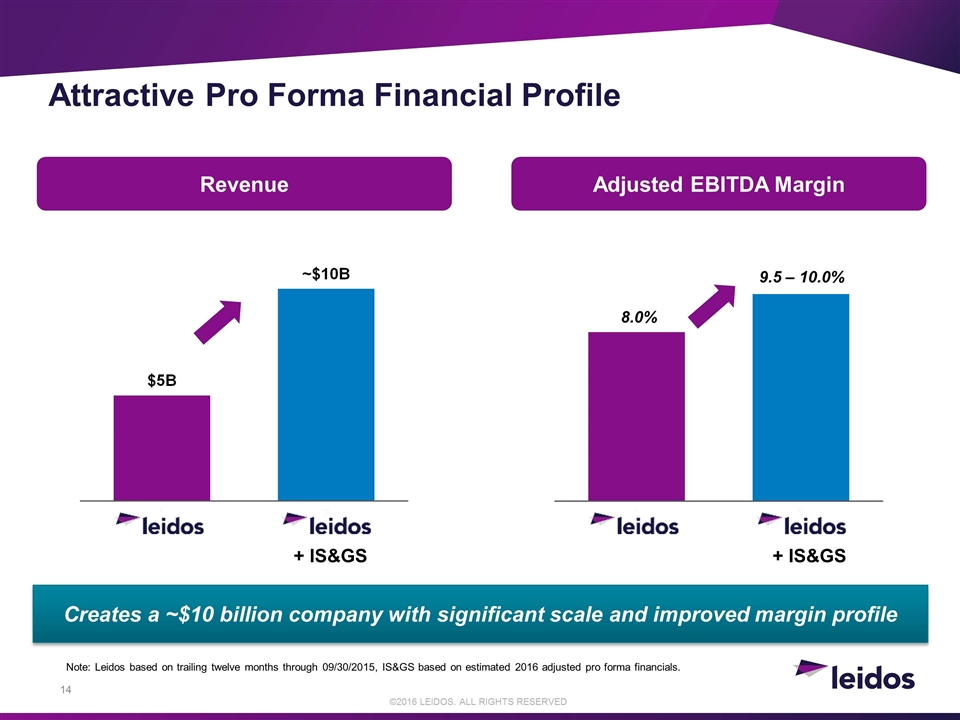

Attractive Pro Forma Financial Profile Creates a ~$10 billion company with significant scale and improved margin profile Note: Leidos based on trailing twelve months through 09/30/2015, IS&GS based on estimated 2016 adjusted pro forma financials. + IS&GS + IS&GS Revenue Adjusted EBITDA Margin 8.0% 9.5 – 10.0%

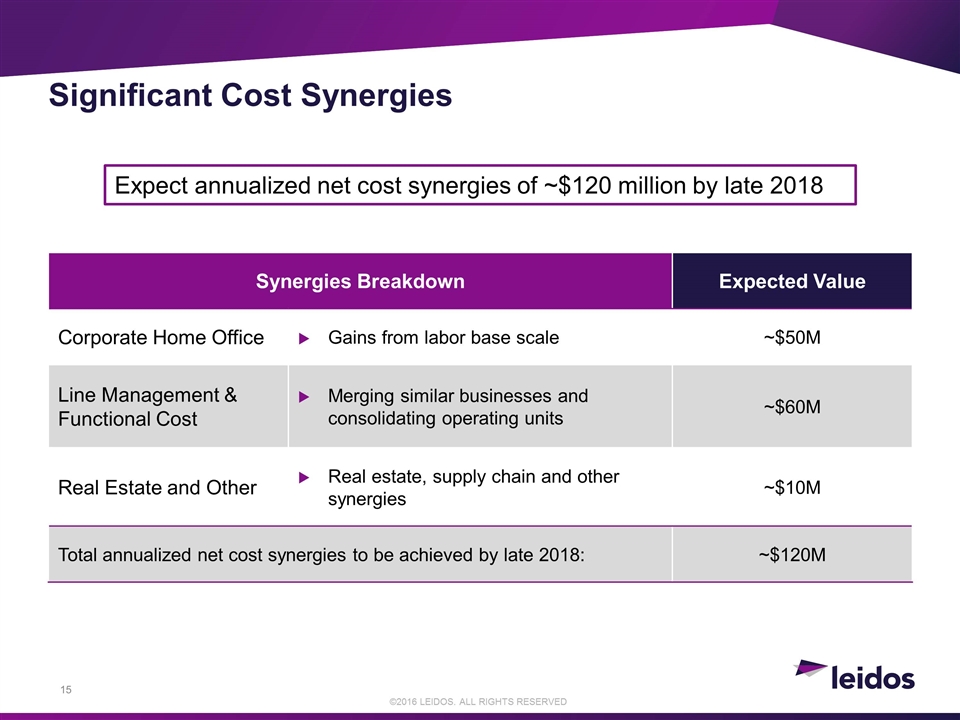

Significant Cost Synergies Synergies Breakdown Expected Value Corporate Home Office Gains from labor base scale ~$50M Line Management & Functional Cost Merging similar businesses and consolidating operating units ~$60M Real Estate and Other Real estate, supply chain and other synergies ~$10M Total annualized net cost synergies to be achieved by late 2018: ~$120M Expect annualized net cost synergies of ~$120 million by late 2018

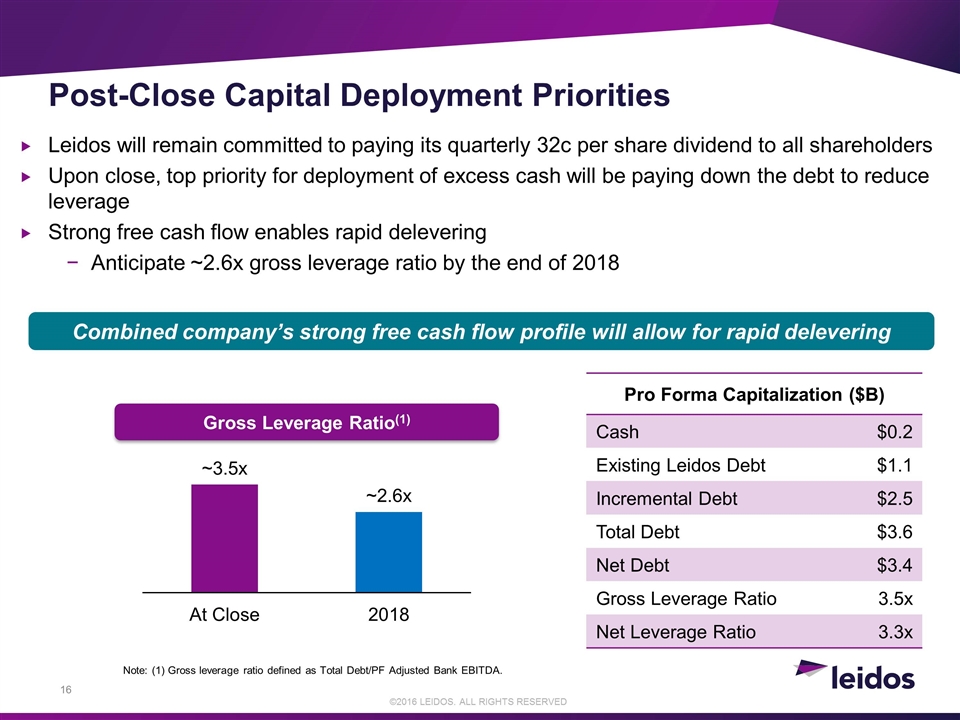

Post-Close Capital Deployment Priorities Gross Leverage Ratio(1) Leidos will remain committed to paying its quarterly 32c per share dividend to all shareholders Upon close, top priority for deployment of excess cash will be paying down the debt to reduce leverage Strong free cash flow enables rapid delevering Anticipate ~2.6x gross leverage ratio by the end of 2018 Combined company’s strong free cash flow profile will allow for rapid delevering Pro Forma Capitalization ($B) Cash $0.2 Existing Leidos Debt $1.1 Incremental Debt $2.5 Total Debt $3.6 Net Debt $3.4 Gross Leverage Ratio 3.5x Net Leverage Ratio 3.3x Note: (1) Gross leverage ratio defined as Total Debt/PF Adjusted Bank EBITDA.

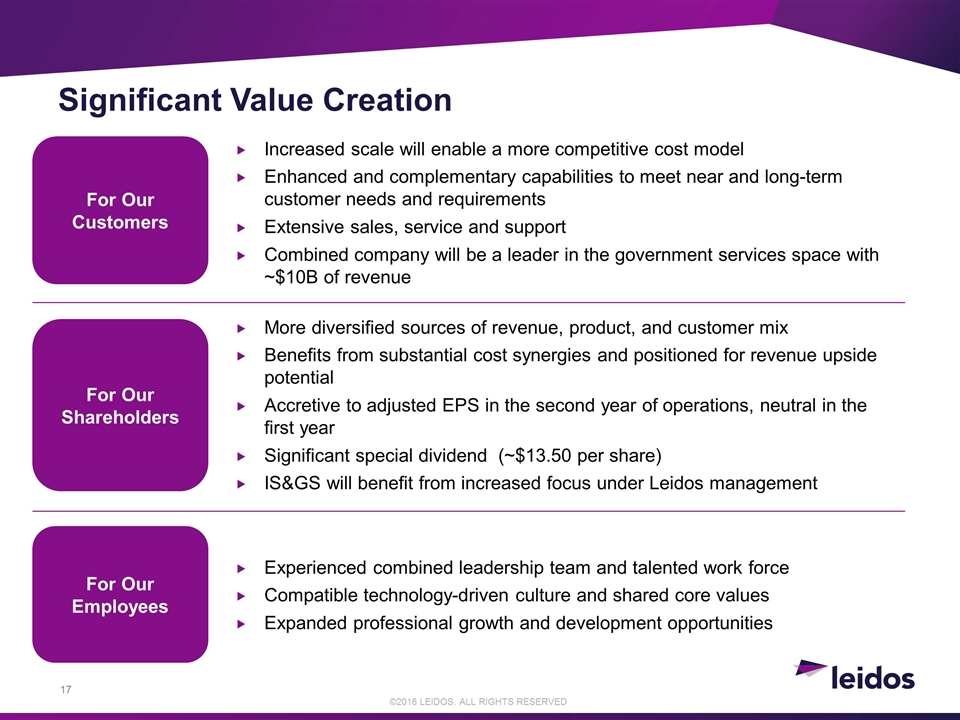

For Our Employees For Our Shareholders More diversified sources of revenue, product, and customer mix Benefits from substantial cost synergies and positioned for revenue upside potential Accretive to adjusted EPS in the second year of operations, neutral in the first year Significant special dividend (~$13.50 per share) IS&GS will benefit from increased focus under Leidos management For Our Customers Increased scale will enable a more competitive cost model Enhanced and complementary capabilities to meet near and long-term customer needs and requirements Extensive sales, service and support Combined company will be a leader in the government services space with ~$10B of revenue Significant Value Creation Experienced combined leadership team and talented work force Compatible technology-driven culture and shared core values Expanded professional growth and development opportunities

File Combined Company S-4/S-1, Leidos Form S-4, and Leidos preliminary proxy statement Next Steps Continue transition and integration planning Hold Investor Day prior to transaction closing