Attached files

| file | filename |

|---|---|

| EX-99.3 - EX-99.3 - Chubb Ltd | d130843dex993.htm |

| EX-99.2 - EX-99.2 - Chubb Ltd | d130843dex992.htm |

| EX-99.1 - EX-99.1 - Chubb Ltd | d130843dex991.htm |

| 8-K - 8-K - Chubb Ltd | d130843d8k.htm |

The Chubb Corporation 2015 Update on Asbestos Reserves Exhibit 99.4

Forward-Looking Statements The following materials contain “forward-looking statements,” including those relating to loss reserves and claim estimates, that are subject to certain risks and uncertainties which could cause actual results to differ materially from those expressed or suggested by such statements. Such risks or uncertainties include but are not limited to those which may be noted more fully in the materials themselves, as well as those discussed or identified from time to time in The Chubb Corporation’s public filings with the Securities and Exchange Commission. Chubb assumes no obligation to update any forward-looking information set forth in the following materials, which speak as of January 26, 2016 or as otherwise specified in the materials.

Contents Purpose of Updated Review Evaluation Methodology Exposure Analysis Asbestos Payments and Reserves Three Year Reserve Comparison Conclusions

Purpose of Review Reassess Chubb’s ultimate liability regarding asbestos exposures using an internal analysis, reviewed by our independent outside consulting actuaries Determine appropriate reserve levels Ensure aggressive case management of asbestos claims manage our exposure identify trends or issues that may impact exposure Provide relevant substantive information requested by investors and rating agencies

Evaluation Methodology Chubb segmented its defendant policyholders into two groups Traditional defendant policyholders (Tiers 1 & 2) Those engaged in asbestos mining, manufacturing and building products industries Peripheral defendant policyholders (Tiers 3 & 4) Those who manufactured, distributed, or installed an asbestos-containing product or who owned or operated a facility where asbestos products were present

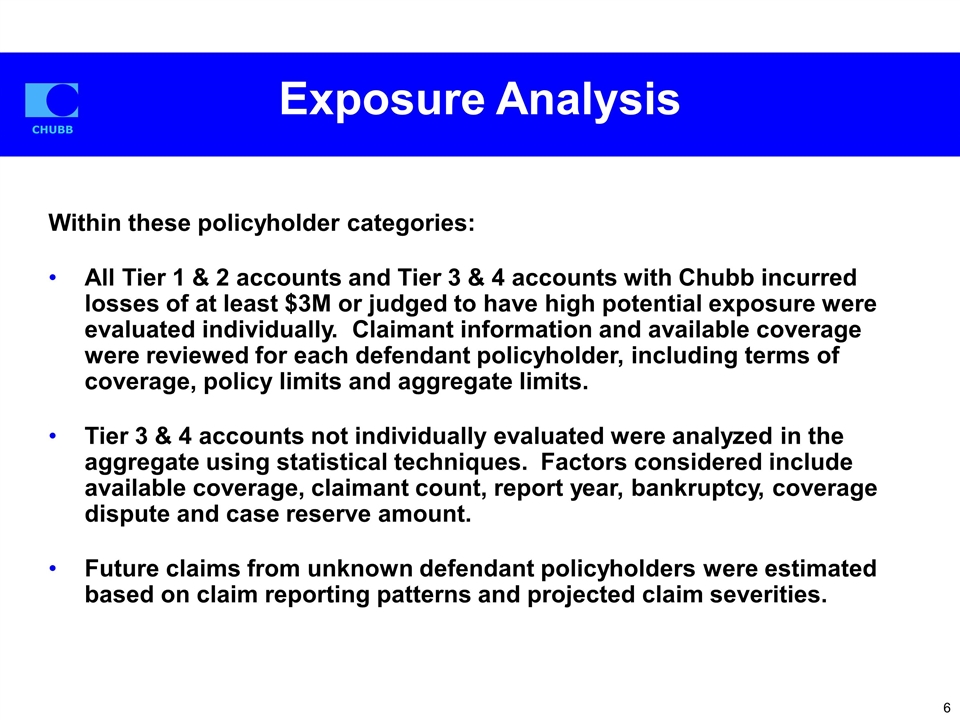

Exposure Analysis Within these policyholder categories: All Tier 1 & 2 accounts and Tier 3 & 4 accounts with Chubb incurred losses of at least $3M or judged to have high potential exposure were evaluated individually. Claimant information and available coverage were reviewed for each defendant policyholder, including terms of coverage, policy limits and aggregate limits. Tier 3 & 4 accounts not individually evaluated were analyzed in the aggregate using statistical techniques. Factors considered include available coverage, claimant count, report year, bankruptcy, coverage dispute and case reserve amount. Future claims from unknown defendant policyholders were estimated based on claim reporting patterns and projected claim severities.

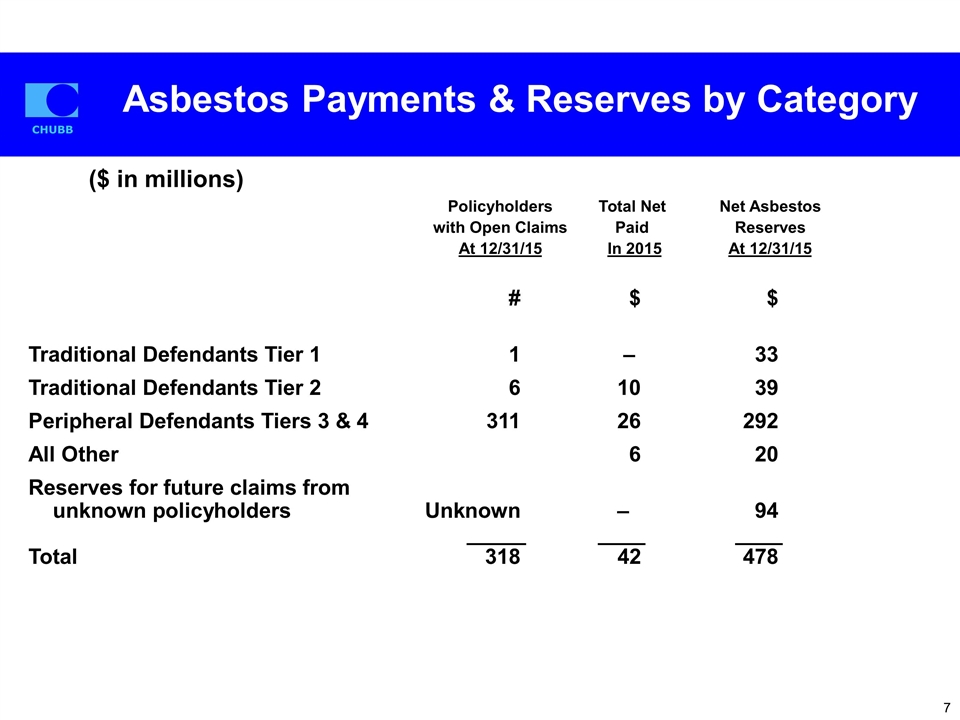

Asbestos Payments & Reserves by Category #$$ Traditional Defendants Tier 1 1 – 33 Traditional Defendants Tier 261039 Peripheral Defendants Tiers 3 & 4311 26 292 All Other 620 Reserves for future claims from unknown policyholders Unknown– 94 _____ ____ ____ Total318 42 478 PolicyholdersTotal NetNet Asbestos with Open ClaimsPaidReserves At 12/31/15 In 2015 At 12/31/15 ($ in millions)

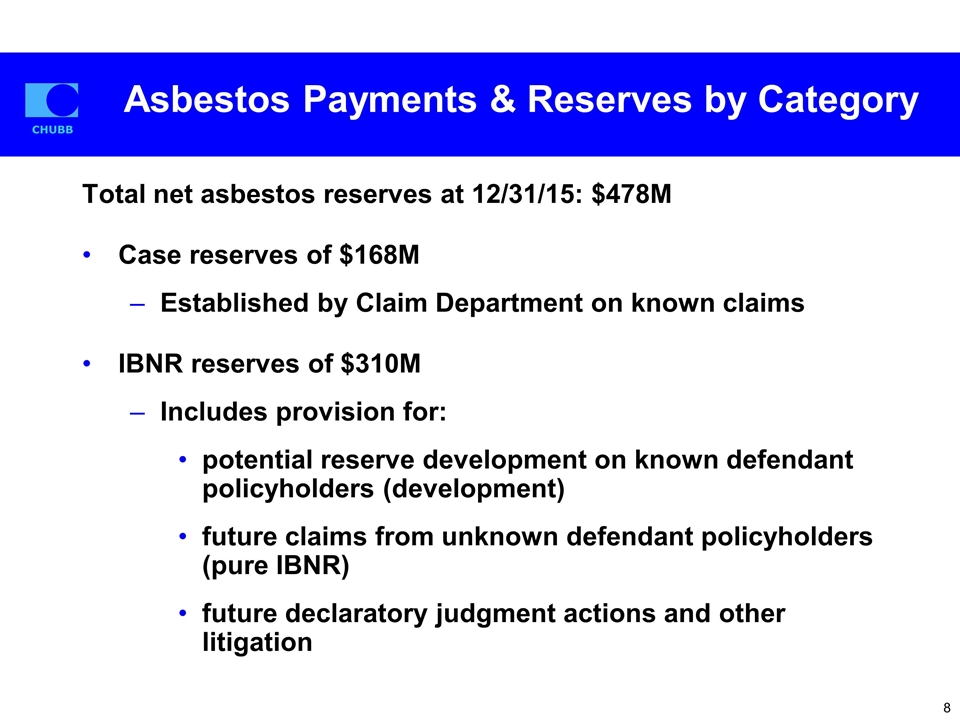

Asbestos Payments & Reserves by Category Total net asbestos reserves at 12/31/15: $478M Case reserves of $168M Established by Claim Department on known claims IBNR reserves of $310M Includes provision for: potential reserve development on known defendant policyholders (development) future claims from unknown defendant policyholders (pure IBNR) future declaratory judgment actions and other litigation

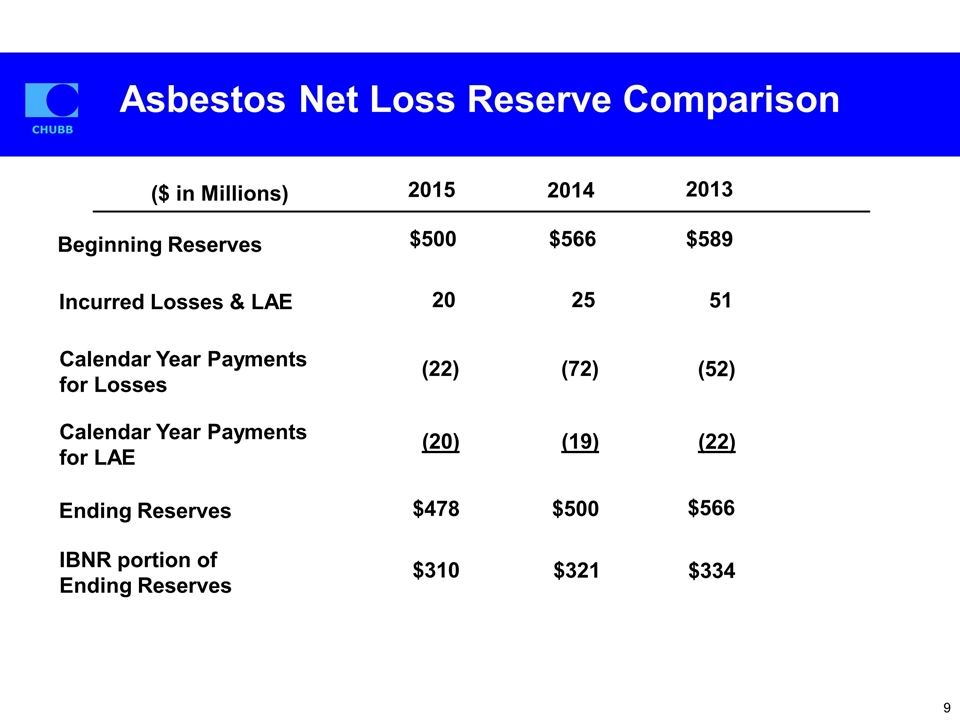

Asbestos Net Loss Reserve Comparison ($ in Millions) 2014 2015 Beginning Reserves $566 Incurred Losses & LAE 25 51 Calendar Year Payments for Losses (72) (52) (19) (22) Ending Reserves $500 $566 IBNR portion of Ending Reserves $310 $321 $589 Calendar Year Payments for LAE 2013 $500 20 (22) (20) $478 $334

Conclusions Chubb’s asbestos net reserves of $478M at 12/31/15 are based on our 2015 analysis of our ultimate asbestos liabilities This reserve represents Chubb’s best estimate of our ultimate asbestos liability at 12/31/15 This reserve amount is at full (undiscounted) value, and no consideration has been given for legislative or judicial relief The net reserve reflects a modest reinsurance recoverable amount of approximately 4% of the gross reserve Net payments for asbestos liabilities in 2015 were $42M Reserves at 12/31/15 calculate to a 3 year survival ratio of 6.9