Attached files

| file | filename |

|---|---|

| 8-K - 4Q2015 EARNINGS RELEASE - ZIONS BANCORPORATION, NATIONAL ASSOCIATION /UT/ | a4q20158-kcoverpage.htm |

| EX-99.1 - FOURTH QUARTER 2015 EARNINGS RESULTS PRESS RELEASE - ZIONS BANCORPORATION, NATIONAL ASSOCIATION /UT/ | a4q20158-kex991.htm |

January 25, 2016 Fourth Quarter 2015 Financial Review

Forward-Looking Statements This presentation contains statements that relate to the projected or modeled performance or condition of Zions Bancorporation and elements of or affecting such performance or condition, including statements with respect to forecasts, opportunities, models, illustrations, scenarios, beliefs, plans, objectives, goals, guidance, expectations, anticipations or estimates, and similar matters. These statements constitute forward- looking information within the meaning of the Private Securities Litigation Reform Act. Actual facts, determinations, results or achievements may differ materially from the statements provided in this presentation since such statements involve significant known and unknown risks and uncertainties. Factors that might cause such differences include, but are not limited to: competitive pressures among financial institutions; economic, market and business conditions, either nationally, internationally, or locally in areas in which Zions Bancorporation conducts its operations, being less favorable than expected; changes in the interest rate environment reducing expected interest margins; changes in debt, equity and securities markets including but not limited to the ability to successfully tender for preferred equity; adverse legislation or regulatory changes; Federal Reserve reviews of our annual capital plan; the actual amount and duration of declines in the price of oil and gas, the Company’s ability to meet its efficiency and noninterest expense goals, and other factors described in Zions Bancorporation’s most recent annual and quarterly reports. In addition, the statements contained in this presentation are based on facts and circumstances as understood by management of the company on the date of this presentation, which may change in the future. Except as required by law, Zions Bancorporation disclaims any obligation to update any statements or to publicly announce the result of any revisions to any of the forward-looking statements included herein to reflect future events, developments, determinations or understandings. 2

Chairman’s Message 3 What is working within expectations: Achieving positive operating leverage: solid progress in 4Q15, expect continuation into 2016 Tracking on efficiency initiative • Noninterest expense was less than $1.6 billion annualized in 2H15 • Efficiency ratio was less than 70% for 2H15 • Charter consolidation complete Substantially investing in premier technology systems, while maintaining stable noninterest expense Enhancing retail and mortgage banking Managed fee income growth Strong deposit growth Deploying cash to short-to-medium duration securities Improved loan growth in 4Q15

35% 40% 45% 50% $42,000 $44,000 $46,000 $48,000 $50,000 $52,000 4Q14 1Q15 2Q15 3Q15 4Q15 Total Deposits Total Deposits (left) Non-Interest Bearing Deposits as a % of Total (right) Total Loan and Deposit Growth 4 In Millions In Millions • Relatively modest loan growth due primarily to attrition in two sub categories: energy and national real estate • Strong mix of deposits, with 44% of total deposits in non-interest bearing accounts $36,000 $39,000 $42,000 $45,000 4Q14 1Q15 2Q15 3Q15 4Q15 Total Loans

Revenue: Net Interest Income Moving meaningfully higher after a period of stability 5 $400 $420 $440 $460 $480 4Q14 1Q15 2Q15 3Q15 4Q15 Net Interest Income In Millions • Net interest income increased more than 5% from the prior quarter • Approximately $8 million of the 4Q15 net interest income was from recoveries, which is not expected to persist into 2016 • Net interest income is expected to increase in 2016 due primarily to the change in benchmark interest rates in December 2015, continued purchases of securities and continued loan growth

Revenue: Fee Income Increased focus is paying dividends 6 $0 $50 $100 $150 $200 Treasury Management Bankcard Capital Markets Mortgage Loan Fees NSF Other Managed Fee Income Components 2014 2015 In Millions $400 $425 $450 $475 $500 2014 2015 Managed Fee Income 4% Growth 13% Growth 4% Growth 28% Growth 14% Growth 16% Decline 10% Decline 2% Growth In Millions • Managed fee income1 increased 4% from the year ago period • Strong growth in Treasury Management • Declines in loan fees attributable in part to declines in energy lending • Declines in non-sufficient funds (NSF) income is consistent with industry trends and reflects a more healthy consumer 1 Managed fee income excludes dividends / income from investments (“Dividends and Other Investment Income”), gains/losses on securities, dividends from the Federal Reserve, bank-owned life insurance, and other similar items.

Efficiency Initiative Expense progress is tracking well 7 Noninterest Expense: • Commitment to hold expenses below $1.6 billion in 2015 (and 2016). • Status: On track Cost savings: • Commitment to achieve $120 million of gross savings by FY17 • Status: On track $0 $20 $40 $60 $80 $100 $120 $140 2017 Gross Cost Savings Goal 2015 Savings Realized Cost Saving Initiative Progress Operations -- Affiliate Banks Operations -- Bancorp Technology Charter Consolidation

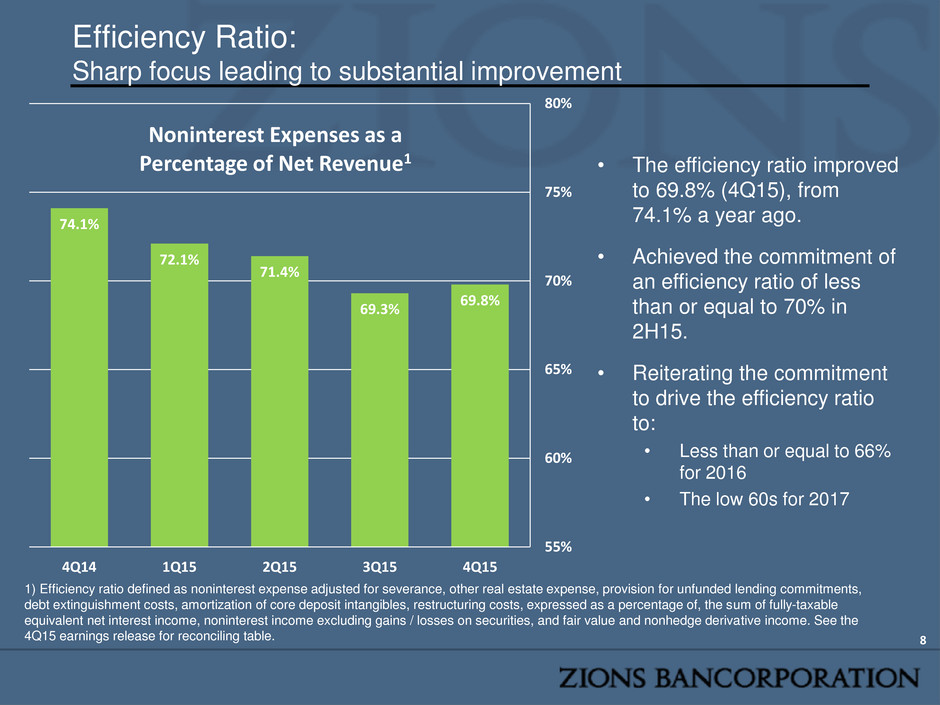

Efficiency Ratio: Sharp focus leading to substantial improvement 8 • The efficiency ratio improved to 69.8% (4Q15), from 74.1% a year ago. • Achieved the commitment of an efficiency ratio of less than or equal to 70% in 2H15. • Reiterating the commitment to drive the efficiency ratio to: • Less than or equal to 66% for 2016 • The low 60s for 2017 1) Efficiency ratio defined as noninterest expense adjusted for severance, other real estate expense, provision for unfunded lending commitments, debt extinguishment costs, amortization of core deposit intangibles, restructuring costs, expressed as a percentage of, the sum of fully-taxable equivalent net interest income, noninterest income excluding gains / losses on securities, and fair value and nonhedge derivative income. See the 4Q15 earnings release for reconciling table. 74.1% 72.1% 71.4% 69.3% 69.8% 55% 60% 65% 70% 75% 80% 4Q14 1Q15 2Q15 3Q15 4Q15 Noninterest Expenses as a Percentage of Net Revenue1

Major Investments in the Business Substantial planning and effort has resulted in an on-track outcome 9 Chart of Accounts / Financial Reporting Simplification Credit Approval Front-End Work Flow System Enterprise Loan Operations Core System (FutureCore): Loan and Deposit Processing Systems Other Announced Organizational Alignments on Schedule

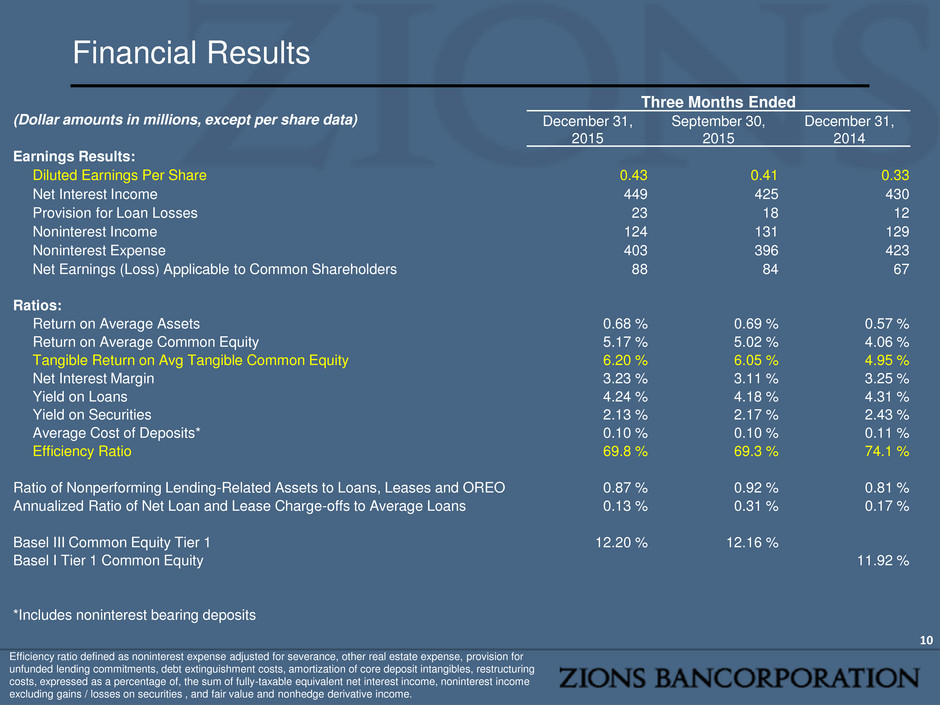

Financial Results 10 Three Months Ended (Dollar amounts in millions, except per share data) December 31, 2015 September 30, 2015 December 31, 2014 Earnings Results: Diluted Earnings Per Share 0.43 0.41 0.33 Net Interest Income 449 425 430 Provision for Loan Losses 23 18 12 Noninterest Income 124 131 129 Noninterest Expense 403 396 423 Net Earnings (Loss) Applicable to Common Shareholders 88 84 67 Ratios: Return on Average Assets 0.68 % 0.69 % 0.57 % Return on Average Common Equity 5.17 % 5.02 % 4.06 % Tangible Return on Avg Tangible Common Equity 6.20 % 6.05 % 4.95 % Net Interest Margin 3.23 % 3.11 % 3.25 % Yield on Loans 4.24 % 4.18 % 4.31 % Yield on Securities 2.13 % 2.17 % 2.43 % Average Cost of Deposits* 0.10 % 0.10 % 0.11 % Efficiency Ratio 69.8 % 69.3 % 74.1 % Ratio of Nonperforming Lending-Related Assets to Loans, Leases and OREO 0.87 % 0.92 % 0.81 % Annualized Ratio of Net Loan and Lease Charge-offs to Average Loans 0.13 % 0.31 % 0.17 % Basel III Common Equity Tier 1 12.20 % 12.16 % Basel I Tier 1 Common Equity 11.92 % *Includes noninterest bearing deposits Efficiency ratio defined as noninterest expense adjusted for severance, other real estate expense, provision for unfunded lending commitments, debt extinguishment costs, amortization of core deposit intangibles, restructuring costs, expressed as a percentage of, the sum of fully-taxable equivalent net interest income, noninterest income excluding gains / losses on securities , and fair value and nonhedge derivative income.

$0 $2,000 $4,000 $6,000 $8,000 $10,000 4Q14 1Q15 2Q15 3Q15 4Q15 Total Securities Other Securities Municipal Securities Small Business Administration Loan-Backed Securities Agency Securities Agency Guaranteed MBS Securities Securities Portfolio Growth Short-to-medium duration portfolio; limited duration extension risk 11 In Millions Added net $1.6B of securities during 4Q15 Securities Portfolio Duration • Current: 2.9 years • 200 bps increase from current interest rates: 3.1 years Modeled Annual Change in a +200 Interest Rate Environment Fast Slow Net Interest Income – 4Q15 (1) 9% 15% Net Interest Income – 3Q15 10% 19% 12-month simulated impact using a static-sized balance sheet and a parallel shift in the yield curve, and is based on statistical analysis relating pricing and deposit migration to benchmark rates (e.g. Libor, U.S. Treasuries). “Fast” refers to an assumption that market rates on deposits will adjust at a faster speed in response to changes in interest rates. “Slow” refers to an assumption that market rates on deposits will adjust at a moderate rate (i.e. supply of deposits exceeds demand for loans). (1) Preliminary analysis, subject to refinement

Loan Growth by Type: Solid loan growth in C&I, Term CRE and Residential Mortgage (1-4 Family), partially offset by headwinds in National Real Estate and Energy 12 Source: Company documents;); NRE = National Real Estate Group, a division of Zions Bank that focuses on small business loans with low loan-to-value ratios, generally in line with SBA 504 program parameters. Other loans includes Leasing, Municipal, Home Equity, and other consumer -20% -10% 0% 10% 20% C&I (ex Energy) Owner Occupied (ex NRE) C&D Term CRE (ex NRE) 1-4 Family National Real Estate Energy Other Total Year-over-Year Loan Growth C&I (ex Energy) 26% Owner Occupied (ex NRE) 14% C&D 5% Term CRE (ex NRE) 19% 1-4 Family 13% National Real Estate 6% Energy 6% Other 11% Loan Portfolio Concentrations

3.25% 3.22% 3.18% 3.11% 3.23% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 4Q14 1Q15 2Q15 3Q15 4Q15 Net Interest Margin (NIM) Net Interest Income Drivers Loan yield has been relatively stable; margin higher in part due to mix shift 13 • The reported 4Q15 NIM was 3.23% • If adjusted for two income recoveries in 4Q15, the NIM would have been 3.18%. This adjustment makes the result more comparable to the prior quarter’s result of 3.11% • Mix shift: An increase in securities and loans, and a decrease in cash as a percentage of earning assets was a significant driver of the linked-quarter NIM expansion • Continued reduction of high-cost debt, completed in November 2015 • Relative to 3Q15, asset sensitivity was not a significant driver of NIM expansion in 4Q15 Loan Yield Securities Yield Interest Expense / Interest Earning Assets: Black Net Interest Margin Cash Yield: White Loans 73% Securities 13% Cash 14% Interest-Earning Asset Mix

Loan Pricing Loan pricing has been generally stable during the past year 14 3.64% 4.24% 3.87% 2.5% 3.0% 3.5% 4.0% 4.5% 4Q14 1Q15 2Q15 3Q15 4Q15 Portfolio Yield vs. Production Yield • Linked-quarter loan yield higher entirely due to recoveries of interest income • Yield essentially flat when adjusting for recoveries – still a positive sign • Coupon rate of new loan production (green) remained relatively stable at 3.64% • Production yields on larger loans improved somewhat more than the move in LIBOR • Volume of new production (not shown) was more concentrated in larger loans than the prior quarter (seasonal pattern) Loans HFI = Loans held for investment; the difference between the coupon and the yield is the net of amortizing fee income, partially offset by amortizing expense. Loan Portfolio HFI Yield Loan Portfolio HFI Coupon Loan HFI Production Yield

Credit Quality: Overall Credit Quality Remains Generally Strong 15 -0.5% 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4Q14 1Q15 2Q15 3Q15 4Q15 Key Credit Quality Ratios Classifieds / Loans Nonperforming Assets / Loans Net Charge-offs / Loans Net Charge-offs / Loans annualized • Continued strong credit quality performance Relative to September 30, 2015: • Classified loans increased 3.4% • NPAs declined 4.1% • Moderate increase in classified loans attributable to energy loans • Allowance for credit loss remains strong, at 1.68% of total loans and leases • 1.7x coverage of NPAs • 12x coverage of annualized NCOs

• Energy Loan Loss Expectation • In January 2015, Zions modeled energy losses for the 9-quarter period (4Q14 – 4Q16) to be between and $75 million and $125 million • The loss range was established using an oil price of approximately $50 per barrel for two years, after which oil reverted to the then-NYMEX curve • Several models were used to triangulate to the loss range, including a CCAR model • Actual losses during the first five quarters of the nine-quarter period were $43 million • Using similar methodologies and with oil at $30 per barrel, energy loan losses are estimated to be between $75 million and $100 million for the next four quarters • Losses are likely to emerge beyond 2016, but are expected to be manageable • Strong Reserve Against Energy Loans – Zions is currently reserved at more than 5% of energy loan balances Updated Energy Loss Expectation: Moderate increase to reflect lower commodity prices and longer duration 16

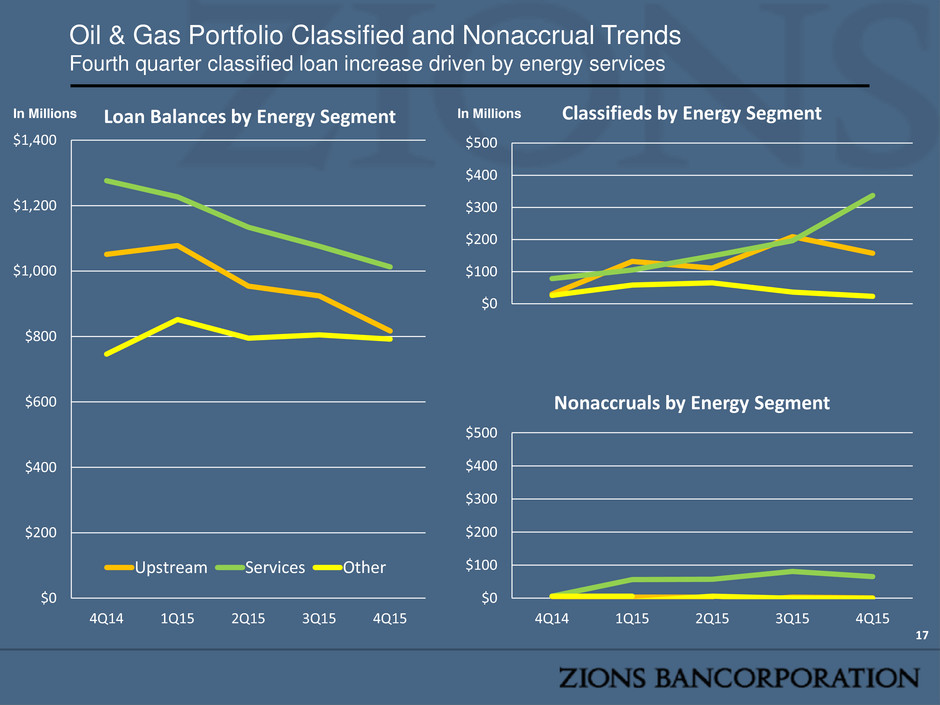

$0 $200 $400 $600 $800 $1,000 $1,200 $1,400 4Q14 1Q15 2Q15 3Q15 4Q15 Loan Balances by Energy Segment Upstream Services Other Oil & Gas Portfolio Classified and Nonaccrual Trends Fourth quarter classified loan increase driven by energy services 17 $0 $100 $200 $300 $400 $500 Classifieds by Energy Segment In Millions In Millions $0 $100 $200 $300 $400 $500 4Q14 1Q15 2Q15 3Q15 4Q15 Nonaccruals by Energy Segment

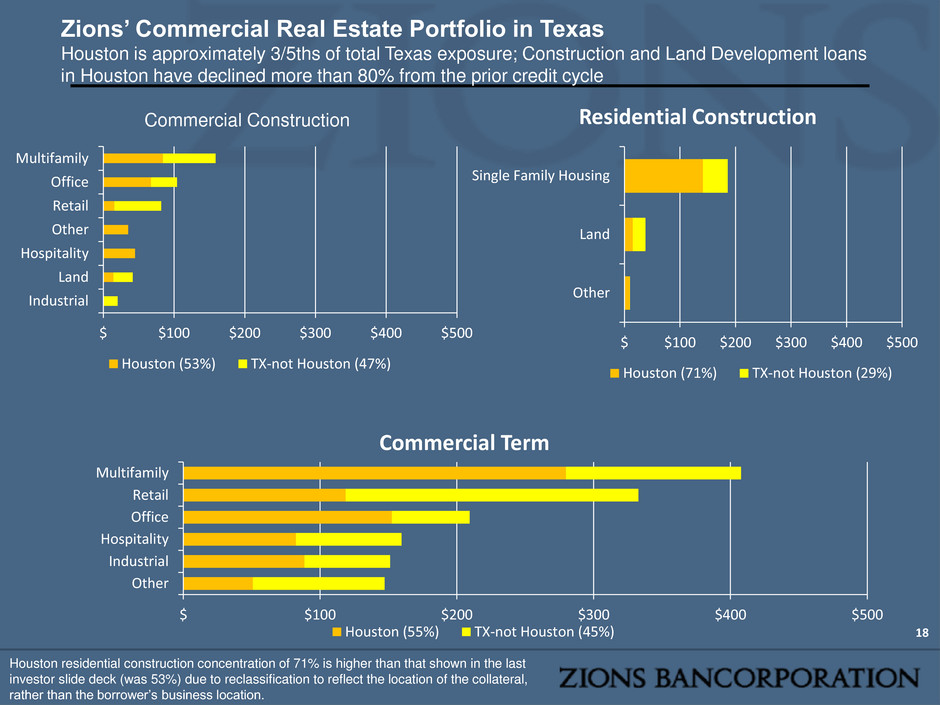

18 Zions’ Commercial Real Estate Portfolio in Texas Houston is approximately 3/5ths of total Texas exposure; Construction and Land Development loans in Houston have declined more than 80% from the prior credit cycle $ $100 $200 $300 $400 $500 Other Industrial Hospitality Office Retail Multifamily Commercial Term Houston (55%) TX-not Houston (45%) $ $100 $200 $300 $400 $500 Other Land Single Family Housing Residential Construction Houston (71%) TX-not Houston (29%) $ $100 $200 $300 $400 $500 Industrial Land Hospitality Other Retail Office Multifamily Commercial Construction Houston (53%) TX-not Houston (47%) Houston residential construction concentration of 71% is higher than that shown in the last investor slide deck (was 53%) due to reclassification to reflect the location of the collateral, rather than the borrower’s business location.

The Derivative Effect: Commercial Real Estate Limited expected NPAs or losses on Zions’ commercial real estate portfolio in Houston 19 Overview Statement: • Zions expects a moderate adverse migration of loan grades, but does not currently expect substantial loss due to strong collateral and cash flow support (subject to duration of downturn) • Zions exercised caution with Texas CRE lending leading up to the decline in energy prices due primarily to concentration limits and CRE risk hurdles 0% 10% 20% 30% 40% 50% 60% Under 50 50-59 60-69 70-79 80-89 90-99 100+ Current Houston Term Loan-To-Values 0% 10% 20% 30% 40% 50% 60% <1.0 1-1.25 1.25-1.5 1.5-1.75 1.75-2 >=2 Current Houston Term Debt Service Coverage Ratios

Next 12-Month Outlook Summary Relative to 4Q15 Results Topic Outlook Comment Loan Balances Slightly to Moderately Increasing • Expect strengthening growth in residential mortgage (mostly short duration ARMs) and general C&I, partially offset by continued attrition from National Real Estate and Energy portfolios Net Interest Income Increasing • Expect 1Q16 to be similar to the reported 4Q15A, driven by asset sensitivity, loan and security growth, partially offset by one fewer day of interest income and no anticipated large interest income recoveries. • Expect continued increases in loans and securities to result in increased net interest income Provisions Increasing • On average, quarterly provisions likely to be moderately higher relative to 4Q15A, reflecting moderate total net charge-offs, loan growth, and expected downgrades of energy-related loans Noninterest Income Slightly to Moderately Increasing • Excluding securities gains/losses and fair value & nonhedge derivative income. • Dividends from federal agencies declining due to charter consolidation and FAST Act (transportation, H.R. 22) Noninterest Expense Stable • Targeting NIE of less than $1.6 billion in FY16. • 1Q16 NIE expected to be slightly above $400 million due to seasonal factors • Includes continued elevated spending on technology systems overhaul Preferred Dividends Declining • $180 million tender offer completed in 4Q15 reduces preferred dividend expense in 2016 by approximately $10 million, or about $0.05/share annually compared to FY15 20

Appendix 21 Energy Portfolio Detail Houston Economic Trends Loan Growth by Bank Brand and Type

Energy Portfolio Detail 22 * Because many borrowers operate in multiple businesses, judgment has been applied in characterizing a borrower as energy-related, including a particular segment of energy-related activity, e.g., upstream or downstream; typically, 50% of revenues coming from the energy sector is used as a guide. Continued attrition of loan balances, generally driven by borrowers paying down or paying off their balances Loan downgrades continued as expected, primarily from oilfield services but also from upstream loans Zions added to the energy loan allowance for credit losses during 4Q15. The decision was driven in part by the decline in oil prices. Zions expects further downgrades, reflecting further stress from oil prices near $30 Reserve for energy loans is considered strong at more than 5% of outstanding balances (In millions) 12/31/2015 % of total 9/30/2015 $ Change % Change 6/30/2015 Loans and leases: Oil and gas related: Upstream - exploration and production $ 817 31 % $ 924 (107) (12)% $ 954 Midstream – marketing and transportation 621 23 % 626 (5) (1) % 589 Downstream – refining 127 5 % 124 3 2 % 131 Other non-services 44 2 % 55 (11) (20)% 75 Oilfield services 784 30 % 825 (41) (5)% 879 Energy service manufacturing 229 9 % 251 (22) (9)% 255 Total oil and gas related 2,622 100 % 2,805 (183) (7)% 2,883 Alternative energy loans 205 214 (9) (4)% 222 Total loan and lease balances 2,287 3,019 (192) (6)% 3,105 Unfunded lending commitments 2,164 2,364 (200) (8)% 2,403 Total credit exposure $ 4,991 $ 5,383 (392) (7)% $ 5,508 Private equity investments 13 17 (4) (24)% 18 Credit Quality Measures of oil and gas related loans Criticized loan ratio 30.3 % 23.2 % 20.3 % Classified loan ratio 19.7 % 15.7 % 11.3 % Nonperforming loan ratio 2.5 % 3.0 % 2.3 % Net charge-off ratio, annualized 3.7 % 2.4 % —%

Houston Economic Data: Unemployment remains in line with national levels; housing indicators show healthy volume and “seller’s market” inventory levels (<5 months of supply); businesses are less optimistic than on a national level 23 Source: Bureau of Labor Statistics, Bloomberg, Texas A&M University Real Estate Center PMI is Purchasing Managers Index. PMI is an indicator of the economic health of the manufacturing sector. The PMI Index is based on five major indicators: new orders, inventory levels, production, supplier deliveries, and the employment environment. 0 1 2 3 4 5 6 0 10,000 20,000 30,000 40,000 50,000 1H12 2H12 1H13 2H13 1H14 2H14 1H15 2H15 Houston Home Sales and Inventory Home Sales (Left) Months Inventory (Right) 4.9% 0% 2% 4% 6% 8% 1Q 1 2 2Q 1 2 3Q 1 2 4Q 1 2 1Q 1 3 2Q 1 3 3Q 1 3 4Q 1 3 1Q 1 4 2Q 1 4 3Q 1 4 4Q 1 4 1Q 1 5 2Q 1 5 3Q 1 5 4Q 1 5 Houston Unemployment Rate National Unemployment Rate: 4.8% 11.8% 0% 2% 4% 6% 8% 10% 12% 14% 1Q 1 2 2Q 1 2 3Q 1 2 4Q 1 2 1Q 1 3 2Q 1 3 3Q 1 3 4Q 1 3 1Q 1 4 2Q 1 4 3Q 1 4 4Q 1 4 1Q 1 5 2Q 1 5 3Q 1 5 4Q 1 5 Houston Employment Growth National Employment Growth: 8.5% 43.3 0 10 20 30 40 50 60 70 1Q 1 2 2Q 1 2 3Q 1 2 4Q 1 2 1Q 1 3 2Q 1 3 3Q 1 3 4Q 1 3 1Q 1 4 2Q 1 4 3Q 1 4 4Q 1 4 1Q 1 5 2Q 1 5 3Q 1 5 4Q 1 5 Houston PMI National PMI: 48.2

Houston Commercial Real Estate Data Moderate weakness realized and expected in vacancy rates; rents still above 2012 levels 24 0% 5% 10% 15% 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 1Q1 4 2Q1 4 3Q1 4 4Q1 4 1Q1 5 2Q1 5 3Q1 5 4Q1 5 Vacancy Rate - Houston 100 110 120 130 140 150 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 1Q1 4 2Q1 4 3Q1 4 4Q1 4 1Q1 5 2Q1 5 3Q1 5 4Q1 5 Price Index - Houston Source: CoStar 95 100 105 110 1Q1 2 2Q1 2 3Q1 2 4Q1 2 1Q1 3 2Q1 3 3Q1 3 4Q1 3 1Q1 4 2Q1 4 3Q1 4 4Q1 4 1Q1 5 2Q1 5 3Q1 5 4Q1 5 Rent Growth - Houston Apartment Office Retail

Consumer customers in high oil and gas employment counties (HOGECs) have not experienced credit score deterioration 25 Takeaways: • Consumer loans from high O&G employment counties performing similarly to overall consumer portfolio. Nearly all of these consumer loans are with Amegy (96%) located in Texas, primarily Houston area. • 81% of consumer loans in high-energy counties are Mortgage and HECL • Consumer FICO scores have not deteriorated in counties with high O&G employment, with the 5th, 10th, and 50th percentiles of FICO scores showing slightly favorable movement Credit Score (FICO) Migration in High Oil & Gas Employment Counties Percentile HOGECs Others HOGECs Others HOGECs Others HOGECs Others HOGECs Others 5% 603 642 598 638 5 4 595 635 8 7 10% 641 677 637 675 4 2 636 673 5 4 50% 750 777 748 779 2 -2 746 778 4 -1 Data includes consumer loans with FICO scores refreshed during the quarter shown. 2015 Q4 2014 Q4 1-Year Difference 2013 Q4 2-Year Difference

Loan Growth by Affiliate and Type 26 Source: Company documents;); NRE = National Real Estate Group, a division of Zions Bank that focuses on small business loans generally underwritten using SBA 504 guidelines. Other loans includes Leasing, Municipal, Home Equity, and other consumer Year-over-Year Loan Growth All Values in Millions Zions Bank California B&T Amegy Nat'l Bank of AZ Nevada State Bank Vectra Commerce Total C&I $348 $220 -$587 $173 -$104 $19 -$21 $49 Owner Occupied (ex NRE) $112 -$49 $12 -$16 -$42 $0 -$2 $14 C&D -$26 -$84 $90 -$11 -$37 -$16 -$2 -$86 Term CRE (ex NRE) $61 $255 $217 -$14 $21 $30 $0 $570 1-4 Family $28 -$122 $241 -$11 -$6 $50 $1 $181 Other $17 $81 $65 $39 $30 $66 $16 $315 NRE -$457 $0 $0 $0 $0 $0 $0 -$457 Total (ex NRE) $540 $302 $39 $158 -$136 $149 -$9 $1,042 Total $84 $302 $39 $158 -$136 $149 -$9 $586