Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Citizens Community Bancorp Inc. | a8kannualreportshareholder.htm |

Exhibit 99.1

FROM YOUR BOARD OF DIRECTORS

Dear Fellow Stockholders,

We believe that the Company achieved significant progress in 2015 by continuing on its path of building for the future. We remain committed to our Strategic Plan, which focuses upon increasing shareholder value through the following main components: (1) providing high-quality products and services for our customers; (2) increasing productivity through disciplined growth; (3) tightly controlling overhead costs; (4) maintaining credit discipline; and (5) expanding our presence in faster-growing markets while trimming less productive assets. Our commercial banking business grew significantly in fiscal 2015 and we believe our branch rationalization program will continue to increase earnings and returns to our shareholders throughout fiscal 2016. Growing our business lending is a key initiative because small to mid-size companies seeking financing are in need of a bank that values relationship banking. We are determined to be that bank.

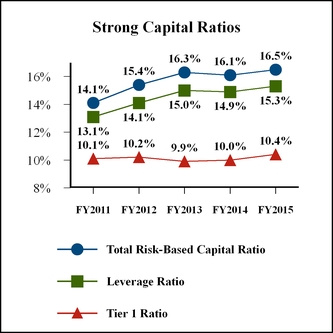

The Company continues to maintain strong capital ratios and based on this strength, we increased the annual cash dividend to $0.08 for fiscal 2015 from $0.04 for the previous year.

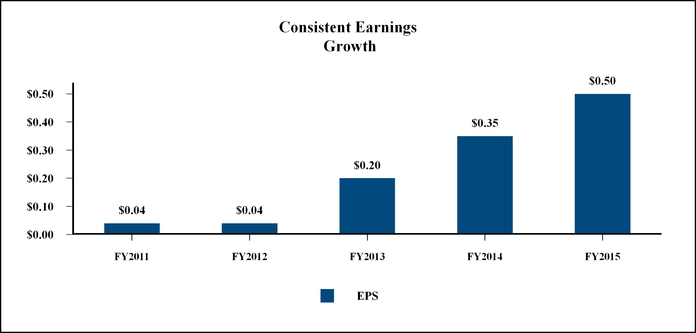

For the third consecutive year, Citizens Community Bancorp reported improved earnings along with solid asset quality. Net income was $2.6 million, or $0.50 per diluted share, for fiscal 2015 compared with $1.8 million, or $0.34 per diluted share, for fiscal 2014. We believe our 2015 earnings reflect our successful implementation of our Strategic Plan. Our reported earnings were affected by non-recurring expenses associated with branch closures, which are discussed in more detail below in this Annual Report.

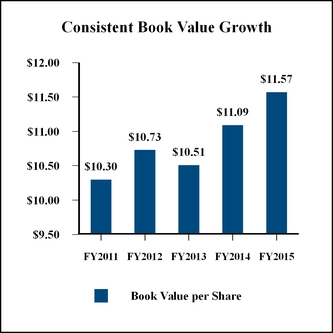

The Company’s improving financials are reflected in our longer term stock performance as shown below. Although our stock price was essentially unchanged during fiscal 2015 (along with the broader market indices), our stock price appreciation was 48% over the past three years, which matched that for both banks traded on the NASDAQ Stock Market and the stock price appreciation for banks and thrifts in the SNL Financial Index of U.S. Banks and Thrifts. Book value per share increased to $11.57 at September 30, 2015 from $11.09 at September 30, 2014, a 4.3% increase.

Source: SNL Financial

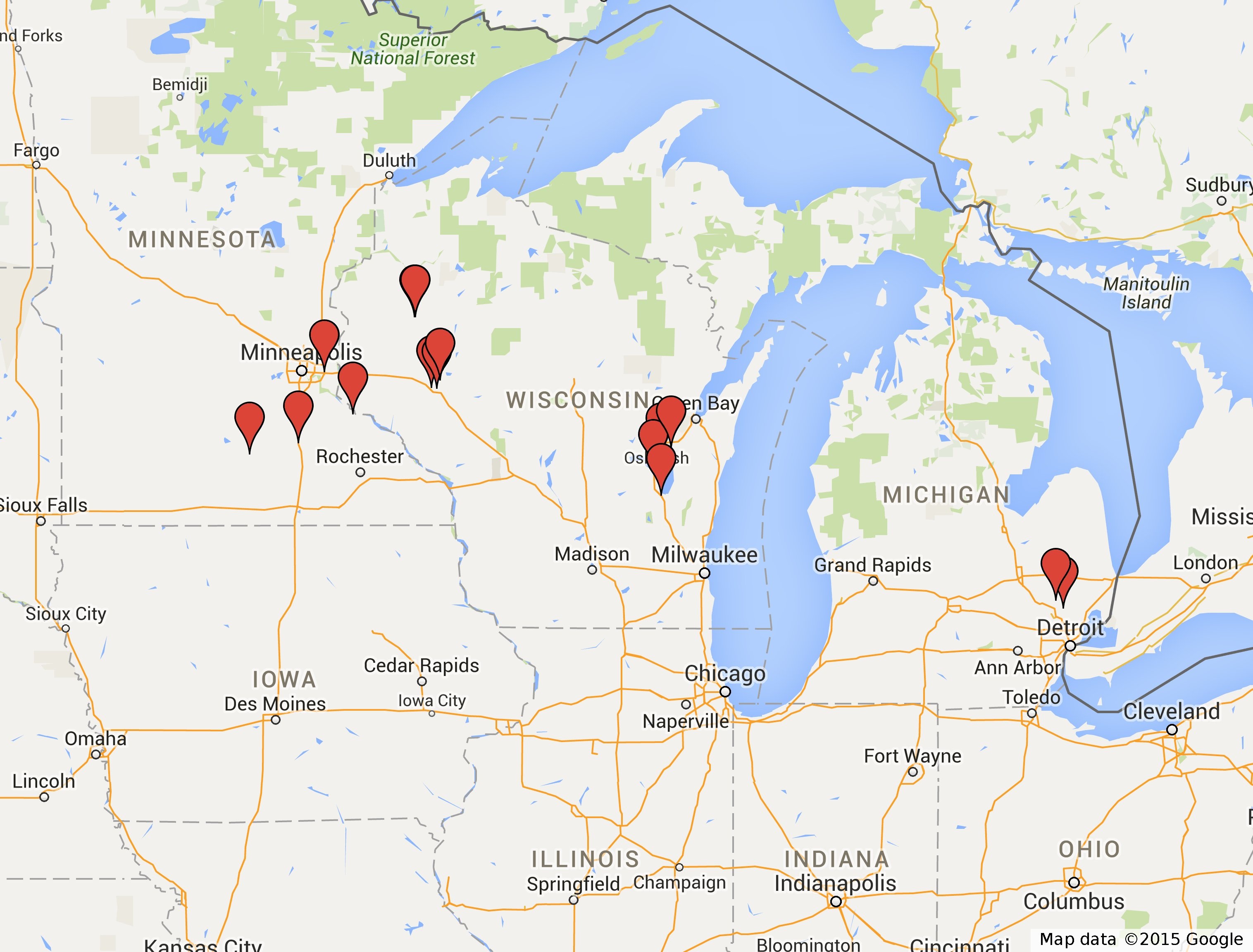

As part of our Strategic Plan, our board of directors and management continues to rationalize our branch network. We closed three in-store branch offices and two limited service branch offices in 2015 and one in-store branch office located in Menomonie, Wisconsin in December 2015. As part of our branch consolidation and efficiency strategy, we expect to close two in-store branch offices located in Brooklyn Park and Winona, Minnesota in January 2016. Our goal is to reinvest in markets where we believe we can grow more profitably. As a result, we opened new traditional branches in Rice Lake and Mankato and recently announced an acquisition in Rice Lake and Barron. We are eager to increase our presence in these markets with expanded products and services, marketing initiatives, and operational support.

• | Citizens Community Federal N.A. Branch Locations |

Financial Highlights

Although the level of market interest rates and the flattening yield curve has caused challenges, net income rose in 2015 largely due to lower credit costs, disciplined expense management, and an increase in fee income. Net interest income, which represents our main source of revenue, declined to $18.6 million for fiscal 2015 compared with $19.8 million for fiscal 2014. The decline was largely due to net interest margin pressure caused by the absolute low level of interest rates and a decrease in total loans over the past 12 months. This decrease was due to our disciplined approach to underwriting new loans, normal payoffs, and the sale of fixed-rate residential mortgage loans. The loan sales occurred to reduce our interest rate risk regardless of the future interest rate environment.

Total assets grew $10.3 million, or 1.8%, to $580.1 million as of September 30, 2015 from $569.8 million at September 30, 2014. Investment securities and cash and cash equivalents increased $17.0 million and $12.4 million, respectively, but were partially offset by the $19.9 million decline in total loans. Total loans decreased to $450.5 million as of September 30, 2015, from $470.4 million at September 30, 2014 primarily due to sales of fixed rate longer term residential mortgage loans and a further reduction in consumer real estate and indirect loans due to normal pay downs and payoffs. These decreases were partially offset by a $28.1 million increase in commercial and agricultural loans in fiscal 2015. We remain committed to growing our loan balances in a competitive banking market without sacrificing our conservative underwriting standards.

Deposits are our primary source of funds for investing and lending. Core deposits, which include all deposit categories other than certificates of deposit, comprised 47.7% of our total deposits as of September 30, 2015, compared with 45.2% at September 30, 2014. Core deposits are prized because they represent a lower cost of funding and are generally less sensitive to withdrawal when interest rates fluctuate compared with certificates of deposit. As of September 30, 2015, total deposits were $456.3 million, compared with $449.8 million at September 30, 2014. Deposit growth in fiscal 2015 was strong due to the Company’s focus on attracting core deposits and maintaining key customer relationships. Our commercial loan department contributed to our deposit growth by matching commercial loan customers with deposit products that fit their banking needs. Consumer checking balances increased also, as well as municipal deposits, which helped to offset the loss in deposits from our closed branches.

We remain committed to maintaining a strong capital base in order to support our long-range strategic plan. The Company and the Bank exceeded all regulatory standards to be considered “well-capitalized”. As of September 30, 2015, the Tier 1 to adjusted total assets ratio was 10.4%, the Tier 1 to risk weighted assets ratio was 15.3%, and total risk-based capital ratio was 16.5%.

Asset Quality Summary

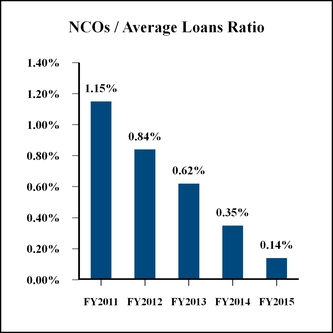

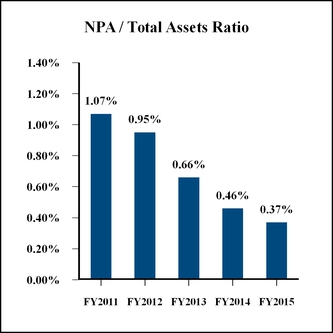

We believe that strong asset quality is a key to our long-term financial success. Our commitment to maintaining prudent underwriting standards is evidenced by the recent trend of declining non-performing assets and lower net charge-offs. Non-performing assets as a percentage of total assets decreased to only 0.37% at September 30, 2015 from 0.46% at September 30, 2014. Net charge-offs were $666,000 for the twelve months ended September 30, 2015, compared to $1.6 million for the same period in 2014. The allowance for loan losses as a percentage of total loans increased to 1.44% as of September 30, 2015 from 1.38% at September 30, 2014.

Outlook for Fiscal 2016

As we look forward to the start of a new fiscal year, we are mindful of the challenges that lie ahead for our company. These concerns include the possibility of higher interest rates and a flatter yield curve, increased regulatory and technology

demands, and the uneven economic recovery across the United States which is being impacted by the global economy. We have made, and will continue to make investments in information technology to protect our customers from the threat of cyber-attacks and security breaches. Our top priority is to protect our customers and we intend to implement measures and protocols to maintain the confidence of our customers that their personal information is secure.

We remain encouraged by our progress and accomplishments over the past several years and are focused on growth, balance sheet management and revenue enhancement for Fiscal 2016. Our customer and community focus has provided valuable benefits to everyone we serve and has resulted in deeper customer relationships. We continue to analyze our branch network, which will allow us to operate in a more efficient manner going forward, as we broaden our customer base. We are accomplishing this goal in markets like Rice Lake, Mankato, and Barron through branch acquisition and expansion of our banking facilities. We also intend to watch for opportunities to acquire additional branches and/or small banks that augment our market penetration and enhance long-term strategic value.

On behalf of our Board, management team, and employees, we thank you for your continued support. Your investment is important to us, and we appreciate your trust as we look forward to our exciting future.

Sincerely,

Richard McHugh Edward H. Schaefer

Chairman of the Board President and CEO