Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Simulations Plus, Inc. | simulations_8k.htm |

| EX-99.1 - PRESS RELEASE - Simulations Plus, Inc. | simulations_8k-ex9901.htm |

Exhibit 99.2

( NASDAQ:SLP ) Investor Conference Call January 14, 2016

2 With the exception of historical information, the matters discussed in this presentation are forward - looking statements that involve a number of risks and uncertainties . The actual results of the Company could differ significantly from those statements . Factors that could cause or contribute to such differences include, but are not limited to : continuing demand for the Company’s products, competitive factors, the Company’s ability to finance future growth, the Company’s ability to produce and market new products in a timely fashion, the Company’s ability to continue to attract and retain skilled personnel, and the Company’s ability to sustain or improve current levels of productivity . Further information on the Company’s risk factors is contained in the Company’s quarterly and annual reports and filed with the Securities and Exchange Commission . Safe Harbor Statement

3 Highlights Walt Woltosz Chairman and Chief Executive Officer

4 • Software renewal rates: 89% (accounts); 94%(fees) • 23 new software client sites added • Product development • Announced development of PKPlus ™ • new software product for noncompartmental analysis and compartmental analysis for regulatory submissions • potential to become significant contributor to revenues and earnings • Working on Version 9.5 of GastroPlus ™ • Intramuscular dosing (FDA RCA helping) • Antibody - drug conjugates (ADCs) • Faster integration speed • New animal physiologies for Additional Dosing Routes • Working on version 8.0 of ADMET Predictor ™ • major overhaul of user interface and code refactoring • greater integration with MedChem Studio™ • Consulting services continue to grow 1QFY16 Highlights

5 • Completed first year of 3 - year, $200,000/year collaboration and contract was renewed for second year) • Met all milestones during first full year • Consortium of leading pharmaceutical companies established to ensure the scientific integrity of the improved model and maximize the impact on the industry. • In a recent report, the global ophthalmic drugs market was valued at $16 billion in 2012, and was expected to reach an estimated value of $21.6 billion in 2018 • Globally, the ophthalmic drugs market is witnessing significant growth due to increasing prevalence of eye disorders, such as diabetic retinopathy and macular degeneration • Began working on second FDA cooperative agreement for $200,000/year for up to 3 years to develop modeling and simulation capabilities for long - acting injectable microsphere dosage forms FDA Office of Generic Drugs (OGD) Funded Collaboration

6 • AEROModeler™ • Application of our artificial neural network ensemble (ANNE) technology to: • Predict aerodynamic force coefficients for missiles at arbitrary Mach number and angle of attack • Classify missiles and other objects from radar tracking data • Discriminate between warheads and decoys from sensor data • Presented at 3 aerospace conferences in 2015 and one so far in 2016 • MRIModeler™ • Application of our ANNE technology to analysis of magnetic resonance imaging (MRI) data to classify patients as healthy or likely to experience various disease states Exploring Business Opportunities Outside of Pharmaceutical Industry

7 • Major provider of software and consulting services for pharma R&D • Earliest drug discovery – when a chemist first draws a molecule • Preclinical development (lab and animals) through first - in - human trials • Phase 2 and 3 clinical trials • Beyond patent life to supporting generic companies • Developing new applications in aerospace and general healthcare based on our machine - learning technologies • 1QFY16 revenues were up by $752,000 (18.4%) to $4.09 million • $1.43 million was from our Buffalo division, a 25.8% increase over 1QFY15. • 1QFY16 net income was up by $578,000 (109.2%) to $1.11 million • Diluted EPS for 1QFY16 increased 107.5% to $0.065 per share compared to $0.031 in 1QFY15. Overview

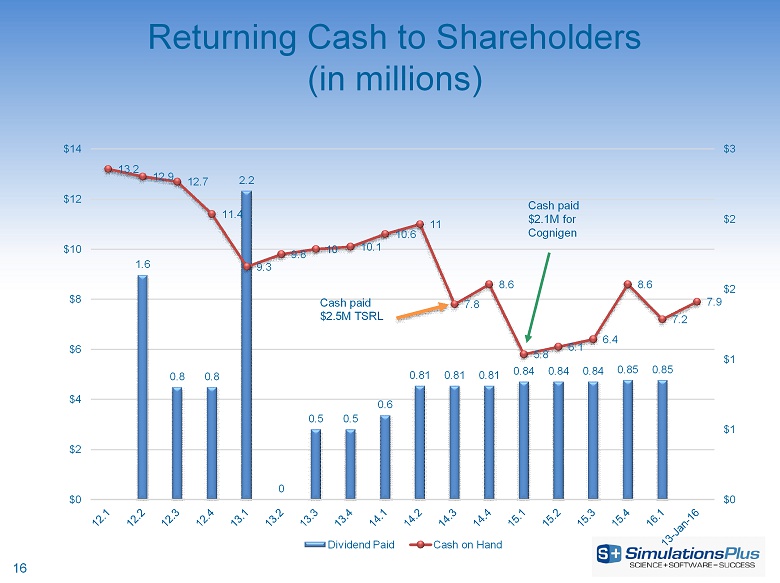

8 • Continued Growth • Seven - year - plus profitable trend • Successful strategic acquisition • Customer base increased: • 23 new software customers in 1QFY16 • 94 percent renewal rate (fees) • Expecting continued compounded growth • 1 ST Quarter earnings per share increased 107% ($0.034) • Strong cash position; returning cash to shareholders • Company has continue to pay dividend of $0.05 per quarter • Approximately $14.5 million in cash dividends distributed since 2012, yet cash remains at $7.9 million as of yesterday Summary

9 Financial Overview John Kneisel Chief Financial Officer

10 Income Statement 1QFY16 Compared to 1QFY15 (in millions) Lancaster Buffalo 1QFY16 1QFY15 Diff % chg Net sales $ 3.410 $ 1.428 $ 4.838 $ 4.086 $0.752 18.4% Gross profit 2.853 0.902 3.755 3.088 0.667 21.6% Gross profit margin 83.67% 63.17% 77.61% 75.58% 2.04% 2.7% SG&A 1.099 0.577 1.676 2.079 - 0.403 - 19.4% R&D 0.330 0.022 0.352 0.260 0.092 35.4% Total operating expenses 1.429 0.599 2.028 2.339 - 0.311 - 13.3% Income from operations 1.424 0.303 1.727 0.749 0.978 130.6% Other income (expense) ( 0.011) - (0.011) (0.003) - 0.008 266.7% Income from operations before income taxes 1.413 0.304 1.717 0.746 0.971 130.2% Net income $ 0.919 $ 0.188 $ 1.107 $ 0.529 0.578 109.3% Diluted earnings per share (in dollars) $ 0.064 $ 0.031 $ 0.033 107.3% EBITDA 1.808 0.395 2.203 1.225 0.978 79.8%

11 Consolidated Revenues, by Fiscal Quarter and YTD (pro forma prior to 2012; in millions) 4.01 4.57 5.99 3.71 4.84 $0 $1 $2 $3 $4 $5 $6 $7 Q1 Q2 Q3 Q4 2009 2010 2011 2012 2013 2014 2015 2016

12 Consolidated Gross Profit, by Fiscal Quarter & YTD (pro forma prior to 2012; in millions) 3.09 3.45 4.83 2.64 3.76 $0 $1 $2 $3 $4 $5 $6 Q1 Q2 Q3 Q4 2009 2010 2011 2012 2013 2014 2015 2016

13 Consolidated Net Income, by Fiscal Quarter and YTD (pro forma prior to 2012; in millions) $0.53 $0.97 $1.85 $0.49 $1.11 $ - $0.50 $1.00 $1.50 $2.00 Q1 Q2 Q3 Q4 2009 2010 2011 2012 2013 2014 2015 2016

14 Consolidated Diluted Earnings Per Share 0 0.02 0.04 0.06 0.08 0.1 0.12 Q1 Q2 Q3 Q4 $0.03 $0.06 $0.11 $0.03 $0.06 Quarterly EPS FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16

15 Consolidated EBITDA, by Fiscal Quarter & YTD (in millions) 1.22 1.97 3.33 1.19 2.2 $0 $1 $2 $3 $4 Q1 Q2 Q3 Q4 2009 2010 2011 2012 2013 2014 2015 2016

16 Returning Cash to Shareholders (in millions) 1.6 0.8 0.8 2.2 0 0.5 0.5 0.6 0.81 0.81 0.81 0.84 0.84 0.84 0.85 0.85 13.2 12.9 12.7 11.4 9.3 9.8 10 10.1 10.6 11 7.8 8.6 5.8 6.1 6.4 8.6 7.2 7.9 $0 $1 $1 $2 $2 $3 $0 $2 $4 $6 $8 $10 $12 $14 Dividend Paid Cash on Hand Cash paid $2.5M TSRL Cash paid $2.1M for Cognigen

17 Selected Balance Sheet Items (in millions) November 30, 2015 August 31, 2015 Cash and cash equivalents $7.155* $8.551 Cash per share 0.42 0.50 Total current assets 12.364 11.533 Total assets 27.958 27.344 Total current liabilities 3.897 3.613 Total liabilities 8.023 7.812 Current ratio 3.17 3.19 Shareholders’ equity 19.935 19.532 Total liabilities and shareholders’ equity 27.958 27.344 Shareholders’ equity per diluted share 1.155 1.147 * Cash as of January 13, 2016 was ~$7.9 million

18 Marketing and Sales John DiBella VP of Marketing and Sales

19 Overview of Products and Services N H O OH O CH 3 CH 3 CH 3 ADMET Predictor™ GastroPlus ™ MedChem Studio™ MedChem Designer™ DDDPlus ™ MembranePlus™ Consulting Services and Collaborations Discovery Preclinical C linical COMING SOON: PKPlus™ KIWI™

20 • Version 9.5 scheduled for spring 2016 ‒ Intramuscular dosing model – optional add - on model ‒ Antibody - drug conjugate (ADC) models for biologics • Version 8.0 scheduled for early 2016 ‒ Significant refresh of the graphical user interface ‒ New ‘Chemistry’ module – optional add - on incorporating items from MedChem Studio™ • Version 5.0 scheduled for spring 2016 ‒ Significant refresh of graphical user interface Software Product News • Version 5.0 scheduled for early 2016 ‒ Integration of models from ADMET Predictor™ – optional add - on ‒ New dosage form options for immediate & controlled release formulations • Version 1.5 scheduled for 2016 ‒ Ability to model multiple compounds to optimize in vitro drug - drug interaction parameters • New product : v ersion 1.0 scheduled for early 2016 ‒ Validated software for noncompartmental (NCA) & compartmental PK modeling ‒ Reports in user - customized formats for regulatory submission ‒ Large potential market

21 1QFY16 Sales Review • Highlights: – Software revenue +12% – PBPK consulting +129% – 89% renewal rate (accounts) – 94% renewal rate (fees) – 29% increase in license units – 10 new commercial clients – 13 new nonprofit groups – 50 - license pack ordered by U.S. FDA 51% 14% 34% 1% Consolidated Sales Breakdown Renewal New Consulting Training 0 50 100 150 200 250 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Software License Units – per Quarter FY13 FY14 FY15 FY16

22 1QFY16 Software & PBPK Consulting: Revenue by Region Europe 27% North America 43% Asia 30% South America <1% Japan = 53% India = 25% China = 21% Korea = 1%

23 Marketing Activities – 1QFY16 • Company rebranding – Launched company rebrand – work continuing on website refresh • Conferences and scientific meetings – 14 scientific meetings attended; co - authors on 19 presentations • Trainings and workshops – Hosted GastroPlus workshops in US, Japan, and Europe – W orkshops scheduled for India, US, Europe, China, Korea, and Japan in calendar 2016 • Strategic digital marketing initiatives – Hosted 3 webinars on our software updates and applications – Active updates: LinkedIn, Twitter, YouTube, and Facebook accounts – Continued web - based advertising for all programs – 19 peer - reviewed publications citing use of software

24 Buffalo Office Update Expanding Our Reach in Consulting Services and Product Offerings Ted Grasela President

25 Buffalo Growth Opportunities • Strategic and synergistic benefits of the Buffalo (Cognigen) acquisition are being realized • Strong collaborations between Buffalo and Lancaster scientists have identified new and innovative ways of using modeling and simulation to bring valuable insights to our clients’ research and development programs • Social media and Email blasts emphasizing − Modeling & simulation services − Data Assembly services − KIWI™ functionality • Enhanced presence at national and international scientific meetings

26 Status Report - Consulting • Working with 19 companies on 32 drugs, 56 projects of which 15 projects started FY16Q1 • Expanded scope of projects with 3 companies • 26 outstanding proposals • Worked with 7 new companies over the past year; continuing to build relationships • Most common therapeutic area is oncology, followed by neurology and immunology – ~25% of projects result directly in regulatory interaction. • Four contracts for process improvement initiatives to enhance the impact of modeling and simulation activities • Presented 12 posters / publications in FY16Q1 describing Clinical Pharmacology M&S analyses and methodologies.

27 Cutting Edge Scientific Projects • Redesigning R&D processes to improve interdisciplinary communications • Modeling and simulation results being used to support client patent applications for new formulations – multiple sclerosis and gout • Emerging applications of systems pharmacology to R&D decision - making in oncology and diabetes • Working to develop “platform” opportunities – the application of PBPK and systems pharmacology modeling and simulation to support multiple programs within a therapeutic area

28 • Analysis in R&D can be messy • Data and inputs coming from many groups • Careful synthesis and communication is essential • The industry has enormous computing power • The industry lacks tools for harnessing that power Behind the scenes in R&D Coping with complexity and chaos

29 KIWI™ – A Software Platform for Accessing Simulations Plus’ Validated Cloud Processing Capabilities

30 • Successful ACCP, ACOP, and AAPS meetings in FY2016 • ~ 20 demonstrations • Targeting release of KIWI ™ Version 1.5 in February 2016 • Improved data visualization tools • Improved metadata labeling • Implementing “agile” methodology for testing and validation that will speed up release of future versions • Next release – July 2016 KIWI Update

31 Summary Buffalo office strong and growing • Revenues and earnings up and contributing to overall growth of Simulations Plus • Consulting expanding through enhanced marketing and sales and through synergies with Lancaster office for PBPK modeling in clinical pharmacology • KIWI software platform generating increased interest with enhanced marketing and sales efforts

32 Final Summary Walt Woltosz Chairman and Chief Executive Officer