Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION - Kibush Capital Corp | dlcr_ex311.htm |

| EX-32.1 - CERTIFICATION - Kibush Capital Corp | dlcr_ex321.htm |

| EX-14.1 - CODE OF ETHICS - Kibush Capital Corp | dlcr_ex141.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE YEAR ENDED SEPTEMBER 30, 2015

Commission file number 000-55256

KIBUSH CAPITAL CORPORATION |

(Exact Name of Small Business Issuer as specified in its charter) |

NEVADA

(State or other Jurisdiction of Incorporation or Organization)

c/o McGee Law Firm LLC

5635 N. Scottsdale Road, Suite 170

Scottsdale, AZ 85250

(Address of principal executive offices)

+(61) 398464288

(Issuer's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: |

| Securities registered pursuant to section 12(g) of the Act: |

None |

| Common Stock |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act: Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (SS 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 if the Exchange Act.

Large Accelerated Filer | ¨ | Accelerated Filer | ¨ |

Non-accelerated Filer | ¨ | Smaller Reporting Company | x |

(Do not check if smaller reporting company) |

|

| |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of September 30, 2015 - $99,617

As of January 10, 2016, there were 80,399,187 shares of the registrant's common stock outstanding.

TABLE OF CONTENTS

|

| Page |

| |

|

|

|

| |

PART I |

|

|

| |

|

|

|

| |

Item 1. | Business. |

| 4 |

|

Item 1A. | Risk Factors. |

| 8 |

|

Item 1B. | Unresolved Staff Comments. |

| 8 |

|

Item 2. | Properties. |

| 8 |

|

Item 3. | Legal Proceedings. |

| 14 |

|

Item 4. | Mine Safety Disclosures. |

| 14 |

|

|

|

|

| |

PART II |

|

|

| |

|

|

|

| |

Item 5. | Market Price for the Registrant's Common Equity, Related Stockholders Matters and Issuer Purchases of Equity Securities. |

| 15 |

|

Item 6. | Selected Financial Data. |

| 16 |

|

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operation. |

| 16 |

|

Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. |

| 19 |

|

Item 8. | Financial Statements and Supplementary Data. |

| 20 |

|

Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure. |

| 38 |

|

Item 9A. | Disclosure Controls and Procedures. |

| 38 |

|

Item 9B. | Other Information. |

| 39 |

|

|

|

|

| |

PART III |

|

|

| |

|

|

|

| |

Item 10. | Directors, Executive Officers and Corporate Governance. |

| 40 |

|

Item 11. | Executive Compensation. |

| 43 |

|

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. |

| 45 |

|

Item 13. | Certain Relationships and Related Transactions, and Director Independence. |

| 46 |

|

Item 14. | Principal Accounting Fees and Services. |

| 47 |

|

|

|

|

| |

PART IV |

|

|

| |

|

|

|

| |

Item 15. | Exhibits and Financial Statement Schedules. |

| 48 |

|

|

|

|

| |

Signatures |

| 49 |

| |

|

|

|

| |

Exhibit Index |

| 50 |

| |

| 2 |

CAUTIONARY NOTE REGARDING EXPLORATION STAGE STATUS

We are considered an "exploration stage" company under the U.S. Securities and Exchange Commission ("SEC") Industry Guide 7, Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations ("Industry Guide 7"), because we do not have reserves as defined under Industry Guide 7. Reserves are defined in Guide 7 as that part of a mineral deposit which can be economically and legally extracted or produced at the time of the reserve determination. The establishment of reserves under Guide 7 requires, among other things, certain spacing of exploratory drill holes to establish the required continuity of mineralization and the completion of a detailed cost or feasibility study.

Because we have no reserves as defined in Industry Guide 7, we have not exited the exploration stage and continue to report our financial information as an exploration stage entity as required under Generally Accepted Accounting Principles ("GAAP"). Although for purposes of FASB Accounting Standards Codification Topic 915, Development Stage Entities, we have exited the development stage and no longer report inception to date results of operations, cash flows and other financial information, we will remain an exploration stage company under Industry Guide 7 until such time as we demonstrate reserves in accordance with the criteria in Industry Guide 7.

Because we have no reserves, we have and will continue to expense all mine construction costs, even though these expenditures are expected to have a future economic benefit in excess of one year. We also expense our reclamation and remediation costs at the time the obligation is incurred. Companies that have reserves and have exited the exploration stage typically capitalize these costs, and subsequently amortize them on a units-of-production basis as reserves are mined, with the resulting depletion charge allocated to inventory, and then to cost of sales as the inventory is sold. As a result of these and other differences, our financial statements will not be comparable to the financial statements of mining companies that have established reserves and have exited the exploration stage.

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking information. Forward-looking information includes statements relating to future actions, prospective products, future performance or results of current or anticipated products, sales and marketing efforts, costs and expenses, interest rates, outcome of contingencies, financial condition, results of operations, liquidity, business strategies, cost savings, objectives of management of Kibush Capital Corporation (hereinafter referred to as the "Company," "Kibush Capital," or "we") and other matters. Forward-looking information may be included in this Annual Report on Form 10-K or may be incorporated by reference from other documents filed with the Securities and Exchange Commission (the "SEC") by the Company. One can find many of these statements by looking for words including, for example, "believes," "expects," "anticipates," "estimates" or similar expressions in this Annual Report on Form 10-K or in documents incorporated by reference in this Annual Report on Form 10-K. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events.

The Company has based the forward-looking statements relating to the Company's operations on management's current expectations, estimates and projections about the Company and the industry in which it operates. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that we cannot predict. In particular, we have based many of these forward-looking statements on assumptions about future events that may prove to be inaccurate. Accordingly, the Company's actual results may differ materially from those contemplated by these forward-looking statements. Any differences could result from a variety of factors, including, but not limited to general economic and business conditions, competition, and other factors.

| 3 |

PART I.

ITEM 1. BUSINESS.

Kibush Capital Corporation ("we", "us", "our", the "Company" or the "Registrant") is a mineral and natural resources exploration company. We are currently undertaking mineral exploration activities in Australia and Papua New Guinea. Our business is comprised two subsidiaries Aqua Mining and Angel Jade. Our Aqua Mining subsidiary is active in mineral exploration in Papua New Guinea where we are exploring for gold. Our Angel Jade subsidiary is active in mineral exploration in New South Wales, Australia where we are exploring for jade. In addition, on June 12, 2015, the Company has taken over management of Paradise Gardens (PNG) Ltd., a timber logging and processing company in Papua New Guinea.

We are an exploration stage company as defined by the Security and Exchange Commission's ("SEC") Industry Guide 7 as the Company has no established reserves as required under the Industry Guide 7.

History

We were incorporated in the State of Nevada on January 5, 2005 under the name Premier Platform Holding Company, Inc. The Company changed its name to Paolo Nevada Enterprises, Inc. on February 4, 2005. On August 18, 2006, the Company completed a merger with Premier Platform Holding Company, Inc., a Colorado corporation, where Paolo Nevada Enterprises, Inc. was the surviving entity. On November 1, 2006, the Company changed its name to the David Loren Corporation. On July 5, 2013, More Superannuation Fund, an Australian entity ("More"), obtained control of the Company from Beachwood Capital, LLC, a Nevada limited liability company. On August 23, 2013, the Company changed its name to Kibush Capital Corporation.

On October 15, 2013, the Company completed the acquisition of 80% of the common stock of Instacash Pty Ltd., a micro-lender licensed in Australia ("Instacash"). For the fiscal year ended September 30, 2014, Instacash had no revenues, $396,493 in assets and $429,270 in liabilities. In order to focus solely on its mining investments, the Company disposed of Instacash during the quarter ended March 31, 2015.

On March 23, 2015, the Company increased its ownership in Aqua Mining Limited, a Papua New Guinea limited company ("Aqua Mining") from 49% to 90% in exchange for assignment of the Company's entire interest in the Koranga Joint Venture to Aqua Mining. Due to the increase in ownership and due to the fact that the additional interest in Aqua Mining was acquired from a related party we changed the ament accounting treatment for this asset and are now consolidating its financials with our own. For the fiscal year ended September 30, 2014, Aqua Mining had no revenues, $18,565 in assets and $91,872 in liabilities. For the interim period ended March 31, 2015, Aqua Mining had no revenues, $46,755 in assets and $215,003 in liabilities.

The Company acquired control of Angel Jade Pty Ltd., an Australian limited company ("Angel Jade") through a series of transactions as follows: In October 2014, the Company negotiated the acquisition of a 50% interest in Angel Jade (which was 90,000,000 shares of common stock) from Five Arrows Limited in exchange for 14,000,000 shares of our common stock. However, this agreement was not formalized until December 10, 2014. On October 9, 2014, the Company acquired 3,673,470 shares of newly issued common stock of Angel Jade in exchange for $17,170 ($19,584 AUD). These two transactions combined were intended to provided Kibush Capital with exactly 51% of the common stock of Angel Jade and control of the that company. On November 6, 2014, the Company further increased its ownership of Angel Jade by purchasing an additional 45,918,300 shares of common stock directly from Angel Jade for $215,994 ($250,000 AUD) and by purchasing 18,367,350 share of common stock from Laima Trust for $86,398 ($100,000 AUD). Several minority shareholders have disputed the issuance of additional shares to the Company. See Item 3 for more detail. We now own approximately 69% share of the issued and outstanding shares of Angel Jade's common stock which totals 229,591,770 shares. For the fiscal year ended September 30, 2014, Angel Jade had no revenues, $13,906 in assets and no liabilities. For the interim period ended March 31, 2015, Angel Jade had no revenues, $179,075 in assets and $397 in liabilities. Angel Jade's financials are consolidated with our own financials in this report.

The Company is an "emerging growth company" as defined in the Jumpstart Our Business Startups Act ("JOBS Act").

Our auditors have issued a going concern opinion. This means that our auditors believe there is substantial doubt that we can continue as an on-going business for the next twelve months unless we obtain additional capital to pay our bills. This is because we have not generated any significant revenues from our current business. In addition, we have sustained losses for the past two years and have a negative working capital at September 30, 2015. We must raise cash from sources other than operations. Our only other source for cash at this time is investments by others in our company. We must raise cash to continue our mining exploration activities and business development.

| 4 |

Our Business

Our business is comprised of mining exploration activities through our subsidiaries Aqua Mining and Angel Jade. Our primary office is located at 7 Sarah Crescent, Templestowe, Victoria 3106, Australia. The company is an exploration stage company and there is no assurance that a commercially viable mineral deposit exists on any of our properties. Further exploration will be required before a final evaluation as to the economic and legal feasibility is determined.

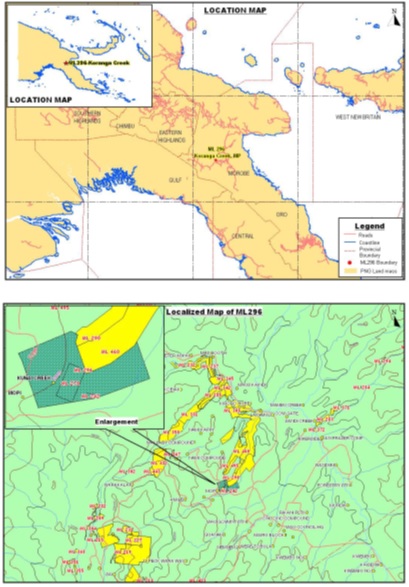

On February 14, 2014, we entered into an Assignment and Bill of Sale with Five Arrows Limited ("Five Arrows") pursuant to which Five Arrows agreed to assign to the Company all of its right, title and interest in two 50 ton per hour trammels, one 35 ton excavator, a warehouse/office, a concrete processing apron and four 35 ton per hour particle concentrators which may be utilized for alluvial mining, the assignment also conveyed Five Arrow's interest in a joint venture with the holders of mining leases ("Leaseholders") for gold exploration in Papua New Guinea, specifically Mining Leases ML296-301 and ML278 covering approximately 26 hectares located at Koranga in Wau, Morobe Province, Papua, New Guinea (the "Koranga Property"). In consideration therefor, the Company issued 40,000,000 shares of its common stock to Five Arrows. On February 28, 2014, we entered into a joint venture agreement with the Leaseholders (the "Joint Venture Agreement") for the exploration of minerals on the Koranga Property. The Joint Venture Agreement entitles the leaseholders to 30% and the Company to 70% of net profits from the joint venture. On May 23rd 2015 this Joint Venture was sold to our subsidiary Aqua Mining (PNG) Ltd. Aqua Mining will manage and carry out the exploration at the site, including entering into contracts with third parties and subcontractors (giving priority to the Leaseholders and their relatives and the local community for employment opportunities and spin-off business) at its cost, and all assets, including equipment and structures built on the site, will be the property of the Company. The Leaseholders and Aqua Mining will each contribute 1% from their share of net profits to a trust account for landowner and government requirements. For the period ending September 30,2014 we have incurred expenditure of $208,512 primarily spent on exploration. From October through to December there has been an expenditure of $56,526 on capital equipment and further exploration costs.

The joint venture involves a lease that, between 2008 and 2011, has produced a total of 55,300 cubic meters of mined material which was processed to extract 51,000 grams of gold - raw weight (approximately 31kg pure gold) over the three years of mining activities. Gold production in 2010 averaged 1.97kg per month and in 2011 averaged 2.26kg per month. The overall raw gold grade is 0.92g per cubic meter. Pure gold grade is 0.55g per cubic meter. The Company is currently in the exploration stage for this lease. If and when successful, the Company may endeavor to undertake additional joint ventures on neighboring leaseholds (8 leaseholds border the area) to capitalize on the infrastructure and equipment we may install at Koranga.

We entered into a memorandum of understanding, dated May 1, 2014 with New Guinea Gold Corporation, for the purchase of New Guinea Gold Ltd., which was terminated by us on May 24, 2014 prior to commencing any transactions contemplated in connection therewith. The Company has no continuing obligations as a result of such termination.

Aqua Mining

Aqua Mining is currently in the exploration stage. Aqua Mining was created to undertake certain opportunities that exist within the mining sector of the economy of Papua New Guinea. The Director Mr. Vincent Appo, has extensive experience and knowledge in this sector and has over the years assembled a vast network of contacts and contractors that will assist the company in their managerial and operational endeavors. From the outset the company is negotiating over 2 mine sites for further exploration.

Aqua Mining in the past six months has negotiated and finalized with landowners in the WAU area of PNG, Joint Ventures to conduct mineral exploration activities. These Joint Venture Agreements will form the basis of applications to the Mining Resource Authority in PNG for Mining Licenses. In addition, Aqua Mining has been accepted as a developer of AML 694-695.

On or about April 8, 2015, the Company commenced exploration of the Alluvial Mining Lease 694/695 via its Subsidiary Aqua Mining PNG Limited. Mr. Vincent Appo, PNG Operations Manager, is overseeing the construction of the required infrastructure which is required for the Company's exploration activities.

On or about April 16, 2015, the Company announced commencement of a Jorc/43-101 report on the Mining Lease 694/695 and pending Mining Lease 296/301 held by its subsidiary, Aqua Mining PNG Limited.

Ken Unamba, a member of the Advisory Committee has been nominated to oversee this report. Vincent Appo, PNG Operations Manager, has undertaken substantial testing over the past 12 months on both areas and has enough data as a basis for assessment and review. Mr. Unamba will undertake additional surveys and sampling where necessary to provide further data to finalize the report to Kibush Capital.

Angel Jade

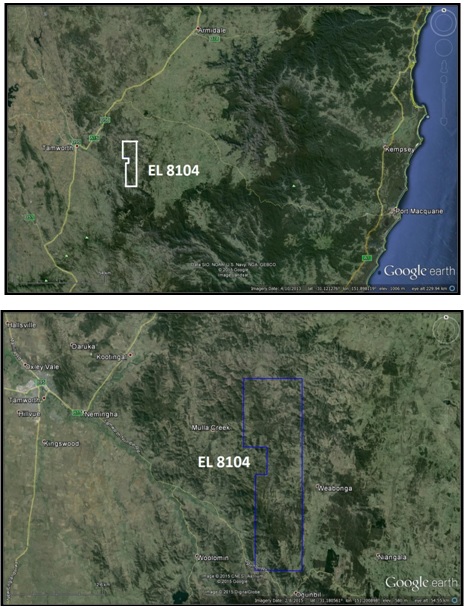

The Company owns 70% of the ordinary shares of Angel Jade Pty Ltd, an Australian company. The assets of Angel Jade are comprised of Exploration License 8104, the area covered is 35 km SE of Tamworth, 300 sq. km in size, 250 km from the port of Newcastle, NSW and accessible by sealed road. Nephrite jade occurs in the New England Fold Belt, which extends from northeast New South Wales into southeast Queensland. The target mineral in this tenement is jade, but we will also explore for rhodonite.

| 5 |

Angel Jade has identified a 3 tiered exploitation of jade. The First Tier, finely ground lower quality jade to nano particle sized powder, enabling the jade to release infra-red radiation. These particles can be added to paint, ceramic tiles and to cotton for use in fabrics. The Second Tier, exclusive works of art created by the renowned artist Xie Shen. These carved pieces are typically between 0.5 and 2 tons each, and would be showcased at major Asian Art Galleries. The Third Tier is to establish a premium high end Jade Brand for jewelry and art, to be sold and marketed through respected gallery and jewelry outlets. The current price of jade per kilogram has a spread of $5 to $50 depending on the grade.

Paradise Gardens Development

Kibush Capital Corporation had entered into a management agreement with Paradise Gardens Development (PNG) Ltd, a Timber Logging and Processing Company with operations in Papua New Guinea ("Paradise Gardens"). The Company has the right to Paradise Gardens operates a Timber Authority registered with the PNG Forest Authority which permits an annual timber harvest of 5000 cubic meters, the total area under the Timber Authority is 3300 hectares. Predominant species include Terminalia, Aglaia, White Cheesewood, Pink Satinwood, Erima, Taun, Rosewood, Kwila and other hardwoods. Paradise Gardens primarily sells its timber locally to retailers and wholesalers in Papua New Guinea. The Company is in negotiations with the owner of Paradise Gardens to acquire control of Paradise Gardens. During the negotiation period, the Company's management fee includes the profit earned by Paradise Gardens during such period.

The Market

Angel Jade

Nephrite jade is not a common mineral and occurs in nature very rarely and usually in remote locations, hence its prized status and value. It is currently mined in New Zealand, Pakistan, Canada, Russia and Australia. Climatic concerns limit the amount of mining that can be done in Canada and Russia and political extremism is a threat in Pakistan. New Zealand nephrite whilst generally high grade only occurs under the southern alps and glaciers and is usually only of the green variety and found in isolated small pods in small quantities.

In Australia, nephrite occurs in South Australia near Cowell, in Western Australia near Ninghan in the Murchison region outside of Perth and in New South Wales at the Angel Jade tenements near Tamworth. The Cowell and Ninghan nephrite deposits consist of 'black' nephrite mainly and are generally lower grade with small quantities of high-grade commercial saleable material.

The Angel Jade Tamworth occurrences are extensive, ranging along the great NS serpentinite belt of NSW that runs for over 200kms. The nephrite found there ranges in quality and varietal characteristics from classic imperial green, through to blue, black and the much prized 'mutton fat' coloration. Angel Jade is better placed than its competitors to be able to successfully continually supply quality and quantity of material to its selected markets.

Aqua Mining

The primary product is Gold and our market price based on the London Metals Exchange Daily Rate. This rate determines a market price for all material sold within the Refinery Market. Outside of that market competition dictates the price available, and that competition has effectively no difference in the quality of the material as it based on a gold percentage. A higher price can be obtained by selling to the spot traders who can distribute the material at lower volumes to industry consumers.

Marketing and Distribution:

Angel Jade

A four pronged distribution approach for our nephrite (jade) has been developed that target: wholesale building suppliers through industry groups and trade shows, wholesale jewelry suppliers in China and SE Asia, direct marketing to the high end art market in China and the Middle East via brokers and producing material suitable for high tech industrial usage such as substrates and insulators through an industry based online campaign targeting research universities, R&D facilities and allied scientific suppliers.

Aqua Mining

As the principal material is gold, the options are to sell either to a refinery and be paid the daily spot rate, or to sell to the jewelry wholesale market. Both of these options exist internally within PNG however the wholesale market is quite small. There are several options when the material is exported from PNG, again it could be to any refinery within the region and that rate again would be the daily spot rate. The wholesale market outside the country would be significant and there are many opportunities within Australia to sell at a higher than spot rate to that market. There may also be parties that would take up the material on a contractual basis.

| 6 |

Competition

The mining industry is acutely competitive in all of its phases. We face strong competition from other mining companies in connection with the acquisition of exploration stage properties or properties containing gold, jade and other mineral reserves. Many of these companies have greater financial resources, operational experience and technical capabilities than us. It is our goal to find under valued properties and team up with local joint venture partners to streamline our time to market and costs. In PNG in particular we are finding a number of such properties, as the enforcement of the Mining Act has forced traditional landowners to comply with the relevant requirements of the act. Their ability to do so is limited as they do not have the financial, or management resources to comply.

Raw Materials, Principal Suppliers and Customers

Angel Jade

We are not dependent on any principal suppliers and our raw materials are produced principally through our own mining activities. Our principal customers for our mining activities are wholesale markers in China, SE Asia and the Middle East. A customer base is yet to be established but that will occur over the next 12 months.

Aqua Mining

We are not dependent on any principal suppliers and our raw materials are produced principally through our own mining activities. Our principal customers for our mining activities are Refineries based in PNG. A wholesale customer base is yet to be established but that will occur over the next 12 months, after the company received the appropriate export licenses from the PNG government.

Intellectual Property

Intellectual property is not a large part of our current business model as we are selling non-unique materials through primarily conventional channels. One or more brands may yet be developed if we determine branding will benefit the Company.

Government Regulations

Our products and services are subject to foreign, federal, state, provincial and local laws and regulations concerning business activities in general, including the laws of Papua New Guinea and Australia.

Our operations will be affected from time to time in varying degrees by domestic and foreign political developments, foreign, federal and state laws.

Angel Jade

The mining industry in Australia is governed by Federal Government law but administered by the States. Angel Jade tenements are administered and regulated by the NSW Department of Trade and Industry (DTI). Its principal field office for the mining sector is located in Maitland, approximately 250 kilometers from Tamworth. To maintain the company's tenements in good order and standing with the DTI, an Annual Report must be lodged every year detailing all works to date and monies expended toward same. An environmental bond is also held by the DTI to ensure compliance and remediation on vacation of the tenement.

Angel Jade currently holds an Exploration License, EL8104, which requires renewal every two years. Current date of renewal is June 30, 2015. Renewal is usually only withheld where there have been serious compliance issues. During the course of the exploration program, the company may elect to apply for one or more mining leases within the boundaries of its EL. This would be subject to satisfactory interpretation of geological data suggesting a commercial mining would be viable and could be established with some certainty.

Aqua Mining

As the 90% owner of Aqua Mining [PNG] Limited, a Papua, New Guinea company, we are required to obtain approval from the Investment Promotion Authority of Papua New Guinea to be recognized as a foreign investor for our mineral exploration joint venture with the Leaseholders of approximately 26 hectares located at Koranga in Wau, Morobe Province, Papua, New Guinea.

| 7 |

On July 24, 2015, we received final approval from the Papua New Guinea Department of Environment and Conservation, the Papua New Guinea Mining Resources Authority and the Mining Advisory Committee. This approval allows for mechanized processing on on land controlled by the Koranga Joint Venture for a period of 20 years and Aqua Mining is the licensed contract miner for a period of 5 years. This AML license is limited to 50,000 tones of processing per year and to a maximum of 5-hectares of mining at any one time. We must report our exploration activities and sales monthly to the Mining Resource Authority and comply with the terms of the agreements with the landowners. The tribute agreement for this land requires contribution of 2% of gross sales over 3 grams of ton and 2% of gross sales when under 5 grams per ton.

Environmental Regulations:

Angel Jade

Environmental issues and compliance are administered by the NSW EPA. The proposed mining activity and processing by Angel Jade will not involve the use of any chemicals, hence the key areas of concern to the EPA will be in the areas of soil erosion, flora and fauna, water monitoring and effective remediation. The EPA can issue non compliance notices that in the case of serious breaches may jeopardize the tenement's standing. However, this is considered a low risk for this style of mining where no chemicals are utilized and the mining activity is near surface.

Aqua Mining

Under our Alluvial Mining Lease, we must comply with the provisions of the Mining Act pertaining to Environmental requirements. We are subject to applicable environmental legislation including specific site conditions attached to the mining tenements imposed by the PNG Government Department of Environment and Conservation ("DEC"), the terms and conditions of operating licenses issued by the PNG Mineral Resources Authority ("MRA") and DEC, and the environment permits for water extraction and waste discharge issued by DEC. In the fourth quarter of fiscal 2014, the PNG Parliament approved a name change for the Department of Environment and Conservation to the Conservation Environment Protection Authority and that change has become effective.

Employees

As of January 10, 2015, the Company has 42 full time employees.

ITEM 1A. RISK FACTORS.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

Not applicable to smaller reporting companies.

ITEM 2. PROPERTIES.

The Company does not lease any properties or facilities. We own a building consisting of 1,200 square feet of office and warehouse space on property owned by James Koitamara, a member of the Kornaga Joint Venture, located on mining lease ML297 in New Guinea. The building and other personal property was assigned to us by Five Arrows pursuant to the Assignment Agreement attached as Exhibit 10.5. The Company utilizes office space from its corporate counsel for a nominal quarterly fee, this space is physically located at 5635 N. Scottsdale Road, Suite 170, Scottsdale, AZ 85250. Management has determined that this arrangement is adequate for its current and immediate foreseeable operating needs.

| 8 |

1. The Koranga Joint Venture properties located in Papua, New Guinea:

Description and Location of the Leases

The Company does not own or lease any of the mining properties directly and we have no right to acquire a lease or license for the Koranga properties. Rather titles are held by the landowners who were given the properties covered by the mining leases by the Papua, New Guinea government from 1966 to 1968. The Company has the right to manage and finance the exploration of each mining license pursuant to a Joint Venture Agreement with each of the landowners. As part of that agreement, the Company is entitled to 70% of the net profits from mineral exploration and any production. The mining licenses included in the Koranga Joint Venture are: ML296, ML297, ML298, ML299, ML300 and ML301.

Our conversion application for Mining Lease Nos. ML 296 through ML 301 was approved on July 24, 2015. The permit requires payment of K6440.96 (approximately $2,329 U.S. Dollars) within 30 days. This fee is comprised of a Security Deposit, a Tribute Agreement Fee, and rent through July 23, 2015. Furthermore, the permit holder must carry out works associated with the mining activity in accordance with the plans and specifications in the environment permit. Such requirements include nominal monetary payments, development of an environmental management plan, a waste management plan, water extraction plan, monitoring and reporting.

Exploration History

The historic alluvial mining activities for the Koranga leases was previously undertaken by New Guinea Gold Ltd. from 1935 to 1942, by Koranga Aluvial Mining Ltd. from 1943 to 1944, and by Koranga Westland Ltd. from 2008 to 2011. Koranga Westland Ltd.'s results were follows:

| 9 |

The results were produced by utilizing day and night shifts each day. Available production data collected over two years shows the following:

1. An average of 75 cubic meters of materials was processed per shift. However, records from Koranga Westland Ltd. show that without breakdowns, 130-50 cubic meters could be processed in a shift period.

2. The gold grade of the material ranges between 0.1g and 5 grams per cubic meter and averages around 0.6grams per cubic meter. Raw weight is around 0.92grams per cubic meter.

3. Fineness of the alluvial gold from the lease area is between 58% and 65%, and at times higher.

4. A total of 55,300 cubic meters of mined material was processed to extract 51,000 grams of gold - raw weight (approximately 31kg pure gold) over the two years of mining activities, during the period from 2008 to 2011.

5. The mined material is comprised both of conglomerates and interbedded conglomerate, siltstone, sandstone and mudstones.

6. The mined material was rare to weakly lithified, free digging, poorly consolidated with rock clasts dislodging easily.

7. Only sluice boxes were used to capture the concentrates. The recovery was 80% during the period from 2008 to 2011.

All production data was recorded in a computer on site. A summary of the production data is given in Table 001 below

|

| Total Loads | Production | Grade (Ave) | Trommels in |

| |||||||||||||

Date From |

| To |

| M3 |

|

| Gold (g) |

|

| (g/m3) |

| Operation | |||||||

11/27/2009 |

| 12/21/2009 |

|

| 311.04 |

|

|

| 245.6 |

|

|

| 0.8 |

|

| Trommel 1 | |||

1/01/2010 |

| 08/16/2010 |

|

| 10295.2 |

|

|

| 9136.2 |

|

|

| 0.9 |

|

| Trommel 1 | |||

8/17/2010 |

| 08/31/2010 |

|

| 924.8 |

|

|

| 2097.1 |

|

|

| 2.3 |

|

| Trommel 1 | |||

09/01/2010 |

| 09/30/2010 |

|

| 1730 |

|

|

| 3447.2 |

|

|

| 1.3 |

|

| Trommel 1 | |||

10/01/2010 |

| 10/31/2010 |

|

| 2513 |

|

|

| 2584.8 |

|

|

| 1.03 |

|

| Trommel 1 | |||

11/01/2010 |

| 11/30/2010 |

|

| 4332 |

|

|

| 2605.3 |

|

|

| 0.6 |

|

| Trommel 1 | |||

01/01/2011 |

| 01/31/2011 |

|

| 1555 |

|

|

| 2018.6 |

|

|

| 1.3 |

|

| Trommel 1 | |||

02/01/2011 |

| 02/28/2011 2061 |

|

| 915.9 |

|

|

| 0.45 |

|

|

|

| Trommel 1&2 | |||||

03/01/2011 |

| 03/31/2011 3666 |

|

| 2967.3 |

|

|

| 0.81 |

|

|

|

| Trommel 1&2 | |||||

04/01/2011 |

| 04/30/2011 4195 |

|

| 4051.4 |

|

|

| 0.97 |

|

|

|

| Trommel 1&2 | |||||

Koranga Westland Ltd. ceased production in 2011 due to capital constraints.

The Company does not plan to undertake any exploration and/or development of the property. The property is split by the Koranga creek with sedimentary deposits running through the creek and side walls with visible gold strata's. The exploration activities will be alluvial mining and to that nature will be open pit. The present condition of the property is an open area with a river running through the center of the mining leases.

The equipment used is new, the modernization is basic as the type of mining at this stage is sluice boxes and pressure hoses. The current mining lease only allows for non-mechanized processing. The current cost of equipment is approximately $150,000 and if and when we move to mechanized processing, we estimate the cost of equipment to be in excess of $1,000,000.

There has been no annual production of minerals to report for the Koranga Joint Venture properties for fiscal years 2015 and 2014.

Geology

The tectonic feature that hosts the project site and may have been influential in creating an environment conducive for the alluvial gold deposit is the Bulolo graben. It is bounded on the East and West by sub parallel Northwest trending transfer structures while bounded by Northeast trending transfer structures on the North and South. The Northwest trending structures and the subsidiary fractures have accommodated much of the mineralization and have controlled a series of intrusions. The basement rock of the area is metamorphics, intruded by Miocene granodiorite, and believed to be the source of high fineness gold mineralization in the area. A serious of other intrusions occurred, giving rise to further mineralization which is believed to have contributed to much of the prospects in the project area. These intrusions where associated with volcanism that resulted in blocking off of the Bulolo River and consequently the formation of the gold bearing sequence.

| 10 |

Otibanda Formation

The Otibanda Formation is the target alluvial gold bearing sedimentary sequence. It is a lacustrine sequence that was deposited in a fresh water lake. Mapping shows the apparent thickness of the sequence to be 700m and is alluvial gold bearing. The sequence is comprised of interbedded agglomerates, sandstones, siltstones and intercalated thin mudstone. The deposit is the result of an eruptive volcanism that blocked off the Bulolo River resulting in blockage and setting up of a fresh water lake. All sediments including gold shedding off from the surrounding hills and mountains were deposited into the lake. The enriched sequence is the source of gold for the miners down creek and our target in this project.

Proven or probable reserves have not been established.

The Koranga property has been physically inspected by Ken Unamba, a professional geologist, but a formal feasibility study for the property has not been prepared. Furthermore, there are no current detailed plans to conduct exploration on the property, nor are any phased programs planned.

Exploration work will be performed and/or supervised by Mr. Ken Unamba, a geologist and member of our advisory committee. Mr. Unamba has a Science Degree majoring in Geology. His 22 years' work experience covers Exploration Geologist for Tolukuma Gold Mine Ltd., Consulting Geologist for Harmony Gold SE Asia and Filmena Resources Corp Philippines. He was appointed to the then Mining Advisory Board in 2000 for five years as Technical Advisor.

Our exploration budget for Aqua Mining is $200,000, including geophysics, sampling and exploration labor.

At this time, we are uncertain how our exploration work will be funded.

2. Angel Jade's EL8104 located near Tamworth, Australia:

EL 8104 is situated approximately 35 kilometres south-east of the major regional centre of Tamworth, in north-eastern New South Wales. The EL covers about 100 square kilometres and was granted for Group 2 and Group 3 mineral exploration for a two-year renewable term. This EL (8104) supersedes Angel Jade's previous EL (7883) which covered the same area but without extensions to the north and east. EL8104 is believed to contain nephrite jade and other minerals. Proven or probable reserves have not been established.

The license for EL8104 is issued by the New South Wales State Government. This license permits us to take up to 70 tons of material for evaluation and testing annually. In order to maintain our license, the Company must undertake exploration activities of at least AUS $150,000 per year. We are currently in the renewal period as our renewal application was submitted June 10, 2015. If approved, the renewal term would run through June 15, 2017. While we have no reason to believe the renewal application will be denied, if our renewal is not approved, our license would immediately terminate.

Access to the license area is obtained along a sealed road connecting Tamworth with Port Macquarie. The road runs south-east from Dungowan to Ogunbil and passes through the south-west corner of the licence area, following Dungowan Creek. The main access to EL8104 is via a dirt road which turns off this road about 10.5 kilometres south-east of Dungowan and follows Spring Creek and Teatree Gully, to Mulla Creek, through the centre of the EL.

There are a number of habitations and other buildings along Dungowan Creek, but most of the licence area is fairly hilly and forested, with no buildings. Cattle are pastured in the Dungowan Creek area and to a lesser extent in the west and north of the licence.

This EL was applied for to cover a serpentinite belt which is known to host several nephrite jade occurrences. This serpentinite trends slightly east of north and is probably a splay from the major north-north-west trending Peel Fault serpentinite belt to the west.

Jade was apparently first found here in about 1962 (MacNevin & Holmes, 1980) but was not officially documented or petrologically identified until 1964 (Smith, 1964).

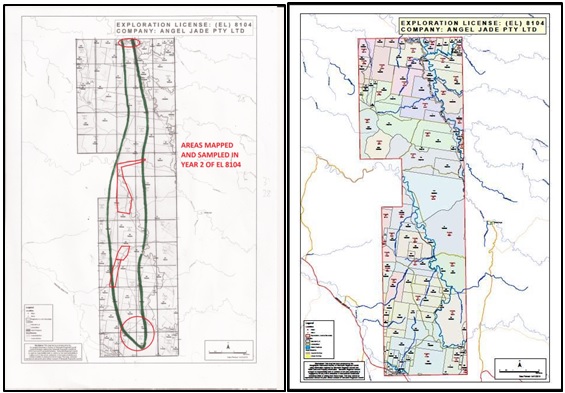

Angel Jade applied for and was granted 59 units in addition to the original EL in June 2013. In October of 2013, access was arranged with three of the landholders whose properties contain the area of old workings and most potential for further discoveries.

| 11 |

The company has been unable to explore significant portions of the EL because access agreements have not yet been established with all of the landowners. The Company has spent money and resources negotiating access agreements with many of the landholders and is making progress with many of the owners. However, there are some landowners who are holding out and may force the Company to take legal action to secure its right to access the property for mineral exploration.

There has been no annual production of minerals to report for Angel Jade for fiscal years 2015 and 2014.

| 12 |

Geology:

The nephrite jade occurs in the New England Fold Belt, which extends from northeast New South Wales into southeast Queensland. The jade occurrence is within the central block of the fold belt, a few kilometres east of the Peel Fault, a major structure which runs slightly west of north in the project area location.

The "country rock" in the jade region is predominantly metamorphosed (sub-green schist facies) fine grained sediments, plus chemical sediments (chert, jasper) and some meta-volcanics (mostly basaltic and/or andesitic). These are part of the Woolomin Group and the stratigraphy is steeply dipping and trends roughly north-south.

EL 8104 covers a smaller serpentinite belt which is known to host several nephrite jade occurrences. The jade-bearing serpentinite belt was evidently not properly recognised when the jade was first found and mined and is not shown on the 1:250,000 Tamworth geological map sheet, first published by the Geological Survey of New South Wales in 1971, about nine years after the first jade discovery in the project area. It is, however, shown in the 1:250,000 digital dataset now available and the fault-bounded serpentinite bodies from this dataset are shown within that dataset. There are three smaller bodies to the south and one larger elongate body to the north.

Copper is probably the main economic mineral in the area, with a number of small to medium sized deposits occurring, usually in association with the serpentinites and/or (possibly) meta-volcanics within the country rock.

No copper has been recorded in the serpentinites hosting the jade occurrences. There are also numerous rhodonite occurrences of varying sizes within a north-south zone extending about 20 kilometres east of the Peel Fault. These are typically lenses in the country rock, associated with stratiform manganese oxide bodies.

There is a small historic gold-field about 5 kilometres east of EL 8104, at Weabonga. The gold is in small quartz veins and recorded production was about 7,000 ounces (Mumbil Mines NL, 1989). This area is currently covered by EL 6620, Icon Resources Ltd.

The Tamworth nephrite jade has been documented as occurring in lens-shaped bodies (locally referred to as "seams") on the faulted contact of the serpentinite and country rock. The country rock is mostly comprised of low-grade metamorphosed shale, siltstone, and silty sandstone. The compact, fine-grained nephrite is inferred to have formed under pressure in this contact zone.

| 13 |

Hockley et al, 1978, identifies a zonation from massive serpentinite, to schistose serpentinite, to talc, to nephrite, to "country rock" (quartz phyllite). This is probably based on one of the two sites apparently visited by Hockley, however and may be a gross simplification, which may not generally apply.

The serpentinite is probably commonly schistose close to the faulted margin/contact with the country rock, as might be expected in such a deformational zone but the nephrite and talc will not always be present (one or both may be missing) and the "talc" may actually (often) be more a massive fine grained serpentine mineral.

Serpentine is a secondary mineral produced by the hydrothermal alteration of magnesium silicate minerals. The distinction needs to be made between serpentine, the mineral and serpentinite, the rock. Serpentine mineral is typically massive, fine grained, moderately soft (hardness 2 to 5), may have a slightly greasy feel and is commonly greenish in colour.

Differentiation between serpentine and nephrite in hand specimen may be difficult, except by identifying the greater hardness of the nephrite. At the Tamworth jade project, much of the material dismissed as "talc" may actually be a serpentine, as may some of the rock initially identified as "jade".

There are a number of varieties of serpentine minerals recognised and some may be of value in their own right (though less so than nephrite) for carving or ornamental purposes. "Bowenite", which apparently occurs within EL 8104, is a variety of antigorite serpentine.

The Angel Jade property has been physically inspected by Matthew Stephens, a professional geologist, but a formal feasibility study for the property has not been prepared. Furthermore, there are no current detailed plans to conduct exploration on the property, nor are any phased programs planned.

Exploration work will be performed and/or supervised by Matthew Stephens. Mr. Stephens has had over 25 years of continuous experience in the Mining Industry, having worked in Metalliferous Mining, Development, Resource Evaluation and Exploration. Matthew has been involved in the active (i.e. "hands on") exploration of a variety of commodities including Gold, Base Metals, Iron and Uranium as well as having detailed exposure with the development and mining of nine underground mines and nine open pit operations throughout Queensland, Western Australia, New South Wales and the Northern Territory. Matthew holds a BAppSc (Geology) and is a member if the AusIMM (MAusIMM).

Our exploration budget for the Angel Jade project is $2,000,000 as follows:

| · | Detailed mapping of EL and new extensions - $250,000 |

|

|

|

| · | Costeaning and trenching on 'Pitt' property - $550,000 |

|

|

|

| · | Drill program to explore nephrite intrusion at depth - $1,200,000 |

At this time, we are uncertain how our exploration work will be funded.

ITEM 3. LEGAL PROCEEDINGS.

We are not presently a party to any litigation. However, the minority shareholders in Angel Jade are challenging the basis of funding by Kibush Capital that resulted in the share issuances that gave Kibush Capital a controlling interest in Angel Jade. Our Australian legal representatives have expressed the opinion that the Angel Jade Board did unanimously resolve and pass the share issuances in question. Kibush Capital will vigorously contest any challenge to the share issuance.

ITEM 4. MINE SAFETY DISCLOSURES.

Not Applicable.

| 14 |

PART II

ITEM 5. MARKET PRICE FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Market Information

Fiscal Year - 2015 |

| High Bid |

|

| Low Bid |

| ||

Fourth Quarter: 7/1/15 to 9/30/15 |

|

| 0.045 |

|

|

| 0.0075 |

|

Third Quarter: 4/1/15 to 6/30/15 |

|

| 0.12 |

|

|

| 0.027 |

|

Second Quarter: 1/1/15 to 3/31/15 |

|

| 0.32 |

|

|

| 0.1004 |

|

First Quarter: 10/1/14 to 12/31/14 |

|

| 0.50 |

|

|

| 0.1101 |

|

|

|

|

|

|

|

|

| |

Fiscal Year - 2014 |

| High Bid |

|

| Low Bid |

| ||

Fourth Quarter: 7/1/14 to 9/30/14 |

|

| 0.52 |

|

|

| 0.30 |

|

Third Quarter: 4/1/14 to 6/30/14 |

|

| 0.4151 |

|

|

| 0.2001 |

|

Second Quarter: 1/1/14 to 3/31/14 |

|

| 0.38 |

|

|

| 0.2001 |

|

First Quarter: 10/1/13 to 12/31/13 |

|

| 1.00 |

|

|

| 0.23 |

|

Our shares of common stock are traded on the OTC Pink operated by the Financial Industry Regulatory Authority (FINRA) under the symbol "DLCR". The shares trading of our common stock began on August 1, 2013.

Holders

As of January 10, 2016, we had 202 stockholders of record.

Dividends

We have never declared or paid cash dividends. There are currently no restrictions which limit our ability to pay dividends in the future.

On January 8, 2016 the closing bid price of our common stock on the OTC pink sheets quotation system was $0.0175 per share.

As of January 10, 2016 there were 202 holders of record of our common stock.

Dividends

We have not declared or paid any cash dividends on our common stock and we do not anticipate paying any dividends in the foreseeable future. We expect to retain any future earnings to finance our business activities and any potential expansion. The payment of cash dividends in the future will depend upon our future revenues, earnings and capital requirements and other factors the Board considers relevant.

Warrants or Options

The Company does not have any warrants outstanding and the Company has not yet adopted a stock option plan.

Securities Authorized for Issuance under Equity Compensation Plans

We do not have any equity compensation plans.

Repurchase of Securities

None.

| 15 |

Recent Sales of Unregistered Securities

On April 29, 2015, the Company issued 3,001,702 shares of its common stock to Warren Sheppard (previously authorized by for issuance by the company on December 10, 2014) pursuant to his employment agreement.

Between April 1, 2015 and June 24, 2015, the Company issued a total of 4,000,000 shares of common stock upon the requests from convertible note holders to convert principal totaling $4,000 into the Company's common stock based on the terms set forth in the loans. The conversion rate was $0.001.

On February 4, 2015, the Company issued 2,000,000 shares of common stock to Cavanagh pursuant to conversion of a portion of the Convertible Promissory Note dated May 1, 2012.

On April 5, 2015, the Company issued 2,000,000 shares of common stock to Cavanagh pursuant to conversion of a portion of the Convertible Promissory Note dated May 1, 2012.

On or about April 24, 2015, the Company issued 14,000,000 shares of common stock to Five Arrows for the Angel Jade acquisition pursuant to that Agreement dated December 10, 2014.

Each of the foregoing issuances was exempt from the registration requirements of the Securities Act of 1933, as amended pursuant to Section 4(2).

As of January 10, 2016, there are 80,399,187 shares of the Company's common stock issued and outstanding.

Securities authorized for issuance under equity compensation plans

We have no equity compensation plans at the present time.

Section 15(g) of the Securities Exchange Act of 1934

Our company's shares are covered by Section 15(g) of the Securities Exchange Act of 1934, as amended that imposes additional sales practice requirements on broker/dealers who sell such securities to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000 or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouses). For transactions covered by the Rule, the broker/dealer must make a special suitability determination for the purchase and have received the purchaser's written agreement to the transaction prior to the sale. Consequently, the Rule may affect the ability of broker/dealers to sell our securities and also may affect your ability to sell your shares in the secondary market.

Section 15(g) also imposes additional sales practice requirements on broker/dealers who sell penny securities. These rules require a one page summary of certain essential items. The items include the risk of investing in penny stocks in both public offerings and secondary marketing; terms important to in understanding of the function of the penny stock market, such as "bid" and "offer" quotes, a dealers "spread" and broker/dealer compensation; the broker/dealer compensation, the broker/dealers duties to its customers, including the disclosures required by any other penny stock disclosure rules; the customers rights and remedies in causes of fraud in penny stock transactions; and, the FINRA's toll free telephone number and the central number of the North American Administrators Association, for information on the disciplinary history of broker/dealers and their associated persons.

The application of the penny stock rules may affect your ability to resell your shares.

ITEM 6. SELECTED FINANCIAL DATA.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Until 2013 we were engaged in the design, production and wholesale merchandising of quality women's and men's apparel, and home furnishings. Since then our business activities are conducted through our wholly-owned subsidiaries. Our business consists of a jade exploration venture in Australia and an gold exploration venture in Papua, New Guinea.

We qualify as an "emerging growth company" under the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements. For so long as we are an emerging growth company, we will not be required to:

| 16 |

| · | have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act; |

|

|

|

| · | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor's report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); |

|

|

|

| · | submit certain executive compensation matters to shareholder advisory votes, such as "say-on-pay" and "say-on-frequency;" and |

|

|

|

| · | disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the CEO's compensation to median employee compensation. |

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an "emerging growth company" for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our total annual gross revenues exceed $1 billion, (ii) the date that we become a "large accelerated filer" as defined in Rule 12b-2 under the Securities Exchange Act of 1934, which would occur if the market value of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

The following discussion of the financial condition and results of our operations should be read in conjunction with the financial statements and the related notes thereto included elsewhere in this Annual Report on Form 10-K for the year ended September 30, 2015 (this "Report"). This report contains certain forward-looking statements and our future operating results could differ materially from those discussed herein. Certain statements including, without limitation, statements containing the words "believes", "anticipates," "expects" and the like, constitute "forward-looking statements". Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Given these uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. We disclaim any obligation to update any such factors or to announce publicly the results of any revisions of the forward-looking statements contained or incorporated by reference herein to reflect future events or developments.

Plan of Operations

The Company's current strategy is to engage in mining activities. We are currently focused on building its management team. The Company hopes to undertake a number of additional mining projects so the cost of the team could be amortized over a number of cost centers. We believe that this team would enable the Company to consider exploration in various geographical locations in addition to Papua New Guinea. For example, there are a number of projects that we have identified that would flow from our involvement in our mining joint venture in Papua New Guinea. Under the terms of our joint venture we are able to supply food, clothing, housing and medical supplies which we would hope to be able to service not only our requirements in the region but to expand and supply other markets within that region. We believe that there may be other opportunities that would evolve from our presence in Papua, New Guinea if we have an infrastructure to capitalize on those opportunities. We currently believe that we will need $2,000,000 over the next 12 months to develop plans for our business.

In addition to the dispute described in Item 3, we have recently experienced a few setbacks with our Angel Jade subsidiary. In addition, the government has imposed new requirements which would require us to hire a registered Mine Manager and limits the extraction volumes allowed under an exploration lease to 1 ton per year. Moreover, the Mining Department has been slow to renew our exploration license for the current period. As a result of the foregoing difficulties, we are reviewing our current opportunities and analyzing whether whether Angel Jade is in alignment with the financial model required by the Company.

| 17 |

We are exited about the opportunity to takeover of the management of Paradise Gardens and its timber operation. In fact, all of our revenue from the year ended September 30, 2015 was generated from the management agreement with Paradise Gardens. The management agreement provides us, through our subsidiary Aqua Mining, with the opportunity to develop the current logging areas under permit, to develop new areas for logging outside the existing area permit area, and to spread the customer base from the existing to now incorporate retail, contract felling and long term commercial orders. In December 2015, we established a small lumber outlet in Port Moresby to serve the local construction industry. We are now seeking to acquire ownership of Paradise Gardens and/or other timber assets in Papua New Guinea.

Results of Operations

For the year ended September 30, 2015 and September 30, 2014

Revenues

The Company had $32,000 in revenue for the year ended September 30, 2015 and no revenue for the year ended September 30, 2014. The increase in revenue of $32,000 is attributable to the sale of timber under the management agreement with Paradise Gardens.

Operating expenses

The Company had operating expenses of $1,243,666 for the year ended September 30, 2015 consisting of general and administrative expenses, as compared with operating expenses of $818,588 for the year ended September 30, 2014 consisting of general and administrative expenses. The increase of $425,078 was attributable in part to the costs associated with getting the timber logging operations up to date, starting works on the infrastructure at Koranga and additional administrative expense

Net Loss

The Company had a net operating loss of $1,211,666 for the year ended September 30, 201 compared with a net operating loss of $818,588 for the year ended September 30, 2014. The increase of $393,078 was primarily attributable to the costs associated with getting the timber logging operations up to date, starting works on the infrastructure at Koranga and additional administrative expense.

Operating Activities

Net cash used in operating activities was $925,853 for the year ended September 30, 2015 compared to net cash used in operating activities of $193,239 for the year ended September 30, 2014. The increase of $732,614 was a result mainly from in part to the costs associated with getting the timber logging operations up to date, starting works on the infrastructure at Koranga and additional administrative expense.

Investing Activities

Net cash used in investing activities was $17,050 for the year ended September 30, 2015 compared to $92,586 for the year ended September 30, 2014. This increase resulted from the acquisition of Instacash which is no longer operated by the Company.

Financing Activities

Net cash provided by financing activities was $1,353,993 for the year ended September 30, 2015 compared to $1,651,454 for the year ended September 30, 2014.The decrease of $297,455 was mainly due to a decrease in cost of financing.

Liquidity and Capital Resources

As of September 30, 2015, the Company had total current assets of $105,496 and total current liabilities of $1,923,196 resulting in a working capital deficit of $1,817,699. As of September 30, 2014, the Company had total current assets of $236,280 and total current liabilities of $1,745,730 resulting in a working capital deficit of $1,509,450. The increase in working capital deficit arose mainly due to increase in loans owing to related parties, who provided advances to the Company for working capital purposes. The Company had cash as of September 30, 2015 of $10,763. The Company intends to fund its exploration through the sale of its equity securities. However, there can be no assurance that the Company will be successful doing so. We currently have no agreements, arrangements or understandings with any person to obtain funds through bank loans, lines of credit or any other sources. We currently believe that the Company will need approximately $2,000,000 over the next 12 months to implement our desired expansion of mining activities.

| 18 |

Going Concern

The Company is in the development stage and has insufficient revenues to cover its operating costs. As of September 30, 2015, the Company had an accumulated deficit of $10,986,677 and a working capital deficiency and insufficient cash resources to meet its planned business objectives. These and other factors raise substantial doubt about the Company's ability to continue as a going concern. Management's plan for our continued existence includes selling additional stock through private placements and borrowing additional funds to pay overhead expenses while maintaining marketing efforts to raise our sales volume. Our future success is dependent upon our ability to achieve profitable operations, generate cash from operating activities and obtain additional financing. There is no assurance that we will be able to generate sufficient cash from operations, sell additional shares of common stock or borrow additional funds. Our inability to obtain additional cash could have a material adverse effect on our financial position, results of operations and our ability to continue as a going concern.

We have only had operating losses which raise substantial doubts about our viability to continue our business and our auditors have issued an opinion expressing the uncertainty of our Company to continue as a going concern. If we are not able to continue operations, investors could lose their entire investment in our Company.

Contractual Obligations

The Company is not party to any contractual obligations other than indicated in Notes 5 and 6.

Off Balance Sheet Arrangements

We have no off balance sheet arrangements other than as described above.

We have not entered into any other financial guarantees or other commitments to guarantee the payment obligations of any third parties. We have not entered into any derivative contracts that are indexed to our shares and classified as shareholder's equity or that are not reflected in our consolidated financial statements. Furthermore, we do not have any retained or contingent interest in assets transferred to an unconsolidated entity that serves as credit, liquidity or market risk support to such entity. We do not have any variable interest in any unconsolidated entity that provides financing, liquidity, market risk or credit support to us or engages in leasing, hedging or research and development services with us.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

| 19 |

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

INDEX TO FINANCIAL STATEMENTS

| Index | ||

|

| ||

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

|

| 21 |

Balance Sheet |

|

| 22 |

Statement of Stockholders' Equity (Deficiency) |

|

| 23 |

Statements of Operations |

|

| 24 |

Statements of Cash Flows |

|

| 25 |

Notes to Financial Statements |

|

| 26 |

| 20 |

Scrudato & Co., PA

CERTIFIED PUBLIC ACCOUNTING FIRM

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of

Kibush Capital Corporation

We have audited the accompanying balance sheet of Kibush Capital Corporation as of September 30, 2015 and 2014 and the related consolidated statements of operations, changes in stockholders' deficit and cash flows for the years then ended. These financial statements are the responsibility of the Company management. Our responsibility is to express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Kibush Capital Corporation at September 30, 2015 and 2014, and the results of their operations and their cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that Kibush Capital Corporation will continue as a going concern. As more fully described in Note 4, the Company had an accumulated deficit at September 30, 2015 and 2014, a net loss and net cash used in operating activities for the fiscal year then ended. These conditions raise substantial doubt about the ability of the Company to continue as a going concern. Management's plans in regards to these matters are also described in Note 4. The financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result from the outcome of this uncertainty.

/s/ Scrudato & Co., PA

Scrudato & Co., PA

Califon, New Jersey

January 6, 2016

7 Valley View Drive Califon, New Jersey 07830 (908)534-0008

Registered Public Company Accounting Oversight Board Firm

| 21 |

KIBUSH CAPITAL CORPORATION

CONSOLIDATED BALANCE SHEET

September 30,

| 2015 |

|

| 2014 |

| |||

ASSETS: |

|

|

|

|

|

| ||

CURRENT ASSETS |

|

|

|

|

|

| ||

Cash |

| $ | 10,763 |

|

| $ | 110,152 |

|

Prepaid expenses |

|

| 0 |

|

|

| 6,035 |

|

TOTAL CURRENT ASSETS |

| $ | 10,763 |

|

| $ | 116,187 |

|

Property and equipment, net |

|

| 48,544 |

|

|

| 79,594 |

|

Investment in unconsolidated Joint Venture/Mining Rights |

|

| 0 |

|

|

| 40,000 |

|

|

|

|

|

|

|

|

| |

OTHER ASSETS |

|

| 22,627 |

|

|

| 499 |

|

Deposits Paid |

|

| 9,562 |

|

|

| 499 |

|

Goodwill |

|

| 14,000 |

|

|

|

|

|

TOTAL CURRENT ASSETS AND TOTAL ASSETS |

|

| 105,496 |

|

|

| 236,280 |

|

|

|

|

|

|

|

|

| |

LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIENCY): |

|

|

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

|

|

|

|

Accounts Payable |

|

| 11,147 |

|

|

| 2,957 |

|

Accrued Expenses |

|

| 326,187 |

|

|

| 354,685 |

|

Promissory Notes Payable |

|

| 34,374 |

|

|

|

|

|

Convertible notes payable, net of discounts of $80,434 and $3,099, respectively |

|

| 182,166 |

|

|

| 108,292 |

|

Loans from Related Parties |

|

| 679,227 |

|

|

| 446,799 |

|

Derivative Liabilities |

|

| 498,417 |

|

|

| 752,997 |

|

Deposits |

|

| 155,300 |

|

|

| 80,000 |

|

Shares to be Issued - Five Arrows |

|

| 36,378 |

|

|

|

|

|

TOTAL CURRENT LIABILITIES |

| $ | 1,923,196 |

|

|

| 1,745,730 |

|

TOTAL CURRENT LIABILITIES |

| $ | 1,923,196 |

|

|

| 1,745,730 |

|

|

|

|

|

|

|

|

| |

STOCKHOLDERS' EQUITY (DEFICIENCY) |

|

|

|

|

|

|

|

|

Preferred stock, $0.001 par value; 50,000,000 shares authorized; Series A 3,000,000 shares issued and outstanding at September 30, 2015 and 2014, respectively |

| $ | 3,000 |

|

| $ | 3,000 |

|

Common stock, $0.001 par value; 500,000,000 shares authorized at September 30, 2015 and 2014, respectively; 53,837,485 and 563,485 shares issued and outstanding at September 30, 2015 and 2014, respectively |

|

| 77,399 |

|

|

| 53,837 |

|

Additional paid-in capital |

|

| 9,151,960 |

|

|

| 8,494,962 |

|

Accumulated deficit |

|

| (10,986,677 | ) |

|

| (10,225,051 | ) |

Accumulated other comprehensive income |

|

| 0 |

|

|

| 55,022 |

|

Total stockholders' deficit, including non-controlling interest |

| $ | (1,754,318 | ) |

| $ | (1,618,230 | ) |

Non-Controlling interest |

| $ | (63,381 | ) |

| $ | 108,780 |

|

Total stockholders' deficit |

|

| (1,817,699 | ) |

|

| (1,509,450 | ) |

Total liabilities and stockholders' deficit |

|

| 105,496 |

|

|

| 236,280 |

|

"See notes to financial statements"

| 22 |

KIBUSH CAPITAL CORPORATION

CONSOLIDATED STATEMENTS OF STOCKHOLDERS EQUITY (DEFICIENCY)

For the years ended September 30, 2015 and 2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Additional |

|

| Non |

|

|

| Accumulated Other |

Total | |||||

| Common Stock |

|

| Preferred Stock |

|

| Paid-in |

|

| Controlling |

| Accumulated |

| Comprehensive |

| Stockholders' |

| |||||||||||

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Capital |

|

| Interest |

| Deficit |

| Income |

| Deficit |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Balance at September 30, 2013 |

|

| 563,485 |

|

| 563 |

|

| 3,000,000 |

|

| 3,000 |

|

| 8,494,962 |

|

|

|

|

| (8,589,817 | ) |

| - |

|

| (91,292 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Purchase of MOU for acquisition of Instacash Group @ 0.0117 per share of common stock |

|

| 10,000,000 |

|

| 10,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 10,000 |

|