Attached files

| file | filename |

|---|---|

| 8-K - KAMAN CORPORATION FORM 8-K DATED JANUARY 13, 2016 - KAMAN Corp | form8-k11316.htm |

Investor PresentationJanuary 13, 2016

Forward Looking Statements FORWARD-LOOKING STATEMENTSThis presentation contains "forward-looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements also may be included in other publicly available documents issued by the Company and in oral statements made by our officers and representatives from time to time. These forward-looking statements are intended to provide management's current expectations or plans for our future operating and financial performance, based on assumptions currently believed to be valid. They can be identified by the use of words such as "anticipate," "intend," "plan," "goal," "seek," "believe," "project," "estimate," "expect," "strategy," "future," "likely," "may," "should," "would," "could," "will" and other words of similar meaning in connection with a discussion of future operating or financial performance. Examples of forward looking statements include, among others, statements relating to future sales, earnings, cash flows, results of operations, uses of cash and other measures of financial performance.Because forward-looking statements relate to the future, they are subject to inherent risks, uncertainties and other factors that may cause the company's actual results and financial condition to differ materially from those expressed or implied in the forward-looking statements. Such risks, uncertainties and other factors include, among others: (i) changes in domestic and foreign economic and competitive conditions in markets served by the Company, particularly the defense, commercial aviation and industrial production markets; (ii) changes in government and customer priorities and requirements (including cost-cutting initiatives, government and customer shut-downs, the potential deferral of awards, terminations or reductions of expenditures to respond to the priorities of Congress and the Administration, or budgetary cuts resulting from Congressional actions or automatic sequestration); (iii) changes in geopolitical conditions in countries where the Company does or intends to do business; (iv) the successful conclusion of competitions for government programs and thereafter contract negotiations with government authorities, both foreign and domestic; (v) the existence of standard government contract provisions permitting renegotiation of terms and termination for the convenience of the government; (vi) the conclusion to government inquiries or investigations regarding government programs; (vii) risks and uncertainties associated with the successful implementation and ramp up of significant new programs; (viii) potential difficulties associated with variable acceptance test results, given sensitive production materials and extreme test parameters; (ix) the receipt and successful execution of production orders for the U.S. government JPF contract, including the exercise of all contract options and receipt of orders from allied militaries, as all have been assumed in connection with goodwill impairment evaluations; (x) the continued support of the existing K-MAX® helicopter fleet, including sale of existing K-MAX® spare parts inventory; (xi) the accuracy of current cost estimates associated with environmental remediation activities; (xii) the profitable integration of acquired businesses into the Company's operations; (xiii) the ability to implement our ERP systems in a cost-effective and efficient manner, limiting disruption to our business, and to capture their planned benefits while maintaining an adequate internal control environment; (xiv) changes in supplier sales or vendor incentive policies; (xv) the effects of price increases or decreases; (xvi) the effects of pension regulations, pension plan assumptions, pension plan asset performance and future contributions; (xvii) future levels of indebtedness and capital expenditures; (xviii) the continued availability of raw materials and other commodities in adequate supplies and the effect of increased costs for such items; (xix) the effects of currency exchange rates and foreign competition on future operations; (xx) changes in laws and regulations, taxes, interest rates, inflation rates and general business conditions; (xxi) future repurchases and/or issuances of common stock; and (xxii) other risks and uncertainties set forth herein and in our 2014 Form 10-K.Any forward-looking information provided in this presentation should be considered with these factors in mind. We assume no obligation to update any forward-looking statements contained in this presentation.

What is Kaman? Solving Our Customers’ Critical Problems with Technically Differentiated Products & Services Leading Provider of Highly Engineered Aerospace & Industrial Products Serving a Broad Range of End Markets

Distribution Kaman Corporation Overview Distribution Aerospace $1.8B Revenues Aerospace Based on LTM Actual Results from Continuing Operations as of October 2, 2015

Aerospace Overview v AEROSYSTEMS SPECIALTY BEARINGS & ENGINEERED PRODUCTS FUZING & PRECISION PRODUCTS Engineering design and testingTooling design & manufactureAdvanced machining and composite aerostructure manufacturing Complex assemblyHelicopter MRO and support Self-lube airframe bearingsTraditional airframe bearingsMiniature ball bearingsFlexible drive systemsAftermarket engineered components Bomb and missile safe and arm fuzing devicesPrecision measuring systems Memory products Global commercial and defense OEM’sSuper Tier I’s to subcontract manufacturersAircraft operators and MRO Specialized aerospace distributorsIndustrial and medical manufacturers of high precision equipment U.S. and allied militariesWeapon system OEMs “One Kaman” combines design and build capabilities to provide customers with a global integrated solutionBearing product lines strong commercial customer base expected to provide growth from new program wins and higher build ratesExpanding engineered products portfolio into new end markets beyond aerospace and building scale in after-market applications Exclusivity and significant backlog provide a stable revenue base BusinessDynamic Customers Products

Market Leading Self-Lube Airframe Bearing Product Lines ProprietaryTechnology Material Science Capability Application EngineeringExpertise Operational Excellence KAron® • KAflex® • Tufflex® New TechnologiesNew ProductsCustomizationCustomer Intimacy Work ForceLean Automation World Class Performance

Acquisition of GRW Bearing GmbH Acquired GRW on November 30, 2015Purchase price was approximately €135 million (Euros), net of cash acquired, or approximately 13 times expected 2015 EBITDADesigner and manufacturer of super precision, miniature ball bearingsKey End MarketsHealthcareAviation and DefenseDrive Systems & AnalysisIndustrial & Distribution Deep GrooveBall Bearings Bearing Units

GRW Bearing Acquisition – Strategic Rationale Adds considerable scale and new market segments to Kaman’s specialty bearing product linesAligned with existing bearing product lines through a focus on solving customers’ critical problemsOpportunity to drive operational and cost synergies given the proximity to Kaman’s existing operations in Germany and the addition of a lower cost facility in the Czech RepublicPotential sales synergy opportunities given Kaman’s aerospace presence and GWR’s limited penetration of U.S. markets

Aftermarket engine/helicopter parts supplier to MRO marketsAcquired October 21, 2015Annual sales in 2014 of approximately $20 millionPurchase price of approximately $45 million (about 9 times 2015 EBITDA)Strategic rationaleAdds significant scale to Kaman’s commercial MRO aftermarket businessStrengthens Kaman’s FAA/PMA process skill set increasing future opportunitiesKaman’s test capabilities facilitate accelerated product developmentDrive sales synergy opportunities through Kaman’s existing global sales channels Acquisition of EXTEX Engineered Products

U.S. Air Force (USAF) bomb fuzeUSAF inventory levels below desired quantity, and foreign orders provide additional opportunitiesStrong demand has driven backlog up 166% since 12/31/2014 to over $300 million27 foreign customersSystem field reliability is greater than 99%Increasing capacity to meet customer demand Bomb CompatibilityJDAMPaveway II and IIIGBU-10, 12, 16, 24, 27, 28, 31, 32, 38, 54BLU-109, 110, 111, 113, 117, 121, 122, 126MK82/BSU-49, MK83/BSU-85, MK84/BSU-50 JPF Program

Helicopter Programs – K-MAX® Re-opened the K-MAX® production line June 2015Deliveries of manned commercial aircraft expected to begin in early 2017Orders for six aircraft are under contract and two more are under depositFirst ten aircraft produced are expected to generate $75 million to $85 million in revenueCommercial fleet service and support provides recurring revenuePartnered with Lockheed Martin on an unmanned version of the K-MAX®Two unmanned aircraft supported the USMC for 33 months in a cargo supply role in AfghanistanContinue research, development and testing of unmanned technologies & capabilities including firefighting and pursuit of a military/government program of record

Distribution Overview PRODUCT PLATFORM Bearings & Mechanical PowerTransmission (BPT) FLUID POWER AUTOMATION, CONTROL & ENERGY (ACE) % of LTM 10/2/2015 Sales 50% 20% 30% Market Size(1) $13 Billion $7 Billion $15 Billion Acquisitions since 2008 Industrial Supply CorpAllied Bearings SupplyPlains BearingFlorida Bearings Inc.Ohio Gear and Transmission INRUMECCatchingNorthwest Hose & FittingsWestern Fluid ComponentsB. W. RogersCalkins Fluid Power ZellerMinarikTarget Electronic SupplyB. W. RogersG.C. Fabrication Major Suppliers Source: PTDA Market Size Report; US Census Bureau; ARC Advisory

Platform Evolution Through acquisitions and organic growth, Kaman has significantly grown its Distribution business while greatly expanding its product offering Bearings & Power Transmission up 34% Automation, Control & Energy up 313% Fluid Power up 233% b b b Sales from continuing operationsGrowth in sales from the full year 2009 thru 10/2/2015 LTM a b

Near-term Issues/Opportunities - Aerospace Specialty bearing product linesExpanding the footprint of our Kamatics facility by 25% to capitalize on strong backlog and order ratesNew RWG facility in Germany was recently qualified by Boeing, opening new opportunitiesGRW acquisition provides new product lines and exposure to additional end markets affording significant sales synergy opportunitiesGRW platform provides operational synergy opportunities with existing German operationsEXTEX acquisition triples our engineered products after-market business adding scale and engineering expertise

Near-term Issues/Opportunities - Aerospace Fuzing programsJPF demand is strong and backlog is at a record more than $300 millionExpanding JPF capacity to meet demandMissile fuzing programs expected to rebound in 2016K-MAX®Continue to pursue additional commercial orders and progress toward new aircraft deliveries in 2017Continue to pursue unmanned opportunities with the USMC and the Department of the InteriorNeed to win new work in competitive structures market and address challengesSecure additional A-10 fundingResolve contract issues with AH-1Z to position program for success

Near-term Issues/Opportunities - Distribution Focused on accelerating cross platform sales opportunity Continued weakness across many of Kaman’s key end markets negatively impacting growthFocused on appropriate cost structure management to address market conditionsExecuting long-term investments, including ERP, to improve competitive position

Near-term Issues/Opportunities - Other Improved cash flow consistency should allow for continuation of capital allocation prioritiesAccretive acquisitionsCapital expendituresDividendsShare repurchasesPension plan was fully frozen at the end of 2015, which should provide a year-over-year P&L benefit in 2016

Capital Deployment Framework Capital deployment is focused on growth investments & return of capital to shareholders Dividends & Share Repurchases Capital Expenditures Acquisitions Total $1.0 Billion Period: Years 2007-2014 and YTD 10/2/2015 plus $190.8M in acquisitions in Q4 2015 Increased dividend 12.5% in 2015 to an annualized rate of $0.72 per shareDividends paid without interruption for 46 years$100 million share repurchase authorization in place to offset dilution from employee stock plans$700 million credit facility provides significant committed capitalContinue to pursue acquisitions to accelerate growth

Long-Term Financial Targets Kaman Corporation 3% – 6% organic sales growth3% – 10% including acquisitions Distribution 3% – 6% organic sales growth3% – 10% including acquisitions7+% operating margin Aerospace Corporate Expense ≤2.5% of sales by 2019 Free Cash Flow 80% – 100% of net income 3% – 6% organic sales growth3% – 10% including acquisitionsHigh-teens operating margin %

Financial Information and Non-GAAP Reconciliations

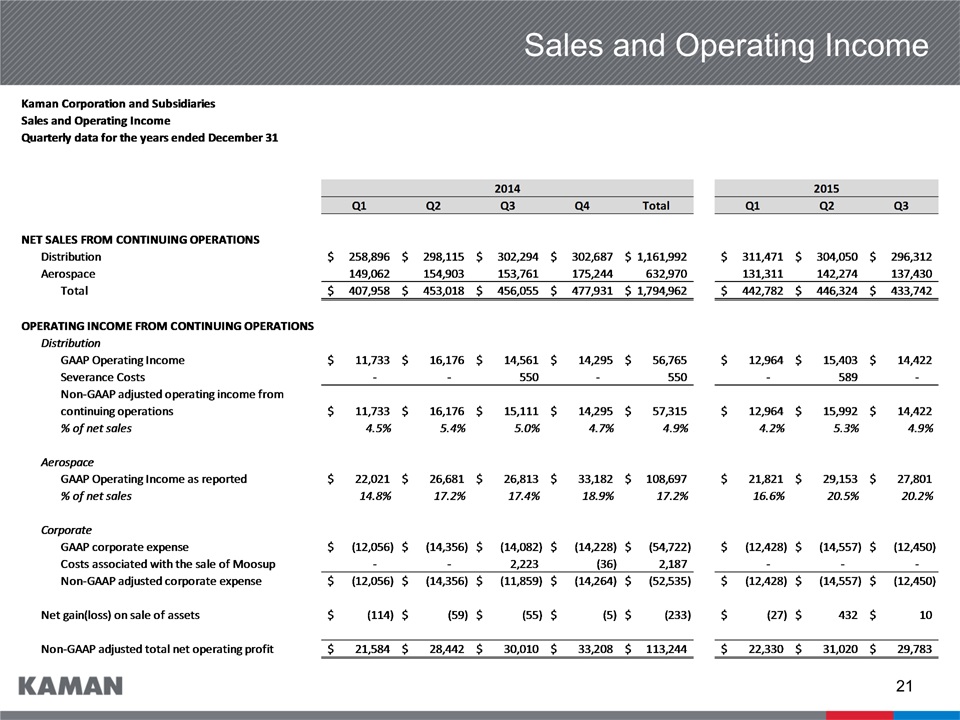

Sales and Operating Income

Net Earnings

Cash Flow, Balance Sheet, and Capital Factors