Attached files

| file | filename |

|---|---|

| 8-K - GM 8-K 01132016 REGFD - General Motors Co | form8-k01132016regfd.htm |

| EX-99.1 - EXHIBIT 99.1-PRESS RELEASE - General Motors Co | form8-k01132016pressrelease.htm |

MARY BARRA Chairman & CEO DEUTSCHE BANK GLOBAL AUTO INDUSTRY CONFERENCE

GM WILL DELIVER another strong year of operating performance in 2015 – ON TRACK with full-year 2015 guidance 1

WE ARE REDEFINING THE FUTURE OF PERSONAL MOBILITY 2 GAME CHANGERS CORE BUSINESS AND GROWTH FOUNDATION

GM IS A COMPELLING INVESTMENT OPPORTUNITY We are REDEFINING the future of PERSONAL MOBILITY From “Best Efforts” to “ACCOUNTABLE FOR RESULTS” Building a TRACK RECORD of DELIVERING on COMMITMENTS 3

DAN AMMANN President DEUTSCHE BANK GLOBAL AUTO INDUSTRY CONFERENCE

MACRO TAILWIND DIMINISHING 0% 2% 4% 6% 8% 10% 12% 14% 60 65 70 75 80 85 90 95 2009 2010 2011 2012 2013 2014 2015 2016 Units ( M ) G rowth R a te % Tr e n d Growth Rate TrendIndustry Source: Industry Units based on IHS Estimates as of 4Q 2015 5

6 DISRUPTION EVERYWHERE

FOCUSED ON RESOURCE ALLOCATION 7 Macro Deceleration Disruption Intense Focus on Resource Allocation

BOLD DECISIONS TO IMPROVE ROIC Chevy Europe Opel Capacity Russia Australia Thailand Indonesia Brazil South Africa 8

TRADED VOLUME FOR SUSTAINABILITY 9 ~11.2% ~27% ~7% Re v enue ($B ) 2013 Revenue Net FX Translation Market Exits Industry Growth Price & Mix Adjacencies 2015 Revenue $155 ~Flat Market Share 11.5% ROIC 20% EBIT-Adj. 5.5% Margin Note: 2015 Revenue and EBIT-Adj. Margin based on analyst consensus ROIC and Market Share based on company outlook

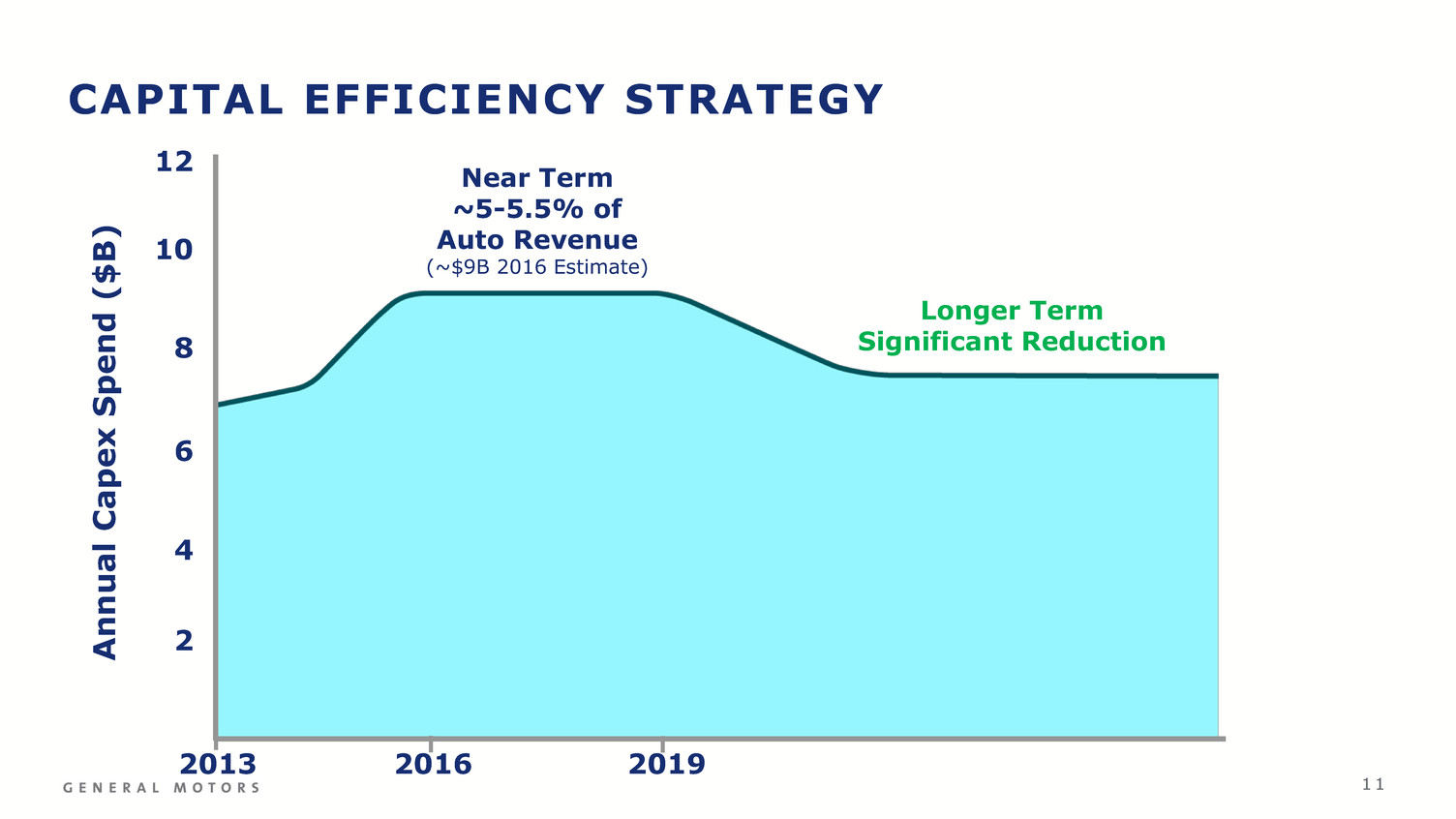

DRIVING CAPITAL EFFICIENCY 1 0 Global Common Vehicles Fewer Plants Higher Volume Long Lifecycle Platforms Higher Utilizations More Flexibility Lower Cost Tooling Reduced Powertrain Capacity Operational Excellence

CAPITAL EFFICIENCY STRATEGY 1 1 A n n u al C a pe x Spend ($B ) 12 10 8 6 4 2 Longer Term Significant Reduction Near Term ~5-5.5% of Auto Revenue (~$9B 2016 Estimate) 2013 2016 2019

PORTFOLIO OF GROWTH OPPORTUNITIES 1 2 % Profit Grow th Emerging Markets Mature Markets OnStar China Luxury GM Financial Aftersales Full-Size Trucks Urban Mobility/ Autonomous

EVOLUTION OF CAR-BASED URBAN MOBILITY PAST CURRENT FUTURE Taxi Owner/Driver Taxi Car Share “Drive Yourself” Owner/Driver Rideshare “Be Driven” Autonomous On-Demand Network Owner/Driver 1 3

OUR STRATEGIC PARTNERSHIP WITH LYFT 1 4 Data Vehicle AccessAutonomous Co-Marketing

1 5 1 5

GM IS A COMPELLING INVESTMENT OPPORTUNITY Strict focus on resource allocation and capital efficiency Significant profit growth opportunities in adjacencies Disruption is real and is a PROFIT OPPORTUNITY for GM 1 6

CHUCK STEVENS Executive Vice President & Chief Financial Officer DEUTSCHE BANK GLOBAL AUTO INDUSTRY CONFERENCE

GM DELIVERING COMMITMENTS 1 8 2014 TARGETS Strong core operating performance ON TRACK 2015 TARGETS Double-digit EBIT- Adj. & EBIT-Adj. margin growth Double-digit EPS- Adj. growth NA EBIT-Adj. margin ~10% 2016 TARGETS Sustain strong margins in NA and China Europe breakeven ON TRACK ON TRACK

KEY DRIVERS – 2016 TARGETS 1 9 Important product launches Cost efficiencies Tailwinds Growth in adjacencies Challenging macroeconomic environment in South America Pricing pressure in Europe and China Headwinds

$8.6 $9.3** >$10 2013 2014 2015 Consensus 2016 Outlook 2 0 $6.5 Memo: EBIT-Adj. Margins 6.0%** ~7% 5.5% * Reconciliation of EBIT-Adjusted on slide S1 ** Represents Core Operating Performance – excluding recalls >20% EBIT-Adjusted Growth 2013-2015 CONTINUED EBIT-ADJ. GROWTH AND MARGIN EXPANSION… GM Consolidated EBIT-Adjusted* $ Billions

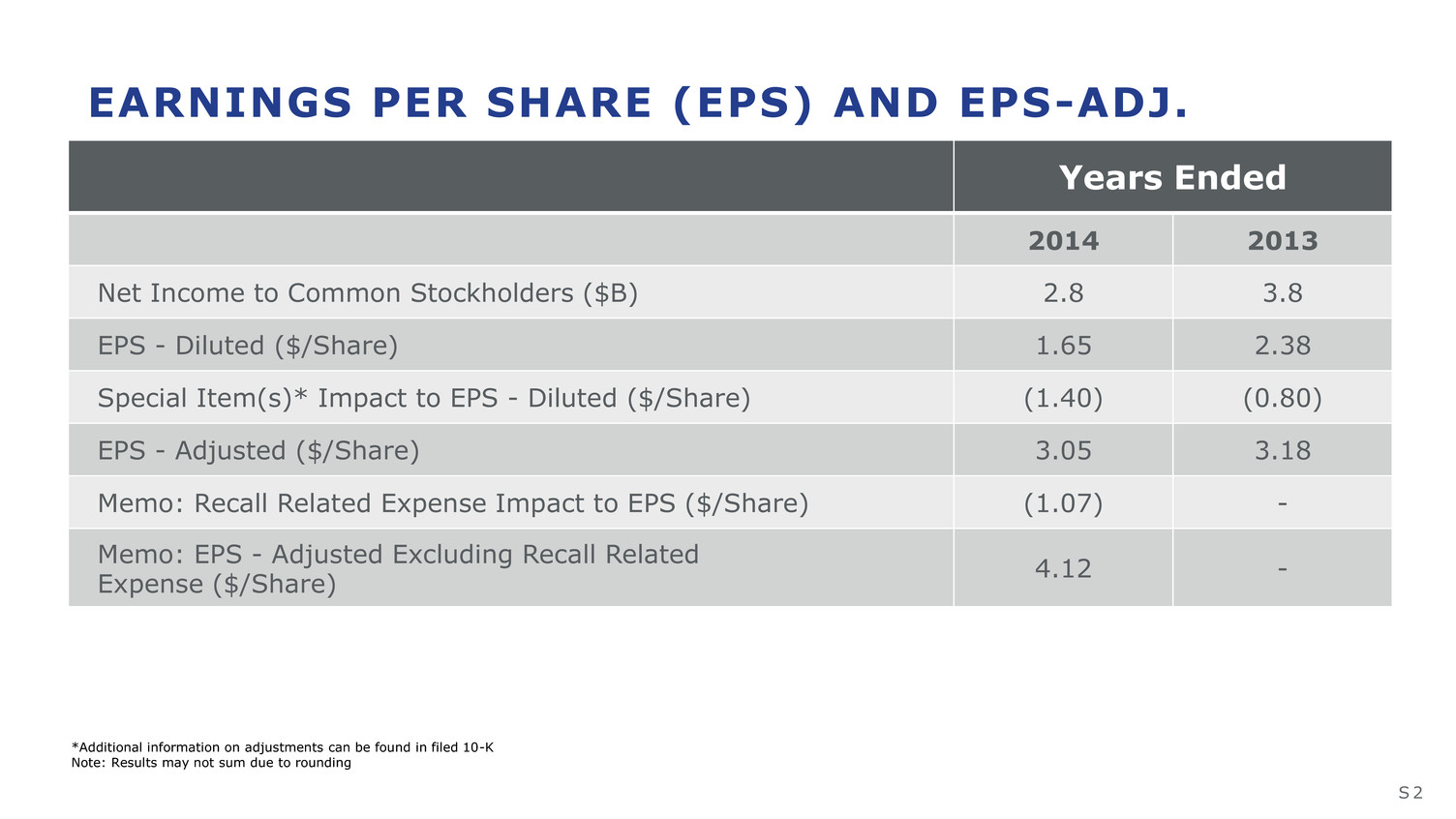

AND CONTINUED EPS-ADJ. GROWTH 2 1 *2014 Represents Core Operating Performance – excluding recalls **Reconciliation of EPS-Adj. on slide S2 Note: Consensus EPS-Adj. calculated using average of Sell Side analysts covering GM as of Jan 11, 2016 EPS-Adj. Growth $4.12* $3.05 EPS-Adj. $4.80 2013 2014 2015 Consensus 2016 Outlook $5.25-$5.75 EPS-Adj.** $3.18 PROFIT GROWTH SHARE BUYBACKS + = >50% EPS-Adjusted Growth 2013-2015

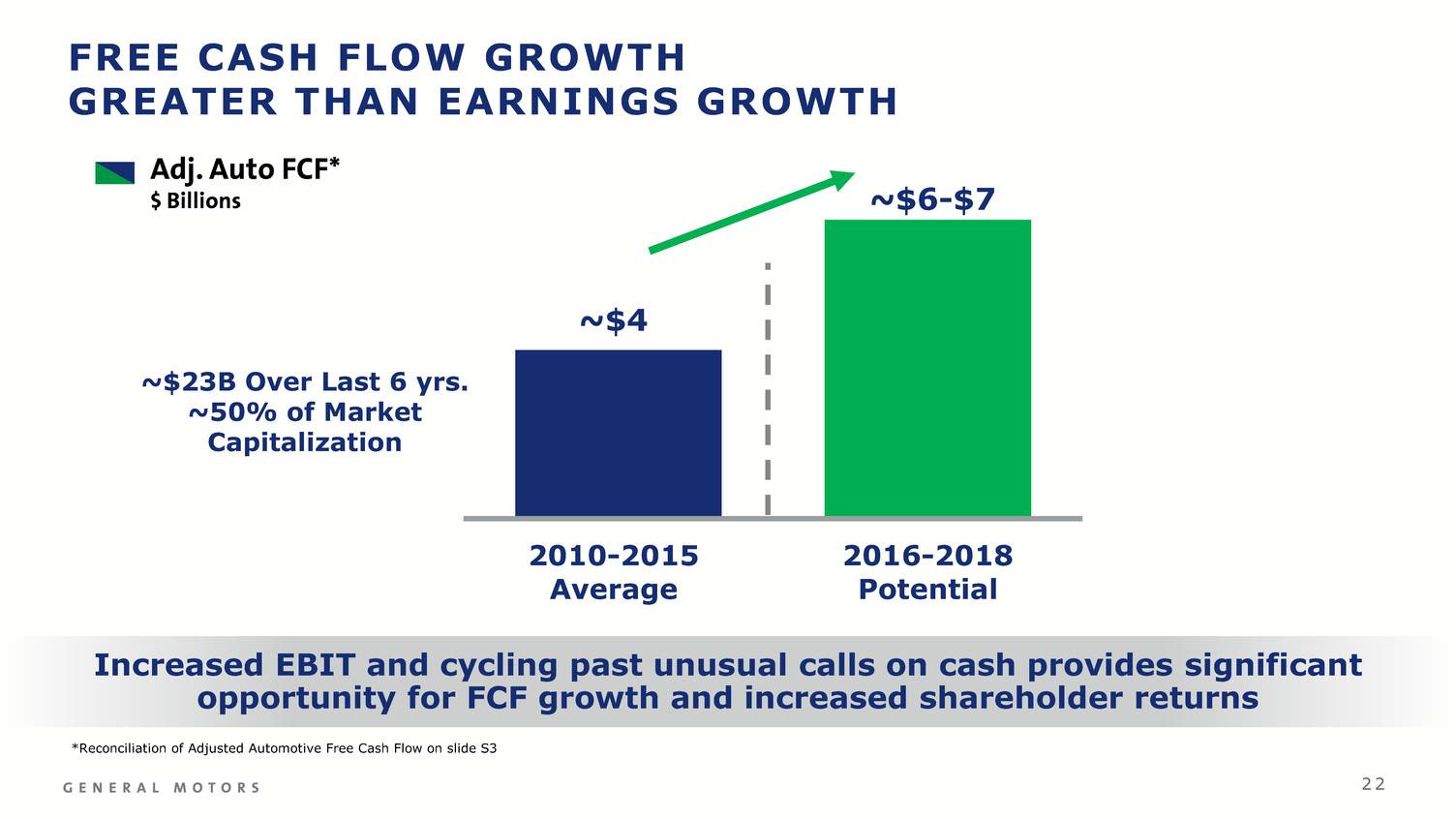

FREE CASH FLOW GROWTH GREATER THAN EARNINGS GROWTH 2 2 2010-2015 Average 2016-2018 Potential Adj. Auto FCF* $ Billions ~$23B Over Last 6 yrs. ~50% of Market Capitalization ~$4 ~$6-$7 Increased EBIT and cycling past unusual calls on cash provides significant opportunity for FCF growth and increased shareholder returns *Reconciliation of Adjusted Automotive Free Cash Flow on slide S3

DISCIPLINED CAPITAL ALLOCATION FRAMEWORK Transparent and disciplined capital allocation framework driving shareholder value Reinvest in Business to Drive Growth and 20+% ROIC Maintain $20B Target Cash Returned ~$6B to shareholders in 2015 All Available Free Cash Flow to Shareholders 2 3

CAPITAL ALLOCATION FRAMEWORK PROOF POINTS Strong financial results Increasing earnings and margin; ROIC ~27% Focused discipline on capital efficiency Returned ~$6B to shareholders in 2015, including $3.5B in share repurchases Initially upsizing share repurchase program to $9B thru 2017 Increasing dividend 6% 2 4 ~$23B expected to be returned to shareholders from 2012-2017, approximately 90% of our FCF

WE REMAIN FOCUSED ON “DOWNSIDE PROTECTION” WE ARE A MUCH DIFFERENT COMPANY TODAY 2007* Today** Total Automotive Debt ($B) $39 $9 Net U.S. Pension + Global OPEB ($B) $49 $18 U.S. Breakeven (SAAR Units) ~16M ~10-11M Investment grade rating demonstrates improved position *Refers to General Motors Corporation as of 12/31/2007 **As of 9/30/2015, except for Pension and OPEB which is as of 12/31/2014 Note: 2007 U.S. pension plan fully funded; 2014 U.S. pension plan underfunded $11B 2 5

GM IS A COMPELLING INVESTMENT OPPORTUNITY 2 6 Continued EPS growth trajectory expected Earnings Growth Disciplined Capital Allocation Robust Downside Protection Disciplined reinvestment and returning cash to shareholders Enables sustained performance through the cycle

SELECT SUPPLEMENTAL FINANCIAL INFORMATION

FORWARD LOOKING STATEMENTS In this presentation and in related comments by our management, our use of the words “plans,” “goals,” “expect,” “anticipate,” “possible,” “target,” “believe,” “commit,” “intend,” “continue,” “may,” “would,” “could,” “should,” “project,” “appears,” “potential,” “projected,” “on track,” “upside,” “positioned,” “outlook” or similar expressions is intended to identify forward-looking statements that represent our current judgment about possible future events. We believe these judgments are reasonable, but these statements are not guarantees of any events or financial results, and our actual results may differ materially due to a variety of important factors. Among other items, such factors may include: our ability to realize production efficiencies and to achieve reductions in costs as a result of our restructuring initiatives and labor modifications; our ability to maintain quality control over our vehicles and avoid material vehicle recalls and the cost and effect on our reputation of product recalls; our ability to maintain adequate financing sources, including as required to fund our planned significant investment in new technology; the ability of our suppliers to timely deliver parts, components and systems; our ability to realize successful vehicle applications of new technology; overall strength and stability of our markets, particularly outside of North America and China; costs and risks associated with litigation and government investigations including those related to our various recalls and risks, consequences and costs associated with failure to comply with the deferred prosecution agreement; our ability to remain competitive and our ability to continue to attract new customers, particularly for our new products. General Motors Co. ("GM”)’s most recent reports on Form 10-K and Form 10-Q provide information about these and other factors, which we may revise or supplement in future reports to the Securities and Exchange Commission (the "SEC'').

Management uses earnings before interest and taxes (EBIT)-Adjusted, EBIT-Adjusted margins, return on invested capital (ROIC), and Automotive adjusted free cash flow in its financial and operational decision making processes, for internal reporting and as part of its forecasting and budgeting processes as they provide additional transparency of our core operations. EBIT- Adjusted, ROIC, and Automotive adjusted free cash flow allow management to view operating trends, perform analytical comparisons and benchmark performance amongst other companies in our industry. In addition, ROIC allows management to assess how effectively we are deploying our assets. We use EBIT-Adjusted for our automotive segments. EBIT-Adjusted excludes interest income, interest expense and income taxes and includes certain additional special adjustments. We use income before income taxes-adjusted for GM Financial because we believe interest income and interest expense are part of operating results. EBIT-Adjusted margins are calculated as EBIT-Adjusted divided by net sales and revenue. We define ROIC as EBIT-Adjusted for the trailing four quarters divided by average net assets during that period, which is considered to be average equity balances adjusted for certain assets and liabilities during the same period. We use adjusted free cash flow to review the liquidity of our automotive operations. GM measures adjusted free cash flow as cash flow from operations less capital expenditures adjusted for management actions, primarily related to strengthening our balance sheet, such as accrued interest on prepayments of debt and voluntary contributions to employee benefit plans. Our calculation of EBIT-Adjusted, ROIC, and Automotive adjusted free cash flow are considered non-GAAP financial measures because we calculate them using financial measures that have been adjusted from the most directly comparable U.S. GAAP financial measure. Our calculation of these non-GAAP measures may not be comparable to similarly titled measures of other companies due to potential differences between companies in the method of calculation. As a result the use of our non-GAAP measures has limitations and should not be considered superior to, in isolation from, or as a substitute for, related U.S. GAAP measures. NON-GAAP MEASURES

RECONCILIATION OF EBIT-ADJUSTED S 1 Years Ended $ (B) 2014 2013 2012 Operating Segments GM North America (GMNA) 6.6 7.5 6.5 GM Europe (GME) (1.4) (0.9) (1.9) GM International Operations (GMIO) 1.2 1.3 2.5 GM South America (GMSA) (0.2) 0.3 0.5 GM Financial (GMF) 0.8 0.9 0.7 Total Operating Segments 7.1 9.1 8.3 Corporate and Eliminations (0.6) (0.5) (0.4) EBIT-Adjusted 6.5 8.6 7.9 Special Items* (2.3) (0.8) (36.1) Automotive Interest Income 0.2 0.2 0.3 Automotive Interest Expense (0.4) (0.3) (0.5) Gain (Loss) on Extinguishment of Debt 0.2 (0.2) (0.3) Income Tax Benefit (Expense) (0.2) (2.1) 34.8 Net Income Attributable to Stockholders 3.9 5.3 6.2 Memo: Consolidated Recall Related Expenses 2.8 Memo: Consolidated EBIT-Adjusted Excluding Recall Related Expenses 9.3 Memo: GMNA Recall Related Expenses 2.4 Memo: GMNA EBIT-Adjusted Excluding Recall Related Expenses 9.0 *Additional information on adjustments can be found in filed 10-K Note: Results may not sum due to rounding

EARNINGS PER SHARE (EPS) AND EPS-ADJ. Years Ended 2014 2013 Net Income to Common Stockholders ($B) 2.8 3.8 EPS - Diluted ($/Share) 1.65 2.38 Special Item(s)* Impact to EPS - Diluted ($/Share) (1.40) (0.80) EPS - Adjusted ($/Share) 3.05 3.18 Memo: Recall Related Expense Impact to EPS ($/Share) (1.07) - Memo: EPS - Adjusted Excluding Recall Related Expense ($/Share) 4.12 - *Additional information on adjustments can be found in filed 10-K Note: Results may not sum due to rounding S 2

ADJUSTED AUTOMOTIVE FREE CASH FLOW Years Ended $ (B) 2014 2013 2012 2011 2010 Operating Cash Flow 10.1 11.0 9.6 7.4 6.6 Less: Capital Expenditures (7.0) (7.5) (8.1) (6.2) (4.2) Adjustments* - 0.2 2.7 1.8 4.0 Adjusted Free Cash Flow 3.1 3.7 4.3 3.0 6.4 *Additional information on adjustments can be found in filed 10-K Note: Results may not sum due to rounding S 3

For additional information please visit: http://www.gm.com/investors investorrelations@gm.com https://www.gmfinancial.com/investors-information.aspx investors@gmfinancial.com