Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DARLING INGREDIENTS INC. | dar-20160113x8kinvestpres.htm |

Randall C. Stuewe, Chairman and CEO John Muse, EVP Chief Financial Officer Exhibit 99.1

2 This presentation contains “forward-looking” statements regarding the business operations and prospects of Darling Ingredients Inc. and industry factors affecting it. These statements are identified by words such as “believe,” “anticipate,” “expect,” “estimate,” “intend,” “could,” “may,” “will,” “should,” “planned,” “potential,” “continue,” “momentum,” and other words referring to events that may occur in the future. These statements reflect Darling Ingredient’s current view of future events and are based on its assessment of, and are subject to, a variety of risks and uncertainties beyond its control, each of which could cause actual results to differ materially from those indicated in the forward-looking statements. These factors include, among others, existing and unknown future limitations on the ability of the Company's direct and indirect subsidiaries to make their cash flow available to the Company for payments on the Company's indebtedness or other purposes; unanticipated costs or operating problems related to the acquisition and integration of Rothsay and Darling Ingredients International (including transactional costs and integration of the new enterprise resource planning (ERP) system); global demands for bio-fuels and grain and oilseed commodities, which have exhibited volatility, and can impact the cost of feed for cattle, hogs and poultry, thus affecting available rendering feedstock and selling prices for the Company’s products; reductions in raw material volumes available to the Company due to weak margins in the meat production industry as a result of higher feed costs, reduced consumer demand or other factors, reduced volume from food service establishments, reduced demand for animal feed, or otherwise; reduced finished product prices; continued decline in fat and used cooking oil finished product prices; changes to worldwide government policies relating to renewable fuels and greenhouse gas emissions that adversely affect programs like the Renewable Fuel Standards Program (RFS2) and tax credits for biofuels both in the United States and abroad; possible product recall resulting from developments relating to the discovery of unauthorized adulterations to food or food additives; the occurrence of Bird Flu including, but not limited to H5N1 flu, bovine spongiform encephalopathy (or "BSE"), porcine epidemic diarrhea ("PED") or other diseases associated with animal origin in the United States or elsewhere; unanticipated costs and/or reductions in raw material volumes related to the Company’s compliance with the existing or unforeseen new U.S. or foreign regulations (including, without limitation, China) affecting the industries in which the Company operates or its value added products (including new or modified animal feed, Bird Flu, PED or BSE or similar or unanticipated regulations); risks associated with the renewable diesel plant in Norco, Louisiana owned and operated by a joint venture between Darling Ingredients and Valero Energy Corporation, including possible unanticipated operating disruptions; risks relating to possible third party claims of intellectual property infringement; increased contributions to the Company’s pension and benefit plans, including multiemployer and employer-sponsored defined benefit pension plans as required by legislation, regulation or other applicable U.S. or foreign law or resulting from a U.S. mass withdrawal event; bad debt write-offs; loss of or failure to obtain necessary permits and registrations; continued or escalated conflict in the Middle East, North Korea, Ukraine or elsewhere; and/or unfavorable export or import markets. These factors, coupled with volatile prices for natural gas and diesel fuel, climate conditions, currency exchange fluctuations, general performance of the U.S. and global economies, disturbances in world financial, credit, commodities and stock markets, and any decline in consumer confidence and discretionary spending, including the inability of consumers and companies to obtain credit due to lack of liquidity in the financial markets, among others, could negatively impact the Company's results of operations. Among other things, future profitability may be affected by the Company’s ability to grow its business, which faces competition from companies that may have substantially greater resources than the Company. The Company’s announced share repurchase program may be suspended or discontinued at any time and purchases of shares under the program are subject to market conditions and other factors, which are likely to change from time to time. Other risks and uncertainties regarding Darling Ingredients Inc., its business and the industries in which it operates are referenced from time to time in the Company’s filings with the Securities and Exchange Commission. Darling Ingredients Inc. is under no obligation to (and expressly disclaims any such obligation to) update or alter its forward-looking statements whether as a result of new information, future events or otherwise.

3 FOOD FEED FUEL INGREDIENTS for a growing population. We will build, acquire and develop businesses where we can achieve a sustainable top 3 market position within 5 years. To be the RECOGNIZED global leader in the production, development and value-adding of sustainable animal and nutrient recovered ingredients.

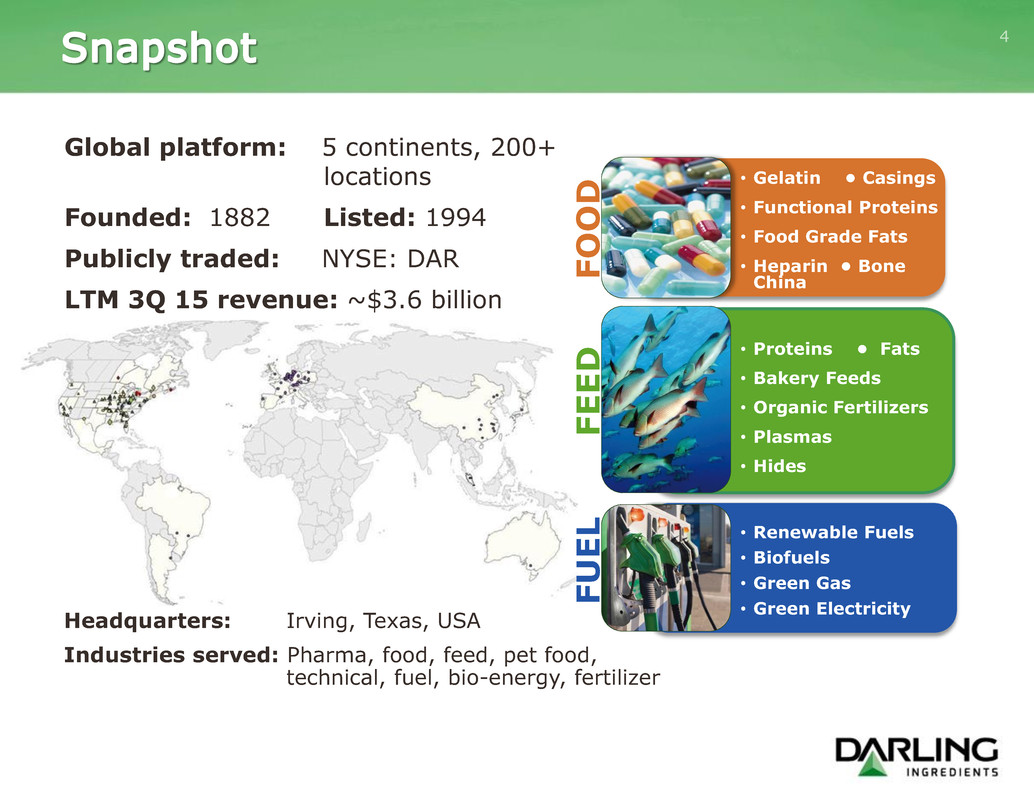

Employees: Approx. 10,000 Headquarters: Irving, Texas, USA Industries served: Pharma, food, feed, pet food, technical, fuel, bio-energy, fertilizer Global platform: 5 continents, 200+ locations Founded: 1882 Listed: 1994 Publicly traded: NYSE: DAR LTM 3Q 15 revenue: ~$3.6 billion • Gelatin • Casings • Functional Proteins • Food Grade Fats • Heparin • Bone China • Proteins • Fats • Bakery Feeds • Organic Fertilizers • Plasmas • Hides • Renewable Fuels • Biofuels • Green Gas • Green Electricity FUE L FEE D FO O D 4

5 Creates Margin Opportunity DAR is operated as a spread business Operating Costs Transportation Costs Energy Costs Raw Material Availability Competing Ingredient Supply Some sources estimate strong growth in world population which will drive Food, Feed & Fuel demand

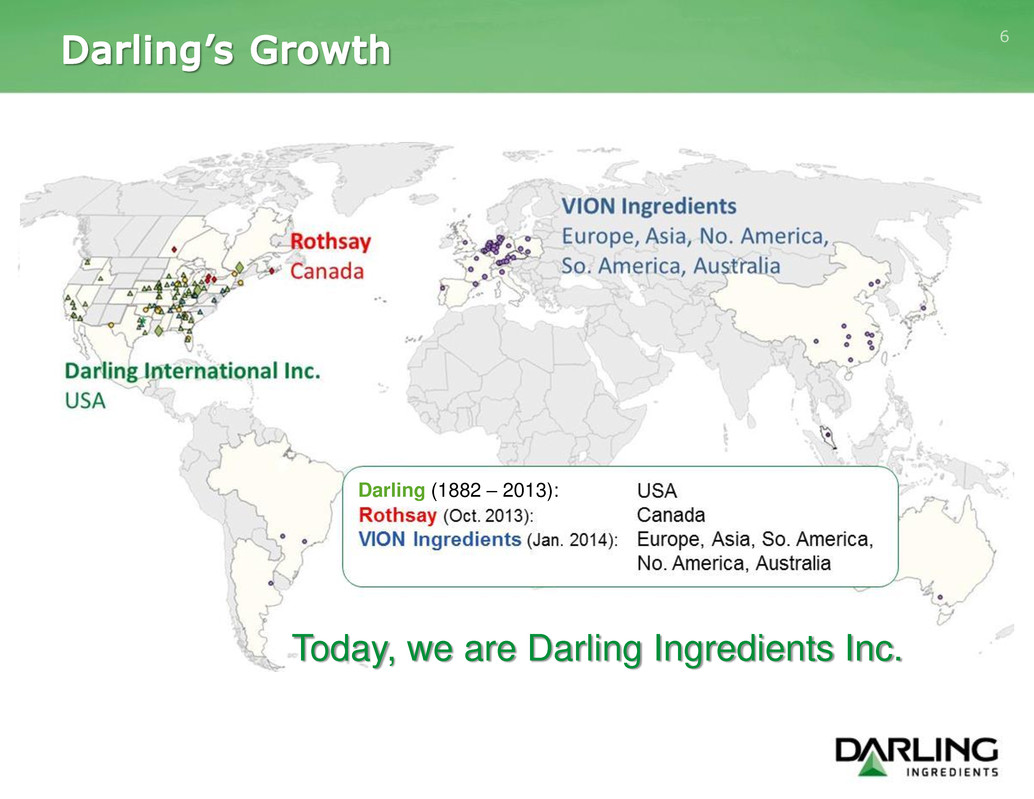

6 Darling (1882 – 2013): USADarling (1882 – 2013): Darling (1882 – 2013): Today, we are Darling Ingredients Inc.

The ingredients we produce are used in three primary segments: - Food (pharmaceutical, gelatin, natural casings, edible fats) - Feed (fats & proteins, pet food, nutritional feed supplements, fertilizers) - Fuel (renewable and bio-diesel, green gas, green energy) 7 FOOD FEED FUELFO FEED FUE

Creating sustainable food, feed and fuel ingredients for a growing population

9 Business Overview o Collection and processing of animal by- products into gelatin and hydrolyzed collagen o Collection and processing of porcine/bovine intestines into natural casings o Production of crude heparin and edible fat Key Drivers o Supply and competing uses for bones, hides and pig skins o Global demand for gelatin/sausage products in end markets o Palm oil, food grade glues and binders (animal fats) o Supply of hogs & sheep/competition from collagen casings Financials (LTM 3Q 2015) o Net Sales: $1,145 mm (32% of total) o Adjusted EBITDA: $120 mm (10.5% of Food sales) End Markets o Pharmaceutical o Gelatin for food market o Bone China o Natural casings o Edible fats Business Highlights o Rousselot is a global leading supplier of gelatin and hydrolyzed collagen with 13 production facilities selling to more than 75 countries o Sonac food-grade fat has processing facilities in Germany and the Netherlands providing high-quality fats for baking, frying & spreads o Sonac Bone provides raw material for our gelatin plants o CTH supplies natural casings and meat products to the food and meat industries

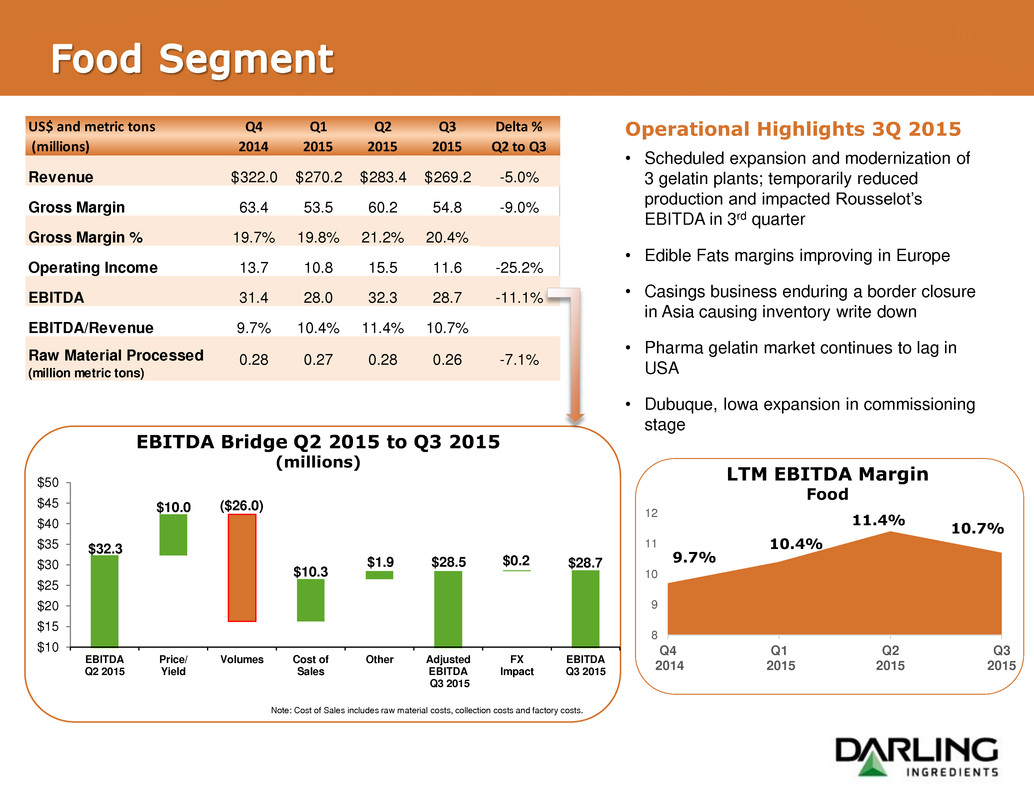

8 9 10 11 12 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Operational Highlights 3Q 2015 10 Note: Cost of Sales includes raw material costs, collection costs and factory costs. EBITDA Bridge Q2 2015 to Q3 2015 (millions) 9.7% 10.4% 11.4% 10.7% LTM EBITDA Margin Food $32.3 $10.0 ($26.0) $10.3 $28.5 $28.7$1.9 $0.2 $10 $15 $20 $25 $30 $35 $40 $45 $50 EBITDA Q2 2015 Price/ Yield Volumes Cost of Sales Other Adjusted EBITDA Q3 2015 FX Impact EBITDA Q3 2015 • Scheduled expansion and modernization of 3 gelatin plants; temporarily reduced production and impacted Rousselot’s EBITDA in 3rd quarter • Edible Fats margins improving in Europe • Casings business enduring a border closure in Asia causing inventory write down • Pharma gelatin market continues to lag in USA • Dubuque, Iowa expansion in commissioning stage US$ and metric tons (millions) Q4 2014 Q1 2015 Q2 2015 Q3 2015 Delta % Q2 to Q3 Revenue 322.0$ 270.2$ 283.4$ 269.2$ -5.0% Gross Margin 63.4 53.5 60.2 54.8 -9.0% Gross Margin % 19.7% 19.8% 21.2% 20.4% Operating Income 13.7 10.8 15.5 11.6 -25.2% EBITDA 31.4 28.0 32.3 28.7 -11.1% EBITDA/Revenue 9.7% 10.4% 11.4% 10.7% Raw Material Processed (million metric tons) 0.28 0.27 0.28 0.26 -7.1%

11 Business Overview o Rendering: Collection & processing of animal by-products into oils and protein meals / blood plasma powder and hemoglobin o Bakery: Collection & processing of residuals into Cookie Meal® o Restaurant Services: Collection & processing of used cooking oil into non-food grade fats Key Drivers o Raw material availability o Commodity prices (e.g. corn) o Competing agricultural-based ingredients o Feed/consumer protein/pet food demand o Global biofuel production Financials (LTM 3Q 2015) o Net Sales: $2,208 mm (61% of total) o Adjusted EBITDA: $304 mm (13.8% of Feed sales) End Markets o Feed & nutritional feed supplements o Bakery feeds o Pet food o Fertilizers o Hides Business Highlights o Feed Ingredients are our largest segment, predominantly attributable to operations in North America o Sonac and Sonac Blood are Europe’s leading supplier of consistent and high-quality proteins, fats and minerals from food-grade animal by-products, used in pet food, animal feed, aquaculture & fertilizers o The Feed segment is operated as margin management business, i.e. majority of US rendering raw materials are procured on formula-based pricing arrangements

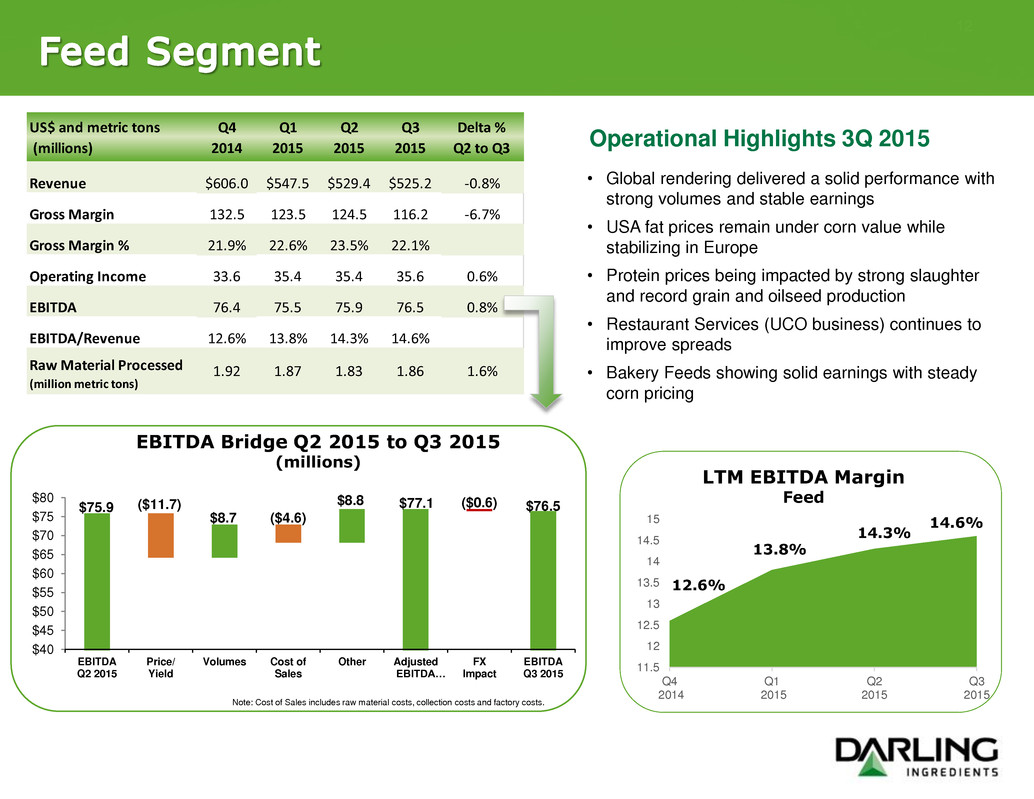

11.5 12 12.5 13 13.5 14 14.5 15 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Operational Highlights 3Q 2015 12 Note: Cost of Sales includes raw material costs, collection costs and factory costs. EBITDA Bridge Q2 2015 to Q3 2015 (millions) 12.6% 13.8% 14.3% 14.6% $75.9 ($11.7) $8.7 ($4.6) $8.8 ($0.6)$77.1 $76.5 $40 $45 $50 $55 $60 $65 $70 $75 $80 EBITDA Q2 2015 Price/ Yield Volumes Cost of Sales Other Adjusted EBITDA… FX Impact EBITDA Q3 2015 LTM EBITDA Margin Feed • Global rendering delivered a solid performance with strong volumes and stable earnings • USA fat prices remain under corn value while stabilizing in Europe • Protein prices being impacted by strong slaughter and record grain and oilseed production • Restaurant Services (UCO business) continues to improve spreads • Bakery Feeds showing solid earnings with steady corn pricing US$ and metric tons (millions) Q4 2014 Q1 2015 Q2 2015 Q3 2015 Delta % Q2 to Q3 Revenue $606.0 $547.5 $529.4 $525.2 -0.8% Gross Margin 132.5 123.5 124.5 116.2 -6.7% Gross Margin % 21.9% 22.6% 23.5% 22.1% Operating Income 33.6 35.4 35.4 35.6 0.6% EBITDA 76.4 75.5 75.9 76.5 0.8% EBITDA/Revenue 12.6% 13.8% 14.3% 14.6% Raw Material Proc ssed (million metric tons) 1.92 1.87 1.83 1.86 1.6%

13 Business Overview o Conversion of animal fats and recycled greases into biodiesel o Conversion of organic sludge and food waste into biogas o Processing of manure into natural bio-phosphate o DGD 50/50 JV with Valero – convert feedstock into renewable diesel Key Drivers o Raw material volume o Government disposal regulations o Energy / fertilizer prices o Customer service requirements o Manure and organics supply Financials (LTM 3Q 2015) o Net Sales: $235 mm (7% of total) o Adjusted EBITDA: $42mm (17.9% of Fuel sales) o Excludes DGD End Markets o Renewable fuels o Biofuels o Green electricity o Green gas Business Highlights o Rendac operates multiple facilities and a specialized collection fleet of approx. 300 trucks in Europe to collect and safely process mortalities and slaughter designated unfit for animal feed (Category 1 & 2) o Ecoson is the largest industrial digestion operation in the Netherlands; organic residuals are converted into biogas for renewable electricity, and process manure into biophosphate used as fertilizer o DAR PRO converts animal fats and used cooking oils into biodiesel

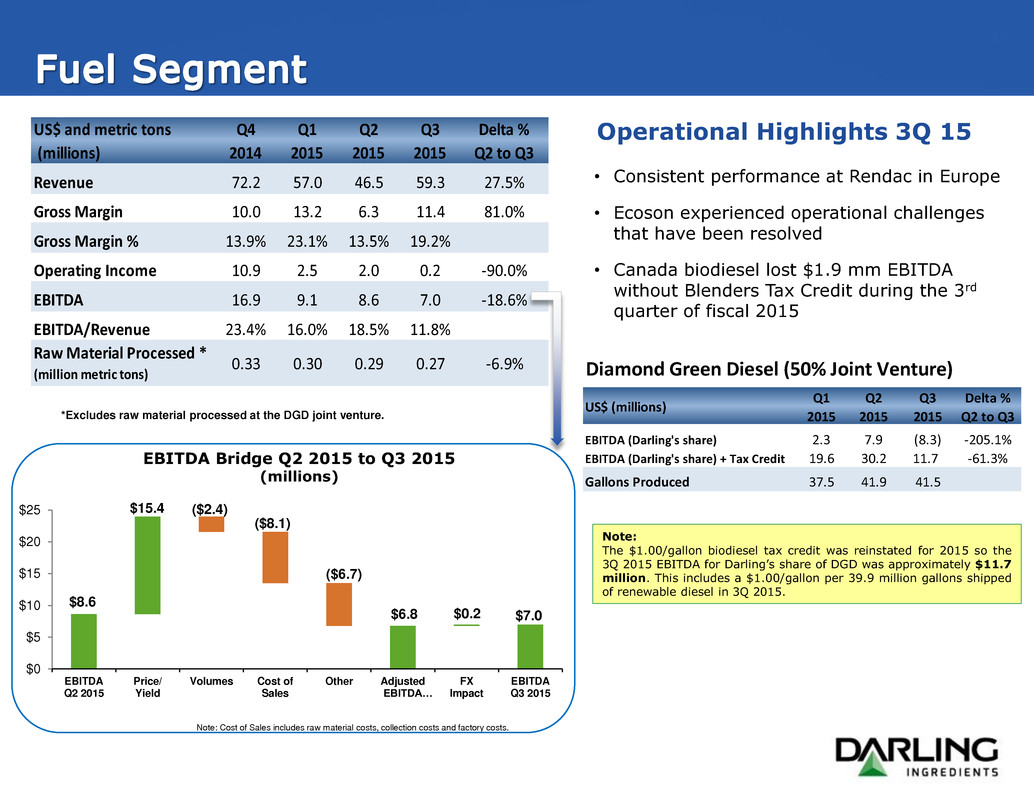

14 Operational Highlights 3Q 15 Note: Cost of Sales includes raw material costs, collection costs and factory costs. Note: The $1.00/gallon biodiesel tax credit was reinstated for 2015 so the 3Q 2015 EBITDA for Darling’s share of DGD was approximately $11.7 million. This includes a $1.00/gallon per 39.9 million gallons shipped of renewable diesel in 3Q 2015. EBITDA Bridge Q2 2015 to Q3 2015 (millions) *Excludes raw material processed at the DGD joint venture. $8.6 $15.4 ($2.4) ($8.1) ($6.7) $0.2$6.8 $7.0 $0 $5 $10 $15 $20 $25 EBITDA Q2 2015 Price/ Yield Volumes Cost of Sales Other Adjusted EBITDA… FX Impact EBITDA Q3 2015 • Consistent performance at Rendac in Europe • Ecoson experienced operational challenges that have been resolved • Canada biodiesel lost $1.9 mm EBITDA without Blenders Tax Credit during the 3rd quarter of fiscal 2015 US$ and metric tons (millions) Q4 2014 Q1 2015 Q2 2015 Q3 2015 Delta % Q2 to Q3 Revenue 72.2 57.0 46.5 59.3 27.5% Gross Margin 10.0 13.2 6.3 11.4 81.0% Gross Margin % 13.9% 23.1% 13.5% 19.2% Operating Income 10.9 2.5 2.0 0.2 -90.0% EBITDA 16.9 9.1 8.6 7.0 -18.6% EBITDA/Revenue 23.4% 16.0% 18.5% 11.8% Raw Material Processed * (million metric tons) 0.33 0.30 0.29 0.27 -6.9% Diamond Green Diesel (50% Joint Venture) US$ (millions) Q1 2015 Q2 2015 Q3 2015 Delta % Q2 to Q3 EBITDA (Darling's share) 2.3 7.9 (8.3) -205.1% EBITDA (Darling's share) + Tax Credit 19.6 30.2 11.7 -61.3% Gallons Produced 37.5 41.9 41.5

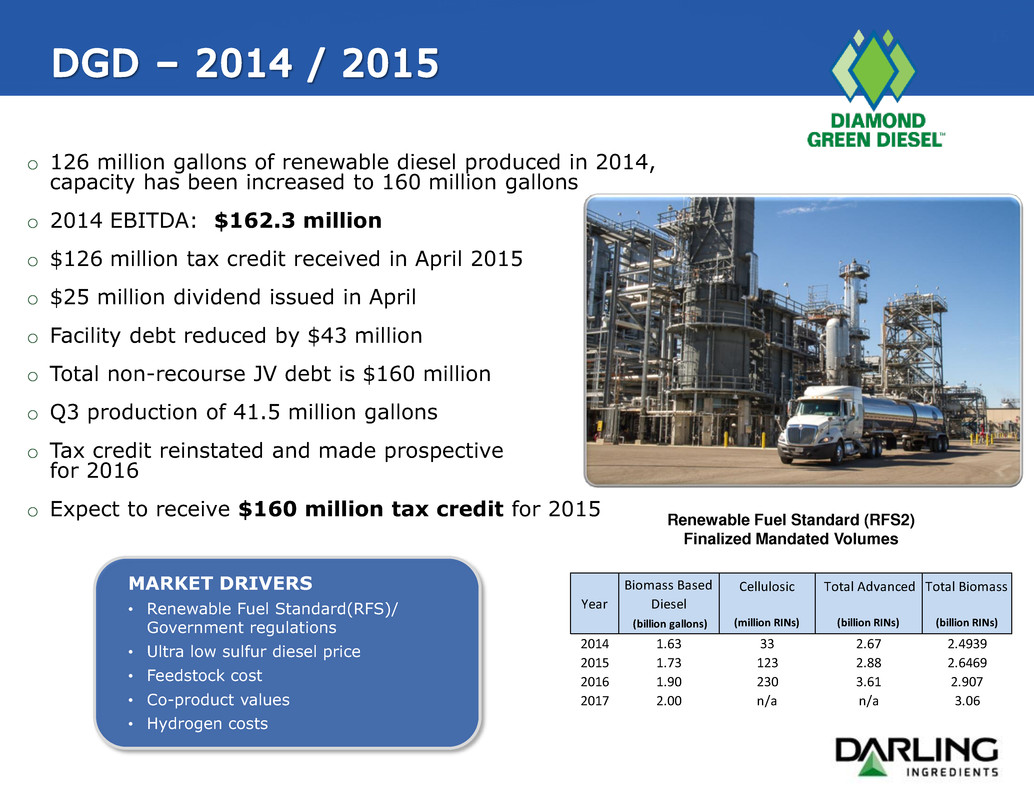

o 126 million gallons of renewable diesel produced in 2014, capacity has been increased to 160 million gallons o 2014 EBITDA: $162.3 million o $126 million tax credit received in April 2015 o $25 million dividend issued in April o Facility debt reduced by $43 million o Total non-recourse JV debt is $160 million o Q3 production of 41.5 million gallons o Tax credit reinstated and made prospective for 2016 o Expect to receive $160 million tax credit for 2015Darling continues to believe in the viability of DGD. Darling constructed this facility to create a new market for its products and to create a counter cyclical hedge to its commodity fat businesses. 15 Renewable Fuel Standard (RFS2) Finalized Mandated Volumes MARKET DRIVERS • Renewable Fuel Standard(RFS)/ Government regulations • Ultra low sulfur diesel price • Feedstock cost • Co-product values • Hydrogen costs Year Biomass Based Diesel (billion gallons) Cellulosic (million RINs) Total Advanced (billion RINs) Total Biomass (billion RINs) 2014 1.63 33 2.67 2.4939 2015 1.73 123 2.88 2.6469 2016 1.90 230 3.61 2.907 2017 2.00 n/a n/a 3.06

Creating sustainable food, feed and fuel ingredients for a growing population

Marco Trends Our Strategy Highlights 17 • Commodities: deflationary environment • Currency: strong dollar • Global supply demand • Population growth • Environmental sustainability focus worldwide • Reduce debt • Allocate capital to synergistic growth opportunities • Leverage international platform for growth • Continued costs reductions • Focus on margin improvements • New plant construction • $100 million debt paydown in 2015; greater in 2016 • 2015 CAPEX: approx. $245 mm • 2016 CAPEX: approx. $220 mm • Int’l operations provide long-term growth platform

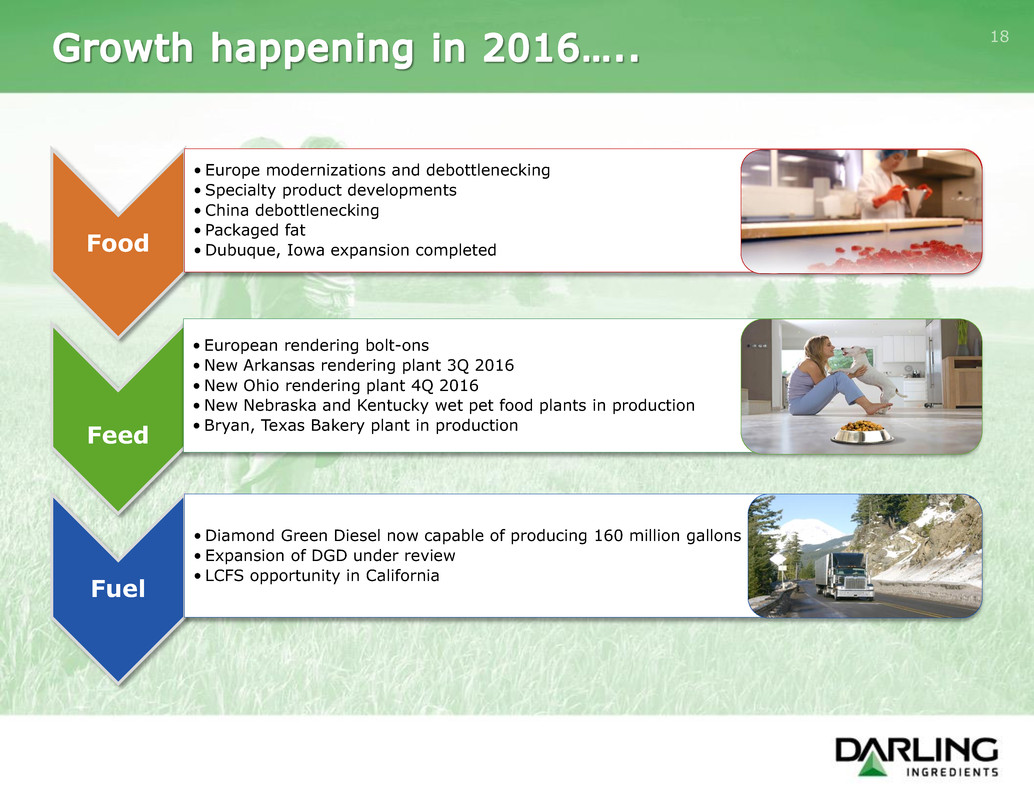

Food • Europe modernizations and debottlenecking •Specialty product developments •China debottlenecking • Packaged fat •Dubuque, Iowa expansion completed Feed • European rendering bolt-ons •New Arkansas rendering plant 3Q 2016 •New Ohio rendering plant 4Q 2016 •New Nebraska and Kentucky wet pet food plants in production •Bryan, Texas Bakery plant in production Fuel •Diamond Green Diesel now capable of producing 160 million gallons • Expansion of DGD under review • LCFS opportunity in California 18

19 We are Darling Ingredients

Creating sustainable food, feed and fuel ingredients for a growing population

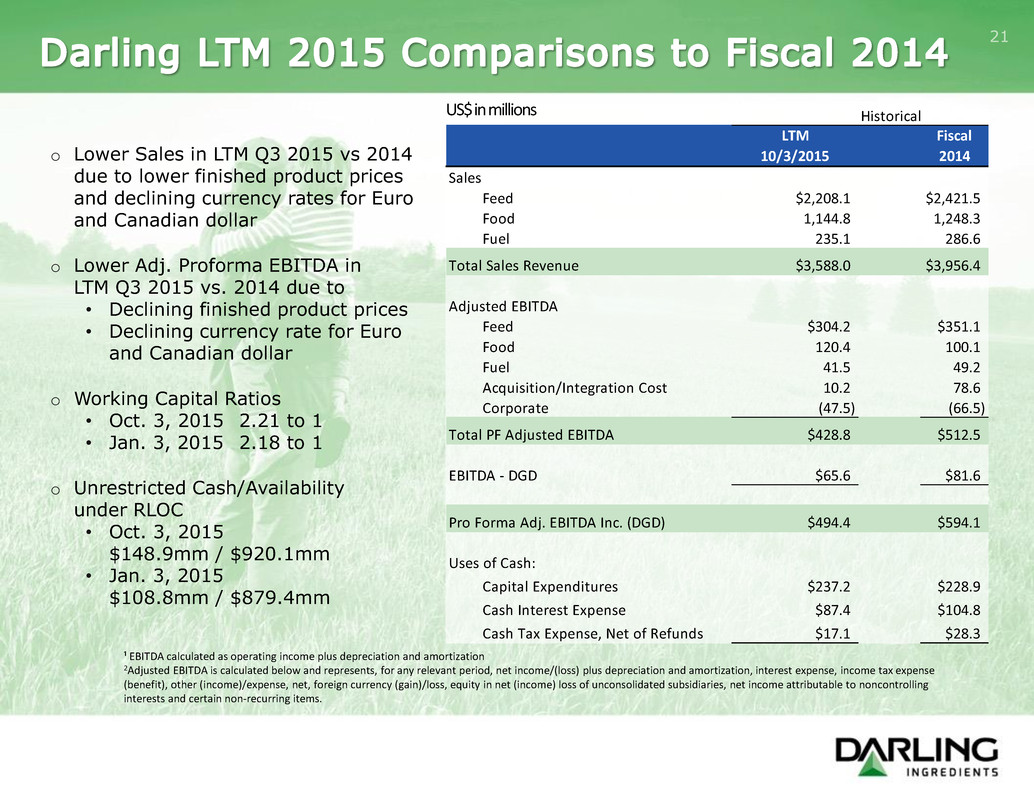

21 o Lower Sales in LTM Q3 2015 vs 2014 due to lower finished product prices and declining currency rates for Euro and Canadian dollar o Lower Adj. Proforma EBITDA in LTM Q3 2015 vs. 2014 due to • Declining finished product prices • Declining currency rate for Euro and Canadian dollar o Working Capital Ratios • Oct. 3, 2015 2.21 to 1 • Jan. 3, 2015 2.18 to 1 o Unrestricted Cash/Availability under RLOC • Oct. 3, 2015 $148.9mm / $920.1mm • Jan. 3, 2015 $108.8mm / $879.4mm ¹ EBITDA calculated as operating income plus depreciation and amortization 2Adjusted EBITDA is calculated below and represents, for any relevant period, net income/(loss) plus depreciation and amortization, interest expense, income tax expense (benefit), other (income)/expense, net, foreign currency (gain)/loss, equity in net (income) loss of unconsolidated subsidiaries, net income attributable to noncontrolling interests and certain non-recurring items. Historical LTM 10/3/2015 Fiscal 2014 Sales Feed $2,208.1 $2,421.5 Food 1,144.8 1,248.3 Fuel 235.1 286.6 Total Sales Revenue $3,588.0 $3,956.4 Adjusted EBITDA Feed $304.2 $351.1 Food 120.4 100.1 Fuel 41.5 49.2 Acquisition/Integration Cost 10.2 78.6 Corporate (47.5) (66.5) Total PF Adjusted EBITDA $428.8 $512.5 EBITDA - DGD $65.6 $81.6 Pro Forma Adj. EBITDA Inc. (DGD) $494.4 $594.1 Uses of Cash: Capital Expenditures $237.2 $228.9 Cash Interest Expense $87.4 $104.8 Cash Tax Expense, Net of Refunds $17.1 $28.3 US$ in millions

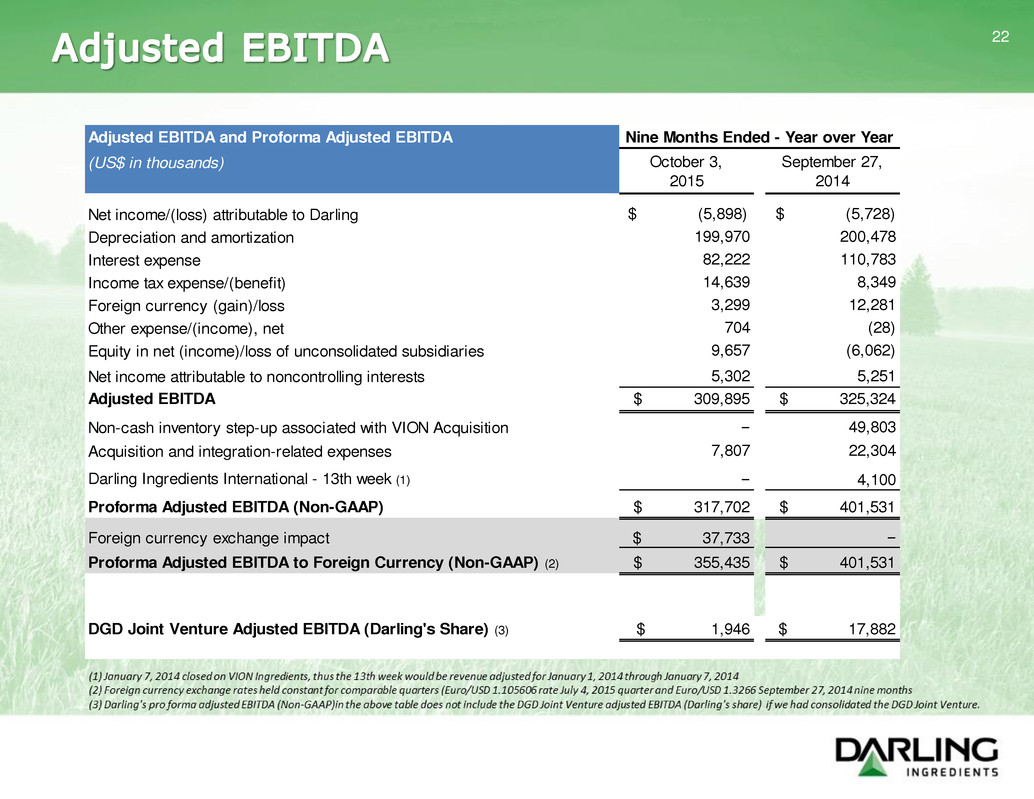

22 Adjusted EBITDA and Proforma Adjusted EBITDA (US$ in thousands) October 3, September 27, 2015 2014 Net income/(loss) attributable to Darling $ (5,898) $ (5,728) Depreciation and amortization 199,970 200,478 Interest expense 82,222 110,783 Income tax expense/(benefit) 14,639 8,349 Foreign currency (gain)/loss 3,299 12,281 Other expense/(income), net 704 (28) Equity in net (income)/loss of unconsolidated subsidiaries 9,657 (6,062) Net income attributable to noncontrolling interests 5,302 5,251 Adjusted EBITDA $ 309,895 $ 325,324 Non-cash inventory step-up associated with VION Acquisition − 49,803 Acquisition and integration-related expenses 7,807 22,304 Darling Ingredients International - 13th week (1) − 4,100 Proforma Adjusted EBITDA (Non-GAAP) $ 317,702 $ 401,531 Foreign currency exchange impact $ 37,733 − Proforma Adjusted EBITDA to Foreign Currency (Non-GAAP) (2) $ 355,435 $ 401,531 DGD Joint Venture Adjusted EBITDA (Darling's Share) (3) $ 1,946 $ 17,882 Nine Months Ended - Year over Year

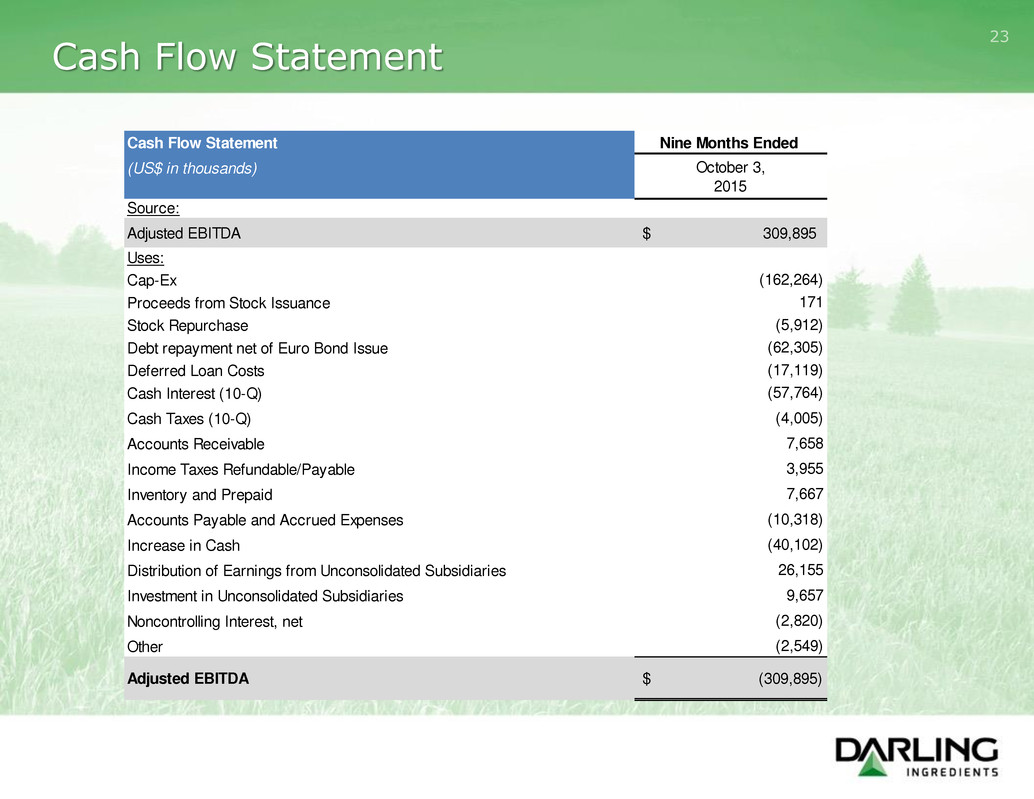

23 Cash Flow Statement Nine Months Ended (US$ in thousands) October 3, 2015 Source: Adjusted EBITDA $ 309,895 Uses: Cap-Ex (162,264) Proceeds from Stock Issuance 171 Stock Repurchase (5,912) Debt repayment net of Euro Bond Issue (62,305) Deferred Loan Costs (17,119) Cash Interest (10-Q) (57,764) Cash Taxes (10-Q) (4,005) Accounts Receivable 7,658 Income Taxes Refundable/Payable 3,955 Inventory and Prepaid 7,667 Accounts Payable and Accrued Expenses (10,318) Increase in Cash (40,102) Distribution of Earnings from Unconsolidated Subsidiaries 26,155 Investment in Unconsolidated Subsidiaries 9,657 Noncontrolling Interest, net (2,820) Other (2,549) Adjusted EBITDA $ (309,895) Cash Flow Statement

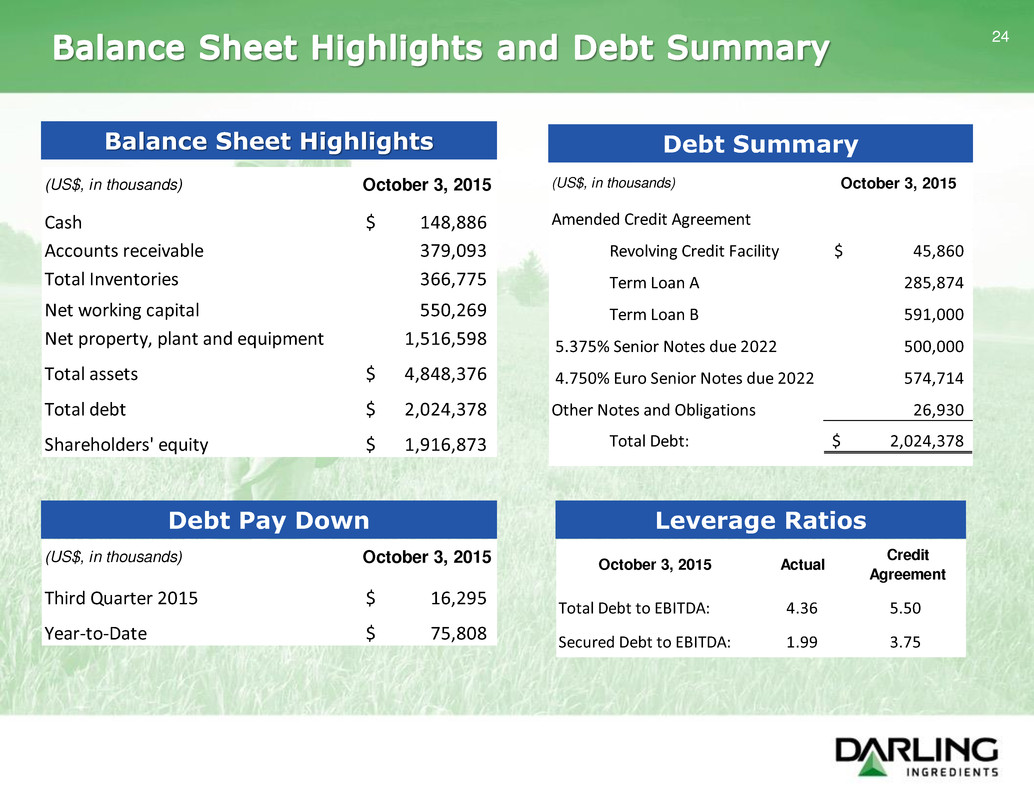

24 Debt SummaryBalance Sheet Highlights (US$, in thousands) October 3, 2015 Cash 148,886$ Accounts receivable 379,093 Total Inventories 366,775 Net working capital 550,269 Net property, plant and equipment 1,516,598 Total assets 4,848,376$ Total debt 2,024,378$ Shareholders' equity 1,916,873$ (US$, in thousands) October 3, 2015 Amended Credit Agreement Revolving Credit Facility 45,860$ Term Loan A 285,874 Term Loan B 591,000 5.375% Senior Notes due 2022 500,000 4.750% Euro Senior Notes due 2022 574,714 Other Notes and Obligations 26,930 Total Debt: 2,024,378$ (US$, in thousands) October 3, 2015 Third Quarter 2015 16,295$ Year-to-Date 75,808$ Debt Pay Down Leverage Ratios October 3, 2015 Actual Credit Agreement Total Debt to EBITDA: 4.36 5.50 Secured Debt to EBITDA: 1.99 3.75

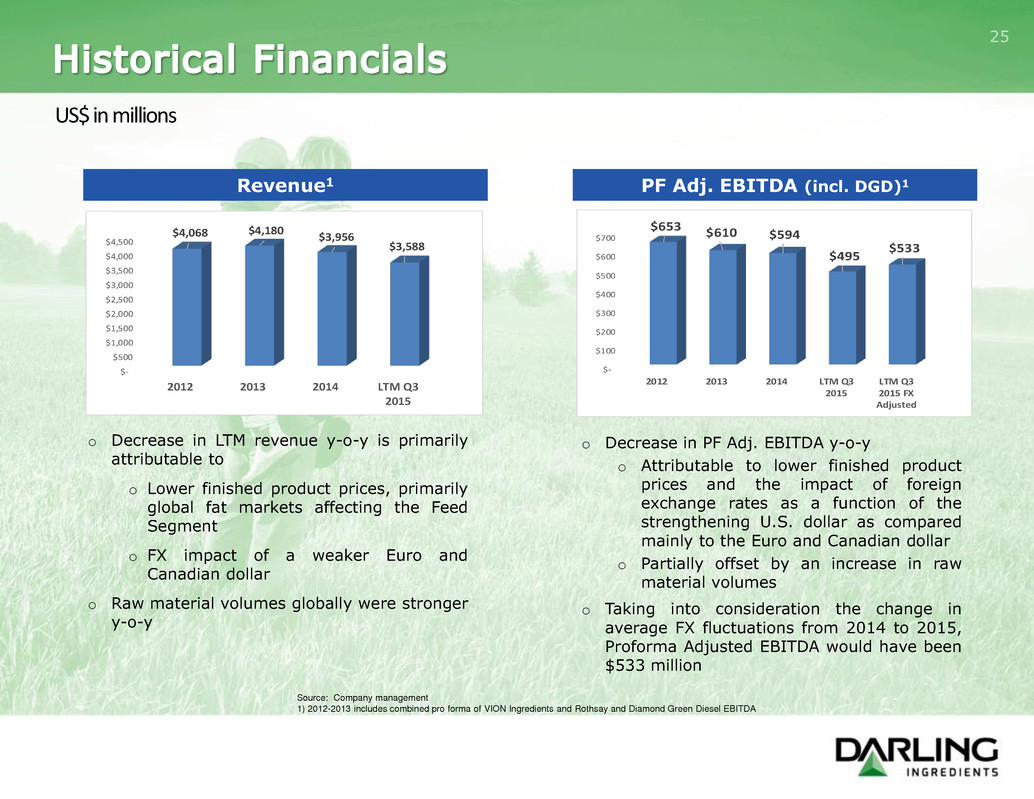

25 Revenue1 PF Adj. EBITDA (incl. DGD)1 o Decrease in LTM revenue y-o-y is primarily attributable to o Lower finished product prices, primarily global fat markets affecting the Feed Segment o FX impact of a weaker Euro and Canadian dollar o Raw material volumes globally were stronger y-o-y o Decrease in PF Adj. EBITDA y-o-y o Attributable to lower finished product prices and the impact of foreign exchange rates as a function of the strengthening U.S. dollar as compared mainly to the Euro and Canadian dollar o Partially offset by an increase in raw material volumes o Taking into consideration the change in average FX fluctuations from 2014 to 2015, Proforma Adjusted EBITDA would have been $533 million US$ in millions $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 2012 2013 2014 LTM Q3 2015 $4,068 $4,180 $3,956 $3,588 Source: Company management 1) 2012-2013 includes combined pro forma of VION Ingredients and Rothsay and Diamond Green Diesel EBITDA $- $100 $200 $300 $400 $500 $600 $700 2012 2013 2014 LTM Q3 2015 LTM Q3 2015 FX Adjusted $653 $610 $594 $495 $533

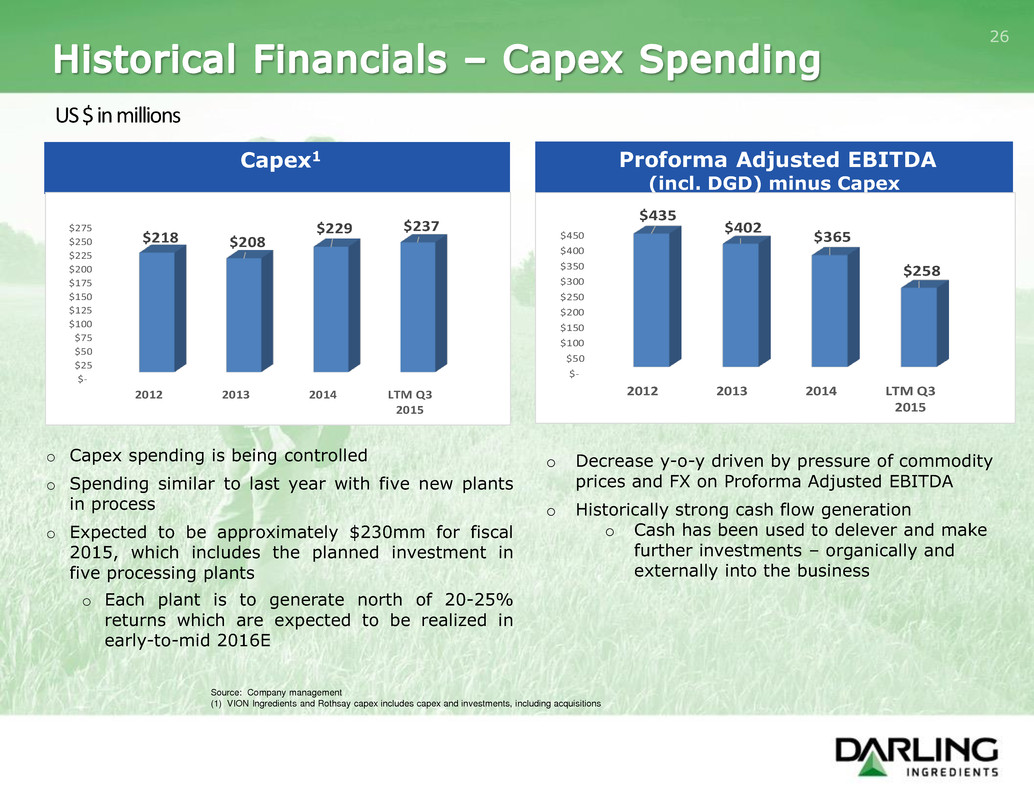

26 Capex1 o Capex spending is being controlled o Spending similar to last year with five new plants in process o Expected to be approximately $230mm for fiscal 2015, which includes the planned investment in five processing plants o Each plant is to generate north of 20-25% returns which are expected to be realized in early-to-mid 2016E US $ in millions Source: Company management (1) VION Ingredients and Rothsay capex includes capex and investments, including acquisitions Proforma Adjusted EBITDA (incl. DGD) minus Capex o Decrease y-o-y driven by pressure of commodity prices and FX on Proforma Adjusted EBITDA o Historically strong cash flow generation o Cash has been used to delever and make further investments – organically and externally into the business $- $25 $50 $75 $100 $125 $150 $175 $200 $225 $250 $275 2012 2013 2014 LTM Q3 2015 $218 $208 $229 $237 $- $50 $100 $150 $200 $250 $300 $350 $400 $450 2012 2013 2014 LTM Q3 2015 $435 $402 $365 $258

APPENDIX 27

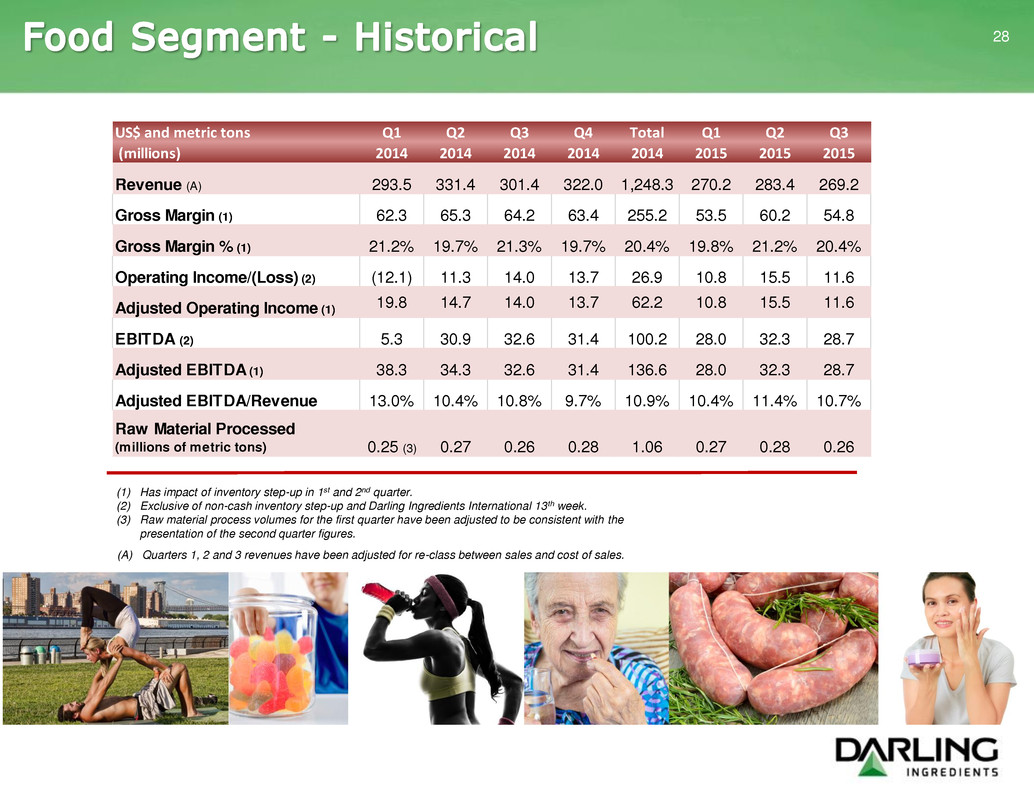

28 (1) Has impact of inventory step-up in 1st and 2nd quarter. (2) Exclusive of non-cash inventory step-up and Darling Ingredients International 13th week. (3) Raw material process volumes for the first quarter have been adjusted to be consistent with the presentation of the second quarter figures. (A) Quarters 1, 2 and 3 revenues have been adjusted for re-class between sales and cost of sales. US$ and metric tons (millions) Q1 2014 Q2 2014 Q3 2014 Q4 2014 Total 2014 Q1 2015 Q2 2015 Q3 2015 Revenue (A) 293.5 331.4 301.4 322.0 1,248.3 270.2 283.4 269.2 Gross Margin (1) 62.3 65.3 64.2 63.4 255.2 53.5 60.2 54.8 Gross Margin % (1) 21.2% 19.7% 21.3% 19.7% 20.4% 19.8% 21.2% 20.4% Operating Income/(Loss) (2) (12.1) 11.3 14.0 13.7 26.9 10.8 15.5 11.6 Adjusted Operating Income (1) 19.8 14.7 14.0 13.7 62.2 10.8 15.5 11.6 EBITDA (2) 5.3 30.9 32.6 31.4 100.2 28.0 32.3 28.7 Adjusted EBITDA (1) 38.3 34.3 32.6 31.4 136.6 28.0 32.3 28.7 Adjusted EBITDA/Revenue 13.0% 10.4% 10.8% 9.7% 10.9% 10.4% 11.4% 10.7% Raw Material Processed (millions of metric tons) 0.25 (3) 0.27 0.26 0.28 1.06 0.27 0.28 0.26

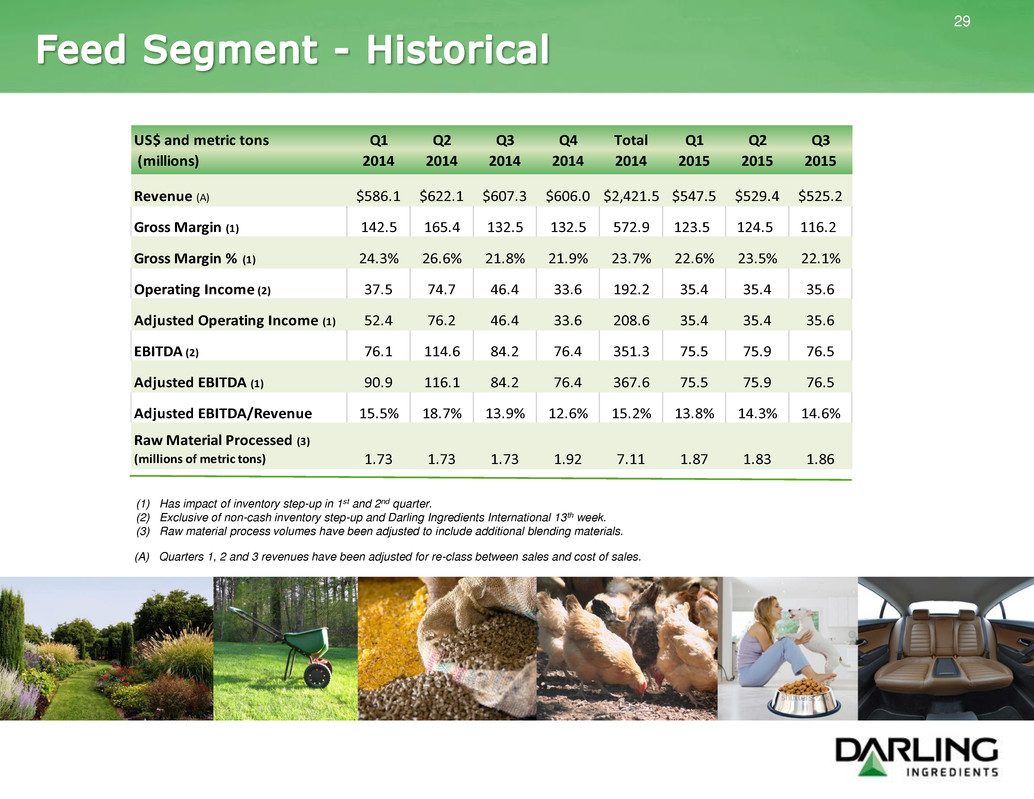

(1) Has impact of inventory step-up in 1st and 2nd quarter. (2) Exclusive of non-cash inventory step-up and Darling Ingredients International 13th week. (3) Raw material process volumes have been adjusted to include additional blending materials. 29 (A) Quarters 1, 2 and 3 revenues have been adjusted for re-class between sales and cost of sales. US$ and metric tons (millions) Q1 2014 Q2 2014 Q3 2014 Q4 2014 Total 2014 Q1 2015 Q2 2015 Q3 2015 Revenue (A) $586.1 $622.1 $607.3 $606.0 $2,421.5 $547.5 $529.4 $525.2 Gross Margin (1) 142.5 165.4 132.5 132.5 572.9 123.5 124.5 116.2 Gross Margin % (1) 24.3% 26.6% 21.8% 21.9% 23.7% 22.6% 23.5% 22.1% Operating Income (2) 37.5 74.7 46.4 33.6 192.2 35.4 35.4 35.6 Adjusted Operating Income (1) 52.4 76.2 46.4 33.6 208.6 35.4 35.4 35.6 EBITDA (2) 76.1 114.6 84.2 76.4 351.3 75.5 75.9 76.5 Adjusted EBITDA (1) 90.9 116.1 84.2 76.4 367.6 75.5 75.9 76.5 Adjusted EBITDA/Revenue 15.5% 18.7% 13.9% 12.6% 15.2% 13.8% 14.3% 14.6% Raw Material Processed (3) (millions of metric tons) 1.73 1.73 1.73 1.92 7.11 1.87 1.83 1.86

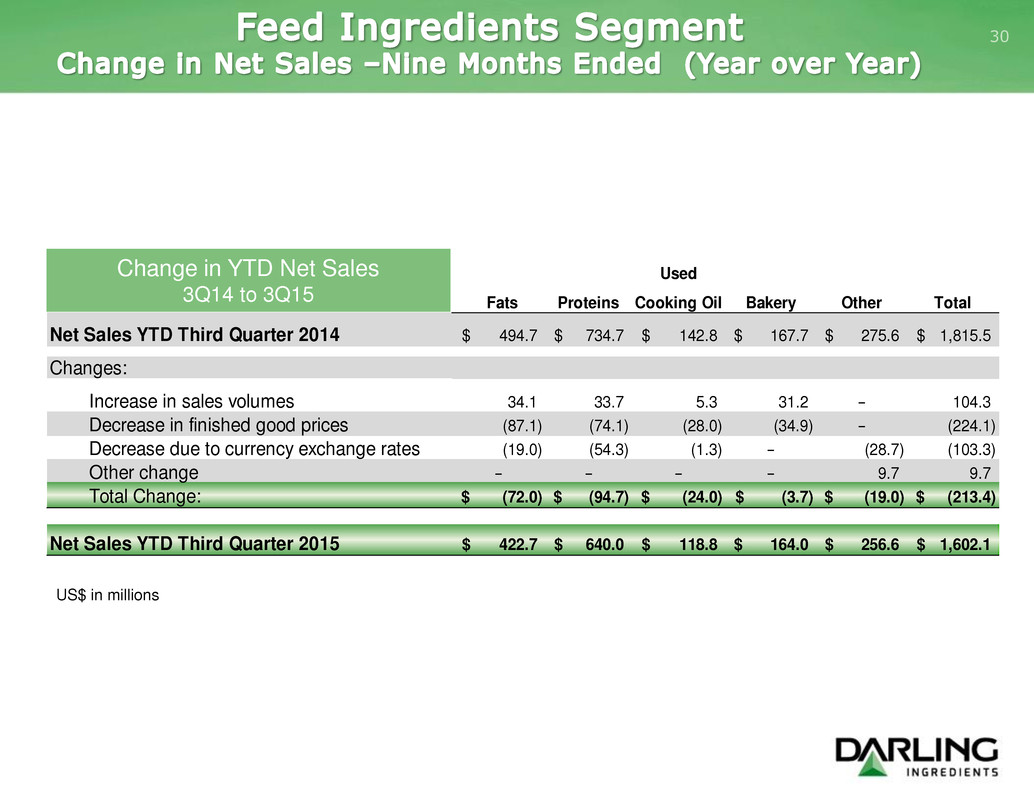

30 Used Fats Proteins Cooking Oil Bakery Other Total Net Sales YTD Third Quarter 2014 494.7$ 734.7$ 142.8$ 167.7$ 275.6$ 1,815.5$ Changes: Increase in sales volumes 34.1 33.7 5.3 31.2 − 104.3 Decrease in finished good prices (87.1) (74.1) (28.0) (34.9) − (224.1) Decrease due to currency exchange rates (19.0) (54.3) (1.3) − (28.7) (103.3) Other change − − − − 9.7 9.7 Total Change: (72.0)$ (94.7)$ (24.0)$ (3.7)$ (19.0)$ (213.4)$ Net Sales YTD Third Quarter 2015 422.7$ 640.0$ 118.8$ 164.0$ 256.6$ 1,602.1$ Change in YTD Net Sales 3Q14 to 3Q15 US$ in millions

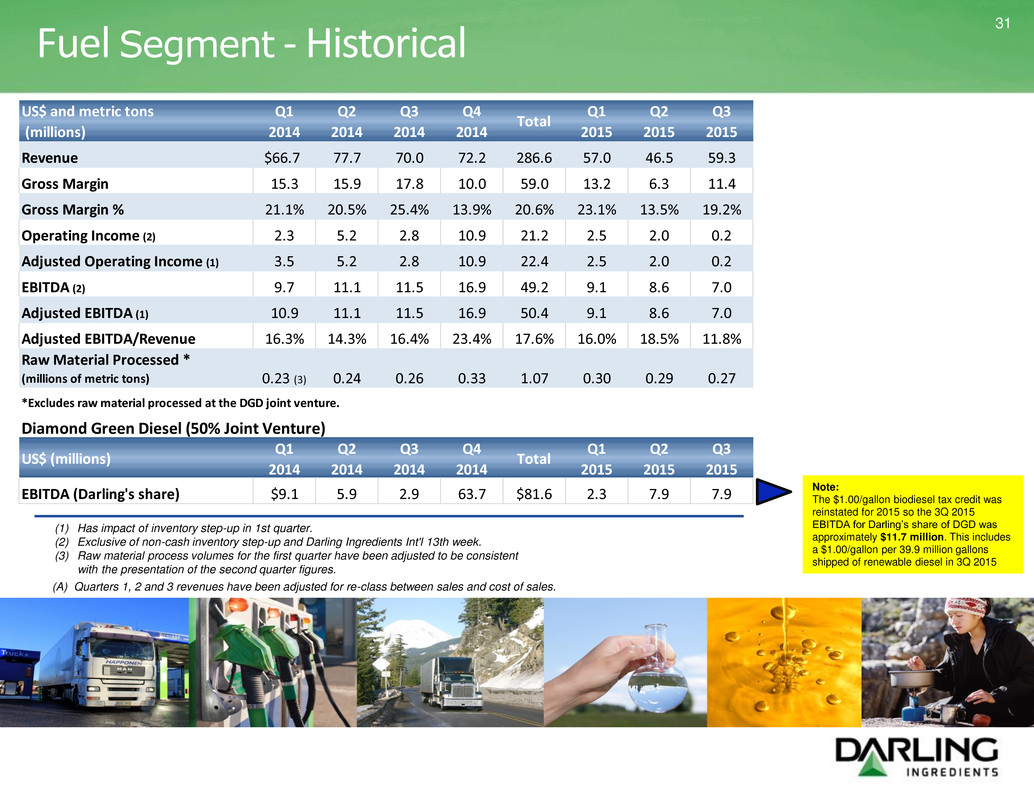

31 (1) Has impact of inventory step-up in 1st quarter. (2) Exclusive of non-cash inventory step-up and Darling Ingredients Int'l 13th week. (3) Raw material process volumes for the first quarter have been adjusted to be consistent with the presentation of the second quarter figures. (A) Quarters 1, 2 and 3 revenues have been adjusted for re-class between sales and cost of sales. Fuel Segment - Historical US$ and metric tons (millions) Q1 2014 Q2 2014 Q3 2014 Q4 2014 Total Q1 2015 Q2 2015 Q3 2015 Revenue $66.7 77.7 70.0 72.2 286.6 57.0 46.5 59.3 Gross Margin 15.3 15.9 17.8 10.0 59.0 13.2 6.3 11.4 Gross Margin % 21.1% 20.5% 25.4% 13.9% 20.6% 23.1% 13.5% 19.2% Operating Income (2) 2.3 5.2 2.8 10.9 21.2 2.5 2.0 0.2 Adjusted Operating Income (1) 3.5 5.2 2.8 10.9 22.4 2.5 2.0 0.2 EBITDA (2) 9.7 11.1 11.5 16.9 49.2 9.1 8.6 7.0 Adjusted EBITDA (1) 10.9 11.1 11.5 16.9 50.4 9.1 8.6 7.0 Adjusted EBITDA/Revenue 16.3% 14.3% 16.4% 23.4% 17.6% 16.0% 18.5% 11.8% Raw Material Processed * (millions of metric tons) 0.23 (3) 0.24 0.26 0.33 1.07 0.30 0.29 0.27 *Excludes raw material processed at the DGD joint venture. Diamond Green Diesel (50% Joint Venture) US$ (millions) Q1 2014 Q2 2014 Q3 2014 Q4 2014 Total Q1 2015 Q2 2015 Q3 2015 EBITDA (Darling's share) $9.1 5.9 2.9 63.7 $81.6 2.3 7.9 7.9 Note: The $1.00/gallon biodiesel tax credit was reinstated for 2015 so the 3Q 2015 EBITDA for Darling’s share of DGD was approximately $11.7 million. This includes a $1.00/gallon per 39.9 million gallons shipped of renewable diesel in 3Q 2015

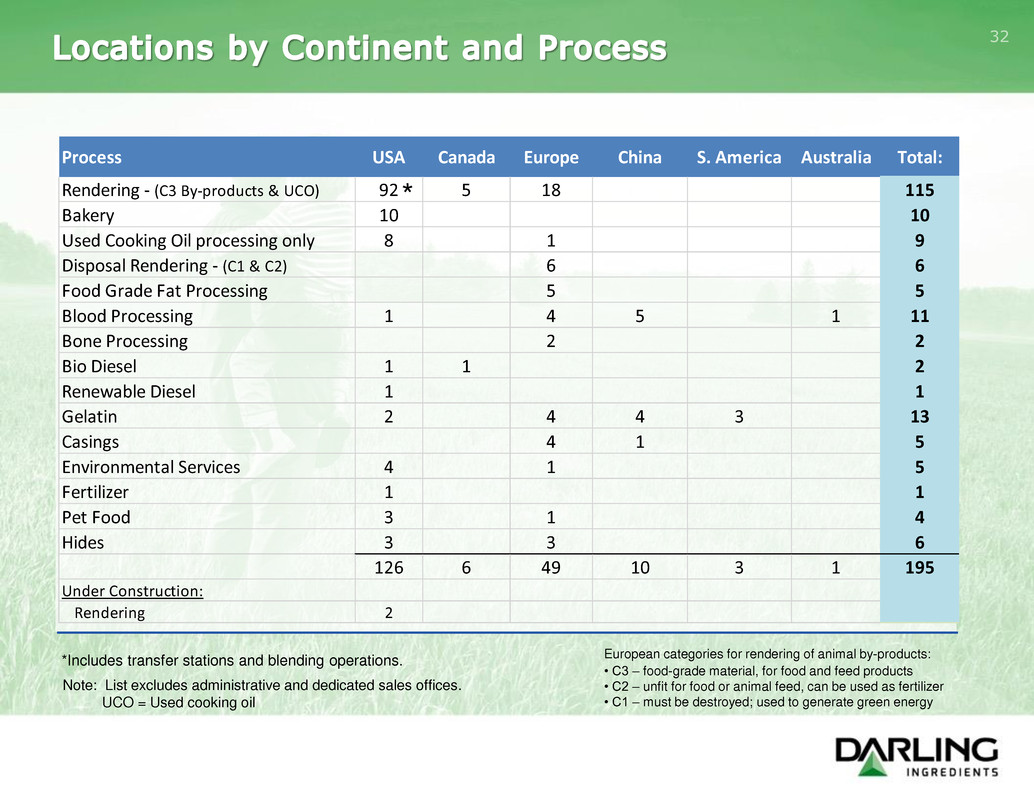

Process USA Canada Europe China S. America Australia Total: Rendering - (C3 By-products & UCO) 92 5 18 115 Bakery 10 10 Used Cooking Oil processing only 8 1 9 Disposal Rendering - (C1 & C2) 6 6 Food Grade Fat Processing 5 5 Blood Processing 1 4 5 1 11 Bone Processing 2 2 Bio Diesel 1 1 2 Renewable Diesel 1 1 Gelatin 2 4 4 3 13 Casings 4 1 5 Environmental Services 4 1 5 Fertilizer 1 1 Pet Food 3 1 4 Hides 3 3 6 126 6 49 10 3 1 195 Under Construction: Rendering 2 32 European categories for rendering of animal by-products: • C3 – food-grade material, for food and feed products • C2 – unfit for food or animal feed, can be used as fertilizer • C1 – must be destroyed; used to generate green energy * Note: List excludes administrative and dedicated sales offices. UCO = Used cooking oil *Includes transfer stations and blending operations.

Adjusted EBITDA is presented here not as an alternative to net income, but rather as a measure of the Company’s operating performance and is not intended to be a presentation in accordance with GAAP. Since EBITDA (generally, net income plus interest expenses, taxes, depreciation and amortization) is not calculated identically by all companies, this presentation may not be comparable to EBITDA or adjusted EBITDA presentations disclosed by other companies. Adjusted EBITDA is calculated in this presentation and represents, for any relevant period, net income/(loss) plus depreciation and amortization, goodwill and long-lived asset impairment, interest expense, (income)/loss from discontinued operations, net of tax, income tax provision, other income/(expense) and equity in net loss of unconsolidated subsidiary. Management believes that Adjusted EBITDA is useful in evaluating the Company’s operating performance compared to that of other companies in its industry because the calculation of Adjusted EBITDA generally eliminates the effects of financing income taxes and certain non-cash and other items that may vary for different companies for reasons unrelated to overall operating performance. As a result, the Company’s management uses Adjusted EBITDA as a measure to evaluate performance and for other discretionary purposes. However, Adjusted EBITDA is not a recognized measurement under GAAP, should not be considered as an alternative to net income as a measure of operating results or to cash flow as a measure of liquidity, and is not intended to be a presentation in accordance with GAAP. In addition to the foregoing, management also uses or will use Adjusted EBITDA to measure compliance with certain financial covenants under the Company’s Senior Secured Credit Facilities and 5.375% Notes and 4.75% Notes that were outstanding at July 4, 2015. However, the amounts shown in this presentation for Adjusted EBITDA differ from the amounts calculated under similarly titled definitions in the Company’s Senior Secured Credit Facilities and 5.375% Notes and 4.75% Notes, as those definitions permit further adjustments to reflect certain other non-recurring costs and non-cash charges. In addition, the Company’s management used adjusted diluted earnings per share as a measure of earnings due to the significant merger and acquisition activity of the Company. However, adjusted earnings per share is not a recognized measurement under GAAP and should not be considered as an alternative to diluted earnings per share presented in accordance with GAAP. Adjusted diluted earnings per share is defined as adjusted net income attributable to Darling divided by the weighted average shares of diluted common stock. Adjusted net income attributable to Darling is defined as a reconciliation of net income attributable to Darling, net of tax (i) adjusted for net of tax acquisition and integration costs related to merger and acquisitions, (ii) net of tax amortization of acquisition related intangibles and (iii) net of tax certain non-recurring items that are not part of normal operations. This measure is solely for the purpose of calculating adjusted diluted earnings per share and is not intended to be a substitute of presentation in accordance with GAAP. 33

34 Creating sustainable food, feed and fuel ingredients for a growing population