Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EPR PROPERTIES | a8-k152016.htm |

ADELAAR UPDATE CALL JANUARY 5, 2016 Exhibit 99.1

DISCLAIMER Statements made in this presentation may constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements relate to, without limitation, the Company’s future economic performance, plans and objectives for future operations and projections of revenue and other financial items. Forward-looking statements can be identified by the use of words such as "may," "will," "plan," "should," "expect,” "anticipate," "estimate," "continue" or comparable terminology. Forward-looking statements are inherently subject to risks and uncertainties, many of which the Company cannot predict with accuracy and some of which the Company might not even anticipate. Although we believe that the expectations reflected in such forward-looking statements are based upon reasonable assumptions at the time made, we can give no assurance that such expectations will be achieved. Future events and actual results, financial and otherwise, may differ materially from the results discussed in the forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements and are advised to consider the factors listed under the headings "Risk Factors" in the Company’s Annual Report on Form 10-K, as may be supplemented or amended by the Company’s Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. The Company assumes no obligation to update and supplement forward-looking statements that become untrue because of subsequent events, new information or otherwise. Definitions and reconciliations of the non-GAAP financial measures used in this presentation are available in our investor supplementals dated September 30, 2015 and December 31, 2014 available on our website at www.eprkc.com. 2

3 • ADELAAR OPPORTUNITY • MONTREIGN RESORT CASINO − TERMS OF GROUND LEASES − ESTIMATED GAAP REVENUE • WATERPARK RESORT − TERMS OF EXPECTED LEASE • ADELAAR FINANCIAL PROJECTIONS • INFRASTRUCTURE – EXPECTED BOND FINANCING • PROJECT TIMELINE • EPR UPDATES DISCUSSION POINTS

4 SIGNIFICANT OPPORTUNITY OVER 25M POTENTIAL VISITORS WITHIN 100 MILES 2016 AVAILABLE MARKET 0-25 MILES 258,000 25-50 MILES 1,490,000 50-100 MILES 23,311,000 TOTAL POTENTIAL VISITORS (0-100 MILES) 25,059,000 SOURCE: CLARITAS, SMITH TRAVEL RESEARCH AND JB RESEARCH COMPANY Activities for all ages: • Montreign Resort Casino • Indoor/Outdoor Waterpark Resort • Bethel Woods Center for the Arts • Off-road biking, hiking trails • Rock climbing • Trout fishing

5 ADELAAR SITE PLAN

6 MONTREIGN RESORT CASINO MONTREIGN RESORT CASINO MONSTER GOLF COURSE

7 MONTREIGN RESORT CASINO CASINO & HOTEL CASINO • 90K SF GAMING FLOOR WITH 2,150 SLOT MACHINES • 102 TABLE GAMES WITH A 14-16 TABLE PRIVATE POKER ROOM • 6 PRIVATE GAMING SALONS ON VIP LEVEL HOTEL • 305 LUXURY SUITES • 12 PENTHOUSE SUITES • 7 TWO-STORY TOWNHOUSE VILLAS AND 8 GARDEN SUITES ENTERTAINMENT VILLAGE INITIAL PHASE OF 50K SF RETAIL VILLAGE WITH DINING AND RETAIL OPTIONS MONSTER GOLF COURSE RENOVATION OF THE MONSTER GOLF COURSE DESIGNED BY REES JONES

8 Casino and Hotel Golf Course and Ent. Village Term: • 70 year ground lease terminable at year 20, 30, 40, 50 and 60 • 70 year ground lease terminable at year 20, 30, 40, 50 and 60 Minimum Rent: • January - February 2016: $500K/month • March 2016 - February 2017: $667K/month (satisfied by option payments received thru 12/31/15) • March 2017 – September 2018: $1M/month • October 2018 – end of lease term: $7.5M/year, subject to escalators described below • Upon opening: $150K/year for each parcel for the first 10 years • Thereafter: $250K/ year for each parcel Percentage Rent: • 5% of eligible revenue (as defined in the casino lease) above $150 million • None Escalators: • Minimum rent increases 8% every 5th year • None Purchase Option (applies to all 3 parcels): • Years 1-5: $175M less up to $25M credit for certain previous payments • Year 6: buyout escalates to $200M with same credit • Deduction for unamortized special assessment overage, if any • Right of first offer on undeveloped resort property TERMS OF GROUND LEASES

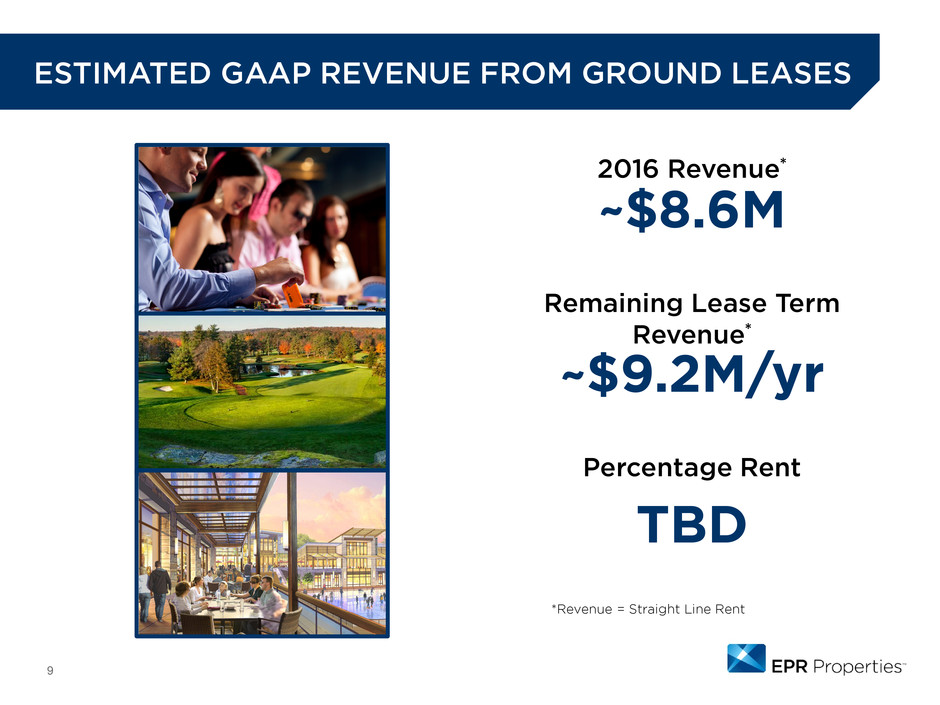

9 ESTIMATED GAAP REVENUE FROM GROUND LEASES ~$8.6M 2016 Revenue* ~$9.2M/yr Remaining Lease Term Revenue* TBD Percentage Rent *Revenue = Straight Line Rent

10 WATERPARK RESORT

11 WATERPARK RESORT WATERPARK & HOTEL WATERPARK LODGE • 300-ROOM LODGE; 12 UNIQUE ROOM LAYOUTS • 75K SF INDOOR WATERPARK FOOD & BEVERAGE • 3 DISTINCTLY THEMED VENUES FAMILY ENTERTAINMENT CENTER • MINIATURE GOLF AND BOWLING • LASER TAG, CLIMBING WALL, ROPES COURSE, PARTY ROOMS ADVENTURE PARK • TUBING, MOUNTAIN COASTER, CLIMBING WALLS, ZIP-LINES • TEAM-BUILDING AND TRAILS SYSTEM FOR CORPORATE OUTINGS CONFERENCE CENTER • 30,000 SF • HOSTS UP TO 750 PEOPLE • BREAKOUT ROOMS AND A BUSINESS CENTER

12 Expected Triple Net Lease Terms Investment: • EPR investment spending: ~$100M - $120M • Tenant Investment: ~$30M • Estimated EPR investment spending is 25% in 2016, 50% in 2017, and 25% in 2018 Term: • 20 years • Renewals up to 48 years Minimum Rent: • ~9% of EPR investment spending • Consideration for Special Allocations Escalators: • Every 5th year based on CPI • Maximum escalation of 10% Estimated GAAP Impact: • Revenue of ~$10.8M/year, assuming $120M of EPR investment spending and excluding escalators WATERPARK RESORT

13 2016 All Parcels Complete Revenue: ~$8.6M* ~$20.0M/yr* Expenses: <$1.0M ~$1.5M/yr Capitalized Interest: ~$1.9M** - Percentage Rent: n/a TBD ADELAAR FINANCIAL PROJECTIONS * Minimum rent on straight line basis over 20 year non-cancellable lease terms ** Relates to waterpark resort only

14 INFRASTRUCTURE—EXPECTED BOND FINANCING Expected Terms Amount of Issue: • ~$106M tax-exempt bond for construction of Infrastructure • Special Districts formed for Roads, Drainage, Water, Sewer, and Lighting payable by Special Allocation to all Benefited Users in each District Issuer: • County of Sullivan Industrial Development Agency Term: • 33 year term (includes 36 month deferral) Bond Rate: • TBD, depending on market at date of issue

15 PROJECT TIMELINE Key Dates Events 12/21/15 • Casino license awarded to Montreign Resort Casino 12/28/15 • Casino, golf course and entertainment village leases signed; cancellable until 3/1/16 3/1/16 • Latest date on which Montreign Resort Casino license is effective and casino, golf course and entertainment village non-cancelable ground lease terms commence 12/31/17 • Expected completion of infrastructure 3/1/18 • Casino gaming floor opening deadline 3/1/19 • Golf course opening deadline (seas. adjusted) • Entertainment village opening deadline • Waterpark opening deadline

SUMMARY 16 • Ground leases upon which our tenant has agreed to invest a minimum of $651M • A waterpark resort under a triple net lease that continues and expands a relationship with a highly successful tenant • ~600 acres of developable land.

17 *Subject to formal declaration by the Board EPR UPDATES $628M TOTAL 2015 ESTIMATED INVESTMENT SPENDING 2016 PLANNED MONTHLY COMMON DIVIDEND INCREASE OF ~6%* ENTERTAINMENT $101M RECREATION $243M EDUCATION $273M OTHER $11M $2.60 $2.80 $3.00 $3.16 $3.42 $3.63 $3.84* $0.00 $1.00 $2.00 $3.00 $4.00 2010 2011 2012 2013 2014 2015 2016 ANNUAL DIVIDENDS AVERAGE INCREASE ~7%