Attached files

| file | filename |

|---|---|

| EX-2.1 - EXHIBIT 2.1 - NAUTILUS, INC. | ofh21.htm |

| EX-99.1 - EXHIBIT 99.1 - NAUTILUS, INC. | ofh991.htm |

| 8-K - 8-K - NAUTILUS, INC. | a8-k_ofh.htm |

Nautilus Investor Call January 4, 2016 Exhibit 99.2

201/04/2016 This presentation includes forward-looking statements (statements which are not historical facts) within the meaning of the Private Securities Litigation Reform Act of 1995, including statements concerning: the anticipated accretive impact of Nautilus’ acquisition of Octane Fitness; the anticipated synergies and other benefits of the acquisition of Octane Fitness; Octane Fitness’ anticipated net sales for the year ended December 31, 2015 and its anticipated rate of revenue growth for future periods; current and anticipated financial and operating trends relating to Octane Fitness, Nautilus or the combined company; and the anticipated results of product, channel and market development initiatives. Factors that could cause Nautilus, Inc.'s actual results to differ materially from these forward-looking statements include costs associated with the acquisition, failure to achieve expected synergies, accretion and other anticipated benefits of the transaction or to successfully integrate the Octane Fitness business, adverse reactions to the acquisition by employees, customers, suppliers or competitors of either Octane Fitness or Nautilus, our ability to effectively develop, market and sell future products, our ability to protect our intellectual property, incurrence of unanticipated obligations under licensing agreements and the impact of disputes regarding royalty obligations owed or owing to us. Additional assumptions, risks and uncertainties are described in detail in our registration statements, reports and other filings with the Securities and Exchange Commission, including the "Risk Factors" set forth in our Annual Report on Form 10-K, as supplemented by our quarterly reports on Form 10-Q. Such filings are available on our website or at www.sec.gov. You are cautioned that such statements are not guarantees of future performance and that our actual results may differ materially from those set forth in the forward-looking statements. We undertake no obligation to publicly update or revise forward-looking statements to reflect subsequent developments, events or circumstances. © Nautilus, Inc. 2016 Safe Harbor Statement

301/04/2016 • Over the past four plus years, we have followed a consistent strategic journey, grounded in deep understanding of the fitness consumer, investment in product and design innovation, increased spend on marketing and brand development…all with strong fiscal discipline • This strategic consistency has resulted in significant growth in revenue, income, a strong balance sheet, and significant shareholder value creation • Today, we are excited to announce the next phase of our strategic journey as we combine the power of two growth companies with very complementary strengths • Octane Fitness, which we acquired on December 31, is a very profitable and growing player in the industry and the brand has strong brand equity at both the trade and consumer level • Octane brings a unique product portfolio and has deep distribution in the commercial, specialty, and international channels…which are all markets where Nautilus is currently underdeveloped • The acquisition of Octane Fitness will provide a broad platform for new growth that is expected to accelerate shareholder value creation, with positive accretion in 2016 Overview of Key Messages

401/04/2016 • Octane Fitness Overview • Transaction Summary • Strategic Fit and Rationale • Alignment with Long Term Nautilus Goals Growth metrics Capital deployment • Q & A Acquisition of Octane Fitness – Agenda

Octane Fitness Overview

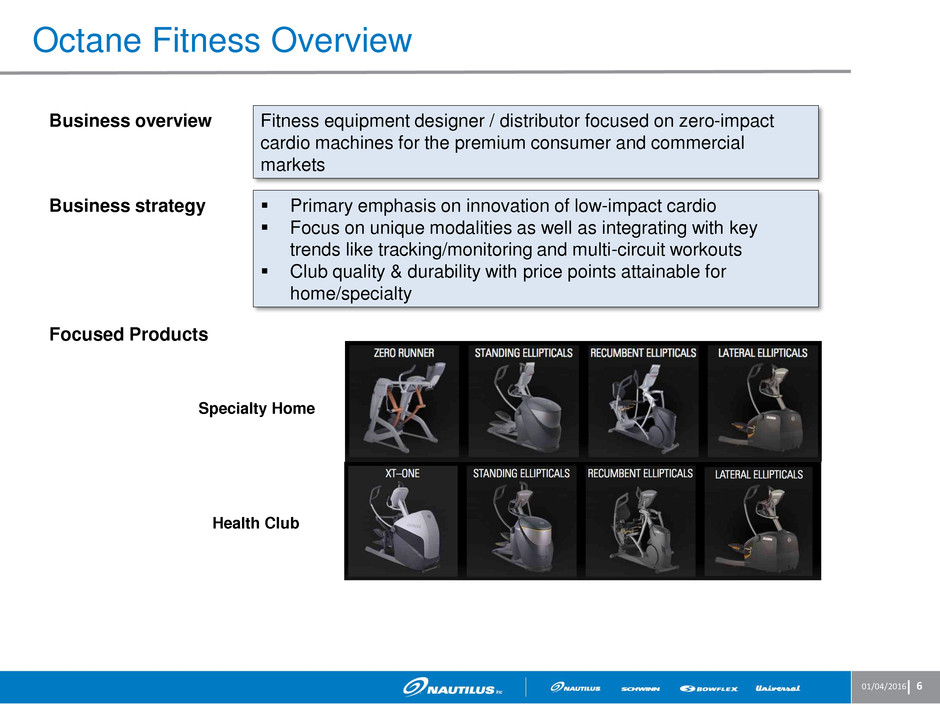

601/04/2016 Octane Fitness Overview Business overview Fitness equipment designer / distributor focused on zero-impact cardio machines for the premium consumer and commercial markets Business strategy Primary emphasis on innovation of low-impact cardio Focus on unique modalities as well as integrating with key trends like tracking/monitoring and multi-circuit workouts Club quality & durability with price points attainable for home/specialty Focused Products Health Club Specialty Home

701/04/2016 • Distribution Overview North American sales primarily into specialty retailers for both consumer and light commercial use Commercial grade products also sold directly to membership based gyms Consumer and commercial products sold internationally through distributors and direct sales team • Locations Headquartered in Brooklyn Park, MN Approximately 80 employees Manufacturing outsourced Sales offices worldwide 3 PL warehouse locations – domestic and international • History, Product timeline 2001 - Octane Fitness Incorporated 2002 - Q35 & Q35e standing ellipticals launched to specialty retail 2005 - North Castle Partners invests in Octane Fitness 2005 - Octane enters health club market with the Pro3500 standing elliptical 2008 - Introduction of xRide redefines seated works by creating the seated elliptical category 2012 - Octane launches LateralX to health clubs and specialty fitness stores 2014 - Octane redefines running with introduction of the Zero Runner to specialty fitness stores 2015 - Octane launches XT-One – a breakthrough in elliptical cross training Octane Fitness Overview

801/04/2016 • Consistent with key growth drivers Expand international footprint Penetrate new distribution channels: Specialty Retail and Commercial Expand into higher price point product offerings • Platform acquisition creates growth oriented synergies Complementary products and channels of distribution (no overlap) Many opportunities to leverage common investments Enhanced innovation and product development capability • Strong cultural fit Experienced founder-led organization Innovation driven mentality Brand, customer and profit orientation • Enhances shareholder value Profitable and growing business Significantly accretive to earnings in FY16 Strategic Rationale

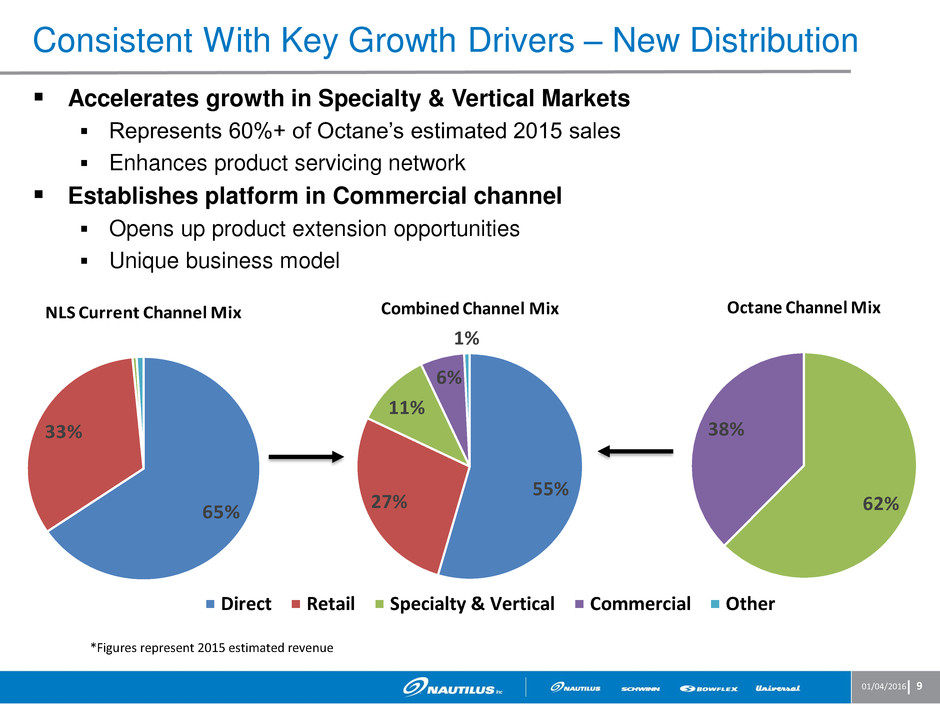

901/04/2016 Accelerates growth in Specialty & Vertical Markets Represents 60%+ of Octane’s estimated 2015 sales Enhances product servicing network Establishes platform in Commercial channel Opens up product extension opportunities Unique business model Consistent With Key Growth Drivers – New Distribution 65% 33% NLS Current Channel Mix 55% 27% 11% 6% 1% Combined Channel Mix 55%27% 11% 6% 1% Combined Channel Mix Direct Retail Specialty & Vertical Commercial Other *Figures represent 2015 estimated revenue 62% 38% Octane Channel Mix

1001/04/2016 Accelerates Distribution in International Markets Represents 23% of Octane’s 2015 projected sales Established distribution in major global markets with minor overlap to Nautilus’ Opportunity to leverage companies’ infrastructure Consistent With Key Growth Drivers – International 94% 2% 4% Combined Geography Mix 98% 2% NLS Current Geography Mix 94% 2% 4% Combined Geography Mix North America EMEA APLA *Figures represent 2015 estimated revenue 77% 10% 13% Octane Geography Mix

1101/04/2016 • Significant cross-selling opportunities Octane’s strong brand known for unique high-quality products Broader product and brand portfolio enhances offering Accelerate efforts with Nautilus and Schwinn brands in Specialty channel leveraging Octane’s strong distribution and customer relationships Octane’s unique features and modalities well suited for Direct channel leveraging NLS’ expertise and dominant position Larger scale more attractive to international distributors • Many opportunities to leverage common investments Enhanced innovation and product development capabilities Intellectual property Sales and marketing Long-term savings potential in sourcing and distribution Platform Acquisition Creates Growth Synergies

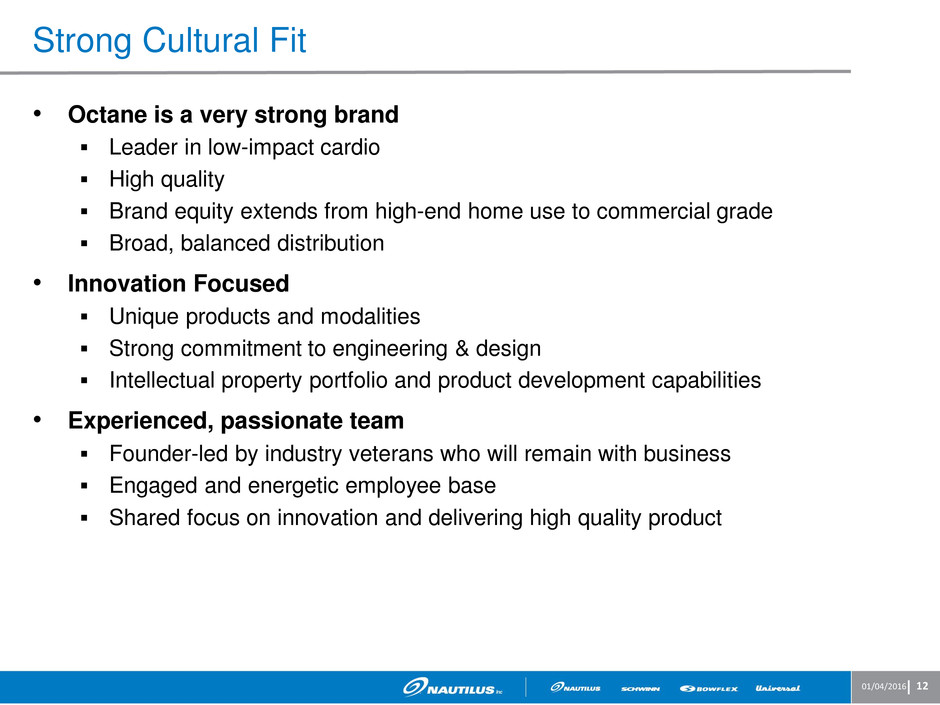

1201/04/2016 • Octane is a very strong brand Leader in low-impact cardio High quality Brand equity extends from high-end home use to commercial grade Broad, balanced distribution • Innovation Focused Unique products and modalities Strong commitment to engineering & design Intellectual property portfolio and product development capabilities • Experienced, passionate team Founder-led by industry veterans who will remain with business Engaged and energetic employee base Shared focus on innovation and delivering high quality product Strong Cultural Fit

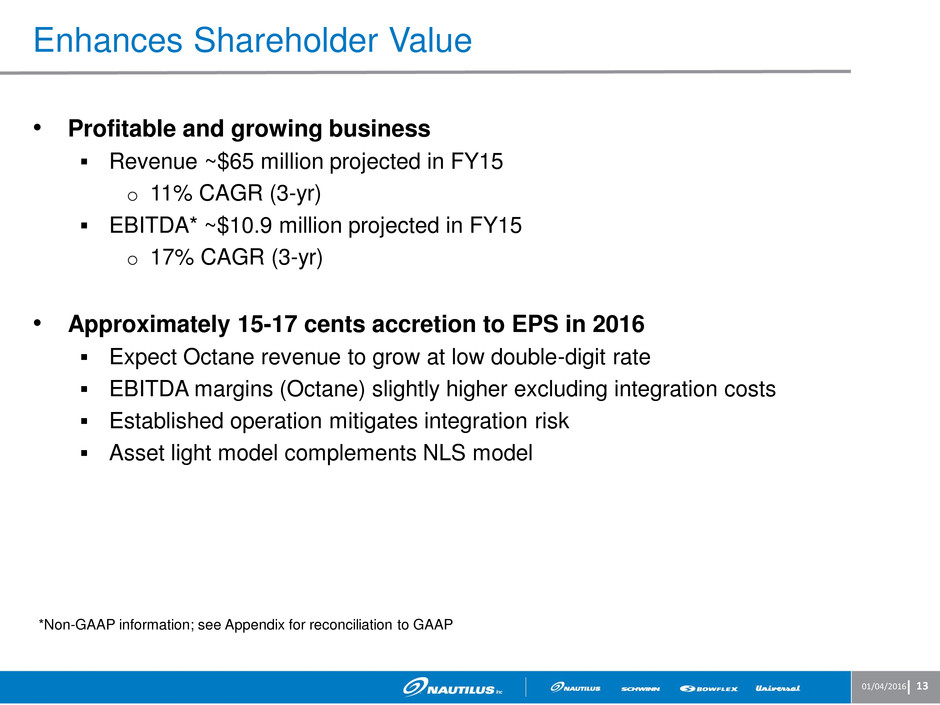

1301/04/2016 • Profitable and growing business Revenue ~$65 million projected in FY15 o 11% CAGR (3-yr) EBITDA* ~$10.9 million projected in FY15 o 17% CAGR (3-yr) • Approximately 15-17 cents accretion to EPS in 2016 Expect Octane revenue to grow at low double-digit rate EBITDA margins (Octane) slightly higher excluding integration costs Established operation mitigates integration risk Asset light model complements NLS model *Non-GAAP information; see Appendix for reconciliation to GAAP Enhances Shareholder Value

1401/04/2016 • Price: $115 million subject to working capital* • Funding: Cash on hand plus $80 million of term debt • Valuation: 10.5x FY15 Projected EBITDA • Financials: In FY15 Octane Fitness is projected to generate approximately $65 million of revenue and $10.9 million of EBITDA** • Timing: Definitive Agreement signed and deal closed on December 31, 2015 *Purchase agreement also contemplates the award of long-term performance-based retention incentives for certain Octane personnel **Non-GAAP information; see Appendix for reconciliation to GAAP Transaction Summary

Summary

1601/04/2016 Key Growth Drivers Supported by Octane • Octane products and innovation expand our product assortment in the retail space to new modalities and price pointsRetail • Octane holds strong market position, and a sterling reputation, in the specialty and vertical market segment, as well as in selected commercial modalities New Distribution Opportunities •Both companies share a strong belief that product innovation is the key to growth. Octane growth has been fueled by innovation. Innovation • Octane has better international presence and existing relationships in markets where Nautilus is not yet fully representedInternational • Adding Octane’s strong position in Specialty fitness to Nautilus’ capabilities in Direct, Retail and Online, increases our share of the overall fitness market while further diversifying our revenue stream Strategic Opportunities

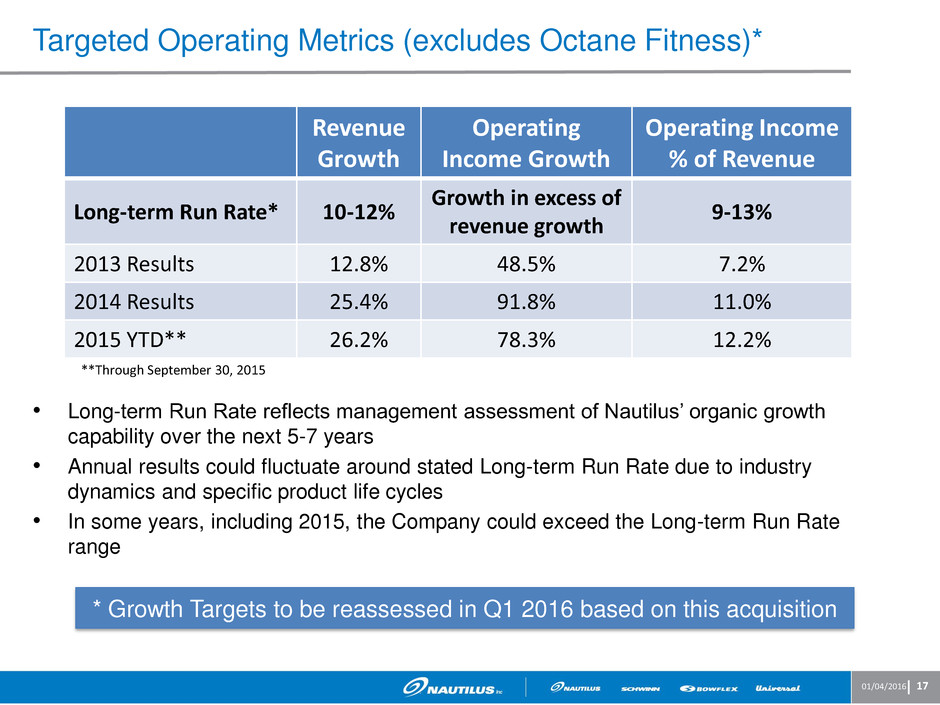

1701/04/2016 • Long-term Run Rate reflects management assessment of Nautilus’ organic growth capability over the next 5-7 years • Annual results could fluctuate around stated Long-term Run Rate due to industry dynamics and specific product life cycles • In some years, including 2015, the Company could exceed the Long-term Run Rate range Targeted Operating Metrics (excludes Octane Fitness)* **Through September 30, 2015 Revenue Growth Operating Income Growth Operating Income % of Revenue Long-term Run Rate* 10-12% Growth in excess of revenue growth 9-13% 2013 Results 12.8% 48.5% 7.2% 2014 Results 25.4% 91.8% 11.0% 2015 YTD** 26.2% 78.3% 12.2% * Growth Targets to be reassessed in Q1 2016 based on this acquisition

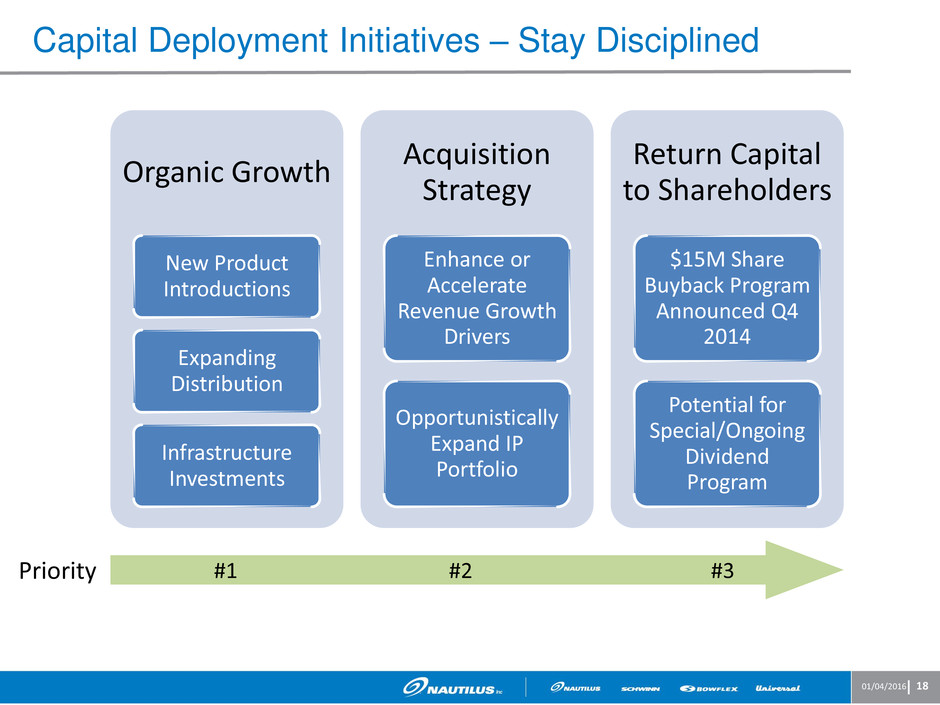

1801/04/2016 Capital Deployment Initiatives – Stay Disciplined Organic Growth New Product Introductions Expanding Distribution Infrastructure Investments Acquisition Strategy Enhance or Accelerate Revenue Growth Drivers Opportunistically Expand IP Portfolio Return Capital to Shareholders $15M Share Buyback Program Announced Q4 2014 Potential for Special/Ongoing Dividend Program #1 #2 #3Priority

1901/04/2016 • The hurdles were high and the search for a perfect strategic and cultural match was extensive… …but all was well worth the effort in finding Octane Fitness • 2016 will be a year to focus on successfully executing existing Nautilus and Octane Fitness strategies... …while carefully aligning our complementary strengths, plans and resources to maximize future opportunities We are very excited about the opportunities the acquisition presents We look forward to sharing more as we enter the next phase of our growth journey

THANK YOU 20

Appendix

2201/04/2016 Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) (unaudited) Reconciliation of Non-GAAP Financial Measures 2015 Estimate Net Income1 $ 3.3 M Interest Expense 2.0 Tax Expense2 2.0 Depreciation 0.9 Intangible and Goodwill Amortization 2.1 Private Equity, Lender, and Director Fees 0.5 EBITDA3 $ 10.9 M (1) Excludes expenses related to current acquisition (2) Excludes tax benefit related to current acquisition expenses (3) May not add due to rounding