Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

(Mark One) | ||

|

[X] |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

|

For the fiscal year ended |

August 31, 2015 | |

|

or | ||

|

[ ] |

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

|

For the transition period from |

[ ] to [ ] | |

|

Commission file number |

333-199818 | |

|

|

|

|

|

SIRRUS CORP. |

|

(Exact name of registrant as specified in its charter) |

|

Nevada |

|

N/A |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

Nyeri Motor Services Building, Moi Nyayo Way, Nyeri, Kenya |

|

|

|

(Address of principal executive offices) |

|

(Zip Code) |

|

Registrant's telephone number, including area code: |

|

+25 (472) 266-8059 |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Name of Each Exchange On Which Registered |

|

N/A |

|

N/A |

Securities registered pursuant to Section 12(g) of the Act:

|

Common Stock, par value $0.00001 | |||

|

(Title of class) | |||

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 the Securities Act. | |||

|

|

Yes ¨ No x | ||

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act | |||

|

|

Yes ¨ No x | ||

|

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the last 90 days. | |||

|

|

Yes x No ¨ | ||

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-K (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). |

| ||

|

|

Yes x No ¨ |

| |

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. | |||

|

|

¨ | ||

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| ||||

|

Large accelerated filer |

¨ |

Accelerated filer |

¨ |

|

|

Non-accelerated filer |

¨ |

Smaller reporting company |

x |

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | ||||

|

|

Yes x No ¨ | |||

|

Indicate the number of shares outstanding of each of the registrant’s classes of common stock as of the latest practicable date. | |

|

35,763,339 common shares as of December 9, 2015. |

|

DOCUMENTS INCORPORATED BY REFERENCE

None.

2

Table of Contents

3

PART I

Item 1. Business

Business Development

SIRRUS CORP. is a start-up company incorporated in the State of Nevada on May 7, 2014 with a fiscal year ending August 31. We are seeking to engage in the designing, marketing and distribution of electronic cigarettes (“e-cigarette”) in East Africa.

Our office is located at Nyeri Motor Services Building, Moi Nyayo Way, Nyeri, Kenya and our telephone number is +254722668059. Our registered statutory office is located at 711 S. Carson Street, Suite 6, Carson City, Nevada 89701, (775) 882-4641. We do not own any property.

E-cigarettes are battery-powered products that simulate tobacco smoking through inhalation of nicotine vapor and non-nicotine vapor without the fire, flame, tobacco, tar, carbon monoxide, ash, stub, smell and other chemicals found in traditional combustible cigarettes.

Africa is poised to become the “future epicenter of the tobacco epidemic,” according to a new analysis from the American Cancer Society[1]. It indicates that the number of adults in Africa who smoke could increase to 572 million by 2100, from 77 million today, unless leaders take steps to curb current trends. The report highlights several reasons for the increase in smoking rates:

§ In Africa, 9% of boys and 3% of girls smoke -- both rates are high compared with other developing regions.

§ Africa is set for massive population growth. The region now accounts for 12% of the global population -- this will climb to 30% by 2100. The study concludes that because of this, Africa will have the second-highest number of smokers of any region by 2060.

§ African nations experienced strong economic growth in the 2000s, which means more people have more money to spend on cigarettes.

We believe this strong consumer demand will lead retailers to allocate additional shelf space to smoking related products and we will strive to offer our e-cigarette products at or near points of distribution where traditional cigarettes are available in the markets we serve. We believe e-cigarettes offer a compelling alternative for smokers, relative to traditional cigarettes.

Our goal is to become the leading e-cigarette marketer and distributor in the East Africa. We expect to achieve our goal by maximizing our points of distribution, maintaining our low-cost position and continuing to differentiate our products and brands in order to resonate with consumers in local markets around the region. Our plan is to finalize our first distribution agreement by the first quarter of 2016 with a health food company that has multi locations and distribution agreements with three of the top 3 grocery chains in Kenya. We are currently in negotiations to finalize this distribution agreement and await their various required approvals.

Our strategy is to increase our future sales by penetrating new and emerging markets where we expect rising consumer incomes and an increase in demand for e-cigarettes. Cigarette smokers in these emerging markets are our target demographic and will represent our primary source of future revenue growth.

We will focus on rapidly securing retail distribution in Kenya and East African markets through strategic partnerships with key retailers and distributors. We believe strong consumer demand will lead retailers to allocate additional shelf space to smoking related products and we strive to offer our products at or near every point of distribution where traditional cigarettes are available in the markets we serve. We believe e-cigarettes offer a compelling alternative for smokers, relative to traditional cigarettes. Our goal is to become the leading e-cigarette marketer and distributor in the East Africa. We expect to achieve our goal by maximizing our points of distribution, maintaining our low-cost position and continuing to differentiate our products and brands in order to resonate with consumers in local markets around the region.

________________________________________________

[1] American Cancer Society, Tobacco Use in Africa: Tobacco Control Through Prevention, 2013

4

The Product Line Offered

The Company has recently purchased a small inventory of 670 single use, single packed, and disposable e-cigarettes to test in the local market of Nairobi, Kenya. The single packaged, and single use disposable e-cigarettes purchased by the Company range from 8mg to 24mg and are all 9.2mm with a 500 puff life. These single use e-cigarettes were chosen by the Company as a cost effective way to test the market and the demand. In addition, the Company also ordered single use and disposable e-cigars which range from16mg-18mg and have a 1,300 puff life. These products have been ordered, shipped but have not been placed in stores yet, but it is anticipated that they will be sold to a wholesaler with distribution in January 2016.

500 Puff e-cigarette

Series 500 Puff disposable e-cigarettes and sample replaceable filters good for up to 500 puffs of vapour

e-Cigars

Series iCigar samples that offer higher volume and a longer draw of vapour with replaceable LED lighting tips.

The full line of the products which the Company has chosen to market and distribute in East Africa and which the Company plans on ordering in the future from our 2 manufacturers from China are as follows:

5

SR 100 e-cigarette

New generation JSB-J100 500 puff e-cigarette with special design box pack

500 Puff e-cigarette

Series 500 Puff disposable e-cigarettes and sample replaceable filters good for up to 500 puffs of vapor.

800 Puff e-Hookah

Series 800 Puff disposable e-Hookah, good for up to 800 puffs of vapor with sample USB charger and replacements filers.

6

E cigarette-How it Works

An electronic cigarette, also known as an e-cigarette, vapor cigarette or an e-cig, is a cylinder-shaped device made of stainless steel or plastic that imitates a cigarette in terms of its appearance, use and sometimes taste. E-cigarettes produce a vapour that resembles smoke and a glow that resembles the tip of a cigarette. They consist of a battery-powered delivery system that vapourizes and delivers a liquid chemical mixture that may be composed of various amounts of nicotine, propylene glycol, and other chemicals.

A typical electronic cigarette consists of three components:

· A cartridge containing nicotine, water, and flavouring in a base of propylene glycol, vegetable glycerine, or polyethylene glycol 400 (Note: not all cartridges or solutions contain nicotine);

· An atomizer containing a heating element which turns the liquid nicotine into a vapour; and

· A battery to power the atomizer and the indicator light that glows like a lit cigarette when inhaled.

When a user draws air through the electronic cigarette and/or vaporizer, the air flow is detected by a sensor, which activates a heating element that vaporizes the solution stored in the mouthpiece/cartridge, the solution is then vaporized and it is this vapor that is inhaled by the user. The cartridge contains either a nicotine solution or a nicotine free solution, either of which may be flavored.

MARKET, INDUSTRY AND OTHER DATA

Unless otherwise indicated, information contained in this report concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market size, is based on information from various sources, on assumptions that we have made that are based on those data and other similar sources and on our knowledge of the markets for our services. These data involve a number of assumptions and limitations. We have not independently verified the accuracy of any third party information. In addition, projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate is necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in section entitled “Risk Factors” of this report and elsewhere in this report. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

Our Market Opportunity

Global Growth

We operate within the rapidly growing and global e-cigarette industry, an emerging product category that is taking market share from the $756 billion global tobacco industry. The American Cancer Society estimates that there are 1.3 billion tobacco smokers in the world, consuming approximately 6 trillion cigarettes per year, or 190 thousand cigarettes per second. Tobacco use is the leading cause of preventable illness and death, causing more than 5 million annual deaths across the globe according to the Center for Disease Control and Prevention (“CDC”). We believe e-cigarettes offer a compelling alternative for current smokers, relative to traditional cigarettes.

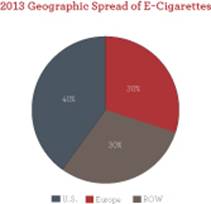

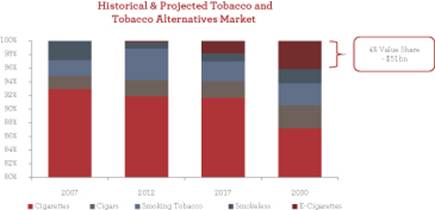

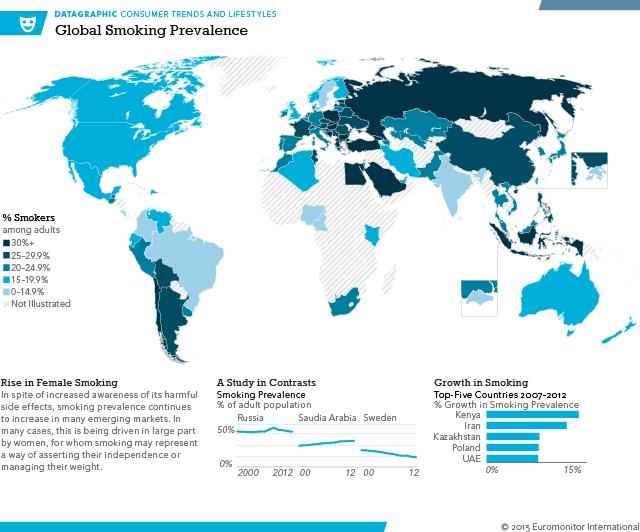

Still in the early stages of its market penetration, the e-cigarette industry is highly fragmented with approximately 250 brands worldwide according to the CDC. Primarily propelled by the cannibalization of the traditional tobacco industry, the global e-cigarette industry has recently experienced dramatic growth. According to Euromonitor, e-cigarettes accounted for approximately $3.5 billion in 2013 global retail sales, with approximately 40% of sales generated in the U.S., 30% of sales generated in Europe, and 30% of sales generated in the rest of the world (“ROW”). Euromonitor estimated that significant market growth was achieved from 2012 to 2013 with the U.S., Europe and ROW generating growth rates of 180%, 160%, and 150%, respectively. Euromonitor projects e-cigarette sales to represent approximately $51 billion, or 4 % of the global tobacco and tobacco alternatives market industry by 2030. We believe that our company will be well positioned to benefit from, and take advantage of, these attractive market trends in the coming years.

|

|

|

|

Source: Euromonitor International 2013.

8

Kenya and East African Growth

Cigarette consumption historically has been highest in high-income countries, but because of targeted marketing, increased social acceptability, continued economic development, and population increases, consumption is expected to increase in low- and middle-income countries. Cigarette consumption in Western Europe dropped by 26% between 1990 and 2009 but increased in the Middle East and Africa by 57% during the same period. Our strategy is to increase our international sales by penetrating new and emerging markets where we expect rising consumer incomes and an increase in demand for e-cigarettes. Kenya is the most developed economy in East Africa. We believe Kenya has favorable market characteristic and is poised for growth in e-cigarette consumption as a viable alternate to tobacco cigarettes. According to Euromonitor, Kenya was a leading nation in growth of smoking prevalence from 2007 to 2012, with an increase of 15% during this time frame. In spite of stronger efforts by the Kenyan government to curb smoking in the country, both retail and illicit trade volume sales of cigarettes continued to increase during 2012. This was mostly the result of an increase in the absolute number of smokers as well as some consumers increasing cigarette consumption. Overall, volume sales increased by 7% in 2012. We believe this continued growth in Kenya represents a market opportunity for growing e-cigarette businesses in the region. We believe we are well positioned to benefit from, and take advantage of these attractive market trends in the coming years.

BUSINESS STRATEGY AND OPERATIONS

Internet

We will advertise our products primarily through our direct marketing campaign, on the Internet. We will also attempt to build brand awareness through social media marketing activities, web-site promotions, and pay-per-click advertising campaigns.

Point of Sale Marketing

We believe it is vital to invest in point of sale marketing, including impactful displays and product placements within retail stores. We believe that packaging and point of sale marketing and display has the highest return on investment of any marketing activity. We believe our attractive branding and packaging will resonates with our key target audience, providing higher visibility to users at the point of purchase to drive future sales.

Moving with Product Trends

The global e-cigarette industry is continually evolving. We will continue to focus our efforts on identifying shifting consumer preferences and responding to those shifts before our competitors. We believe that it is paramount to quickly identify consumer and product trends in each geographic location, analyze and adapt our business as needed, and rapidly drive appropriate changes to our other planned markets. We plan to continue to adapt to new technologies and products in order to increase our share of the market.

Distribution and Sales

We will offer our electronic cigarettes and related products through our online store at www.sirruscorp.com and through a wholesale distributor reseller network for large bulk orders. Since their introduction, electronic cigarettes have predominantly been sold online, while tobacco products, most notably cigarettes are currently sold at retail locations. We believe that future growth of electronic cigarettes is dependent on higher volume, lower margin sales channels, like the broad based distribution network through which tobacco cigarettes are sold. We believe we can increase sales to new and existing retail and distribution customers by offering them attractive value chain economics through competitive mark-ups. We are focused on rapidly securing additional retail distribution in East African markets through strategic partnerships with key retailers and distributors. Our plan is to finalize our first distribution agreement by the first quarter of 2016 with a health food company that has multi locations and distribution agreements with three of the top 3 grocery chains in Kenya. We are currently in negotiations to finalize this distribution agreement and await their various required approvals.

9

Manufacturing

We have no manufacturing capabilities and do not intend to develop any manufacturing capabilities. We depend on third party manufacturers for our electronic cigarettes, vaporizers and accessories. Any interruption in supply and or consistency of our products may harm our relationships and reputation with customers, and have a materially adverse effect on our business, results of operations and financial condition.

The company currently relies on third party manufacturers for the production of our products. Our products are manufactured on a purchase-order basis with production being initiated following receipt of an initial order and payment from us. On September 17, 2014, we have established two Exclusive Distribution Agreements with two separate e-cigarette manufactures.

The first of the two manufacturers is Shenzhen Jieshibo Technology Co., Ltd (“JSB”) which was founded in 2010. This high standard and efficient company integrates the development, production, marketing and service that is specialized in the research and development of electronic cigarettes, cartridges and e-liquid.

JSB is located in Shenzhen, a rising modernization city which is next to Hong Kong. The details of the manufacturer are as follows:

· 29,000 square meters plant area, 7 production buildings, 2 R&D buildings

· 159 automatic production lines

· More than 2,800 staffs

· 58 in research and development team

· 12 in after-sale service team

· 12 in marketing development team

· 30 in foreign trade team

· The products from JSB have obtained CE, RoHS, FCC, UL, PSE certificates through TUV detection.

· Patent certificate: 2 US patent certificates, 7 EU patent certificates, 10 Chinese patent certificates.

· OEM/ODM experience: 6 years.

JSB has earned several world class GMP production workshops, physics and biochemistry labs and has an e-liquid experimental center with precision detecting instruments. Through the ISO22000 food safety and quality management system certification, JSB can make sure that every single product must get through 32 strict detecting processes for world class quality and standards. Since being founded, the company has offered ODM and OEM service for more than 300 foreign dealers. JSB proprietary brand e-cigs have been sold all over the world.

The Company`s second manufacturer is Shenzhen Langjietong Electronics Co., Ltd., (``SLE``) which was established in 2007 and is located in Shenzhen. SLE is a professional and innovative company engaged in the electronic cigarette research, development, production, sale and service business. SLE offers all kinds of finished electronic cigarettes, atomizers and other e-cigarette related accessories. SLE`s R&D team and engineers have many years of practical experience with electronic cigarettes.

All materials are in line with environment protection standards. The newest single orientation anti-interference PCB is used. SLE`s finished e-cigarette owns SGS and no Nicotine test report and the power has CE and PSE certifications. Cartridge flavor includes tobacco series (Tobacco, SevenStars, Zhongnanhai, and Marlboro) and fruit series (Apple, Lemon, Strawberry, Chocolate, and Coffee).

SLE customers spread all over the world and include the USA, UK, Australia, Japan and other countries and regions. SLE also accepts OEM and ODM orders as is the case with our company.

Both agreements with our manufacturers stated that we shall undertake to buy not less than 100 of the aforesaid devices during the first three months from the date of the signing of the agreement, which was September 17, 2014. Exclusivity will become effective after the delivery of the initial sample order which we placed to the manufacturer in the first month from the signing of the agreement, which was September 17, 2014, and the sample order was to be no less than 100 devices. The Company ordered more than 100 devices in the first month of the signing of the agreement and the samples have already been delivered to Kenya as of December 2014. Thereafter, the Company also purchased a small inventory of 670 single use, single packed, and disposable e-cigarettes to test in the local market of Nairobi, Kenya. The

10

single packaged, and single use disposable e-cigarettes purchased by the Company range from 8mg to 24 mg and are all 9.2mm with a 500 puff life. These single use e-cigarettes were chosen by the Company as a cost effective way to test the market and the demand. In addition, the Company also ordered single use and disposable e-cigars which range from16mg-18mg and have a 1,300 puff life. These products have been ordered, shipped and tested and will be placed in stores to be sold in the first quarter of 2016.

Distributor’s Sales Territory

The sales territory designated for both Agreements is the geographical area of Kenya, Uganda, Tanzania, Rwanda, Ethiopia, Burundi and Southern Sudan as the area mutually agreed upon for which we shall have sales responsibility and in which we will exert our efforts for sales, marketing, and distribution of the aforesaid products. We will also market our products online, giving access to anyone wanting to purchase our products from our website.

Our manufacturer will provide us with finished products, which we plan to hold in inventory for distribution, sale and use. Certain Chinese factories and the products they export have recently been the source of safety concerns and recalls, which is generally attributed to lax regulatory, quality control and safety standards. Should Chinese factories continue to draw public criticism for exporting unsafe products, whether those products relate to our products or not we may be adversely affected by the stigma associated with Chinese production, which could have a material adverse effect on our business, results of operations and financial condition.

Although we believe that several alternative sources for our products are available, any failure to obtain the components, chemical constituents and manufacturing services necessary for the production of our products would have a material adverse effect on our business, results of operations and financial condition

Competition

The e-cigarette industry is extremely competitive with low barriers to entry. Competition is based on availability, brand development and recognition and price. We compete with other sellers of e-cigarettes, such as big tobacco companies- through their electronic cigarettes business segments, independent domestic and international e-cigarette companies, small internet and kiosk e-cigarette companies as well as multiple resellers and distributors.

Our direct competitors sell products that are substantially similar to ours and through the same channels we use to sell our products. We compete primarily on the basis of product quality, brand recognition, brand loyalty, service, marketing, advertising and price. We are subject to highly competitive conditions in all aspects of our business. The competitive environment and our competitive position can be significantly influenced by weak economic conditions, erosion of consumer confidence, competitors’ introduction of low-priced products or innovative products, cigarette excise taxes, higher absolute prices and larger gaps between price categories, and product regulation that diminishes the ability to differentiate tobacco products. We compete with these direct competitors for sales through the internet as well as distributors, wholesalers and retailers including national chain stores, tobacco shops, gas stations, grocery chains and other outlets associated with the selling of tobacco products.

Government Regulation

Kenya

The Kenyan government has introduced market-based reforms and provided more incentives for both local and foreign private investment. Foreign investors seeking to establish a presence in Kenya generally receive the same treatment as local investors, and multinational companies make up a large percentage of Kenya's industrial sector. Furthermore, there is no discrimination against foreign investors in access to government-financed research, and the government's export promotion programs do not distinguish between local and foreign-owned goods.

11

The Companies Ordinance, the Partnership Act, the Foreign Investment Protection Act, and the Investment Promotion Act of 2004 provide the legal framework for foreign direct investment (FDI). To attract investment, the Kenyan government enacted several reforms, including abolishing export and import licensing except for a few items listed in the Imports, Exports and Essential Supplies Act; rationalizing and reducing import tariffs; revoking all export duties and current account restrictions; freeing the Kenya shilling's exchange rate; allowing residents and non-residents to open foreign currency accounts with domestic banks; and removing restrictions on borrowing by foreign as well as domestic companies. In 2005, the Kenyan government reviewed its investment policy and launched a private sector development strategy. One component of this effort was a comprehensive policy review by UNCTAD that was the basis for the 2005 UNCTAD Investment Guide to Kenya, published in conjunction with the International Chamber of Commerce (ICC).

Kenya's investment code, articulated in the Investment Promotion Act of 2004, which came into force in 2005, streamlined the administrative and legal procedures to create a more attractive investment climate. The act’s objective is to attract and facilitate investment by assisting investors in obtaining the licenses necessary to invest and by providing other assistance and incentives. The act replaced the government's Investment Promotion Center with the Kenya Investment Authority (KIA).

Kenyan investment law is modeled on British investment law. The Companies Act, the Investment Promotion Act, and the Foreign Investment Act are the main pieces of legislation governing investment in Kenya. Kenyan law provides protection against the expropriation of private property, except where due process is followed and adequate and prompt compensation is provided. Various bilateral agreements also guarantee further protection with other countries. Expropriation may only occur for either security reasons or public interest. The Kenyan government may revoke a foreign investment license if (1) an untrue statement is made while applying for the license; the provisions of the Investment Promotion Act or of any other law under which the license is granted are breached; or, if (2) there is a breach of the terms and conditions of the general authority. The Investment Promotion Act of 2004 provides for revocation of the license in instances of fraudulent representation to the Kenya Investment Authority (KIA) by giving a written notice to the investor granting 30 days from the date of notice to justify maintaining the license. In practice, the KIA rarely revokes licenses.

Kenya is a member of the World Bank-affiliated Multilateral Investment Guarantee Agency (MIGA), which issues guarantees against non-commercial risk to enterprises that invest in member countries. It is also a signatory to the Convention on the Settlement of Investment Disputes between States and Nationals of Other States. The Convention established the International Center for Settlement of Investment Disputes (ICSID) under the auspices of the World Bank. Kenya is also a member of the Africa Trade Insurance Agency (ATIA) as well as many other global and regional organizations and treaties, including the Common Market for Eastern and Southern Africa (COMESA); the Cotonou Agreement between the European Union and the African, Caribbean and Pacific States (ACP); the East African Community (EAC); the Paris Convention on Intellectual Property, the Universal Copyright Convention, and the Berne Copyright Convention; the World Intellectual Property Organization (WIPO); and the World Trade Organization (WTO). Kenya has also signed double taxation treaties with a number of countries, including Canada, China, Germany, France, Japan, Netherlands, and India. On November 27, 2007, Kenya joined with its EAC sister states in signing the first-ever interim economic partnership agreement (EPA) with the European Community (EC). In mid-July 2008, Kenya and its fellow EAC members signed a Trade and Investment Framework Agreement (TIFA) with the United States at the conclusion of the 2008 African Growth and Opportunity Act (AGOA) Forum in Washington, D.C.

Foreign investors are able to obtain credit on the local market; however, the number of credit instruments is relatively small. Legal, regulatory, and accounting systems are generally transparent and consistent with international norms. The corporate tax for newly listed companies is 25 percent for a period of five years from the date of listing. The withholding tax on dividends is 7.5 percent for foreign investors and 5 percent for local investors. Foreign investors can acquire shares in a listed company subject to a minimum reserve ratio of 40 percent of the share capital of the listed company for domestic investors, with the remaining 60 percent considered as a free float available to local, foreign, and regional investors without restrictions on the level of holding. To encourage the transfer of technology and skills, the government allows foreign investors to acquire up to 49 percent of local stockbrokerage firms and up to 70 percent of local fund management companies. Dividends distributed to residents and non-residents are subject to a final withholding tax at the rate of 5 percent. Dividends received by financial institutions as trading income are not subject to tax. In 2007, the Kenyan government granted two fiscal incentives to encourage growth of capital markets: exemption from income tax on interest income accruing from cash flows of securitized assets; and exemption from income tax on interest income accruing from all listed bonds with at least a maturity period of three years. The fiscal incentive targets providers of infrastructure services such as roads, water, power, telecommunication, schools, and hospitals. Company capital expenditures on legal costs and other incidental expenses associated with listing by introduction at the NSE are tax deductible.

12

The Kenyan government focuses its investment promotion on opportunities that earn foreign exchange, provide employment, promote backward and forward linkages, and transfer technology. The only significant sectors in which investment (both foreign and domestic) are constrained are those where state corporations still enjoy a statutory monopoly. These monopolies are restricted almost entirely to infrastructure (e.g., power, posts, telecommunications, and ports), although there has been partial liberalization of these sectors. For example, in recent years, five Independent Power Producers (IPPs) have begun operations in Kenya.

Work permits are required for all foreign nationals wishing to work in the country, and the Kenyan government requires foreign employees to be key senior managers or have special skills not available locally. Still, any enterprise, whether local or foreign, may recruit expatriates for any category of skilled labor if Kenyans are not available. Currently, foreign investors seeking to hire expatriates must demonstrate that the specific skills needed are not available locally through an exhaustive search, although the Ministry of Labor plans to replace this requirement with an official inventory of skills that are not available in Kenya, as discussed below. Firms must also sign an agreement with the government describing training arrangements for phasing out expatriates.

Kenya does not have a bilateral investment trade agreement with the United States, although there are hopes that this might change sometime in the future. According to UNCTAD, Kenya has signed bilateral investment agreements with Burundi, China, Finland, France, Germany, Iran, Italy, Libya, Netherlands, Switzerland, and the United Kingdom, although only those with Germany, Italy, Netherlands, and Switzerland have entered into force as of June 2011. Kenya and its EAC partners signed a Trade and Investment Framework Agreement with the United States in July 2008 as a bloc.

A company incorporated outside Kenya may carry on business in Kenya through a subsidiary. In order to establish a subsidiary, the following documents and details must be submitted to the Registrar of Companies within 30 days of establishing such a subsidiary:

- A certified copy of the Charter, Statutes or Memorandum and Articles of the company, or other instruments defining the constitution of the company;

- A list of the directors and the secretary of the company;

- A statement of all existing charges entered into by the company affecting properties in Kenya;

- Names and postal addresses of one or more persons resident in Kenya authorized to accept, on behalf of the company, service of notices required to be served on the company;

- Full address of the registered or principal office of the company in its home country; and

- Full address of place of business in Kenya.

Once the process is complete, the Registrar will issue a Certificate of Compliance. The process may take up to 4 weeks. Companies that may want to have representative or liaison offices are required to register using the above process.

Kenyan Currency Conversion and Transfer Policies

There are no restrictions on the transfer of funds from the Kenyan operating company to the Nevada corporation for the payment of dividends to our shareholders or otherwise. As of December 1995, Kenya repealed its Foreign Exchange Control Act (ministerial decrees had previously removed nearly all limitations). There are no remaining restrictions on converting or transferring funds associated with an investment. No recent changes or plans to tighten remittance policies exist. Foreign exchange is readily available. Kenya has had a floating exchange rate since late 1993. On July 1, 1996, Kenyan shillings became freely convertible into Tanzanian and Ugandan shillings and vice versa.

Kenya’s Foreign Investment Protection Act (FIPA) guarantees capital repatriation and remittance of dividends and interest to foreign investors, who are free to convert and repatriate profits including un-capitalized retained profits (proceeds of an investment after payment of the relevant taxes and the principal and interest associated with any loan). Kenya has no restrictions on converting or transferring funds associated with investment. Kenyan law requires the declaration of amounts above KSH 500,000 (about $5,600) as a formal check against money laundering. Foreign exchange is readily available from commercial banks and foreign exchange bureaus and can be freely bought and sold by local and foreign investors. The Kenyan shilling has a floating exchange rate tied to a basket of foreign currencies.

13

United Nations Guidelines on Privacy

The right of privacy is well established in international law. The core privacy principle in modern law may be found in the UN Universal Declaration of Human Rights. Article 12 of the UDHR states ""No one shall be subjected to arbitrary interference with his privacy, family, home or correspondence, nor to attacks upon his honor and reputation. Everyone has the right to the protection of the law against such interference or attacks."

The UN Guidelines for the Regulation of Computerized Personal Data Files (1990) set out Fair Information Practices and recommend the adoption of national guidelines to protect personal privacy. Appropriately, the UN Guidelines note that derogation from these principles "may be specifically provided for when the purpose of the file is the protection of human rights and fundamental freedoms of the individual concerned or humanitarian assistance." More generally, the protection of privacy is considered a fundamental human right, indispensable to the protection of liberty and democratic institutions.

International Regulation

The Tobacco industry expects significant regulatory developments to take place internationally over the next few years, driven principally by the World Health Organization’s Framework Convention on Tobacco Control (“FCTC”). As of May 6, 2014, 178 countries, as well as the European Community, have become parties to the FCTC. The FCTC is the first international public health treaty on tobacco, and its objective is to establish a global agenda for tobacco regulation with the purpose of reducing initiation of tobacco use and encouraging cessation. Regulatory initiatives that have been proposed, introduced or enacted include:

|

|

• |

|

the levying of substantial and increasing tax and duty charges; |

|

|

• |

|

restrictions or bans on advertising, marketing and sponsorship; |

|

|

• |

|

the display of larger health warnings, graphic health warnings and other labeling requirements; |

|

|

• |

|

restrictions on packaging design, including the use of colors and generic packaging; |

|

|

• |

|

restrictions or bans on the display of tobacco product packaging at the point of sale, and restrictions or bans on cigarette vending machines; |

|

|

• |

|

requirements regarding testing, disclosure and performance standards for tar, nicotine, carbon monoxide and other smoke constituents levels; |

|

|

• |

|

requirements regarding testing, disclosure and use of tobacco product ingredients; |

|

|

• |

|

increased restrictions on smoking in public and work places and, in some instances, in private places and outdoors; |

|

|

• |

|

elimination of duty free allowances for travelers; and |

|

|

• |

|

encouraging litigation against tobacco companies. |

If e-cigarettes are subject to one or more significant regulatory initiatives enacted under the FCTC, our business, results of operations and financial condition could be materially and adversely affected.

14

General

We cannot predict the scope of any of the new rules described above or the impact they may have on our company specifically or the e-cigarette industry generally, though they could have a material adverse effect on our business, results of operations and financial condition. In this regard, total compliance and related costs are not possible to predict and depend on the future requirements imposed by the EU Member States under the Tobacco Product Directive or by any other relevant regulatory authority under applicable law. Costs, however, could be substantial and could have a material adverse effect on our business, results of operations and financial condition and ability to market and sell our products. In addition, failure to comply with any of the rules promulgated in accordance with the Tobacco Product Directive or any other applicable law could result in significant financial penalties and could have a material adverse effect on our business, financial condition and results of operations. Furthermore, if we are ultimately required to obtain a license to sell e-cigarettes as a medicine in the United Kingdom or elsewhere in the EU, we can give no assurances that we would be able to demonstrate to the satisfaction of the relevant competent authorities that the conditions for granting a marketing authorization are satisfied,. At present, we are not able to predict whether any of the regulation described above will impact us to a greater degree than competitors in the industry, thus affecting our competitive position

Government Regulation: Internet

We are subject to federal, state and local laws and regulations applicable to businesses generally in the United States, where our business is incorporated in the state of Nevada. We are also subject to a number of foreign and domestic laws and regulations that affect companies conducting business on the Internet, many of which are still evolving and could be interpreted in ways that could harm our business. In the United States and abroad, laws relating to the liability of providers of online services for activities of their users and other third parties are currently being tested by a number of claims, including actions based on invasion of privacy and other torts, unfair competition, copyright and trademark infringement, and other theories based on the nature and content of the materials searched, the ads posted, or the content provided by users. Any court ruling or other governmental action that imposes liability on providers of online services for the activities of their users and other third parties could harm our business. In addition, rising concern about the use of data collection and GPS tracking technologies for illegal conduct, such as the unauthorized dissemination of national security information, money laundering or supporting terrorist activities may in the future produce legislation or other governmental action that could require changes to our products or services, restrict or impose additional costs upon the conduct of our business or cause users to abandon material aspects of our service.

In the area of information security and data protection, many states have passed laws requiring notification to users when there is a security breach for personal data, such as the 2002 amendment to California’s Information Practices Act, or requiring the adoption of minimum information security standards that are often vaguely defined and difficult to practically implement. The costs of compliance with these laws may increase in the future as a result of changes in interpretation. Furthermore, any failure on our part to comply with these laws may subject us to significant liabilities.

We are also subject to federal, state, and foreign laws regarding privacy and protection of member data. We intend to post on our website a privacy policy and user agreement, which will describe our practices concerning the use, transmission and disclosure of member data. Any failure by us to comply with our posted privacy policy or privacy related laws and regulations could result in proceedings against us by governmental authorities or others, which could harm our business. In addition, the interpretation of privacy and data protection laws, and their application to the Internet is unclear, evolving and in a state of flux. There is a risk that these laws may be interpreted and applied in conflicting ways from state to state, country to country, or region to region, and in a manner that is not consistent with our current data protection practices, or that new regulations will be enacted. Complying with these varying domestic and international requirements could cause us to incur additional costs and change our business practices. Further, any failure by us to adequately protect our members’ privacy and data could result in a loss of member confidence in our services and ultimately in a loss of members and customers, which could adversely affect our business.

In addition, because our services are accessible worldwide, certain foreign jurisdictions may claim that we are required to comply with their laws, including in jurisdictions where we have no local entity, employees, or infrastructure.

Intellectual Property

We do not currently possess any intellectual property that has been approved nor pending.

15

Research and Development

We did not incur any significant research and development expenses during the period from May 7, 2014 (inception) to August 31, 2015.

Employees and Employment Agreements

As the date of this report, we have no permanent staff other than our sole officer and director, Mr. Ahmed Guled, who is our President and CEO. Mr. Guled is employed elsewhere and has the flexibility to work on our company up to 15 hours per week. He is prepared to devote more time to our operations as may be required. He is not being paid at present.

There are no employment agreements in existence. We presently do not have pension, health, annuity, insurance, stock options, profit sharing or similar benefit plans; however, we may adopt plans in the future. Management does not plan to hire additional employees at this time. Our sole officer and director will be responsible for the initial servicing.

Item 1A. Risk Factors

Smaller reporting companies are not required to provide the information required by this item.

Item 1B. Unresolved Staff Comments

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 2. Properties

Our principal executive offices are located at Nyeri Motor Services Building, Moi Nyayo Way, Nyeri, Kenya. We rent the space for approximately $100 per month.

Item 3. Legal Proceedings

We know of no existing or pending legal proceedings against us, nor are we involved as a plaintiff in any proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our company. From time to time, we may become involved in various lawsuits and legal proceedings, which arise, in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business.

Item 4. Mine Safety Disclosures

Not applicable.

16

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our shares of common stock are listed on the OTCPink under the trading symbol “SRUP”. The shares have not traded as of the date of this filing. Over-the-counter market quotations reflect inter-dealer prices without retail mark-up, mark-down or commission, and may not represent actual transactions. The following table presents the high and low bid price for our common stock for the periods indicated:

|

Quarter Ended |

High |

Low |

|

February 28, 2015 |

N/A |

N/A |

|

May 31, 2015 |

N/A |

N/A |

|

August 31, 2015 |

N/A |

N/A |

Holders

As of December 15, 2015 there were 40 holders of record of our common stock. As of such date, 35,763,339 shares of our common stock were issued and outstanding.

Dividend Policy

To date, we have not paid dividends on shares of our common stock and we do not expect to declare or pay dividends on shares of our common stock in the foreseeable future. The payment of any dividends will depend upon our future earnings, if any, our financial condition, and other factors deemed relevant by our board of directors.

Equity Compensation Plan Information

We do not have any equity compensation plans.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

On February 27, 2015, our registration statement on Form S-1 (File No. 333-199818) was declared effective by the Securities and Exchange Commission for our initial public offering pursuant to which we sold an aggregate of 10,763,339 shares of our common stock at $0.003 per share for a total of $32,290. There has been no material change in the planned use of proceeds from our initial public offering as described in our final prospectus filed with the Securities and Exchange Commission on February 17, 2015 pursuant to Rule 424(b).

Purchase of Equity Securities by the Issuer and Affiliated Purchasers

We did not purchase any of our shares of common stock or other securities during our fiscal year ended August 31, 2015.

Item 6. Selected Financial Data

As a “smaller reporting company”, we are not required to provide the information required by this Item.

17

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward Looking Statements

The information set forth in this Management's Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, including, among others (i) expected changes in our revenue and profitability, (ii) prospective business opportunities and (iii) our strategy for financing our business. Forward-looking statements are statements other than historical information or statements of current condition. Some forward-looking statements may be identified by use of terms such as “believes”, “anticipates”, “intends” or “expects”. These forward-looking statements relate to our plans, liquidity, ability to complete financing and purchase capital expenditures, growth of our business including entering into future agreements with companies, and plans to successfully develop and obtain approval to market our product. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs.

Although we believe that our expectations with respect to the forward-looking statements are based upon reasonable assumptions within the bounds of our knowledge of our business and operations, in light of the risks and uncertainties inherent in all future projections, the inclusion of forward-looking statements in this Quarterly Report should not be regarded as a representation by us or any other person that our objectives or plans will be achieved.

We assume no obligation to update these forward-looking statements to reflect actual results or changes in factors or assumptions affecting forward-looking statements.

Our revenues and results of operations could differ materially from those projected in the forward-looking statements as a result of numerous factors, including, but not limited to, the following: the risk of significant natural disaster, the inability of the our company to insure against certain risks, inflationary and deflationary conditions and cycles, currency exchange rates, and changing government regulations domestically and internationally affecting our products and businesses.

You should read the following discussion and analysis in conjunction with the Financial Statements and Notes attached hereto, and the other financial data appearing elsewhere in this Quarterly Report.

US Dollars are denoted herein by “USD”, "$" and "dollars".

Overview

Sirrus Corp. is a start-up company that seeks to engage in the designing, marketing and distribution of electronic cigarettes (“e-cigarette”) in East Africa. Our goal is to become a leading e-cigarette marketer and distributor in the East Africa. We expect to achieve our goal by maximizing our points of distribution, maintaining our low-cost position and continuing to differentiate our products and brands in order to resonate with consumers in local markets around the region. Our strategy is to increase our future sales by penetrating new and emerging markets where we expect rising consumer incomes and an increase in demand for e-cigarettes. Cigarette smokers in these emerging markets are our target demographic and will represent our primary source of future revenue growth.

We plan to focus on rapidly securing retail distribution in Kenya and East African markets through strategic partnerships with key retailers and distributors. We believe strong consumer demand will lead retailers to allocate additional shelf space to smoking related products and we strive to offer our products at or near every point of distribution where traditional cigarettes are available in the markets we serve. We believe e-cigarettes offer a compelling alternative for smokers, relative to traditional cigarettes. Our goal is to become a leading e-cigarette marketer and distributor in the East Africa. We expect to achieve our goal by establishing an E-commerce presence, maximizing our points of distribution, maintaining our low-cost position and continuing to differentiate our products and brands in order to resonate with consumers in local markets around the region.

18

Plan of Operations

Our business objectives for the next twelve months (beginning upon completion of this Offering), provided the necessary funding is available, are to expand upon our business with a focus on the development of our e-cigarette distribution and sales.

We believe that we will be able to generate revenue once we secure 4 distribution contracts and through a direct public offering of our shares pursuant a registration statement that was declared effective by the Securities and Exchange Commission (the “SEC”) on February 26, 2015. If we are able to establish additional contracts, we hope to generate additional revenue and prove our business model to be effective. However, even if we are able to sell all of the shares being registered under the registration statement, we will still require an additional $180,000 in order to carry out our anticipated business operations for the next twelve months. It is management’s goal to continue raising capital, we will be able to secure distribution contacts, generate revenues and attract additional financing. However, there can be no assurance that we will be able to sell any of the shares under the registration statement, establish distribution contracts, or generate revenues from our operations. There can also be no assurance that we will be able to raise the additional capital we require to operate our business for the next twelve months.

The following chart provides an overview of our budgeted expenditures for the next twelve months. The expenditures are categorized by significant area of activity.

|

Description |

Estimated Completion Date |

Estimated Expenses |

|

Legal and accounting fees |

12 months |

35,000 |

|

Website Development and Server Acquisition |

12 months |

10,000 |

|

Samples and Inventory |

12 months |

15,000 |

|

Marketing and advertising |

12 months |

50,000 |

|

Investor relations and capital raising |

12 months |

20,000 |

|

Management fees* |

12 months |

10,000 |

|

Salaries and consulting fees** |

12 months |

10,000 |

|

General and administrative expenses*** |

12 months |

30,000 |

|

Total |

|

$180,000 |

*Management fees will consist of remuneration payable to any manager engaged to oversee the day to day operation of our business.

**Salaries will be paid to future employees or consultants retained to assist the Company with its sales and marketing efforts. Consultants may also be retained to contribute special expertise not possessed by the sole officer and director of the Company.

***General and administrative expenses are the costs which we will incur sustaining our day to day business. These include such costs such as rent, phone, utilities, insurance, business licenses and incidental expenses.

Our Company will use the funds raised by our public offering to pay for the expenses related to our offering and the expenses to maintain our reporting status for twelve months after the effective date. Our plan of operations is based on the net proceeds from our offering (gross proceeds less expenses related to this offering, estimated at a fixed cost of $10,000 and expenses to maintain our report status for twelve months after effective date, estimated at a fixed cost of $17,500).

We currently do not have any arrangements in place for the completion of any further private placement financings and there is no assurance that we will be successful in completing any further private placement financings. If we are unable to achieve the necessary additional financing, then we plan to reduce the amounts that we spend on our business activities and administrative expenses in order to be within the amount of capital resources that are available to us.

19

Results of Operations – For the Year Ended August 31, 2015 and the Period from Inception to August 31, 2014

We have not earned any revenues from inception through August 31, 2015.

|

Year Ended August 31, 2015 |

Period from Inception to August 31, 2014 | |

|

Revenues |

$ - |

$ - |

|

Operating Expenses |

$ 45,888 |

$ 6,719 |

|

Other Income, Net |

$ 2 |

$ - |

|

Net Loss |

$ (45,886) |

$ (6,719) |

We incurred a net loss in the amount of $45,886 and $6,719 for year ended August 31, 2015 and the period from inception to August 31, 2014, respectively.

Liquidity and Capital

|

Working Capital |

As of |

As of |

|

|

August 31, 2015 |

August 31, 2014 |

|

Current Assets |

$ 15,229 |

$ 19,833 |

|

Current Liabilities |

$ 10,544 |

$ 1,902 |

|

Working Capital |

$ 4,685 |

$ 17,931 |

|

Cash Flows |

Year Ended |

Period from Inception to |

|

August 31, 2015 |

August 31, 2014 | |

|

Net Cash Used in Operating Activities |

$ (38,575) |

(6,649) |

|

Net Cash Provided by Financing Activities |

$ 31,144 |

26,532 |

|

Net Increase (Decrease) In Cash During The Period |

$ (7,431) |

19,883 |

As of August 31, 2015 and 2014, we had a working capital of $4,685 and $18,281, $15,229 and $20,183 in current assets, and $10,544 and $1,902 in current liabilities, respectively. We used a total of $38,575 and $6,649 in operating activities and received $31,144 and $26,532 through financing activities for the year ended August 31, 2015 and for the period from inception to August 31, 2014, respectively.

Critical Accounting Policies

Use of Estimates

The discussion and analysis of our financial condition and results of operations is based upon the accompanying consolidated financial statements, which have been prepared in accordance with the accounting principles generally accepted in the United States of America and are expressed in United States Dollars. Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, and expenses. These estimates and assumptions are affected by management’s application of accounting policies. We believe that understanding the basis and nature of the estimates and assumptions involved with the following aspects of our financial statements is critical to an understanding of our financial statements.

20

Inventory

Inventory is recorded at lower of cost or market; cost is computed on a first-in first-out basis. The inventory consists of e-cigarettes.

Revenue Recognition

Revenue from the sale of goods is recognized when the following conditions are satisfied:

· The Company has transferred to the buyer the significant risks and rewards of ownership of the goods;

· The Company retains neither continuing managerial involvement to the degree usually associated with ownership nor effective control over the goods sold;

· The amount of revenue can be measured reliably;

· It is probable that the economic benefits associated with the transaction will flow to the entity; and

· The costs incurred or to be incurred in respect of the transaction can be measured reliably.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements.

Foreign Currency Translation

Our company’s planned operations will be in the United States, which results in exposure to market risks from changes in foreign currency exchange rates. The financial risk is the risk to our company’s operations that arise from fluctuations in foreign exchange rates and the degree of volatility of these rates. Currently, our company does not use derivative instruments to reduce its exposure to foreign currency risk. Our company’s functional currency for all operations worldwide is the U.S. dollar. Nonmonetary assets and liabilities are translated at historical rates and monetary assets and liabilities are translated at exchange rates in effect at the end of the year. Revenues and expenses are translated at average rates for the year. Gains and losses from translation of foreign currency financial statements into US dollars are included in current results of operations.

Recent Accounting Pronouncements

Our company has implemented all new accounting pronouncements that are in effect and that may impact its financial statements and does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

As a “smaller reporting company”, we are not required to provide the information required by this Item.

21

Item 8. Financial Statements and Supplementary Data

Sirrus Corp.

As of August 31, 2015 and 2014 and for the year ended August 31, 2015 and the period from May 7, 2014 (Inception) to August 31, 2014

|

Index

|

|

|

F-1 | |

|

F-2 | |

|

F-3 | |

|

F-4 | |

|

F-5 | |

|

F-6 |

22

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and

Stockholders of Sirrus Corp.

Carson City, Nevada

We have audited the accompanying balance sheets of Sirrus Corp. as of August 31, 2015 and 2014 and the related statements of operations, changes in stockholders’ deficit and cash flows for the year ended August 31, 2015 and period from May 7, 2014 (Inception) to August 31, 2014. Sirrus Corp.’s management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Sirrus Corp. as of August 31, 2015 and 2014 and the results of its operations and its cash flows for the year ended August 31, 2015 and period from May 7, 2014 (Inception) to August 31, 2014 in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that Sirrus Corp. will continue as a going concern. As discussed in Note 1 to the financial statements, Sirrus Corp. has suffered recurring losses from operations and has a net capital deficiency that raise substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ GBH CPAs, PC

GBH CPAs, PC

www.gbhcpas.com

Houston, Texas

December 15, 2015

F-1

SIRRUS CORP.

Balance Sheets

|

|

|

August 31, 2015 |

|

|

August 31, 2014 | |

|

ASSETS |

|

|

|

|

| |

|

|

|

|

|

|

| |

|

Current Assets |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

12,452 |

|

$ |

19,883 |

|

Inventory |

|

1,840 |

|

- | ||

|

Prepaid expenses |

|

937 |

|

- | ||

|

|

|

|

|

|

| |

|

Total current assets |

|

15,229 |

|

|

19,883 | |

|

|

|

|

|

|

|

|

|

Deposit |

|

- |

|

300 | ||

|

|

|

|

||||

|

Total assets |

$ |

15,229 |

|

$ |

20,183 | |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

| |

|

|

|

|

|

|

| |

|

Current Liabilities |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

$ |

10,158 |

|

$ |

370 |

|

|

Due to related party |

|

386 |

|

|

1,532 |

|

|

|

|

|

|

|

|

|

|

Total Liabilities |

|

10,544 |

|

|

1,902 |

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Preferred stock, $0.00001 par value, 100,000,000 shares authorized; no shares issued and outstanding |

|

- |

|

- | ||

|

|

Common stock, $0.00001 par value, 200,000,000 shares authorized, 35,763,339 shares and 25,000,000 shares issued and outstanding, respectively |

|

358 |

|

|

250 |

|

Additional paid-in capital |

|

56,932 |

|

24,750 | ||

|

|

Accumulated deficit |

|

(52,605) |

|

|

(6,719) |

|

|

|

|

|

|

|

|

|

|

TOTAL STOCKHOLDERS’ EQUITY |

|

4,685 |

|

|

18,281 |

|

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

$ |

15,229 |

|

$ |

20,183 |

The accompany notes are an integral part of these financial statements

F-2

SIRRUS CORP.

Statements of Operations

|

|

|

For the Year Ended August 31, |

For the Period from May 7, 2014 (Inception) to August 31, | |||

|

|

|

2015 |

|

2014 | ||

|

|

|

|

|

| ||

|

Operating expenses |

|

|

|

| ||

|

|

General and administrative |

$ |

45,888 |

$ |

6,719 | |

|

|

|

|

|

|

| |

|

Total operating loss |

|

(45,888) |

|

(6,719) | ||

|

|

|

|

|

| ||

|

Other income (expenses) |

|

|

|

| ||

|

Foreign exchange gain (loss) |

|

(13) |

|

- | ||

|

Interest |

|

15 |

|

- | ||

|

|

|

|

| |||

|

Total other income (expenses) |

|

2 |

|

- | ||

|

|

|

|

| |||

|

Net loss |

$ |

(45,886) |

$ |

(6,719) | ||

|

|

|

|

|

| ||

|

Net Loss Per Common Share – Basic and Diluted |

$ |

(0.00) |

$ |

(0.00) | ||

|

|

|

|

|

| ||

|

Weighted Average Common Shares Outstanding – Basic and Diluted |

|

35,763,339 |

|

25,000,000 | ||

The accompany notes are an integral part of these financial statements

F-3

SIRRUS CORP.

Statement of Changes in Stockholders’ Equity

For the period from May 7, 2014 (Inception) to August 31, 2015

|

|

|

|

Additional |

|

|

|

|||

|

|

Common stock |

|

Paid-In |

|

Accumulated |

|

| ||

|

|

Shares |

|

Amount |

|

Capital |

|

Deficit |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

Balance - May 7, 2014 (Inception) |

- |

$ |

- |

$ |

- |

$ |

- |

$ |

- |

|

|

|

|

|

|

|

|

|

|

|

|

Common stock issued for cash |

25,000,000 |

|

250 |

|

24,750 |

|

- |

|

25,000 |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

- |

|

- |

|

|

(6,719) |

|

(6,719) | |

|

|

|

|

|

|

|

|

|

|

|

|

Balance - August 31, 2014 |

25,000,000 |

250 |

|

24,750 |

(6,719) |

|

18,281 | ||

|

|

|

|

|

|

|

|

|

|

|

|

Common stock issued for cash |

10,763,339 |

|

108 |

|

32,182 |

|

- |

|

32,290 |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

- |

|

- |

|

- |

|

(45,886) |

|

(45,886) |

|

|

|

|

|

|

|

|

|

|

|

|

Balance – August 31, 2015 |

35,763,339 |

$ |

358 |

$ |

56,932 |

$ |

(52,605) |

$ |

(4,685) |

The accompany notes are an integral part of these financial statements

F-4

SIRRUS CORP.

Statements of Cash Flows

|

For the Year Ended August 31, |

For the Period from May 7, 2014 (Inception) to August 31, | ||||

|

|

2015 |

2014 | |||

|

|

|

|

|

| |

|

Cash Flows From Operating Activities |

|

|

|

| |

|

|

Net loss |

$ |

(45,886) |

$ |

(6,719) |

|

|

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Inventory |

|

(1,840) |

|

- |

|

|

Prepaid expenses |

|

(637) |

|

- |

|

Accounts payable and accrued liabilities |

|

9,788 |

|

370 | |

|

Cash used in operating activities |

|

(38,575) |

|

(6,649) | |

|

|

|

|

|

| |

|

Cash Flows From Financing Activities |

|

|

|

| |

|

Proceeds from sale of common stock |

|

32,290 |

|

25,000 | |

|

Proceeds from (repayments of) related party advances |

|

(1,146) |

|

1,532 | |

|

Cash provided by financing activities |

|

31,144 |

|

26,532 | |

|

|

|

|

|

|

|

|

Net change in cash and cash equivalents |

|

(7,431) |

|

19,883 | |

|

|

|

|

|

| |

|

Cash and Cash Equivalents, Beginning of Period |

|

19,883 |

|

- | |

|

|

|

|

|

| |

|

Cash and Cash Equivalents, End of Period |

$ |

12,452 |

$ |

19,883 | |

|

|

|

|

| ||

|

Supplementary Cash Flows Information: |

|

|

|

| |

|

Interest paid |

$ |

- |

$ |

- | |

|

Income taxes paid |

$ |

- |

$ |

- | |

The accompany notes are an integral part of these financial statements

F-5

SIRRUS CORP.

Notes to the Financial Statements

(Unaudited)

NOTE 1. NATURE OF BUSINESS AND CONTINUANCE OF OPERATIONS

Sirrus Corp. (the “Company”) was formed on May 7, 2014 in Nevada. The Company is engaged in the business of designing, marketing and distributing electronic cigarettes (“e-cigarette”) in East Africa. The Company’s products and services are all in the startup stage.

These financial statements have been prepared on a going concern basis which assumes the Company will continue to realize it assets and discharge its liabilities in the normal course of business. As of August 31, 2015, the Company has incurred losses totaling $52,605 since inception, has not yet generated revenue from operations, and will require additional funds to maintain our operations. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern. The Company’s ability to continue as a going concern is dependent upon its ability to generate future profitable operations and/or obtain the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they become due. The Company intends to finance operating costs over the next twelve months through continued financial support from its shareholders and private placements of common stock. These financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

a) Basis of Presentation

These financial statements of the Company have been prepared in accordance with generally accepted accounting principles in the United States and are expressed in US dollars. The Company’s year end is August 31.

b) Estimates and Assumptions