Attached files

| file | filename |

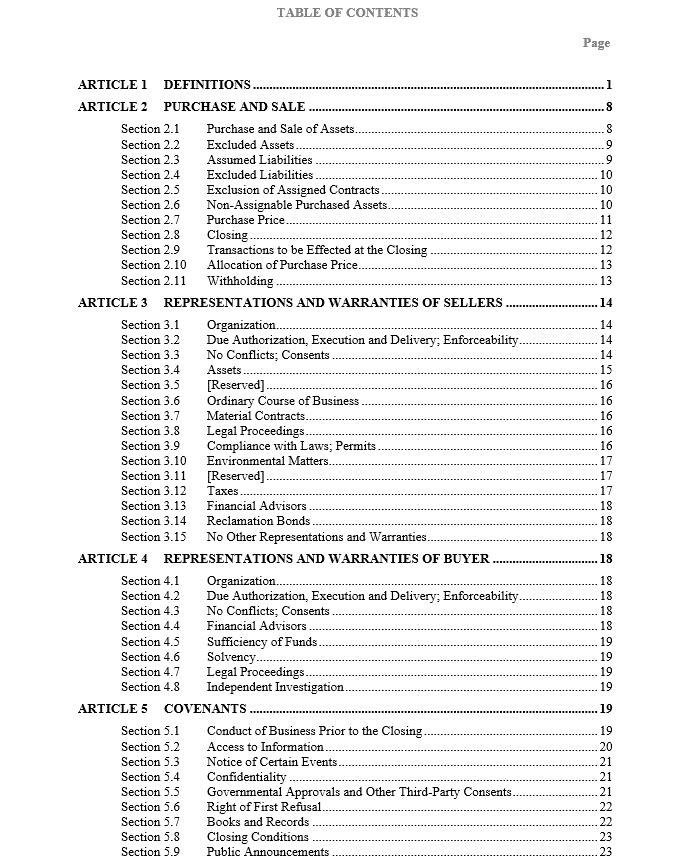

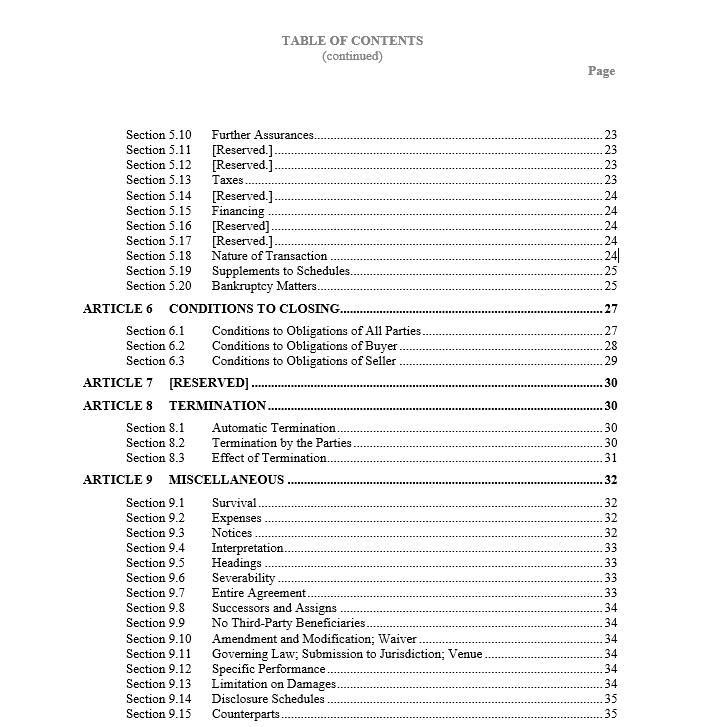

|---|---|

| 8-K - 8-K - Midway Gold Corp | c009-20151203x8k.htm |

| EX-99.1 - EX-99.1 - Midway Gold Corp | c009-20151203ex99191187e.htm |

ASSET PURCHASE AGREEMENT

BY AND AMONG

MIDWAY GOLD US INC.

and

NEVADA TALON LLC,

as SELLERS

and

SOLIDUS RESOURCES, LLC,

as BUYER

dated as of

NOVEMBER 30, 2015

2

ASSET PURCHASE AGREEMENT

THIS ASSET PURCHASE AGREEMENT (this “Agreement”), dated as of November 30, 2015 is entered into by and among Midway Gold US Inc., a Nevada corporation (“Midway US”), Nevada Talon LLC, a Nevada limited liability company (“Nevada Talon” and, together with Midway US, “Sellers”) and Solidus Resources, LLC, a Nevada limited liability company (“Buyer”).

RECITALS

A.On June 22, 2015 (the “Petition Date”), each Seller filed a voluntary petition for relief (commencing the “Chapter 11 Cases”) under chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of Colorado (the “Bankruptcy Court”).

B.Sellers collectively own, among other things, (a) a 30% undivided interest in the Spring Valley Venture (as defined below), which owns the Spring Valley development project in Pershing County, Nevada (the “Spring Valley Development Project”) and (b) all the Additional Spring Valley Assets (as defined below), including the Spring Valley East development project (the “Spring Valley East Development Project”).

C.Upon the terms and subject to the conditions contained in this Agreement, and as authorized under sections 105, 363 and 365 of the Bankruptcy Code, Sellers wish to sell to Buyer, and Buyer wishes to purchase from Sellers, all of the right, title and interest of Sellers in the Purchased Assets (as defined below), including Sellers’ interests in the Spring Valley Development Project and all the Additional Spring Valley Assets, and to assume from Sellers the Assumed Liabilities.

In consideration of the mutual covenants and agreements hereinafter set forth and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

The following terms have the meanings specified or referred to in this ARTICLE 1:

“Additional Spring Valley Assets” means those assets of Sellers described in Schedule 2.1(m), including the Spring Valley East Development Project.

“Additional Spring Valley Business” means the business conducted by Sellers with respect to the Additional Spring Valley Assets.

“Affiliate” of a Person means any other Person that directly or indirectly, through one or more intermediaries, controls, is controlled by, or is under common control with, such Person. The term “control” (including the terms “controlled by” and “under common control with”) means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by contract or otherwise.

“Agreement” has the meaning set forth in the Preamble.

“Allocation Schedule” has the meaning set forth in Section 2.10.

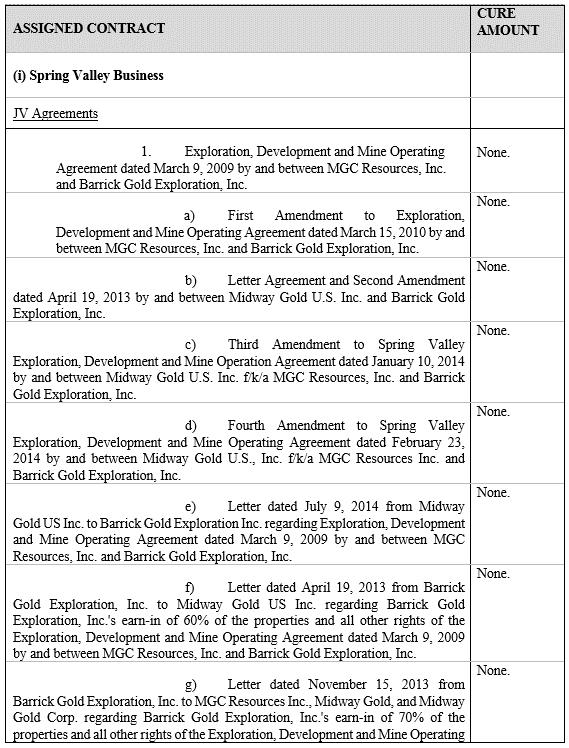

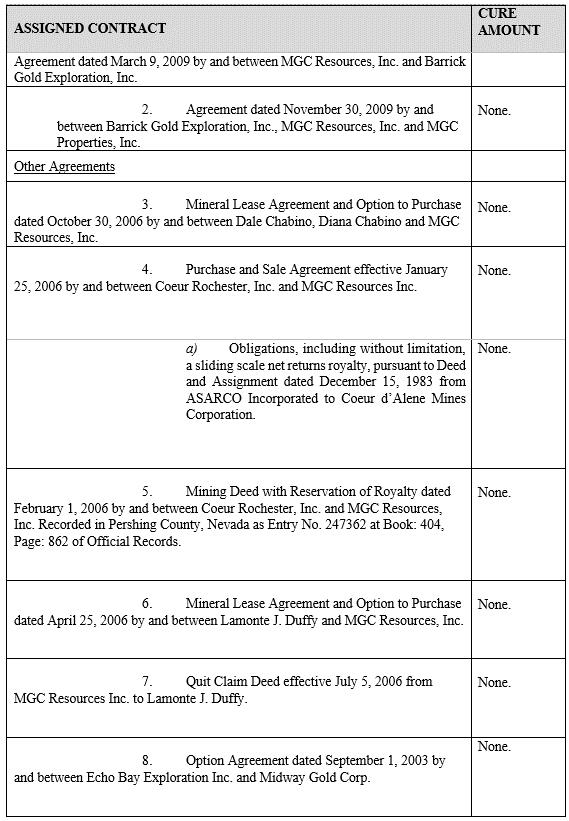

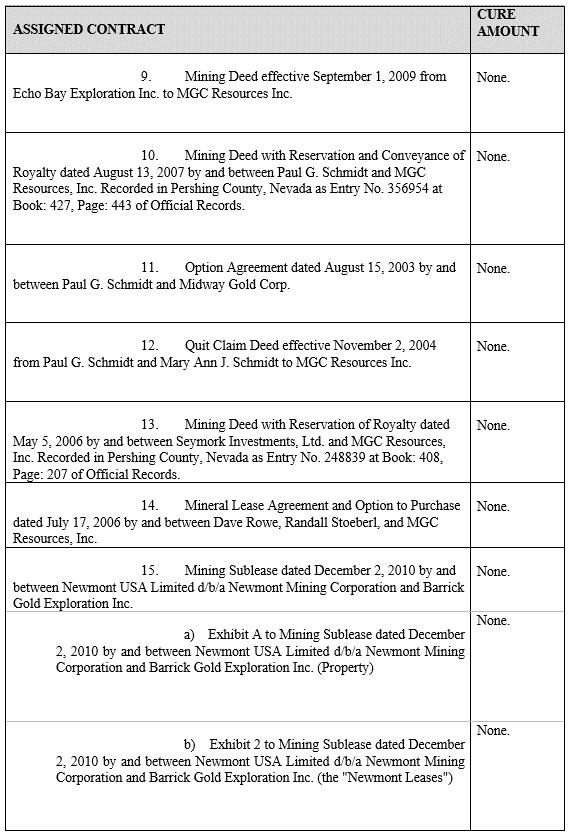

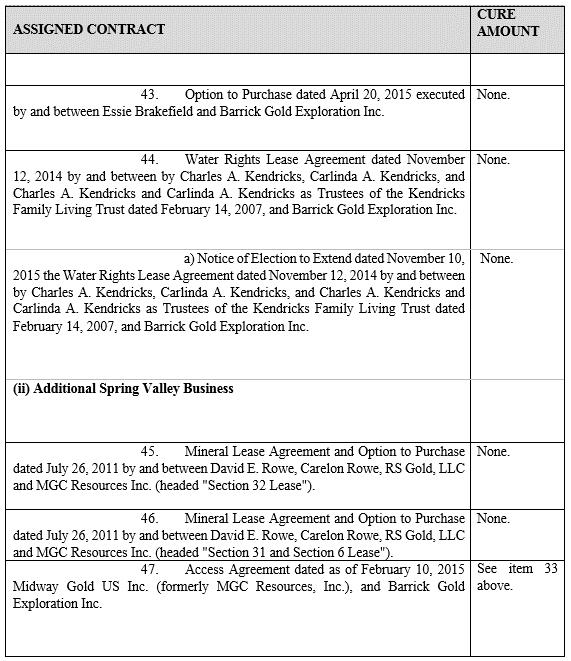

“Assigned Contracts” means the Contracts in which any Seller or any of its Affiliates has an interest relating to the Spring Valley Business or the Additional Spring Valley Business set forth in Schedule 2.1(h).

3

“Assumed Liabilities” has the meaning set forth in Section 2.3.

“Bankruptcy Code” has the meaning set forth in the recitals.

“Bankruptcy Court” has the meaning set forth in the recitals.

“Bankruptcy Rules” means the Federal Rules of Bankruptcy Procedure, as in effect from time to time.

“Barrick” means Barrick Gold Exploration Inc., a Delaware corporation.

“Barrick Asset Purchase Agreement” means that certain Asset Purchase Agreement, dated November 11, 2015, by and among Barrick, Barrick Gold Corporation, an Ontario Corporation, Buyer and Buyer Parent.

“Base Purchase Price” has the meaning set forth in Section 2.7(a).

“Books and Records” means books and records, including books of account, ledgers and general, financial and accounting records, machinery and equipment maintenance files, suppliers lists, production data, quality control records and procedures, assay reports, environmental studies, reports and analysis, mine plans, nonproprietary mining and reserve models, sales records, tax records, strategic plans, material and research, including all technical records, files, papers, surveys and plans or specifications.

“Business Day” means any day except Saturday, Sunday or any other day on which commercial banks located in Toronto, Canada or Denver, Colorado are closed for business.

“Buyer” has the meaning set forth in the Preamble.

“Buyer Parent” means Waterton Precious Metals Fund II Cayman, LP, a Cayman Islands exempted limited partnership.

“Cash Amount” has the meaning set forth in Section 2.7(a)(ii).

“Chapter 11 Cases” has the meaning set forth in the recitals.

“Claims” means all rights or causes of action (whether in law or equity), legal proceedings, obligations, demands, restrictions, warranties, guaranties, indemnities, consent rights, options, contract rights, rights of recovery, setoff, recoupment, indemnity or contribution, covenants and interests of any kind or nature whatsoever (known or unknown, matured or unmatured, accrued or contingent and regardless of whether currently exercisable), whether arising prior to or subsequent to the commencement of the Chapter 11 Cases, and whether imposed by agreement, understanding, law, equity or otherwise, including all “claims” as defined in section 101(5) of the Bankruptcy Code.

“Closing” has the meaning set forth in Section 2.8.

“Closing Date” has the meaning set forth in Section 2.8.

“Code” means the Internal Revenue Code of 1986, as amended.

“Confidentiality Agreement” means the Non-Disclosure Agreement dated as of July 7, 2015 between Waterton Global Resource Management, Inc. and Midway Gold Corp.

“Contract” means any agreement, indenture, contract, lease, deed of trust, royalty, license, option, instrument, or other written commitment.

4

“Credit Documents” means the DIP Credit Agreement collectively with any other agreements and documents executed or delivered in connection therewith, including the “Credit Documents” as defined in the DIP Credit Agreement.

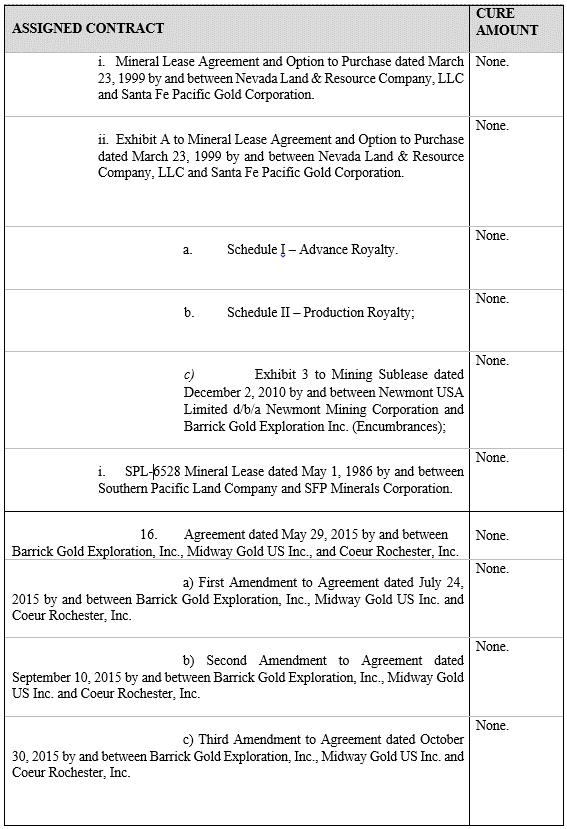

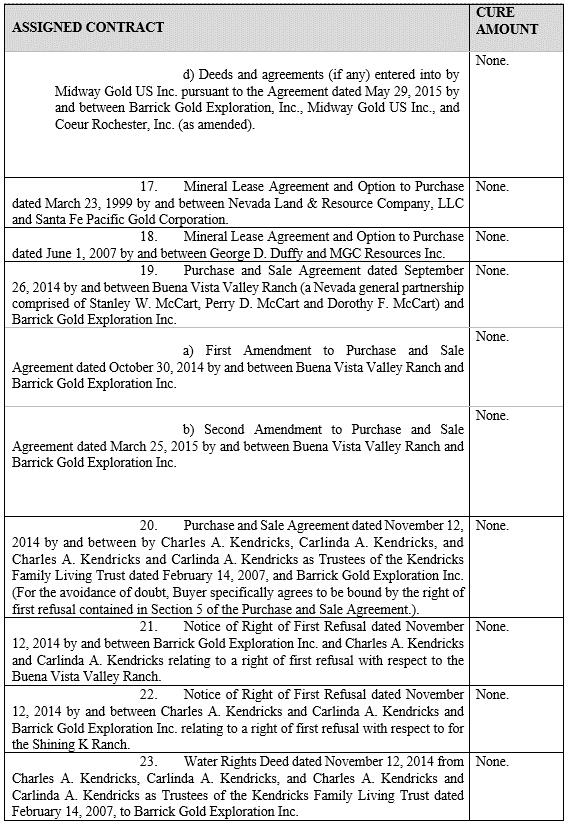

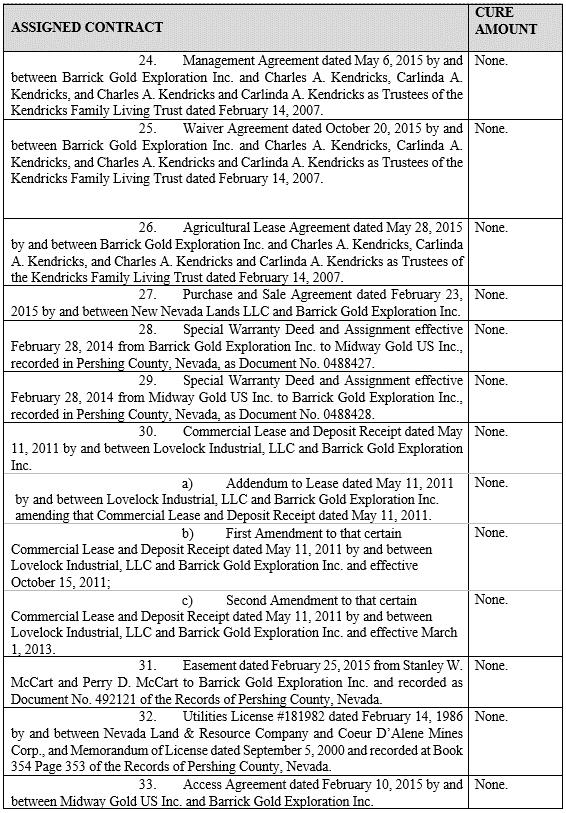

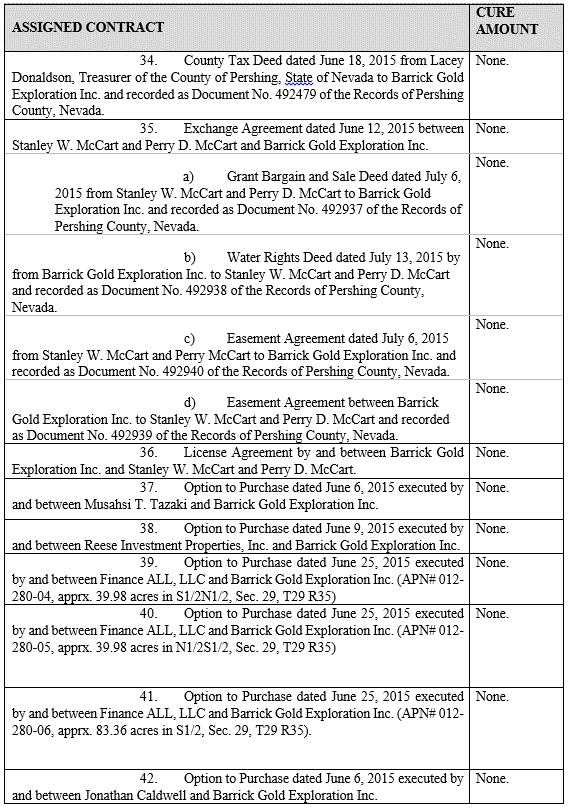

“Cure Amounts” means the amounts which must be paid or otherwise satisfied by Buyer, including pursuant to Sections 365(b)(1)(A) and (B) of the Bankruptcy Code, in connection with the assumption and/or assignment of the Assigned Contracts to the Buyer as provided herein as those amounts are allowed by the Bankruptcy Court, unless such amounts are otherwise agreed upon by the Buyer and the counterparty to the applicable Assigned Contract, including the Cure Amounts set forth on Schedule 3.7(c) (as may be supplemented or modified in accordance with Section 2.5 and Section 5.19).

“Cut-Off Date” has the meaning set forth in Section 2.5.

“DIP Credit Agreement” means the Debtor-In-Possession Credit Agreement (as may be amended, restated, supplemented, or otherwise modified from time to time in accordance with its terms) by and among Midway US, as borrower, each of the other debtors party thereto as guarantors, and Waterton Precious Metals Fund II Cayman, LP, as lender.

“Disclosed Litigation” means only those actions, suits, claims and legal proceedings set forth in Schedule 3.8.

“Disclosure Schedules” means the Disclosure Schedules delivered by Sellers concurrently with the execution and delivery of this Agreement and all references in this Agreement to a particular Schedule are references to Schedules in the Disclosure Schedules and not schedules to this Agreement.

“Dollars” and “$” means the lawful currency of the United States.

“Drop Dead Date” has the meaning set forth in Section 8.2(b)(i)

“Encumbrance” means any lien, pledge, mortgage, deed of trust, security interest, charge, claim, easement, encroachment or other similar encumbrance.

“Environmental Claim” means any action, suit, claim, investigation or other legal proceeding alleging liability of whatever kind or nature (including liability or responsibility for the costs of enforcement proceedings, investigations, cleanup, governmental response, removal or remediation, natural resources damages, property damages, personal injuries, medical monitoring, penalties, contribution, indemnification and injunctive relief) arising out of, based on or resulting from: (i) the presence, Release of, or exposure to, any Hazardous Materials, or (ii) any actual or alleged non-compliance with any Environmental Law or term or condition of any Environmental Permit.

“Environmental Law” means any applicable Law, Governmental Order or binding agreement with any Governmental Authority: (i) relating to pollution (or the cleanup thereof) or the protection of natural resources, endangered or threatened species, human health or safety, or the environment (including ambient air, soil, surface water or groundwater, or subsurface strata), or (ii) concerning the Release or presence of, exposure to, or the management, manufacture, use, containment, storage, recycling, reclamation, reuse, treatment, generation, discharge, transportation, processing, production, disposal or remediation of any Hazardous Materials.

“Environmental Notice” means any written directive, notice of violation or infraction, or notice or written communication from a Governmental Authority relating to actual or potential liability arising under or non-compliance with any Environmental Law or any term or condition of any Environmental Permit.

5

“Environmental Permit” means any Permit, letter, clearance, consent, waiver, closure, exemption, decision or other action required under or issued, granted, given, authorized by or made pursuant to Environmental Law.

“Equity Commitment Letter” has the meaning set forth in Section 4.5.

“Excess Consideration Amount” means an amount equal to (a) 0.3, multiplied by (b) the excess, if any, of (i) the Base Purchase Price (as defined in the Barrick Asset Purchase Agreement) plus the Base Purchase Price (as defined in this Agreement), over (ii) $83,100,000.

“Excluded Assets” has the meaning set forth in Section 2.2.

“Excluded Contracts” means any Contract that is not an Assigned Contract.

“Excluded Liabilities” has the meaning set forth in Section 2.4.

“Exploration Agreement” means the Exploration, Development and Mine Operating Agreement dated March 9, 2009 between Midway US (f/k/a to MGC Resources Inc.) and Barrick.

“FIRPTA Certificate” has the meaning set forth in Section 6.2(e).

“Governmental Authority” means any federal, state, local or foreign government or political subdivision thereof, or any agency or instrumentality of such government or political subdivision, or any self-regulated organization or other non-governmental regulatory authority or quasi-governmental authority (to the extent that the rules, regulations or orders of such organization or authorities have the force of Law), or any arbitrator, court or tribunal of competent jurisdiction.

“Governmental Order” means any order, writ, judgment, injunction, decree, stipulation, determination or award entered by or with any Governmental Authority.

“Hazardous Materials” means: (i) any material, substance, chemical, waste, product, derivative, compound, mixture, solid, liquid, mineral or gas, in each case, whether naturally occurring or man-made, that is hazardous, acutely hazardous, toxic, or words of similar import or regulatory effect under Environmental Laws, and (ii) any petroleum or petroleum-derived products, radon, radioactive materials or wastes, asbestos in any form, lead or lead-containing materials, urea formaldehyde foam insulation and polychlorinated biphenyls.

“Knowledge” of each Seller means the actual knowledge of William M. Zisch, after making diligent inquiry of other responsible officers and employees of Sellers to inform himself as to the relevant matters, but without the requirement to make any inquiries of third parties or Governmental Authorities or to perform any search of any public records.

“Law” means any statute, law, ordinance, regulation, rule, code, order, constitution, treaty, common law, judgment, decree, other requirement or rule of law of any Governmental Authority.

“Leased Mining Claims” means unpatented mining claims, including any associated royalties, leased by any Seller or the Spring Valley Venture and held for use in connection with the Spring Valley Business or the Additional Spring Valley Business.

“Leased Real Property” means real property (other than unpatented mining claims), including any associated royalties, leased by any Seller or the Spring Valley Venture and held for use in connection with the Spring Valley Business or the Additional Spring Valley Business.

“Loss” or “Losses” means actual out-of-pocket losses, damages, liabilities, costs or expenses, including reasonable attorneys’ fees.

6

“Material Adverse Effect” means any event, occurrence, fact, condition or change that is, or would reasonably be expected to be, materially adverse to the business, results of operations, financial condition, rights or assets of the Spring Valley Business taken as a whole; provided, however, that “Material Adverse Effect” shall not include any event, occurrence, fact, condition or change, directly or indirectly, arising out of or attributable to: (i) general economic or political conditions, (ii) conditions generally affecting the industries in which the Sellers and the Spring Valley Venture operate, (iii) any changes in financial, banking or securities markets in general, including any disruption thereof and any decline in the price of any security or any market index or any change in prevailing interest rates or capital costs or commodity markets, (iv) acts of war (whether or not declared), armed hostilities or terrorism, or the escalation or worsening thereof, (v) any action required or permitted by this Agreement or any action taken (or omitted to be taken) with the written consent of or at the written request of Buyer, (vi) any change in the price of gold or other relevant metals or any change in currency exchange rates, (vii) any changes in applicable Laws or accounting rules, (viii) the announcement, pendency or completion of the transactions contemplated by this Agreement, including losses or threatened losses of employees, customers, suppliers, distributors or others having relationships with the Spring Valley Business, (ix) any natural or man-made disaster or acts of God, (x) any failure by the Spring Valley Business to meet any internal or published projections, forecasts or revenue or earnings predictions (provided, however, that the underlying causes of such failures (subject to the other provisions of this definition) shall not be excluded), or (xi) the pendency of the Chapter 11 Cases and any action approved by, or motion made before, the Bankruptcy Court, except in the case of clause (i), (ii) or (vii), where such change, effect, circumstance or event has a materially disproportionate effect on the Spring Valley Business, relative to comparable businesses operating in the mining industry.

“Material Contracts” means each Assigned Contract to which any Seller or any of its Affiliates is a signatory that relates to the Spring Valley Business, the Additional Spring Valley Business or the Purchased Assets (i) which, if terminated or modified or if it ceased to be in effect, would result in a Material Adverse Effect, (ii) that has annual payment obligations that are in excess of $500,000 and which may not be cancelled on 30 days’ prior notice or less, (iii) that relates to indebtedness for borrowed money, whether incurred, assumed, guaranteed or secured by any asset, with an outstanding principal amount in excess of $500,000, (iv) that relates to the acquisition of any business (whether by merger, sale of stock, sale of assets or otherwise), for consideration in excess of $500,000, (v) that materially limits or restricts the operator of the Spring Valley Business or the Additional Spring Valley Business from engaging in any line of business, in any geographic area or with any other person, or (vi) that provides for the assumption of any material liability of any other Person by any Seller.

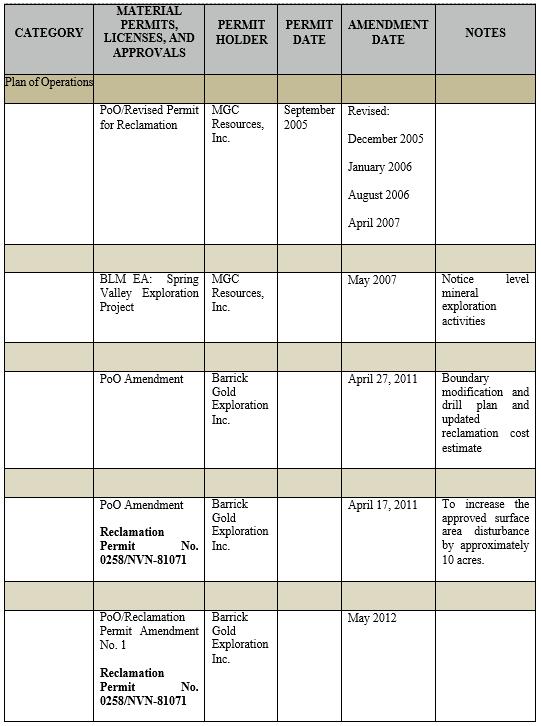

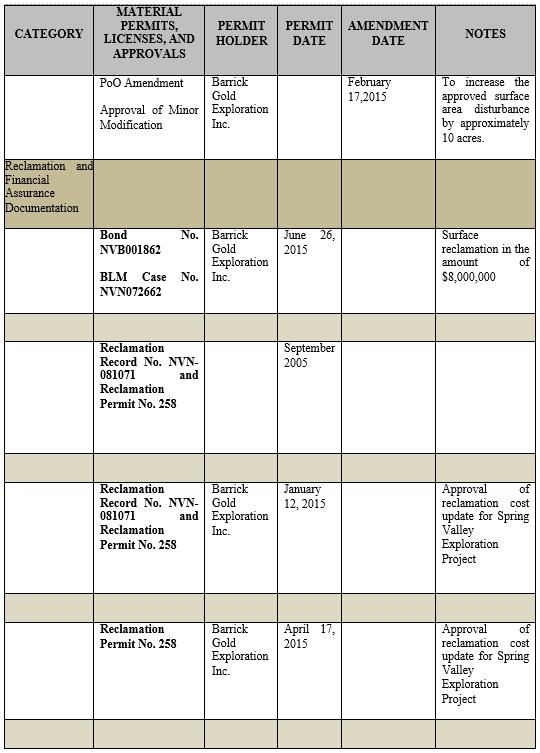

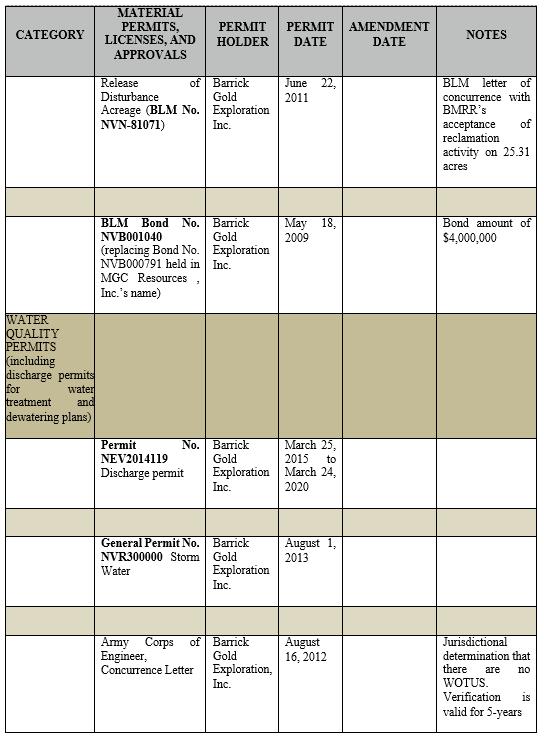

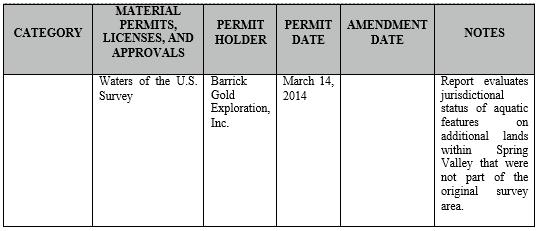

“Material Permits” has the meaning set forth in Section 3.9(b).

“Midway US” has the meaning set forth in the Preamble.

“Nevada Talon” has the meaning set forth in the Preamble.

“Obligations” has the meaning set forth in the DIP Credit Agreement.

“Other Contracts” has the meaning set forth in Section 3.7(a).

“Owned Mining Claims” means unpatented mining claims, including any associated royalties, owned by any Seller, its Affiliates or the Spring Valley Venture and held for use in connection with the Spring Valley Business or the Additional Spring Valley Business.

“Owned Real Property” means real property (other than unpatented mining claims), including any associated royalties, owned by any Seller or the Spring Valley Venture and held for use in connection with the Spring Valley Business or the Additional Spring Valley Business.

7

“Permits” means all permits, licenses, franchises, approvals, authorizations and consents required to be obtained from Governmental Authorities and held for use in connection with the Spring Valley Business or the Additional Spring Valley Business.

“Permitted Encumbrances” means: (i) statutory liens for current Taxes, assessments or other governmental charges not yet delinquent or the amount or validity of which is being contested in good faith by appropriate proceedings, (ii) mechanics', carriers', workers', repairers' and similar liens arising or incurred in the ordinary course of business and that do not, and would not, materially interfere with the mine development and operation of the Spring Valley Business or the Additional Spring Valley Business in the ordinary course of business, as such development and operation are currently contemplated in the Site Visit Presentation delivered by Midway US to Buyer entitled "Spring Valley Project, Pershing County, Nevada dated September 2015" (the "Management Presentation"), (iii) environmental regulations by any Governmental Authority, (iv) title of a lessor under a capital or operating lease, (v) terms and conditions of, and liens and security interests created by, any Material Contract, including the Exploration Agreement, that have been disclosed in the Disclosure Schedules, (vi) all covenants, conditions, restrictions, easements, charges, rights-of-way, title defects or other encumbrances on title and similar matters filed of record in the real property records to which they relate or are located in the Nevada State Office of the Bureau of Land Management or the Nevada Division of Water Resources and that do not materially interfere with the mine development and operation of the Spring Valley Business or the Additional Spring Valley Business in the ordinary course of business, as such development and operation are currently contemplated in the Management Presentation, (vii) such liens, imperfections in title, charges, easements, restrictions, encumbrances or other matters that are due to zoning or subdivision, entitlement, and other land use Laws or regulations, (viii) encumbrances on, or reservations in, title arising by operation of any applicable United States federal, state or foreign securities Law, (ix) liens or encumbrances that arise solely by reason of acts of, or with the written approval of, Buyer, (x) liens not created by either Seller or the Spring Valley Venture that affect the underlying interest of any Owned Real Property, Leased Real Property, Owned Mining Claims, Leased Mining Claims or Water Rights and that do not, and would not, materially interfere with the mine development and operation of the Spring Valley Business or the Additional Spring Valley Business in the ordinary course of business, as such development and operation are currently contemplated in the Management Presentation, (xi) any set of facts an accurate up-to-date survey would show, provided, however, that such facts do not materially interfere with the mine development and operation of the Spring Valley Business or the Additional Spring Valley Business in the ordinary course of business, as such development and operation are currently contemplated in the Management Presentation, (xii) orders or rulings of the Nevada State Office of the Bureau of Land Management or the Nevada Division of Water Resources, (xiii) any Encumbrances listed in the Disclosure Schedules, (xiv) royalties or similar interests disclosed on Schedule 2.3(e) or Schedule 3.4(i) and (xv) any Encumbrance that will no longer burden any of the Purchased Assets following the entry of the Sale Order by the Bankruptcy Court.

“Person” means an individual, corporation, partnership, joint venture, limited liability company, Governmental Authority, unincorporated organization, trust, association or other entity.

“Petition Date” has the meaning set forth in the recitals.

“Purchase Price” has the meaning set forth in Section 2.7(a).

“Purchased Assets” has the meaning set forth in Section 2.1.

“Reclamation Bonds” has the meaning set forth in Section 3.14.

“Release” means any actual or threatened release, spilling, leaking, pumping, pouring, emitting, emptying, discharging, injecting, escaping, leaching, dumping, abandonment, disposing or allowing to escape or migrate into or through the environment (including, without limitation, ambient air (indoor

8

or outdoor), surface water, groundwater, land surface or subsurface strata or within any building, structure, facility or fixture).

“Representative” means, with respect to any Person, any and all directors, officers, employees, consultants, financial advisors, counsel, accountants and other agents of such Person.

“ROFR” means the right of first refusal to purchase the Purchased Assets pursuant to the terms of the Exploration Agreement.

“Sale Hearing” means the hearing conducted by the Bankruptcy Court to approve the transactions contemplated by this Agreement.

“Sale Order” means an Order or Orders of the Bankruptcy Court issued pursuant to sections 105, 363, and 365 of the Bankruptcy Code, in substantially the form set forth in Exhibit A hereto, authorizing and approving, among other things, (a) the sale, transfer and assignment of the Purchased Assets to Buyer in accordance with the terms and conditions of this Agreement, free and clear of all Claims and Encumbrances (except for Permitted Encumbrances), (b) the assumption and assignment of the Assigned Contracts in connection therewith and (c) that Buyer is a “good faith” purchaser entitled to the protections of section 363(m) of the Bankruptcy Code.

“Sellers” has the meaning set forth in the Preamble.

“Spring Valley Business” means the business conducted by the Spring Valley Venture.

“Spring Valley Development Project” has the meaning set forth in the recitals.

“Spring Valley East Development Project” has the meaning set forth in the recitals.

“Spring Valley Venture” means the business relationship between Midway US and Barrick in respect of the Spring Valley Development Project, including under the Exploration Agreement.

“Straddle Period” has the meaning set forth in Section 2.3(c).

“Tangible Property” means all tangible personal property listed on Schedule 2.1(j) and, to the extent not included therein, any tangible personal property included in the Additional Spring Valley Assets.

“Tax” or “Taxes” means (i) all federal, state, local, foreign and other income, gross receipts, sales, use, production, ad valorem, transfer, franchise, registration, profits, license, lease, service, service use, withholding, payroll, employment, unemployment, estimated, excise, severance, environmental, stamp, occupation, premium, property (real or personal), real property gains, windfall profits, customs, duties, unclaimed property and escheat obligations, or other taxes, fees, assessments or charges of any kind whatsoever, together with any interest, additions or penalties with respect thereto and any interest in respect of such additions or penalties, and (ii) any liability for the payment of any amounts of the type described in clause (i) as a result of the operation of Law or any express or implied obligation to indemnify any other Person.

“Tax Return” means any return, document, declaration, report, election, estimated tax filing, claim for refund, declaration of estimated Tax, information return or statement or other document relating to Taxes, including any schedule or attachment thereto, and including any amendment thereof.

“Transfer Taxes” has the meaning set forth in Section 5.13(a).

“Transitional Services Agreement” means the transitional services agreement to be entered into between Buyer and Barrick pursuant to the Barrick Asset Purchase Agreement.

9

“Water Rights” means water rights owned or leased by any Seller, its Affiliates or the Spring Valley Venture and held for use in connection with the Spring Valley Business or the Additional Spring Valley Business.

Section 2.1Purchase and Sale of Assets. Subject to the terms and conditions set forth in this Agreement and in the Sale Order, at the Closing, Sellers shall irrevocably sell, assign and transfer to Buyer, and Buyer shall purchase from Sellers, free and clear of all Encumbrances other than Permitted Encumbrances, all of Sellers’ right, title and interest in, to and under the following assets, properties and rights, whether held as an equitable interest, as a tenant in common interest or otherwise (the “Purchased Assets”):

|

a) Sellers’ 30% undivided interest in the Spring Valley Venture, including all of Sellers’ right, title and interest in, to and under the Exploration Agreement; |

|

m) to the extent not covered by clauses (a) through (k) above, the Additional Spring Valley Assets; and |

Section 2.2Excluded Assets. Other than the Purchased Assets, Buyer expressly acknowledges and agrees that it is not purchasing or acquiring, and Sellers are not selling or assigning, any other assets or properties of Sellers, and all such other assets and properties shall be excluded from the Purchased

10

Assets (the “Excluded Assets”). For greater certainty, Excluded Assets include the following assets and properties of each Seller:

|

d) all insurance policies of such Seller and all rights to applicable claims and proceeds thereunder; |

|

h) the rights which accrue or will accrue to such Seller under this Agreement and the documents and instruments delivered in connection herewith; and |

Section 2.3Assumed Liabilities. Subject to the terms and conditions set forth herein, Buyer shall assume, pay, satisfy, perform and discharge when due only the following liabilities and obligations of Sellers with respect to the Purchased Assets, the Spring Valley Business and the Additional Spring Valley Business (collectively, the “Assumed Liabilities”):

11

Section 2.4Excluded Liabilities. Other than the Assumed Liabilities and Permitted Encumbrances, Buyer shall not assume and shall not be responsible to pay, perform or discharge any debts, liabilities or obligations of any Seller or with respect to the Purchased Assets, the Spring Valley Business or the Additional Spring Valley Business, whether known, unknown, direct, indirect, absolute, contingent or otherwise, or arising out of facts, circumstances or events in existence on or prior to Closing including the following (collectively, the “Excluded Liabilities”):

|

d) any liabilities or obligations relating to or arising out of the broker fees disclosed in Section 3.13; |

Section 2.5Exclusion of Assigned Contracts. From the date hereof until two (2) Business Days prior to the Sale Hearing (the “Cut-Off Date”), Buyer shall have the right, upon written notice to Sellers, to exclude any Contract from the Assigned Contracts that is related solely to the Additional Spring Valley Assets, or supplement the list of Assigned Contracts to include any Contract that is related solely to the Additional Spring Valley Assets that should have been listed on Schedule 2.1(h) (in each case, subject to the requirements of sections 365(a) and 365(f) of the Bankruptcy Code), for any reason. Any Contract so excluded by Buyer shall be deemed to no longer be an Assigned Contract and shall be deemed an Excluded Asset. Any Schedules hereto shall be amended to reflect any changes made pursuant to this Section 2.5 and Buyer shall have no obligation to pay the Cure Amount (if any) associated with any Contract that is excluded from the Assigned Contracts pursuant to this Section 2.5. For the avoidance of doubt, any such exclusion or addition of any Assigned Contract shall not result in a change to the amount of the Cure Amount. Buyer shall assume, and be obligated to pay, the Cure Amount with respect to (i) any Contract added pursuant to its right to supplement the list of Assigned Contracts and Cure Amounts under this Section 2.5 and (ii) any increased Cure Amounts set forth in any order of the Bankruptcy Court to the extent Buyer fails to exclude the Contract associated with such Cure Amount within five (5) Business Days of the issuance of such order (and any such Cure Amounts shall be deemed added to Schedule 2.1(h) and become an Assumed Liability).

12

Section 2.6Non-Assignable Purchased Assets.

|

c) The provisions of Section 2.6(a) and Section 2.6(b) shall not apply to any consent, authorization, approval or waiver relating to the ROFR (if applicable). |

13

|

i. a credit bid of the Obligations (if any) owed by Sellers to Buyer under the Credit Documents in an amount (as determined by Buyer in its sole discretion) up to $5 million; plus |

Section 2.8Closing. Subject to the terms and conditions of this Agreement, the consummation of the transactions contemplated herein, including the purchase and sale of the Purchased Assets and the assumption of the Assumed Liabilities (the “Closing”), shall take place electronically via email or facsimile beginning at 9:00 a.m., Mountain time, on the third Business Day after the last of the conditions to Closing set forth in ARTICLE 6 have been satisfied or waived (other than conditions which, by their nature, are to be satisfied on the Closing Date) or at such other time or on such other date or at such other place as Sellers and Buyer may mutually agree upon in writing (the day on which the Closing takes place being the “Closing Date”).

Section 2.9Transactions to be Effected at the Closing. At the Closing:

Each Seller shall deliver to Buyer the following, substantially in the applicable form attached hereto as Exhibit B with respect to the items listed in Section 2.9(a)(ii) through Section 2.9(a)(vi) below:

a true and correct copy of the Sale Order;

duly executed deeds sufficient to transfer such Seller’s right, title and interest in, to and under all of the Purchased Assets that are Owned Real Property or Owned Mining Claims;

duly executed assignments sufficient to transfer such Seller’s right, title and interest in, to and under all of the Purchased Assets that are Leased Real Property or Leased Mining Claims;

duly executed deeds or assignments sufficient to transfer such Seller’s right, title and interest in, to and under all of the Purchased Assets that are Water Rights;

duly executed assignments and bills of sale sufficient to transfer such Seller’s right, title and interest in, to and under the Purchased Assets that are Tangible Property;

duly executed assignments sufficient to transfer all of the Purchased Assets that are Assigned Contracts or Material Permits; and

all other agreements, documents, instruments or certificates required to be delivered by such Seller at or prior to the Closing pursuant to Section 6.2.

Buyer shall deliver to, or on behalf of (in the case of Section 2.9(b)(ii)), Sellers the following:

14

the Cash Amount;

the Cure Amounts required to be paid by Buyer in accordance with the terms hereof to the counterparties of the applicable Assigned Contracts;

a counterpart in form and substance satisfactory to Buyer and Sellers, acting reasonably, pursuant to which Buyer agrees to be bound by the Exploration Agreement to the same extent as Sellers;

duly executed assumption agreements sufficient to assume the Assumed Liabilities substantially in the form attached as Exhibit C hereto; and

all other agreements, documents, instruments or certificates required to be delivered by Buyer at or prior to the Closing pursuant to Section 6.3.

Section 2.10Allocation of Purchase Price. Within 60 days after the Closing Date, Buyer shall deliver to Sellers a schedule allocating the Purchase Price and any other amounts required to be taken into account among the applicable assets of each Seller (the “Allocation Schedule”). The Allocation Schedule shall be prepared, and subsequently adjusted, in accordance with section 1060 of the Code. The Allocation Schedule shall be deemed final unless Sellers notify Buyer in writing that Sellers objects to one or more items reflected in the Allocation Schedule within 30 days after delivery of the Allocation Schedule to Sellers. In the event of any such objection, Buyer and Sellers will work expeditiously and in good faith in an attempt to resolve such dispute within a further period of 15 days after the date of notification by Sellers to Buyer of such dispute, failing which the dispute shall be submitted for determination to an independent national firm of certified public accountants mutually agreed to by Sellers and Buyer (and, failing agreement between Sellers and Buyer on the firm of certified public accountants within a further period of five Business Days, such independent national firm of certified public accountants shall be Ernst & Young LLP). The determination of the firm of certified public accountants shall be final and binding upon the parties and shall not be subject to appeal. The firm of certified public accountants shall be deemed to be acting as experts and not as arbitrators. The fees and expenses of such accounting firm shall be borne equally by Sellers, on the one hand, and Buyer, on the other. Sellers and Buyer agree to (a) file their respective IRS Forms 8594 and all federal, state and local Tax Returns in a manner consistent with the Allocation Schedule (as it may be subsequently adjusted) and (b) notify and provide the other party with reasonable assistance in the event of an examination, audit or other proceeding relating to Taxes or any other filing with a Governmental Authority regarding the appropriate allocation of the Purchase Price among the Purchased Assets. Notwithstanding the preceding sentence, the parties may settle any proposed deficiency or adjustment by any Governmental Authority based upon or arising out of the allocation of the Purchase Price and other applicable items among the Purchased Assets, and neither Buyer nor Sellers shall be required to litigate before any court any proposed deficiency or adjustment by any Governmental Authority challenging any final Allocation Schedule. Notwithstanding anything in this Agreement to the contrary, this Section 2.10 shall survive the Closing Date without limitation.

Section 2.11Withholding. Buyer shall be entitled to withhold from amounts payable to any Seller hereunder amounts of Taxes that are required to be withheld under applicable Law and if any such Taxes are withheld, they shall be remitted by Buyer in accordance with applicable Law; provided that, if a Seller has provided the FIRPTA Certificate in accordance with Section 6.2(e) upon which Buyer may rely that reasonably establishes that the transactions contemplated hereby are not subject to withholding under Code section 1445(a), Buyer shall not deduct or withhold any amount for Taxes under Code section 1445(a) with respect to such Seller. To the extent that such Taxes are withheld and paid over to the applicable Governmental Authority with respect to amounts payable to a Seller hereunder, such amounts shall be treated for purposes of this Agreement as having been paid to such Seller.

15

Except as set forth in the Disclosure Schedules, Sellers jointly and severally represent and warrant to Buyer as follows:

Section 3.1Organization. Such Seller is a corporation or limited liability company, as applicable, duly organized, validly existing and in good standing under the Laws of the state of its formation, is duly qualified to do business as a foreign corporation or limited liability company, as applicable, and is in good standing under the Laws of each jurisdiction that requires such qualification as a consequence of the Spring Valley Business or the Additional Spring Valley Business.

Section 3.2Due Authorization, Execution and Delivery; Enforceability. Subject to the entry of the Sale Order by the Bankruptcy Court, such Seller has the requisite organizational power and authority to enter into this Agreement and the other agreements contemplated hereby, and to perform its obligations hereunder and thereunder and has taken all necessary action required for the due authorization, execution, delivery and performance by it of this Agreement and the transactions contemplated hereby. Subject to the entry of the Sale Order by the Bankruptcy Court, the execution and delivery by such Seller of this Agreement, the performance by such Seller of its obligations hereunder and the consummation by such Seller of the transactions contemplated hereby have been duly authorized by all requisite organizational action. This Agreement has been duly executed and delivered by such Seller and, subject to the entry of the Sale Order by the Bankruptcy Court, constitutes the legal, valid and binding obligation of such Seller, enforceable against such Seller in accordance with its terms, except as such enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium or similar Laws affecting creditors’ rights generally and by general principles of equity (regardless of whether enforcement is sought in a proceeding at law or in equity).

Section 3.3No Conflicts; Consents. Except as set forth in Schedule 3.3 or pursuant to the ROFR (if applicable), subject to the Sale Order having been entered by the Bankruptcy Court, the execution, delivery and performance by such Seller of this Agreement, and the consummation of the transactions contemplated hereby, do not and will not: (i) conflict with or result in a violation or breach of any provision of its organizational documents, (ii) conflict with or result in a violation or breach of any Governmental Order applicable to such Seller, or (iii) require the consent of any Person under, conflict with, result in a violation or breach of, constitute a default or an event that, with or without notice or lapse of time or both, would constitute a default under, result in the acceleration of or create in any party the right to accelerate, terminate, modify or cancel, any Material Contract. No consent, approval, Permit, Governmental Order, declaration or filing with, or notice to, any Governmental Authority or other Person is required by or with respect to such Seller in connection with the execution and delivery of this Agreement and the consummation of the transactions contemplated hereby, except (x) as set forth in Schedule 3.3, (y) entry of the Sale Order by the Bankruptcy Court, and (z) such consents, approvals, Permits, Governmental Orders, declarations, filings or notices which, in the aggregate, would not have a Material Adverse Effect.

Section 3.4Assets.

Schedule 2.1(c) sets forth a true and complete list of (i) all Owned Real Property held or used in connection with the Additional Spring Valley Business and (ii) to the Knowledge of Sellers, all Owned Real Property held or used in connection with the Spring Valley Business.

Schedule 2.1(d) sets forth a true and complete list of (i) all Leased Real Property held or used in connection with the Additional Spring Valley Business and (ii) to the Knowledge of Sellers, all Leased Real Property held or used in connection with the Spring Valley Business.

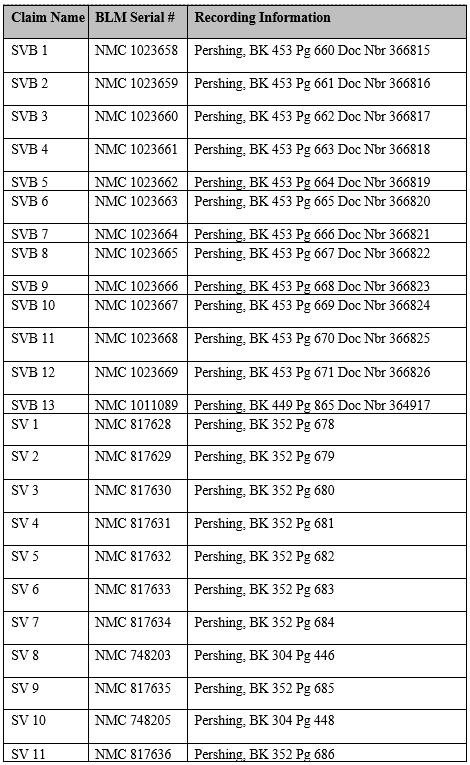

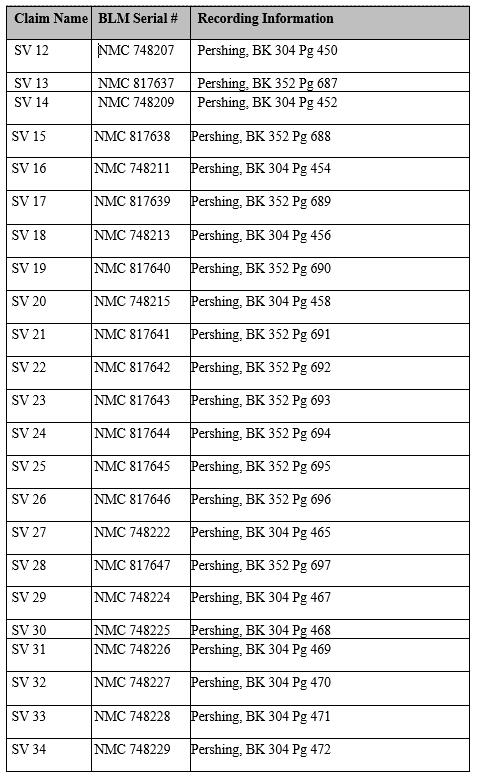

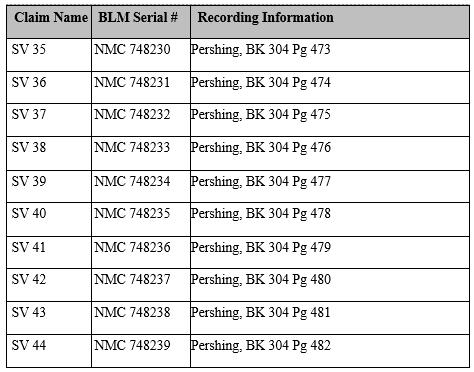

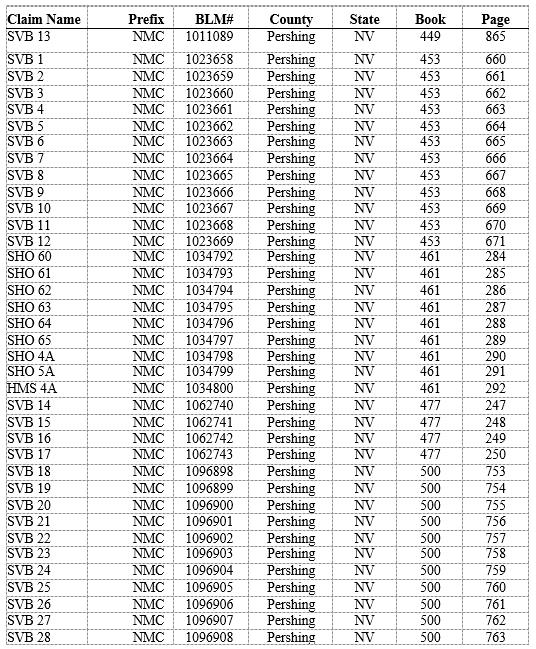

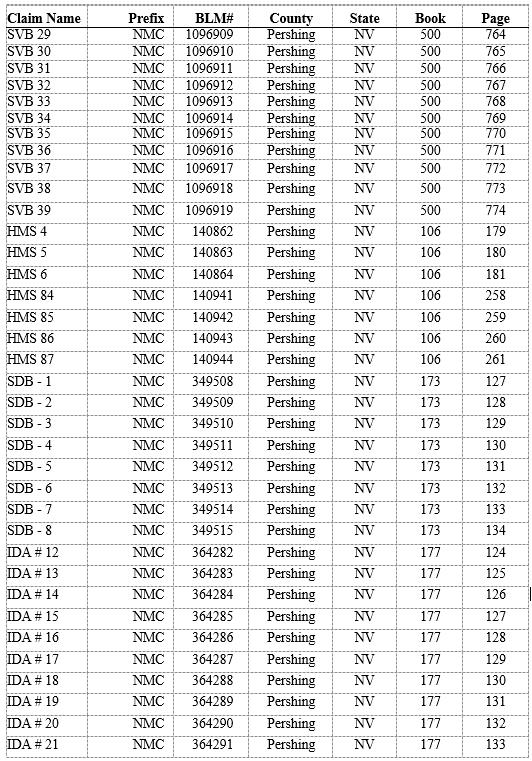

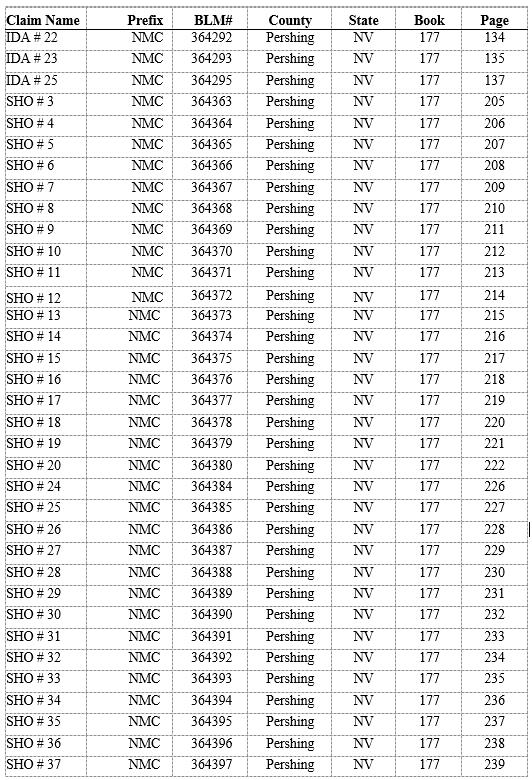

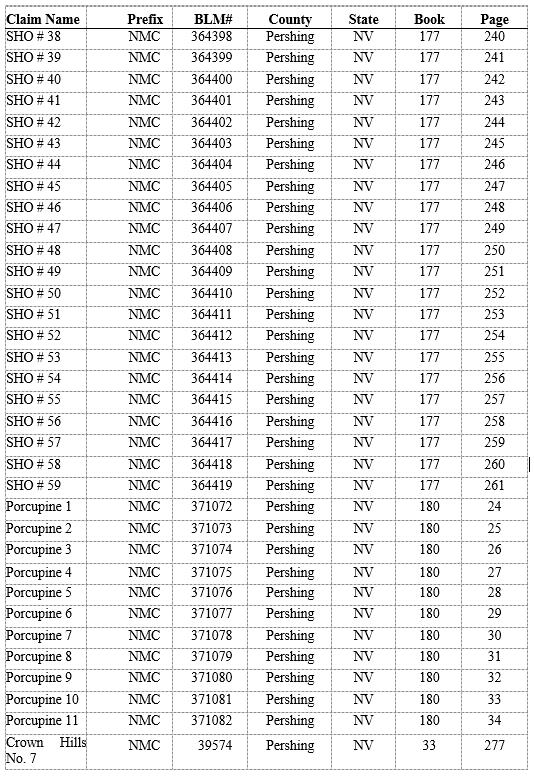

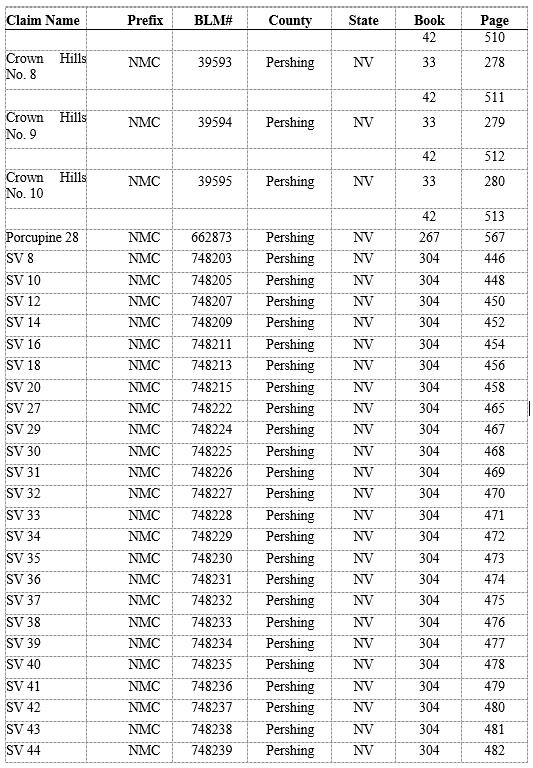

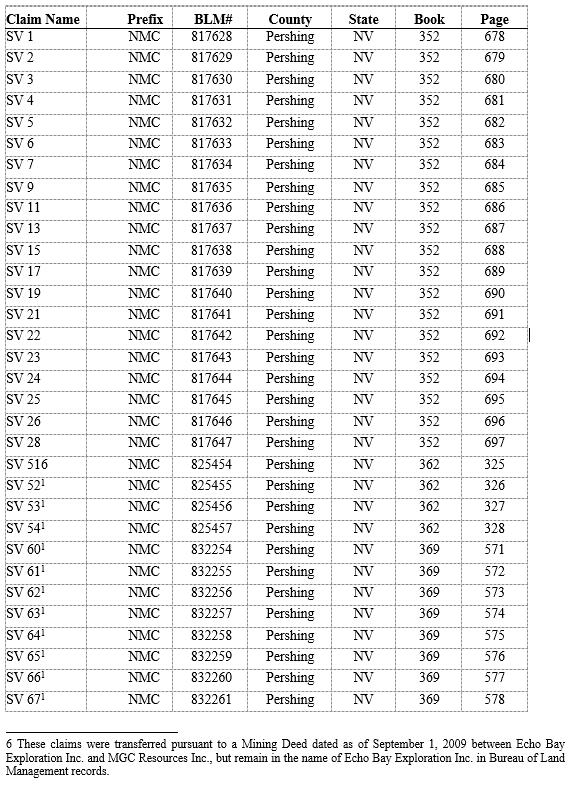

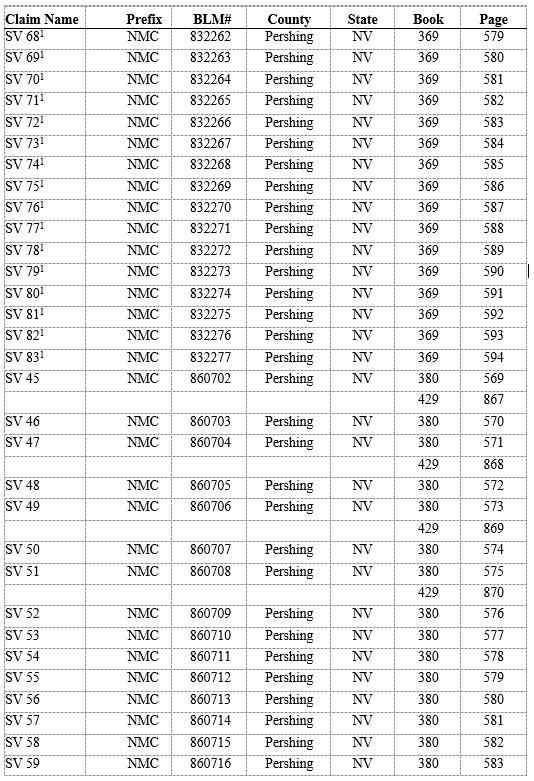

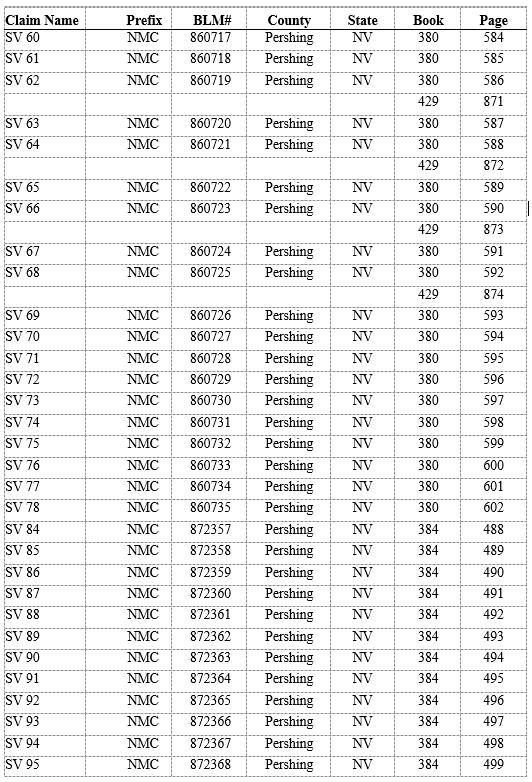

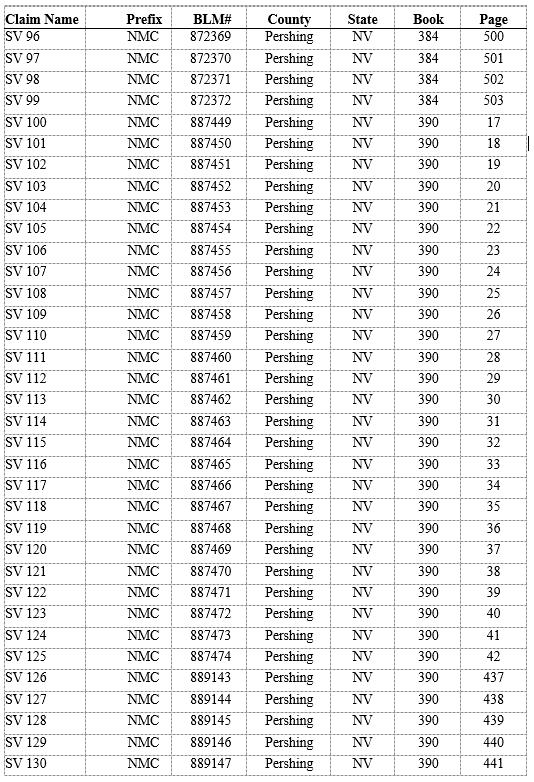

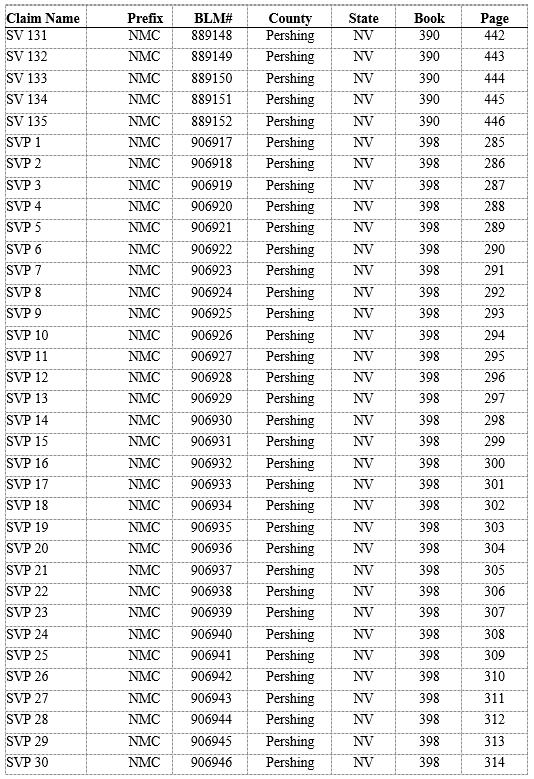

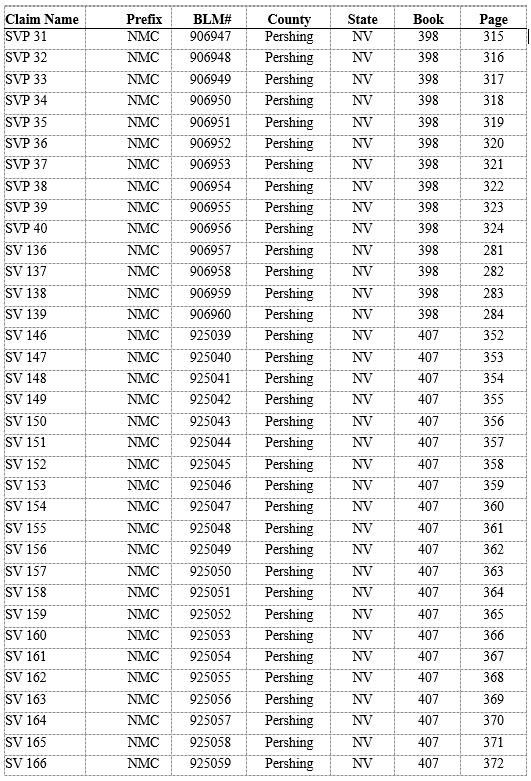

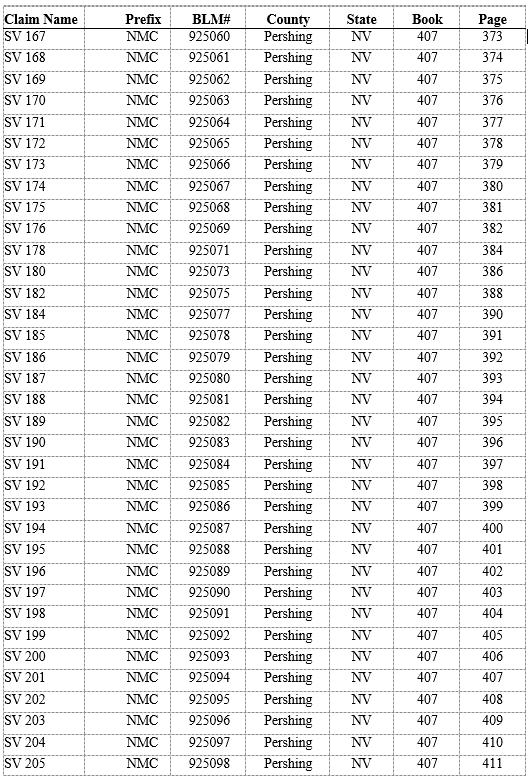

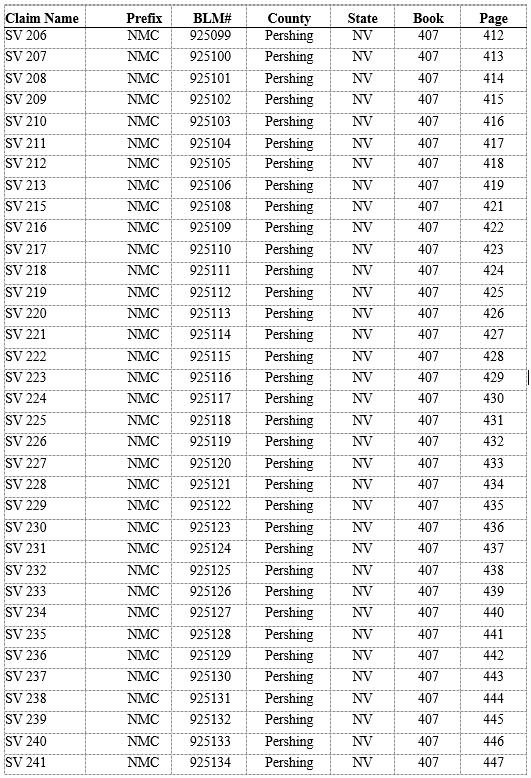

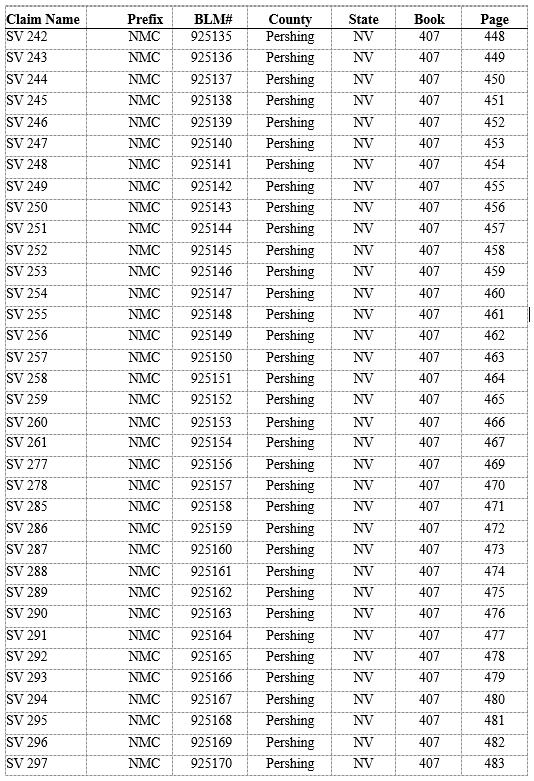

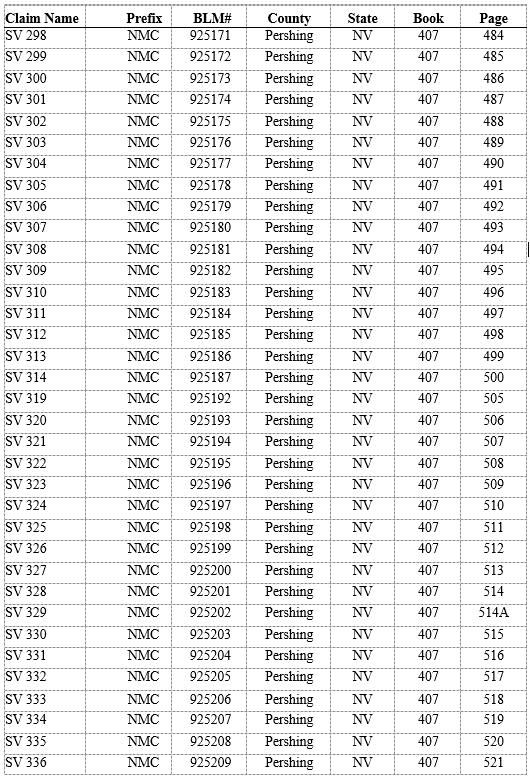

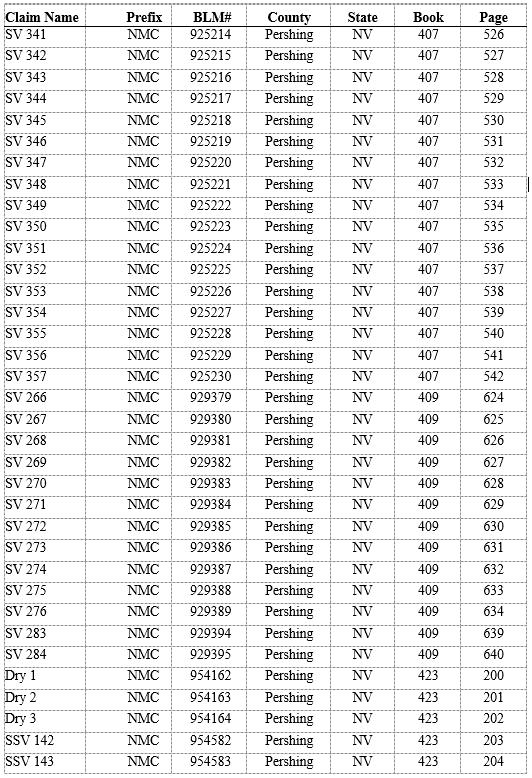

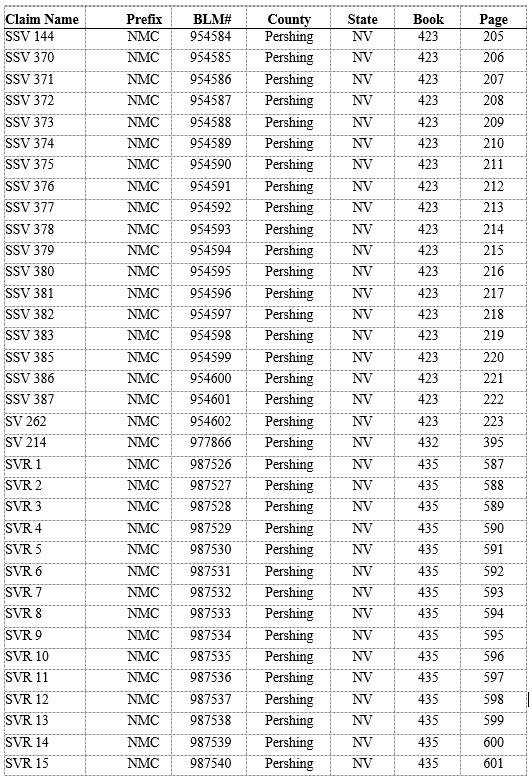

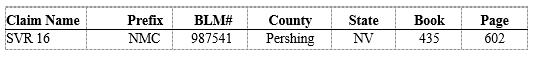

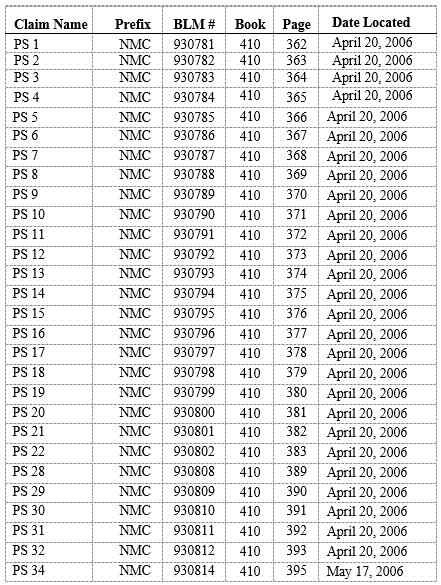

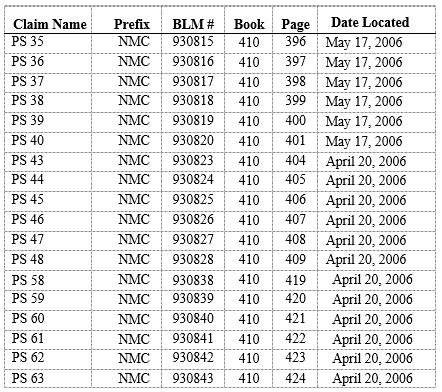

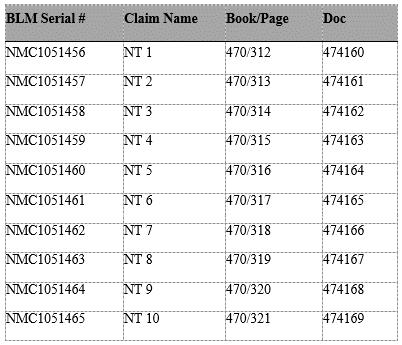

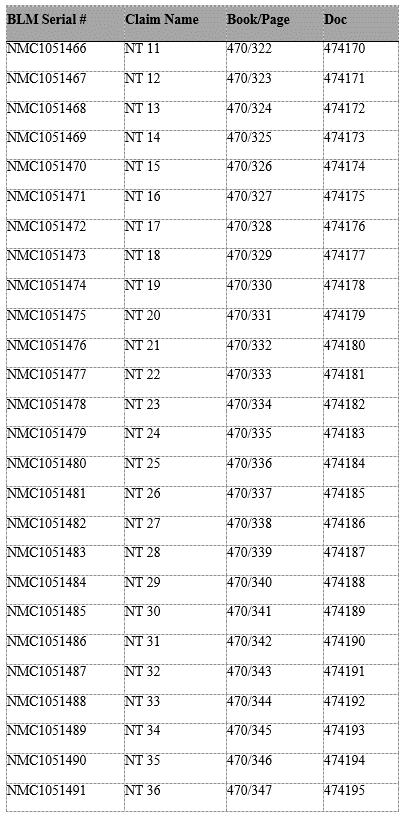

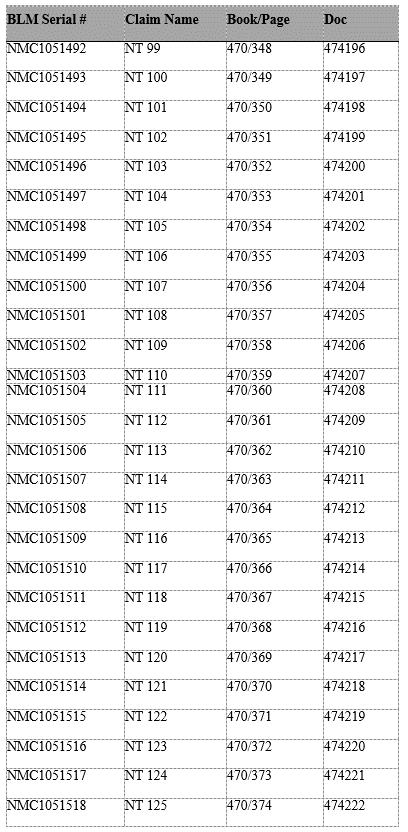

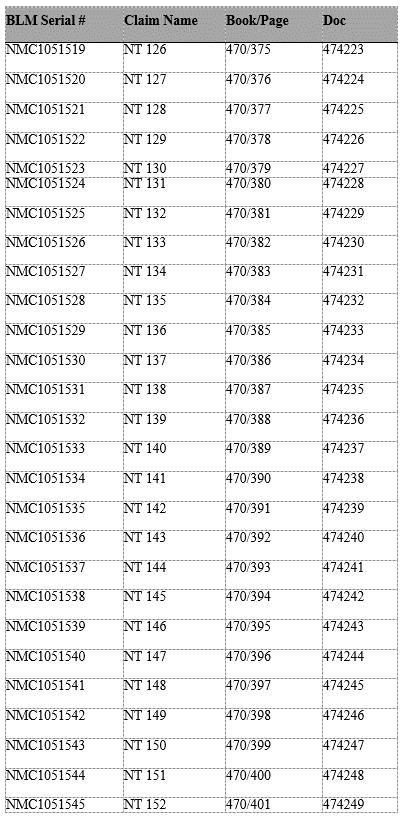

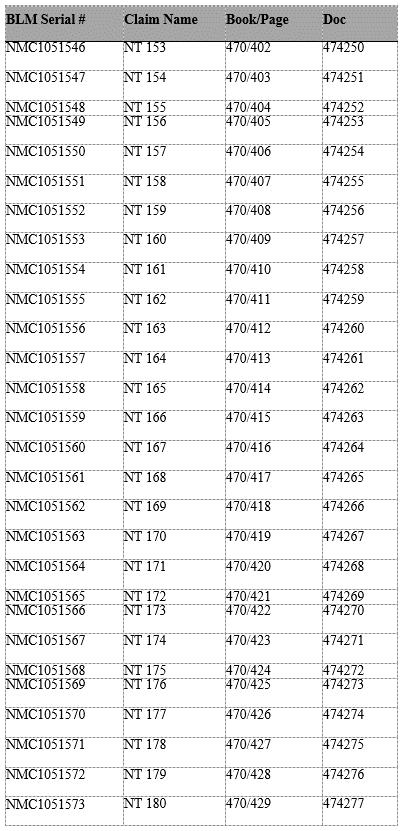

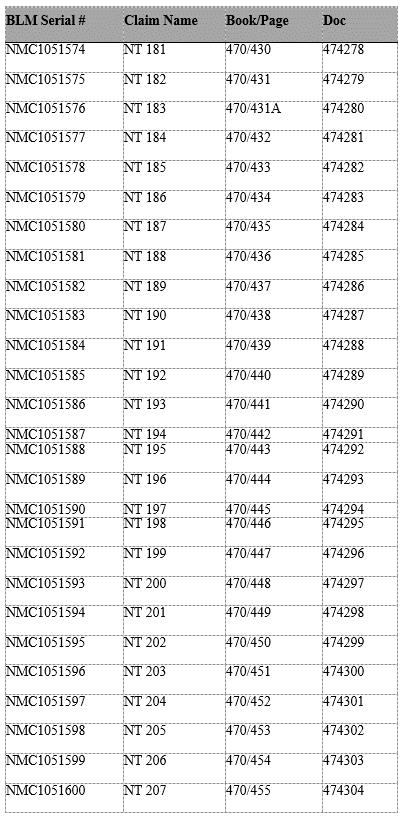

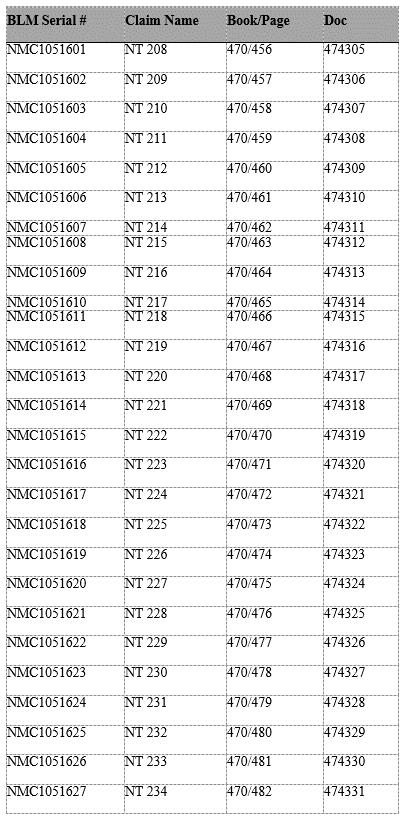

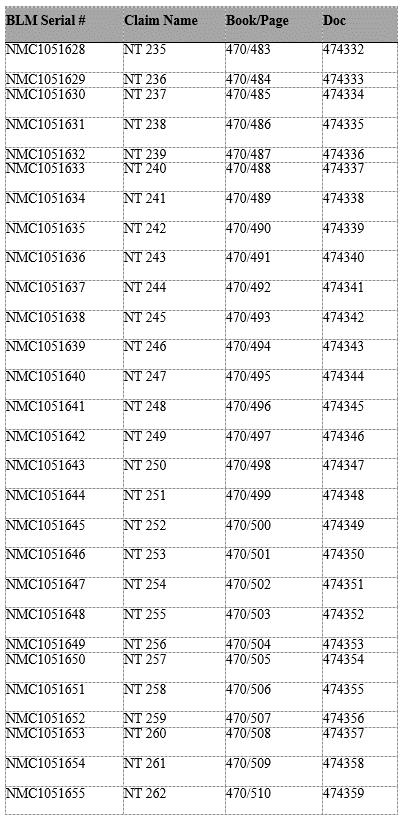

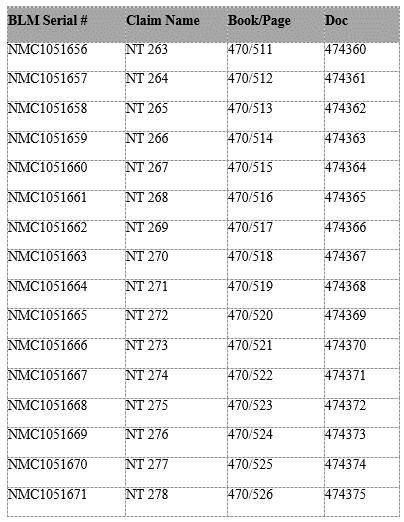

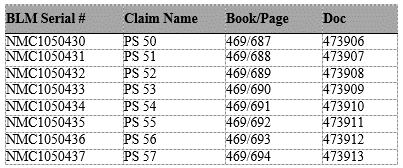

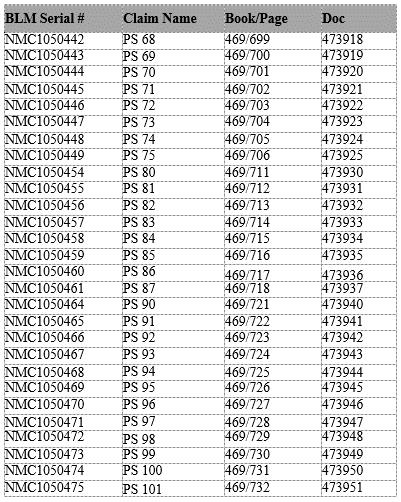

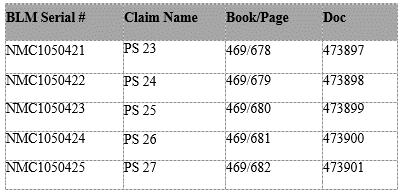

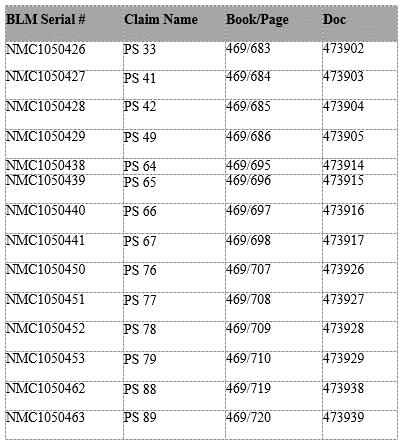

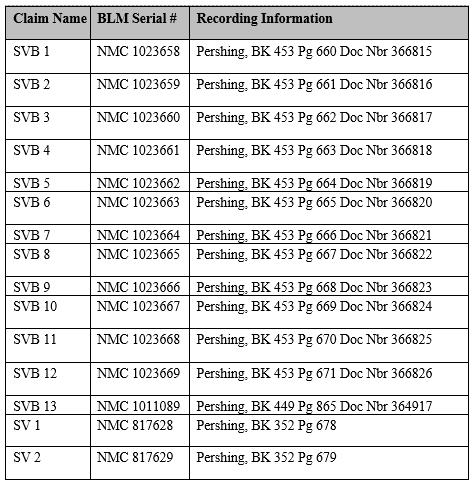

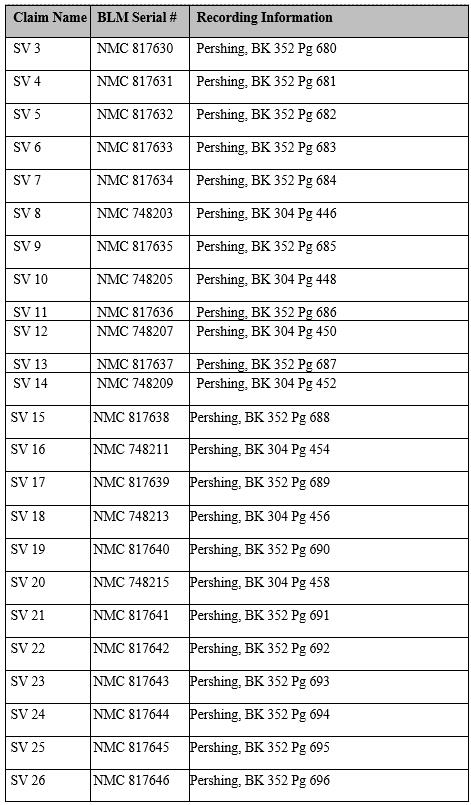

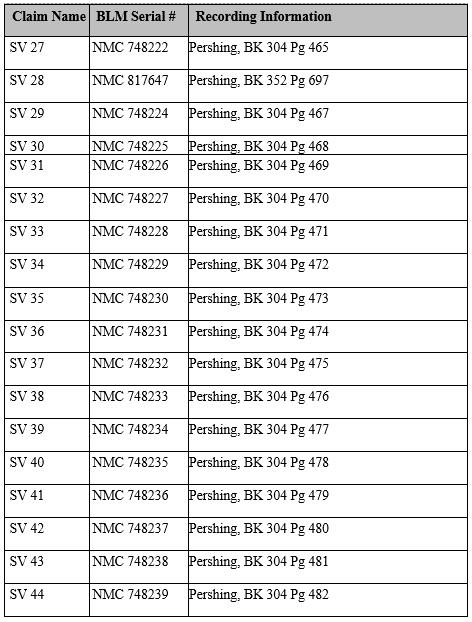

Schedule 2.1(e) sets forth a true and complete list of (i) all Owned Mining Claims held or used in connection with the Additional Spring Valley Business and (ii) to the Knowledge of Sellers, all Owned Mining Claims held or used in connection with the Spring Valley Business.

16

Schedule 2.1(f) sets forth a true and complete list of (i) all Leased Mining Claims held or used in connection with the Additional Spring Valley Business and (ii) to the Knowledge of Sellers, all Leased Mining Claims held or used in connection with the Spring Valley Business.

Schedule 2.1(g) sets forth a true and complete list of (i) all Water Rights held or used in connection with the Additional Spring Valley Business and (ii) to the Knowledge of Sellers, all Water Rights held or used in connection with the Spring Valley Business.

Midway US owns a 30% undivided interest in and to the Spring Valley Venture and (i) a 30% legal interest in the Owned Real Property held or used in connection with the Spring Valley Business set forth in part (i) of Schedule 2.1(c), to which it has good record title, (ii) a 30% legal interest in the Leased Real Property held or used in connection with the Spring Valley Business set forth in part (i) of Schedule 2.1(d), to which it has a valid and enforceable leasehold or subleasehold interest, (iii) subject to the paramount title of the United States, a 30% legal interest in the Owned Mining Claims held or used in connection with the Spring Valley Business set forth in part (i) of Schedule 2.1(e), to which it has good record title, (iv) subject to the paramount title of the United States, a 30% legal interest in the Leased Mining Claims held or used in connection with the Spring Valley Business set forth in part (i) of Schedule 2.1(f), to which it has a valid and enforceable leasehold or subleasehold interest, and (v) a 30% legal interest in the Water Rights held or used in connection with the Spring Valley Business set forth in part (i) of Schedule 2.1(g), to which it has valid title, in each case, free and clear of all Encumbrances except for Permitted Encumbrances. To the Knowledge of Sellers, other than those assets held by Barrick or its Affiliates and any global supply contracts to which Affiliates of Barrick are a party, the Purchased Assets represent all of the material assets and property used by the Spring Valley Venture in carrying on the Spring Valley Business for exploration purposes as it is currently conducted and, together with any services to be provided by Barrick and its Affiliates pursuant to the Transitional Services Agreement, constitute all assets that are necessary for the conduct of the Spring Valley Business in all material respects for exploration purposes as it is currently conducted. Except for Buyer under this Agreement, the ROFR (if applicable) and as set forth in Schedule 3.3, no Person has any written or oral agreement, option, understanding or commitment, or any right or privilege capable of becoming such for the purchase or other acquisition from Sellers or their Affiliates of any of the Purchased Assets, other than such rights that have been waived by such Person and other than with respect to Purchased Assets which are obsolete and which individually or in the aggregate do not exceed $500,000. All material assets, properties and rights used by the Spring Valley Venture in the conduct of the Spring Valley Business are held solely by Sellers and Barrick, and all material Contracts, obligations, expenses and transactions relating to the Spring Valley Business have been entered into, incurred and conducted only by Sellers and Barrick.

Sellers have not sold, assigned, transferred or conveyed their interest in the Purchased Assets, or any right, title or interest therein, to any Person other than the sale to Buyer contemplated hereby, and Sellers have not created or consented to any Encumbrance arising by, through or under such Seller, other than Permitted Encumbrances.

With respect to the Owned Mining Claims listed, or required to be listed, on Schedule 2.1(e), all required claim maintenance fees have been paid in the manner required by Law in order to maintain the Owned Mining Claims in good standing through the end of the current assessment year (inclusive of the Closing Date), and proof thereof has been properly and timely recorded and filed in accordance with Law, and with respect to the Leased Mining Claims listed, or required to be listed, on Schedule 2.1(f), to the Knowledge of Sellers, all required claim maintenance fees have been paid in the manner required by Law in order to maintain the Leased Mining Claims in good standing through the end of the current assessment year (inclusive of the Closing Date), and proof thereof has been properly and timely recorded and filed in accordance with Law.

To the Knowledge of Sellers, Schedule 2.3(e) and Schedule 3.4(i) set forth a true and complete list of all royalties on or burdening all or any portion of the Owned Real Property, Leased Real Property, Owned Mining Claims, Leased Mining Claims, whether such royalty is characterized as a net smelter

17

return royalty, overriding royalty, net profit interest, gross proceeds royalty, production payment, streaming transaction, share of mineral production or otherwise.

Sellers own (i) all of the legal interest in the Owned Real Property set forth (or required to be set forth) in Schedule 2.1(m) and part (ii) of Schedule 2.1(c), to which they have good record title, (ii) all of the legal interest in the Leased Real Property set forth (or required to be set forth) in Schedule 2.1(m) and part (ii) of Schedule 2.1(d), to which they have a valid and enforceable leasehold or subleasehold interest, (iii) subject to the paramount title of the United States, all of the legal interest in the Owned Mining Claims set forth (or required to be set forth) in Schedule 2.1(m) and part (ii) of Schedule 2.1(e), to which they have good record title, (iv) subject to the paramount title of the United States, all of the legal interest in the Leased Mining Claims set forth (or required to be set forth) in Schedule 2.1(m) and part (ii) of Schedule 2.1(f), to which they have a valid and enforceable leasehold or subleasehold interest, and (v) all of the legal interest in the Water Rights set forth (or required to be set forth) in Schedule 2.1(m) and part (ii) of Schedule 2.1(g), to which they have valid title, in each case, free and clear of all Encumbrances except for Permitted Encumbrances.

The Tangible Property that is (i) material and used regularly in the conduct of the Additional Spring Valley Business has been maintained in all material respects in the ordinary course consistent with standard industry practice or (ii) material and used regularly in the conduct of the Spring Valley Business has, to the Knowledge of Sellers, been maintained in all material respects in the ordinary course consistent with standard industry practice.

No Affiliate of any Seller owns or has any rights in or to any of the Purchased Assets or other properties or rights relating primarily to the Spring Valley Business or the Additional Spring Valley Business.

Section 3.6Ordinary Course of Business. Except as expressly contemplated by this Agreement or as set forth in Schedule 3.6, from and after September 30, 2015, (a) the Spring Valley Business has, to the Knowledge of Sellers, been operated in the ordinary course of business in all material respects, (b) the Additional Spring Valley Business has been operated in the ordinary course of business in all material respects and (c) there has not been any change, event or development or prospective change, event or development with respect to the Purchased Assets that, individually or in the aggregate, has had a Material Adverse Effect.

Section 3.7Material Contracts.

Schedule 3.7(a) lists (i) all of the Material Contracts entered into by any Seller with respect to the Spring Valley Business or the Purchased Assets (other than the Additional Spring Valley Assets) and (ii) all other Contracts entered into by any Seller with respect to the Additional Spring Valley Business or the Additional Spring Valley Assets (the “Other Contracts”). Schedule 3.7(a) also lists or describes all material written or unwritten Contracts, arrangements, understandings or dealings, including with respect to the provision of any toll-processing or shared services, between Sellers and an Affiliate or other non-arm’s length party with respect to the Spring Valley Business or the Purchased Assets (it being acknowledged that these arrangements, understandings or dealings shall not be included in the Purchased Assets).

Except as disclosed in Schedule 3.7(b), each Material Contract or Other Contract is a legal, valid, binding and enforceable agreement of the applicable Seller, and is in full force and effect and will continue to be in full force and effect immediately following the Closing Date. Except as disclosed in Schedule 3.7(b) or as a result of the Chapter 11 Cases, such Seller: (i) has performed in all material respects all of the obligations required to be performed by it under each Material Contract or Other Contract, and (ii) is not in material breach of, or default under, any Material Contract or Other Contract.

18

Schedule 3.7(c) sets forth Sellers’ estimate, based on reasonable inquiry, as of the date hereof, of the Cure Amounts associated with each Assigned Contract.

Section 3.8Legal Proceedings. Except for the Disclosed Litigation, there are no actions, suits, claims or other legal proceedings pending, in each case before a Governmental Authority, or to such Sellers’ Knowledge threatened, against any Seller relating to the Additional Spring Valley Business or, to the Knowledge of Sellers, the Spring Valley Business, which would reasonably be expected to be material and adverse to such Seller in connection with its conduct of the Spring Valley Business, the Additional Spring Valley Business or the Purchased Assets.

Section 3.9Compliance with Laws; Permits.

Except as disclosed in Schedule 3.9(a), each Seller is, and, to the Knowledge of Sellers, the Spring Valley Venture is, in compliance with all Laws applicable to the Spring Valley Business or the Additional Spring Valley Business, as applicable, except where the failure to be in such compliance would not be expected to be material and adverse to such Seller or the Spring Valley Venture in connection with the conduct of the Spring Valley Business or the Additional Spring Valley Business, as applicable.

Schedule 3.9(b) sets forth the material Permits necessary for the operation of the Additional Spring Valley Business and, to the Knowledge of Sellers, the Spring Valley Business as presently being conducted (the “Material Permits”). The Material Permits necessary for the operation of the Additional Spring Valley Business and, to the Knowledge of Sellers, the Material Permits necessary for the operation of the Spring Valley Business, have been duly obtained and neither Sellers nor, to the Knowledge of Sellers, the Spring Valley Venture is in material default or material breach of any such Material Permit.

None of the representations and warranties contained in this Section 3.9 shall relate to or be deemed to relate to environmental matters (which are governed exclusively by Section 3.10) or tax matters (which are governed exclusively by Section 3.12).

Section 3.10Environmental Matters.

To Sellers’ Knowledge, except as set forth in Schedule 3.10(a), the Spring Valley Business, the Additional Spring Valley Business and the Purchased Assets are in compliance with all Environmental Laws except where the failure to be in such compliance would not be expected to be material and adverse to any Seller or the conduct of the Spring Valley Business or the Additional Spring Valley Business, and neither such Seller nor, to the Knowledge of Sellers, the Spring Valley Venture has received any Environmental Notice or Environmental Claim relating to the Spring Valley Business, the Additional Spring Valley Business or the Purchased Assets, which either remains pending or unresolved, or is the source of ongoing obligations or requirements as of the Closing Date.

To the Knowledge of Sellers, Schedule 3.10(b) sets forth each of the material Environmental Permits necessary for the operation of the Spring Valley Business, each of which is in full force and effect. Sellers and, to the Knowledge of Sellers, the Spring Valley Venture, have obtained and are in material compliance with all Environmental Permits listed in Schedule 3.10(b). No Environmental Permits are necessary for the operation of the Additional Spring Valley Business.

To Sellers’ Knowledge, and except as set forth in Schedule 3.10(c), there has been no Release of Hazardous Materials in contravention of Environmental Laws or that would give rise to any material liability or response costs with respect to the Additional Spring Valley Business or the Additional Spring Valley Assets.

Except as indicated in Schedule 3.10(d), neither Seller nor, to the Knowledge of Sellers, the Spring Valley Venture has entered into, and the Additional Spring Valley Assets are not, and to the Knowledge

19

of Sellers, the Spring Valley Assets are not, otherwise subject to (i) any consent decree, order, judgment or judicial order relating to compliance with Environmental Laws or Environmental Permits or the investigation, sampling, monitoring, treatment, remediation, removal or cleanup of Hazardous Materials, and no litigation is pending with respect thereto, or (ii) any environmental indemnification in connection with any threatened or asserted claim by any third party for any liability under any Environmental Law or relating to any Hazardous Materials.

Except as set forth in Schedule 3.12(a), (i) all Taxes due and owing by each Seller have been duly and timely paid in full, (ii) no Tax deficiencies are being proposed in writing or have been assessed by any Governmental Authority with respect to any Seller that remain outstanding or unsatisfied, (iii) there are no Tax liens on any of the Purchased Assets for which any Seller would be responsible, other than liens for Taxes not yet due and payable, (iv) no federal, state, local or foreign audits or administrative or judicial proceedings are presently pending, or threatened in writing, with regard to any Taxes or Tax Returns with respect to any Seller, and (v) all Tax Returns required to be filed by each Seller have been filed, and all such Tax Returns are true and correct in all material respects.

Neither Seller is a “foreign person” as that term is used in Treasury Regulations section 1.1445-2(b).

None of the Purchased Assets is treated, or required to be treated, as held in an arrangement requiring a partnership income Tax Return to be filed under Subchapter K of Chapter 1 of Subtitle A of the Code.

Neither Seller has entered into an agreement with any Governmental Authority requiring it or its Affiliates to take action, or refrain from taking action, in order to secure Tax benefits not otherwise available.

The representations and warranties set forth in this Section 3.12 are the exclusive representations and warranties made by the Sellers with respect to Taxes.

Section 3.13Financial Advisors. Except for Moelis & Company LLC, no broker, finder or investment banker is entitled to any brokerage, finder’s or other fee or commission in connection with the transactions contemplated by this Agreement based upon arrangements made by or on behalf of Sellers.

Section 3.14Reclamation Bonds. To the Knowledge of Sellers, Schedule 3.14 sets forth a description of all surety instruments, bonds, letters of credit, guarantees and other instruments or arrangements securing or guarantying performance of obligations with respect to the operation, closure, reclamation or remediation of the Purchased Assets (collectively, the “Reclamation Bonds”). To the Knowledge of Sellers, no Governmental Authority has claimed any deficiency with respect to, or called on, any Reclamation Bond. No Reclamation Bonds are in place or required with respect to the Additional Spring Valley Assets.

Section 3.15No Other Representations and Warranties. Except for the representations and warranties contained in this ARTICLE 3 (including the related portions of the Disclosure Schedules), Sellers have not and no Affiliate or Representative of Sellers, or any other Person, has made or makes any other express or implied representation or warranty, either written or oral, on behalf of either Seller, including any representation or warranty as to the accuracy or completeness of any information furnished or made available to Buyer and its Representatives (including any projections, information, documents or material made available to Buyer, management presentations or in any other form in expectation of the transactions contemplated hereby) or as to the future revenue, profitability or success of the Spring Valley Business or the Additional Spring Valley Business or any representation or warranty arising from statute or otherwise in law.

20

Buyer represents and warrants to Sellers as follows:

Section 4.1Organization. Buyer is a limited liability company duly organized, validly existing and in good standing under the Laws of the State of Nevada.

Section 4.2Due Authorization, Execution and Delivery; Enforceability. Buyer has the requisite company power and authority to enter into this Agreement, to carry out its obligations hereunder and to consummate the transactions contemplated hereby. The execution and delivery by Buyer of this Agreement, the performance by Buyer of its obligations hereunder and the consummation by Buyer of the transactions contemplated hereby have been duly authorized by all requisite company action. This Agreement has been duly executed and delivered by Buyer and constitutes the legal, valid and binding obligation of Buyer, enforceable against Buyer in accordance with its terms, except as such enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium or similar Laws affecting creditors’ rights generally and by general principles of equity (regardless of whether enforcement is sought in a proceeding at law or in equity).

Section 4.3No Conflicts; Consents. The execution, delivery and performance by Buyer of this Agreement, and the consummation of the transactions contemplated hereby, do not and will not: (i) result in a violation or breach of any provision of the organizational documents of Buyer, or (ii) result in a violation or breach of any provision of any Law or Governmental Order applicable to Buyer. No consent, approval, Permit, Governmental Order (other than in connection with the Chapter 11 Cases), declaration or filing with, or notice to, any Governmental Authority or other Person is required by or with respect to Buyer in connection with the execution and delivery of this Agreement and the consummation of the transactions contemplated hereby.

Section 4.4Financial Advisors. No broker, finder or investment banker is entitled to any brokerage, finder’s or other fee or commission in connection with the transactions contemplated by this Agreement based upon arrangements made by or on behalf of Buyer.

Section 4.5Sufficiency of Funds. As of the date of this Agreement, Buyer has received an executed equity commitment letter dated the date of this Agreement (the “Equity Commitment Letter”) from Buyer Parent, pursuant to which Buyer Parent has committed, subject to the terms and conditions set forth therein, to provide to Buyer cash in an aggregate amount set forth in the Equity Commitment Letter, which Equity Commitment Letter provides that Midway US is a third party beneficiary thereof. A true and complete copy of the fully executed Equity Commitment Letter as in effect on the date hereof has been provided to Sellers. As of the date of this Agreement, the Equity Commitment Letter is valid and in full force and effect and enforceable in accordance with its terms against Buyer and each other party thereto, except as such enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium or similar Laws affecting creditors’ rights generally and by general principles of equity (regardless of whether enforcement is sought in a proceeding at law or in equity).

Section 4.6Solvency. Immediately after giving effect to the transactions contemplated hereby, Buyer shall be solvent and shall: (a) be able to pay its debts as they become due, (b) own property that has a fair saleable value greater than the amounts required to pay its debts (including a reasonable estimate of the amount of all contingent liabilities), and (c) have adequate capital to carry on its business. No transfer of property is being made and no obligation is being incurred in connection with the transactions contemplated hereby with the intent to hinder, delay or defraud either present or future creditors of Buyer or Sellers. In connection with the transactions contemplated hereby, Buyer has not incurred, nor plans to incur, debts beyond its ability to pay as they become absolute and matured.

21

Section 4.7Legal Proceedings. There are no actions, suits, claims or other legal proceedings pending against or by Buyer or any Affiliate of Buyer that challenge or seek to prevent, enjoin or otherwise delay the transactions contemplated by this Agreement.

Section 4.8Independent Investigation. Buyer has conducted its own independent investigation, review and analysis of the Spring Valley Business, the Additional Spring Valley Business and the Purchased Assets. Buyer acknowledges and agrees that: (i) in making its decision to enter into this Agreement and to consummate the transactions contemplated hereby, Buyer has relied upon its own investigation and the express representations and warranties of Sellers set forth in ARTICLE 3 (including the related portions of the Disclosure Schedules), and (ii) none of Sellers, the Spring Valley Venture or any Affiliate or Representative of Sellers, the Spring Valley Venture or any other Person has made or makes any other express or implied representation or warranty, either written or oral, on behalf of Sellers.

Section 5.1Conduct of Business Prior to the Closing. From the date hereof until the Closing:

Each Seller shall use its commercially reasonable efforts to:

conduct the Additional Spring Valley Business in the ordinary course of business;

maintain and preserve intact the current organization, business and franchise of the Additional Spring Valley Business and to preserve the rights, franchises, goodwill and relationships of the customers, lenders, suppliers, regulators and others having business relationships with the Additional Spring Valley Business;

pay all Taxes when due with respect to the Purchased Assets required to be paid by any Seller and not allow the Purchased Assets to become subject to a lien for Taxes required to be paid by any Seller, other than for Taxes not yet due and payable; and

except (i) as expressly required or permitted by this Agreement, (ii) as required pursuant to applicable Laws, (iii) as set forth in Schedule 5.1, (iv) as consented to in writing by Buyer (which consent shall not be unreasonably withheld, conditioned or delayed), or (v) as required to respond reasonably and prudently to an emergency or disaster (including the right to take forthwith any action required to insure the safety and integrity of the Additional Spring Valley Business), no Seller shall:

acquire any business, other than acquisitions with a purchase price that does not exceed $250,000 individually or $1,000,000 in the aggregate;

sell, transfer, dispose of, lease, encumber, relinquish or abandon any of the Purchased Assets, except (A) pursuant to the exercise of the ROFR (if applicable) or in compliance with a Governmental Order, (B) with respect to Tangible Property, sales and other dispositions in the ordinary course of business or (C) sales, transfers or dispositions of Tangible Property that do not exceed $250,000 in the aggregate (excluding those sales described in clauses (A) or (B));

enter into any Contract that would reasonably be likely to become an Assigned Contract;

hire any employees to work in the Spring Valley Business or the Additional Spring Valley Business;

incur any indebtedness for borrowed money that will constitute an Assumed Liability other than short-term indebtedness, letters of credit or sureties in the ordinary course of business consistent with past practices;

22

make any loans or advances that will be a Purchased Asset to any Person or assume or guarantee the liabilities of any Person that will constitute an Assumed Liability other than in the ordinary course of business;

settle, offer or propose to settle, compromise, assign or release any material proceeding brought against such Seller in respect of or in connection with the Purchased Assets;

enter into any agreement creating a joint venture or partnership or effecting a business combination or other similar arrangement with another Person in respect of any of the Purchased Assets;

permit the Spring Valley Venture to acquire any asset that would materially change the conduct of the business as contemplated by the Exploration Agreement; and

attempt or agree to do any of the foregoing matters listed in clauses (i) through (ix) above.

Section 5.2Access to Information. From the date hereof until the Closing, each Seller shall: (a) afford Buyer and its Representatives reasonable access to and the right to inspect all of the properties, assets, premises, Books and Records, Contracts and other documents and data related to the Additional Spring Valley Business and shall enforce Midway US’s rights under the Exploration Agreement to obtain such access with respect to the Spring Valley Business, (b) furnish Buyer and its Representatives with such financial, operating and other data and information related to the Additional Spring Valley Business as Buyer or any of its Representatives may reasonably request and furnish Buyer and its Representatives with all financial, operating and other data and information received by Sellers from Barrick related to the Spring Valley Business, and (c) instruct the Representatives of such Seller to cooperate with Buyer in its investigation of the Purchased Assets and the Spring Valley Business; provided, however, that any such investigation shall be conducted at Buyer’s sole risk and at Buyer’s sole cost and expense during normal business hours upon reasonable advance notice to such Seller, under the supervision of such Seller’s personnel, in compliance with all of such Seller’s health, safety and environmental regulations and procedures, and in such a manner as not to interfere with the normal operations of the Additional Spring Valley Business or Spring Valley Business. Notwithstanding anything to the contrary in this Agreement, such Seller shall not be required to disclose any information to Buyer if such disclosure would, in such Seller’s discretion: (x) cause significant competitive harm to such Seller, the Additional Spring Valley Business or the Spring Valley Business if the transactions contemplated by this Agreement are not consummated, (y) jeopardize any attorney-client or other privilege, or (z) contravene any applicable Law, fiduciary duty or binding agreement entered into prior to the date of this Agreement. Prior to the Closing, without the prior written consent of such Seller, Buyer shall not contact any suppliers to, or customers of, the Additional Spring Valley Business or the Spring Valley Business and Buyer shall have no right to perform invasive or subsurface investigations of any properties. Buyer shall, and shall cause its Representatives to, abide by the terms of the Confidentiality Agreement with respect to any access or information provided pursuant to this Section 5.2.

Section 5.3Notice of Certain Events. Sellers and Buyer agree that, subject to applicable Law, each shall provide the other prompt notice in writing of:

any notice or communication from any Person alleging that the consent of such Person is or may be required in connection with the transactions contemplated by this Agreement;

any material notice or communication from any Governmental Authority in connection with the transactions contemplated by this Agreement;

any material proceeding commenced or threatened against it which relates to the consummation of the transactions contemplated by this Agreement;

23

any failure by it to comply with or satisfy in any material respect any covenant, condition or agreement to be complied with or satisfied under this Agreement; and

and copies of all documents related thereto, provided that the giving of any such notice shall not in any way change or modify the representations and warranties of the parties or the conditions in their favor contained in this Agreement or otherwise affect the remedies available to Sellers and Buyer under this Agreement.

Section 5.4Confidentiality. Buyer acknowledges and agrees that the Confidentiality Agreement remains in full force and effect and, in addition, covenants and agrees to keep confidential, in accordance with the provisions of the Confidentiality Agreement, information provided to Buyer pursuant to this Agreement. If this Agreement is, for any reason, terminated prior to the Closing, the Confidentiality Agreement and the provisions of this Section 5.4 shall nonetheless continue in full force and effect. Notwithstanding the foregoing provisions of this Section 5.4, the parties hereto agree and acknowledge that (a) this Agreement and any and all schedules, exhibits and other ancillary documents may be disclosed to third parties and filed with the Bankruptcy Court in connection with the Chapter 11 Cases and Sellers’ efforts to obtain entry of the Sale Order by the Bankruptcy Court and (b) such provisions shall not be construed to prohibit or restrict any party hereto or its Affiliates from making disclosures required by, or in connection with, applicable Laws or stock exchange requirements, rules or regulations.

Section 5.5Governmental Approvals and Other Third-Party Consents.

Each party hereto shall, as promptly as possible use commercially reasonable efforts to obtain, or cause to be obtained, all consents, authorizations, orders and approvals from all Governmental Authorities that may be or become necessary for its execution and delivery of this Agreement and the performance of its obligations pursuant to this Agreement, except for consents, authorizations, orders and approvals with respect to Permits that cannot be obtained until after the Closing. Each party shall cooperate fully with the other party and its Affiliates in promptly seeking to obtain all such consents, authorizations, orders and approvals. The parties hereto shall not willfully take any action that will have the effect of delaying, impairing or impeding the receipt of any required consents, authorizations, orders and approvals.

Sellers and Buyer shall use commercially reasonable efforts to give all notices to, and obtain all consents or waivers from, all third parties that are described in Schedule 3.3; provided, however, that (i) the foregoing shall not require Sellers or Buyer to give notices to (other than the notices provided for in Section 5.20(b)(ii)), or obtain consents or waivers from, any non-debtor parties to Material Contracts regarding assignments thereof to Buyer and (ii) neither Sellers nor Buyer shall be obligated to pay any consideration therefor to any third party from whom consent or approval is requested, other than customary filing fees.

Section 5.6Right of First Refusal

Sellers shall give or cause to be given such required notices to the holder of the ROFR as a result of entry into this Agreement. To the extent permitted by the ROFR, Sellers shall provide to Buyer copies of all written notices and written responses received in response to the notices given by Sellers pursuant to this Section 5.6. Buyer shall, at the request of Sellers, co-operate with Sellers and use all reasonable efforts to assist Sellers to comply with the provisions of this Section 5.6 and shall promptly give to Sellers such information and copies of such documents relating to Buyer which Sellers may reasonably request from time to time as is necessary and appropriate in order to comply with the provisions of this

24

Section 5.6. Buyer and Sellers shall use all reasonable efforts to obtain a waiver from Barrick of any rights it has under the ROFR with respect to the transactions contemplated by this Agreement.

The parties agree to cooperate in good faith to take such actions and execute such documents or instruments as may be necessary or desirable in order to effectuate the provisions of this Section 5.6.

(i) Sellers intend that nothing in this Agreement shall be construed as an admission, concession, acknowledgment or agreement that Barrick or any other party has any rights under the ROFR as a result of the parties’ execution and delivery of, the entering into, and/or the consummation of the transactions contemplated in, this Agreement and (ii) Sellers reserve all rights to challenge, contest or otherwise take the position that neither Barrick nor any other party has any rights under the ROFR as a result of the parties’ execution and delivery of, the entering into, and/or the consummation of the transactions contemplated in, this Agreement.

In order to facilitate the resolution of any claims made against or incurred by any Seller prior to the Closing, or for any other reasonable purpose, for a period of seven years after the Closing, Buyer shall: (i) retain the Books and Records (including personnel files) of the Spring Valley Business delivered to Buyer relating to periods prior to the Closing in accordance with Buyer’s document retention policies, and (ii) upon reasonable notice, afford the Representatives of such Seller reasonable access (including the right to make, at such Seller’s expense, photocopies), during normal business hours, to those portions, and only those portions, of such Books and Records as relate to the Purchased Assets prior to Closing and, if required by Buyer, subject to such Seller executing a non-disclosure agreement with respect to such information, in form and substance acceptable to the parties, acting reasonably.

Buyer shall not be obligated to provide any Seller with access to any books or records (including personnel files) pursuant to this Section 5.7 where such access would violate any Law.

Section 5.8Closing Conditions. From the date hereof until the Closing, each party hereto shall use commercially reasonable efforts to take such actions as are necessary to expeditiously satisfy the closing conditions set forth in ARTICLE 6 for which it is responsible.

Section 5.9Public Announcements. Sellers and Buyer shall consult with each other prior to issuing any press releases or otherwise making public statements with respect to this Agreement or the transactions contemplated by this Agreement and, to the extent practicable, shall provide the other parties with no less than two Business Days to review and comment on all such press releases or statements prior to the release thereof. To the extent that any such press release or public statement is required by applicable Law, by a rule of a stock exchange on which a party’s shares (or those of any of its Affiliates) are listed or traded or by a Governmental Authority, the press release or public announcement shall be issued or made after consultation with the other parties and after taking into account the other parties’ comments. If such advance consultation is not reasonably practicable or legally permitted, to the extent permitted by applicable Law, the disclosing party shall provide the other parties with a copy of any written disclosure made by such disclosing party as soon as practicable thereafter.

Section 5.10Further Assurances. Following the Closing, each of the parties hereto shall, and shall cause their respective Affiliates to, execute and deliver such additional documents, instruments, conveyances and assurances and take such further actions as may be reasonably required to vest title to the Purchased Assets in Buyer, carry out the provisions hereof and give effect to the transactions contemplated by this Agreement, in each case, at the sole cost and expense of the requesting party; provided that with respect to any Purchased Asset that is not transferred by Sellers at Closing , any such cost and expense shall be borne by Sellers.

25

Transfer Taxes. All transfer, documentary, sales, use, stamp, registration, value added and other such Taxes and fees (including any penalties and interest) incurred in connection with this Agreement (including any real property transfer Tax and any other similar Tax) (all such Taxes collectively, “Transfer Taxes”) shall be borne and paid by Buyer when due. Buyer shall, at its own expense, timely file any Tax Return with respect to Transfer Taxes (and Sellers shall cooperate with respect thereto as necessary). Each of Buyer and Sellers agree to timely sign and deliver (or to cause to be timely signed and delivered) such certificates or forms as may be necessary or appropriate and otherwise to cooperate to establish any available exemption from (or otherwise reduce) any Transfer Taxes.