Attached files

| file | filename |

|---|---|

| EX-31.2 - EX-31.2 - VERU INC. | c894-20150930xex312.htm |

| EX-31.1 - EX-31.1 - VERU INC. | c894-20150930xex311.htm |

| EX-23.1 - EX-23.1 - VERU INC. | c894-20150930xex231.htm |

| EX-10.29 - EX-10.29 - VERU INC. | c894-20150930ex1029e165b.htm |

| EX-10.9 - EX-10.9 - VERU INC. | c894-20150930ex1097330b1.htm |

| EX-10.24 - EX-10.24 - VERU INC. | c894-20150930ex102447ca7.htm |

| EX-32.1 - EX-32.1 - VERU INC. | c894-20150930xex321.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

|

|

|

|

☑ |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2015

|

|

|

|

|

☐ |

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-13602

The Female Health Company

(Name of registrant as specified in its charter)

|

|

|

|

|

Wisconsin |

|

39-1144397 |

|

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

515 N. State Street, Suite 2225, Chicago, Illinois |

|

60654 |

|

|

|

|

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (312) 595-9123

Securities registered under Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Name of each exchange on which registered |

|

Common stock, $.01 par value |

|

NASDAQ Stock Market |

|

|

|

|

Securities registered under Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☑

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

1

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

|

|

Accelerated filer |

☑ |

|

|

|

|

|

|

|

|

Non-accelerated filer |

☐ |

(Do not check if a smaller reporting company) |

|

Smaller reporting company |

☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the voting stock held by non-affiliates of the registrant as of March 31, 2015, was approximately $75.0 million based on the per share closing price as of March 31, 2015 quoted on the NASDAQ Capital Market for the registrant’s common stock, which was $2.83.

There were 29,023,832 shares of the registrant’s common stock, $0.01 par value per share outstanding at November 27, 2015.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the Proxy Statement for the 2016 Annual Meeting of the Shareholders of the Registrant are incorporated by reference into Part III of this report.

As used in this report, the terms “we,” “us,” “our,” “The Female Health Company,” “FHC” and the “Company” mean The Female Health Company and its subsidiaries collectively, unless the context indicates another meaning, and the term "common stock" means shares of our common stock, par value of $0.01 per share.

2

THE FEMALE HEALTH COMPANY

FORM 10-K

September 30, 2015

|

PART I |

Page |

|||

|

|

5 |

|

||

|

|

12 |

|

||

|

|

15 |

|

||

|

|

16 |

|

||

|

|

16 |

|

||

|

|

16 |

|

||

|

|

|

|

|

|

|

PART II |

|

|

|

|

|

|

|

|

|

|

|

|

17 |

|

||

|

|

19 |

|

||

|

Management's Discussion and Analysis of Financial Condition and Results of Operations |

|

20 |

|

|

|

|

26 |

|

||

|

|

26 |

|

||

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

|

26 |

|

|

|

|

26 |

|

||

|

|

26 |

|

||

|

|

|

|

|

|

|

PART III |

|

|

|

|

|

|

|

|

|

|

|

|

28 |

|

||

|

|

28 |

|

||

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

28 |

|

|

|

Certain Relationships and Related Transactions, and Director Independence |

|

29 |

|

|

|

|

29 |

|

||

|

|

|

|

|

|

|

PART IV |

|

|

|

|

|

|

|

|

|

|

|

|

30 |

|

||

|

|

|

34 |

|

|

3

FORWARD-LOOKING STATEMENTS

Certain statements included in this Annual Report on Form 10-K which are not statements of historical fact are intended to be, and are hereby identified as, "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the use of forward-looking words or phrases such as "anticipate," "believe," "could," "expect," "intend," "may," "opportunity," "plan," "predict," "potential," "estimate," "will," "would" or the negative of these terms or other words of similar meaning. These statements are based upon the Company's current plans and strategies, and reflect the Company's current assessment of the risks and uncertainties related to its business, and are made as of the date of this report. The Company cautions readers that forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, but are not limited to, those described under the caption "Risk Factors" in Item 1A. of this report. The Company undertakes no obligation to make any revisions to the forward-looking statements contained in this report or to update them to reflect events or circumstances occurring after the date of this report.

4

PART I

General

The Female Health Company manufactures, markets, and sells the FC2 Female Condom (FC2). FC2 is the only currently available female-controlled product approved by the U.S. Food and Drug Administration (FDA) and cleared by the World Health Organization (WHO) for purchase by U.N. agencies that provides dual protection against unintended pregnancy and sexually transmitted infections (STIs), including HIV/AIDS. FC2 was approved by the FDA as a Class III medical device in 2009.

FC2’s primary usages are for disease prevention and family planning, and the public health sector is the Company’s main market. Within the public health sector, various organizations supply critical products such as FC2, at no cost or low cost, to those who need but cannot afford to buy such products for themselves.

The Company has a relatively small customer base, with a limited number of customers who generally purchase in large quantities. Over the past few years, significant customers have included large global agencies, such as the United Nations Population Fund (UNFPA) and the United States Agency for International Development (USAID), through its facilitator, John Snow, Inc., Sekunjalo Investments Corporation (PTY) Ltd (Sekunjalo), the Company’s distributor in the Republic of South Africa (RSA), and the Brazil Ministry of Health either through UNFPA or Semina Indústria e Comércio Ltda (Semina), the Company’s distributor in Brazil. Other customers include ministries of health or other governmental agencies, which either purchase directly or via in-country distributors, and non-governmental organizations (NGOs).

FC2 has been distributed in 144 countries. A significant number of countries with the highest demand potential are in the developing world. The incidence of HIV/AIDS, other STIs, and unwanted pregnancy in these countries represents a remarkable potential for significant sales of a product that benefits some of the world’s most underprivileged people. However, conditions in these countries can be volatile and result in unpredictable delays in program development, tender applications, and processing orders.

Purchasing patterns vary significantly from one customer to another, and may reflect factors other than simple demand. For example, some governmental agencies purchase through a formal procurement process in which a tender (request for bid) is issued for either a specific or a maximum unit quantity. Tenders also define the other elements required for a qualified bid submission (such as product specifications, regulatory approvals, clearance by WHO, unit pricing, and delivery timetable). Bidders have a limited period of time in which to submit bids. Bids are subjected to an evaluation process which is intended to conclude with a tender award to the successful bidder. The entire tender process, from publication to award, may take many months to complete. A tender award indicates acceptance of the bidder’s price rather than an order or guarantee of the purchase of any minimum number of units. Many governmental tenders are stated to be “up to” the maximum number of units, which gives the applicable government agency discretion to purchase less than the full maximum tender amount. Orders are placed after the tender is awarded; there are often no set dates for orders in the tender and there are no guarantees as to the timing or amount of actual orders or shipments. Orders received may vary from the amount of the tender award based on a number of factors including vendor supply capacity, quality inspections, and changes in demand. Administrative issues, politics, bureaucracy, process errors, changes in leadership, funding priorities, and/or other pressures may delay or derail the process and affect the purchasing patterns of public sector customers. As a result, the Company may experience significant quarter-to-quarter sales variations due to the timing and shipment of large orders.

The Company currently operates in one industry segment which includes the development, manufacture, and marketing of consumer health care products. Therefore, no segment data is disclosed in the Notes to the Consolidated Financial Statements contained in this report. Information regarding the Company's operations by geographic area is included in Note 10 in the Notes to the Consolidated Financial Statements contained in this report.

Company History

The female condom was invented by a Danish physician who obtained a U.S. patent for FC1, the Company’s first generation product, in 1988. The physician subsequently sold certain rights to the condom to Chartex Resources Limited (Chartex). In the years that followed, Chartex, with resources provided by a Danish entrepreneur and a nonprofit Danish foundation, developed the manufacturing processes and completed other activities associated with bringing the female condom to market in certain non-U.S. countries. The Wisconsin Pharmacal Company, Inc. (Wisconsin Pharmacal) owned certain rights to the female condom in the U.S., Canada, and Mexico. Wisconsin Pharmacal pursued the pre-clinical and clinical studies and overall development of the product, necessary for U.S. FDA approval and worldwide distribution of the product.

The Female Health Company is the successor to Wisconsin Pharmacal, a company which manufactured and marketed disparate specialty chemical and branded consumer products. Wisconsin Pharmacal was originally incorporated in 1971.

5

In fiscal 1995, the Company's Board of Directors approved a plan to complete a series of actions designed, in part, to maximize the potential of the Female Condom. First, the Company restructured and transferred the Wisconsin Pharmacal name and all of the assets and liabilities of the Company other than those related to the Female Condom to a newly formed, wholly-owned subsidiary of the Company, WPC Holdings, Inc. (Holdings). In January 1996, the Company sold Holdings to an unrelated third party. Then, in February 1996, the Company acquired Chartex. At the same time, the Company was renamed The Female Health Company. As a result of the sale of Holdings and the acquisition of Chartex, The Female Health Company evolved to its current state with its sole business consisting of the manufacture, marketing, and sale of the Female Condom.

The FDA approved FC1 for distribution in the U.S. in 1993 and approved the Company's U.K. FC1 manufacturing facility in 1994. FC1 was produced from a costly raw material, polyurethane, in a labor intensive manufacturing process in London, England. To expand women’s access to the female condom, increase sales volume, reduce costs, and significantly increase gross margin, the Company developed its second generation Female Condom, FC2, which was completed in 2005. The second generation product is made from a less costly raw material, a nitrile polymer. FC2’s production process is more efficient and less labor and capital intensive than that of FC1, making it less costly to produce. Its price is now approximately 30 percent less than FC1. FC2 is currently being produced at the Company’s facility in Selangor D.E., Malaysia. Production in London was discontinued with the final shipment of FC1 in October 2009. As a result of the successful development of FC2, the Company was able to both reduce the price to the public health sector and increase its gross margin.

FC2 was first marketed internationally in March 2007 and has been marketed in the U.S. since August 2009. In October 2009, the Company completed the transition from its first generation product, FC1, to its second generation product, FC2, and production of FC1 ceased. The Company retains ownership of certain world-wide rights, as well as various patents, regulatory approvals, and other intellectual property related to FC1.

FC2 was approved by the FDA as a Class III medical device on March 10, 2009. In addition to FDA approval, FC2 has been approved by other regulatory agencies, including the European Union, India, and Brazil. Based on a rigorous scientific review, WHO cleared FC2 for purchase by U.N. agencies in 2006.

Since FC2’s introduction in March 2007 through September 30, 2015, approximately 329 million FC2’s have been distributed in 144 countries. It is marketed to consumers through distributors, global public sector procurement organizations, and retailers in 16 countries. Since the first FDA approval in 1993 through September 30, 2015, the Company has manufactured and sold approximately 504 million Female Condoms (FC1 and FC2).

Strategy

The Company’s strategy is to fully develop global markets for FC2 for both contraception and STI prevention, including HIV/AIDS. Since the introduction of its first generation product, FC1, the Company has developed contacts and relationships with global public health sector organizations such as WHO, UNFPA, USAID, and the United Nations Joint Programme on HIV/AIDS (UNAIDS), country-specific health ministries, NGOs and commercial partners in various countries. The Company has representatives in various locations around the world to provide technical sales support and assist with its customers’ prevention and family planning programs.

In July 2014, the Company announced a new growth strategy with two key elements. The first element seeks to accelerate demand for FC2 by strengthening key customer relationships and creating greater awareness of FC2 in our current markets through increased sales and marketing efforts. The Company is currently evaluating the potential for FC2 in consumer markets in the U.S, to be followed by certain European and other markets. The Company believes its increased sales and marketing investment will accelerate global demand for FC2. The second element of the Company’s new growth strategy is product diversification. The Company is actively pursuing the potential acquisition of additional products, technologies, and businesses.

Products

Currently, there are only two FDA approved and marketed products that prevent the transmission of HIV/AIDS through sexual intercourse: the male condom and FC2. FC2 is currently the only FDA approved and marketed female-controlled product that prevents STIs, including HIV/AIDS. Used consistently and correctly, FC2 provides women dual protection against STIs, including HIV/AIDS, and unintended pregnancy. When used correctly the protection rates against unintended pregnancies are 95 percent for female condoms compared to 98 percent for male condoms according to the FDA. FC2 is not seen as directly competing with the male condom; it provides an alternative to either unprotected sex or male condom usage.

6

An economic analysis of the cost effectiveness of an FC2 HIV/AIDS prevention program conducted by Dr. David Holtgrave, the chairman of the Department of Health Behavior and Society at the Johns Hopkins Bloomberg School of Public Health, was featured in the March 26, 2012 issue of AIDS and Behavior. The study showed that the Washington, D.C. FC2 prevention program, a public-private partnership to provide and promote FC2, prevented enough HIV infections in the first year alone to save over $8 million in avoided future medical care costs (over and above the cost of approximately $445,000 for the program). This means that for every dollar spent on the program, there was a cost savings of nearly $20. In the article Dr. Holtgrave concluded, “These results clearly indicate that delivery of, and education about, Female Condoms is an effective HIV prevention intervention and an outstanding public health investment.” Washington, D.C. began its program in 2010 to fight a disease that is at epidemic levels. At least 3 percent of Washington, D.C. residents have HIV or AIDS, a prevalence rate that is the highest of any U.S. city.

In May 2014, a business case was published by Global Health Visions, LLC, commissioned by Rutgers WPF, the advocacy partner of the Universal Access to Female Condoms (UAFC) Joint Programme. Part of the publication was a study comparing total expected costs with total estimated economical benefits and it determined there was an excellent return on investment for female condoms in sub-Saharan Africa. For example, in Nigeria an investment of $1 offers a $3.20 return on investment to the country’s economy.

Numerous clinical and behavioral studies have been conducted regarding use of the female condom. Studies show that in many cultures, the female condom is found acceptable by women and their partners. Importantly, studies also show that when the female condom is made available as an option along with male condoms there is a significant increase in protected sex acts with a concurrent decrease in STIs. The increase in protected sex acts varies by country and averages between 10 percent and 35 percent.

FC2 has basically the same physical design, specifications, safety, and efficacy profile as FC1. Manufactured from a nitrile polymer formulation that is exclusive to the Company, FC2 is produced more economically than FC1, which was made from a more costly raw material, polyurethane. FC2 consists of a soft, loose fitting sheath and two rings: an external ring of rolled nitrile and a loose internal ring made of flexible polyurethane. FC2’s soft sheath lines the vagina, preventing skin-to-skin contact during intercourse. Its external ring remains outside the vagina, partially covering the external genitalia. The internal ring is used for insertion and helps keep the device in place during use.

FC2’s primary raw material, a nitrile polymer, offers a number of benefits over natural rubber latex, the raw material most commonly used in male condoms. FC2’s nitrile polymer is stronger than latex, reducing the probability that the female condom sheath will tear during use. Unlike latex, FC2’s nitrile polymer quickly transfers heat. FC2 can warm to body temperature immediately upon insertion, which may enhance the user’s sensation and pleasure. Unlike the male condom, FC2 may be inserted in advance of arousal, eliminating disruption during sexual intimacy. FC2 is also an alternative to latex sensitive users who are unable to use male condoms without irritation. For example, 7 percent to 20 percent of the individuals with significant exposure to latex rubber (i.e., health care workers) experience such irritation. To the Company's knowledge, there is no reported allergy to the nitrile polymer. FC2 is pre-lubricated, disposable, and recommended for use during a single sex act. FC2 is not reusable.

Global Market Potential

Because FC2 offers a woman dual protection against both unintended pregnancy and STIs, including HIV/AIDS, its market encompasses both family planning and disease prevention.

Disease Prevention. The first clinical evidence of AIDS was noted more than thirty years ago. Since then, HIV/AIDS has become the most devastating pandemic facing humankind in recorded history. In November 2009, WHO released statistics indicating that on a world-wide basis, HIV/AIDS is now the leading cause of death in women 15 to 44 years of age. According to WHO, in 2012 worldwide women comprised 50 percent of all the adults living with HIV and approximately 58 percent of all new adult cases of HIV/AIDS in Sub-Saharan Africa. In the United States the Centers for Disease Control and Prevention (CDC) and FDA both list heterosexual sex as the most common method of HIV transmission in women.

For sexually active couples, male condoms and FC2 are the only barrier methods approved by the FDA for preventing sexual transmission of HIV/AIDS. In recent years, scientists have sought to develop alternative means of preventing HIV/AIDS. Based on the complexities of such research, a viable prevention alternative is unlikely to be available in the foreseeable future. To date, it is clear that condoms, male and female, continue to play a key role in the prevention of STIs, including HIV/AIDS. UNAIDS has reported that, since the beginning of the HIV/AIDS epidemic, it is estimated that condoms have averted approximately 50 million new cases. FC2, when used consistently and correctly, gives a woman control over her sexual health by providing dual protection against STIs, including HIV/AIDS, and unintended pregnancy.

7

In the United States, the CDC continues to report that the HIV/AIDS epidemic is taking an increasing toll on women and girls. Women of color, particularly black women, have been especially hard hit. Women of color comprise both the majority of new HIV and AIDS cases among women and the majority of women living with the disease. In 2010, the CDC listed the rate of new HIV infection for black women as approximately 8 times the rate for white women in the United States. In 2010, in the United States, it estimated that one in 32 black women would be diagnosed with HIV in her lifetime, compared to the one in 526 incidence rate amongst white women.

The CDC estimates there are 20 million new cases of STIs that they track in the U.S. each year. It is also estimated that over 24,000 women each year in the U.S. lose the ability to conceive or carry a pregnancy to term due to undiagnosed or untreated STIs. In March 2008, the CDC announced that a study indicated 26 percent of female adolescents in the U.S. have at least one of the most common STIs. Led by the CDC’s Sara Forhan, the study is the first to examine the combined national prevalence of common STIs among adolescent women in the U.S. In addition to overall STI prevalence, the study found that by race, African American teenage girls had the highest prevalence, with an overall prevalence of 48 percent compared to 20 percent among both whites and Mexican Americans. Overall, approximately half of all the teens in the study reported ever having sex. Among these girls, the STI prevalence was 40 percent.

On November 29, 2012, in conjunction with World AIDS Day, U.S. Secretary of State Hillary Clinton, as part of the President’s Emergency Plan For AIDS Relief (PEPFAR), issued a blueprint for an AIDS Free Generation. In the blueprint it states that female condoms are unique in providing a female-controlled HIV prevention option and that PEPFAR will work with partner governments and other donors to promote female condoms wherever effective programs can build a sustained demand.

On December 3, 2013, donors pledged $12 billion, which includes $1.5 billion from the U.K. Government, over a 3 year period to the Global Fund to Fight AIDS, Tuberculosis and Malaria.

Contraception. The feminization of HIV/AIDS has increased the relevance of FC2 for the prevention of unintended pregnancies as well as disease prevention. Unintended pregnancy may result in maternal and infant death, babies with HIV/AIDS, AIDS orphans, and increased health care costs.

On July 11, 2012, World Population Day, the U.K. Government and the Bill and Melinda Gates Foundation held a Summit on Family Planning in London, England (the London Summit). It was attended by public health officials, government officials, and private sector companies that supply contraceptives and related products. FHC was one of only fourteen companies, and the only condom manufacturer, invited to attend the London Summit. The primary goal of the London Summit was to increase access to contraceptives to an additional 120 million poor women in 69 developing countries by 2020.

The Condom Market

The global public health sector market for male condoms is estimated to be greater than 8-10 billion units annually. The private sector market for male condoms is estimated at 10-15 billion units annually. The combined global male condom market (public and private sector) is estimated at a value of $4.5 billion annually. The female condom market represents a very small portion of the total global condom market.

Government Regulation

Female condoms as a group were classified by the FDA as a Class III medical device in 1989. Class III medical devices are deemed by the FDA to carry potential risks with use which must be tested prior to FDA approval, referred to as Premarket Approval (PMA), for sale in the U.S. As FC2 is a Class III medical device, prior to selling FC2 in the U.S., the Company was required to submit a PMA application containing technical information on the use of FC2, such as pre-clinical and clinical safety and efficacy studies, which was gathered together in a required format and content. The FC2 PMA was approved by the FDA as a Class III medical device in March 2009.

FC2 received the CE Mark which allows it to be marketed throughout the European Union. FC2 has also been approved by regulatory authorities in Brazil, India, Canada, and other jurisdictions.

8

In the U.S., FC2 is regulated by the FDA. Pursuant to section 515(a)(3) of the Safe Medical Amendments Act of 1990 (the SMA Act), the FDA may temporarily suspend approval and initiate withdrawal of the PMA if the FDA finds that FC2 is unsafe or ineffective, or on the basis of new information with respect to the device, which, when evaluated together with information available at the time of approval, indicates a lack of reasonable assurance that the device is safe or effective under the conditions of use prescribed, recommended, or suggested in the labeling. Failure to comply with the conditions of FDA approval invalidates the approval order. Commercial distribution of a device that is not in compliance with these conditions is a violation of the SMA Act. As an FDA approved medical device, the facilities in which FC2 is produced and tested are subject to periodic FDA inspection to ensure compliance with current Good Manufacturing Processes. The Company’s most recent FDA inspection was completed in September 2010.

The FDA’s approval order for FC2 includes conditions that relate to product labeling, including information on the package itself and instructions for use called a “package insert” which accompanies each product. The Company believes it is in compliance with the FDA approval order.

The Company’s facility may also be subject to inspection by UNFPA, USAID, International Organization for Standardization (ISO), and country specific ministries of health.

Significant Customers

Because FC2 provides dual protection against both STIs, including HIV/AIDS, and unintended pregnancy, it is an integral part of both HIV/AIDS prevention and family planning programs throughout the world. These programs are typically supplied by global public health sector buyers who purchase products for distribution, at low cost or no cost, to those who need but cannot afford to buy such products themselves. Within the global public health sector are large global agencies, such as UNFPA, USAID, DFID (the U.K.’s Department for International Development), and PSI (Population Services International), other social marketing groups, various government health agencies, and NGOs. The Company’s most significant customers are either global public health sector agencies, country specific ministries of health, or those who facilitate their purchases and/or distribution.

The Company's three largest customers in fiscal 2015 were the Brazil Ministry of Health (through Semina), UNFPA, and USAID. Semina accounted for 47 percent of unit sales in fiscal 2015 and less than 10 percent of unit sales in fiscal 2014 and 2013. UNFPA accounted for 18 percent of unit sales in fiscal 2015, 40 percent of unit sales in fiscal 2014, and 62 percent of unit sales in fiscal 2013. USAID accounted for 16 percent of unit sales in fiscal 2015, 17 percent of unit sales in fiscal 2014, and less than 10 percent of unit sales in fiscal 2013. Sekunjalo accounted for less than 10 percent of unit sales in fiscal 2015, 13 percent of unit sales in fiscal 2014, and less than 10 percent of unit sales in fiscal 2013. Azinor International Lda, a customer in Angola (Azinor), accounted for 11 percent of unit sales in fiscal 2014. No other single customer accounted for more than 10 percent of unit sales in fiscal 2015, 2014, or 2013. The Company considers its most significant customers to be UNFPA, USAID, Sekunjalo, and the Brazil Ministry of Health (either through UNFPA or Semina).

Commercial Markets – Direct to Consumers

The Company has distribution agreements and other arrangements with commercial partners which market to consumers through distributors and retailers in 16 countries, including the United States, Brazil, Spain, France, and the United Kingdom. These agreements are generally exclusive for a single country. Under these agreements, the Company sells FC2 to the distributor partners, who market and distribute the product to consumers in the established territory.

In the U.S., FHC initiated the FC2 College Health Mini-Grant Program in early 2013. The objective is to create awareness and sexual health knowledge that results in FC2 online/in-store retail purchases by young women and men. Education and training is the key content element for this program, similar to the public sector. College health and wellness centers were contacted and advised that they could apply to participate in the FC2 Program. During the pilot, FHC provided a mini-grant ($50-$500) and related education and training materials to help start or enhance an on-campus FC2 program. Grants were awarded based on a school’s intention to (1) raise awareness of FC2 on campus, (2) increase access to FC2 on campus, and (3) enhance students’ capacity to effectively and accurately use FC2. The pilot regions for The FC2 College Campus Program were determined through selection of the following four American College Health Associations Regional Affiliates: New England, New York, South, and South West College Health Associations. In total 30 colleges were chosen to receive grants for The FC2 College Campus Program, including Colgate University, Tulane University, and Duke University, plus student groups from institutions such as Boston College and University of Florida.

Due to the pilot program’s success, the program was implemented in 2014 with 20 schools chosen to receive grants between $500 and $1,000 along with related education and training materials. In 2015, 49 schools were chosen to receive an in kind donation of 300 FC2’s along with related education and training materials.

9

The Company is currently evaluating the potential for FC2 in consumer markets in the U.S., to be followed by certain European and other markets. Some recent changes in the market environment may represent an opportunity for the promotion of FC2 to consumers:

|

· |

FC2 is now reimbursable under the Affordable Care Act and most health plans. FC2 was registered and now has a UPC code to support reimbursement. |

|

· |

Increased public focus on preventing unwanted pregnancy and disease in young women. |

|

· |

The rise of social media in marketing to young women. |

|

· |

Increased online purchasing of condoms. It is estimated 33 percent of male condoms are purchased online. |

The Company believes the promotion of FC2 to consumers will be complementary to public sector marketing by increasing awareness of FC2.

An online store for direct-to-consumer purchases, ShopFemaleHealth.com, was launched in March 2015. Additionally, FC2 may now be purchased online through various ecommerce websites, including (but not limited to): Amazon.com, Walgreens.com, Drugstore.com, and MyQuestStore.com.

The Company has formed a medical advisory board to assist with determining the optimal approach to inform health care professionals of the benefits of FC2. Sampling and support information at gynecological practices is one tactic employed.

Relationships and Agreements with Public Health Sector Organizations

The Company’s customers are primarily large global agencies, NGOs, ministries of health, and other government agencies which purchase and distribute FC2 for use in HIV/AIDS prevention and family planning programs. The Company offers uniform, volume-based pricing to such agencies, rather than entering into long-term supply agreements.

In the U.S., FC2 is sold to city and state public health clinics as well as not-for-profit organizations such as Planned Parenthood. Municipal and state departments of health have been increasing access to FC2 within established condom programming. Chicago, Los Angeles, San Francisco, New York, and Washington, D.C. are all examples of cities with programs providing female and male condoms free of charge. In New York City, as of September 30, 2015, FC2 has been distributed to 1,760 locations.

The Company has encouraged growth in the U.S. through education and program development support. To make health professional education broadly available, the Company introduced its FC2 Online Training Program in March 2012.

The National Female Condom Coalition (NFCC) and UAFC sponsored the fourth annual Global Female Condom Day on September 16, 2015. The 2015 Global Female Condom Day drew greater attention and participation than in the previous years. Public events highlighting the need for access to female condoms and promoting their use in family planning and disease prevention were organized around the world and in the U.S., including events specifically initiated or co-sponsored by the Company.

Globally, the Company has a multilingual website that provides downloadable training and education information in English, Portuguese, Spanish, and French.

Outside of the U.S., training and education sessions were held in 10 countries, with an estimated 32,000 people participating in the sessions in 2015.

Employees

As of November 27, 2015, the Company had 180 full-time employees, including 11 located in the U.S., 13 in the U.K., 154 in Malaysia, and 2 in other countries to implement training and programs, and 1 part-time employee located in the U.S. None of the Company’s employees are represented by a labor union. The Company believes that its employee relations are good. In Malaysia, a significant proportion of direct labor is supplied by a contracted work force.

Environmental Regulation

The Company believes there are no material issues or material costs associated with the Company's compliance with environmental laws related to the manufacture and distribution of FC2. The Company has not incurred environmental expenses in fiscal 2015, 2014, or 2013, nor does it anticipate environmental expenses in the foreseeable future.

10

Raw Materials

The principal raw material used to produce FC2 is a nitrile polymer. While general nitrile formulations are available from a number of suppliers, the Company has chosen to work closely with the technical market leader in synthetic polymers to develop a grade ideally suited to the bio-compatibility and functional needs of a female condom. As a result, the Company relies on supply for its principal raw material from one supplier that could produce the raw material from multiple supply points within its organization.

Manufacturing Facilities

The Company leases production space in Selangor D.E., Malaysia for the production of FC2, which currently has manufacturing capacity of approximately 100 million units annually. In fiscal 2014 the Company added additional space, resulting in a total of 45,800 sq. ft. in the Company’s Malaysia facility, comprised of production and warehouse space and which provides sufficient space to add manufacturing capacity of up to an additional 100 million units annually. The Company will consider manufacturing in other locations as the demand for FC2 develops.

Competition

FC2 participates in the same market as male condoms; however, it is not seen as directly competing with male condoms. Rather, studies show that providing FC2 is additive in terms of prevention and choice. Male condoms cost less and have brand names that are more widely recognized than FC2. In addition, male condoms are generally manufactured and marketed by companies with significantly greater financial resources than the Company.

Other parties have developed and marketed female condoms. None of these female condoms marketed or under development by other parties have secured FDA approval. FDA approval is required to sell female condoms in the U.S. The Cupid female condom became the second female condom design to successfully complete the WHO prequalification process in July 2012 and be cleared for purchase by U.N. agencies. FC2 has also been competing with other female condoms in markets that do not require either FDA approval or WHO prequalification. We have experienced increasing competition in the global public sector, and competitors including Cupid received part of the last two South African tenders. Increasing competition in FC2’s markets may put pressure on pricing for FC2 or adversely affect sales of FC2, and some customers, particularly in the global public sector, may prioritize price over other features where FC2 may have an advantage. It is also possible that other female condoms may receive FDA approval or complete the WHO prequalification process, which would increase competition from other female condoms in FC2’s markets.

Patents and Trademarks

FC2 patents have been issued by the United States, Europe, Canada, Australia, South Africa, the People’s Republic of China, Japan, Mexico, Brazil, India and the African Regional Intellectual Property Organization (ARIPO), which includes Botswana, Gambia, Ghana, Kenya, Lesotho, Malawi, Mozambique, Namibia, Sierra Leone, Sudan, Swaziland, Tanzania, Uganda, Zambia, and Zimbabwe. Further, the European patent for FC2 has been validated in the following countries: Austria, Belgium, Bulgaria, Switzerland, Republic of Cyprus, Czech Republic, Germany, Denmark, Estonia, Spain, Finland, France, United Kingdom, Greece, Hungary, Ireland, Italy, Luxembourg, Monaco, Netherlands, Portugal, Romania, Sweden, Slovenia, Slovakia, and Turkey. The patents cover the key aspects of FC2, including its overall design and manufacturing process. The patents have expiration dates in 2023 and 2024. In addition, patent applications for FC2 are pending in a number of other countries around the world. There can be no assurance that pending patent applications provide the Company with protection against copycat products entering markets during the pendency of the applications.

The Company has a registration for the trademark “FC2 Female Condom” in the United States. Furthermore, the Company has filed applications or secured registrations in 39 countries or jurisdictions around the world to protect the various names and symbols used in marketing FC2. In addition, the experience that has been gained through years of manufacturing its Female Condoms (FC1 and FC2) has allowed the Company to develop trade secrets and know-how, including certain proprietary production technologies, that further protect its competitive position.

Backlog

Unfilled product orders totaled $7,386,526 at November 27, 2015 and $9,848,220 at November 28, 2014. Unfilled orders materially fluctuate from quarter-to-quarter, and the amount at November 27, 2015 includes orders with requested delivery dates later in fiscal 2016. The Company expects current unfilled orders to be filled during fiscal 2016.

11

Available Information

The Company maintains a corporate website for investors at www.fhcinvestor.com and it makes available, free of charge, through this website its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports that the Company files with or furnishes to the Securities and Exchange Commission (SEC), as soon as reasonably practicable after it electronically files such material with, or furnishes it to, the SEC. Information on the Company's website is not part of this report.

You should carefully consider the risks described below, together with all of the other information included in this Annual Report and our other SEC filings, in considering our business and prospects. The risks described below are not the only risks we face. Additional risks that we do not yet know of or that we currently think are immaterial may also impair our business operations. If any of the events or circumstances described in the following risks occur, our business, financial condition, or results of operations could be materially adversely affected. In such cases, the trading price of our common stock could decline.

Our success is dependent upon the success of FC2.

At this time, we derive our revenues from sales of our only current product, FC2. The ultimate level of demand for FC2 is uncertain, and we may not be able to grow our business if demand for FC2 does not increase. We also depend on public sector agencies around the world to continue to include FC2 in their STI prevention and family planning programs, and on our commercial sector distribution partners to successfully market and distribute FC2. A decline in demand for FC2 would reduce our net revenues and profitability.

Our business may be affected by contracting risks with government and other international health agencies.

Our customers are primarily large international agencies and government health agencies which purchase and distribute FC2 for use in family planning and HIV/AIDS prevention programs. Sales to such agencies may be subject to government contracting risks, including the appropriations process and funding priorities, potential bureaucratic delays in awarding contracts under governmental tenders, process errors, politics or other pressures, and the risk that contracts may be subject to cancellation, delay, or restructuring. A governmental tender award indicates acceptance of the bidder’s price rather than an order or guarantee of the purchase of any minimum number of units. Many governmental tenders are stated to be “up to” the maximum number of units, which gives the applicable government agency discretion to purchase less than the full maximum tender amount. As a result, government agencies may order and purchase fewer units than the full maximum tender amount and there are no guarantees as to the timing or amount of actual orders or shipments under government tenders. Orders received may vary from the amount of the tender award based on a number of factors, including vendor supply capacity, quality inspections, and changes in demand. These contracting risks may cause significant quarter-to-quarter variations in our operating results and could adversely affect our net revenues and profitability. Budget issues, spending cuts, and global health spending priorities affecting government health agencies may also adversely affect demand for our product and our net revenues.

Competition from other products, including other female condoms, may have an adverse effect on our net revenues and profit margins.

We may be unable to compete successfully against current and future competitors, and competitive pressures could have a negative effect on our net revenues and profit margins. Other parties have developed and marketed female condoms, although only one such product has WHO pre-clearance and none of these female condoms have been approved by the FDA. FDA approval is required to sell female condoms in the U.S., and WHO pre-clearance is required to sell female condoms to U.N. agencies. FC2 has also been competing with other female condoms in markets that do not require either FDA approval or WHO prequalification. We have experienced increasing competition in the global public sector, and competitors received part of the last two South African tenders. Increasing competition in FC2’s markets may put pressure on pricing for FC2 or adversely affect sales of FC2, and some customers, particularly in the global public sector, may prioritize price over other features where FC2 may have an advantage. It is also possible that other companies will develop a female condom, and such companies could have greater financial resources and customer contacts than us. In addition, other contraceptive methods may compete with FC2 for funding and attention in the global public sector.

12

We may experience difficulties in implementing our growth initiatives.

We have announced new initiatives to increase our investment in sales and marketing activities. We may face a number of obstacles to successfully implement these initiatives, such as the costs associated with entering new markets or expanding current markets, retaining adequate numbers of effective sales and marketing personnel, developing and implementing effective marketing efforts, and establishing and maintaining appropriate regulatory compliance. We cannot assure you that we will be successful in implementing our growth strategies or that such strategies, even if implemented, will lead to the successful achievement of our objectives. Even if we are able to increase our sales as a result of our growth initiatives, we may not be able to achieve an adequate return on the amount we invest in these initiatives.

An inability to identify or complete future acquisitions could adversely affect our future growth.

As part of our growth initiatives, we intend to pursue acquisitions of new products, technologies, and/or businesses that are complementary to FC2 and enable us to leverage our competitive strengths. While we continue to evaluate potential acquisitions, we may not be able to identify and successfully negotiate suitable acquisitions, obtain financing for future acquisitions on satisfactory terms, obtain regulatory approval for acquisitions where required, or otherwise complete acquisitions in the future. An inability to identify or complete future acquisitions could limit our future growth.

We may experience difficulties in integrating strategic acquisitions.

The integration of acquired companies and their operations into our operations involves a number of risks, including:

|

· |

the acquired business may experience losses that could adversely affect our profitability; |

|

· |

unanticipated costs relating to the integration of acquired businesses may increase our expenses; |

|

· |

possible failure to accomplish the strategic objectives for an acquisition; |

|

· |

the loss of key personnel of the acquired business; |

|

· |

difficulties in achieving planned cost-savings and synergies may increase our expenses or decrease our net revenues; |

|

· |

diversion of management’s attention could impair their ability to effectively manage our business operations; |

|

· |

the acquired business may require significant expenditures for product development or regulatory approvals; |

|

· |

the acquired business may lack adequate internal controls or have other issues with its financial systems; |

|

· |

there may be regulatory compliance or other issues relating to the business practices of an acquired business; |

|

· |

we may record goodwill and nonamortizable intangible assets that are subject to impairment testing on a regular basis and potential impairment charges and we may also incur amortization expenses related to intangible assets; and |

|

· |

unanticipated management or operational problems or liabilities may adversely affect our profitability and financial condition. |

Additionally, we may borrow funds or issue equity to finance strategic acquisitions. Debt leverage resulting from future acquisitions could adversely affect our operating margins and limit our ability to capitalize on future business opportunities. Such borrowings may also be subject to fluctuations in interest rates. Equity issuances may dilute our existing shareholders and adversely affect the market price of our shares.

We depend on four major customers for a significant portion of our net revenues.

The Company's four largest customers currently are UNFPA, USAID, Sekunjalo and Semina. UNFPA accounted for 18 percent of unit sales in fiscal 2015, 40 percent of unit sales in fiscal 2014, and 62 percent of unit sales in fiscal 2013. USAID accounted for 16 percent of unit sales in fiscal 2015, 17 percent of unit sales in fiscal 2014, and less than 10 percent of unit sales in fiscal 2013. Sekunjalo accounted for less than 10 percent unit sales in fiscal 2015, 13 percent of unit sales in fiscal 2014, and less than 10 percent of unit sales in fiscal 2013. Semina accounted for 47 percent of unit sales in fiscal 2015, and less than 10 percent of unit sales in fiscal 2014 and 2013. An adverse change in our relationship with our largest customers could have a material adverse effect on our net revenues and profitability. In addition, we may have a concentration of accounts receivable with one or more of our largest customers, and a delay in payment by a large customer could have a material adverse effect on our cash flows and liquidity.

Since we sell product in foreign markets, we are subject to international business risks that could adversely affect our operating results.

Our international operations subject us to risks, including:

|

· |

economic and political instability; |

|

· |

changes in international regulatory requirements, import duties, or export restrictions, including limitations on the repatriation of earnings; |

|

· |

difficulties in staffing and managing foreign operations; |

13

|

· |

complications in complying with trade and foreign tax laws; |

|

· |

price controls and other restrictions on foreign currency; and |

|

· |

difficulties in our ability to enforce legal rights and remedies. |

Any of these risks might disrupt the supply of our products, increase our expenses or decrease our net revenues. The cost of compliance with trade and foreign tax laws increases our expenses, and actual or alleged violations of such laws could result in enforcement actions or financial penalties that could result in substantial costs.

Increases in the cost of raw materials, labor, and other costs used to manufacture our product could increase our cost of sales and reduce our gross margins.

We may experience increased costs of raw materials, including the nitrile polymer used in FC2, and increased labor costs. We may not be able to pass along such cost increases to our customers. As a result, an increase in the cost of raw materials, labor or other costs associated with manufacturing FC2 could increase our cost of sales and reduce our gross margins.

Currency exchange rate fluctuations could increase our expenses.

Because we manufacture FC2 in a leased facility located in Malaysia, a portion of our operating costs are denominated in a foreign currency. While a material portion of our future sales of FC2 are likely to be in foreign markets, all sales of FC2 are denominated in U.S. dollars. Manufacturing costs are subject to normal currency risks associated with fluctuations in the exchange rate of the Malaysian ringgit (MYR) relative to the U.S. dollar. Historically, we have not hedged our foreign currency risk.

We rely on a single facility to manufacture FC2, which subjects us to the risk of supply disruptions.

We manufacture FC2 in a single leased facility located in Malaysia. Difficulties encountered by this facility, such as fire, accident, natural disaster, or an outbreak of a contagious disease could halt or disrupt production at the facility, delay the completion of orders, or cause the cancellation of orders. Any of these risks could increase our expenses or reduce our net revenues.

Our product is subject to substantial government regulation, which exposes us to risks that we will be fined or exposed to civil or criminal liability, receive negative publicity, or be prevented from selling our product.

FC2 is subject to regulation by the FDA under the Food, Drug and Cosmetic Act, and by foreign regulatory agencies. Under the Food, Drug and Cosmetic Act, medical devices must receive FDA clearance before they can be sold. FDA regulations also require us to adhere to "Good Manufacturing Practices," which include testing, quality control, and documentation procedures. Our compliance with applicable regulatory requirements is monitored through periodic inspections by the FDA and foreign regulatory agencies. If we fail to comply with applicable regulations, we could:

|

· |

be fined or exposed to civil or criminal liability; |

|

· |

face suspensions of clearances, seizures, or recalls of products or operating restrictions; |

|

· |

receive negative publicity; or |

|

· |

be prohibited from selling our product in the U.S. or in foreign markets. |

Uncertainty and adverse changes in the general economic conditions may negatively affect our business.

If general economic conditions in the U.S. and other global markets in which we operate decline, or if consumers fear that economic conditions will decline, consumers may reduce expenditures for products such as our product. Adverse changes may occur as a result of adverse global or regional economic conditions, fluctuating oil prices, declining consumer confidence, unemployment, fluctuations in stock markets, contraction of credit availability, or other factors affecting economic conditions generally. These changes may negatively affect the sales of our product, increase the cost, and decrease the availability of financing, or increase costs associated with producing and distributing our product. In addition, a substantial portion of the sales of FC2 are made in the public market to government agencies, including USAID and other government agencies around the world. Worsening economic conditions as well as budget deficits and austerity measures may cause pressures on government budgets and result in a reduction in purchases of FC2 by governmental agencies. Sales of our product fluctuate, which causes our operating results to vary from quarter-to-quarter.

Sales of our product fluctuate based upon demand from our commercial partners and the public sector and the nature of government procurement processes. Historically, our net revenues and profitability have varied from quarter–to-quarter due to such buying patterns. Quarterly variations in operating results may cause us to fail to meet our earnings guidance or market expectations for our operating results and may tend to depress our stock price during such quarters.

14

Material adverse or unforeseen legal judgments, fines, penalties, or settlements could have an adverse impact on our profits and cash flows.

We may, from time to time, become a party to legal proceedings incidental to our business, including, but not limited to, alleged claims relating to product liability, environmental compliance, patent infringement, commercial disputes, and employment matters. Future litigation could require us to record reserves or make payments which could adversely affect our profits and cash flows. Even the successful defense of legal proceedings may cause us to incur substantial legal costs and may divert management's attention and resources away from our business.

Our success depends, in part, on our ability to protect our intellectual property.

We rely on our patented and other proprietary technology relating to FC2. The actions taken by us to protect our proprietary rights may not be adequate to prevent imitation of our product, processes, or technology. We cannot assure you that our proprietary technology will not become known to competitors, or that others will not independently develop a substantially equivalent or better female condom that does not infringe on our intellectual property rights, or will not challenge or assert rights in, and ownership of, our patents and other proprietary rights.

There are provisions in our charter documents, Wisconsin law, and change of control agreements with our officers that might prevent or delay a change in control of our company.

We are subject to a number of provisions in our charter documents, Wisconsin law, and change of control agreements that may discourage, delay, or prevent a merger or acquisition that a shareholder may consider favorable. These provisions include the following:

|

· |

the authority provided to our Board of Directors in our Amended and Restated Articles of Incorporation to issue preferred stock without further action by our shareholders; |

|

· |

change of control agreements we have entered into with three of our employees which provide for up to three years of compensation following a change of control as defined in the agreements; |

|

· |

the provision under Wisconsin law that permits shareholders to act by written consent only if such consent is unanimous; |

|

· |

the provision under Wisconsin law that requires for a corporation such as us, that was formed before January 1, 1973, the affirmative vote of the holders of at least two-thirds of the outstanding shares of our voting stock to approve an amendment to our articles of incorporation, a merger submitted to a vote of our shareholders, or a sale of substantially all of our assets; and |

|

· |

the Wisconsin control share acquisition statute and Wisconsin's "fair price" and "business combination" provisions which limit the ability of an acquiring person to engage in certain transactions or to exercise the full voting power of acquired shares under certain circumstances. |

The trading price of our common stock has been volatile, and investors in our common stock may experience substantial losses.

The trading price of our common stock has been volatile and may become volatile again in the future. The trading price of our common stock could decline or fluctuate in response to a variety of factors, including:

|

· |

our failure to meet market expectations for our performance; |

|

· |

the timing of announcements by us or our competitors concerning significant product developments, acquisitions, or financial performance; |

|

· |

fluctuation in our quarterly operating results; |

|

· |

substantial sales of our common stock; |

|

· |

general stock market conditions; or |

|

· |

other economic or external factors. |

You may be unable to sell your stock at or above your purchase price.

Item 1B. Unresolved Staff Comments

Not Applicable

15

Item 2. Properties

The Company leases approximately 5,100 square feet of office space at 515 North State Street, Suite 2225, Chicago, IL 60654. The lease expires October 31, 2016, although the Company has delivered notice of its intent to extend the term of the lease for an additional three year period ending October 31, 2019, provided that the Company has the right to rescind such lease extension upon receipt of the landlord’s notice of the new base rent for the extended term. The Company utilizes warehouse space and sales fulfillment services of an independent public warehouse located in Glendale Heights, IL for storage and distribution of FC2. In June 2010, the Company entered a new lease agreement for 6,400 square feet of office space located in London, England. The lease expires in June 2020. The Company manufactures and warehouses FC2 within a leased facility with 45,800 sq. ft. of production and warehouse space, in Selangor D.E., Malaysia. The FDA-approved manufacturing process is subject to periodic inspections by the FDA as well as the U.K. based “notified body”, which is responsible for CE and ISO accreditation. The lease currently has an expiration date of September 1, 2016 and is renewable at the option of the Company for an additional three year term. The Company’s Malaysian production capacity is approximately 100 million units annually.

The Company is not currently involved in any pending legal proceedings.

Item 4. Mine Safety Disclosures

Not Applicable

16

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Shares of our common stock trade on the NASDAQ Capital Market under the symbol "FHCO". The approximate number of record holders of our common stock at November 27, 2015 was 270. In January 2010, the Board of Directors adopted a quarterly cash dividend policy and declared the first cash dividend in the Company's history, which was paid in February 2010. In total, the Board has declared eighteen quarterly dividends, the most recent of which was paid in May 2014. All dividends have been paid from the Company's cash on hand. On July 14, 2014, the Company announced that its Board of Directors elected to suspend the payment of quarterly cash dividends in order to devote operating cash flows towards strategic growth initiatives. Under the Company's credit facility with Midland States Bank, dividends and share repurchases are permitted as long as after giving effect to the dividend or share repurchase the Company has a ratio of total liabilities to total stockholders' equity of not more than 1:1. Information regarding the high and low reported closing prices for our common stock and dividends paid on our common stock for the quarters indicated is set forth in the table below.

|

QUARTERS |

|||||||||||

|

FIRST |

SECOND |

THIRD |

FOURTH |

||||||||

|

2015 Fiscal Year |

|||||||||||

|

Price per common share – High |

$ |

4.59 |

$ |

3.92 |

$ |

3.33 |

$ |

1.78 | |||

|

Price per common share – Low |

$ |

3.32 |

$ |

2.80 |

$ |

1.80 |

$ |

1.32 | |||

|

Dividends paid |

$ |

— |

$ |

— |

$ |

— |

$ |

— |

|||

|

2014 Fiscal Year |

|||||||||||

|

Price per common share – High |

$ |

9.94 |

$ |

8.42 |

$ |

7.76 |

$ |

5.84 | |||

|

Price per common share – Low |

$ |

7.87 |

$ |

6.70 |

$ |

5.49 |

$ |

3.49 | |||

|

Dividends paid |

$ |

0.07 |

$ |

0.07 |

$ |

0.07 |

$ |

— |

|||

17

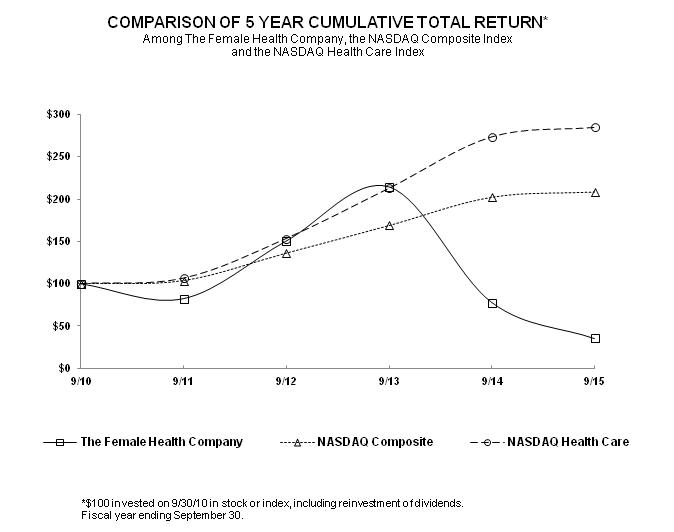

Performance Graph

The performance graph set forth below shows the value of an investment of $100 on September 30, 2010 in each of The Female Health Company, the NASDAQ Composite Index and NASDAQ Health Care Index. All values assume reinvestment of the pre-tax value of dividends paid by FHC and the companies included in the indices, and are calculated as of September 30 each year. The historical stock price performance of FHC is not necessarily indicative of future stock performance.

|

9/10 |

9/11 |

9/12 |

9/13 |

9/14 |

9/15 |

|

|

The Female Health Company |

100.00 | 82.42 | 150.44 | 214.34 | 77.79 | 35.22 |

|

NASDAQ Composite |

100.00 | 103.65 | 136.22 | 168.91 | 202.57 | 208.69 |

|

NASDAQ Health Care |

100.00 | 106.39 | 153.48 | 213.08 | 274.04 | 285.21 |

18

Item 6. Selected Financial Data

The data set forth below should be read in conjunction with Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Consolidated Financial Statements and Notes thereto appearing in this Annual Report on Form 10-K. The Consolidated Statement of Income Data for the years ended September 30, 2015, 2014, and 2013, and the Consolidated Balance Sheet Data as of September 30, 2015 and 2014, are derived from the Consolidated Financial Statements included elsewhere in this report. The Consolidated Statement of Income Data for the years ended September 30, 2012 and 2011, and the Consolidated Balance Sheet Data as of September 30, 2013, 2012 and 2011, are derived from Consolidated Financial Statements that are not included in this report. The historical results are not necessarily indicative of results to be expected for future periods.

|

Year ended September 30, |

||||||||||||||

|

Condensed Consolidated Statement of Income Data: |

2015 |

2014 |

2013 |

2012 |

2011 |

|||||||||

|

(In thousands, except per share data) |

||||||||||||||

|

Net revenues |

$ |

32,605 |

$ |

24,491 |

$ |

31,457 |

$ |

35,034 |

$ |

18,565 | ||||

|

Cost of sales |

13,635 | 11,370 | 13,953 | 14,413 | 8,700 | |||||||||

|

Gross profit |

18,970 | 13,121 | 17,504 | 20,621 | 9,865 | |||||||||

|

Operating expenses |

12,352 | 9,197 | 7,714 | 9,681 | 6,570 | |||||||||

|

Operating income |

6,618 | 3,924 | 9,790 | 10,940 | 3,295 | |||||||||

|

Non-operating income (expense) |

69 | 33 | 144 | (148) | (63) | |||||||||

|

Income before income taxes |

6,687 | 3,957 | 9,934 | 10,792 | 3,232 | |||||||||

|

Income tax expense (benefit) |

2,341 | 1,524 | (4,409) | (4,507) | (2,167) | |||||||||

|

Net income |

$ |

4,346 |

$ |

2,433 |

$ |

14,343 |

$ |

15,299 |

$ |

5,399 | ||||

|

Net income per basic common share outstanding |

$ |

0.15 |

$ |

0.09 |

$ |

0.51 |

$ |

0.55 |

$ |

0.20 | ||||

|

Basic weighted average common shares outstanding |

28,532 | 28,523 | 28,377 | 27,694 | 27,287 | |||||||||

|

Net income per diluted common share outstanding |

$ |

0.15 |

$ |

0.08 |

$ |

0.50 |

$ |

0.53 |

$ |

0.19 | ||||

|

Diluted weighted average common shares outstanding |

28,834 | 28,865 | 28,726 | 28,933 | 28,971 | |||||||||

|

Cash dividends declared per share |

$ |

— |

$ |

0.21 |

$ |

0.26 |

$ |

0.22 |

$ |

0.20 | ||||

|

Year ended September 30, |

||||||||||||||

|

Condensed Consolidated Balance Sheet Data: |

2015 |

2014 |

2013 |

2012 |

2011 |

|||||||||

|

(In thousands) |

||||||||||||||

|

Cash and cash equivalents |

$ |

4,106 |

$ |

5,796 |

$ |

8,922 |

$ |

5,296 |

$ |

4,318 | ||||

|

Working capital |

17,361 | 9,695 | 13,424 | 10,966 | 7,454 | |||||||||

|

Total assets |

37,472 | 31,673 | 35,170 | 30,446 | 19,443 | |||||||||

|

Accumulated deficit |

(27,996) | (32,342) | (28,715) | (35,594) | (44,697) | |||||||||

|

Long-term obligations |

15 | 39 | 67 | 174 | 209 | |||||||||

|

Total stockholders' equity |

$ |

33,133 |

$ |

28,065 |

$ |

31,403 |

$ |

24,218 |

$ |

16,753 | ||||

19

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations

Overview

The Company manufactures, markets and sells FC2. FC2 is the only currently available female-controlled product approved by the FDA that provides dual protection against unintended pregnancy and STIs, including HIV/AIDS.

FC2’s primary usages are for disease prevention and family planning, and the public health sector is the Company’s main market. Within the public health sector, various organizations supply critical products such as FC2, at no cost or low cost, to those who need but cannot afford to buy such products for themselves.

FC2 has been distributed in 144 countries. A significant number of countries with the highest demand potential are in the developing world. The incidence of HIV/AIDS, other STIs and unwanted pregnancy in these countries represents a remarkable potential for significant sales of a product that benefits some of the world’s most underprivileged people. However, conditions in these countries can be volatile and result in unpredictable delays in program development, tender applications and processing orders.

The Company has a relatively small customer base, with a limited number of customers who generally purchase in large quantities. Over the past few years, major customers have included large global agencies, such as UNFPA and USAID. Other customers include ministries of health or other governmental agencies, which either purchase directly or via in-country distributors, and NGOs.

Purchasing patterns vary significantly from one customer to another, and may reflect factors other than simple demand. For example, some governmental agencies purchase through a formal procurement process in which a tender (request for bid) is issued for either a specific or a maximum unit quantity. Tenders also define the other elements required for a qualified bid submission (such as product specifications, regulatory approvals, clearance by WHO, unit pricing and delivery timetable). Bidders have a limited period of time in which to submit bids. Bids are subjected to an evaluation process which is intended to conclude with a tender award to the successful bidder. The entire tender process, from publication to award, may take many months to complete. A tender award indicates acceptance of the bidder’s price rather than an order or guarantee of the purchase of any minimum number of units. Many governmental tenders are stated to be “up to” the maximum number of units, which gives the applicable government agency discretion to purchase less than the full maximum tender amount. Orders are placed after the tender is awarded; there are often no set dates for orders in the tender and there are no guarantees as to the timing or amount of actual orders or shipments. Orders received may vary from the amount of the tender award based on a number of factors including vendor supply capacity, quality inspections and changes in demand. Administrative issues, politics, bureaucracy, process errors, changes in leadership, funding priorities and/or other pressures may delay or derail the process and affect the purchasing patterns of public sector customers. As a result, the Company may experience significant quarter-to-quarter sales variations due to the timing and shipment of large orders.

During fiscal 2011, the Company’s unit shipments, revenues, and net income were adversely affected by bureaucratic delays and other timing issues involving the receipt and shipment of large orders from Brazil and RSA. Significant orders for both countries were received in the first quarter of fiscal 2012. The 20 million unit order received for shipment to Brazil which had been the largest order in the Company’s history. Receipt of these orders positively impacted fiscal 2012 and 2013 results.

In October 2014, the Company announced that Semina was awarded an exclusive contract under a public tender. The contract was valid through August 20, 2015, allowing the Brazil Ministry of Health to place orders against this tender at its discretion. Through the end of the contract, the Company received orders for 40 million units in fulfillment of the tender, 28 million of which were shipped during the year ended September 30, 2015.

Details of the quarterly unit sales for the last five fiscal years are as follows:

|

Period |

2015 |

2014 |

2013 |

2012 |

2011 |

|

October 1 – December 31 |

12,154,570 | 11,832,666 | 17,114,630 | 15,166,217 | 6,067,421 |

|

January 1 – March 31 |

20,760,519 | 7,298,968 | 16,675,035 | 13,945,320 | 8,905,099 |

|

April 1 – June 30 |

14,413,032 | 13,693,652 | 12,583,460 | 15,198,960 | 5,922,334 |

|

July 1 - September 30 |

13,687,462 | 9,697,341 | 8,386,800 | 17,339,500 | 11,977,716 |

|

Total |

61,015,583 | 42,522,627 | 54,759,925 | 61,649,997 | 32,872,570 |

Revenues. The Company's revenues are derived from sales of FC2, and are recognized upon shipment of the product to its customers.

20

The Company’s most significant customers are either global public health sector agencies or those who facilitate their purchases and/or distribution of FC2 for use in HIV/AIDS prevention and/or family planning. The Company's four largest customers currently are UNFPA, USAID, Sekunjalo and Semina. UNFPA accounted for 18 percent of unit sales in fiscal 2015, 40 percent of unit sales in fiscal 2014, and 62 percent of unit sales in fiscal 2013. USAID accounted for 16 percent of unit sales in fiscal 2015, 17 percent of unit sales in fiscal 2014, and less than 10 percent of unit sales in fiscal 2013. Sekunjalo accounted for less than 10 percent of unit sales in fiscal 2015, 13 percent of unit sales in fiscal 2014, and less than 10 percent of unit sales in fiscal 2013. Semina accounted for 47 percent of unit sales in fiscal 2015 and less than 10 percent of unit sales in fiscal 2014 and 2013. Azinor accounted for 11 percent of unit sales in fiscal 2014. No other single customer accounted for more than 10 percent of unit sales in fiscal 2015, 2014, or 2013. We sell to the Brazil Ministry of Health either through UNFPA or Semina. In the U.S., FC2 is sold to city and state public health clinics as well as to not-for-profit organizations such as Planned Parenthood.

Because the Company manufactures FC2 in a leased facility located in Malaysia, a portion of the Company's operating costs are denominated in foreign currencies. While a material portion of the Company's future sales are likely to be in foreign markets, all sales are denominated in the U.S. dollar. Effective October 1, 2009, the Company’s U.K. and Malaysia subsidiaries adopted the U.S. dollar as their functional currency, further reducing the Company’s foreign currency risk.