Attached files

| file | filename |

|---|---|

| EX-32.2 - Kaya Holdings, Inc. | kays10q111615ex32_2.htm |

| EX-32.1 - Kaya Holdings, Inc. | kays10q111615ex32_1.htm |

| EX-31.1 - Kaya Holdings, Inc. | kays10q111615ex31_1.htm |

| EX-31.2 - Kaya Holdings, Inc. | kays10q111615ex31_2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-Q

[x] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period ended September 30, 2015

OR

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE ACT

For the transition period from

__________to __________

Commission File No.: 333-177532

Kaya Holdings, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 90-0898007 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

305 S. Andrews Avenue

Suite 209

Ft. Lauderdale, Florida 33301

(Address of principal executive offices)

(561) 210-5784

(Issuer's telephone number)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.) Yes [ ] No [X]

As of November 16, 2015, the Issuer had 88,855,991 shares of its common stock outstanding

KAYA HOLDINGS, INC.

INDEX TO QUARTERLY REPORT

| Part I – Financial Information | Page | |

| Item 1. | Condensed Consolidated Financial Statements | 1 |

| Condensed Consolidated Balance Sheet | 1 | |

| Condensed Consolidated Statements of Operation | 2 | |

| Condensed Consolidated Statements of Cash Flows | 3 | |

| Notes to Condensed Consolidated Financial Statements | 5 | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 22 |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | |

| Item 4. | Controls and Procedures | 35 |

| Part II - Other Information | ||

| Item 1. | Legal Proceedings | 36 |

| Item 1A | Risk Factors | |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 36 |

| Item 3. | Defaults Upon Senior Securities | 37 |

| Item 4. | Mine Safety Disclosures | 37 |

| Item 5. | Other Information | 37 |

| Item 6. | Exhibits | 37 |

| Signatures | 38 | |

| Kaya Holdings, Inc. and Subsidiaries | ||||||||

| Condensed Consolidated Balance Sheet | ||||||||

| (Unaudited) | (Audited) | |||||||

| September 30, 2015 | December 31, 2014 | |||||||

| ASSETS | ||||||||

| CURRENT ASSETS: | ||||||||

| Cash and equivalents | $ | 302,782 | 35,194 | |||||

| Inventory - Net of Allowance | 29,823 | 5,267 | ||||||

| Prepaid license fee | 12,000 | 1,667 | ||||||

| Total Current Assets | 344,605 | 42,128 | ||||||

| OTHER ASSETS: | ||||||||

| Property and equipment, net | 154,451 | 57,379 | ||||||

| Deposits | 37,986 | 16,200 | ||||||

| Total Other Assets | 192,437 | 73,579 | ||||||

| Total Assets | 537,042 | 115,707 | ||||||

| LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIENCY) | ||||||||

| CURRENT LIABILITIES: | ||||||||

| Accounts payable and accrued expense | 258,999 | 215,174 | ||||||

| Accounts payable and accrued expense - related parties | — | 20,109 | ||||||

| Accrued interest | 45,103 | 8,705 | ||||||

| Convertible notes payable | 25,000 | 25,000 | ||||||

| Convertible note payable - net of discount | 677,179 | 189,993 | ||||||

| Derivative liabilities | 9,201 | 8,434 | ||||||

| Notes payable | — | 200,000 | ||||||

| Total Current Liabilities | 1,015,482 | 667,415 | ||||||

| LONG TERM LIABILITIES: | ||||||||

| Convertible note payable - related party - net of discount | 400,682 | 303,213 | ||||||

| Notes payable - net of discount | 64,328 | — | ||||||

| Note payable - related party | 286,415 | 270,809 | ||||||

| Total Long Term Liabilities | 751,425 | 574,022 | ||||||

| Total Liabilities | 1,766,907 | 1,241,437 | ||||||

| STOCKHOLDERS' EQUITY (DEFICIT): | ||||||||

| Convertible Preferred Stock, Series C, par value $.001; 10,000,000 shares authorized; 55,120 and 55,120 issued and outstanding at September 30, 2015 and December 31, 2014 | 55 | 55 | ||||||

| Common stock , par value $.001; 250,000,000 shares authorized; 89,855,991 shares issued as of September 30, 2015 and 77,289,325 shares issued as of December 31, 2014 | 89,856 | 77,289 | ||||||

| Additional paid in capital | 6,341,169 | 4,436,217 | ||||||

| Subscriptions payable | 5,000 | 114,500 | ||||||

| Accumulated deficit | (7,359,653 | ) | (5,519,469 | ) | ||||

| Non-controlling interest | (306,292 | ) | (234,323 | ) | ||||

| Net Stockholders' Equity/(Deficit) | (1,229,865 | ) | (1,125,730 | ) | ||||

| Total Liabilities and Stockholders' Equity/(Deficit) | $ | 537,042 | $ | 115,707 | ||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

| Kaya Holdings, Inc. and Subsidiaries | ||||||||||||||||

| Condensed Consolidated Statements of Operations | ||||||||||||||||

| (Unaudited) | ||||||||||||||||

| For the three | For the three | For the nine | For the nine | |||||||||||||

| months ended | months ended | months ended | months ended | |||||||||||||

| September 30, 2015 | September 30, 2014 | September 30, 2015 | September 30, 2014 | |||||||||||||

| Net Sales | $ | 32,765 | $ | 36,978 | $ | 90,597 | $ | 36,978 | ||||||||

| Cost of Sales | 22,243 | 22,839 | 35,527 | 22,839 | ||||||||||||

| Gross Profit | 10,522 | 14,139 | 55,070 | 14,139 | ||||||||||||

| Operating Expenses: | ||||||||||||||||

| Professional fees | 124,050 | 265,497 | 734,260 | 561,253 | ||||||||||||

| Salaries and wages | 42,101 | 3,446 | 90,153 | 3,446.00 | ||||||||||||

| General and administrative | 141,450 | 98,697 | 288,499 | 294,644 | ||||||||||||

| Total Operating Expenses | 307,601 | 367,640 | 1,112,913 | 859,343 | ||||||||||||

| Operating Loss | (297,079 | ) | (353,502 | ) | (1,057,842 | ) | (845,204 | ) | ||||||||

| Other Income(expense) | ||||||||||||||||

| Interest expense | (100,236 | ) | (108,766 | ) | (627,022 | ) | (226,377 | ) | ||||||||

| Derivative liabilities expense | — | (22,368 | ) | — | (22,368 | ) | ||||||||||

| Gain on extinguishment of debt | 1,347,971 | 38,864 | 417,713 | 38,864 | ||||||||||||

| Change in derivative liabilities expense | (242 | ) | — | (767 | ) | — | ||||||||||

| Inventory valuation | — | 28,000 | ||||||||||||||

| Other income | — | — | — | 20,369 | ||||||||||||

| Amortization of debt discount | (672,307 | ) | (25,000 | ) | (672,307 | ) | (25,000 | ) | ||||||||

| Forgiveness of debts | — | (4,500 | ) | — | 86,495 | |||||||||||

| Total Other Income(Expense) | 575,186 | (121,770 | ) | 854,383 | (128,017 | ) | ||||||||||

| Net Income/(loss) before Income Taxes | 278,107 | (475,271 | ) | (1,912,225 | ) | (973,221 | )# | |||||||||

| Provision for Income Taxes | — | — | — | — | ||||||||||||

| Net Income/(loss) | 278,107 | (475,271 | ) | (1,912,225 | ) | (973,221 | ) | |||||||||

| Net (Loss) attributed to non-controlling interest | (53,936 | ) | (114,496 | ) | (71,961 | ) | (312,429 | ) | ||||||||

| Net Income(loss) attributed to Kaya Holdings, Inc. | 332,043 | (360,775 | ) | (1,840,224 | ) | (660,792 | ) | |||||||||

| Basic and diluted net loss per common share | $ | * | $ | (0.01 | ) | $ | (0.02 | ) | $ | (0.01 | ) | |||||

| Weighted average number of common shares outstanding | 86,989,325 | 75,746,064 | 85,497,017 | 73,958,516 | ||||||||||||

* Less than $0.01

The accompanying notes are an integral part of these condensed consolidated financial statements.

| Kaya Holdings, Inc. and Subsidiaries | ||||||||

| Condensed Consolidated Statement of Cashflows | ||||||||

| (Unaudited) | ||||||||

| For the nine | For the nine | |||||||

| months ended | months ended | |||||||

| September 30, 2015 | September 30, 2014 | |||||||

| OPERATING ACTIVITIES: | ||||||||

| Net loss | $ | (1,840,264 | ) | $ | (660,792 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Net loss attributable to non-controlling interest | (71,961 | ) | (312,429 | ) | ||||

| Depreciation | 4,288 | 6,346 | ||||||

| Gain from restructure of stockholder loan | — | (76,459 | ) | |||||

| Gain on extinguishment of debt | (417,713 | ) | 4,500 | |||||

| Derivative expense | 767 | 22,368 | ||||||

| Change in derivative liabilities | (38,954 | ) | ||||||

| Amortization of debt discount | 1,019,134 | 235,121 | ||||||

| Stock issued for services | 481,500 | 376,983 | ||||||

| Stock issued for interest | 39,500 | — | ||||||

| Stock issued as contribution | — | 42,500 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Prepaid expense | (10,333 | ) | (11,400 | ) | ||||

| Inventory | (24,556 | ) | (17,759 | ) | ||||

| Other assets | (20,291 | ) | (15,000 | ) | ||||

| Accrued interest | 34,138 | — | ||||||

| Accounts payable and accrued expenses | 24,201 | (137,512 | ) | |||||

| Net cash used in operating activities | (611,064 | ) | (582,487 | ) | ||||

| INVESTING ACTIVITIES: | ||||||||

| Purchase of property and equipment | (56,349 | ) | (64,730 | ) | ||||

| Proceeds for equipment | — | — | ||||||

| Net cash used in investing activities | (56,349 | ) | (64,730 | ) | ||||

| FINANCING ACTIVITIES: | ||||||||

| Payments on installment agreement | — | (5,000 | ) | |||||

| Payments on related party debt | — | (47,770 | ) | |||||

| Proceeds from related party debt | — | — | ||||||

| Proceeds from convertible debt | 600,000 | 335,000 | ||||||

| Proceeds from note payable | 210,000 | 100,000 | ||||||

| Payment on note payable | (10,000 | ) | ||||||

| Stock subscription received | 5,000 | |||||||

| Proceeds from sales of common stock | 130,000 | 310,000 | ||||||

| Net cash provided by (used in) financing activities | 935,000 | 692,230 | ||||||

| NET INCREASE IN CASH | 267,588 | 45,013 | ||||||

| CASH BEGINNING BALANCE | 35,194 | 185 | ||||||

| CASH ENDING BALANCE | $ | 302,782 | $ | 45,198 | ||||

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | ||||||||

| Taxes paid | — | — | ||||||

| Interest paid | — | — | ||||||

| NON-CASH TRANSACTIONS AFFECTING OPERATING, INVESTING AND FINANCING ACTIVITIES: | ||||||||

| Value of convertible preferred shares of subsidiary issued | 96,000 | |||||||

| Value of common shares issued as payment of debt | 60,000 | |||||||

| Value of common shares issued as payment for equipment | 44,500 | |||||||

| Value of common shares issued to settle accrued expenses | 35,000 | |||||||

| Value of common shares issued to settle accounts payable | 100,000 | |||||||

| Value of common shares issued to settle interest expense | 38,000 | 4,000 |

The accompanying notes are an integral part of these condensed consolidated financial statements.

NOTE 1 – ORGANIZATION AND NATURE OF THE BUSINESS

Organization

Kaya Holdings, Inc. (f/k/a Alternative Fuels Americas, Inc.), (the “Company” or “KAYS”) is a holding company. The Company was incorporated in 1993 in Delaware, and has engaged in a number of businesses. Its name was changed on May11, 2007 to NetSpace International Holdings, Inc. (“NetSpace”). NetSpace acquired 100% of Alternative Fuels Americas, Inc. (a Florida corporation) in January 2010 in a stock for stock transaction and issued 100,000 shares of Series C convertible preferred stock to existing shareholders of the Florida corporation. A certificate of Amendment to the Certificate of Incorporation was filed in October 2010 changing the Company’s name from NetSpace International Holdings, Inc. to Alternative Fuels Americas, Inc. In March 2015 another certificate of Amendment to the Certificate of Incorporation was filed changing the Company’s name from Alternative Fuels Americas, Inc. (a Delaware corporation) to Kaya Holdings, Inc. The Company has two subsidiaries: Alternative Fuels Americas, Inc. (a Florida corporation) which is wholly owned, and Marijuana Holdings Americas, Inc. a Florida corporation, (“MJAI”) which is a majority owned subsidiary.

Nature of the Business

The Company operates a subsidiary, Marijuana Holdings Americas, Inc., a Florida corporation, that pursues medical and/or recreational licenses for the growing, processing and/or sale of marijuana in jurisdictions where it is legal and permissible under local laws. The subsidiary was formed in March 2014.

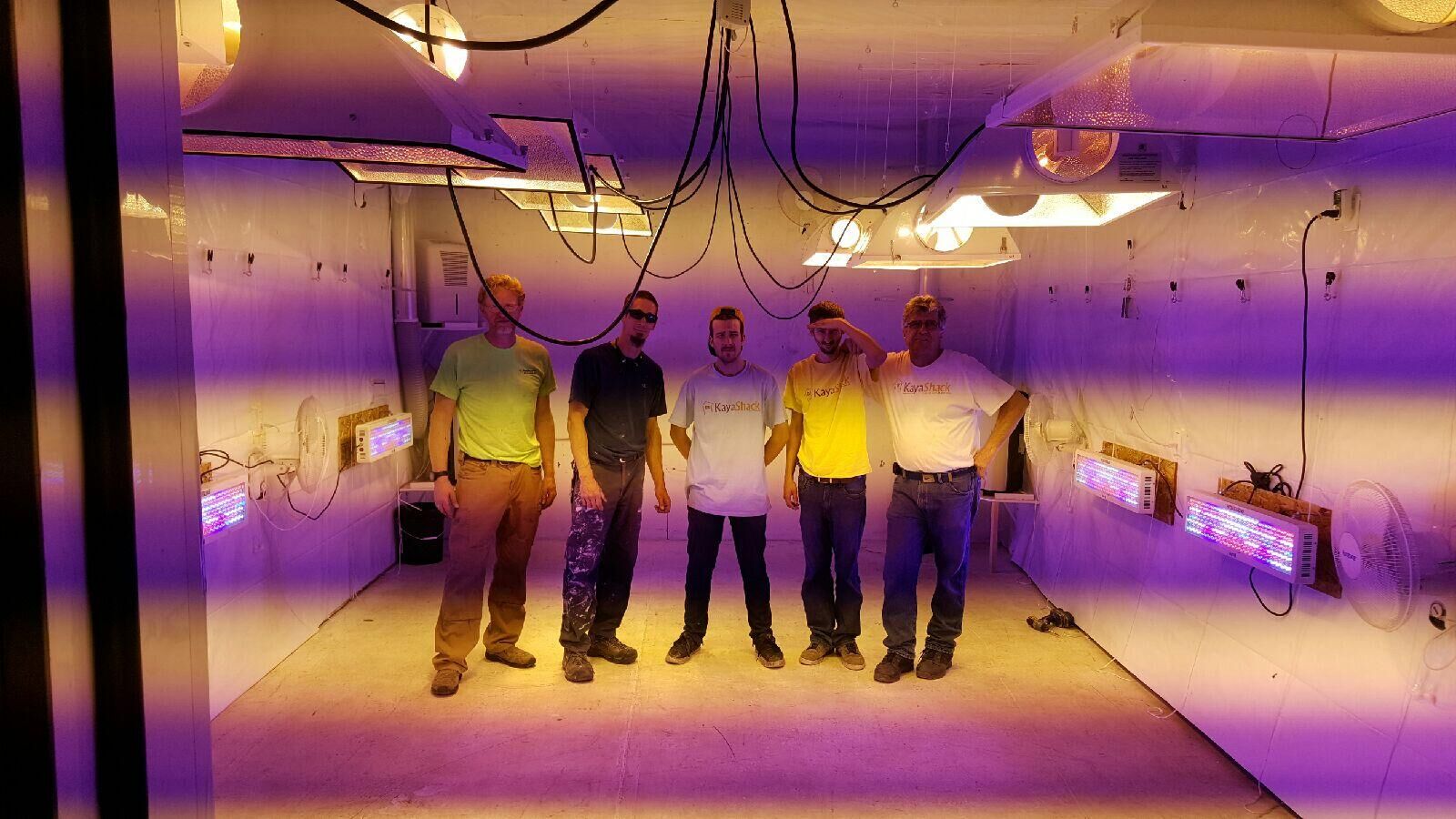

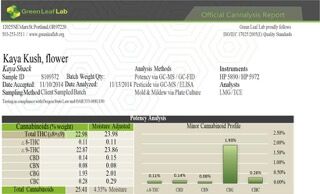

In March 2014 Marijuana Holdings Americas, Inc. (through local Oregon subsidiaries) began the application process to obtain licenses to operate medical marijuana dispensaries in Oregon. On March 21, 2014 the Company received notice from the Oregon Health Authority that MJAI Oregon 1 had been granted provisional licensing approval to operate their first Medical Marijuana Dispensary in Portland, Oregon and subsequently received full licensing approval for the first “Kaya ShackTM” retail medical marijuana dispensary, which we began operating July 3, 2014 and had subsequently received license for two additional facilities.

In April 2015, KAYS announced that it has commenced with its own medical marijuana grow operations for the cultivation and harvesting of legal marijuana. In October 2015, Oregon commenced legal recreational marijuana sales through licensed medical marijuana dispensaries, including those operated by the company.

NOTE 2 - LIQUIDITY AND GOING CONCERN

The Company’s consolidated financial statements as of and for the nine months ended September 30, 2015 have been prepared on a going concern basis, which contemplates the realization of assets and the settlement of liabilities and commitments in the normal course of business. The Company incurred a net loss of $1,840,264 for the nine months ended September 30, 2015 and a net loss of $1,414,250 for the year ended December 31, 2014. At September 30, 2015 the Company has a working capital deficiency of $735,196 and is totally dependent on its ability to raise capital. The Company has a plan of operations and acknowledges that its plan of operations may not result in generating positive working capital in the near future. Even though management believes that it will be able to successfully execute its business plan, which includes third-party financing and capital issuance, and meet the Company’s future liquidity needs, there can be no assurances in that regard. These matters raise substantial doubt about the Company’s ability to continue as a going concern. The consolidated financial statements do not include any adjustments that might result from the outcome of this material uncertainty. Management recognizes that the Company must generate additional funds to successfully develop its operations and activities. Management plans include:

| • | the sale of additional equity and debt securities, |

| • | alliances and/or partnerships with entities interested in and having the resources to support the further development of the Company’s business plan, |

| • | other business transactions to assure continuation of the Company’s development and operations, |

| • | development of a unified brand and the pursuit of licenses to operate medical marijuana facilities under the branded name. |

NOTE 3 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES AND BASIS OF PRESENTATION

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements of the Company and the notes thereto have been prepared in accordance with the instructions for Form 10-Q and Article 10 of Regulation S-X of the Securities and Exchange Commission (“SEC”). The December 31, 2014 condensed consolidated balance sheet data was derived from audited financial statements but does not include all disclosures required by accounting principles generally accepted in the United States of America. The unaudited condensed consolidated financial statements included herein should be read in conjunction with the audited financial statements and the notes thereto that are included in the Company’s Annual Report on form 10-K for the year ended December 31, 2014 filed with the SEC on April 15, 2015.

The accounting policies applied by the Company in these condensed interim financial statements are the same as those applied by the Company in its audited consolidated financial statements as at and for the year ended December 31, 2014. The quarterly information presented should be read in conjunction with the annual report filed on Form 10-K with the Securities and Exchange Commission.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes.

Such estimates and assumptions impact both assets and liabilities, including but not limited to: net realizable value of accounts receivable and inventory, estimated useful lives and potential impairment of property and equipment, the valuation of intangible assets, estimate of fair value of share based payments and derivative liabilities, estimates of fair value of warrants issued and recorded as debt discount, estimates of tax liabilities and estimates of the probability and potential magnitude of contingent liabilities.

Making estimates requires management to exercise significant judgment. It is at least reasonably possible that the estimate of the effect of a condition, situation or set of circumstances that existed at the date of the financial statements, which management considered in formulating its estimate could change in the near term due to one or more future non-conforming events. Accordingly, actual results could differ significantly from estimates.

Risks and Uncertainties

The Company’s operations are subject to risk and uncertainties including financial, operational, regulatory and other risks including the potential risk of business failure.

The Company has experienced, and in the future expects to continue to experience, variability in its sales and earnings. The factors expected to contribute to this variability include, among others, (i) the uncertainty associated with the commercialization and ultimate success of the product, (ii) competition inherent at other locations where product is expected to be sold (iii) general economic conditions and (iv) the related volatility of prices pertaining to the cost of sales.

Fiscal Year

The Company’s fiscal year-end is December 31.

Principles of Consolidation

The consolidated financial statements include the accounts of Kaya Holdings, Inc. and its subsidiary, Alternative Fuels Americas, Inc. (a Florida corporation) and Marijuana Holdings Americas, Inc. (a Florida corporation) which is a majority owned subsidiary. All inter-company accounts and transactions have been eliminated in consolidation.

Non-Controlling Interest

The company owns 55% of Marijuana Holdings Americas, Inc.

Cash and Cash Equivalents

Cash and cash equivalents are carried at cost and represent cash on hand, demand deposits placed with banks or other financial institutions and all highly liquid investments with an original maturity of three months or less. The Company had no cash equivalents

Inventory

Inventory will consist of finished goods purchased, which are valued at the lower of cost or market value, with cost being determined on the first-in, first-out method. The Company will periodically review historical sales activity to determine potentially obsolete items and also evaluates the impact of any anticipated changes in future demand.

Property and Equipment

Property and equipment is stated at cost, less accumulated depreciation and is reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable.

Depreciation of property and equipment is provided utilizing the straight-line method over the estimated useful lives, ranging from 5-7 years of the respective assets. Expenditures for maintenance and repairs are charged to expense as incurred.

Upon sale or retirement of property and equipment, the related cost and accumulated depreciation are removed from the accounts and any gain or loss is reflected in the statements of operations.

Fair Value of Financial Instruments

The Company measures assets and liabilities at fair value based on an expected exit price as defined by the authoritative guidance on fair value measurements, which represents the amount that would be received on the sale of an asset or paid to transfer a liability, as the case may be, in an orderly transaction between market participants. As such, fair value may be based on assumptions that market participants would use in pricing an asset or liability. The authoritative guidance on fair value measurements establishes a consistent framework for measuring fair value on either a recurring or nonrecurring basis whereby inputs, used in valuation techniques, are assigned a hierarchical level.

The following are the hierarchical levels of inputs to measure fair value:

Level 1 – Observable inputs that reflect quoted market prices in active markets for identical assets or liabilities.

Level 2 - Inputs reflect quoted prices for identical assets or liabilities in markets that are not active; quoted prices for similar assets or liabilities in active markets; inputs other than quoted prices that are observable for the assets or liabilities; or inputs that are derived principally from or corroborated by observable market data by correlation or other means.

Level 3 – Unobservable inputs reflecting the Company’s assumptions . incorporated in valuation techniques used to determine fair value. These assumptions are required to be consistent with market participant .assumptions that are reasonably available.

The carrying amounts of the Company’s financial assets and liabilities, such as cash, prepaid expenses, other current assets, accounts payable & accrued expenses, certain notes payable and notes payable – related party, approximate their fair values because of the short maturity of these instruments.

The Company accounts for its derivative liabilities, at fair value, on a recurring basis under level 3. See Note 6.

Embedded Conversion Features

The Company evaluates embedded conversion features within convertible debt under ASC 815 “Derivatives and Hedging” to determine whether the embedded conversion feature(s) should be bifurcated from the host instrument and accounted for as a derivative at fair value with changes in fair value recorded in earnings. If the conversion feature does not require derivative treatment under ASC 815, the instrument is evaluated under ASC 470-20 “Debt with Conversion and Other Options” for consideration of any beneficial conversion feature.

Derivative Financial Instruments

The Company does not use derivative instruments to hedge exposures to cash flow, market, or foreign currency risks. The Company evaluates all of it financial instruments, including stock purchase warrants, to determine if such instruments are derivatives or contain features that qualify as embedded derivatives.

For derivative financial instruments that are accounted for as liabilities, the derivative instrument is initially recorded at its fair value and is then re-valued at each reporting date, with changes in the fair value reported as charges or credits to income. For option-based simple derivative financial instruments, the Company uses the Black-Scholes option-pricing model to value the derivative instruments at inception and subsequent valuation dates. The classification of derivative instruments, including whether such instruments should be recorded as liabilities or as equity, is re-assessed at the end of each reporting period.

Beneficial Conversion Feature

For conventional convertible debt where the rate of conversion is below market value, the Company records a "beneficial conversion feature" ("BCF") and related debt discount.

When the Company records a BCF, the relative fair value of the BCF is recorded as a debt discount against the face amount of the respective debt instrument (offset to additional paid in capital) and amortized to interest expense over the life of the debt.

Debt Issue Costs and Debt Discount

The Company may record debt issue costs and/or debt discounts in connection with raising funds through the issuance of debt. These costs may be paid in the form of cash, or equity (such as warrants). These costs are amortized to interest expense over the life of the debt. If a conversion of the underlying debt occurs, a proportionate share of the unamortized amounts is immediately expensed.

Original Issue Discount

For certain convertible debt issued, the Company may provide the debt holder with an original issue discount. The original issue discount would be recorded to debt discount, reducing the face amount of the note and is amortized to interest expense over the life of the debt.

Extinguishments of Liabilities

The Company accounts for extinguishments of liabilities in accordance with ASC 860-10 (formerly SFAS 140) “Accounting for Transfers and Servicing of Financial Assets and Extinguishment of Liabilities”. When the conditions are met for extinguishment accounting, the liabilities are derecognized and the gain or loss on the sale is recognized.

Stock-Based Compensation - Employees

The Company accounts for its stock based compensation in which the Company obtains employee services in share-based payment transactions under the recognition and measurement principles of the fair value recognition provisions of section 718-10-30 of the FASB Accounting Standards Codification. Pursuant to paragraph 718-10-30-6 of the FASB Accounting Standards Codification, all transactions in which goods or services are the consideration received for the issuance of equity instruments are accounted for based on the fair value of the consideration received or the fair value of the equity instrument issued, whichever is more reliably measurable.

The measurement date used to determine the fair value of the equity instrument issued is the earlier of the date on which the performance is complete or the date on which it is probable that performance will occur.

If the Company is a newly formed corporation or shares of the Company are thinly traded, the use of share prices established in the Company’s most recent private placement memorandum (based on sales to third parties) (“PPM”), or weekly or monthly price observations would generally be more appropriate than the use of daily price observations as such shares could be artificially inflated due to a larger spread between the bid and asked quotes and lack of consistent trading in the market.

The fair value of share options and similar instruments is estimated on the date of grant using a Black-Scholes option-pricing valuation model. The ranges of assumptions for inputs are as follows:

| • | Expected term of share options and similar instruments: The expected life of options and similar instruments represents the period of time the option and/or warrant are expected to be outstanding. Pursuant to Paragraph 718-10-50-2(f)(2)(i) of the FASB Accounting Standards Codification the expected term of share options and similar instruments represents the period of time the options and similar instruments are expected to be outstanding taking into consideration of the contractual term of the instruments and employees’ expected exercise and post-vesting employment termination behavior into the fair value (or calculated value) of the instruments. Pursuant to paragraph 718-10-S99-1, it may be appropriate to use the simplified method, i.e., expected term = ((vesting term + original contractual term) / 2), if (i) A company does not have sufficient historical exercise data to provide a reasonable basis upon which to estimate expected term due to the limited period of time its equity shares have been publicly traded; (ii) A company significantly changes the terms of its share option grants or the types of employees that receive share option grants such that its historical exercise data may no longer provide a reasonable basis upon which to estimate expected term; or (iii) A company has or expects to have significant structural changes in its business such that its historical exercise data may no longer provide a reasonable basis upon which to estimate expected term. The Company uses the simplified method to calculate expected term of share options and similar instruments as the company does not have sufficient historical exercise data to provide a reasonable basis upon which to estimate expected term. |

| • | Expected volatility of the entity’s shares and the method used to estimate it. Pursuant to ASC Paragraph 718-10-50-2(f)(2)(ii) a thinly-traded or nonpublic entity that uses the calculated value method shall disclose the reasons why it is not practicable for the Company to estimate the expected volatility of its share price, the appropriate industry sector index that it has selected, the reasons for selecting that particular index, and how it has calculated historical volatility using that index. The Company uses the average historical volatility of the comparable companies over the expected contractual life of the share options or similar instruments as its expected volatility. If shares of a company are thinly traded the use of weekly or monthly price observations would generally be more appropriate than the use of daily price observations as the volatility calculation using daily observations for such shares could be artificially inflated due to a larger spread between the bid and asked quotes and lack of consistent trading in the market. |

| • | Expected annual rate of quarterly dividends. An entity that uses a method that employs different dividend rates during the contractual term shall disclose the range of expected dividends used and the weighted-average expected dividends. The expected dividend yield is based on the Company’s current dividend yield as the best estimate of projected dividend yield for periods within the expected term of the share options and similar instruments. |

| • | Risk-free rate(s). An entity that uses a method that employs different risk-free rates shall disclose the range of risk-free rates used. The risk-free interest rate is based on the U.S. Treasury yield curve in effect at the time of grant for periods within the expected term of the share options and similar instruments. |

Generally, all forms of share-based payments, including stock option grants, warrants and restricted stock grants and stock appreciation rights are measured at their fair value on the awards’ grant date, based on estimated number of awards that are ultimately expected to vest.

The expense resulting from share-based payments is recorded in general and administrative expense in the statements of operations.

Stock-Based Compensation – Non Employees

Equity Instruments Issued to Parties Other Than Employees for Acquiring Goods or Services

The Company accounts for equity instruments issued to parties other than employees for acquiring goods or services under guidance of Sub-topic 505-50 of the FASB Accounting Standards Codification (“Sub-topic 505-50”).

Pursuant to ASC Section 505-50-30, all transactions in which goods or services are the consideration received for the issuance of equity instruments are accounted for based on the fair value of the consideration received or the fair value of the equity instrument issued, whichever is more reliably measurable. The measurement date used to determine the fair value of the equity instrument issued is the earlier of the date on which the performance is complete or the date on which it is probable that performance will occur. If the Company is a newly formed corporation or shares of the Company are thinly traded the use of share prices established in the Company’s most recent private placement memorandum (“PPM”), or weekly or monthly price observations would generally be more appropriate than the use of daily price observations as such shares could be artificially inflated due to a larger spread between the bid and asked quotes and lack of consistent trading in the market.

The fair value of share options and similar instruments is estimated on the date of grant using a Black-Scholes option-pricing valuation model. The ranges of assumptions for inputs are as follows:

| • | Expected term of share options and similar instruments: Pursuant to Paragraph 718-10-50-2(f)(2)(i) of the FASB Accounting Standards Codification the expected term of share options and similar instruments represents the period of time the options and similar instruments are expected to be outstanding taking into consideration of the contractual term of the instruments and holder’s expected exercise behavior into the fair value (or calculated value) of the instruments. The Company uses historical data to estimate holder’s expected exercise behavior. If the Company is a newly formed corporation or shares of the Company are thinly traded the contractual term of the share options and similar instruments is used as the expected term of share options and similar instruments as the Company does not have sufficient historical exercise data to provide a reasonable basis upon which to estimate expected term. |

| • | Expected volatility of the entity’s shares and the method used to estimate it. Pursuant to ASC Paragraph 718-10-50-2(f)(2)(ii) a thinly-traded or nonpublic entity that uses the calculated value method shall disclose the reasons why it is not practicable for the Company to estimate the expected volatility of its share price, the appropriate industry sector index that it has selected, the reasons for selecting that particular index, and how it has calculated historical volatility using that index. The Company uses the average historical volatility of the comparable companies over the expected contractual life of the share options or similar instruments as its expected volatility. If shares of a company are thinly traded the use of weekly or monthly price observations would generally be more appropriate than the use of daily price observations as the volatility calculation using daily observations for such shares could be artificially inflated due to a larger spread between the bid and asked quotes and lack of consistent trading in the market. |

| • | Expected annual rate of quarterly dividends. An entity that uses a method that employs different dividend rates during the contractual term shall disclose the range of expected dividends used and the weighted-average expected dividends. The expected dividend yield is based on the Company’s current dividend yield as the best estimate of projected dividend yield for periods within the expected term of the share options and similar instruments. |

| • | Risk-free rate(s). An entity that uses a method that employs different risk-free rates shall disclose the range of risk-free rates used. The risk-free interest rate is based on the U.S. Treasury yield curve in effect at the time of grant for periods within the expected term of the share options and similar instruments. |

Pursuant to ASC paragraph 505-50-25-7, if fully vested, non-forfeitable equity instruments are issued at the date the grantor and grantee enter into an agreement for goods or services (no specific performance is required by the grantee to retain those equity instruments), then, because of the elimination of any obligation on the part of the counterparty to earn the equity instruments, a measurement date has been reached. A grantor shall recognize the equity instruments when they are issued (in most cases, when the agreement is entered into). Whether the corresponding cost is an immediate expense or a prepaid asset (or whether the debit should be characterized as contra-equity under the requirements of paragraph 505-50-45-1) depends on the specific facts and circumstances.

Pursuant to ASC paragraph 505-50-45-1, a grantor may conclude that an asset (other than a note or a receivable) has been received in return for fully vested, non-forfeitable equity instruments that are issued at the date the grantor and grantee enter into an agreement for goods or services (and no specific performance is required by the grantee in order to retain those equity instruments). Such an asset shall not be displayed as contra-equity by the grantor of the equity instruments. The transferability (or lack thereof) of the equity instruments shall not affect the balance sheet display of the asset. This guidance is limited to transactions in which equity instruments are transferred to other than employees in exchange for goods or services. Section 505-50-30 provides guidance on the determination of the measurement date for transactions that are within the scope of this Subtopic.

Pursuant to Paragraphs 505-50-25-8 and 505-50-25-9, an entity may grant fully vested, non-forfeitable equity instruments that are exercisable by the grantee only after a specified period of time if the terms of the agreement provide for earlier exercisability if the grantee achieves specified performance conditions. Any measured cost of the transaction shall be recognized in the same period(s) and in the same manner as if the entity had paid cash for the goods or services or used cash rebates as a sales discount instead of paying with, or using, the equity instruments. A recognized asset, expense, or sales discount shall not be reversed if a share option and similar instrument that the counterparty has the right to exercise expires unexercised.

Pursuant to ASC paragraph 505-50-30-S99-1, if the Company receives a right to receive future services in exchange for unvested, forfeitable equity instruments, those equity instruments are treated as unissued for accounting purposes until the future services are received (that is, the instruments are not considered issued until they vest). Consequently, there would be no recognition at the measurement date and no entry should be recorded.

Revenue Recognition

Revenue is recorded when all of the following have occurred: (1) persuasive evidence of an arrangement exists, (2) asset is transferred to the customer without further obligation, (3) the sales price to the customer is fixed or determinable, and (4) collectability is reasonably assured.

Cost of Sales

Cost of sales represents costs directly related to the purchase of goods and third party testing of the Company’s products.

Related Parties

The Company follows subtopic 850-10 of the FASB Accounting Standards Codification for the identification of related parties and disclosure of related party transactions.

Pursuant to Section 850-10-20 the related parties include a. affiliates of the Company; b. Entities for which investments in their equity securities would be required, absent the election of the fair value option under the Fair Value Option Subsection of Section 825–10–15, to be accounted for by the equity method by the investing entity; c. trusts for the benefit of employees, such as pension and profit-sharing trusts that are managed by or under the trusteeship of management; d. principal owners of the Company; e. management of the Company; f. other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests; and g. Other parties that can significantly influence the management or operating policies of the transacting parties or that have an ownership interest in one of the transacting parties and can significantly influence the other to an extent that one or more of the transacting parties might be prevented from fully pursuing its own separate interests.

The consolidated financial statements shall include disclosures of material related party transactions, other than compensation arrangements, expense allowances, and other similar items in the ordinary course of business. However, disclosure of transactions that are eliminated in the preparation of consolidated or combined financial statements is not required in those statements.

The disclosures shall include: a. the nature of the relationship(s) involved; b. a description of the transactions, including transactions to which no amounts or nominal amounts were ascribed, for each of the periods for which income statements are presented, and such other information deemed necessary to an understanding of the effects of the transactions on the financial statements; c. the dollar amounts of transactions for each of the periods for which income statements are presented and the effects of any change in the method of establishing the terms from that used in the preceding period; and d. amounts due from or to related parties as of the date of each balance sheet presented and, if not otherwise apparent, the terms and manner of settlement.

Contingencies

The Company follows subtopic 450-20 of the FASB Accounting Standards Codification to report accounting for contingencies. Certain conditions may exist as of the date the consolidated financial statements are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company assesses such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or unasserted claims that may result in such proceedings, the Company evaluates the perceived merits of any legal proceedings or unasserted claims as well as the perceived merits of the amount of relief sought or expected to be sought therein.

If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company’s financial statements. If the assessment indicates that a potentially material loss contingency is not probable but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, and an estimate of the range of possible losses, if determinable and material, would be disclosed.

Loss contingencies considered remote are generally not disclosed unless they involve guarantees, in which case the guarantees would be disclosed. However, there is no assurance that such matters will not materially and adversely affect the Company’s business, consolidated financial position, and consolidated results of operations or consolidated cash flows.

Subsequent Events

The Company follows the guidance in Section 855-10-50 of the FASB Accounting Standards Codification for the disclosure of subsequent events. The Company will evaluate subsequent events through the date when the financial statements are issued.

Pursuant to ASU 2010-09 of the FASB Accounting Standards Codification, the Company as an SEC filer considers its financial statements issued when they are widely distributed to users, such as through filing them on EDGAR.

Recently Issued Accounting Pronouncements

In April 2015, the FASB issued Accounting Standards Update No. 2015-03, Interest—Imputation of Interest (Topic 835-30): Simplifying the Presentation of Debt Issuance Costs (“ASU 2015-03”). ASU 2015-03 requires that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a direct deduction from the carrying amount of that debt liability, consistent with debt discounts. The recognition and measurement guidance for debt issuance costs is not affected by ASU 2015-03. ASU 2015-03 is effective for financial statements issued for fiscal years beginning after December 15, 2015, and interim periods within those fiscal years. Early adoption is permitted. Upon adoption, the Company will reclassify debt issuance costs from prepaid expenses and other current assets and other assets as a reduction to debt in the condensed consolidated balance sheets. The Company is not planning to early adopt ASU 2015-03 and does not anticipate that the adoption of ASU 2015-03will materially impact its condensed consolidated financial statements.

In July 2015, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update No. 2015-11, Inventory (Topic 330): Simplifying the Measurement of Inventory (“ASU 2015-11”), which applies guidance on the subsequent measurement of inventory. ASU 2015-11 states that an entity should measure inventory at the lower of cost and net realizable value. Net realizable value is the estimated selling price in the ordinary course of business, less reasonable predictable costs of completion, disposal and transportation. The guidance excludes inventory measured using last-in, first-out or the retail inventory method. ASU 2015-11 is effective for interim and annual reporting periods beginning after December 15, 2016. Early adoption is permitted. The Company is not planning to early adopt ASU 2015-11 and is currently evaluating ASU 2015-11 to determine the potential impact to its condensed consolidated financial statements and related disclosures.

Management does not believe that any other recently issued, but not yet effective accounting pronouncements, if adopted, would have a material effect on the accompanying financial statements.

Re-Classifications

Certain amounts in 2014 were reclassified to conform to the 2015 presentation. These reclassifications had no effect on consolidated net loss for the periods presented.

The fair value of the warrants on the date of issuance and on each re-measurement date of those warrants classified as liabilities is estimated using the Black-Scholes option pricing model using the following assumptions: contractual life according to the remaining terms of the warrants, no dividend yield, weighted average risk-free interest rate of 2.17% at December 31, 2014 and weighted average volatility of 85.63%. For this liability, the Company developed its own assumptions that do not have observable inputs or available market data to support the fair value. This method of valuation involves using inputs such as the fair value of the Company's various classes of preferred stock, stock price volatility, the contractual term of the warrants, risk free interest rates and dividend yields. Due to the nature of these inputs, the valuation of the warrants is considered a Level 3 measurement. The warrant liability is recorded in other liabilities on the Company's Consolidated Balance Sheets. The warrant liability is marked-to-market each reporting period with the change in fair value recorded on the Consolidated Statement of Operations and Comprehensive Loss until the warrants are exercised, expire or other facts and circumstances lead the warrant liability to be reclassified as an equity instrument.

NOTE 4 – NOTE PAYABLE

| September 30, 2015 | December 31, 2014 | |||||||

| Loan payable - Stockholder, Due December 31, 2015, unsecured (1) | $ | 250,000 | $ | 250,000 | ||||

| Note Payable – 10% due September 9, 2017 (4) also see note 5, see footnote (11) | 100,000 | -0- | ||||||

| Note Payable – 10% due September 9, 2017 (5) also see note 5, see footnote (11) | 100,000 | -0- | ||||||

| Note Payable -10% due May 31, 2015 (3) | -0- | 100,000 | ||||||

| Note Payable - 12% due May 30, 2015 (2) | -0- | 100,000 | ||||||

| Total Face Value of Non-Conv. Debt | $ | 450,000 | $ | 450,000 | ||||

| Less (discounts) imputed interest | (99,257 | ) | 20,809 | |||||

| Net Long-term Debt Non Convertible debt | $ | 350,743 | $ | 270,809 | ||||

| Net Short-term Debt Non Convertible | $ | 0 | $ | 200,000 | ||||

| (1) | At December 31, 2013 the Company was indebted to an affiliated shareholder of the Company for $840,955, which consisted of $737,100 principal and $103,895 accrued interest, with interest accruing at 10%. On January 2, 2014 the Company entered into a Debt Modification Agreement whereby the total amount of the debt was reduced to $750,000 and there is no accrued interest or principal due until December 31, 2015. On June 20, 2015 the $500,000 convertible portion of the debt was extended to December 31, 2017. $500,000 of the debt is convertible into 50,000 Series C Convertible Preferred Shares of AFAI, which if converted are subject to resale restrictions through December 31, 2017. The two-year note in the aggregate amount of $500,000 is convertible into the Company’s preferred stock at a conversion rate of $10.00 per share of preferred. At a conversion rate of 433.9297 common shares to 1 preferred share, this would result in a total of 21,696,485 common shares issued if all debt was converted. The market value of the stock at the date of issuance of the debt was $0.04. |

| The debt issued is a result of a financing transaction and contain a beneficial conversion feature valued at $367,859 to be amortized over the life of the debt. Total amortization for the year ended December 31, 2014 was $183,928. As of December 31, 2014, the balance of the debt was $500,000. The net balance reflected on the balance sheet is $303,213. The remaining $250,000 is not convertible. The company has imputed interest on both the convertible debt and the non-convertible debt. The company used an interest rate of 4% for calculation purposes. The net balance of $250,000 of the non-convertible portion is reflected on the balance sheet, plus imputed interest of $10,406. As of September 30, 2015, the balance of the debt was $500,000. The net balance reflected on the balance sheet is $400,682. The remaining $250,000 is not convertible. The company has imputed interest on both the convertible debt and the non-convertible debt. The company used an interest rate of 4% for calculation purposes. The net balance of $250,000 of the non-convertible portion is reflected on the balance sheet, plus imputed interest of $36,415. This note was modified and restated as of June 20, 2015, see Footnote 9. |

| (2) | On August 11, 2014 the Company received a total of $100,000 from an accredited investor in exchange for a senior promissory note due May 25, 2015 in the aggregate amount of $100,000. Interest rate is stated at 12%. As of June 30, 2015, this note balance along with $10,000 of interest was renegotiated into a convertible note with a face value of $110,000. This note was modified and restated as of June 20, 2015, see Footnote 9. |

| (3) | On November 25, 2014 the Company received a total of $100,000 from an accredited investor in exchange for a senior promissory note due May 31, 2015 in the aggregate amount of $100,000. Interest rate is stated at 10%. As of June 30, 2015, this note balance along with $10,000 of interest was renegotiated into a convertible note with a face value of $110,000. This note was modified and restated as of June 20, 2015, see Footnote 9. |

| (4) | On September 8, 2015 the Company received a total of $100,000 from an accredited investor in exchange for a two year note in the aggregate amount of $100,000 with interest accruing at 10%. The note holder is entitled to subscribe for and purchase from the company 3,161,583 paid and non-assessable shares of the Common Stock at the price of $0.0316297 per share (the “Warrant Exercise Price”) for a period of five (5) years commencing from the earlier of such time as that certain $100K, 10% promissory note due September 9, 2017 has been fully repaid or the start of the Acceleration Period as defined in “The Note” or September 9, 2017. |

| (5) | On September 9, 2015 the Company received a total of $100,000 from an accredited investor in exchange for a two year note in the aggregate amount of $100,000 with interest accruing at 10%. The note holder is entitled to subscribe for and purchase from the company 3,161,583 paid and non-assessable shares of the Common Stock at the price of $0.0316297 per share (the “Warrant Exercise Price”) for a period of five (5) years commencing from the earlier of such time as that certain $100K, 10% promissory note due September 9, 2017 has been fully repaid or the start of the Acceleration Period as defined in “The Note” or September 9, 2017. |

NOTE 5 – CONVERTIBLE DEBT

| September 30, 2015 | December 31, 2014 | |||||||

| Convertible note - related party, Due December 31, 2017 unsecured (2) | 500,000 | 500,000 | ||||||

| Convertible note - 10% due June 9, 2015 (3) | -0- | 50,000 | ||||||

| Convertible note - 10% due June 13, 2015 (4) | -0- | 25,000 | ||||||

| Convertible note - 10% due July 11, 2015 (5) | -0- | 160,000 | ||||||

| Convertible note - 10% due June 13, 2015 (6) | -0- | 100,000 | ||||||

| Convertible note - 10% due June 30, 2015 (7) | -0- | 30,000 | ||||||

| Convertible note - 10% due December 31, 2015 (9) | 55,000 | -0- | ||||||

| Convertible note - 12% due December 31, 2015 (9) | 27,500 | -0- | ||||||

| Convertible note - 12% due December 31, 2015 (9) | 175,000 | -0- | ||||||

| Convertible note - 12% due December 31, 2015 (9) | 116,500 | -0- | ||||||

| Convertible note - 12% due December 31, 2015 (9) | 110,000 | -0- | ||||||

| Convertible note - 12% due December 31, 2015 (9) | 110,000 | -0- | ||||||

| Convertible note - 12% due December 31, 2015 (9) | 52,500 | -0- | ||||||

| Convertible note - 12% due December 31, 2015 (9) | 63,000 | -0- | ||||||

| Convertible note - 12% due December 31, 2015 (9) | 22,000 | -0- | ||||||

| Convertible note - 12% due December 31, 2015 (9) | 22,000 | -0- | ||||||

| Convertible note - 12% due December 31, 2015 (9) | 25,000 | -0- | ||||||

| Convertible note - 12% due December 31, 2015 (10) | 110,000 | -0- | ||||||

| Convertible note - due September 30, 2015 (8) | 25,000 | -0- | ||||||

| Convertible note-10% due September 21, 2017 (11) | 50,000 | |||||||

| Convertible note-10% due September 21, 2017 (12) | 100,000 | |||||||

| Convertible note-10% due September 21, 2017 (13) | 50,000 | |||||||

| Convertible note- 6% due April 1, 2016 (14) | 28,500 | |||||||

| Convertible note - stockholder, 10%, due April 30, 2013, unsecured (1) | 25,000 | 25,000 | ||||||

| $ | 1,227,000 | $ | 890,000 | |||||

| (1) | At the option of the holder the convertible note may be converted into shares of the Company’s common stock at the lesser of $0.40 or 20% discount to the market price, as defined, of the Company’s common stock. The Company is currently in discussions with the lender on a payment schedule. The outstanding balance of this note is convertible into a variable number of the Company’s common stock. Therefore the Company accounted for these Notes under ASC Topic 815-15 “Embedded Derivative.” The derivative component of the obligation are initially valued and classified as a derivative liability with an offset to discounts on convertible debt. Discounts have being amortized to interest expense over the respective term of the related note. In determining the indicated value of the convertible note issued, the Company used the Black Scholes Option Model with a risk-free interest rate of ranging from 0.018% to .02%, volatility ranging from 160% of 336%, trading prices ranging from $.105 per share to $0.105 per share and a conversion price ranging from $0.084 per share to $0.40 per share. Accrued interest on this note that was charged to operations for the year ended December 31, 2014 totaled approximately $7,760. Accrued interest on this note that was charged to operations for the quarter ended September 30, 2015 totaled approximately $945) Amortization of the discounts for the year ended December 31, 2014 totaled $25,000, which was charged to interest expense. The balance of the convertible note at December 31, 2014 including accrued interest and net of the discount amounted to $32,760. |

A recap of the balance of outstanding convertible debt with derivative liabilities at September 30, 2015 is as follows:

| Principal balance | $ | 25,000 | ||

| Accrued interest | 11,526 | |||

| Balance maturing for the period ending: | ||||

| September 30, 2015 | $ | 36,526 |

The Company valued the derivative liabilities at December 31, 2014 at $8,658. The Company recognized a change in the fair value of derivative liabilities for the three months ended September 30, 2015 of $242, which were charged to operations.. In determining the indicated values at September 30, 2015, the Company used the Black Scholes Option Model with risk-free interest rates ranging from 0.018% to 0.02%, volatility ranging from 160% to 336%, a trading price of $.089, and conversion prices ranging from $.05 per share.

| (2) | At December 31, 2013 the Company was indebted to an affiliated shareholder of the Company for $840,955, which consisted of $737,100 principal and $103,895 accrued interest, with interest accruing at 10%. On January 2, 2014 the Company entered into a Debt Modification Agreement whereby the total amount of the debt was reduced to $750,000 and there is no accrued interest or principal due until December 31, 2015. $500,000 of the debt is convertible into 50,000 Series C Convertible Preferred Shares of AFAI, which if converted are subject to resale restrictions through December 31, 2015. The two-year note in the aggregate amount of $500,000 is convertible into the Company’s preferred stock at a conversion rate of $10.00 per share of preferred. At a conversion rate of 433.9297 common shares to 1 preferred share, this would result in a total of 21,696,485 common shares issued if all debt was converted. The market value of the stock at the date of issuance of the debt was $0.04. The debt issued is a result of a financing transaction and contain a beneficial conversion feature valued at $367,859 to be amortized over the life of the debt. Total amortization for the year ended December 31, 2014 was $183,929. As of December 31, 2014, the balance of the debt was $500,000. The net balance reflected on the balance sheet is 303,213. The remaining $250,000 is not convertible. The company has imputed interest on both the convertible debt and the non-convertible debt. The company used an interest rate of 4% for calculation purposes. The net balance of $250,000 of the non-convertible portion is reflected on the balance sheet. Total amortization for the quarter ended June 30, 2015 was $Update this number. As of September 30, 2015, the balance of the debt was $500,000. The net balance reflected on the balance sheet is $400,682. The remaining $250,000 is not convertible. The company has imputed interest on both the convertible debt and the non-convertible debt. The company used an interest rate of 4% for calculation purposes. The net balance of $250,000 of the non-convertible portion is reflected on the balance sheet. This note was modified and restated as of June 20, 2015. |

| (3) | On June 9, 2014 the Company received a total of $50,000 from an accredited investor in exchange for one year notes in the aggregate amount of $50,000. The note is convertible after December 9, 2014 and is convertible into the Company’s common stock at a conversion rate of $0.04 per share. The market value of the stock at the date (December 9, 2014) when the debt becomes convertible was $0.09. The debt issued is a result of a financing transaction and contain a beneficial conversion feature. As of December 31, 2014, the balance was $50,000. The beneficial conversion feature in the amount of $50,000 is being expensed as interest over the term of the note. At December 31, 2014 the Company has recorded interest expense from amortization of beneficial conversion feature in the amount of $17,551. As of September 30, 2015, the balance was $50,000. The beneficial conversion feature in the amount of $50,000 is being expensed as interest over the term of the note. At September 30, 2015 the Company has recorded interest expense from amortization of beneficial conversion feature in the amount of $update number. This note was extinguished and re-issued under new terms as of June 20, 2015, see Footnote 9. |

| (4) | On June 15, 2014, the Company received a total of $25,000 from an accredited investor in exchange for one year notes in the aggregate amount of $25,000. The note is convertible after December 13, 2014 and is convertible into the Company’s common stock at a conversion rate of $0.04 per share. The market value of the stock at the date (December 13, 2014) when the debt becomes convertible was $0.085. The debt issued is a result of a financing transaction and contain a beneficial conversion feature. As of December 31, 2014, the balance was $25,000. The beneficial conversion feature in the amount of $25,000 is being expensed as interest over the term of the note. At December 31, 2014 the Company has recorded interest expense from amortization of beneficial conversion feature in the amount of $13,767. As of September 30, 2015, the balance was $25,000. The beneficial conversion feature in the amount of $25,000 is being expensed as interest over the term of the note. At September 30, 2015 the Company has recorded interest expense from amortization of beneficial conversion feature in the amount of $25,000. This note was extinguished and re-issued under new terms as of June 20, 2015, see Footnote 9. |

| (5) | On July 11, 2014 the Company received a total of $160,000 from an accredited investor in exchange for one year note in the aggregate amount of $160,000. The note is convertible after January 13, 2015 and is convertible into the Company’s common stock at a conversion rate of $0.04 per share. The market value of the stock at the date (January 13, 2015) when the debt becomes convertible was $0.077. The debt issued is a result of a financing transaction and contains a beneficial conversion feature when the debt becomes convertible as of January 13, 2015. As of December 31, 2014, the balance was $160,000 The beneficial conversion feature in the amount of $160,000 is being expensed as interest over the term of the note. At December 31, 2014 the Company has recorded interest expense from amortization of beneficial conversion feature in the amount of $75,836. This note was extinguished and re-issued under new terms as of June 20, 2015, see Footnote 9. |

| (6) | On September 19, 2014 the Company received a total of $100,000 from an accredited investor in exchange for a six month note in the aggregate amount of $100,000. The note is convertible after December 13, 2014 and is convertible into the Company’s common stock at a conversion rate of $0.04 per share. The market value of the stock at the date (December 13, 2014) when the debt becomes convertible was $0.085. The debt issued is a result of a financing transaction and contain a beneficial conversion feature. As of December 31, 2014, the balance was $100,000. The beneficial conversion feature in the amount of $100,000 is being expensed as interest over the term of the note. At December 31, 2014 the Company has recorded interest expense from amortization of beneficial conversion feature in the amount of $56,906. As of September 30, 2015, the balance was $100,000. The beneficial conversion feature in the amount of $100,000 is being expensed as interest over the term of the note. At September 30, 2015 the Company has recorded interest expense from amortization of beneficial conversion feature in the amount of $100,000. This note was extinguished and re-issued under new terms as of June 20, 2015, see Footnote 9. |

| (7) | On November 14, 2014 the Company received a total of $30,000 from an accredited investor in exchange for a six month note in the aggregate amount of $30,000. The note is convertible after December 15, 2014 and is convertible into the Company’s common stock at a conversion rate of $0.07 per share. The market value of the stock at the date (December 15, 2014) when the debt becomes convertible was $0.085. The debt issued is a result of a financing transaction and contain a beneficial conversion feature. As of December 31, 2014, the balance was $30,000. The beneficial conversion feature in the amount of $8,250 is being expensed as interest over the term of the note. At December 31, 2014 the Company has recorded interest expense from amortization of beneficial conversion feature in the amount of $30,000. As of September 30, 2015, the balance was $-0-. The note was converted into 450,000 shares common stock. |

| (8) | On March 13, 2015 the Company received a total of $25,000 from an accredited investor in exchange for a six month note in the aggregate amount of $25,000. The note is convertible after March 13, 2015 and is convertible into the Company’s common stock at a conversion rate of $0.06 per share. The market value of the stock at the date when the debt becomes convertible was $0.085. The debt issued is a result of a financing transaction and contain a beneficial conversion feature. As of September 30, 2015, the balance was $25,000. The beneficial conversion feature in the amount of $25,000 is being expensed as interest over the term of the note. At September 30, 2015 the Company has recorded interest expense from amortization of beneficial conversion feature in the amount of $7,917. The company has issued 150,000 shares of common stock as prepaid interest. |

| (9) | On June 20, 2015 the Company renegotiated nine convertible and non-convertible notes payable. The Total face value of the notes issued was $778,500 the six month notes are due on December 31, 2015 in the aggregate amount of $778,500. The notes are convertible after June 20, 2015 and are convertible into the Company’s common stock at a conversion rate of $0.03 per share. The market value of the stock at the date when the debt becomes convertible was $0.089. The debt was issued is a result of a financing transaction and contain a beneficial conversion feature. As of September 30, 2015, the balance was $778,500. The beneficial conversion feature in the amount of $778,500 is being expensed as interest over the term of the note. At September 30, 2015 the Company has recorded interest expense from amortization of beneficial conversion feature in the amount of $449,443. These notes were the result of extinguishment and re-issued under new terms as of June 20, 2015, see Footnote 9. |

| (10) | On June 24, 2015 the Company received a total of $110,000 from an accredited investor in exchange for a six month note due on December 31, 2015 in the aggregate amount of $110,000. The note is convertible after June 24, 2015 and is convertible into the Company’s common stock at a conversion rate of $0.03 per share. The market value of the stock at the date when the debt becomes convertible was $0.081. The debt issued is a result of a financing transaction and contain a beneficial conversion feature. As of September 30, 2015, the balance was $110,000. The beneficial conversion feature in the amount of $110,000 is being expensed as interest over the term of the note. At September 30, 2015 the Company has recorded interest expense from amortization of beneficial conversion feature in the amount of $62,526. This note was extinguished and re-issued under new terms as of June 20, 2015, see Footnote 9. |

| (11) | On April 27, 2015 the Company received a total of $30,000 from an accredited investor in exchange for a six month note in the aggregate amount of $30,000. The note is convertible after April 27, 2015 and is convertible into the Company’s common stock at a conversion rate of $0.05 per share. The market value of the stock at the date when the debt becomes convertible was $0.089. The debt issued is a result of a financing transaction and contain a beneficial conversion feature. As of September 30, 2015, the balance was -0- |

| (11) | On September 23, 2015 the Company received a total of $50,000 from an accredited investor in exchange for a two year note in the aggregate amount of $50,000 with interest accruing at 10%. The note is convertible after September 23, 2015 and is convertible into the Company’s common stock at a conversion rate of $0.03 per share. The market value of the stock at the date when the debt becomes convertible was $0.078. The debt issued is a result of a financing transaction and contain a beneficial conversion feature. Note due on September 21, 2017 |

| (12) | On September 23, 2015 the Company received a total of $100,000 from an accredited investor in exchange for a two year note in the aggregate amount of $100,000 with interest accruing at 10%. The note is convertible after September 23, 2015 and is convertible into the Company’s common stock at a conversion rate of $0.03 per share. The market value of the stock at the date when the debt becomes convertible was $0.078. The debt issued is a result of a financing transaction and contain a beneficial conversion feature. Note due on September 21, 2015 |

| (13) | On September 23, 2015 the Company received a total of $50,000 from an accredited investor in exchange for a two year note in the aggregate amount of $50,000 with interest accruing at 10%. The note is convertible after September 23, 2015 and is convertible into the Company’s common stock at a conversion rate of $0.03 per share. The market value of the stock at the date when the debt becomes convertible was $0.078. The debt issued is a result of a financing transaction and contain a beneficial conversion feature. Note due on September 21, 2015 |

On September 8, 2015 the Company received a total of $100,000 from an accredited investor in exchange for a two year note in the aggregate amount of $100,000 with interest accruing at 10%. The note holder is entitled to subscribe for and purchase from the company 3,161,583 paid and non-assessable shares of the Common Stock at the price of $0.0316297 per share (the “Warrant Exercise Price”) for a period of five (5) years commencing from the earlier of such time as that certain $100K, 10% promissory note due September 9, 2017 has been fully repaid or the start of the Acceleration Period as defined in “The Note” or September 9, 2017.

On September 9, 2015 the Company received a total of $100,000 from an accredited investor in exchange for a two year note in the aggregate amount of $100,000 with interest accruing at 10%. The note holder is entitled to subscribe for and purchase from the company 3,161,583 paid and non-assessable shares of the Common Stock at the price of $0.0316297 per share (the “Warrant Exercise Price”) for a period of five (5) years commencing from the earlier of such time as that certain $100K, 10% promissory note due September 9, 2017 has been fully repaid or the start of the Acceleration Period as defined in “The Note” or September 9, 2017.

| (14) | On July 27, 2015 the company issued a note payable for $28,500 The Company agrees to pay to the Holder $28,500 plus accrued interest pursuant to the following schedule: |

An initial payment of $5,000 is due no later than December 1, 2015. This amount represents the balance of the security deposit due for the lease of Commercial/Manufacturing Space occupied by MJAI Oregon 1, LLC, a majority-owned subsidiary of the company. A final payment of $23,500 principal, plus any accrued Interest at 10% is due no later than April 1, 2016. This amount represents the balance of accrued rent due for the initial monthly lease payments from August 1, 2015 through March 31, 2016. The note is convertible after March 31, 2016 and is convertible into the Company’s common stock at a conversion rate of $0.10 per share or 20% discount to the thirty day moving average stock price.

NOTE 6 – STOCKHOLDERS’ EQUITY

The Company has 10,000,000 shares of preferred stock authorized with a par value of $0.001, of which 100,000 shares have been designated as Series C convertible preferred stock (“Series C” or “Series C preferred stock”). The Board has the authority to issue the shares in one or more series and to fix the designations, preferences, powers and other rights, as it deems appropriate.

Each share of Series C has 433.9297 votes on any matters submitted to a vote of the stockholders of the Company and is entitled to dividends equal to the dividends of 433.9297 shares of common stock. Each share of Series C preferred stock is convertible at any time at the option of the holder into 433.9297 shares of common stock.

The Company has 250,000,000 shares of common stock authorized with a par value of $0.001. Each share of common stock has one vote per share for the election of directors and all other items submitted to a vote of stockholders. The common stock does not have cumulative voting rights, preemptive, redemption or conversion rights.

During January 2015 the company issued 8,200,000 shares of common stock valued in a range of $0.05 to $0.07 per share. Total cash received was $114,000. Total interest paid with shares was $1,500. Total value of debt paid was $30,000. Total value of assets acquired was $17,500. Total consulting services were $444,500.

During the Quarter ended September 30, 2015 the Company issued 800,000 shares of common stock valued in a range of $0.05 to $0.09 per share Total value of assets acquired was $27,000. Total consulting services were 37,000

During the Quarter ended September 30, 2015 the Company issued 100,000 shares of common stock valued at $0.08 as payment for interest of $8,000

On August 12, 2015 the Company received $20,000 from the sale of 400,000 restricted common shares of stock to an accredited investor that is a current shareholder of the company.

On August 15, 2015 the Company received $20,000 from the sale of 400,000 restricted common shares of stock to an accredited investor that is a current shareholder of the company.

On April 27, 2015 the Company received a total of $30,000 from an accredited investor in exchange for a six month note in the aggregate amount of $30,000. The note is convertible after April 27, 2015 and is convertible into the Company’s common stock at a conversion rate of $0.05 per share. On September 23, 2015 the balance was converted into 600,000 shares of common stock... The company issued 150,000 shares of common stock as interest. The value of the shares as of the date of issuance as $0.08.

On September 10, 2015 the Company received $25,000 from the sale of 416,666 restricted common shares of Kaya Holdings, Inc. stock to an accredited investor that is a current shareholder of the company.

On September 29, 2015 the Company received $5,000 from the sale of 100,000 restricted common shares of Kaya Holdings, Inc. stock to an accredited investor.

NOTE 7 – LEASES

The Company is obligated under operating lease agreements for its corporate office in Fort Lauderdale, which expires March 2016. The Company concluded an agreement in March 2014 terminating its obligations for leases held for land in Tempate, Costa Rica. The Company concluded the term of its lease agreement for offices maintained in Hollywood, Florida. The Company signed 2 new leases that started in May 2014 and June 2014.

Minimum future lease commitments are:

| Year | Amount | |||||

| 2015 | 56,880 | |||||

| 2016 | 36,396 | |||||

| 2017 | 30,360 | |||||

| 2018 | 31,584 | |||||

Rent expense was $45,686 for the nine months ended September 30, 2015, and $65,162 for the year ended December 31, 2014, respectively.

In April, 2014 MJAI, through its wholly owned subsidiary, MJAI Oregon 1, LLC (MJAI Oregon 1) Oregon company, entered into a lease for space to operate their first medical marijuana dispensary in Portland, Oregon. The five-year lease requires MJAI Oregon 1 to pay a monthly rental fee of $2,255 the first year with annual lease payment escalations of 4% and a security deposit of $12,000. The dispensary is located are located at 1719 SE Hawthorne Boulevard, Portland, Oregon and will operate under the proprietary brand name of “Kaya Shack “TM.

On August 1, 2015 the Company announced that it had signed a lease for a 6,000 square foot facility in central Portland to serve as the Company's expanded Marijuana and Cannabis Manufacturing Complex and West Coast Operations Base.

NOTE 8 – RELATED PARTY TRANSACTIONS

The Company has agreements covering certain of its management personnel. Such agreements provide for minimum compensation levels and are subject to annual adjustment.

The Company’s Chief Executive Officer holds 50,000 shares of its Series C preferred stock. These shares can be converted into 21,696,485 shares of the Company’s common stock at his option.

The Company’s largest stockholder has from time to time provided unsecured loans to the Company, See Note 4 for the detail of the convertible and non-convertible debt with a face value of $750,000

NOTE 9– DEBT EXTINGUISHMENT