Attached files

| file | filename |

|---|---|

| EX-31.2 - CERTIFICATION OF CHIEF FINANCIAL OFFICER PURSUANT TO RULE 13A-14(A) - Fifth Street Asset Management Inc. | fsam-ex312_201593010xq.htm |

| EX-31.1 - CERTIFICATION OF CHIEF EXECUTIVE OFFICER PURSUANT TO RULE 13A-14(A) - Fifth Street Asset Management Inc. | fsam-ex311_201593010xq.htm |

| EX-32.1 - CERTIFICATION OF CHIEF EXECUTIVE OFFICER PURSUANT TO SECTION 906 - Fifth Street Asset Management Inc. | fsam-ex321_201593010xq.htm |

| EX-32.2 - CERTIFICATION OF CHIEF FINANCIAL OFFICER PURSUANT TO SECTION 906 - Fifth Street Asset Management Inc. | fsam-ex322_201593010xq.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-Q

(Mark One)

þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) | ||

OF THE SECURITIES EXCHANGE ACT OF 1934 | |||

For the quarterly period ended September 30, 2015

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) | ||

OF THE SECURITIES EXCHANGE ACT OF 1934 | |||

COMMISSION FILE NUMBER: 001-36701

Fifth Street Asset Management Inc.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

DELAWARE | 46-5610118 | |

(State or jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

777 West Putnam Avenue, 3rd Floor Greenwich, CT | 06830 | |

(Address of principal executive office) | (Zip Code) | |

REGISTRANT'S TELEPHONE NUMBER, INCLUDING AREA CODE:

(203) 681-3600

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter periods as the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES þ NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES þ NO ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | Accelerated filer o | Non-accelerated filer þ | Smaller reporting company o | |||

(Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) YES ¨ NO þ

The number of shares of the registrant's Class A common stock, par value $0.01 per share, outstanding as of November 20, 2015 was 5,782,392. The number of shares of the registrant's Class B common stock, par value $0.01 per share, outstanding as of November 20, 2015 was 42,856,854.

TABLE OF CONTENTS

Item 1. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 1. | ||

Item 1A. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934 as amended, (the "Exchange Act"), that reflect our current views with respect to, among other things, future events and financial performance. You can identify these forward-looking statements by the use of forward-looking words such as "outlook," "believes," "expects," "potential," "continues," "may," "will," "should," "seeks," "approximately," "predicts," "intends," "plans," "estimates," "anticipates" or the negative version of those words or other comparable words. The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. Such forward-looking statements are subject to various risks and uncertainties and assumptions relating to our operations, financial results, financial condition, business prospects, growth strategy and liquidity. We believe these factors include, but are not limited to, those described under "Risk Factors" in this Quarterly Report on Form 10-Q and in "Item 1A Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2014, as such factors may be updated from time to time in our periodic filings with the Securities and Exchange Commission (the "SEC"), which are accessible on the SEC's website at www.sec.gov. If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, our actual results may vary materially from those indicated in these forward-looking statements. New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us. Therefore, you should not place undue reliance on these forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. We do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

Unless the context otherwise requires, references to "we," "us," "our" and "the Company" are intended to mean the business and operations of Fifth Street Asset Management Inc. and its consolidated subsidiaries since the consummation of our initial public offering on November 4, 2014. When used in the historical context (i.e., prior to November 4, 2014), these terms are intended to mean the business and operations of Fifth Street Management Group.

When used in this Quarterly Report on Form 10-Q, unless the context otherwise requires:

• | "Adjusted Net Income" represents income before income tax benefit (provision) as adjusted for (i) certain compensation-related charges, including the amortization of equity-based awards related to the Reorganization and initial public offering, (ii) non-recurring underwriting costs relating to public offerings of our funds, (iii) non-recurring professional fees and other expenses incurred in connection with our initial public offering, (iv) unrealized gains (losses) on beneficial interests in CLO and (v) other non-recurring items; |

• | "AUM" refers to assets under management of the Fifth Street Funds and material control investments of these funds, and represents the sum of the net asset value of such funds and investments, the drawn debt and unfunded debt and equity commitments at the fund or investment-level (including amounts subject to restrictions) and uncalled committed debt and equity capital (including commitments to funds that have yet to commence their investment periods); |

• | "base management fees" refer to fees we earn for advisory services provided to our funds, which are generally based on a fixed percentage of fair value of assets, total commitments, invested capital, net asset value, total assets or par value of the investment portfolios managed by us; |

• | "catch-up" refers to a provision for a manager or adviser of a fund to receive the majority or all of the profits of such fund until the agreed upon profit allocation is reached; |

• | "CLO" refers to a collateralized loan obligation; |

• | “CLO I” refers to Fifth Street Senior Loan Fund I, LLC, a CLO in our senior loan fund strategy managed by CLO Management; |

• | "CLO II" refers to Fifth Street SLF II, Ltd. (formerly Fifth Street Senior Loan Fund II, LLC, prior to securitization), a CLO in our senior loan fund strategy managed by CLO Management; |

• | "CLO Management" refers to Fifth Street CLO Management LLC, the collateral manager for CLO I and CLO II; |

• | "Consolidated Fund" refers to CLO II; |

• | "fee-earning AUM" refers to the AUM on which we directly or indirectly earn management fees, and represents the sum of the net asset value of the Fifth Street Funds and their material control investments, and the drawn debt and unfunded debt and equity commitments at the fund or investment-level (including amounts subject to restrictions); |

• | "Fifth Street BDCs" and "our BDCs" refer to FSC and FSFR together; |

• | "Fifth Street Funds" and "our funds" refer to the Fifth Street BDCs and the other funds advised or managed by Fifth Street Management or CLO Management; |

• | "Fifth Street Management" refers to Fifth Street Management LLC and, unless the context otherwise requires, its subsidiaries; |

i

• | "Fifth Street Management Group" and the "Predecessor" refers to Fifth Street Management LLC, FSC, Inc., FSC CT, Inc., FSC Midwest, Inc., Fifth Street Capital West, Inc. (and their wholly-owned subsidiaries) and certain combined funds; |

• | "FSC" refers to Fifth Street Finance Corp., a publicly-traded business development company managed by Fifth Street Management; |

• | "FSFR" refers to Fifth Street Senior Floating Rate Corp., a publicly-traded business development company managed by Fifth Street Management; |

• | "FSOF" refers to "Fifth Street Opportunities Fund, L.P.", a hedge fund managed by Fifth Street Management; |

• | "Fund II" refers to Fifth Street Mezzanine Partners II, L.P., a fund advised by an affiliate of Fifth Street Management; |

• | "Holdings Limited Partners" refers to active, limited partners in Fifth Street Holdings (other than us), which include, among other persons, the Principals; |

• | "hurdle rate" or "hurdle" refers to a specified minimum rate of return that a fund must exceed in order for the investment adviser or manager of such a fund to receive performance fees; |

• | "management fees" refer to base management fees and Part I Fees; |

• | "MMKT" refers to MMKT Exchange LLC, a financial technology company in which FSM owns 80% of the common membership interests; |

• | "Part I Fees" refer to fees paid to us by our BDCs that are based on a fixed percentage of pre-incentive fee net investment income, which are calculated and paid quarterly, and subject to certain specified performance hurdles. Part I Fees are classified as management fees as they are predictable and are recurring in nature, are not subject to repayment (or clawback) and are generally cash-settled each quarter; |

• | "Part II Fees" refer to fees paid to us by our BDCs that are based on net capital gains, which are paid annually; |

• | "performance fees" refer to fees we earn based on the performance of a fund, which are generally based on certain specific hurdle rates as defined in the fund's investment management or partnership agreements, may be either an incentive fee or carried interest, are paid annually and also include Part II Fees; |

• | "permanent capital" refers to capital of funds that do not have redemption provisions or a requirement to return capital to investors upon exiting the investments made with such capital, except as required by applicable law, which funds currently consist of FSC and FSFR; such funds may be required to distribute all or a portion of capital gains and investment income or elect to distribute capital; |

• | "Principals" refers to Leonard M. Tannenbaum and Bernard D. Berman and, where applicable, any entities controlled directly or indirectly by them; |

• | "SLF I" refers to Fifth Street Senior Loan Fund I, LLC, a fund in our senior loan fund strategy, previously managed by Fifth Street Management prior to CLO I securitization; |

• | "SLF II" refers to Fifth Street Senior Loan Fund II, LLC, a fund in our senior loan fund strategy, previously managed by Fifth Street Management prior to CLO II securitization; and |

• | "TRA recipients" refers to the Principals and Ivelin M. Dimitrov. |

Many of the terms used in this Quarterly Report on Form 10-Q, including AUM, fee-earning AUM and Adjusted Net Income, may not be comparable to similarly titled measures used by other companies. In addition, our definitions of AUM and fee-earning AUM are not based on any definition of AUM or fee-earning AUM that is set forth in the agreements governing the investment funds that we manage and may differ from definitions of AUM set forth in other agreements to which we are a party from time to time, including the agreements governing our revolving credit facility. Please see "Management's Discussion and Analysis of Financial Condition and Results of Operations — Non-GAAP Financial Measures and Operating Metrics — Assets Under Management" and "— Fee-earning AUM" for more information on AUM and fee-earning AUM. Further, Adjusted Net Income is not a performance measure calculated in accordance with U.S. Generally Accepted Accounting Principles ("GAAP"). We use Adjusted Net Income as a measure of operating performance, not as a measure of liquidity. We believe that Adjusted Net Income provides investors with a meaningful indication of our core operating performance and Adjusted Net Income is evaluated regularly by our management as a decision tool for deployment of resources. We believe that reporting Adjusted Net Income is helpful in understanding our business and that investors should review the same supplemental non-GAAP financial measures that our management uses to analyze our performance. Adjusted Net Income has limitations as an analytical tool and should not be considered in isolation or as a substitute for analyzing our results prepared in accordance with GAAP. The use of Adjusted Net Income without consideration of related GAAP measures is not adequate due to the adjustments described above. See "Management's Discussion and Analysis of Financial Condition and Results of Operations — Non-GAAP Financial Measures and Operating Metrics — Adjusted Net Income."

Amounts and percentages throughout this Quarterly Report on Form 10-Q may reflect rounding adjustments and consequently totals may not appear to sum.

ii

PART I - FINANCIAL INFORMATION

Item 1. Consolidated Financial Statements

Fifth Street Asset Management Inc.

Consolidated Statements of Financial Condition

All management and performance fees are earned from affiliates of the Company. See notes to Consolidated Financial Statements.

As of | ||||||||

September 30, 2015 | December 31, 2014 | |||||||

Assets | (unaudited) | (see Note 2) | ||||||

Cash and cash equivalents | $ | 6,037,923 | $ | 3,238,008 | ||||

Management fees receivable (includes Part I Fees of $5,838,844 and $7,809,194 at September 30, 2015 and December 31, 2014, respectively) | 19,891,214 | 23,363,901 | ||||||

Performance fees receivable | 79,451 | 106,635 | ||||||

Prepaid expenses (includes $436,468 and $185,580 related to income taxes at September 30, 2015 and December 31, 2014, respectively) | 1,052,684 | 1,335,593 | ||||||

Investments in equity method investees | 6,415,175 | 4,115,429 | ||||||

Investments in available-for-sale securities | 1,350,775 | — | ||||||

Beneficial interest in CLOs at fair value: (cost: $4,496,624) | 3,906,078 | — | ||||||

Due from affiliates | 2,129,104 | 3,799,542 | ||||||

Fixed assets, net | 10,106,099 | 10,274,263 | ||||||

Deferred tax assets | 53,048,823 | 57,972,039 | ||||||

Deferred financing costs | 2,055,266 | 2,432,764 | ||||||

Other assets | 4,066,579 | 4,197,358 | ||||||

Assets of Consolidated Fund: | ||||||||

Cash and cash equivalents | 74,519,096 | — | ||||||

Investments at fair value (cost: $323,434,153) | 323,434,153 | — | ||||||

Interest and dividends receivable | 3,277,652 | — | ||||||

Unsettled trades receivable | 1,094,500 | — | ||||||

Deferred financing costs | 2,744,979 | — | ||||||

Total assets | $ | 515,209,551 | $ | 110,835,532 | ||||

Liabilities and Equity | ||||||||

Liabilities | ||||||||

Accounts payable and accrued expenses | $ | 1,983,793 | $ | 3,045,651 | ||||

Accrued compensation and benefits | 10,446,425 | 11,095,548 | ||||||

Income taxes payable | — | 361,052 | ||||||

Loans payable (including $4,644,895 of MMKT Notes at fair value) | 25,620,819 | 4,000,000 | ||||||

Credit facility payable | 35,000,000 | 12,000,000 | ||||||

Dividend payable | 1,608,759 | — | ||||||

Due to Principal | — | 9,063,792 | ||||||

Due to affiliates | 19,059 | 62,781 | ||||||

Deferred rent liability | 3,187,864 | 3,261,434 | ||||||

Payable to related parties pursuant to tax receivable agreements | 45,821,556 | 47,373,245 | ||||||

Liabilities of Consolidated Fund: | ||||||||

Unsettled trades payable | 20,093,490 | — | ||||||

Notes payable at fair value (proceeds: $364,066,775) | 364,066,775 | — | ||||||

Total liabilities | 507,848,540 | 90,263,503 | ||||||

Commitments and contingencies | ||||||||

Equity | ||||||||

Class A common stock, $0.01 par value 500,000,000 shares authorized; 5,782,392 and 6,000,033 shares issued and outstanding as of September 30, 2015 and December 31, 2014, respectively | 57,824 | 60,000 | ||||||

Class B common stock, $0.01 par value 50,000,000 shares authorized; 42,856,854 shares issued and outstanding as of September 30, 2015 and December 31, 2014 | 428,569 | 428,569 | ||||||

Preferred stock, $0.01 par value; 5,000,000 shares authorized; none issued and outstanding as of September 30, 2015 and December 31, 2014 | — | — | ||||||

Additional paid-in capital | 7,319,605 | 4,975,073 | ||||||

Accumulated other comprehensive loss | (2,075 | ) | — | |||||

Retained earnings | 1,052,519 | 1,273,485 | ||||||

Total stockholders' equity, Fifth Street Asset Management Inc. | 8,856,442 | 6,737,127 | ||||||

Non-controlling interests | (1,495,431 | ) | 13,834,902 | |||||

Total equity | 7,361,011 | 20,572,029 | ||||||

Total liabilities and equity | $ | 515,209,551 | $ | 110,835,532 | ||||

1

Fifth Street Asset Management Inc.

(Prior to November 4, 2014 - Fifth Street Management Group)

Consolidated Statements of Income

(unaudited)

For the three months ended September 30, | For the nine months ended September 30, | |||||||||||||||

2015 | 2014 | 2015 | 2014 | |||||||||||||

Revenues | (see Notes 1 and 2) | (see Notes 1 and 2) | ||||||||||||||

Management fees (includes Part I Fees of $9,166,813 and $9,868,682 and $26,766,547 and $26,172,673 for the three and nine months ended September 30, 2015 and 2014, respectively) | $ | 23,609,474 | $ | 22,987,898 | $ | 70,417,077 | $ | 66,707,202 | ||||||||

Performance fees | 2,596 | 139,049 | 79,451 | 139,049 | ||||||||||||

Other fees | 1,347,133 | 2,187,933 | 3,668,878 | 4,205,987 | ||||||||||||

Total revenues | 24,959,203 | 25,314,880 | 74,165,406 | 71,052,238 | ||||||||||||

Expenses | ||||||||||||||||

Compensation and benefits | 10,258,766 | 6,529,830 | 28,791,731 | 25,711,012 | ||||||||||||

Fund offering and start-up expenses | — | 909,681 | — | 1,200,434 | ||||||||||||

General, administrative and other expenses | 3,349,712 | 3,432,949 | 8,548,115 | 7,491,543 | ||||||||||||

Depreciation and amortization | 434,146 | 408,541 | 1,254,544 | 641,449 | ||||||||||||

Total expenses | 14,042,624 | 11,281,001 | 38,594,390 | 35,044,438 | ||||||||||||

Other income (expense) | ||||||||||||||||

Interest income | 110,525 | 1,891 | 293,665 | 11,530 | ||||||||||||

Interest expense | (507,647 | ) | (25,206 | ) | (1,337,827 | ) | (74,795 | ) | ||||||||

Income (loss) from equity method investments | 12,492 | 102,838 | 2,540 | 216,750 | ||||||||||||

Unrealized loss on beneficial interests in CLOs | (23,148 | ) | — | (590,546 | ) | — | ||||||||||

Other income (expense), net | — | 66,000 | 122,000 | 132,000 | ||||||||||||

Total other income (expense), net | (407,778 | ) | 145,523 | (1,510,168 | ) | 285,485 | ||||||||||

Income before provision for income taxes | 10,508,801 | 14,179,402 | 34,060,848 | 36,293,285 | ||||||||||||

Provision for income taxes | 995,506 | — | 3,551,329 | — | ||||||||||||

Net income | 9,513,295 | 14,179,402 | 30,509,519 | 36,293,285 | ||||||||||||

Net income attributable to Predecessor | — | (14,179,402 | ) | — | (36,293,285 | ) | ||||||||||

Net income attributable to non-controlling interests | (8,341,728 | ) | — | (26,859,217 | ) | — | ||||||||||

Net income attributable to Fifth Street Asset Management Inc. | $ | 1,171,567 | $ | — | $ | 3,650,302 | $ | — | ||||||||

Net income per share attributable to Fifth Street Asset Management Inc. Class A common stock: Basic and Diluted | $ | 0.20 | $ | 0.61 | ||||||||||||

Weighted average shares of Class A common stock outstanding - Basic | 5,901,718 | 5,956,389 | ||||||||||||||

Weighted average shares of Class A common stock outstanding - Diluted | 5,908,463 | 5,963,318 | ||||||||||||||

All revenues are earned from affiliates of the Company. See notes to consolidated financial statements.

2

Fifth Street Asset Management Inc.

(Prior to November 4, 2014 - Fifth Street Management Group)

Consolidated Statements of Comprehensive Income

(unaudited)

For the three months ended September 30, | For the nine months ended September 30, | |||||||||||||||

2015 | 2014 | 2015 | 2014 | |||||||||||||

(see Notes 1 and 2) | (see Notes 1 and 2) | |||||||||||||||

Net income | $ | 9,513,295 | $ | 14,179,402 | $ | 30,509,519 | $ | 36,293,285 | ||||||||

Other comprehensive income (loss): | ||||||||||||||||

Adjustment for change in fair value on available-for-sale securities | 538,494 | — | (28,904 | ) | — | |||||||||||

Tax effect on adjustment for change in fair value on available-for-sale securities | (25,410 | ) | — | 1,370 | — | |||||||||||

Total comprehensive income | 10,026,379 | 14,179,402 | 30,481,985 | 36,293,285 | ||||||||||||

Less: Comprehensive income attributable to Predecessor | — | (14,179,402 | ) | — | (36,293,285 | ) | ||||||||||

Less: Comprehensive income attributable to non-controlling interests | (8,549,626 | ) | — | (26,709,534 | ) | — | ||||||||||

Comprehensive income attributable to Fifth Street Asset Management Inc. | $ | 1,476,753 | $ | — | $ | 3,772,451 | $ | — | ||||||||

See notes to consolidated financial statements.

3

Fifth Street Asset Management Inc.

Consolidated Statement of Changes in Equity

For the Nine Months Ended September 30, 2015

(unaudited)

Class A Common Stock | Class B Common Stock | Additional Paid-in Capital | Accumulated Other Comprehensive Income | Retained Earnings | Non-Controlling Interests | Total Equity | ||||||||||||||||||||||||||||

Shares | Amount | Shares | Amount | |||||||||||||||||||||||||||||||

Balance, December 31, 2014 (see Notes 1 and 2) | 6,000,033 | $ | 60,000 | 42,856,854 | $ | 428,569 | $ | 4,975,073 | $ | — | $ | 1,273,485 | $ | 13,834,902 | $ | 20,572,029 | ||||||||||||||||||

Capital contributions | — | — | — | — | — | — | — | 20,000 | 20,000 | |||||||||||||||||||||||||

Distributions to Holdings limited partners | — | — | — | — | — | — | — | (41,639,038 | ) | (41,639,038 | ) | |||||||||||||||||||||||

Accrued and paid dividends - $0.64 per Class A common share | — | — | — | — | — | — | (3,815,114 | ) | — | (3,815,114 | ) | |||||||||||||||||||||||

Accrual of dividends on restricted stock units | — | — | — | — | — | — | (71,664 | ) | (529,543 | ) | (601,207 | ) | ||||||||||||||||||||||

Adjustment of tax benefit in connection with tax receivable agreements | — | — | — | — | (273,828 | ) | — | — | — | (273,828 | ) | |||||||||||||||||||||||

Repurchase of Class A common shares | (217,641 | ) | (2,176 | ) | — | — | (1,846,964 | ) | — | — | — | (1,849,140 | ) | |||||||||||||||||||||

Amortization of equity-based compensation | — | — | — | — | 4,465,324 | — | — | — | 4,465,324 | |||||||||||||||||||||||||

Change in fair value on available-for-sale securities, net of tax | — | — | — | — | — | (2,075 | ) | — | (25,459 | ) | (27,534 | ) | ||||||||||||||||||||||

Net income | — | — | — | — | — | — | 3,650,302 | 26,859,217 | 30,509,519 | |||||||||||||||||||||||||

Special allocation of adjustments relating to the Revision | — | — | — | — | — | — | 15,510 | (15,510 | ) | — | ||||||||||||||||||||||||

Balance, September 30, 2015 | 5,782,392 | $ | 57,824 | 42,856,854 | $ | 428,569 | $ | 7,319,605 | $ | (2,075 | ) | $ | 1,052,519 | $ | (1,495,431 | ) | $ | 7,361,011 | ||||||||||||||||

See notes to consolidated financial statements.

4

Fifth Street Asset Management Inc.

(Prior to November 4, 2014 - Fifth Street Management Group)

Consolidated Statements of Cash Flows

(unaudited)

For the nine months ended September 30 | ||||||||

2015 | 2014 | |||||||

Cash flows from operating activities | (see Note 1) | |||||||

Net income | $ | 30,509,519 | $ | 36,293,285 | ||||

Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

Depreciation and amortization | 1,042,224 | 641,449 | ||||||

Amortization of fractional interests in aircrafts | 212,320 | — | ||||||

Amortization of deferred financing costs | 377,498 | — | ||||||

Amortization of equity-based compensation | 4,480,918 | 3,815,194 | ||||||

Interest income accreted on beneficial interest in CLO | (231,231 | ) | — | |||||

Reclassification of distributions to former member | — | 800,381 | ||||||

Income (loss) from equity method investments | (2,540 | ) | (216,750 | ) | ||||

Deferred taxes | 3,224,078 | — | ||||||

Fair value adjustment – due to former member | — | 180,863 | ||||||

Deferred rent | (73,570 | ) | 1,239,886 | |||||

Unrealized loss on beneficial interests in CLOs | 590,546 | — | ||||||

Changes in operating assets and liabilities: | ||||||||

Management fees receivable | 3,472,687 | (43,117 | ) | |||||

Performance fees receivable | 27,184 | (54,826 | ) | |||||

Prepaid expenses | 282,909 | (258,937 | ) | |||||

Due from affiliates | 1,670,438 | 1,861,107 | ||||||

Other assets | (81,541 | ) | (182,749 | ) | ||||

Accounts payable and accrued expenses | (1,061,858 | ) | 724,613 | |||||

Accrued compensation and benefits | (649,123 | ) | 6,884,548 | |||||

Income taxes payable | (361,052 | ) | — | |||||

Due to Principal | (16,863 | ) | — | |||||

Due to affiliates | (59,316 | ) | (2,528,204 | ) | ||||

Due to former member | — | (895,086 | ) | |||||

Attributable to Consolidated Fund: | ||||||||

Purchases of investments of Consolidated Fund | (304,435,163 | ) | — | |||||

Change in other assets of Consolidated Fund | (3,277,652 | ) | — | |||||

Net cash provided by (used in) operating activities | (264,359,588 | ) | 48,261,657 | |||||

Cash flows from investing activities | ||||||||

Purchases of fixed assets | (874,060 | ) | (9,460,980 | ) | ||||

Purchases of equity method investments | (7,500,000 | ) | (3,881,796 | ) | ||||

Redemptions of equity method investments | 1,200,000 | — | ||||||

Distributions received from equity method investments | 225,282 | — | ||||||

Purchases of investments in available-for-sale securities | (1,379,679 | ) | — | |||||

Purchases of beneficial interest in CLO | (612,889 | ) | — | |||||

Net cash used in investing activities | (8,941,346 | ) | (13,342,776 | ) | ||||

Cash flows from financing activities | ||||||||

Borrowings under credit facility | 48,000,000 | — | ||||||

Repayments under credit facility | (25,000,000 | ) | — | |||||

Repayments of notes payable | (9,046,929 | ) | — | |||||

Proceeds from issuance of loans payable | 21,620,819 | — | ||||||

Capital contributions from non-controlling interests | 20,000 | — | ||||||

Distributions to members | (41,639,038 | ) | (38,590,110 | ) | ||||

Dividends to Class A shareholders | (2,807,562 | ) | — | |||||

Repurchases of Class A common shares | (1,849,140 | ) | — | |||||

Attributable to Consolidated Fund | ||||||||

Issuance of notes payable by Consolidated Fund | 364,066,775 | — | ||||||

Deferred financing costs | (2,744,980 | ) | — | |||||

Net cash provided by (used in) financing activities | 350,619,945 | (38,590,110 | ) | |||||

Net increase (decrease) in cash and cash equivalents | 77,319,011 | (3,671,229 | ) | |||||

Cash and cash equivalents, beginning of period | 3,238,008 | 4,015,728 | ||||||

Cash and cash equivalents, end of period (including Consolidated Fund) | 80,557,019 | 344,499 | ||||||

5

Fifth Street Asset Management Inc.

(Prior to November 4, 2014 - Fifth Street Management Group)

Consolidated Statements of Cash Flows

(unaudited)

Less: Cash and cash equivalents of the Consolidated Fund | 74,519,096 | — | ||||||

Cash and cash equivalents of the Company, end of period | $ | 6,037,923 | $ | 344,499 | ||||

Supplemental disclosures of cash flow information: | ||||||||

Cash paid during the period for interest | $ | 887,425 | $ | 74,795 | ||||

Cash paid during the period for income taxes | $ | 1,064,200 | $ | — | ||||

Non-cash investing activities: | ||||||||

Fixed asset purchases included in accounts payable | $ | 11,519 | $ | 51,121 | ||||

Non-cash financing activities: | ||||||||

Non-cash capital contribution by member | $ | — | $ | 2,967,749 | ||||

Non-cash distribution to members | $ | — | $ | (2,967,749 | ) | |||

Accrued dividends | $ | 1,608,759 | $ | — | ||||

All management and performance fees are earned from affiliates of the Company. See notes to consolidated financial statements.

6

Fifth Street Asset Management Inc.

(Prior to November 4, 2014 - Fifth Street Management Group)

Notes to Consolidated Financial Statements

Note 1. Organization and Basis of Presentation

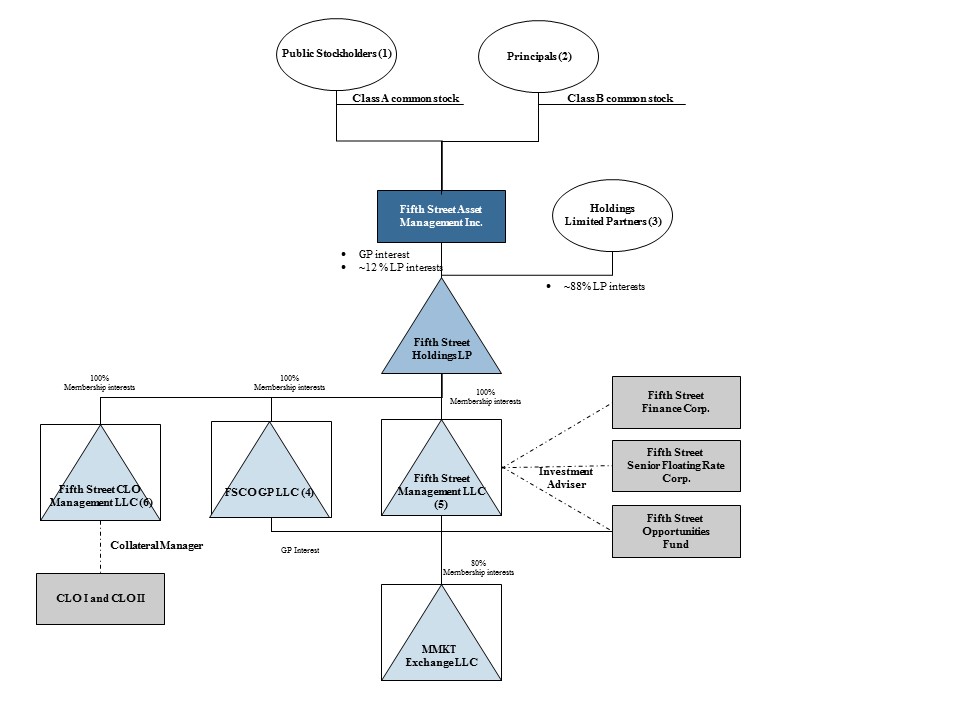

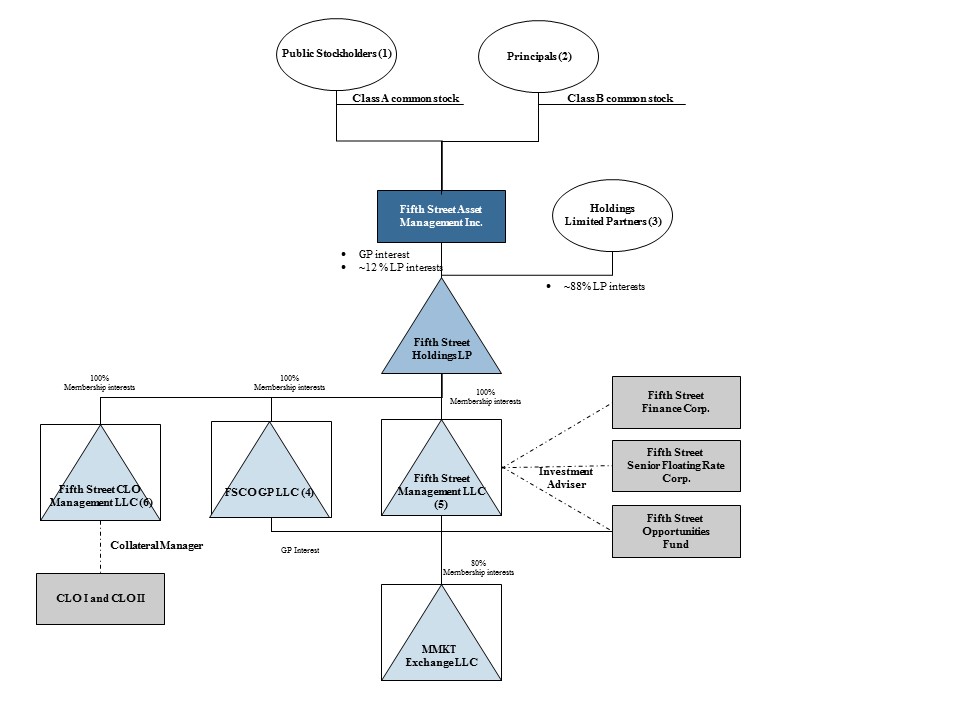

Fifth Street Asset Management Inc. ("FSAM"), together with its consolidated subsidiaries (collectively, the "Company"), is a leading alternative asset management firm headquartered in Greenwich, CT that provides asset management services to its investment funds, which, to date, consist primarily of Fifth Street Finance Corp. (formed on January 2, 2008, "FSC") and Fifth Street Senior Floating Rate Corp. (formed on May 22, 2013, "FSFR"), both publicly-traded business development companies regulated under the Investment Company Act of 1940 (together, the "BDCs"). The Company conducts substantially all of its operations through its consolidated subsidiaries, Fifth Street Management LLC ("FSM") and CLO Management.

The accompanying consolidated financial statements include (1) the results of the Company subsequent to the Reorganization as described below and (2) prior to the Reorganization, the financial results of Fifth Street Management Group (the "Predecessor") which includes affiliated entities either wholly or substantially owned and/or under the voting control of Leonard M. Tannenbaum. Historical financial results relating to the Predecessor are presented as net income attributable to Predecessor.

The Company's primary sources of revenues are management fees, primarily from the BDCs, which are driven by the amount of the assets under management and quarterly investment performance of the funds it manages. The Company conducts substantially all of its operations through one reportable segment that provides asset management services to its alternative investment vehicles. The Company generates all of its revenues in the United States.

Reorganization

In anticipation of its initial public offering (the "IPO") that closed November 4, 2014, FSAM was incorporated in Delaware on May 8, 2014 as a holding company with its primary asset expected to be a limited partnership interest in Fifth Street Holdings L.P. ("Fifth Street Holdings"). Fifth Street Holdings was formed on June 27, 2014 by Leonard M. Tannenbaum and another member of FSM (the "Principals") as a Delaware limited partnership. Prior to the transactions described below, the Principals were the general partners and limited partners of Fifth Street Holdings. Fifth Street Holdings has a single class of limited partnership interests (the "Holdings LP Interests"). Immediately prior to the IPO:

• | The Principals contributed their general partnership interests in Fifth Street Holdings to FSAM in exchange for 100% of the FSAM's Class B common stock; |

• | The members of FSM contributed 100% of their membership interests in FSM to Fifth Street Holdings in exchange for Holdings LP Interests; and |

• | The members of FSCO GP LLC ("FSCO GP"), a Delaware limited liability company, formed on January 6, 2014 to serve as the general partner of Fifth Street Opportunities Fund, L.P. (''FSOF,'' formerly Fifth Street Credit Opportunities Fund, L.P.) contributed 100% of their membership interests in FSCO GP to Fifth Street Holdings in exchange for Holdings LP Interests. |

As a result of the above transactions, FSAM became the general partner of Fifth Street Holdings, which was also organized to be a holding company for FSM and FSCO GP. As a holding company, FSAM conducts all of its operations through FSM, CLO Management and FSCO GP, wholly-owned subsidiaries of Fifth Street Holdings, including the provision of management services to FSC, FSFR and other affiliated private funds. Fifth Street Management Group is the Company's predecessor prior to the IPO.

In connection with the Reorganization, FSAM entered into the Exchange Agreement with the Fifth Street Holdings Limited Partners that granted each Fifth Street Holdings Limited Partner and certain permitted transferees the right, beginning two years after the closing of the IPO and subject to vesting and minimum retained ownership requirements, on a quarterly basis, to exchange such person's Holdings LP Interests for shares of Class A common stock of FSAM, on a one-for-one basis, subject to customary conversion rate adjustments for splits, unit distributions and reclassifications. As a result, each Fifth Street Holdings Limited Partner, over time, has the ability to convert his or her illiquid ownership interests in Fifth Street Holdings into Class A common stock that can more readily be sold in the public markets.

These collective actions are referred to herein as the "Reorganization."

Initial Public Offering

On November 4, 2014, FSAM issued 6,000,000 shares of Class A common stock in the IPO at a price of $17.00 per common share. The net proceeds totaled $95.9 million after deducting underwriting commissions of $6.1 million and before offering costs of approximately $3.9 million that were borne by FSAM. The net proceeds were used to purchase a 12.0% limited partnership interest in Fifth Street Holdings from its limited partners.

7

Fifth Street Asset Management Inc.

(Prior to November 4, 2014 - Fifth Street Management Group)

Notes to Consolidated Financial Statements

Immediately following the Reorganization transactions described above and the closing of the IPO on November 4, 2014:

• | the Principals held 42,856,854 shares of Class B common stock and 42,856,854 Holdings LP Interests, the Holdings Limited Partners, including the Principals, held 44,000,000 Holdings LP Interests and FSAM held 6,000,000 Holdings LP Interests; and |

• | through their holdings of Class B common stock, the Principals, in the aggregate, had approximately 97.3% of the voting power of FSAM's common stock. |

FSAM's purchase of Holdings LP Interests concurrent with its IPO, and the subsequent and future exchanges by holders of Holdings LP Interests for shares of FSAM's Class A common stock pursuant to the Exchange Agreement are expected to result in increases in its share of the tax basis of the tangible and intangible assets of Fifth Street Holdings, which will increase the tax depreciation and amortization deductions that otherwise would not have been available to FSAM. These increases in tax basis and tax depreciation and amortization deductions are expected to reduce the amount of cash taxes that FSAM would otherwise be required to pay in the future. FSAM entered into a tax receivable agreement ("TRA") with certain limited partners of Fifth Street Holdings (the "TRA Recipients") that requires it to pay them 85% of the amount of cash savings, if any, in U.S. federal, state, local and foreign income tax that FSAM actually realizes (or, under certain circumstances, is deemed to realize) as a result of the increases in tax basis in connection with exchanges by the TRA Recipients described above and certain other tax benefits attributable to payments under the tax receivable agreement.

In connection with the above transactions, the previous members of FSM agreed to allocate to the limited partners of Fifth Street Holdings and FSAM the Company's earnings (excluding the compensation charges related to the Reorganization) from October 1, 2014 through the date of the IPO.

Basis of Presentation

The unaudited interim consolidated financial statements presented in this quarterly report on Form 10-Q have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for interim financial information and pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”). All adjustments that, in the opinion of management, are necessary for a fair presentation for the periods presented, have been reflected as required by Regulation S-X, Rule 10-01. Such adjustments are of a normal and recurring nature. Accordingly, certain information and footnote disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted. These consolidated financial statements should be read in conjunction with the consolidated financial statements and notes thereto included in the Company’s annual report on Form 10-K for the year ended December 31, 2014. The results of operations for interim periods are not necessarily indicative of the operating results to be expected for the full year or any other interim period. All significant intercompany transactions and balances have been eliminated in consolidation.

Prior to the completion of the IPO, the historical consolidated financial statements consisted of the combined results of Fifth Street Management Group which includes affiliated entities either wholly or substantially owned and/or under the voting control of Leonard M. Tannenbaum at the time of the Reorganization and IPO. As such, FSAM's acquisition of a 12.0% partnership interest in Fifth Street Holdings and related Reorganization have been accounted for as transactions among entities under common control, pursuant to ASC 805-50, and recorded on a historical cost basis.

After the completion of the IPO, FSAM became the general partner of Fifth Street Holdings and acquired a 12.0% limited partnership interest in Fifth Street Holdings. Accordingly, Fifth Street Holdings and its wholly-owned subsidiaries (including FSM) are consolidated in FSAM's financial statements. The Company has presented the Consolidated Statements of Income after giving effect to the Reorganization, as discussed above. All amounts attributable to the Company's Predecessor are recorded as "Net income attributable to Predecessor" within the consolidated financial statements. Subsequent to November 4, 2014, the portion of the net income attributable to Fifth Street Holdings limited partnership interests is recorded as "net income attributable to non-controlling interests."

On October 13, 2014, FSAM effectuated a 1-for-3 reverse stock split. All share information has been retroactively adjusted to reflect the reverse stock split.

On December 22, 2014, FSM entered into a limited liability company agreement, as majority member, with Leonard Tannenbaum’s brother, as minority member, for the purpose of forming MMKT Exchange LLC (previously IMME LLC), a Delaware limited liability company (“MMKT”). MMKT is a secure digital exchange that introduces efficiency, liquidity and transparency to the outdated middle market loan syndication process while increasing accessibility to a broader base of purchasers. The purpose of MMKT is to develop technology related to the financial services industry. FSM made a capital contribution of $80,000 for an 80% membership interest in MMKT.

8

Fifth Street Asset Management Inc.

(Prior to November 4, 2014 - Fifth Street Management Group)

Notes to Consolidated Financial Statements

On September 29, 2015, CLO Management closed a securitization of senior secured loans warehoused in Fifth Street Senior Loan Fund II, LLC ("SLF II") as a Collateralized Loan Obligation ("CLO"). In connection with the securitization, SLF II merged into Fifth Street SLF II Ltd. ("CLO II"). CLO II issued a total of approximately $416.6 million of notes, including a subordinated note tranche of $52.1 million. The Company has concluded that CLO II should be consolidated by FSM (see Note 3). The Company invested $20,910,115 in senior and subordinated notes in CLO II, which was partially financed by the Risk Retention Credit Facility in the amount of $16,975,924 (see Note 9).

Deconsolidation of Combined Funds

During the year ended December 31, 2014, the Company formed the following entities (collectively referred to as the “Combined Funds”) whose financial results were included in the Company’s combined financial statements in previous filings with the SEC:

• | FSCO GP, a Delaware limited liability company, formed on January 6, 2014 to serve as the general partner of FSOF, which primarily invests in yield-oriented corporate credit assets and equities; |

• | Fifth Street EIV, LLC ("Fifth Street EIV"), a Delaware limited liability company formed on February 7, 2014 to hold FSM's equity interest in Fifth Street Senior Loan Fund I, LLC ("SLF I"), which primarily invests in senior secured loans to middle-market companies; and |

• | Fifth Street EIV II, LLC ("Fifth Street EIV II"), a Delaware limited liability company formed on July 10, 2014 to hold certain of the Company's employees' equity interests in SLF II, which primarily invests in senior secured loans to middle market companies. |

Such Combined Funds were included in the financial statements previously filed with the SEC through periods ended September 30, 2014 based on the then existing consolidation guidance. In February 2015, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") No. 2015-02, Consolidation (Topic 810) - Amendments to the Consolidation Analysis ("ASU 2015-02"), as discussed in Note 3. As of December 31, 2014, the Company elected to early adopt such guidance, which resulted in deconsolidation of the Combined Funds. The Company determined that these entities were variable interest entities and that the Company was not the primary beneficiary because under ASU 2015-02, the Company's fee arrangements, which are commensurate with the level of effort performed and include only customary terms, do not represent variable interests. Also see Note 3 for the related disclosures for certain unconsolidated variable interest entities. There was no gain or loss recognized as a result of the deconsolidation of the Combined Funds and the Company will continue to earn management and/or performance fees from these funds. Although total assets and equity significantly decreased as a result of the Combined Funds' deconsolidation, it did not change net income or equity attributable to controlling interests in FSAM.

9

Fifth Street Asset Management Inc.

(Prior to November 4, 2014 - Fifth Street Management Group)

Notes to Consolidated Financial Statements

Impact of Reorganization and Deconsolidation of Combined Funds

The following tables show the impact on the Consolidated Statements of Income for the three and nine months ended September 30, 2014 for the deconsolidation of previously combined funds and the Reorganization:

Three months ended September 30, 2014 | ||||||||||||

As revised (see Note 2) | Deconsolidation of Combined Funds and Effects of Reorganization | As adjusted | ||||||||||

Revenues | $ | 25,042,949 | $ | 271,931 | $ | 25,314,880 | ||||||

Net income | $ | 17,161,160 | $ | (2,981,758 | ) | $ | 14,179,402 | |||||

Net income attributable to redeemable non-controlling interests in Combined Fund | $ | (1,072,218 | ) | $ | 1,072,218 | $ | — | |||||

Net income attributable to non-controlling interests in Combined Funds | $ | (1,909,540 | ) | $ | 1,909,540 | $ | — | |||||

Net income attributable to Predecessor | $ | — | $ | (14,179,402 | ) | $ | (14,179,402 | ) | ||||

Net income attributable to non-controlling interests in Fifth Street Holdings L.P. | $ | — | $ | — | $ | — | ||||||

Net income attributable to controlling interests in Fifth Street Management Group | $ | 14,179,402 | $ | (14,179,402 | ) | $ | — | |||||

Net income attributable to Fifth Street Asset Management Inc. | $ | — | $ | — | $ | — | ||||||

Nine months ended September 30, 2014 | ||||||||||||

As revised (see Note 2) | Deconsolidation of Combined Funds and Effects of Reorganization | As adjusted | ||||||||||

Revenues | $ | 70,678,754 | $ | 373,484 | $ | 71,052,238 | ||||||

Net income | $ | 41,554,502 | $ | (5,261,217 | ) | $ | 36,293,285 | |||||

Net income attributable to redeemable non-controlling interests in Combined Fund | $ | (2,336,539 | ) | $ | 2,336,539 | $ | — | |||||

Net income attributable to non-controlling interests in Combined Funds | $ | (2,924,678 | ) | $ | 2,924,678 | $ | — | |||||

Net income attributable to Predecessor | $ | — | $ | (36,293,285 | ) | $ | (36,293,285 | ) | ||||

Net income attributable to non-controlling interests in Fifth Street Holdings L.P. | $ | — | $ | — | $ | — | ||||||

Net income attributable to controlling interests in Fifth Street Management Group | $ | 36,293,285 | $ | (36,293,285 | ) | $ | — | |||||

Net income attributable to Fifth Street Asset Management Inc. | $ | — | $ | — | $ | — | ||||||

Note 2. Revision of Previously Issued Financial Statements for Correction of Immaterial Errors

During the three months ended September 30, 2015, the Company identified errors in the calculation of Part I Fees previously paid to the Company by the BDCs. The amounts paid were originally recognized as revenue in the first quarter of 2012 through the second quarter of 2015. The cumulative adjustment of $811,025 related to the years ended 2012 and 2013, was not considered material and is reflected as an out-of-period adjustment to the three months ended March 31, 2014. The identified errors related to incorrect information used by FSC CT LLC, the Company's administrator, a wholly-owned subsidiary of the Company. The errors related primarily to the timing of when Part I fees should have been recorded and paid. The aggregate adjustment was a net reduction of Part I Fees in the amount of $3,327,969 as of June 30, 2015. The Company

10

Fifth Street Asset Management Inc.

(Prior to November 4, 2014 - Fifth Street Management Group)

Notes to Consolidated Financial Statements

assessed the materiality of the errors on its prior quarterly and annual financial statements, assessing materiality both quantitatively and qualitatively, in accordance with the SEC’s Staff Accounting Bulletin (“SAB”) No. 99 and SAB No. 108 and concluded that the errors were not material to any of its previously issued financial statements. However, the Company concluded the cumulative corrections of these errors would be material to the Company's financial statements for the three and nine months ended September 30, 2015 and, therefore, it is not appropriate to recognize the cumulative corrections in this period. Accordingly, the prior period financial statements provided herein have been revised to correct these errors (the "Revision") as well as other unrelated, immaterial out-of-period adjustments that had been previously recorded.

These prior period adjustments will be reflected in future quarterly and annual filings for the respective period. The revision had no net impact on the Company’s net cash provided by operating activities for any period presented.

The Holdings Limited Partners have agreed to refund all of the overpaid fees to the Company and therefore none of the expense will be borne by the Class A stockholders of FSAM.

Set forth below is a summary of the financial statement line items impacted by these revisions for the periods presented in this Form 10-Q and previous filings.

June 30, 2015 | ||||||||||||

Consolidated Statements of Financial Condition: | As previously reported | Adjustment | As revised | |||||||||

Management fees receivable | $ | 23,065,693 | $ | (3,327,969 | ) | $ | 19,737,724 | |||||

Prepaid expenses | 795,591 | 166,888 | 962,479 | |||||||||

Subordinated debt interest in CLO | 1,043,144 | (1,043,144 | ) | — | ||||||||

Beneficial interest in CLO | 3,022,329 | 1,043,144 | 4,065,473 | |||||||||

Total assets | $ | 111,289,257 | $ | (3,161,081 | ) | $ | 108,128,176 | |||||

Accumulated other comprehensive income (loss) | (40,575 | ) | 40,575 | — | ||||||||

Retained earnings | 945,531 | (40,575 | ) | 904,956 | ||||||||

Non-controlling interests | 4,879,615 | (3,161,081 | ) | 1,718,534 | ||||||||

Total equity | 13,517,127 | (3,161,081 | ) | 10,356,046 | ||||||||

Total liabilities and equity | $ | 111,289,257 | $ | (3,161,081 | ) | $ | 108,128,176 | |||||

Three Months Ended June 30, 2015 | ||||||||||||

Consolidated Statements of Income: | As previously reported | Adjustment | As revised | |||||||||

Management fees | $ | 23,058,289 | $ | 514,753 | $ | 23,573,042 | ||||||

Total revenues | 24,166,163 | 514,753 | 24,680,916 | |||||||||

General, administrative and other expenses | 2,633,265 | (139,071 | ) | 2,494,194 | ||||||||

Total expenses | 12,276,236 | (139,071 | ) | 12,137,165 | ||||||||

Other income (expense), net | (226,967 | ) | (567,398 | ) | (794,365 | ) | ||||||

Income before provision for income taxes | 11,662,960 | 86,426 | 11,749,386 | |||||||||

Provision for income taxes | (1,315,041 | ) | (45,628 | ) | (1,360,669 | ) | ||||||

Net income | 10,347,919 | 40,798 | 10,388,717 | |||||||||

Net income attributable to non-controlling interests | (9,141,173 | ) | (75,322 | ) | (9,216,495 | ) | ||||||

Net income attributable to Fifth Street Asset Management Inc. | $ | 1,206,746 | $ | (34,524 | ) | $ | 1,172,222 | |||||

11

Fifth Street Asset Management Inc.

(Prior to November 4, 2014 - Fifth Street Management Group)

Notes to Consolidated Financial Statements

Six Months Ended June 30, 2015 | ||||||||||||

Consolidated Statements of Income: | As previously reported | Adjustment | As revised | |||||||||

Management fees | $ | 46,637,687 | $ | 169,916 | $ | 46,807,603 | ||||||

Total revenues | 49,036,287 | 169,916 | 49,206,203 | |||||||||

General, administrative and other expenses | 5,434,574 | (236,171 | ) | 5,198,403 | ||||||||

Total expenses | 24,787,937 | (236,171 | ) | 24,551,766 | ||||||||

Other income (expense), net | (534,992 | ) | (567,398 | ) | (1,102,390 | ) | ||||||

Income before provision for income taxes | 23,713,358 | (161,311 | ) | 23,552,047 | ||||||||

Provision for income taxes | (2,537,107 | ) | (18,716 | ) | (2,555,823 | ) | ||||||

Net income | 21,176,251 | (180,027 | ) | 20,996,224 | ||||||||

Net income attributable to non-controlling interests | (18,660,175 | ) | 142,686 | (18,517,489 | ) | |||||||

Net income attributable to Fifth Street Asset Management Inc. | $ | 2,516,076 | $ | (37,341 | ) | $ | 2,478,735 | |||||

Net income per share attributable to Fifth Street Asset Management Inc. Class A common stock: Basic and Diluted | $ | 0.42 | $ | (0.01 | ) | $ | 0.41 | |||||

Three Months Ended June 30, 2015 | ||||||||||||

Consolidated Statements of Comprehensive Income: | As previously reported | Adjustment | As revised | |||||||||

Net income | $ | 10,347,919 | $ | 40,798 | $ | 10,388,717 | ||||||

Total comprehensive income | 9,807,301 | 40,798 | 9,848,099 | |||||||||

Less: Comprehensive income attributable to non-controlling interests | (8,641,130 | ) | 40,798 | (8,600,332 | ) | |||||||

Comprehensive income attributable to Fifth Street Asset Management Inc. | $ | 1,166,171 | $ | 40,798 | $ | 1,206,969 | ||||||

Six Months Ended June 30, 2015 | ||||||||||||

Consolidated Statements of Comprehensive Income: | As previously reported | Adjustment | As revised | |||||||||

Net income | $ | 21,176,251 | $ | (180,027 | ) | $ | 20,996,224 | |||||

Total comprehensive income | 20,635,633 | (180,027 | ) | 20,455,606 | ||||||||

Less: Comprehensive income attributable to non-controlling interests | (18,160,132 | ) | (180,027 | ) | (18,340,159 | ) | ||||||

Comprehensive income attributable to Fifth Street Asset Management Inc. | $ | 2,475,501 | $ | (180,027 | ) | $ | 2,295,474 | |||||

12

Fifth Street Asset Management Inc.

(Prior to November 4, 2014 - Fifth Street Management Group)

Notes to Consolidated Financial Statements

March 31, 2015 | ||||||||||||

Consolidated Statements of Financial Condition: | As previously reported | Adjustment | As revised | |||||||||

Management fees receivable | $ | 23,344,726 | $ | (3,842,722 | ) | $ | 19,502,004 | |||||

Prepaid expenses | 856,405 | 223,511 | 1,079,916 | |||||||||

Subordinated debt interest in CLO | 1,043,144 | (1,043,144 | ) | — | ||||||||

Beneficial interest in CLO | 3,443,940 | 1,043,144 | 4,487,084 | |||||||||

Fixed assets, net | 9,977,576 | 631 | 9,978,207 | |||||||||

Total assets | $ | 106,953,005 | $ | (3,618,580 | ) | $ | 103,334,425 | |||||

Retained earnings | 523,066 | 631 | 523,697 | |||||||||

Total stockholders' equity, Fifth Street Asset Management Inc. | 7,466,620 | 631 | 7,467,251 | |||||||||

Non-controlling interests | 12,062,033 | (3,619,211 | ) | 8,442,822 | ||||||||

Total equity | 19,528,653 | (3,618,580 | ) | 15,910,073 | ||||||||

Total liabilities and equity | $ | 106,953,005 | $ | (3,618,580 | ) | $ | 103,334,425 | |||||

Three Months Ended March 31, 2015 | ||||||||||||

Consolidated Statements of Income: | As previously reported | Adjustment | As revised | |||||||||

Management fees | $ | 23,579,398 | $ | (344,837 | ) | $ | 23,234,561 | |||||

Total revenues | 24,870,124 | (344,837 | ) | 24,525,287 | ||||||||

General administrative and other expenses | 2,801,309 | (97,100 | ) | 2,704,209 | ||||||||

Total expenses | 12,511,701 | (97,100 | ) | 12,414,601 | ||||||||

Income before provision for income taxes | 12,050,398 | (247,737 | ) | 11,802,661 | ||||||||

Provision for income taxes | (1,222,066 | ) | 26,911 | (1,195,155 | ) | |||||||

Net income | 10,828,332 | (220,826 | ) | 10,607,506 | ||||||||

Net income attributable to non-controlling interests | (9,519,002 | ) | 218,009 | (9,300,993 | ) | |||||||

Net income attributable to Fifth Street Asset Management Inc. | $ | 1,309,330 | $ | (2,817 | ) | $ | 1,306,513 | |||||

December 31, 2014 | ||||||||||||

Consolidated Statements of Financial Condition: | As previously reported | Adjustment | As revised | |||||||||

Management fees receivable | $ | 26,861,787 | $ | (3,497,886 | ) | $ | 23,363,901 | |||||

Prepaid expenses | 1,150,013 | 185,580 | 1,335,593 | |||||||||

Total assets | $ | 114,147,838 | $ | (3,312,306 | ) | $ | 110,835,532 | |||||

Retained earnings | 1,288,995 | (15,510 | ) | 1,273,485 | ||||||||

Total stockholders' equity, Fifth Street Asset Management Inc. | 6,752,637 | (15,510 | ) | 6,737,127 | ||||||||

Non-controlling interests | 17,131,698 | (3,296,796 | ) | 13,834,902 | ||||||||

Total equity | 23,884,335 | (3,312,306 | ) | 20,572,029 | ||||||||

Total liabilities and equity | $ | 114,147,838 | $ | (3,312,306 | ) | $ | 110,835,532 | |||||

13

Fifth Street Asset Management Inc.

(Prior to November 4, 2014 - Fifth Street Management Group)

Notes to Consolidated Financial Statements

Year Ended December 31, 2014 | ||||||||||||

Consolidated Statements of Income: | As previously reported | Adjustment | As revised | |||||||||

Management fees | $ | 95,425,407 | $ | (3,497,886 | ) | $ | 91,927,521 | |||||

Total revenues | 103,206,061 | (3,497,886 | ) | 99,708,175 | ||||||||

Compensation and benefits | 53,697,430 | 129,252 | 53,826,682 | |||||||||

Total expenses | 66,297,065 | 129,252 | 66,426,317 | |||||||||

Income before provision for income taxes | 36,935,074 | (3,627,138 | ) | 33,307,936 | ||||||||

Provision for income taxes | 1,877,758 | 185,580 | 2,063,338 | |||||||||

Net income | 38,812,832 | (3,441,558 | ) | 35,371,274 | ||||||||

Net income attributable to non-controlling interests | (38,284,255 | ) | 3,409,177 | (34,875,078 | ) | |||||||

Net income attributable to Fifth Street Asset Management Inc. | $ | 528,577 | $ | (32,381 | ) | $ | 496,196 | |||||

Net income per share attributable to Fifth Street Asset Management Inc. Class A common stock: Basic and Diluted | $ | 0.09 | $ | (0.01 | ) | $ | 0.08 | |||||

September 30, 2014 | ||||||||||||

Consolidated Statements of Financial Condition: | As previously reported | Adjustment | As revised | |||||||||

Management fees receivable | $ | 23,263,679 | $ | (1,810,799 | ) | $ | 21,452,880 | |||||

Total assets | $ | 46,642,231 | $ | (1,810,799 | ) | $ | 44,831,432 | |||||

Members' equity | 25,154,063 | (1,810,799 | ) | 23,343,264 | ||||||||

Total equity | 25,154,063 | (1,810,799 | ) | 23,343,264 | ||||||||

Total liabilities and equity | $ | 46,642,231 | $ | (1,810,799 | ) | $ | 44,831,432 | |||||

Three Months Ended September 30, 2014 | ||||||||||||

Consolidated Statements of Income: | As previously reported | Adjustment | As revised (see Note 1) | |||||||||

Management fees | $ | 23,091,676 | $ | (375,709 | ) | $ | 22,715,967 | |||||

Total revenues | 25,418,658 | (375,709 | ) | 25,042,949 | ||||||||

Income before provision for income taxes | 17,536,869 | (375,709 | ) | 17,161,160 | ||||||||

Net income | 17,536,869 | (375,709 | ) | 17,161,160 | ||||||||

Net income attributable to controlling interests in Fifth Street Management Group | (14,555,111 | ) | 375,709 | (14,179,402 | ) | |||||||

Nine Months Ended September 30, 2014 | ||||||||||||

Consolidated Statements of Income: | As previously reported | Adjustment | As revised (see Note 1) | |||||||||

Management fees | $ | 68,144,517 | $ | (1,810,799 | ) | $ | 66,333,718 | |||||

Total revenues | 72,489,553 | (1,810,799 | ) | 70,678,754 | ||||||||

Income before provision for income taxes | 43,365,301 | (1,810,799 | ) | 41,554,502 | ||||||||

Net income | 43,365,301 | (1,810,799 | ) | 41,554,502 | ||||||||

Net income attributable to controlling interests in Fifth Street Management Group | (38,104,084 | ) | 1,810,799 | (36,293,285 | ) | |||||||

14

Fifth Street Asset Management Inc.

(Prior to November 4, 2014 - Fifth Street Management Group)

Notes to Consolidated Financial Statements

June 30, 2014 | ||||||||||||

Consolidated Statements of Financial Condition: | As previously reported | Adjustment | As revised | |||||||||

Management fees receivable | $ | 22,653,659 | $ | (1,435,090 | ) | $ | 21,218,569 | |||||

Total assets | $ | 39,301,825 | $ | (1,435,090 | ) | $ | 37,866,735 | |||||

Members' equity | 19,157,235 | (1,435,090 | ) | 17,722,145 | ||||||||

Total equity | 19,157,235 | (1,435,090 | ) | 17,722,145 | ||||||||

Total liabilities and equity | $ | 39,301,825 | $ | (1,435,090 | ) | $ | 37,866,735 | |||||

Three Months Ended June 30, 2014 | ||||||||||||

Consolidated Statements of Income: | As previously reported | Adjustment | As revised | |||||||||

Management fees | $ | 22,451,668 | $ | (386,998 | ) | $ | 22,064,670 | |||||

Total revenues | 23,405,083 | (386,998 | ) | 23,018,085 | ||||||||

Income before provision for income taxes | 9,060,459 | (386,998 | ) | 8,673,461 | ||||||||

Net income | 9,060,459 | (386,998 | ) | 8,673,461 | ||||||||

Net income attributable to Predecessor | (9,060,459 | ) | 386,998 | (8,673,461 | ) | |||||||

Six Months Ended June 30, 2014 | ||||||||||||

Consolidated Statements of Income: | As previously reported | Adjustment | As revised | |||||||||

Management fees | $ | 45,154,394 | $ | (1,435,090 | ) | $ | 43,719,304 | |||||

Total revenues | 47,172,448 | (1,435,090 | ) | 45,737,358 | ||||||||

Income before provision for income taxes | 23,548,973 | (1,435,090 | ) | 22,113,883 | ||||||||

Net income | 23,548,973 | (1,435,090 | ) | 22,113,883 | ||||||||

Net income attributable to Predecessor | (23,548,973 | ) | 1,435,090 | (22,113,883 | ) | |||||||

March 31, 2014 | ||||||||||||

Consolidated Statements of Financial Condition: | As previously reported | Adjustment | As revised | |||||||||

Management fees receivable | $ | 22,702,726 | $ | (656,462 | ) | $ | 22,046,264 | |||||

Total assets | $ | 45,405,391 | $ | (656,462 | ) | $ | 44,748,929 | |||||

Members' equity | 28,701,287 | (656,462 | ) | 28,044,825 | ||||||||

Total equity | 28,701,287 | (656,462 | ) | 28,044,825 | ||||||||

Total liabilities and equity | $ | 45,405,391 | $ | (656,462 | ) | $ | 44,748,929 | |||||

Three Months Ended March 31, 2014 | ||||||||||||

Consolidated Statements of Income: | As previously reported | Adjustment | As revised | |||||||||

Management fees | $ | 22,702,726 | $ | (1,048,094 | ) | $ | 21,654,632 | |||||

Total revenues | 23,767,365 | (1,048,094 | ) | 22,719,271 | ||||||||

Income before provision for income taxes | 14,488,514 | (1,048,094 | ) | 13,440,420 | ||||||||

Net income | 14,488,514 | (1,048,094 | ) | 13,440,420 | ||||||||

Net income attributable to Predecessor | (14,488,514 | ) | 1,048,094 | (13,440,420 | ) | |||||||

15

Fifth Street Asset Management Inc.

(Prior to November 4, 2014 - Fifth Street Management Group)

Notes to Consolidated Financial Statements

Note 3. Significant Accounting Policies

Principles of Consolidation

The consolidated financial statements include the accounts of the Company and entities in which it, directly or indirectly, is determined to have a controlling financial interest under ASC 810, as amended by ASU No. 2015-02. Under the variable interest model, the Company determines whether, if by design, an entity has equity investors who lack substantive participating or kick-out rights. If equity investors do not have such rights, the entity is considered a variable interest entity ("VIE") and must be consolidated by its primary beneficiary. An enterprise is determined to be the primary beneficiary if it holds a controlling financial interest. A controlling financial interest is defined as (a) the power to direct the activities of a VIE that most significantly impact the entity's economic performance and (b) the obligation to absorb losses of the entity or the right to receive benefits from the entity that could potentially be significant to the VIE. The consolidation guidance requires an analysis to determine (a) whether an entity in which the Company holds a variable interest is a VIE and (b) whether the Company's involvement, through holding interests directly or indirectly in the entity, would give it a controlling financial interest. Performance of that analysis requires the exercise of judgment.

Under the consolidation guidance, the Company determines whether it is the primary beneficiary of a VIE at the time it becomes involved with a variable interest entity and reconsiders that conclusion continually. In evaluating whether the Company is the primary beneficiary, the Company evaluates its economic interests in the entity held either directly by the Company and its affiliates or indirectly through employees. The consolidation analysis can generally be performed qualitatively; however, if it is not readily apparent that the Company is not the primary beneficiary, a quantitative analysis may also be performed. Investments and redemptions (either by the Company, affiliates of the Company or third parties) or amendments to the governing documents of the respective investment funds could affect an entity's status as a VIE or the determination of the primary beneficiary. At each reporting date, the Company assesses whether it is the primary beneficiary and will consolidate or deconsolidate accordingly.

For equity investments where the Company does not control the investee, and where it is not the primary beneficiary of a VIE, but can exert significant influence over the financial and operating policies of the investee, the Company follows the equity method of accounting. The evaluation of whether the Company exerts control or significant influence over the financial and operational policies of its investees requires significant judgment based on the facts and circumstances surrounding each individual investment. Factors considered in these evaluations may include the type of investment, the legal structure of the investee, the terms and structure of the investment agreement, including investor voting or other rights, the terms of the Company's investment advisory agreement or other agreements with the investee, any influence the Company may have on the governing board of the investee, the legal rights of other investors in the entity pursuant to the fund’s operating documents and the relationship between the Company and other investors in the entity.

Consolidated Variable Interest Entities

Fifth Street Holdings

FSAM is the sole general partner of Fifth Street Holdings and, as such, it operates and controls all of the business and affairs of Fifth Street Holdings and its wholly-owned subsidiaries, FSM, CLO Management and FSCO GP. Under ASC 810, Fifth Street Holdings meets the definition of a VIE because the limited partners do not hold substantive kick-out or participating rights. Since FSAM has the obligation to absorb expected losses that could be significant to Fifth Street Holdings and is the sole general partner, FSAM is considered to be the primary beneficiary of Fifth Street Holdings.

As a result, the Company consolidates the financial results of Fifth Street Holdings and its wholly-owned subsidiaries and records a non-controlling interest for the economic interest in Fifth Street Holdings held by the limited partners as a separate component of stockholders' equity in its Consolidated Statements of Financial Condition for the remaining economic interests in Fifth Street Holdings. The non-controlling interest in the income of Fifth Street Holdings is included in the Consolidated Statements of Income as a reduction of net income.

16

Fifth Street Asset Management Inc.

(Prior to November 4, 2014 - Fifth Street Management Group)

Notes to Consolidated Financial Statements

As of September 30, 2015 and December 31, 2014, the Company has recorded the following amounts in its Consolidated Statements of Financial Condition relating to Fifth Street Holdings:

September 30, 2015 | December 31, 2014 (as revised) | |||||||

Assets | ||||||||

Cash and cash equivalents | $ | 6,021,384 | $ | 3,236,830 | ||||

Management fees receivable | 19,891,214 | 23,363,901 | ||||||

Performance fees receivable | 79,451 | 106,635 | ||||||

Prepaid expenses (includes $266,402 related to income taxes) | 882,618 | 1,335,593 | ||||||

Investments in equity method investees | 6,415,175 | 4,115,429 | ||||||

Investments in available-for-sale securities | 1,350,775 | — | ||||||

Beneficial interest in CLOs at fair value: (cost: $4,496,624) | 3,906,078 | — | ||||||

Due from affiliates (1) | 6,750,454 | 8,369,501 | ||||||

Fixed assets, net | 10,106,099 | 10,274,263 | ||||||

Deferred tax assets | — | 2,705,934 | ||||||

Deferred financing costs | 2,055,266 | 2,432,764 | ||||||

Other assets | 4,066,579 | 4,197,358 | ||||||

Assets of Consolidated Fund: | ||||||||

Cash and cash equivalents | 74,519,096 | — | ||||||

Investments at fair value (cost: $323,434,153) | 323,434,153 | — | ||||||

Interest and dividends receivable | 3,277,652 | — | ||||||

Unsettled trades receivable | 1,094,500 | — | ||||||

Deferred financing costs | 2,744,979 | — | ||||||

Total assets | $ | 466,595,473 | $ | 60,138,208 | ||||

Liabilities | ||||||||

Accounts payable and accrued expenses | $ | 1,983,793 | $ | 2,830,052 | ||||

Accrued compensation and benefits | 10,446,425 | 11,095,548 | ||||||

Income taxes payable | 438,794 | — | ||||||

Loans payable | 25,620,819 | 4,000,000 | ||||||

Credit facility payable | 35,000,000 | 12,000,000 | ||||||

Dividend payable | 601,207 | — | ||||||

Due to Principal | — | 9,063,792 | ||||||

Due to affiliates (2) | 710,203 | 747,505 | ||||||

Deferred rent liability | 3,187,864 | 3,261,434 | ||||||

Deferred tax liability | 424,316 | — | ||||||

Liabilities of Consolidated Fund: | ||||||||

Unsettled trades payable | 20,093,490 | — | ||||||

Notes payable at fair value (proceeds: $364,066,775) | 364,066,775 | — | ||||||

Total liabilities | 462,573,686 | 42,998,331 | ||||||

Equity | 4,021,787 | 17,139,877 | ||||||

Total liabilities and equity | $ | 466,595,473 | $ | 60,138,208 | ||||

(1) The amounts due from affiliates include $4,621,350 that is eliminated in consolidation.

(2) The amounts due to affiliates include $691,144 that is eliminated in consolidation.

The liabilities recognized as a result of consolidating Fifth Street Holdings do not represent additional claims on FSAM’s general assets; rather, they represent claims against the specific assets of Fifth Street Holdings and its subsidiaries. Conversely, assets recognized as a result of consolidating Fifth Street Holdings do not represent additional assets that could be used to satisfy claims against FSAM's general assets.

17

Fifth Street Asset Management Inc.

(Prior to November 4, 2014 - Fifth Street Management Group)

Notes to Consolidated Financial Statements

CLO II

Fifth Street CLO Management LLC ("CLO Management"), a wholly owned-consolidated subsidiary of Fifth Street Holdings, is the collateral manager of CLO II, and as such, it operates and controls all of the business and affairs of CLO II. As part of the CLO II securitization, CLO Management retained approximately 5% of each tranche of notes issued and Leonard M. Tannenbaum directly invested in Class D and subordinated notes.

Under ASC 810, CLO II meets the definition of a VIE because the limited partners do not hold substantive kick-out or participating rights. Since CLO Management has the obligation to absorb expected losses that could be significant to CLO II and is its collateral manager, FSM is considered to be the primary beneficiary of CLO II. As a result, the Company consolidates the financial results of CLO II (the "Consolidated Fund") and eliminates its investment in senior and subordinated notes in the entity. The Consolidated Statements of Financial Condition separately presents these amounts as assets and liabilities of the Consolidated Fund.

Including the results of the Consolidated Fund significantly increases the reported amounts of the assets, liabilities, revenues, expenses and cash flows of the Company; however, the Consolidated Fund's results included herein have no direct effect on the net income attributable to controlling interests or on total controlling equity.

Voting Interest Entities

For entities that are not VIEs, the Company consolidates those entities in which it has an equity investment of greater than 50% and has control over significant operating, financial and investing decisions of the entity. Additionally, the Company consolidates entities in which the Company is a substantive, controlling general partner and the limited partners have no substantive rights to participate in the ongoing governance and operating activities.

Unconsolidated Variable Interest Entities

The Company holds interests in certain VIEs that are not consolidated because the Company is not deemed the primary beneficiary as of September 30, 2015. The Company's interest in such entities generally is in the form of direct equity interests and fixed fee arrangements. The maximum exposure to loss represents the potential loss of assets by the Company relating to these non-consolidated entities. The Company's interests in these non-consolidated VIEs and their respective maximum exposure to loss relating to non-consolidated VIEs as of September 30, 2015 is $10,321,253, which represents the fair value at such date.

Use of Estimates

The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions affecting amounts reported in the consolidated financial statements and accompanying notes. The most significant of these estimates are related to: (i) the valuation of equity-based compensation, (ii) the estimate of future taxable income, which impacts the carrying amount of the Company’s deferred income tax assets, (iii) the determination of net tax benefits in connection with the Company's tax receivable agreements and (iv) the valuation of the Consolidated Fund's investments and the fair value measurements of the Company's investments in unconsolidated VIEs. These estimates are based on the information that is currently available to the Company and on various other assumptions that the Company believes to be reasonable under the circumstances. Actual results could differ materially from those estimates under different assumptions and conditions.

Concentration of Credit Risk and Other Risks and Uncertainties

Financial instruments which potentially subject the Company to concentrations of credit risk consist primarily of cash and cash equivalents. The Company maintains its cash and cash equivalents with high-credit quality financial institutions.

For the nine months ended September 30, 2015 and 2014, substantially all revenues and receivables were earned or derived from advisory or administrative services provided to the BDCs and other affiliated entities.

The Company is dependent on its chief executive officer, Leonard M. Tannenbaum, who holds over 90% of the combined voting power of the Company through his ownership of shares of common stock. If for any reason the services of the Company's chief executive officer were to become unavailable, there could be a material adverse effect on the Company's operations, liquidity and profitability.

Fair Value Measurements

The carrying amounts of cash and cash equivalents, management and performance fees receivable from affiliates, prepaid expenses, due from/to affiliates, accounts payable and accrued expenses, accrued compensation and benefits and income taxes payable approximate fair value due to the immediate or short-term maturity of these financial instruments.

18

Fifth Street Asset Management Inc.

(Prior to November 4, 2014 - Fifth Street Management Group)

Notes to Consolidated Financial Statements

Cash and Cash Equivalents

Cash equivalents include short-term, highly liquid investments that are readily convertible to known amounts of cash and have original maturities of three months or less. The Company places its cash and cash equivalents with U.S. financial institutions and, at times, amounts may exceed federally insured limits. The Company monitors the credit standing of these financial institutions.

Investments in Equity Method Investees

Investments in equity method investees consists of the Company's interests in unconsolidated VIEs. Entities and investments over which the Company exercises significant influence but which do not meet the requirements for consolidation are accounted for using the equity method of accounting, whereby the Company records its share of the underlying income or losses of these entities. Intercompany profit arising from transactions with affiliates is eliminated to the extent of its beneficial interest. Equity in losses of equity method investments is not recognized after the carrying value of an investment, including advances and loans, has been reduced to zero, unless guarantees or other funding obligations exist.

The Company evaluates its equity method investments for impairment, whenever events or changes in circumstances indicate that the carrying amounts of such investments may not be recoverable. The difference between the carrying value of the equity method investment and its estimated fair value is recognized as an impairment when the loss in value is deemed other than temporary. No impairment charges related to equity method investments were recorded during the nine months ended September 30, 2015 and 2014.

The Company's only equity method investment is its general partnership interest in FSOF, a credit-oriented hedge fund which was previously consolidated. FSOF follows GAAP specialized industry accounting which requires it to carry its investments at fair value. Accordingly, the Company's income allocated from the equity method investees includes net unrealized gain/loss allocations from FSOF.

Investments in Available-for-Sale Securities