Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 - COMTECH TELECOMMUNICATIONS CORP /DE/ | t1502782_ex99-3.htm |

| EX-99.4 - EXHIBIT 99.4 - COMTECH TELECOMMUNICATIONS CORP /DE/ | t1502782_ex99-4.htm |

| EX-99.2 - EXHIBIT 99.2 - COMTECH TELECOMMUNICATIONS CORP /DE/ | t1502782_ex99-2.htm |

| 8-K - FORM 8-K - COMTECH TELECOMMUNICATIONS CORP /DE/ | t1502782_8k.htm |

Exhibit 99.1

Comtech Telecommunications Corp. To Acquire TeleCommunication Systems, Inc. in a $430.8 Million Strategic and Cash Accretive Transaction Creates Scale and More Diversified Earnings Provides Entry into Growing Commercial Markets Enhances Position with Existing Customers Generates Meaningful Cost Synergies + This presentation contains information as of November 23, 2015. See disclosures on page 2 and 11.

Forward - Looking Statements 2 Cautionary Statement Regarding Forward - Looking Statements Certain information in this presentation contains forward - looking statements regarding Comtech Telecommunications Corp . (“ Comtech ” or the “Company ”) , including but not limited to, information relating to Comtech’s f uture performance and financial condition, plans and objectives of Comtech’s management and Comtech’s assumptions regarding such future performance, financial condition, plans and objectives that involve certain significant known and unknown risks and uncertainties and other factors not under Comtech’s control which may cause actual results, future performance and financial condition, and achievement of plans and objectives of Comtech’s management to be materially different from the results, performance or other expectations implied by these forward - looking statements . These factors include, among other things : the risk that the acquisition of TeleCommunication Systems, Inc . (“TCS”) may not be consummated for reasons including that the conditions precedent to the completion of the acquisition may not be satisfied or the occurrence of any event, change or circumstance that could give rise to the termination of the merger agreement ; the possibility that the expected synergies from the proposed merger will not be realized, or will not be realized within the anticipated time period ; the risk that Comtech’s and TCS’s businesses will not be integrated successfully ; the risk that requisite regulatory approvals will not be obtained ; the possibility of disruption from the merger making it more difficult to maintain business and operational relationships or retain key personnel ; any actions taken by either of the companies, including but not limited to, restructuring or strategic initiatives (including capital investments or asset acquisitions or dispositions) ; the timing of receipt of, and Comtech’s performance on, new orders that can cause significant fluctuations in net sales and operating results ; the timing and funding of government contracts ; adjustments to gross profits on long - term contracts ; risks associated with international sales, rapid technological change, evolving industry standards, frequent new product announcements and enhancements, changing customer demands, and changes in prevailing economic and political conditions ; risks associated with Comtech’s legal proceedings and other matters ; risks associated with Comtech’s obligations under its revolving credit facility ; and other factors described in Comtech’s and TCS’s filings with the SEC . Use of Non - GAAP Financial Metrics This presentation contains a Non - GAAP financial metric called Adjusted EBITDA which represents earnings before interest, income taxes, depreciation and amortization of intangibles and stock - based compensation, amortization of deferred financing fees, strategic alternatives analysis expenses and other (income) expenses . Adjusted EBITDA is a non - GAAP operating metric used by Comtech in assessing Comtech’s and TCS’s operating results . The Company's definition of Adjusted EBITDA may differ from the definition of EBITDA used by other companies and may not be comparable to similarly titled measures used by other companies . Adjusted EBITDA is also a measure frequently requested by the Company's investors and analysts . The Company believes that investors and analysts may use Adjusted EBITDA, along with other information contained in its SEC filings, in assessing its ability to generate cash flow and service debt .

Overview of TeleCommunication Systems 3 Commercial • Leading provider of 911 technology for routing calls via cellular, VoIP, and NextGen systems • Hosts and manages cellular carrier infrastructure for text messaging • Developing “Trusted Location” technology Government • Provides mission - critical C4ISR solutions and field support – Designs , installs, and operates wireless communications systems – Prime on over - the - horizon (troposcatter systems) contract vehicles – Classified cybersecurity contracts – Provides traditional IT services and cyber training ~$364.1 Million of TTM Revenue ~1,100 Employees A technology innovator in secure, highly reliable wireless communications

Key Strategic Benefits 4 + Provides Entry Into Growing Commercial Markets • TCS markets are at growth inflection points • Expands Comtech into public safety markets that are adopting NextGeneration 911 solutions • Expands Comtech into the mobile application market which has a need for Trusted Location solutions • Brings new relationships with large U.S . domestic customers, including Verizon, AT&T, and state and local governments Creates Scale and More Diversified Earnings • More than doubles the size of Comtech’s business with combined revenues exceeding $600 million • Reduces volatility associated with challenging international (including emerging market) business conditions • Comtech’s business will include repeat - type revenue from hosted systems such as NextGeneration 911 solutions • Expands Comtech’s hardware product portfolio and positions Comtech on mobile devices Provides for Meaningful Cost Synergies • Total synergies of $12.0 million (with approximately $8.0 million incurred in the first year after closing) • Comtech intends to reduce duplicate public company costs • Reduced spending on maintaining multiple information technology systems • Obtain increased operating efficiencies throughout the combined companies Enhances Position With Existing Customers • Secures prime contractor position on U.S. government contracts which include our OTH ( troposcatter) equipment • Provides more opportunities for cross - selling Comtech’s equipment including modems, amplifiers and Blue - Force Tracking - like services to TCS’s federal, state and local government customers • Provides opportunities for TCS to cross - sell their commercial applications to Comtech’s international customers

44% 56% 50% 50% 68% 32% 53% 47% 89% 11% 56% 44% Creates Scale and More Diversified Earnings 5 Standalone Revenue Breakdown (2) Pro Forma Combined Revenue Breakdown Notes: (1) Represents TCS’s financials for the four fiscal quarters ended September 30, 2015. (2) Based on Comtech’s fiscal year ended July 31, 2015 and TCS’s fiscal year ended December 31, 2014. (3) For purposes of this presentation, Comtech’s government revenue represents sales to the U.S. Government and a North African country, while commercial revenue represents sales to U.S. commercial and other International customers , as presented in Comtech’s filings with the SEC . Domestic International Commercial Government (1) (3) Fiscal Year 2015 LTM 3Q 2015 FY 2015 + LTM 3Q 2015 ($ in millions) July 31, 2015 September 30, 2015 Pro Forma b Revenue $307.3 $364.1 $671.4 Adjusted EBITDA $51.8 $40.4 $92.2 % Margin 16.8% 11.1% 13.7% See disclosures on page 2 and reconciliation to GAAP on page 10 related to the definition and use of Adjusted EBITDA.

TCS Markets Are at Growth Inflection Points 6 Notes: (1) Based on TCS’s fiscal year ended December 31, 2014. Safety & Security Solutions Applications Solutions Government Solutions Cyber Intelligence Solutions 50% Examples: • NextGen 911 • ESInet Examples: • Trusted Location • Indoor Location Examples: • C4ISR • Mission critical communication systems such as deployable troposcatter systems Examples: • Cyber Security 16% Percent of Revenue (1) 50% • Wireless / VoIP 911 service for network operators • TCS routes ~50% of all U.S. wireless 911 calls • Software & equipment for location - based & messaging infrastructure • Managed “cloud - services” • C4ISR systems integration • Broad suite of tactical communications products • Managed networks, logistics, etc. services • Cyber security training • Security assessments and audits • Computer network operations Commercial Government

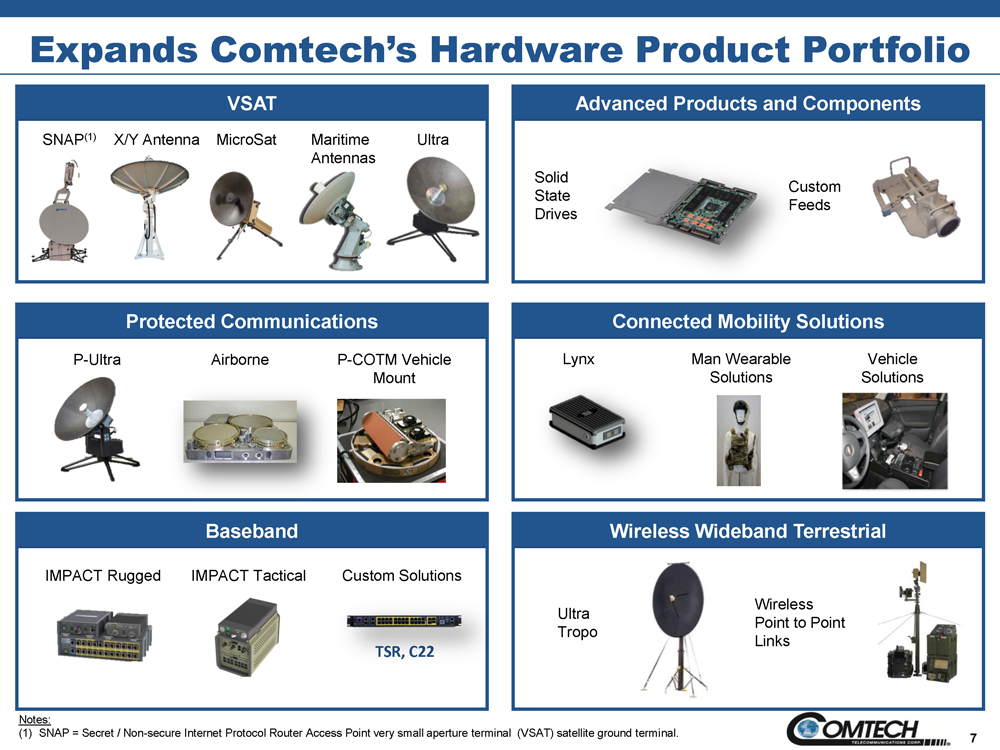

Expands Comtech’s Hardware Product Portfolio 7 Notes: (1) SNAP = Secret / Non - secure Internet Protocol Router Access Point very small aperture terminal (VSAT) satellite ground termi nal. VSAT Advanced Products and Components Protected Communications Connected Mobility Solutions Baseband Wireless Wideband Terrestrial MicroSat SNAP (1) X/Y Antenna Maritime Antennas Wireless Point to Point Links Solid State Drives P - COTM Vehicle Mount P - Ultra Airborne IMPACT Tactical IMPACT Rugged Custom Solutions Lynx Custom Feeds TSR, C22 Man Wearable Solutions Ultra Vehicle Solutions Ultra Tropo

Positions Comtech on Mobile Devices 8 Short Message Service Center (“SMSC”) • Software has been used by wireless carrier subscribers to send and receive text or data messages since 1997 • Systems enable the use of text messaging to communicate with 911 public safety answering points through major network operators • Provides ongoing operational support (administration, optimization , and configuration) for installed base • Maintenance services include customer support, troubleshooting , and developing and installing maintenance releases • Application / People (A2P ) and Machine / Machine (M2M) usage continues to rise Trusted Location - Based Services (“LBS”) • Applications – TCS white label applications – Build your own on a standards based Location Based Services (LBS) or Location ToolKit (LTK) software development kit – Co - develop with TCS • Platform – LBS network based location – LTK software development kits – Alternative LBS suppliers Indoor and high - accuracy applications becoming more important, where TCS is particularly strong Continued investment in next generation protocols (3G , LTE and IP) extend the life of the platform for years to come

TCS Brings Adjusted EBITDA of ~$40.4 million Excluding Synergies to Comtech 9 Transaction Related Expenses Acquisition Expected to be Cash Accretive • Comtech preliminarily estimates that it will incur approximately $27.5 million of transaction related expenses including certain change - in - control payments, and professional fees for financial and legal advisors and debt extinguishment costs • Excluding the impact of amortization of intangibles associated with purchase accounting and transaction related expenses, the acquisition is expected to be cash accretive • Comtech will provide its expectations of when the transaction is expected to close and provide revenue and earnings guidance in a future announcement Transaction Overview • Comtech will make a first step cash tender offer of $ 5.00 per TCS share. Once the first step cash tender is completed, it will be followed by a merger at the same price. All existing TCS debt of approximately $143.6 million is anticipated to be repaid upon closing • The acquisition has a transaction equity value of approximately $ 339.7 million and an enterprise value of approximately $430.8 million. The purchase price represents an implied transaction multiple of approximately 8.9x based on the last trailing twelve months of reported TCS Adjusted EBITDA. Comtech has received a commitment for a credit facility funded in the amount of up to $400.0 million • Upon closing, Comtech is expected to have $52.7 million of cash and total leverage of about 3.9x trailing twelve months combined pro forma Adjusted EBITDA. This leverage is expected to decrease over time, based on cash flows generated from the combined businesses. Although the credit facility is expected to have restrictions, the credit facility permits and Comtech anticipates maintaining its annual targeted dividend rate of $1.20 per share. The credit facility provides that Comtech may conduct an equity offering for newly issued common shares to reduce total leverage prior to or after the close

10 Reconciliation of GAAP Net Income to Adjusted EBITDA TCS CMTL Excluding Synergies Four Fiscal Quarters Ended September 30, 2015 Four Fiscal Quarters Ended July 31, 2015 Pro Forma Combined (2) Reconciliation of GAAP Net Income to Adjusted EBITDA (1) : GAAP net income $ 3,688 $23,245 $26,933 Interest, net 8,123 74 8,197 Depreciation and amortization 17,443 12,736 30,179 Income taxes 3,509 10,758 14,267 Amortization of stock-based compensation 4,747 4,363 9,110 Amortization of deferred financing fees 895 - 895 Strategic alternatives expenses 2,131 585 2,716 Other (income) expense (104) - (104) Adjusted EBITDA $40,432 $51,761 $92,193 (1) Represents earnings before interest, income taxes, d epreciation and amortization of intangibles and stock - based compensation based on the Adjusted EBITDA calculation utilized by Comtec h. Adjusted EBITDA is a non-GAAP operating metric used by Comtech in assessing both its and TCS’s operating results. Comtech’s definition of Adjusted EBITDA may differ from the definition of Adjusted EBITDA used by TCS and other companies, and may not be c omparable to similarly titled measures used by other companies. Adjusted EBITDA is also a measure frequently requested by Comt ech’s investors and analysts. Comtech believes that investors and analysts may use Adjusted EBITDA, along with other information c ontained in its SEC filings, in assessing its ability to generate cash flow and service debt. (2) Pro Forma Combined results exclude all expenses resulting from the acquisition (including, for example changes in interest expense associated with the cre dit facility commitment received by Comtech as well as synergies and changes in amortization of acquired intangibles).

11 Additional Information About the Tender Offer The tender offer described herein has not yet commenced . The description contained herein is for informational purposes only and is not an offer to buy or the solicitation of an offer to sell any shares of TCS . At the time the tender offer is commenced, Comtech and its wholly owned subsidiary, Typhoon Acquisition Corp . , intend to file with the U . S . Securities and Exchange Commission (the “SEC”) a Tender Offer Statement on Schedule TO containing an offer to purchase, a form of letter of transmittal and other documents relating to the tender offer, and TCS intends to file a Solicitation/Recommendation Statement on Schedule 14 D - 9 with respect to the tender offer . Comtech, Typhoon Acquisition Corp . and TCS intend to mail these documents to the stockholders of TCS . THESE DOCUMENTS, EACH AS MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME, WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TENDER OFFER AND TCS STOCKHOLDERS ARE URGED TO READ THEM CAREFULLY WHEN THEY BECOME AVAILABLE . Stockholders of TCS will be able to obtain a free copy of these documents (when they become available) and other documents filed by TCS, Comtech or Typhoon Acquisition Corp . with the SEC at the website maintained by the SEC at www . sec . gov . Stockholders will be able to obtain a free copy of these documents (when they become available) from the information agent named in the offer to purchase, or from Comtech by directing a written request to : Comtech Telecommunications Corp . , 68 South Service Road, Suite 230 , Melville, New York 11747 , Attention : Investor Relations .