Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SPRINT Corp | d15545d8k.htm |

| EX-10.5 - EX-10.5 - SPRINT Corp | d15545dex105.htm |

| EX-10.1 - EX-10.1 - SPRINT Corp | d15545dex101.htm |

| EX-10.7 - EX-10.7 - SPRINT Corp | d15545dex107.htm |

| EX-10.6 - EX-10.6 - SPRINT Corp | d15545dex106.htm |

| EX-10.4 - EX-10.4 - SPRINT Corp | d15545dex104.htm |

| EX-10.3 - EX-10.3 - SPRINT Corp | d15545dex103.htm |

| EX-10.2 - EX-10.2 - SPRINT Corp | d15545dex102.htm |

#MoveForward Template Version: 4:3MF1.1 Version Date: 10/23/15 1 Sprint Executes Agreement With Mobile Leasing Solutions Exhibit 99.1 November 20 th , 2015 ©2015 Sprint. This information is subject to Sprint policies regarding use and is the property of Sprint and/or its relevant affiliates and

may contain restricted, confidential or privileged materials intended for

the sole use of the intended recipient. Any review, use, distribution or disclosure is prohibited without authorization. |

#MoveForward Template Version: 4:3MF1.1 Version Date: 10/23/15 2 ©2015 Sprint. This information is subject to Sprint policies regarding use and is the property of Sprint and/or its relevant affiliates and

may contain restricted, confidential or privileged materials intended for

the sole use of the intended recipient. Any review, use, distribution or disclosure is prohibited without authorization. Cautionary Statement SAFE HARBOR This presentation includes “forward-looking statements” within the meaning of the securities laws. The words “may,”

“could,” “should,” “estimate,”

“project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “target,” “plan,” “providing guidance,” and similar expressions are intended to identify information that is not historical in nature. All statements

that address operating performance, events or developments that we expect or anticipate

will occur in the future — including statements relating to the

LeaseCo transaction and statements expressing general views about future

operating results — are forward-looking statements. Forward-looking

statements are estimates and projections reflecting management’s

judgment based on currently available information and involve a number of risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking

statements. With respect to these forward-looking statements, management has made

assumptions regarding, among other things, ability to recognize the

expected benefits of the LeaseCo transaction; availability of devices;

availability of various financings, including any additional leasing transactions; and

the timing of various events. Sprint believes these forward-looking

statements are reasonable; however, you should not place undue reliance on forward-looking statements, which are based on current expectations and speak only as of the date when made.

Sprint undertakes no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events or

otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our company's

historical experience and our present expectations or projections. Factors that might

cause such differences include, but are not limited to, those discussed

in Sprint Corporation’s Annual Report on Form 10-K for the fiscal year ended March 31, 2015. You should understand that it is not possible to predict or identify all such factors. Consequently, you

should not consider any such list to be a complete set of all potential risks or

uncertainties. |

#MoveForward Template Version: 4:3MF1.1 Version Date: 10/23/15 3 ©2015 Sprint. This information is subject to Sprint policies regarding use and is the property of Sprint and/or its relevant affiliates and

may contain restricted, confidential or privileged materials intended for

the sole use of the intended recipient. Any review, use, distribution or disclosure is prohibited without authorization. *Non-GAAP Financial Measures Sprint provides financial measures determined in accordance with GAAP and adjusted GAAP (non-GAAP). The

non-GAAP financial measures reflect industry conventions, or standard measures of

liquidity, profitability or performance commonly used by the investment

community for comparability purposes. These measurements should be

considered in addition to, but not as a substitute for, financial information prepared in accordance with GAAP. We have defined below each of the non-GAAP measures we use, but these measures may not be

synonymous to similar measurement terms used by other companies.

Sprint provides reconciliations of these non-GAAP measures in its financial

reporting. Because Sprint does not predict special items that might occur

in the future, and our forecasts are developed at a level of detail different than that used to prepare GAAP-based financial measures, Sprint does not provide reconciliations to GAAP of its

forward-looking financial measures.

The measures used in this presentation include the following:

EBITDA is operating income/(loss) before depreciation and amortization. Adjusted EBITDA

is EBITDA excluding severance, exit costs, and other special items.

Adjusted EBITDA Margin represents Adjusted EBITDA divided by

non-equipment net operating revenues for Wireless and Adjusted EBITDA divided by

net operating revenues for Wireline. We believe that Adjusted EBITDA and

Adjusted EBITDA Margin provide useful information to investors because

they are an indicator of the strength and performance of our ongoing business operations. While depreciation and amortization are considered operating costs under GAAP, these expenses primarily represent

non-cash current period costs associated with the use of long-lived tangible

and definite-lived intangible assets. Adjusted EBITDA and Adjusted

EBITDA Margin are calculations commonly used as a basis for investors, analysts and credit rating agencies to evaluate and compare the periodic and future operating performance and value of

companies within the telecommunications industry.

Reconciliations between the non-GAAP financial measures and the GAAP financial

measures are available on the company’s website at

www.sprint.com/investors. |

#MoveForward Template Version: 4:3MF1.1 Version Date: 10/23/15 4 ©2015 Sprint. This information is subject to Sprint policies regarding use and is the property of Sprint and/or its relevant affiliates and

may contain restricted, confidential or privileged materials intended for

the sole use of the intended recipient. Any review, use, distribution or disclosure is prohibited without authorization. Deal Summary Sprint expects to receive $1.1B in cash proceeds at closing in early December from off balance sheet sale-leaseback transaction with Mobile Leasing Solutions Creates a repeatable structure to sell discrete pools of future leased devices Aligns the timing of cash outflows for device purchases with the cash inflows from the sale of certain leased devices Diversifies liquidity portfolio away from unsecured high-yield concentration

today, allows Sprint to access $600 billion annual global ABS liquidity pool

Implied cost of funds is well below high-yield

alternatives Strong combination of financial and strategic parties

supporting the transaction |

#MoveForward Template Version: 4:3MF1.1 Version Date: 10/23/15 5 ©2015 Sprint. This information is subject to Sprint policies regarding use and is the property of Sprint and/or its relevant affiliates and

may contain restricted, confidential or privileged materials intended for

the sole use of the intended recipient. Any review, use, distribution or disclosure is prohibited without authorization. Mobile Leasing Solutions (MLS) Structure Equity investors include Softbank and 6 leasing companies Lenders include 3 international banks providing low cost capital to MLS Residual value protection provided by Brightstar through Foxconn forward purchase commitment Sprint entitled to 100% of any net residual value upside on devices Brightstar manages logistics and acts as sole remarketing agent for MLS to monetize returned devices Limited recourse to Sprint Represents a unique structure that considers credit risk and asset risk within one vehicle EQUITY FOXCONN LENDERS $ $ $ |

©2015 Sprint. This information is subject to Sprint policies regarding use and is

the property of Sprint and/or its relevant affiliates and may contain restricted, confidential or privileged materials intended for the sole use of the intended recipient. Any review, use, distribution or disclosure is

prohibited without authorization. #MoveForward

Template Version: 4:3MF1.1

Version Date: 10/23/15

6 ©2015 Sprint. This information is subject to Sprint policies regarding use and is the property of Sprint and/or its relevant affiliates and

may contain restricted, confidential or privileged materials intended for

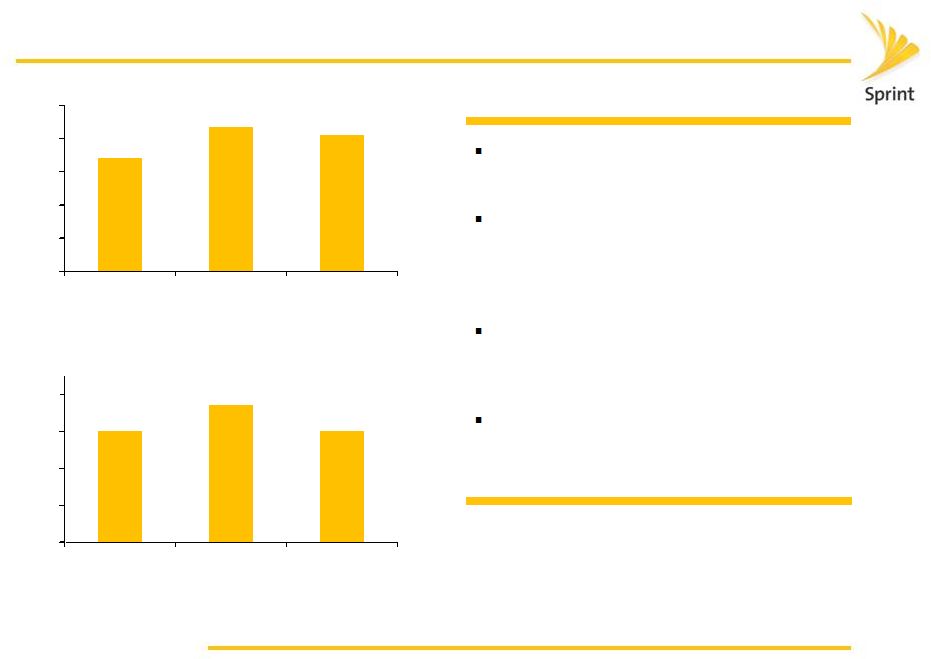

the sole use of the intended recipient. Any review, use, distribution or disclosure is prohibited without authorization. Diversifying the Capital Portfolio Sale-leaseback structure similar to asset backed lending construct Important for Sprint to diversify its sources of capital, which today is highly concentrated around high-yield unsecured debt Effective cost of capital from the ABS market has historically been lower than the high-yield market ABS market supply is nearly $400 billion annually in the US alone, and $600 billion globally 0 100 200 300 400 500 2013 2014 2015 US Annual ABS Supply ($B) 0 200 400 600 800 2013 2014 2015 Global Annual ABS Supply ($B) |

#MoveForward Template Version: 4:3MF1.1 Version Date: 10/23/15 7 ©2015 Sprint. This information is subject to Sprint policies regarding use and is the property of Sprint and/or its relevant affiliates and

may contain restricted, confidential or privileged materials intended for

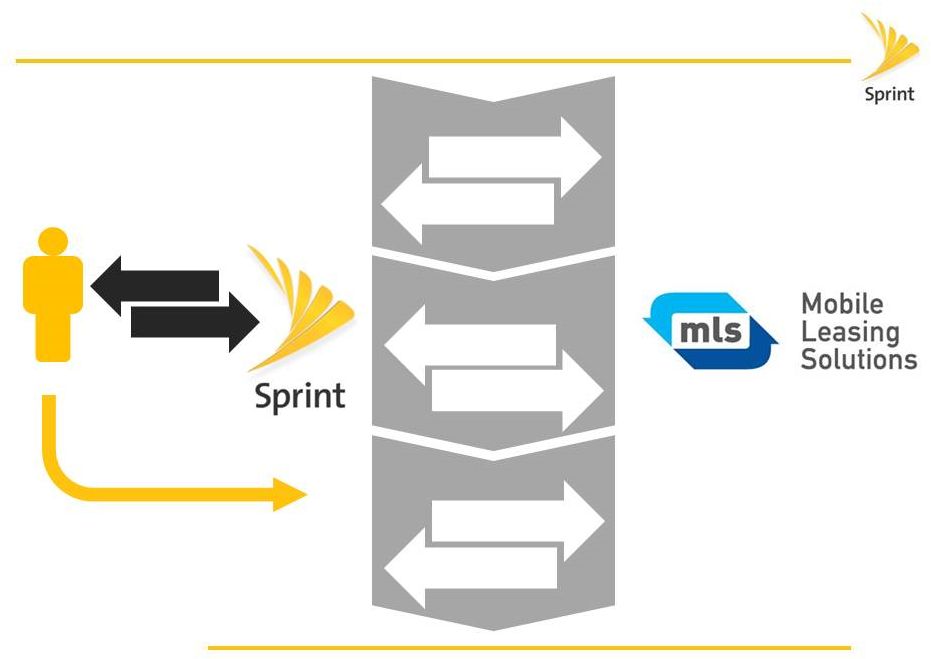

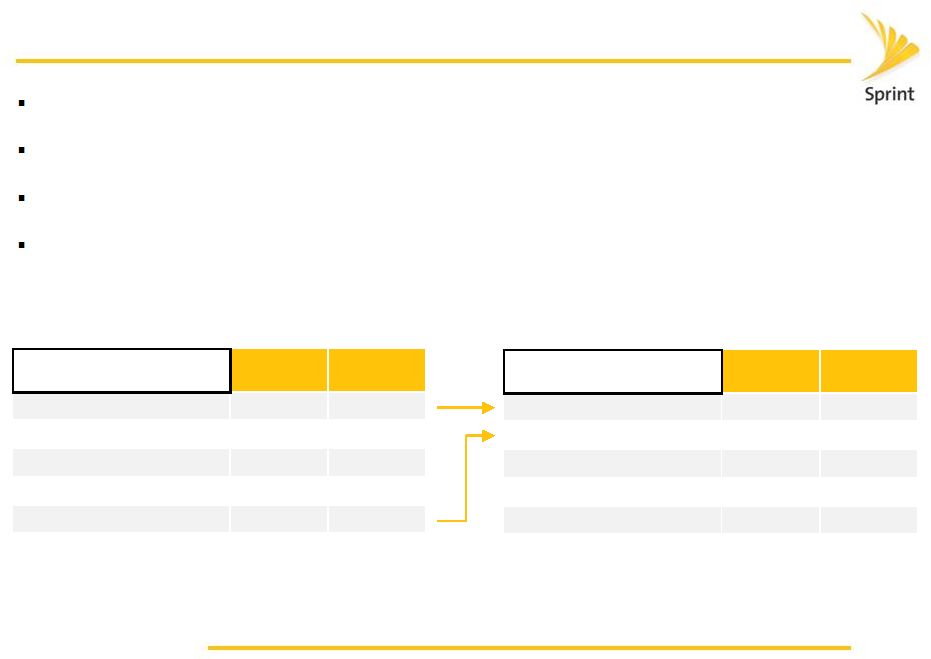

the sole use of the intended recipient. Any review, use, distribution or disclosure is prohibited without authorization. Sprint - MLS Relationship 0 Customer 1 2 3 Device Sale Leaseback Device Return Cash Devices Sold Leaseback Devices Leaseback Payments Upside Participation Return Device Payment Lease • Return Device • Purchase Device • Month-to-Month |

#MoveForward Template Version: 4:3MF1.1 Version Date: 10/23/15 8 ©2015 Sprint. This information is subject to Sprint policies regarding use and is the property of Sprint and/or its relevant affiliates and

may contain restricted, confidential or privileged materials intended for

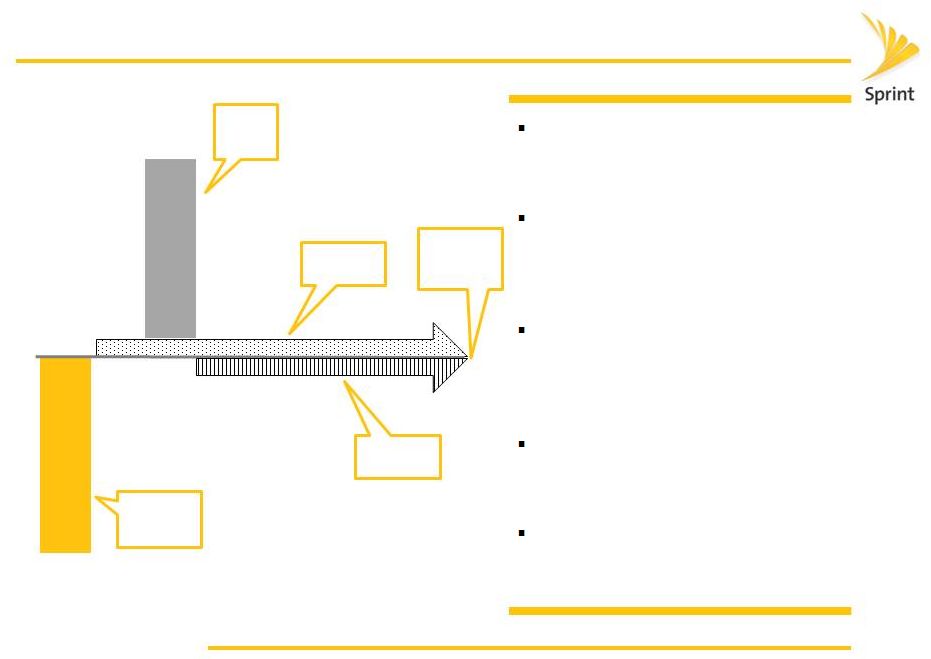

the sole use of the intended recipient. Any review, use, distribution or disclosure is prohibited without authorization. Expected Initial Tranche Details Book value of ~2.5 million devices sold is removed from PP&E on the Balance Sheet Total consideration of ~$1.2B includes ~$1.1B in cash plus deferred consideration Implied cost of funds of mid-single digits, well below the current high-yield alternatives The difference between the net book value and total proceeds will be recognized on Sprint’s P&L as a loss at the time of sale Deferred consideration is held as protection for MLS towards potential losses, and will be trued-up with upside, at the close-out of the transaction *Adjusted at closing to reflect final assets sold/received ~$1.3B Book Value Sold ~$1.2B Proceeds* |

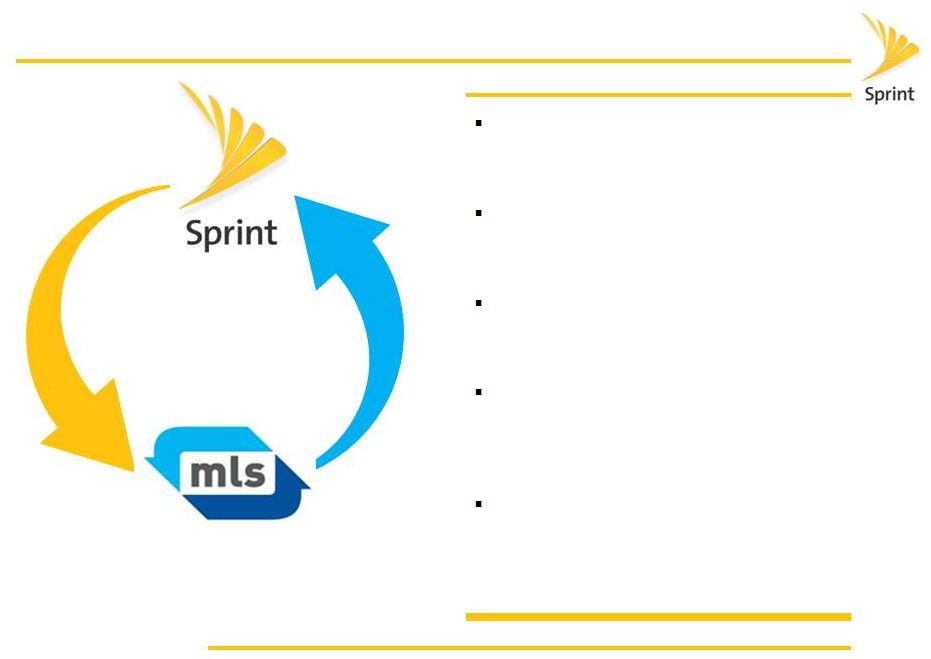

#MoveForward Template Version: 4:3MF1.1 Version Date: 10/23/15 9 ©2015 Sprint. This information is subject to Sprint policies regarding use and is the property of Sprint and/or its relevant affiliates and

may contain restricted, confidential or privileged materials intended for

the sole use of the intended recipient. Any review, use, distribution or disclosure is prohibited without authorization. Cash Flow Impact Addresses the working capital impact of leasing by aligning the timing of cash flows Proceeds from sale of devices to MLS is expected to approximate the net book value of the associated leased devices For subsequent tranches Sprint expects to sell the leased devices to MLS 1-3 months after initiating lease with the customer Monthly leaseback payments to MLS approximates lease payments received from customers Any net residual value upside would be realized by Sprint at the end of the transaction Lease/Leaseback Term Customer Payments Leaseback Payments Device Sale to MLS Device Purchase From OEM Residual Value Upside Illustrative example only |

©2015 Sprint. This information is subject to Sprint policies regarding use and is

the property of Sprint and/or its relevant affiliates and may contain restricted, confidential or privileged materials intended for the sole use of the intended recipient. Any review, use, distribution or disclosure is

prohibited without authorization. #MoveForward

Template Version: 4:3MF1.1

Version Date: 10/23/15

10 Income Statement Impact No change to equipment revenue recognition during customer lease term Leaseback payment recorded in Cost of Product on P&L No depreciation after device sale to MLS Small upfront loss expected to be recognized equal to difference between total proceeds and net book

value of devices sold

Illustrative example only

Customer Each Transaction Month Equipment Revenue $0 $20 Cost of Product $0 $0 Other, Net $0 $0 EBITDA $0 $20 Depreciation $0 ($20) EBIT $0 $0 Business As Usual MLS Each Transaction Month Equipment Revenue $0 $20 Cost of Product $0 ($20) Other, Net ($30) $0 EBITDA ($30) $0 Depreciation $0 $0 EBIT ($30) $0 Sale-Leaseback |

©2015 Sprint. This information is subject to Sprint policies regarding use and is

the property of Sprint and/or its relevant affiliates and may contain restricted, confidential or privileged materials intended for the sole use of the intended recipient. Any review, use, distribution or disclosure is

prohibited without authorization. #MoveForward

Template Version: 4:3MF1.1

Version Date: 10/23/15

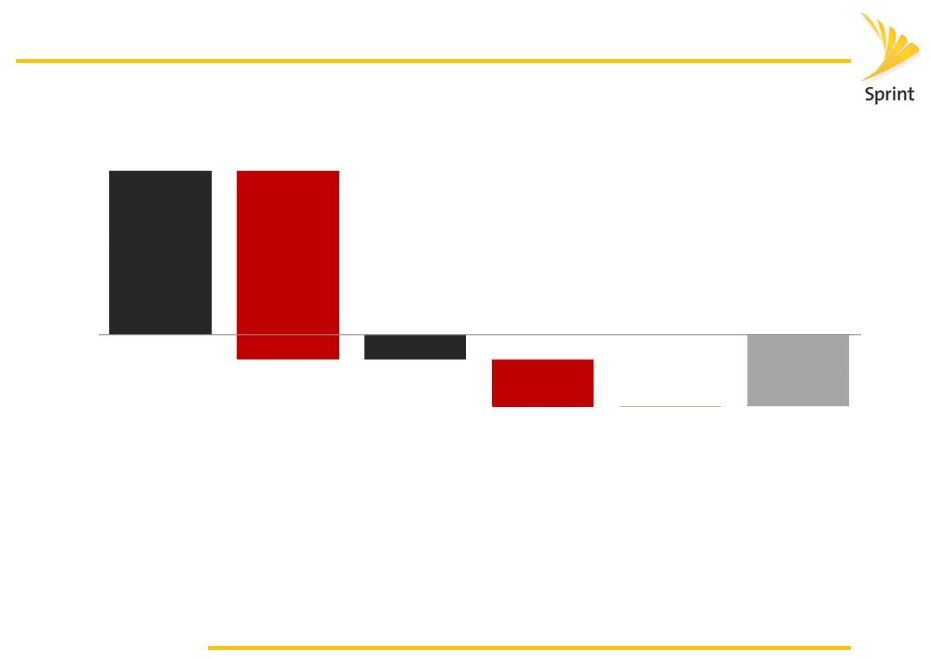

11 Adjusted EBITDA* Guidance $6.8B - $7.1B $7.2B - $7.6B Low end of $7.2B - $7.6B Updated Guidance Only Reflects First Tranche Business As Usual Transformation & Program Costs Prior Guidance Tranche Loss Leaseback Payments Revised Guidance |

©2015 Sprint. This information is subject to Sprint policies regarding use and is

the property of Sprint and/or its relevant affiliates and may contain restricted, confidential or privileged materials intended for the sole use of the intended recipient. Any review, use, distribution or disclosure is

prohibited without authorization. #MoveForward

Template Version: 4:3MF1.1

Version Date: 10/23/15

12 Operating Income Guidance ($50M) – ($250M) $200M – $500M $0M – ($150M) Updated Guidance Only Reflects First Tranche Business As Usual Transformation & Program Costs Prior Guidance Tranche Loss Leaseback Payments Revised Guidance |

©2015 Sprint. This information is subject to Sprint policies regarding use and is

the property of Sprint and/or its relevant affiliates and may contain restricted, confidential or privileged materials intended for the sole use of the intended recipient. Any review, use, distribution or disclosure is

prohibited without authorization. #MoveForward

Template Version: 4:3MF1.1

Version Date: 10/23/15

13 Questions & Answers |

|

©2015 Sprint. This information is subject to Sprint policies regarding use and is

the property of Sprint and/or its relevant affiliates and may contain restricted, confidential or privileged materials intended for the sole use of the intended recipient. Any review, use, distribution or disclosure is

prohibited without authorization. #MoveForward

Template Version: 4:3MF1.1

Version Date: 10/23/15

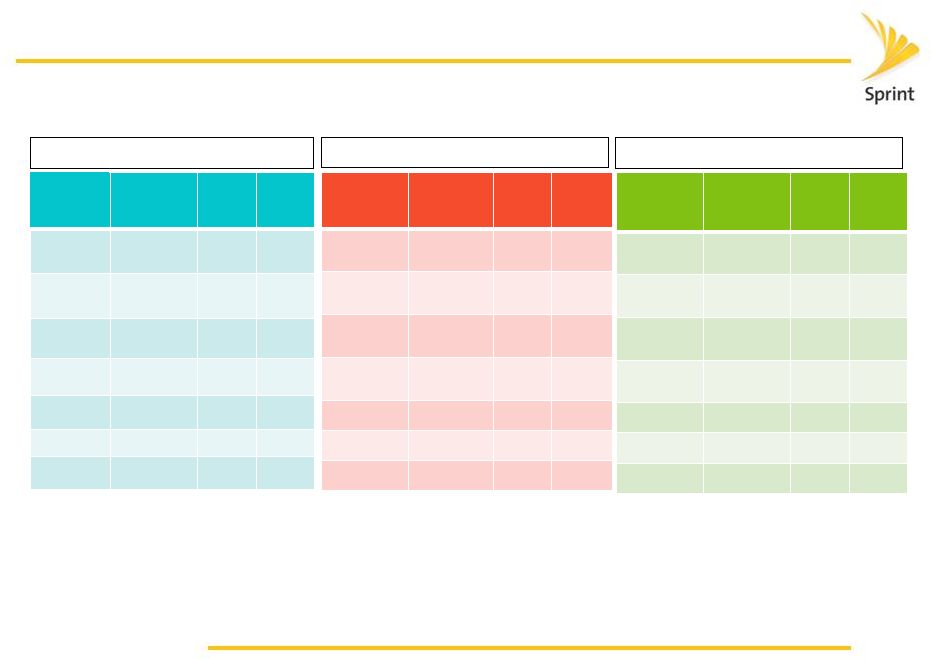

15 Device Purchase Method Accounting Traditional Subsidy Equipment Installment Plan Leasing Customer Device Transaction Each Month 24 Month Total Service Revenue $0 $60 $1,440 Equipment Revenue $600 $0 $600 Imputed Interest $0 $2 $50 Cost of Goods Sold ($650) $0 ($650) EBITDA ($50) $62 $1,440 Depreciation $0 $0 $0 EBIT ($50) $62 $1,440 Customer Device Transaction Each Month 24 Month Total Service Revenue $0 $60 $1,440 Equipment Revenue $0 $20 $480 Imputed Interest $0 $0 $0 Cost of Goods Sold $0 $0 $0 EBITDA $0 $80 $1,920 Depreciation $0 ($20) ($480) EBIT $0 $60 $1,440 Customer Device Transaction Each Month 24 Month Total Service Revenue $0 $78.75 $1,890 Equipment Revenue $200 $0 $200 Imputed Interest $0 $0 $0 Cost of Goods Sold ($650) $0 ($650) EBITDA ($450) $78.75 $1,440 Depreciation $0 $0 $0 EBIT ($450) $78.75 $1,440 HYPOTHETICAL EXAMPLE FOR ILLUSTRATIVE PURPOSES ONLY: • numbers are simplified, representing a single device • device is purchased from a Sprint direct channel |