Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - GLOBAL GOLD CORP | ex31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - GLOBAL GOLD CORP | ex32-1.htm |

| EX-10.76 - EXHIBIT 10.76 - GLOBAL GOLD CORP | ex10-76.htm |

| EX-10.77 - EXHIBIT 10.77 - GLOBAL GOLD CORP | ex10-77.htm |

| EX-10.75 - EXHIBIT 10.75 - GLOBAL GOLD CORP | ex10-75.htm |

| EX-31.2 - EXHIBIT 31.2 - GLOBAL GOLD CORP | ex31-2.htm |

| 10-Q - FORM 10-Q - GLOBAL GOLD CORP | gbgd20150930_10q.htm |

Exhibit 10.74

|

INSTRUMENT |

|

DATED 17th JANUARY 2012 |

|

GLOBAL GOLD CONSOLIDATED RESOURCES LIMITED

constituting not less than US$2,000,000 nominal Secured Fixed Rate Convertible Notes 2013 |

CONTENTS

|

Clause |

Page | |

|

1. |

Interpretation |

1 |

|

2. |

Amount of Notes |

2 |

|

3. |

Status of Notes |

3 |

|

4. |

Issue and Form of Notes |

3 |

|

5. |

Conditions of Issue |

3 |

|

6. |

Undertaking by THE Company |

3 |

|

7. |

Register of Notes |

3 |

|

8. |

Freedom from Equities |

4 |

|

9. |

Further Notes |

4 |

|

10. |

Representations And Warranties |

4 |

|

11. |

Covenants |

5 |

|

12. |

Governing Law and Jurisdiction |

5 |

|

Schedule |

||

|

1. |

Form of Note |

7 |

|

2. |

Binding Term Sheet |

15 |

|

Signatories |

20 | |

THIS INSTRUMENT is made on 17th January 2012 by GLOBAL GOLD CONSOLIDATED RESOURCES LIMITED, a private limited company incorporated in Jersey with registered number 109058, whose registered office is at Ogier House, The Esplanade, St Helier, JE4 9WG (the Company).

WHEREAS the Company has by a resolution of its board of directors passed on _________ January 2012, created and authorised the issue of not less than US$2,000,000 nominal Secured Fixed Rate Convertible Notes 2013 to be constituted as provided below.

WHEREAS the Company has executed a binding term sheet (the Term Sheet) together with GGC and CRA in relation to the Notes as constituted by this Instrument (a copy of the Term Sheet is appended hereto at Schedule 2).

NOW THIS INSTRUMENT WITNESSES AND IT IS DECLARED as follows:

|

|

1. |

Interpretation |

|

|

1.1 |

In this Instrument: |

Business Day means a day (other than a Saturday or a Sunday) on which banks in Jersey are generally open for normal business;

Change of Control means a change of 50.1% or more of a beneficial ownership of the legal or beneficial ownership of the Company or the relevant subsidiary except in the case of an Initial Public Offering;

Conditions means the conditions of the Notes set out in Schedule 1, as from time to time modified in accordance with this Instrument;

Conversion Rate means, in respect of a conversion of the Notes into ordinary shares of the Company, a rate of 1% of the issued share capital of the Company for each $784,314 of Notes based on a Company valuation of $78.4314 million;

Directors means the board of directors for the time being of the Company or a duly authorised committee of the board;

Extraordinary Resolution means a resolution passed at a meeting of the Noteholders duly convened and held in accordance with the provisions of this Instrument by a majority consisting of not less than three-quarters of the votes cast on the resolution;

Final Payment Date means, in respect of a Note, the first anniversary of the date of issue of that Note;

Group means the Company and the Company's subsidiaries;

IRR Value means an amount or sum which, based upon the value of the Notes, would result in a minimum annual internal rate of return of 15 per cent. on a Liquidity Event;

JV Agreement means the joint venture agreement dated 27 April 2011 entered into between Global Gold Corporation, Global Gold Armenia, LLC, Mego-Gold, LLC, Getik Mining Company, LLC, Consolidated Resources Armenia and Consolidated Resources USA, LLC;

Liquidity Event means an initial public offering of the Company's ordinary shares on a stock exchange or a Change of Control of the Company or any of its subsidiaries including Mego-Gold LLC or Getik Mining Company LLC;

Market Value means the difference between the value of the Company's shares on a Liquidity Event (and in the case of an IPO, the value of the shares at IPO ) and the Conversion Value;

Noteholder means a person whose name is entered in the Register as the holder of a Note;

Notes means the Secured Fixed Rate Convertible Notes 2013 constituted by this Instrument or the nominal amounts represented by them and for the time being outstanding, as the case requires;

Register means the register of holders of the Notes kept by or on behalf of the Company;

Security means the security created pursuant to a guarantee agreement and security agreement entered into between Global Gold Corporation (a Delaware corporation) and Consolidated Resources Armenia (an exempt non-resident Cayman Islands company) on or about the date hereof made in connection with the Notes; and

Subsidiary, subsidiaries and holding company have the meanings given in articles 2 and 2A of the Companies (Jersey) Law 1991.

References to this Instrument are to this Instrument and the Schedules and include any instrument supplemental to this Instrument; and

Words denoting the singular number only include the plural number and vice versa; words denoting one gender include the other genders; and words denoting a person include a corporation and an unincorporated association of persons.

|

|

1.2 |

Any reference, express or implied, to an enactment includes references to: |

|

(a) |

that enactment as re-enacted, amended, extended or applied by or under any other enactment (before or after the date of this Instrument); |

|

(b) |

any enactment which that enactment re-enacts (with or without modification); and |

|

(c) |

any subordinate legislation made (before or after the date of this Instrument) under that enactment, as re-enacted, amended, extended or applied as described in paragraph 1.2(a) above, or under any enactment referred to in paragraph 1.2(b) above, |

and enactment includes any legislation in any jurisdiction.

|

|

1.3 |

Sub clauses 1.1 and 1.2 above apply unless the contrary intention appears. |

|

|

1.4 |

The headings in this Instrument do not affect its interpretation. |

|

|

1.5 |

Capitalised terms used in this Instrument shall, unless otherwise defined above, have the same meaning as set out in the JV Agreement. |

|

|

1.6 |

To the extent that there is any inconsistency between the terms or Conditions of this Instrument and the Term Sheet, the terms and Conditions of this Instrument shall prevail. |

|

|

2. |

Amount of Notes |

The aggregate nominal amount of the Notes is not less than US$2,000,000. The Notes will be issued in integral multiples of US$1.00.

|

|

3. |

Status of Notes |

|

|

3.1 |

The Notes shall be known as Secured Fixed Rate Convertible Notes 2013. The Notes shall be issued in registered form and shall be transferable in accordance with the provisions of this Instrument. |

|

|

3.2 |

The Notes are direct obligations of the Company and shall among themselves rank pari passu and equally and rateably without discrimination or preference as an obligation of the Company and shall form a single series, except to the extent provided by law or by the terms of this Instrument. |

|

|

4. |

Issue and Form of Notes |

|

|

4.1 |

Each Note shall be in or substantially in the form set out in Schedule 1, shall have a denoting serial number and the Conditions endorsed on it. Each Note shall be executed under the seal of the Company or otherwise by or on behalf of the Company. |

|

|

4.2 |

Every person who becomes a Noteholder shall be entitled without charge to receive a Note stating the total nominal amount of the Note held by him but in the case of a Note held jointly by several persons the joint holders will be entitled to only one Note in respect of their joint holding and delivery of the Note to one of such persons shall be sufficient delivery to all of them. |

|

|

5. |

Conditions of Issue |

|

|

5.1 |

The Conditions and other provisions contained in the Schedules shall be deemed to be incorporated in this Instrument and the Notes shall be held subject to and with the benefit of the Conditions and of those provisions, all of which shall be binding on the Company and the Noteholders and all persons claiming through or under them respectively. |

|

|

6. |

Undertaking by THE Company |

The Company undertakes, for the benefit of each Noteholder, to perform and observe the obligations on its part contained in this Instrument, to the intent that this Instrument shall enure for the benefit of all Noteholders each of whom may enforce the provisions of this Instrument against the Company so far as his holding of Notes is concerned.

|

|

7. |

Register of Notes |

|

|

7.1 |

The Company shall cause a register to be maintained at its registered office (or such other place within Jersey as the Company may, from time to time have appointed for the purpose). The Register shall show the amount of the Notes for the time being outstanding, the dates of issue and all subsequent transfers or changes of ownership of the Notes, the names and addresses of the Noteholders, the serial number of each Note issued and the nominal amounts of the Notes held by the Noteholders respectively. In the event of a change in the location of the Register, the Company shall, where practicable, give not less than 21 days' notice to the Noteholders before such change takes effect. |

|

|

7.2 |

The Company shall not be bound to register more than four persons as the joint holders of any Note. |

|

|

7.3 |

Any change of name or address on the part of any Noteholder shall immediately be notified by the Noteholder to the Company and the Company shall alter the Register accordingly. |

|

|

7.4 |

The Register shall be open to inspection at all reasonable times during normal office hours. |

|

|

8. |

Freedom from Equities |

|

|

8.1 |

Notwithstanding any notice the Company may have of the right, title, interest or claim of any other person, to the fullest extent permitted by law, the Company: |

|

(a) |

may treat the registered holder of any Note as the absolute owner of it; |

|

(b) |

shall not enter notice of any trust on the Register or otherwise be bound to take notice or see to the execution of any trust to which any Note may be subject; and |

|

(c) |

may accept the receipt from the registered holder for the time being of any Note for the interest from time to time accruing due or for any other monies payable in respect of it as a good discharge to the Company. |

|

|

8.2 |

The Company will recognise every Noteholder as entitled to his Notes free from any equity, set-off or counterclaim on the part of the Company against the original or any intermediate holder of the Notes. |

|

|

9. |

Further Notes |

The Company may from time to time, by resolution of the Directors, cancel any unissued Notes or create and issue further notes either ranking pari passu in all respects (or in all respects) so as to form a single series with the Notes or carrying such rights as to redemption and otherwise as the Directors may think fit. Any further notes which are to form a single series with the Notes shall be constituted by an instrument expressed to be supplemental to this Instrument.

|

|

10. |

REPRESENTATIONS AND WARRANTIES |

The Company represents to the Noteholders as follows:

|

|

10.1 |

it has the power and authority to enter into this Instrument and to issue the Notes and to exercise its rights and perform its obligations under this Instrument and the Notes; |

|

|

10.2 |

it has taken all necessary corporate, shareholder and other action to authorise the execution, delivery and performance of this Instrument and the Notes; |

|

|

10.3 |

the obligations expressed to be assumed by it in this Instrument and the Notes are, in each case, legal and valid obligations, binding on it in accordance with the terms of this Instrument and the Notes; |

|

|

10.4 |

all consents, licences, approvals, authorisations, filings and registrations required: |

|

(a) |

in connection with the entry into and performance of this Instrument and the Notes by it; and |

|

(b) |

to make this Instrument and the Notes admissible in evidence have been obtained and are in full force and effect; and |

|

|

10.5 |

the execution and delivery of this Instrument and the performance by it of its obligations under this Instrument and the Notes do not, and will not, contravene: |

|

(a) |

any provision of its constitutional documents (if any); or |

|

(b) |

any law, regulation, official or judicial order or any agreement, mortgage, bond or other instrument or document to which it is a party or which is binding on it or any of its assets. |

|

|

10.6 |

the Company is not engaged in any litigation, arbitration or other dispute resolution process, or administrative or criminal proceedings, whether as claimant, defendant or otherwise and no litigation, arbitration or other dispute resolution process, or administrative or criminal proceedings by or against the Company is pending, threatened or expected; |

|

|

10.7 |

the Company's financial statements, to the extent these have been prepared, show a true and fair view of the state of affairs, including the financial position, assets, liabilities, income, expenses, results of operations and cash flow of the Company as at the end of the period to which they relate; and |

|

|

10.8 |

there has been no material adverse change in the financial or trading position or prospects of the Company and no circumstance has arisen which would give rise to any such change. |

|

|

11. |

Covenants |

The Company hereby covenants and agrees that so long as there are any Notes in issue:

|

|

11.1 |

it shall procure the delivery of the Company's financial statements and any other financial reports or accounts to the Noteholders on a quarterly basis (provided such statements, reports or accounts are available); |

|

|

11.2 |

it shall ensure notice is given to the Noteholders within a reasonable time of it becoming aware of any threat or initiation of litigation, arbitration or other dispute resolution process, administrative or criminal proceedings by or against the Company; |

|

|

11.3 |

it shall ensure compliance with all relevant laws, consents, licences, approvals, authorisations, filings and registrations required in connection with the Notes and its business activities; |

|

|

11.4 |

it shall ensure that any tax liability due by the Company is effectively dealt with in each relevant accounting period; |

|

|

11.5 |

it shall not permit any lien, encumbrance or security to be granted or created over any of its assets; |

|

|

11.6 |

it shall not declare, make or pay any distribution or dividend; |

|

|

11.7 |

subject to the provisions of this Instrument and the Conditions, it shall not issue any securities (whether debt, equity or otherwise); and |

|

|

11.8 |

it shall use its best endeavours to ensure that no material changes are made to its business activities as conducted or intended as at the date of this Instrument. |

|

|

12. |

Governing Law and Jurisdiction |

|

|

12.1 |

This Instrument and any non-contractual obligations arising out of or in connection with is shall be governed by Jersey law. |

|

|

12.2 |

The Jersey courts have exclusive jurisdiction to settle any dispute arising out of or in connection with this Instrument and/or the Notes (including a dispute relating to any non-contractual obligations arising out of or in connection with this Instrument and/or the Notes) and the Company and the Noteholders submit to the exclusive jurisdiction of the Jersey courts. |

|

|

12.3 |

The Company and the Noteholders waive any objection to the Jersey courts on grounds that they are an inconvenient or inappropriate forum to settle any such dispute. |

IN WITNESS of which this Instrument has been executed on the date which appears first on page .

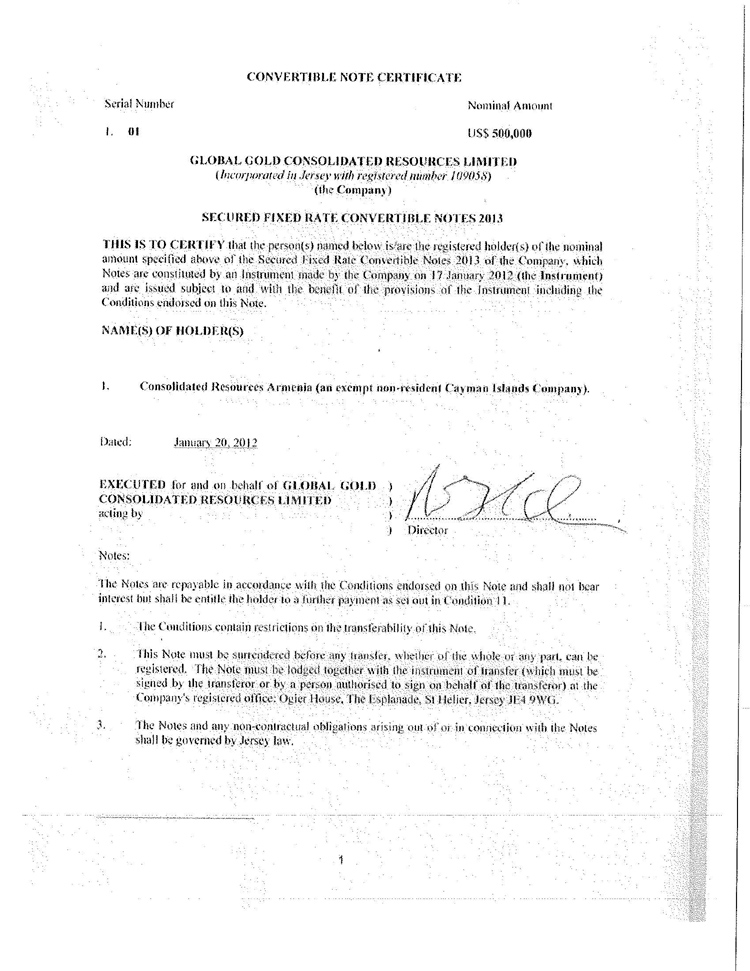

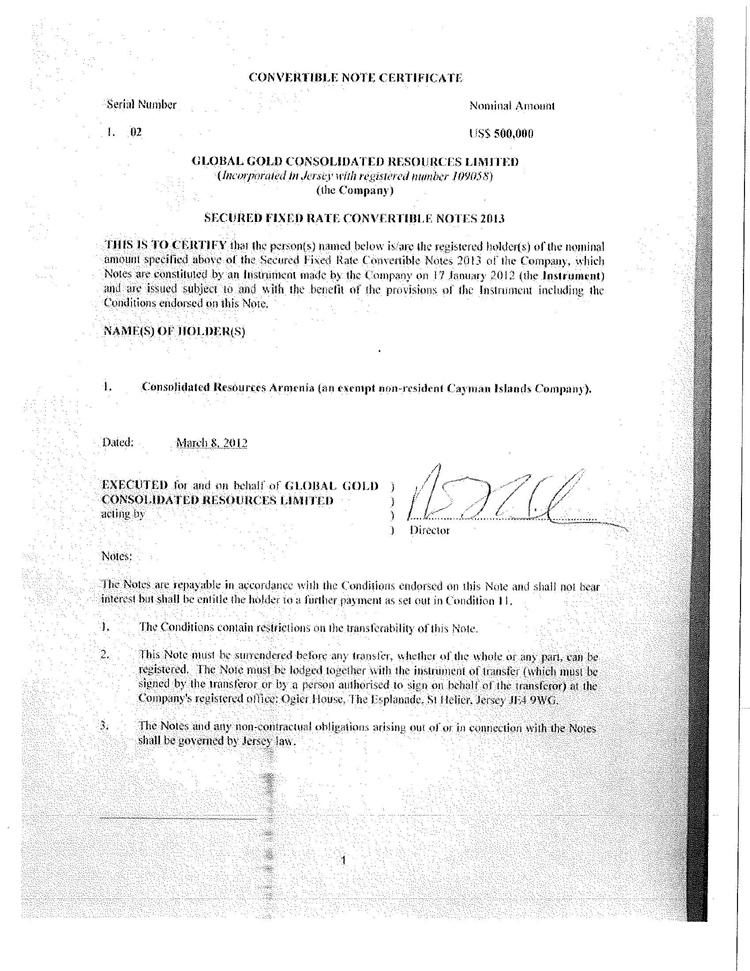

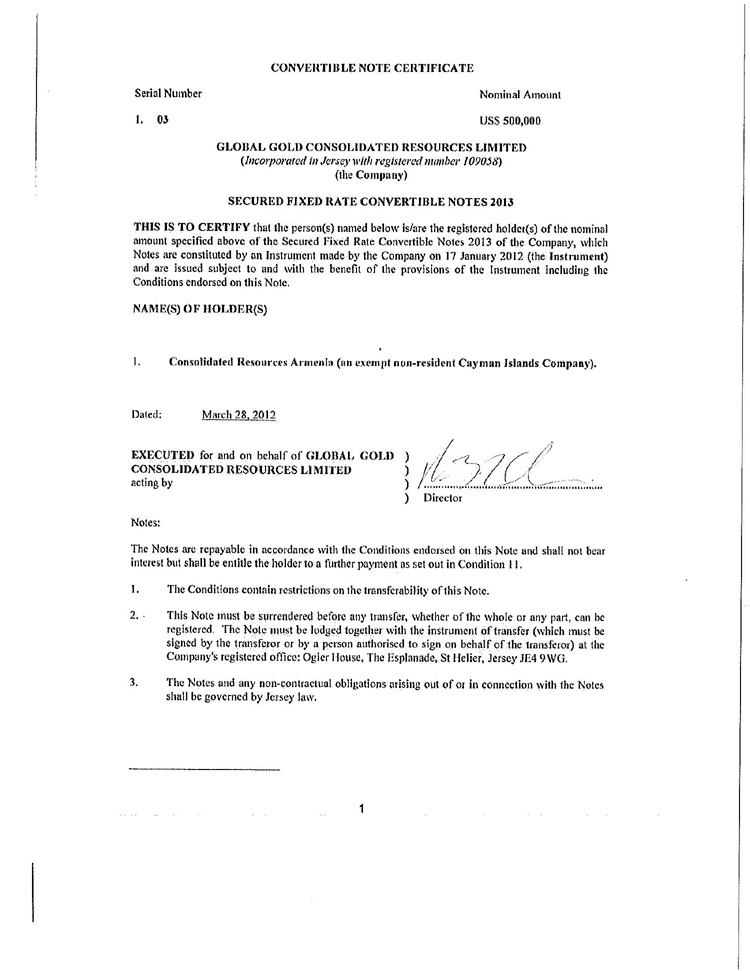

Schedule 1

Form of Note

|

Serial Number |

Nominal Amount |

|

……………… |

US$……………….. |

GLOBAL GOLD CONSOLIDATED RESOURCES LIMITED

(Incorporated in Jersey with registered number 109058)

(the Company)

Secured Fixed Rate Convertible Notes 2013

THIS IS TO CERTIFY that the person(s) named below is/are the registered holder(s) of the nominal amount specified above of the Secured Fixed Rate Convertible Notes 2013 of the Company, which Notes are constituted by an Instrument made by the Company on [•] January 2012 (the Instrument) and are issued subject to and with the benefit of the provisions of the Instrument including the Conditions endorsed on this Note.

NAME(S) OF HOLDER(S)

| 1. ………………………………….. | 2. ………………………………… | |

| 3. ………………………………… | 4. ………………………………… | |

| Dated: 2012 | ||

|

EXECUTED for and on behalf of GLOBAL GOLD CONSOLIDATED RESOURCES LIMITED |

) |

|

|

acting by |

) |

.............................................................. |

|

) |

Director |

Notes:

The Notes are repayable in accordance with the Conditions endorsed on this Note and shall not bear interest but shall be entitle the holder to a further payment as set out in Condition 11.

|

|

1. |

The Conditions contain restrictions on the transferability of this Note. |

|

|

2. |

This Note must be surrendered before any transfer, whether of the whole or any part, can be registered. The Note must be lodged together with the instrument of transfer (which must be signed by the transferor or by a person authorised to sign on behalf of the transferor) at the Company's registered office: Ogier House, The Esplanade, St Helier, Jersey JE4 9WG. |

|

|

3. |

The Notes and any non-contractual obligations arising out of or in connection with the Notes shall be governed by Jersey law. |

NOTICE OF REPAYMENT

|

|

To: |

[ ] |

|

|

1. |

I/We being the registered holder(s) of this Note give notice that I/we require repayment of all/US$[ ] of the nominal amount of this Note in accordance with Condition 5 and I/we elect for repayment in US dollars in accordance with Condition 12. (note 1) |

|

|

2. |

I/We authorise and request you to: |

|

(a) |

make the cheque or wire transfer payable to the person whose name is set out below or, if none is set out, to me/us; and |

|

(b) |

send by post at my/our risk to the person whose name and address is set out below or, if none is set out, to the registered address of the sole or first-named Noteholder the cheque or wire transfer and a Note for the balance (if any) of the nominal amount of this Note which is not repaid. |

|

Name .............................................................. |

|

Address .............................................................. |

| .............................................................. |

|

(note 2 below) |

|

|

Dated |

[ ] |

|

Signature(s) of Noteholder(s) | |

| (note 3 below) | .............................................................. |

| .............................................................. | |

| .............................................................. | |

| .............................................................. | |

Notes:

|

|

1. |

Delete and/or complete as appropriate. If repayment is required of part only, the repayment specified must be an integral multiple of US$1,000. If no indication is given of the nominal amount of the Note to be repaid, all of the Note will be repaid. |

|

|

2. |

Insert in BLOCK CAPITALS the name of the person to whom you wish the cheque or wire transfer to be made payable and/or the address of the person to whom you wish the cheque or wire transfer and any balance Note to be sent (if, in either case, it is different from that of the sole or first-named holder). If this space is left blank, the cheque or wire transfer will be made payable to the sole holder or all of the joint holders and it and any balance Note will be sent to the registered address of the sole or first-named holder. |

|

|

3. |

In the case of joint holders ALL must sign. A body corporate should execute under its common seal or with the signature of two directors, a director and the company secretary or a director and a witness, or under the hand of some officer or agent duly authorised in that behalf in which event the Note must be accompanied by the authority under which this Notice is completed. |

CONDITIONS

Terms defined in the JV Agreement have the same meaning in these Conditions.

|

|

1. |

Form and status |

|

|

1.1 |

This Note is one of a series of Notes and is issued subject to and with the benefit of the provisions of the Instrument. A copy of the Instrument may be inspected during normal office hours at the registered office of the Company. The Instrument does not contain any restrictions on borrowing, or on the charging or disposal of assets, by the Company or any of its subsidiaries. |

|

|

1.2 |

To the extent that the Security is to terminate or otherwise be discharged pursuant to the Closing of the JV Agreement or otherwise, where a Noteholder is a secured party pursuant to the Security it shall procure that the Security is only terminated or discharged provided the Company extends its full faith and credit to secure repayment to the Noteholder. |

|

|

2. |

Early Repayment |

|

|

2.1 |

The Company may at any time prior to a Liquidity Event or the Final Repayment Date, on giving not more than 20 days' notice and not less than 5 days' notice to the Noteholders, repay at par all or part of the Notes. |

|

|

3. |

No Interest |

|

|

3.1 |

Other than any payment in accordance with Condition 11, the Notes shall be non interest bearing unless otherwise agreed between the Company and the Noteholder(s). |

|

|

4. |

Use of Proceeds |

|

|

4.1 |

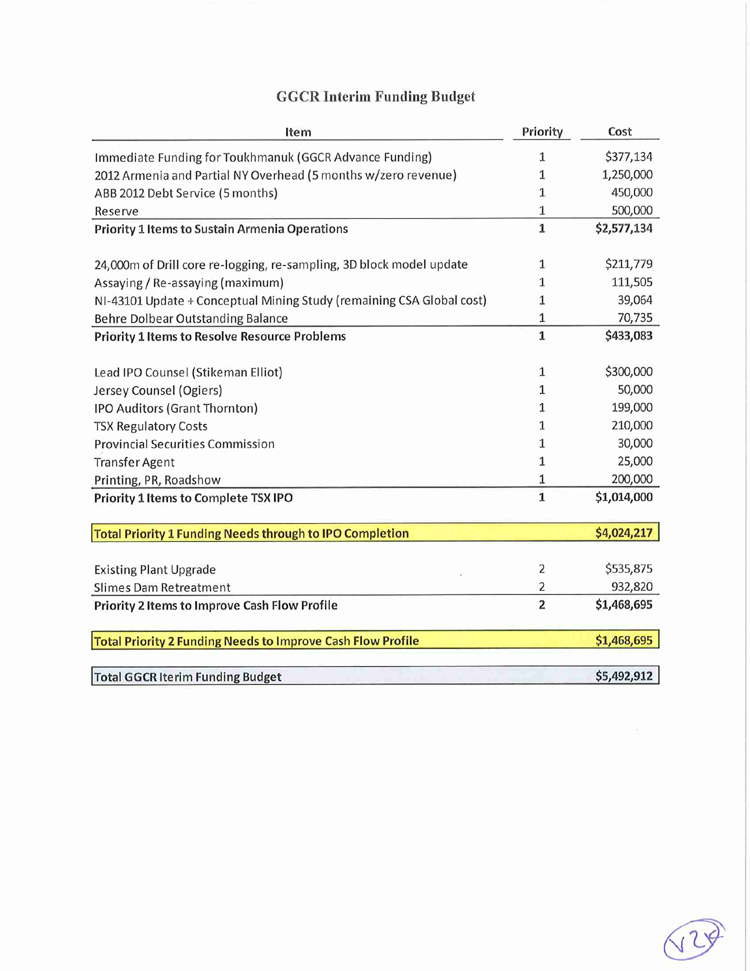

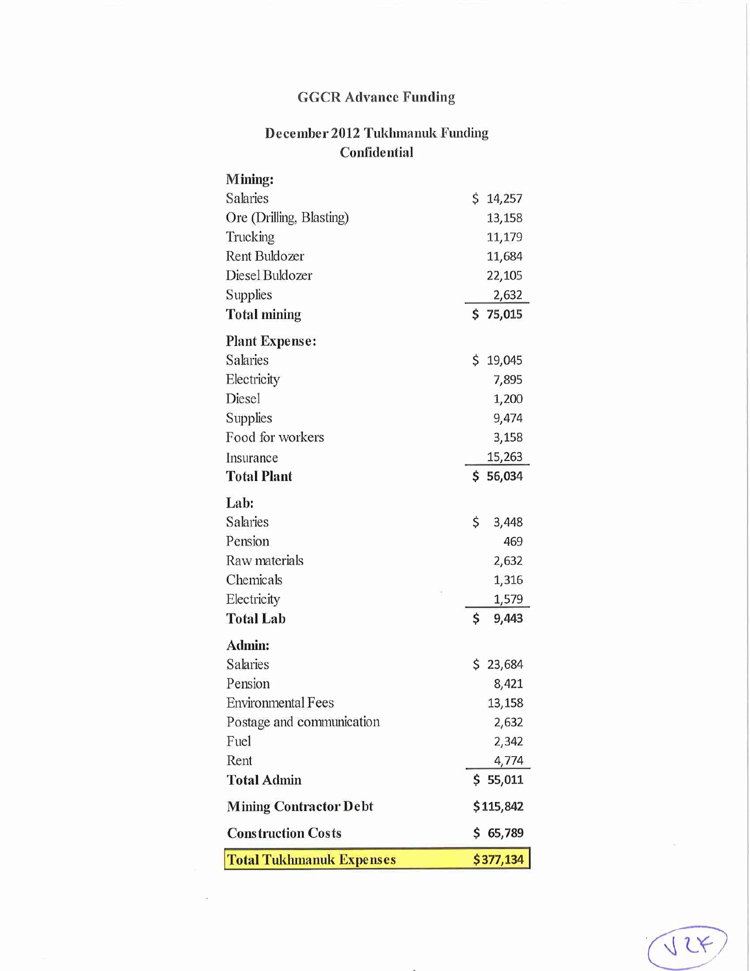

Any proceeds arising from the issue of the Notes shall only be used in accordance with the Company's interim funding budget as unanimously approved by the Company from time to time or as the Company may agree with the majority of the Noteholders. |

|

|

5. |

Surrender of Notes on repayment and prescription |

|

|

5.1 |

Whenever any Notes are due to be repaid under any of these Conditions (in whole or in part) the Noteholder shall, not more than 20 days and not less than 5 days before the due date for such repayment, deliver those Notes to the registered office for the time being of the Company (or to such other place as the Company may direct by notice to the Noteholders). |

|

|

5.2 |

If part only of the principal amount of any Note so delivered is repaid, the Company shall cancel such Note and without charge issue to the Noteholder a new Note for the balance of the principal amount due to him. |

|

|

5.3 |

If any Noteholder fails or refuses to deliver up any Note which is liable to be repaid in whole or in part under these Conditions at the time and place fixed for repayment, or fails or refuses to accept payment of the monies due on repayment, those monies may be set aside by the Company and paid into a separate bank account and held by the Company for that Noteholder on the following terms: |

|

(a) |

the Company shall not be responsible for the safe custody of such monies or for any interest accruing on them; |

|

(b) |

the Company may deduct from such interest (if any) as those monies may earn while on deposit, any expenses incurred by the Company in that connection; |

|

(c) |

any such amount so paid or deposited, together with such interest (if any), will immediately be paid to the Noteholder or his successors upon delivery of the relevant Note at any time during the period of ten years from the making of the deposit; and |

|

(d) |

any such amount so paid or deposited, together with such interest (if any), which remains unclaimed after a period of ten years from the making of the deposit shall revert to the Company, notwithstanding that in the intervening period the obligation to pay the same may have been provided for in the books, accounts and other records of the Company. |

|

|

6. |

Payments |

|

|

6.1 |

If any payment of principal in respect of the Notes would otherwise fall to be made on a day which is not a Business Day, payment shall be postponed to the next day which is a Business Day and no further interest or other payment will be made as a consequence of any such postponement. |

|

|

6.2 |

Payment of any principal in respect of any Note will be made to the person shown in the Register as the holder of that Note at the close of business on the fifth Business Day before the relevant payment date (the Record Date), notwithstanding any intermediate transfer or transmission of the Note. |

|

|

6.3 |

Payment of any principal in respect of any Note may be made by cheque or wire transfer sent through the post to the registered address of the Noteholder or, in the case of joint Noteholders, to the registered address of that one of them who is first named on the Register on the Record Date (or to such person and to such address as the Noteholder or joint Noteholders may in writing to the Company direct prior to the Record Date). Every such cheque or wire transfer shall be made payable to the person to whom it is sent (or to such person as the Noteholder or joint Noteholders may direct in writing to the Company prior to the Record Date) and payment of the cheque or wire transfer shall be a good discharge to the Company. |

|

|

6.4 |

Every such cheque or wire transfer shall be sent through the post not later than the Business Day preceding the due date for payment. Payments of principal or interest will only be mailed to an address in the United Kingdom. Payments will be subject in all cases to any applicable fiscal and other laws and regulations but shall otherwise be made without set-off or counterclaim. |

|

|

7. |

Purchase |

The Company may at any time purchase any Notes by tender (available to all Noteholders alike) or by private treaty at any price.

|

|

8. |

Cancellation |

Notes purchased or repaid by the Company will be cancelled and shall not be available for reissue.

|

|

9. |

Modification |

|

|

9.1 |

The provisions of the Instrument (including the Conditions) and the rights of the Noteholders may from time to time be amended, modified, abrogated or compromised or any arrangement agreed in any respect with the sanction of an Extraordinary Resolution and the written consent of the Company. |

|

|

9.2 |

Any such amendment, modification, abrogation, compromise, or arrangement effected pursuant to Condition 9.1 shall be binding on all Noteholders. |

|

|

10. |

Transfer |

|

|

10.1 |

Notes may be transferred (subject to these Conditions) by an instrument in writing in the usual or common form. An instrument of transfer must not include any securities other than the Notes. |

|

|

10.2 |

Every instrument of transfer must be signed by or on behalf of the transferor and the transferor shall remain the owner of the Notes to be transferred until the name of the transferee is entered in the Register in respect of those Notes. |

|

|

10.3 |

Every instrument of transfer must be lodged for registration at the registered office of the Company accompanied by the relevant Note(s) and such other evidence as the Company may require to prove the title of the transferor or his right to transfer the Notes or the authority of the person signing the instrument. |

|

|

10.4 |

No transfer of a Note shall be registered: |

|

(a) |

if a notice requiring repayment of that Note (in whole or in part) has been given; or |

|

(b) |

when the Register is closed; or |

|

(c) |

if such transfer would mean there are 10 or more registered holders of Notes. |

|

|

10.5 |

If part only of the principal amount of any Note so lodged is transferred, the Company shall without charge issue to the Noteholder a new Note for the balance of the principal amount due to him. All instruments of transfer which are registered may be retained by the Company. |

|

|

11. |

Repayment or Conversion at Liquidity Event |

|

|

11.1 |

On the Final Repayment Date the Notes shall be repaid with no interest having accrued and without penalty. |

|

|

11.2 |

Immediately prior to a Liquidity Event the Notes, subject to Condition 11.3, shall be repayable for a sum (the Repayment Amount) in cash equal to the greater of either the IRR Value or Market Value. |

|

|

11.3 |

The Notes may be converted into ordinary shares of the Company (a Conversion), however any Conversion is subject to unanimous consent of the board of the Company. Any portion of a Conversion which results in GGC holding less than 51% of the ordinary shares in the Company (the Excess Shares) shall instead be settled by the payment in cash to CRA in an amount equal to the Market Value of such Excess Shares. |

|

|

11.4 |

On a Conversion the Company shall allot fully paid ordinary shares (the Conversion Shares) to the Noteholder(s) in exchange for and in satisfaction of all or part of the Repayment Amount at the Conversion Rate. The rights of conversion conferred by these conditions are hereinafter referred to as the Conversion Rights. |

|

|

11.5 |

Subject to Condition 11.3 above, any Conversion Right shall be exercisable by the Noteholder concerned completing and signing the Conversion Notice in such form as the Directors may approve (the Conversion Notice) and lodging the same together with such certificate, and such other evidence (if any) as the Company may reasonably require to prove the title of the person exercising the Conversion Rights, at the registered office of the Company at least 14 days prior to the anticipated date of the Liquidity Event. A Conversion Notice shall not be withdrawn without the consent in writing of the Company. |

|

|

11.6 |

Following a Liquidity Event and against delivery of a Conversion Notice, the Company will not later than the date of the Liquidity Event, allot and issue the Conversion Shares as fully paid to which he shall be entitled by virtue of the exercise of his Conversion Rights and such allotment and issue shall be in full satisfaction and discharge of such part of the Repayment amount as has been approved, if any, by the board of the Company. |

|

|

11.7 |

The Company shall, not later than the expiry of 14 days following the relevant Conversion Date, send (or procure to be sent) free of charge to each Noteholder who has exercised his Conversion Rights or as otherwise directed a certificate for the ordinary shares arising on conversion together (if appropriate) with a certificate in respect of any balance of such Noteholder's holding of Notes in respect of which the Conversion Rights have not been exercised as aforesaid. |

|

|

11.8 |

All ordinary shares in the Company allotted on conversion shall be credited as fully paid and shall carry the right to participate in full in all dividends and other distributions declared, paid or made on the ordinary share capital of the Company in or in respect of the financial period of the Company in which the relevant Conversion Date falls by reference to a record date on or after such Conversion Date other than any dividends and other distributions declared, paid or made in respect of any earlier financial period of the Company and shall rank pari passu in all other respects and form one class with the ordinary shares in issue on the relevant Conversion Date. |

|

|

12. |

Transmission |

|

|

12.1 |

Any person becoming entitled to a Note in consequence of the death or bankruptcy of any Noteholder or otherwise by operation of law may upon producing evidence that he sustains the character in respect of which he proposes to act under this Condition or of his title to the Note as the Directors shall reasonably require be registered himself as the Noteholder or, subject to Condition 10, may transfer the Note. |

|

|

12.2 |

The executors or administrators of a deceased holder of a Note (not being one of several joint holders) shall be the only persons recognised by the Company as having any title to or interest in such Note. |

|

|

12.3 |

In the case of the death of any of the joint holders of a Note the survivors or survivor will be the only persons or person recognised by the Company as having any title to or interest in such Note. |

|

|

13. |

Lost or destroyed Notes |

If a Note is defaced, lost or destroyed it may be renewed on payment by the Noteholder of the expenses of renewal and on such terms (if any) as to evidence and indemnity as the Directors may require but so that, in the case of defacement, the defaced Note shall be surrendered before a new Note is issued. An entry as to the issue of a new Note and indemnity (if any) shall be made in the Register.

|

|

14. |

Notices |

|

|

14.1 |

Any notice or document may be served on a Noteholder by sending it by prepaid post to his registered address. |

|

|

14.2 |

In the case of joint Noteholders, a notice or document served on the Noteholder whose name stands first in the Register shall be sufficient notice to all the joint Noteholders. |

|

|

14.3 |

Any notice or document may be served on the person entitled to a Note in consequence of the death or bankruptcy of any Noteholder by sending it by prepaid post to him by name or by the title of the representative or trustees of such Noteholder at the address (if any) supplied for the purpose by such persons or (until such address is supplied) by giving notice in the manner in which it would have been given if the death or bankruptcy had not occurred. |

|

|

14.4 |

Any notice or document sent by post shall be deemed to have been served at the expiration of 24 hours (or, where second class post is employed, 48 hours) after the time when it is put into the post and in proving such service it shall be sufficient to prove that the envelope containing the notice or document was properly addressed, stamped and posted. |

|

|

14.5 |

Any document or remittance sent by post shall be sent at the risk of the Noteholder entitled to it. |

|

|

15. |

Events Of Default |

|

|

15.1 |

Any Noteholder shall be entitled by notice in writing to the Company to require repayment of any amounts of principal and/or interest owing in respect of the Notes held by him (whereupon such amounts shall become immediately due and payable) if any of the following events (Events of Default) shall occur: |

|

(a) |

if the Company fails to make any payment of any principal amount due in respect of the Notes within 10 Business Days of the due date for payment; or |

|

(b) |

if any member of the Group proposes or passes a resolution for its winding up (other than a solvent winding up for the purposes of a voluntary reconstruction or amalgamation the terms of which have previously been approved by Noteholders in accordance with the Conditions); or |

|

(c) |

if any member of the Group is subject to an application to, or order or notice issued by, a court or other authority of competent jurisdiction for its winding up or striking off (unless such an application is defended in good faith and an order is made dismissing it within 90 days of the application being made); or |

|

(d) |

if any member of the Group proposes, makes or is subject to an arrangement or composition with its creditors generally or a scheme of arrangement pursuant to part 18A of the Companies (Jersey) Law 1991 or analogous legislation of another relevant jurisdiction (other than in the latter case for the purpose of a voluntary reconstruction or amalgamation the terms of which have previously been approved by Noteholders in accordance with the Conditions); or |

|

(e) |

if the Company has a liquidator appointed over all or a substantial part of its assets, undertaking or income or any assets of the Company have been declared en désastre or placed under the control of the Royal Court of Jersey; or |

|

(f) |

if any member of the Group suspends payment of its debts generally or ceases to carry on its business (other than in connection with a voluntary reconstruction or amalgamation the terms of which have previously been approved by Noteholders in accordance with the Conditions); or |

|

(g) |

if any member of the Group becomes insolvent, or unable to pay its debts as they fall due or becomes bankrupt within the meaning of the Interpretation (Jersey) Law 1954; |

|

(h) |

if any other loan notes or any loan stock or other indebtedness issued or owing by the Company or any member of the Group becomes repayable before its due date by reason of the Company’s or its relevant subsidiary's default; or |

|

(i) |

if the Company materially defaults in the observance or performance of any material provision of any of these Conditions (other than a provision relating to the payment of any principal amount or interest) and such default, if capable of remedy, continues unremedied for 30 Business Days after the Company has been notified by any Noteholder with details of the default and requiring it to be remedied; or |

|

|

15.2 |

The Company shall notify the Noteholders within 2 Business Days of its becoming aware of the occurrence of any Event of Default. |

|

|

16. |

Governing Law |

The Notes and any non-contractual obligations arising out of or in connection with the Notes shall be governed by Jersey law.

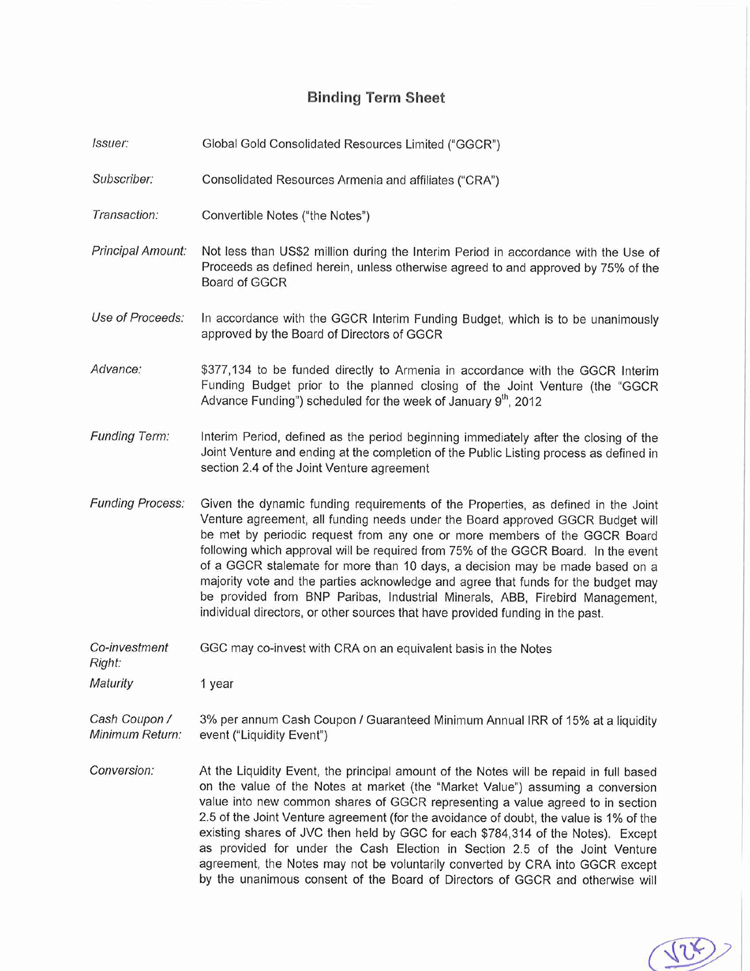

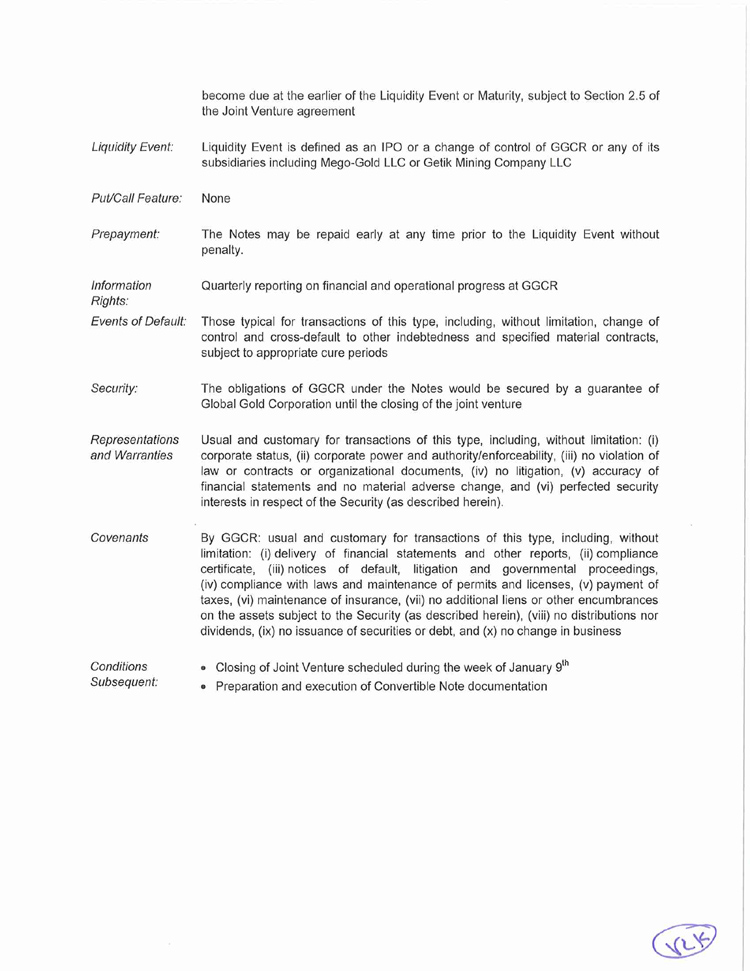

Schedule 2

Binding Term Sheet

24