Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SEQUENTIAL BRANDS GROUP, INC. | v425167_8k.htm |

Exhibit 99.1

NOVEMBER 2015 INVESTOR PRESENTATION

SAFE HARBOR The slide presentation and the accompanying oral presentation contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are made as of the date hereof and are based on current expectations, estimates, forecasts and projections as well as the beliefs and assumptions of management. Our actual results could differ materially from those stated or implied in forward-looking statements. Readers of this presentation should be aware of the speculative nature of “forward looking statements.” Forward-looking statements include statements concerning plans, objectives, goals, strategies, expectations, intentions, projections, developments, future events, performance or products, underlying assumptions and other statements that are not historical in nature, including those that include the words “anticipate”, “estimate”, “plan”, “project”, “continuing”, “ongoing”, “target”, “aim” “expect”, “believe”, “intend”, “may”, “will”, “should”, “could”, or the negative of those words and other comparable words, are based on current expectations, estimates and projections about, among other things, revenue, adjusted EBITDA, organic growth, aggregate and 2016 minimum revenue, benefits of net operating losses, margins, and the industry and the markets in which Sequential and Martha Stewart (“MSO”) operates, and they are not guarantees of future performance. Whether actual results will conform to expectations and predictions is subject to known and unknown risks and uncertainties, including risks and uncertainties discussed in the reports that Sequential has filed with the Securities and Exchange Commission (the “SEC”); general economic, market, or business conditions; changes in Sequential’s competitive position or competitive actions by other companies; Sequential’s ability to maintain strong relationships with its licensees; Sequential’s ability to retain key personnel; Sequential’s ability to achieve and/or manage growth and to meet target metrics associated with such growth; Sequential’s ability to successfully attract new brands; Sequential’s ability to identify suitable targets for acquisitions; Sequential’s ability to obtain financing for the acquisitions on commercially reasonable terms; Sequential’s ability to integrate successfully the new acquisitions into its ongoing business; and the ability to achieve the anticipated results of these and other potential acquisitions; Sequential’s ability to comply with government regulations; changes in laws or regulations or policies of federal and state regulators and agencies; and other circumstances beyond Sequential’s control. Consequently, all of the forward-looking statements made in this presentation are qualified by these cautionary statements, and there can be no assurance that the actual results anticipated will be realized or, if substantially realized, will have the expected consequences on Sequential’s business or operations. These and other risks are discussed in detail in the periodic reports that Sequential files with the SEC. Except as required by applicable laws, Sequential does not intend to publish updates or revisions of any forward-looking statements it makes to reflect new information, future events or otherwise. Readers should understand that it is not possible to predict or identify all risks and uncertainties to which Sequential may be subject. Consequently, readers should not consider such disclosures to be a complete discussion of all potential risks or uncertainties. This slide presentation includes certain financial projections, which are also forward-looking statements, relating to Sequential and potential acquisitions. The projections are based on a number of assumptions, some of which are set forth in the footnotes and on slide 29. Although the Company believes the assumptions underlying such projections are reasonable, the reasonableness of these assumptions has not been independently passed upon. There can be no assurance that the projections will be realized and the projections may prove incorrect, including, without limitation, as relates to the anticipated aggregate guaranteed minimum royalties expected, retail revenues, total revenues and adjusted EBITDA. Nothing contained in the projections is, or should be relied upon, as a promise or representation as to the future results or prospects of Sequential. This presentation contains certain non-GAAP financial measures. The Company believes the use of non-GAAP measures in addition to GAAP measures is an additional useful method of evaluating its results of operations. The non-GAAP financial measures disclosed should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and the expected results calculated in accordance with GAAP and reconciliations to those expected results should be carefully evaluated. The non-GAAP financial measures used by the Company may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies. This presentation contains trade names, trademarks and service marks of other companies. We do not intend our use or display of other parties’ trade names, trademarks and service marks to imply a relationship with, or endorsement or sponsorship of, these other parties. 2

SEQUENTIAL BRANDS GROUP We are building a world-class brand management organization with our portfolio of established consumer brands and the leading growth activation team in the industry 3

THE PLATFORM 4

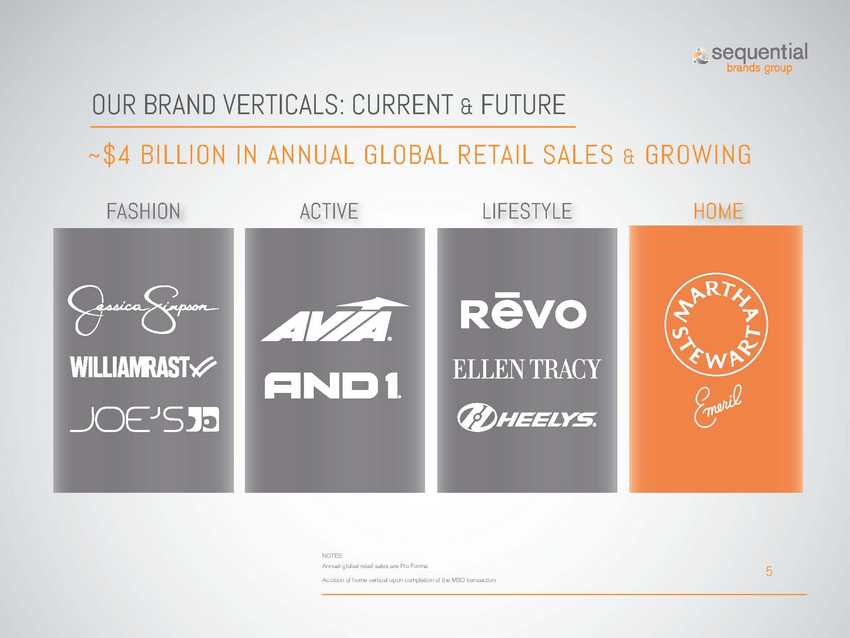

OUR BRAND VERTICALS: CURRENT & FUTURE ~$4 BILLION IN ANNUAL GLOBAL RETAIL SALES & GROWING FASHION ACTIVE LIFESTYLE HOME NOTES: Annual global retail sales are Pro Forma. Addition of home vertical upon completion of the MSO transaction. 5

THE PLATFORM AT WORK 6

2012 2013 2014 2015 P 2015 PRO FORMA1 Revenue $5.3M $22.7M $41.8M $81.0 - $83.0M $98.0 - $100.0M Adjusted EBITDA $0.0 $12.3M $24.0M $50.0 - $52.0M $61.0 - $63.0M Organic Growth N/A N/A 8% 10% HSD FINANCIAL REVIEW NOTES: For a definition of Adj. EBITDA, see page 29. HSD: High Single Digit Growth (1) Pro Forma 2015 Financials when including the full year impact of the Jessica Simpson and Joe’s Jeans financials. Does not include any financial impact of the pending MSO transaction. 7

STRONG AND NIMBLE PLATFORM • Own and Control Intellectual Property • Diversified Revenue Base • Solid Foundation with Predictable Guaranteed Minimum Revenue (GMRs) • Insulated from Typical Brick & Mortar Challenges, including: »» Retail Lease Liabilities »» Fluctuations in Weather »» Specific Same Store Sales Comps »» Inventory Risk • High-Margin Growth Drivers, including: »» Digital & E-Commerce Growth »» Mobile Growth »» International Growth 8

DOWNSIDE PROTECTION

• Over $300M in aggregate GMR’s currently under License • Represents 88% Coverage against Net Debt (as of 9/30/15)

• Of the $300M, approximately $70M in guaranteed revenue for 2016 (pre MSO) 9

DOWNSIDE PROTECTION

• Over $300M in aggregate GMR’s currently under License • Represents 88% Coverage against Net Debt (as of 9/30/15)

• Of the $300M, approximately $70M in guaranteed revenue for 2016 (pre MSO) 9

Total MSO NOLs1 $113.8M SQBG NOLs2 $22. 4M SQBG Amortization of Intangibles2 $329. 4M Total Tax Deductions $465.6M Statutory Tax Rate 35% Potential Cash Benefit to SQBG $163.0M NOTES: (1) Estimated usable NOLs based on 12/31/14 financials. (2) Estimated usable NOLs and amortization of intangibles based on 9/30/15 financials. MINIMAL CASH TAXES IN FORESEEABLE FUTURE POST MSO MERGER • NOLs and tax deduction related to the amortization of intangibles expected to offset up to $466M (in aggregate) of future taxable income • Drives to potential $163M aggregate cash benefit 10

INTRODUCING NEW 3 YEAR PLAN 11

ESTABLISHING NEW 3 YEAR PLAN E X I S T I N G 3 Y E A R P L A N ESTABLISHED SPRING 2 0 1 4 NEW 3 Y E A R P L A N PUBLISHED NOVEMBER 2 0 1 5 $8.0 BILLION retail sales $250M total revenue $70M adj. ebitda $175M adj. ebitda $100M total revenue $3.5 BILLION retail sales ASSUMPTIONS: High Single Digit Organic Growth 2-3 New Brand Acquisitions Each Year Acquire Brands Through Combination of Cash + Debt + Equity, weighted mostly toward Cash/Debt Each Brand Acquired at Adj. EBITDA Multiples Consistent with Historical Track Record Each Brand Acquired Operates at ~75% Stand Alone Adj. EBITDA Margin NOTES: For a definition of Adj. EBITDA, see slide 29. For illustrative purposes only, the above is not intended to suggest guidance. See safe harbor statement regarding projections and risks. 12

VALUE CREATION CHAPTER 1: ORGANIC GROWTH 13

• Strong Retail Relationships • Managing like a wholesaler/merchant • Broadening Distribution • Driving Category Growth • Initiating Digital Growth • Expanding International Growth ORGANIC GROWTH PLAYBOOK 14

PLAYBOOK AT WORK | ORGANIC GROWTH 10.0% 5.0% 0.0% ORIGINAL COMPANY GOAL 2015 HSD 10% REVISED COMPANY GOAL 2015P TOTAL COMPANY YEAR OVER YEAR PERFORMANCE NOTES: HSD: High Single Digit Growth 15

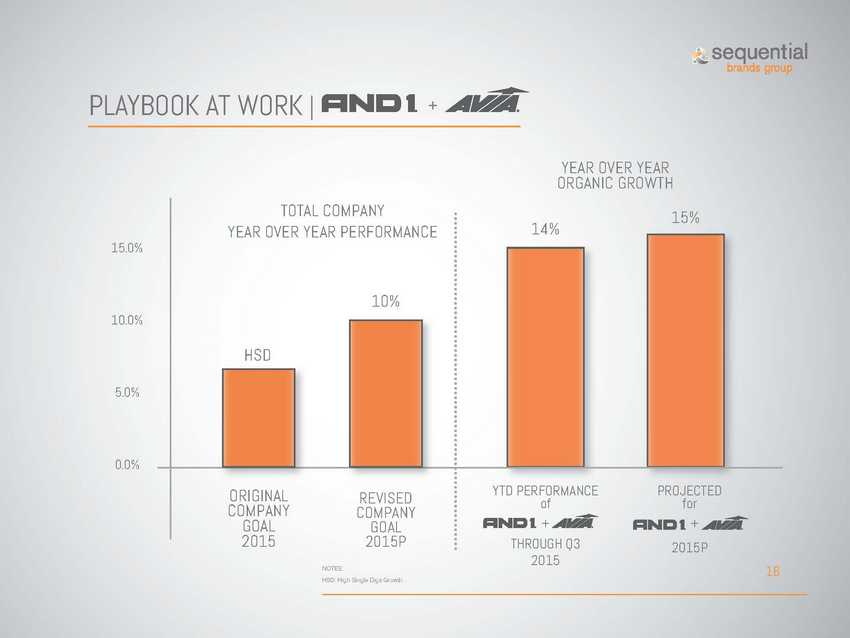

PLAYBOOK AT WORK | PROJECTED for + 2015P YTD PERFORMANCE of + THROUGH Q3 2015 + 15.0% 10.0% 5.0% 0.0% YEAR OVER YEAR ORGANIC GROWTH ORIGINAL COMPANY GOAL 2015 HSD 14% 10% 15% REVISED COMPANY GOAL 2015P TOTAL COMPANY YEAR OVER YEAR PERFORMANCE NOTES: HSD: High Single Digit Growth 16

Find more great colors and styles at Walmart.comSM6 . 988 each AND1® Cinch Sack • Available in 9 styles Orange/ Blue Black/ Black Grey/ Orange 2997 each pair Men’s AND1® Mythos Shoes • Sizes 7.5–13 497 Men’s AND1® Socks 3-Pack • Availble in crew, ankle, low cut, or no show 1997 each pair Boys’ AND1® Mythos Basketball Shoes • Sizes 12–6 1488 each AND1® BackPack • 2 or 4 pockets with laptop sleeve • Available in 9 styles 696 each Boys’ AND1® Performance Tee or All Courts Shorts • Sizes 4/5–18/20 2497 each pair Men’s AND1® Playmaker Shoes • Sizes 7–13 797 each Men’s AND1® Performance Tee • Sizes S–XL • 2X–3X, 9.97 997 each Men’s AND1® Basketball Shorts • Sizes S–XL • 2X–3X, 11.97 Get your game looking good. + 17

LEVERAGING THE PLATFORM CHAPTER 2: ACQUISITION GROWTH 18

riding jacket in shaye O82SSY7040 // bambina tank in heather army G151547SRJ // japanse denim the vixen bootcut in kai K6SKA25841 76 $67M PURCHASE PRICE ~$250M GLOBAL RETAIL SALES 90% GMR COVERAGE ON PURCHASE PRICE NEW LONG-TERM LICENSE WITH LI & FUNG /GLOBAL BRANDS GROUP TRANSACTION SUMMARY 19

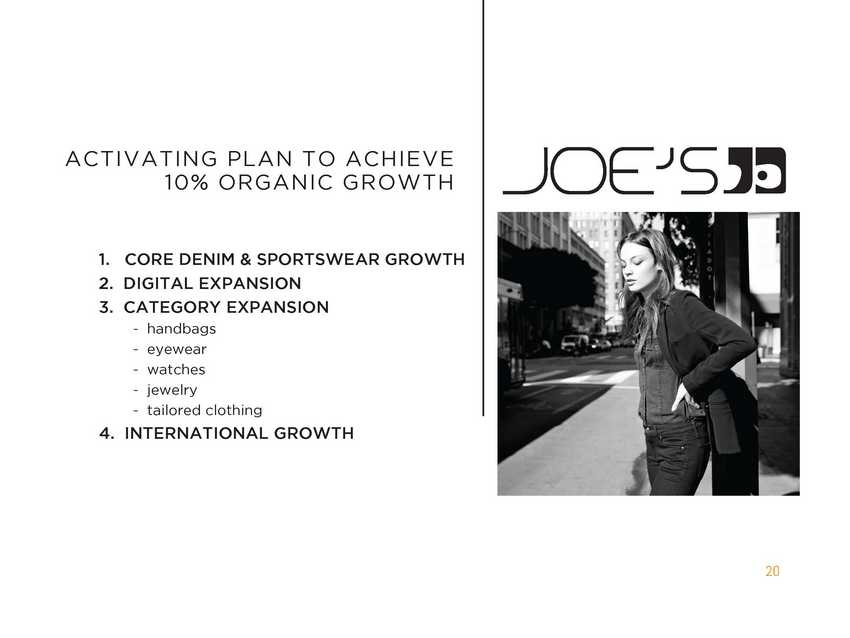

5hawk blazer in navy G154086WDF // leigh shirt in medium wash G151549JDN // fahrenheit the icon skinny in noemi AMANME5252 4 1. CORE DENIM & SPORTSWEAR GROWTH 2. DIGITAL EXPANSION 3. CATEGORY EXPANSION - handbags - eyewear - watches - jewelry - tailored clothing 4. INTERNATIONAL GROWTH ACTIVATING PLAN TO ACHIEVE 10% ORGANIC GROWTH 20

IMMEDIATE MARGIN GROWTH 100.0% TRANSFORMATIONAL MARGIN IMPROVEMENT upon conversion to SQBG Platform 80.0% 60.0% 40.0% 20.0% 0.0% -20.0% Pre SQBG Post SQBG 21

22

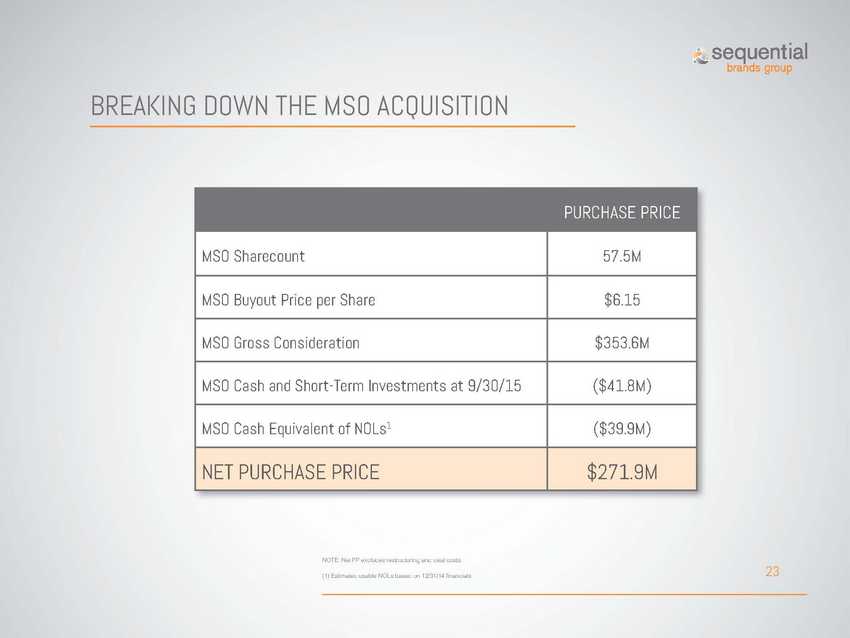

BREAKING DOWN THE MSO ACQUISITION PURCHASE PRICE MSO Sharecount 57.5M MSO Buyout Price per Share $6.15 MSO Gross Consideration $353.6M MSO Cash and Short-Term Investments at 9/30/15 ($41.8M) MSO Cash Equivalent of NOLs1 ($39.9M) NET PURCHASE PRICE $271.9M NOTE: Net PP excludes restructuring and deal costs. (1) Estimated usable NOLs based on 12/31/14 financials. 23

SQBG PLAYBOOK FOR MSO ACQUISITION • Integration Strategy »» Alvarez & Marsal retained to assist with integration • Focused on Growth in MSO’s Merchandising Division »» $24. 4M in operating income YTD (as reported through (9/30/15) »» $30. 4M in Operating Income for 2014 • Future Value Creation »» Activate Sequential’s Organic Growth playbook for the Martha Stewart and Emeril Lagasse brands 24

25

CONCLUSION 26

THE FOUNDATION FOR SEQUENTIAL’S GROWTH TRACK RECORD FOR DELIVERING ORGANIC G R O W T H PORTFOLIO of STRONG, SCALABLE BRANDS MANAGING like a WHOLESALER, without the “WHOLESALE” RISK A WINNING PLATFORM with a FOCUSED STRATEGY SUPPORTIVE STAKEHOLDERS 27

APPENDIX 28

NON-GAAP RECONCILIATION TABLE For the year ending December 31 2012 2013 2014 2015 High 2015 Low 2015 Pro Forma High (e) 2015 Pro Forma Low (e) (Unaudited) GAAP net (loss) income $ (9,125) $ (17,974) $ (1,068) $ 8,840 $ 7,540 $ 16,284 $ 14,559 Adjustments: Taxes 27 1,849 2,936 4,760 4,060 8,769 8,494 Interest expense, net 829 15,589 9,746 22,776 22,776 28,373 28,373 Non-cash compensation 674 1,118 2,184 6,600 6,600 5,684 5,684 Depreciation and amortization 296 598 1,107 1,724 1,724 1,890 1,890 Restructuring charges 2,854 - - - - - - Discontinued operations 1,780 6,244 - - - - - Deal costs (a) 2,669 4,856 7,689 8,000 8,000 2,000 2,000 Brand Matter LLC purchase price adjustment (b) - - 550 - - - - Write-off of JCP fixturing (c) - - 900 - - - - Gain on sale of People’s Liberation brand (d) - - - (700) (700) - - 9,129 30,254 25,112 43,160 42, 460 46,716 46,441 Adjusted EBITDA (1) $ 4 $12,280 $ 24,044 $ 52,000 $50,000 $ 63,000 $ 61,000 (1) Adjusted EBITDA is defined as net (loss) income, excluding interest income or expense, taxes, depreciation and amortization, restructuring charges, discontinued operations and excluding deal costs, non-cash compensation, gain on sale of People’s Liberation brand, write-off of JCP fixturing and Brand Matter LLC purchase price adjustment. Management uses Adjusted EBITDA as a measure of operating performance to assist in comparing performance from period to period on a consistent basis and to identify business trends relating to the Company’s financial condition and results of operations. The Company believes Adjusted EBITDA provides additional information for determining its ability to meet future debt service requirements and capital expenditures. (a) Represents deal related costs for certain of the Company’s acquisitions. (b) Represents the settlement and legal costs related to a pre-acquisition litigation matter in which Brand Matter LLC was named as an affiliate. (c) Represents the write-off of JC Penney fixtures for the William Rast business that terminated June 30, 2014 and relaunched exclusively with Lord & Taylor in Fall 2014. (d) Represents the gain on sale of the People’s Liberation brand in Q1 2015. (e) Pro Forma 2015 Financials when including the full year impact of the Jessica Simpson and Joe’s Jeans financials. Does not include any financial impact of the pending MSO transaction. 29

No Offer or Solicitation The information in this communication is for informational purposes only and is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transactions or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law. Additional Information and Where To Find It The proposed transaction involving Sequential Brands Group, Inc. (“Sequential”) and Martha Stewart Living Omnimedia, Inc. (“MSO”) will be submitted to the stockholders of MSO for their consideration. In connection with the proposed transaction, Sequential and MSO have caused Singer Madeline Holdings, Inc. (“New Sequential”) to file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 (the “Registration Statement”) (File No. 333-205940), which included a prospectus with respect to the New Sequential shares to be issued in the proposed transaction, a proxy statement for the stockholders of MSO and an information statement for the stockholders of Sequential (the “Combined Statement”). The definitive Registration Statement and the Combined Statement contain important information about the proposed transaction and related matters. SECURITY HOLDERS ARE URGED AND ADVISED TO READ THE REGISTRATION STATEMENT AND THE COMBINED STATEMENT CAREFULLY, AS WELL AS ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC AND ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION. The Registration Statement, the Combined Statement and other relevant materials (as they become available) and any other documents filed or furnished by MSO, Sequential or New Sequential with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov. In addition, security holders may obtain free copies of the Registration Statement and the Combined Statement from Sequential by going to its investor relations page on its corporate website at ir.sequentialbrandsgroup.com and from MSO on its investor relations page on its corporate website at www.marthastewart.com/ir. Participants in the Solicitation MLSO, Sequential, their respective directors and certain of their executive officers and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about Sequential’s directors and executive officers is set forth in its definitive proxy statement for its 2015 Annual Meeting of Stockholders, which was filed with the SEC on April 16, 2015, and information about MSLO’s directors and executive officers is set forth in its amendment to its Annual Report on Form 10-K/A for the calendar year ended December 31, 2014, which was filed with the SEC on April 27, 2015. These documents are available free of charge from the sources indicated above, from Sequential by going to its investor relations page on its corporate website at ir.sequentialbrandsgroup.com and from MSLO on its investor relations page on its corporate website at www.marthastewart.com/ir. Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed transaction will be included in the Registration Statement, the Combined Statement and other relevant materials Sequential, MLSO and TopCo intend to file with the SEC. 30

NOVEMBER 2015 INVESTOR PRESENTATION