Attached files

| file | filename |

|---|---|

| 8-K - SUPPORT.COM, INC 8-K 11-17-2015 - Support.com, Inc. | form8k.htm |

| EX-99.2 - EXHIBIT 99.2 - Support.com, Inc. | ex99_2.htm |

Exhibit 99.1Support.com: Well-Positioned to Deliver Stockholder Value 1 Support.com (Nasdaq: SPRT)November 2015

Safe Harbor Statement © 2015 Support.com, Inc. All Rights Reserved. * Statements made in this document that are not historical facts are "forward-looking statements" and accordingly involve risks and uncertainties that could cause actual results to differ materially from those described herein. Forward-looking statements include, for example, all assumptions, projections and statements relating to projected financial performance (including without limitation statements involving projections of revenue, margin, income (loss), earning (loss) per share, cash usage, cash balance, capital structure, and other financial items); the plans and objectives of management for future operations, products or services and future performance in all other respects; the future size of potential markets for our products and services (including without limitation statements involving growth in adoption rates, device proliferation, and market growth in financial terms). The potential risks and uncertainties that could cause results to differ materially include, among others, our expectations and beliefs regarding future financial results; our expectations regarding partners, renewal of contracts with these partners and the anticipated timing and magnitude of revenue from programs with these partners; our ability to successfully license, implement and support our Nexus SaaS offering; our expectations regarding sales of our end-user software products, and our ability to source, develop and distribute enhanced versions of these products; our ability to successfully monetize customers who receive free versions of our end-user software products; our ability to expand and diversify our customer base; our ability to execute effectively in the small business market; our ability to offer subscriptions to our services in a profitable manner; our expectations regarding our ability to deliver technology services efficiently and through arrangements that are profitable, including both in SKU-based and time-based pricing models and other pricing models we may employ; our ability to attract and retain qualified management and employees; our ability to hire, train, manage and retain technology specialists in a home-based model in quantities sufficient to meet forecast requirements, and our ability to continue to enhance the flexibility of our staffing model; our ability to match staffing levels with service volume in a cost-effective manner; our ability to manage contract labor as a component of our workforce; our ability to operate successfully in a time-based billing model; our ability to adapt to changes in the market for technology support services; our ability to manage sales costs in programs where we are responsible for sales; our ability to successfully manage advertising costs associated with our end-user software products; our beliefs and expectations regarding the introduction of new services and products, including additional software products and service offerings for devices beyond computers and routers; our expectations regarding revenues, cash flows and expenses, including cost of revenue, sales and marketing, research and development efforts, and administrative expenses; our assessment of seasonality, mix of revenue, and other trends for our business and the business of our partners; our ability to deliver projected levels of profitability; our expectations regarding the costs and other effects of acquisition and disposition transactions; our expectations regarding unit volumes, pricing and other factors in the market for computers and other technology devices, and the effects of such factors on our business; our ability to successfully operate in markets that are subject to extensive regulation, such as support for home security systems; our expectations regarding the results of pending, threatened or future litigation; actions of activist investors and the cost and disruption caused in responding to such actions; the assumptions underlying our Critical Accounting Policies and Estimates, including our assumptions regarding revenue recognition assumptions used to estimate the fair value of stock-based compensation assumptions regarding the impairment of goodwill and intangible assets and expected accounting for income taxes; and the expected effects of the adoption of new accounting standards. These and other risks are detailed in Support.com's reports filed with the Securities and Exchange Commission, including without limitation our latest Annual Report on Form 10-K and our latest quarterly report on Form 10-Q, copies of which may be obtained from www.sec.gov. Forward-looking statements represent our management’s beliefs and assumptions only as of the date such statements are made. Support.com does not intend to update information herein to reflect future events or circumstances, and disclaims any obligation to do so except as may be required by law.

© 2015 Support.com, Inc. All Rights Reserved. | CONFIDENTIAL – DO NOT DISTRIBUTE * Table of Contents Value Proposition 4 Company Overview and Evolving Market Trends 5 Services: Positioned for Diversification and to Accelerate Nexus 13 Nexus: Positioned for Growth in the Connected World 18 Financial Strategy 25 Commitment to Strong Corporate Governance and Stockholder Engagement 30 Highly Qualified and Engaged Board and New Management Team 33 Conclusion 38 Appendix 40

The Support.com Value Proposition © 2015 Support.com, Inc. All Rights Reserved. * Well-defined strategic plan has positioned the Company to capture growth from evolving support trendsLeveraging technical support expertise, Nexus and industry reputation advantagesDifferentiated Services programsLarge enterprise: high-quality customers with stickiness Bundled offers and IoT present attractive new opportunities Nexus is the growth engineMeets the demand for better support tools and technology in the connected worldServices heritage and Nexus deliver powerful synergiesUnique competitive advantage enabling Support.com to better meet customers’ evolving needs Accelerated learning, better product development and superior service deliveryHighly experienced and proven leadership team Board brought on an experienced CEO to reenergize and refocus the organization; also added talented, new marketing and engineering leadsNew management team possesses combination of services, software, and product experience

Company Overview © 2015 Support.com, Inc. All Rights Reserved. * Leading provider of SaaS technology and turnkey support services for next-generation technical support in the connected world Nexus: Optimizing the support interaction on both the agent’s desktop and for the end user via Web and mobile appsInnovative cloud-based software provides step-by-step resolution through Guided Paths™SaaS-based revenue is a predictable, reliable financial foundationServices and Nexus deliver powerful synergies – accelerated learning, better product development and superior service delivery Services: 1,400+ technically advanced, work-from-home agents across North AmericaManaging 17,000 support interactions per dayNet Promoter Scores for direct subscribers consistently ranked among industry’s bestStable and gross profit positive with large enterprise customers and new opportunities to expand bundled services and support IoT

Q3 2015 Summary © 2015 Support.com, Inc. All Rights Reserved. * (EPS in $) Note GAAP Revenue and Non-GAAP Revenue are the same* Reconciliation table on slide 41 Q3 2015 Results Total revenue of $17.9M (GAAP)EPS ($0.05) (non-GAAP)*Balance sheet: $68.4M cash; no debt (GAAP)Q3 2015 Operational HighlightsSubscription-based tech support contract signed with a large North American service provider, with full ramp expected to be completed by the end of Q1 2016Announced the release of Embeddable Nexus® Self-Support cloud application at the ICMI Contact Center Demo & Conference in Las VegasNexus grew more than 40 percent in both active agent users and in number of customer sessionsNexus seats more than doubled quarter over quarter, and Nexus is on a path to meet the Company’s 2015 year-end goals of 1,300 to 1,700 seats and $1 million in annual recurring revenueGuidance for Q4 2015 Revenue of $14.8 M - $16.0 M (GAAP)EPS ($0.10) – ($0.12) (non-GAAP)*Continue to invest in Nexus development and go-to-market capabilities

Support Delivery Is Undergoing a Paradigm Shift © 2015 Support.com, Inc. All Rights Reserved. * Connected Support Traditional Support

Trends Driving the Paradigm Shift © 2015 Support.com, Inc. All Rights Reserved. * Source: Gartner press release, www.gartner.com/newsroom/id/2905717, November 2014 5XGROWTH 25B 5B IoT Installed Units (Billions) The Number of Connected Devices Is Exploding

Trends Driving the Paradigm Shift © 2015 Support.com, Inc. All Rights Reserved. * Customers Are Requiring Ubiquitous Support Source: Forrester Research, “Trends 2015: The Future Of Customer Service”, March 2015

Trends Driving the Paradigm Shift © 2015 Support.com, Inc. All Rights Reserved. * The Business Mindset Is Evolving Source: Forrester Research, “Forrester Perspective: The Business Impact of Customer Experience”, 2014 CXi Leaders S&P 500 Index CXi Laggards 43% 14.5% -33.9% Cumulative Total Returnon Stock Portfolio CUSTOMER EXPERIENCE LEADERS OUTPERFORM THE COMPETITION Forrester stock index of companies that score high in terms of quality of Customer Experience Forrester stock index of companies that score low in terms of quality of Customer Experience

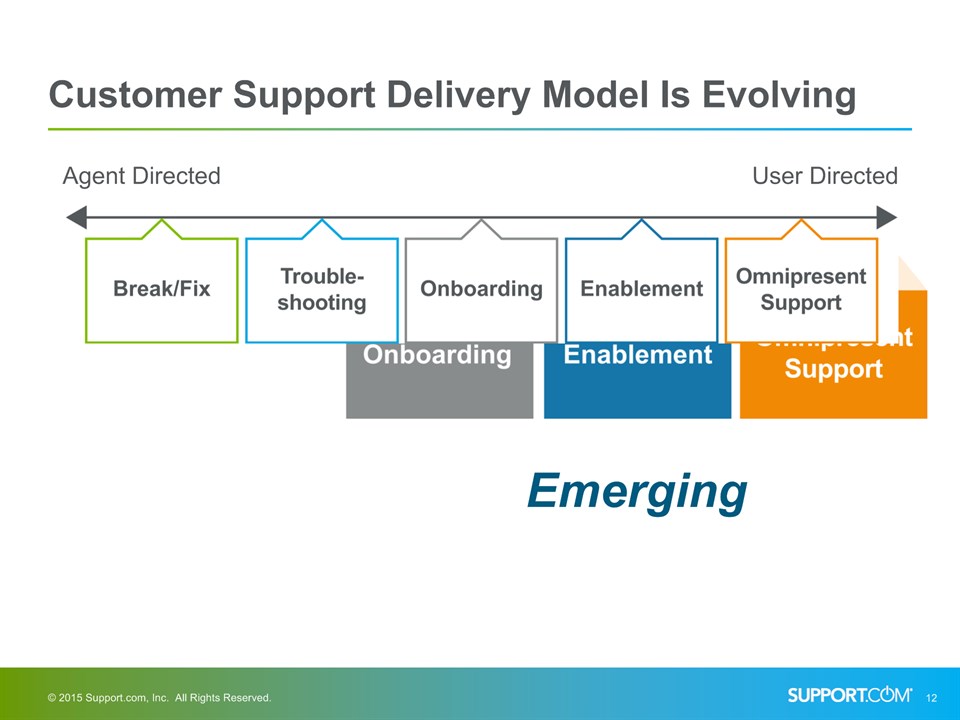

Customer Support Delivery Model Is Evolving © 2015 Support.com, Inc. All Rights Reserved. * Agent Directed User Directed Traditional

Customer Support Delivery Model Is Evolving © 2015 Support.com, Inc. All Rights Reserved. * Agent Directed User Directed Emerging

© 2015 Support.com, Inc. All Rights Reserved. * Services: Positioned for Diversification and to Accelerate Nexus

The Evolving Technical Support Market © 2015 Support.com, Inc. All Rights Reserved. * Consumer Technical Support Services Source: Parks Associates, “The Evolution of Tech Support: Trends and Outlook - 2nd Ed. 2015”, December 2014 CAGR 0% 4% 15% Subscription-based tech support market experiencing little growth One-time support driven by increased number of devices per household Annual Revenue ($B)

Our Strong Heritage as a Support Leader © 2015 Support.com, Inc. All Rights Reserved. * Leading provider of Premium Technical Support (PTS) since 2007Solve complex problems: home automation, networks, anti-virus, device optimizationServing clients across a wide range of industries (retail, cable providers, software, ISP)1,400+ technically advanced, work-at-home agents across North AmericaManaging over 17,000 support interactions per dayNet Promoter Scores for Support.com’sdirect subscribers above 80 for last 3 yearsConsistently ranked among industry’s best Programs are diferentiated and gross profit positive

Our Services Competitive Advantage © 2015 Support.com, Inc. All Rights Reserved. * High Breadth of Services Types Offered Support Complexity Low High Low PlumChoice iYogi Radial Point Sutherland Teleperformance Services programs lead the technical support industryService program differentiatorsNorth American agentsScalable work-from-home modelTechnical agent recruiting expertiseTechnology-enabled service delivery TeleTech Alorica Support.com

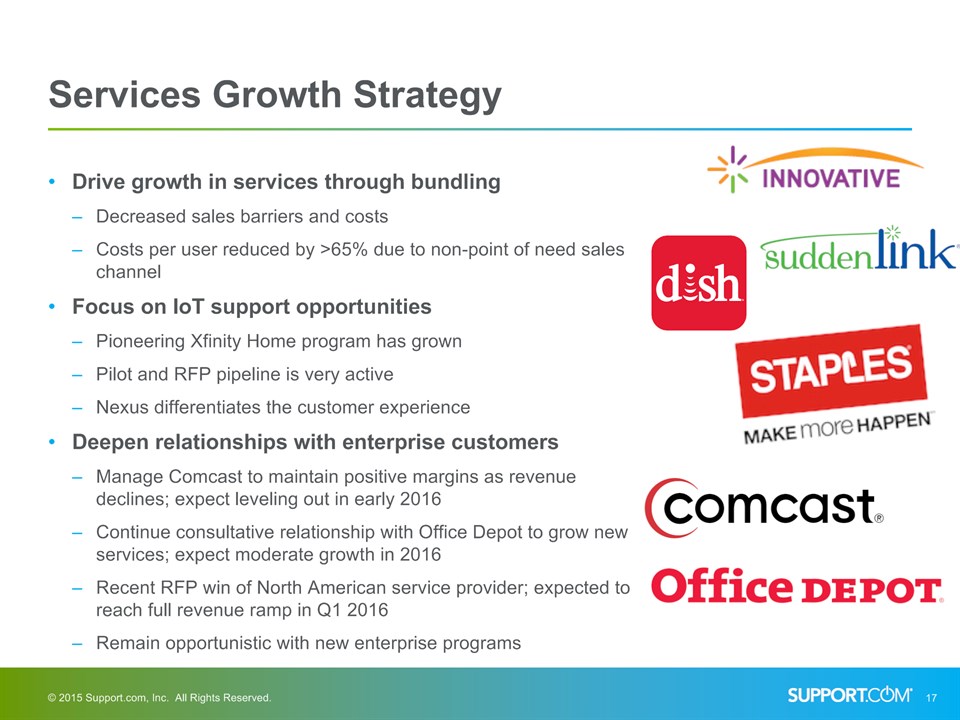

Services Growth Strategy © 2015 Support.com, Inc. All Rights Reserved. * Drive growth in services through bundlingDecreased sales barriers and costsCosts per user reduced by >65% due to non-point of need sales channelFocus on IoT support opportunitiesPioneering Xfinity Home program has grownPilot and RFP pipeline is very activeNexus differentiates the customer experienceDeepen relationships with enterprise customersManage Comcast to maintain positive margins as revenue declines; expect leveling out in early 2016Continue consultative relationship with Office Depot to grow new services; expect moderate growth in 2016Recent RFP win of North American service provider; expected to reach full revenue ramp in Q1 2016Remain opportunistic with new enterprise programs

© 2015 Support.com, Inc. All Rights Reserved. * Nexus: Positioned for Growth in the Connected World

Nexus: SaaS-Based Automation Tools for Scalable, Efficient Support © 2015 Support.com, Inc. All Rights Reserved. | CONFIDENTIAL – DO NOT DISTRIBUTE * Live agent navigator with Guided Paths® for efficient problem resolutionUser guided embedded support for self-helpInteraction analytics for real time data analysis

Addressing a Large, Growing Technology Market © 2015 Support.com, Inc. All Rights Reserved. * Source: Frost & Sullivan, “Support Interaction Optimization”, 2014 CAGR12% $2.6B $1.3B Support Interaction Optimization $1M

Nexus Addresses the Needs of the Connected World © 2015 Support.com, Inc. All Rights Reserved. * Nexus cloud-based software provides optimized user- and agent-driven live interactions using Guided Paths® Sophisticated analytics for continual optimization of support interactionsDelivered on the agent’s desktop or directly to the end user via Web and mobile apps and self-servicePurpose-built to include support of Internet of Things connected devices in both the home and business SaaS-based revenue provides predictable, reliable financial foundation

Nexus is Competitively Uniquely Positioned © 2015 Support.com, Inc. All Rights Reserved. * Poised to capture open market windowNexus differentiatorsFocused on resolution interactionGuided assistanceEmphasizes content and contextEmbeddable in IoT and other applications Breadth of Solution Support Interaction Focus Interaction Pre & PostInteraction PointSolutions SuiteProviders Nexus Team Viewer Zing Tree Sight Call Pegasystems Microsoft Salesforce Five9 Oracle Zendesk Kana Bomgar LogMein Mind Touch

Customer Use Cases and Growth in Usage © 2015 Support.com, Inc. All Rights Reserved. * Example Use Cases Growth in Usage Sessions (per day) Users Guided Paths Created OnboardingOnboard SMB customers of cloud-based software tools Warranty/ReturnAvoidanceTroubleshoot & resolve mobile device issues Technical SupportDeliverySales & service delivery for customers of technical support services June ‘14 Sept ‘15 June ‘14 Sept ‘15 June ‘14 Sept ‘15

Services and Nexus Are a Powerful Combination © 2015 Support.com, Inc. All Rights Reserved. * Service program expertise feeds Nexus Guided Paths®Creates differentiated IP within the Nexus productFaster product feedback loopsNexus enables Support.com to deliver better services throughout the customer journey, increasingly critical in the connected worldGo-to-market investment benefits both Services and NexusBrand awareness reaches both sets of potential customersOne sales and marketing infrastructure for both areas Two sets of capabilities makes for a powerful and differentiated offering

© 2015 Support.com, Inc. All Rights Reserved. * Financial StrategyGrowing Our Leadershipin Support Services and Technology

Guiding Principles for Business Investment © 2015 Support.com, Inc. All Rights Reserved. * Must directly contribute to our ability to grow Nexus and ServicesEnable Support.com to achieve non-GAAP break-even exiting 2018Acquisitions focused to accelerate Nexus and grow a profitable top-line Business Investment Expansion of product capabilitiesGrow SaaS sales capacityExpand partner eco-systemTargeted marketing initiatives Service delivery platform toolsIoT lab environmentTargeted sales capabilities focused on IoT Continue improvement in data center operationsImprovement in business systems Nexus Services Infrastructure

2018 Model: Diversification of Company Revenue Mix © 2015 Support.com, Inc. All Rights Reserved. * 1 - 2% FY 2015 90 - 92% 20 - 25% Exiting2018 70 - 75% Services Nexus Winning new services programs and expanding current customersExecuting a “land and expand” strategy with product and service companiesDesign and position Nexus to address the connected support market opportunity Revenue summary excludes end user software

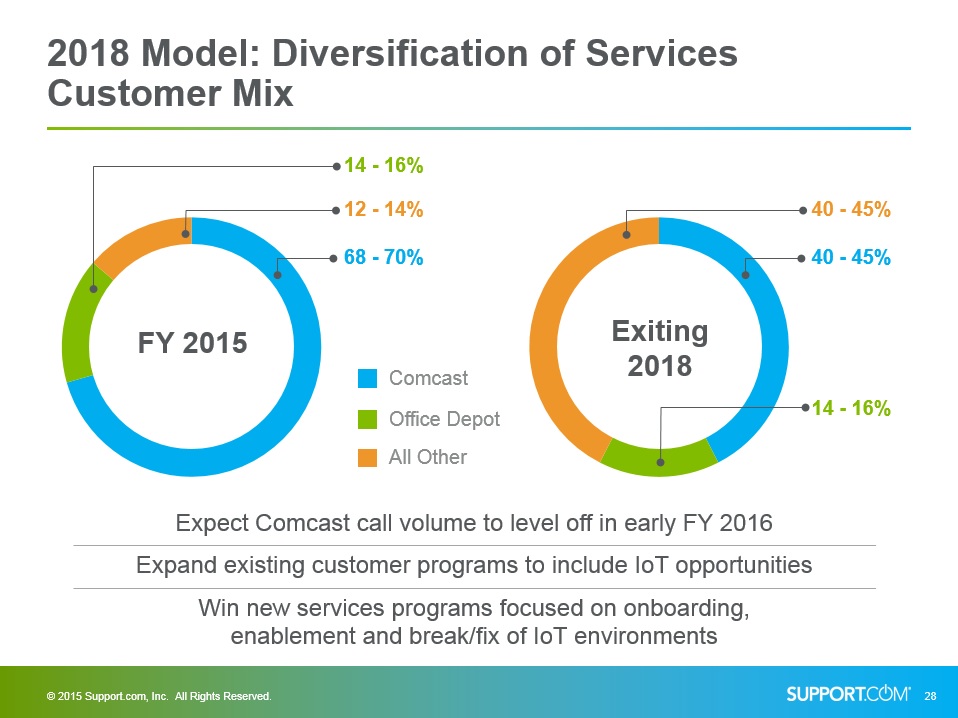

2018 Model: Diversification of Services Customer Mix © 2015 Support.com, Inc. All Rights Reserved. * 12 - 14% FY 2015 68 - 70% Comcast Office Depot Expect Comcast call volume to level off in early FY 2016Expand existing customer programs to include IoT opportunitiesWin new services programs focused on onboarding,enablement and break/fix of IoT environments All Other 14 - 16% 40 - 45% Exiting2018 40 - 45% 14 - 16%

2018 Model: Expanding Gross Margins © 2015 Support.com, Inc. All Rights Reserved. * Adding higher margin Services IoT focused programsContinue Services operational excellenceBuilding a high growth recurring subscription revenue modelthrough a “land and expand” strategy Exiting 201872 - 76% FY 2015Break Even FY 201514 - 18% Exiting 201820 - 25% Target gross margin view excludes end user software

© 2015 Support.com, Inc. All Rights Reserved. * Commitment to Strong Corporate Governance and Stockholder Engagement

Strong Commitment to Corporate Governance © 2015 Support.com, Inc. All Rights Reserved. * Annually-elected directors and separate Chairman and CEO positionsHighly-qualified and experienced Chairman, Jim StephensDirectors bring deep expertise in cloud-based solutions and other technology services, as well as proven management and finance experience, including three sitting CEOsCEO is the only management representative on the Board; all other directors qualify as independent under NASDAQ standardsAll Board committee memberships restricted to independent directorsDiverse Board – a third of Board members are womenBoard and committee self-evaluations performed annuallyStockholders have the right to remove directors with or without causeAnti-hedging policy in placeAverage tenure of Board is six years The Board and management team routinely evaluate opportunities for enhancing stockholder value

Support.com is Open to Constructive Dialogue © 2015 Support.com, Inc. All Rights Reserved. | CONFIDENTIAL – DO NOT DISTRIBUTE * Support.com strives to maintain constructive, ongoing communications with all of its stockholdersHeld Investor Day in September where management laid out the Company’s detailed operational and financial strategyThe Board and management team meet frequently with stockholders and welcome their views and opinions with the goal of enhancing value for all stockholders Participate in industry and investor conferencesRegularly meet with investors, including 1:1 meetings at Investor Day and conversations following earningsParticipated in multiple discussions with representatives from Vertex Capital and BLR Partners, and Joshua E. Schechter to hear their views and concerns

© 2015 Support.com, Inc. All Rights Reserved. * Highly Qualified and Engaged Board and Management Team

Jim has served as a member of the Board since October 2006 and was elected Executive Chairman in 2014. He also served as the Company’s interim CEO in 2014. From February 1990 until November 2005, Jim worked at Adobe Systems Incorporated, where he held a number of positions of increasing responsibility, including SVP of Worldwide Sales and Field Operations. Jim has served as a member of the Board of Wolfe Video, LLC, a film distribution company, since July 2013, and has served as Co-President since January 2015. Jim brings to the Board extensive experience in executive management, leadership, sales, marketing and mergers and acquisitions for high-growth industries, as well as his knowledge of Support.com’s history and experience. Jim also brings experience from 15 years of service in the software industry driving growth strategies. Shawn has served as a member of the Board since February 2007. Since July 2015, Shawn has served as President and CEO for Aryaka Networks, a private company delivering WAN application acceleration and performance software to small and large enterprises. From 2011-2015, Shawn worked at Saba Software, a publicly-traded company before it was acquired by Vector Capital in 2015. He first served as COO and then as CEO as well as a Director. From 2006 through its acquisition by IBM Corporation in 2010, Shawn was COO of Coremetrics, a leading provider of web analytics solutions. From 2003-2006, Shawn served as CIO and VP of Technical Operations at WebEx Communications, Inc., a multimedia collaboration services company. Earlier roles included Regional VP of Managed Services at Oracle Corporation. He also serves on the Board of NewLineNoosh, a leading provider of cloud-based integrated project and procurement solutions. Shawn brings technical understanding and knowledge, as well as operational management experience, to the Board. His experience with SaaS businesses is valuable to us as we build out our Nexus® SaaS offerings. Mark has served as a member of the Board since August 2009. In 2009, Mark co-founded The ROIG Group LLC, a management consulting firm with focusing on helping companies identify and create value for their clients with practices in Retail, Services and Connectivity/Convergence, where he currently serves as Managing Partner – Services. Previously, he served in leadership roles at Target Corporation and Honeywell Inc. Mark brings services, sales, business development and strategy experience to the Board. Mark’s experience with technology service offerings and with the retail industry, including ten years of senior positions with Best Buy Companies, which operates the Geek Squad, gives him a perspective on Support.com’s services business and retail distribution relationships. Highly Experienced and Engaged Board © 2015 Support.com, Inc. All Rights Reserved. * Shawn FarshchiIndependent Director Mark FriesIndependent Director Jim StephensChairman of the Board

Toni has served as a member of the Board since February 2011. In November 2014, Toni was appointed CEO and Executive Chairman of the Board at The Distribution Hospitality Intelligent Systems Company (DHISCO). From February 2011 until May 2014, she served as CEO of LIT OnLine, an e-learning platform company, and she was Chairman of the Board of Resolvity, a provider of intelligent, personalized on-demand interactive voice response solutions, from February 2006 until February 2014. Toni also was President and CEO of Stream, a global business process outsourcing provider, from June 2003 to September 2008. Toni brings more than 30 years of leadership experience in service, sales, and marketing, including at companies such as Diebold and IBM. Toni also brings expertise and experience in managing large-scale world class technical support operations. Martin has served as a member of the Board since April 2006. Since July 2005, Martin has served as a Managing Director with Andersen Tax LLC (formerly known as WTAS, LLC), a tax and financial advisory firm. From January 2005 until July 2005, Martin served as a Managing Director with Alvarez and Marsal, a tax and financial advisory firm. From June 2002 until December 2004, he was a Partner with PricewaterhouseCoopers and held the same title at Arthur Andersen from September 1992 until June 2002. Martin brings financial and accounting experience, as well as knowledge of Support.com’s history and experience, to the Board. Martin provides the Board with insight into financial management, disclosure issues and tax matters relevant to Support.com’s business. Elizabeth joined Support.com in May 2014 as President and CEO and was elected to the Board in July 2014. She has over 25 years of executive experience in the technology industry, and is an award-winning product thought leader who has grown businesses through organic innovation and acquisitions. Most recently, she was GM and VP of IT Support and Access at Citrix. During her time at Citrix, she also held executive positions in the Citrix SaaS division, with leadership roles spanning product management, general management, global client services and the contact center. In addition to bringing to the Board her knowledge and perspective of the Company as President and CEO, Elizabeth also brings extensive experience in leadership, general management, and the successful development and marketing of innovative SaaS offerings for support-related markets. Highly Experienced and Engaged Board (cont.) © 2015 Support.com, Inc. All Rights Reserved. * J. Martin O’MalleyIndependent Director Elizabeth CholawskyDirector Toni PortmannIndependent Director

Elizabeth joined Support.com in May 2014 and is President and CEO and a member of the Board. She has over 25 years of experience as an executive in technology industries, and she is an award-winning product thought leader who has grown businesses through organic innovation and acquisitions. Most recently, she was GM and VP of IT Support and Access at Citrix. During her time at Citrix, she held executive positions in the Citrix SaaS division, with leadership roles spanning product management, general management, global client services and the contact center. Roop joined Support.com in October 2013 and is EVP, CFO and COO. He has over 20 years of leadership experience in technology companies. Prior to joining Support.com, he served as CFO of Quantros, Inc., a cloud provider to advance healthcare quality and safety performance and 2Wire. He also held various executive positions at Solectron and Safeguard Scientifics. Roop began his career in public accounting, first with Grant Thornton and then PricewaterhouseCoopers. Shaun joined Support.com in January 2012 and is SVP, Sales and Business Development. He has a background in telecommunications, wireless and software and has over 15 years of experience in technology companies. Previously, he served as COO of a rapidly growing IT services company focused on small and medium businesses. Shaun also worked as an investment banker and has held business development and marketing positions at DSC Communications (acquired by Alcatel), Telica (acquired by Lucent Technologies) and Senitito Networks (acquired by Verso Technologies). Sampath joined Support.com in September 2014 as SVP of Product. He brings over 20 years of experience as a product and business leader in the software industry. Prior to Support.com, Sampath, spent almost five years at the Citrix SaaS division where he held multiple product and general management roles, including VP and GM for the Collaboration product group. He has run product management and services and was a GM at enterprise software companies such as SAP, CommerceOne and ClickCommerce. He also serves on the Board of Continental Automated Buildings Association (CABA). Highly Experienced and New Management Team © 2015 Support.com, Inc. All Rights Reserved. * Elizabeth CholawskyPresident and CEO Roop LakkarajuEVP, CFO and COO Shaun DonnellySVP, Sales and Business Development Sampath GomatamSVP, Product

Chris joined Support.com in August 2014 and is VP of Engineering and Operations. He brings more than 20 years of experience in engineering and senior management. Prior to joining Support.com, Chris held numerous senior management positions including: Director of Engineering for the Workflow Cloud Line of Business at Citrix; VP Engineering at Casabi, a cloud content startup (acquired by Broadsoft); VPof BusDev and Strategy for Dulance; and VP of Engineering at Clarent Communications Corp. Alex joined Support.com in June 2015 and is VP of Marketing. He brings nearly 20 years of experience as a marketing and business leader in the software industry, particularly in the SaaS space. Prior to Support.com, Alex was CMO at NetDimensions, where he built the marketing organization to a global scale, led its transition into becoming a SaaS provider and increased brand awareness in a highly competitive market. Alex has also worked for early-stage companies including the network mediation and billing vendor Narus (now a subsidiary of Boeing), as well as for technology leaders such as Silicon Graphics, where he started his career. Lee joined Support.com in July 2014 as VP, Strategic Initiatives. Prior to joining Support.com, he consulted to clients including Citrix, where he contributed to the design of a customer care system for the SaaS division and helped guide the integration of several acquisitions. He also served as SVP/GM of the SaaS product division he started for New Wave Automation (acquired by Global Cash Access). Earlier, he was a partner in the management consulting practice of Deloitte in New York and Los Angeles. He previously served as a member of the Board for the Society of Certified Data Processors. Michelle joined Support.com in July 2015 as VP, General Counsel and Secretary. Michelle has more than 15 years of experience advising companies in Silicon Valley on a broad array of legal matters. For the previous seven years, Michelle was Managing Counsel in the Corporate, Securities and Acquisitions group at Oracle Corporation. She has also served as Associate General Counsel at Openwave Systems, Inc. (now Unwired Planet, Inc.). Highly Experienced and New Management Team © 2015 Support.com, Inc. All Rights Reserved. * Chris KovermanVP, Engineering and Operationst Alex PoulosVP, Marketing Lee GruenfeldVP, Strategic Initiatives Michelle JohnsonVP, General Counsel and Secretary

© 2015 Support.com, Inc. All Rights Reserved. * Conclusion

Why Support.com © 2015 Support.com, Inc. All Rights Reserved. * Well-defined strategic plan has positioned the Company to capture growth from evolving support trendsLeveraging technical support expertise, Nexus and industry reputation advantagesDifferentiated Services programsLarge enterprise: high quality customers with stickiness Bundled offers and IoT present attractive new opportunities Nexus is the growth engineMeets the demand for better support tools and technology in the connected worldServices heritage and Nexus deliver powerful synergiesUnique competitive advantage enabling Support.com to better meet customers’ evolving needs Accelerated learning, better product development and superior service deliveryHighly experienced and proven leadership team Board brought on an experienced CEO to reenergize and refocus the organization; also added talented, new marketing and engineering leadsNew management team possesses combination of services, software, and product experience

© 2015 Support.com, Inc. All Rights Reserved. * Appendix

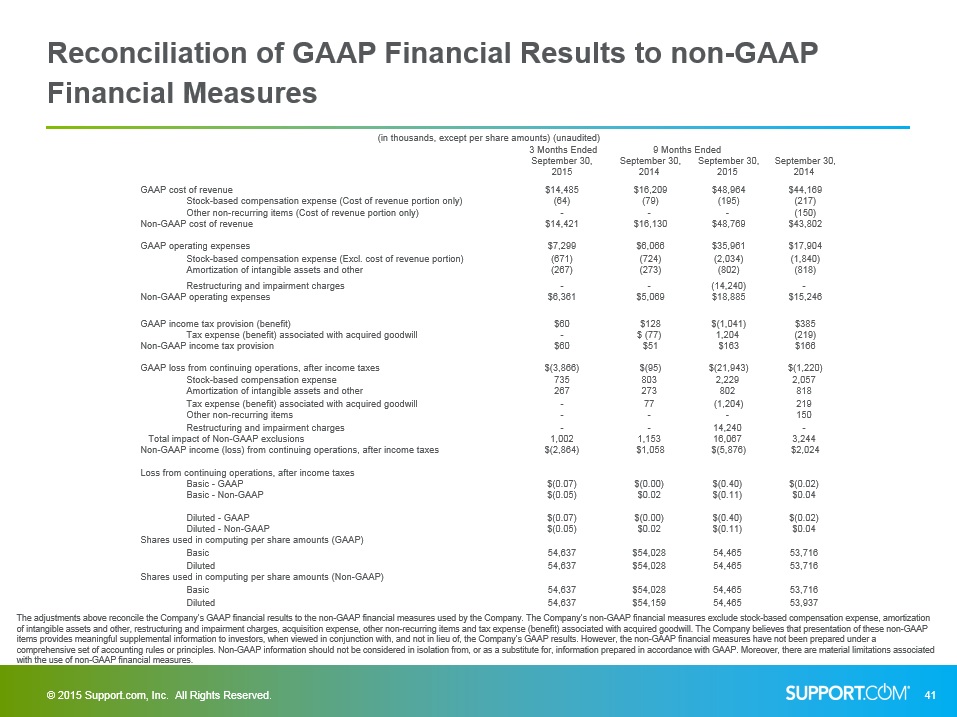

Reconciliation of GAAP Financial Results to non-GAAP Financial Measures © 2015 Support.com, Inc. All Rights Reserved. * (in thousands, except per share amounts) (unaudited) (in thousands, except per share amounts) (unaudited) (in thousands, except per share amounts) (unaudited) (in thousands, except per share amounts) (unaudited) (in thousands, except per share amounts) (unaudited) (in thousands, except per share amounts) (unaudited) (in thousands, except per share amounts) (unaudited) (in thousands, except per share amounts) (unaudited) (in thousands, except per share amounts) (unaudited) (in thousands, except per share amounts) (unaudited) (in thousands, except per share amounts) (unaudited) 3 Months Ended 9 Months Ended 9 Months Ended 9 Months Ended September 30, 2015 September 30, 2014 September 30, 2015 September 30, 2014 GAAP cost of revenue GAAP cost of revenue GAAP cost of revenue $14,485 $16,209 $48,964 $44,169 Stock-based compensation expense (Cost of revenue portion only) Stock-based compensation expense (Cost of revenue portion only) Stock-based compensation expense (Cost of revenue portion only) (64) (79) (195) (217) Other non-recurring items (Cost of revenue portion only) Other non-recurring items (Cost of revenue portion only) - - - (150) Non-GAAP cost of revenue Non-GAAP cost of revenue Non-GAAP cost of revenue $14,421 $16,130 $48,769 $43,802 GAAP operating expenses GAAP operating expenses GAAP operating expenses $7,299 $6,066 $35,961 $17,904 Stock-based compensation expense (Excl. cost of revenue portion) Stock-based compensation expense (Excl. cost of revenue portion) Stock-based compensation expense (Excl. cost of revenue portion) (671) (724) (2,034) (1,840) Amortization of intangible assets and other Amortization of intangible assets and other (267) (273) (802) (818) Restructuring and impairment charges Restructuring and impairment charges - - (14,240) - Non-GAAP operating expenses Non-GAAP operating expenses Non-GAAP operating expenses $6,361 $5,069 $18,885 $15,246 GAAP income tax provision (benefit) GAAP income tax provision (benefit) GAAP income tax provision (benefit) $60 $128 $(1,041) $385 Tax expense (benefit) associated with acquired goodwill Tax expense (benefit) associated with acquired goodwill - $ (77) 1,204 (219) Non-GAAP income tax provision Non-GAAP income tax provision Non-GAAP income tax provision $60 $51 $163 $166 GAAP loss from continuing operations, after income taxes GAAP loss from continuing operations, after income taxes GAAP loss from continuing operations, after income taxes $(3,866) $(95) $(21,943) $(1,220) Stock-based compensation expense Stock-based compensation expense 735 803 2,229 2,057 Amortization of intangible assets and other Amortization of intangible assets and other 267 273 802 818 Tax expense (benefit) associated with acquired goodwill Tax expense (benefit) associated with acquired goodwill - 77 (1,204) 219 Other non-recurring items Other non-recurring items - - - 150 Restructuring and impairment charges Restructuring and impairment charges - - 14,240 - Total impact of Non-GAAP exclusions Total impact of Non-GAAP exclusions Total impact of Non-GAAP exclusions 1,002 1,153 16,067 3,244 Non-GAAP income (loss) from continuing operations, after income taxes Non-GAAP income (loss) from continuing operations, after income taxes Non-GAAP income (loss) from continuing operations, after income taxes Non-GAAP income (loss) from continuing operations, after income taxes $(2,864) $1,058 $(5,876) $2,024 Loss from continuing operations, after income taxes Loss from continuing operations, after income taxes Loss from continuing operations, after income taxes Basic - GAAP Basic - GAAP $(0.07) $(0.00) $(0.40) $(0.02) Basic - Non-GAAP Basic - Non-GAAP $(0.05) $0.02 $(0.11) $0.04 Diluted - GAAP Diluted - GAAP $(0.07) $(0.00) $(0.40) $(0.02) Diluted - Non-GAAP Diluted - Non-GAAP $(0.05) $0.02 $(0.11) $0.04 Shares used in computing per share amounts (GAAP) Shares used in computing per share amounts (GAAP) Shares used in computing per share amounts (GAAP) Basic Basic 54,637 $54,028 54,465 53,716 Diluted Diluted 54,637 $54,028 54,465 53,716 Shares used in computing per share amounts (Non-GAAP) Shares used in computing per share amounts (Non-GAAP) Shares used in computing per share amounts (Non-GAAP) Basic Basic 54,637 $54,028 54,465 53,716 Diluted Diluted 54,637 $54,159 54,465 53,937 The adjustments above reconcile the Company’s GAAP financial results to the non-GAAP financial measures used by the Company. The Company’s non-GAAP financial measures exclude stock-based compensation expense, amortization of intangible assets and other, restructuring and impairment charges, acquisition expense, other non-recurring items and tax expense (benefit) associated with acquired goodwill. The Company believes that presentation of these non-GAAP items provides meaningful supplemental information to investors, when viewed in conjunction with, and not in lieu of, the Company’s GAAP results. However, the non-GAAP financial measures have not been prepared under a comprehensive set of accounting rules or principles. Non-GAAP information should not be considered in isolation from, or as a substitute for, information prepared in accordance with GAAP. Moreover, there are material limitations associated with the use of non-GAAP financial measures.