Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - MOBETIZE, CORP. | exh_312.htm |

| EX-32.2 - EXHIBIT 32.2 - MOBETIZE, CORP. | exh_322.htm |

| EX-32.1 - EXHIBIT 32.1 - MOBETIZE, CORP. | exh_321.htm |

| EX-31.1 - EXHIBIT 31.1 - MOBETIZE, CORP. | exh_311.htm |

U.S. SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

Mark One

[ X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2015

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to _______

Commission File No. 333-181747

MOBETIZE CORP.

(Exact name of registrant as specified in its charter)

Nevada

(State or Other Jurisdiction of Incorporation or Organization)

|

7299 |

99-0373704 |

| (Primary Standard Industrial Classification Number) | (IRS Employer Identification Number) |

8105 Birch Bay Square St, Suite 205, Blaine WA 98230

(Address of principal executive offices)

Issuer’s telephone number: (206) 347-4515

Indicate by checkmark whether the issuer: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X ] No[ ]

Indicate by check mark whether the registrant is a large accelerated filed, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☐ | (Do not check if a smaller reporting company) | Smaller reporting company | ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐Yes ☒No

Indicate the number of shares outstanding of each of the issuer’s classes of common

stock, as of the most practicable date: As at November 13, 2015, there were 33,261,154 shares of the issuer's $0.001 par value

common stock issued and outstanding.

| Page 1 |

MOBETIZE CORP.

| Page 2 |

September 30, 2015

(Unaudited)

| US $ | ||||||||

| SEPTEMBER 30, 2015 | MARCH 31, 2015 | |||||||

| ASSETS | ||||||||

| Current Assets: | ||||||||

| Cash | $ | 490,478 | $ | 312,899 | ||||

| Accounts receivable | 4,080 | 6,534 | ||||||

| Accounts receivable – related party (Note 6) | - | 14,687 | ||||||

| Prepaid expenses and deposits | 39,944 | 56,424 | ||||||

| Total Current Assets | 534,502 | 390,544 | ||||||

| Property and equipment, net (Note 4) | 13,002 | 13,606 | ||||||

| TOTAL ASSETS | $ | 547,504 | $ | 404,150 | ||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||

| LIABILITIES | ||||||||

| Current Liabilities: | ||||||||

| Accounts payable and accrued liabilities | $ | 70,873 | $ | 37,300 | ||||

| Accounts payable and accrued liabilities - related party (Note 6) | 99,546 | 72,810 | ||||||

| Total Current Liabilities | 170,419 | 110,110 | ||||||

| Due to related party (Note 6) | - | 53,105 | ||||||

| TOTAL LIABILITIES | $ | 170,419 | $ | 163,215 | ||||

| STOCKHOLDERS' EQUITY | ||||||||

| Common stock, $0.001 Par Value: 525,000,000 authorized and 33,261,154 and 30,185,505 common shares issued and outstanding, respectively (Note 7) | $ | 33,261 | $ | 30,186 | ||||

| Additional paid-in capital | 4,736,355 | 4,191,177 | ||||||

| Warrants | 562,764 | 263,111 | ||||||

| Share subscriptions payable | 20,933 | 14,303 | ||||||

| Accumulated deficit | (4,968,862 | ) | (4,255,516 | ) | ||||

| Accumulated other comprehensive loss | (7,366 | ) | (2,326 | ) | ||||

| Total Stockholders' Equity | 377,085 | 240,935 | ||||||

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 547,504 | $ | 404,150 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

| Page 3 |

MOBETIZE CORP.

Consolidated Statements of Operations

For the three and six months ended September 30, 2015 and 2014

(Unaudited)

| US $ THREE MONTHS ENDED SEPTEMBER 30, | US $ SIX MONTHS ENDED SEPTEMBER 30, | |||||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||

| OPERATING REVENUES | ||||||||||||||||

| Revenues | $ | 3,742 | $ | 2,415 | $ | 7,077 | $ | 22,155 | ||||||||

| OPERATING EXPENSES | ||||||||||||||||

| Depreciation | 655 | - | 1,431 | - | ||||||||||||

| General and administrative | 68,874 | 41,686 | 113,416 | 76,081 | ||||||||||||

| General and administrative – related party (Note 6) | 728 | 5,830 | 2,162 | 13,245 | ||||||||||||

| Investor relations and promotion | 7,155 | 51,224 | 7,155 | 81,140 | ||||||||||||

| Listing fees | 8,956 | 7,153 | 21,191 | 15,431 | ||||||||||||

| Management salaries and consulting fees | 63,479 | 63,009 | 173,845 | 238,706 | ||||||||||||

| Management salaries and consulting fees - related party (Note 6) | 30,000 | 56,000 | 60,000 | 100,250 | ||||||||||||

| Professional fees | 10,743 | 33,809 | 38,010 | 53,453 | ||||||||||||

| Research and development | 125,050 | 14,101 | 236,616 | 14,101 | ||||||||||||

| Research and development - related party (Note 6) | 12,205 | 108,908 | 12,836 | 181,160 | ||||||||||||

| Sales and marketing | 29,578 | - | 53,761 | - | ||||||||||||

| Sales and marketing - related party (Note 6) | - | - | - | 2,638 | ||||||||||||

| Total Operating Expenses | 357,423 | 381,720 | 720,423 | 776,205 | ||||||||||||

| NET LOSS | $ | (353,681 | ) | $ | (379,305 | ) | $ | (713,346 | ) | $ | (754,050 | ) | ||||

| NET LOSS PER SHARE | ||||||||||||||||

| Basic | $ | (0.01 | ) | $ | (0.01 | ) | $ | (0.02 | ) | $ | (0.03 | ) | ||||

| WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING | ||||||||||||||||

| Basic | 31,324,934 | 29,490,763 | 30,761,084 | 29,489,564 | ||||||||||||

| COMPREHENSIVE LOSS | ||||||||||||||||

| Net loss | $ | (353,681 | ) | $ | (379,305 | ) | $ | (713,346 | ) | $ | (754,050 | ) | ||||

| Other comprehensive loss: | ||||||||||||||||

| Unrealized loss on investments | - | (130,723 | ) | - | (294,129 | ) | ||||||||||

| Cumulative translation adjustment | (6,499 | ) | - | (5,040 | ) | - | ||||||||||

| Comprehensive loss: | $ | (360,180 | ) | $ | (510,028 | ) | $ | (718,386 | ) | $ | (1,048,179 | ) | ||||

The accompanying notes are an integral part of these consolidated financial statements.

| Page 4 |

MOBETIZE CORP.

Consolidated Statements of Stockholders’ Equity

For the six months ended September 30, 2015

(Unaudited)

| Common Shares | Additional | Share | Accumulated Other | Total | ||||||||||||||||||||||||||||

| Number | Value | Paid-In Capital | Warrants | Subscriptions Payable | Accumulated Deficit | Comprehensive Loss | Stockholders’ Equity | |||||||||||||||||||||||||

| Balance - March 31, 2014 | 28,364,200 | $ | 28,364 | $ | 2,992,747 | $ | - | $ | - | $ | (1,246,498 | ) | $ | - | $ | 1,774,613 | ||||||||||||||||

| Shares issued for consultancy services (Note 7a) | 19,861 | 20 | 24,367 | - | - | - | - | 24,387 | ||||||||||||||||||||||||

| Sale of 1,122,831 shares at $0.75/share net of $58,500 financing fees (Note 7b) | 1,122,831 | 1,123 | 631,841 | 150,659 | - | - | - | 783,623 | ||||||||||||||||||||||||

| Sale of 490,000 shares at $1.00/share (Note 7c) | 490,000 | 490 | 377,058 | 112,452 | - | - | - | 490,000 | ||||||||||||||||||||||||

| Shares issued due to repricing of December 2014 private placement from $1.00/share to $0.75/share (Note 7c) | 163,333 | 163 | (163 | ) | - | - | - | - | - | |||||||||||||||||||||||

| Valuation of financing warrants (Notes 7b and 7c) | - | - | 114,200 | - | - | - | - | 114,200 | ||||||||||||||||||||||||

| Valuation of options issued for consultancy services received | - | - | 46,097 | - | - | - | - | 46,097 | ||||||||||||||||||||||||

| Stock payable for consultancy services received (Note 7d) | - | - | - | - | 14,303 | - | - | 14,303 | ||||||||||||||||||||||||

| Conversion of interest payable | 25,280 | 26 | 5,030 | - | - | - | - | 5,056 | ||||||||||||||||||||||||

| Net loss for the year | - | - | - | - | - | (3,009,018 | ) | - | (3,009,018 | ) | ||||||||||||||||||||||

| Other comprehensive loss | - | - | - | - | - | - | (2,326 | ) | (2,326 | ) | ||||||||||||||||||||||

| Balance - March 31, 2015 | 30,185,505 | $ | 30,186 | $ | 4,191,177 | $ | 263,111 | $ | 14,303 | $ | (4,255,516 | ) | $ | (2,326 | ) | $ | 240,935 | |||||||||||||||

| Stock payable for consultancy services received (Note 7d) | - | - | - | - | 6,630 | - | - | 6,630 | ||||||||||||||||||||||||

| Sale of 161,481 shares at $0.50/share (Note 7i) | 161,481 | 161 | 65,022 | 15,556 | - | - | - | 80,739 | ||||||||||||||||||||||||

| Sale of 2,724,688 shares at $0.25/share, net of $12,122 financing fee (Note 7h) | 2,724,668 | 2,725 | 403,850 | 262,470 | - | - | - | 669,045 | ||||||||||||||||||||||||

| Valuation of financing warrants | - | - | - | 3,372 | - | - | - | 3,372 | ||||||||||||||||||||||||

| Exercise of warrants in the period (Note 7f,g) | 189,500 | 189 | 94,561 | - | - | - | - | 94,750 | ||||||||||||||||||||||||

| Warrants issued on exercise of expiring warrants | - | - | (18,255 | ) | 18,255 | - | - | - | - | |||||||||||||||||||||||

| Net loss for the year | - | - | - | - | - | (713,346 | ) | - | (713,346 | ) | ||||||||||||||||||||||

| Other comprehensive loss | - | - | - | - | - | - | (5,040 | ) | (5,040 | ) | ||||||||||||||||||||||

| Balance - September 30, 2015 | 33,261,154 | $ | 33,261 | $ | 4,736,355 | $ | 562,764 | $ | 20,933 | $ | (4,968,862 | ) | $ | (7,366 | ) | $ | 377,085 | |||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

| Page 5 |

MOBETIZE CORP.

Consolidated Statements of Cash Flow

For the six months ended September 30, 2015 and 2014

(Unaudited)

| US $ SIX MONTHS ENDED SEPTEMBER 30, | ||||||||

| 2015 | 2014 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||

| Net loss | $ | (713,346 | ) | $ | (754,050 | ) | ||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

| Depreciation expense | 1,431 | 59 | ||||||

| Shares issued for services | 6,630 | 152,556 | ||||||

| Changes in assets and liabilities | ||||||||

| Accounts receivable | 2,454 | 28,676 | ||||||

| Accounts receivable – related party | 14,687 | - | ||||||

| Prepaid expenses | 16,480 | (46,066 | ) | |||||

| Accounts payables and accrued liabilities | 33,573 | 18,676 | ||||||

| Accounts payable - related party | 26,736 | 6,468 | ||||||

| Net cash used in operating activities | (611,355 | ) | (593,681 | ) | ||||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||

| Purchase of computer equipment | (1,606 | ) | (7,124 | ) | ||||

| Net cash used in investing activities | (1,606 | ) | (7,124 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITES | ||||||||

| Proceeds from sale of common stock and warrant exercise, net of financing costs | 619,667 | 783,622 | ||||||

| Proceeds from sale of common stock and warrant exercise, net of financing costs - related party | 228,240 | - | ||||||

| Repayments, net of proceeds from related party | (53,105 | ) | - | |||||

| Net cash provided by financing activities | 794,802 | 783,622 | ||||||

| EFFECT OF EXCHANGE RATE CHANGES ON CASH | (4,262 | ) | - | |||||

| NET INCREASE IN CASH | 177,579 | 182,817 | ||||||

| CASH - BEGINNING OF PERIOD | 312,899 | 90,537 | ||||||

| CASH - END OF PERIOD | $ | 490,478 | $ | 273,354 | ||||

| CASH PAID DURING THE PERIOD FOR: | ||||||||

| Interest expense, net of interest income | $ | 1,025 | $ | - | ||||

| Tax expense | $ | - | $ | - | ||||

The accompanying notes are an integral part of these consolidated financial statements.

| Page 6 |

MOBETIZE CORP.

Notes to the Consolidated Financial Statements

September 30, 2015

(Unaudited)

1. Nature of Operations and Continuance of Business

Mobetize, Corp. (the “Company”) was incorporated in the state of Nevada on February 23, 2012 under the name Slavia, Corp. The Company plans to offer mobile banking technologies and service.

The Company’s activities are subject to significant risks and uncertainties, including the need to secure additional funding to operationalize the Company’s current technology before another company develops competitive products.

On September 4, 2013, the Company entered into a purchase and sale agreement with Mobetize, Inc. (“Mobetize”), a private corporation formed under the state of Nevada on March 14, 2012. Under the terms of the agreement, the Company acquired the net assets of Mobetize in exchange for 22,003,000 common shares of the Company. After the close of the share exchange agreement, there were 26,633,000 common shares outstanding and the former shareholders of Mobetize controlled approximately 84% of the total issued and outstanding common shares of the Company including 500,000 common shares held by the President and Director of Mobetize, which were acquired in a private transaction prior to the share exchange agreement.

Going Concern

These financial statements have been prepared on a going concern basis, which implies that the Company will continue to realize its assets and discharge its liabilities in the normal course of business. As of September 30, 2015, the Company has an accumulated deficit of $4,968,862 and a history of net losses and cash used in operating activities. These factors raise substantial doubt regarding the Company’s ability to continue as a going concern. The continuation of the Company as a going concern is dependent upon the continued financial support from its management, and its ability to identify future investment opportunities and obtain the necessary debt or equity financing, and generating profitable operations from the Company’s future operations. These financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

2. Summary of Significant Accounting Policies

| a) | Basis of Presentation |

The interim consolidated financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States (“US GAAP”) and are expressed in U.S. dollars. The Company is a development stage company, as defined by Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 2014–10–Topic–915, Development Stage Entities (note 2q). The Company’s fiscal year end is March 31.

| b) | Use of Estimates |

The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period.

| Page 7 |

The Company regularly evaluates estimates and assumptions related to the collectability of accounts receivable, valuation of intangible assets, fair value of stock-based compensation, and deferred income tax asset valuation allowances. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by the Company may differ materially and adversely from the Company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected.

| c) | Financial Statements |

These financial statements have been prepared in the opinion of management to reflect all adjustments, which include only normal recurring adjustments, necessary to present fairly the Company’s financial position, results of operations and cash flows for the periods shown. The results of operations for such periods are not necessarily indicative of the results expected for a full year or for any future period.

| d) | Cash |

The Company considers all highly liquid instruments with maturity of three months or less at the time of issuance to be cash equivalents. As of September 30, 2015 and 2014, the Company had no cash equivalents.

| e) | Accounts Receivable |

The Company evaluates the collectability of accounts receivable based on the age of receivable balances and customer credit-worthiness. If the Company determines that financial conditions of its customers have deteriorated, an allowance for doubtful accounts may be made or the accounts receivable written off if all collection attempts have failed.

| f) | Prepaid Expenses |

The Company pays for some services in advance and recognizes these expenses as prepaid at the balance sheet date. Prepaid expenses are carried at fair value which is deemed to be the gross value of the pre-payment due to the short-term maturity of these payments. If certain prepaid expenses extend beyond one-year, those are classified as non-current assets.

| g) | Revenue Recognition |

The Company recognizes revenue from licensing and professional fees. Revenue will be recognized only when the price is fixed and determinable, persuasive evidence of an arrangement exists, the service has been provided, and collectability is reasonably assured.

| h) | Property and Equipment |

Property and equipment is accounted for at cost less accumulated amortization and includes computer equipment and office furniture. Amortization is computed using the straight-line method over the estimated useful lives of the assets, which are five years.

| Page 8 |

| i) | Research and Development Costs |

The Company incurs research and development costs during the course of its operations. The costs are expensed except in cases where development costs meet certain identifiable criteria for capitalization. Capitalized development costs are amortized over the life of the related commercial production.

| j) | Stock-Based Compensation |

The Company records stock-based compensation in accordance with ASC 718, Compensation – Stock Compensation, which requires the measurement and recognition of compensation expense based on estimated fair values for all share-based awards made to employees and directors, including stock options.

ASC 718 requires companies to estimate the fair value of share-based awards on the date of grant using an option-pricing model. The Company uses the Black-Scholes option-pricing model as its method of determining fair value. This model is affected by the Company’s stock price as well as assumptions regarding a number of subjective variables. These subjective variables include, but are not limited to the Company’s expected stock price volatility over the term of the awards, and actual and projected employee stock option exercise behaviours. The value of the portion of the award that is ultimately expected to vest is recognized as an expense in the statement of consolidated comprehensive loss over the requisite service period.

Options granted to consultants are valued at the fair value of the equity instruments issued, or the fair value of the services received, whichever is more reliably measureable.

| k) | Income Taxes |

Deferred income taxes are determined using the liability method for the temporary differences between the financial reporting basis and income tax basis of the Company’s assets and liabilities. Deferred income taxes are measured based on the tax rates expected to be in effect when the temporary differences are included in the Company’s tax return. Deferred tax assets and liabilities are recognized based on anticipated future tax consequences attributable to differences between financial statement carrying amounts of assets and liabilities and their respective tax bases.

The Company’s policy is to recognize penalties and interest, if any, related to uncertain tax positions as general and administrative expense.

| l) | Basic and Diluted Net Income (Loss) per Share |

The Company computes net income (loss) per share in accordance with ASC 260, Earnings per Share. ASC 260 requires presentation of basic and diluted earnings per share (“EPS”) on the face of the income statement. Basic EPS is computed by dividing net loss available to common shareholders (numerator) by the weighted average number of shares outstanding (denominator) during the period. Diluted EPS gives effect to all dilutive potential common shares outstanding during the period using the treasury stock method and convertible preferred stock using the if-converted method. In computing diluted EPS, the average stock price for the period is used in determining the number of shares assumed to be purchased from the exercise of stock options or warrants. Diluted EPS excludes all dilutive potential shares if their effect is anti-dilutive. As of September 30, 2015, the Company has 2,693,697 (2014 – 1,206,858) potentially dilutive shares.

| Page 9 |

| m) | Comprehensive Loss |

ASC 220, Comprehensive Income, establishes standards for the reporting and display of comprehensive loss and its components in the financial statements.

| n) | Fair Instruments / Concentration |

Financial instruments consist principally of cash, accounts receivable, accounts payable, and due to related parties. Pursuant to ASC 820, Fair Value Measurements and Disclosures and ASC 825, Financial Instruments the fair value of cash is determined based on “Level 1” inputs, which consist of quoted prices in active markets for identical assets. The recorded values of all other financial instruments approximate their current fair values because of their nature and respective relatively short maturity dates and current market rates for similar instruments. The Company is exposed to credit risk through its cash and accounts receivable, but mitigates this risk by keeping deposits at major financial institutions and advancing credit only to bona fide creditworthy entities. The maximum amount of credit risk is equal to the carrying amount.

| o) | Financial Instruments |

Pursuant to ASC 820, Fair Value Measurements and Disclosures, an entity is required to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. ASC 820 establishes a fair value hierarchy based on the level of independent, objective evidence surrounding the inputs used to measure fair value. A financial instrument’s categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. ASC 820 prioritizes the inputs into three levels that may be used to measure fair value:

Level 1

Level 1 applies to assets or liabilities for which there are quoted prices in active markets for identical assets or liabilities.

Level 2

Level 2 applies to assets or liabilities for which there are inputs other than quoted prices that are observable for the asset or liability such as quoted prices for similar assets or liabilities in active markets; quoted prices for identical assets or liabilities in markets with insufficient volume or infrequent transactions (less active markets); or model-derived valuations in which significant inputs are observable or can be derived principally from, or corroborated by, observable market data.

Level 3

Level 3 applies to assets or liabilities for which there are unobservable inputs to the valuation methodology that are significant to the measurement of the fair value of the assets or liabilities.

The Company’s financial instruments consist principally of cash, amounts receivable, accounts payable and accrued liabilities, and amounts due to related parties. Pursuant to ASC 820, the fair value of our cash is determined based on “Level 1” inputs, which consist of quoted prices in active markets for identical assets. We believe that the recorded values of all of our other financial instruments approximate their current fair values because of their nature and respective maturity dates or durations.

| Page 10 |

| p) | Foreign Currency |

The functional and reporting currency of the Company and its subsidiary, Mobetize USA Inc. is the United States Dollar. The functional currency of the Company’s international subsidiary, Mobetize Canada Inc., is the local currency, which is Canadian dollar. The Company translates the financial statements of this subsidiary to U.S. dollars in accordance with ASC 740, Foreign Currency Translation Matters using month-end rates of exchange for assets and liabilities, and average rates for the annual period are derived from daily spot rates for revenues and expenses. Translation gains and losses are recorded in accumulated other comprehensive income as a component of stockholders’ equity. The Company has not, to the date of these consolidated financial statements, entered into derivative instruments to offset the impact of foreign currency fluctuations.

| q) | Recently Adopted Accounting Standards |

In June 2014, ASU guidance was issued to resolve the diversity of practice relating to the accounting for stock based performance awards that the performance target could be achieved after the employee completes the required service period. The update is effective prospectively or retrospectively for annual reporting periods beginning December 15, 2015. The adoption of the pronouncement did not have a material effect on the Company’s consolidated financial statements.

In June 2014, the FASB issued ASU No. 2014-10, Development Stage Entities (Topic 915): Elimination of Certain Financial Reporting Requirements. The amendments in this Update remove the definition of a development stage entity from the Master Glossary of the Accounting Standards Codification, thereby removing the financial reporting distinction between development stage entities and other reporting entities. In addition, the amendments eliminate the requirements for development stage entities to (1) present inception-to-date information in the statements of income, cash flows, and shareholder equity, (2) label the financial statements as those of a development stage entity, (3) disclose a description of the development stage activities in which the entity is engaged, and (4) disclose in the first year in which the entity is no longer a development stage entity that in prior years it had been in the development stage. Accordingly, we have elected to adopt ASU No. 2014-10.

| r) | Recent Accounting Pronouncements |

In May 2014, ASU guidance was issued related to revenue from contracts with customers. The new standard provides a five-step approach to be applied to all contracts with customers and also requires expanded disclosures about revenue recognition. The ASU is effective for annual reporting periods beginning after December 15, 2016, including interim periods and is to be retrospectively applied. Early adoption is not permitted. The Company is currently evaluating this guidance and the impact it will have on its consolidated financial statements.

3. Share Exchange Agreement between Mobetize Corp. and Mobetize Inc.

On September 4, 2013, the Company entered into a purchase and sale agreement with Mobetize and the shareholders of all of the issued and outstanding common shares of Mobetize.

Pursuant to the agreement, the Company acquired the net assets of Mobetize Inc. in exchange for 22,003,000 common shares of the Company. Following the close of the share exchange agreement, there were 26,633,000 common shares outstanding, of which the former shareholders of Mobetize Inc. controlled approximately 22,503,000 common shares, or 84% of the total issued and outstanding common shares of the Company, resulting in a change of control. The 22,503,000 common shares held by former shareholders of Mobetize Inc. were comprised of 22,003,000 common shares from the share exchange agreement and 500,000 common shares held by the President and Director of Mobetize Inc., which were acquired in a private transaction prior to the share exchange agreement.

The transaction was accounted for as a reverse recapitalization transaction, as the Company qualified as a non-operating public shell company given the fact that the Company held nominal net monetary assets, consisting primarily of cash at the time of merger transaction. As Mobetize Inc. is deemed to be the purchaser for accounting purposes under recapitalization accounting, these financial statements are presented as a continuation of Mobetize Inc. The equity of Mobetize Inc. is presented as the equity of the combined company and the capital stock account of Mobetize Inc. is adjusted to reflect the part value of the outstanding and issued common stock of the legal acquirer (the Company) after giving effect to the number of shares issued in the purchase and sale agreement. Shares retained by the Company are reflected as issuance as of the acquisition date for the historical amount of the net assets of the acquired entity, which in this case is zero.

| Page 11 |

4. Property and Equipment

Property and equipment, net consisted of the following:

September 30, 2015 | March 31, 2015 | |||||||

| Computer equipment | $ | 14,319 | $ | 13,428 | ||||

| Furniture | 1,166 | 1,231 | ||||||

| Total | 15,485 | 14,659 | ||||||

| Less: accumulated amortization | 2,483 | 1,053 | ||||||

| Property and equipment, net | $ | 13,002 | $ | 13,606 |

During the six months ended September 30, 2015 property and equipment decreased by $723 as a result of foreign currency translation adjustments.

5. Investment

On December 24, 2013 the Company completed a debt for equity swap transaction, through which it converted the notes receivable and accrued interest it held from Telupay International Inc. (“Telupay”) into 3,268,097 common shares in Telupay. As a result of this transaction, the Company owned approximately 2.02% of the outstanding share capital of Telupay.

The Company recognizes the holding of these shares as an investment available for sale and values it at the fair market value of the shares. As Telupay is a public company on the OTC market, the shares are valued at the market price. During the twelve month period ending March 31, 2015 the Company fully liquidated 3,268,097 common shares of Telupay for $130,527 in cash proceeds, realizing a loss on sale of investment of $1,503,523.

6. Related Party Transactions

| a) | During the three and six months ended September 30, 2015, the Company incurred $nil (2014 - $26,000) and $nil (2014 - $53,000), respectively, of management fees and $nil (2014 - $22,300) and $nil (2014 - $43,375), respectively, of general and administrative expenses to the former President of the Company, currently serving as the Chief Financial Officer of the Company (the “CFO”). In fiscal 2015 the Chief Financial Officer was remunerated as an employee. |

| Page 12 |

| b) | During the three and six months ended September 30, 2015, the Company incurred $30,000 (2014 - $30,000) and $60,000 (2014 - $47,250), respectively, of management fees, $12,205 (2014 - $108,908) and $12,836 (2014 - $181,160), respectively, of development and engineering fees, $nil (2014 - $nil) and $nil (2014 - $2,638), respectively, of advertising expenses, and $728 (2014 - $5,830) and $2,162 (2014 - $13,245), respectively, of general and administration expenses to a company controlled by the Chief Executive Officer of the Company (the “CEO”). |

| c) | During the three and six months ended September 30, 2015, the Company generated $nil (2014 - $nil) and $nil (2014 - $nil), respectively, in revenues from a company controlled by the CEO. |

| d) | As at September 30, 2015, the Company owes $47,387 (March 31, 2015 - $89,338) to the CFO of the Company for advances, management fees, outstanding compensation, and reimbursement of general and administrative expenses (as applicable) incurred but unpaid during the period. Amounts previously owing were unsecured, non-interest bearing, and due on demand. |

| e) | Relating to the advances, during the three and six months ended September 30, 2015, the Company received additional advances of $110,000 (2014 - $nil) and $137,500 (2014 - $nil), respectively, from the CFO, which were reinvested during the three months ended September 30, 2015 as part of a $175,000 private placement for common shares of the Company (see Note 7(h)) by the CFO and direct members of the CFO’s family. During the three and six months ended September 30, 2015, the Company also paid $994 (2014 - $nil) in interest to the CFO relating to the above noted advances. |

| f) | During the three and six months ended September 30, 2015, the CFO exercised 25,000 warrants at $0.50 (see Note 7(f)). |

| g) | As at September 30, 2015, the Company owes $52,159 (March 31, 2015 - $36,577) to a Company controlled by the CEO for management fees, development expenses, advertising expenses, and general and administration expenses (as applicable) incurred but unpaid during the period. The amounts owing are unsecured, non-interest bearing, and due on demand. |

| h) | Relating to the advances, during the three and six months ended September 30, 2015, the Company received additional advances of $nil (2014 - $nil) and $40,741 (2014 - $nil), respectively, from the CEO, which were reinvested during the three months ended September 30, 2015 as part of a $40,741 private placement for common shares of the Company (see Note 7(i)) by a company controlled by the CEO. |

7. Common Stock and Preferred Stock

| a) | On April 4, 2014 the Company issued 1,334 common shares in exchange for services in the amount of $1,800 pursuant to the agreement entered into on October 1, 2013. The shares issued were valued at $1,800 based on the quoted closing price of the Company’s common stock on the date of settlement. |

On September 8, 2014 the Company issued 1,240 common shares in exchange for services in the amount of $1,500 pursuant to the agreement entered into on October 1, 2013. The shares issued were valued at $1,500 based on the quoted closing price of the Company’s common stock on the date of settlement.

On September 8, 2014 the Company issued 8,750 common shares in exchange for services in the amount of $10,567 pursuant to the agreement entered into on November 13, 2013. The shares issued were valued at $10,587 based on the quoted closing price of the Company’s common stock on the date of settlement.

| Page 13 |

On August 18, 2014 the Company entered into agreement with a supplier to provide consultancy services in exchange for shares. During the twelve months ended March 31, 2015 the value of services received was $10,500 resulting in 8,537 shares issued to the supplier. During the three months ended June 30, 2015 the value of services received was $nil (2014 - $nil).

| b) | On June 25, 2014 the Company closed a private placement under which it sold 1,122,831 investment units for proceeds of $783,623, net of financing fees of $58,500 paid in cash. Each investment unit consisted of one common share of the Company’s stock and one half-warrant. |

The warrants are exercisable at $1.00 per share and were initially valid for two years from the date of issue. 133,000 financing warrants were issued on the same terms as those in the investment units. The financing warrants were valued at $80,752 using the Black Scholes method, which included the dividend yield of nil, risk-free interest rate of 0.47%, expected volatility of 111.0%, and expected term of 2 years. The full value of financing warrants was expensed to stock based compensation.

On March 17, 2015, the term of both the financing and investment unit warrants was extended from 2 to 4 years. No additional compensation expense relating to the 133,000 financing warrants was recorded as a result of the term extension.

| c) | On December 11, 2014 the Company closed a private placement under which it sold 490,000 investment units for proceeds of $490,000. Each investment unit consisted of one common share of the Company’s stock and one half-warrant. The warrants are exercisable at $1.25 per share and were initially valid for three years from the date of issue. No financing fees were payable in cash associated with this private placement. 60,000 financing warrants were issued on the same terms as those in the investment units. The financing warrants were valued at $33,448 using the Black Scholes method, which included the dividend yield of nil, risk-free interest rate of 1.10%, expected volatility of 96.4%, and expected term of 3 years. The full value of financing warrants was expensed to stock based compensation. |

On March 17, 2015, the term of both the financing and investment unit warrants was extended from 3 to 4 years. No additional compensation expense relating to the 60,000 financing warrants was recorded as a result of the term extension.

On March 17, 2015, the Company repriced 490,000 investment units from the December 11, 2014 private placement from $1.00 per unit to $0.75 per unit resulting in additional 163,333 investment units issued to the private placement shareholders. Each investment unit consisted of one common share of the Company’s stock and one half-warrant. The warrants are exercisable at $1.25 per share and are valid for four years from the date of issue.

| d) | On December 15, 2014, the Company entered into agreement with an Advisor to provide advisory services in exchange for shares. During the three months ending June 30, 2015 the value of services received was $6,630. At September 30, 2015 $20,933 (March 31, 2015 - $14,303) in share subscriptions payable was due for advisory and consulting services. |

| e) | On March 4, 2015, the Company issued 25,280 shares at a price of $0.20 per share to convert interest payable on notes payable in the amount of $5,056 to equity. |

| f) | On June 10, 2015, the Company issued 184,500 shares at a price of $0.50 per share for proceeds of $92,250 upon the exercise of warrants. $184 was recorded to common shares at the par value of $0.001 per share and $92,066 was recorded to additional paid-in capital. |

| Page 14 |

| g) | On August 15, 2015, the Company issued 5,000 shares at a price of $0.50 per share for proceeds of $2,500 upon the exercise of warrants. $5 was recorded to common shares at the par value of $0.001 per share and $2,495 was recorded to additional paid-in capital |

| h) | On September 1, 2015, the Company closed a private placement under which it sold 2,724,668 investment units for $0.25 per unit for gross proceeds of $681,167, which were exclusively offered to subscribers of previous $0.75 private placements. Each investment unit consists of one common share of the Company’s stock and one half-warrant. The warrants are exercisable at $1.00 per share and are valid for three years from the date of issue (see Note 8(b)). $8,750 cash financing fees and 17,500 financing warrants with a value of $3,372 (see Note 8(d)) are payable with this private placement. |

| i) | On September 1, 2015, the Company closed a private placement under which it sold 161,481 investment units for $0.50 per unit for gross proceeds of $80,741. Each investment unit consists of one common share of the Company’s stock and one half-warrant. The warrants are exercisable at $1.00 per share and are valid for three years from the date of issue (see Note 8(c)). Neither financing fees nor financing warrants were payable with this private placement. |

8. Share Purchase Warrants

The following table summarizes the continuity of share purchase warrants:

| Number of warrants | Weighted average exercise price (US$) | |||||||

| Balance, March 31, 2014 | 500,000 | 0.50 | ||||||

| Issued, June 25, 2014 | 694,414 | 1.00 | ||||||

| Issued, December 11, 2014 | 305,000 | 1.25 | ||||||

| Issued, March 17, 2015 | 81,670 | 1.25 | ||||||

| Balance, March 31, 2015 | 1,581,084 | 0.90 | ||||||

| Exercised, June 10, 2015 | (184,500 | ) | 0.50 | |||||

| Exercised, August 15, 2015 | (5,000 | ) | 0.50 | |||||

| Issued, July 15, 2015 | 94,750 | 1.00 | ||||||

| Issued, September 1, 2015 | 1,460,572 | 1.00 | ||||||

| Expired, September 2, 2015 | (310,500 | ) | 0.50 | |||||

| Balance, September 30, 2015 | 2,636,406 | 1.04 | ||||||

During the three months ended September 30, 2015 the company issued the following tranches of warrants:

| a) | 94,750 warrants were issued with an exercise price of $1.00 and a three year term ending September 1, 2018 to holders of the September 3, 2013 warrants who had exercised a total of 189,500 warrants during the six months ended September 30, 2015 prior to the expiry date of September 2, 2105. These warrant holders each received a half warrant for each full warrant they exercised. These warrants were valued at $18,255 using the Black Scholes method criteria as below. |

| b) | 1,362,332 warrants were issued with an exercise price of $1.00 and a three year term ending September 1, 2018 to the parties participating in the $0.25 private placement for common shares (the “$0.25 PP”) in the quarter. Each subscriber to the private placement received a half warrant for each common share they subscribed for. These warrants were valued at $262,470 using the Black Scholes method criteria as below. |

| Page 15 |

| c) | 80,740 warrants were issued with an exercise price of $1.00 and a three year term ending September 1, 2018 to the parties participating in the $0.50 private placement for common shares (the “$0.50 PP”) in the quarter. Each subscriber to the private placement received a half warrant for each common share they subscribed for. These warrants were valued at $15,566 using the Black Scholes method criteria as below. |

| d) | 17,500 finder’s warrants were issued with an exercise price of $1.00 and a three year term ending September 1, 2018 to an arms-length third party assisting in the $0.25 PP. These warrants were valued at $3,372 using the Black Scholes method criteria as below. |

Each of the warrant issuances above were valued using the Black Scholes method, which included the dividend yield as nil, risk-free interest rate of 1.07%, expected volatility of 70.42%, and expected term of 3 years.

As at September 30, 2015, the following share purchase warrants were outstanding:

| Number of warrants outstanding | Exercise price (US$) |

Expiry date | ||||||||

| 694,414 | 1.00 | June 24, 2018 | ||||||||

| 386,670 | 1.25 | December 10, 2018 | ||||||||

| 1,555,322 | 1.00 | September 01, 2018 | ||||||||

| 2,636,406 | ||||||||||

9. Share Options

The following table summarizes the continuity of share purchase options:

| Number of options | Weighted average exercise price (US$) | |||||||

| Balance, March 31, 2014 | 5,500 | 1.00 | ||||||

| Issued in period | 250,000 | 1.25 | ||||||

| Expired in period | (5,500 | ) | 1.00 | |||||

| Cancelled in period | (192,709 | ) | 1.25 | |||||

| Balance, March 31, 2015 | 57,291 | 1.25 | ||||||

| Balance, September 30, 2015 | 57,291 | 1.25 | ||||||

As at September 30, 2015, the following share purchase options were outstanding:

| Number of options outstanding | Exercise price (US$) |

Expiry date | ||||||||

| 57,291 | 1.25 | August 31, 2017 |

On September 1, 2014 the Company issued 250,000 share options for consulting services with a three year term, expiring on August 31, 2017. The options vested monthly in equal installments and were valued at $201,150 using the Black Scholes method, which included the dividend yield or nil, risk-free interest rate of 0.99%, expected volatility of 111.0%, and expected term of 3 years. At March 31, 2015 192,709 options were cancelled as a result of the termination of consulting services while 57,291 options were vested and outstanding.

| Page 16 |

There were no options exercised since the date of issue. For each of the three and six months ended September 30, 2015 $nil (2014 - $nil) stock based compensation expense was recorded.

On August 10, 2015, the Company’s directors approved the adoption of the 2015 Stock Option Plan (“the Stock Option Plan”) which permits the Company to issue stock options for up to 3,000,000 common shares of the Company to directors, officers, employees and consultants of the Company. The 3,000,000 shares allocation was approximately 10% of the issued and outstanding shares as of August 10, 2015.

10. Concentration of Risk

During the three and six months period ending September 30, 2015, revenues generated were $3,742 and $7,077, respectively, compared to revenues of $2,415 and $22,155, respectively, during the same period in 2014. Revenues are generated through m-commerce services provided in line with the contracts acquired by Mobetize from Alligato Inc. and revenues generated through consulting services provided to Alligato Inc., and to independent customers.

During the three months ended September 30, 2015, the Company had revenues from two customers (2014 – revenues from one customer) with 67% (2014 – 100%) of revenues generated from the Company’s largest customer.

During the six months ended September 30, 2015, the Company had revenues from three customers (2014 – revenues from two customers) with 72% (2014 – 84%) of revenues generated from the Company’s largest customer.

11. Commitment and Contingencies

The Company has obligation under rental lease for its operating office. As of September 30, 2015, the remaining term of the lease is 12 months with monthly payments of $4,900. The Company's lease includes a renewal option.

12. Segment Information

The company has currently one operating segment located in Canada. Therefore, there is a single reportable segment and operating unit structure. The Company’s chief operating decision maker reviews financial information presented on a consolidated basis for purposes of allocating resources and evaluating financial performance.

13. Comparative Periods

Certain comparative amounts for the prior period have been reclassified to conform to the current period presentation.

14. Subsequent Events

From October 1, 2015 through November 3, 2015 2,630,000 stock options from the Stock Option Plan were issued to directors, employees, advisors and consultants for the exercise of up to 2,630,000 common shares with a $0.60 exercise price, a 5 year life, and vesting terms ranging from immediate to 32 months depending, generally, on the tenure of staff.

| Page 17 |

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

PRELIMINARY NOTE REGARDING FORWARD LOOKING STATEMENTS

The following discussion should be read in conjunction with our financial statements, which are included elsewhere in this Form 10-Q (the “Report”). This Report contains forward-looking statements which relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

In evaluating these statements, you should consider various factors which may cause our actual results to differ materially from any forward-looking statements. Although we believe that the predictions reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements. We undertake no obligation to revise or update publicly any forward-looking statements for any reason.

We are considered a development stage company. Our auditors have issued a going concern opinion on the financial statements for the year ended March 31, 2015.

GENERAL

We were incorporated in the State of Nevada on February 23, 2012. Our business office is at 8150 Birch Bay Road, Suite 205, Blaine WA 98230. Our telephone number is (206) 347-4515.

Our original business was to provide service to international students who want to study in Canada. We have not generated any revenues and our principal business activities had consisted of creating a business plan and entering into a Referral Agreement dated May 7, 2012 with Novy Mir, Ltd., an independent contractor who was to refer international students to us.

Our business plan was to help international students enroll in appropriate universities, institutes, colleges or schools in Canada. We also had planned to help students obtain student visas and find accommodations in the cities of study. Our service was to start from preliminary consultation and end when the client was enrolled to the program, entered to the destination country and accommodated at a desired place.

Unfortunately, we were not able to raise sufficient capital to fund our business development and consequently our management began considering alternative strategies, such as business combinations or acquisitions to create value for our shareholders.

On July 9, 2013, we entered into an asset purchase and sale agreement with Mobetize Inc. (“Priveco”), a State of Nevada corporation and formerly “Telupay Inc.”. Pursuant to the terms of the agreement, we agreed to acquire substantially all the assets of Priveco in exchange for the issuance by our company of 22,003,000 shares of our common stock to Priveco.

| Page 18 |

On July 12, 2013, Ms. Shpeyzer had resigned as our President, Principal Executive Officer, Principal Financial Officer, Principal Accounting Officer and Director. Ms. Shpeyzer’s resignation was not the result of any disagreement with our company regarding our operations, policies, practices or otherwise. Concurrently with Ms. Shpeyzer’s resignation, Mr. Stephen Fowler was appointed as our President, Principal Financial Officer, Principal Accounting Officer and as a director.

In accordance with board approval, we filed a Certificate of Change dated August 8, 2013 with the Nevada Secretary of State to give effect to a forward split of our authorized, issued and outstanding shares of common stock on a 7 new for 1 old basis, such that our authorized capital increased from 75,000,000 to 525,000,000 shares of common stock and, correspondingly, our issued and outstanding shares of common stock was increased from 3,290,000 to 23,030,000 common shares, all with a par value of $0.001.

Further, effective August 13, 2013, in accordance with approval from the Financial Industry Regulatory Authority (“FINRA”), our company changed its name from “Slavia, Corp.” to “Mobetize Corp.”. The name change and forward split became effective with the Over-the-Counter Bulletin Board at the opening of trading on August 14, 2013 under the symbol SAVID”. Effective October 1, 2013, our stock symbol changed from “SAVID” to “MPAY” to better reflect the new name of our company.

In connection with the asset purchase and sale agreement, Mr. Fowler agreed to return for cancellation 18,400,000 shares of our common stock on September 4, 2013. Concurrently, we closed the asset purchase and sale by issuing the required 22,003,000 common shares to Priveco. Also pursuant to the asset purchase and sale agreement, on September 4, 2013, Ajay Hans was appointed as a director and Principal Executive Officer of our company.

On September 20, 2013, Stephen Fowler had resigned as our Principal Financial Officer and Principal Accounting Officer. Mr. Fowler’s resignation was not the result of any disagreement with our company regarding our operations, policies, practices or otherwise. Concurrently with Mr. Fowler resignation, Mr. Chris Convey was appointed as our Chief Financial Officer.

On September 16, 2013, our company issued 315,000 common shares to Source Capital Group, Inc., a US investment-banking firm, as part of an on-going consulting agreement with our company. Additionally on October 7, 2013 the Company issued 1,050,000 shares in a private placement at $0.50 per share for gross funds of $525,000.

On December 15, 2013 our company issued 15,000 common shares for prepaid marketing services with a fair value of $19,500. All these services had been received and amortized by June 30, 2014.

On December 31, 2013 our company issued 1,200 common shares in payment of consultancy services received with a fair market value of $1,500.

On March 14, 2014 our company issued 200,000 common shares at a deemed price of $0.20 a share to Bacarrat Overseas Ltd upon conversion of the outstanding notes payable to equity.

On March 26, 2014 our company entered in to a debt for equity settlement agreement with the president of our company. Under the terms of this agreement, the Company settled debts of $112,500 owed to the president of our company in return for the issuance of 150,000 common shares. This transaction was valued at the prevailing market price of $1.35 per share, so our company incurred an interest charge of $90,000 as a result of this transaction.

On April 4, 2014 our company issued 1,334 common shares in exchange for services valued at $1,800.

| Page 19 |

On June 25, 2014 our company closed a private placement under which it sold 1,122,831 investment units for gross proceeds of $842,123. Each investment unit consisted of one common share of our company’s stock and one half-warrant. The warrants are exercisable at $1.00 per share and are valid for two years from issue. $58,500 financing fees are payable in cash associated with this private placement and 133,000 financing warrants were issued on the same terms as those in the investment units.

On September 1, 2014 the Company issued 250,000 share options for consulting services with a three year term, expiring on August 31, 2017. The options vest monthly in equal installments.

On September 8, 2014 the Company issued 9,990 common shares in settlement of supplier liabilities valued at $12,087.

On December 11, 2014 the Company closed a private placement under which it sold 490,000 investment units for net proceeds of $490,000. Each investment unit consisted of one common share of our company’s stock and one half-warrant. The warrants are exercisable at $1.25 per share and are valid for three years from issue. No financing fees are payable in cash associated with this private placement. 60,000 financing warrants were issued on the same terms as those in the investment units.

On March 17, 2015, the Company repriced 490,000 investment units from the December 11, 2014 private placement from $1.00 per unit to $0.75 per unit resulting in additional 163,333 investment units issued to the private placement shareholders. Each investment unit consisted of one common share of the Company’s stock and one half-warrant. The warrants are exercisable at $1.25 per share and are valid for four years from the date of issue.

On March 4, 2015, the Company issued 25,280 shares at a conversion price of $0.20 per share to convert interest payable on notes payable in the amount of $5,056 to equity.

On June 10, 2015, the Company issued 184,500 shares at a conversion price of $0.50 per share for proceeds of $92,250 upon the exercise of warrants. $184 was recorded to common shares at the par value of $0.001 per share and $92,065 was recorded to additional paid-in capital.

On August 15, 2015, the Company issued 5,000 shares at a conversion price of $0.50 per share for proceeds of $2,500 upon the exercise of warrants. $5 was recorded to common shares at the par value of $0.001 per share and $2,495 was recorded to additional paid-in capital

On September 1, 2015, the Company closed a private placement under which it sold 2,724,668 investment units for $0.25 per unit for gross proceeds of $681,167, which were exclusively offered to subscribers of previous $0.75 private placements. Each investment unit consists of one common share of the Company’s stock and one half-warrant. The warrants are exercisable at $1.00 per share and are valid for three years from the date of issue (see Note 8(b)). $8,750 cash financing fees and 17,500 financing warrants with a value of $56,350 (see Note 8(d)) are payable with this private placement.

On September 1, 2015, the Company closed a private placement under which it sold 161,481 investment units for $0.50 per unit for gross proceeds of $80,741. Each investment unit consists of one common share of the Company’s stock and one half-warrant. The warrants are exercisable at $1.00 per share and are valid for three years from the date of issue (see Note 8(c)). Neither financing fees nor financing warrants were payable with this private placement.

| Page 20 |

BUSINESS OVERVIEW

Our original business was to provide service to international students who want to study in Canada. We did not generate any revenues and our principal business activities consisted of creating a business plan. Our business plan was to help international students enrol in appropriate universities, institutes, colleges or schools in Canada. We also had planned to help students obtain student visas and find accommodations in the cities of study. Our service was to start from preliminary consultation and will end when the client is enrolled to the program, entered to the destination country and accommodated at desired place.

Unfortunately, we were not able to raise sufficient capital to fund our business development and consequently our management began considering alternative strategies, such as business combinations or acquisitions to create value for our shareholders.

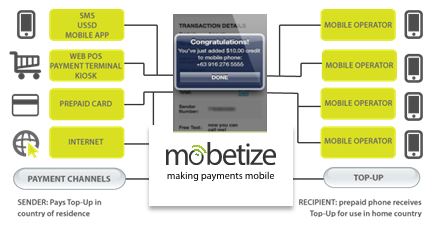

As such, we purchased all or substantially all of the business assets of Mobetize Inc. on September 4, 2013 and our new business offers us the opportunity to become a leading online and mobile commerce platform provider for telecom operators, payment service providers and banks. Our platform is brand-able and enables telecom operators, employers and prepaid card issuers to simplify the delivery of mobile financial services. We ensure end-to-end integration for services such as retail/online payments, air-time top ups, international remittances/money transfer, P2P transfers and Visa/Mastercard programs on mobile devices. We seamlessly integrate and white label our secure mobile money platform with our delivery partners to help increase their average revenue per customer (ARPU), decrease customer service costs, and increase loyalty to existing offerings.

Telecom Products and Solutions:

Adoption of the smart phone has created an unprecedented increase in the use of the mobile devices for financial transactions. This paradigm is changing the way people receive financial services across the globe. MFS are part of a long-term strategy for telecom operators worldwide to enhance their relationship with their subscribers and increase Average Revenue Per User (“ARPU”). For telcos with predominantly prepaid customer bases, we assist them in significantly increasing their enterprise value, as we effectively convert pre-paid subscribers in to post-paid subscribers. We have commenced operations with our first products designed and ready for sale and/or implementation.

smartWallet:

Our smartWallet solution is provided via mobile web and web OS Apple and Android app to the desktop, iPad or mobile phone of our users.

The smartWallet is the core of our mobile financial services offerings and allows users to load funds in to their mobile wallet and access global services such as prepaid top-ups for themselves or for gifts for family members, Person 2 Person money transfers, international money transfer remittances, bill payments and bill management, with other financial services being added.

Users can load funds in to their smartWallet from their bank account (ACH or real time ACH), via credit or prepaid debit card and by Q2 2015 by electronic remote check deposit, plus cashing and cash load at Green Dot affiliated locations across the US.

smartWallet can be integrated with a billing system to allow to offer a mobile ‘my account’ as part of a mobile wallet with rich features including:

| • | Registration - Sign in and sign up process capabilities based on current systems. |

| • | User Account Settings - Allows the user to update their information, edit/add and save different payment methods while changing password and saving account numbers to favorites for fast access. |

| Page 21 |

| • | View Balance - Subscribers are able to track their balances by viewing their real-time balance. |

| • | Add and Save Services -Create, save, and edit a list of Favorites for easy and fast access to all transactions. |

| • | Favorites - Create, save, and edit a list of Favorite contacts, remittances, airtime transactions and more for convenience and accessibility. |

| • | Stored Payment Methods - Safely store and edit a list of preferred method of payments to load the smartWallet and increase convenience and accessibility including credit cards, debit cards, and ACH. |

smartRemit:

A fully integrated mobile platform dedicated to providing the most convenient, efficient, scalable and inexpensive global money transfer solution for your subscriber.

It allows customers to send funds person to person via multiple convenient ways; bank account deposits, pick-up at agent location, and home delivery. Users can send funds in one currency and have the beneficiary receive in another. Cash delivery options include:

| • | Cash to cash |

| • | Cash to account |

| • | Door service |

| • | Mobile transfers |

smartRemit is accessed via the smartWallet and provides users with 24/7 mobile money transfer remittance capabilities via the mobile web to initially 39 countries worldwide, with 50,000+ agent locations. We anticipate this reach to grow during the remainder of 2015 with money transfer capability to 150 countries with 170,000 payout agents and delivery to any bank accounts in over 600 Banks worldwide.

smartCharge:

smartCharge enables real time prepaid mobile top-ups to any mobile phone and recharge transfers to over 250 partner mobile network operators in 90 countries, reaching 3.6 billion prepaid users. Subscribers can offer top-ups as a gift to any mobile phone globally.

smartBill:

smartBill allows users to pay bills to approximately 14,000 companies within the US, including utilities, mobile phone providers and other. A full list of the billers currently supported via smartBill is available on request or via the smartWallet application.

| Page 22 |

smartTel:

Through the integration with a billing system, users will be able to access their ‘my account’ features through the Mobetize smartTel application. This is where we will provide users the ability to access the Got Prepaid domestic top up solution.

smartCard:

Now with our agreement with DCR Strategies users will be able to request (during sign-up or at any time via the Mobetize app) a prepaid MasterCard or Visa card, which is linked to their smartWallet. Users will be able to move any cleared funds from their smartWallet on to the MasterCard, allowing them to make purchases both online and in retail locations, plus withdraw cash from ATMs and Green Dot affiliated locations across the US that includes Walmart, CVS, RiteAid, Walgreens and 7 Eleven Stores.

Users will be able to track the balance and see recent transactions via the Mobetize smartWallet and can easily move money back to the smartWallet via the Mobetize App. The smartCard MasterCard will have the same white-label branding as the smartWallet for a seamless user experience.

CRM and Reporting Tool:

Mobetize will also provide an online access to its CRM and reporting system.

The reporting system can be configured so that different levels within a customer’s team can see and access different levels of information, through user access rights and logons. The reporting tool provides real time data, at different levels of detail, allowing to track such metrics as:

| • | Transactions $ values |

| • | Transaction volume-by type of transaction |

| • | Number of registered users |

| • | Number of active users |

| • | Geographic splits |

| • | Other KPIs as defined |

The web based CRM tool, will allow staff to provide Tier 1 customer support for the smartWallet solutions. Through this web-tool, the staff will be able to access and update customer data such as:

| • | User information (name, address, etc.) |

| • | User transaction history |

| • | User wallet balance |

| • | Issue refunds of balances in wallet |

Payment Products and Solutions:

Additionally, we offer accessible, convenient and powerful for both merchants and consumers. Our business has a global leading mobile commerce platform that enables merchant customers to offer secure and convenient non-near field communication payment solutions. With our revolutionary mobile commerce technologies, merchants are able to provide enhanced purchasing experiences to their consumers. We have commenced operations with our first products designed and ready for sale and/or implementation.

We have implemented revolutionary mobile commerce solutions that cater to the needs of merchants and consumers alike both online and in-store. Our mobile services platform makes it easier for consumers to perform mobile transactions through a secure, bank grade mobile interface anytime, anyplace. Our attention to detailed user experience makes payments simple, convenient and safe. Our carefully chosen features provide unparalleled quality to our customers, partners and business associates across the world.

| Page 23 |

Our mobile commerce solution has the advantages of;

| • | a custom branded wallet; |

| • | deepening customer relationships and loyalty; |

| • | launching new products and services via mobile; |

| • | attracting new customers and increase sales; |

| • | reducing customer payment-processing costs; |

| • | interoperability; and |

| • | reducing fraud and increase customers’ security. |

With our mWallet, mPay and mPos solutions we address the needs of merchants worldwide.

mPOS

With our mobile point of sale product (“mPOS”) we allow merchant customers to shift their cashiers out from behind a register and into the storefront. Our mPOS leverages the merchant’s most valuable assets – their employees. Cashiers are empowered to act as in-store sales associates with a mobile device to connect with shoppers and provide them with detailed product information, real-time pricing and inventory data and provide a higher level of customer service.

The interactive and fully integrated solution offers powerful selling tools, including cross-sells, up-sells and individual shopper history to increase average cart size. mPOS ensures a more personalized and interactive in-store experience to drive higher conversion rates while decreasing both the number of registers needed and the time shoppers spend in line.

mPay

mPay is designed to transform the in-store customer experience using the most convenient device for payment- their mobile device. mPay accelerates a merchant’s customer’s shopping process by turning their smartphones into a self-checkout device. The customer’s mobile device is the ubiquitous point of access to converge data and metrics of online and retail shopping from both ecommerce and in-store technologies. The mPay solution allows consumers to engage and transact with merchants in-store and complete a self-checkout process. mPay is designed to transform the in-store customer experience using the most convenient device for payment- their mobile device.

mWallet

With mWallet, merchant customers can securely store credit cards, offers, and loyalty points on their phones specific to merchant brands ensuring a safe, secure and scalable platform for merchants to implement their mobile payment strategy.

The mWallet solution can be implemented by merchants to enable mobile shopping and ordering for their customers. As more and more retail shopping is shifting to mobile, the mWallet solution ensures a safe, secure and scalable platform for merchants to implement their mobile payment strategy.

Mobile Banking Products and Solutions:

On March 26, 2012, Telupay PLC entered into a five-year License Agreement with Baccarat Overseas, Ltd. (“Baccarat”) for the latter’s use and distribution of the mobile banking and payment software owned by Telupay PLC. A License Assignment Agreement between Priveco and Baccarat Overseas Ltd. dated August 21, 2012 assigned the license from the License Agreement to Priveco, which made up part of the asset purchase by us.

| Page 24 |

Our mobile banking services (“MBS”) technology is a secure, robust method of delivering bank-grade transactions via an intuitive interface on mobile devices. Our MBS technology is not tied to proprietary bank or operator technologies, which gives it the ability to provide its service to all of the major banks, mobile operators, and agent networks worldwide. Highlights of our MBS business development include strong progress in Philippine business where three top ten banks and one of two interbank networks are now using our MBS platform, including Metrobank, Union Bank, United Coconut Planters Bank, and MegaLink, an interbank network servicing 17 national banks in the Philippines.

Latest Developments and Customers:

On September 3, 2014, we were selected by DCR Strategies Inc – TruCash., to be the core mobile wallet and mobile financial services (MFS) provider, which will be fully integrated to the TruCash prepaid card mobile application.

We have extended our existing partnership with DCR to offer Mobetize mobile financial services and products to the many millions of existing DCR prepaid card users in North America.

On September 8, 2014 we entered into an agreement with Impact Telecom, a global provider of voice, messaging, and data services, to offer the Mobetize mobile wallet platform to deliver international money transfer, mobile airtime top-up, and bill payments to Impact Telecom’s extensive customer base in the United States and Canada.

Impact Telecom customers—including Startec customers, Impact’s leading brand for international calling— will see these features available online and on their mobile devices in Q4 2014. U.S. and Canada currently remit over $100 billion annually, and most of that money is transferred utilizing traditional storefront methods. The Mobetize mobile wallet platform improves reach, convenience, and low cost to customers by digitizing these financial transactions via mobile devices.

We accelerate the migration of traditional e-commerce to mobile payment. Our smart solutions platform provides telecommunications operators and payment gateways unparalleled mobile functionality in bill management, payments, recharge, domestic money transfers, international remittances, point-of-sale functionality, and numerous other related technologies.

Our wallet platform—designed to enable telecommunications operators to increase customer retention, maximize average revenue per user, and minimize churn—provides the market’s smoothest and most cost-effective transition of existing e-commerce to mobile.

On October 27, 2014, we entered into an agreement with SurePay Payment Services, an emerging global payment solutions provider in UAE funded by the Royal Group UAE www.royalclubuae.ae. We will enable SurePay to provide mobile wallet services such as money transfer and airtime top-up funded via the payroll from expatriate workers living in the United Arab Emirates (UAE). This follows the previously-announced memorandum of understanding signed with iWire Consulting, SurePay's integration, development and technology partner.

| Page 25 |

With more than 8 million foreign residents from 140 different countries, the international money transfer remittance market is very large in the UAE. According to the UAE Government, over US$20 billion was remitted from the UAE during 2012 and other money transfer experts have stated remittances from UAE were nearly US$30 Billion for 2013. Many expatriate workers in the UAE and consumers need better information about their finances, and desire the ease and convenience of conducting financial transactions via a mobile device. Although these workers and consumers often have insufficient access to financial services, their access to mobile phones is widespread. According to Nielsen, there is 78 percent smartphone penetration in the UAE, which is one of the highest penetration rates in the MENAP region. In fact, 81 percent of mobile owners age 16-34 now own smartphones, and penetration is rising steadily among other age groups as well.

Our smartWallet platform will enable SurePay, on a white label basis, to offer a rich mobile wallet feature set and services to employers and their expatriate workers including features such as user registration, customized account settings, balance view, and stored payment methods. According to the terms of the three-year agreement, we will initially provide SurePay's users our smartWallet platform, smartRemit international money transfer service, and our smartCharge mobile phone airtime top-up/ recharge service. Additional services, including bill payments, POS payments, prepaid cards and other services will be added to the wallet. In exchange for our services, SurePay will pay us an integration fee and receive a variable fee per transaction based on volumes and types of financial service provided. Discussions on integration have begun with several leading banks in the UAE, with service expected to commence in 2015.

On December 22, 2014 Mr. Kenneth F Douglas joined Mobetize Corp. as a strategic advisor to assist the Company's expansion of mobile financial services, partnerships, and M&A in North America and Europe.

Mr. Douglas is currently a Senior VP Business and Partnership Development in SEQR USA, Inc. He is responsible for building the US operations for SEQR USA, Inc., (www.seqr.com) a subsidiary of Seamless Distribution AB (www.seamless.se) based in Stockholm, Sweden, a global mobile payment company providing prepaid top-up and mobile payments in 30 countries with over 3.1 billion transactions annually.

Mr. Douglas speaks regularly as an Industry Leader for Pacific Crest Securities MOSAIC group as an SME (Subject Matter Expert) for the payment industry, payments, emerging/alternative payments, mobile payments and technology.

Previously, Mr. Douglas served as Executive VP Partnerships and Alliances at Zipmark, Executive VP Partnerships and Alliances at Adility (acquired by inComm), Executive VP of Social Gaming and Commerce at Twitpay (acquired by Acculynk), and VP and General Manager of Merchant Services at Revolution Money (acquired by American Express) where he was responsible for building the RevolutionCard Network(TM) with over 700,000 accepting merchants and 300,000 card holders/members.

Currently, Mr. Douglas sits on the Advisory Board for a number of fintech companies in multiple stages of growth -- ShelfBucks, ShopMyNeighborhood(TM), EyeBuyTV, OrderIt, RedCritter, BRANDedTray, and Zipmark.

In April 2015 we completed the production version of Mobile Web application 1.0. This consists of smartCard, Paypal, bank ACH and credit card processing as cash-in options. Cash-out options include smartCharge, smartBill, person-to-person transfers, and smartCard for ATM withdrawals and POS purchases. The CRM, reporting, and incident management tools have also been completed while the desktop version and Representation State Transfer (REST) APIs with all of the above features have been completed. During the three months ended June 30, 2015 Mobetize began receiving the initial revenue stream from its first customer, CostMaster, who began using the Mobile Web application Version 1.0 for delivery of their foreign payroll.

| Page 26 |

In May 2015 we were in the final phase of development of Version 2.0 for rollout to two additional customers Impactel and TruConnect. This release will cover REST APIs, Mobile Web, Desktop Web, CRM, and reporting tools as well as native applications for iOS and Android. MPAY’s Version 2.0 includes the most significant component and key differentiator of our offering to-date being International Money Transfer capabilities globally via our two International Money Transfer partners. Version 2 allows our 2 current Telco customers Impactel and TruConnect to offer their combined 1.3 million customers International Money Transfer capabilities from USA to over 150 countries via a network of nearly 200,000 payout agent locations and bank transfers to over 600 Banks in those countries. The World Bank estimated in 2014 $131 Billion dollars was sent from the USA by residents and immigrants works to their family members in their respective countries. The USA is the largest market for these money transfer services accounting for over 22% of all global money transfers. MPAY’s Version 2.0 is expected to generate multiple revenue streams for Mobetize from the deployment of these mobile and desktop financial services via Impactel and TruConnect to their 1.3 million current customers.