Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Yellow Corp | d94883d8k.htm |

YRC Worldwide Inc. Investor Presentation November 2015 Exhibit 99.1

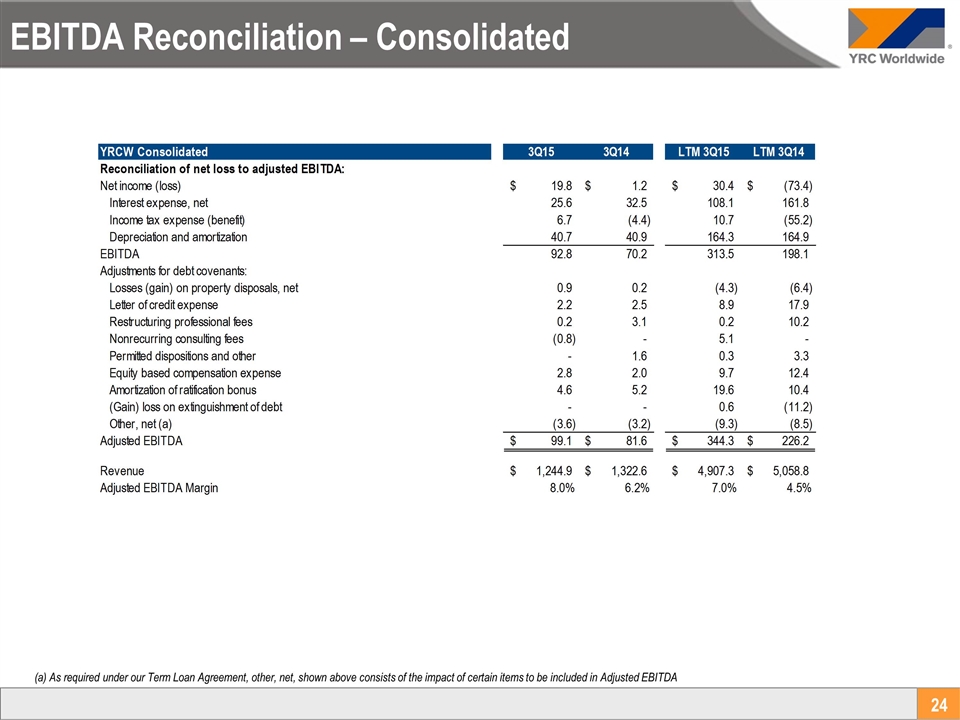

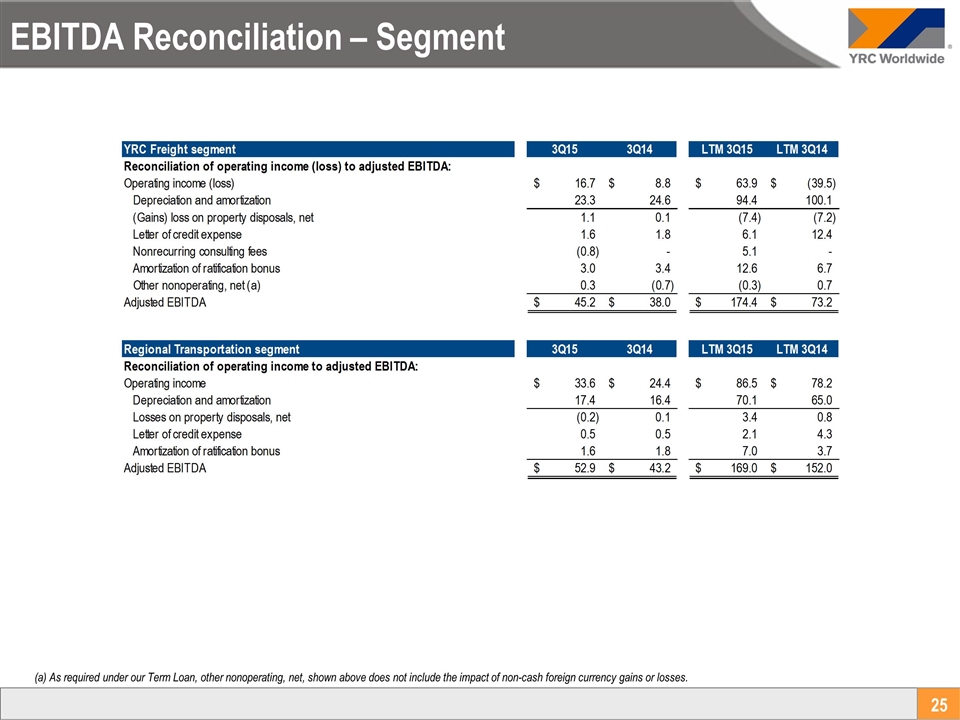

Forward Looking Disclosures The information in this presentation is summary in nature and may not contain all information that is important to you. The Recipient acknowledges and agrees that (i) no representation or warranty regarding the material contained in this presentation is made by YRC Worldwide Inc. (the “Company” or “we”) or any of its affiliates and (ii) that the Company and its affiliates have no obligation to update or supplement this presentation or otherwise provide additional information. This presentation is for discussion and reference purposes only and does not constitute an offer to sell or the solicitation of an offer to buy any securities or other property. This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements relate to future events or future performance of the Company and include statements about the Company’s expectations or forecasts for future periods and events. Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or “continue,” the negative of such terms or other comparable terminology. We disclaim any obligation to update those statements, except as applicable law may require us to do so, and we caution you not to rely unduly on them. We have based those forward-looking statements on our current expectations and assumptions about future events, and while our management considers those expectations and assumptions to be reasonable, they are inherently subject to significant business, economic, competitive, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. Therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to, those we discuss in the “Risk Factors” section of our Annual Report on Form 10-K and in other reports we file with the Securities and Exchange Commission. This presentation includes the presentation of Adjusted EBITDA, a non-GAAP financial measure. Adjusted EBITDA is not a measure of financial performance in accordance with generally accepted accounting principles and may exclude items that are significant in understanding and assessing our financial results. Therefore, this measure should not be considered in isolation or as an alternative to net income from operations, cash flows from operations, earnings per fully-diluted share or other measures of profitability, liquidity or performance under generally accepted accounting principles. You should be aware that this presentation of Adjusted EBITDA may not be comparable to similarly-titled measures used by other companies. A reconciliation of this measure to the most comparable measures presented in accordance with generally accepted accounting principles has been included in this presentation.

Introduction YRC Worldwide is one of the largest less-than-truckload (LTL) carriers in North America and generates approximately $5 billion of annual revenue by providing services under a portfolio of four subsidiaries Approximately 23% of the public carrier market share by tonnage Providing the broadest coverage and more service capability throughout North America than any competitor

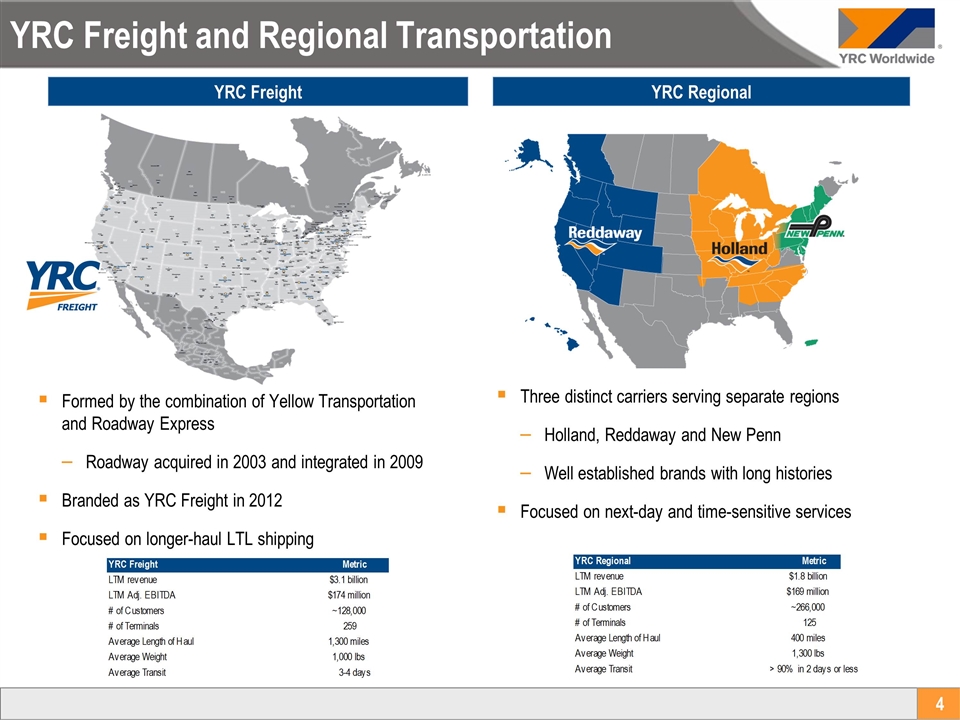

YRC Freight and Regional Transportation Formed by the combination of Yellow Transportation and Roadway Express Roadway acquired in 2003 and integrated in 2009 Branded as YRC Freight in 2012 Focused on longer-haul LTL shipping Three distinct carriers serving separate regions Holland, Reddaway and New Penn Well established brands with long histories Focused on next-day and time-sensitive services YRC Freight YRC Regional

Diversified Customer Base Long-standing and stable relationships with a large, diversified base of customers Customers range from Fortune 1000 global corporations to small, privately-held businesses Top 5 customers account for approximately 10% of total revenue Recognized by customers as leading operator Recently received Walmart’s “2014 National LTL Carrier of the Year” award for outstanding service Received this award in 3 of the last 5 years Diversified Customer Base

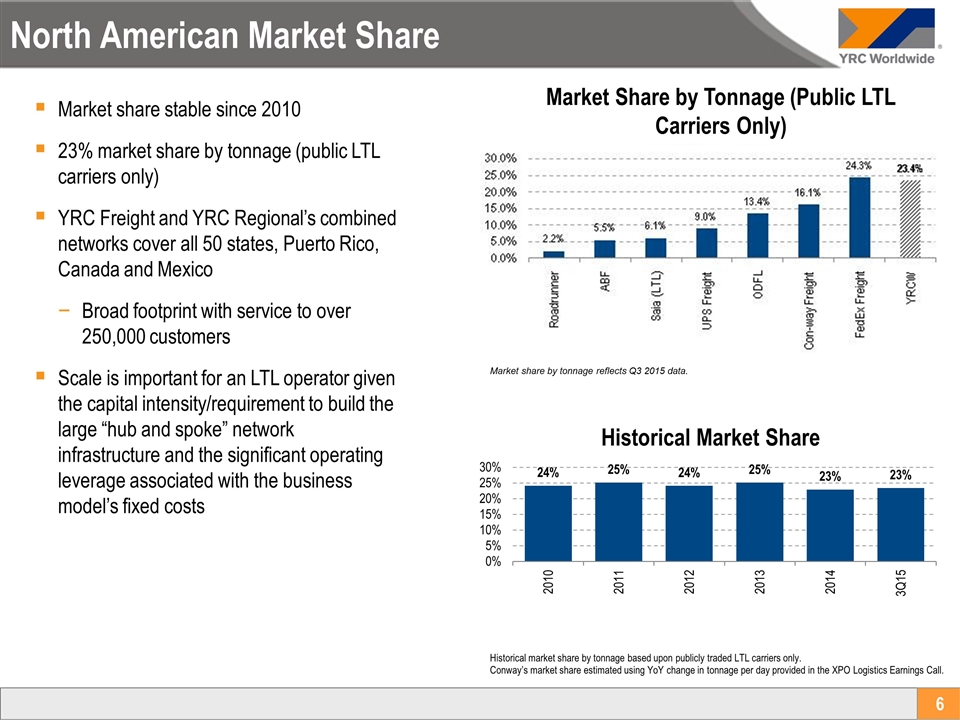

North American Market Share Market share stable since 2010 23% market share by tonnage (public LTL carriers only) YRC Freight and YRC Regional’s combined networks cover all 50 states, Puerto Rico, Canada and Mexico Broad footprint with service to over 250,000 customers Scale is important for an LTL operator given the capital intensity/requirement to build the large “hub and spoke” network infrastructure and the significant operating leverage associated with the business model’s fixed costs Historical market share by tonnage based upon publicly traded LTL carriers only. Conway’s market share estimated using YoY change in tonnage per day provided in the XPO Logistics Earnings Call. Market share by tonnage reflects Q3 2015 data. Market Share by Tonnage (Public LTL Carriers Only)

Highly Experienced Management 24 years of industry experience Prior to being named President of YRC Freight, Darren was Senior Vice President of Sales for the Company James Welch CEO, YRCW Jamie Pierson CFO, YRCW Scott Ware President, Holland 34 years of experience in the transportation and logistics industry Returned to the Company in 2011 to become CEO Acted as an advisor to the Company from early 2009 – November 2011 Joined as CFO in late 2011 27 years of industry experience Prior to being named President of Holland, Scott was Vice President of Operations and Linehaul for the Company Don Foust President, New Penn 35 years of industry experience Recognized throughout his career for strong leadership, team building and outstanding results in sales and operations performance TJ O’Connor President, Reddaway 30 years of industry experience Prior to being named President of Reddaway in 2007, T.J. served as President and CEO of USF Bestway James Fry Vice President – General Counsel & Corporate Secretary, YRCW 20 years of industry experience Prior to YRCW, James served as Executive Vice President, General Counsel, and Secretary for Swift Transportation Company Darren Hawkins President, YRC Freight 150 Years of Operating Experience

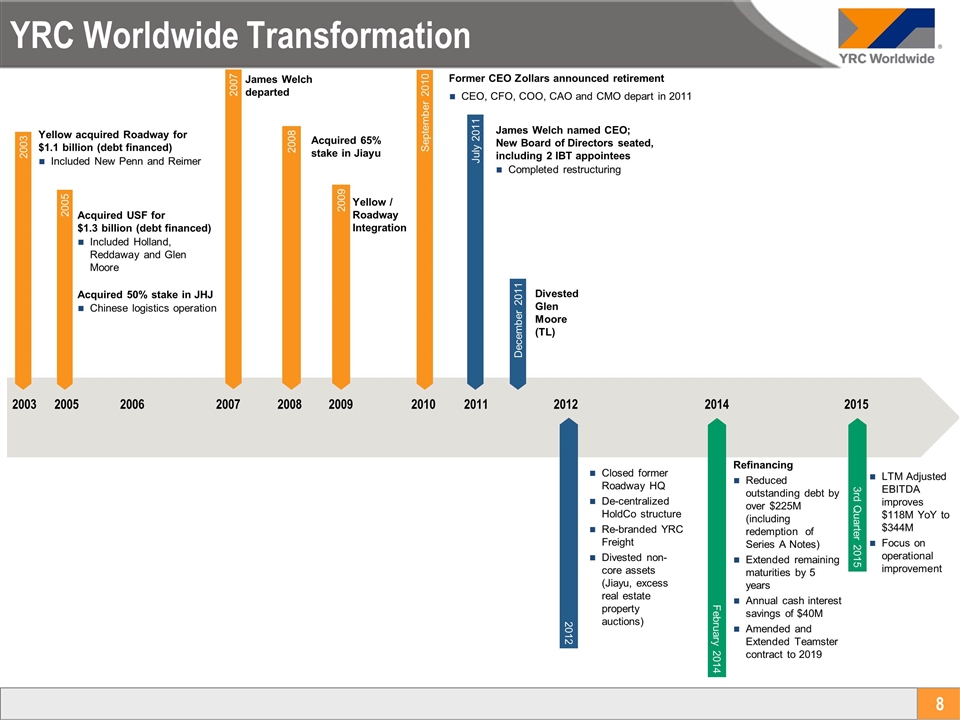

2003 2005 2006 2007 2008 2009 2010 2011 2012 2014 2015 Yellow acquired Roadway for $1.1 billion (debt financed) Included New Penn and Reimer Acquired USF for $1.3 billion (debt financed) Included Holland, Reddaway and Glen Moore Acquired 50% stake in JHJ Chinese logistics operation James Welch named CEO; New Board of Directors seated, including 2 IBT appointees Completed restructuring 2005 2003 July 2011 Closed former Roadway HQ De-centralized HoldCo structure Re-branded YRC Freight Divested non-core assets (Jiayu, excess real estate property auctions) Former CEO Zollars announced retirement CEO, CFO, COO, CAO and CMO depart in 2011 September 2010 James Welch departed 2007 Divested Glen Moore (TL) December 2011 Acquired 65% stake in Jiayu 2008 Historical Adj. EBITDA(1) ($ in millions) NM(2) 2010A – 2012A CAGR of ~63% 2009 Yellow / Roadway Integration Refinancing Reduced outstanding debt by over $225M (including redemption of Series A Notes) Extended remaining maturities by 5 years Annual cash interest savings of $40M Amended and Extended Teamster contract to 2019 YRC Worldwide Transformation 2012 February 2014 3rd Quarter 2015 LTM Adjusted EBITDA improves $118M YoY to $344M Focus on operational improvement

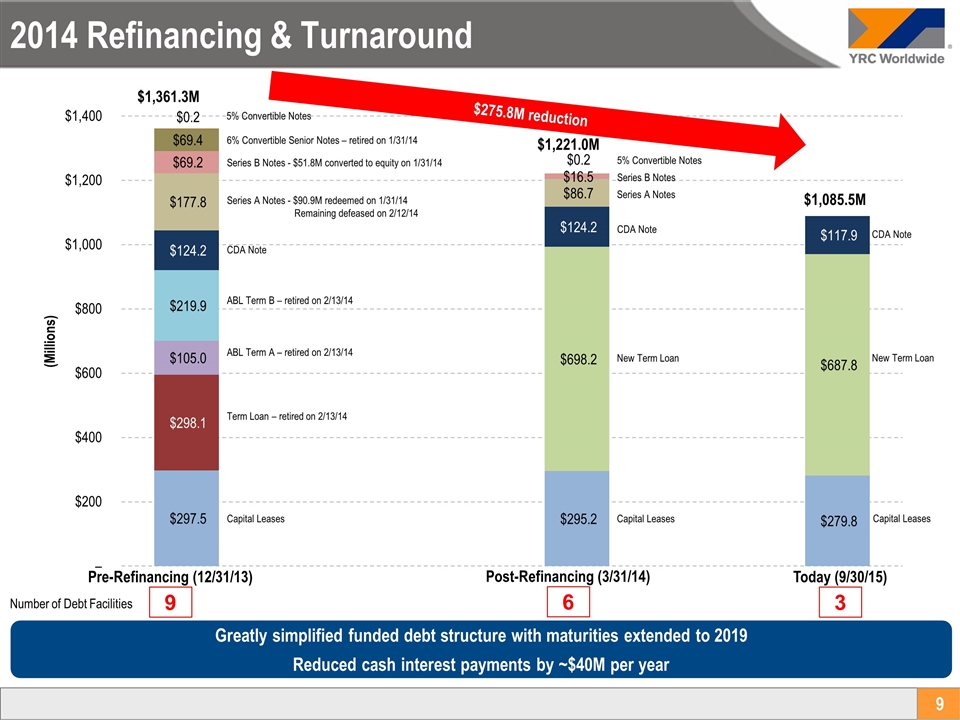

2014 Refinancing & Turnaround Term Loan – retired on 2/13/14 ABL Term A – retired on 2/13/14 Capital Leases ABL Term B – retired on 2/13/14 CDA Note Series A Notes - $90.9M redeemed on 1/31/14 Remaining defeased on 2/12/14 Series B Notes - $51.8M converted to equity on 1/31/14 6% Convertible Senior Notes – retired on 1/31/14 Capital Leases New Term Loan CDA Note $1,361.3M $1,085.5M $275.8M reduction Pre-Refinancing (12/31/13) Today (9/30/15) Greatly simplified funded debt structure with maturities extended to 2019 Reduced cash interest payments by ~$40M per year 9 3 5% Convertible Notes 5% Convertible Notes Series B Notes Series A Notes Post-Refinancing (3/31/14) 6 Capital Leases New Term Loan CDA Note $1,221.0M Number of Debt Facilities

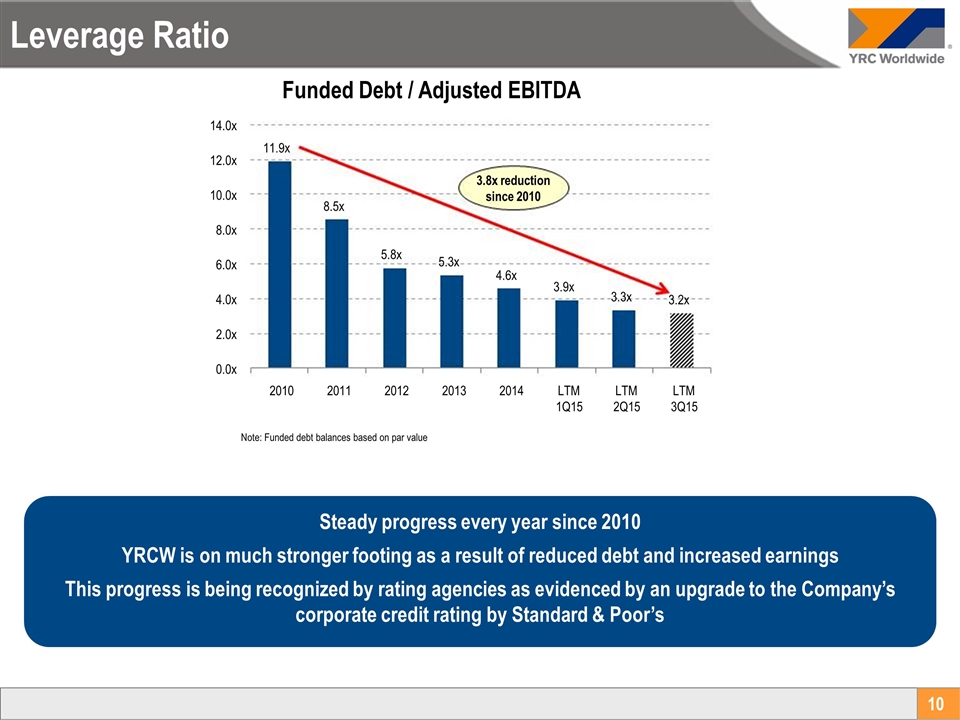

Leverage Ratio Steady progress every year since 2010 YRCW is on much stronger footing as a result of reduced debt and increased earnings This progress is being recognized by rating agencies as evidenced by an upgrade to the Company’s corporate credit rating by Standard & Poor’s Note: Funded debt balances based on par value 3.8x reduction since 2010 11.9x 8.5x 5.8x 5.3x 4.6x 3.9x 3.3x 3.2x 0.0x 2.0x 4.0x 6.0x 8.0x 10.0x 12.0x 14.0x 2010 2011 2012 2013 2014 LTM 1Q15 LTM 2Q15 LTM 3Q15 Funded Debt / Adjusted EBITDA

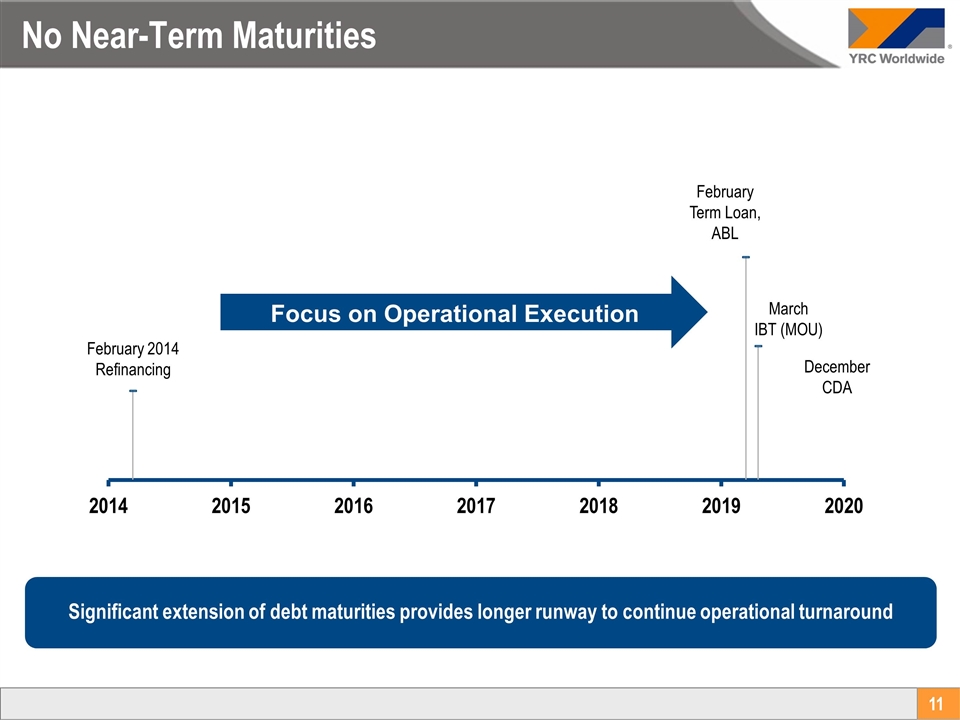

No Near-Term Maturities Focus on Operational Execution Runway February 2014 Refinancing February Term Loan, ABL March IBT (MOU) December CDA Significant extension of debt maturities provides longer runway to continue operational turnaround

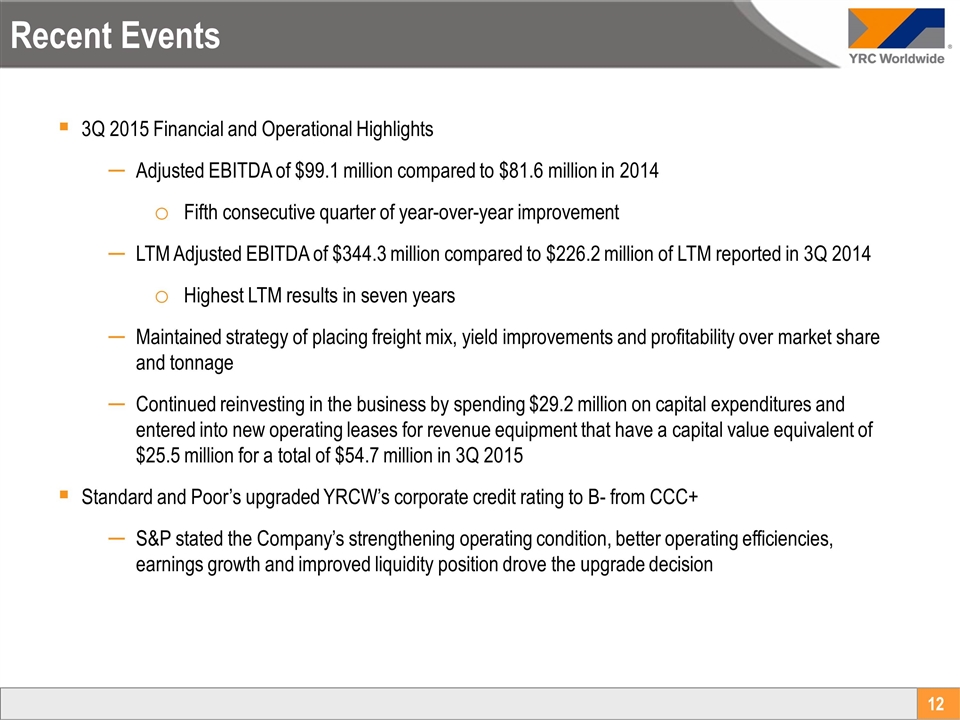

Recent Events 3Q 2015 Financial and Operational Highlights Adjusted EBITDA of $99.1 million compared to $81.6 million in 2014 Fifth consecutive quarter of year-over-year improvement LTM Adjusted EBITDA of $344.3 million compared to $226.2 million of LTM reported in 3Q 2014 Highest LTM results in seven years Maintained strategy of placing freight mix, yield improvements and profitability over market share and tonnage Continued reinvesting in the business by spending $29.2 million on capital expenditures and entered into new operating leases for revenue equipment that have a capital value equivalent of $25.5 million for a total of $54.7 million in 3Q 2015 Standard and Poor’s upgraded YRCW’s corporate credit rating to B- from CCC+ S&P stated the Company’s strengthening operating condition, better operating efficiencies, earnings growth and improved liquidity position drove the upgrade decision

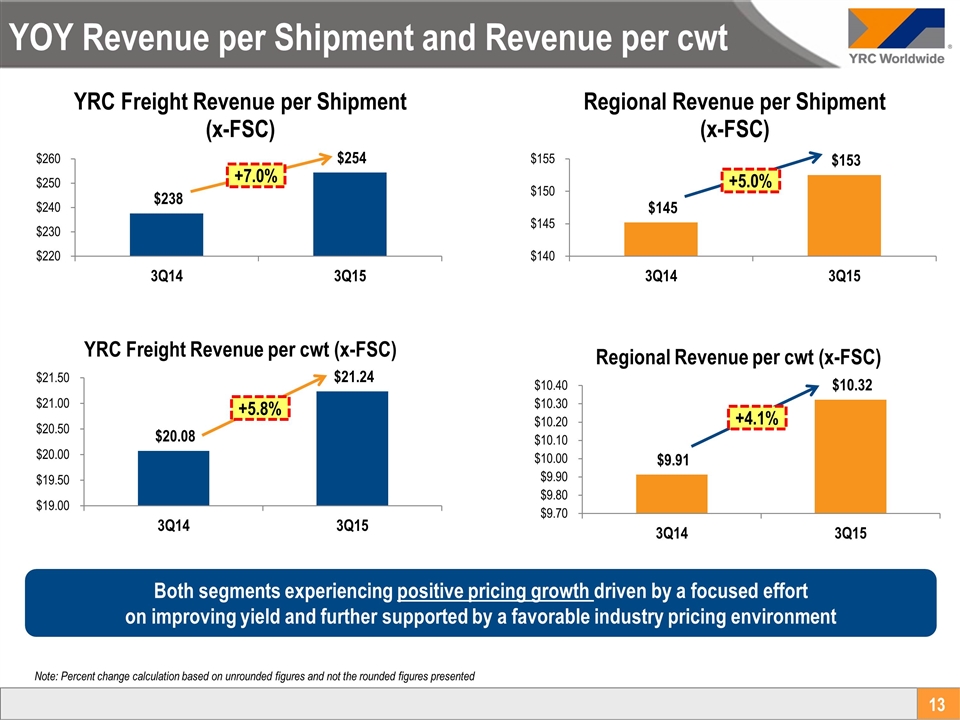

YOY Revenue per Shipment and Revenue per cwt Both segments experiencing positive pricing growth driven by a focused effort on improving yield and further supported by a favorable industry pricing environment Note: Percent change calculation based on unrounded figures and not the rounded figures presented +5.8% +7.0% +5.0% +4.1%

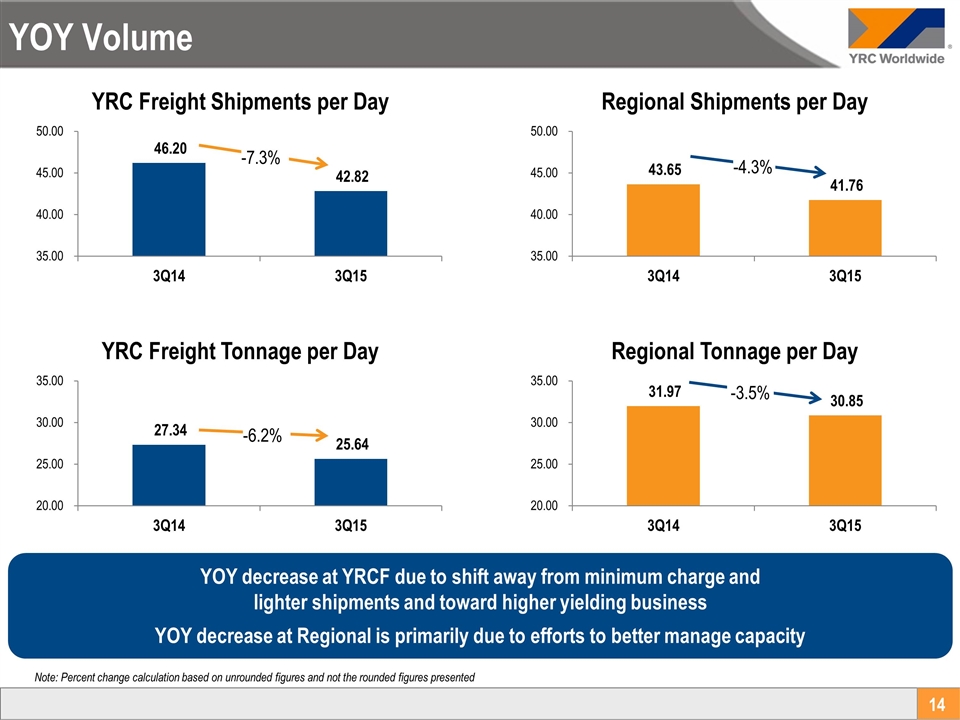

YOY Volume YOY decrease at YRCF due to shift away from minimum charge and lighter shipments and toward higher yielding business YOY decrease at Regional is primarily due to efforts to better manage capacity Note: Percent change calculation based on unrounded figures and not the rounded figures presented -7.3% -6.2% -4.3% -3.5%

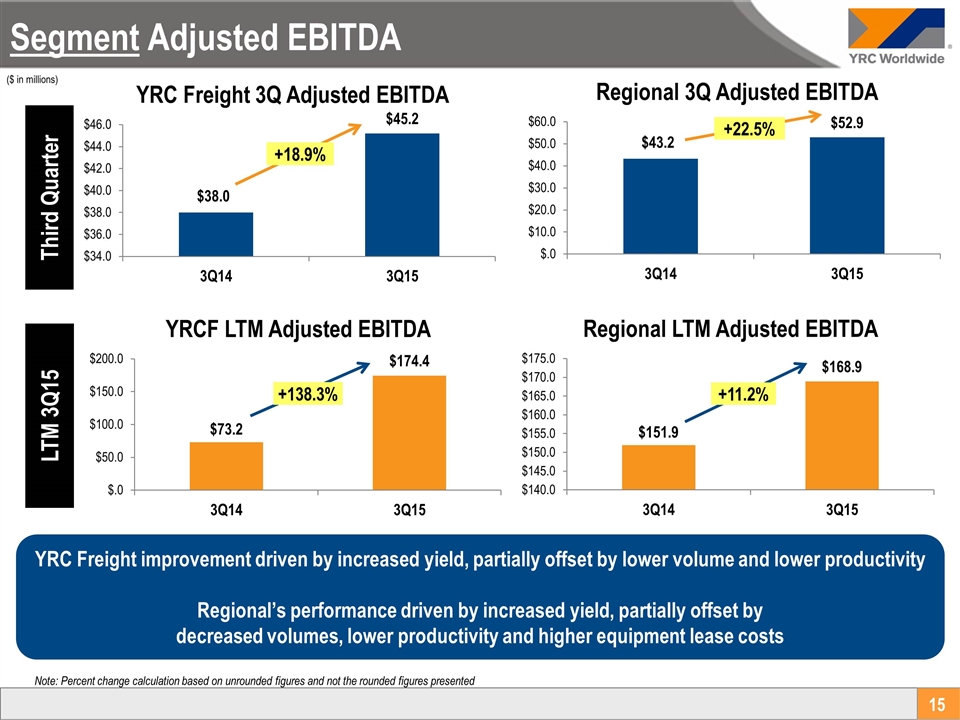

Segment Adjusted EBITDA ($ in millions) YRC Freight improvement driven by increased yield, partially offset by lower volume and lower productivity Regional’s performance driven by increased yield, partially offset by decreased volumes, lower productivity and higher equipment lease costs Third Quarter LTM 3Q15 Note: Percent change calculation based on unrounded figures and not the rounded figures presented +18.9% +138.3% +22.5% +11.2%

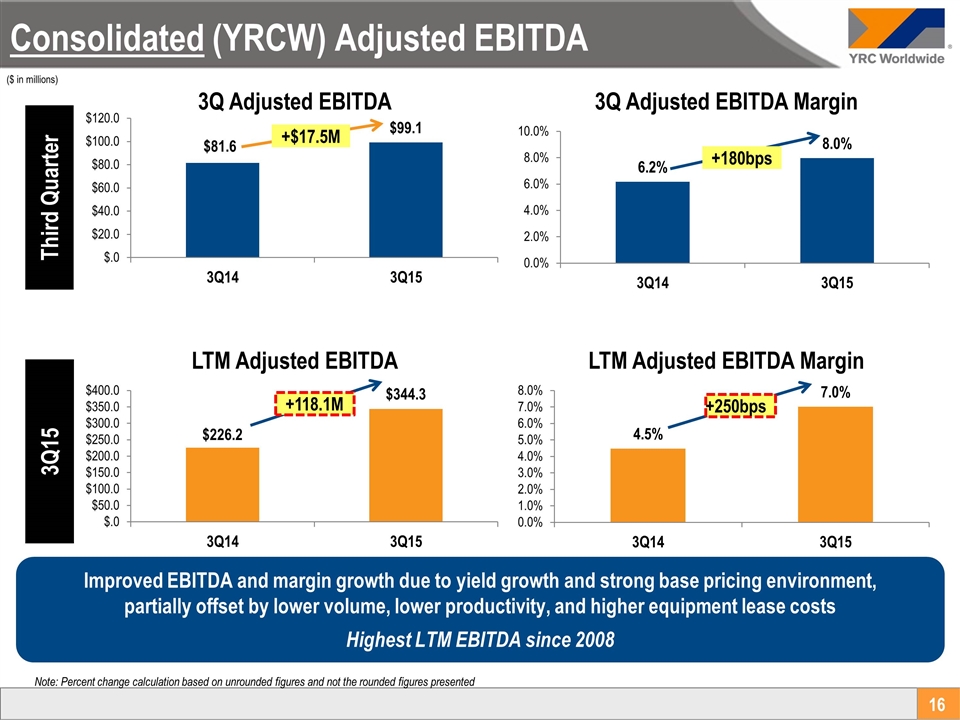

Consolidated (YRCW) Adjusted EBITDA ($ in millions) Improved EBITDA and margin growth due to yield growth and strong base pricing environment, partially offset by lower volume, lower productivity, and higher equipment lease costs Highest LTM EBITDA since 2008 Third Quarter 3Q15 Note: Percent change calculation based on unrounded figures and not the rounded figures presented +$17.5M +118.1M +250bps +180bps

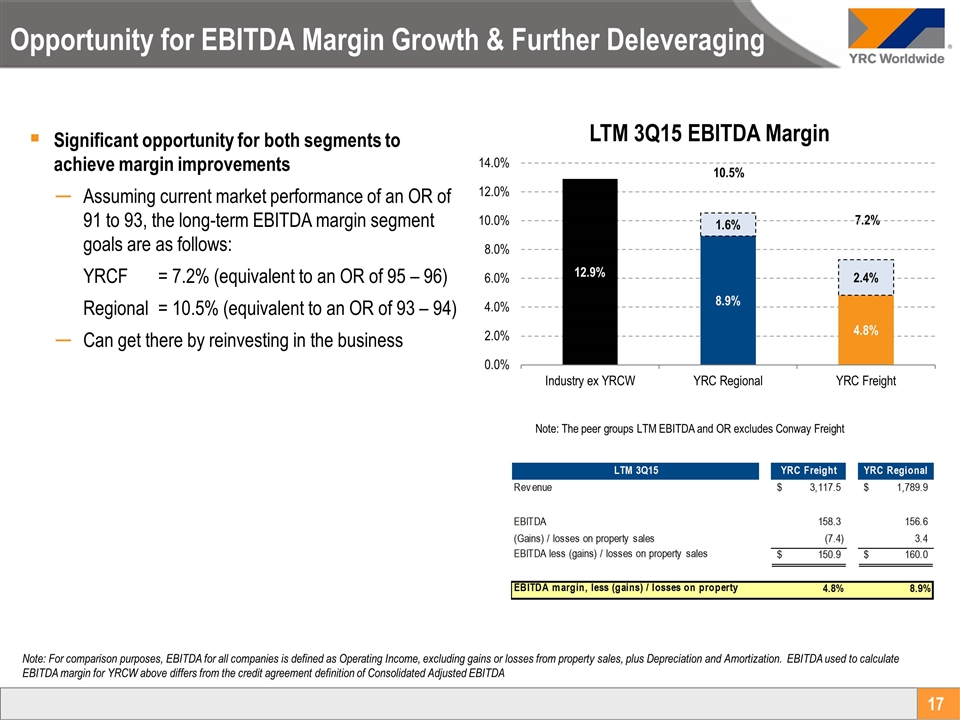

Opportunity for EBITDA Margin Growth & Further Deleveraging Significant opportunity for both segments to achieve margin improvements Assuming current market performance of an OR of 91 to 93, the long-term EBITDA margin segment goals are as follows: YRCF= 7.2% (equivalent to an OR of 95 – 96) Regional = 10.5% (equivalent to an OR of 93 – 94) Can get there by reinvesting in the business Note: For comparison purposes, EBITDA for all companies is defined as Operating Income, excluding gains or losses from property sales, plus Depreciation and Amortization. EBITDA used to calculate EBITDA margin for YRCW above differs from the credit agreement definition of Consolidated Adjusted EBITDA 10.5% 7.2% Note: The peer groups LTM EBITDA and OR excludes Conway Freight

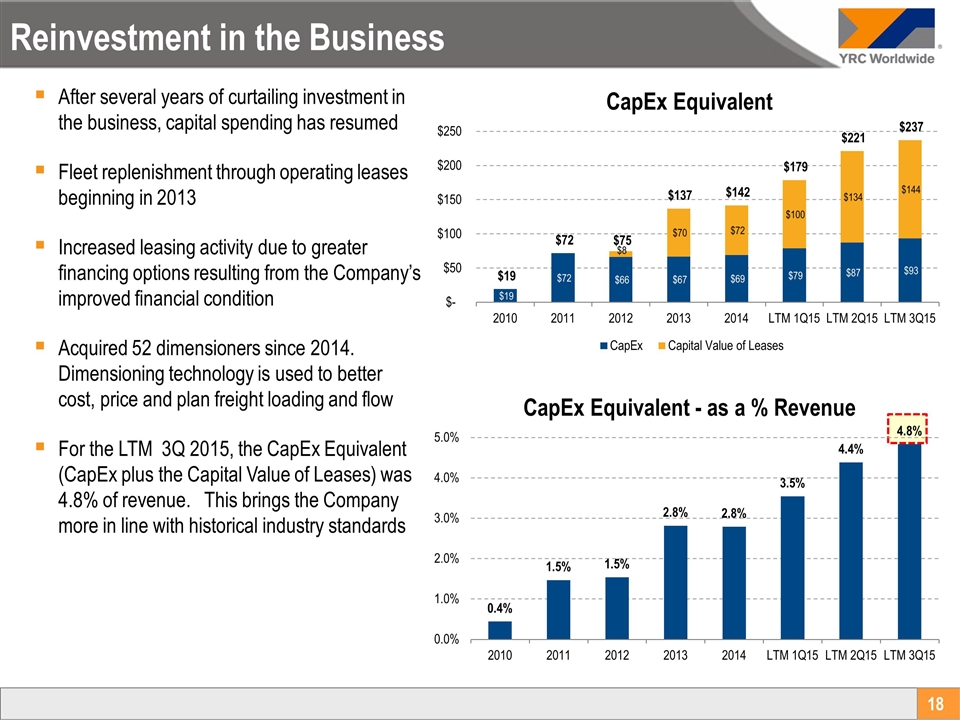

Reinvestment in the Business After several years of curtailing investment in the business, capital spending has resumed Fleet replenishment through operating leases beginning in 2013 Increased leasing activity due to greater financing options resulting from the Company’s improved financial condition Acquired 52 dimensioners since 2014. Dimensioning technology is used to better cost, price and plan freight loading and flow For the LTM 3Q 2015, the CapEx Equivalent (CapEx plus the Capital Value of Leases) was 4.8% of revenue. This brings the Company more in line with historical industry standards

Reinvestment in the Business YRCW’s goal is to more aggressively replenish the fleet through a combined approach of purchasing and leasing new tractors and trailers Further roll-out of dimensioning technology Retrofitting existing fleet with in-cab collision avoidance systems to enhance safety Tablets for dock supervisors to more efficiently manage dock operations Implemented Kronos workforce management technology Logistical planning technology to improve network efficiencies

Forward Looking Considerations Plan to continue investing back into the business to enhance shareholder value Teamster contract (memorandum of understanding) in place through March 2019 Wage increases of $0.34 per hour each year from 2016 - 2018 Required contributions to pension plans remain at $1.75 per hour Established profit sharing bonuses contingent upon operating ratio metrics No long-term debt / facility maturities until 2019 Federal net operating losses (NOL) as of year-end 2014 that expire between 2028 - 2034 $462.8 million of NOL carryforwards (total of $697.8 million less $234.7 million that will not be utilized due to IRS limitations) Minimizes federal cash income tax payments Projected 4Q 2015 settlement charge of $25 – $35 million resulting from pension lump sum benefit payments Non-cash income statement expense to salaries, wages and employee benefits Final settlement charge will be dependent on actual year-end discount rate and asset returns

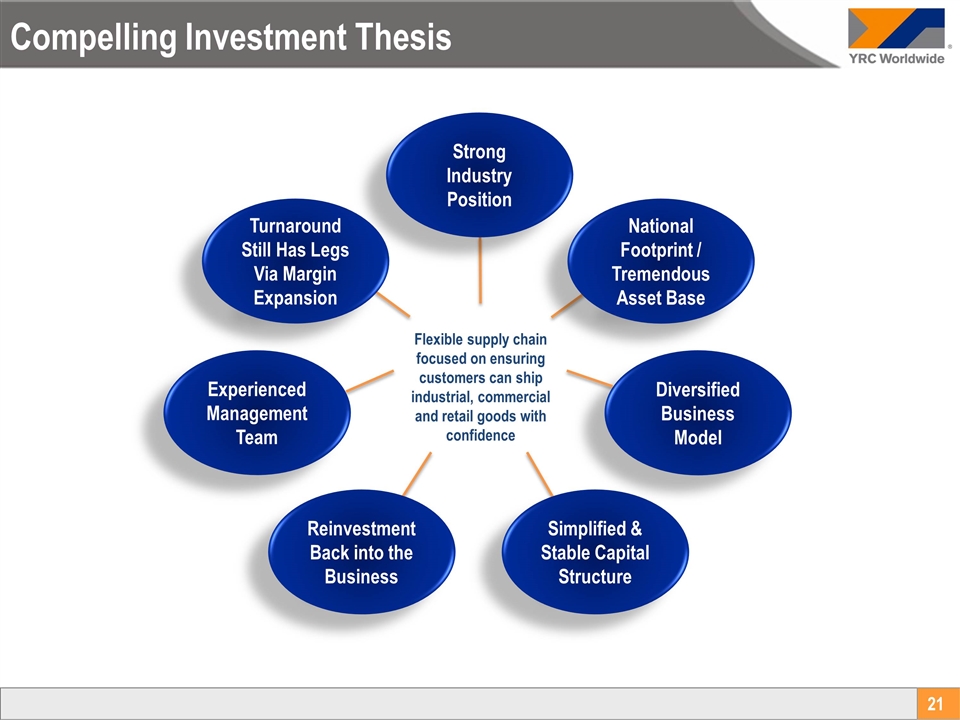

Compelling Investment Thesis Strong Industry Position Simplified & Stable Capital Structure Diversified Business Model National Footprint / Tremendous Asset Base Experienced Management Team Turnaround Still Has Legs Via Margin Expansion Reinvestment Back into the Business Flexible supply chain focused on ensuring customers can ship industrial, commercial and retail goods with confidence

Investor Relations Information NASDAQ: YRCW www.yrcw.com Company contact: Tony Carreño Vice President – Investor Relations (913) 696-6108 tony.carreno@yrcw.com

Appendix

EBITDA Reconciliation – Consolidated (a) As required under our Term Loan Agreement, other, net, shown above consists of the impact of certain items to be included in Adjusted EBITDA

EBITDA Reconciliation – Segment (a) As required under our Term Loan, other nonoperating, net, shown above does not include the impact of non-cash foreign currency gains or losses.