Attached files

| file | filename |

|---|---|

| 8-K - 8-K NOVEMBER 2015 INVESTOR PRESENTATION - TALMER BANCORP, INC. | form8knovember2015investor.htm |

November 2015 David Provost Chief Executive Officer Tom Shafer Chief Operating Officer Exhibit 99.1

1.60% 0.98% 2.09% 1.61% 0.62% 1.11% 1.23% 2011Y2012Y2013Y2014Y Q1 2015 Q2 2015 Q3 2015 Organic 67% Acquired 33% Franchise Overview Note: Assets and loans shown in billions. (1) NPLs to loans, excluding covered loans. 2 Talmer is Building a High-Performing Midwest Franchise through Organic Growth & Successful Acquisitions • $6.5bn Midwestern bank holding company headquartered in Michigan • Grew from $70mm in 2009 as a result of private placements with sophisticated investors and a stream of disciplined acquisitions – 4 FDIC, 2 strategic, and 2 bankruptcy transactions • Experienced executive management team with over 300 years of combined industry experience and well-aligned interests stemming from large ownership share • Instituted common dividend beginning in 2Q 2014 • Repurchased and retired 5,077,000 common shares August 31, 2015 • Cultivated a core franchise through organic growth and successful integrations – 13.7% CAGR on TBV per share from 4/30/2010 through 3Q 2015 – Executing on organic growth strategy and continued expansion of production efficiency – Flexible balance sheet with 11.02% TCE / TA and 1.02% NPL(1) – Acquired loans were marked to fair value – 7% of loans covered by FDIC loss sharing agreements Tangible Results Asset Growth Organic and Acquired Loans In-market Loan Portfolio Reported ROAA $3.1bn $1.6bn $0.1 $1.7 $2.1 $2.3 $4.5 $5.9 $6.5

3 Experienced & Accomplished Executive Management Team • Over 300 years of combined industry experience • Experience overseeing commercial and consumer banking, mergers and acquisitions, systems integrations, technology, operations, credit and regulatory compliance matters for private and public banks • The management team has successfully managed numerous merger & acquisition and capital transactions Officer Title Age Years Exp. Talmer Tenure Prior Experience Includes David Provost President, Chief Executive Officer & Director 61 38 7 Chairman & CEO of The PrivateBank - Michigan Gary Torgow Chairman of the Company & Board of Directors 59 36 5 Founder and Chairman of Sterling Group Dennis Klaeser Chief Financial Officer 58 34 5 CFO of PrivateBancorp, Inc. Thomas Shafer Chief Operating Officer 57 33 5 Executive VP of Specialty Banking at Citizens Republic Bancorp Gary Collins Vice Chairman & Director 57 32 4 Founding MD and Vice Chairman of The PrivateBank – Chicago Bradley Adams Executive MD - Corporate Development 41 18 4 Director of Investor Relations for Fifth Third Bancorp Gregory Bixby Executive MD & Chief Information Officer 50 27 4 CIO for Capitol Bancorp Ltd. James Dunn Executive MD & Chief Legal Officer 56 34 7 Managing Director for The PrivateBank - Michigan Karl Grunawalt Executive MD & Chief Credit Officer 60 36 1 Senior Credit Executive for KeyCorp Kathleen Wendt Executive MD & Chief Accounting Officer 42 20 4 Senior VP for Comerica, Inc.

(1) Data as of November 6, 2015 (2) Source: SNL Financial; deposit market share data per FDIC as of 6/30/2015 (3) Third quarter 2015 4 Core Franchise Driven by Disciplined & Strategic Decisions Strategic Positioning Focused Investment Scalable Infrastructure Core Customer Franchise • Invested in infrastructure, including significant talent • Approximately 2/3rds of Managing Directors are non- acquisition related hires or legacy Talmer • “Just-in-Time” capital deployment • Focus on major Midwest geographic markets • Maintain core transaction account deposits • Acquired franchises with deep roots in local communities (average acquired charter age of 75 years) • Streamlined redundant cost- structures and headcount • New front-line executives and support teams have replaced acquired management teams • Produced $1.36b in net non- acquisition loan growth in 2014; continued to invest in key new lending hires • Well-positioned in local markets, which are benefiting from the economic recovery • Generating consistent growth in the organic loan portfolio and core deposits • Low cost, transaction account oriented, local customer base • 33bps cost of deposits(3) Disciplined Actions & Strategic Decisions Tangible Results Regional Anecdotes Michigan / Detroit – • Michigan recovering faster than most states benefitted by strong auto sales and a rebound in the housing sector • Benefiting from unemployment falling from recession peak of 17% in 2009 • University of Michigan experts report that Michigan had the 4th highest private-sector job growth from 2010-2014 and predicts the addition of more than 132,000 jobs in 2015 and 2016 • Detroit Mayor, Mike Duggan, announced Detroit will have a balanced budged this year for the first time since 2002 Cleveland – Recovering economy benefiting from auto and energy industries OH Youngstown-Warren – • Similar recovery with industrial-focused economy • Within the past two years, 107 businesses have invested $682 million in the Mahoning Valley, creating 4,510 new jobs (Chamber of Commerce) OH • Operates 81 branches primarily in 4 Midwestern states (1) – 50 in MI, 27 in OH, 2 in IN, 1 in IL, and 1 in NV • Strategically focused in primary geographic areas: – Greater Detroit market with rank of #9 (2) – Youngstown-Warren market with a rank of #6 (2) Focus Market Overview MI

(1) Loan mark is inclusive of the credit and interest rate mark. (2) $5.27 TBV per share at 4/30/2010 is after the first P/E investment and before the CF Bancorp BPG. The calculation of tangible book value per share includes pre-tax bargain purchase gains of $53.8 million for the year ended December 31, 2010, $39.4 million for the year ended December 31, 2011, $71.7 million for the year ended December 31, 2013 and $42.0 million for the year ended December 31, 2014. 5 Consistent Tangible Book Value per Share Growth Demonstrable Tangible Book Value per Share Growth Over Time with a 13.7% CAGR CAGR = +13.7% (Total) CAGR = +7.9% (Excl. BPGs) 2010 2011 2013 2014 (2) 2015 CF Bancorp First Banking Center Peoples State Bank Community Central Bank Lake Shore Wisconsin Corp First Place Bank Michigan Commerce First of Huron Corp. Date of Acquisition 4/30/2010 11/19/2010 2/11/2011 4/29/2011 12/15/2011 1/1/2013 1/1/2014 2/6/2015 Type of Acquisition FDIC-Assisted FDIC-Assisted FDIC-Assisted FDIC-Assisted Strategic 363-Acquisition 363-Acquisition Strategic Deposits Acquired $1.2bn $475mm $386mm $302mm - $2.2bn $858mm $201mm Assets Acquired $941mm $684 $390 $402 $26mm $2.6bn $910 $215 Branches Acquired 22 17 10 4 - 43 17 8 Bargain Purchase Gain $52.7mm $2.9mm $12.7mm $24.9mm - $71.7mm $42.0mm - Gross Loan Mark 41.2% (1) 22.9% (1) 35.2% (1) 40.4% (1) - 7.5% (1) 10.7% (1) 5.4% (1) Age of Charter 1937 1920 1909 1996 - 1922 1990 1894

(1) Source: SNL Financial; Regulatory data used for Acquisition Targets. Demonstrated Ability to Build a Strong Core Funding Base 6 Deposit Costs(1) – Streamlining of Deposit Costs is Evident Over Time Deposit Mix Transformation Clear trend of decreased costs of deposits CF Bancorp First Banking Center Peoples State Bank Community Central Bank First Place Bank Cost of Deposits = 0.82% Total Deposits = $1.0bn 54% Non-Time Cost of Deposits = 0.33% Total Deposits = $5.1bn 67% Non-Time 2Q 2010 3Q 2015 MMDA & Savings 26% Time Deposits 31% Other Brokered 6% MMDA & Savings 44% Time Deposits 46% Non int-bear. DDA 7% Int-bear. DDA 3% Non int-bear. DDA 21% Int-bear. DDA 16% Michigan Commerce Bank First of Huron Corp.

(1) Data as of September 30, 2015. 7 Organic Loans – 85% CAGR Since 4Q 2011 Organic Loan Composition (1) Organic Loans Off-Setting Runoff in Covered Portfolio - Inflection point reached in 2Q 2012 at which organic loans were growing faster than the covered loans were running off C&I 35% CRE 27% RE Construction 6% Residential 27% Consumer 5% Total Loan Composition by State (1) Ninefold Growth of Organic Loans Since 2011, with Focus on Mid-Market Commercial and Industrial Clients

• Accretable yield(1) results from the purchase accounting applied to acquired loans – Accretable yield includes both the expected coupon rate of the loan and the discount accretion • The chart below provides a comparison of the actual NIM earned compared to the NIM that would have been earned if it reflected just the expected coupon rate and removes the negative accretion on the FDIC indemnification asset, the “Adjusted NIM” – This difference is the excess accretable yield (“EAY”) – EAY is earned over the life of the loan • For example, in 3Q 2015 Talmer’s NIM would have decreased by 0.30% from 3.76% to 3.46% if the EAY was not included Strong NIM Even When Excluding Excess Accretable Yield 8 Excess Accretable Yield was a benefit of 9 bps for 2Q 2015 and 30 bps for 3Q 2015 (1) The accretable yield represents the excess of the net present value of expected future cash flows over the acquisition date fair value and includes both the expected coupon of the loan and the discount accretion. The difference between the actual yield earned on total loans and the yield generated based on the expected coupon represents excess accretable yield. In addition, our net interest margin is adversely impacted by the negative yield on the FDIC indemnification asset. This negative yield on the FDIC indemnification asset partially offsets the benefits provided by the excess accretable yield discussed previously. Adjusted NIM is equal to the sum of the excess accretable yield and the negative yield on the FDIC indemnification asset.

9 Effectiveness in Building Recurring Earnings Streams • During periods without bargain purchase gains, Talmer experienced an average ROA of 1.07% • Earnings performance has been driven by: – Maintaining and developing the core customer base – Investing in infrastructure, creating efficiencies – Building organic loan growth capacity to pace acquired loan run-off • Importantly, Talmer has maintained a low cost of deposits – Total deposits costs were just 0.33% for 3Q 2015 Profitability Over Time for Talmer (ROAA) 13.88 Average ROA of 1.07% in periods without BPGs (denoted by blue bars) CF Bancorp First Banking Center Peoples State Bank Community Central Bank First Place Bank 5.06 Michigan Commerce Bank Denotes period with an acquisition

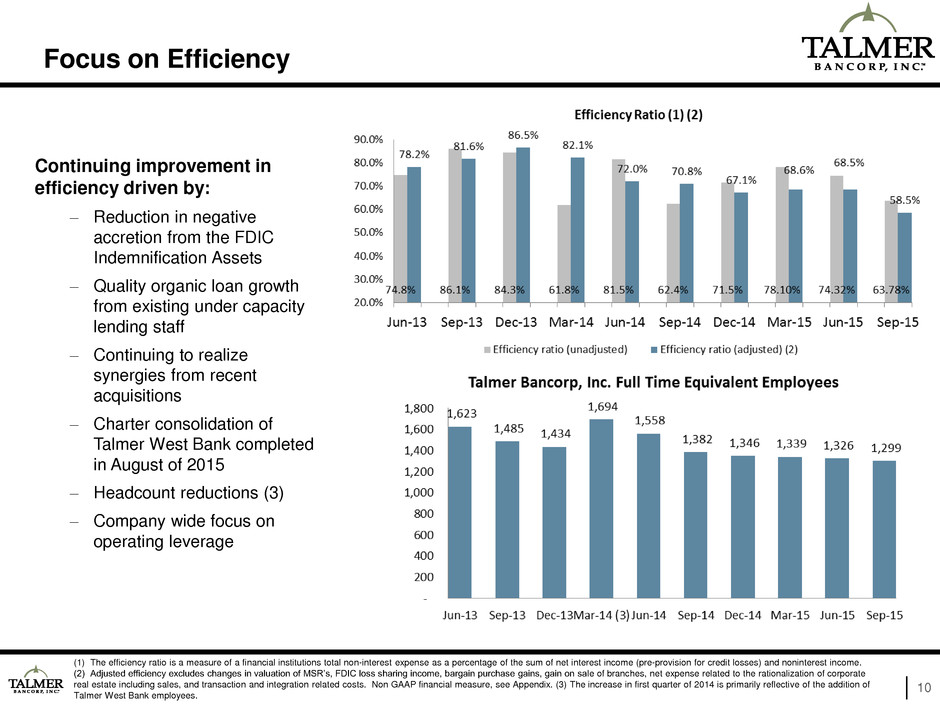

Continuing improvement in efficiency driven by: – Reduction in negative accretion from the FDIC Indemnification Assets – Quality organic loan growth from existing under capacity lending staff – Continuing to realize synergies from recent acquisitions – Charter consolidation of Talmer West Bank completed in August of 2015 – Headcount reductions (3) – Company wide focus on operating leverage (1) The efficiency ratio is a measure of a financial institutions total non-interest expense as a percentage of the sum of net interest income (pre-provision for credit losses) and noninterest income. (2) Adjusted efficiency excludes changes in valuation of MSR’s, FDIC loss sharing income, bargain purchase gains, gain on sale of branches, net expense related to the rationalization of corporate real estate including sales, and transaction and integration related costs. Non GAAP financial measure, see Appendix. (3) The increase in first quarter of 2014 is primarily reflective of the addition of Talmer West Bank employees. Focus on Efficiency 10

(1) Our uncovered allowance for loan losses was $45.1 million, or 1.00% of uncovered loans, at 9/30/2015, compared to $10.9 million, or 1.81%, of uncovered loans at 12/31/2012. The decline in the ALLL / Uncovered Loans at 9/30/2015, compared to 12/31/2012, was due to the addition of loans we acquired in our acquisitions of First Place Bank, Talmer West Bank and First of Huron Corp. which were recorded at their estimated fair value, including a credit mark of the acquired loans at the acquisition date, and which did not include a separate allowance for loan losses. The credit marks at acquisition were 6.4% for First Place Bank, 9.1% for Talmer West Bank and 5.4% for First of Huron Corporation. 11 Asset Quality • Loss share agreements with the FDIC cover approximately 80% of potential losses on covered loans – Approx. 4% of portfolio is covered by FDIC loss share at 3Q 2015 • All acquired loans were marked to fair market value at the date of acquisition • At 4Q 2014, NPLs (excl. covered loans) was 0.90%, ALLL to total loans was 1.30%, and ALLL to uncovered loans was 0.83% • At 3Q 2015, NPLs (excl. covered loans) was 1.02%, ALLL to total loans was 1.19%, and ALLL to uncovered loans was 1.00% Commentary & Perspectives Nonperforming Asset Trends Reserve Levels (1)

Strong Capital Ratios 12 Capital Levels & Targets (1) Non GAAP financial measure; see Appendix

Strategic Focus 13 Talmer’s focus is on realizing significant operating synergies associated with the acquisitions of First Place Bank, Talmer West Bank and First of Huron Corp. – Consolidation of back office processes and personnel – Wind-down of third-party expenses associated with regulatory compliance and systems enhancements – Elimination of “troubled bank” expenses, including excess FDIC insurance expense – Improved efficiency ratio run rate – Goal of improving ROE and delivering sustainable earnings growth Driving strong core deposit growth to fund organic loan growth – Focus on effectively cross selling core deposits to commercial customers – Engaging retail branches to cross sell deposits and recruit new customers – Non-time deposits represent approximately 67% of deposits Transforming the overall loan portfolio to be more oriented to commercial and industrial lending and less concentrated in investor commercial real estate and single family residential loans – FDIC-assisted acquisition loan portfolio attrition has slowed considerably in recent periods – First Place Bank loan portfolio was comprised of more core relationships and characterized by longer maturities with less prepayment risk than previous acquisitions; however, we are allowing significant run-off in the Talmer West Bank loan portfolio given its concentration in investor commercial real estate loans – Continuing to build upon our demonstrated organic commercial loan growth capabilities Balance sheet, operating focus and income statement diversity provides flexibility to respond to an uncertain / changing interest rate environment – Stable rate environment: organic earning asset growth. Minimum 10% leverage capital requirements expired on April 29, 2014 providing capacity for greater common equity leverage – Rising rate environment: organic earning asset growth, servicing exposure, increasing value of core deposit funding, migrating the overall balance sheet to be more asset sensitive Near term Focus Continue to Cultivate a Strong Deposit Base Organic Loan Growth Balance Sheet Flexibility

Certain statements contained in this presentation are “forward-looking statements” within the meaning of the federal securities laws. The words “may,” “will,” “anticipate,” “should,” “would,” “believe,” "expect,” “estimate,” “predict,” “continue,” “goal,” and “intend,” as well as other similar words and expressions of the future, are intended to identify forward-looking statements. Examples of forward-looking statements, include, among others, statements related to our core customer franchise and strategic positioning (slide 4), including our ability to maintain core deposits and statements related to economic recovery in our markets, statements related to our focus on efficiency (slide 10), including our ability to continue to realize synergies from recent acquisitions, statements regarding our long-term target leverage ratio and excess capital (slide 12), statements related to our strategic focus (slide 13), including statements regarding organic loan growth, run-off of acquired bank loans and balance sheet flexibility, and statements regarding financial projections, the assumptions related to such projections, and statements regarding our strategic plan. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to risks, uncertainties and other factors, such as a downturn in the economy, unanticipated losses related to the integration of, and accounting for, our acquisition transactions, prior to termination of our loss share agreements, our ability to collect reimbursements on losses that we incur on our assets covered under loss share agreements with the FDIC as we anticipate, access to funding sources, greater than expected noninterest expenses, volatile credit and financial markets both domestic and foreign, potential deterioration in real estate values, regulatory changes, excessive loan losses, and, with respect to our recent acquisitions and consolidations, the reaction of acquired banks’ customers, employees and counterparties or difficulties related to the transition of services, as well as additional risks and uncertainties contained in the “Risk Factors” and the forward-looking statement disclosure contained in our Annual Report on Form 10-K for the most recently ended fiscal year, any of which could cause actual results to differ materially from future results expressed or implied by those forward-looking statements. All forward-looking statements speak only as of the date on which such statement is made. We undertake no obligation to update or revise any forward-looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future events or otherwise. Cautionary Note Regarding Forward-Looking Statements 14

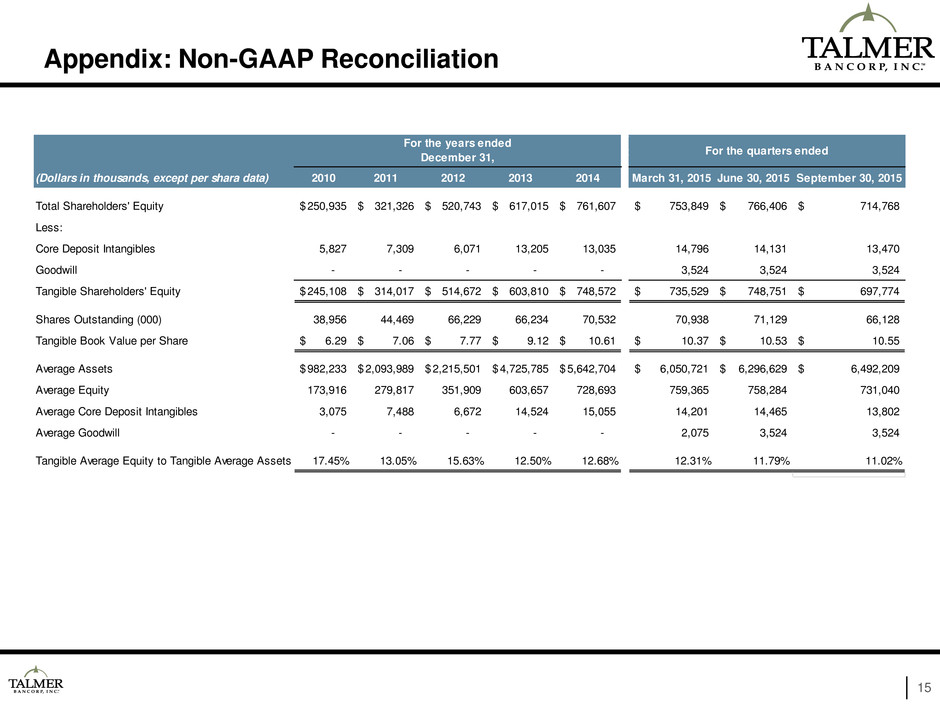

15 Appendix: Non-GAAP Reconciliation F o r (Dollars in thousands, except per shara data) 2010 2011 2012 2013 2014 March 31, 2015 June 30, 2015 September 30, 2015 Total Shareholders' Equity 250,935$ 321,326$ 520,743$ 617,015$ 761,607$ 753,849$ 766,406$ 714,768$ Less: Core Deposit Intangibles 5,827 7,309 6,071 13,205 13,035 14,796 14,131 13,470 Goodwill - - - - - 3,524 3,524 3,524 Tangible Shareholders' Equity 245,108$ 314,017$ 514,672$ 603,810$ 748,572$ 735,529$ 748,751$ 697,774$ Shares Outstanding (000) 38,956 44,469 66,229 66,234 70,532 70,938 71,129 66,128 Tangible Book Value per Share 6.29$ 7.06$ 7.77$ 9.12$ 10.61$ 10.37$ 10.53$ 10.55$ Average Assets 982,233$ 2,093,989$ 2,215,501$ 4,725,785$ 5,642,704$ 6,050,721$ 6,296,629$ 6,492,209$ Average Equity 173,916 279,817 351,909 603,657 728,693 759,365 758,284 731,040 Average Core Deposit Intangibles 3,075 7,488 6,672 14,524 15,055 14,201 14,465 13,802 Average Goodwill - - - - - 2,075 3,524 3,524 Tangible Average Equity to Tangible Average Assets 17.45% 13.05% 15.63% 12.50% 12.68% 12.31% 11.79% 11.02% For the years ended December 31, For the quarters ended

16 Appendix: Non-GAAP Reconciliation (Dollars in thousands) 2Q '13 3Q '13 4Q '13 YTD 2013 1Q '14 2Q '14 3Q '14 4Q '14 1Q '15 2Q '15 3Q '15 Net interest income 44,055$ 44,001$ 39,284$ 167,997$ 48,205$ 52,378$ 52,217$ 51,463$ 51,032$ 49,609$ 55,647$ Noninterest income 36,006 17,984 23,557 181,138 57,740 13,951 29,974 15,834 21,430 22,098 19,342 Total revenue 80,061 61,985 62,841 349,135 105,945 66,329 82,191 67,297 72,462 71,707 74,989 Less: (Expense)/benefit due to change in the fair value of loan servicing rights 6,477 1,587 5,647 14,218 (2,205) (4,200) (176) (3,656) (4,084) 3,146 (3,831) FDIC loss sharing income (2,343) (4,846) (3,167) (10,226) (113) (3,434) (2,420) (244) (1,068) (5,928) (2,696) Net gains on sales of branches - - - - - - 14,410 - - - - Bargin purchase gain - - - 71,702 41,977 - - - - - - Total core revenue 75,927$ 65,244$ 60,361$ 273,441$ 66,286$ 73,963$ 70,377$ 71,197$ 77,614$ 74,489$ 81,516$ Total noninterest expense 59,849 53,373 53,009 250,814 65,448 54,071 51,263 48,098 56,595 53,293 47,829 Less: Transaction and integration related costs 474 171 819 30,849 11,015 837 1,428 329 3,347 419 113 Property efficiency review - - - - - - - - - 1,820 - Total core noninterest expense 59,375 53,202 52,190 219,965 54,433 53,234 49,835 47,769 53,248 51,054 47,716 Core efficiency ratio 78.2% 81.5% 86.5% 80.4% 82.1% 72.0% 70.8% 67.1% 68.6% 68.5% 58.5%