Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - North America Frac Sand, Inc. | xtrr_ex321.htm |

| EX-31.1 - CERTIFICATION - North America Frac Sand, Inc. | xtrr_ex311.htm |

United States

Securities and Exchange Commission

Washington, D.C. 20549

Form 10-Q

x QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2015

or

¨ TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE ACT

For the transition period from __________ to __________.

Commission file number 333-175692

North America Frac Sand, Inc. |

(fka Xterra Building Systems, Inc.) |

(Name of small business issuer in its charter)

Florida

(State or other jurisdiction of incorporation or organization)

20-8926549

(I.R.S. Employer Identification No.)

Suite 917, 1811 - 4th Street S.W., Calgary, AB T2X 1W2

(Address of principal executive offices and Zip Code)

Registrant's telephone number, including area code: (587) 896-1900

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes x No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.See the definitions of "large accelerated filer", "accelerated filer" "smaller reporting company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ¨ | Accelerated filer | ¨ |

Non-accelerated filer | ¨ | Smaller reporting company | x |

(Do not check if a smaller company) |

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) Yes ¨ No x.

The number of shares of the issuer's common stock, par value $.00001 per share, outstanding as of November 6, 2015 was 45,165,448.

TABLE OF CONTENTS

| Page | ||||

PART I. FINANCIAL INFORMATION |

|

| |||

|

|

| |||

Item 1. | Condensed Financial Statements. |

|

| 3 |

|

|

|

| |||

Condensed Balance Sheets for the periods ending September 30, 2015 (unaudited) and December 31, 2014 (audited). |

|

| 3 |

| |

|

|

| |||

Condensed Statements of Operations for the three and nine months ended September 30, 2015 and September 30, 2014 (unaudited). |

|

| 4 |

| |

|

|

| |||

Condensed Statements of Cash Flows for the nine ended September 30, 2015 and September 30, 2014 (unaudited). |

|

| 5 |

| |

|

|

| |||

Notes to Condensed Financial Statements (unaudited). |

|

| 6 |

| |

|

|

| |||

Item 2. | Management's Discussion and Analysis of Financial Condition and Results of Operations. |

|

| 13 |

|

Item 3. | Quantitative and Qualitative Disclosures About Market Risks |

|

| 22 |

|

Item 4. | Controls and Procedures. |

|

| 22 |

|

|

|

| |||

PART II. OTHER INFORMATION |

|

| |||

|

|

| |||

Item 1. | Legal Proceedings. |

|

| 23 |

|

Item 1A. | Risk Factors |

|

| 23 |

|

Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds. |

|

| 23 |

|

Item 3. | Defaults Upon Senior Securities. |

|

| 23 |

|

Item 4. | Mine Safety Disclosure. |

|

| 23 |

|

Item 5. | Other Information. |

|

| 23 |

|

Item 6. | Exhibits. |

|

| 24 |

|

|

|

| |||

Signatures |

|

| 26 | ||

| 2 |

Part I.Financial Information

Item 1.Financial Statements.

North America Frac Sand, Inc.

(fka Xterra Building Systems, Inc.)

Condensed Balance Sheets

(unaudited)

| September 30, |

|

| December 31, |

| |||

| 2015 |

|

| 2014 |

| |||

| (unaudited) |

|

| (audited) |

| |||

ASSETS |

|

|

|

|

|

| ||

Current Assets |

|

|

|

|

|

| ||

Cash and cash equivalents |

| $ | — |

|

| $ | — |

|

Total Current Assets |

|

| — |

|

|

| — |

|

INVESTMENT |

|

|

|

|

|

|

|

|

Investment in shares of North America Frac Sand (Alberta) Ltd. |

|

| — |

|

|

| — |

|

TOTAL ASSETS |

| $ | — |

|

| $ | — |

|

|

|

|

|

|

|

|

| |

LIABILITIES AND STOCKHOLDERS' DEFICIT |

|

|

|

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

|

|

|

Accounts payable |

| $ | 26,935 |

|

| $ | 22,878 |

|

Note payable, related party |

|

| 55,976 |

|

|

| 3,590 |

|

Total Current Liabilities |

|

| 82,910 |

|

|

| 26,468 |

|

|

|

|

|

|

|

|

| |

TOTAL LIABILITIES |

|

| 82,910 |

|

|

| 26,468 |

|

|

|

|

|

|

|

|

| |

COMMITMENTS AND CONTINGENCIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY (DEFICIT) |

|

|

|

|

|

|

| |

Preferred stock, Series A: 10 authorized; $0.00001 par value 1 and 1 shares issued and outstanding, respectively |

|

| 13,741,679 |

|

|

| 13,741,679 |

|

Preferred stock: 100,000,000 authorized; $0.00001 par value 76,133 and 76,133 shares issued and outstanding, respectively |

|

| 1 |

|

|

| 1 |

|

Common stock: 10,000,000,000 authorized; $0.00001 par value, 43,665,448 and 865,448 shares issued and outstanding, respectively |

|

| 437 |

|

|

| 9 |

|

Additional paid in capital |

|

| 21,566,601 |

|

|

| 20,674,529 |

|

Accumulated deficit |

|

| (35,391,628 | ) |

|

| (34,442,686 | ) |

Total Stockholders' Deficit |

|

| (82,910 | ) |

|

| (26,468 | ) |

|

|

|

|

|

|

|

| |

TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT |

| $ | — |

|

| $ | — |

|

See notes to interim condensed financial statements

| 3 |

North America Frac Sand, Inc.

(fka Xterra Building Systems, Inc.)

Condensed Statements of Operations

(unaudited)

For the Three Months Ended September 30, | For the Nine Months Ended September 30, | |||||||||||||||

| 2015 |

|

| 2014 |

|

| 2015 |

|

| 2014 |

| |||||

| (unaudited) |

|

| (unaudited) |

|

| (unaudited) |

|

| (unaudited) |

| |||||

|

|

|

|

|

|

|

|

|

|

|

| |||||

Revenues |

| $ | — |

|

| $ | — |

|

| $ | — |

|

| $ | — |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Professional fees |

|

| 17,264 |

|

|

| 17,558 |

|

|

| 54,100 |

|

|

| 29,801 |

|

Selling, general and administrative expense |

|

| 2,301 |

|

|

| — |

|

|

| 2,343 |

|

|

| 90 |

|

Total operating expenses |

|

| 19,565 |

|

|

| 17,558 |

|

|

| 56,442 |

|

|

| 29,891 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net loss from operations |

|

| (19,565 | ) |

|

| (17,558 | ) |

|

| (56,442 | ) |

|

| (29,891 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Benefit conversion of preferred shares to common shares |

|

| 892,500 |

|

|

| 10,218,592 |

|

|

| 892,500 |

|

|

| 10,236,150 |

|

Net loss |

| $ | (912,065 | ) |

| $ | (10,236,150 | ) |

| $ | (948,942 | ) |

| $ | (10,248,483 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic and diluted loss per share |

| $ | (0.02 | ) |

| $ | (29.21 | ) |

| $ | (0.07 | ) |

| $ | (29.25 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Weighted average number of shares outstanding |

|

| 37,988,818 |

|

|

| 350,400 |

|

|

| 13,375,888 |

|

|

| 350,400 |

|

See notes to interim condensed financial statements

| 4 |

North America Frac Sand, Inc.

(fka Xterra Building Systems, Inc.)

Condensed Statements of Cash Flows

(unaudited)

| For the Nine Months Ended | |||||||

| 2015 |

|

| 2014 |

| |||

| (unaudited) |

|

| (unaudited) |

| |||

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

| ||

Net (loss) |

| $ | (948,942 | ) |

| $ | (10,248,483 | ) |

Adjustment to reconcile net loss to net cash provided in operations: |

|

|

|

|

|

|

|

|

Forgiveness of debt |

|

| --- |

|

|

| 27,641 |

|

Benefit from conversion of preferred stock to common stock |

|

| 892,500 |

|

|

| 10,218,592 |

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

|

| 4,057 |

|

|

| 1,048 |

|

Net Cash (used in) provided by operating activities |

|

| (52,386 | ) |

|

| (1,202 | ) |

|

|

|

|

|

|

|

| |

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

Proceeds from notes payable |

|

| --- |

|

|

| (3,100 | ) |

Due to related party |

|

| 52,386 |

|

|

| 3,590 |

|

Net Cash provided by financing activates |

|

| 52,386 |

|

|

| 490 |

|

|

|

|

|

|

|

|

| |

Net change in cash and cash equivalents |

|

| --- |

|

|

| (712 | ) |

|

|

|

|

|

|

|

| |

Cash and cash equivalents |

|

|

|

|

|

|

|

|

Beginning of period |

|

| --- |

|

|

| 712 |

|

End of period |

| $ | — |

|

| $ | — |

|

Supplemental cash flow information |

|

|

|

|

|

|

|

|

Cash paid for interest |

| $ | — |

|

| $ | — |

|

Cash paid for taxes |

| $ | — |

|

| $ | — |

|

See notes to interim condensed financial statements

| 5 |

NOTE 1. NATURE OF BUSINESS

The Company was incorporated in the State of Indiana as a for-profit Company on April 26, 2007. On June 26, 2012 the Company changed its domicile to the State of Florida. The Company was formed to provide consultation to the aquatic farming industry. The Company will provide consolidation opportunities for on-going and start-up aquatic farming operations. The Company's approach will be to assist aquatic farming operations with the organizational structure, customer service and marketing aspects of their business, allowing our customers to focus on the business aspects of operating the farms.

The Company is headquartered in Indianapolis, Indiana.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

BASIS OF PRESENTATION

The accompanying unaudited financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America for interim financial information and with the instructions to Form 10-Q and Regulation S-X. Accordingly, these condensed financial statements do not include all of the information and footnotes required by generally accepted accounting principles for complete financial statements. In the opinion of management, all adjustments considered necessary for a fair presentation have been included and such adjustments are of a normal recurring nature. These financial statements should be read in conjunction with the financial statements for the year ended December 31, 2014 and notes thereto and other pertinent information contained in our Form 10-K the Company has filed with the Securities and Exchange Commission (the "SEC").

The results of operations for the nine month period ended September 30, 2015 are not necessarily indicative of the results for the full fiscal year ending December 31, 2015.

USE OF ESTIMATES

The Company prepares its financial statements in conformity with accounting principles generally accepted in the United States of America ("GAAP"), which require management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

CASH AND CASH EQUIVALENTS

The Company considers all highly liquid investments with an original maturity of three months or less at the date of acquisition to be cash equivalents.Cash and cash equivalents at September 30, 2015 and December 31, 2014 were $nil.

CASH FLOWS REPORTING

The Company follows ASC 230, Statement of Cash Flows, for cash flows reporting, classifies cash receipts and payments according to whether they stem from operating, investing, or financing activities and provides definitions of each category, and uses the indirect or reconciliation method ("Indirect method") as defined by ASC 230, Statement of Cash Flows, to report net cash flow from operating activities by adjusting net income to reconcile it to net cash flow from operating activities by removing the effects of (a) all deferrals of past operating cash receipts and payments and all accruals of expected future operating cash receipts and payments and (b) all items that are included in net income that do not affect operating cash receipts and payments. The Company reports the reporting currency equivalent of foreign currency cash flows, using the current exchange rate at the time of the cash flows and the effect of exchange rate changes on cash held in foreign currencies is reported as a separate item in the reconciliation of beginning and ending balances of cash and cash equivalents and separately provides information about investing and financing activities not resulting in cash receipts or payments in the period.

| 6 |

FINANCIAL INSTRUMENTS

The Company's balance sheet includes certain financial instruments. The carrying amounts of current assets and current liabilities approximate their fair value because of the relatively short period of time between the origination of these instruments and their expected realization.

ASC 820, Fair Value Measurements and Disclosures, defines fair value as the exchange price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. ASC 820 also establishes a fair value hierarchy that distinguishes between (1) market participant assumptions developed based on market data obtained from independent sources (observable inputs) and (2) an entity's own assumptions about market participant assumptions developed based on the best information available in the circumstances (unobservable inputs). The fair value hierarchy consists of three broad levels, which gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy are described below:

· Level 1 - Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities · Level 2 - Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly, including quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities in markets that are not active; inputs other than quoted prices that are observable for the asset or liability (e.g., interest rates); and inputs that are derived principally from or corroborated by observable market data by correlation or other means. · Level 3 - Inputs that are both significant to the fair value measurement and unobservable.

Fair value estimates discussed herein are based upon certain market assumptions and pertinent information available to management as of September 30, 2015. The respective carrying value of certain on-balance-sheet financial instruments approximated their fair values due to the short-term nature of these instruments.

REVENUE RECOGNITION

The Company has not had significant revenues from operations. The Company follows ASC 605-, Revenue Recognition -The Company recognizes revenue when it is realized or realizable and earned.The Company considers revenue realized or realizable and earned when all of the following criteria are met: (i) persuasive evidence of an arrangement exists, (ii) the product has been shipped or the services have been rendered to the customer, (iii) the sales price is fixed or determinable, and (iv) collectability is reasonably assured.

DEFERRED INCOME TAXES AND VALUATION ALLOWANCE

The Company accounts for income taxes under FASB ASC 740 "Income Taxes." Under the asset and liability method of FASB ASC 740, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statements carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Under FASB ASC 740, the effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period the enactment occurs. A valuation allowance is provided for certain deferred tax assets if it is more likely than not that the Company will not realize tax assets through future operations. No deferred tax assets or liabilities were recognized as of September 30, 2015 and December 31, 2014.

| 7 |

SHARE-BASED EXPENSE

ASC 718, Compensation – Stock Compensation, prescribes accounting and reporting standards for all share-based payment transactions in which employee services are acquired. Transactions include incurring liabilities, or issuing or offering to issue shares, options, and other equity instruments such as employee stock ownership plans and stock appreciation rights. Share-based payments to employees, including grants of employee stock options, are recognized as compensation expense in the financial statements based on their fair values. That expense is recognized over the period during which an employee is required to provide services in exchange for the award, known as the requisite service period (usually the vesting period).

The Company accounts for stock-based compensation issued to non-employees and consultants in accordance with the provisions of ASC 505-50, Equity – Based Payments to Non-Employees.Measurement of share-based payment transactions with non-employees is based on the fair value of whichever is more reliably measurable:(a) the goods or services received; or (b) the equity instruments issued. The fair value of the share-based payment transaction is determined at the earlier of performance commitment date or performance completion date.

Share-based expense for the periods ended September 30, 2015 and 2014 were $-0- and $-0-, respectively.

NET INCOME (LOSS) PER COMMON SHARE

Net income (loss) per share is calculated in accordance with FASB ASC 260, "Earnings Per Share." The weighted-average number of common shares outstanding during each period is used to compute basic earning or loss per share. Diluted earnings or loss per share is computed using the weighted average number of shares and diluted potential common shares outstanding. Dilutive potential common shares are additional common shares assumed to be exercised.

Basic net income (loss) per common share is based on the weighted average number of shares of common stock outstanding at September 30, 2015.

RECENT ACCOUNTING PRONOUNCEMENTS

In June 2014, the Financial Accounting Standards Board issued Accounting Standards Update No. 2014-10, which eliminated certain financial reporting requirements of companies previously identified as "Development Stage Entities" (Topic 915). The amendments in this ASU simplify accounting guidance by removing all incremental financial reporting requirements for development stage entities. The amendments also reduce data maintenance and, for those entities subject to audit, audit costs by eliminating the requirement for development stage entities to present inception-to-date information in the statements of income, cash flows, and shareholder equity. Early application of each of the amendments is permitted for any annual reporting period or interim period for which the entity's financial statements have not yet been issued (public business entities) or made available for issuance (other entities). Upon adoption, entities will no longer present or disclose any information required by Topic 915.The Company has adopted this standard.

In May 2014, FASB issued Accounting Standards Update (ASU) No. 2014-09, Revenue from Contracts with Customers. The revenue recognition standard affects all entities that have contracts with customers, except for certain items. The new revenue recognition standard eliminates the transaction-and industry-specific revenue recognition guidance under current GAAP and replaces it with a principle-based approach for determining revenue recognition.Public entities are required to adopt the revenue recognition standard for reporting periods beginning after December 15, 2016, and interim and annual reporting periods thereafter. Early adoption is not permitted for public entities.The Company has reviewed the applicable ASU and has not, at the current time, quantified the effects of this pronouncement, however it believes that there will be no material effect on the consolidated financial statements.

| 8 |

In June 2014, FASB issued Accounting Standards Update (ASU) No. 2014-12 Compensation — Stock Compensation (Topic 718), Accounting for Share-Based Payments When the Terms of an Award Provide That a Performance Target Could Be Achieved after the Requisite Service Period.A performance target in a share-based payment that affects vesting and that could be achieved after the requisite service period should be accounted for as a performance condition under Accounting Standards Codification (ASC) 718, Compensation — Stock Compensation. As a result, the target is not reflected in the estimation of the award's grant date fair value. Compensation cost would be recognized over the required service period, if it is probable that the performance condition will be achieved.The guidance is effective for annual periods beginning after 15 December 2015 and interim periods within those annual periods. Early adoption is permitted.Management has reviewed the ASU and believes that they currently account for these awards in a manner consistent with the new guidance, therefore there is no anticipation of any effect to the consolidated financial statements.

We have reviewed the FASB issued Accounting Standards Update ("ASU") accounting pronouncements and interpretations thereof that have effectiveness dates during the periods reported and in future periods. The Company has carefully considered the new pronouncements that alter previous generally accepted accounting principles and does not believe that any new or modified principles will have a material impact on the corporation's reported financial position or operations in the near term. The applicability of any standard is subject to the formal review of our financial management and certain standards are under consideration.

NOTE 3. GOING CONCERN

The Company's financial statements are prepared using accounting principles generally accepted in the United States of America applicable to a going concern which contemplates the realization of assets and liquidation of liabilities in the normal course of business. The Company has not yet established an ongoing source of revenues sufficient to cover its operating cost and allow it to continue as a going concern. The ability of the Company to continue as a going concern is dependent on the Company obtaining adequate capital to fund operating losses until it becomes profitable.If the Company is unable to obtain adequate capital, it could be forced to cease operations.

In order to continue as a going concern, the Company will need, among other things, additional capital resources. Management's plan to obtain such resources for the Company include, obtaining capital from management and significant stockholders sufficient to meet its minimal operating expenses. However, management cannot provide any assurance that the Company will be successful in accomplishing any of its plans.

There is no assurance that the Company will be able to obtain sufficient additional funds when needed or that such funds, if available, will be obtainable on terms satisfactory to the Company. In addition, profitability will ultimately depend upon the level of revenues received from business operations.However, there is no assurance that the Company will attain profitability. The accompanying financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern

NOTE 4. ACQUISITION OF NORTH AMERICA FRAC SAND (CA) LTD.

On July 10, 2015, the Company announced that it had entered into an agreement to acquire 100% of the issued and outstanding shares of North America Frac Sand (CA) Ltd. ("NAFS Shares") for 37,800,000 shares of the common stock. Both the Company's 37,800,000 and 100% of the issued and outstanding NAFS Shares will be held in escrow until NAFS provides the Company with firstly, required audited financial statements, secondly, a certificate that the leases held by NAFS are unencumbered and are in good standing, and thirdly, confirmation that recoverable reserves are at least 6.4 million tons of frac sand, and that potential reserves are at least 66 million tons of frac sand. It was anticipated that the audited financial statements and the report confirming the reserves and the potential reserves would be completed before October 15, 2015. On October 5, 2015, through amendment, the Company has extended the October 15, 2015 date, to November 30, 2015. Upon completion of the acquisition, the Company will account for the transaction as a reverse takeover by North America Frac Sand (CA) Ltd. In the interim, the Company has not valued the shares issued.

| 9 |

NOTE 5. INCOME TAXES

At September 30, 2015, the Company had a net operating loss carry–forward for Federal income tax purposes of $1,683,822 that may be offset against future taxable income through 2031. The impact of the reverse takeover on future taxable income reduced the amount of tax carried forward to the percentage which previous shareholders held in corporation divided by the number of shares issued and outstanding after the reverse takeover. This reduced the operating loss carry-forward available for Federal income tax purposes by $32,479,563.

No tax benefit has been reported with respect to these net operating loss carry-forwards in the accompanying financial statements because the Company believes that the realization of the Company's net deferred tax assets of $572,499, calculated at an effective tax rate of 34%, was not considered more likely than not and accordingly, the potential tax benefits of the net loss carry-forwards are fully offset by a valuation allowance of $572,499.

Deferred tax assets consist primarily of the tax effect of NOL carry-forwards. The Company has provided a full valuation allowance on the deferred tax assets because of the uncertainty regarding its realizability.

The Company has open tax periods, subject to IRS audit for the years 2009 through 2014.

NOTE 6. SHAREHOLDERS' EQUITY

COMMON STOCK

The Company has been authorized to issue 10,000,000,000 shares of common stock, $0.00001 par value.Each share of issued and outstanding common stock shall entitle the holder thereof to fully participate in all shareholder meetings, to cast one vote on each matter with respect to which shareholders have the right to vote, and to share ratably in all dividends and other distributions declared and paid with respect to common stock, as well as in the net assets of the corporation upon liquidation or dissolution.

The Company effected a 1 to 100 reverse stock split, declared effective on May 20, 2015. All shares and per shares presented have been adjusted to reflect the reverse stock split.

On December 4, 2013 the Company issued 297,437 shares of restricted common stock to Davisson and Associates escrow to facilitate an anticipated acquisition. The shares have been issued in certificate form in trust.In the event that the acquisition is not consummated, the shares will be returned into escrow, less fees incurred. There has been no expense or change in control recognized. We anticipate the completion of the acquisition in a subsequent period.

On July 10, 2015, the Company issued 38,750,000 shares of restricted common stock valued at $2,646,000 to Canadian Sandtech Inc. in exchange for 100% of the issued and outstanding shares of North America Frac Sand (CA) Ltd. Both the 38,750,000 shares of the Company and 100% of the issued and outstanding shares of North America Frac Sand (CA) Ltd. are being held in escrow subject to due diligence.

On July 17, 2015, the Company issued 3,750,000 shares of common stock valued at $262,500 upon conversion of 15 shares of series B Preferred Stock. On August 25, 2015, the Company issued 500,000 shares of common stock valued at $255,000 upon conversion of 2 shares of series B Preferred Stock. On September 8, 2015, the Company issued 750,000 shares of common stock valued at $375,000 upon conversion of 3 shares of series B Preferred Stock.

At September 30, 2015 and December 31, 2014 there were 43,665,448 and 865,448 shares of common stock issued and outstanding, respectively.

| 10 |

PREFERRED STOCK

The Company has been authorized to issue 100,000,000 shares of $0.00001 par value Preferred Stock.The Board of Directors is expressly vested with the authority to divide any or all of the Preferred Stock into series and to fix and determine the relative rights and preferences of the shares of each series so established, within certain guidelines established in the Articles of Incorporation.

Series A: The certificate of designations for the Preferred A Stock provides that as a class it possesses a number of votes equal to seventy-five percent (75%) of all votes of capital stock of the Company that could be asserted in any matter put to a vote of the shareholders of the Company.

Series B: The certificate of designation for the Preferred B Stock provides that as a class shall be entitled to receive dividends when, as and if declared by the Board of Directors, in its sole discretion. Each share of Series B Preferred Stock shall be convertible, at any time, and/or from time to time, into the number of shares of the Corporation's Common Stock, par value $0.00001 per share, equal to the price of the Series B Preferred Stock, divided by the par value of the Common Stock, subject to adjustment as may be determined by the Board of Directors from time to time (the "Conversion Rate").

On November 5, 2013 the Company cancelled 8,000 shares of Series B Preferred stock from a non-related party for non- performance of a contract.

During the month of December 2013 the Company allowed several non-related parties to convert a total of 21 shares of Series B Preferred stock into 5,250,000 unrestricted shares of common stock. The conversion rate was at par, $0.00001 according to the stated articles of designation.

On September 17, 2014, the Company amended its Articles of Incorporation. The amendment modified the terms of the Preferred Series A conversion exchange to common stock. As a result of this modification, the addition of a material conversion option triggered extinguishment accounting which requires the Company to fair value the new instrument and consider the incremental value of the fair value of the modified preferred stock over the carrying value at the date of the modification as a reduction of income available to common stockholders. The Preferred Series A was deemed to have a fair value of $13,741,679 based upon the converted valuation approach as the primary driver of value in the instrument, its common stock equivalency.

In addition, as a result of this new conversion feature, the Company cannot assert it has sufficient shares to settle both Preferred Series A and Preferred Series B and accordingly has reclassed such share to mezzanine equity. The Preferred Series A is reclassified at its modification fair value of $13,741,679.

During the three month period ended September 30, 2015, 20 shares of Preferred Series B stock were converted into 5,000,000 shares of Common Stock of the Company.

At September 30, 2015 and December 31, 2014 there was 1 share of Series A Convertible Preferred Stock issued and outstanding.

At September 30, 2015 and December 31, 2014 there were 76,133 and 76,133 shares of Series B Convertible Preferred Stock issued and outstanding, respectively.

OPTIONS AND WARRANTS

There are no warrants or options outstanding to acquire any additional shares of common stock of the Company.

| 11 |

NOTE 7. RELATED PARTY TRANSACTIONS

EQUITY TRANSACTIONS

On June 16, 2014, the Company had a change in control of the majority shares. In agreement, the shareholders forgave $27,641 of accounts payable and other debts due. The Company recognized the forgiveness as a contribution to capital.

As at September 30, 2015 and December 31, 2014, included in accounts payable was $18,000 and $9,000, respectively due to an officer and director of the Company.

OTHER

The sole officer and both directors of the Company are involved in other business activities and may, in the future, become involved in other business opportunities that become available. They may face a conflict in selecting between the Company and other business interests. The Company has not formulated a policy for the resolution of such conflicts.

The Company does not own or lease property or lease office space. The Company has been provided office space by a member of the Board of Directors at no cost. The management determined that such cost is nominal and did not recognize the rent expense in its financial statements.

The above amounts are not necessarily indicative of the amounts that would have been incurred had comparable transactions been entered into with independent parties.

NOTE 8. NOTES PAYABLE

Notes payable consisted of the following as of September 30, 2015 and December 31, 2014:

| September 30, |

|

| December 31, |

| |||

|

|

|

|

|

|

|

|

|

Demand note from David Alexander.The note has no stated interest rate and no maturity date. |

| $ | 55,976 |

|

| $ | 3,590 |

|

|

|

|

|

|

|

|

| |

Total notes payable |

| $ | 55,976 |

|

| $ | 3,590 |

|

Less current portion |

|

| (55,976 | ) |

|

| (3,590 | ) |

Long-term potion |

| $ | --- |

|

| $ | --- |

|

NOTE 9. COMMITMENTS AND CONTINGENCIES

From time to time the Company may be a party to litigation matters involving claims against the Company.Management believes that there are no current matters that would have a material effect on the Company's financial position or results of operations.

NOTE 10. SUBSEQUENT EVENTS

On October 7, 2015, the Company issued 500,000 shares of common stock valued at $200,000 upon conversion of 2 shares of series B Preferred Stock.

Subsequent events have been evaluated through the date the financial statements were issued, considered to be the date of filing with the Securities and Exchange Commission.Management has determined that there are no additional subsequent events to disclose.

| 12 |

Item 2. Management's Discussion and Analysis or Plan of Operations

Note Regarding Forward Looking Statements.

This quarterly report on Form 10-Q of North America Frac Sand, Inc. (fka Xterra Building Systems, Inc.) f/k/a Innovate Building Systems, Inc. for the period ended September 30, 2015 contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbors created thereby.To the extent that such statements are not recitations of historical fact, such statements constitute forward-looking statements which, by definition, involve risks and uncertainties. In particular, statements under the Sections; Description of Business, Management's Discussion and Analysis or Plan of Operation contain forward-looking statements. Where, in any forward-looking statement, the Company expresses an expectation or belief as to future results or events, such expectation or belief is expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the statement of expectation or belief will result or be achieved or accomplished.

Our Business Overview

To date, North America Frac Sand, Inc. (fka Xterra Building Systems, Inc.), a Florida corporation (the "Company"),provides marketing of consulting services primarily to independent aquatic farming operators and other market participants located in the Midwest of the United States of America (the "U.S."). Historically, we conducted initial marketing and sales activities to take advantage of opportunities related to time, location and quality of aquatic farming operations. We have conducted our operations primarily in Indiana but have recently moved them to British Columbia, Canada.

On May 1, 2014, the Company entered into a share purchase agreement with Innovate Building Systems, Inc., an Alberta corporation, hereinafter referred to as "Innovate". During the audit of Innovate, previously undisclosed material items were disclosed, consequently, on August 27, 2014, the Company terminated its share purchase agreement with Innovate.

On July 10, 2015, the Company announced that it had entered into an agreement to acquire 100% of the issued and outstanding shares of North America Frac Sand (CA) Ltd. ("NAFS Shares") for 37,800,000 shares of the common stock. Both the Company's 37,800,000 and 100% of the issued and outstanding NAFS Shares will be held in escrow until NAFS provides the Company with firstly, required audited financial statements, secondly, a certificate that the leases held by NAFS are unencumbered and are in good standing, and thirdly, confirmation that recoverable reserves are at least 6.4 million tonnes of frac sand, and that potential reserves are at least 66 million tonnes of frac sand. It was anticipated that the audited financial statements and the report confirming the reserves and the potential reserves would be completed before October 15, 2015. On October 5, 2015, through amendment, the Company has extended the October 15, 2015 date, to November 30, 2015.

Plan of Operation- Consulting

If we do not proceed with our plan to acquire NAFS Shares our plan of operation for the next twelve months will be to expand our client base. We daily market our consulting services to small and medium size businesses that are focused on the aquaculture industry. We are also continually looking for new business opportunities to invest in. As we continue to grow we will need to raise additional funds. We do anticipate obtaining additional financing to fund operations through common stock offerings, to the extent available, or to obtain additional financing to the extent necessary to augment our working capital. The Company does intend to continue to use the income from our current client to continue to meet our operating expenses. We do not have need for the purchase of any property or equipment at this time. The Company will not have any significant changes in the current number of employees.

In addition, our Plan of Operation for the next twelve months is to raise capital to continue to expand our operations. Although we are not presently engaged in any capital raising activities, we anticipate that we may engage in one or more private offering of our company's securities after the completion of this offering.We would most likely rely upon the transaction exemptions from registration provided by Regulation D, Rule 506 or conduct another private offering under Section 4(2) of the Securities Act of 1933. See "Note 2 – Going Concern" in our financial statements for additional information as to the possibility that we may not be able to continue as a "going concern."

| 13 |

12 Month Growth Strategy and Milestones

While a strategic and wisely executed marketing campaign is the key to expanding our customer base; providing new, cutting-edge, innovative ideas will ensure a solid operation built for long-term success.

The Company planned the milestones over the next twelve months:

0-3 Months | · | Create contact plan for current operational farms Explore online marketing options Interview producing aquatic farmers |

4-6 Months | · | Begin development of Online Marketing Website Hire photographer and determine farm operations to use for literature Continue design literature explaining our services Negotiate for online merchant account |

7-9 Months | · | Finish Website Add content to website |

10-12 Months | · | Analyze online marketing and make necessary changes for increased exposure Prepare for year 2 marketing |

Any need for outside services in which we cannot provide will all be initially outsourced in order to cut costs by not having facilities in excess of our needs.The company will not attempt to establish relationships with providers of outsourcing services until the company will be able to utilize such services.

Plan of Operation- Acquisition of NAFS Shares

If we do proceed with our plan to acquire NAFS Shares our plan of operation for the next twelve months will be to:

| 1. | raise funds to continue to continue drilling and testing of the resource, thereby increasing the recoverable reserves; | |

| 2. | Complete a feasibility study completed under Rule 43-101; | |

| 3. | Obtain financing to complete a 1.2 million ton facility; and | |

| 4. | Commence sales of the frac sand to the oil and gas industry of Western Canada and the Northwest United States |

In addition, our Plan of Operation for the next twelve months is to raise capital to continue to expand our operations. Although we are not presently engaged in any capital raising activities, we anticipate that we may engage in one or more private offering of our company's securities after the completion of this offering.We would most likely rely upon the transaction exemptions from registration provided by Regulation D, Rule 506 or conduct another private offering under Section 4(2) of the Securities Act of 1933. See "Note 2 – Going Concern" in our financial statements for additional information as to the possibility that we may not be able to continue as a "going concern."

| 14 |

The Frac Sand Industry

Our mineral properties are:

Eagle Creek Property

On July 10, 2015, the Company entered into a Share Purchase Agreement to acquire North America Frac Sand (CA) Ltd. by issuing 37,800,000 shares of the Company. The Company has issued the shares and placed them in trust pending receipt of the audited financial statements of North America Frac Sand (CA) Ltd. as well as a reserve report.

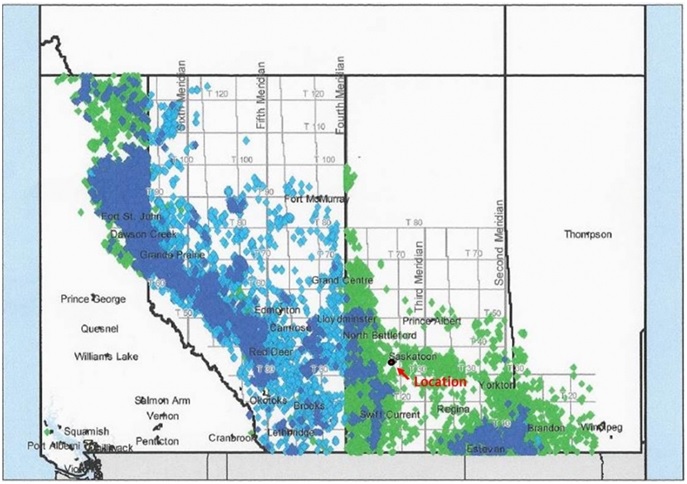

North America Frac Sand (CA) Ltd. owns have 1, 680 acres under lease which have been tested, as well as option for an additional 28,000 acres which will become under lease upon completion of testing, hereinafter referred to as the "Properties".As indicated in the following map, the Properties are located approximately 30 kilometres east of Saskatoon.

BLUE– sites that have been fraced and completed

GREEN – sites that have yet to be fraced and completed

Green Engineering Ltd., an Edmonton engineering firm completed a report dated December 15, 2014 which estimated the tonnages of mineral sand. The results summary for the lab testing is as follows:

| a. | With respect to quality of sand in crust test of floatation concentrate |

| i. | For the size fraction -20/+40% fines test result: 9.8% (meets 14% criteria for API RP-56); | |

| ii. | For the size fraction -30/+50% fines test result: 4.6% (meets 10% criteria for API RP-56); | |

| iii. | For the size fraction -40/+70% fines test result: 7.2% (meets 8% criteria for API RP-56). | |

|

|

| (The crush test results for the -30/+50 sands are particularly good) |

| 15 |

| b. | Quantity: Categorized Estimated Tonnages of Mineral Sand | |

Order of increasing risk from A [medium to high expectation of accuracy] to E: [highly speculative geological targets. |

Category: Exploration Programs |

| Description |

| Tonnage (-20/+40,-40/+79, -70/+140 mesh sand) |

|

A* |

| EXPLORATION HOLE INDICATED AT 300' O.C. |

| 3,000,000 tons |

|

B** |

| EXPLORATION HOLE INDICATED AT 600' O.C. |

| 2,400,000 tons |

|

C** |

| EXPLORATION HOLE INDICATED > 600' |

| 350,000 tons |

|

D |

| HOLES EXTED VERTICLE DEPTH |

| 600,000 tons |

|

| MINERAL RESOURCE |

| 6,400,000 tons |

| |

E |

| FUTURE EXPLORATION |

|

|

|

E1 |

| LEASE/OPTIONED LANDS |

| 66,000,000 tons |

|

E2 |

| UN-OPTIONED LANDS |

| 31,500,000 tons |

|

| TOTAL |

| 100,000,000 tons approximately |

|

_______________

| * | At 300 feet o.c., hole spacing provides reasonable assurance of continuity of sand between holes. |

| ** | At 600 feet o.c. or greater, continuity of sand between holds is not assured. |

Location and Access

The Eagle Creek Property is located approximately 30 kilometers (18.6 miles) east of Saskatoon, Saskatchewan. The area where the claim is located is an active mineral exploration and development region with heavy equipment and operators available for hire.Businesses in Saskatoon are able to provide all necessary amenities and supplies including, fuel, hardware, drilling companies and assay services. Access to our Claim is via road. Any electrical power that might be required in the foreseeable future could be supplied by the Saskatchewan hydro grid.

Exploration Work – Plan of Operation Planned and Actual

The company has tested over 107 holes and core drilled 67 hols under the supervision of an independent engineer.Upon completion of lab testing of core samples, an independent report was prepared by Green Engineering Ltd. which stated that the company had a mineral resource of 6.4 million tons, and a possible mineral resource of 100 million tons.

Future work planned are designed to continue to test the resource in the leases with an objective of not only increasing the size of the mineral resource through a four phase exploration and development program of core drilling and lab testing. In order to complete phases 1 through 4, the Company must raise approximately CAD$6 million. Upon establishing the actual proved mineral resource, the Company will complete a full NI 43-101 which will provide a feasibility study to develop and market the frac sand. It is estimated that the plant design and equipment required to provide production capacity of a 1.4 million ton per year plant will be approximately CAD$60 million.

Competitive Factors

Canada currently uses approximately 4.5 to 5 million tonnes of frac sand per year.70% of this frac sand comes from 3,000 km away in Wisconsin. Canada represents the fastest growing global market for frac sand. We are looking forward to eliminating the long distance transportation costs and removing the transportation logistic delays by providing high quality source of frac sand closer to the well site.

In 2014, 70% of the frac sand supplied to Western Canada came from Arkansas, Connecticut, Nebraska, Iowa and Wisconsin. The American Suppliers include US Silica, Unimin & Badger Mining Corp. Canadian suppliers include Sil Industrial Minerals (Edmonton Distribution Center).

| 16 |

Government Regulation

Exploration and development activities are subject to various national, provincial, foreign and local laws and regulations in Saskatchewan and Canada, which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances and other matters. We believe that we are in compliance in all material respects with applicable mining, health, safety and environmental statutes and the regulations passed there under in Saskatchewan and Canada.

Environmental Regulation

Our exploration activities are subject to various federal, provincial and local laws and regulations governing protection of the environment. These laws are continually changing and, as a general matter, are becoming more restrictive. Our policy is to conduct business in a way that safeguards public health and the environment. We believe that our exploration activities are conducted in material compliance with applicable laws and regulations. Changes to current local, state or federal laws and regulations in the jurisdictions where we operate could require additional capital expenditures and increased operating and/or reclamation costs. Although we are unable to predict what additional legislation, if any, might be proposed or enacted, additional regulatory requirements could render certain exploration activities uneconomic.

Employees

Initially, we intend to use the services of subcontractors for labor exploration work on our claim.At present, we have no employees as such although each of our officers and directors devotes a portion of their time to the affairs of the Company. None of our officers and directors has an employment agreement with us. We presently do not have pension, health, annuity, insurance, profit sharing or similar benefit plans; however, we may adopt such plans in the future. There are presently no personal benefits available to any employee.

There are no permanent facilities, plants, buildings or equipment on our mineral claim.

Adjacent Properties

There are possible expansions to the project properties in the general area but there is intent to add acreage to the project during the development of the deposit is better evaluated.

Recommendations by:

Green Engineering Ltd. as of December 15, 2014.

North America Frac Sand (CA) Ltd.

During 2015, the previous owner of the sand frac mineral resource, Canadian Sandtech Inc., transferred ownership to the leases and lease option on which sand frac mineral resources are located to a wholly owned subsidiary North America Frac Sand (CA) Ltd. On July 10, 2015, the Company agreed to acquire North America Frac Sand (CA) Inc. by issuing 37,800,000 shares of the Company to the owners of North America Frac Sand (CA) Ltd.

| 17 |

Risks Associated with our Company if it goes into the Sand Frac Industry:

1. | The test drilling and assaying to test the possible mineral resource of 100,000,000 tons will probably result in a mineral resource significantly different from the 100,000,000 tons. |

It is most likely that the actual recoverable mineral resource will differ markedly from the possible mineral resource. This may result in the mineral deposit not being economically feasible.

2. | If we don't raise enough money for exploration, we will have to delay exploration or go out of business, which will result in the loss of our shareholders' investment. |

We estimate that, with funding committed by our management combined, we do not have sufficient cash to continue operations for twelve months even if we only carry out our planned exploration activity on the Eagle Creek Property. We need to raise additional capital to undertake our planned exploration activity. We may not be able to raise additional funds. If that occurs we will have to delay exploration or cease our exploration activity and go out of business which will result in the loss of our shareholders' entire investment in our Company.

3. | Because we are small and do not have much capital, we must limit our exploration and as a result may not be able to develop the mineral resource. By not developing the mineral resource, we cannot generate revenues and our shareholders will lose their investment. |

Any potential development of and production from our exploration property depends upon the results of exploration programs and/or feasibility studies and the recommendations of duly qualified engineers and geologists. Because we are small and do not have much capital, we must limit our exploration activity unless and until we raise additional capital. Any decision to expand our operations on our exploration property will involve the consideration and evaluation of several significant factors including, but not limited to:

● | Costs of bringing the property into production including exploration preparation of production feasibility studies, and construction of production facilities; |

● | Availability and cost of financing; |

● | Ongoing costs of production; |

● | Market prices for the frac sand to be produced; |

● | Environmental compliance regulations and restraints; and |

● | Political climate and/or governmental regulations and controls. |

Such programs will require very substantial additional funds. Because we may have to limit our exploration, we may not find an ore body, even though our property may contain mineralized material. Without an ore body, we cannot generate revenues and our shareholders will lose their entire investment in our Company.

We may not have access to all of the supplies and materials we need to begin exploration which could cause us to delay or suspend exploration activity.

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies and certain equipment such as bulldozers and excavators that we might need to conduct exploration. We have not attempted to locate or negotiate with any suppliers of products, equipment or materials. We will attempt to locate products, equipment and materials as and when we are able to raise the requisite capital. If we cannot find the products and equipment we need, we will have to suspend our exploration plans until we do find the products and equipment we need.

| 4. | No matter how much money is spent on our Properties, the risk is that we might never identify a commercially viable mineral reserves. |

No matter how much money is spent over the years on the Eagle Creek Property, we might never be able to find a commercially viable mineral reserve. Over the coming years, we could spend a great deal of money on the Eagle Creek Property without finding sufficient quantity and quality of frac sand.

| 18 |

| 5. | Even with positive results during exploration, the Properties might never be put into commercial production due to inadequate tonnage, low frac sand prices or high extraction costs. |

We might be successful, during future exploration programs, in identifying a source of frac sand of good grade but not in the quantity, the tonnage, required to make commercial production feasible.If the cost of extracting any frac sand that might be found on the Eagle Creek Property is in excess of the selling price of such frac sand, we would not be able to develop the Eagle Creek Property. Accordingly even if frac sand reserves are proved on the Eagle Creek Property, without sufficient tonnage we would still not be able to economically extract the frac sand from the Eagle Creek Property in which case we would have to abandon the Eagle Creek Property and seek another properties to develop, or cease operations altogether.

Critical Accounting Policies

We prepare our condensed financial statements in conformity with GAAP, which requires management to make certain estimates and apply judgments. We base our estimates and judgments on historical experience, current trends and other factors that management believes to be important at the time the condensed financial statements are prepared. Due to the need to make estimates about the effect of matters that are inherently uncertain, materially different amounts could be reported under different conditions or using different assumptions. On a regular basis, we review our critical accounting policies and how they are applied in the preparation of our condensed financial statements.

While we believe that the historical experience, current trends and other factors considered support the preparation of our condensed financial statements in conformity with GAAP, actual results could differ from our estimates and such differences could be material.

For a full description of our critical accounting policies, please refer to Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations" in our 2014 Annual Report on Form 10-K.

Results of Operations for three months ended September 30, 2015 and September 30, 2014

Revenues

Total Revenue. Total revenues for the three months ended September 30, 2015 and September 30, 2014 were both $-0-, respectively.

Expenses

Total Expenses. Total operating expenses for the three months ended September 30, 2015 (Q3-15) and September 30, 2014 (Q3-14) were $19,565 and $17,558, respectively. Total expenses consisted of professional fees of $17,264 in Q3-15 compared to $17,558 in Q3-14. During Q3-15, News release expenses were $2,227 compared to $nil for Q3-14.

| 19 |

Net income

Net Income. Net loss for Q3-15 was $912,065 compared to a loss of $10,236,150 for Q3-14. The reason for the increase in loss was due to the benefit incurred when preferred shares were converted to common shares. The Benefit was $892,500 for Q3-15, down from $10,218,592 for Q3-14.

Results of Operations for nine months ended September 30, 2015 and September 30, 2014

Revenues

Total Revenue. Total revenues for the nine months ended September 30, 2015 (YTD-15) and 2014 (YTD-14) were both $-0-, respectively.

Expenses

Total Expenses. Total operating expenses for the YTD15 and YTD14 were $56,442 and $29,801, respectively. Total expenses consisted of professional fees of $54,100 in YTD15 compared to $29,801 in YTD14. These increased costs of $10,340 due to fees required to join the QBX exchange. Increases in Filing Fees of $7,150 to $9,420 in YTD-15 was due to additional costs of reporting in Canada; audit increase by $3,200 to $10,700 in YTD-15 was due to change of auditors; legal fees increased $3,126 to $7,593 in YTD-15 due to name changes and abandonment of Innovate Building Systems, Inc

Net income

Net Income. Net loss for YTD-15 was $948,942 compared to a loss of $10,248,483 for YTD-14. The reason for the increase in loss was due to the benefit incurred when preferred shares were converted to common shares. The Benefit was $892,500 for Q3-15, down from $10,218,592 for Q3-14.

Financial Condition

Total Assets. Total assets at September 30, 2015 and December 31, 2014 were $2,646,000 and $Nil, respectively.

Total Liabilities. Total liabilities at September 30, 2015 and December 31, 2014 were $82,910 and $26,468, respectively. Total liabilities at September 30, 2015 and December 31, 2014 consist of non-related party accounts payable of $8,935 ($18,000 was due to a related party) and $13,878 ($9,000 is due to a related party) respectively; and a note payable to a director of $55,976 and $3,590, respectively.

Liquidity

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern which contemplates, among other things, the realization of assets and satisfaction of liabilities in the ordinary course of business.

| 20 |

The Company sustained a net loss for the nine months ended September 30, 2015 and 2014 of $948,942 and $10,248,483 respectively. Because of the absence of positive cash flows from operations, the Company will require additional funding for continuing the development and marketing of products. These factors raise substantial doubt about the Company's ability to continue as a going concern. The accompanying financial statements do not include any adjustments that might result from the outcome of this uncertainty.

We are presently not able to meet our obligations as they come due. At September 30, 2015 we had working capital deficit of $82,910. Our working capital is due to the results of operations.

Net cash from (used in) operating activities for the nine months ended September 30, 2015 and 2014 was $(52,386) and $(1,202), respectively. Net cash used in operating activities includes our net loss and changes in working capital components, such as accounts payable.

Net cash provided by (used in) financing activities for the nine months ended September 30, 2015 and 2014 was $52,398 and $490, respectively.

We anticipate that our future liquidity requirements will arise from the need to fund our growth from operations, pay current obligations and future capital expenditures. The primary sources of funding for such requirements are expected to be cash generated from operations and raising additional funds from the private sources and/or debt financing. However, we can provide no assurances that we will be able to generate sufficient cash flow from operations and/or obtain additional financing on terms satisfactory to us, if at all, to remain a going concern. Our continuation as a going concern is dependent upon our ability to generate sufficient cash flow to meet our obligations on a timely basis and ultimately to attain profitability. Our Plan of Operation for the next twelve months is to raise capital to continue to expand our operations. Although we are not presently engaged in any capital raising activities, we anticipate that we may engage in one or more private offering of our company's securities after the completion of this offering.We would most likely rely upon the transaction exemptions from registration provided by Regulation D, Rule 506 or conduct another private offering under Section 4(2) of the Securities Act of 1933. See "Note 3 – Going Concern" in our financial statements for additional information as to the possibility that we may not be able to continue as a "going concern."

We have no known demands or commitments and are not aware of any events or uncertainties that will result in or that are reasonably likely to materially increase or decrease our current liquidity.

We are not aware of any trends or known demands, commitments, events or uncertainties that will result in or that are reasonably likely to result in material increases or decreases in liquidity.

Capital Resources.

We had no material commitments for capital expenditures as of September 30, 2015.

Off-Balance Sheet Arrangements

We have made no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

| 21 |

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

We are a Smaller Reporting Company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

Item 4. Controls and Procedures.

(a) Management's Conclusions Regarding Effectiveness of Disclosure Controls and Procedures.

The management of the Company is responsible for establishing and maintaining adequate internal control over financial reporting. The Company's internal control over financial reporting is a process designed under the supervision of the Company's Chief Executive Officer and Chief Financial Officer to provide reasonable assurance regarding the reliability of financial reporting and the preparation of the Company's financial statements for external purposes in accordance with U.S. generally accepted accounting principles.

With respect to the period ending September 30, 2015, under the supervision and with the participation of our management, we conducted an evaluation of the effectiveness of the design and operations of our disclosure controls and procedures, as defined in Rules 13a-15(e) and 15d-15(e) promulgated under the Securities Exchange Act of 1934.

Based upon our evaluation regarding the period ending September 30, 2015, the Company's management, including its Principal Executive Officer and Principal Financial Officer, has concluded that its disclosure controls and procedures were not effective due to the Company's limited internal resources and lack of ability to have multiple levels of transaction review. Material weaknesses noted are lack of an audit committee, lack of a majority of outside directors on the board of directors, resulting in ineffective oversight in the establishment and monitoring of required internal controls and procedures; and management is dominated by two individuals, without adequate compensating controls. Through the use of external consultants and the review process, management believes that the financial statements and other information presented herewith are materially correct.

The Company's disclosure controls and procedures are designed to provide reasonable assurance of achieving their objectives.However, the Company's management, including its Principal Executive Officer and Principal Financial Officer, does not expect that its disclosure controls and procedures will prevent all error and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefit of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been detected.

(b) Changes in Internal Controls.

There have been no changes in the Company's internal control over financial reporting during the period ended September 30, 2015 that have materially affected, or are reasonably likely to materially affect, the Company's internal controls over financial reporting.

For a full discussion of controls and procedures refer to Item 9A, Controls and Procedures, in our 2014 Annual Report on Form 10K.

| 22 |

Part II. Other Information

Item 1. Legal Proceedings.

None.

Item 1A. Risk Factors

We are a Smaller Reporting Company as defined by Rule 12b-2 of the Securities Exchange Act of 1934 and are not required to provide the information under this item.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds.

During the period ending September 30, 2015, the Company did not issue any unregistered shares of its common stock.

Item 3. Defaults Upon Senior Securities

None.

Item 4. Mine Safety Disclosures

Not applicable.

Item 5. Other Information.

None.

| 23 |

Item 6. Exhibits

Exhibit Number and Description |

| Location Reference | |||

|

|

|

|

|

|

(a) | Financial Statements |

| Filed herewith | ||

|

|

|

|

|

|

(b) | Exhibits required by Item 601, Regulation S-K; |

|

| ||

|

|

|

|

|

|

| (3.0) | Articles of Incorporation |

|

| |

|

|

|

|

|

|

|

| (3.1) | Amended Articles of Incorporation filed with Form 10-Q on July 31, 2012. |

| See Exhibit Key |

|

|

|

|

|

|

|

| (3.2) | Amended Articles of Incorporation filed with Form 8-K on April 24, 2014. |

| See Exhibit Key |

|

|

|

|

|

|

|

| (3.3) | Bylaws filed with S-1 Registration Statement on July 21, 2011. |

| See Exhibit Key |

|

|

|

|

|

|

| (10.0) | Material Contracts |

|

| |

|

|

|

|

|

|

|

| (10.1) | Consulting Agreement dated May 24, 2011 Filed with S-1 Registration Statement on July 21, 2011. |

| See Exhibit Key |

|

|

|

|

|

|

|

| (10.2) | Consulting Agreement dated May 8, 2012 |

| See Exhibit Key |

|

|

|

|

|

|

|

| (10.3) | Consulting Agreement dated May 8, 2012 |

| See Exhibit Key |

|

|

|

|

|

|

|

| (10.4) | Share Purchase Agreement dated June 4, 2014 |

| See Exhibit Key |

|

|

|

|

|

|

| (11.0) | Statement re: computation of per share Earnings Financial Stmts. |

| Note 2 to | |

|

|

|

|

|

|

| (14.0) | Code of Ethics |

| See Exhibit Key | |

|

|

|

|

|

|

| (31.1) | Certificate of Chief Executive Officer Certificate of Chief Financial Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| Filed herewith | |

|

|

|

|

|

|

| (32.1) | Certification of Chief Executive Officer Certification of Chief Financial Officer pursuant to 18 U.S.C. § 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| Filed herewith | |

|

|

|

|

|

|

(101.INS) |

| XBRL Instance Document |

| Filed herewith | |

(101.SCH) |

| XBRL Taxonomy Ext. Schema Document |

| Filed herewith | |

(101.CAL) |

| XBRL Taxonomy Ext. Calculation Linkbase Document |

| Filed herewith | |

(101.DEF) |

| XBRL Taxonomy Ext. Definition Linkbase Document |

| Filed herewith | |

(101.LAB) |

| XBRL Taxonomy Ext. Label Linkbase Document |

| Filed herewith | |

(101.PRE) |

| XBRL Taxonomy Ext. Presentation Linkbase Document |

| Filed herewith | |

| 24 |

Exhibit Key

3.1 | Incorporated by reference herein to the Company's Form 10-Q filed with the Securities and Exchange Commission on July 31, 2012. |

3.2 | Incorporated by reference herein to the Company's Form 8-K filed with the Securities and Exchange Commission on April 24, 2014. |

3.3 | Incorporated by reference herein to the Company's Form S-1 Registration Statement filed with the Securities and Exchange Commission on July 21, 2011. |

10.1 | Incorporated by reference herein to the Company's Form S-1 Registration Statement filed with the Securities and Exchange Commission on July 21, 2011. |

10.2 | Incorporated by reference herein to the Company's Form 10-Q Form 8K filed with the Securities and Exchange Commission on May 14, 2012 |

10.3 | Incorporated by reference herein to the Company's Form 10-Q Form 8K filed with the Securities and Exchange Commission on May 14, 2012 |

10.4 | Incorporated by reference herein to the Company's Form 10-Q Form 8K filed with the Securities and Exchange Commission on June 4, 2014 |

10.5 | Incorporated by reference herein to the Company's Form 10-Q Form 8K filed with the Securities and Exchange Commission on May 14, 2012 |

10.6 | Incorporated by reference herein to the Company's Form 10-Q Form 8K filed with the Securities and Exchange Commission on June 11, 2014 |

10.7 | Incorporated by reference herein to the Company's 10-Q Form 8K filed with the Securities and Exchange Commission on August 27, 2014 |

10.8 | Incorporated by reference herein to the Company's Form 10-Q Form 8K filed with the Securities and Exchange Commission on October 16, 2014 |

10.9 | Incorporated by reference herein to the Company's Form 10-Q Form 8K filed with the Securities and Exchange Commission on February 20, 2015 |

10.10 | Incorporated by reference herein to the Company's Form 10-Q Form 8K filed with the Securities and Exchange Commission on July 7, 2015 |

10.11 | Incorporated by reference herein to the Company's Form 10-Q Form 8K filed with the Securities and Exchange Commission on July 17, 2015 |

10.12 | Incorporated by reference herein to the Company's Form 10-Q Form 8K filed with the Securities and Exchange Commission on August 14, 2015 |

10.13 | Incorporated by reference herein to the Company's Form 10-Q Form 8K filed with the Securities and Exchange Commission on October 6, 2015 |

14.0 | Incorporated by reference herein to the Company's Form S-1 Registration Statement filed with the Securities and Exchange Commission on July 21, 2011. |

| 25 |

Signatures

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

NORTH AMERICA FRAC SAND, INC. (FKA XTERRA BUILDING SYSTEMS, INC.)

NAME | TITLE | DATE | ||

/s/ David Alexander | Principal Executive and Accounting Officer | November 6 , 2015 |

26