Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Horizon Global Corp | hzn_093015x8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Horizon Global Corp | hzn_093015xexhibit991.htm |

1 DRIVEN TO DELIVER 3Q 2015 Earnings NYSE: HZN Horizon Global Third Quarter 2015 Earnings Presentation November 11, 2015

2 DRIVEN TO DELIVER 3Q 2015 Earnings NYSE: HZN Safe Harbor Statement Forward-Looking Statements Any "forward-looking" statements contained herein, including those relating to market conditions or the Company's financial condition and results, expense reductions, liquidity expectations, business goals and sales growth, involve risks and uncertainties, including, but not limited to, the future prospects of the Company as an independent company, risks and uncertainties with respect to general economic and currency conditions, various conditions specific to the Company's business and industry, the Company's leverage, liabilities imposed by the Company's debt instruments, market demand, competitive factors, supply constraints, material and energy costs, technology factors, litigation, government and regulatory actions, the Company's ability to successfully implement its profitability improvement measures, the Company's accounting policies, future trends, and other risks which are detailed in the Company's Registration Statement filed on Form S-1 and the other reports that the Company files with the SEC (available at www.sec.gov). These risks and uncertainties may cause actual results to differ materially from those indicated by the forward-looking statements. All forward-looking statements made herein are based on information currently available, and the Company assumes no obligation to update any forward-looking statements. Non-GAAP Financial Measures In this presentation, certain non-GAAP financial measures may be used. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measure may be found at the end of this presentation. Additional information is available at www.horizonglobal.com.

3 DRIVEN TO DELIVER 3Q 2015 Earnings NYSE: HZN Business Update • Mark Zeffiro Financial Results • David Rice Outlook • Mark Zeffiro Q&A Horizon Global Third Quarter 2015

4 DRIVEN TO DELIVER 3Q 2015 Earnings NYSE: HZN • Foreign currency headwinds • Commodities stable • Evolving customer landscape • Retail and eCommerce growing • Global economic trends Market trends • First quarter as stand-alone independent public company • Adjusted operating profit margin(1) improved 210 bps to 7.6% • Operating cash flow of $12.8 million YTD, an improvement of nearly 90% • Net sales up 2.6% on constant currency basis(2) • 56% improvement in adjusted earnings per share(1) Third quarter results exceeded expectations Trends and Results Third Quarter 2015 (1) Excluding “Special Items” for each period, which are provided in the Appendix, “Company and Business Segment Financial Information” (2) Reconciliation provided in the Appendix, “Constant Currency Reconciliation”

5 DRIVEN TO DELIVER 3Q 2015 Earnings NYSE: HZN • Leverage product portfolio and global footprint • Expand existing distribution channels • Develop new distribution channels, including eCommerce • Leverage relationships with OEs across globe • Expand sales to higher- growth emerging markets • Prioritize new product development • Bolt-on acquisitions drive non-organic growth • Commitment to reducing debt and increasing profitability • Cash flow supports deleveraging • Recently completed capex cycle • Consistent cash flow generation through business cycle • Working capital efficiency improvement • Acquire well-run companies • Foster culture focused on operational excellence • Execute six major priorities • Leverage past investments in low-cost manufacturing • Integrate Cequent Americas organization • Enhance Multi- Generational Product Planning • Margin accretive acquisitions Drive Sales Growth Improve Capital Structure Improve Margins Three Financial Priorities for Value Creation Significant opportunity for value creation 10% & 10% Less than 2x 3-5% Organic

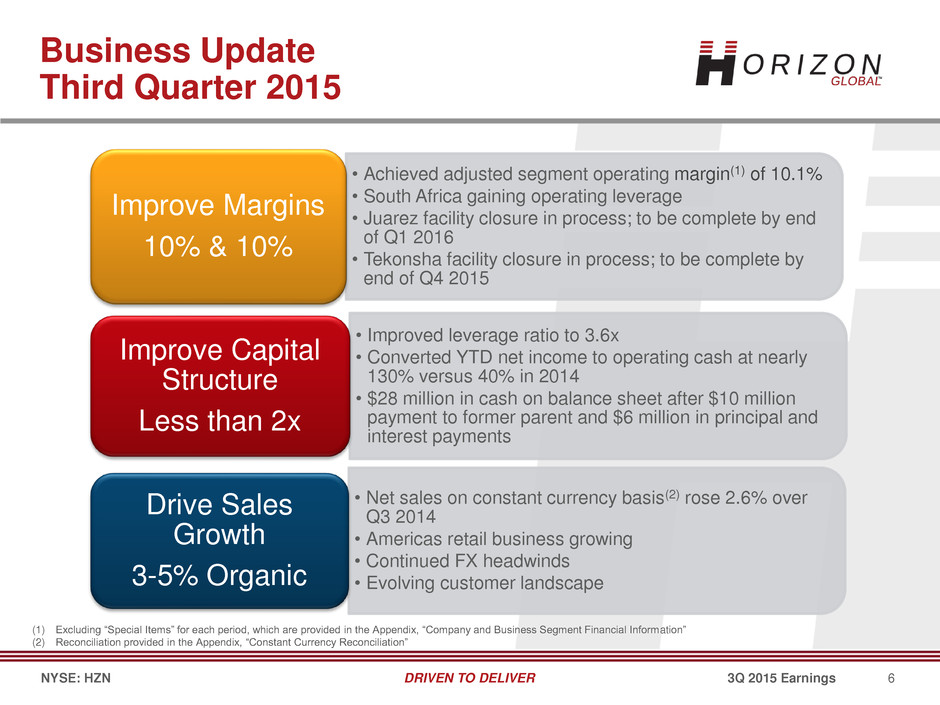

6 DRIVEN TO DELIVER 3Q 2015 Earnings NYSE: HZN • Achieved adjusted segment operating margin(1) of 10.1% • South Africa gaining operating leverage • Juarez facility closure in process; to be complete by end of Q1 2016 • Tekonsha facility closure in process; to be complete by end of Q4 2015 Improve Margins 10% & 10% • Improved leverage ratio to 3.6x • Converted YTD net income to operating cash at nearly 130% versus 40% in 2014 • $28 million in cash on balance sheet after $10 million payment to former parent and $6 million in principal and interest payments Improve Capital Structure Less than 2x • Net sales on constant currency basis(2) rose 2.6% over Q3 2014 • Americas retail business growing • Continued FX headwinds • Evolving customer landscape Drive Sales Growth 3-5% Organic Business Update Third Quarter 2015 (1) Excluding “Special Items” for each period, which are provided in the Appendix, “Company and Business Segment Financial Information” (2) Reconciliation provided in the Appendix, “Constant Currency Reconciliation”

7 DRIVEN TO DELIVER 3Q 2015 Earnings NYSE: HZN Driven to Deliver • Global Reach • Product Development Engine • Multi-Channel Expertise • Best-in-Class Manufacturing and Sourcing Cost Platform • Talent Experienced Management Team ENABLERS CORE VALUES MISSION VISION: Enriching lives through great products Positioned to drive value for: All Stakeholders All Customers All Employees Utilize forward-thinking technology to develop and deliver best-in-class products for our users, engage with our employees and realize value creation for our shareholders.

8 DRIVEN TO DELIVER 3Q 2015 Earnings NYSE: HZN Business Update • Mark Zeffiro Financial Results • David Rice Outlook • Mark Zeffiro Q&A Horizon Global Third Quarter 2015

9 DRIVEN TO DELIVER 3Q 2015 Earnings NYSE: HZN Third Quarter 2015 (Unaudited, excluding Special Items, dollars in millions, except per share amounts) (1) Segment operating profit, excluding “Special Items” refers to the sum of Cequent Americas and Cequent APEA. “Special Items” for each period are provided in the Appendix, “Company and Business Segment Financial Information”. Income and diluted earnings per share excluding “Special Items” for each period are provided in the Appendix, “Additional Information Regarding Special Items Impacting Reported GAAP Financial Measures”. (2) Reconciliation provided in the Appendix, “Constant Currency Reconciliation” Quarter Highlights • Net sales increase of 2.6% on constant currency basis(2) over prior year • Currency translation headwinds of approximately $9M, about half of which is Australian dollar • Segment operating profit improvement of 220 bps reflects margin improvement initiatives • Operating cash flow improvement of nearly 90% as compared to prior year • Leverage ratio of 3.6x, a decline from 3.8x in Q2 2015 Q3 2015 QTD Q3 2014 QTD Variance Revenue $153.3 $157.9 (2.9%) Segment operating profit $12.4 $11.7 6.3% Excl. Total Special Items (1) , Segment operating profit would have been: $15.5 $12.4 24.6% Excl. Total Special Items (1) , Segment operating profit margin would have been: 10.1% 7.9% 220 bps Corporate expense $3.8 $3.8 0.0% In ome $6.4 $5.2 21.9% Excl. Total Special Items (1) , Income would have been: $9.0 $5.8 55.7% Diluted earnings per share $0.35 $0.29 21.2% Excl. Total Special Items (1) , Diluted earnings per share: $0.50 $0.32 56.3% Operating Cash Flow - YTD $12.8 $6.8 88.6% Total debt $203.7 $2.8 Leverage ratio (covenant 5.25x) 3.6x

10 DRIVEN TO DELIVER 3Q 2015 Earnings NYSE: HZN Cequent Americas Third Quarter 2015 Q3 Results Sales • Net sales increased 2.6% as compared with Q3 2014 • Retail channel growth of 9.8% versus Q3 2014 • Aftermarket and retail customer landscape continues to evolve • Aftermarket demand strengthened versus previous quarter • Industrial challenged by agricultural and oil & gas end markets Operating Profit(1) • Operating profit improved to 11.8% of sales from 7.8% in Q3 2014 • Reynosa 9% more productive than 2014 YTD • Favorable margin impact from lower input costs • Americas integration continue to provide benefits Focus • Continued emphasis on increasing productivity in Mexico • Execution of Americas integration, including transition of manufacturing to Reynosa and other rationalizations (1) Excluding “Special Items” for each period, which are provided in the Appendix, “Company and Business Segment Financial Information” 7.8% (Unaudited, dollars in millions) Net Sales Q3-15 Q3-14 $116.5 $113.6 2.6% Operating Profit (1) Q3-15 Q3-14 54.4% $13.8 $8.9 11.8% 7.8%

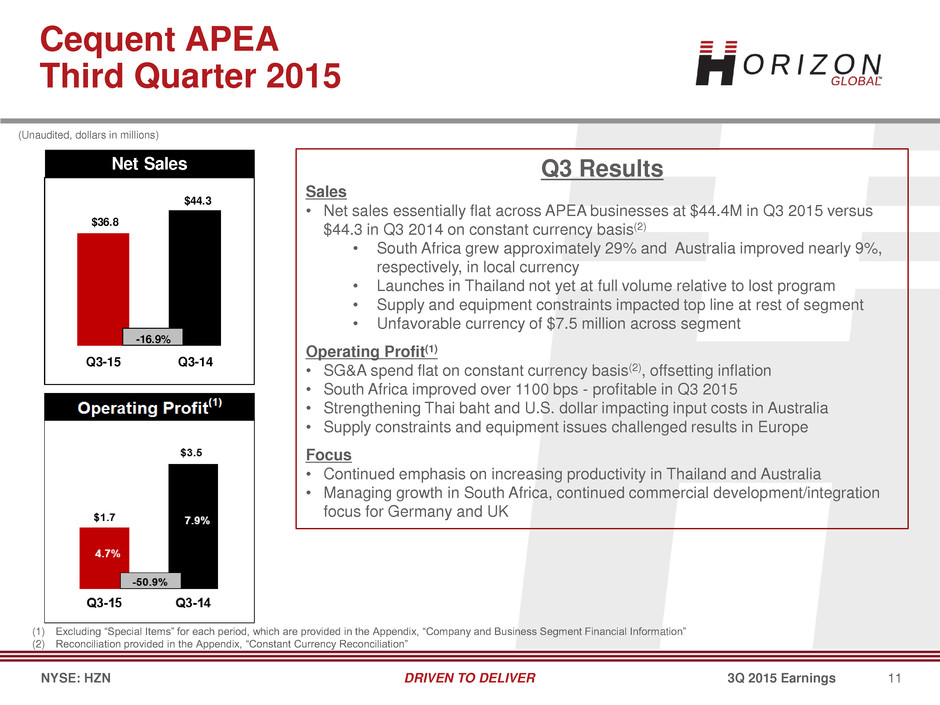

11 DRIVEN TO DELIVER 3Q 2015 Earnings NYSE: HZN Cequent APEA Third Quarter 2015 Q3 Results Sales • Net sales essentially flat across APEA businesses at $44.4M in Q3 2015 versus $44.3 in Q3 2014 on constant currency basis(2) • South Africa grew approximately 29% and Australia improved nearly 9%, respectively, in local currency • Launches in Thailand not yet at full volume relative to lost program • Supply and equipment constraints impacted top line at rest of segment • Unfavorable currency of $7.5 million across segment Operating Profit(1) • SG&A spend flat on constant currency basis(2), offsetting inflation • South Africa improved over 1100 bps - profitable in Q3 2015 • Strengthening Thai baht and U.S. dollar impacting input costs in Australia • Supply constraints and equipment issues challenged results in Europe Focus • Continued emphasis on increasing productivity in Thailand and Australia • Managing growth in South Africa, continued commercial development/integration focus for Germany and UK (1) Excluding “Special Items” for each period, which are provided in the Appendix, “Company and Business Segment Financial Information” (2) Reconciliation provided in the Appendix, “Constant Currency Reconciliation” 7.8% (Unaudited, dollars in millions) Net Sales Q3-15 Q3-14 $36.8 $44.3 -16.9%

12 DRIVEN TO DELIVER 3Q 2015 Earnings NYSE: HZN Initiative Objective Current Action/Result Project Realization Plant Performance Execute plant level productivity initiatives Productivity improvement of 9% over 2014 Consolidation of the Americas Fully integrate as one, lean business Distribution study, ERP implementation and Tekonsha closure underway Europe, Africa, Latin America Performance Realize accretive level of performance South Africa up 1100 bps Brazil down 110 bps Europe down 90 bps “Juarez” Closure Consolidate production in Reynosa to achieve annual savings of $4.5M Heavy duty product moved, facility prep and move plan underway Sourcing Initiatives Optimize supply base through increased integration and performance Partner identification and financing alternative discussion underway Brand Consolidation Enhanced value from “shoulder” brands First three brands to be rationalized in 2016 Horizon – Margin Dashboard

13 DRIVEN TO DELIVER 3Q 2015 Earnings NYSE: HZN Capitalization Leverage 3.60x Covenant 5.25x Liquidity of $98 million for Q3 Liquidity and leverage results include: • Payment of $9.6M to former parent under tax sharing agreement • Interest payments of $3.5M under new capital structure • First amortization payment under term loan of $2.5M Cash generation and leverage reduction remain priorities (0 .25) 0.75 x 1.75 x 2.75 x 3.75 x 4.75 x 5.75 x 6.75 x $- $50 $100 $150 $200 $250 $300 $350 2015 - Q3 Debt vs. Liquidity Debt Cash and ABL Availability (Unaudited, dollars in millions) 2015 - Q3 Debt 204$ Cash 28$ ABL Availability 70$ Horizon Global Liquidity

14 DRIVEN TO DELIVER 3Q 2015 Earnings NYSE: HZN Business Update • Mark Zeffiro Financial Results • David Rice Outlook • Mark Zeffiro Q&A Horizon Global Third Quarter 2015

15 DRIVEN TO DELIVER 3Q 2015 Earnings NYSE: HZN Revenues $285 to $300M $275 to $285M Operating Profit(1) Growth 50% to 75% improvement as compared to 2014; ≈200 basis points Operating Cash Flow To be updated with future guidance $20 to $30M full year 2015 Guidance Previous Guidance Six-Months Ended 12/31/15 Full year 2015 EPS guidance of $0.95 to $1.00 per common share(1) (1) The Appendix details certain costs, expenses and other charges, collectively described as ''Special Items,'' that are included in the determination of net income under GAAP, but that management would consider important in evaluating the quality of the Company's operating results. Accordingly, the company presents adjusted net income, operating profit and diluted earnings per share excluding these special items to help investors evaluate our operating performance and trends in our business consistent with how management evaluates such performance and trends. Current Guidance Six-Months Ended 12/31/15

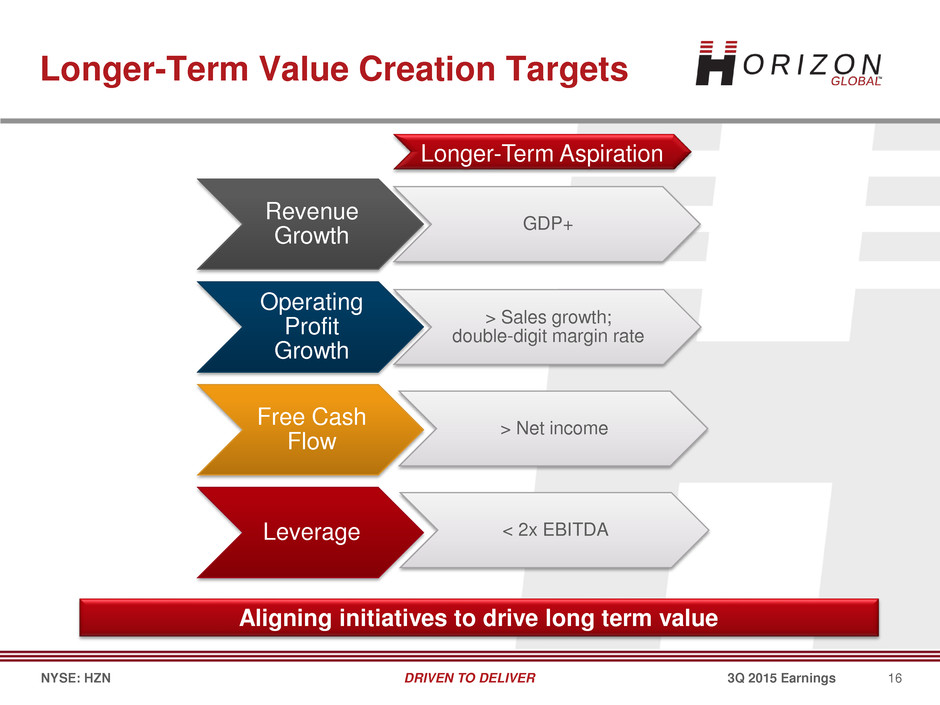

16 DRIVEN TO DELIVER 3Q 2015 Earnings NYSE: HZN Revenue Growth GDP+ Operating Profit Growth > Sales growth; double-digit margin rate Free Cash Flow > Net income Leverage < 2x EBITDA Longer-Term Value Creation Targets Longer-Term Aspiration Aligning initiatives to drive long term value

17 DRIVEN TO DELIVER 3Q 2015 Earnings NYSE: HZN • Improved segment operating margin(1) to 10.1% • Used cash to de-lever; leverage ratio of 3.6 times • Grew net sales by 2.6% on constant currency basis(2) Delivered strong performance against financial priorities • Operating cash flow versus net income Strong cash flow • FX headwinds • Global economy • Evolving customer landscape End market challenges Wrap-up (1) Excluding “Special Items” for each period, which are provided in the Appendix, “Company and Business Segment Financial Information” (2) Reconciliation provided in the Appendix, “Constant Currency Reconciliation”

18 DRIVEN TO DELIVER 3Q 2015 Earnings NYSE: HZN Business Update • Mark Zeffiro Financial Results • David Rice Outlook • Mark Zeffiro Q&A Horizon Global Third Quarter 2015

19 DRIVEN TO DELIVER 3Q 2015 Earnings NYSE: HZN Q&A

20 DRIVEN TO DELIVER 3Q 2015 Earnings NYSE: HZN Appendix – Q3 2015

21 DRIVEN TO DELIVER 3Q 2015 Earnings NYSE: HZN Third Quarter 2015 YTD (Unaudited, dollars in millions, except for per share amounts) YTD Highlights • Net sales declined 2.0% on constant currency basis(2) from prior year • First half distributor consolidation in Americas • Delayed OE launches in Americas • Industrial challenged by agricultural and oil and gas end markets • Currency translation headwinds of $20M, about half of which is Australian dollar • Q3 reflects turnaround in comparative segment operating profit(1) performance (1) Segment operating profit, excluding “Special Items” refers to the sum of Cequent Americas and Cequent APEA. “Special Items” for each period are provided in the Appendix, “Company and Business Segment Financial Information”. Income and diluted earnings per share excluding “Special Items” for each period are provided in the Appendix, “Additional Information Regarding Special Items Impacting Reported GAAP Financial Measures”. (2) Reconciliation provided in the Appendix, “Constant Currency Reconciliation” Q3 2015 YTD Q3 2014 YTD Variance Revenue $454.2 $484.2 (6.2%) Segment operating profit $30.1 $38.9 (22.7%) Excl. Total Special Items (1) , Segment operating profit would have been: $38.5 $42.1 (8.4%) Excl. Total Special Items (1) , Segment operating profit margin would have been: 8.5% 8.7% (20) bps Corporate expense $12.4 $11.8 5.1% Income $10.0 $18.4 (45.5%) Excl. Total Special Items (1) , Income would have been: $16.4 $20.6 (20.2%) Diluted earnings per share $0.55 $1.02 (45.7%) Excl. Total Special Items (1) , Diluted earnings per share would have been: $0.90 $1.14 (21.1%) Operating Cash Flow - YTD $12.8 $6.8 88.6% Total Debt $203.7 $2.8 Leverage Ratio (covenant 5.25x) 3.6x

22 DRIVEN TO DELIVER 3Q 2015 Earnings NYSE: HZN Condensed Consolidated Balance Sheet September 30, December 31, 2015 2014 (unaudited) Assets Current assets: Cash and cash equivalents....................................................................... 28,130$ 5,720$ Receivables, net...................................................................................... 73,440 63,840 Inventories.............................................................................................. 113,880 123,530 Deferred income taxes............................................................................. 4,840 4,840 Prepaid expenses and other current assets............................................... 6,610 5,690 Total current assets.............................................................................. 226,900 203,620 Property and equipment, net........................................................................ 46,310 55,180 Goodwill..................................................................................................... 4,420 6,580 Other intangibles, net.................................................................................. 57,820 66,510 Other assets............................................................................................... 11,370 11,940 Total assets......................................................................................... 346,820$ 343,830$ Liabilities and Shareholders' Equity Current liabilities: Current maturities, long-term debt............................................................. 14,460$ 460$ Accounts payable.................................................................................... 74,670 81,980 Accrued liabilities.................................................................................... 38,130 37,940 Total current liabilities........................................................................... 127,260 120,380 Long-term debt........................................................................................... 189,280 300 Deferred income taxes................................................................................ 7,290 8,970 Other long-term liabilities............................................................................. 19,540 25,990 Total liabilities...................................................................................... 343,370 155,640 Total shareholders' equity..................................................................... 3,450 188,190 Total liabilities and shareholders' equity................................................. 346,820$ 343,830$ (Dollars in thousands)

23 DRIVEN TO DELIVER 3Q 2015 Earnings NYSE: HZN Condensed Consolidated Statement of Income (Unaudited, dollars in thousands, except for per share amounts) Three months ended Nine months ended 2015 2014 2015 2014 Net sales............................................................................................................. 153,340$ 157,860$ 454,240$ 484,210$ Cost of sales....................................................................................................... (115,580) (119,690) (343,430) (363,720) Gross profit...................................................................................................... 37,760 38,170 110,810 120,490 Selling, general and administrative expenses.......................................................... (29,090) (30,310) (91,280) (93,330) Net gain (loss) on dispositions of property and equipment....................................... (60) 10 (1,850) (60) Operating profit................................................................................................ 8,610 7,870 17,680 27,100 Other expense, net: Interest expense............................................................................................... (4,350) (150) (4,590) (510) Other expense, net........................................................................................... (1,060) (810) (3,030) (2,290) Other expense, net........................................................................................ (5,410) (960) (7,620) (2,800) Income before income tax expense....................................................................... 3,200 6,910 10,060 24,300 Income tax credit (expense).................................................................................. 3,150 (1,700) (30) (5,890) Net income.......................................................................................................... 6,350$ 5,210$ 10,030$ 18,410$ Net income per share: Basic.............................................................................................................. $ 0.35 $ 0.29 $ 0.55 $ 1.02 Diluted............................................................................................................. $ 0.35 $ 0.29 $ 0.55 $ 1.02 Weighted average common shares outstanding: Basic.............................................................................................................. 18,098,404 18,062,027 18,073,836 18,062,027 Diluted............................................................................................................. 18,215,209 18,114,032 18,160,858 18,113,399 September 30, September 30,

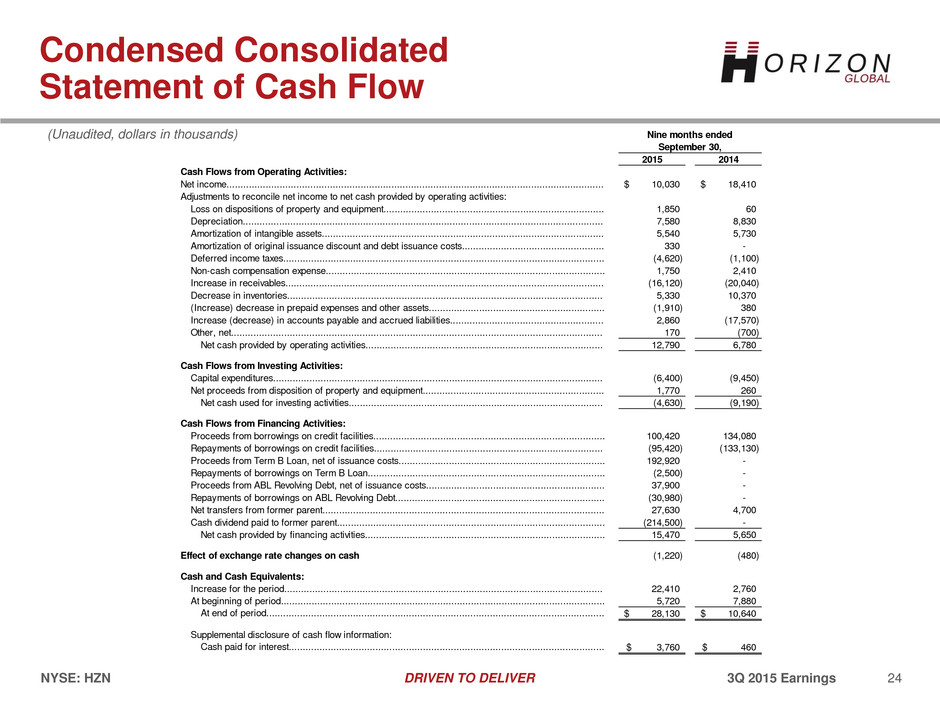

24 DRIVEN TO DELIVER 3Q 2015 Earnings NYSE: HZN (Unaudited, dollars in thousands) Condensed Consolidated Statement of Cash Flow 2015 2014 Cash Flows from Operating Activities: Net income....................................................................................................................................... 10,030$ 18,410$ Adjustments to reconcile net income to net cash provided by operating activities: Loss on dispositions of property and equipment............................................................................... 1,850 60 Depreciation................................................................................................................................. 7,580 8,830 Amortization of intangible assets..................................................................................................... 5,540 5,730 Amortization of original issuance discount and debt issuance costs................................................... 330 - Deferred income taxes................................................................................................................... (4,620) (1,100) Non-cash compensation expense.................................................................................................... 1,750 2,410 Increase in receivables.................................................................................................................. (16,120) (20,040) Decrease in inventories................................................................................................................. 5,330 10,370 (Increase) decrease in prepaid expenses and other assets............................................................... (1,910) 380 Increase (decrease) in accounts payable and accrued liabilities....................................................... 2,860 (17,570) Other, net..................................................................................................................................... 170 (700) Net cash provided by operating activities..................................................................................... 12,790 6,780 Cash Flows from Investing Activities: Capital expenditures...................................................................................................................... (6,400) (9,450) Net proceeds from disposition of property and equipment................................................................. 1,770 260 Net cash used for investing activities........................................................................................... (4,630) (9,190) Cash Flows from Financing Activities: Proceeds from borrowings on credit facilities................................................................................... 100,420 134,080 Repayments of borrowings on credit facilities.................................................................................. (95,420) (133,130) Proceeds from Term B Loan, net of issuance costs.......................................................................... 192,920 - Repayments of borrowings on Term B Loan..................................................................................... (2,500) - Proceeds from ABL Revolving Debt, net of issuance costs................................................................ 37,900 - Repayments of borrowings on ABL Revolving Debt........................................................................... (30,980) - Net transfers from former parent..................................................................................................... 27,630 4,700 Cash dividend paid to former parent................................................................................................ (214,500) - Net cash provided by financing activities...................................................................................... 15,470 5,650 Effect of exchange rate changes on cash (1,220) (480) Cash and Cash Equivalents: Increase for the period.................................................................................................................. 22,410 2,760 At beginning of period.................................................................................................................... 5,720 7,880 At end of period......................................................................................................................... 28,130$ 10,640$ Supplemental disclosure of cash flow information: Cash paid for interest................................................................................................................. 3,760$ 460$ Nine months ended September 30,

25 DRIVEN TO DELIVER 3Q 2015 Earnings NYSE: HZN Company and Business Segment Financial Information Three months ended 2015 2014 2015 2014 Net sales................................................................................................................... 116,540$ 113,580$ 342,030$ 356,660$ Operating profit.......................................................................................................... 10,700$ 8,550$ 24,400$ 31,100$ Special Items to consider in evaluating operating profit: Severance and business restructuring costs............................................................. 3,060$ 360$ 5,530$ 2,800$ Loss on software disposal....................................................................................... -$ -$ 1,870$ -$ Excluding Special Items, operating profit would have been..................................... 13,760$ 8,910$ 31,800$ 33,900$ Net sales................................................................................................................... 36,800$ 44,280$ 112,210$ 127,550$ Operating profit.......................................................................................................... 1,730$ 3,140$ 5,650$ 7,770$ Special Items to consider in evaluating operating profit: Severance and business restructuring costs............................................................. -$ 380$ 1,060$ 380$ Excluding Special Items, operating profit would have been..................................... 1,730$ 3,520$ 6,710$ 8,150$ Operating Segments Operating profit.......................................................................................................... 12,430$ 11,690$ 30,050$ 38,870$ Special Items to consider in evaluating operating profit: Severance and business restructuring costs............................................................. 3,060$ 740$ 6,590$ 3,180$ Loss on software disposal....................................................................................... -$ -$ 1,870$ -$ Excluding Special Items, segment operating profit would have been........................ 15,490$ 12,430$ 38,510$ 42,050$ Operating loss............................................................................................................ (3,820)$ (3,820)$ (12,370)$ (11,770)$ Net sales................................................................................................................... 153,340$ 157,860$ 454,240$ 484,210$ Operating profit.......................................................................................................... 8,610$ 7,870$ 17,680$ 27,100$ Total Special Items to consider in evaluating operating profit.......................................... 3,060$ 740$ 8,460$ 3,180$ Excluding Special Items, operating profit would have been..................................... 11,670$ 8,610$ 26,140$ 30,280$ September 30, September 30, Nine months ended Total Company Cequent Americas Cequent APEA Corporate Expenses (Unaudited, dollars in thousands)

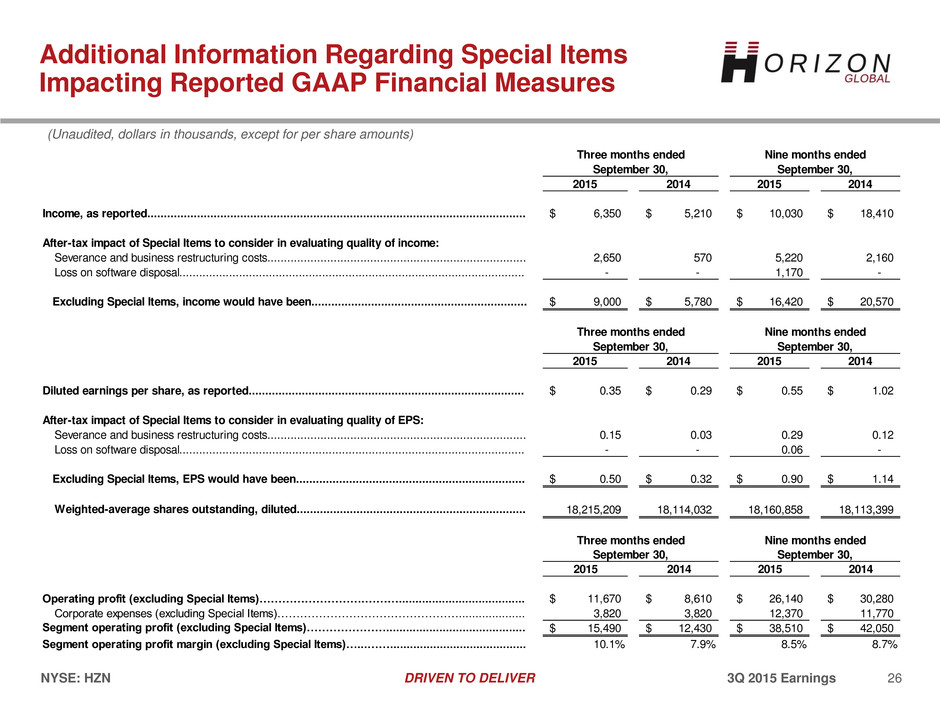

26 DRIVEN TO DELIVER 3Q 2015 Earnings NYSE: HZN Additional Information Regarding Special Items Impacting Reported GAAP Financial Measures Three months ended Nine months ended September 30, September 30, 2015 2014 2015 2014 Income, as reported.................................................................................................................. 6,350$ 5,210$ 10,030$ 18,410$ After-tax impact of Special Items to consider in evaluating quality of income: Severance and business restructuring costs.............................................................................. 2,650 570 5,220 2,160 Loss on software disposal........................................................................................................ - - 1,170 - Excluding Special Items, income would have been................................................................. 9,000$ 5,780$ 16,420$ 20,570$ Three months ended Nine months ended September 30, September 30, 2015 2014 2015 2014 Diluted earnings per share, as reported................................................................................... 0.35$ 0.29$ 0.55$ 1.02$ After-tax impact of Special Items to consider in evaluating quality of EPS: Severance and business restructuring costs.............................................................................. 0.15 0.03 0.29 0.12 Loss on software disposal........................................................................................................ - - 0.06 - Excluding Special Items, EPS would have been..................................................................... 0.50$ 0.32$ 0.90$ 1.14$ Weighted-average shares outstanding, diluted..................................................................... 18,215,209 18,114,032 18,160,858 18,113,399 2015 2014 2015 2014 Operating profit (excluding Special Items)……………………….………...................................... 11,670$ 8,610$ 26,140$ 30,280$ Corporate expenses (excluding Special Items)………………………………………….................... 3,820 3,820 12,370 11,770 Segment operating profit (excluding Special Items)………………….......................................... 15,490$ 12,430$ 38,510$ 42,050$ Segment operating profit margin (excluding Special Items)…...……......................................... 10.1% 7.9% 8.5% 8.7% September 30, September 30, Three months ended Nine months ended (Unaudited, dollars in thousands, except for per share amounts)

27 DRIVEN TO DELIVER 3Q 2015 Earnings NYSE: HZN LTM Bank EBITDA as Defined in Credit Agreement (Unaudited, dollars in thousands) 6,970$ Interest expense, net(1)………………………………………………………………………………….. 4,800 Income tax expense............................................................................................................... (620) Depreciation and amortization................................................................................................ 17,490 Non-cash compensation expense............................................................................................ 2,000 Other non-cash expenses or losses......................................................................................... 14,450 Non-recurring expenses or costs in connection with acquisition integration................................ 5,300 Acquisition integration costs................................................................................................... - Interest-equivalent costs associated with any Specified Vendor Receivables financing(1)…………. 990 51,380$ (1) As defined in the Credit Agreement dated June 30, 2015 Net income for the twelve months ended September 30, 2015 ................................................ Bank EBITDA - LTM Ended September 30, 2015(1)….………………………………………………..

28 DRIVEN TO DELIVER 3Q 2015 Earnings NYSE: HZN Constant Currency Reconciliation The following unaudited table reconciles revenue growth to constant currency revenue for the same measure: We evaluate growth in our operations on both an as reported and a constant currency basis. The constant currency presentation, which is a non-GAAP measure, excludes the impact of fluctuations in foreign currency exchange rates. We believe providing constant currency information provides valuable supplemental information regarding our growth, consistent with how we evaluate our performance. Constant currency revenue results are calculated by translating current year revenue in local currency using the prior year's currency conversion rate. This non-GAAP measure has limitations as an analytical tool and should not be considered in isolation or as a substitute for an analysis of our results as reported under GAAP. Our use of this term may vary from the use of similarly-titled measures by other issuers due to the potential inconsistencies in the method of calculation and differences due to items subject to interpretation. Consolidated Americas APEA Consolidated Americas APEA Revenue Growth as reported (2.9%) 2.6% (16.9%) (6.2%) (4.1%) (12.0%) Less: Currency impact (5.5%) (1.0%) (17.1%) (4.2%) (0.7%) (14.0%) Revenue growth at constant currency 2.6% 3.6% 0.2% (2.0%) (3.4%) 2.0% Three Months, Ended September 30, 2015 Nine Months, Ended September 30, 2015