Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PLUM CREEK TIMBER CO INC | d31996d8k.htm |

| EX-99.9 - EX-99.9 - PLUM CREEK TIMBER CO INC | d31996dex999.htm |

| EX-99.4 - EX-99.4 - PLUM CREEK TIMBER CO INC | d31996dex994.htm |

| EX-99.1 - EX-99.1 - PLUM CREEK TIMBER CO INC | d31996dex991.htm |

| EX-99.6 - EX-99.6 - PLUM CREEK TIMBER CO INC | d31996dex996.htm |

| EX-99.3 - EX-99.3 - PLUM CREEK TIMBER CO INC | d31996dex993.htm |

| EX-99.5 - EX-99.5 - PLUM CREEK TIMBER CO INC | d31996dex995.htm |

| EX-99.7 - EX-99.7 - PLUM CREEK TIMBER CO INC | d31996dex997.htm |

| EX-99.2 - EX-99.2 - PLUM CREEK TIMBER CO INC | d31996dex992.htm |

| EX-99.10 - EX-99.10 - PLUM CREEK TIMBER CO INC | d31996dex9910.htm |

| EX-99.8 - EX-99.8 - PLUM CREEK TIMBER CO INC | d31996dex998.htm |

Exhibit 99.11

FACT SHEET

|

|

WY + PCL = A WINNING COMBINATION

MERGER FACTS

NAME: Weyerhaeuser (NYSE: WY)

All-stock transaction: HEADQUARTERS

PCL shareholders will receive 1.6 WY Seattle, WA

shares for each PCL share owned

Creates $23 billion timber REIT

Timing: Late Q1 or early Q2 2016

FINANCIAL BENEFITS

$2.5 $100 FAD $1 .24

BILLION MILLION ACCRETION DIVIDEND

post-closing Total annual in first full year per common

share repurchase cost synergies(per share) share (annual)

STRONG BALANCE SHEET

BEST-IN-CLASS TEAM

NON-EXECUTIVE CHAIRMAN: Rick R. Holley

PRESIDENT & CEO: Doyle R. Simons More than

SENIOR MANAGEMENT TEAM: 14K

Rhonda Hunter—SVP, Timberlands

Tom Lindquist—EVP, Real Estate, Energy & EMPLOYEES

Natural Resources

Adrian Blocker—SVP, Wood Products

Russell Hagen—SVP, CFO

Devin Stockfish—SVP, General Counsel & Serving

Corporate Secretary customers

Denise Merle—SVP, Human Resources worldwide

Tim Punke—SVP, Corporate Affairs

DIVERSE & PRODUCTIVE TIMBERLANDS

Largest private timberland owner in U.S.

22% SOUTHERN REGION

3.0 million acres

Pacific Northwest Highly productive Southern Yellow Pine forests

Primarily serves the U.S. housing market

20% PACIFIC NORTHWEST

56% 13.2 2.6 acres million Primarily High-value serves softwood West saw Coast logs, housing mostly and Douglas Asian fir

7.3 million Northern export markets

acres MILLION ACRES Region

Southern TOTAL* NORTHERN REGION

Region Mixed hardwoods

High-value hardwood sawlog & pulpwood

2% markets

323,000 Inland West softwood sawlogs

acres URUGUAY

Uruguay

Fast-growing eucalyptus and pine

*Acreage based on pro forma ownership as of 9-30-15

LEADING WOOD PRODUCTS MANUFACTURING

20 6 1 5 6 21

Lumber OSB Medium Density Plywood/Veneer Engineered Distribution

Mills Mills Fiberboard Mills Lumber Centers

Mill Mills

COMMITTED TO SUSTAINABILITY

Together we planted nearly

650 MILLION TREES

over the last five years

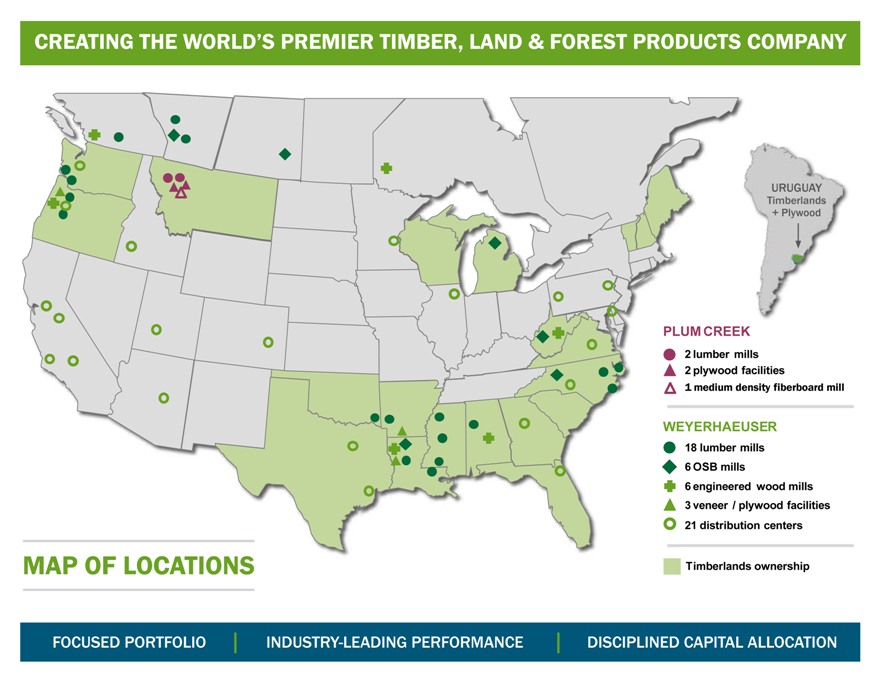

CREATING THE WORLD’S PREMIER TIMBER, LAND & FOREST PRODUCTS COMPANY

|

|

CREATING THE WORLD’S PREMIER TIMBER, LAND & FOREST PRODUCTS COMPANY

URUGUAY

Timberlands

+ Plywood

PLUM CREEK

2 lumber mills

2 plywood facilities

1 medium density fiberboard mill

WEYERHAEUSER

18 lumber mills

6 OSB mills

6 engineered wood mills

3 veneer / plywood facilities

21 distribution centers

Timberlands ownership

MAP OF LOCATIONS

FOCUSED PORTFOLIO INDUSTRY-LEADING PERFORMANCE DISCIPLINED CAPITAL ALLOCATION

|

|

REQUIRED LEGAL LANGUAGE

The following legal language is required on all company communication related to this transaction.

FORWARD-LOOKING STATEMENTS

This communication contains statements that are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, with respect to Weyerhaeuser’s future results and performance, the expected benefits of the proposed transaction such as efficiencies, cost savings and growth potential and the expected timing of the completion of the transaction, all of which are subject to risks and uncertainties. Factors listed below, as well as other factors, may cause actual results to differ significantly from these forward-looking statements. There is no guarantee that any of the events anticipated by these forward-looking statements will occur. If any of the events occur, there is no guarantee what effect they will have on company operations or financial condition. Weyerhaeuser will not update these forward-looking statements after the date of this communication.

Some forward-looking statements discuss Weyerhaeuser’s and Plum Creek’s plans, strategies, expectations and intentions. They use words such as “expects,” “may,” “will,” “believes,” “should,” “approximately,” “anticipates,” “estimates,” and “plans.” In addition, these words may use the positive or negative or other variations of those and similar words.

Major risks, uncertainties and assumptions that affect Weyerhaeuser’s and Plum Creek’s businesses and may cause actual results to differ materially from those expressed or implied in these forward-looking statements, including, without limitation, the failure to receive, on a timely basis or otherwise, the required approval of Weyerhaeuser’s shareholders or Plum Creek’s stockholders with respect to the proposed transaction; the risk that any of the conditions to closing of the proposed transaction may not be satisfied; the risk that the businesses of Weyerhaeuser and Plum Creek will not be integrated successfully; the effect of general economic conditions, including employment rates, housing starts, interest rate levels, availability of financing for home mortgages, and strength of the U.S. dollar; market demand for our products, which is related to the strength of the various U.S. business segments and U.S. and international economic conditions; performance of our manufacturing operations, including maintenance requirements; the level of competition from domestic and foreign producers; the successful execution of internal performance plans, including restructurings and cost reduction initiatives; raw material prices; energy prices; the effect of weather; the risk of loss from fires, floods, windstorms, hurricanes, pest infestation and other natural disasters; transportation availability and costs; federal tax policies; the effect of forestry, land use, environmental and other governmental regulations; legal proceedings; performance of pension fund investments and related derivatives; the effect of timing of retirements and changes in the market price of company stock on charges for stock-based compensation; changes in accounting principles; and other factors described in Weyerhaeuser’s and Plum Creek’s filings with the SEC, including the “Risk Factors” section in Weyerhaeuser’s and Plum Creek’s respective annual reports on Form 10-K for the year ended December 31, 2014.

NO OFFER OR SOLICITATION

This communication is neither an offer to purchase, nor a solicitation of an offer to sell, subscribe for or buy any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

ADDITIONAL INFORMATION AND WHERE TO FIND IT

The proposed transaction involving Weyerhaeuser and Plum Creek will be submitted to Weyerhaeuser’s shareholders and Plum Creek’s stockholders for their consideration. In connection with the proposed transaction, Weyerhaeuser intends to file with the SEC a registration statement on Form S-4 (the “Registration Statement”), which will include a prospectus with respect to Weyerhaeuser’s common shares to be issued in the proposed transaction and a joint proxy statement for Weyerhaeuser’s shareholders and Plum Creek’s stockholders (the “Joint Proxy Statement”) and each of

Weyerhaeuser and Plum Creek will mail the Joint Proxy Statement to their respective shareholders or stockholders, as applicable, and file other documents regarding the proposed transaction with the SEC. SECURITY HOLDERS ARE URGED AND ADVISED TO READ ALL RELEVANT MATERIALS FILED WITH THE SEC, INCLUDING THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT, CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. The Registration Statement, the Joint Proxy Statement and other relevant materials (when they become available) and any other documents filed or furnished by Weyerhaeuser or Plum Creek with the SEC may be obtained free of charge at the SEC’s web site at www.sec.gov. In addition, security holders will be able to obtain free copies of the Registration Statement and the Joint Proxy Statement from Weyerhaeuser upon written request to Weyerhaeuser Company, 33663 Weyerhaeuser Way South, Federal Way, Washington 98003, Attention: Director, Investor Relations, or by calling (253) 924-2058, or from Plum Creek upon written request to Plum Creek, 601 Union Street, Suite 3100, Seattle Washington 98101, Attention: Investor Relations, or by calling (800) 858-5347.

PARTICIPANTS IN THE SOLICITATION

Weyerhaeuser, Plum Creek, their respective directors and certain of their respective executive officers and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information about Weyerhaeuser’s directors and executive officers is set forth in its definitive proxy statement for its 2015 Annual Meeting of Shareholders, which was filed with the SEC on April 1, 2015, and information about Plum Creek’s directors and executive officers is set forth in its definitive proxy statement for its 2015 Annual Meeting of Stockholders, which was filed with the SEC on March 26, 2015. These documents are available free of charge from the sources indicated above, and from Weyerhaeuser by going to its investor relations page on its corporate web site at www.weyerhaeuser.com and from Plum Creek by going to its investor relations page on its corporate web site at www.plumcreek.com.

Additional information regarding the interests of participants in the solicitation of proxies in connection with the proposed transaction will be included in the Registration Statement, the Joint Proxy

Statement and other relevant materials Weyerhaeuser and Plum Creek intend to file with the SEC.