Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K RE 2015 GRC FINAL DECISION - EDISON INTERNATIONAL | eix-sceform8xkre2015grcfin.htm |

November 9, 2015 Business Update Supplement SCE 2015 General Rate Case Decision

November 9, 2015 1 Forward-Looking Statements Statements contained in this presentation about future performance, including, without limitation, operating results, asset and rate base growth, capital expenditures, financial outlook, and other statements that are not purely historical, are forward-looking statements. These forward-looking statements reflect our current expectations; however, such statements involve risks and uncertainties. Actual results could differ materially from current expectations. These forward- looking statements represent our expectations only as of the date of this presentation, and Edison International assumes no duty to update them to reflect new information, events or circumstances. Important factors that could cause different results are discussed under the headings “Risk Factors” and “Management’s Discussion and Analysis” in Edison International’s Form 10-K, most recent form 10-Q, and other reports filed with the Securities and Exchange Commission, which are available on our website: www.edisoninvestor.com. These filings also provide additional information on historical and other factual data contained in this presentation. This presentation updates certain information contained in the company’s Business Update dated October 28, 2015. The company continues to analyze the regulatory, tax and accounting implications of the final decision and preliminary conclusions maybe subject to change.

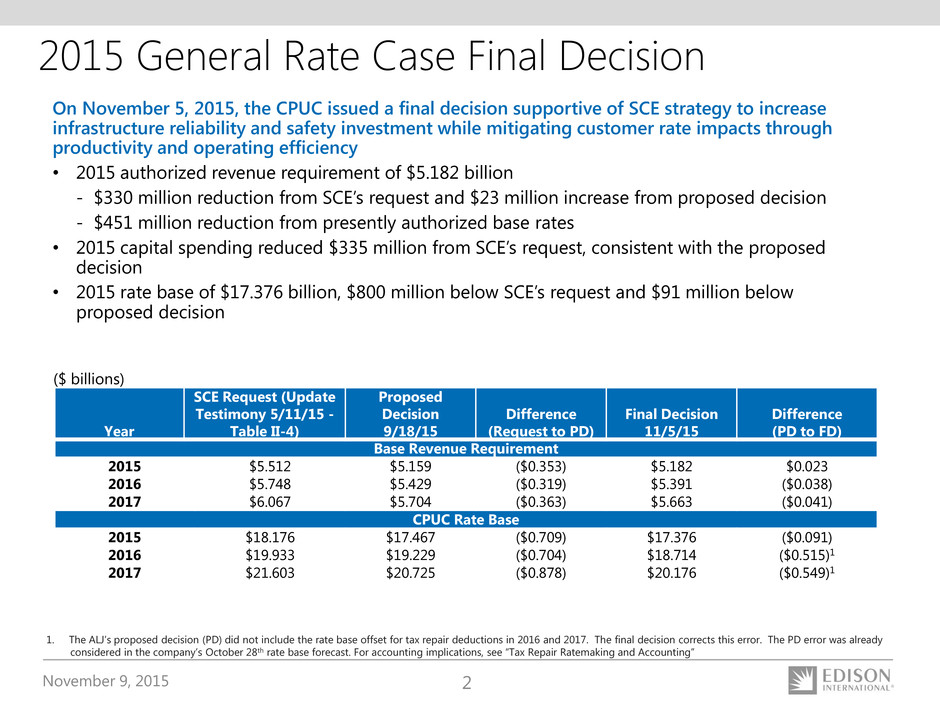

November 9, 2015 2 On November 5, 2015, the CPUC issued a final decision supportive of SCE strategy to increase infrastructure reliability and safety investment while mitigating customer rate impacts through productivity and operating efficiency • 2015 authorized revenue requirement of $5.182 billion - $330 million reduction from SCE’s request and $23 million increase from proposed decision - $451 million reduction from presently authorized base rates • 2015 capital spending reduced $335 million from SCE’s request, consistent with the proposed decision • 2015 rate base of $17.376 billion, $800 million below SCE’s request and $91 million below proposed decision Year SCE Request (Update Testimony 5/11/15 - Table II-4) Proposed Decision 9/18/15 Difference (Request to PD) Final Decision 11/5/15 Difference (PD to FD) Base Revenue Requirement 2015 $5.512 $5.159 ($0.353) $5.182 $0.023 2016 $5.748 $5.429 ($0.319) $5.391 ($0.038) 2017 $6.067 $5.704 ($0.363) $5.663 ($0.041) CPUC Rate Base 2015 $18.176 $17.467 ($0.709) $17.376 ($0.091) 2016 $19.933 $19.229 ($0.704) $18.714 ($0.515)1 2017 $21.603 $20.725 ($0.878) $20.176 ($0.549)1 ($ billions) 2015 General Rate Case Final Decision 1. The ALJ’s proposed decision (PD) did not include the rate base offset for tax repair deductions in 2016 and 2017. The final decision corrects this error. The PD error was already considered in the company’s October 28th rate base forecast. For accounting implications, see “Tax Repair Ratemaking and Accounting”

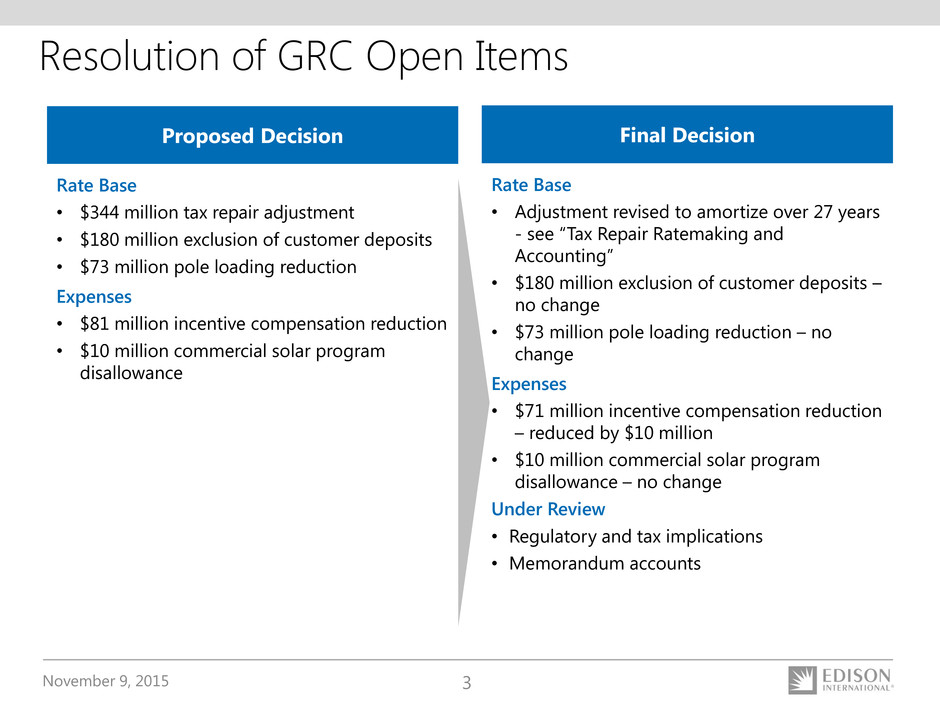

November 9, 2015 3 Rate Base • Adjustment revised to amortize over 27 years - see “Tax Repair Ratemaking and Accounting” • $180 million exclusion of customer deposits – no change • $73 million pole loading reduction – no change Expenses • $71 million incentive compensation reduction – reduced by $10 million • $10 million commercial solar program disallowance – no change Under Review • Regulatory and tax implications • Memorandum accounts Resolution of GRC Open Items Proposed Decision Final Decision Rate Base • $344 million tax repair adjustment • $180 million exclusion of customer deposits • $73 million pole loading reduction Expenses • $81 million incentive compensation reduction • $10 million commercial solar program disallowance

November 9, 2015 4 Tax Repair Ratemaking and Accounting Tax Repair Ratemaking • In SCE’s 2015 GRC final decision, the CPUC adopted a rate base offset associated with forecasted tax repair deductions during 2012-2014 – In 2015, the CPUC rate base offset is $324 million1 and amortizes on a straight line basis over 27 years • SCE disagrees with the CPUC’s actions and is concerned that the rate base offset approach may be retroactive ratemaking. SCE will also confirm with the IRS that the offset approach is not a normalization violation Tax Repair Accounting • SCE’s regulatory assets include $382 million for recovery of deferred taxes related to incremental repair deductions for 2012-2014 • Based on the decision, it is no longer probable that SCE will recover the regulatory asset. Therefore, SCE will write off this amount in the fourth quarter of 2015 (treated as non-core) • Because the ”rate base offset” will be implemented through the regulatory asset write- off, no “rate base offset” is needed for future earning forecasts 1. The CPUC final decision refers to a $344 million rate base adjustment of which $324 million represents the CPUC jurisdictional rate base

November 9, 2015 5 • No changes in capital spending outlook based on GRC final decision SCE 2015-2017 Capital Expenditure Forecast Note: Forecasted capital spending subject to timely receipt of permitting, licensing, and regulatory approvals. Forecasted capital spending includes CPUC, FERC and other spending Range case includes a 12% reduction of FERC expenditures in 2016 and 2017 ($ billions) 2015-17 Total Outlook $3.9 $3.8 $4.1 $11.8 Range $3.9 $3.7 $4.0 $11.6 $3.9 $3.8 $4.1 2015 2016 2017 Distribution Transmission Generation $11.6 – $11.8 Billion Capital Program for 2015-2017 2018+ Capital Spending Outlook • SCE anticipates post-2017 capital spending to continue at least in the range of ~$4 billion annually. Higher spending dependent on CPUC approval in future GRCs • FERC shift of $400 million of capital spending to 2018-2020 • Excludes DRP, Charge Ready program and energy storage capital spending

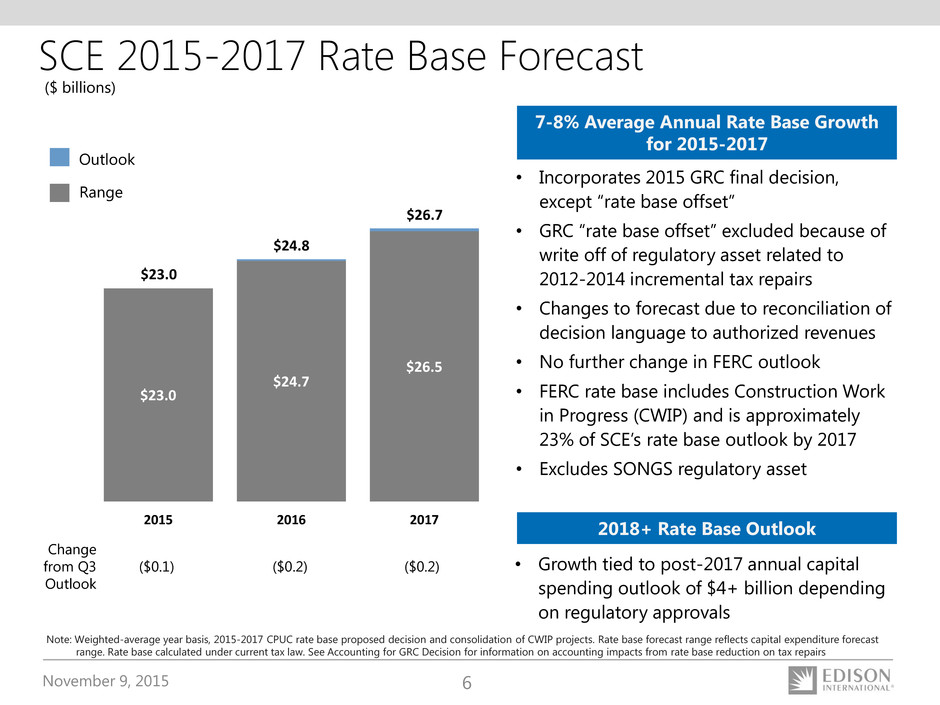

November 9, 2015 6 SCE 2015-2017 Rate Base Forecast • Incorporates 2015 GRC final decision, except “rate base offset” • GRC “rate base offset” excluded because of write off of regulatory asset related to 2012-2014 incremental tax repairs • Changes to forecast due to reconciliation of decision language to authorized revenues • No further change in FERC outlook • FERC rate base includes Construction Work in Progress (CWIP) and is approximately 23% of SCE’s rate base outlook by 2017 • Excludes SONGS regulatory asset ($ billions) Outlook Range $23.0 $24.7 $26.5 $23.0 $24.8 $26.7 2015 2016 2017 Note: Weighted-average year basis, 2015-2017 CPUC rate base proposed decision and consolidation of CWIP projects. Rate base forecast range reflects capital expenditure forecast range. Rate base calculated under current tax law. See Accounting for GRC Decision for information on accounting impacts from rate base reduction on tax repairs 7-8% Average Annual Rate Base Growth for 2015-2017 2018+ Rate Base Outlook • Growth tied to post-2017 annual capital spending outlook of $4+ billion depending on regulatory approvals Change from Q3 Outlook ($0.1) ($0.2) ($0.2)

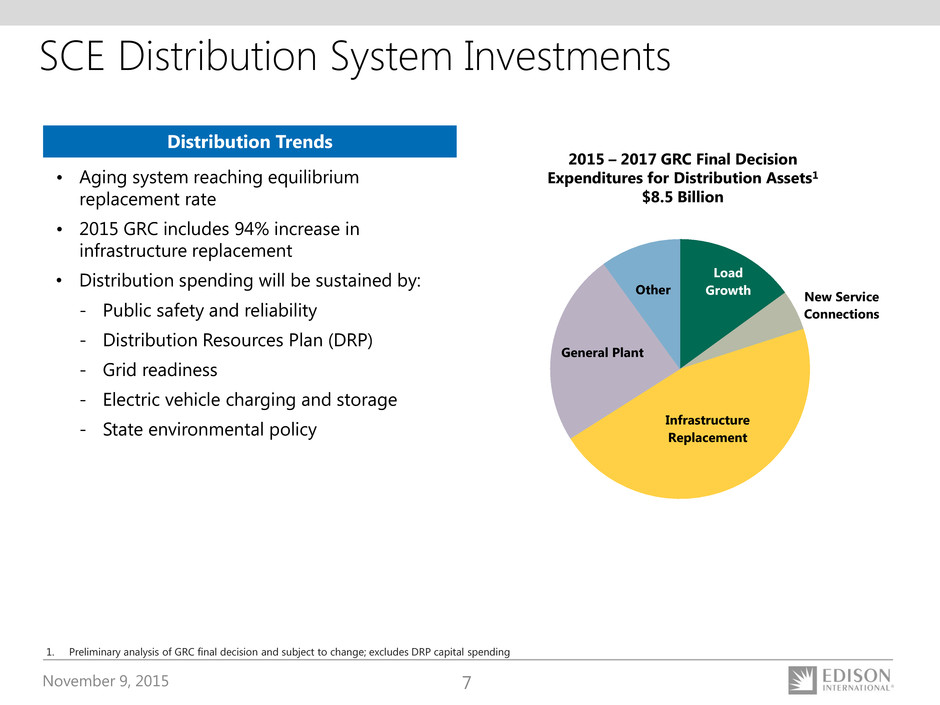

November 9, 2015 7 SCE Distribution System Investments Distribution Trends • Aging system reaching equilibrium replacement rate • 2015 GRC includes 94% increase in infrastructure replacement • Distribution spending will be sustained by: - Public safety and reliability - Distribution Resources Plan (DRP) - Grid readiness - Electric vehicle charging and storage - State environmental policy Load Growth New Service Connections Infrastructure Replacement General Plant Other 2015 – 2017 GRC Final Decision Expenditures for Distribution Assets1 $8.5 Billion 1. Preliminary analysis of GRC final decision and subject to change; excludes DRP capital spending

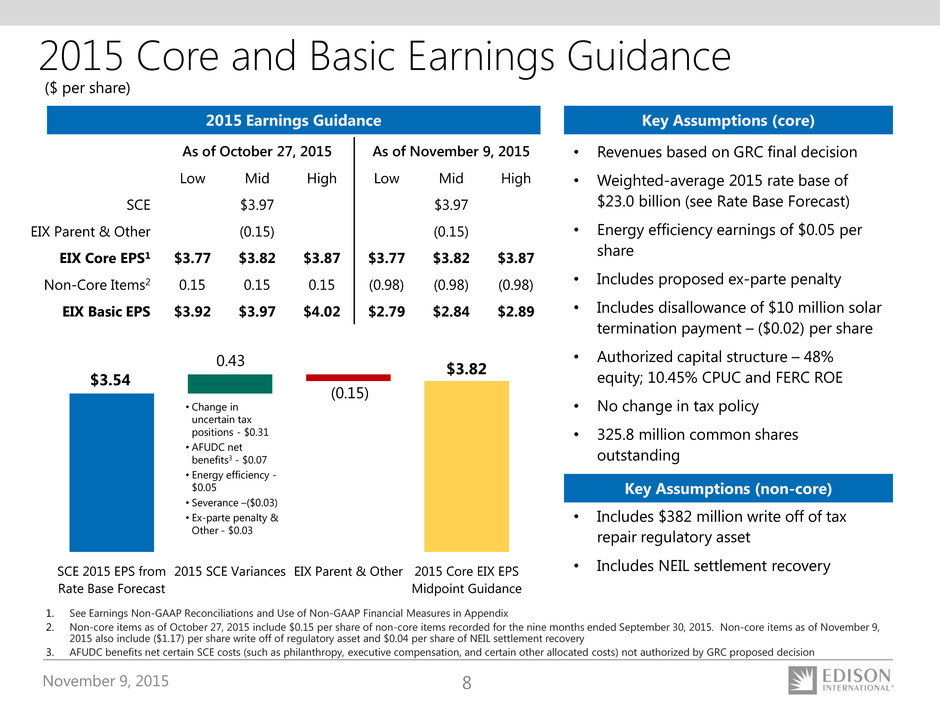

November 9, 2015 8 • Revenues based on GRC final decision • Weighted-average 2015 rate base of $23.0 billion (see Rate Base Forecast) • Energy efficiency earnings of $0.05 per share • Includes proposed ex-parte penalty • Includes disallowance of $10 million solar termination payment – ($0.02) per share • Authorized capital structure – 48% equity; 10.45% CPUC and FERC ROE • No change in tax policy • 325.8 million common shares outstanding Key Assumptions (core) $3.54 3.54 3.82 $3.82 (0.15) 0.43 SCE 2015 EPS from Rate Base Forecast 2015 SCE Variances EIX Parent & Other 2015 Core EIX EPS Midpoint Guidance 2015 Core and Basic Earnings Guidance 1. See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix 2. Non-core items as of October 27, 2015 include $0.15 per share of non-core items recorded for the nine months ended September 30, 2015. Non-core items as of November 9, 2015 also include ($1.17) per share write off of regulatory asset and $0.04 per share of NEIL settlement recovery 3. AFUDC benefits net certain SCE costs (such as philanthropy, executive compensation, and certain other allocated costs) not authorized by GRC proposed decision As of October 27, 2015 As of November 9, 2015 Low Mid High Low Mid High SCE $3.97 $3.97 EIX Parent & Other (0.15) (0.15) EIX Core EPS1 $3.77 $3.82 $3.87 $3.77 $3.82 $3.87 Non-Core Items2 0.15 0.15 0.15 (0.98) (0.98) (0.98) EIX Basic EPS $3.92 $3.97 $4.02 $2.79 $2.84 $2.89 • Change in uncertain tax positions - $0.31 • AFUDC net benefits3 - $0.07 • Energy efficiency - $0.05 • Severance –($0.03) • Ex-parte penalty & Other - $0.03 ($ per share) 2015 Earnings Guidance Key Assumptions (non-core) • Includes $382 million write off of tax repair regulatory asset • Includes NEIL settlement recovery

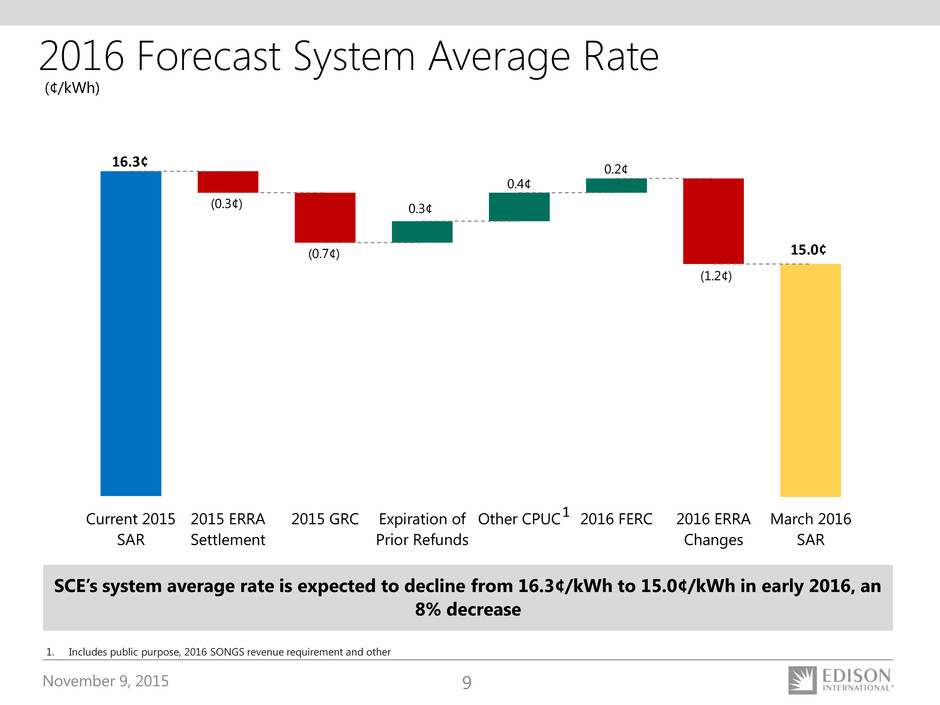

November 9, 2015 9 (0.3¢) (0.7¢) (1.2¢) 0.3¢ 0.4¢ 0.2¢ 5.30 4.00 Current 2015 SAR 2015 ERRA Settlement 2015 GRC Expiration of Prior Refunds Other CPUC 2016 FERC 2016 ERRA Changes March 2016 SAR 2016 Forecast System Average Rate SCE’s system average rate is expected to decline from 16.3¢/kWh to 15.0¢/kWh in early 2016, an 8% decrease (¢/kWh) 1. Includes public purpose, 2016 SONGS revenue requirement and other 1 16. ¢ 15.0¢

November 9, 2015 10 Earnings Per Share Non-GAAP Reconciliations Reconciliation of EIX Core Earnings Per Share to EIX GAAP Earnings Per Share 1. See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix of the October 2015 Business Update 2. Refer to “Management Overview” in the September 30, 2015 Form 10-Q for discussion of non-core items ($ per share) Q3 2015 Q3 2014 YTD 2015 YTD 2014 Core Earnings Per Share (EPS)1 SCE $1.19 $1.54 $3.31 $3.58 EIX Parent & Other (0.03) (0.02) (0.09) (0.08) Core EPS1 $1.16 $1.52 $3.22 $3.50 Non-Core Items2 SCE $ – $ – $ – ($0.29) EIX Parent & Other – – 0.02 – Discontinued Operations 0.13 (0.05) 0.13 0.45 Total Non-Core $0.13 ($0.05) $0.15 $0.16 Basic EPS $1.29 $1.47 $3.37 $3.66 Diluted EPS $1.28 $1.46 $3.34 $3.62

November 9, 2015 11 Use of Non-GAAP Financial Measures Edison International's earnings are prepared in accordance with generally accepted accounting principles used in the United States. Management uses core earnings internally for financial planning and for analysis of performance. Core earnings are also used when communicating with investors and analysts regarding Edison International's earnings results to facilitate comparisons of the Company's performance from period to period. Core earnings are a non-GAAP financial measure and may not be comparable to those of other companies. Core earnings (or losses) are defined as earnings or losses attributable to Edison International shareholders less income or loss from discontinued operations and income or loss from significant discrete items that management does not consider representative of ongoing earnings, such as: exit activities, including sale of certain assets, and other activities that are no longer continuing; asset impairments and certain tax, regulatory or legal settlements or proceedings. A reconciliation of Non-GAAP information to GAAP information is included either on the slide where the information appears or on another slide referenced in this presentation. Investor Relations Contacts Scott Cunningham, Vice President (626) 302-2540 scott.cunningham@edisonintl.com Allison Bahen, Senior Manager (626) 302-5493 allison.bahen@edisonintl.com