Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BANK OF THE OZARKS INC | d35255d8k.htm |

| EX-99.1 - EXHIBIT 99.1 - BANK OF THE OZARKS INC | d35255dex991.htm |

| EX-99.3 - EXHIBIT 99.3 - BANK OF THE OZARKS INC | d35255dex993.htm |

Acquisition of C1 Financial, Inc. November 9, 2015 Exhibit 99.2

ADDITIONAL INFORMATION This communication is being made in respect of the proposed merger transaction involving Bank of the Ozarks, Inc. (“Company”) and C1 Financial, Inc. (“C1”). This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. In connection with the proposed merger, the Company will file with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-4 that will include a proxy statement of C1 and a prospectus of the Company. The Company and C1 also plan to file other documents with the SEC regarding the proposed merger transaction and a definitive proxy statement/prospectus will be mailed to shareholders of C1. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED TRANSACTION AND ANY OTHER RELEVANT DOCUMENTS CAREFULLY IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. The proxy statement/prospectus, as well as other filings containing information about the Company and C1 will be available without charge, at the SEC’s Internet site (http://www.sec.gov). Copies of the proxy statement/prospectus and the filings with the SEC that will be incorporated by reference in the proxy statement/prospectus can also be obtained, when available, without charge, from the Company’s website at http://www.bankozarks.com under the Investor Relations tab (in the case of documents filed by the Company) and on C1’s website at https://www.c1bank.com (in the case of documents filed by C1). The Company and C1, and certain of their respective directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from the shareholders of C1 in respect of the proposed merger transaction. Certain information about the directors and executive officers of the Company is set forth in its Annual Report on Form 10-K for the year ended December 31, 2014, which was filed with the SEC on February 27, 2015 and its proxy statement for its 2015 annual meeting of shareholders, which was filed with the SEC on March 25, 2015. Certain information about the directors and executive officers of C1 is set forth in its Annual Report on Form 10-K for the year ended December 31, 2014, which was filed with the SEC on February 20, 2015, its proxy statement for its 2015 annual meeting of shareholders, which was filed with the SEC on March 10, 2015, and its Current Reports on Form 8-K, which were filed with the SEC on July 1, 2015 and September 14, 2015. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the proxy statement/prospectus and other relevant documents filed with the SEC when they become available. CAUTION ABOUT FORWARD-LOOKING STATEMENTS This communication contains certain forward-looking information about the Company and C1 that is intended to be covered by the safe harbor for “forward-looking statements” provided by the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are forward-looking statements. In some cases, you can identify forward-looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “continue,” “could,” “future” or the negative of those terms or other words of similar meaning. These forward-looking statements include, without limitation, statements relating to the terms and closing of the proposed transaction between the Company and C1, the proposed impact of the merger on the Company’s financial results, including any expected increase in the Company’s book value and tangible book value per common share and any expected increase in diluted earnings per common share, acceptance by C1’s customers of the Company’s products and services, the opportunities to enhance market share in certain markets, market acceptance of the Company generally in new markets, and the integration of C1’s operations. You should carefully read forward-looking statements, including statements that contain these words, because they discuss the future expectations or state other “forward-looking” information about the Company and C1. A number of important factors could cause actual results or events to differ materially from those indicated by such forward-looking statements, many of which are beyond the parties’ control, including the parties’ ability to consummate the transaction or satisfy the conditions to the completion of the transaction, including the receipt of shareholder approval, the receipt of regulatory approvals required for the transaction on the terms expected or on the anticipated schedule; the parties’ ability to meet expectations regarding the timing, completion and accounting and tax treatments of the transaction; the possibility that any of the anticipated benefits of the proposed merger will not be realized or will not be realized within the expected time period; the risk that integration of C1’s operations with those of the Company will be materially delayed or will be more costly or difficult than expected; the failure of the proposed merger to close for any other reason; the effect of the announcement of the merger on customer relationships and operating results (including, without limitation, difficulties in maintaining relationships with employees or customers); dilution caused by the Company’s issuance of additional shares of its common stock in connection with the merger; the possibility that the merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events; the diversion of management time on transaction related issues; general competitive, economic, political and market conditions and fluctuations; changes in the regulatory environment; changes in the economy affecting real estate values; C1’s ability to achieve loan and deposit growth; projected population and income growth in C1’s targeted market areas; volatility and direction of market interest rates and a weakening of the economy which could materially impact credit quality trends and the ability to generate loans; and the other factors described in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and in its most recent Quarterly Reports on Form 10-Q filed with the SEC, or described in C1’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and its most recent Quarterly Reports on Form 10-Q filed with the SEC. The Company and C1 assume no obligation to update the information in this communication, except as otherwise required by law. Readers are cautioned not to place undue reliance on these forward-looking statements, all of which speak only as of the date hereof. Forward Looking Information

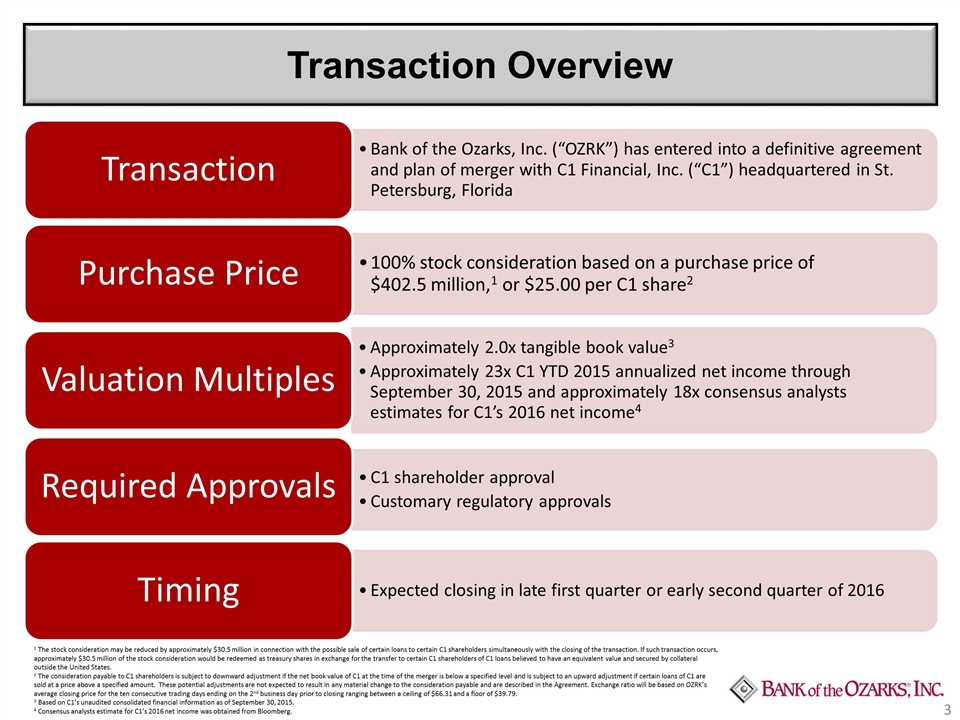

Transaction Overview 1 The stock consideration may be reduced by approximately $30.5 million in connection with the possible sale of certain loans to certain C1 shareholders simultaneously with the closing of the transaction. If such transaction occurs, approximately $30.5 million of the stock consideration would be redeemed as treasury shares in exchange for the transfer to certain C1 shareholders of C1 loans believed to have an equivalent value and secured by collateral outside the United States. 2 The consideration payable to C1 shareholders is subject to downward adjustment if the net book value of C1 at the time of the merger is below a specified level and is subject to an upward adjustment if certain loans of C1 are sold at a price above a specified amount. These potential adjustments are not expected to result in any material change to the consideration payable and are described in the Agreement. Exchange ratio will be based on OZRK’s average closing price for the ten consecutive trading days ending on the 2nd business day prior to closing ranging between a ceiling of $66.31 and a floor of $39.79. 3 Based on C1’s unaudited consolidated financial information as of September 30, 2015. 4 Consensus analysts estimate for C1’s 2016 net income was obtained from Bloomberg. Purchase Price Valuation Multiples Approximately 2.0x tangible book value 3 Required Approvals C1 shareholder approval 100% stock consideration based on a purchase price of $402.5 million, 1 or $25.00 per C1 share 2 Customary regulatory approvals Timing Expected closing in late first quarter or early second quarter of 2016 Transaction Bank of the Ozarks, Inc. (“OZRK”) has entered into a definitive agreement and plan of merger with C1 Financial, Inc. (“C1”) headquartered in St. Petersburg, Florida Approximately 23x C1 YTD 2015 annualized net income through September 30, 2015 and approximately 18x consensus analysts estimates for C1’s 2016 net income 4

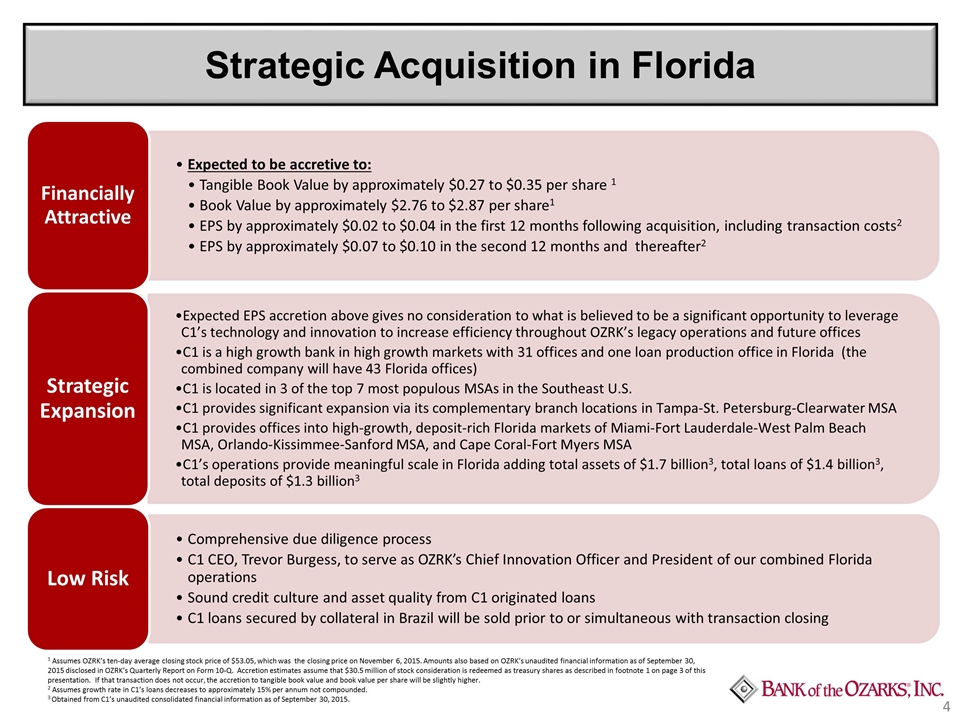

Strategic Acquisition in Florida 1 Assumes OZRK’s ten-day average closing stock price of $53.05, which was the closing price on November 6, 2015. Amounts also based on OZRK’s unaudited financial information as of September 30, 2015 disclosed in OZRK’s Quarterly Report on Form 10-Q. Accretion estimates assume that $30.5 million of stock consideration is redeemed as treasury shares as described in footnote 1 on page 3 of this presentation. If that transaction does not occur, the accretion to tangible book value and book value per share will be slightly higher. 2 Assumes growth rate in C1’s loans decreases to approximately 15% per annum not compounded. 3 Obtained from C1’s unaudited consolidated financial information as of September 30, 2015. Financially Attractive Expected to be accretive to: Strategic Expansion C1’s operations provide meaningful scale in Florida adding total assets of $1.7 billion 3 , total loans of $1.4 billion 3 , total deposits of $1.3 billion 3 Low Risk Comprehensive due diligence process Tangible Book Value by approximately $ 0.27 to $ 0.35 per share 1 C1 CEO, Trevor Burgess, to serve as OZRK’s Chief Innovation Officer and President of our combined Florida operations Sound credit culture and asset quality from C1 originated loans Expected EPS accretion above gives no consideration to what is believed to be a significant opportunity to leverage C1’s technology and innovation to increase efficiency throughout OZRK’s legacy operations and future offices EPS by approximately $0.07 to $0.10 in the second 12 months and thereafter 2 EPS by approximately $0.02 to $0.04 in the first 12 months following acquisition, including transaction costs 2 Book Value by approximately $2.76 to $2.87 per share 1 C1 is located in 3 of the top 7 most populous MSAs in the Southeast U.S. C1 is a high growth bank in high growth markets with 31 offices and one loan production office in Florida (the combined company will have 43 Florida offices) C1 loans secured by collateral in Brazil will be sold prior to or simultaneous with transaction closing C1 provides significant expansion via its complementary branch locations in Tampa-St. Petersburg-Clearwater MSA C1 provides offices into high-growth, deposit-rich Florida markets of Miami-Fort Lauderdale-West Palm Beach MSA, Orlando-Kissimmee-Sanford MSA, and Cape Coral-Fort Myers MSA

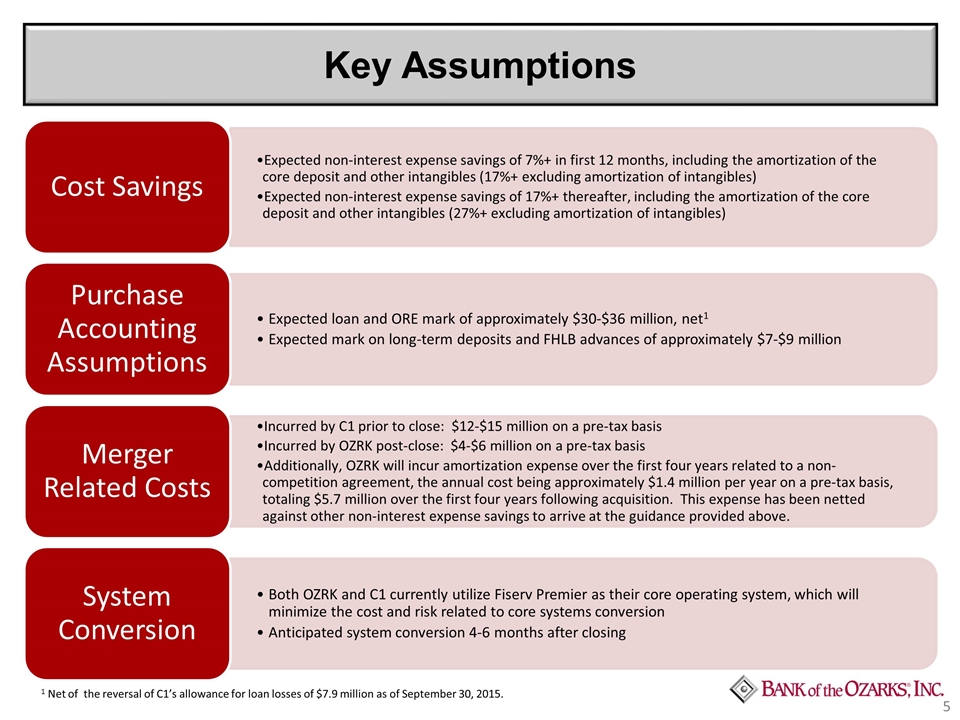

Key Assumptions 1 Net of the reversal of C1’s allowance for loan losses of $7.9 million as of September 30, 2015. Cost Savings Expected non-interest expense savings of 7%+ in first 12 months, including the amortization of the core deposit and other intangibles (17%+ excluding amortization of intangibles) Purchase Accounting Assumptions Expected loan and ORE mark of approximately $30-$36 million, net 1 Merger Related Costs Incurred by C1 prior to close: $ 12- $ 15 million on a pre-tax basis System Conversion Anticipated system conversion 4-6 months after closing Expected non-interest expense savings of 17 %+ thereafter, including the amortization of the core deposit and other intangibles (27%+ excluding amortization of intangibles) Expected mark on long-term deposits and FHLB advances of approximately $7-$9 million Incurred by OZRK post-close: $4-$6 million on a pre-tax basis Additionally, OZRK will incur amortization expense over the first four years related to a non-competition agreement, the annual cost being approximately $1.4 million per year on a pre-tax basis, totaling $5.7 million over the first four years following acquisition. This expense has been netted against other non-interest expense savings to arrive at the guidance provided above. Both OZRK and C1 currently utilize Fiserv Premier as their core operating system, which will minimize the cost and risk related to core systems conversion

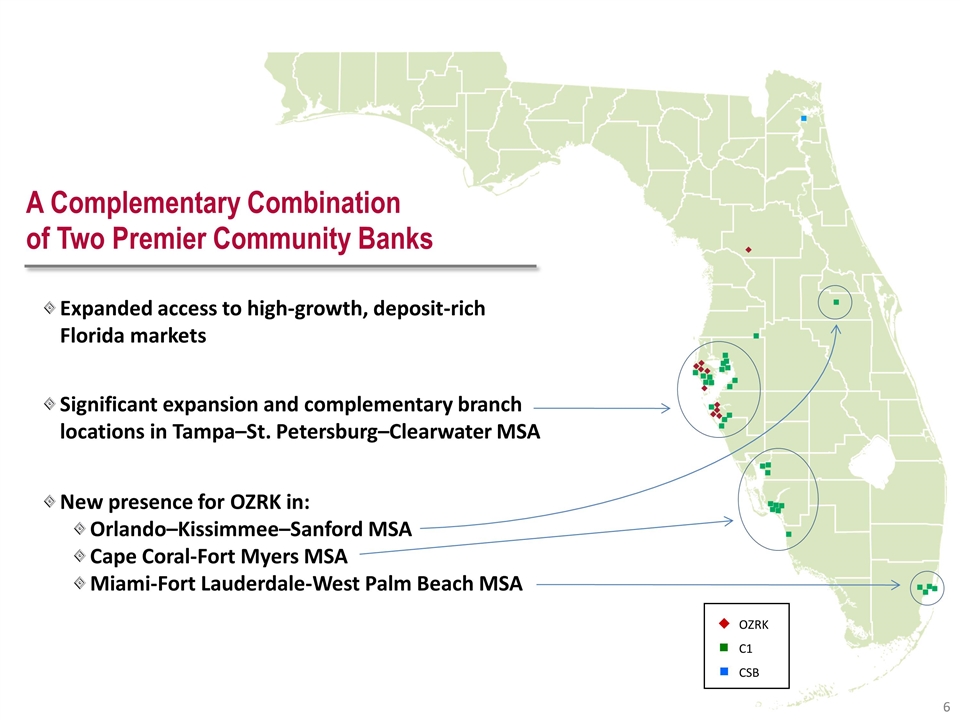

6 A Complementary Combination of Two Premier Community Banks Expanded access to high-growth, deposit-rich Florida markets Significant expansion and complementary branch locations in Tampa–St. Petersburg–Clearwater MSA New presence for OZRK in: Orlando–Kissimmee–Sanford MSA Cape Coral-Fort Myers MSA Miami-Fort Lauderdale-West Palm Beach MSA OZRK C1 CSB

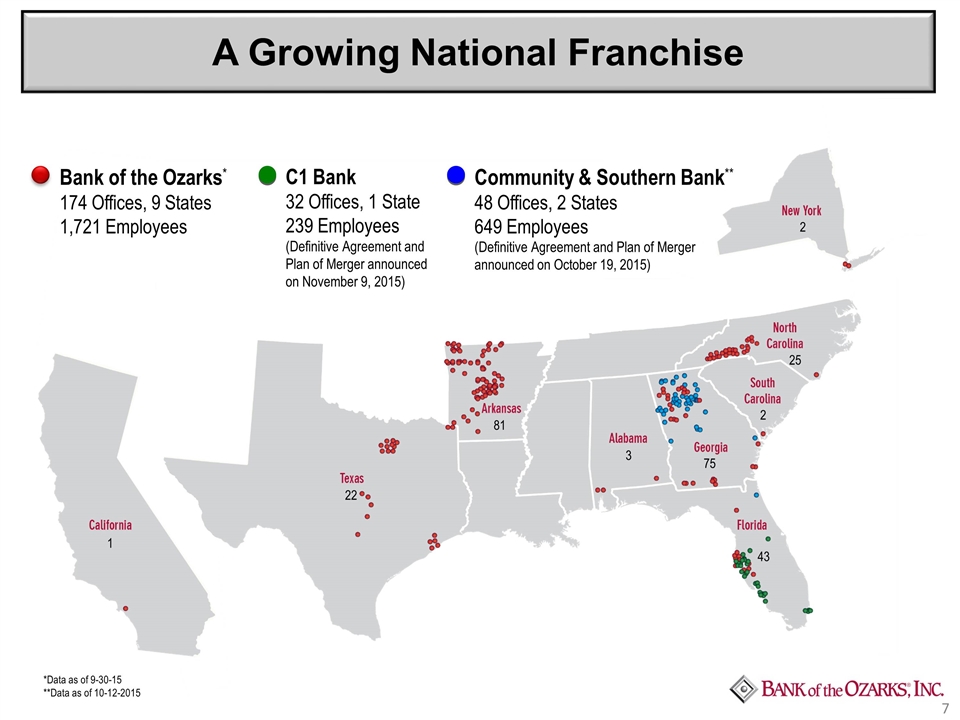

Bank of the Ozarks* 174 Offices, 9 States 1,721 Employees Community & Southern Bank** 48 Offices, 2 States 649 Employees (Definitive Agreement and Plan of Merger announced on October 19, 2015) *Data as of 9-30-15 **Data as of 10-12-2015 1 22 81 3 43 75 2 25 2 C1 Bank 32 Offices, 1 State 239 Employees (Definitive Agreement and Plan of Merger announced on November 9, 2015) A Growing National Franchise

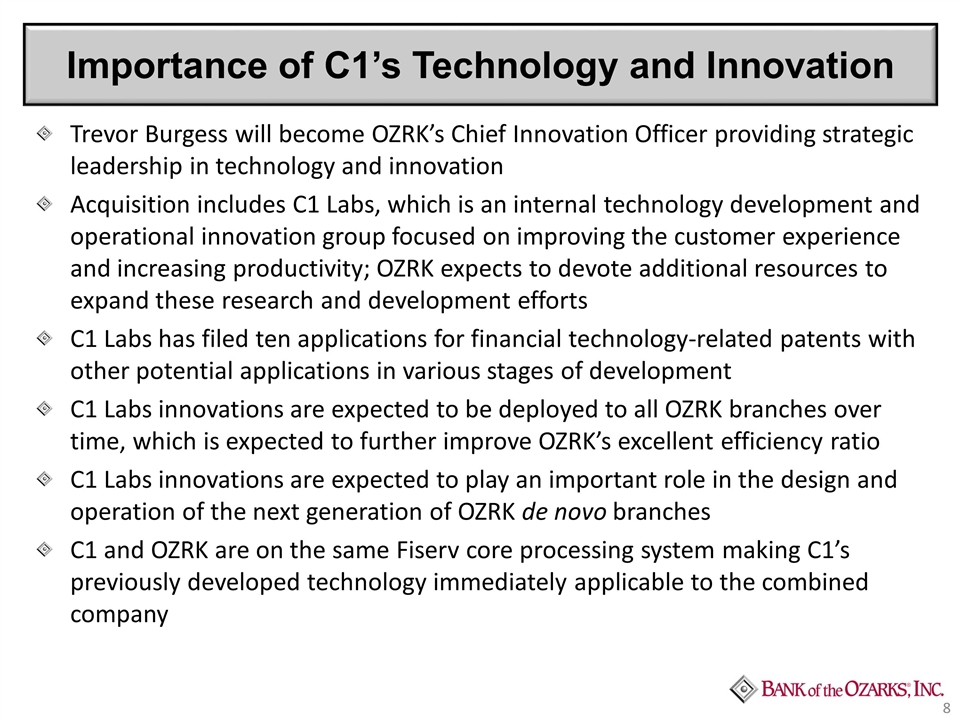

Importance of C1’s Technology and Innovation Trevor Burgess will become OZRK’s Chief Innovation Officer providing strategic leadership in technology and innovation Acquisition includes C1 Labs, which is an internal technology development and operational innovation group focused on improving the customer experience and increasing productivity; OZRK expects to devote additional resources to expand these research and development efforts C1 Labs has filed ten applications for financial technology-related patents with other potential applications in various stages of development C1 Labs innovations are expected to be deployed to all OZRK branches over time, which is expected to further improve OZRK’s excellent efficiency ratio C1 Labs innovations are expected to play an important role in the design and operation of the next generation of OZRK de novo branches C1 and OZRK are on the same Fiserv core processing system making C1’s previously developed technology immediately applicable to the combined company

Concluding Remarks Major expansion through a premier community bank in a number of high-growth, deposit-rich Florida markets Significant potential benefits from C1’s demonstrated capabilities in technology and innovation Immediately accretive to tangible book value and book value per share, and slightly accretive to diluted earnings per share in the first 12 months and increasing thereafter Pro forma total assets of approximately $15.5 billion with this acquisition and OZRK’s recently announced acquisition of Community & Southern Bank1,2 Fifteenth acquisition announced by OZRK since March 2010 While OZRK is now intensely focused on integrating its two pending acquisitions, OZRK continues to actively pursue additional acquisition opportunities 1 Includes unaudited consolidated assets of OZRK as of September 30, 2015 disclosed in OZRK’s Quarterly Report on Form 10-Q, C1’s unaudited consolidated assets as of September 30, 2015 and Community & Southern Holdings, Inc. unaudited consolidated financial information as of September 30, 2015 pro forma adjusted for the acquisition of CertusBank branches, deposits and loans on October 9, 2015. For illustrative purposes only and does not indicate actual results of combined company. 2 The order and timing of the Community & Southern and C1 acquisitions is uncertain, being dependent on regulatory approvals, satisfaction of other closing conditions and other factors, which are difficult to predict.