Attached files

| file | filename |

|---|---|

| EX-31.2 - EXHIBIT 31.2 - Virtu KCG Holdings LLC | kcgexhibit312q315.htm |

| EX-32.2 - EXHIBIT 32.2 - Virtu KCG Holdings LLC | kcgexhibit322q315.htm |

| EX-31.1 - EXHIBIT 31.1 - Virtu KCG Holdings LLC | kcgexhibit311q315.htm |

| EX-32.1 - EXHIBIT 32.1 - Virtu KCG Holdings LLC | kcgexhibit321q315.htm |

| 10-Q - KCG Q3 10-Q - Virtu KCG Holdings LLC | kcgq31510q.htm |

EXHIBIT 10.1

LEASE

between

BOP ONE NORTH END LLC,

as Landlord,

and

KCG HOLDINGS, INC.,

as Tenant,

Dated as of July 31, 2015

Premises: The Entire 9th, 10th and 11th Floors and a Portion of the 12th Floor Brookfield Place 300 Vesey Street (a/k/a One North End Avenue) New York, New York 10282 |

TABLE OF CONTENTS

i | ||

ii | ||

iii | ||

EXHIBITS:

A Description of Land

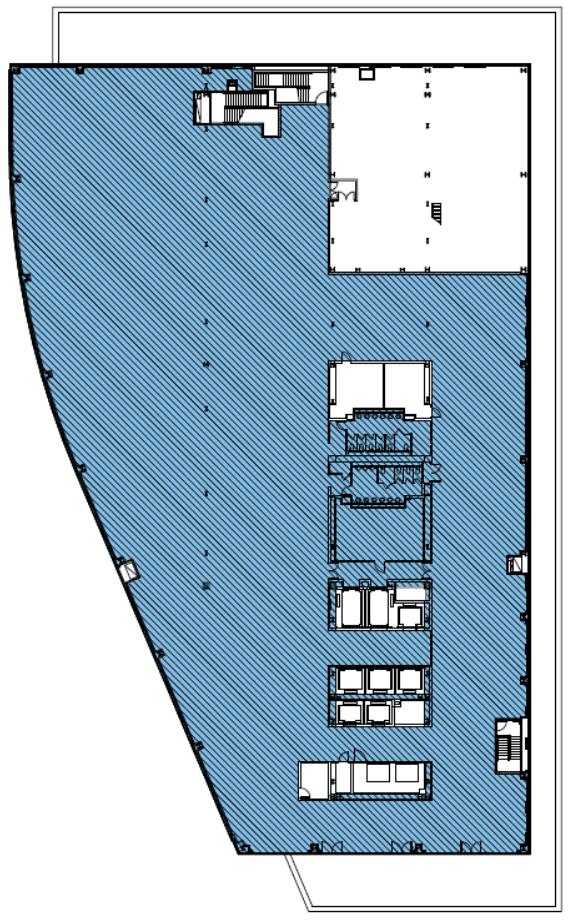

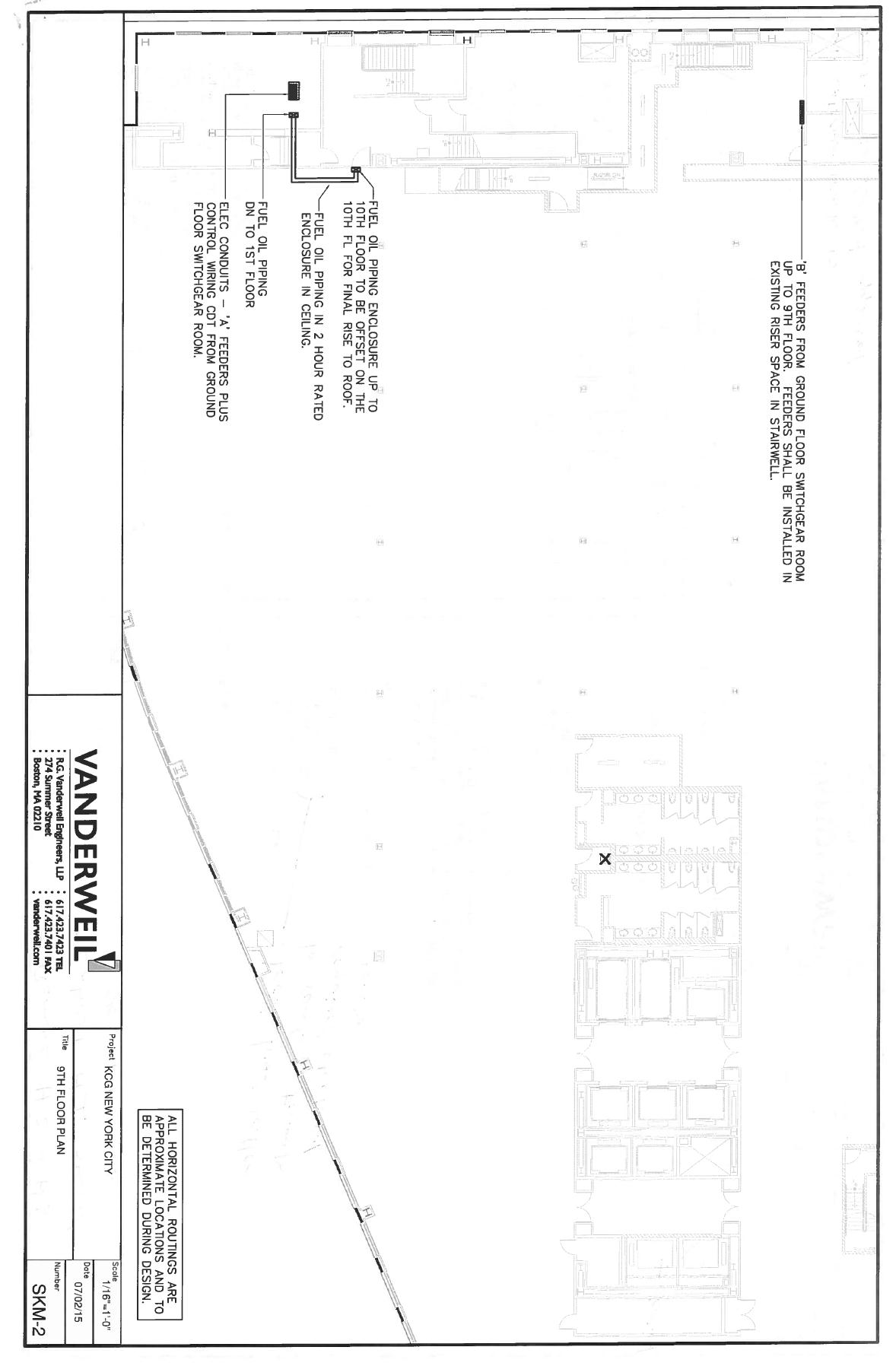

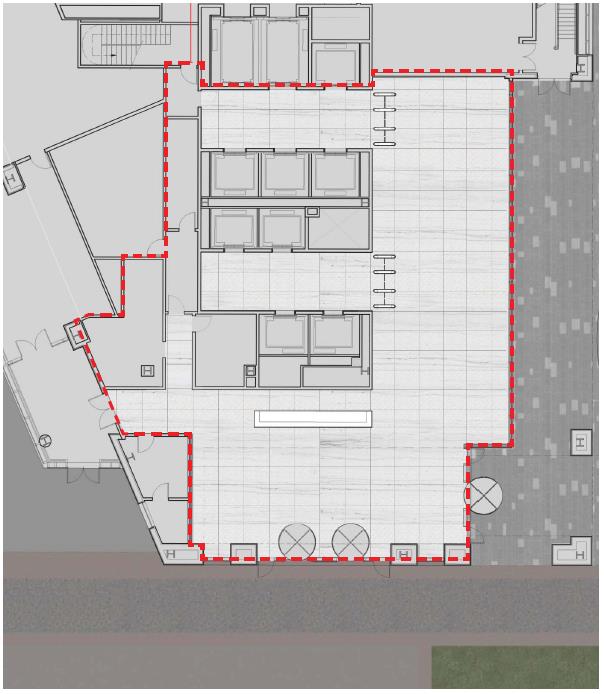

B-1 Floor Plan of Ninth Floor Premises

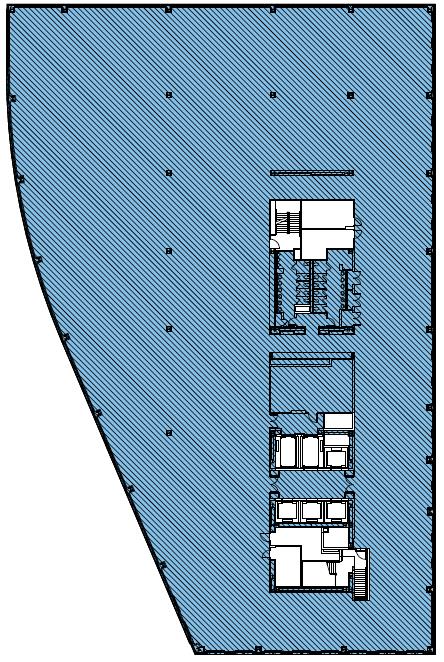

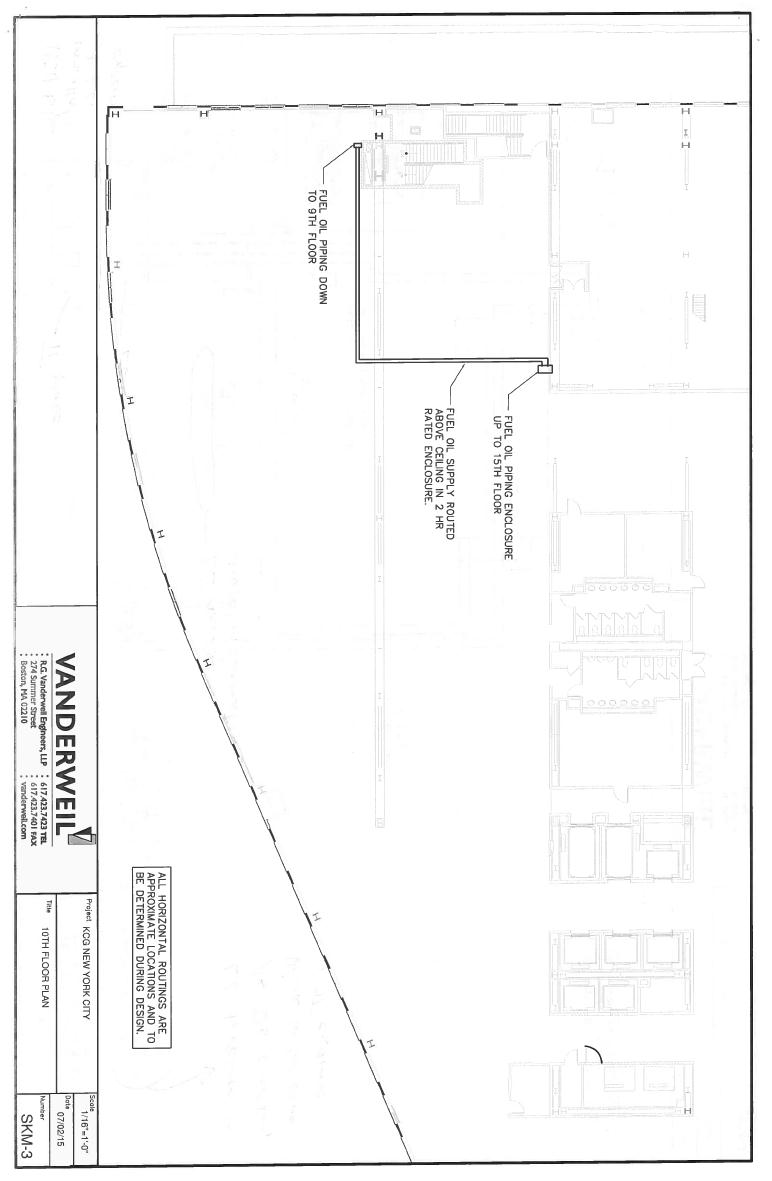

B-2 Floor Plan of Tenth Floor Premises

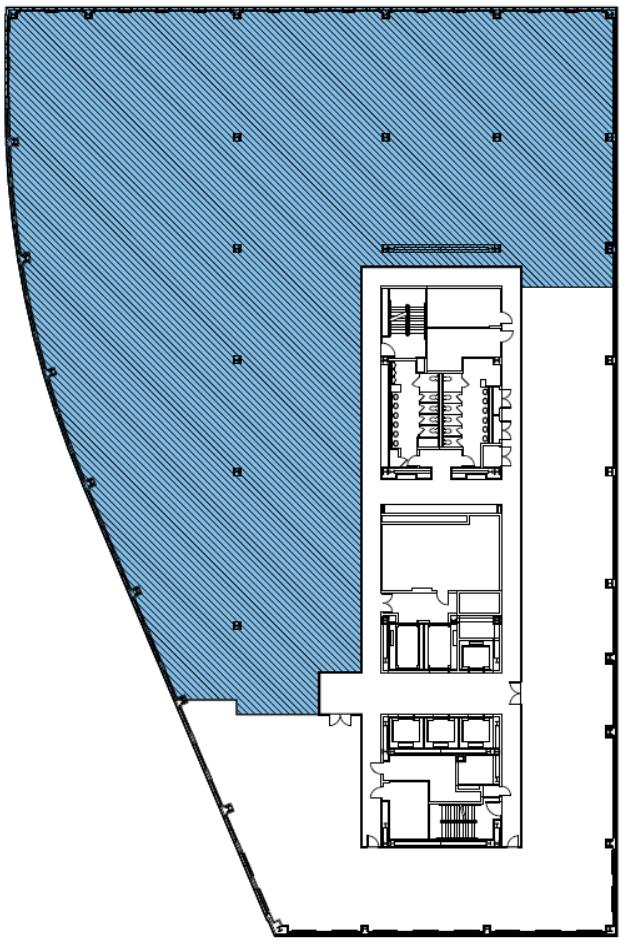

B-3 Floor Plan of Eleventh Floor Premises

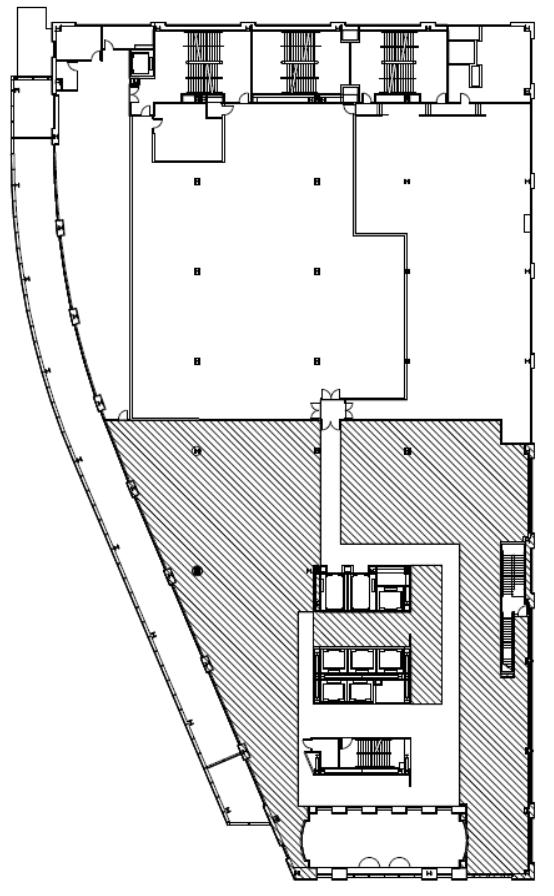

B-4 Floor Plan of Twelfth Floor Premises

C Rules and Regulations

D Alterations Rules and Regulations

E HVAC Specifications

F Standard Cleaning Specifications

G Form of Letter of Credit

H Landlord’s Work

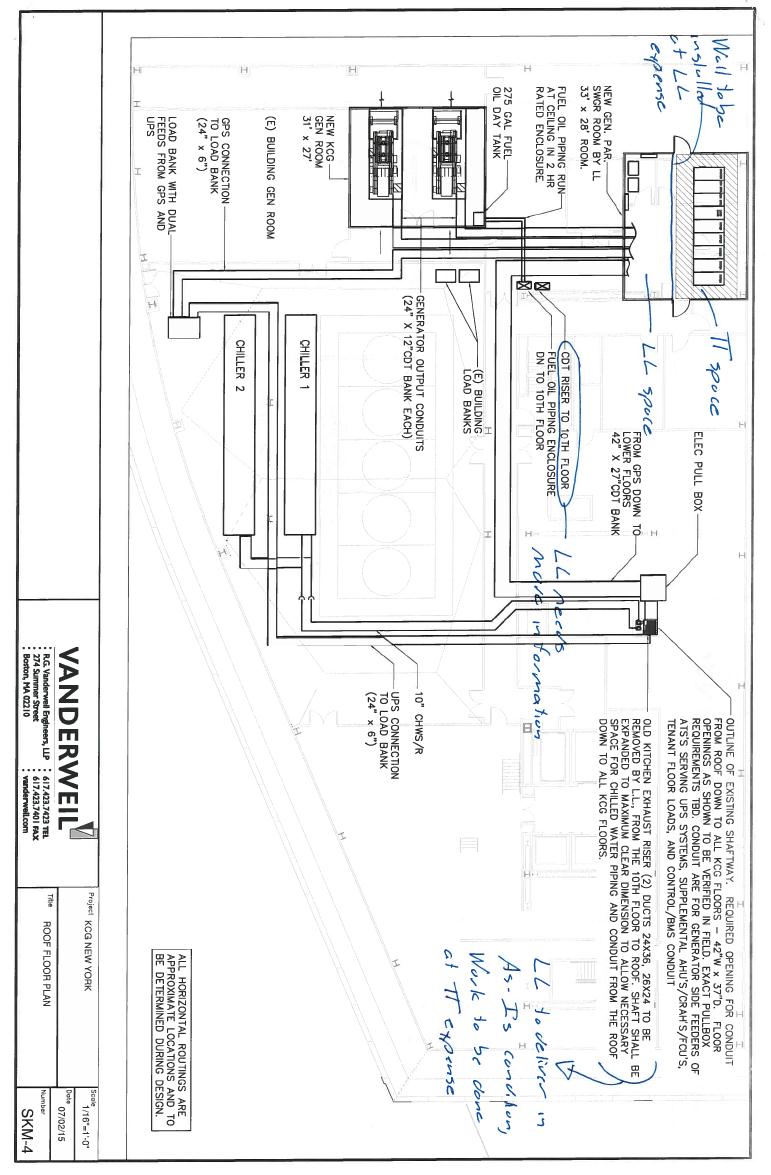

H-1 Tenant’s Riser Plan

I Form of Commencement Date Agreement

J Form of Lender SNDA

K Form of Ground Lessor Nondisturbance Agreement

L Rentable Square Feet of the Premises

M Terrace

N Second Floor Offer Space

O Lockbox Account Instructions

P List of Approved Local Unions

Q Form of Subtenant Recognition Agreement

R Lobby Work Renderings

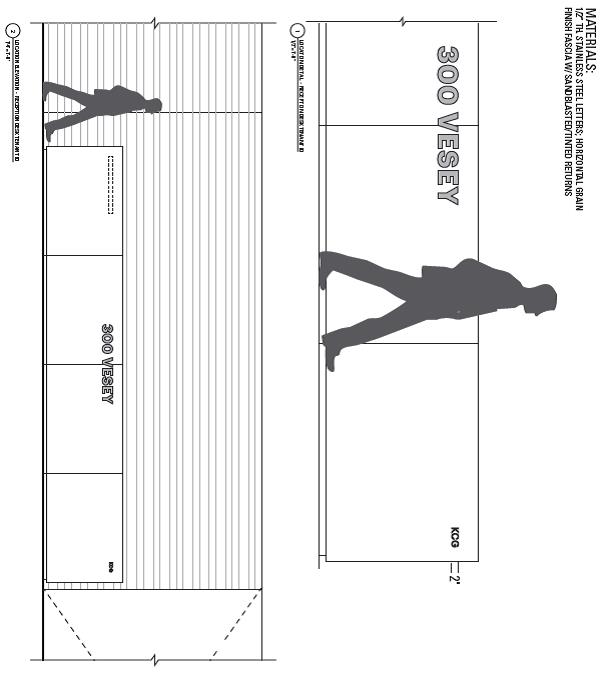

S Tenant’s Lobby Signage

T Pre-Existing Rights

U Passenger Elevator Specifications

V Form of Memorandum of Lease

W Form of Termination Memorandum

A Description of Land

B-1 Floor Plan of Ninth Floor Premises

B-2 Floor Plan of Tenth Floor Premises

B-3 Floor Plan of Eleventh Floor Premises

B-4 Floor Plan of Twelfth Floor Premises

C Rules and Regulations

D Alterations Rules and Regulations

E HVAC Specifications

F Standard Cleaning Specifications

G Form of Letter of Credit

H Landlord’s Work

H-1 Tenant’s Riser Plan

I Form of Commencement Date Agreement

J Form of Lender SNDA

K Form of Ground Lessor Nondisturbance Agreement

L Rentable Square Feet of the Premises

M Terrace

N Second Floor Offer Space

O Lockbox Account Instructions

P List of Approved Local Unions

Q Form of Subtenant Recognition Agreement

R Lobby Work Renderings

S Tenant’s Lobby Signage

T Pre-Existing Rights

U Passenger Elevator Specifications

V Form of Memorandum of Lease

W Form of Termination Memorandum

iv | ||

INDEX OF DEFINED TERMS

TERM | SECTION NUMBER |

AAA | 4.05(c)(ii) |

Acceptance Notice | 34.01(c) |

ADA | 11.01(b) |

Additional Rent | 3.02 |

Additional Specialty Alterations | 14.07(a)(i) |

Affiliate | 1.01 |

Alterations | 14.01(a) |

Anticipated Commencement Date | 2.04(c) |

Anticipated Inclusion Date | 34.01(b) |

Applicable Percentage | 28.02(a)(ii) |

Arbiter | 4.05(c)(ii) |

Assignment Profit | 10.12(a)(i) |

Available | 34.01(a)(i) |

Available Electric Capacity | 5.04(a) |

Bankruptcy Code | 1.01 |

Base Lease Year | 1.01 |

Base Operating Amount | 1.01 |

Base PILOT Amount | 1.01 |

Base Rent | 3.01(a) |

Base Rent Abatement Period | 3.01(c) |

Benefits | 32.11(a) |

BID Charges | 1.01 |

BMS | 17.15 |

Broker | 18.01 |

Building | Preamble |

Building Generators | 38.01 |

Building Standard Rate | 1.01 |

Building Systems | 1.01 |

Business Days | 17.01(a)(i) |

Business Hours | 17.01(a)(i) |

Cancelled Floor | 37.01 |

Casualty | 22.01 |

Casualty Restoration Period | 22.03 |

Chilled Water Charge | 17.01(a)(iii) |

Commencement Date | 2.04(a) |

Commencement Date Notice | 2.04(c) |

Communications | 31.01(a) |

v | ||

TERM | SECTION NUMBER |

Condemnation | 23.01 |

Consumer Price Index or CPI | 1.01 |

Contraction Notice | 37.01 |

Contraction Option | 37.01 |

Contraction Option Effective Date | 37.01 |

Contraction Payment | 37.01 |

Contractor | 11.03(b) |

Decorative Alterations | 14.01(a) |

Default Interest Charge | 3.04(a) |

Default Rate | 3.04(a) |

Deficiency | 20.04(e) |

Depositary | 12.06(b) |

Desk Space | 10.01(c)(i) |

Dining Facility | 14.09 |

Effective Date | Introduction |

Electricity Billing Period | 5.01(b) |

Elevator Work | 35.02 |

Eleventh Floor Premises | 1.01 |

Energy Star Rating System | 4.01(a) |

Equipment Financings | 32.19 |

Estimate Notice | 22.03 |

Estimator | 22.03 |

Event of Default | 20.01 |

Excess Holdover Rent | 2.05 |

Exercise Facility | 14.09 |

Expiration Date | 1.01 |

Extra Personnel | 1.01 |

Fair Market Rent | 33.03(c) |

Fair Offer Rental | 34.01(e) |

First Extended Target Date | 2.04(b) |

First Renewal Notice | 33.01(b) |

First Renewal Option | 33.01(a) |

First Renewal Premises | 33.01(b) |

First Renewal Term | 33.01(a) |

Five Year Renewal Option | 33.01(a) |

Floor | 1.01 |

Force Majeure | 1.01 |

Fuel Storage Space | 14.08 |

Future Lessor SNDA | 8.01(d)(ii) |

Future Mortgagee SNDA | 8.01(c) |

vi | ||

TERM | SECTION NUMBER |

GAAP | 4.01(a)(xiv) |

Garage | 39.01 |

Governmental Authority | 1.01 |

Green CapEx | 4.01(a) |

Green Globes™-CIEB | 4.01(a) |

Ground Lease. | 1.01 |

Ground Lessor | 1.01 |

Ground Lessor Nondisturbance Agreement | Section 8.01(d)(i) |

Ground Rents | 1.01 |

Hazardous Materials | 11.04 |

Holdover Premium | 10.08(f)(vii) |

Holidays | 17.01(a)(i) |

HVAC | 17.01(a) |

HVAC Hours | 17.01(a)(i) |

Indemnified Parties | 26.01(a) |

Indemnified Party | 26.01(a) |

Initial Fair Offer Rental Meeting | 34.01(g)(ii) |

Initial Meeting | 33.03(e)(ii) |

Initial Premises | 1.01 |

Initial Restroom Work | 7.02(b) |

Initial Tenant Work | 7.01(b) |

Initial Term | 1.01 |

Insurance Requirements | 1.01 |

Issuing Bank | 29.02 |

Issuing Bank Criteria | 29.02 |

Land | Preamble |

Landlord | Introduction |

Landlord Delay | 1.01 |

Landlord Delay Credit | 7.03 |

Landlord’s Average Cost Per Kilowatt Hour | 1.01 |

Landlord’s Benefits Cooperation | 32.11(a) |

Landlord’s Determination | 33.03(d) |

Landlord’s Offer Determination | 34.01(f) |

Landlord’s PILOT Reconciliation Notice | 4.06(b) |

Landlord’s Recapture Options | 10.08(b) |

Landlord’s Restoration Work | 22.01 |

Landlord’s Saving Calculation | 4.01(a)(xiv) |

Landlord’s Separation Work | 10.08(e) |

Landlord’s Violations Cure Deadline | 11.02(b) |

Landlord’s Work | 2.04(a), Exhibit H |

vii | ||

TERM | SECTION NUMBER |

Late Charge | 3.04(b) |

Late Delivery Termination Notice | 2.04(b) |

Lease | Introduction |

Lease Year | 1.01 |

Leasehold Improvements | 1.01 |

LEED | 4.01(a) |

Legal Requirements | 11.01(b) |

Lender | 8.01(b) |

Lender SNDA | 8.01(b) |

Letter of Credit | 29.02 |

List of Approved Local Unions | 14.01(i), Exhibit P |

Lobby Work | 35.01 |

Lobby Work Target Date | 35.01 |

Lockbox Account Instructions | 1.01, Exhibit O |

Master Lease | 1.01 |

Material Alteration | 14.01(a) |

MOL | 32.20 |

Net Worth Test | 10.01(b) |

New Tenant | 28.02(a)(ii) |

Ninth Floor Premises | 1.01 |

Non-disturbance Financial Test | 10.20(e) |

Non-Material Alterations | 14.01(a) |

Non-Renewal Notice | 29.02 |

NYMEX | 1.01 |

OFAC | 27.01(a) |

Offer Notice | 34.01(b) |

Offer Space | 34.01(a)(iv) |

Offer Space Holdover Premium | 34.01(h) |

Offer Space Inclusion Date | 34.01(d) |

Offer Space Option | 34.01(c) |

Offer Space Rent Notice | 34.01(f) |

Offer Space Termination Notice | 34.01(h) |

Operating Estimate | 4.04 |

OLP | 2.05 |

OLP Landlord | 2.05 |

OLP Lease | 2.05 |

OLP Space | 2.05 |

Operating Expenses | 4.01(a) |

Operating Share Denominator | 1.01 |

Operating Statement | 4.05(a) |

viii | ||

TERM | SECTION NUMBER |

Order | 27.01(a) |

Outside Delivery Date | 2.04(b) |

Partnership Event | 10.01(a) |

Payment Date | 3.01(a) |

Permitted Equipment | 32.19 |

Permitted Occupants | 10.01(c)(i) |

Person | 1.01 |

PILOT | 1.01 |

PILOT Charges | 1.01 |

PILOT Statement | 4.06(b) |

PILOT Year | 1.01 |

Pre-Existing Hazardous Materials | 4.01(b)(36) |

Pre-Existing Hazardous Materials Notice | 11.05 |

Premises | 1.01 |

Prime Rate | 1.01 |

Prohibited Person | 27.01(b) |

Prohibited Uses | 6.02(a) |

Project | 1.01 |

Property Manager | 1.01 |

Prospective Party Information | 10.08(a) |

Qualifying Sublease | 10.20(d) |

Real Property | Preamble |

Records | 4.05(c)(i) |

Regular Elevator Hours | 17.01(b) |

REIT | 32.10 |

Remediation Work | 11.05 |

Remediation Work Deadline | 11.05 |

Renewal Notice | 33.02(b) |

Renewal Option | 33.02(a) |

Renewal Portion | 33.01(c) |

Renewal Premises | 33.02(b) |

Renewal Term | 33.02(a) |

Rent | 3.03 |

Rent Commencement Date | 1.01 |

Rent Notice | 33.03(d) |

Rentable Square Feet | 1.01 |

Rentable Square Feet of the Premises | 1.01 |

Rentable Square Foot | 1.01 |

Rentable Square Footage | 1.01 |

Reset Date | 3.01(a) |

ix | ||

TERM | SECTION NUMBER |

Restoration Funds | 22.06(b)(i) |

Restrictive Covenant Agreement | 1.01 |

Restroom Allowance | 7.02(a) |

Roof Space | 14.08 |

RSF | 1.01 |

Rules and Regulations | 13.01 |

Second Extended Target Date | 2.04(b) |

Second Floor Offer Space | 34.01(a)(ii) |

Second Renewal Notice | 33.02(b) |

Second Renewal Option | 33.02(a) |

Second Renewal Premises | 33.02(b) |

Second Renewal Term | 33.02(a) |

Security Deposit | 29.01 |

Service Provider | 32.10 |

Specialty Alterations | 14.07(a)(i) |

Specified Restoration Work | 22.01 |

Staging Space | 14.10 |

Subject to CPI Adjustment | 1.01 |

Sublease Restoration Condition | 10.08(a) |

Subleasing Profit | 10.12(a)(ii) |

Substantially Completes | 2.04(c) |

Substantially Completed | 2.04(c) |

Substantially Completion | 2.04(c) |

Subtenant | 10.03 |

Successor Entity | 10.01(b) |

Superior Instrument | 8.01(h) |

Superior Interest | 8.01(h) |

Superior Lease | 8.01(a) |

Superior Lessor | 8.01(a) |

Superior Mortgage | 8.01(a) |

Superior Mortgagee | 8.01(a) |

Superior Party | 8.01(h) |

Tax Share Denominator | 1.01 |

Ten Year Renewal Option | 33.01(a) |

Tenant | Introduction, 1.01 |

Tenant Indemnified Party | 26.01(b) |

Tenant Delay | 1.01 |

Tenant’s Chillers | 14.08 |

Tenant’s Determination | 33.03(d) |

Tenant’s Electricity Bill | 5.01(b) |

x | ||

TERM | SECTION NUMBER |

Tenant’s Electricity Costs | 1.01 |

Tenant’s Electricity Payment | 5.01(b) |

Tenant’s Examiner | 4.05(c)(i) |

Tenant’s Generators | 14.08 |

Tenant’s Kitchen | 14.09 |

Tenant’s Lobby Signage | 17.04(c) |

Tenant’s Notice | 33.03(d) |

Tenant’s Offer Determination | 34.01(f) |

Tenant’s Offer Notice | 10.08(a) |

Tenant’s Operating Payment | 4.03 |

Tenant’s Parking Notice | 39.01 |

Tenant’s PILOT Payment | 4.06(a) |

Tenant’s Preparation Work | 2.04(g) |

Tenant’s Property | 15.02 |

Tenant’s Proportionate Operating Share | 1.01 |

Tenant’s Proportionate Tax Share | 1.01 |

Tenant’s Punchlist | 2.04(c) |

Tenant’s Restoration Punchlist | 22.02 |

Tenant’s Restoration Work | 22.01 |

Tenant’s ROFO Rent Notice | 34.01(f) |

Tenant’s Specialty Alterations Notice | 14.07(a)(ii) |

Tenant’s Statement | 4.05(c)(ii) |

Tenant’s Submeters | 1.01 |

Tenant’s UPS | 14.08 |

Tenth Floor Premises | 1.01 |

Term | 2.02 |

Termination Memorandum | 32.20 |

Terrace | 36.01(a) |

Third Extended Target Date | 2.04(b) |

Third Party Assignee | 10.04 |

Transfer Notice | 10.09(a) |

Twelfth Floor Common Area Work | Exhibit H |

Twelfth Floor Common Area Work Target Date | 35.03 |

Twelfth Floor Offer Space | 34.01(a)(iii) |

Twelfth Floor Premises | 1.01 |

Untenantable | 17.03(b) |

Valet Parking Permits | 39.01 |

Violation Notice | 11.02(b) |

Work Allowance | 7.01(a) |

Zoning Resolution | 1.01 |

xi | ||

THIS LEASE (this “Lease”), dated as of , 2015 (the “Effective Date”), between BOP ONE NORTH END LLC, a Delaware limited liability company, having an office c/o Brookfield Financial Properties, L.P., 250 Vesey Street, 15th Floor, New York, New York 10281-1023 (“Landlord”), and KCG HOLDINGS, INC., a Delaware corporation, having an office at 545 Washington Boulevard, Jersey City, New Jersey 07310 (“Tenant”).

TO W I T N E S S T H A T:

WHEREAS, Landlord is willing to lease to Tenant and Tenant is willing to lease from Landlord, on the terms hereinafter set forth, certain space in the office building located at 300 Vesey Street (a/k/a One North End Avenue), New York, New York (which building, together with all additions and replacements thereto, is referred to herein as the “Building”) on the land more particularly described in Exhibit A (which land, together with the exclusive easements appurtenant thereto, is referred to herein as the “Land”; the Land and the Building and the plaza, the esplanade, all entranceways, access and egress points, sidewalks and curbs adjacent thereto or servicing the Land and the Building are collectively called the “Real Property”).

NOW, THEREFORE, Landlord and Tenant agree as follows:

ARTICLE 1

TERMS AND DEFINITIONS

TERMS AND DEFINITIONS

Section 1.01 Defined Terms. As used herein, the following terms shall have the respective meanings set forth below:

“Affiliate”, when used with respect to any Person, shall mean a Person that, directly or indirectly, controls, is controlled by or is under common control with such Person. For purposes of the foregoing definition, “control” (including “controlled by” and “under common control with”), when used with respect to a Person that is a corporation, shall be deemed to exist by reason of ownership of more than 50% in voting points of all classes of authorized and outstanding voting stock of a corporation, and when used with respect to a Person that is a partnership, limited liability company, tenancy-in-common or other business entity, more than 50% of all of the legal and equitable interests in a partnership, limited liability company, tenancy-in-common or other business entity (determined without regard to cash flow preferences and similar items).

“Bankruptcy Code” shall mean Title 11 of the United States Code, as amended from time to time.

“Base Lease Year” means calendar year 2016.

“Base Operating Amount” means Operating Expenses for the Base Lease Year.

“Base PILOT Amount” means the PILOT Charges (excluding any BID Charges) for the PILOT Year commencing on July 1, 2016 and ending on June 30, 2017.

“BID Charges” shall mean (i) business improvement district charges and any similar charges imposed on the Real Property, and (ii) any customary out-of-pocket expenses, including but not limited to reasonable attorneys’ fees, actually incurred by Landlord in contesting the same, which expenses shall be allocated to the PILOT Year to which such expenses relate. BID Charges shall not include (x) any component of Operating Expenses or (y) any interest and/or penalties resulting from the late payment of BID Charges by Landlord.

“Building Standard Rate” shall mean the rate generally charged by Landlord at the time in question to tenants in the Building for a particular service, as such rate may be increased and/or decreased from time to time by Landlord in its sole and absolute discretion.

“Building Systems” shall mean the systems servicing the Building (excluding distribution thereof within the Premises or within the premises demised to any other tenant and any systems dedicated exclusively to any tenant), including, without limitation, life safety (including Class E and emergency generator serving the Building); base Building HVAC; base Building electric; base Building plumbing and standpipes; base Building management systems; and service elevators and passenger elevators.

“Consumer Price Index” or “CPI” shall mean the Consumer Price Index for All Urban Consumers published by the Bureau of Labor Statistics of the United States Department of Labor, New York, N.Y. — Northeastern N.J. Area. All Items (1982–84 = 100), or any successor index thereto, appropriately adjusted. If the Consumer Price Index is converted to a different standard reference base or otherwise revised, then whenever the determination of a Consumer Price Index figure is called for herein, the Consumer Price Index shall be converted in accordance with the conversion factors published by the United States Department of Labor, Bureau of Labor Statistics, or, if such Bureau shall not publish the same, as the same may be published by Prentice-Hall, Inc. or any other nationally recognized publisher of similar statistical information reasonably satisfactory to Landlord and Tenant. If the Consumer Price Index ceases to be published, and there is no successor thereto, such other index as Landlord shall reasonably designate and as shall be reasonably accepted by Tenant shall be substituted for the Consumer Price Index (it being agreed that any dispute as to the replacement index, if the Consumer Price Index ceases to be published and there is no successor thereto, shall be subject to arbitration initiated by Tenant pursuant to the terms of Article 21).

“Expiration Date” shall mean 11:59 p.m. on the last day of the month in which the day immediately preceding the fifteenth (15th) anniversary of the Rent Commencement Date (as hereinafter defined) shall occur, as such date may be extended pursuant to any Renewal Option, or such earlier date on which this Lease may be cancelled or terminated pursuant to any of the conditions or covenants of this Lease or pursuant to law.

“Extra Personnel” shall mean operating engineers, elevator operators and mechanics, loading dock guards, master mechanics, maintenance mechanics, teamster foremen, dockmasters, electricians, security personnel and other support personnel in each case contracted for or employed by or on behalf of Landlord.

2 | ||

“Floor” shall mean each entire floor and each partial floor of the Building which comprises part of the Premises.

“Force Majeure” shall mean strikes, labor troubles, acts of God, enemy action, acts of terrorism, bioterrorism (e.g., the release or threatened release of an airborne agent that may adversely affect the Real Property or any portion thereof including the Building or its occupants), civil commotion, unavailability of materials and supplies, any event or circumstance outside the Building, or any event or circumstance whatsoever reasonably beyond Landlord’s or Tenant’s control, whether similar or dissimilar, including, but not limited to, any governmental preemption in connection with an emergency and any Legal Requirements; provided, however, that (a) in no event shall an inability to obtain financing or to obtain funds or make any payment(s) under this Lease be deemed a Force Majeure and (b) the party whose obligation under this Lease is affected by a Force Majeure shall give a notice to the other party within a reasonable time after learning of its inability to perform its obligation under this Lease, which notice shall identify the reasons for such party’s inability to perform with reasonable specificity. Each party, to the extent practicable, shall use commercially reasonable efforts to mitigate the delay caused by any event of Force Majeure; provided that, except as otherwise expressly set forth herein, neither party shall be required to perform any work on an overtime or premium basis, unless (i) such party elects to do so within such party’s sole and absolute discretion or (ii) the other party elects to pay for the incremental additional cost of performing any work on an overtime or premium basis. Without limiting the foregoing, the following shall be deemed to be reasonably beyond Landlord’s control:

(x) lack of access to the Building or the Premises when it or they are structurally sound but inaccessible due to evacuation of the surrounding area or damage to nearby structures or public areas; and

(y) reduced air quality or other contaminants within the Building not introduced to the Building by Landlord or its Affiliates that would adversely affect the Building or its occupants (such as the presence of biological or other airborne agents within the Building or the Premises).

“Governmental Authority” shall mean the United States of America, the State of New York, New York City and any agency, department, commission, board, bureau, instrumentality or political subdivision of any of the foregoing, now existing or hereafter created, having jurisdiction over the Real Property, the Premises or any portions thereof.

“Ground Lease” shall mean that certain Ground Lease dated May 18, 1995 and recorded in the Office of the City Register for New York County, New York on May 31, 1995 in Reel 2211 at Page 1446, as amended by that First Amendment to Ground Lease, made as of November 25, 2013, a memorandum of which was recorded in the Office of the City Register for New York County, New York on December 13, 2013 at CRFN 2013000514033 (as further modified, amended and restated from time to time, the “Ground Lease”), currently by and between Landlord (as successor-in-interest to New York Mercantile Exchange, Inc. (“NYMEX”)), as tenant, and Ground Lessor, as landlord, encumbering the Real Property. Landlord represents and warrants to Tenant that pursuant to Section 2.02 of the First Amendment to Ground Lease, the Master Lease (as hereinafter defined) has been subordinated to the Ground Lease and to subleases made by Landlord

3 | ||

as Tenant under the Ground Lease (including, without limitation, this Lease). Landlord shall not amend the Ground Lease in any manner that would adversely affect Tenant’s rights or increase Tenant’s obligations under this Lease during the Term hereof, in each case, except to a de minimis extent.

“Ground Lessor” shall mean Battery Park City Authority, d/b/a “The Hugh L. Carey Battery Park City Authority,” a public benefit corporation under the laws of the State of New York, or its successor under the Ground Lease.

“Ground Rents” shall mean, collectively, (i) the annual sums of base rent payable by Landlord as tenant under Section 3.01 of the Ground Lease, and (ii) the annual sums, if any, of other rent payable with respect to the Real Property by Landlord, as tenant, under the Ground Lease (including, without limitation, Sections 3.04, 3.05 and 26.04 thereof).

“Initial Premises” has the meaning set forth in this Section 1.01 in the definition of “Premises”.

“Initial Term” shall mean the period commencing on the Commencement Date and ending on 11:59 p.m. on the last day of the month in which the day immediately preceding the fifteenth (15th) anniversary of the Rent Commencement Date shall occur.

“Insurance Requirements” shall mean the conditions and requirements of any insurance policy affecting the Real Property or any portion thereof and the rules, regulations, orders and other requirements of the New York Board of Underwriters and/or the New York Fire Insurance Rating Organization and/or any other similar body performing the same or similar functions and having jurisdiction or cognizance over the Building and/or the Premises, whether now or hereafter in force.

“Landlord Delay” shall mean any actual delay that Tenant encounters in the performance of the Initial Tenant Work and the Initial Restroom Work due to (i) the willful misconduct of Landlord or its agents, employees, contractors or subcontractors and/or (ii) the breach by Landlord of any of its obligations under this Lease. Notwithstanding the foregoing, Landlord Delay shall not be deemed to have accrued unless (x) Tenant shall have given Landlord notice reasonably identifying the alleged misconduct or breach resulting in delay of the completion of Initial Tenant Work and the Initial Restroom Work (which notice shall have been given within seven (7) Business Days after Tenant first had knowledge thereof) and (y) Landlord shall have failed to correct the same within one Business Day following receipt of such notice.

“Landlord’s Average Cost Per Kilowatt Hour” shall mean an amount equal to the quotient obtained by dividing (a) the total dollar amount billed by the electrical provider(s) servicing the Building for the relevant Electricity Billing Period (including any taxes, fuel rate adjustments, demand charges and surcharges and less any discounts or refunds actually received by Landlord) by (b) the total kilowatt hours of electricity used at the Building for such billing period determined by reference to the meter or meters measuring the same, carried to six (6) decimal places.

“Lease Year” shall mean each calendar year that shall include any part of the Term.

4 | ||

“Leasehold Improvements” shall mean leasehold improvements, Alterations and any fixtures attached to or built into the Premises, including those existing on the Commencement Date for the applicable portion of the Premises, and including those installed by or on behalf of Tenant in connection with its build-out. “Leasehold Improvements” shall also include all Alterations made by or on behalf of Tenant outside the Premises on the Real Property (including any equipment and cabling placed or installed by or on behalf of Tenant outside the Premises on the Real Property). Notwithstanding anything contained in this definition of “Leasehold Improvements” to the contrary, the term “Leasehold Improvements” shall not include Tenant’s Property.

“Lockbox Account Instructions” shall mean the instructions for the payment of Rent set forth on Exhibit O hereof, as the same may be added to or modified by Landlord from time to time on at least ten (10) Business Days’ prior written notice to Tenant.

“Master Lease” shall mean the Restated Amended Agreement of Lease, made as of June 10, 1980 between BPC Development Corporation, as landlord, and Ground Lessor, as tenant, a Memorandum of which was recorded on June 11, 1980 in the Office of the City Register for New York County, New York in Reel 527 at Page 163, as amended by the (i) First Amendment to Restated Amended Lease dated as of June 15, 1983 and recorded on June 20, 1983 in the Office of the City Register for New York County, New York in Reel 696 at Page 424, (ii) Second Amendment to Restated Amended Lease dated June 15, 1983 and recorded on June 20, 1983 in the Office of the City Register for New York County, New York in Reel 696 at Page 432, (iii) Third Amendment to Restated Amended Lease dated as of August 15, 1986 and recorded on October 22, 1986 in the Office of the City Register for New York County, New York in Reel 1133 at Page 569, and (iv) Fourth Amendment to Restated Amended Lease dated as of May 25, 1990 and recorded on May 30, 1990 in the Office of the City Register for New York County, New York in Reel 1697 at Page 307.

“Operating Share Denominator” has the meaning set forth in this Section 1.01 in the definition of “Rentable Square Feet of the Premises”.

“Person” shall mean and include, (a) with respect to Article 10, an individual, corporation, partnership, limited liability company or limited liability partnership and (b) with respect to all other Sections of this Lease, an individual, corporation, partnership, limited liability company, limited liability partnership, joint venture, estate, trust, unincorporated association, any federal, state, county or municipal government or any bureau, department, authority or agency thereof.

“PILOT Charges” shall mean (i) any and all “Payments in Lieu of Taxes” (“PILOT”) payable by Landlord to the Ground Lessor pursuant to Section 3.02 and 3.03 of the Ground Lease, (ii) any and all BID Charges and (iii) any customary out-of-pocket costs and expenses, including but not limited to reasonable attorneys’ fees, actually incurred by Landlord in contesting the assessed value of the Real Property, which expenses shall be allocated to the PILOT Year to which such expenses relate. PILOT Charges shall not include any interest and/or penalties resulting from the late payment of PILOT Charges by Landlord to the Ground Lessor under the Ground Lease.

“PILOT Year” means each period of twelve (12) months, commencing on the first day of July of each such period, in which occurs any part of the Term.

5 | ||

“Premises” shall mean, collectively, (x) the entire rentable area of each of the (i) ninth (9th) floor of the Building, as shown hatched on the floor plan annexed hereto as Exhibit B-1, which the parties conclusively agree for the purposes of this Lease, without representation or warranty on the part of Landlord, contains 50,395 RSF (the “Ninth Floor Premises”), (ii) tenth (10th) floor of the Building, as shown hatched on the floor plan annexed hereto as Exhibit B-2, which the parties conclusively agree for the purposes of this Lease, without representation or warranty on the part of Landlord, contains 39,372 RSF (the “Tenth Floor Premises”), and (iii) eleventh (11th) floor of the Building, as shown hatched on the floor plan annexed hereto as Exhibit B-3, which the parties conclusively agree for the purposes of this Lease, without representation or warranty on the part of Landlord, contains 45,923 RSF (the “Eleventh Floor Premises”); and (y) a portion of the rentable area of the twelfth (12th) floor of the Building, as shown hatched on the floor plan annexed hereto as Exhibit B-4, which the parties conclusively agree for the purposes of this Lease, without representation or warranty on the part of Landlord, contains 33,183 RSF (the “Twelfth Floor Premises”). The Ninth Floor Premises, the Tenth Floor Premises, the Eleventh Floor Premises and the Twelfth Floor Premises are also sometimes referred to as the “Initial Premises”. The term “Initial Premises” shall not include any Offer Space.

“Prime Rate” shall mean the average, at the time in question, of the rates announced as their respective prime commercial lending rates by Citibank, N.A. and JPMorgan Chase & Co. or their respective successors, and if such prime rates shall cease to be so announced by either or both of such banks, then the term “Prime Rate” shall mean the prime commercial lending rate for large commercial banks reported in The Wall Street Journal. Any interest payable with reference to the Prime Rate shall be adjusted on a daily basis, based upon the Prime Rate in effect at the time in question, and shall be calculated with respect to the actual number of days elapsed on the basis of a 365-day year. If (i) such prime commercial lending rates shall cease to be so announced by either or both of such banks, and (ii) The Wall Street Journal does not report the prime commercial lending rate for large commercial banks, then, the term “Prime Rate” shall mean a rate, reasonably determined by Landlord, from time to time, to be comparable to the rate that had formerly constituted the “Prime Rate” hereunder.

“Project” shall mean the “Brookfield Place” project of which the Building is a part, which comprises, inter alia, 200 Liberty Street, 225 Liberty Street, 200 Vesey Street, 250 Vesey Street and the Building, as well as any and all pedestrian bridges, entranceways, access and egress points, sidewalks and curbs, and the plaza and esplanade adjacent to the North Cove, and any and all future additions thereto and replacements thereof.

“Property Manager” shall mean Brookfield Financial Properties, L.P. or any successor manager of the Building.

“Rentable Square Feet of the Premises” shall mean for all purposes under this Lease the Rentable Square Feet of the Premises as set forth in Exhibit L annexed hereto. Tenant hereby acknowledges that it has independently determined the useable and rentable areas being leased hereunder, that no representation, express or implied, has been or is being made by Landlord with respect to square footage (rentable or otherwise) contained in the Premises and that the term “Rentable Square Footage”, “Rentable Square Foot” or “Rentable Square Feet” is being defined

6 | ||

and employed herein only for purposes of making certain Rent calculations in the express manner set forth herein. Landlord and Tenant further agree that neither party shall have any right to dispute the Rentable Square Feet of the Premises, and the parties waive any claim in connection with the measurement of the Premises, regardless of whether the Premises is found to contain more or less Rentable Square Feet. Landlord and Tenant agree that as of the date of this Lease, the Building is conclusively deemed to contain 566,712 RSF for the purpose of calculating Tenant’s Proportionate Operating Share (the “Operating Share Denominator”) and 577,923 RSF for the purpose of calculating Tenant’s Proportionate Tax Share (the “Tax Share Denominator”). If, during the Term, Landlord shall construct an addition to the Building resulting in an increase in the rentable area thereof, then upon completion of such construction, Landlord shall notify Tenant of (i) the revised Operating Share Denominator and the adjusted Tenant’s Proportionate Operating Share and/or (ii) the revised Tax Share Denominator and the adjusted Tenant’s Proportionate Tax Share, as applicable (it being agreed that such adjustment(s), if any, shall take effect on the first day of the first month following the month in which such construction of additional rentable area is complete).

“Rent Commencement Date” shall mean the date that is thirteen (13) consecutive calendar months after the Commencement Date.

“Restrictive Covenant Agreement” shall mean that certain Restrictive Covenant Agreement dated May 18, 1995, made by and among WFC Tower A Company, Olympia & York Tower B Company, WFC Tower D Company, American Express Company, Merrill Lynch/WFC/L, Inc., Merrill Lynch, Pierce, Fenner & Smith Incorporated and NYMEX.

“RSF” shall mean Rentable Square Feet.

“Subject to CPI Adjustment”, with reference to a specified amount, means the specified amount, multiplied by a fraction, the numerator of which shall be the Consumer Price Index for the calendar month preceding the date on which such amount is to be adjusted under the provision in question, and the denominator of which is the Consumer Price Index in effect on the date of this Lease.

“Tax Share Denominator” has the meaning set forth in this Section 1.01 in the definition of “Rentable Square Feet of the Premises”.

“Tenant” shall mean the Person named as Tenant on the cover page and in the introductory paragraph hereof, and any successor and assign thereof (provided that nothing in this definition shall be construed as permitting any assignment or subletting or any other transfer otherwise prohibited by the terms of this Lease).

“Tenant Delay” shall mean any actual delay that Landlord may encounter in the performance of Landlord’s obligations under this Lease by reason of (i) any intentional act, negligence or omission (where there is a duty to act) of any nature of Tenant or Tenant’s agents, employees, contractors, subcontractors or invitees, including, without limitation, (x) delays due to changes in or additions to any work (including, but not limited to, Landlord’s Work) requested by Tenant after the date hereof, and/or (y) Tenant’s failure to timely submit information or to timely give authorizations or approvals required to be given by Tenant within the time periods required

7 | ||

hereunder, and/or (ii) postponement of any item of Landlord’s Work at the request of Tenant. Tenant shall not be charged for any Tenant Delay unless Landlord shall give Tenant notice reasonably identifying any act, negligence, omission or requested change resulting in a Tenant Delay within seven (7) Business Days after Landlord shall become aware thereof and Tenant shall have failed to correct the same within one Business Day following receipt of such notice.

“Tenant’s Electricity Costs” shall mean an amount equal to (i) Landlord’s Average Cost Per Kilowatt Hour for any relevant billing period (taking all applicable rebates, savings and incentives into account, it being agreed that Landlord shall be required to pass on to Tenant the benefit of all rebates, savings and incentives granted and or applicable specifically with respect to the electrical use consumed in the Premises), multiplied by (ii) the total kilowatt hours of electricity used in the Premises during such billing period, as measured by Tenant’s Submeters.

“Tenant’s Proportionate Operating Share” for the Initial Premises shall mean 29.799%.

“Tenant’s Proportionate Tax Share” for the Initial Premises shall mean 29.221%.

“Tenant’s Submeters” shall mean the electric submeters (if any) installed by Landlord throughout the Premises, at Tenant’s cost, and any additional electric submeters which may be installed in accordance with Section 5.02(a).

“Zoning Resolution” shall mean the Zoning Resolution of the City of New York effective December 15, 1961, as amended.

Section 1.02 General Terms. (a) The terms “hereof,” “herein” and “hereunder,” and words of similar import, shall be construed to refer to this Lease as a whole (including the annexed Exhibits), and not to any particular Article, Section, Exhibit or provision, unless expressly so stated.

(b) All words or terms used in this Lease, regardless of the number or gender in which they are used, shall be deemed to include any other number and any other gender, as the context may require.

(c) Wherever the word “including” appears in this Lease without the word “not” preceding it and without the phrase “but not limited to” or “without limitation” or a phrase having a similar meaning following it, it shall be deemed that the phrase “but not limited to” shall appear immediately following the word “including”. Likewise, wherever the word “include” appears in this Lease, in a similar grammatical context, without the word “not” preceding it and without the phrase “but not limited to” or “without limitation” or a phrase having a similar meaning following it, it shall be deemed to be followed by the phrase “but not be limited to” or “without limitation”.

ARTICLE 2

PREMISES; TERM

PREMISES; TERM

8 | ||

Section 2.01 Premises Demised. Landlord hereby demises to Tenant, and Tenant hereby hires and leases from Landlord, the Premises upon and subject to all of the terms, covenants, rentals and conditions provided for herein.

Section 2.02 Term. This Lease shall have a term (the “Term”) commencing on the Commencement Date and expiring on the Expiration Date.

Section 2.03 Delivery of the Premises. Subject to Section 2.04(h), Tenant shall accept the Premises on the Commencement Date with Landlord’s Work therein Substantially Complete and otherwise in its then “as is” condition, and Landlord shall not be required (i) to perform any work (other than Landlord’s Work) or render any services to make the Premises ready for Tenant’s use and occupancy, or (ii) to pay any allowance or any other amount to Tenant (except for the Work Allowance and the Restroom Allowance, as applicable in accordance with Article 7) for Tenant’s improvements to the Premises, or (iii) to provide any abatement of Base Rent or Additional Rent for the Premises (except as expressly set forth in this Lease) as a condition to the occurrence of the Commencement Date.

Section 2.04 Commencement Date. (a) “Commencement Date” means the date that is five (5) Business Days after the latest to occur of the following dates: (i) the date on which this Lease shall have been fully executed and unconditionally delivered to Tenant (with the consent of Lender and the Ground Lessor having been obtained); (ii) the date on which the Lender SNDA (as hereinafter defined) shall have been fully executed and acknowledged and unconditionally delivered to Tenant; (iii) the date on which the Ground Lessor Nondisturbance Agreement (as hereinafter defined) shall have been fully executed and acknowledged and unconditionally delivered to Tenant; and (iv) the date on which Landlord shall have Substantially Completed (as defined below) the work set forth in Exhibit H annexed to this Lease (“Landlord’s Work”) and tendered delivery of possession of the Premises to Tenant.

(b) (c) If for any reason Landlord shall be unable to deliver possession of the Premises (or any Floor thereof) to Tenant in accordance with the provisions of this Lease by any date certain, Landlord shall have no liability to Tenant therefor and the validity of this Lease shall not be impaired thereby, except as otherwise expressly set forth in this Section 2.04(b).

(i) Notwithstanding anything to the contrary set forth herein, if the Commencement Date shall not have occurred by the date that is 124 days after the Effective Date (such date, as the same shall be extended on a day-for-day basis by Force Majeure and any Tenant Delay, the “First Extended Target Date”), then, in such event, provided that no Event of Default (as hereinafter defined) shall have occurred and then be continuing, Tenant shall have the right, as Tenant’s sole and exclusive remedy for such delay in the occurrence of the Commencement Date (except as otherwise expressly set forth in Sections 2.04(b)(iii), (iv) and (v) hereof), to a credit against Base Rent to be applied commencing on the Rent Commencement Date, in the amount of $32,836.42 per day for each day after the First Extended Target Date on which the Commencement Date fails to occur.

(ii) Notwithstanding anything to the contrary set forth herein, if the Commencement Date shall not have occurred by the date that is 185 days after the Effective Date

9 | ||

(such date, as the same shall be extended on a day-for-day basis by Force Majeure and any Tenant Delay, the “Second Extended Target Date”), then, in such event, provided that no Event of Default shall have occurred and then be continuing, Tenant shall have the right, as Tenant’s sole and exclusive remedy for such delay in the occurrence of the Commencement Date (in lieu of accruing any further credit against Base Rent in accordance with Section 2.04(b)(ii) above, and except as otherwise expressly set forth in Sections 2.04(b)(iv) and (v) hereof), to a credit against Base Rent in the amount of $49,254.63 per day for each day after the Second Extended Target Date on which the Commencement Date fails to occur (it being agreed that any such credit shall be applied immediately after the application of the credit accrued against Base Rent in accordance with Section 2.04(b)(ii) above).

(iii) Notwithstanding anything to the contrary set forth herein, if the Commencement Date shall not have occurred by the date that is 245 days after the Effective Date (such date, as the same shall be extended on a day-for-day basis by Force Majeure and any Tenant Delay, the “Third Extended Target Date”), then, in such event, provided that no Event of Default shall have occurred and then be continuing, Tenant shall have the right, as Tenant’s sole and exclusive remedy for such delay in the occurrence of the Commencement Date (in lieu of accruing any further credit against Base Rent in accordance with Section 2.04(b)(iii) above, and except as otherwise expressly set forth in Section 2.04(b)(v) below), to a credit against Base Rent in the amount of $65,672.83 per day for each day after the Third Extended Target Date on which the Commencement Date fails to occur (it being agreed that any such credit shall be applied immediately after the application of the credit accrued against Base Rent in accordance with Section 2.04(b)(iii) above).

(iv) Notwithstanding anything to the contrary set forth herein, if the Commencement Date shall not have occurred by the date that is 276 days after the Effective Date (such date, as the same shall be extended on a day-for-day basis by Tenant Delay, the “Outside Delivery Date”), then, in such event, provided that no Event of Default shall have occurred and then be continuing, Tenant shall have the right, as Tenant’s sole and exclusive remedy for such delay in the occurrence of the Commencement Date (in lieu of Tenant’s receipt of any credits accrued against Base Rent in accordance with Sections 2.04(b)(ii), (iii) and (iv) above), to terminate this Lease upon written notice (a “Late Delivery Termination Notice”) given to Landlord within the fifteen (15) day period immediately following the Outside Delivery Date (but prior to the occurrence of the Commencement Date), with time being of the essence with respect to Tenant’s exercise of such termination right. If Tenant shall timely give a Late Delivery Termination Notice in accordance with this Section 2.04(b)(v), this Lease shall terminate effective as of the date such notice is delivered to Landlord, as if such termination date were the Expiration Date. For the avoidance of doubt, if Tenant shall not give a Late Delivery Termination Notice within the fifteen (15) day period immediately following the Outside Delivery Date (with time being of the essence), or if the Commencement Date shall occur prior to Tenant giving such notice, then this Lease shall continue in full force and effect, and Tenant shall be entitled to receive the credits against Base Rent accrued in accordance with Sections 2.04(b)(ii), (iii) and (iv) above.

(v) This Section shall be an express provision to the contrary for purposes of Section 223-a of the New York Real Property Law and any other law of like import now or hereafter in effect.

10 | ||

(d) “Substantially Completes”, “Substantially Completed” and “Substantial Completion” shall, whenever used in this Lease with respect to Landlord’s Work, be deemed to mean that stage of the progress of Landlord’s Work as shall enable Tenant to have access to the Premises to commence any initial work therein and to occupy the Premises for the conduct of its business, and that Landlord’s Work shall be complete except for minor unfinished details of Landlord’s Work to be performed by Landlord in the Premises that do not interfere (to more than a de minimis extent) with the performance of such initial work or such occupancy of any part of the Premises. Landlord shall give Tenant notice (the “Commencement Date Notice”) of the date (the “Anticipated Commencement Date”) on which Landlord anticipates that Landlord’s Work shall be Substantially Completed at least five (5) Business Days prior to the Anticipated Commencement Date. Within five (5) Business Days after the later to occur of (x) the giving of the Commencement Date Notice and (y) the date fixed in the Commencement Date Notice as the Anticipated Commencement Date, Landlord and Tenant shall meet at the Premises and jointly inspect Landlord’s Work (it being agreed that the failure or refusal of Tenant to schedule such inspection and meet with Landlord therefor prior to the expiration of such five (5) Business Day period shall constitute Tenant Delay, provided further that Landlord shall have given Tenant a proposed date of inspection at least two (2) Business Days prior to such proposed date). Promptly following Landlord’s and Tenant’s joint inspection of Landlord’s Work, Tenant shall prepare a punchlist of any items of unfinished Landlord’s Work required by this Lease to be performed by Landlord (“Tenant’s Punchlist”). If Tenant shall fail to prepare and deliver Tenant’s Punchlist to Landlord within two (2) Business Days (with time being of the essence) after the parties’ inspection of Substantial Completion of Landlord’s Work, then Tenant shall be deemed to have agreed that, except for latent defects, there are no unfinished items of Landlord’s Work, and Tenant shall thereby waive its right to deliver Tenant’s Punchlist. Landlord shall perform the work required to complete the unfinished items of Landlord’s Work identified in Tenant’s Punchlist (if any) within thirty (30) days after Landlord’s receipt of Tenant’s Punchlist (subject to day-for-day extension(s) of such period due to Force Majeure and Tenant Delay), provided that Landlord shall not dispute the inclusion of such item(s) on Tenant’s Punchlist, and provided further that Tenant shall give Landlord reasonable access to the Premises to complete such Landlord’s Work (i.e., those items identified on Tenant’s Punchlist), it being agreed that Landlord and Tenant shall take commercially reasonable steps to coordinate Landlord’s completion of the items on Tenant’s Punchlist and Tenant’s performance of the Initial Tenant Work and the Initial Restroom Work, so that neither is delayed in the completion of its work. Any dispute as to whether an item has been properly placed on Tenant’s Punchlist that cannot be resolved by the parties within fifteen (15) days after the date Tenant has given Tenant’s Punchlist to Landlord (with time being of the essence), may be submitted to arbitration in accordance with Article 21. Prior to Landlord’s giving of the Commencement Date Notice, at Tenant’s request, upon reasonable prior notice to Landlord in each instance, Landlord shall meet with Tenant at the Premises or at Landlord’s office in the Project to review the status and progress of Landlord’s Work, provided that such meetings shall not be held more frequently than on a bi-weekly basis.

(e) Without limiting the provisions of this Section 2.04, in the event that the Commencement Date is delayed by Tenant Delay, Tenant agrees that, notwithstanding anything contained in this Lease to the contrary, the Commencement Date shall be deemed to have occurred on the date that Landlord’s Work would have been Substantially Completed and the Commencement Date would have occurred if the same had not been so delayed by Tenant Delay (it being agreed

11 | ||

that nothing contained herein shall vitiate Landlord’s obligation to Substantially Complete Landlord’s Work).

(f) Tenant shall conclusively be deemed to have agreed that the Anticipated Commencement Date set forth in the Commencement Date Notice constitutes the Commencement Date, unless within ten (10) days after the Anticipated Commencement Date (with time being of the essence), Tenant shall deliver a notice to Landlord specifying with reasonable detail the reasons why Tenant asserts that the conditions specified herein for the occurrence of the Commencement Date have not been satisfied. Pending the resolution of such dispute, Tenant shall pay rent and the parties shall conduct themselves based upon the assumption that the Commencement Date was the Anticipated Commencement Date set forth in the Commencement Date Notice, without prejudice to Tenant’s position. If it is resolved that the Commencement Date for the Premises was not the Anticipated Commencement Date set forth in the Commencement Date Notice, any payments of rent paid by Tenant to Landlord for periods prior to the Rent Commencement Date shall be credited by Landlord against amounts first due under this Lease.

(g) After the Commencement Date has been determined, either Tenant or Landlord shall, at the other’s request, within ten (10) days after such request is made, execute and deliver a Commencement Date Agreement, substantially in the form attached hereto as Exhibit I, confirming the Commencement Date, the Rent Commencement Date and the Expiration Date; provided, however, that the failure of the parties to sign such agreement shall not affect the Commencement Date, the Rent Commencement Date or the Expiration Date determined in accordance with the terms and conditions of this Lease.

(h) Tenant shall have no right to access the Premises (or any Floor thereof) prior to the Commencement Date, unless Tenant shall obtain Landlord’s prior written consent to such access. Subject to Section 26.01 of this Lease and subject to the rights of any existing tenants or occupants, Landlord shall not unreasonably withhold, condition or delay its consent to any request by Tenant to access any Floor of the Premises prior to the Commencement Date; provided, however, that such access is for the sole purpose of taking measurements, performing layouts and surveys and preparing plans and specifications (collectively, “Tenant’s Preparation Work”) and not for the purpose of performing any other work (including, without limitation, any installing of furniture or cabling). In the event that Landlord consents to any such access, then such access by Tenant shall be subject to Tenant’s compliance with all of the terms, covenants and conditions of this Lease (other than the covenants to pay Base Rent, Tenant’s PILOT Payment and Tenant’s Operating Payment), including, without limitation, Tenant’s indemnification obligations under this Lease and Tenant’s obligations to maintain insurance and deliver to Landlord evidence of such insurance pursuant to Article 12. Tenant shall be accompanied by a representative of Landlord during any such access, and Landlord agrees to make a representative available at reasonable times on reasonable notice for such purpose upon the prior request of Tenant.

(i) Landlord shall repair any latent defects with respect to Landlord’s Work, provided that Tenant shall notify Landlord of the existence of any such latent defects on or prior to the earlier to occur of (i) the first (1st) anniversary of the Rent Commencement Date and (ii) the first (1st) anniversary of the date on which Tenant shall commence occupancy of the Premises for

12 | ||

the conduct of Tenant’s business therein (in either case, with time being of the essence). Tenant shall permit Landlord to enter the Premises for the purpose of repairing any such latent defects, and Landlord shall do so in a prompt and timely manner following Landlord’s receipt of notice thereof. Landlord shall use commercially reasonable efforts to minimize any interference with respect to the conduct of the Initial Tenant Work and the Initial Restroom Work and, if applicable, with respect to the conduct of Tenant’s business in the Premises, while performing any such work. Notwithstanding the foregoing, in no event shall Landlord be obligated to repair any latent defects in Landlord’s Work on an overtime or premium pay basis, and Landlord’s performance of any such work shall not be deemed a constructive eviction of Tenant or entitle Tenant to any diminution or abatement of any Rent payable by Tenant under this Lease.

Section 2.05 OLP Lease. (a) If the Commencement Date shall be delayed beyond the First Extended Target Date solely by reason of Force Majeure and if as a direct result of such delay in the Commencement Date, Tenant holds over in the space (the “OLP Space”) it leases on the 19th floor of the building known as One Liberty Plaza, New York, New York (“OLP”) after the expiration of the term of such lease (the “OLP Lease”), Landlord shall reimburse Tenant, within thirty (30) days after Tenant shall have provided Landlord with reasonable supporting documentation, for that portion of the Fixed Rent (as such term is defined in the OLP Lease) that Tenant is required to pay (and actually does pay) to the landlord of OLP (the “OLP Landlord”), pursuant to Article 34 of the OLP Lease that is in excess of the Fixed Rent and Additional Charges payable by Tenant pursuant to Articles 4 and 5 of the OLP Lease during the last year of the term of the OLP Lease (i.e., the year immediately prior to the holdover period; such portion that Tenant is required to pay (and actually does pay) to the OLP Landlord being referred to as the “Excess Holdover Rent”). In addition, if the Commencement Date shall be delayed beyond the First Extended Target Date solely by reason of Force Majeure and/or Landlord Delay, and if as a direct result of such delay in the Commencement Date, Tenant holds over in the OLP Space after the expiration of the term of the OLP Lease, Landlord shall reimburse Tenant, within thirty (30) days after Tenant shall have provided Landlord with reasonable supporting documentation, for any consequential damages that Tenant is required to pay (and actually does pay) to the OLP Landlord.

(b) If for any reason, Tenant shall holdover in the OLP Space after the expiration of the term of the OLP Lease, then for the period during which (and only during such period) that the OLP Landlord shall not have entered in a lease which includes all or a portion of the OLP Space, Landlord shall reimburse Tenant for the Excess Holdover Rent within thirty (30) days after Tenant shall have provided Landlord with reasonable supporting documentation.

(c) If Landlord shall fail to reimburse Tenant for any such sums on a timely basis when required in accordance with Sections 2.05 (a) or (b), Tenant may provide written notice of such failure to Landlord, which notice must contain bold face 18 point type AND CAPITALIZED LETTERS making demand for such payment or an explanation of non-payment with specific reference to the provisions of this Section 2.05. Landlord shall then, within fifteen (15) days after receipt of such notice, either make the required payment or provide Tenant with a reasonably detailed explanation of the reason(s) for non-payment. If Landlord shall not respond to Tenant’s notice given in accordance with this Section 2.05 within fifteen (15) days after such notice shall have been given to Landlord (with time being of the essence), or if Landlord shall provide an explanation for

13 | ||

non-payment with which Tenant shall disagree, then, Tenant shall have the right to submit any dispute arising between Landlord and Tenant as to whether Landlord has failed properly so to reimburse Tenant to arbitration initiated by Tenant pursuant to the terms of Article 21. In the event that Tenant shall obtain a final determination in such arbitration to the effect that Landlord was required so to reimburse Tenant, then Landlord shall, within ten (10) Business Days after such determination has been obtained, pay such required reimbursement amount to Tenant, plus interest thereon at the Default Rate accruing from the date on which the payment should initially have been made in accordance with this Section 2.05; and if Landlord shall fail to make such payment within such ten (10) Business Day period (with time being of the essence), then Tenant shall have the right to offset against the next installment(s) of Rent becoming due hereunder the amount which Tenant was determined by arbitration to have been entitled, plus interest thereon at the Default Rate accruing from the date on which the payment should initially have been made in accordance with this Section 2.05, until Tenant has been fully credited therefor.

ARTICLE 3

RENT

RENT

Section 3.01 Base Rent. (a) Tenant shall pay to Landlord, with respect to the Initial Premises, base rent (the “Base Rent”) at the following annual rates in equal monthly installments in advance, commencing on the Rent Commencement Date, and thereafter on the first day of each and every month during the Term (a “Payment Date”):

(i) from the Rent Commencement Date to the last day of the month (the “Reset Date”) in which the day immediately preceding the fifth (5th) anniversary of the Rent Commencement Date occurs, at the rate of $11,821,110.00 per annum, payable in equal monthly installments of $985,092.50;

(ii) from the day following the Reset Date to the fifth (5th) anniversary of the Reset Date, at the rate of $12,665,475.00 per annum, payable in equal monthly installments of $1,055,456.25; and

(iii) from the day following the fifth (5th) anniversary of the Reset Date to the Expiration Date, at the rate of $13,509,840.00 per annum, payable in equal monthly installments of $1,125,820.00.

If the day on which Base Rent is payable is a Saturday or Sunday, or a Holiday on which the banks in New York City are closed, Base Rent shall be due and payable on the next immediately succeeding day on which such banks are open.

(b) Tenant shall pay all Rent as the same shall become due and payable under this Lease either by (i) wire transfer of immediately available federal funds as directed by Landlord, or (ii) by check (subject to collection) drawn on a United States bank having a branch office in the continental United States, in each case at the times provided herein and except as expressly set forth in this Lease, without notice or demand (except as otherwise expressly required by the terms and

14 | ||

conditions of this Lease with respect to Additional Rent) and without set-off, deduction or counterclaim. All Rent shall be paid in lawful money of the United States to Landlord in accordance with the Lockbox Account Instructions. Tenant shall not be in default of Tenant’s obligation to pay any such Base Rent and Additional Rent if and for so long as Tenant shall timely comply with Landlord’s wire instructions (which wire instructions are set forth in the Lockbox Account Instructions) in connection with such payments. Accordingly, if Tenant shall have timely complied with Landlord’s instructions pertaining to a wire transfer, but the funds shall thereafter have been misdirected or not accounted for properly by the recipient bank designated by Landlord, then the same shall not relieve Tenant of its obligation to make the payment so wired, but shall toll the due date for such payment until the wired funds shall have been located. Except to the extent specifically otherwise provided, all bills, invoices and statements rendered to Tenant with respect to this Lease shall be binding and conclusive on Tenant unless, within one hundred eighty (180) days after receipt of same, Tenant notifies Landlord that it is disputing the same.

(c) The parties acknowledge that this Lease has been structured so that provided that no Event of Default or Bankruptcy Event shall have occurred under this Lease, the Base Rent is abated during the period commencing on the Commencement Date and ending on the day immediately preceding the Rent Commencement Date (such period being referred to herein as the “Base Rent Abatement Period”). Tenant shall continue to pay all Additional Rent during the Base Rent Abatement Period, except that Tenant shall not be required to pay Tenant’s Operating Payment or Tenant’s PILOT Payment during the Base Rent Abatement Period.

Section 3.02 Additional Rent. All amounts, other than Base Rent, required under this Lease to be paid by Tenant, including Tenant’s Operating Payment, Tenant’s PILOT Payment, Tenant’s Electricity Costs and any fine, penalty or interest that may be imposed for nonpayment or late payment thereof, shall constitute additional rent (“Additional Rent”) and shall be paid when due in accordance with the terms of this Lease, without, except as may be specifically provided in this Lease, any abatement, set-off, deduction or counterclaim. Unless another due date or time period is provided in this Lease, Additional Rent shall be paid by Tenant to Landlord within thirty (30) days after a statement from Landlord is delivered to Tenant that such Additional Rent is due. If Tenant shall fail to pay any Additional Rent when the same shall be due and payable in accordance with the terms hereof, Landlord shall have all rights, powers and remedies with respect hereto as are provided herein or by law in the case of nonpayment of any Base Rent.

Section 3.03 Survival of Rent Obligation. Tenant’s obligation to pay Base Rent and Additional Rent (collectively, “Rent”) as provided in this Lease shall survive the expiration or earlier termination of this Lease.

Section 3.04 Default Interest Charge/Late Charge. (d) If any payment of Rent (which term, for purposes of this Section 3.04 only, shall exclude any charges imposed under this Section 3.04) is not paid (a) on the due date specified therefor in this Lease, or (b) if no due date is specified but a number of days is expressly provided within which the item of Rent in question shall be paid, within such number of days, or (c) if no due date or number of days for payment is set forth in this Lease with respect to the item of Rent in question, within thirty (30) days after the date upon which demand therefor is made, then interest (the “Default Interest Charge”) on the sums so overdue at

15 | ||

an annual rate (the “Default Rate”) equal to the lesser of (i) the highest rate permitted by law, and (ii) three percent (3%) in excess of the Prime Rate, for the period from the day following the date or period referred to in clause (a), (b) or (c) (whichever is applicable) to the date of actual payment, shall become due and payable to Landlord by Tenant after demand. In calculating the Default Interest Charge, the Default Rate shall accrue from the date such item of Rent was due (without regard to any grace period set forth in this Section 3.04), to and including the date of payment. Notwithstanding the foregoing, Landlord shall waive the applicability of the Default Interest Charge the first time that the same shall accrue in any twelve (12) consecutive calendar month period during the Term, provided that the payment of Rent in question is made to Landlord within five (5) Business Days after notice from Landlord that the same is past due.

(e) If Tenant shall fail to make any payment of Rent for a period longer than ten (10) days after the same shall have become due, Tenant shall pay to Landlord, in addition to such payment of Rent and in addition to the Default Interest Charge payable by Tenant pursuant to Section 3.04(a), and as Additional Rent, a sum (the “Late Charge”) equal to three percent (3%) of the amount unpaid for the administrative costs and expenses incurred by Landlord by reason of Tenant’s failure to make prompt payment.

(f) No failure by Landlord to insist upon the strict performance by Tenant of its obligations to pay any Default Interest Charge or Late Charge shall constitute a waiver by Landlord of its right to enforce the provisions of this Section 3.04 in any instance thereafter occurring. The provisions of this Section 3.04 shall not be construed in any way to extend any grace periods or notice periods or limit any remedies of Landlord that may be provided for in Article 20.

Section 3.05 Payment of Lesser Amount. No payment by Tenant or receipt or acceptance by Landlord of a lesser amount than the correct amount of any Rent shall be deemed to be other than a payment on account, nor shall any endorsement or statement on any check or any letter accompanying any check or payment be deemed an accord and satisfaction, and Landlord may accept such check or payment without prejudice to Landlord’s right to recover the balance or pursue any other remedy in this Lease or at law.

Section 3.06 Legal Rent Restrictions. If any portion of the Rent payable under the terms and provisions of this Lease shall be or become uncollectible, reduced or required to be refunded because of any rent control or similar act or law enacted by a Governmental Authority, Tenant shall enter into such agreements and take such other steps (without any additional expense or liability to Tenant) as Landlord may reasonably request and as may be legally permissible to permit Landlord to collect the maximum rents which from time to time during the continuance of such legal rent restriction may be legally permissible (and not in excess of the amounts reserved therefor under this Lease). Upon the termination of such legal rent restriction, (a) the Rent in question shall become and thereafter be payable in accordance with the amounts reserved herein for the periods following such termination, and (b) Tenant shall pay to Landlord, to the maximum extent legally permissible, an amount equal to the amount of the Rent in question which would have been paid pursuant to this Lease but was not paid due to such legal rent restriction together with interest on such amount at the Prime Rate from the date the Rent in question would have been paid to the date on which such amount is paid.

16 | ||

ARTICLE 4

OPERATING EXPENSES; PILOT

OPERATING EXPENSES; PILOT

Section 4.01 Operating Expenses. (a) “Operating Expenses” shall mean, subject to the limitations hereinafter set forth, all costs and expenses (and taxes thereon, if any, provided that such taxes, or any portion thereof, shall not be included within PILOT Charges) paid or incurred by Landlord or on behalf of Landlord, without duplication, in respect of the operation, cleaning, repair, replacement, safety (including fire safety), management, security and maintenance of the Real Property, and the services provided to occupants of the Building, including, without limitation:

(i) salaries, wages, bonuses and termination payments as required by any union contracts paid to, and the cost of any hospitalization, medical, surgical, union and general welfare benefits (including group life insurance), any pension, retirement or life insurance plans and other benefits or similar expenses relating to, the Building manager, his staff and other employees of Landlord or its Affiliates engaged in providing services at the Building; provided, however, that if and to the extent that any employees provide services at or with respect to properties other than the Real Property, then the foregoing amounts shall only be included in Operating Expenses in the same proportion that such employee’s work at or with respect to the Real Property bears to the aggregate of such employee’s work;

(ii) social security, unemployment and other payroll taxes, and the cost of providing disability and workers’ compensation coverage imposed by any Legal Requirements, union contract or otherwise with respect to said employees;

(iii) the cost of electricity (other than that furnished to space occupied or available to be occupied by tenants or other occupants of rentable areas in the Building), gas, hot water for heating, steam, water, chilled water, air conditioning and other fuel and utilities furnished to all tenants in reasonably proportionate amounts without express cost to such tenants or other occupants or furnished to the Real Property (or any common area thereof);

(iv) premiums for casualty, rent, liability, fidelity and any other insurance required to be carried by Landlord under the Ground Lease and such other insurance (of a type customary for real property similar to the Real Property) as Landlord carries or hereafter carries with respect to the Real Property, as reasonably allocated to the Real Property by Landlord in accordance with its current practices;

(v) the cost of maintenance and painting common areas of the Building (but not any space occupied by tenants or available for occupancy by tenants);

(vi) the cost or rental of all building and cleaning supplies, tools, materials and equipment (excluding the cost of tools, materials and equipment which are properly depreciated under GAAP (as defined below));

(vii) the cost of uniforms, work clothes and dry cleaning for Building employees and personnel at and below the grade of Building manager;

17 | ||

(viii) the costs and expenses attributable to window cleaning, concierge, security and fire safety personnel, services or systems;

(ix) charges of independent contractors rendering services or materials to the extent relating to the operations of the Real Property;

(x) telephone and stationery to the extent related to the operation of the Real Property;

(xi) accounting and other professional fees and disbursements and reasonable legal fees and disbursements (including those incurred in the calculation of Tenant’s Operating Payments, PILOT Charges and electricity payments owed by tenants pursuant to provisions comparable to Article 5 and in the enforcement of the Ground Lease on behalf of tenants generally of the Building); provided, that (i) such fees and disbursements shall not be included to the extent that they are incurred by Landlord in connection with disputes with tenants or other occupants of the Building, including, without limitation, disputes related to the calculation of escalation payments similar in nature to the escalation rent payable hereunder, or the enforcement of leases, licenses or other occupancy agreements, and (ii) such fees and disbursements shall be reasonably apportioned if the services relate to properties in addition to the Real Property;

(xii) the Common Area Contribution (as defined in the Restrictive Covenant Agreement);

(xiii) the cost of common area decorations in the Building (except to the extent set forth in Section 4.01(b)(29));

(xiv) the cost of all alterations, repairs, replacements and/or improvements made at any time by or on behalf of Landlord, whether structural or non-structural, ordinary or extraordinary, foreseen or unforeseen, and whether or not required by this Lease, and all tools and equipment related thereto; provided that if in accordance with generally accepted accounting principles consistently applied (“GAAP”), any of the costs referred to in this clause (xiv) are required to be capitalized, then, except as provided in the last paragraph of this Section 4.01(a) with respect to Green CapEx (as hereinafter defined), such costs shall not be included in Operating Expenses unless they (I) are required by any Legal Requirements (x) hereafter enacted or hereafter applicable to the Real Property, or (y) currently in effect or applicable to the Real Property for which periodic or cyclical compliance may continue to be required from and after the date of this Lease, (II) are intended to reduce expenses that would otherwise be included in Operating Expenses, or (III) constitute a replacement which in Landlord’s reasonable judgment is prudent to make in lieu of repairs to the replaced item(s), in which event the cost thereof, together with interest on such costs under clauses (I) and (III) above at the greater of (A) the Prime Rate in effect on December 31 of the Lease Year in which such costs were incurred or (B) the actual costs incurred by Landlord to finance such alterations, repairs, replacements and/or improvements described in clauses (I), (II) and (III) of this clause (xiv), shall be amortized on a level payment basis (including principal and, as applicable, interest) and included in Operating Expenses commencing when the item in question is put into service and continuing over the useful life of the item in question (as determined in accordance with GAAP), provided that no such costs shall be included in Operating Expenses for

18 | ||

the Base Lease Year. The annual amortized amount so included in Operating Expenses for any year on account of such capital improvements or capital items which are intended to reduce Operating Expenses, as described in clause (II) of this clause (xiv), shall not exceed Landlord’s reasonable calculation (“Landlord’s Saving Calculation”) of the annual savings in Operating Expenses that such improvements or items were designed to achieve. Landlord’s Savings Calculation shall be supported by an analysis prepared by a reputable third party engineer or consultant on behalf of Landlord in accordance with commercially reasonable industry standards with respect to the applicable item (and which analysis, at Tenant’s request, shall be furnished by Landlord to Tenant).

(xv) customary costs and expenses allocated by Landlord to areas in the Building that are used for Building management offices, storage areas, workshops or similar purposes, provided, that such costs are for the purpose of managing the Building and provided further, that such rent shall not exceed the then fair market rental value for any such space (based upon recently completed transactions in the Building) and that the amount of space allocated for the Building management office shall not exceed 4,500 rentable square feet;

(xvi) levies and assessments, fees, dues, contributions and other similar or like charges paid by or on behalf of Landlord or Landlord’s affiliates to civic or other real estate organizations (provided the same do not exceed the level customarily paid by owners of first-class office buildings located in downtown Manhattan that are comparable to the Building; and further provided, however, that if and to the extent that any of such levies, assessments, dues, fees, contributions or charges are properly allocable to properties other than the Real Property, then the foregoing amounts shall only be included as Operating Expenses in the same proportion that their proper allocation to the Real Property bears to all property (including the Real Property) and any assessments, dues, levies or charges paid to any business improvement district or re-development agency or similar organization or to any entity on behalf of such an organization, including the Downtown Lower Manhattan Business Improvement District or any other similar agency (except to the extent included in PILOT Charges);

(xvii) all other costs and expenses properly allocated by Landlord to the operation, cleaning, repair, replacement, safety (including fire safety), management, security and maintenance of the Land and Building and the entranceways, access and egress points, sidewalks, curbs, plazas and other areas forming a part of or adjoining or servicing the Land and the Building, in accordance with the standards applicable to a first-class office building in downtown Manhattan; and

(xviii) management fees not to exceed three percent (3%) of the gross revenues derived from the Building (calculated as though the rent commencement dates have occurred for 100% of the leases in the Building (including, without limitation, this Lease)); provided that if Landlord or an Affiliate of Landlord is the Property Manager then the annual management fee shall be equal to three percent (3%) of the gross revenues derived from the Building (calculated as though the rent commencement dates have occurred for 100% of the leases in the Building (including, without limitation, this Lease)).