Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Shutterstock, Inc. | a8-kdocument.htm |

| EX-99.1 - EXHIBIT 99.1 - Shutterstock, Inc. | ex-991.htm |

Q3 2015 Summary November 5, 2015

2 This presentation contains “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995 that are based on our management’s beliefs and assumptions and on information currently available to management. Forward-looking statements include information concerning our possible or assumed future results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities, potential market opportunities and the effects of competition. Forward-looking statements include all statements that are not historical facts and can be identified by terms such as “anticipates,” “believes,” “could,” “seeks,” “estimates,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions and the negatives of those terms. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements represent our management’s beliefs and assumptions only as of the date of our most recent public filings. You should read our public filings, including the Risk Factors set forth therein and the documents that we have filed as exhibits to those filings, completely and with the understanding that our actual future results may be materially different from what we currently expect. Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in the forward-looking statements, even if new information becomes available in the future. In addition, as we refer to earnings, we will also refer to adjusted EBITDA, adjusted EBITDA margin, non-GAAP net income and free cash flow, which we consider to be important financial indicators of the Company’s operational strength and the performance of its business. Shutterstock defines adjusted EBITDA as net income adjusted for other (expense)/income, income taxes, depreciation, amortization, disposals and non-cash equity-based compensation; adjusted EBITDA margin as adjusted EBITDA divided by revenue; non-GAAP net income as net income excluding the after tax impact of non-cash equity-based compensation, the amortization of acquisition-related intangible assets and changes in fair value of contingent consideration related to acquisitions; and free cash flow as cash provided by/(used in) operating activities adjusted for capital expenditures and content acquisition. These figures are non-GAAP financial measures and should be considered in addition to results prepared in accordance with generally accepted accounting principles (GAAP), and should not be considered as a substitute for, or superior to, GAAP results. Safe Harbor

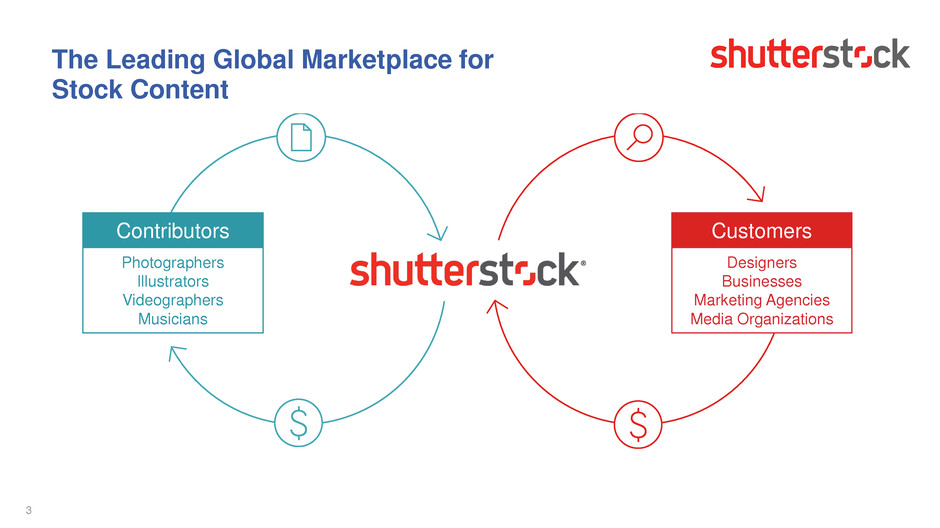

3 The Leading Global Marketplace for Stock Content Contributors Photographers Illustrators Videographers Musicians Customers Designers Businesses Marketing Agencies Media Organizations

4 - Reported revenue increased 28% to $107.3 million - Revenues increased approximately 25% excluding the impact of currency and contributions from acquired businesses primarily driven by new customers, increased paid downloads and higher revenue per download - Reported Adjusted EBITDA increased 11% to $19.6 million - Adjusted EBITDA increased approximately 27% excluding the impact of currency and contributions from acquired businesses; revenue growth was partially offset by higher operating expenses due primarily to royalty costs associated with the increase in paid downloads as well as higher personnel and marketing costs - Net Income available to common stockholders decreased to $4.1 million - Non-GAAP net income per diluted share increased 4% to $0.28; excludes non-cash equity-based compensation, amortization of acquisition related intangible assets and changes in the fair value of contingent consideration - Announced $100 million share repurchase program Q3 2015 Financial Highlights

5 - Image library expanded 49% to 63.7 million images - Video library expanded 60% to 3.3 million video clips - Paid downloads grew 22% to 38.1 million - Revenue per download increased 4% to $2.76 - 1.4 million customers contributed to revenue in the prior 12 months Q3 2015 Operating Highlights

Consolidated Financial Results ($ in millions) Three Months Ended September 30 Nine Months Ended September 30 2015 2014 % 2015 2014 % Operating Revenues $107.3 $83.7 28% $309.1 $236.7 31% Operating Expenses 99.2 74.5 33% 283.2 210.0 35% Operating Profit 8.1 9.2 (12%) 26.0 26.7 (3%) Add: Dep. & Amort. 3.9 2.1 86% 10.4 5.8 79% Add: Stock Based Comp. 7.7 6.3 22% 22.8 15.7 45% Add: Other Adjustments -- -- -- -- 0.4 -- Adjusted EBITDA $19.6 $17.7 11% $59.1 $48.6 22% Adjusted EBITDA Margin 18.3% 21.1% 19.1% 20.5% Add: Executive Severance 0.7 -- -- 0.8 -- -- $20.3 $17.7 15% $59.9 $48.6 23% 6 Note: “Other Adjustments” includes write-off of property & equipment in Q1’14. Totals may not sum due to rounding.

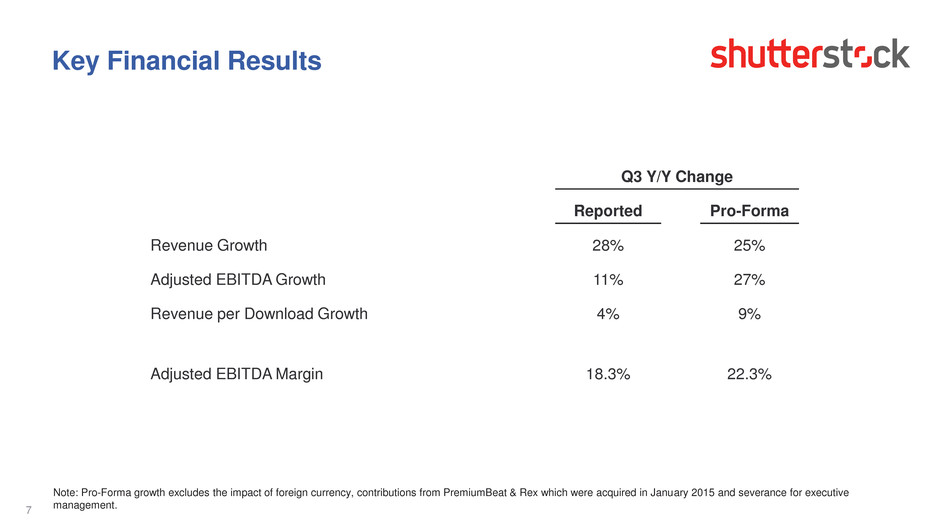

Key Financial Results Q3 Y/Y Change Reported Pro-Forma Revenue Growth 28% 25% Adjusted EBITDA Growth 11% 27% Revenue per Download Growth 4% 9% Adjusted EBITDA Margin 18.3% 22.3% Note: Pro-Forma growth excludes the impact of foreign currency, contributions from PremiumBeat & Rex which were acquired in January 2015 and severance for executive management. 7

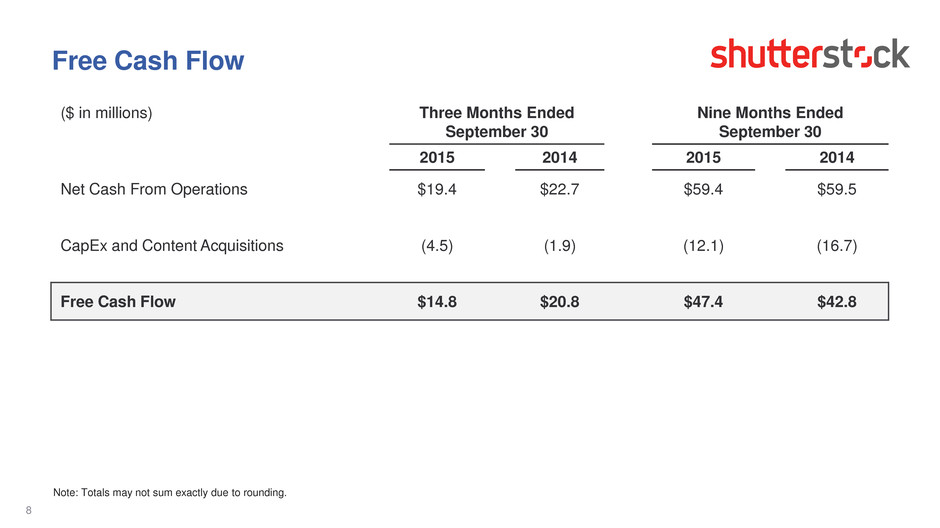

Free Cash Flow 8 ($ in millions) Three Months Ended September 30 Nine Months Ended September 30 2015 2014 2015 2014 Net Cash From Operations $19.4 $22.7 $59.4 $59.5 CapEx and Content Acquisitions (4.5) (1.9) (12.1) (16.7) Free Cash Flow $14.8 $20.8 $47.4 $42.8 Note: Totals may not sum exactly due to rounding.

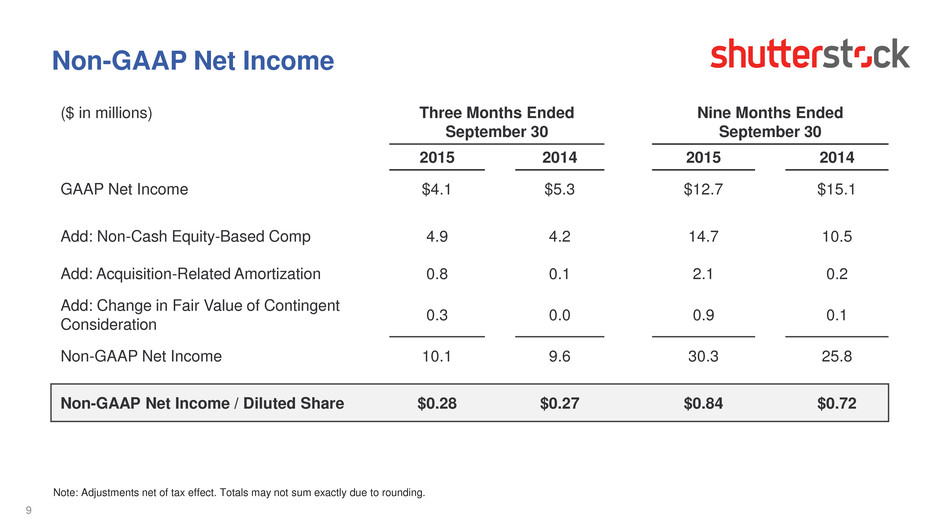

Non-GAAP Net Income 9 ($ in millions) Three Months Ended September 30 Nine Months Ended September 30 2015 2014 2015 2014 GAAP Net Income $4.1 $5.3 $12.7 $15.1 Add: Non-Cash Equity-Based Comp 4.9 4.2 14.7 10.5 Add: Acquisition-Related Amortization 0.8 0.1 2.1 0.2 Add: Change in Fair Value of Contingent Consideration 0.3 0.0 0.9 0.1 Non-GAAP Net Income 10.1 9.6 30.3 25.8 Non-GAAP Net Income / Diluted Share $0.28 $0.27 $0.84 $0.72 Note: Adjustments net of tax effect. Totals may not sum exactly due to rounding.

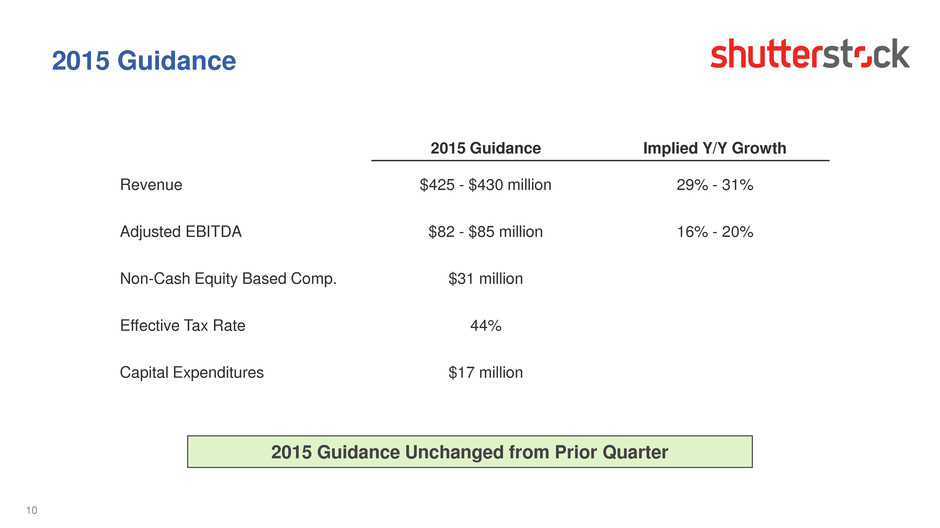

2015 Guidance 2015 Guidance Implied Y/Y Growth Revenue $425 - $430 million 29% - 31% Adjusted EBITDA $82 - $85 million 16% - 20% Non-Cash Equity Based Comp. $31 million Effective Tax Rate 44% Capital Expenditures $17 million 10 2015 Guidance Unchanged from Prior Quarter