Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Orexigen Therapeutics, Inc. | d47311d8k.htm |

| EX-99.1 - EX-99.1 - Orexigen Therapeutics, Inc. | d47311dex991.htm |

3Q 2015 Conference Call November 5, 2015 Exhibit 99.2

Forward Looking Statements This presentation contains forward-looking statements about Orexigen Therapeutics, Inc. and its recently approved product, Contrave. Words such as “believes,” “anticipates,” “plans,” “expects,” “indicates,” “will,” “should,” “intends,” “potential,” “suggests,” “assuming,” “designed” and similar expressions are intended to identify forward‐looking statements. These statements are based on the Company‘s current beliefs and expectations. These forward‐looking statements include statements regarding: the potential for Contrave and Mysimba to achieve commercial success globally; the potential to continue a successful launch in the United States, the potential to commercialize in the European Union in 2016; the potential for the acquisition of new assets; the potential success of Orexigen’s go to market approach outside of the United States; Orexigen’s ability to retain ownership of Contrave/Mysimba in certain markets; the potential for significant sales for Contrave/Mysimba outside of the United States; the projections for overall obesity prescription market growth; the potential unmet need and market opportunity in United States and Europe; the potential for additional regulatory filings and approvals through 2016; the potential for Orexigen to obtain marketing authorizations or commercialization partner(s) for Contrave in territories outside the United States and South Korea; the sufficiency of Orexigen’s cash resources; anticipated trends in our business and industry; the potential to maintain and strengthen the intellectual property protection for Contrave/Mysimba globally and other characterizations of future events or circumstances. The inclusion of forward‐looking statements should not be regarded as a representation by Orexigen that any of its plans will be achieved. Actual results may differ materially from those expressed or implied in this release due to the risk and uncertainties inherent in the Orexigen business, including, without limitation: the potential that the marketing and commercialization of Contrave and Mysimba will not be successful; the ability to obtain partnerships and marketing authorizations globally; competition in the global obesity market, particularly from existing therapies; additional analysis of the interim results or the final data from the terminated Light Study, including safety-related data, and the additional CVOT may produce negative or inconclusive results, or may be inconsistent with the conclusion that the interim analysis was successful; our ability to retain ownership of Contrave and Mysimba and create value in certain markets outside of the United States; our dependence on Takeda to carry out the commercial launch of Contrave in the United States; our ability to obtain and maintain global intellectual property protection for Contrave and Mysimba; the potential that the interim analysis of the Light Study may not be predictive of future results in the Light Study or other clinical trials; the potential for early termination of our collaboration agreement with Takeda; legal or regulatory proceedings against Orexigen, as well as potential reputational harm, as a result of misleading public claims about Orexigen; the therapeutic and commercial value of Contrave and Mysimba; our ability to successfully acquire, develop and market additional product candidates or approved products; our ability to maintain sufficient capital to fund our operations for the foreseeable future; estimates of the capacity of manufacturing and other facilities to support Contrave; the Company’s reliance on Takeda to vigorously enforce the CONTRAVE intellectual property rights; the potential for a Delaware court to determine that one or more of the patents are not valid or that Actavis' proposed generic product is not infringing each of the patents at issue; and other risks described in Orexigen’s filings with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward‐looking statements, which speak only as of the date hereof, and Orexigen undertakes no obligation to revise or update this news release to reflect events or circumstances after the date hereof. Further information regarding these and other risks is included under the heading "Risk Factors" in Orexigen's Current Report on Form 10-Q filed with the Securities and Exchange Commission on August 7, 2015 and its other reports, which are available from the SEC's website (www.sec.gov) and on Orexigen's website (www.orexigen.com) under the heading "Investors." All forward‐looking statements are qualified in their entirety by this cautionary statement. This caution is made under the safe harbor provisions of Section 21E of the Private Securities Litigation Reform Act of 1995. For investor purposes only – not for use in product promotion

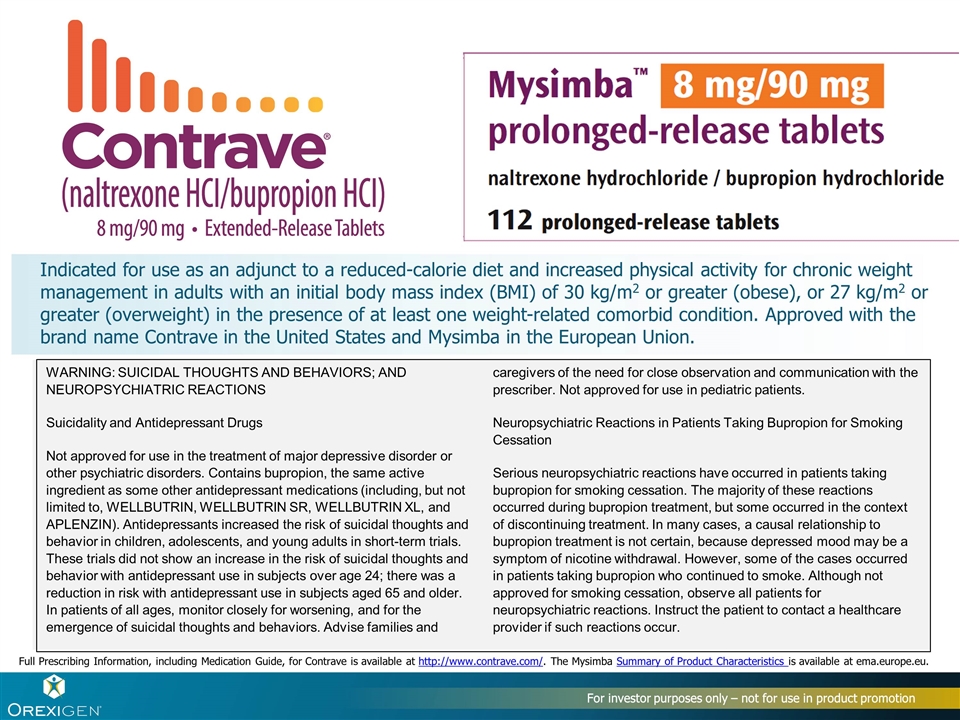

Indicated for use as an adjunct to a reduced-calorie diet and increased physical activity for chronic weight management in adults with an initial body mass index (BMI) of 30 kg/m2 or greater (obese), or 27 kg/m2 or greater (overweight) in the presence of at least one weight-related comorbid condition. Approved with the brand name Contrave in the United States and Mysimba in the European Union. WARNING: SUICIDAL THOUGHTS AND BEHAVIORS; AND NEUROPSYCHIATRIC REACTIONS Suicidality and Antidepressant Drugs Not approved for use in the treatment of major depressive disorder or other psychiatric disorders. Contains bupropion, the same active ingredient as some other antidepressant medications (including, but not limited to, WELLBUTRIN, WELLBUTRIN SR, WELLBUTRIN XL, and APLENZIN). Antidepressants increased the risk of suicidal thoughts and behavior in children, adolescents, and young adults in short-term trials. These trials did not show an increase in the risk of suicidal thoughts and behavior with antidepressant use in subjects over age 24; there was a reduction in risk with antidepressant use in subjects aged 65 and older. In patients of all ages, monitor closely for worsening, and for the emergence of suicidal thoughts and behaviors. Advise families and caregivers of the need for close observation and communication with the prescriber. Not approved for use in pediatric patients. Neuropsychiatric Reactions in Patients Taking Bupropion for Smoking Cessation Serious neuropsychiatric reactions have occurred in patients taking bupropion for smoking cessation. The majority of these reactions occurred during bupropion treatment, but some occurred in the context of discontinuing treatment. In many cases, a causal relationship to bupropion treatment is not certain, because depressed mood may be a symptom of nicotine withdrawal. However, some of the cases occurred in patients taking bupropion who continued to smoke. Although not approved for smoking cessation, observe all patients for neuropsychiatric reactions. Instruct the patient to contact a healthcare provider if such reactions occur. Full Prescribing Information, including Medication Guide, for Contrave is available at http://www.contrave.com/. The Mysimba Summary of Product Characteristics is available at ema.europe.eu. For investor purposes only – not for use in product promotion

2H 2015 Focus for Orexigen EU and ROW commercialization Continuing US launch success For investor purposes only – not for use in product promotion Acquisition of new assets

Successful US Contrave® (naltrexone HCl / bupropion HCl extended-release) launch, branded market share leader EU Approval for Mysimba™ (naltrexone HCl / bupropion HCl prolonged-release) Balance sheet strengthened $233 million in cash at September 30, 2015 (unaudited) Began earning royalties on US sales Established Orexigen Ireland to manage ex-US business Partnering process yielded first deal in South Korea Orexigen: An eventful 2015 For investor purposes only – not for use in product promotion

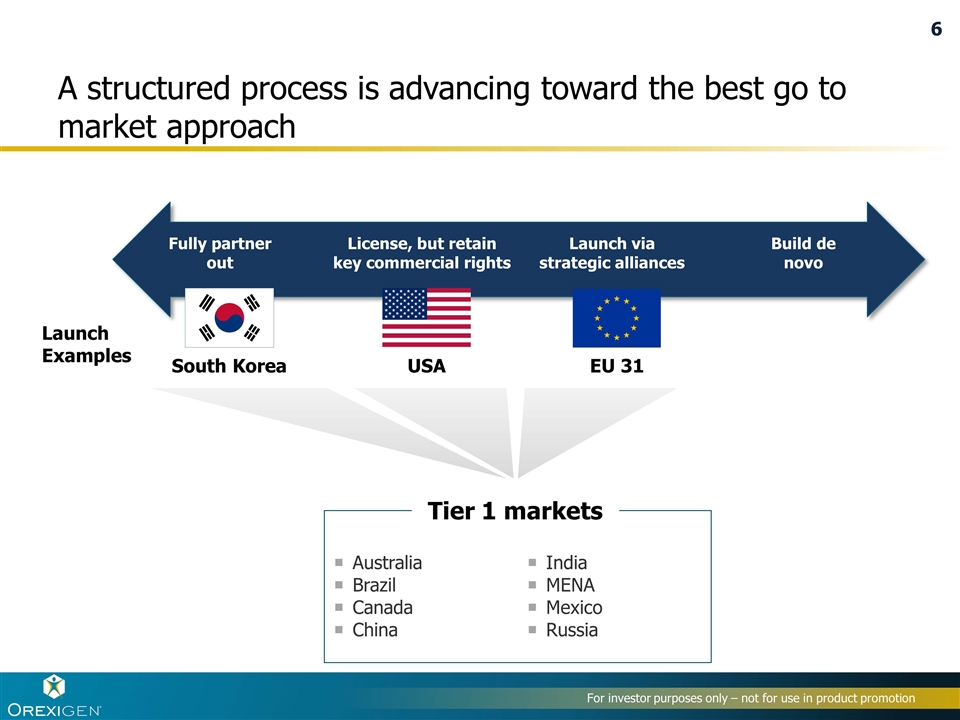

A structured process is advancing toward the best go to market approach Fully partner out License, but retain key commercial rights Launch via strategic alliances Build de novo South Korea USA EU 31 Australia Brazil Canada China India MENA Mexico Russia Launch Examples Tier 1 markets

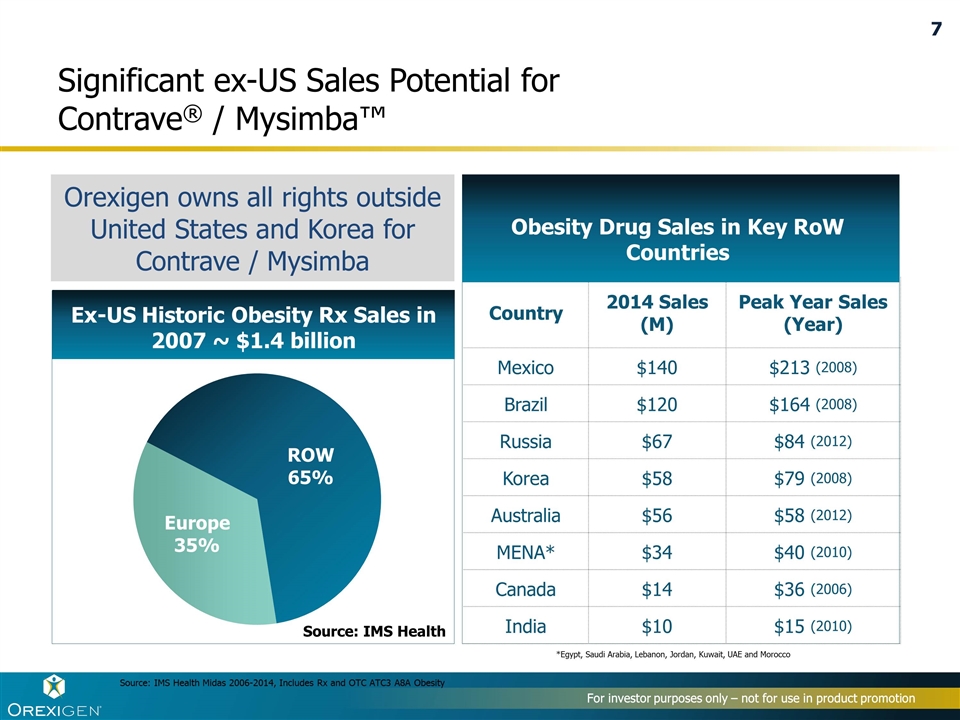

Country 2014 Sales (M) Peak Year Sales (Year) Mexico $140 $213 (2008) Brazil $120 $164 (2008) Russia $67 $84 (2012) Korea $58 $79 (2008) Australia $56 $58 (2012) MENA* $34 $40 (2010) Canada $14 $36 (2006) India $10 $15 (2010) Significant ex-US Sales Potential for Contrave® / Mysimba™ For investor purposes only – not for use in product promotion Obesity Drug Sales in Key RoW Countries *Egypt, Saudi Arabia, Lebanon, Jordan, Kuwait, UAE and Morocco Source: IMS Health Midas 2006-2014, Includes Rx and OTC ATC3 A8A Obesity Ex-US Historic Obesity Rx Sales in 2007 ~ $1.4 billion Europe 35% ROW 65% Source: IMS Health Orexigen owns all rights outside United States and Korea for Contrave / Mysimba 7

U.S. Market

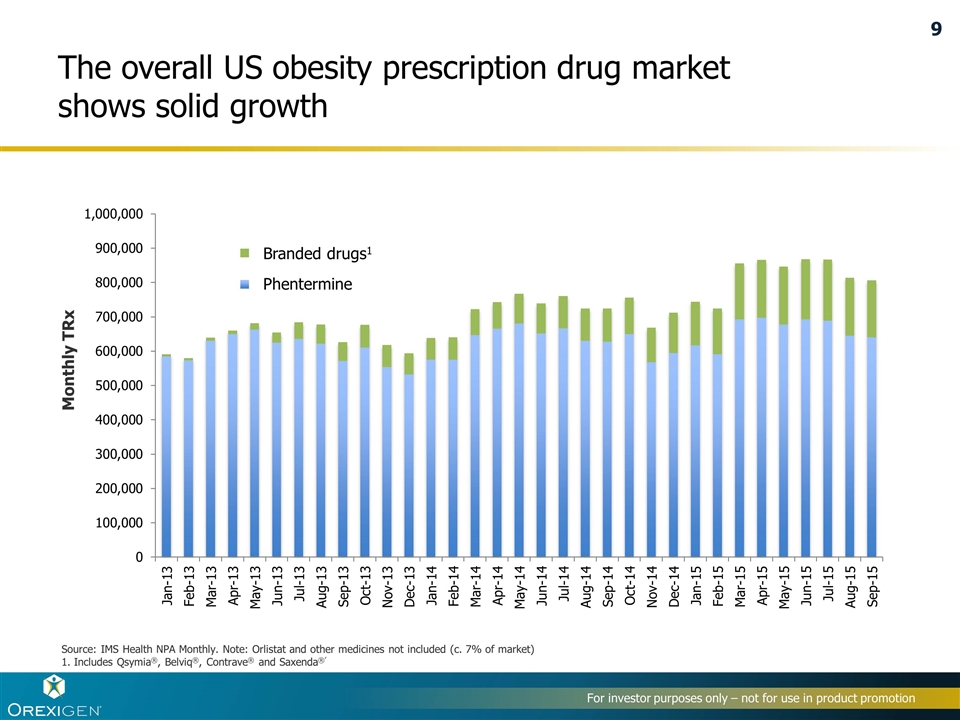

The overall US obesity prescription drug market shows solid growth Monthly TRx Source: IMS Health NPA Monthly. Note: Orlistat and other medicines not included (c. 7% of market) 1. Includes Qsymia®, Belviq®, Contrave® and Saxenda®’ Branded drugs1 Phentermine 9

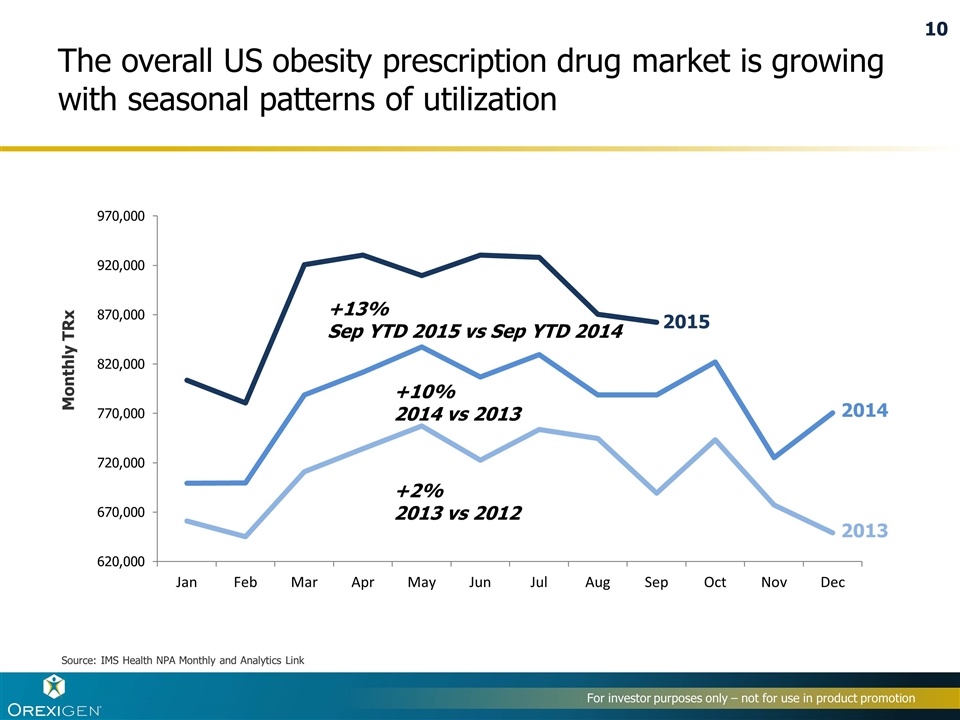

The overall US obesity prescription drug market is growing with seasonal patterns of utilization +10% 2014 vs 2013 Monthly TRx Source: IMS Health NPA Monthly and Analytics Link +2% 2013 vs 2012 2015 2014 2013 +13% Sep YTD 2015 vs Sep YTD 2014 10

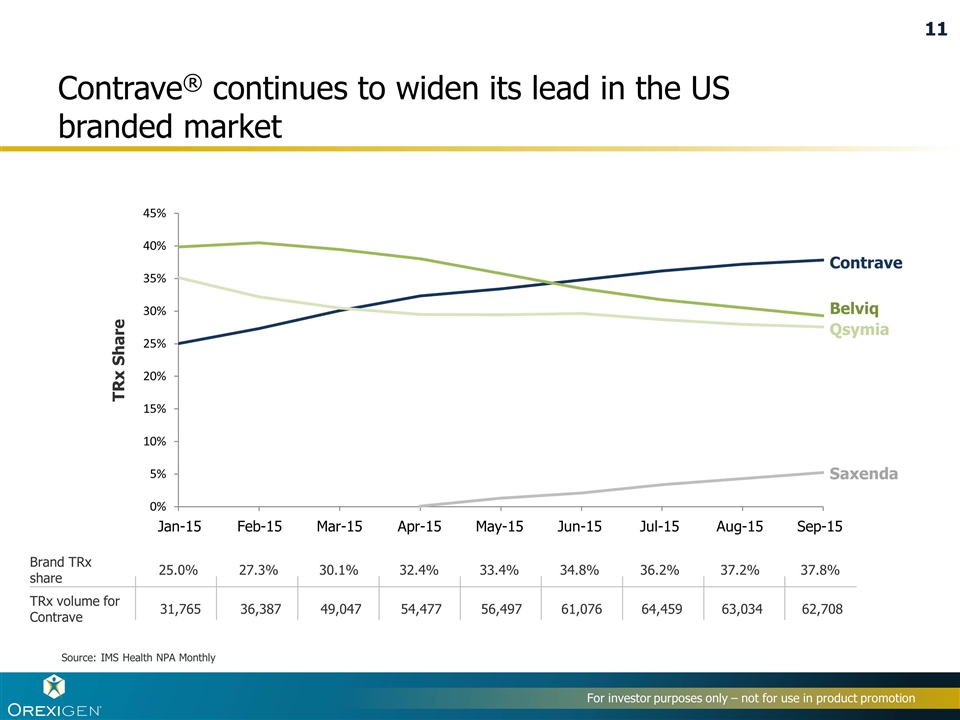

Contrave® continues to widen its lead in the US branded market TRx Share Source: IMS Health NPA Monthly Contrave Belviq Qsymia Saxenda 25.0% 27.3% 30.1% 32.4% 33.4% 34.8% 36.2% 37.2% 31,765 36,387 49,047 54,477 56,497 61,076 64,459 63,034 Brand TRx share TRx volume for Contrave 37.8% 62,708 Jan-15 Feb-15 Mar-15 Apr-15 May-15 Jun-15 Jul-15 Aug-15 Sep-15 11

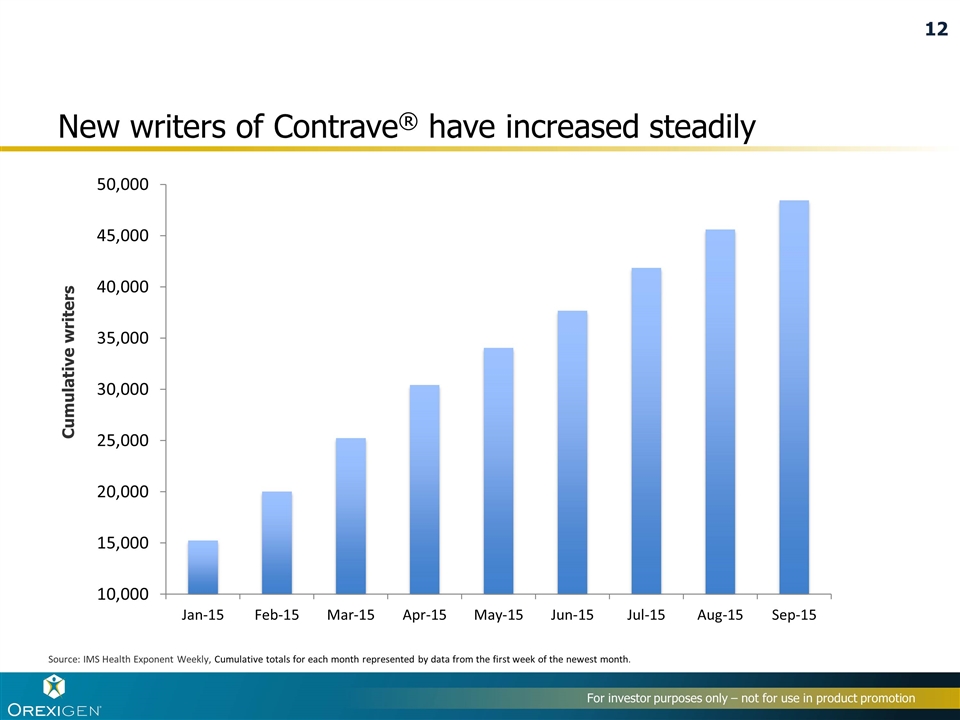

New writers of Contrave® have increased steadily Cumulative writers Source: IMS Health Exponent Weekly, Cumulative totals for each month represented by data from the first week of the newest month. 12

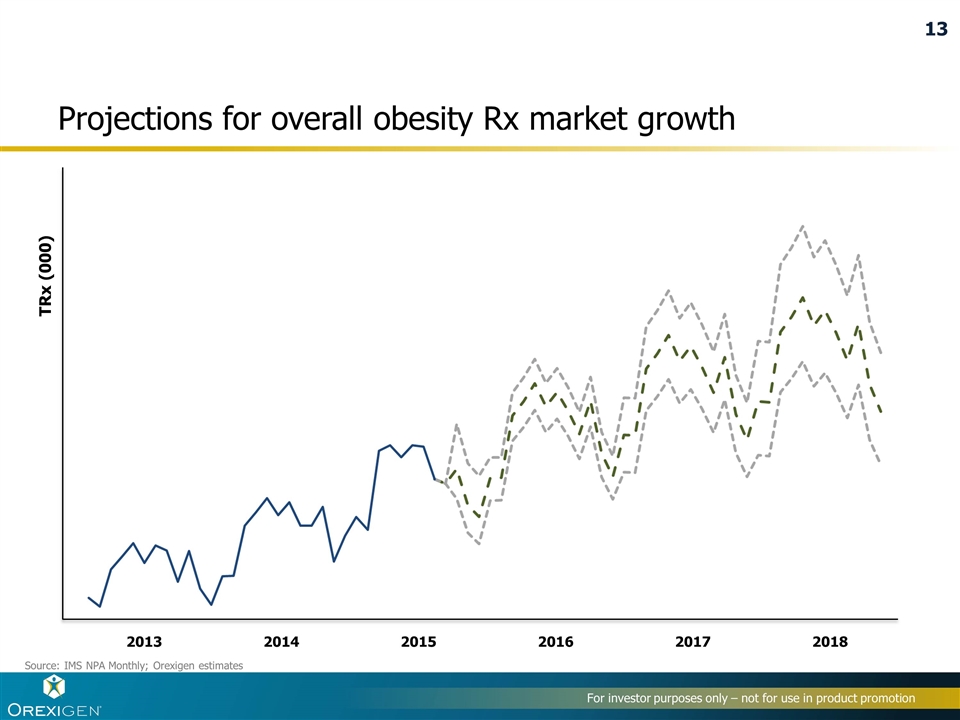

Projections for overall obesity Rx market growth Source: IMS NPA Monthly; Orexigen estimates TRx (000) 2013 2014 2017 2016 2015 2018 13

EU Market

Three overarching goals guide European Strategy Realize maximum value for Orexigen's shareholders 1 Maximize market penetration and Mysimba sales 2 Deploy Orexigen's resources efficiently and effectively 3 Maintain strategic flexibility 15

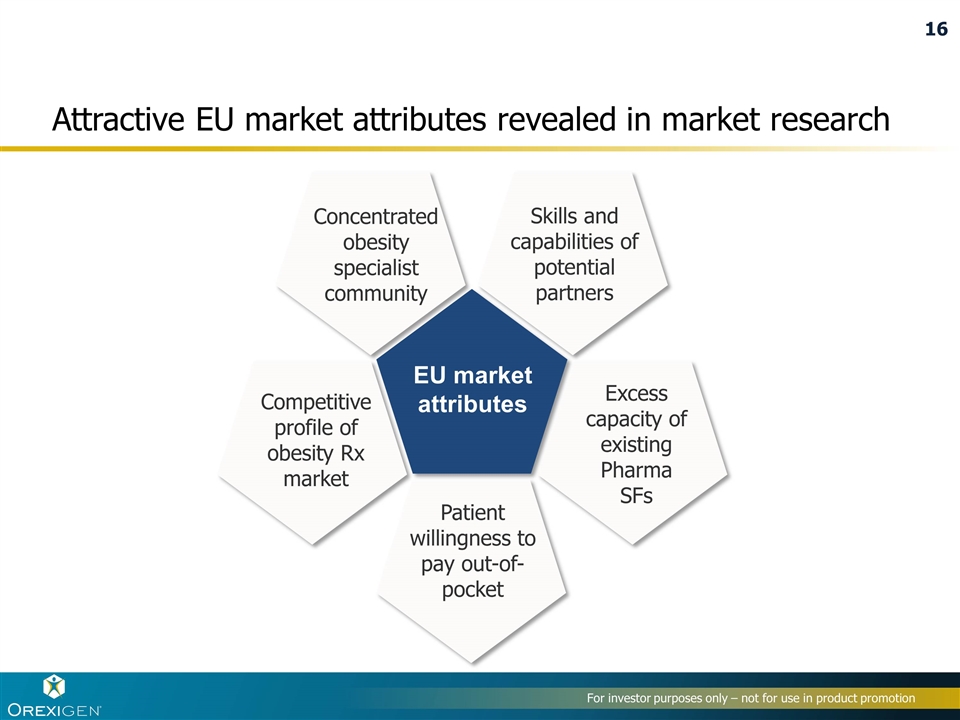

EU market attributes Concentrated obesity specialist community Excess capacity of existing Pharma SFs Patient willingness to pay out-of-pocket Competitive profile of obesity Rx market Skills and capabilities of potential partners Attractive EU market attributes revealed in market research

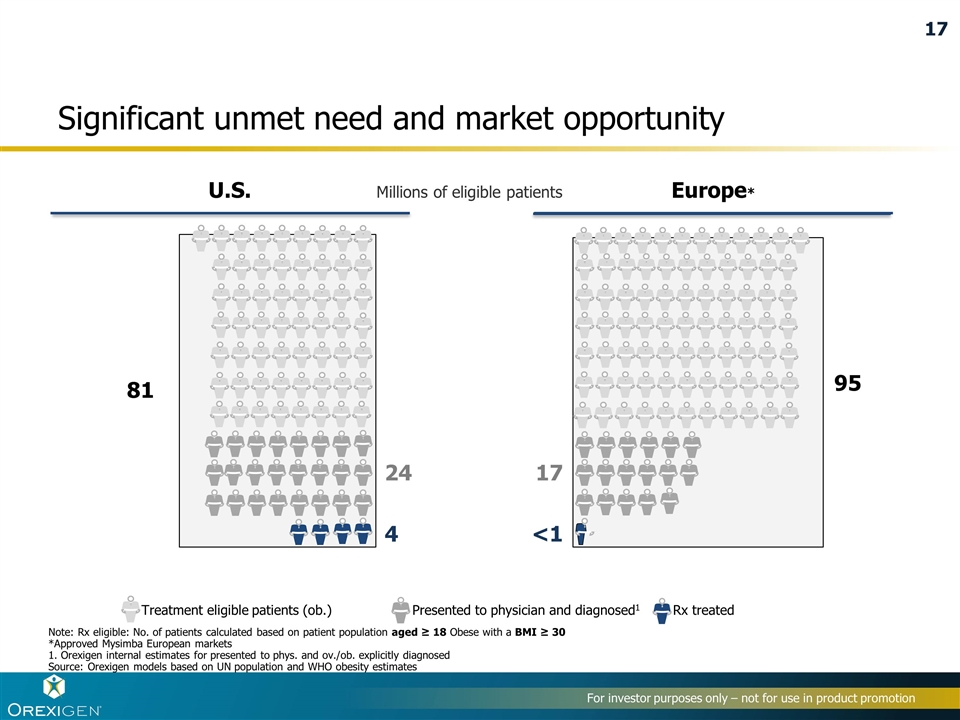

Significant unmet need and market opportunity Note: Rx eligible: No. of patients calculated based on patient population aged ≥ 18 Obese with a BMI ≥ 30 *Approved Mysimba European markets 1. Orexigen internal estimates for presented to phys. and ov./ob. explicitly diagnosed Source: Orexigen models based on UN population and WHO obesity estimates Treatment eligible patients (ob.) U.S. Europe* 81 24 4 95 17 <1 Presented to physician and diagnosed1 Rx treated Millions of eligible patients 17

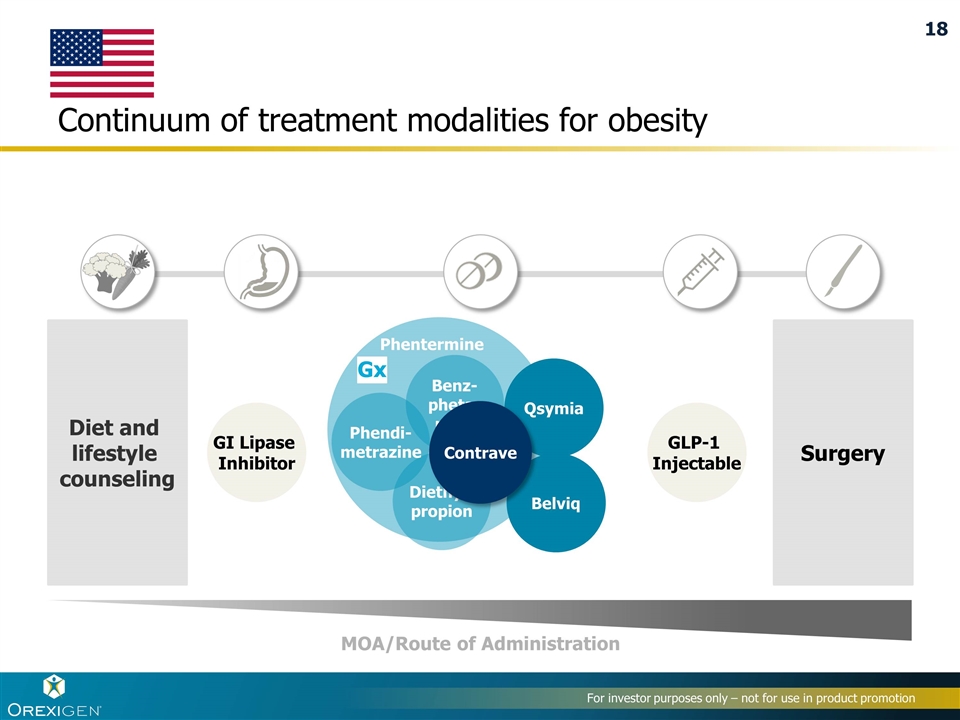

Phentermine Diethyl- propion Benz- pheta- mine Phendi- metrazine Gx Continuum of treatment modalities for obesity GI Lipase Inhibitor GLP-1 Injectable Diet and lifestyle counseling Surgery MOA/Route of Administration Qsymia Belviq Contrave 18

Continuum of treatment modalities for obesity Diet and lifestyle counseling Surgery GLP-1 Injectable Mysimba GI Lipase Inhibitor MOA/Route of Administration 19

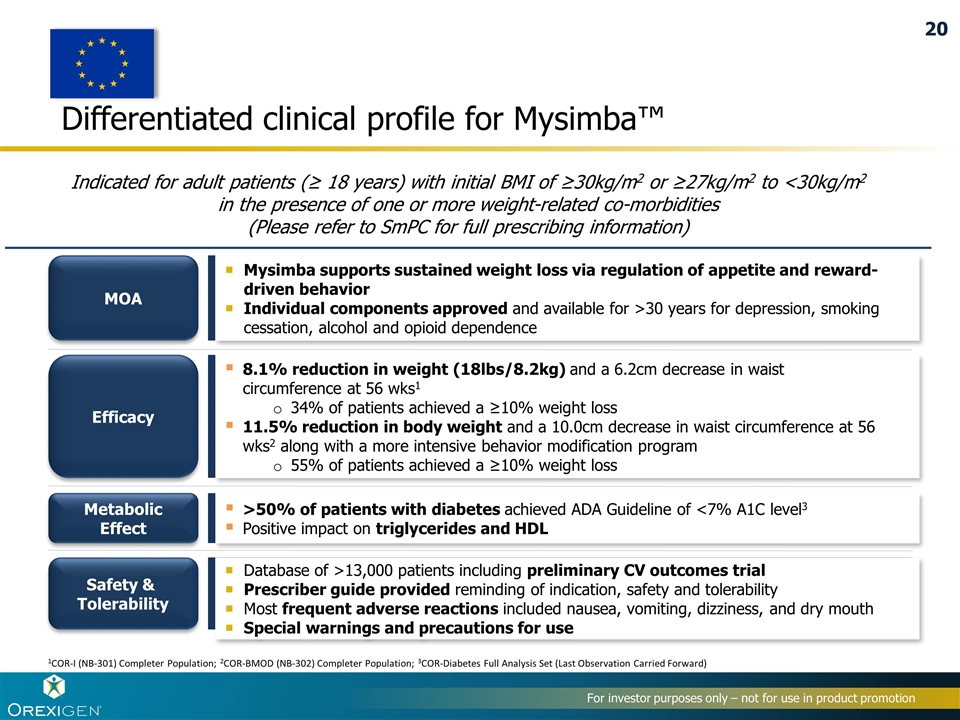

Differentiated clinical profile for Mysimba™ MOA Efficacy Safety & Tolerability Metabolic Effect Mysimba supports sustained weight loss via regulation of appetite and reward-driven behavior Individual components approved and available for >30 years for depression, smoking cessation, alcohol and opioid dependence Database of >13,000 patients including preliminary CV outcomes trial Prescriber guide provided reminding of indication, safety and tolerability Most frequent adverse reactions included nausea, vomiting, dizziness, and dry mouth Special warnings and precautions for use >50% of patients with diabetes achieved ADA Guideline of <7% A1C level3 Positive impact on triglycerides and HDL 8.1% reduction in weight (18lbs/8.2kg) and a 6.2cm decrease in waist circumference at 56 wks1 34% of patients achieved a ≥10% weight loss 11.5% reduction in body weight and a 10.0cm decrease in waist circumference at 56 wks2 along with a more intensive behavior modification program 55% of patients achieved a ≥10% weight loss Indicated for adult patients (≥ 18 years) with initial BMI of ≥30kg/m2 or ≥27kg/m2 to <30kg/m2 in the presence of one or more weight-related co-morbidities (Please refer to SmPC for full prescribing information) 1COR-I (NB-301) Completer Population; 2COR-BMOD (NB-302) Completer Population; 3COR-Diabetes Full Analysis Set (Last Observation Carried Forward) 20

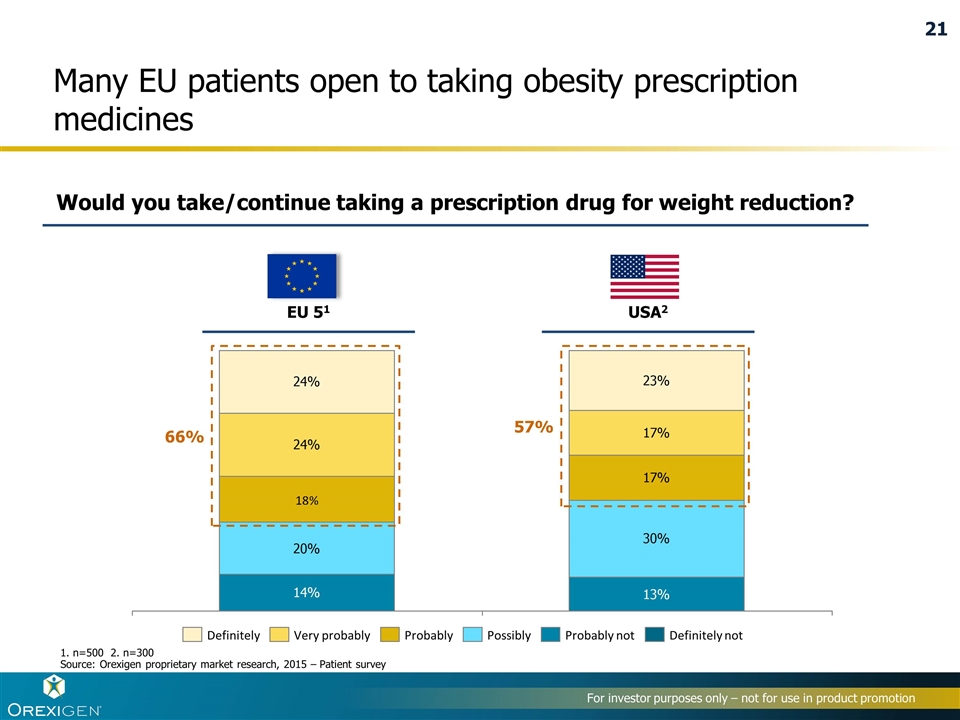

Many EU patients open to taking obesity prescription medicines EU 51 USA2 1. n=500 2. n=300 Source: Orexigen proprietary market research, 2015 – Patient survey 66% Would you take/continue taking a prescription drug for weight reduction? 57% 21

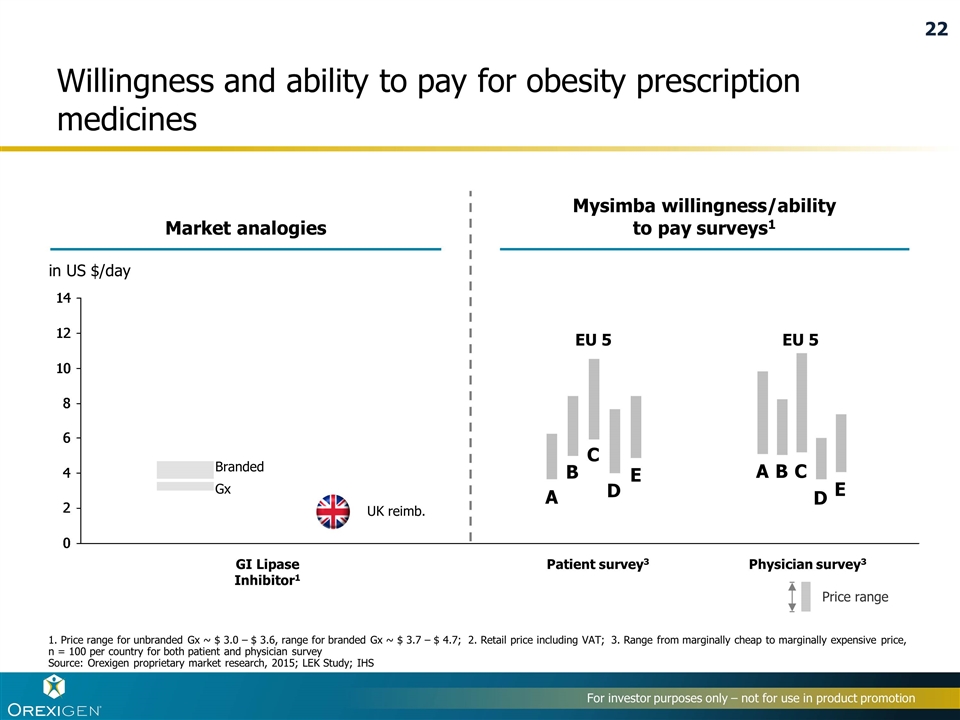

3 3 GI Lipase Inhibitor1 Willingness and ability to pay for obesity prescription medicines Price range Mysimba willingness/ability to pay surveys1 Market analogies Gx Branded UK reimb. in US $/day 1. Price range for unbranded Gx ~ $ 3.0 – $ 3.6, range for branded Gx ~ $ 3.7 – $ 4.7; 2. Retail price including VAT; 3. Range from marginally cheap to marginally expensive price, n = 100 per country for both patient and physician survey Source: Orexigen proprietary market research, 2015; LEK Study; IHS A B D C E A B C D E EU 5 EU 5 22

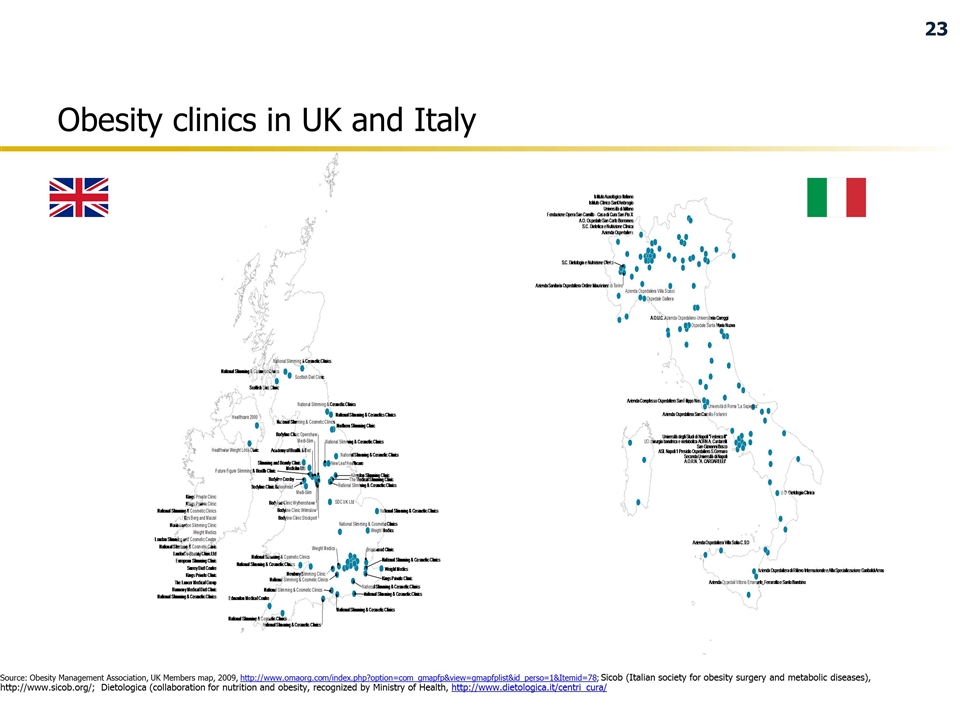

Obesity clinics in UK and Italy Source: Obesity Management Association, UK Members map, 2009, http://www.omaorg.com/index.php?option=com_gmapfp&view=gmapfplist&id_perso=1&Itemid=78; Sicob (Italian society for obesity surgery and metabolic diseases), http://www.sicob.org/; Dietologica (collaboration for nutrition and obesity, recognized by Ministry of Health, http://www.dietologica.it/centri_cura/ 23

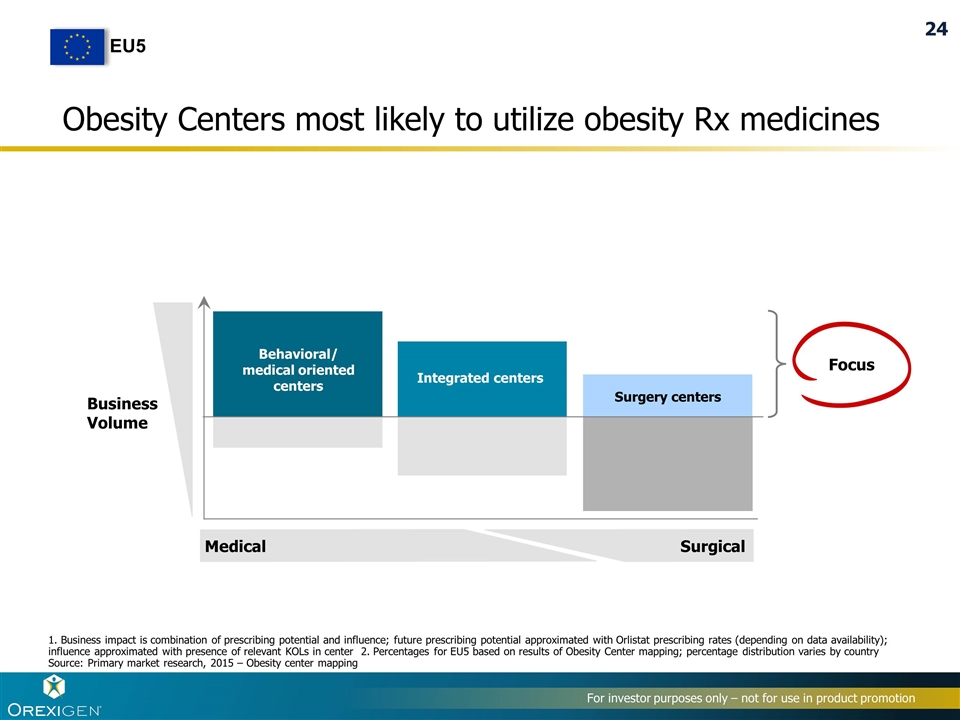

Obesity Centers most likely to utilize obesity Rx medicines Focus Integrated centers N/A Surgery centers Behavioral/ medical oriented centers Business Volume Medical Surgical 1. Business impact is combination of prescribing potential and influence; future prescribing potential approximated with Orlistat prescribing rates (depending on data availability); influence approximated with presence of relevant KOLs in center 2. Percentages for EU5 based on results of Obesity Center mapping; percentage distribution varies by country Source: Primary market research, 2015 – Obesity center mapping EU5 24

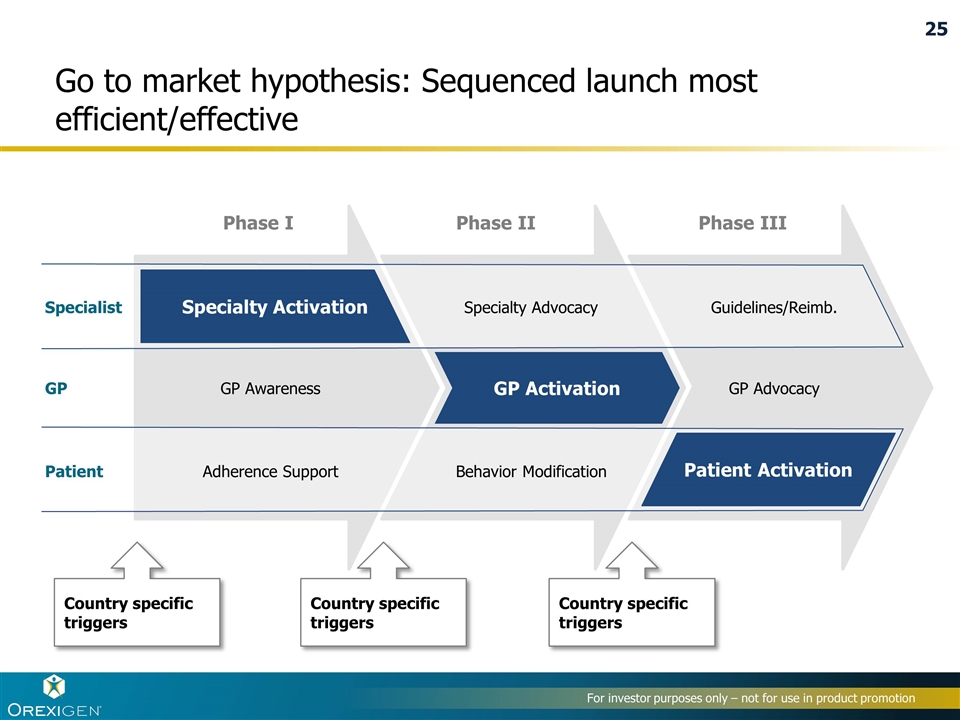

Go to market hypothesis: Sequenced launch most efficient/effective Country specific triggers Country specific triggers Country specific triggers Phase I Phase II Phase III Patient GP Specialist Specialty Activation GP Activation Patient Activation Adherence Support GP Awareness Behavior Modification Specialty Advocacy GP Advocacy Guidelines/Reimb. 25

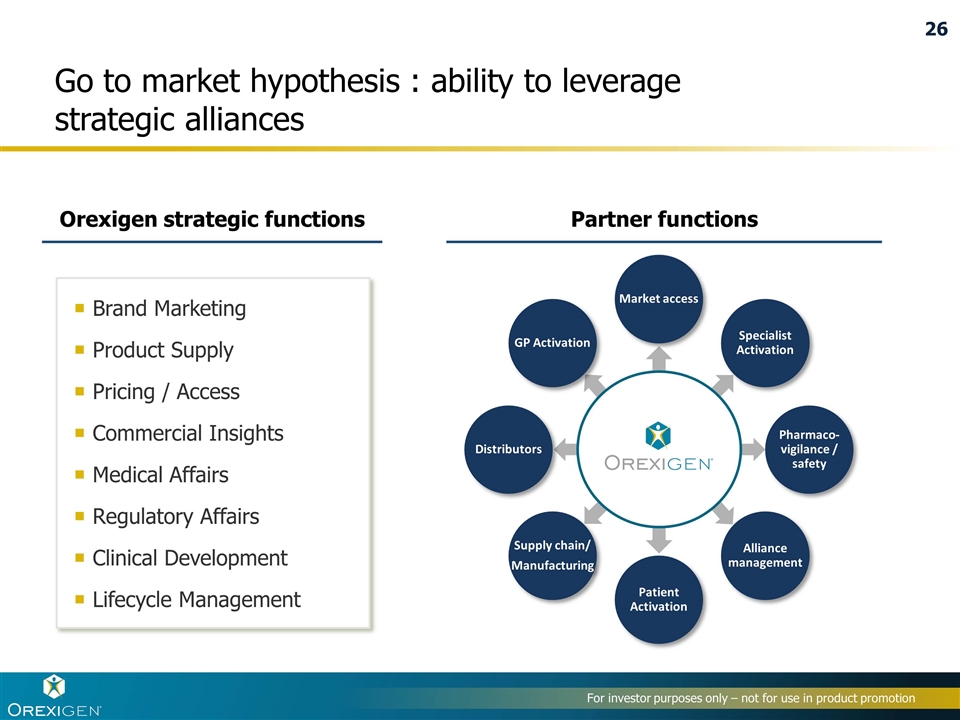

Go to market hypothesis : ability to leverage strategic alliances Market access Specialist Activation Pharmaco-vigilance / safety Alliance management Patient Activation Supply chain/ Manufacturing Distributors GP Activation Partner functions Brand Marketing Product Supply Pricing / Access Commercial Insights Medical Affairs Regulatory Affairs Clinical Development Lifecycle Management Orexigen strategic functions

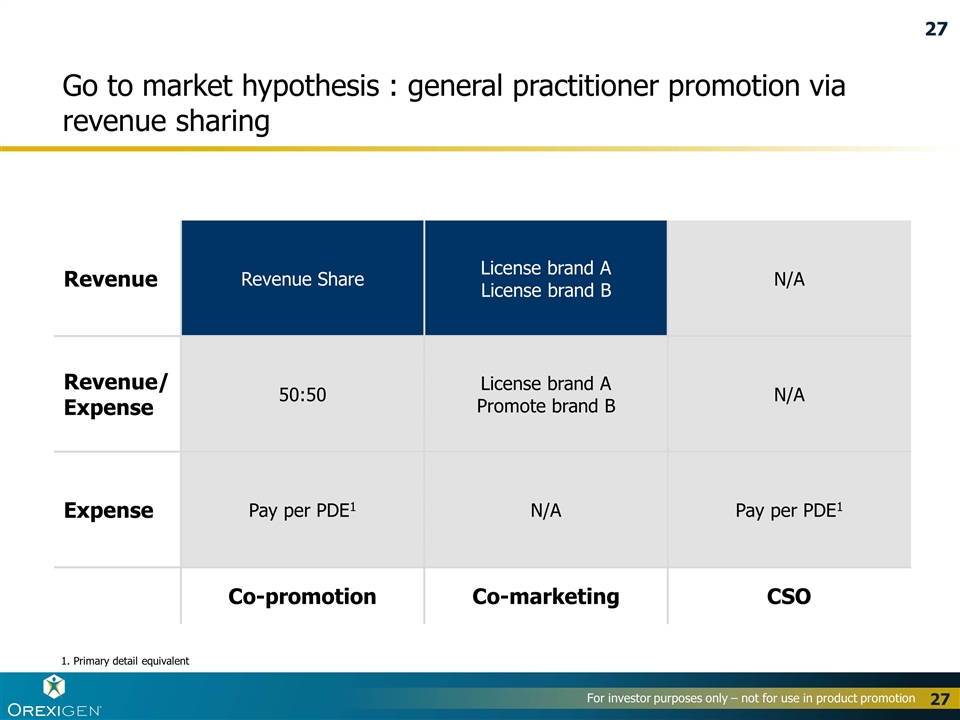

Go to market hypothesis : general practitioner promotion via revenue sharing 1. Primary detail equivalent Revenue Revenue Share License brand A License brand B N/A Revenue/ Expense 50:50 License brand A Promote brand B N/A Expense Pay per PDE1 N/A Pay per PDE1 Co-promotion Co-marketing CSO 27

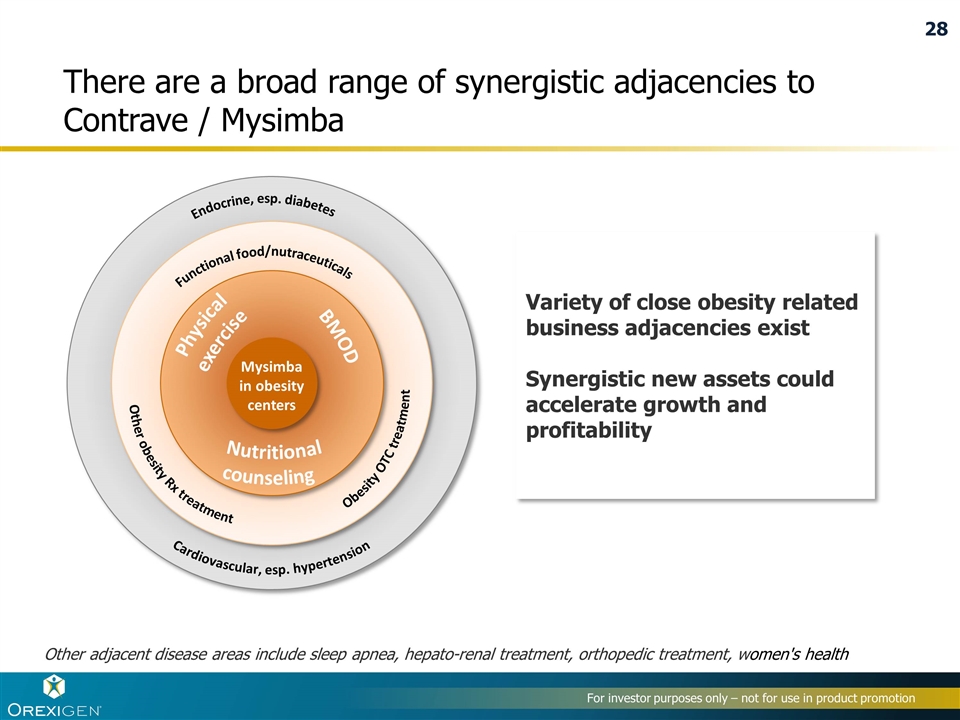

There are a broad range of synergistic adjacencies to Contrave / Mysimba Variety of close obesity related business adjacencies exist Synergistic new assets could accelerate growth and profitability Other adjacent disease areas include sleep apnea, hepato-renal treatment, orthopedic treatment, women's health Close Cardiovascular, esp. hypertension Endocrine, esp. diabetes Other obesity Rx treatment Obesity OTC treatment Functional food/nutraceuticals Mysimba in obesity centers Nutritional counseling BMOD Physical exercise 28

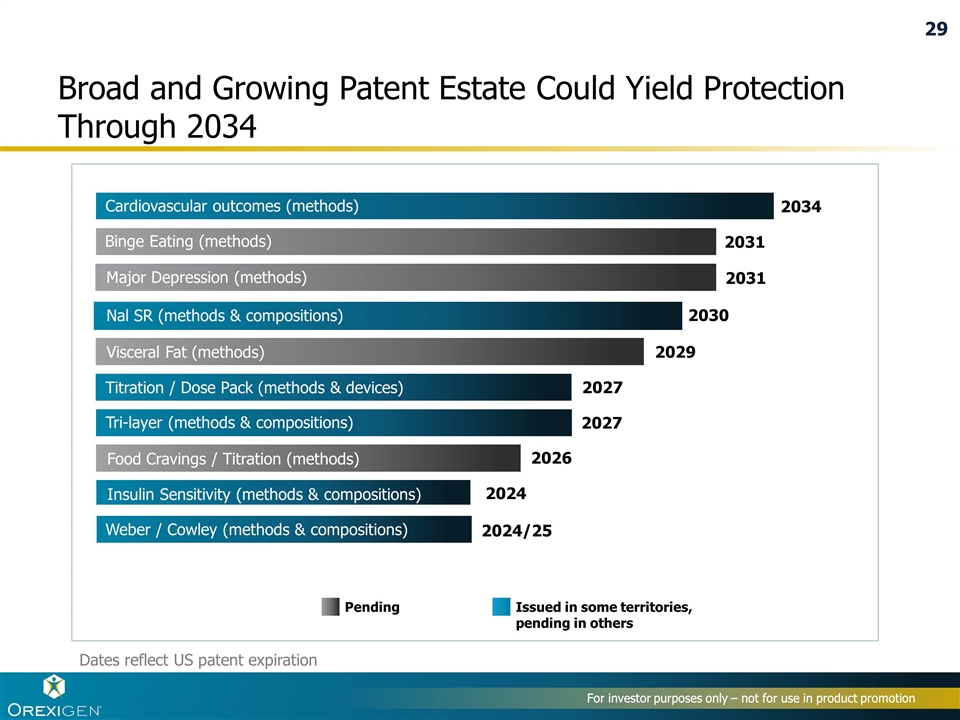

Broad and Growing Patent Estate Could Yield Protection Through 2034 2034 2031 2031 2029 2027 2027 2026 2024 2024/25 Binge Eating (methods) Major Depression (methods) Visceral Fat (methods) Titration / Dose Pack (methods & devices) Tri-layer (methods & compositions) Food Cravings / Titration (methods) Insulin Sensitivity (methods & compositions) Weber / Cowley (methods & compositions) Pending Issued in some territories, pending in others 2030 Nal SR (methods & compositions) For investor purposes only – not for use in product promotion Dates reflect US patent expiration Cardiovascular outcomes (methods) 29

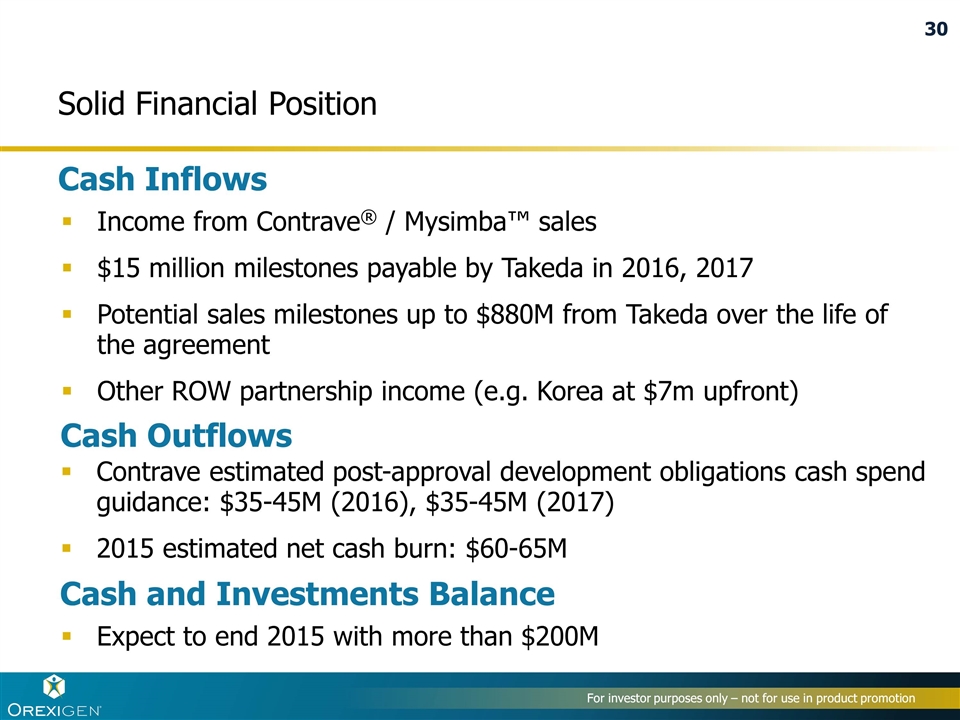

Solid Financial Position Cash Inflows Income from Contrave® / Mysimba™ sales $15 million milestones payable by Takeda in 2016, 2017 Potential sales milestones up to $880M from Takeda over the life of the agreement Other ROW partnership income (e.g. Korea at $7m upfront) Cash Outflows Contrave estimated post-approval development obligations cash spend guidance: $35-45M (2016), $35-45M (2017) 2015 estimated net cash burn: $60-65M Cash and Investments Balance Expect to end 2015 with more than $200M For investor purposes only – not for use in product promotion 30