Attached files

| file | filename |

|---|---|

| 8-K - KAI FORM 8-K 11-05-2015 - KADANT INC | kaiform8k11052015.htm |

Third Quarter 2015 Business Review Jonathan W. Painter, President & CEO Michael J. McKenney, Senior Vice President & CFO

2 KAI 3Q15 Business Review–November 5, 2015 © 2015 Kadant Inc. All rights reserved. Forward-Looking Statements The following constitutes a “Safe Harbor” statement under the Private Securities Litigation Reform Act of 1995: This presentation contains forward-looking statements that involve a number of risks and uncertainties, including forward-looking statements about our expected future financial and operating performance, demand for our products, and economic and industry outlook. Our actual results may differ materially from these forward-looking statements as a result of various important factors, including those set forth under the heading "Risk Factors" in Kadant’s annual report on Form 10-K for the year ended January 3, 2015 and subsequent filings with the Securities and Exchange Commission. These include risks and uncertainties relating to adverse changes in global and local economic conditions; the variability and difficulty in accurately predicting revenues from large capital equipment and systems projects; the variability and uncertainties in sales of capital equipment in China; the effect of currency fluctuations on our financial results; our customers’ ability to obtain financing for capital equipment projects; changes in government regulations and policies; oriented strand board market and levels of residential construction activity; development and use of digital media; price increases or shortages of raw materials; dependence on certain suppliers; international sales and operations; disruption in production; our acquisition strategy; our internal growth strategy; competition; soundness of suppliers and customers; our effective tax rate; future restructurings; soundness of financial institutions; our debt obligations; restrictions in our credit agreement; loss of key personnel; reliance on third-party research; protection of patents and proprietary rights; failure of our information systems or breaches of data security; fluctuations in our share price; and anti-takeover provisions. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise.

3 KAI 3Q15 Business Review–November 5, 2015 © 2015 Kadant Inc. All rights reserved. Use of Non-GAAP Financial Measures In addition to the financial measures prepared in accordance with generally accepted accounting principles (GAAP), we use certain non-GAAP financial measures, including increases or decreases in revenues excluding the effect of acquisitions and foreign currency translation, adjusted operating income, adjusted net income, adjusted diluted EPS, and adjusted earnings before interest, taxes, depreciation, and amortization. A reconciliation of those numbers to the most directly comparable U.S. GAAP financial measures is shown in our 2015 third quarter earnings press release issued November 4, 2015, which is available in the Investors section of our website at www.kadant.com under the heading Recent News.

4 KAI 3Q15 Business Review–November 5, 2015 © 2015 Kadant Inc. All rights reserved. BUSINESS REVIEW Jonathan W. Painter President & CEO

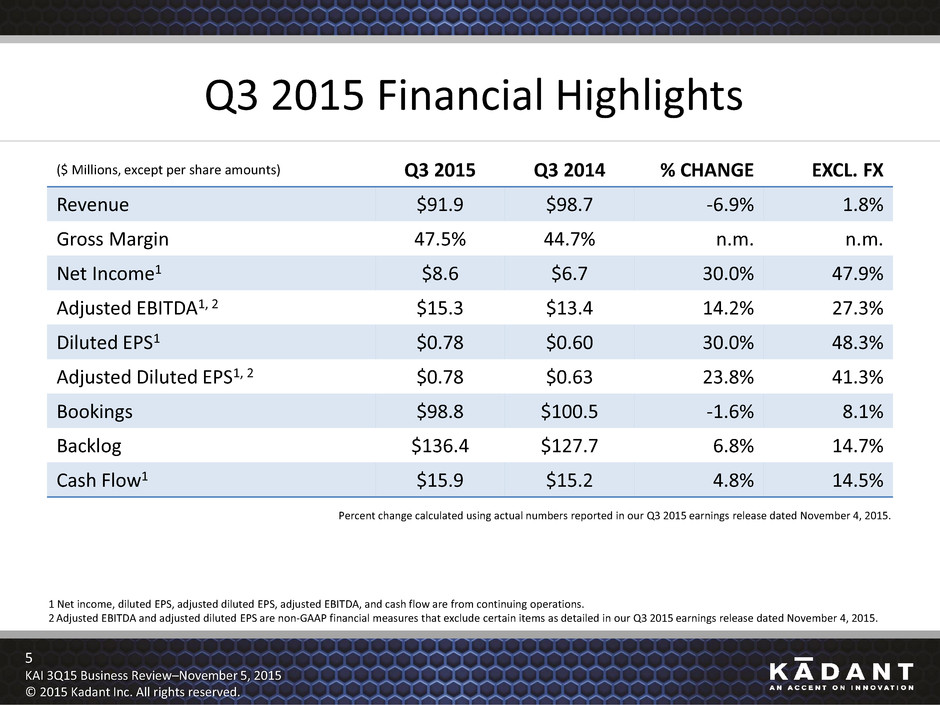

5 KAI 3Q15 Business Review–November 5, 2015 © 2015 Kadant Inc. All rights reserved. Q3 2015 Financial Highlights ($ Millions, except per share amounts) Q3 2015 Q3 2014 % CHANGE EXCL. FX Revenue $91.9 $98.7 -6.9% 1.8% Gross Margin 47.5% 44.7% n.m. n.m. Net Income1 $8.6 $6.7 30.0% 47.9% Adjusted EBITDA1, 2 $15.3 $13.4 14.2% 27.3% Diluted EPS1 $0.78 $0.60 30.0% 48.3% Adjusted Diluted EPS1, 2 $0.78 $0.63 23.8% 41.3% Bookings $98.8 $100.5 -1.6% 8.1% Backlog $136.4 $127.7 6.8% 14.7% Cash Flow1 $15.9 $15.2 4.8% 14.5% 1 Net income, diluted EPS, adjusted diluted EPS, adjusted EBITDA, and cash flow are from continuing operations. 2 Adjusted EBITDA and adjusted diluted EPS are non-GAAP financial measures that exclude certain items as detailed in our Q3 2015 earnings release dated November 4, 2015. Percent change calculated using actual numbers reported in our Q3 2015 earnings release dated November 4, 2015.

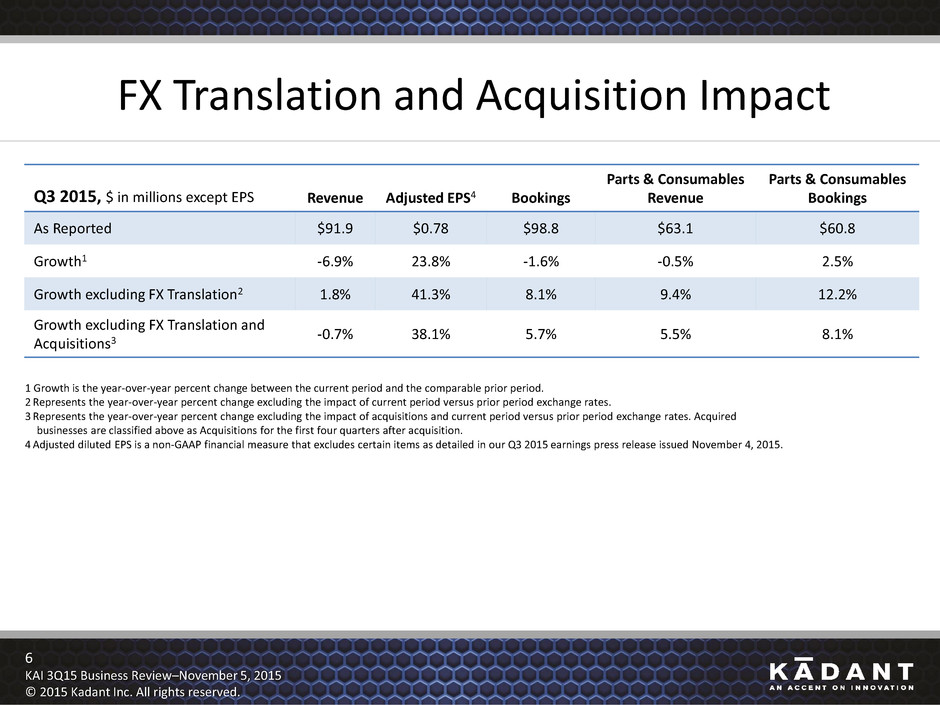

6 KAI 3Q15 Business Review–November 5, 2015 © 2015 Kadant Inc. All rights reserved. FX Translation and Acquisition Impact Q3 2015, $ in millions except EPS Revenue Adjusted EPS4 Bookings Parts & Consumables Revenue Parts & Consumables Bookings As Reported $91.9 $0.78 $98.8 $63.1 $60.8 Growth1 -6.9% 23.8% -1.6% -0.5% 2.5% Growth excluding FX Translation2 1.8% 41.3% 8.1% 9.4% 12.2% Growth excluding FX Translation and Acquisitions3 -0.7% 38.1% 5.7% 5.5% 8.1% 1 Growth is the year-over-year percent change between the current period and the comparable prior period. 2 Represents the year-over-year percent change excluding the impact of current period versus prior period exchange rates. 3 Represents the year-over-year percent change excluding the impact of acquisitions and current period versus prior period exchange rates. Acquired businesses are classified above as Acquisitions for the first four quarters after acquisition. 4 Adjusted diluted EPS is a non-GAAP financial measure that excludes certain items as detailed in our Q3 2015 earnings press release issued November 4, 2015.

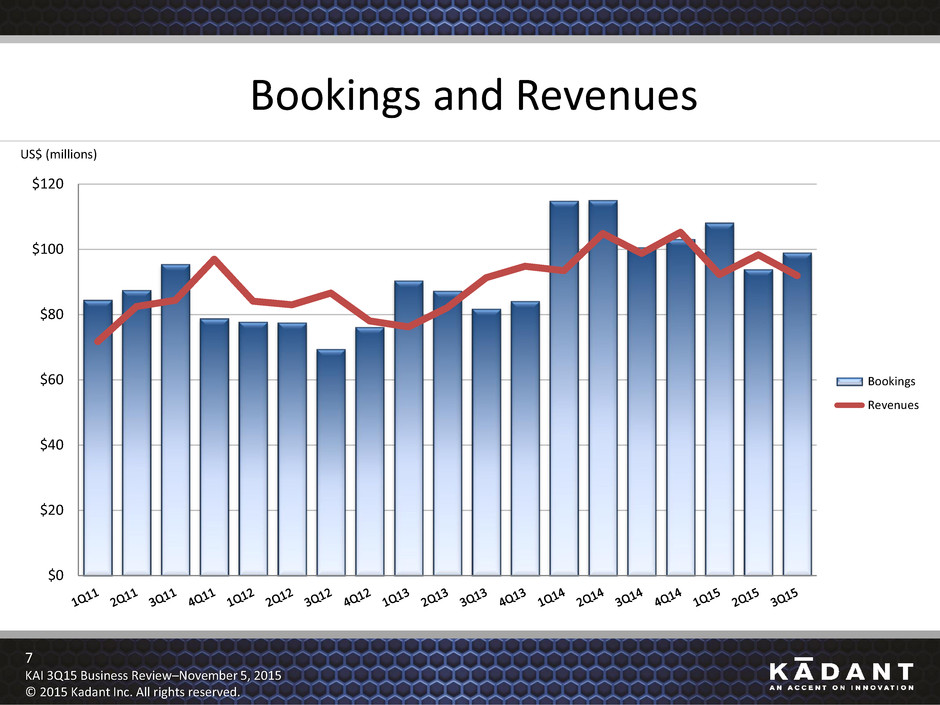

7 KAI 3Q15 Business Review–November 5, 2015 © 2015 Kadant Inc. All rights reserved. Bookings and Revenues US$ (millions) $0 $20 $40 $60 $80 $100 $120 Bookings Revenues

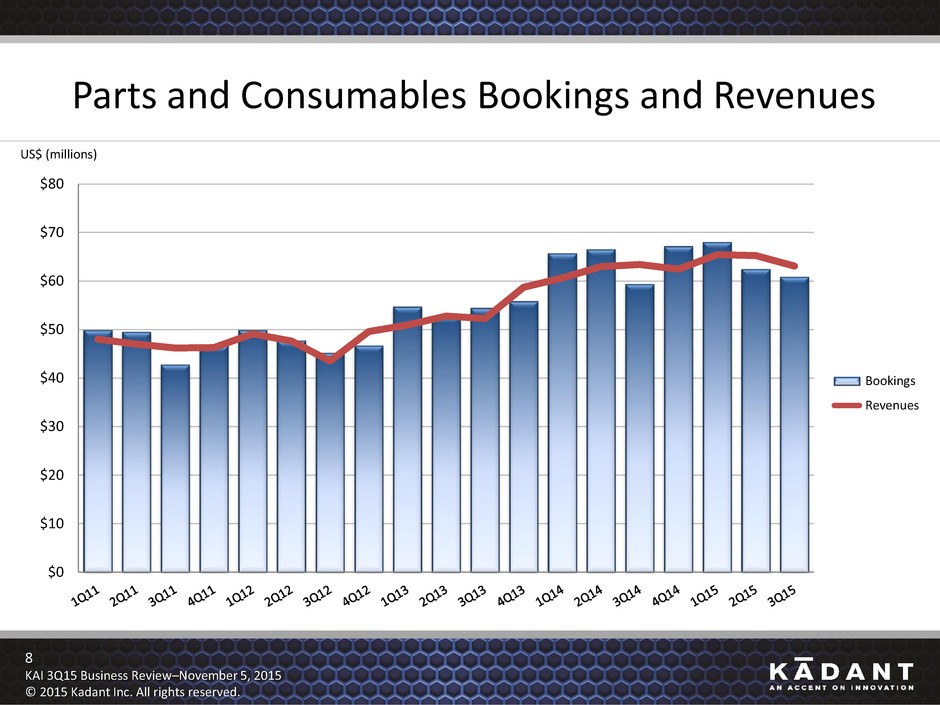

8 KAI 3Q15 Business Review–November 5, 2015 © 2015 Kadant Inc. All rights reserved. Parts and Consumables Bookings and Revenues US$ (millions) $0 $10 $20 $30 $40 $50 $60 $70 $80 Bookings Revenues

9 KAI 3Q15 Business Review–November 5, 2015 © 2015 Kadant Inc. All rights reserved. REGIONAL PERFORMANCE

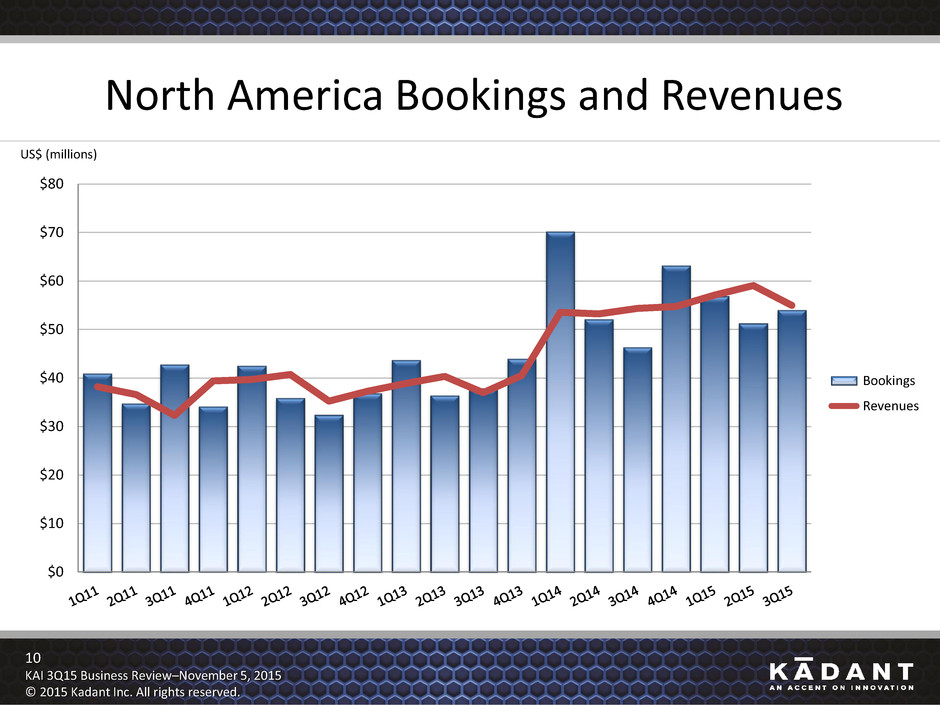

10 KAI 3Q15 Business Review–November 5, 2015 © 2015 Kadant Inc. All rights reserved. North America Bookings and Revenues US$ (millions) $0 $10 $20 $30 $40 $50 $60 $70 $80 Bookings Revenues

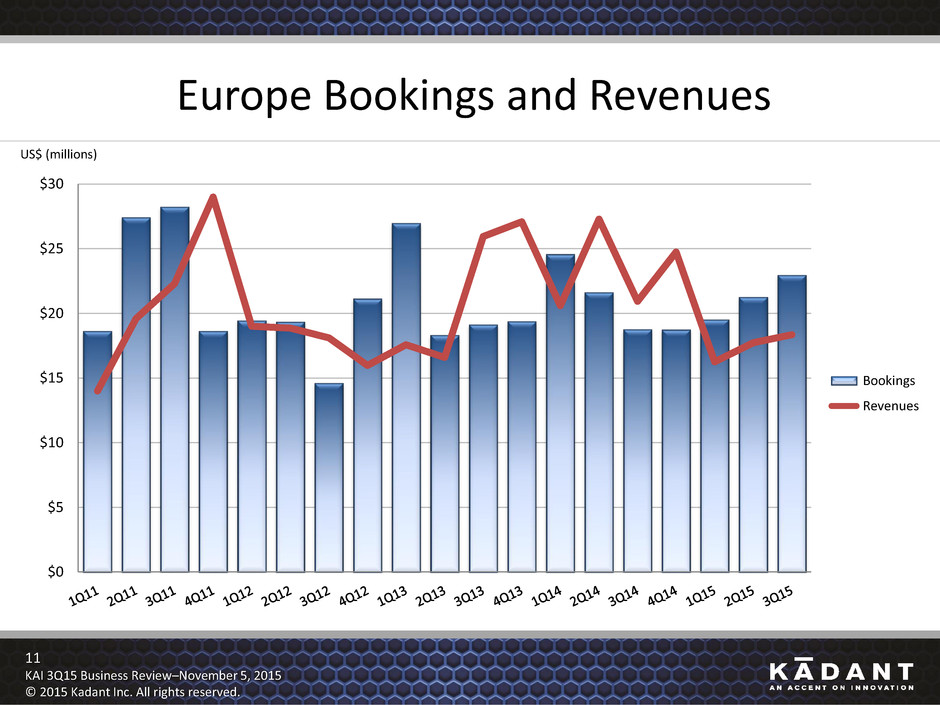

11 KAI 3Q15 Business Review–November 5, 2015 © 2015 Kadant Inc. All rights reserved. Europe Bookings and Revenues US$ (millions) $0 $5 $10 $15 $20 $25 $30 Bookings Revenues

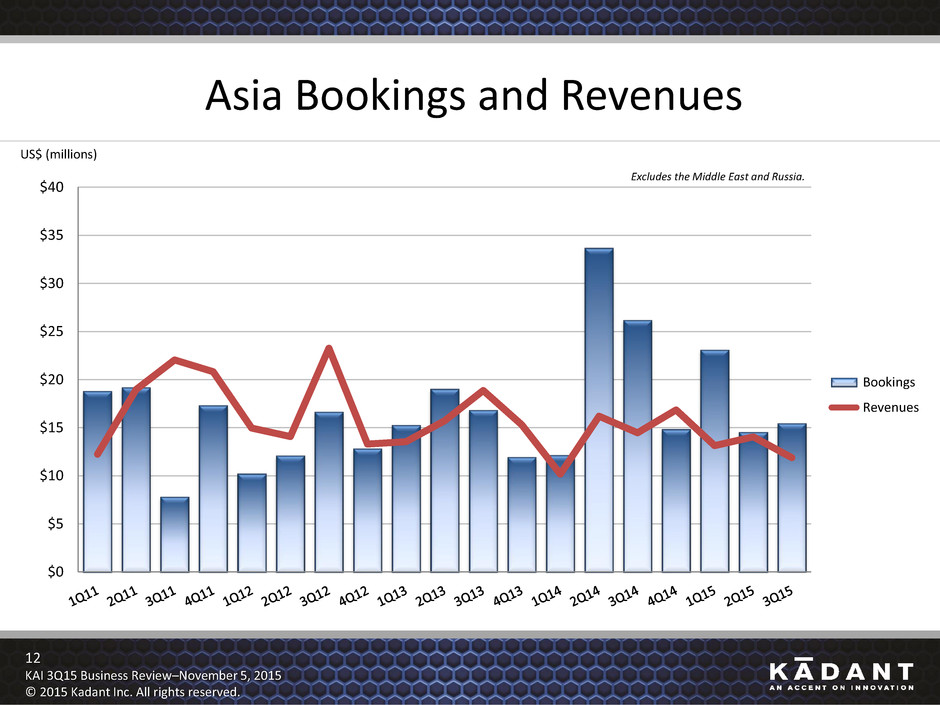

12 KAI 3Q15 Business Review–November 5, 2015 © 2015 Kadant Inc. All rights reserved. Asia Bookings and Revenues US$ (millions) Excludes the Middle East and Russia. $0 $5 $10 $15 $20 $25 $30 $35 $40 Bookings Revenues

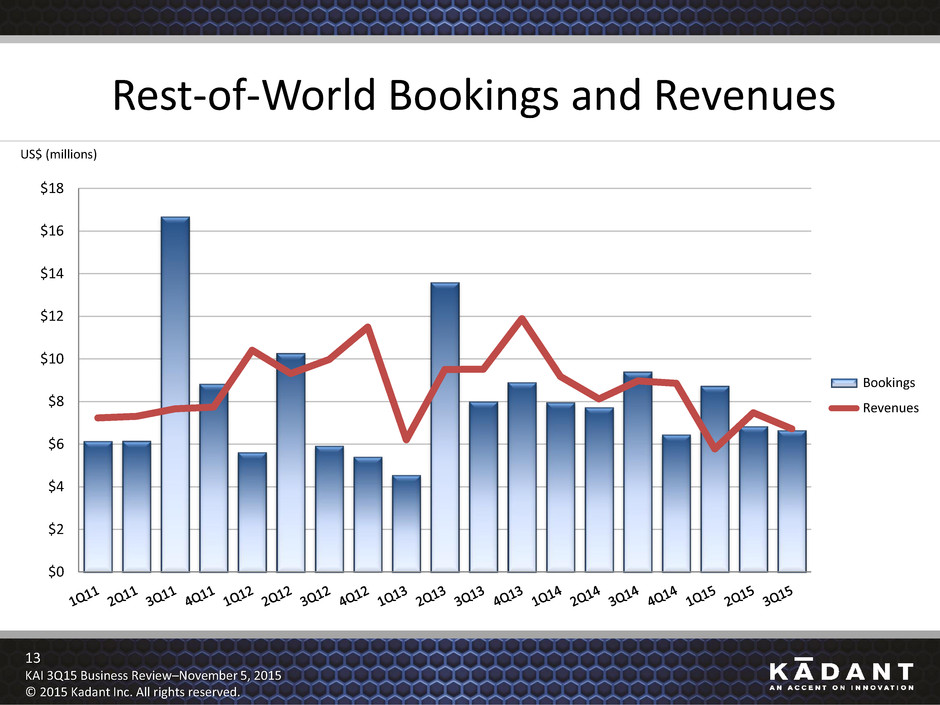

13 KAI 3Q15 Business Review–November 5, 2015 © 2015 Kadant Inc. All rights reserved. Rest-of-World Bookings and Revenues US$ (millions) $0 $2 $4 $6 $8 $10 $12 $14 $16 $18 Bookings Revenues

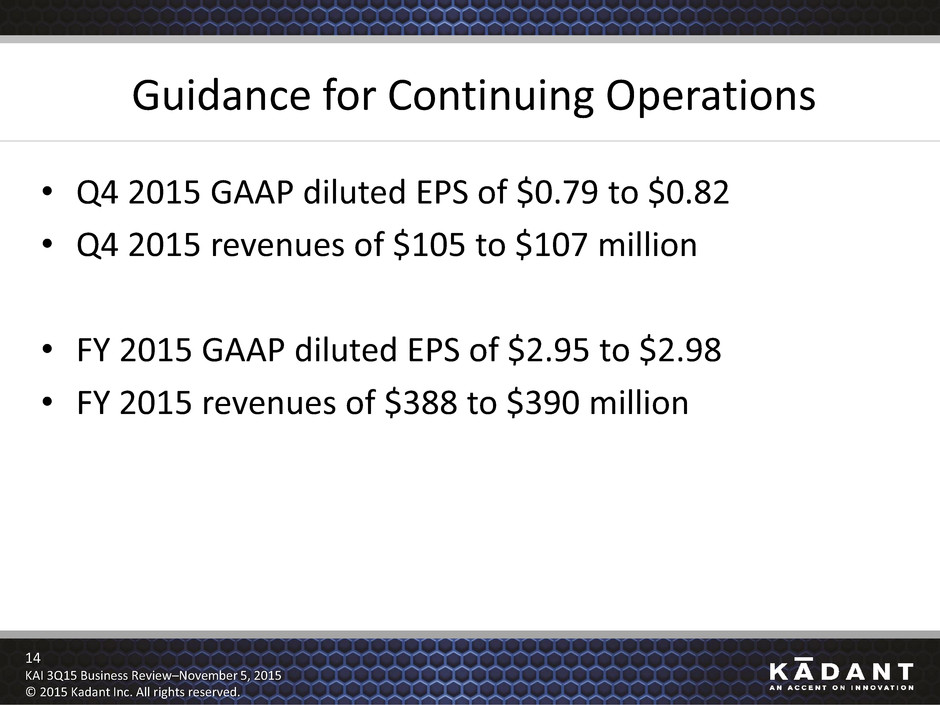

14 KAI 3Q15 Business Review–November 5, 2015 © 2015 Kadant Inc. All rights reserved. Guidance for Continuing Operations • Q4 2015 GAAP diluted EPS of $0.79 to $0.82 • Q4 2015 revenues of $105 to $107 million • FY 2015 GAAP diluted EPS of $2.95 to $2.98 • FY 2015 revenues of $388 to $390 million

15 KAI 3Q15 Business Review–November 5, 2015 © 2015 Kadant Inc. All rights reserved. FINANCIAL REVIEW Michael J. McKenney Senior Vice President & Chief Financial Officer

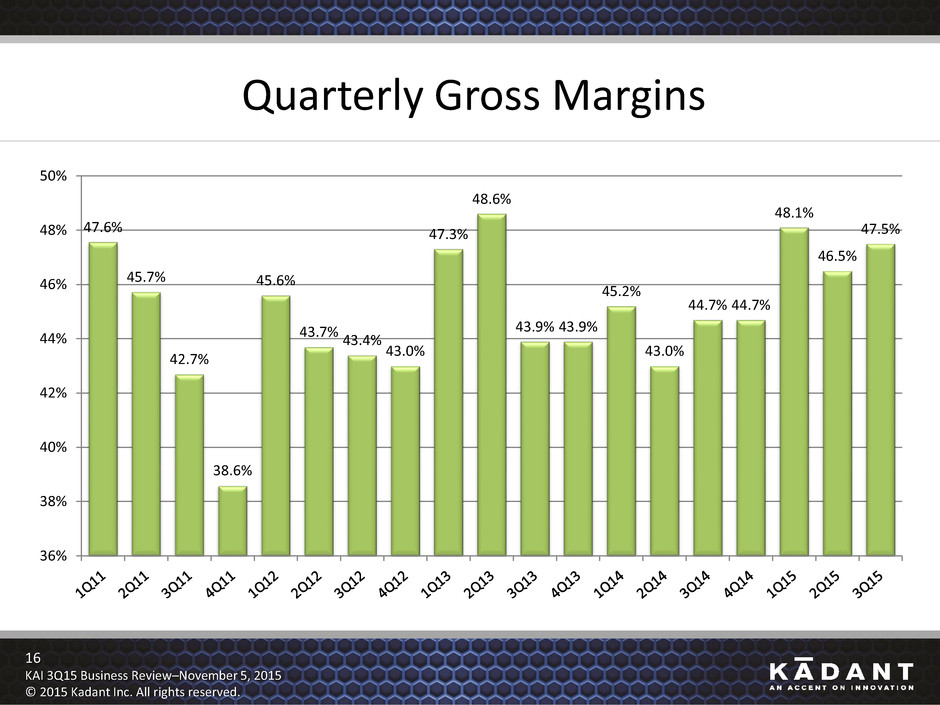

16 KAI 3Q15 Business Review–November 5, 2015 © 2015 Kadant Inc. All rights reserved. Quarterly Gross Margins 47.6% 45.7% 42.7% 38.6% 45.6% 43.7% 43.4% 43.0% 47.3% 48.6% 43.9% 43.9% 45.2% 43.0% 44.7% 44.7% 48.1% 46.5% 47.5% 36% 38% 40% 42% 44% 46% 48% 50%

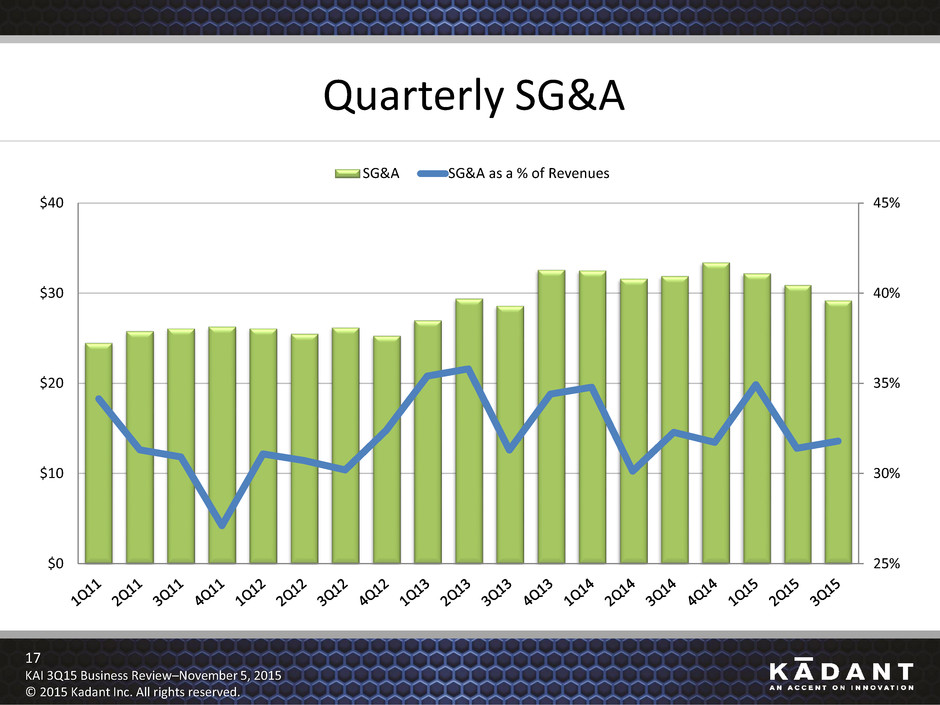

17 KAI 3Q15 Business Review–November 5, 2015 © 2015 Kadant Inc. All rights reserved. Quarterly SG&A 25% 30% 35% 40% 45% $0 $10 $20 $30 $40 SG&A SG&A as a % of Revenues

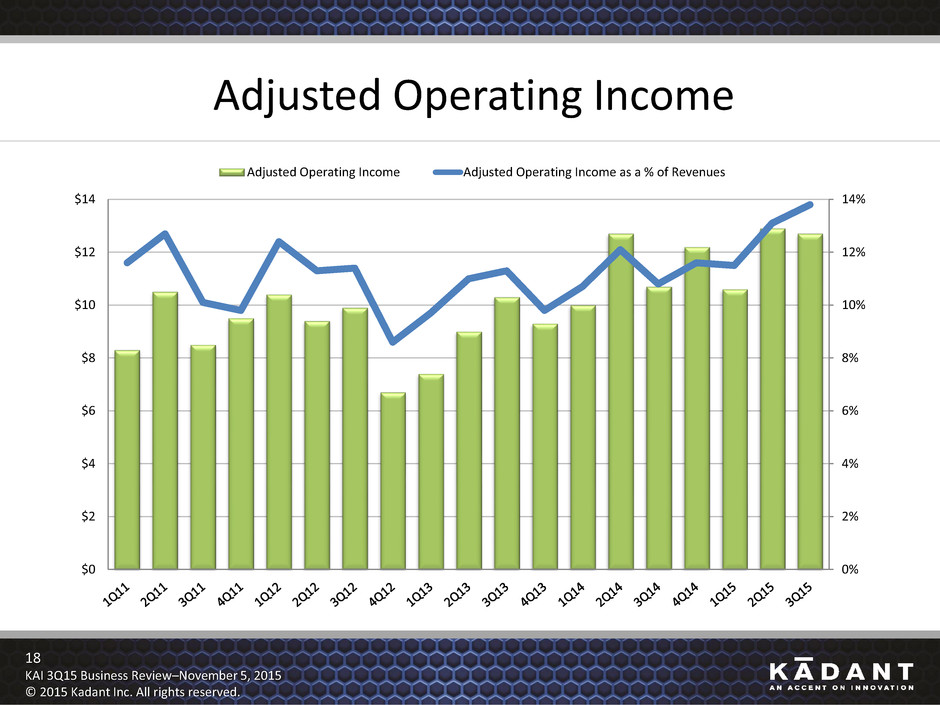

18 KAI 3Q15 Business Review–November 5, 2015 © 2015 Kadant Inc. All rights reserved. Adjusted Operating Income 0% 2% 4% 6% 8% 10% 12% 14% $0 $2 $4 $6 $8 $10 $12 $14 Adjusted Operating Income Adjusted Operating Income as a % of Revenues

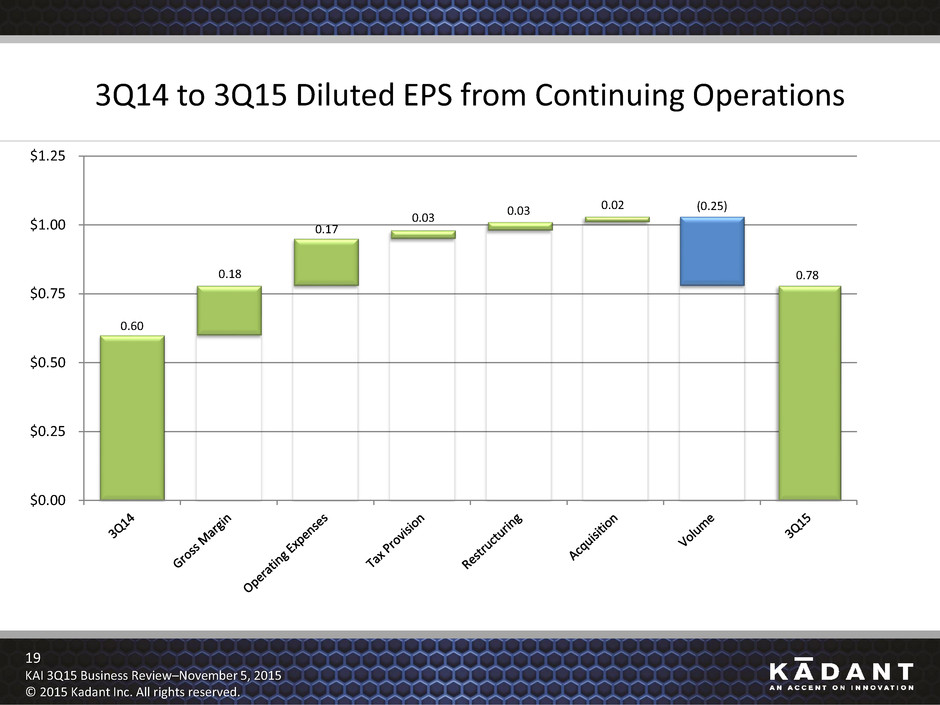

19 KAI 3Q15 Business Review–November 5, 2015 © 2015 Kadant Inc. All rights reserved. 3Q14 to 3Q15 Diluted EPS from Continuing Operations 0.60 0.18 0.17 0.03 0.03 0.02 (0.25) 0.78 $0.00 $0.25 $0.50 $0.75 $1.00 $1.25

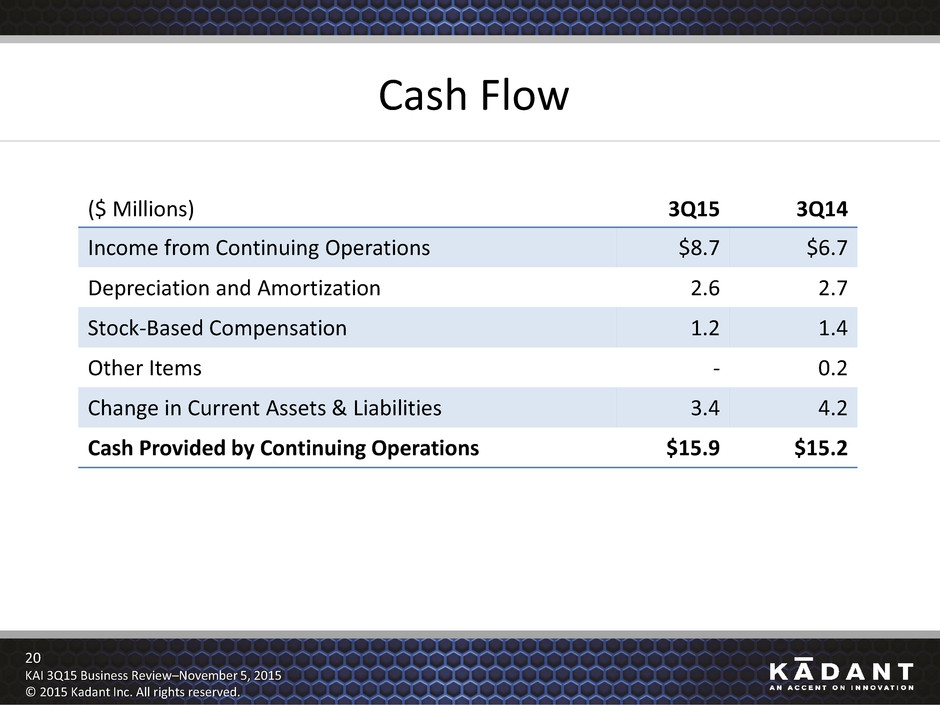

20 KAI 3Q15 Business Review–November 5, 2015 © 2015 Kadant Inc. All rights reserved. Cash Flow ($ Millions) 3Q15 3Q14 Income from Continuing Operations $8.7 $6.7 Depreciation and Amortization 2.6 2.7 Stock-Based Compensation 1.2 1.4 Other Items - 0.2 Change in Current Assets & Liabilities 3.4 4.2 Cash Provided by Continuing Operations $15.9 $15.2

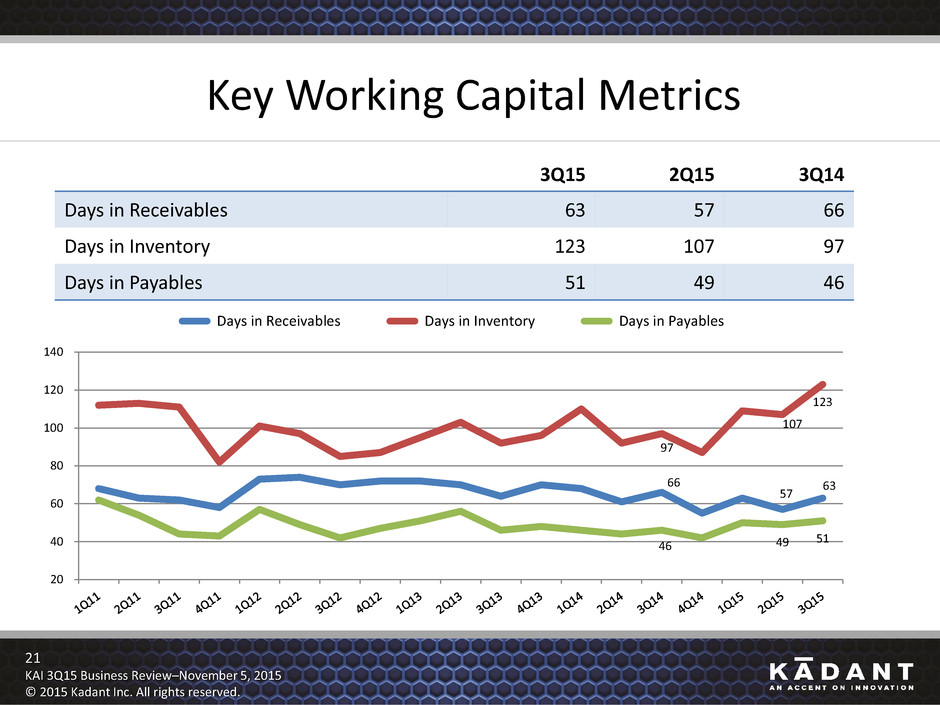

21 KAI 3Q15 Business Review–November 5, 2015 © 2015 Kadant Inc. All rights reserved. Key Working Capital Metrics 3Q15 2Q15 3Q14 Days in Receivables 63 57 66 Days in Inventory 123 107 97 Days in Payables 51 49 46 66 57 63 97 107 123 46 49 51 20 40 60 80 100 120 140 Days in Receivables Days in Inventory Days in Payables

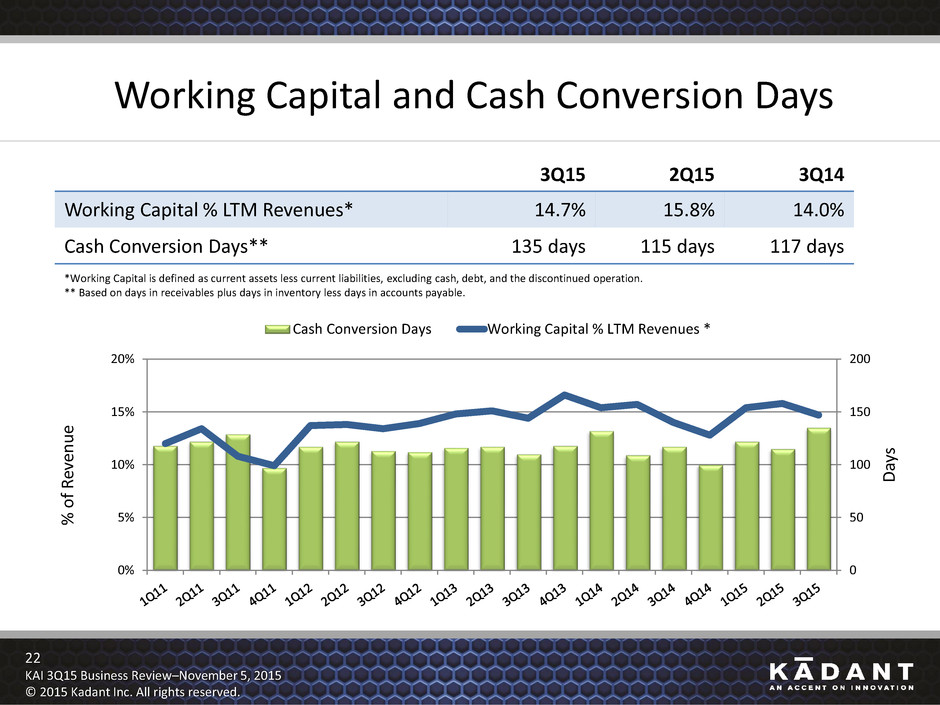

22 KAI 3Q15 Business Review–November 5, 2015 © 2015 Kadant Inc. All rights reserved. Working Capital and Cash Conversion Days 3Q15 2Q15 3Q14 Working Capital % LTM Revenues* 14.7% 15.8% 14.0% Cash Conversion Days** 135 days 115 days 117 days *Working Capital is defined as current assets less current liabilities, excluding cash, debt, and the discontinued operation. ** Based on days in receivables plus days in inventory less days in accounts payable. 0 50 100 150 200 0% 5% 10% 15% 20% D ay s % o f R ev en u e Cash Conversion Days Working Capital % LTM Revenues *

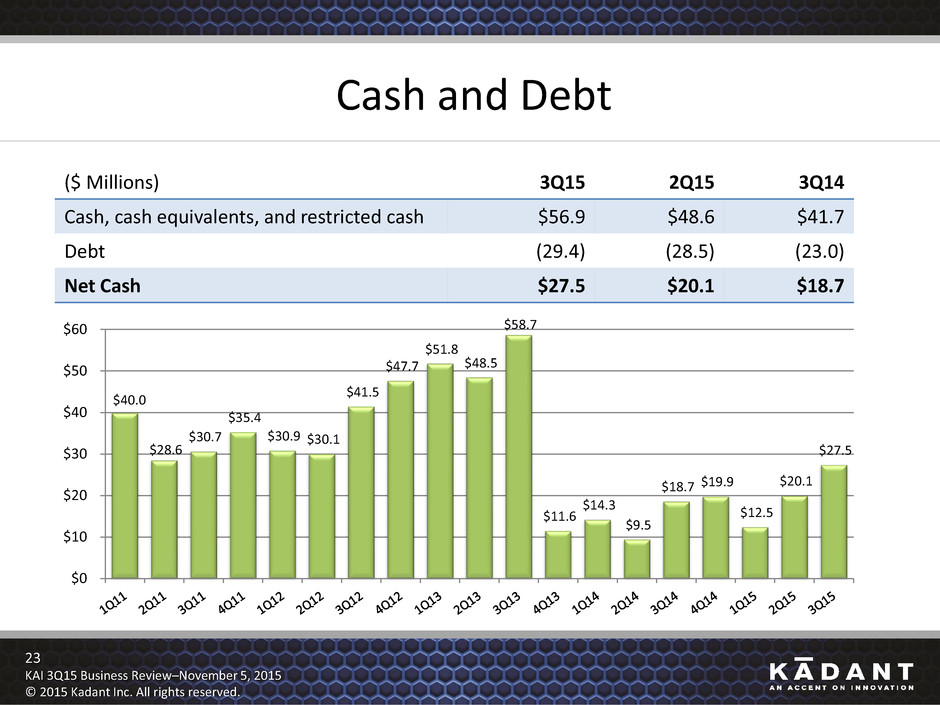

23 KAI 3Q15 Business Review–November 5, 2015 © 2015 Kadant Inc. All rights reserved. Cash and Debt ($ Millions) 3Q15 2Q15 3Q14 Cash, cash equivalents, and restricted cash $56.9 $48.6 $41.7 Debt (29.4) (28.5) (23.0) Net Cash $27.5 $20.1 $18.7 $40.0 $28.6 $30.7 $35.4 $30.9 $30.1 $41.5 $47.7 $51.8 $48.5 $58.7 $11.6 $14.3 $9.5 $18.7 $19.9 $12.5 $20.1 $27.5 $0 $10 $20 $30 $40 $50 $60

24 KAI 3Q15 Business Review–November 5, 2015 © 2015 Kadant Inc. All rights reserved. Questions & Answers To ask a question, please call 877-703-6107 within the U.S. or +1-857-244-7306 outside the U.S. and reference 83375884. Please mute the audio on your computer.

25 KAI 3Q15 Business Review–November 5, 2015 © 2015 Kadant Inc. All rights reserved. Q3 2015 Key Take-Aways • Strong quarter with 30% EPS growth • Parts and consumables revenue up 9% excluding FX • 2015 expected to be an excellent year with record EPS

Third Quarter 2015 Business Review Jonathan W. Painter, President & CEO Michael J. McKenney, Senior Vice President & CFO