Attached files

| file | filename |

|---|---|

| S-1/A - S-1/A - Help International, Inc | s102047_s1a.htm |

| EX-99.1 - EXHIBIT 99.1 - Help International, Inc | s102047_99-1.htm |

| EX-99.7 - EXHIBIT 99.7 - Help International, Inc | s102047_99-7.htm |

| EX-99.8 - EXHIBIT 99.8 - Help International, Inc | s102047_99-8.htm |

| EX-99.2 - EXHIBIT 99.2 - Help International, Inc | s102047_99-2.htm |

| EX-99.3 - EXHIBIT 99.3 - Help International, Inc | s102047_99-3.htm |

| EX-99.5 - EXHIBIT 99.5 - Help International, Inc | s102047_99-5.htm |

| EX-99.6 - EXHIBIT 99.6 - Help International, Inc | s102047_99-6.htm |

| EX-23.1 - EXHIBIT 23.1 - Help International, Inc | s102047_ex23-1.htm |

Exhibit 99.4

| COLLOQUYtalk / 04.07 | WWW.COLLOQUY.COM |

| Quo Vadis |

| S I Z I N G U P T H E U . S . L O Y A L T Y M A R K E T I N G I N D U S T R Y |

“Dum loquor, hora fugit.” – Horace

(Time flies while we speak.)

I: Introduction

Around the time that B.C. became A.D., the Roman emperor Augustus dispatched his bean counters out into the countryside to conduct what would become the most complete census of the population—not only of Rome, but of the Empire’s far-flung provinces, as well. While evidence of mass census-taking exists in both the Chinese Han Dynasty and the early Persian Empire, Augustus’s version is the foundation on which the modern census was built.

Augustus’s purpose was not merely to gain empirical knowledge of the empire, but rather for self-preservation. By counting the populace, Augustus could more accurately know how to properly levy taxes—and as King George III of Great Britain could tell you, levying taxes unfairly is one of the surest ways to foment rebellion in your subjects.

The Romans soon learned that one side benefit of a regular census was the ability to measure growth, or the lack thereof. Implications derived from the comparison of succeeding surveys would reveal where the Empire was headed. Unfortunately, the Emperor’s census couldn’t count the barbarians massing on the borders, which is why the Romans are now only a memory. Still, the legacy of Augustus’s census lives on—which brings us to the COLLOQUY Loyalty Census.

Caveat venditor: Let the Seller Beware

Six years ago, COLLOQUY released its then-landmark white paper, Loyalty Trends for the 21st Century, which predicted profound and rapid change ahead for the U.S. loyalty-marketing industry —change predicated by the rampant ubiquity of loyalty-marketing programs in developed countries. The paper argued that pervasive penetration of reward and recognition techniques throughout the U.S. meant that the industry had entered a new phase of maturity, and offered strategies based on observable trends to overcome market saturation and consumer ennui.

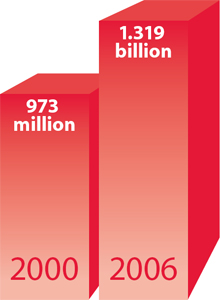

The evidence supporting the notion of ubiquity came from a research study conducted by COLLOQUY in 2000 that, in the spirit of those first official Roman head-counters, attempted to conduct a census of loyalty program participation in the U.S. The 2000 study reported that loyalty marketing programs in all U.S. industries sported 973 million (that’s XMLXXIII million) memberships, with the average U.S. household belonging to multiple programs.

Borrowing from that earlier work, the crack research team at COLLOQUY conducted another full census in the 4th Quarter of 2006 (for details, see “The Loyalty Census Methodology” sidebar on page 16). If our 2000 watchword was ubiquity, then our new watchword must be saturation. Our 2006 Loyalty Census reveals that the total U.S. loyalty program membership grew 35.5 percent from 2000 to 2006, and now tops 1.3 billion individual memberships.

| PAGE 1 |

| COLLOQUYtalk / 04.07 | WWW.COLLOQUY.COM |

This rather staggering number had us double-checking our math. It also begs a whole host of questions about the health of the U.S. loyalty-marketing industry. What does this membership number—more than four times the total U.S. population—say about active participation in loyalty programs? Is every man, woman and child in the country earning points and miles in an average of four different programs? Are loyalty-marketers padding their membership numbers or counting the deceased? Most importantly, is this 35.5 percent growth a sign of the industry’s overall health —or a sign that loyalty has jumped the shark?

| PAGE 2 |

| COLLOQUYtalk / 04.07 | WWW.COLLOQUY.COM |

II: From ubiquity to saturation

“Inopem me copla fecit.” – Ovid

(Plenty has made me poor.)

Total U.S. Loyalty Memberships

Executives, shareholders, and Wall Street analysts all agree that top-line growth is an unqualified good. When applied to stock prices, this opinion makes sense. When considering 35.5 percent growth in loyalty-program membership, however, we remain skeptical. Growth brings challenges. For loyalty practitioners, membership growth means spreading resources and effort across a wider swath of consumers — a premise contradictory to the very paradigms that made loyalty programs successful in the first place.

In the past, membership growth rates correlated strongly to general economic indicators. Our 2000 census calculations occurred at a time of robust economic growth, and the 973 million member count made intuitive sense for an industry that had expanded rapidly beyond its historical roots in the travel and credit card industries. During the boom times of the 1990s, the economy enjoyed declining interest rates, low unemployment, nonexistent inflation and gasoline at $1.50 a gallon. Increased economic activity fueled program membership. Customer Relationship Management (CRM) and One-to-One became the hot catch-phrases as opportunistic software developers and marketing gurus attempted redefine customer loyalty.

| “Is every man, woman and child in the country earning points and miles in an average of four different programs? Are loyalty-marketers padding their membership numbers or counting the deceased? Most importantly, is this 35.5 percent growth a sign of the industry’s overall health—or a sign that loyalty has jumped the shark?” |

The internet boom likewise contributed to a loyalty explosion that included web currencies and points-for-clicks. Retailers yearning to identify invisible customers had finally acquired the technology to do so. Grocers launched two-tiered pricing schemes as their preferred frequent-shopper mechanism. Private label credit cards with value-added loyalty programs proliferated in both department store and specialty-apparel environments. Airline frequent-flyer programs mushroomed out of their traditional miles-for-flights model to become the go-to incentive for marketing partners in search of a quick loyalty fix. These economic ingredients coalesced into a perfect cocktail for growth.

But during the past six years, a lot of water flowed under the Roman viaduct to potentially alter the course of the loyalty industry. We experienced the full economic impact of the post-Y2K technology bust. The internet bubble burst. The tragic events of 9/11 were quickly followed by war and a collective consumer uncertainty not seen since Pearl Harbor. Large corporations were caught cooking their books and Wall Street headed south for a prolonged winter of discontent. Fuel prices soared, interest rates ballooned, and the U.S. Gross Domestic Product (GDP) barely managed a 3 percent growth rate. While inflation remained modest at 2.69 percent between 2000 and 2005, higher costs began to squeeze profit margins for many loyalty sectors. And the founding fathers of loyalty — the airlines — started appearing in bankruptcy court.

And yet, despite these roadblocks, U.S. loyalty programs continued to march forward. The average annual membership growth between 2000 and 2006 stands at a robust 5.93 percent—more than twice the annual growth rate of the Consumer Price Index (CPI) and 85 percent higher than the broadest growth measure of all, the annual growth rate of the U.S. GDP.

Cineri gloria sera est: Glory paid to ashes comes too late

The 1.3 billion memberships revealed in the 2006 census means that the average U.S. household belongs to approximately 12 loyalty programs — an astounding number, and dramatically higher than any other forecasts or our own estimates from 2000. If almost two adults exist in every household, then the average American adult is resident in the loyalty program database of some six different companies. As researchers have suggested that approximately 20 percent of all customers never belong to a loyalty initiative, we must conclude that a significant percentage of households play the loyalty game to the extreme.

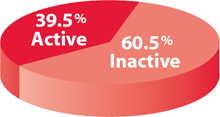

As we collected the census data through a combination of publicly available membership numbers and practitioner interviews, we paid special attention to the concept of “active” program participation versus inactive names in the database. The definition of an active member varies by industry; grocers like to see frequent-shopper cardholders at least once per month, while apparel and other specialty retailers may be happy to see their private-label cardholders four times a year. Overall, however, the blended average of active program participation across all verticals is a dismal 39.5 percent. Several vertical market sectors hover at only 25 percent active membership rates.

| PAGE 3 |

| COLLOQUYtalk / 04.07 | WWW.COLLOQUY.COM |

Percentage of Active Loyalty Memberships in the U.S.

Some marketers are happy with 39.5 percent. We aren’t. Of those 12 average programs per household, only 4.7 yield active participation. What does that figure say about the overall health of the loyalty industry?

Consider the effort expended to enroll a customer in a loyalty program. The marketer must first spend time and money generating program awareness. The value proposition must then convince the customer to raise a hand and opt in to the program. The marketer must distribute enrollment materials, build a loyalty database to house customer information, and finally expend more time and money crafting offers that encourage participation, redemption and loyalty.

Collectively, marketers have engaged in this activity for 1.3 billion consumers—and yet, only 39.5 percent of consumers reward them for this effort. Does this mean the loyalty empire is rotting from within?

Back to loyalty basics: Activity breeds success

Our first key insight emerges: Fat membership rolls may look good in a press release or a company’s annual report, but active loyalty program members are the only members who count.

As a conscientious loyalty-marketing practitioner, you must periodically measure your program’s active participation rate and drive engagement as a precursor to driving incremental revenue, retention and loyalty. The relevance, quality and frequency of your program communications will spur member engagement. By regularly injecting life into your loyalty strategy with new offers, partners, and rewards, you create the strategic foundation to support your company’s business objectives.

| PAGE 4 |

| COLLOQUYtalk / 04.07 | WWW.COLLOQUY.COM |

| “Fat membership rolls may look good in a press release or a company’s annual report, but active loyalty program members are the only members who count.” |

III: The Loyalty Census, Sector by Sector

“Festina lente.” – Augustus Caesar

(Make haste slowly.)

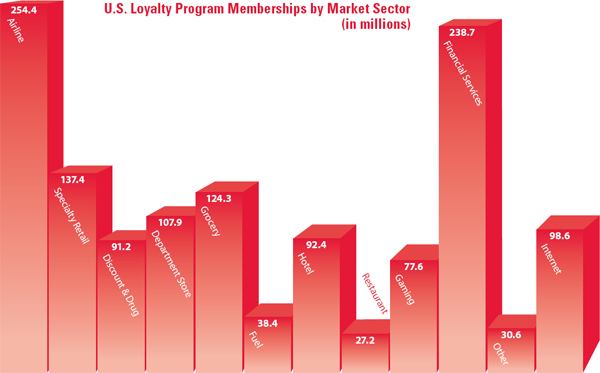

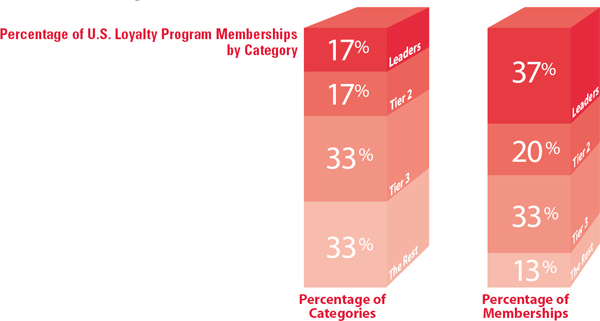

Of the twelve specific market sectors we studied, two—Airlines and Financial Services—continue to drive overall U.S. loyalty program membership growth. Combined, these two category leaders account for 37 percent of the total membership base and clearly compose the top tier of loyalty program market segments.

The next two market sectors in absolute weight—Grocery and Specialty Retail—boost the concentration rate to 57 percent of total members within only four categories. Concentration of membership in these sectors makes intuitive sense, as these four sectors likely account for the vast majority of household penetration. The third-tier group includes Hotels, Department Stores, Pharmacy and Discount Stores. Internet-only programs add to the membership base for a cumulative total of 87 percent across only eight market sectors. The remaining sectors — Gaming, Retail Fuel, Restaurant and all other categories — round out the U.S. membership base.

| PAGE 5 |

| COLLOQUYtalk / 04.07 | WWW.COLLOQUY.COM |

The Empire at a Glance:

Using a relative gauge, this comparative growth chart summarizes growth speeds for membership and active participation metrics uncovered by the 2006 census: green (fast), cautionary/moderate (yellow), and slow (red).

| Vertical | Relative Member Growth | Relative Active Growth |

| Airline | ||

| Speciality Retail | ||

| Grocery | ||

| Hotel | ||

| Restaurant | ||

| Gaming | ||

| Financial Services | ||

| Internet |

| PAGE 6 |

| COLLOQUYtalk / 04.07 | WWW.COLLOQUY.COM | |||

| “The continued influx of infrequent flyers who siphon miles through third-party relationships–rather than by earning them by buying a seat on a flight–will drive the continued growth of miles in circulation.” |

CATEGORY LEADER: AIRLINES

| Census Snapshot | |

| Membership 2006 | 254,435,000 |

| Primary Trends | · Programs are multi-generational |

| · Low-cost carriers are on board | |

| · Programs are still major revenue source | |

| · Airlines are cooperating more fully than ever | |

| · Mileage devaluation will accelerate | |

·

Growth forecast:  |

The modern age of loyalty marketing began in 1981 with the launch of the American Airlines AAdvantage program. The airlines invented the loyalty industry, and many loyalty best practices were incubated by airline marketers. So it should come as no surprise that airlines still have the largest overall program memberships. Consumers still love free trips.

But given the prolonged period of inventory slashing by the airline industry this decade, shouldn’t we find that frequent-flyer programs experienced similar levels of decreased activity? Not quite. Since 2000, frequent-flyer membership and activity continue to experience moderate levels of growth compared to other verticals—and an overall membership of 254.4 million means that airlines are still loyalty champs. Several factors drive this growth.

Airline programs are multi-generational. Even the oldest Baby Boomers who joined airline programs at their advent are still a few years from retirement. At the same time, Gen-X and Gen-Y travelers have joined the ranks of frequent flyers in droves. Hence, most members still hold active miles and remain within those databases.

Low-cost carriers have joined the party. Since 2000, low-cost carriers have fully embraced the frequent-flyer program concept, resulting in additional membership growth. While many low-cost carriers run simpler programs that are nothing more than the frequent-flyer version of free-sandwich punch-card programs, members of those programs—many of whom also belong to legacy-carrier programs—have helped drive up the overall industry numbers.

The goose still lays golden eggs. Frequent-flyer programs are still a major revenue source for airlines —and in some cases, the primary revenue source. According to industry analyst Tim Winship of Travel Insider, airline programs today “are more like frequent-buyer than frequent-flyer programs thanks to [the] thousands of [partners] that allow members to earn and redeem miles without stepping on a plane.” Although airlines continually tighten mileage expiration dates and add incremental fees, the thousands of earning opportunities make the game easy to play for even the most infrequent of travelers.

Everyone’s in the same boat. Bankruptcy fears are rampant, merger talk continues and even the most successful low-cost carriers are beginning to struggle. Loyalty to one carrier is rare. The industry is so beleaguered that airlines have banded together to combine their frequent-flyer efforts in an orgy of multiple airline alliances that offer code-sharing and swapping of miles. Delta has partnerships with 17 other carriers, American has 24 relationships, and United has 25, just to name three. These trends drive the collecting of loyalty program memberships by individual customers.

Our prediction

Airlines will soon reach the “tipping point” in their ability to generate revenue by adding members and selling miles. The continued influx of infrequent flyers who siphon miles through third-party relationships–rather than by earning them by buying a seat on a flight–will drive the continued growth of miles in circulation. At the same time, reward-seat inventory continues to shrink and mileage expiration periods grow ever shorter—which means that the devaluation of mileage currency will continue. Look for a market correction in the coming years as frequent-flyer program rolls shrink and airlines return to marketing to their most valuable segments.

| PAGE 7 |

| COLLOQUYtalk / 04.07 | WWW.COLLOQUY.COM |

| “While Airline programs have always been the top membership category, the emergence of Financial Services as a strong contender for the throne at nearly 239 million members should surprise no one. Growth has been fueled by intense competition in the general-purpose credit card segment, with rewards as a primary weapon.” |

CATEGORY LEADER: FINANCIAL SERVICES

| Census Snapshot | |

| Membership 2006 | 238,783,000 |

| Primary Trends | · Rewards are price of entry |

| · Debit is in play | |

| · Total relationship banking drives growth | |

| · Affluent consumers are key | |

| · Small business is the new frontier | |

·

Growth forecast:  |

While Airline programs have always been the top membership category, the emergence of Financial Services as a strong contender for the throne at nearly 239 million members should surprise no one. Growth has been fueled by intense competition in the general-purpose credit card segment, with rewards as a primary weapon. The 2006 Visa Payments Panel Study reported that reward initiatives tied to general-purpose credit cards have soared from 21 percent to 50 percent of cards issued during the six years between our census reports. According to Visa, as of 2006, 77 percent of all general-purpose credit card volume and 80 percent of all transactions are linked to rewards. Add in the 26 percent overall growth in charge volume as reported by The Nilson Report, and it’s easy to see why the financial services loyalty market has exploded since our last census. Other factors fueling sector growth:

Debit reward cards are now in play. Debit card volume has also soared during the intervening six years, and rewards propositions tied to debit have followed suit. In 2000, few debit card rewards programs existed. The lack of interest income, coupled with lower interchange rates, meant that marketers had a hard time funding a worthy value proposition; early debit reward programs were often paltry and tied to signature-only transactions. Merchant-funded programs, such as that from AmSouth Bank, help card-holders accelerate their reward velocity by using their debit cards at designated merchant networks. In 2006, 37 percent of financial institutions offered debit rewards cards, according to the PULSE 2007 Debit Issuer Study.

Relationship banking has taken hold: Following on such pioneering efforts as Banco Popular’s Premia program in Puerto Rico and Citi’s ThankYou Network, U.S. banks are slowly adopting variations of the Total Relationship Banking model and rewarding consumers across retail banking lines. The programs will continue to fuel membership growth in the sector. COLLOQUY outlines this evolution more thoroughly in our 2006 White Paper The Million-Dollar Swing: Choosing the Right Tools for Your Relationship Banking Strategy.

Affluent households lead the way. With the exception of the American Express Platinum card and Diner’s Club, affluent reward cards were virtually nonexistent in 2000. Today, dozens of card products now cater exclusively to affluent U.S. households, and Visa’s Signature Rewards platform allows any issuer a ready-made vehicle for market entry. Brokerages and other wealth-management-related financial services firms are also playing the loyalty game. Though small in terms of demographic size, affluent consumers spend more on credit cards and respond more to reward programs than any other segment —and the number of affluent households is growing. Issuers will continue to chase these consumers with high-end and lifestyle-driven rewards.

Small business takes charge. According to The Office of Advocacy of the Small Business Administration, 97.5 percent of the 26 million firms in the U.S. have fewer than 20 employees. Those small businesses account for over half of the country’s non-farm real domestic product and generate 60 to 80 percent of the net new jobs. Credit card issuers have paid attention and brought rewards along for the ride. Small business reward programs, led by the Open Network from American Express, will continue to drive significant growth. The real challenge in this segment will be to leverage the unique mindset of the small business owner with “Gemini Effect” rewards.

Our prediction

We’re living in the Golden Age of financial services reward programs, and we see no downturn ahead in this sector. A compelling reward program is nearly a cost-of-entry component for any new card launch; as more issuers continue to flirt with relationship banking strategies, launch merchant-funded network programs, and chase affluent consumers and small business owners, we predict continued robust growth in this sector. The challenge will be for issuers and their loyalty service providers to resist the siren call of simple “cash-back” rewards schemes and to provide differentiated reward programs while controlling costs. At the same time, issuers that want to maintain a strong ROI for their programs must now step up to the challenge of how to leverage their rich analytical insights to allocate bonus funds and communications resources.

| PAGE 8 |

| COLLOQUYtalk / 04.07 | WWW.COLLOQUY.COM |

| “Between 2000 and 2006, specialty retailers—those merchants who sell in a single consumer category (apparel, books, electronics, home improvement, sporting goods, toys, etc.) — underwent a loyalty renaissance. Membership now stands at over 137 million, making the specialty retail sector the third largest consumer membership category.” |

TIER TWO: SPECIALTY RETAIL

| Census Snapshot | |

| Membership 2006 | 137,472,000 |

| Primary Trends | · Technology has evolved to meet the retail loyalty vision |

| · Competition from discount retailers fuels loyalty differentiation | |

| · PLCCs evolving into sophisticated marketing platforms | |

| · Loyalty data will transform the customer experience | |

·

Growth forecast:  |

Between 2000 and 2006, specialty retailers—those merchants who sell in a single consumer category (apparel, books, electronics, home improvement, sporting goods, toys, etc.) — underwent a loyalty renaissance. Membership now stands at over 137 million, making the specialty retail sector the third-largest consumer membership category. Armed with the increased need to identify invisible customers and the historic success that loyalty programs have delivered in achieving transactional identification, it isn’t surprising that specialty retailers have hopped on the bandwagon.

While many retailers contributed to this growth, perhaps no example is as widely known as Best Buy’s Reward Zone. In 2000, Best Buy had no loyalty program. Now Best Buy’s 2006 annual report states that the Reward Zone membership base has reached 7.2 million consumers, and the year-over-year growth rate stands at 50 percent. Add this statistic to their public announcements about customer-centricity, their highly segmented approach to consumer markets, the elimination of mail-in rebates, and a host of leading-edge in-store customer experience initiatives, and it’s no wonder the company’s stock price has been favorably rewarded since 2000.

Other trends driving membership growth in this sector include:

Technology has evolved to meet the vision. Point-of-sale (POS) technology has improved retailers’ ability to capture member behavior. Web technology has given them the ability to link brick to click, giving loyalty programs a unique role in the multi-channel environment. Back-office CRM and database investments are paying off, giving retailers greater insight into segment behavior. Technology has now given retailers a plethora of value proposition tools to recognize and reward good customers: Some retailers issue points, others auto-issue certificates or gift cards, and others favor discounts and soft benefits. Retailers now have more ability to differentiate than any other sector.

Competition fuels growth. When one category merchant launches a loyalty initiative, you can be sure that competitors will follow. Specialty merchants not only must fight amongst themselves, but also must defend their turf against Wal-Mart, club stores and the internet. The combined sales growth of these competitors has been exceptional since 2000; for the specialty retailer, loyalty techniques provide a platform for differentiation, the ability to take the focus off price and a means to enrich their customer-centric knowledge base.

Store cards have evolved into loyalty tools. Even in the face of withering competition from general-purpose reward cards, the private label credit card (PLCC) remains one of the retailers’ most effective means of building retail customer loyalty. Since 2000, many retailers have outsourced their credit operations or sold their portfolios in order to concentrate on their customers rather than their credit risk, and the move has seen PLCC marketers evolve ever more sophisticated segmentation schemes and dialogue-marketing techniques to build share of wallet. The Info Shop’s report The U.S. Market for Private Label Credit Cards projected the PLCC market to grow 56 percent between 1998 and 2010; that growth will continue to rely on retailers’ ability to leverage the PLCC has a loyalty-marketing tool.

Our prediction

Continued pressure from general-purpose issuers will vie with the continued sophistication of PLCC loyalty-marketing programs to create a new era of détente between general-purpose and PLCC card marketers. We therefore predict relatively modest growth in this sector for the remainder of the decade. Retailers who learn to leverage customer data to fundamentally transform the customer experience will enjoy a decided advantage in the marketplace.

| PAGE 9 |

| COLLOQUYtalk / 04.07 | WWW.COLLOQUY.COM |

| “Insight

derived from consumer data should be applied at an enterprise level to drive strategies for merchandising, store operations,

store experience and marketing. Using customer behavior data to drive these strategies will create the relevance and experiences

that truly engender loyalty.” BRYAN PEARSON, PRESIDENT ALLIANCE DATA LOYALTY SERVICES |

TIER TWO: GROCERY

| Census Snapshot | |

| Membership 2006 | 124,293,000 |

| Primary Trends | · Discount cards are the price of entry |

| · Need for data to compete on thin margins | |

| · Kroger leads by example for U.S. grocers | |

| · Coalition participation growing | |

·

Growth forecast:  |

Loyalty program membership growth in the U.S. Grocery sector has been significant. We estimate total membership today at nearly 125 million consumers. According to Forrester Analyst Christine Overby, seven of the top ten U.S. grocers now offer frequent-shopper cards, and 54 percent of U.S. households have two or more cards.

Grocers’ interest in retaining best customers has come as a competitive response to Wal-Mart. In the past ten years, Wal-Mart’s encroachment has deteriorated traditional grocers’ share of market from 81 percent to 52 percent. In the U.S. grocery markets, the loyalty value proposition is still dominated by two-tier pricing programs. Customers must use their loyalty or club card to take advantage of advertised sale prices. While the occasional points program can be found on the grocery shelf, the two-tiered price model has become a virtual must-have for those marketers working beyond the walls of Wal-Mart and Costco. The result of this rampant sameness is that loyalty initiatives in the space have devolved into background noise.

But the old two-tiered pricing model may be in its last days. Some continued trends driving grocery program membership:

All eyes are on Kroger. U.K. grocer Tesco has often served as the global poster child for retail loyalty schemes. Tesco favors the points model versus the U.S. discounting approach, but the real eye-opener for U.S. marketers is Tesco’s success at mining actionable gold from their Clubcard program database. The Kroger Co. is now attempting to replicate Tesco’s data-mining ability here in the U.S. The rest of the industry has taken a wait-and-see approach — but if the Kroger experiment drives profits, then you can bet the rest of the industry will follow.

The data will drive experience. Just as specialty retailers will look to use data to transform the retail experience, so will grocers look to leverage data for more than just targeted coupon offers. Loyalty industry veteran Bryan Pearson, President of Alliance Data Loyalty Services, stresses that the “insight derived from consumer data should be applied at an enterprise level.” Building loyalty depends on more than points or discounts. “It can drive strategies for merchandising, store operations, store experience and marketing,” says Pearson. “Using customer behavior data to drive these strategies will create the relevance and experiences that truly engender loyalty.”

Regional coalitions are thriving. While a grocer has yet to step up and anchor a national loyalty coalition, many grocers also participate in niche coalition models, most notably Upromise and Vesdia’s BabyMint. Upromise requires consumers to register their grocery club card to accrue the 529 college savings benefit. As a plus for the grocer, the accrual benefit is typically paid out of consumer packaged goods pockets. Out West, Safeway uses a similar registered card approach, but Safeway rebates the accrual to the registered member’s school of choice. Such programs are spreading faster than the Roman occupation, and help explain the census results for 2006.

Our prediction

The old model of grocery store loyalty cards will soon go the way of the dodo bird. Consumers already perceive that the two-tiered pricing model is unrelated to loyalty; in recent survey results published by The Hartmann Group, 74 percent of shoppers disagreed with the statement “the fact that a store offers a shopper card makes me want to buy more groceries there.” Forrester reached a similar conclusion in 2003. To overcome consumers’ perception of ubiquity and sameness, grocers will adopt loyalty models that allow for richer customer segmentation—and this segmentation will be funded in large part by packaged goods manufacturers, who now see the wisdom of using individual customer data drive insight. Membership growth in the industry will remain flat, but both members and grocers will derive more value from the relationship.

| PAGE 10 |

| COLLOQUYtalk / 04.07 | WWW.COLLOQUY.COM |

| “The original wave of first-generation web programs is long gone: do you remember AOL AAdvantage, Netcentives, Beenz or Flooz? Neither do your customers.” |

TIER

THREE: INTERNET

| Census Snapshot | |

| Membership 2006 | 98,679,000 |

| Primary Trends | · Virtual landscape littered with failures |

| · The business model is the loyalty program | |

| · Player-model partnerships will proliferate | |

| · Web 2.0 still searching for revenue | |

·

Growth forecast:  |

While internet-based loyalty program membership stands at nearly 99 million members, the relatively flat growth in the sector is consistent with the dot-com bust experienced in the early years of the census interval. The original wave of first-generation web programs is long gone: do you remember AOL AAdvantage, Netcentives, Beenz or Flooz? Neither do your customers. Just as many of the early dot-com aspirants crashed in the fiery wreckage of flawed or nonexistent business models, so too did these companies lavish marketing dollars on poorly-designed loyalty models without a compelling value proposition for consumers. MyPoints is the last of those first-wave programs standing. Even a few second-generation programs have come and gone—eBay Anything Points, anyone? Growth trends in this sector include:

The internet will follow the player model. Online travel aggregator Expedia’s recent partnership with Citi’s ThankYou Network is an example of what may prove to be the dot-com world’s go-to loyalty strategy—partnerships with loyalty programs in other sectors. Other than a few giants such as Amazon and eBay, most ecommerce sites are still too niche or too dependent on the dirtmap to fund rich, compelling loyalty value propositions on their own. Look for more partnerships in the Expedia mold as dot-coms market to lifestyle segments rather than hardened internet junkies.

Social networking will remain the fore. While it remains to be seen just how companies such as MySpace and YouTube will translate the mass appeal of their virtual communities into bottom-line profit, the concept of Web 2.0—web content driven and controlled by users rather than broadcast by central authorities—is here to stay. Look for more ecommerce sites to leverage this concept to build loyalty value propositions for members.

Our prediction

Formal branded loyalty-marketing programs will grow little in the internet sector for a simple reason: for companies like Amazon.com and eBay, a solo loyalty play doesn’t make economic sense. These e-tailers have a captive audience; they can track behavior as a natural outgrowth of their direct channel; and they know who customers are, how they shop, and how to market to them based on their previous purchase behavior. A standalone loyalty program based on promotional currency for them would simply erode margin. In essence, the business model is the loyalty program. What matters is how well these companies use click-through and purchase data to drive value and relevance. Amazon is a loyalty-marketing program —whether they realize it or not.

| PAGE 11 |

| COLLOQUYtalk / 04.07 | WWW.COLLOQUY.COM |

| “We predict moderate growth in hotel program memberships as consumers purged from the airline rolls migrate to hotel programs offering better value.” |

TIER THREE: HOTEL

| Census Snapshot | |

| Membership 2006 | 92,463,000 |

| Primary Trends | · Mileage devaluation fuels consumer interest in hotel programs |

| · Economy brands have joined the party | |

| · Umbrella corporate programs are the norm | |

| · The battle will be won at the property level | |

·

Growth forecast:  |

The Hotel sector naturally trends with the airline industry in loyalty program member growth and program participation. Our census count pegs the industry at over 92 million members. So hotels are also seeing their databases grow as new travelers enter the scene and veterans hold onto their benefits. At the same time, there are more programs to choose from, increasing the attractiveness of the hotel loyalty concept. Growth trends include:

Mileage devaluation helps hotels. The devaluation of airline frequent-flyer miles due to reduced capacity and increased redemption costs have allowed consumers to take a fresh look at hotel loyalty programs—and in many cases, the comparison is favorable for the hotels. Hotel loyalty programs offer a rich velocity of earning, aspirational reward offerings that rival the airlines, and fewer rules and restrictions. Coupled with the ubiquitous co-branded credit card, there are more ways to earn hotel points than ever before. It’s not quite a zero-sum game, but the devaluation of airline programs has been a boon for their hotel partners.

The late-bloomers have arrived. In recent years, bargain hotel chains have introduced loyalty programs as a competitive response to the big marquee-brand chains that allow points earning through their economy brands. For example, travelers once earned Marriott Rewards points only for stays with Marriott-branded hotels; by 2006 the entire Marriott family of hotels—including Residence Inn, Fairfield Inn and Springhill Suites — were issuing the same currency. In response, Cendant (now Wyndham Worldwide) pulled all their brands together under one loyalty umbrella called TripRewards. As in other consumer sectors, hotel loyalty programs have become the cost of entry for those brands hoping to acquire and retain valuable customers.

Our prediction

With the proliferation of hotel loyalty programs having inaugurated a new era of parity, the onus will be on hotel marketers to use the data to differentiate the guest experience. Consumers are already on board; in writing about a recent survey of hotel guests, Jonathan Barsky of hotelmotel.com confirms that “the percentage of all guests who indicated club membership is ‘very important’ when selecting their most recent hotel stay.” a percentage that has increased in recent years. We predict moderate growth in hotel program memberships as consumers purged from the airline rolls migrate to hotel programs offering better value.

| PAGE 12 |

| COLLOQUYtalk / 04.07 | WWW.COLLOQUY.COM |

| “As frequent-flyer programs were the incubators of loyalty best practices in the 1980s, so too will the healthy profit margins of the big gaming companies allow them to incubate many of the best practices of the coming years. As the gaming industry leads, the rest of the loyalty industry will follow.” |

TIER FOUR: GAMING

| Census Snapshot | |

| Membership 2006 | 77,660,000 |

| Primary Trends | · Loyalty best practices now driven by the gaming industry |

| · Expansion of the gaming market drives growth | |

| · Enterprise loyalty practiced by industry leaders | |

| · Customer experience will determine the winners | |

·

Growth forecast:  |

Gaming and Casino sector growth has been slow, but gaming loyalty-program memberships and levels of member activity are demonstrating moderately better health. The current census count is 77.7 million. For years, most players’ clubs awarded only slot play and existed only at the individual property level in Las Vegas and Atlantic City. The spread of gaming to riverboats, race tracks and Native-American reservations across the U.S. has catalyzed U.S. membership growth. In addition, tremendous industry consolidation has imported smaller casinos into the mega-brands and introduced customer databases to casinos that once kept their best-customer information in the casino manager’s Rolodex. Growth trends include:

Total Relationship Gaming will grow. Casinos have learned the value of is capturing, tracking and rewarding of behavior beyond the slot machine. Some major Las Vegas venues now rake in more than 50 percent of their revenue from nongaming transactions: From restaurants, shows, golf courses, spas, and the incredible malls attached to the casinos. Gaming analysts have revisited their profitability equations and learned that visibility into all customer transactions is a prerequisite. Members are now rewarded for their loyalty not only to the one-armed bandit, but also for their lodging and restaurant choices.

Enterprise loyalty is the future. As Tesco is to the grocery industry, so is Harrah’s to the gaming industry. Widely acknowledged as the data-driven customer relationship leader in the gaming space, Harrah’s has pioneered the concept of Enterprise Loyalty: using customer data to target relevant messages, aimed at highly differentiated segments, to nurture loyalty at the enterprise level. Harrah’s uses sophisticated business intelligence (BI) software and CRM to drive desired behaviors. According to a recent Computerworld article by analyst Nestor Arellano, Harrah’s BI software “can identify the frequent players and their habits to help make decisions on how to market to these individuals.” As an added benefit, Arellano writes that their system “builds predictive models that tell Harrah’s which customers should be targeted for loyalty and incentive programs.” Everyone in the loyalty industry should take note.

Our prediction

As the gaming industry spreads beyond Atlantic City and Vegas into flyover country, so too will gaming loyalty programs lead customers into deeper relationships with gaming brands. As frequent-flyer programs were the incubators of loyalty best practices in the 1980s, so too will the healthy profit margins of the big gaming companies allow them to incubate many of the best practices of the coming years. As the gaming industry leads, the rest of the loyalty industry will follow.

| PAGE 13 |

| COLLOQUYtalk / 04.07 | WWW.COLLOQUY.COM |

| “Restaurants are ideal partners for the regional coalitions flourishing under the radar in the U.S. In addition to Rewards Network, Midwest coalition program Kickback Points has proven a valuable acquisition and marketing tool for its restaurant partners.” |

TIER FOUR: RESTAURANT

| Census Snapshot | |

| Membership 2006 | 27,208,000 |

| Primary Trends | · Small chains and sole proprietors are leading the way |

| · National chains are loyalty laggards | |

| · Retention a better play than costly acquisition | |

| · Coalition may be the best loyalty model for this sector | |

·

Growth forecast:  |

Comparatively speaking, the restaurant industry has been slow to enter the loyalty arena. According to a report published by Direct magazine in June 2006, only 5 percent of the top 130 chains have a loyalty program. Since the previous census, percentage growth has been substantial, but building from a small base means that total sector membership stands at a modest 27 million consumers. T.G.I. Friday’s, multi-restaurant programs like Rewards Network, and small restaurants who understand the significance of repeat business lead the way. Growth trends in this space include:

Small chains serve first. Oddly enough, it isn’t the big national chains leading the way in industry best practices — it’s the smaller, regional chains and even individual restaurants shedding the most light on how loyalty can impact their businesses. For example, a recent article in Chief Marketer notes that Atlanta’s Fifth Group Restaurants report that Frequent Guest Rewards member spending increased 17 percent over pre-membership spending, and the Table One program from San Francisco’s Spectrum Foods 15 restaurants bumped average sales 10 percent. Says Karen Zaniker with Pasadena’s Lawry’s Restaurant, “Eighteen percent of members say they hold private parties at Lawry’s, which they never did before becoming members, because of the points generated.”

Coalitions will proliferate. Restaurants are ideal partners for the regional coalitions flourishing under the radar in the U.S. In addition to Rewards Network, Midwest coalition program Kickback Points has proven a valuable acquisition and marketing tool for its restaurant partners. The returns are there and other restaurants will seek to garner the benefits of the coalition model of loyalty.

Our prediction

The restaurant industry is poised for a loyalty renaissance. According to a quantitative 2004 study by the National Restaurant Association, 50 percent of table-service customers said they’d be more likely to patronize a restaurant that had a loyalty program. Facing stiff competition and high acquisition costs, the restaurant industry will accelerate their loyalty initiatives in the years ahead. Once again, the ability of marketers to leverage loyalty data to improve the customer experience one patron at a time will spell the difference.

| PAGE 14 |

| COLLOQUYtalk / 04.07 | WWW.COLLOQUY.COM |

NEW SECTOR ADDITIONS TO THE CENSUS

Although our 2000 study didn’t break out three now-significant verticals, we wanted to take a quick look at them and their membership patterns.

Fuel-Convenience Retail Membership: 38,467,000

The primary device of loyalty programs in the fuel space is a co-branded credit card that bestows rebates and discounts on the cardholder. Concern over the sustainability of this model is growing. With bonuses and promotions included, what began as a 1 percent rebate is quickly spiraling to over 5 percent. For a product that already suffers from razor-thin margins, the copycat nature of this value proposition could do significant damage to profitability. Until differentiated benefits are associated with the card, customers will continue to focus on price and discounts.

Fortunately, U.S. fuel-convenience retailers are beginning to adopt proprietary loyalty models that are already proven successful in other parts of the world. Speedway launched the multi-tender, promotional -currency based Speedy Rewards to drive business from the front to the back court. ExxonMobil’s SpeedPass contactless payment system offers a more convenient customer experience, and Sheetz is an innovator in customer experience with their Blink terminals and food-ordering kiosks. Hope springs eternal.

Pharmacy / Health and Beauty Retail Membership: 91,239,00

In 2001, CVS became the first national drug store chain to enter the loyalty arena with its ExtraCare program. By all accounts, the program has proven a boon in customer intelligence and has positioned CVS as the loyalty leader in this sector. If there is a warning sign to watch out for, however, it’s in the program’s rebate-based value proposition, which could subject the industry to a downward discount-and-price spiral of a rival chain were to match CVS’s offer. Perhaps recognizing this danger, CVS recently upgraded and expanded its value proposition, including introducing in-store kiosks that issue coupons tailored to ExtraCare members’ previous purchases.

With category bleed an ongoing concern as grocers and pharmacy retailers become carbon copies of each other, the price pressure will remain a considerable problem in the industry. Pharmacy retailers should look for inspiration to successful loyalty models outside the U.S., such as Shoppers Drug Mart in Canada and Boots the Chemist in the U.K.

Department Stores Membership: 107,985,000

While many retail analysts have noted this segment’s resurgence, consolidation of players is likely the most significant factor affecting future loyalty program membership. Those acquiring chains who believe in a rewards proposition, likely tied to their venerable PLCC, will continue to push forward; those who favor low cost and intense price competition will avoid the added costs associated with loyalty.

The question is: Which model will win out? There can be only one low-price leader in a sector—and if your company isn’t it, then you’d better convince your customers to shop with you for reasons beyond price. It may prove prophetic that even the 800-pound gorilla Wal-Mart has started making noise about building and leveraging a customer database.

| PAGE 15 |

| COLLOQUYtalk / 04.07 | WWW.COLLOQUY.COM |

| “Loyalty memberships are flying dangerously high. To borrow mythology from Rome’s neighbors to the east, how can we avoid memberships from soaring so precipitously that their Icarean wings melt in the sun?” |

IV: The Solution: Carpe Diem

Fortius quo fidelus. – unknown

(In loyalty, strength.)

The census results speak for themselves: Across the board, the loyalty-marketing industry has experienced significant growth in membership since 2000. Yet low active participation rates signal that multiple millions of customer files in a database do not a successful loyalty strategy make.

Strategic membership enrollment strategies should suggest a finite population of best or highest potential spenders. Yet many of the verticals we observed are enrolling everybody who walks through the door. Are we really driving growth in membership from those segments of the universe most likely to yield positive return on our loyalty marketing investments? Are we truly using data captured by these massive memberships to understand customer behavior? Have we forgotten that the original loyalty paradigm centered on retention and increased yield metrics, not customer-acquisition objectives?

If program membership growth continues unabated, we may all end up with massive headaches. Never forget that big is the enemy of great. The biggest and potentially most progressive method of making loyalty programs more successful is the one thing that loyalty marketers are most loath to do: trim the fat from their membership rolls.

We understand the reluctance. It’s the age-old cost-versus-benefit analysis. While the costs associated with launching and operating a loyalty program haven fallen dramatically, runaway program memberships significantly strain loyalty-marketing investments. Many loyalty initiative costs are variable, and as membership grows, so does the absolute dollar outlay in the important areas of rewards liability, member communications, member care, and rewards fulfillment. When the inevitable pressure descends from the boardroom to cut marketing costs, the loyalty-marketer is tempted to morph what began as a retention program into just another mass-acquisition campaign. Millions of members justify a large budget and a big staff.

But if we make the hard choice to strategically apply the surgeon’s knife to membership and cut out some of the fat, then we risk the Law of Unintended Consequences. If we confine program invitations to only those customers who exhibit the highest spend or the greatest potential, then we’ll likely end up with a very small group of absolute members. If 2 percent of our customers increase their volume or profitability by 20 percent on average, the CFO is staring at only a 40 basis-point lift—hardly enough to get a meeting with him, let alone ask for a loyalty program budget increase. If 20 percent of that base increases volume or profit by 15 percent, we’re still stuck with only a 3 percent lift at the enterprise level. Nobody will listen to a loyalty marketer whose greatest successes won’t move the stock price even a quarter of a point.

Yet the fact remains: Loyalty memberships are flying dangerously high. To borrow mythology from Rome’s neighbors to the east, how can we avoid memberships from soaring so precipitously that their Icarean wings melt in the sun?

The answer: highly-targeted enrollment strategies (in most verticals) and smart resource allocation. Just as Rome sent its vaunted legions to both conquer regions of great potential value and to retain troublesome regions in danger of rebelling, so must loyalty-marketers target marketing dollars and human resources where they can do the most good. Consider these best practices:

| · | Enroll the right customers. Marketing resources are precious. If you spread them too thin across too many customers, then you’ll never gain efficiency. Unless you have a fundamental customer identification problem – like in the retail sector – concentrate your enrollment dollars on high-value targets through such tactics as selective invitations and program membership fees, and you’ll enjoy marketing effectiveness and increased customer engagement. Your overall membership number will be lower, but the number of engaged members will improve dramatically. |

| · | Drive active program participation. Base communications on trigger events and sophisticated, data-driven rules, not broadcast models suggested by the agency, the email service bureau or the printer. Use COLLOQUY’s Relationship Chain tactics — as outlined by contributing editor Colleen Ryan in our Spring 2007 issue — to drive engagement and build customer value by building program participation at the earliest stages of the customer life cycle. |

| · | Employ selective bonusing. Employ targeted bonuses based on the dimensions of loyalty: temporal, spatial, demographic and behavioral bonuses perform double-duty by increasing customer yield and building relationship equity to improve retention and increase customer lifetime value. Stop giving everyone in your customer file a 2 percent rebate—starve out the bottom feeders at 1 percent and practice targeted generosity with your most critical segments. |

| · | Use loyalty data at the enterprise level. While a loyalty program must be a profit center, margin contribution is but a means to an end. Share business intelligence and customer insight throughout the organization. Seek buy-in from your executive team and the input of your front-line customer service associates. Successful customer-centric companies evolve their loyalty programs to become synonymous with the brand. |

| PAGE 16 |

| COLLOQUYtalk / 04.07 | WWW.COLLOQUY.COM |

If there is an object lesson in Augustus Caesar’s pioneering census, it lies in the Emperor’s commitment to learning everything he could about the Empire in order to govern more effectively. Although the reign of Augustus marked the unfortunate transition of Rome from a democratic republic to a dictatorial empire, Augustus is nonetheless revered by historians for ushering in the Pax Romana, the roughly 200-year period during which Rome enjoyed unprecedented peace and prosperity. There are worse role models for a loyalty marketer to follow.

FINIS

This white paper was first presented in preliminary format at the 2006 Loyalty Marketing Summit.

The Loyalty Census Methodology

How the beans were meticulously tallied

In the last half of 2000 and 2006, COLLOQUY undertook a comprehensive review of loyalty program membership among consumers in the U.S. Using our existing archives of known programs across 11 different vertical markets, we researched program websites, sponsor-company press releases, annual report filings and third-party publications or research reports to estimate the total number of adults belonging to each program, by vertical market. We counted members, not unique individuals, allowing for the consumer loyalty junkie who belonged to eight different frequent-whatever programs to be counted eight times. When no data was available, we attempted to get it by phoning and/or emailing the company in question, most often using our existing subscriber database. We also interviewed program “owners” and marketing personnel involved in program execution to obtain membership counts. Finally, through the normal course of business within our consulting group, our Alliance Data Systems sister companies, including Epsilon and Alliance Data Retail Services, and our frequent industry appearances, we consistently strived to determine and/or validate the membership counts reported.

Only consumer programs across the following industries were included in both census projects: Airlines, Hotels, Financial Services, Gaming, Specialty Retail, Grocery, Department Stores, Retail Fuel Operators, Drug and Discount Stores, Restaurants and Internet-only programs. Miscellaneous programs not included above were classified as All Other. Department Stores, Drug and Discount Stores, and Retail Fuel Operators were included but not counted separately in 2000. Membership counts were confined to U.S. residents, adults, 18 years of age and above, who were enrolled in a rewards and recognition program sponsored by the listed companies. More than 1,000 sponsor firms were separately listed and researched, yielding an estimated 91 percent of the total U.S. loyalty program membership base. The remaining 9 percent were lumped together as All Other and included our best estimate of any remaining verticals and/or unidentified firms/programs that were not separately listed. Census counts are estimates for the years ended 12/31/00 and 12/31/06.

| PAGE 17 |

T H E A U T H O R S

| COLLOQUYtalk / 04.07 | WWW.COLLOQUY.COM |

The Authors

Kelly Hlavinka

As director of COLLOQUY, Kelly Hlavinka directs a strategic consulting, publishing, education and research projects. Kelly established the COLLOQUY Consulting group in 2003. and under her direction, it has grown to a team of seven internationally recognized practitioners, working with such notable clients as MGM, Mirage, Eddie Bauer, Best Buy, HP Software, and VISA Internationa.

Kelly specializes in helping companies determine their customers’ current purchasing behavior, so they can track loyalty more effectively and set up good strategies and program structures to match their needs. Her extensive knowledge of loyalty marketing is supported by expertise in direct marketing, consumer research and customer analysis.

An acknowledged expert in the theory and practice of loyalty marketing Kelly’s bylined articles have been published by DM News, The DMA Insider, DIRECT and COLLOQUY and she is often quoted by publications, including Newsweek, Advertising Age, CMO, Cards & Payments, Smart Money and 1to1 Magazine. Kelly has been a featured presenter at industry conferences sponsored by the DMA, FTMA, IIR and Source Media. and she leads COLLOQUY’s faculty in teaching a series of Loyalty Marketing Workshop and webinars around the world.

Rick Ferguson

As Editorial Director for COLLOQUY, Rick directs all publishing, education and research products for a global audience of marketing professionals. An acknowledged expert in the theory and practice of loyalty marketing, Rick has published numerous articles and white papers describing the characteristics of marketing programs which seek to change customer behavior. He has been quoted as a loyalty expert in the Wall Street Journal, Guardian UK, Fast Company, USA Today, Forbes.com and MSNBC.com; serves as a contributor to The Journal of Consumer Marketing; and writes a monthly column for Chief Marketer magazine. Rick has been a featured presenter at industry conferences sponsored by the DMA, NACS, FTMA and Terrapinn. As a senior member of the COLLOQUY faculty, he has delivered educational workshops and webinars on the principles, practices and technologies of loyalty marketing in the U.S., U.K., Malaysia and Singapore.

T H E P U B L I S H E R

The Publisher

COLLOQUY comprises a collection of resources devoted to the global loyalty-marketing industry. The flagship resources are COLLOQUY Consulting, a loyalty consulting practice; COLLOQUY®, a quarterly publication serving the loyalty-marketing industry since 1990; www.colloquy.com, the most comprehensive loyalty web site in the world; COLLOQUY’s Research and Education divisions; and the COLLOQUY Network, a global network of consultants certified in COLLOQUY’s consulting methodology. Together they provide a worldwide audience of 25,000+ marketers with consulting services, news, editorial, educational and research services across all verticals and around the globe. COLLOQUY magazine subscriptions are available at no cost to qualified persons at www.colloquy.com.

1000

Summit Dr., Suite 200

Milford, Ohio 45150

Telephone: +1.513.248.5910

Fax: +1.513.248.9084

Email: info@colloquy.com

www.colloquy.com

© LoyaltyOne, Inc. 2007, MMVII

COLLOQUY is a registered trademark of LoyaltyOne, Inc. All rights reserved.

| PAGE 18 |