Attached files

| file | filename |

|---|---|

| EX-10.2 - EXHIBIT 10.2 - Fibrocell Science, Inc. | fcsc-2015930ex102.htm |

| EX-32.1 - EXHIBIT 32.1 - Fibrocell Science, Inc. | fcsc-2015930ex321.htm |

| EX-31.1 - EXHIBIT 31.1 - Fibrocell Science, Inc. | fcsc-2015930ex311.htm |

| EX-32.2 - EXHIBIT 32.2 - Fibrocell Science, Inc. | fcsc-2015930ex322.htm |

| EX-31.2 - EXHIBIT 31.2 - Fibrocell Science, Inc. | fcsc-2015930ex312.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________________________________

FORM 10-Q

x Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended September 30, 2015

OR

o Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

___________________________________________________________________

Commission File Number 001-31564

Fibrocell Science, Inc.

(Exact name of registrant as specified in its Charter)

Delaware | 87-0458888 | |

(State or other jurisdiction of incorporation) | (I.R.S. Employer Identification No.) | |

405 Eagleview Boulevard

Exton, Pennsylvania 19341

(Address of principal executive offices, including zip code)

(484) 713-6000

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant: (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for any shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o | Accelerated filer x | |

Non-accelerated filer o | Smaller reporting company o | |

(Do not check if a smaller reporting company) | ||

Indicate by check mark whether the registrant is shell company (as defined in Rule 12b-2of the Exchange Act) Yes o No ý

As of October 30, 2015, there were 43,898,785 outstanding shares of the registrant's common stock, par value $0.001.

TABLE OF CONTENTS

PAGE | |||

PART I. | FINANCIAL INFORMATION | ||

PART II. | OTHER INFORMATION | ||

SIGNATURES | |||

EXHIBIT INDEX | |||

_____________________________

Unless the context otherwise requires, all references in this Form 10-Q to the "Company," "Fibrocell," "we," "us," and "our" include Fibrocell Science, Inc. and its subsidiaries.

Trademark Notice

Fibrocell Science® and LAVIV® are registered and common law trademarks of Fibrocell Science, Inc. (Exton, PA). All other trademarks, service marks or trade names appearing in this Form 10-Q are the property of their respective owners.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Form 10-Q contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, included in this Form 10-Q regarding our future operations, financial performance and financial position, prospects, strategies, objectives and other future events (including assumptions relating to the foregoing) are forward-looking statements. In some cases, you can identify forward-looking statements by words such as “may,” “will,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “ongoing,” “scheduled” and similar expressions, although not all forward-looking statements contain these identifying words. Forward-looking statements appear in this Form 10-Q primarily in Part I., Item 1. “Notes to Condensed Consolidated Financial Statements (unaudited)” and Part I., Item 2. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and include, among others, statements relating to:

• | the potential advantages of our product candidates; |

• | our expectation to complete dosing in our Phase II clinical trial for azficel-T for chronic dysphonia by year-end 2015 and announce efficacy results in the second quarter of 2016; |

• | our interpretation of the FDA's feedback relating to our IND for FCX-007 and our plans to address such feedback and submit an amended IND in the first quarter of 2016; |

• | the initiation, design and timing of the additional toxicology study requested by the FDA; |

• | the initiation, design and timing of a Phase I/II clinical trial for FCX-007; |

• | our expectation to complete preclinical proof-of-concept studies for FCX-013 in the first half of 2016 and submit an IND application to the FDA in the fourth quarter of 2016; |

• | our plan to seek orphan drug designation for FCX-013; |

• | our ability to complete, or obtain modifications to, the postmarketing study that the FDA required as a condition for the approval of LAVIV; |

• | the potential for our collaboration with UCLA to provide new development programs; and |

• | the sufficiency of our cash and cash equivalents to fund our operations into the fourth quarter of 2016. |

Forward-looking statements are based upon our current expectations, intentions and beliefs and are subject to a number of risks, uncertainties, assumptions and other factors that could cause actual results to differ materially and adversely from those expressed or implied by such statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this Form 10-Q and in our Annual Report on Form 10-K for the fiscal year ended December 31, 2014 (our "Form 10-K for 2014") under the caption "Item 1A. Risk Factors." As a result, you should not place undue reliance on forward-looking statements.

Additionally, the forward-looking statements contained in this Form 10-Q represent our views only as of the date of this Form 10-Q (or any earlier date indicated in such statement). While we may update certain forward-looking statements from time to time, we specifically disclaim any obligation to do so, whether as a result of new information, future developments or otherwise. You are advised, however, to consult any further disclosures we make on related subjects in the periodic and current reports that we file with the SEC.

1

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements.

Fibrocell Science, Inc.

Condensed Consolidated Balance Sheets

(unaudited)

($ in thousands, except share and per share data)

September 30, 2015 | December 31, 2014 | ||||||

Assets | |||||||

Current assets: | |||||||

Cash and cash equivalents | $ | 36,931 | $ | 37,495 | |||

Accounts receivable, net of allowance for doubtful accounts of $12 and $17, respectively | — | 4 | |||||

Inventory | 566 | 571 | |||||

Prepaid expenses and other current assets | 467 | 1,279 | |||||

Total current assets | 37,964 | 39,349 | |||||

Property and equipment, net of accumulated depreciation of $1,191 and $1,051, respectively | 1,697 | 1,598 | |||||

Intangible assets, net of accumulated amortization of $2,067 and $1,653, respectively | 4,273 | 4,687 | |||||

Total assets | $ | 43,934 | $ | 45,634 | |||

Liabilities and Stockholders’ Equity | |||||||

Current liabilities: | |||||||

Accounts payable | $ | 2,624 | $ | 1,124 | |||

Accrued expenses | 1,731 | 1,675 | |||||

Deferred revenue | 473 | 416 | |||||

Warrant liability, current | 505 | 278 | |||||

Total current liabilities | 5,333 | 3,493 | |||||

Warrant liability, long term | 6,459 | 11,008 | |||||

Deferred rent | 776 | 724 | |||||

Total liabilities | 12,568 | 15,225 | |||||

Stockholders’ equity: | |||||||

Preferred stock, $0.001 par value; 5,000,000 shares authorized; no shares outstanding | — | — | |||||

Common stock, $0.001 par value; 100,000,000 shares authorized; 43,898,785 and 40,856,815 shares issued and outstanding, respectively | 44 | 41 | |||||

Additional paid-in capital | 160,842 | 143,086 | |||||

Accumulated deficit | (129,520 | ) | (112,718 | ) | |||

Total stockholders’ equity | 31,366 | 30,409 | |||||

Total liabilities and stockholders’ equity | $ | 43,934 | $ | 45,634 | |||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

2

Fibrocell Science, Inc.

Condensed Consolidated Statements of Operations

(unaudited)

($ in thousands, except share and per share data)

Three months ended September 30, 2015 | Three months ended September 30, 2014 | Nine months ended September 30, 2015 | Nine months ended September 30, 2014 | ||||||||||||

Revenue from product sales | $ | 49 | $ | 20 | $ | 217 | $ | 124 | |||||||

Collaboration revenue | 30 | — | 193 | — | |||||||||||

Total revenue | 79 | 20 | 410 | 124 | |||||||||||

Cost of product sales | 62 | 512 | 283 | 1,852 | |||||||||||

Cost of collaboration revenue | 142 | — | 230 | — | |||||||||||

Total cost of revenue | 204 | 512 | 513 | 1,852 | |||||||||||

Gross loss | (125 | ) | (492 | ) | (103 | ) | (1,728 | ) | |||||||

Research and development expense | 4,221 | 3,069 | 11,902 | 13,909 | |||||||||||

Selling, general and administrative expense | 2,477 | 2,630 | 9,041 | 8,150 | |||||||||||

Operating loss | (6,823 | ) | (6,191 | ) | (21,046 | ) | (23,787 | ) | |||||||

Other income: | |||||||||||||||

Warrant revaluation and other finance income | 5,301 | 177 | 4,240 | 1,135 | |||||||||||

Other income | — | — | — | 370 | |||||||||||

Interest income | 1 | 2 | 4 | 4 | |||||||||||

Loss before income taxes | (1,521 | ) | (6,012 | ) | (16,802 | ) | (22,278 | ) | |||||||

Income tax benefit | — | — | — | — | |||||||||||

Net loss | $ | (1,521 | ) | $ | (6,012 | ) | $ | (16,802 | ) | $ | (22,278 | ) | |||

Per Share Information: | |||||||||||||||

Net loss: | |||||||||||||||

Basic | $ | (0.04 | ) | $ | (0.15 | ) | $ | (0.40 | ) | $ | (0.55 | ) | |||

Diluted | $ | (0.07 | ) | $ | (0.17 | ) | $ | (0.44 | ) | $ | (0.60 | ) | |||

Weighted average number of common shares outstanding: | |||||||||||||||

Basic | 43,021,121 | 40,856,815 | 41,598,632 | 40,766,741 | |||||||||||

Diluted | 43,712,918 | 41,300,105 | 41,829,231 | 41,045,861 | |||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

3

Fibrocell Science, Inc.

Condensed Consolidated Statement of Stockholders’ Equity

(unaudited)

($ in thousands, except share data)

Common Stock | Additional paid-in capital | Accumulated deficit | Total Equity | |||||||||||||||

Shares | Amount | |||||||||||||||||

Balance, December 31, 2014 | 40,856,815 | $ | 41 | $ | 143,086 | $ | (112,718 | ) | $ | 30,409 | ||||||||

Proceeds from common stock offering, net | 2,974,136 | 3 | 15,869 | — | 15,872 | |||||||||||||

Stock-based compensation expense | — | — | 1,550 | — | 1,550 | |||||||||||||

Exercise of stock options | 56,250 | — | 255 | — | 255 | |||||||||||||

Exercise of warrants | 11,584 | — | 82 | — | 82 | |||||||||||||

Net loss | — | — | — | (16,802 | ) | (16,802 | ) | |||||||||||

Balance, September 30, 2015 | 43,898,785 | $ | 44 | $ | 160,842 | $ | (129,520 | ) | $ | 31,366 | ||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

4

Fibrocell Science, Inc.

Condensed Consolidated Statements of Cash Flows

(unaudited)

($ in thousands)

Nine months ended September 30, 2015 | Nine months ended September 30, 2014 | ||||||

Cash flows from operating activities: | |||||||

Net loss | $ | (16,802 | ) | $ | (22,278 | ) | |

Adjustments to reconcile net loss to net cash used in operating activities: | |||||||

Stock-based compensation expense | 1,550 | 1,005 | |||||

Stock issued for supplemental stock issuance agreement | — | 5,154 | |||||

Warrant revaluation and other finance income | (4,240 | ) | (1,135 | ) | |||

Depreciation and amortization | 554 | 673 | |||||

Provision for doubtful accounts | (5 | ) | 15 | ||||

Change in operating assets and liabilities: | |||||||

Accounts receivable | 9 | 11 | |||||

Inventory | 5 | (13 | ) | ||||

Prepaid expenses and other current assets | 812 | 722 | |||||

Other assets | — | 214 | |||||

Accounts payable | 1,469 | (1,904 | ) | ||||

Accrued expenses and deferred rent | 111 | 1,693 | |||||

Deferred revenue | 57 | 331 | |||||

Net cash used in operating activities | (16,480 | ) | (15,512 | ) | |||

Cash flows from investing activities: | |||||||

Purchase of property and equipment | (208 | ) | (307 | ) | |||

Net cash used in investing activities | (208 | ) | (307 | ) | |||

Cash flows from financing activities: | |||||||

Proceeds from common stock offering, net | 15,872 | — | |||||

Proceeds from the exercise of stock options | 255 | — | |||||

Principle payments on capital lease obligations | (3 | ) | — | ||||

Net cash provided by financing activities | 16,124 | — | |||||

Effect of exchange rate changes on cash balances | — | 1 | |||||

Net decrease in cash and cash equivalents | (564 | ) | (15,818 | ) | |||

Cash and cash equivalents, beginning of period | 37,495 | 60,033 | |||||

Cash and cash equivalents, end of period | $ | 36,931 | $ | 44,215 | |||

Supplemental Cash Flow Disclosures: | |||||||

Non Cash Investing and Financing Activities: | |||||||

Property and equipment in accounts payable | $ | 31 | $ | — | |||

Reduction of warrant liability upon issuance of shares | $ | 82 | $ | — | |||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

5

Fibrocell Science, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 1. Business and Organization

Organization.

Fibrocell Science, Inc. (as used herein, “we,” “us,” “our,” “Fibrocell” or the “Company”) is the parent company of Fibrocell Technologies, Inc. (“Fibrocell Tech”) and Fibrocell Science Hong Kong Limited (“Fibrocell Hong Kong”), a company organized under the laws of Hong Kong. Fibrocell Tech is the parent company of Isolagen International, S.A., a company organized under the laws of Switzerland (“Isolagen Switzerland”). Previously, Fibrocell Tech was the parent of Isolagen Australia Pty Limited, a company organized under the laws of Australia (“Isolagen Australia”), and Isolagen Europe Limited, a company organized under the laws of the United Kingdom (“Isolagen Europe”). During the third quarter of 2015, the Company's board of directors approved the formal dissolution of Isolagen Australia and Isolagen Europe. As these entities had previously ceased to operate, there was no impact on the condensed consolidated financial statements. The Company’s remaining international activities are currently immaterial.

Business Overview.

Fibrocell is an autologous cell and gene therapy company focused on developing first-in-class treatments for rare and serious skin and connective tissue diseases with high unmet medical needs. Fibrocell's most advanced product candidate, azficel-T, uses its proprietary autologous fibroblast technology and is in a Phase II clinical trial for the treatment of chronic dysphonia resulting from vocal cord scarring or atrophy. In collaboration with Intrexon Corporation ("Intrexon") (NYSE:XON), a leader in synthetic biology, Fibrocell is also developing gene therapies for skin diseases using gene-modified autologous fibroblasts. Fibrocell is in preclinical development of FCX-007, its lead gene-therapy product candidate, for the treatment of recessive dystrophic epidermolysis bullosa ("RDEB"). Fibrocell is also in preclinical development of FCX-013, its second gene-therapy product candidate, for the treatment of linear scleroderma.

Liquidity.

As of September 30, 2015, we had cash and cash equivalents of approximately $36.9 million and working capital of approximately $32.6 million. We believe that our cash and cash equivalents at September 30, 2015 will be sufficient to fund our operations into the fourth quarter of 2016. However, the Company expects to continue to incur losses and require additional financial resources to advance its product candidates to either commercial stage or liquidity events. There can be no assurance that the Company will be able to generate sufficient revenues or be able to obtain additional debt or equity financing on terms acceptable to the Company, or on a timely basis or at all. The failure of the Company to obtain sufficient funds on acceptable terms when needed could have a material adverse effect on the Company’s business, results of operations and financial condition.

Note 2. Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnote disclosures required by GAAP for complete consolidated financial statements. In the opinion of management, all adjustments (consisting of normal recurring adjustments) considered necessary for a fair presentation have been included. These financial statements should be read in conjunction with the financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014, filed with the Securities and Exchange Commission (“SEC”). The results of the Company’s operations for any interim period are not necessarily indicative of the results of operations for any other interim period or full year.

There have been certain reclassifications made to the prior year’s results of operations to conform to the current year’s presentation. Compensation and related expenses for manufacturing and facilities personnel of $0.2 million and $1.0 million were reclassified from selling, general and administrative expense to research and development expense for the three and nine months ended September 30, 2014, respectively.

6

Fibrocell Science, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 3. Summary of Significant Accounting Policies

Use of Estimates.

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts in the condensed consolidated financial statements and notes. In addition, management’s assessment of the Company’s ability to continue as a going concern involves the estimation of the amount and timing of future cash inflows and outflows. Actual results may differ materially from those estimates.

Revenue Recognition.

Product Sales. In June 2011, the FDA approved the Company's Biologics License Application ("BLA") for LAVIV (azficel-T) for the treatment of nasolabial fold wrinkles. As one full course of LAVIV therapy includes three series of injections, the Company recognizes associated revenue over the period LAVIV is shipped for injection in accordance with the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification ("ASC") 605, Revenue Recognition (“ASC 605”). In general, ASC 605 requires that four basic criteria must be met before revenue can be recognized: (1) persuasive evidence of an arrangement exists, (2) delivery has occurred or services rendered, (3) the fee is fixed and determinable and (4) collectability is reasonably assured. Corresponding revenue is recognized on a prorata basis as each of the three series of injections is shipped to the physician. Currently, the Company no longer actively markets or promotes LAVIV to physicians or patients; however, prescriptions are still being accepted and filled.

Collaboration Revenue. The Company's collaboration agreements may contain multiple elements, such as fees to perform proof of concept studies, product development, aid in obtaining U.S. patents and trademarks, and provide for royalties based upon future commercial sales. The deliverables under such an arrangement are evaluated under ASC 605-25, Revenue Recognition: Multiple-Element Arrangements. Each required deliverable is evaluated to determine whether it qualifies as a separate unit of accounting based on whether the deliverable has “stand-alone value” to the customer. The arrangement’s consideration that is fixed or determinable is then allocated to each separate unit of accounting based on the relative selling price of each deliverable. In general, the consideration allocated to each unit of accounting is recognized as the related goods or services are delivered, limited to the consideration that is not contingent upon future deliverables. Collaboration revenue is recognized on a gross basis, in accordance with the criteria set forth in ASC 605-45, Revenue Recognition: Principal Agent Considerations.

Collaboration revenue for the three and nine months ended September 30, 2015 is related to a research and development agreement that the Company has with an unrelated third party to investigate potential new non-pharmaceutical applications for the Company's conditioned fibroblast media technology. Revenue recognized from this collaboration relates to an upfront license fee and a proof of concept study currently underway.

Cost of Revenue.

Cost of revenue includes expenses related to product sales and collaboration revenue.

Cost of Product Sales. Costs include the processing of cells for LAVIV, including direct and indirect costs. Cost of product sales is accounted for using a standard cost system which allocates the direct costs associated with the Company’s manufacturing, facility, quality control, and quality assurance operations as well as an allocation of overhead costs.

Cost of Collaboration Revenue. Costs directly related to deliverables in a revenue-generating collaboration are charged to cost of revenue as incurred.

Research and Development Expense.

Research and development costs are expensed as incurred and include salaries and benefits, costs paid to third party contractors to perform research, conduct clinical trials, develop and manufacture product candidates, and an allocation of overhead cost. Research and development costs also include costs to develop manufacturing, cell collection and logistical process improvements.

Clinical trial costs are a significant component of research and development expenses and include costs associated with third party contractors. Invoicing from third party contractors for services performed can lag several months. The

7

Fibrocell Science, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 3. Summary of Significant Accounting Policies (continued)

Company accrues the costs of services rendered in connection with third party contractor activities based on its estimate of management fees, site management and monitoring costs and data management costs incurred in a given period.

Warrant Liability.

The Company accounts for stock warrants as either equity instruments or derivative liabilities depending on the specific terms of the warrant agreement. Stock warrants are accounted for as a derivative in accordance with ASC 815, Derivatives and Hedging, (“ASC 815”) if the stock warrants contain “down-round protection” or other terms that could potentially require “net cash settlement” and therefore, do not meet the scope exception for treatment as a derivative. Since “down-round protection” is not an input into the calculation of the fair value of the warrants, the warrants cannot be considered indexed to the Company’s own stock which is a requirement for the scope exception as outlined under ASC 815. Warrant instruments that could potentially require “net cash settlement” in the absence of express language precluding such settlement and those which include “down-round protection” are initially classified as derivative liabilities at their estimated fair values, regardless of the likelihood that such instruments will ever be settled in cash. The Company will continue to classify the fair value of the warrants that contain “down-round protection” and “net cash settlement” as a liability until the warrants are exercised, expire or are amended in a way that would no longer require these warrants to be classified as a liability.

Income Taxes.

In accordance with ASC 270, Interim Reporting, and ASC 740, Income Taxes, the Company is required at the end of each interim period to determine the best estimate of its annual effective tax rate and then apply that rate in providing for income taxes on a current year-to-date (interim period) basis. For the three and nine months ended September 30, 2015 and 2014, the Company recorded no tax expense or benefit due to the expected current year loss and its historical losses. The Company had not recorded its net deferred tax asset as of either September 30, 2015 or December 31, 2014, because it maintains a full valuation allowance against all deferred tax assets as management has determined that it is not more likely than not that the Company will realize these future tax benefits. As of September 30, 2015 and December 31, 2014, the Company had no uncertain tax positions.

Intangible Assets.

Intangible assets are research and development assets related to the Company’s primary study on azficel-T that was recognized upon emergence from bankruptcy. Azficel-T has three current or target indications: the Company’s FDA-approved biological product, LAVIV; a clinical development program for azficel-T for the treatment of chronic dysphonia resulting from vocal cord scarring or atrophy; and a clinical development program for azficel-T for the treatment of restrictive burn scarring. Effective January 1, 2012, the Company launched LAVIV and as a result, the research and development intangible assets related to the Company’s primary study were considered to be finite-lived intangible assets and are being amortized over 12 years, the estimated useful life of the assets which is analogous with the exclusivity period granted to the Company under the azficel-T BLA.

Finite-lived intangible assets are recorded at cost, net of accumulated amortization and, if applicable, impairment charges. Amortization of finite-lived intangible assets is provided over their estimated useful lives on a straight-line basis. The Company reviews the estimated remaining useful life of its intangible assets on an annual basis with any changes, if applicable, accounted for prospectively. In accordance with ASC 360-10-35, Impairment or Disposal of Long-Lived Assets, the Company reviews its finite-lived intangible assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. There was no impairment expense recognized for either the three or nine months ended September 30, 2015 or 2014. Clinical trials and the development of biopharmaceutical products is a lengthy and complex process with significant uncertainty and risk. If development programs for azficel-T are not successful and the Company does not obtain regulatory approval, or there is a lack of commercial viability of the product(s), our intangible assets may become impaired.

Recently Issued Accounting Pronouncements.

In July 2015, the FASB issued ASU No. 2015-11, Inventory (Topic 330): Simplifying the Measurement of Inventory, which requires an entity to measure in scope inventory at the lower of cost and net realizable value rather than at the lower of cost or market, where market could be replacement cost, net realizable value, or net realizable value less an approximately normal profit margin. The amendments do not apply to inventory that is measured using last-in, first-out (LIFO) or the retail

8

Fibrocell Science, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 3. Summary of Significant Accounting Policies (continued)

inventory method. The amendments apply to all other inventory, which includes inventory that is measured using first-in, first-out (FIFO) or average cost. The amendment is effective for public companies for fiscal years beginning after December 15, 2016, including interim periods within those fiscal years and should be applied prospectively. Early application is permitted. The Company has evaluated the effects of the adoption of this ASU on its financial statements and does not believe the impact will be material.

In August 2015, the FASB issued ASU No. 2015-14, Revenue from Contracts with Customers (Topic 606): Deferral of the Effective Date, which defers by one year the effective date of ASU 2014-09, Revenue from Contracts with Customers. The guidance is effective for public companies with annual reporting periods beginning after December 15, 2017, including interim periods within that reporting period. Earlier application is permitted. The Company is currently evaluating the effects of the adoption of ASU 2014-09 deferred by this update on its financial statements but does not believe the impact to be material.

Note 4. Inventory

Inventories consist of raw materials and work-in-process intended for use in the manufacture of LAVIV. However, raw materials may be used for clinical trials and are charged to research and development (“R&D”) expense when consumed.

Inventories consisted of the following as of:

($ in thousands) | September 30, 2015 | December 31, 2014 | ||||||

Raw materials (LAVIV and product candidates) | $ | 398 | $ | 357 | ||||

Work in process (LAVIV) | 168 | 214 | ||||||

Total Inventory | $ | 566 | $ | 571 | ||||

Note 5. Warrants

The Company accounts for stock warrants as either equity instruments or derivative liabilities depending on the specific terms of the warrant agreement. See Note 3 for further details on accounting policies related to the Company's common stock warrants. As of September 30, 2015 and December 31, 2014, all of the company's outstanding stock warrants were classified as derivative liabilities.

The following table summarizes outstanding liability-classified warrants to purchase common stock as of:

Number of Warrants | |||||||||||

Liability-classified warrants | September 30, 2015 | December 31, 2014 | Exercise Price | Expiration Dates | |||||||

Issued in Series A, B and D Preferred Stock offerings | 2,231,118 | 2,247,118 | $ | 6.25 | Oct 2015 - Dec 2016 | ||||||

Issued in March 2010 financing | 319,789 | 393,416 | $ | 6.25 | Mar 2016 | ||||||

Issued in June 2011 financing | 6,113 | 6,113 | $ | 22.50 | Jun 2016 | ||||||

Issued in August 2011 financing | 565,759 | 565,759 | $ | 18.75 | Aug 2016 | ||||||

Issued to placement agents in August 2011 financing | 50,123 | 50,123 | $ | 13.635 | Aug 2016 | ||||||

Issued in Series B, D and E Preferred Stock offerings | 74,800 | 76,120 | $ | 2.50 | Nov 2015 - Dec 2017 | ||||||

Issued with Convertible Notes | 1,125,578 | 1,125,578 | $ | 2.50 | Jun 2018 | ||||||

Issued in Series E Preferred Stock offering | 1,568,823 | 1,568,823 | $ | 7.50 | Dec 2018 | ||||||

Total | 5,942,103 | 6,033,050 | |||||||||

9

Fibrocell Science, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 5. Warrants (continued)

The table below is a summary of the Company’s warrant activity during the nine months ended September 30, 2015.

Number of warrants | Weighted- average exercise price | |||||

Outstanding at December 31, 2014 | 6,033,050 | $ | 7.08 | |||

Granted | — | — | ||||

Exercised (1) | (90,947 | ) | (6.20 | ) | ||

Expired | — | — | ||||

Outstanding at September 30, 2015 | 5,942,103 | $ | 7.09 | |||

(1) All warrants were exercised on a cashless basis resulting in the issuance of 11,584 shares of the Company's common stock.

Liability-classified Warrants.

The foregoing warrants were recorded as derivative liabilities at their estimated fair value at the date of issuance, with the subsequent changes in estimated fair value recorded in other income or expense in the Company’s condensed consolidated statement of operations in each subsequent period. The change in the estimated fair value of the warrant liability for the three and nine months ended September 30, 2015 resulted in non-cash income of approximately $5.3 million and $4.2 million, respectively. The change in the estimated fair value of the warrant liability for the three and nine months ended September 30, 2014 resulted in non-cash income of approximately $0.2 million and $1.1 million, respectively. The Company utilizes a Monte Carlo simulation valuation method to value its liability-classified warrants.

The estimated fair value of these warrants is determined using Level 3 inputs. Inherent in the Monte Carlo simulation valuation method are inputs and assumptions related to expected stock-price volatility, expected life, risk-free interest rate and dividend yield. The Company estimates the volatility of its common stock based on historical volatility of a peer group that matches the expected remaining life of the warrants. The risk-free interest rate is based on the U.S. Treasury zero-coupon yield curve on the grant date for a maturity similar to the expected remaining life of the warrants. The expected life of the warrants is assumed to be equivalent to their remaining contractual term. The dividend rate is based on the historical rate, which the Company anticipates will remain at zero.

The following table summarizes the calculated aggregate fair values, along with the assumptions utilized in each calculation:

($ in thousands except share and per share data) | September 30, 2015 | December 31, 2014 | |||||

Calculated aggregate value | $ | 6,964 | $ | 11,286 | |||

Weighted average exercise price per share | $ | 7.09 | $ | 7.08 | |||

Closing price per share of common stock | $ | 3.85 | $ | 2.59 | |||

Volatility | 86.3 | % | 67.6 | % | |||

Weighted average remaining expected life | 1 year, 10 months | 2 years, 7 months | |||||

Risk-free interest rate | 0.60 | % | 0.86 | % | |||

Dividend yield | — | — | |||||

Note 6. Fair Value Measurements

Assets and Liabilities Measured at Fair Value on a Recurring Basis.

The Company uses the accounting guidance on fair value measurements for financial assets and liabilities measured on a recurring basis. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. As such, fair value is a market-based measurement that should be determined based on assumptions that market participants would use in pricing an asset or liability. The Company uses a fair

10

Fibrocell Science, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 6. Fair Value Measurements (continued)

value hierarchy, which distinguishes between assumptions based on market data (observable inputs) and an entity's own assumptions (unobservable inputs). The guidance requires fair value measurements be classified and disclosed in one of the following three categories within the hierarchy:

•Level 1: Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities.

•Level 2: Quoted prices in markets that are not active or inputs which are observable, either directly or indirectly, for substantially the full term of the asset or liability.

•Level 3: Prices or valuation techniques that require inputs that are both significant to the fair value measurement and unobservable (i.e., supported by little or no market activity).

Determining which category an asset or liability falls within the hierarchy requires significant judgment. The Company evaluates its hierarchy disclosures each reporting period.

The following fair value hierarchy table presents information about each major category of the Company’s financial assets and liabilities measured at fair value on a recurring basis as of:

September 30, 2015 | |||||||||||||||

($ in thousands) | Level 1 | Level 2 | Level 3 | Total | |||||||||||

Assets: | |||||||||||||||

Cash and cash equivalents | $ | 36,931 | $ | — | $ | — | $ | 36,931 | |||||||

Liabilities: | |||||||||||||||

Warrant liability | $ | — | $ | — | $ | 6,964 | $ | 6,964 | |||||||

December 31, 2014 | |||||||||||||||

($ in thousands) | Level 1 | Level 2 | Level 3 | Total | |||||||||||

Assets: | |||||||||||||||

Cash and cash equivalents | $ | 37,495 | $ | — | $ | — | $ | 37,495 | |||||||

Liabilities: | |||||||||||||||

Warrant liability | $ | — | $ | — | $ | 11,286 | $ | 11,286 | |||||||

Changes in Level 3 Liabilities Measured at Fair Value on a Recurring Basis - Common Stock Warrants.

The reconciliation of the warrant liability measured at fair value on a recurring basis using unobservable inputs (Level 3) was as follows:

Warrant | |||

($ in thousands) | Liability | ||

Balance at December 31, 2014 | $ | 11,286 | |

Exercise of warrants (1) | (82 | ) | |

Change in fair value of warrant liability | (4,240 | ) | |

Balance at September 30, 2015 | $ | 6,964 | |

(1) All warrants were exercised under the cashless exercise method per the corresponding warrant agreement. As a result of such exercises, the Company issued 11,584 shares of common stock. Consequently, these instruments were no longer classified as liabilities. These common stock warrants were remeasured to their fair value as of the exercise date with the change in fair value recorded to other income. The fair value related to the shares issued in connection with the exercised warrants was reclassified from liability to additional paid-in capital in the condensed consolidated balance sheet.

Effect of Fibrocell's Stock Price and Volatility Assumptions on the Calculation of Fair Value of Warrant Liabilities.

The fair value of the warrant liability is based on Level 3 inputs. As discussed in Note 5, the Company uses a Monte Carlo simulation valuation method to value its liability-classified warrants. The determination of fair value as of the reporting

11

Fibrocell Science, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 6. Fair Value Measurements (continued)

date is affected by Fibrocell's stock price as well as assumptions regarding a number of subjective variables that do not have observable inputs or available market data to support the fair value. These variables include, but are not limited to, expected stock price volatility over the term of the warrants and the risk-free interest rate. The primary factors affecting the fair value of the warrant liability are the Company's stock price and volatility as well as certain assumptions by the Company as to the likelihood of provisions to the underlying warrant agreements being triggered. The methods described above and in Note 5 may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, while the Company believes its valuation method is appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value could result in a different fair value measurement at the reporting date.

Fair Value of Certain Financial Assets and Liabilities.

The Company believes that the fair values of the Company’s current assets and liabilities approximate their reported carrying amounts. There were no transfers between Level 1, 2 and 3 during the periods presented.

Note 7. Stock-Based Compensation

The Company’s board of directors (the “Board”) adopted the 2009 Equity Incentive Plan (as amended to date, the “Plan”) effective September 3, 2009. The Plan is intended to further align the interests of the Company and its stockholders with its employees, including its officers, non-employee directors, consultants and advisers by providing incentives for such persons to exert maximum efforts for the success of the Company. The Plan allows for the issuance of up to 5,600,000 shares of the Company’s common stock. The Company previously issued 206,000 options outside of the Plan to consultants.

The types of awards that may be granted under the Plan include stock options (both non-qualified stock options and incentive stock options), stock appreciation rights, stock awards, stock units and other stock-based awards. The term of each award is determined by the Compensation Committee of the Board at the time each award is granted, provided that the terms of options do not exceed ten years. Vesting schedules for stock options vary, but generally vest 25% per year, over four years. The Plan had 2,369,409 shares available for future grants as of September 30, 2015.

Total stock-based compensation expense, net of estimated forfeitures, recognized using the straight-line attribution method in the condensed consolidated statements of operations is as follows:

Three months ended September 30, | Nine months ended September 30, | ||||||||||||||

($ in thousands) | 2015 | 2014 | 2015 | 2014 | |||||||||||

Stock-based compensation expense for employees and directors | $ | 506 | $ | 266 | $ | 1,550 | $ | 1,002 | |||||||

Equity awards for non-employees issued for services | — | — | — | 3 | |||||||||||

Total stock-based compensation expense | $ | 506 | $ | 266 | $ | 1,550 | $ | 1,005 | |||||||

The following table summarizes stock option activity for the nine months ended September 30, 2015:

($ in thousands except share and per share data) | Number of shares | Weighted- average exercise price | Weighted-average remaining contractual term | Aggregate intrinsic value | ||||||||

Outstanding at December 31, 2014 | 2,086,450 | $ | 7.43 | 8 years | $ | — | ||||||

Granted | 1,352,114 | 4.48 | ||||||||||

Exercised | (56,250 | ) | 4.53 | |||||||||

Forfeited | (178,970 | ) | 5.63 | |||||||||

Expired | (12,000 | ) | 10.50 | |||||||||

Outstanding at September 30, 2015 | 3,191,344 | $ | 6.32 | 8 years, 1 month | $ | 602 | ||||||

Exercisable at September 30, 2015 | 1,469,897 | $ | 8.81 | 7 years | $ | 189 | ||||||

12

Fibrocell Science, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 7. Stock-Based Compensation (continued)

The total fair value of options vested during the nine months ended September 30, 2015 was approximately $1.3 million. As of September 30, 2015, there was approximately $4.5 million of total forfeiture adjusted unrecognized compensation cost, related to time-based non-vested stock options. That cost is expected to be recognized over a weighted-average period of 2.9 years. As of September 30, 2015, there was no unrecognized compensation expense related to non-vested non-employee options.

During the nine months ended September 30, 2015 and 2014, the weighted average fair market value of the options granted was $3.59 and $2.64, respectively. The fair market value of these options was computed using the Black-Scholes option-pricing model with the following key weighted average assumptions for the nine months ended as of the dates indicated:

September 30, 2015 | September 30, 2014 | ||||

Expected life | 6 years, 1 month | 5 years, 11 months | |||

Interest rate | 1.56 | % | 1.91 | % | |

Dividend yield | — | — | |||

Volatility | 103.2 | % | 70.3 | % | |

The Company uses a peer group to determine historical stock price volatility as it has not had enough standalone trading to satisfy the "look-back" requirements of ASC 718, Compensation: Stock Compensation. For grants issued during the nine months ended September 30, 2015, the Company reassessed those companies it includes in its peer group, which resulted in an increase in volatility as compared to the nine months ended September 30, 2014.

Note 8. Collaboration Agreement with Related Party

The Company and Intrexon are parties to an exclusive channel collaboration agreement, as amended ("ECC"). Randal J. Kirk is the chairman of the board and chief executive officer of Intrexon and, together with his affiliates, owns more than 50% of Intrexon's common stock. Affiliates of Randal J. Kirk also collectively own more than 35% of our common stock. Our directors, Marcus Smith and Julian Kirk (who is the son of Randal J. Kirk), are employees of Third Security, LLC, which is an affiliate of Randal J. Kirk.

For the three months ended September 30, 2015 and 2014, the Company incurred total expenses of $1.8 million and $1.2 million, respectively, with Intrexon. Of the $1.8 million incurred during the 2015 period, $0.7 million related to direct expenses for work performed by Intrexon and $1.1 million related to pass-through costs. Of the $1.2 million incurred during the 2014 period, $0.5 million related to direct expenses for work performed by Intrexon and $0.7 million related to pass-through costs.

For the nine months ended September 30, 2015 and 2014, the Company incurred total expenses of $4.7 million and $3.0 million, respectively, with Intrexon. Of the $4.7 million incurred during the 2015 period, $2.4 million related to direct expenses for work performed by Intrexon and $2.3 million related to pass-through costs. Of the $3.0 million incurred during the 2014 period, $1.7 million related to direct expenses for work performed by Intrexon and $1.3 million related to pass-through costs.

As of September 30, 2015 and December 31, 2014, the Company had outstanding payables to Intrexon of $1.4 million and $1.0 million, respectively.

The Company and Intrexon entered into a letter agreement on September 29, 2015 pursuant to which the parties mutually agreed to terminate their collaboration with respect to the development of potential therapies to treat Ehlers-Danlos Syndrome. As a result, neither party will have any further obligations under the ECC with respect to “autologous human fibroblasts genetically modified to express bioactive Tenascin X locally to correct connective tissue disorders”. All other provisions of the ECC remain in full force and effect.

Note 9. Loss Per Share

Basic loss per share is computed by dividing net loss for the period by the weighted-average number of shares of common stock outstanding during that period. The diluted loss per share calculation gives effect to dilutive stock options,

13

Fibrocell Science, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 9. Loss Per Share (continued)

warrants and other potentially dilutive common stock equivalents outstanding during the period. Diluted loss per share is based on the treasury stock method and includes the effect from potential issuance of common stock, such as shares issuable pursuant to the exercise of stock options and warrants, assuming the exercise of all in-the-money stock options based on the average market price during the period. Common stock equivalents have been excluded where their inclusion would be anti-dilutive.

Details in the computation of basic and diluted loss per share is as follows:

For the three months ended September 30, | For the nine months ended September 30, | ||||||||||||||

($ in thousands except share and per share data) | 2015 | 2014 | 2015 | 2014 | |||||||||||

Loss per share - basic: | |||||||||||||||

Numerator for basic loss per share | $ | (1,521 | ) | $ | (6,012 | ) | $ | (16,802 | ) | $ | (22,278 | ) | |||

Denominator for basic loss per share | 43,021,121 | 40,856,815 | 41,598,632 | 40,766,741 | |||||||||||

Basic loss per common share | $ | (0.04 | ) | $ | (0.15 | ) | $ | (0.40 | ) | $ | (0.55 | ) | |||

Loss per share - diluted: | |||||||||||||||

Numerator for diluted loss per share | $ | (1,521 | ) | $ | (6,012 | ) | $ | (16,802 | ) | $ | (22,278 | ) | |||

Adjustment for income (expense) for change in fair value of warrant liability for dilutive warrants | 1,529 | 1,098 | 1,529 | 2,364 | |||||||||||

Net loss attributable to common share | $ | (3,050 | ) | $ | (7,110 | ) | $ | (18,331 | ) | $ | (24,642 | ) | |||

Denominator for basic loss per share | 43,021,121 | 40,856,815 | 41,598,632 | 40,766,741 | |||||||||||

Plus: Incremental shares underlying dilutive “in the money” warrants outstanding | 691,797 | 443,290 | 230,599 | 279,120 | |||||||||||

Denominator for diluted loss per share | 43,712,918 | 41,300,105 | 41,829,231 | 41,045,861 | |||||||||||

Diluted net loss per common share | $ | (0.07 | ) | $ | (0.17 | ) | $ | (0.44 | ) | $ | (0.60 | ) | |||

The following potentially dilutive securities have been excluded from the computations of diluted weighted-average shares outstanding, as their effect would be anti-dilutive:

Three months ended September 30, | Nine months ended September 30, | ||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||

“In the money” stock options | 2,733,864 | 35,000 | 1,923,926 | 741,000 | |||||||

“Out of the money” stock options | 457,480 | 2,231,200 | 1,113,960 | 1,571,546 | |||||||

“In the money” warrants | — | — | 801,132 | 400,566 | |||||||

“Out of the money” warrants | 4,741,725 | 4,831,352 | 4,801,476 | 4,831,352 | |||||||

Other securities excluded from the calculation of diluted loss per share: | |||||||||||

Stock options with performance condition | — | — | 66,667 | — | |||||||

Note 10. Equity

Common Stock - 2015 Follow-on Public Offering.

On July 27, 2015, the Company closed an underwritten public offering of shares of the Company's common stock at a price per share of $5.80 per share (the "Offering"). The shares sold in the Offering included 2,586,206 shares of common stock plus an additional 387,930 shares of common stock pursuant to the exercise by the underwriters of the over-allotment option the Company granted to them. Total gross proceeds to the Company in the Offering (including the sale of shares of common stock pursuant to the exercise of the over-allotment option) totaled $17.3 million, and resulted in net proceeds of approximately $15.9 million after the deduction of underwriting discounts and other offering expenses.

14

Fibrocell Science, Inc.

Notes to Condensed Consolidated Financial Statements

(unaudited)

Note 11. Legal Matters

Settlement Agreement and Mutual Release

On or about December 19, 2014, Shandong Fabosaier Bio-Tech Co., Ltd. of China (“Shandong”) and Ran Liu of Vancouver, Canada, who is allegedly a director of Shandong, commenced a lawsuit against the Company in the United States District Court for the Eastern District of Pennsylvania, Case No. 2:14-cv-07180-CMR. The Complaint asserted claims for breach of contract, promissory estoppel, and unjust enrichment against Fibrocell relating to the marketing of our LAVIV product in China and Vancouver. On February 12, 2015, the Company filed an amended answer, additional defenses and counterclaims against Shandong and Ms. Liu. Our counterclaims include counts for trademark infringement, violations of the Lanham Act and the Anti-cybersquatting Consumer Protection Act, unfair competition, and tortious interference with contractual relations resulting from Shandong’s repeated, unauthorized use of our marks on Shandong’s website and in other marketing materials.

In order to avoid the expense, burden and uncertainties inherent in litigation, we entered into a Settlement Agreement and Mutual Release with Shandong and Ms. Liu on September 14, 2015 (the “Settlement Agreement”) to settle all matters in controversy between us relating to this litigation. The Settlement Agreement does not provide for any payments to be made by the parties and contains a mutual release of all claims relating to the subject matter of the litigation. On September 21, 2015, a Stipulation and Order of Dismissal was entered by the Court dismissing all of the claims and counterclaims asserted by the parties in accordance with the Settlement Agreement. Legal fees related to the matter have been expensed as incurred and are included within selling, general and administrative expense in the condensed consolidated statements of operations.

15

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis should be read in conjunction with:

• | our unaudited condensed consolidated financial statements and accompanying notes included in Part I, Item 1 of this Form 10-Q; and |

• | our audited consolidated financial statements and accompanying notes included in our Form 10-K for 2014, as well as the information contained under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Form 10-K for 2014. |

Overview

We are an autologous cell and gene therapy company focused on developing first-in-class treatments for rare and serious skin and connective tissue diseases with high unmet medical needs. All of our product candidates use our proprietary autologous fibroblast technology. Fibroblasts are the most common cells located in skin and connective tissue and are responsible for synthesizing extracellular matrix proteins that provide cellular structure and support. Our autologous fibroblast technology uses our patented manufacturing process, which involves collecting small skin biopsies from patients, separating the tissue into its component cells, then expanding the fibroblast cells using classic tissue culture techniques until the numbers are adequate for repeated injection. In this manner, each patient is treated with cells that were cultivated from his or her own dermal tissue (i.e., autologous).

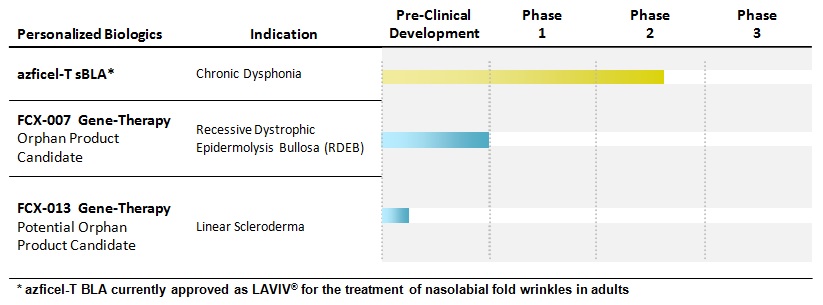

Our current clinical and preclinical development program pipeline consists of the following:

Our most advanced development program is azficel-T for the treatment of chronic dysphonia resulting from vocal cord scarring or atrophy. We are currently in a Phase II clinical trial for this indication. We expect to complete dosing in our Phase II clinical trial by year-end 2015 and announce efficacy results in the second quarter of 2016. In collaboration with Intrexon Corporation, we are also in preclinical development with two gene-therapy product candidates. Our lead gene-therapy product candidate, FCX-007, has received orphan drug designation as well as rare pediatric disease designation from the FDA and is in late-stage preclinical development for the treatment of recessive dystrophic epidermolysis bullosa ("RDEB"), a devastating, rare, congenital, painful, progressive blistering skin disease that typically leads to premature death. We are also in preclinical development of our second gene-therapy product candidate, FCX-013, for the treatment of linear scleroderma, an excess production of extracellular matrix characterized by skin fibrosis and linear scars. We plan to seek orphan drug designation for FCX-013.

Development Programs

Azficel-T for Chronic Dysphonia

Dysphonia is a reduction in vocal capacity and is caused by damage to the fibroblast layer of the vocal cords, which limits airflow and results in severe and significant limitations in voice quality. Depending on the severity of dysphonia, a patient's resulting voice is hoarse or raspy and is perceived by sufferers as a communication disorder. Severe cases can lead to a total loss of voice. The number of U.S. patients suffering from chronic dysphonia caused by vocal cord scarring is approximately 125,000. No long-term effective therapy is presently available, and rehabilitation of subjects (for example, with voice therapy) is difficult. In our Phase I clinical trial of azficel-T for chronic dysphonia, which involved a feasibility study to determine the safety and efficacy of injections for the treatment of chronic dysphonia in patients who had failed to improve

16

following currently available treatments, a positive trend of sustained improvement was noted in a majority of clinical trial subjects. Our Phase II clinical trial for chronic dysphonia currently in progress is a double-blind, randomized, placebo-controlled trial that is designed to test the safety and efficacy of azficel-T in subjects with chronic dysphonia caused by idiopathic vocal cord scarring or atrophy. Efficacy endpoints will be assessed four months after administration of final treatment. We expect to complete dosing in our Phase II trial by year-end 2015, and to report efficacy results in the second quarter of 2016.

Through September 30, 2015, we have incurred approximately $2.2 million in direct research and development costs related to the azficel-T for chronic dysphonia program, life-to-date.

FCX-007 for RDEB

Recessive dystrophic epidermolysis bullosa is a congenital, progressive, devastatingly painful and debilitating genetic disorder that often leads to death, and is the most severe form of dystrophic epidermolysis bullosa ("DEB"). RDEB is caused by a mutation of the COL7A1 gene, the gene which encodes for type VII collagen ("COL7"), a protein that forms anchoring fibrils. Anchoring fibrils hold together the layers of skin, and without them, skin layers separate causing severe blistering, open wounds and scarring in response to any kind of friction, including normal daily activities like rubbing or scratching. Children who inherit the condition are often called "butterfly children" because their skin is as fragile as a butterfly's wings. We estimate that there are approximately 1,100 - 2,500 RDEB patients in the United States. Current treatments for RDEB address only the sequelae, including daily bandaging, hydrogel dressings, antibiotics, feeding tubes and surgeries.

FCX-007, our lead gene-therapy product candidate, is an autologous fibroblast cell genetically modified to express COL7. We are developing FCX-007 in collaboration with Intrexon. We submitted an investigational new drug application ("IND") for FCX-007 to the FDA in July 2015. In September 2015, we received feedback from the FDA on the IND which delayed the initiation of our proposed Phase I/II clinical trial. The FDA's feedback related to the areas of CMC, toxicology and our proposed Phase I/II clinical trial protocol. Although the hybrid pharmacology/toxicology study performed based on the injection of FCX-007 into human skin that was xenografted onto SCID (severe combined immunodeficiency) mice was included in the IND and showed no signs of toxicity, the FDA requested that we execute a toxicology-specific study in which FCX-007 will be injected in non-grafted SCID mice. The new toxicology study is targeted to initiate in the fourth quarter of 2015. We expect to amend the IND in response to the FDA's feedback and to include data from the new toxicology study in the first quarter of 2016. As a result, we now expect to initiate a Phase I/II clinical trial for FCX-007 in the second quarter of 2016 subject to successful completion of the new toxicology study and addressing the FDA's other feedback.

Through September 30, 2015, we have incurred approximately $16.1 million in direct research and development costs related to the FCX-007 program, life-to-date, which includes non-cash expenses of $6.9 million in stock issuance costs associated with the original exclusive channel collaboration agreement with Intrexon.

FCX-013 for Linear Scleroderma

Linear scleroderma is a localized autoimmune skin disorder that manifests as excess production of extracellular matrix characterized by fibrosis and linear scars. The linear areas of skin thickening may extend to underlying tissue and muscle in children which may impair growth and development. Lesions appearing across joints can be painful, impair motion and may be permanent. Current treatments only address symptoms, including systemic or topical corticosteroids, UVA light therapy and physical therapy. Our second gene-therapy product candidate, FCX-013, is also being developed in collaboration with Intrexon and is currently in preclinical development for the treatment of linear scleroderma. Our product development efforts to date have included gene selection and design, transduction efficiency and protein expression analysis, ligand development for use in connection with Intrexon's proprietary RheoSwitch Therapeutic System® ("RTS®") expression technology and analytical assay design. RTS® is a biologic switch activated by a small molecule ligand that provides the ability to control level and timing of protein expression in those diseases where such control is critical. Research is ongoing to select the optimal gene configuration, optimize RTS® control, develop animal models to establish proof of concept and progress the regulatory path for FCX-013. We expect to complete the proof-of-concept studies in the first half of 2016 and plan to submit our IND to the FDA in the fourth quarter of 2016.

Through September 30, 2015, we have incurred approximately $8.9 million in direct research and development costs related to the FCX-013 program, life-to-date, which includes non-cash expenses of $6.4 million in stock issuance costs associated with the first amendment to the exclusive channel collaboration agreement with Intrexon. The first amendment related to the Company's current and future autoimmune development programs, of which linear scleroderma is the first.

17

Research Collaboration with UCLA

We have a scientific research collaboration with the Regents of the University of California, Los Angeles ("UCLA") focusing on discoveries and technologies related to regenerative medicine. The technologies from this collaboration with UCLA may provide new development programs.

Commercial Programs

LAVIV (azficel-T) for Nasolabial Fold Wrinkles

LAVIV (azficel-T) is an FDA-approved biological product that uses our proprietary autologous fibroblast technology for the improvement of the appearance of moderate to severe nasolabial fold wrinkles in adults. In 2013, we shifted our strategic focus to rare skin and connective tissue diseases, resulting in the clinical and preclnical product candidates mentioned above. As a result, we no longer actively market or promote LAVIV to physicians but will continue to accept prescriptions, for which we expect a nominal amount in 2015. Given the limited use of LAVIV, we are experiencing difficulties in recruiting a sufficient number of subjects for the postmarketing study that the FDA required as a condition for the approval of LAVIV. We are actively engaged in discussions with the FDA about how to fulfill the requirement in light of the limited population of LAVIV users.

Results of Operations

Comparison of Three Months Ended September 30, 2015 and 2014

Revenue and Cost of Revenue.

Revenue and cost of revenue was comprised of the following:

Three months ended September 30, | Increase (Decrease) | |||||||||||||

($ in thousands) | 2015 | 2014 | $ | % | ||||||||||

Revenue from product sales | $ | 49 | $ | 20 | $ | 29 | 145.0 | % | ||||||

Collaboration revenue | 30 | — | 30 | 100.0 | % | |||||||||

Total revenue | 79 | 20 | 59 | 295.0 | % | |||||||||

Cost of product sales | 62 | 512 | (450 | ) | (87.9 | )% | ||||||||

Cost of collaboration revenue | 142 | — | 142 | 100.0 | % | |||||||||

Total cost of revenue | 204 | 512 | (308 | ) | (60.2 | )% | ||||||||

Gross loss | $ | (125 | ) | $ | (492 | ) | $ | 367 | (74.6 | )% | ||||

Revenue from product sales is recognized based on the shipment of LAVIV injections to patients and was immaterial for each of the three months ended September 30, 2015 and 2014, as the Company has not actively promoted LAVIV since 2013. Collaboration revenue is related to a research and development agreement that we have with an unrelated third party to investigate potential new non-pharmaceutical applications for our conditioned fibroblast media technology. Revenue recognized from our collaboration relates to an upfront license fee and a proof of concept study currently underway. No collaboration revenue was recognized in the comparable 2014 period.

Cost of product sales includes the costs related to the processing of cells for LAVIV, including direct and indirect costs. The decrease of approximately $0.5 million in the 2015 period compared to the 2014 period is primarily due to our continued de-emphasis on commercial sales in the aesthetic market (LAVIV) as well as the increase in clinical manufacturing which reduces the allocation of fixed overhead costs to commercial sales. We believe that cost of product sales will remain at or above product sales for the foreseeable future and, thus, we anticipate that we will continue to report gross losses from product sales of LAVIV. Cost of collaboration revenue was approximately $0.1 million for the three months ended September 30, 2015, and consists primarily of manufacturing costs related to a proof of concept study which began in 2015.

Research and Development Expense.

For each of our research and development programs, we incur both direct and indirect expenses. Direct expenses include third party costs related to these programs such as contract research, consulting, preclinical and clinical development costs. Indirect expenses include regulatory, laboratory, personnel, facility, stock compensation and other overhead costs that we do not allocate to any specific program. We expect research and development costs to continue to be significant for the

18

foreseeable future as we continue in our efforts to develop first-in-class treatments for rare and serious skin and connective tissue diseases.

Research and development expense was comprised of the following:

Three months ended September 30, | Increase (Decrease) | |||||||||||||

($ in thousands) | 2015 | 2014 | $ | % | ||||||||||

Direct costs: | ||||||||||||||

azficel-T for chronic dysphonia | $ | 218 | $ | 183 | $ | 35 | 19.1 | % | ||||||

FCX-007 | 1,298 | 1,135 | 163 | 14.4 | % | |||||||||

FCX-013 | 512 | 74 | 438 | 591.9 | % | |||||||||

Other | 23 | 210 | (187 | ) | (89.0 | )% | ||||||||

Total direct costs | 2,051 | 1,602 | 449 | 28.0 | % | |||||||||

Indirect costs: | ||||||||||||||

Regulatory costs | 236 | 246 | (10 | ) | (4.1 | )% | ||||||||

Intangible amortization | 138 | 138 | — | — | ||||||||||

Compensation and related expense | 1,165 | 752 | 413 | 54.9 | % | |||||||||

Process development | 481 | — | 481 | 100.0 | % | |||||||||

Other indirect R&D costs | 150 | 331 | (181 | ) | (54.7 | )% | ||||||||

Total indirect costs | 2,170 | 1,467 | 703 | 47.9 | % | |||||||||

Total research and development expense | $ | 4,221 | $ | 3,069 | $ | 1,152 | 37.5 | % | ||||||

Total research and development expense increased approximately $1.2 million, or 38%, for the three months ended September 30, 2015 as compared to the same period last year. This increase is discussed by program below.

Direct research and development expense by major clinical and preclinical development program was as follows:

• | azficel-T for chronic dysphonia — Our Phase II clinical trial began enrollment in the second quarter of 2014. Costs were relatively constant for the three months ended September 30, 2015 as compared to the same period last year. |

• | FCX-007 — Costs increased approximately $0.2 million for the three months ended September 30, 2015 as compared to the same period last year. The increase was primarily due to the progression of our preclinical development program and additional IND enabling development work performed related to the IND filed with the FDA in July 2015. |

• | FCX-013 — Costs increased approximately $0.4 million for the three months ended September 30, 2015 as compared to the same period last year due to increases in costs incurred with Intrexon related to the advancement of our preclinical work, specifically for gene screening and selection, construct build and optimization, vector optimization, assay development, RheoSwitch® and ligand optimization and early animal model work. |

• | Other - Other direct research and development expenses decreased approximately $0.2 million for the three months ended September 30, 2015 as compared to the same period last year due to the reduction of efforts on our azficel-T program for the treatment of restrictive burn scarring. Enrollment for the Phase II clinical trial for this indication was closed in the fourth quarter of 2014 and the trial is continuing with the subjects currently enrolled. |

Total indirect research and development expense increased by $0.7 million for the three months ended September 30, 2015 as compared to the same period last year. This increase is primarily due to an increase in compensation and related expense of $0.4 million and process development costs of $0.5 million, offset by a decrease in other miscellaneous indirect costs of $0.2 million. The overall increases in compensation and related expense and process development costs are primarily due to a greater allocation of fixed overhead costs for our manufacturing facility to indirect research and development expense, as the result of lower commercial volume of LAVIV, and additional resources directed towards optimizing our current manufacturing processes which will benefit our ongoing development programs.

19

Selling, General and Administrative Expense.

Selling, general and administrative expense was comprised of the following:

Three months ended September 30, | Increase (Decrease) | |||||||||||||

($ in thousands) | 2015 | 2014 | $ | % | ||||||||||

Compensation and related expense | $ | 1,304 | $ | 1,102 | $ | 202 | 18.3 | % | ||||||

Professional fees | 461 | 769 | (308 | ) | (40.1 | )% | ||||||||

Facilities and related expense and other | 712 | 759 | (47 | ) | (6.2 | )% | ||||||||

Total selling, general and administrative expense | $ | 2,477 | $ | 2,630 | $ | (153 | ) | (5.8 | )% | |||||

Selling, general and administrative expense decreased by approximately $0.2 million, or 6%, for the three months ended September 30, 2015 as compared to the same period last year. This decrease is primarily attributable to a $0.3 million decrease in professional fees, particularly legal fees related to contract negotiations and contracted labor costs incurred during the same period in 2014. These decreases were partially offset by a $0.2 million increase in compensation and related expense due to an increase in stock-based compensation and an increase in salaries and wages.

Warrant Revaluation and Other Finance Income.

During the three months ended September 30, 2015 and 2014, we recorded non-cash warrant income of approximately $5.3 million and $0.2 million in our condensed consolidated statements of operations, respectively, related to the change in the fair value of our warrants. The significant increase in non-cash warrant income recognized during the three months ended September 30, 2015 over the same period in the prior year was caused by a the reduction in the fair value of our warrants, primarily due to the larger decrease in our stock price experienced during the three months ended September 30, 2015 compared to the three months ended September 30, 2014, as well as the continued decline in the weighted average remaining term of the outstanding warrants.

Comparison of Nine Months Ended September 30, 2015 and 2014

Revenue and Cost of Revenue.

Revenue and cost of revenue was comprised of the following:

Nine months ended September 30, | Increase (Decrease) | |||||||||||||

($ in thousands) | 2015 | 2014 | $ | % | ||||||||||

Revenue from product sales | $ | 217 | $ | 124 | $ | 93 | 75.0 | % | ||||||

Collaboration revenue | 193 | — | 193 | 100.0 | % | |||||||||

Total revenue | 410 | 124 | 286 | 230.6 | % | |||||||||

Cost of product sales | 283 | 1,852 | (1,569 | ) | (84.7 | )% | ||||||||

Cost of collaboration revenue | 230 | — | 230 | 100.0 | % | |||||||||

Total cost of revenue | 513 | 1,852 | (1,339 | ) | (72.3 | )% | ||||||||

Gross profit (loss) | $ | (103 | ) | $ | (1,728 | ) | $ | 1,625 | (94.0 | )% | ||||

Revenue from product sales is recognized based on the shipment of LAVIV injections to patients. Although the number of injections can fluctuate from period to period, product revenues continue to be, and are expected to remain, insignificant to our operations. Collaboration revenue received in 2015 is related to a research and development agreement that we have with an unrelated third party to investigate potential new non-pharmaceutical applications for our conditioned fibroblast media technology. This revenue relates to an upfront license fee and a proof of concept study currently underway. No collaboration revenue was recognized in the comparable 2014 period.

Cost of product sales includes the costs related to the processing of cells for LAVIV, including direct and indirect costs. The decrease of $1.6 million is primarily due to our continued de-emphasis on commercial sales in the aesthetic market (LAVIV) as well as the increase in clinical manufacturing which reduces the allocation of fixed overhead costs to commercial sales. We believe that cost of product sales will remain at or above product sales for the foreseeable future and, thus, we anticipate that we will continue to report gross losses from product sales of LAVIV. Cost of collaboration revenue recognized during the nine months ended September 30, 2015 consists primarily of manufacturing costs related to a proof of concept study which began in 2015.

20

Research and Development Expense.

For each of our research and development programs, we incur both direct and indirect expenses. Direct expenses include third party costs related to these programs such as contract research, consulting, preclinical and clinical development costs. Indirect expenses include regulatory, laboratory, personnel, facility, stock compensation and other overhead costs that we do not allocate to any specific program. We expect research and development costs to continue to be significant for the foreseeable future as we continue in our efforts to develop first-in-class treatments for rare and serious skin and connective tissue diseases with high unmet medical needs.

Research and development expense was comprised of the following:

Nine months ended September 30, | Increase (Decrease) | |||||||||||||

($ in thousands) | 2015 | 2014 | $ | % | ||||||||||

Direct costs: | ||||||||||||||

azficel-T for chronic dysphonia | $ | 942 | $ | 381 | $ | 561 | 147.2 | % | ||||||

FCX-007 | 3,527 | 2,757 | 770 | 27.9 | % | |||||||||

FCX-013 | 1,216 | 336 | 880 | 261.9 | % | |||||||||

Ehlers-Danlos Syndrome (hypermobility type) | — | 5,176 | (5,176 | ) | (100.0 | )% | ||||||||

Other | 122 | 501 | (379 | ) | (75.6 | )% | ||||||||

Total direct costs | 5,807 | 9,151 | (3,344 | ) | (36.5 | )% | ||||||||

Indirect costs: | ||||||||||||||

Regulatory costs | 716 | 638 | 78 | 12.2 | % | |||||||||

Intangible amortization | 414 | 414 | — | — | ||||||||||

Compensation and related expense | 2,981 | 2,185 | 796 | 36.4 | % | |||||||||

Process development | 552 | 37 | 515 | 1,391.9 | % | |||||||||

Other indirect R&D costs | 1,432 | 1,484 | (52 | ) | (3.5 | )% | ||||||||

Total indirect costs | 6,095 | 4,758 | 1,337 | 28.1 | % | |||||||||

Total research and development expense | $ | 11,902 | $ | 13,909 | $ | (2,007 | ) | (14.4 | )% | |||||

Total research and development expense decreased approximately $2.0 million, or 14%, for the nine months ended September 30, 2015 as compared to the same period last year. The overall decrease is due primarily to $5.2 million of supplemental stock issuance costs incurred in the 2014 period related to our Ehlers-Danlos Syndrome (hypermobility type) program in connection with the second amendment to the exclusive channel collaboration agreement with Intrexon. Excluding the non-recurring supplemental stock issuance costs incurred in the 2014 period, total research and development costs would have increased approximately $3.2 million, or 36%, for the nine months ended September 30, 2015 as compared to the same period last year. This increase is discussed by program below.

Direct research and development expense by major clinical and preclinical development program was as follows:

• | azficel-T for chronic dysphonia — Our Phase II clinical trial began enrollment in the second quarter of 2014. Costs increased approximately $0.6 million for the nine months ended September 30, 2015 as compared to the same period last year due to costs for additional patient enrollment, clinical site fees and clinical manufacturing costs. |

• | FCX-007 — Costs increased approximately $0.8 million for the nine months ended September 30, 2015 as compared to the same period last year due to the progression of our preclinical development program, specifically our animal studies and preclinical product manufacturing costs, as well as additional IND enabling development work performed related to the IND filed with the FDA in July 2015. |