Attached files

| file | filename |

|---|---|

| S-1/A - AMENDMENT NO. 1 TO FORM S-1 - PB Bancorp, Inc. | t1502162_s1a.htm |

| EX-1.2 - EXHIBIT 1.2 - PB Bancorp, Inc. | t1502162_ex1-2.htm |

| EX-8.2 - EXHIBIT 8.2 - PB Bancorp, Inc. | t1502162_ex8-2.htm |

| EX-8.1 - EXHIBIT 8.1 - PB Bancorp, Inc. | t1502162_ex8-1.htm |

| EX-23.2 - EXHIBIT 23.2 - PB Bancorp, Inc. | t1502162_ex23-2.htm |

| EX-99.5 - EXHIBIT 99.5 - PB Bancorp, Inc. | t1502162_ex99-5.htm |

| EX-23.4 - EXHIBIT 23.4 - PB Bancorp, Inc. | t1502162_ex23-4.htm |

| EX-23.3 - EXHIBIT 23.3 - PB Bancorp, Inc. | t1502162_ex23-3.htm |

Exhibit 99.4

MARKETING MATERIALS

prepared for:

PUTNAM BANK

SECOND STEP CONVERSION

October 2015

Putnam Bank

Second Step Transaction

Marketing Materials

TABLE OF CONTENTS

These documents (non-typeset) are included behind this index. All other listed documents (typeset) are included in the accompanying email enclosures.

LETTERS

Subscription and Community Offering Stock Order Acknowledgment Letter

Final Reminder Proxygram (if needed)

ADVERTISEMENTS/SIGNS

Branch Lobby Poster – Vote

Branch Lobby Poster – Buy (Optional)

Final Branch Lobby Poster (if needed)

Bank Statement Enclosure - Vote Reminder Slip (Optional)

Bank Website Vote Reminder Notice (Optional)

Bank Website Voting Link (Optional)

Recorded Message to High Vote Depositors (Optional)

Email Vote Reminder (Optional)

Tombstone Newspaper Advertisement (Optional)

NOTE: The above are offering – related documents. Upon closing the transaction, minority stockholders holding stock certificates will be mailed share exchange documents. The documents will be drafted at a later date. (Street name beneficial owners will have automatic share exchange within their accounts.)

NOTE: Stockholders may buy in the Community Offering. Their proxy statement/prospectus will inform them that they may contact the Stock Information Center if they would like a prospectus and order form.

SUBSCRIPTION AND COMMUNITY OFFERING STOCK ORDER ACKNOWLEDGEMENT LETTER

[PB Bancorp, Inc. Letterhead]

| [Imprinted with Name & Address of Subscriber] | Date |

STOCK ORDER ACKNOWLEDGEMENT

This letter is to acknowledge receipt of your order form to purchase common stock offered by PB Bancorp, Inc. Please check the following information carefully to ensure that we have entered your order correctly. Each order is assigned an order priority described below. Acceptance of your order does not guarantee that you will receive the shares you have ordered. If there are not sufficient shares available to satisfy all subscriptions, the shares of common stock you will receive is subject to the allocation provisions of the plan of conversion and reorganization, as well as other conditions and limitations described in the PB Bancorp, Inc. Prospectus dated __________, 2015. Refer to the PB Bancorp, Inc. Prospectus for further information regarding subscription priorities. Shares will be allocated first to categories in the subscription offering in the order of priority set forth below.

Following completion of the offering, allocation information, when available, will be released as soon as practicable on the following website: https://allocations.kbw.com/

|

Stock Registration (please review carefully) Name1 Name2 Street1 Street2 City, State Zip Ownership: Social Security / Tax ID #: |

Other Order Information: Batch #: _____ Order #: _____ Number of Shares Requested: _________ Offering Category: _____ (subject to verification; see descriptions below)

|

Offering Category Descriptions:

Subscription Offering

| · | Depositors of Putnam Bank with aggregate balances of at least $50 at the close of business on July 1, 2014; |

| · | Putnam Bank’s Employee Stock Ownership Plan; |

| · | Depositors of Putnam Bank with aggregate balances of at least $50 at the close of business on September 30, 2015; and |

| · | Depositors of Putnam Bank at the close of business on November 3, 2015. |

Community Offering

| · | Residents of New London and Windham Counties, Connecticut; |

| · | PSB Holdings, Inc.’s public stockholders as of November 3, 2015; and |

| · | General Public |

Thank you for your order,

PB BANCORP, INC.

STOCK INFORMATION CENTER

1-(877) 821-5778

FINAL REMINDER PROXYGRAM (if needed)

[Putnam Bank Letterhead]

(Depending on vote status and number of days until the special meeting of depositors, this can be mailed. It can be personalized, as shown - or it can be a short, non-personalized version printed on a postcard. Both alternatives allow quick mailing and quick receipt of the vote, because proxy cards and return envelopes are not enclosed.)

Dear Depositor,

WE REQUEST YOUR VOTE.

Not voting the Proxy Card(s) we mailed to you has the same effect as voting “Against” the plan of conversion.

IF YOU HAVE NOT VOTED OR ARE UNSURE WHETHER YOU VOTED:

Please take a few minutes to call the number shown below. A representative of Laurel Hill, our Independent Voting Agent, will record your confidential vote by phone. This is the quickest way to cast your vote. You do NOT need your Proxy Card in order to vote.

If you are unsure whether you voted, don’t worry. Your vote will not be counted twice.

VOTING HOTLINE:

________________________

1- ( ) ____ - ____ (toll-free)

DAYS/HOURS:

Monday - Friday

____ a.m. to ____ p.m., Eastern Time

I appreciate your participation.

Sincerely,

Thomas A. Borner

President and Chief Executive Officer

BRANCH LOBBY POSTER - VOTE

[This notice should be printed by Putnam Bank, and should be placed in the branch lobby after the Stock Information Center opens. Position it in one or more ways: on an easel, on the front doors, on counters, at customer service/branch manager’s desk or electronically on the TVs in the branch.]

HAVE YOU VOTED YET?

We would like to remind eligible depositors to vote on our

plan of conversion (the “Plan”).

| ü | The Plan will not result in changes to our staff or your account relationships with Putnam Bank. |

| ü | Your deposit accounts will continue to be insured by the FDIC, up to the maximum legal limits. |

| ü | Voting does not obligate you to purchase shares of common stock during our stock offering. |

Your Board of Directors recommends that you join them in voting “FOR” the Plan.

If you have questions about voting,

call our Information Center, toll-free,

at 1-(877) 821-5778,

from 10:00 a.m. to 4:00 p.m., Monday through Friday.

Our Information Center is closed on bank holidays.

[Putnam Bank Logo]

This notice is neither an offer to sell nor a solicitation of an offer to buy shares of common stock. The offer is made only by the Prospectus. The shares of common stock are not deposits or savings accounts and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

BRANCH LOBBY POSTER – BUY (Optional)

******************************

OUR SUBSCRIPTION STOCK OFFERING EXPIRES DECEMBER 16, 2015

We are conducting a subscription offering of shares of our common stock

UP TO 3,953,125 SHARES

COMMON STOCK

(subject to increase to 4,546,094 shares)

$8.00 Per Share

THIS SUBSCRIPTION OFFERING EXPIRES AT 2:00 P.M., EASTERN TIME,

ON DECEMBER 16, 2015

******************************

If you have questions about the stock offering,

call our Stock Information Center, toll-free, at 1-(877) 821-5778,

from 10:00 a.m. to 4:00 p.m., Monday through Friday.

Our Stock Information Center is closed on bank holidays.

[PB Bancorp, Inc. Logo]

This notice is neither an offer to sell nor a solicitation of an offer to buy shares of common stock. The offer is made only by the Prospectus. These securities are not deposits or savings accounts and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

FINAL BRANCH LOBBY POSTER (if needed)

[To encourage “late” voting. Tear-off phone number slips can accompany this poster. Generally, this poster is used after a Final Reminder Proxygram is mailed.]

PLEASE VOTE NOW!!!

You do not need YOUR proxy card in order to vote.

TO PLACE YOUR CONFIDENTIAL VOTE BY PHONE:

Take a minute to call

Laurel Hill, our Independent Voting Agent,

at 1-(___) -___-____ (toll-free),

Monday through Friday,

____ a.m. to ____ p.m.

If you are unsure whether you voted already, please call. Your vote will not be counted twice!

YOUR BOARD OF DIRECTORS ASKS THAT YOU VOTE

“FOR” the Plan of Conversion (the “Plan”).

NOT VOTING HAS THE SAME EFFECT

AS VOTING “AGAINST” THE PLAN.

THANK YOU!

[Putnam Bank logo]

This notice is neither an offer to sell nor a solicitation of an offer to buy shares of common stock. The offer is made only by the Prospectus. The shares of common stock are not deposits or savings accounts and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

BANK STATEMENT ENCLOSURE - VOTE REMINDER SLIP - (Optional)

You may have received a large white envelope containing a Proxy Card(s) to be used to vote on our organization’s plan of conversion. If you received a Proxy Card(s), but have not voted, please do so. If you have questions about voting, call our Information Center, toll-free, at 1-(877) 821-5778, Monday through Friday, 10:00 a.m. to 4:00 p.m., Eastern Time. Our Information Center is closed on bank holidays.

[Putnam Bank logo]

BANK WEBSITE VOTE REMINDER NOTICE – (Optional)

HAVE YOU VOTED YET?

YOUR VOTE IS IMPORTANT!

Our depositors as of November 3, 2015 were mailed Proxy Card(s) and other materials requesting them to cast votes regarding our plan of conversion (the “Plan”).

If you received Proxy Cards but have not voted, please vote by mail or by following the telephone or Internet voting instructions on the Proxy Card(s). We hope that you will vote “FOR” the Plan. If you have questions about voting, please call our Information Center, toll-free, at 1-(877) 821-5778, Monday through Friday, 10:00 a.m. to 4:00 p.m., Eastern Time. Our Information Center is closed on bank holidays.

BANK WEBSITE VOTING LINK – (Optional)

HAVE YOU VOTED YET?

Our depositors and stockholders as of November 3, 2015 were mailed Proxy Card(s) and other materials requesting them to cast votes regarding our plan of conversion. If you have not yet voted, a quick way to do so is to click on the link below. This will link you to a confidential voting site.

DEPOSITORS VOTE HERE NOW www.myproxyvotecounts.com

Thank you for taking a few minutes to cast your vote online. Have your Proxy Card in hand so that you can enter online the 12 digit control number printed on your Proxy Card.

STOCKHOLDERS VOTE HERE NOW www.

RECORDED MESSAGE TO HIGH VOTE DEPOSITORS

(This automatic dial message, meant to encourage depositors to open offering/proxy packages, will be used one time - right after the initial packages are mailed)

“Hello - This is Tom Borner, President and CEO of Putnam Bank calling with a quick message. Within the next few days, you will be receiving a package or packages from us about our stock offering and asking you to vote on an item of importance to our bank and our valued depositors. Please help us by opening the package and voting PROMPTLY. The materials will include a phone number to call if you have questions.

Thank you for voting. We appreciate your business and look forward to continuing to serve you as a customer of Putnam Bank.”

EMAIL VOTE REMINDER – (Optional)

(Email reminder is best sent after initial contacts, but before most people will have discarded materials.)

HAVE YOU VOTED YOUR PROXY CARDS?

YOUR VOTE IS IMPORTANT TO US!

If you were a Putnam Bank depositor on November 3, 2015, you recently received a large white envelope containing proxy materials requesting your vote on our plan of conversion (the “Plan”).

If you have not yet voted, please promptly vote each Proxy Card you received. None are duplicates! Proxy Cards describe the simple procedures for voting by mail, telephone or Internet.

Without sufficient favorable votes, we cannot implement the Plan. NOT VOTING HAS THE SAME EFFECT AS VOTING "AGAINST" THE PLAN.

Do you have questions about the Plan or voting?

Please call our Information Center, toll-free, at 1-(877) 821-5778, Monday through Friday, 10:00 a.m. to 4:00 p.m., Eastern Time. Our Information Center is closed on bank holidays.

We appreciate your participation.

TOMBSTONE NEWSPAPER ADVERTISEMENT- (Optional)

[Newspaper ads may be appropriate for some market areas]

PB BANCORP, INC.

Proposed Holding Company for Putnam Bank

UP TO 3,953,125 SHARES

COMMON STOCK

(subject to increase to up to 4,546,094 shares)

$8.00 Per Share

Purchase Price

PB Bancorp, Inc. is conducting an offering of its common stock. Shares may be purchased directly from PB Bancorp, Inc., without sales commission, during the offering period.

This offering expires at 2:00 p.m., Eastern Time, on December 16, 2015.

To receive a copy of the Prospectus and Stock Order Form,

call our Stock Information Center, toll-free, at 1-(877) 821-5778,

from 10:00 a.m. to 4:00 p.m., Eastern Time, Monday through Friday.

Our Stock Information Center is closed on bank holidays.

This advertisement is neither an offer to sell nor a solicitation of an offer to buy shares of common stock. The offer is made only by the Prospectus. These securities are not deposits or savings accounts and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Dear Valued Depositor:

I am pleased to tell you about an investment opportunity and, just as importantly, to request your vote. Pursuant to a plan of conversion and reorganization (the “Plan”), our organization will convert from the mutual holding company to the stock holding company form of organization. To accomplish the conversion, PB Bancorp, Inc., newly formed to own Putnam Bank, is offering shares of its common stock. Enclosed you will find a Prospectus, a Proxy Statement and a Questions and Answers Brochure describing the proxy vote, the offering and the Plan.

THE PROXY VOTE:

Your vote is extremely important for us to meet our goals. The Plan is subject to approval by Putnam Bank’s depositors. NOT VOTING YOUR ENCLOSED PROXY CARD(S) WILL HAVE THE SAME EFFECT AS VOTING “AGAINST” THE PLAN. Note that you may receive more than one Proxy Card, depending on the ownership structure of your accounts at Putnam Bank. Please vote all the Proxy Cards you receive — none are duplicates! To cast your vote, please sign and date each Proxy Card and return the card(s) in the Proxy Reply Envelope provided. Alternatively, you may vote by telephone or the Internet by following the simple instructions on the Proxy Card. Our Board of Directors urges you to vote “FOR” the Plan.

Please note:

| • | The proceeds resulting from the sale of stock will support our business strategy. |

| • | There will be no change to account numbers, interest rates or other terms of your accounts at Putnam Bank. Deposit accounts will not be converted to stock. Your deposit accounts will continue to be insured by the FDIC, up to the maximum legal limits. |

| • | You will continue to enjoy the same services with the same Board of Directors, management and staff. |

| • | Voting does not obligate you to purchase shares of common stock in our offering. |

THE STOCK OFFERING:

As an eligible Putnam Bank depositor, you have non-transferable rights, but no obligation, to purchase shares of common stock during our Subscription Offering before any shares are made available for sale to the general public. The common stock is being offered at $8.00 per share, and there will be no sales commission charged to purchasers during the offering.

Please read the enclosed materials carefully. If you are interested in purchasing shares of common stock, complete the enclosed Stock Order Form and return it with full payment. You may submit your Stock Order Form by overnight delivery to the indicated address on the Stock Order Form, by hand-delivery to Putnam Bank’s main office located at 40 Main Street, Putnam, Connecticut, or by mail using the Stock Order Reply Envelope provided. Stock Order Forms and full payment must be received (not postmarked) before 2:00 p.m., Eastern Time, on December 16, 2015. If you are considering purchasing stock with funds you have in an IRA or other retirement account, please call our Stock Information Center promptly for guidance, because these orders require additional processing time.

I invite you to consider this opportunity to share in our future. Thank you for your continued support as a Putnam Bank depositor.

Sincerely,

Thomas A. Borner

President and Chief Executive Officer

This letter is neither an offer to sell nor a solicitation of an offer to buy shares of common stock. The offer is made only by the Prospectus. These securities are not deposits or savings accounts and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

| Questions? |

Call our Stock Information Center, toll-free, at 1-(877) 821-5778,

from 10:00 a.m. to 4:00 p.m., Eastern Time, Monday through Friday, except bank holidays.

| M |

Dear Friend:

I am pleased to tell you about an investment opportunity. PB Bancorp, Inc., newly formed to own Putnam Bank, is offering shares of its common stock for sale at a price of $8.00 per share. No sales commission will be charged to purchasers during the offering.

Our records indicate that you were a depositor as of the close of business on either July 1, 2014 or September 30, 2015, whose account(s) was/were closed thereafter. As such, you have non-transferable rights, but no obligation, to subscribe for shares of common stock during our Subscription Offering before any shares are made available for sale to the general public.

Please read the enclosed materials carefully before making an investment decision. If you are interested in purchasing shares of common stock, complete the enclosed Stock Order Form and return it with full payment. You may submit your Stock Order Form by overnight delivery to the indicated address on the Stock Order Form, by hand-delivery to Putnam Bank’s main office located at 40 Main Street, Putnam, Connecticut, or by mail using the Stock Order Reply Envelope provided. Stock Order Forms and full payment must be received (not postmarked) before 2:00 p.m., Eastern Time, on December 16, 2015. If you are considering purchasing stock with funds you have in an IRA or other retirement account, please call our Stock Information Center promptly for guidance, because these orders require additional processing time.

If you have questions about our organization or purchasing shares, please refer to the enclosed Prospectus and Questions and Answers Brochure, or call our Stock Information Center at the number shown below.

I invite you to consider this opportunity to share in our future as a PB Bancorp, Inc. stockholder.

Sincerely,

Thomas A. Borner

President and Chief Executive Officer

This letter is neither an offer to sell nor a solicitation of an offer to buy shares of common stock. The offer is made only by the Prospectus. These securities are not deposits or savings accounts and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Questions?

Call our Stock Information Center, toll-free, at 1-(877) 821-5778,

from 10:00 a.m. to 4:00 p.m., Eastern Time, Monday through Friday, except bank holidays.

F |

Dear Friend:

I am pleased to tell you about an investment opportunity. PB Bancorp, Inc., newly formed to own Putnam Bank, is offering shares of its common stock for sale at a price of $8.00 per share. No sales commission will be charged to purchasers during the offering.

Please read the enclosed materials carefully before making an investment decision. If you are interested in purchasing shares of PB Bancorp, Inc. common stock, complete the enclosed Stock Order Form and return it with full payment. You may submit your Stock Order Form by overnight delivery to the indicated address on the Stock Order Form, by hand-delivery to Putnam Bank’s main office located at 40 Main Street, Putnam, Connecticut, or by mail using the Stock Order Reply Envelope provided. Stock Order Forms and full payment must be received (not postmarked) before 2:00 p.m., Eastern Time, on December 16, 2015. If you are considering purchasing stock with funds you have in an IRA or other retirement account, please call our Stock Information Center promptly for guidance, because these orders require additional processing time.

If you have questions about our organization or purchasing shares, please refer to the enclosed Prospectus and Questions and Answers Brochure, or call our Stock Information Center at the number shown below.

I invite you to consider this opportunity to share in our future as a PB Bancorp, Inc. stockholder.

Sincerely,

Thomas A. Borner

President and Chief Executive Officer

This letter is neither an offer to sell nor a solicitation of an offer to buy shares of common stock. The offer is made only by the Prospectus. These securities are not deposits or savings accounts and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Questions?

Call our Stock Information Center, toll-free, at 1-(877) 821-5778,

from 10:00 a.m. to 4:00 p.m., Eastern Time, Monday through Friday, except bank holidays.

C |

Dear Sir/Madam:

Keefe, Bruyette & Woods, a Stifel Company has been retained by PB Bancorp, Inc. as selling agent in connection with the offering of PB Bancorp, Inc. common stock.

At the request of PB Bancorp, Inc., we are enclosing materials regarding the offering of shares of PB Bancorp, Inc. common stock. Included in this package is a Prospectus describing the stock offering. We encourage you to read the enclosed information carefully, including the ‘‘Risk Factors’’ section of the Prospectus.

Sincerely,

This letter is neither an offer to sell nor a solicitation of an offer to buy shares of common stock. The offer is made only by the Prospectus. These securities are not deposits or savings accounts and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

D |

IMPORTANT NOTICE

THIS PACKAGE INCLUDES

PROXY CARD(S)

REQUIRING YOUR PROMPT VOTE.

PLEASE VOTE EACH CARD.

THERE ARE NO DUPLICATE CARDS!

THANK YOU!

| PF |

PLEASE VOTE

THE ENCLOSED PROXY CARD!

If you have not yet voted the Proxy Card(s) we recently mailed

to you in a large white package,

please vote the enclosed replacement Proxy Card.

You may vote by mail using the enclosed envelope, or follow the

telephone or Internet voting instructions on the Proxy Card.

PLEASE JOIN YOUR BOARD OF DIRECTORS IN VOTING “FOR” THE PLAN OF CONVERSION AND REORGANIZATION (THE “PLAN”).

NOT VOTING HAS THE SAME EFFECT AS VOTING

“AGAINST” THE PLAN.

VOTING DOES NOT OBLIGATE YOU TO PURCHASE SHARES OF COMMON STOCK DURING THE OFFERING.

THE CONVERSION WILL CHANGE OUR FORM OF CORPORATE ORGANIZATION, BUT WILL NOT RESULT IN CHANGES TO BANK STAFF, MANAGEMENT OR YOUR DEPOSIT ACCOUNTS OR LOANS. DEPOSIT ACCOUNTS WILL CONTINUE TO BE INSURED BY THE FDIC, UP TO THE MAXIMUM LEGAL LIMITS.

If you receive more than one of these reminder mailings,

please vote each Proxy Card received. None are duplicates!

QUESTIONS?

Please call our Information Center, toll-free, at 1-(877) 821-5778, from 10:00 a.m. to 4:00 p.m., Eastern Time, Monday through Friday, except bank holidays.

| PG1 |

HAVE YOU VOTED YET?

PLEASE VOTE THE ENCLOSED

PROXY CARD!

Our records indicate that you have not voted the Proxy Card(s) we mailed to you.

IF YOU ARE UNSURE WHETHER YOU VOTED, PLEASE

VOTE THE ENCLOSED REPLACEMENT PROXY

CARD. YOUR VOTE WILL NOT BE COUNTED TWICE.

NOT VOTING HAS THE SAME EFFECT AS VOTING

“AGAINST” THE PLAN OF CONVERSION AND REORGANIZATION (THE “PLAN”).

You may receive a courtesy telephone call. Please feel free to ask questions.

Your Board of Directors urges you to vote “FOR” the Plan.

VOTING DOES NOT OBLIGATE YOU TO PURCHASE SHARES

OF COMMON STOCK DURING THE OFFERING, NOR DOES IT

AFFECT YOUR PUTNAM BANK

DEPOSIT ACCOUNTS OR LOANS.

If you receive more than one of these reminder mailings,

please vote each Proxy Card received. None are duplicates!

QUESTIONS?

Please call our Information Center, toll-free, at 1-(877) 821-5778,

From 10:00 a.m. to 4:00 p.m., Eastern Time, Monday through Friday,

except bank holidays.

| PG2 |

YOUR VOTE IS IMPORTANT!

NOT VOTING HAS THE SAME EFFECT

AS VOTING AGAINST THE PLAN OF CONVERSION

AND REORGANIZATION (THE “PLAN”).

In order to implement the Plan,

we must obtain the approval of our voting depositors.

Please disregard this notice if you have already voted.

If you are unsure whether you voted,

vote the enclosed replacement Proxy Card.

Your vote will not be counted twice!

If you receive more than one of these reminder mailings,

please vote each Proxy Card received. None are duplicates!

Please note: Implementing the Plan will not affect your deposit accounts or loans at Putnam Bank. Deposit accounts will continue to be insured by the FDIC, up to the maximum legal limits. Voting does not require you to purchase shares of common stock during the offering.

THANK YOU VERY MUCH!

QUESTIONS?

Please call our Information Center toll-free at 1-(877) 821-5778,

From 10:00 a.m. to 4:00 p.m., Eastern Time, Monday through Friday,

except bank holidays.

| PG3 |

| CONTROL NUMBER | PROXY CARD |

|

| þ Please vote by marking one of the boxes as shown. | FOR | AGAINST | ||

| 1. | ||||

| IF SIGNED, THIS PROXY WILL BE VOTED FOR THE PROPOSAL | ||

| STATED IF NO CHOICE IS MADE HEREON | ||

| The undersigned acknowledges receipt of a Notice of Special Meeting and attached proxy statement dated ____, 2015, prior to the execution of this proxy. | ||

| x | ||

| Signature | Date | |

| NOTE: Only one signature is required in the case of a joint deposit account. Please sign exactly as your name appears on this proxy card. When signing as attorney, executor, administrator, trustee or guardian, please give your full title. Corporations or partnership proxies should be signed by an authorized officer. | ||

| 5 FOLD AND DETACH THE PROXY VOTING CARD HERE 5 |

YOUR PROMPT VOTE IS IMPORTANT!

Internet and telephone voting are quick and simple ways to vote, available through

11:59 P.M., Eastern Time, on December 22, 2015

| VOTE BY INTERNET | VOTE BY TELEPHONE (Toll-free) | VOTE BY MAIL | ||

|

WWW.MYPROXYVOTECOUNTS.COM Use the Internet to vote your proxy. Have your Proxy Card in hand when you access the website. You will be prompted to enter online your 12 digit control number, located in the shaded box above. Each Proxy Card has a unique control number. |

OR |

1- (866) 437-4667 Use the touch-tone telephone to vote your proxy. Have your Proxy Card in hand when you call. You will be prompted to enter your 12 digit control number, located in the shaded box above. Each Proxy Card has a unique control number. |

OR |

þ Mark, sign and date your Proxy Card and return it in the postage-paid Proxy Reply Envelope provided. |

If you vote by Internet or by Telephone, you do NOT need to return

your Proxy Card by mail.

NOT VOTING HAS THE SAME EFFECT AS VOTING “AGAINST”

THE PLAN.

PLEASE VOTE ALL PROXY CARDS RECEIVED.

NONE ARE DUPICATES.

REVOCABLE PROXY

PUTNAM BANCORP, MHC

SPECIAL MEETING OF DEPOSITORS

DECEMBER 23, 2015

The Board of Directors recommends a vote “FOR” the Plan.

THE BOARD OF DIRECTORS IS SOLICITING YOUR PROXY.

THIS PROXY, WHEN PROPERLY SIGNED, WILL BE VOTED AS DIRECTED, BUT IF NO INSTRUCTIONS ARE SPECIFIED, THIS PROXY, IF SIGNED, WILL BE VOTED FOR THE PROPOSAL STATED ABOVE. IF ANY OTHER BUSINESS IS PRESENTED AT THE MEETING, THIS PROXY WILL BE VOTED BY THE ABOVE NAMED PROXIES AT THE DIRECTION OF A MAJORITY OF THE BOARD OF DIRECTORS. AT THE PRESENT TIME, THE BOARD OF DIRECTORS KNOWS OF NO OTHER BUSINESS TO BE PRESENTED AT THE MEETING.

PLEASE PROMPTLY COMPLETE, SIGN AND DATE THIS PROXY CARD ON THE REVERSE SIDE AND RETURN IT IN THE ENCLOSED PROXY REPLY ENVELOPE. ALTERNATIVELY, YOU MAY VOTE BY INTERNET OR BY TELEPHONE BY FOLLOWING THE SIMPLE INSTRUCTIONS ON THE REVERSE SIDE.

(CONTINUED ON REVERSE SIDE)

| 5 FOLD AND DETACH THE PROXY VOTING CARD HERE 5 |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE PLAN. NOT

VOTING IS THE EQUIVALENT OF VOTING “AGAINST” THE PLAN. PLEASE

VOTE ALL CARDS THAT YOU RECEIVE. NONE ARE DUPLICATES.

VOTING DOES NOT REQUIRE YOU TO PURCHASE SHARES OF PUTNAM

BANCORP, INC. COMMON STOCK IN THE OFFERING.

STOCK ORDER FORM – SIDE 2

(8) ASSOCIATES/ACTING IN CONCERT (continued from front of Stock Order Form)

Associate – The term “associate” of a person means:

| (1) | any corporation or organization (other than Putnam Bank, PB Bancorp, Inc. PSB Holdings, Inc., or Putnam Bancorp, MHC or a majority-owned subsidiary of any of those entities) of which the person is a senior officer, partner or, directly or indirectly, 10% beneficial stockholder; |

| (2) | any trust or other estate in which the person has a substantial beneficial interest or serves as a trustee or in a similar fiduciary capacity; provided, however, it does not include any employee stock benefit plan in which the person has a substantial beneficial interest or serves as trustee or in a similar fiduciary capacity; and |

| (3) | any blood or marriage relative of the person, who either has the same home as the person or who is a director or officer of PSB Holdings, Inc. or Putnam Bank. |

Acting in concert – The term “acting in concert” means:

| (1) | knowing participation in a joint activity or interdependent conscious parallel action towards a common goal whether or not pursuant to an express agreement; or |

| (2) | a combination or pooling of voting or other interests in the securities of an issuer for a common purpose pursuant to any contract, understanding, relationship, agreement or other arrangement, whether written or otherwise. |

A person or company that acts in concert with another person or company (“other party”) will also be deemed to be acting in concert with any person or company who is also acting in concert with that other party, except that any tax-qualified employee stock benefit plan will not be deemed to be acting in concert with its trustee or a person who serves in a similar capacity solely for determining whether common stock held by the trustee and common stock held by the employee stock benefit plan will be aggregated.

Our directors are not treated as associates of each other solely because of their membership on the Board of Directors. We have the sole discretion to determine whether prospective purchasers are associates or acting in concert. Persons having the same address and persons exercising subscription rights through qualifying deposits registered at the same address will be deemed to be acting in concert, unless we determine otherwise.

Please see the Prospectus section entitled “The Conversion and Offering – Additional Limitations on Common Stock Purchases” for more information on purchase limitations.

(10) ACKNOWLEDGMENT AND SIGNATURE(S) (continued from front of Stock Order Form)

I agree that, after receipt by PB Bancorp, Inc., this Stock Order Form may not be modified or canceled without PB Bancorp, Inc.’s consent, and that if withdrawal from a deposit account has been authorized, the authorized amount will not otherwise be available for withdrawal. Under penalty of perjury, I certify that (1) the Social Security or Tax ID information and all other information provided hereon are true, correct and complete, (2) I am purchasing shares solely for my own account and that there is no agreement or understanding regarding the sale or transfer of such shares, or my right to subscribe for shares, and (3) I am not subject to backup withholding tax [cross out (3) if you have been notified by the IRS that you are subject to backup withholding]. I acknowledge that my order does not conflict with the overall purchase limitation of 62,500 shares in all categories of the offering combined, for any person or entity, together with any associate or group of persons acting in concert, as set forth in the plan of conversion and the Prospectus dated _____________, 2015.

Subscription rights pertain to those eligible to subscribe in the Subscription Offering. Subscription rights are only exercisable by completing and submitting a Stock Order Form, with full payment for the shares subscribed for. Federal regulations prohibit any person from transferring or entering into any agreement directly or indirectly to transfer the legal or beneficial ownership of subscription rights, or the underlying securities, to the account of another.

I ACKNOWLEDGE THAT THE SHARES OF COMMON STOCK ARE NOT DEPOSITS OR SAVINGS ACCOUNTS AND ARE NOT INSURED OR GUARANTEED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION OR ANY OTHER GOVERNMENT AGENCY.

I further certify that, before purchasing the shares of the common stock of PB Bancorp, Inc., I received the Prospectus dated ____________, 2015, and I have read the terms and conditions described in the Prospectus, including disclosure concerning the nature of the security being offered and the risks involved in the investment, described by PB Bancorp, Inc. in the “Risk Factors” section, beginning on page __. Risks include, but are not limited to the following:

| 1. | A worsening of economic conditions in our market area could reduce demand for our products and services and/or result in increases in our level of non-performing loans, which could adversely affect our operations, financial condition and earnings. |

| 2. | Strong competition within our market area may limit our growth and profitability. |

| 3. | Because we intend to increase our commercial real estate and commercial loan originations, our lending risk will increase and downturns in the real estate market or local economy could adversely affect our earnings. |

| 4. | Our business strategy includes growth, and our financial condition and results of operations could be negatively affected if we fail to grow or fail to manage our growth effectively. |

| 5. | Future changes in interest rates may reduce our profits. |

| 6. | A continuation of the historically low interest rate environment may adversely affect our net interest income and profitability. |

| 7. | We could record future losses on our investment securities portfolio. |

| 8. | A significant percentage of our assets is invested in securities, which typically have a lower yield than our loan portfolio. |

| 9. | Our emphasis on one- to four-family residential mortgage loans exposes us to increased credit risks. |

| 10. | Continued declines in our loan portfolio may negatively impact our earnings and results of operations. |

| 11. | Our cost of operations is high relative to our revenues. |

| 12. | Building market share by expanding of our commercial real estate and commercial business lending capacity could cause our expenses to increase faster than revenues. |

| 13. | If our allowance for loan losses is not sufficient to cover actual loan losses, our earnings could decrease. |

| 14. | Declines in property values can increase the loan-to-value ratios on our residential mortgage loan portfolio, which could expose us to greater risk of loss. |

| 15. | Changes in laws and regulations and the cost of regulatory compliance with new laws and regulations may adversely affect our operations and/or increase our costs of operations. |

| 16. | We have become subject to more stringent capital requirements, which may adversely impact our return on equity, require us to raise additional capital, or limit our ability to pay dividends or repurchase shares. |

| 17. | Non-compliance with the USA PATRIOT Act, Bank Secrecy Act, or other laws and regulations could result in fines or sanctions. |

| 18. | Proposed and final regulations could restrict our ability to originate and sell loans. |

| 19. | Our success depends on hiring and retaining certain key personnel. |

| 20. | We face significant operational risks because the nature of the financial services business involves a high volume of transactions. |

| 21. | Cyber-attacks or other security breaches could adversely affect our operations, net income or reputation. |

| 22. | Risks associated with system failures, interruptions, or breaches of security could negatively affect our earnings. |

| 23. | Legal and regulatory proceedings and related matters could adversely affect us or the financial services industry in general. |

| 24. | Managing reputational risk is important to attracting and maintaining customers, investors and employees. |

| 25. | Changes in management’s estimates and assumptions may have a material impact on our consolidated financial statements and our financial condition or operating results. |

| 26. | We are subject to environmental liability risk associated with lending activities. |

| 27. | The future price of the shares of common stock may be less than the $8.00 purchase price per share in the offering. |

| 28. | Our failure to effectively deploy the net proceeds may have an adverse effect on our financial performance. |

| 29. | Our return on equity will be low following the stock offering. This could negatively affect the trading price of our shares of common stock. |

| 30. | Our stock-based benefit plans will increase our expenses and reduce our income. |

| 31. | The implementation of stock-based benefit plans may dilute your ownership interest. Historically, stockholders have approved these stock-based benefit plans. |

| 32. | We have not determined when we will adopt one or more new stock-based benefit plans. Stock-based benefit plans adopted more than 12 months following the completion of the conversion may exceed regulatory restrictions on the size of stock-based benefit plans adopted within 12 months, which would further increase our costs. |

| 33. | Various factors may make takeover attempts more difficult to achieve. |

| 34. | You may not revoke your decision to purchase PB Bancorp common stock in the subscription or community offerings after you send us your order. |

| 35. | The distribution of subscription rights could have adverse income tax consequences. |

By executing this form, the investor is not waiving any rights under federal or state securities laws, including the Securities Act of 1933 and the Securities Exchange Act of 1934.

See Front of Stock Order Form Æ

PB BANCORP, INC.

STOCK INFORMATION CENTER: 1-(877) 821-5778

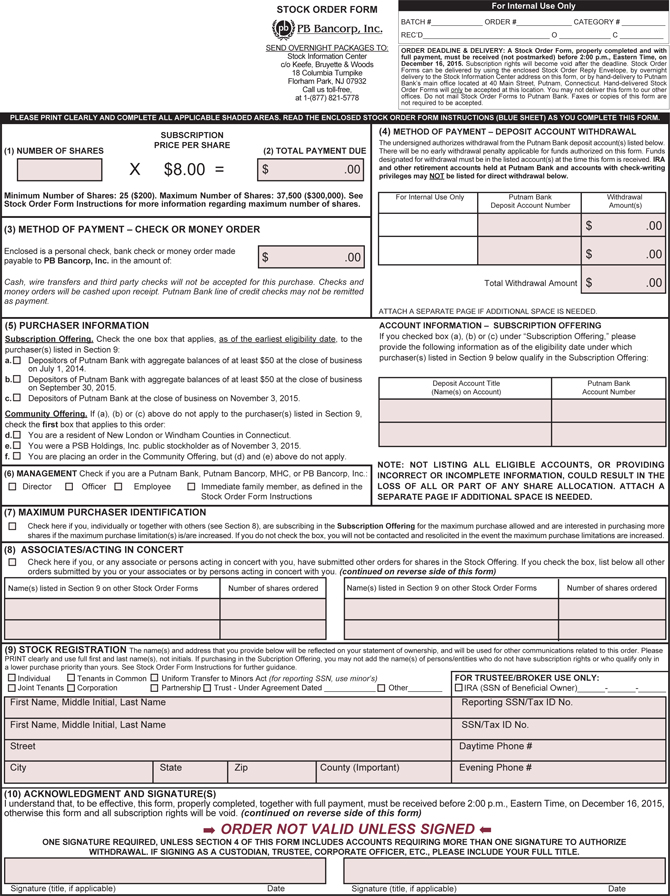

STOCK ORDER FORM INSTRUCTIONS – SIDE 1

Sections (1) and (2) – Number of Shares and Total Payment Due. Indicate the number of shares that you wish to subscribe for and the Total Payment Due. Calculate the Total Payment Due by multiplying the number of shares by the $8.00 price per share. The minimum purchase is 25 shares ($200). The maximum allowable purchase by a person or entity is 37,500 shares ($300,000). Further, no person or entity, together with associates or persons acting in concert with such person or entity, may purchase more than 62,500 shares ($500,000) in all categories of the offering combined. Current PSB Holdings, Inc. stockholders are subject to these purchase limitations and an overall ownership limitation. Please see the Prospectus section entitled “The Conversion and Offering – Additional Limitations on Common Stock Purchases” for more specific information. By signing this form, you are certifying that your order does not conflict with these purchase limitations.

Section (3) – Method of Payment – Check or Money Order. Payment may be made by including with this form a personal check, bank check or money order made payable directly to PB Bancorp, Inc. These will be deposited upon receipt. The funds remitted by personal check must be available within the account(s) when your Stock Order Form is received. Indicate the amount remitted. Interest will be calculated at a rate of 0.05% per annum from the date payment is processed until the offering is completed, at which time the purchaser will be issued a check for interest earned. Please do not remit cash, a Putnam Bank line of credit check, wire transfers or third party checks for this purchase.

Section (4) – Method of Payment – Deposit Account Withdrawal. Payment may be made by authorizing a direct withdrawal from your Putnam Bank deposit account(s). Indicate the account number(s) and the amount(s) you wish withdrawn. Attach a separate page, if necessary. Funds designated for withdrawal must be available within the account(s) at the time this Stock Order Form is received. Upon receipt of this order, we will place a hold on the amount(s) designated by you – the funds will be unavailable to you for withdrawal thereafter. The funds will continue to earn interest within the account(s) at the account’s contractual rate. The interest will remain in the accounts when the designated withdrawal is made, at the completion of the offering. There will be no early withdrawal penalty for withdrawal from a Putnam Bank certificate of deposit (CD) account. Note that you may NOT designate accounts with check-writing privileges. Please submit a check instead. If you request direct withdrawal from such accounts, we reserve the right to interpret that as your authorization to treat those funds as if we had received a check for the designated amount, and we will immediately withdraw the amount from your checking account(s). Additionally, you may not designate direct withdrawal from a Putnam Bank IRA or other retirement accounts. For guidance on using retirement funds, whether held at Putnam Bank or elsewhere, please contact the Stock Information Center as soon as possible – preferably at least two weeks before the December 16, 2015 offering deadline. See the Prospectus section entitled “The Conversion and Offering – Procedure for Purchasing Shares in the Subscription and Community Offerings – Using Individual Retirement Account Funds.” Your ability to use retirement account funds to purchase shares cannot be guaranteed and depends on various factors, including timing constraints and the institution where those funds are currently held.

Section (5) – Purchaser Information. Please check the one box that applies to the purchaser(s) listed in Section 9 of this form. Purchase priorities in the Subscription Offering are based on eligibility dates. Boxes (a), (b) and (c) refer to the Subscription Offering. If you checked one of these boxes, list all Putnam Bank deposit account numbers that you had ownership in as of the applicable eligibility date. Include all forms of account ownership (e.g. individual, joint, IRA, etc.). If purchasing shares for a minor, list only the minor’s eligible accounts. If purchasing shares for a corporation or partnership, list only that entity’s eligible accounts. Attach a separate page, if necessary. Boxes (d), (e) and (f) refer to the Community Offering. Orders placed in the Subscription Offering will take priority over orders placed in the Community Offering. See the Prospectus section entitled “The Conversion and Offering” for further details about the Subscription and Community Offerings. Failure to complete this section, or providing incorrect or incomplete information, could result in a loss of part or all of your share allocation in the event of an oversubscription.

Section (6) – Management. Check the box if you are a Putnam Bank, Putnam Bancorp, MHC, PSB Holdings, Inc. or PB Bancorp, Inc. director, officer or employee, or a member of their immediate family. Immediate family includes spouse, parents, siblings and children who live in the same house as the director, officer or employee.

Section (7) – Maximum Purchaser Identification. Check the box, if applicable. Failure to check the box will result in you not receiving notification in the event the maximum purchase limit(s) is/are increased. If you checked the box but have not subscribed for the maximum amount in the subscription offering, you will not receive this notification.

Section (8) – Associates/Acting in Concert. Check the box, if applicable, and provide the requested information. Attach a separate page if necessary.

Section (9) – Stock Registration. Clearly PRINT the name(s) in which you want the shares registered and the mailing address for all correspondence related to your order, including a stock ownership statement. Each Stock Order Form will generate one stock ownership statement, subject to the stock allocation provisions described in the Prospectus. IMPORTANT: Subscription rights are non-transferable. If placing an order in the Subscription Offering, you may not add the names of persons/entities who do not have subscription rights or who qualify only in a lower purchase priority than yours. A Social Security or Tax ID Number must be provided. The first number listed will be identified with the stock for tax reporting purposes. Listing at least one phone number is important in the event we need to contact you about this form. NOTE FOR FINRA MEMBERS (Formerly NASD): If you are a member of the Financial Industry Regulatory Authority (“FINRA”), formerly the National Association of Securities Dealers (“NASD”), or a person affiliated or associated with a FINRA member, you may have additional reporting requirements. Please report this subscription in writing to the applicable department of the FINRA member firm within one day of payment thereof.

(over)

PB BANCORP, INC.

STOCK INFORMATION CENTER: 1-(877) 821-5778

STOCK ORDER FORM INSTRUCTIONS – SIDE 2

Form of Stock Ownership. For reasons of clarity and standardization, the stock transfer industry has developed uniform stockholder registrations for issuance of stock ownership statements. Beneficiaries may not be named on stock registrations. If you have any questions on wills, estates, beneficiaries, etc., please consult your legal advisor. When registering stock, do not use two initials – use the full first name, middle initial and last name. Omit words that do not affect ownership such as “Dr.” or “Mrs” Check the one box that applies.

Buying Stock Individually – Used when shares are registered in the name of only one owner. To qualify in the Subscription Offering, the individual named in Section 9 of the Stock Order Form must have had an eligible deposit account at Putnam Bank at the close of business on July 1, 2014, September 30, 2015, or November 3, 2015.

Buying Stock Jointly – To qualify in the Subscription Offering, the persons named in Section 9 of the Stock Order Form must have had an eligible deposit account at Putnam Bank at the close of business on July 1, 2014, September 30, 2015, or November 3, 2015.

Joint Tenants – Joint Tenancy (with Right of Survivorship) may be specified to identify two or more owners where ownership is intended to pass automatically to the surviving tenant(s). All owners must agree to the sale of shares.

Tenants in Common – May be specified to identify two or more owners where, upon the death of one co-tenant, ownership of the stock will be held by the surviving co-tenant(s) and by the heirs of the deceased co-tenant. All owners must agree to the sale of shares.

Buying Stock for a Minor – Shares may be held in the name of a custodian for a minor under the Uniform Transfer to Minors Act. To qualify in the Subscription Offering, the minor (not the custodian) named in Section 9 of the Stock Order Form must have had an eligible deposit account at Putnam Bank at the close of business on July 1, 2014, September 30, 2015, or November 3, 2015. The standard abbreviation for custodian is “CUST.” The Uniform Transfer to Minors Act is “UTMA.” Include the state abbreviation. For example, stock held by John Smith as custodian for Susan Smith under the CT Uniform Transfer to Minors Act, should be registered as John Smith CUST Susan Smith UTMA-CT (list only the minor’s social security number).

Buying Stock for a Corporation/Partnership – On the first name line, indicate the name of the corporation or partnership and indicate the entity’s Tax ID Number for reporting purposes. To qualify in the Subscription Offering, the corporation or partnership named in Section 9 of the Stock Order Form must have had an eligible deposit account at Putnam Bank at the close of business on July 1, 2014, September 30, 2015, or November 3, 2015.

Buying Stock in a Trust/Fiduciary Capacity – Indicate the name of the fiduciary and the capacity under which the fiduciary is acting (for example, “Executor”), or name of the trust, the trustees and the date of the trust. Indicate the Tax ID Number to be used for reporting purposes. To qualify in the Subscription Offering, the entity named in Section 9 of the Stock Order Form must have had an eligible deposit account at Putnam Bank at the close of business on July 1, 2014, September 30, 2015, or November 3, 2015.

Buying Stock in a Self-Directed IRA (for trustee/broker use only) – Registration should reflect the custodian or trustee firm’s registration requirements. For example, on the first name line, indicate the name of the brokerage firm, followed by CUST or TRUSTEE. On the second name line, indicate the name of the beneficial owner (for example, “FBO John SMITH IRA”). You can indicate an account number or other underlying information and the custodian or trustee firm’s address and department to which all correspondence should be mailed related to this order, including a stock ownership statement. Indicate the TAX ID Number under which the IRA account should be reported for tax purposes. To qualify in the Subscription Offering, the beneficial owner named in Section 9 of this form must have had an eligible deposit account at Putnam Bank at the close of business on July 1, 2014, September 30, 2015, or November 3, 2015.

Section (10) – Acknowledgment and Signature(s). Sign and date the Stock Order Form where indicated. Before you sign, please carefully review the information you provided and read the acknowledgment. Verify that you have printed clearly and completed all applicable shaded areas on the Stock Order Form. Only one signature is required, unless any account listed in Section 4 requires more than one signature to authorize a withdrawal.

Please review the Prospectus carefully before making an investment decision. Deliver your completed Stock Order Form, with full payment or deposit account withdrawal authorization, so that it is received (not postmarked) before 2:00 p.m., Eastern Time, on December 16, 2015. Stock Order Forms may be delivered by using the enclosed postage paid Stock Order Reply Envelope, by overnight delivery to the Stock Information Center address on the front of the Stock Order Form, or by hand-delivery to Putnam Bank’s main office located at 40 Main Street, Putnam, Connecticut. Hand delivered stock order forms will only be accepted at this location. You may not deliver Stock Order Forms to our other offices. Please do not mail Stock Order Forms to Putnam Bank. We are not required to accept Stock Order Forms that are found to be deficient or incorrect, or that do not include proper payment or the required signature. Faxes or copies of this form are not required to be accepted.

OVERNIGHT DELIVERY can be made to the Stock Information Center address provided on the front of the Stock Order Form.

QUESTIONS? Call our Stock Information Center, toll-free, at 1-(877) 821-5778, from 10:00 a.m. to 4:00 p.m., Eastern Time, Monday through Friday. The Stock Information Center is not open on bank holidays.

Questions and Answers

About Our Plan of Conversion

and Stock Offering

This pamphlet answers questions about our plan of conversion and stock offering. Investing in shares of common stock involves certain risks. Before making an investment decision, please read the enclosed Prospectus carefully, including the ‘‘Risk Factors’’ section.

GENERAL — THE CONVERSION

Our Board of Directors has determined that the plan of conversion and reorganization is in the best interests of our organization, our customers and the communities we serve.

| Q. | What is the conversion and offering? |

| A. | Under our plan of conversion and reorganization (the “Plan”), our organization is converting from the partially public mutual holding company form of ownership to the fully public stock holding company form of ownership. At June 30, 2015, Putnam Bancorp, MHC owned 57.0% of the common stock of PSB Holdings, Inc. (“PSB Holdings”). The remaining 43.0% of the common stock was owned by the public and by The Putnam Bank Foundation. As a result of the conversion, our newly formed corporation, PB Bancorp, Inc. (“PB Bancorp”) will own Putnam Bank. Shares of common stock of PB Bancorp representing the ownership interest of Putnam Bancorp, MHC in PSB Holdings, as adjusted for the assets of Putnam Bancorp, MHC, are currently being offered for sale. |

At the completion of the conversion, public stockholders of PSB Holdings will exchange their shares of common stock for newly issued shares of common stock of PB Bancorp, maintaining their approximate percentage ownership in our organization immediately prior to the conversion, as adjusted for the assets of Putnam Bancorp, MHC.

At the completion of the conversion, 100% of the common stock of PB Bancorp will be owned by public stockholders (including the charitable foundation). Putnam Bancorp, MHC’s shares of PSB Holdings will be cancelled, and PSB Holdings and Putnam Bancorp, MHC will cease to exist.

| Q. | What are the reasons for the conversion and offering? |

| A. | Our primary reasons for converting to the fully public stock form of ownership and undertaking the stock offering are to: (i) enhance our regulatory capital position; (ii) eliminate the uncertainties associated with the mutual holding company structure under financial reform legislation; (iii) transition us to a more familiar and flexible organizational structure; (iv) improve the liquidity of our shares of common stock; and (v) facilitate future mergers and acquisitions. |

| Q. | Is Putnam Bank considered “well-capitalized” for regulatory purposes? |

| A. | Yes. As of June 30, 2015, Putnam Bank was considered “well-capitalized” for regulatory purposes. |

| Q. | Will customers notice any change in Putnam Bank’s day-to-day activities as a result of the conversion and offering? |

| A. | No. It will be business as usual. The conversion is an internal change in our corporate structure. There will be no change to our Board of Directors, management, and staff as a result of the conversion. Putnam Bank will continue to operate as an independent bank. |

| Q. | Will the conversion and offering affect customers’ deposit accounts or loans? |

| A. | No. The conversion and offering will not affect the balance or terms of deposits or loans, and deposits will continue to |

be insured by the Federal Deposit Insurance Corporation up to the maximum legal limits. Deposit accounts will not be converted to stock.

THE PROXY VOTE

Although we have received conditional regulatory approval, the Plan is also subject to approval by stockholders, corporators and voting depositors.

| Q. | Why should I vote “For” the Plan? |

| A. | Your vote “For” the Plan is extremely important to us. Each voting depositor of Putnam Bank received a Proxy Card attached to a Stock Order Form. These depositor packages also include a Proxy Statement describing the Plan. The Plan cannot be implemented without stockholder, corporator and depositor approval. |

Our Board of Directors believes that converting to a fully public ownership structure will best support our future growth.

Voting does not obligate you to purchase shares of common stock during the offering.

| Q. | What happens if I don’t vote? |

| A. | Your vote is very important. Proxy Cards not voted will have the same effect as voting “Against” the Plan. |

Without sufficient favorable votes, we cannot complete the conversion and the related stock offering.

| Q. | How do I vote? |

| A. | Mark your vote, sign and date each Proxy Card enclosed and return the card(s) in the enclosed Proxy Reply Envelope. Alternatively, you may vote by Internet or telephone, by following the simple instructions on the Proxy Card. PLEASE VOTE PROMPTLY. NOT VOTING HAS THE SAME EFFECT AS VOTING “AGAINST” THE PLAN. Telephone and Internet voting are available 24 hours a day. |

| Q. | How many votes are available to me? |

| A. | Depositors at the close of business on November 3, 2015 are entitled to one vote for each $100 or fraction thereof on deposit. However, no depositor may cast more than 1,000 votes. Proxy Cards are not imprinted with your number of votes; however, votes will be automatically tallied by computer. |

| Q. | Why did I receive more than one Proxy Card? |

| A. | If you had more than one deposit account on November 3, 2015, you may have received more than one Proxy Card, depending on the ownership structure of your account. There are no duplicate cards — please promptly vote all the Proxy Cards sent to you. |

| Q. | More than one name appears on my Proxy Card. Who must sign? |

| A. | The names reflect the title of your deposit account. Proxy Cards for joint accounts require the signature of only one of the account holders. Proxy Cards for trust or custodian accounts must be signed by the trustee or the custodian, not the listed beneficiary. |

THE STOCK OFFERING AND PURCHASING SHARES

| Q. | How many shares are being offered and at what price? |

| A. | PB Bancorp is offering for sale between 2,921,875 and 3,953,125 shares of common stock (subject to increase to 4,546,094 shares) at $8.00 per share. No sales commission will be charged to purchasers. |

| Q. | Who is eligible to purchase stock during the stock offering? |

| A. | Pursuant to our Plan, non-transferable rights to subscribe for shares of PB Bancorp common stock in the Subscription Offering have been granted in the following descending order of priority: |

Priority #1 — Depositors of Putnam Bank with aggregate balances of at least $50 at the close of business on July 1, 2014;

Priority #2 — Our tax-qualified employee benefit plans;

Priority #3 — Depositors of Putnam Bank with aggregate balances of at least $50 at the close of business on September 30, 2015; and

Priority #4 — Depositors of Putnam Bank at the close of business on November 3, 2015.

Shares not sold in the Subscription Offering may be offered for sale to the public in a Community Offering, with a preference given first to natural persons including trusts of natural persons residing in New London and Windham Counties, Connecticut and then to PSB Holdings public stockholders as of November 3, 2015. Remaining shares may be offered to members of the general public.

Shares not sold in the Subscription and Community Offerings may be offered for sale to the general public through a Syndicated Offering.

| Q. | I am eligible to subscribe for shares of common stock in the Subscription Offering but am not interested in investing. May I allow someone else to use my Stock Order Form to take advantage of my priority as an eligible account holder? |

| A. | No. Subscription rights are non-transferable! Only those eligible to subscribe in the Subscription Offering, as listed above, may purchase shares in the Subscription Offering. To preserve subscription rights, the shares may only be registered in the name(s) of eligible account holder(s). On occasion, unscrupulous people attempt to persuade account holders to transfer subscription rights, or to purchase shares in the offering based on an understanding that the shares will be subsequently transferred to others. Participation in such schemes is against the law and may subject involved parties to prosecution. If you become aware of any such activities, please notify our Stock Information Center promptly so that we can take the necessary steps to protect our eligible account holders’ subscription rights in the offering. |

| Q. | How may I buy shares during the Subscription and Community Offerings? |

| A. | Shares can be purchased by completing a Stock Order Form and returning it, with full payment, so that it is received (not postmarked) before the offering deadline. You may submit your Stock Order Form by overnight delivery to the indicated address on the Stock Order Form, by hand- |

delivery to Putnam Bank’s main office Street, Putnam, Connecticut, or by mail using the Stock Order Reply Envelope provided. Please do not mail Stock Order Forms to Putnam Bank’s offices.

| Q. | What is the deadline for purchasing shares? |

| A. | To purchase shares in the Subscription and Community Offerings, you must deliver a properly completed, signed Stock Order Form, with full payment, so that it is received (not postmarked) before 2:00 p.m., Eastern Time, on December 16, 2015. Acceptable methods for delivery of Stock Order Forms are described above. |

| Q. | How may I pay for the shares? |

| A. | Payment for shares can be remitted in two ways: |

| (1) | By personal check, bank check or money order, made payable to PB Bancorp, Inc. These will be deposited upon receipt. We cannot accept wires or third party checks. Putnam Bank line of credit checks may not be remitted for this purchase. Please do not mail cash! |

| (2) | By authorized deposit account withdrawal of funds from your Putnam Bank deposit account(s). The Stock Order Form section entitled “Method of Payment — Deposit Account Withdrawal” allows you to list the account number(s) and amount(s) to be withdrawn. Funds designated for direct withdrawal must be in the account(s) at the time the Stock Order Form is received. You may not authorize direct withdrawal from accounts with check-writing privileges. Please submit a check instead. If you request direct withdrawal from such accounts, we reserve the right to interpret that as your authorization to treat those funds as if we had received a check for the designated amount, and we will immediately withdraw the amount from your checking account(s). Also, IRA or other retirement accounts held at Putnam Bank may not be listed for direct withdrawal. See information on retirement accounts below. |

| Q. | Will I earn interest on my funds? |

| A. | Yes. If you pay by personal check, bank check or money order, you will earn interest at a rate of 0.05% per annum from the date we process your payment until the completion of the conversion and offering. At that time, you will be issued a check for interest earned on funds. If you pay for shares by authorizing a direct withdrawal from your Putnam Bank deposit account(s), your funds will continue earning interest within the account, at the account’s contractual rate. The interest will remain in your account(s) when the designated withdrawal is made, upon completion of the conversion and offering. |

| Q. | Are there limits to how many shares I can order? |

| A. | Yes. The minimum order is 25 shares ($200). The maximum number of shares that may be purchased by a person or entity is 37,500 shares ($300,000). Additionally, no person or entity, together with associates or persons acting in concert with such person or entity, may purchase more than 62,500 shares ($500,000) in all categories of the offerings combined. |

More detail on purchase limits, including the definition of “associate” and “acting in concert,” can be found in the Prospectus section entitled ‘‘The Conversion and Offering — Additional Limitations on Common Stock Purchases.’’

| Q. | May I use my Putnam Bank individual retirement account (“IRA”) to purchase shares? |

| A. | You may use funds currently held in retirement accounts with Putnam Bank. However, before you place your stock order, the funds you wish to use must be transferred to a self-directed retirement account maintained by an independent trustee or custodian, such as a brokerage firm. If you are interested in using IRA or any other retirement funds held at Putnam Bank or elsewhere, please call our Stock Information Center as soon as possible for guidance, but preferably at least two weeks before the December 16, 2015 offering deadline. Your ability to use such funds for this purchase may depend on time constraints, because this type of purchase requires additional processing time, and may be subject to limitations imposed by the institution where the funds are held. |

| Q. | May I use a loan from Putnam Bank to pay for shares? |

| A. | No. Putnam Bank, by regulation, may not extend a loan for the purchase of PB Bancorp common stock during the offering. Similarly, you may not use existing Putnam Bank line of credit checks to purchase stock during the offering. |

| Q. | May I change my mind after I place an order to subscribe for stock? |

| A. | No. After receipt, your executed Stock Order Form cannot be modified or revoked without our consent, unless the offering is terminated or is extended beyond February 1, 2016 or the number of shares of common stock to be sold is increased to more than 4,546,094 shares or decreased to less than 2,921,875 shares. |

| Q. | Are directors and executive officers of Putnam Bank planning to purchase stock? |

| A. | Yes. Directors and executive officers, together with their associates, are expected to subscribe for an aggregate of _______ shares ($_______) or approximately ___% of the shares to be sold in the offering at the minimum of the offering range. |

| Q. | Will the stock be insured? |

| A. | No. Like any common stock, PB Bancorp stock will not be insured. |

| Q. | Will dividends be paid on the stock? |

| A. | Following completion of the conversion, PB Bancorp intends to pay cash dividends on our common stock. PSB Holdings currently pays quarterly dividends at a rate of $0.04 per share. |

The amount of dividends to be paid will be subject to our capital requirements, our financial condition and results of operations, tax considerations, statutory and regulatory limitations, and general economic conditions. We cannot assure you that we will pay dividends in the future, or that any such dividends will not be reduced or eliminated in the future.

| Q. | How will PB Bancorp shares trade? |

| A. | Upon completion of the conversion and offering, PB Bancorp shares will be exchanged for the existing shares of PSB Holdings and will trade on the Nasdaq Capital Market under the symbol “PBBI.” Once the shares have begun trading, you |

may contact a brokerage or other firm offering investment services in order to buy or sell PB Bancorp shares in the future.

| Q. | If I purchase shares during the Subscription and Community Offerings, when will I receive my shares? |

| A. | All shares of PB Bancorp common stock sold in the Subscription and Community Offerings will be issued in book-entry form on the books of our transfer agent, through the Direct Registration System. Paper stock certificates will not be issued. As soon as practicable after completion of the stock offering, our transfer agent will send, by first class mail, a statement reflecting your stock ownership. |

THE SHARE EXCHANGE

| Q. | What is the share exchange? |

| A. | The outstanding shares of PSB Holdings common stock held by public stockholders at the completion date of the conversion and stock offering will be exchanged for newly issued shares of PB Bancorp common stock. The number of shares of PB Bancorp common stock to be received by stockholders will depend on the number of shares sold in the offering. Although the shares of PB Bancorp common stock will have begun trading, brokerage firms may require that you have received your stock ownership statement prior to selling your shares. Your ability to sell shares of common stock prior to your receipt of this statement will depend on arrangements you may make with a brokerage firm. |

WHERE TO GET MORE INFORMATION

| Q. | How can I get more information? |

| A. | For more information, refer to the enclosed Prospectus or call our Stock Information Center, toll-free, at 1-(877) 821-5778, from 10:00 a.m. to 4:00 p.m., Eastern Time, Monday through Friday. The Stock Information Center is not open on bank holidays. |

This brochure is neither an offer to sell nor a solicitation of an offer to buy shares of common stock. The offer is made only by the Prospectus. These securities are not deposits or savings accounts and are not insured by the Federal Deposit Insurance Corporation or any other government agency.