Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BBVA USA Bancshares, Inc. | bbvacompass093020158k.htm |

Exhibit 99.1

Total revenue increases 5 percent in third quarter of 2015

BBVA Compass reports earnings of $402 million for the first nine months of 2015, up 10 percent

◦ | Total loans end the quarter at $60.9 billion, up 10 percent from prior year levels |

◦ | Total deposits increase 7 percent to $64.5 billion, fueled by a 12 percent increase in noninterest bearing deposits |

◦ | Strong business activity drives 4 percent increase in total revenue; revenue growth in third quarter balanced as both net interest income and noninterest income increase 5 percent |

◦ | Focus on driving efficiencies and disciplined expense management result in 1 percent decline in noninterest expenses |

◦ | Credit quality metrics at historical lows; net charge-off ratio at 18 basis points, nonperforming loan ratio at 75 basis points and coverage ratio strong at 159 percent |

HOUSTON, October 30, 2015 - BBVA Compass Bancshares, Inc., a Sunbelt-based bank holding company (BBVA Compass), reported today net income attributable to shareholder of $402 million for the first nine months of 2015, a 10 percent increase compared to $364 million earned during the first nine months of 2014. Return on average assets and return on average tangible equity1 for the first nine months of 2015 were 0.62 percent and 7.64 percent, respectively.

Net income attributable to shareholder for the third quarter of 2015 was $125 million compared to the $143 million earned during the third quarter of 2014. Return on average assets and return on average tangible equity1 for the third quarter of 2015 were 0.56 percent and 6.96 percent, respectively.

“Our strong business activity allowed us to deliver solid revenue growth despite the continued challenging, low interest rate environment,” said Manolo Sánchez, chairman and CEO of BBVA Compass. “Total loans increased 10 percent and we have funded more than $13.3 billion in new loans to our customers so far this year. At the same time, total deposits increased 7 percent, fueled by a 12 percent increase in noninterest bearing demand deposits.”

“This level of activity also reflects our commitment to be at the forefront of the digital change sweeping the banking industry,” Sánchez said. “We’ve been able to quickly adapt our products and services to meet our customers’ changing needs due to our real-time platform and our work with digital disruptors.”

Total revenue increased 4 percent as both net interest income and noninterest income posted positive results. Net interest income increased 2 percent from prior year levels while income from fee-based businesses grew 7 percent. Revenue growth in the third quarter of 2015 was more balanced as both net interest income and noninterest income grew at 5 percent. Expense growth was well contained as improved efficiencies and disciplined expense management resulted in a 1 percent decrease in total noninterest expenses.

Sánchez noted that while balance sheet growth was robust, credit quality metrics continue to measure at historical lows. Net charge-offs as a percentage of average loans were 18 basis points for the first nine months of 2015, while the ratio of nonperforming loans to total loans at 75 basis points improved from both second quarter 2015 and third quarter 2014 levels. The coverage ratio that measures the amount of reserves to nonperforming loans remains strong at 159 percent.

“Our entire organization is committed to maintaining sound underwriting standards and a strong risk profile,” Sánchez said. “Importantly, each of our loan portfolios continue to perform well and within our expectations, including our energy portfolio. The prolonged period of low energy prices has, as expected, resulted in some modest, negative migration within internal classifications. But at this point we have not seen any deterioration that gives us undue concern and we remain comfortable with this conservatively underwritten and well-collateralized portfolio.”

Total shareholder’s equity ended the third quarter of 2015 at $12.4 billion, a 4 percent increase from $11.9 billion at the end of the third quarter of 2014. Each of the company’s regulatory capital ratios remain significantly above “well-capitalized” guidelines.

During the third quarter, BBVA Compass debuted the BBVA Compass ClearSpend prepaid Visa® debit card in response to the increasing use of prepaid debit cards across all ages and income levels. The card comes with a mobile budgeting app to give users better control of their financial lives. Real-time in-app mobile alerts contain information on transaction amounts and locations, current balances and category budgeting trends.

1

BBVA Compass also announced its new BBVA Compass Community Advisory Board. Made up of 19 community leaders from across the BBVA Compass franchise, as well as national leaders, the board is designed to help steer the bank’s efforts to better serve low-to moderate-income individuals and neighborhoods, and strengthen its community development programs.

1 Average tangible equity is a non-GAAP financial measure that we believe aids in understanding certain areas of our performance. The calculation of this measure is included on the page titled Non-GAAP Reconciliation.

Contact details: | ||

Christina Anderson | Ed Bilek | |

Corporate Communications | Investor Relations | |

Tel. 205.524.5214 | Tel. 205.297.3331 | |

christina.anderson@bbva.com | ed.bilek@bbva.com | |

About BBVA Compass

BBVA Compass Bancshares, Inc. is a Sunbelt-based bank holding company whose principal subsidiary, BBVA Compass, operates 672 branches, including 341 in Texas, 89 in Alabama, 77 in Arizona, 62 in California, 45 in Florida, 38 in Colorado and 20 in New Mexico. BBVA Compass ranks among the top 25 largest U.S. commercial banks based on deposit market share and ranks among the largest banks in Alabama (2nd), Texas (4th) and Arizona (4th). BBVA Compass’ mobile app recently earned the Mobile Banking Leader in Functionality Award for the second consecutive year in the Javelin Strategy & Research’s Mobile Banking Financial Institution Scorecard. Additional information about BBVA Compass can be found under the Investor Relations tab at bbvacompass.com, by following @BBVACompassNews on Twitter or visiting newsroom.bbvacompass.com.

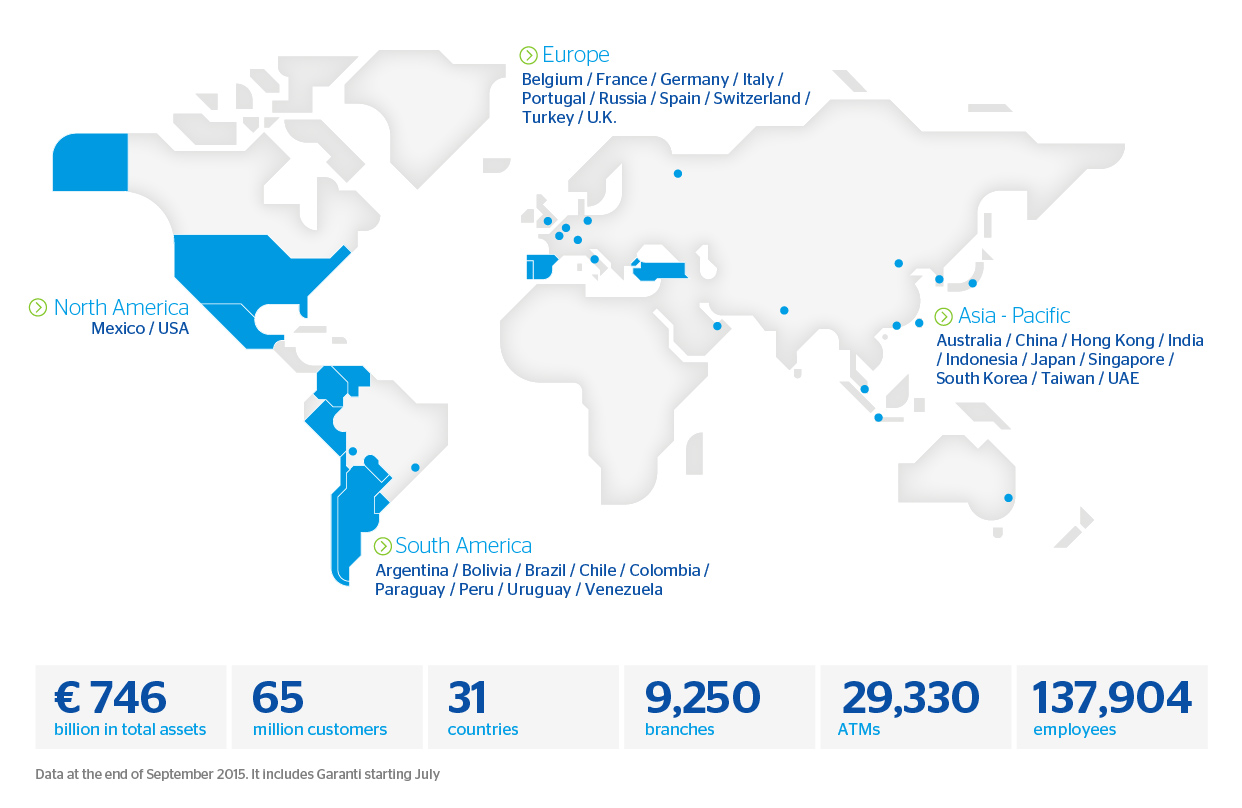

About BBVA Group

BBVA Compass Bancshares, Inc. is a wholly owned subsidiary of BBVA (NYSE: BBVA) (MAD: BBVA). BBVA is a customer-centric global financial services group founded in 1857. The Group has a solid position in Spain, is the largest financial institution in Mexico and has leading franchises in South America and the Sunbelt region of the United States. Its diversified business is geared toward high-growth markets and relies on technology as a key sustainable competitive advantage. Corporate responsibility is at the core of its business model. BBVA fosters financial education and inclusion, and supports scientific research and culture. It operates with the highest integrity, a long-term vision and applies the best practices. The Group is present in the main sustainability

2

indexes. More information about the BBVA Group can be found at bbva.com.

On April 15, 2015, BBVA filed its annual report on Form 20-F for the year ended December 31, 2014, with the Securities and Exchange Commission. A copy can be accessed on the BBVA website at http://shareholdersandinvestors.bbva.com/TLBB/tlbb/bbvair/ing/share/adrs/index.jsp. Holders of BBVA’s American Depositary Receipts (ADRs) may request a hard copy of the Form 20-F for the year ended December 31, 2014, including its complete audited financial statements, free of charge. To request a copy, contact Ed Bilek at ed.bilek@bbva.com.

Forward-Looking Statements

Certain statements in this press release may contain forward-looking statements about BBVA Compass Bancshares, Inc. (the “Company”) and its industry that involve substantial risks and uncertainties. The use of “we,” “our” and similar terms refer to the Company. Statements other than statements of current or historical fact, including statements regarding our future financial condition, results of operations, business plans, liquidity, cash flows, projected costs, and the impact of any laws or regulations applicable to the Company, constitute forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “may,” “will,” “should,” and other similar expressions are intended to identify these forward-looking statements. These forward-looking statements reflect the Company’s views regarding future events and financial performance. Such statements are subject to risks, uncertainties, assumptions and other important factors, many of which may be beyond the Company’s control, that could cause actual results to differ materially from anticipated results. If the Company’s assumptions and estimates are incorrect, or if the Company becomes subject to significant limitations as the result of litigation or regulatory action, then the Company’s actual results could vary materially from those expressed or implied in these forward-looking statements. The forward-looking statements are and will be based on the Company’s then current views and assumptions regarding future events and speak only as of their dates made. The Company assumes no obligation to update any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by securities law or regulation. For further information regarding risks and uncertainties associated with the Company’s business, please refer to the “Risk Factors” section of the Company’s Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 11, 2015, as updated by our subsequent SEC filings.

3

BBVA COMPASS BANCSHARES, INC. (Unaudited) (Dollars in thousands) | ||||||||||||||||||||||

Three Months Ended September 30, | % | Nine Months Ended September 30, | % | |||||||||||||||||||

2015 | 2014 | Change | 2015 | 2014 | Change | |||||||||||||||||

EARNINGS SUMMARY | ||||||||||||||||||||||

Net interest income | $ | 507,867 | $ | 481,968 | 5 | $ | 1,508,878 | $ | 1,476,041 | 2 | ||||||||||||

Noninterest income [a] | 226,640 | 216,578 | 5 | 680,366 | 633,911 | 7 | ||||||||||||||||

Total revenue [a] | 734,507 | 698,546 | 5 | 2,189,244 | 2,109,952 | 4 | ||||||||||||||||

Investment securities gain, net | 6,736 | 9,710 | (31 | ) | 66,967 | 47,608 | 41 | |||||||||||||||

Gain (loss) on prepayment of FHLB advances | — | 143 | NM | (6,118 | ) | (315 | ) | NM | ||||||||||||||

Provision for loan losses | 29,151 | 3,869 | 653 | 117,331 | 86,387 | 36 | ||||||||||||||||

Noninterest expense | 536,250 | 533,142 | 1 | 1,578,605 | 1,597,271 | (1 | ) | |||||||||||||||

Pretax income | 175,842 | 171,388 | 3 | 554,157 | 473,587 | 17 | ||||||||||||||||

Income tax expense | 50,110 | 27,770 | 80 | 150,008 | 107,467 | 40 | ||||||||||||||||

Net income | 125,732 | 143,618 | (12 | ) | 404,149 | 366,120 | 10 | |||||||||||||||

Net income attributable to noncontrolling interests | 491 | 815 | (40 | ) | 1,738 | 1,772 | (2 | ) | ||||||||||||||

Net income attributable to shareholder | $ | 125,241 | $ | 142,803 | (12 | ) | $ | 402,411 | $ | 364,348 | 10 | |||||||||||

SELECTED RATIOS | ||||||||||||||||||||||

Return on average assets | 0.56 | % | 0.73 | % | 0.62 | % | 0.65 | % | ||||||||||||||

Return on average tangible equity [b] | 6.96 | 8.48 | 7.64 | 7.41 | ||||||||||||||||||

Average common equity to average assets | 13.72 | 15.3 | 13.95 | 15.56 | ||||||||||||||||||

Average loans to average total deposits | 94.72 | 92.75 | 94.93 | 93.49 | ||||||||||||||||||

Common equity tier I capital (CET1) [c] | 10.68 | NA | 10.68 | NA | ||||||||||||||||||

Tier I capital ratio [c] | 10.75 | 11.25 | 10.75 | 11.25 | ||||||||||||||||||

Total capital ratio [c] | 13.39 | 13.30 | 13.39 | 13.30 | ||||||||||||||||||

Leverage ratio [c] | 8.69 | 9.58 | 8.69 | 9.58 | ||||||||||||||||||

[a] Excludes net gain on sales of investment securities and gain (loss) on prepayment of FHLB advances. | ||||||||||||||||||||||

[b] Non-GAAP measure that we believe aids in understanding certain areas of our performance. The calculation of this measure is included on the page titled Non-GAAP Reconciliation. | ||||||||||||||||||||||

[c] Current period regulatory capital ratios are estimated. Figures for 2015 calculated using the applicable Transitional Basel III regulatory capital methodology. Figures for 2014 calculated using the applicable Basel I regulatory capital methodology in place at that time. | ||||||||||||||||||||||

NM = Not meaningful | ||||||||||||||||||||||

NA = Not applicable | ||||||||||||||||||||||

4

BBVA COMPASS BANCSHARES, INC. (Unaudited) (Dollars in thousands) | |||||||||||||||||||||||||||||||||

Average for Three Months | Average for Nine Months | Ending Balance | |||||||||||||||||||||||||||||||

Ended September 30, | % | Ended September 30, | % | September 30, | % | ||||||||||||||||||||||||||||

2015 | 2014 | Change | 2015 | 2014 | Change | 2015 | 2014 | Change | |||||||||||||||||||||||||

BALANCE SHEET HIGHLIGHTS | |||||||||||||||||||||||||||||||||

Total loans | $ | 60,632,304 | $ | 55,349,649 | 10 | $ | 59,737,187 | $ | 53,751,488 | 11 | $ | 60,921,379 | $ | 55,200,115 | 10 | ||||||||||||||||||

Total investment securities | 11,883,785 | 10,593,570 | 12 | 11,604,103 | 10,378,884 | 12 | 12,161,461 | 10,744,398 | 13 | ||||||||||||||||||||||||

Earning assets | 77,366,246 | 66,142,913 | 17 | 75,721,921 | 64,268,874 | 18 | 77,534,173 | 66,503,180 | 17 | ||||||||||||||||||||||||

Total assets | 89,761,730 | 77,909,087 | 15 | 87,588,735 | 75,774,391 | 16 | 89,360,000 | 79,192,189 | 13 | ||||||||||||||||||||||||

Noninterest bearing demand deposits | 19,311,966 | 17,039,477 | 13 | 18,749,621 | 16,349,912 | 15 | 19,060,016 | 16,979,235 | 12 | ||||||||||||||||||||||||

Interest bearing transaction accounts | 31,364,714 | 29,558,841 | 6 | 31,172,051 | 28,290,142 | 10 | 31,813,690 | 30,283,451 | 5 | ||||||||||||||||||||||||

Total transaction accounts | 50,676,680 | 46,598,318 | 9 | 49,921,672 | 44,640,054 | 12 | 50,873,706 | 47,262,686 | 8 | ||||||||||||||||||||||||

Total deposits | 64,012,429 | 59,675,681 | 7 | 62,925,579 | 57,494,671 | 9 | 64,492,396 | 60,270,958 | 7 | ||||||||||||||||||||||||

Shareholder's equity | 12,317,150 | 11,917,267 | 3 | 12,222,970 | 11,786,754 | 4 | 12,380,335 | 11,927,053 | 4 | ||||||||||||||||||||||||

5

BBVA COMPASS BANCSHARES, INC. (Unaudited) (Dollars in thousands) | ||||||||||||||||||||

2015 | 2014 | |||||||||||||||||||

September 30 | June 30 | March 31 | December 31 | September 30 | ||||||||||||||||

NONPERFORMING ASSETS | ||||||||||||||||||||

Nonaccrual loans [b] | $ | 380,930 | $ | 395,350 | $ | 357,539 | $ | 322,654 | $ | 344,937 | ||||||||||

Loans 90 days or more past due [a] | 73,588 | 69,710 | 70,750 | 71,454 | 76,196 | |||||||||||||||

TDRs 90 days or more past due | 678 | 1,224 | 820 | 1,722 | 991 | |||||||||||||||

Total nonperforming loans [b] | 455,196 | 466,284 | 429,109 | 395,830 | 422,124 | |||||||||||||||

Other real estate owned, net (OREO) | 23,762 | 20,188 | 17,764 | 20,600 | 17,058 | |||||||||||||||

Other repossessed assets | 3,331 | 4,255 | 3,823 | $ | 3,920 | $ | 3,618 | |||||||||||||

Total nonperforming assets | $ | 482,289 | $ | 490,727 | $ | 450,696 | $ | 420,350 | $ | 442,800 | ||||||||||

TDRs accruing and past due less than 90 days | $ | 154,397 | $ | 155,592 | $ | 157,252 | $ | 161,261 | $ | 170,789 | ||||||||||

Covered loans [c] | 458,066 | 473,842 | 488,560 | 495,190 | 580,756 | |||||||||||||||

Covered nonperforming loans [c] | 43,192 | 44,664 | 45,581 | 48,071 | 56,221 | |||||||||||||||

Covered nonperforming assets [c] | 45,569 | 47,085 | 47,598 | 51,989 | 59,609 | |||||||||||||||

Total nonperforming loans as a % of loans | 0.75 | % | 0.77 | % | 0.73 | % | 0.69 | % | 0.76 | % | ||||||||||

Total nonperforming loans as a % of loans, excluding covered loans | 0.68 | 0.71 | 0.66 | 0.61 | 0.67 | |||||||||||||||

Total nonperforming assets as a % of total loans, other real estate, and other repossessed assets | 0.79 | 0.81 | 0.77 | 0.73 | 0.80 | |||||||||||||||

Total nonperforming assets as a % of total loans, other real estate, and other repossessed assets, excluding covered assets | 0.72 | 0.74 | 0.69 | 0.65 | 0.70 | |||||||||||||||

[a] Excludes loans classified as troubled debt restructuring (TDRs). | ||||||||||||||||||||

[b] Includes loans held for sale. | ||||||||||||||||||||

[c] Covered assets includes loans and OREO acquired from the FDIC subject to loss sharing agreements. | ||||||||||||||||||||

6

Three Months Ended | ||||||||||||||||||||

2015 | 2014 | |||||||||||||||||||

September 30 | June 30 | March 31 | December 31 | September 30 | ||||||||||||||||

ALLOWANCE FOR LOAN LOSSES | ||||||||||||||||||||

Balance at beginning of period | $ | 721,471 | $ | 701,864 | $ | 685,041 | $ | 695,878 | $ | 714,760 | ||||||||||

Net charge-offs (NCO) | 28,500 | 26,542 | 25,208 | 30,751 | 22,751 | |||||||||||||||

Provision for loan losses | 29,151 | 46,149 | 42,031 | 19,914 | 3,869 | |||||||||||||||

Balance at end of period | $ | 722,122 | $ | 721,471 | $ | 701,864 | $ | 685,041 | $ | 695,878 | ||||||||||

Allowance for loan losses as a % of total loans | 1.20 | % | 1.20 | % | 1.20 | % | 1.19 | % | 1.27 | % | ||||||||||

Allowance for loan losses as a % of nonperforming loans [a] | 158.64 | 154.73 | 163.56 | 173.06 | 164.85 | |||||||||||||||

Allowance for loan losses as a % of nonperforming assets [a] | 149.73 | 147.02 | 155.73 | 162.97 | 157.15 | |||||||||||||||

Annualized as a % of average loans: | ||||||||||||||||||||

NCO - QTD | 0.19 | 0.18 | 0.17 | 0.22 | 0.16 | |||||||||||||||

NCO - YTD | 0.18 | 0.18 | 0.17 | 0.22 | 0.23 | |||||||||||||||

[a] Includes loans held for sale that are on nonaccrual status. | ||||||||||||||||||||

7

BBVA COMPASS BANCSHARES, INC. (Unaudited) (Dollars in thousands) | ||||||||||||||||||||||

Three Months Ended September 30, | ||||||||||||||||||||||

2015 | 2014 | |||||||||||||||||||||

Average Balance | Income/ Expense | Yield/ Rate | Average Balance | Income/ Expense | Yield/ Rate | |||||||||||||||||

YIELD/RATE ANALYSIS | ||||||||||||||||||||||

(Taxable Equivalent Basis) | ||||||||||||||||||||||

Assets | ||||||||||||||||||||||

Earning assets: | ||||||||||||||||||||||

Loans | $ | 60,632,304 | $ | 555,713 | 3.64 | % | $ | 55,349,649 | $ | 523,843 | 3.75 | % | ||||||||||

Investment securities available for sale [a] | 10,507,688 | 47,360 | 1.79 | 9,128,401 | 50,150 | 2.18 | ||||||||||||||||

Investment securities held to maturity | 1,366,529 | 10,119 | 2.94 | 1,428,009 | 9,871 | 2.74 | ||||||||||||||||

Other earning assets | 4,850,157 | 16,090 | 1.32 | 199,694 | 984 | 1.95 | ||||||||||||||||

Total earning assets [a] | 77,356,678 | 629,282 | 3.23 | 66,105,753 | 584,848 | 3.51 | ||||||||||||||||

Allowance for loan losses | (725,871 | ) | (712,811 | ) | ||||||||||||||||||

Unrealized gain (loss) on securities available for sale | 9,568 | 37,160 | ||||||||||||||||||||

Other assets | 13,121,355 | 12,478,985 | ||||||||||||||||||||

Total assets | $ | 89,761,730 | $ | 77,909,087 | ||||||||||||||||||

Liabilities and Shareholder's Equity | ||||||||||||||||||||||

Interest bearing liabilities: | ||||||||||||||||||||||

Interest bearing demand deposits | $ | 6,949,920 | $ | 2,943 | 0.17 | $ | 7,079,309 | $ | 2,971 | 0.17 | ||||||||||||

Savings and money market accounts | 24,414,794 | 22,260 | 0.36 | 22,479,532 | 24,256 | 0.43 | ||||||||||||||||

Certificates and other time deposits | 13,158,735 | 42,990 | 1.30 | 12,956,374 | 39,478 | 1.21 | ||||||||||||||||

Foreign office deposits | 177,014 | 89 | 0.20 | 120,989 | 58 | 0.19 | ||||||||||||||||

Total interest bearing deposits | 44,700,463 | 68,282 | 0.61 | 42,636,204 | 66,763 | 0.62 | ||||||||||||||||

FHLB and other borrowings | 6,331,187 | 20,422 | 1.28 | 3,827,684 | 16,399 | 1.70 | ||||||||||||||||

Federal funds purchased and securities sold under agreement to repurchase | 677,351 | 2,506 | 1.47 | 838,802 | 447 | 0.21 | ||||||||||||||||

Other short-term borrowings | 4,370,077 | 11,129 | 1.01 | 51,290 | 394 | 3.05 | ||||||||||||||||

Total interest bearing liabilities | 56,079,078 | 102,339 | 0.72 | 47,353,980 | 84,003 | 0.70 | ||||||||||||||||

Noninterest bearing deposits | 19,311,966 | 17,039,477 | ||||||||||||||||||||

Other noninterest bearing liabilities | 2,053,536 | 1,598,363 | ||||||||||||||||||||

Total liabilities | 77,444,580 | 65,991,820 | ||||||||||||||||||||

Shareholder's equity | 12,317,150 | 11,917,267 | ||||||||||||||||||||

Total liabilities and shareholder's equity | $ | 89,761,730 | $ | 77,909,087 | ||||||||||||||||||

Net interest income/ net interest spread | 526,943 | 2.51 | % | 500,845 | 2.81 | % | ||||||||||||||||

Net yield on earning assets | 2.70 | % | 3.01 | % | ||||||||||||||||||

Total taxable equivalent adjustment | 19,076 | 18,877 | ||||||||||||||||||||

Net interest income | $ | 507,867 | $ | 481,968 | ||||||||||||||||||

[a] Excludes adjustment for market valuation. | ||||||||||||||||||||||

8

BBVA COMPASS BANCSHARES, INC. (Unaudited) (Dollars in thousands) | ||||||||||||||||||||||

Nine Months Ended September 30, | ||||||||||||||||||||||

2015 | 2014 | |||||||||||||||||||||

Average Balance | Income/ Expense | Yield/ Rate | Average Balance | Income/ Expense | Yield/ Rate | |||||||||||||||||

YIELD/RATE ANALYSIS | ||||||||||||||||||||||

(Taxable Equivalent Basis) | ||||||||||||||||||||||

Assets | ||||||||||||||||||||||

Earning assets: | ||||||||||||||||||||||

Loans | $ | 59,737,187 | $ | 1,659,303 | 3.71 | % | $ | 53,751,488 | $ | 1,578,007 | 3.93 | % | ||||||||||

Investment securities available for sale [a] | 10,193,624 | 146,583 | 1.92 | 8,873,269 | 151,229 | 2.28 | ||||||||||||||||

Investment securities held to maturity | 1,366,299 | 29,782 | 2.91 | 1,465,399 | 30,310 | 2.77 | ||||||||||||||||

Other earning assets | 4,380,631 | 41,895 | 1.28 | 138,502 | 2,172 | 2.10 | ||||||||||||||||

Total earning assets [a] | 75,677,741 | 1,877,563 | 3.32 | 64,228,658 | 1,761,718 | 3.67 | ||||||||||||||||

Allowance for loan losses | (707,459 | ) | (707,630 | ) | ||||||||||||||||||

Unrealized gain (loss) on securities available for sale | 44,180 | 40,216 | ||||||||||||||||||||

Other assets | 12,574,273 | 12,213,147 | ||||||||||||||||||||

Total assets | $ | 87,588,735 | $ | 75,774,391 | ||||||||||||||||||

Liabilities and Shareholder's Equity | ||||||||||||||||||||||

Interest bearing liabilities: | ||||||||||||||||||||||

Interest bearing demand deposits | $ | 7,281,588 | $ | 8,868 | 0.16 | $ | 7,269,983 | $ | 9,066 | 0.17 | ||||||||||||

Savings and money market accounts | 23,890,463 | 70,465 | 0.39 | 21,020,159 | 59,922 | 0.38 | ||||||||||||||||

Certificates and other time deposits | 12,832,859 | 123,546 | 1.29 | 12,733,405 | 111,717 | 1.17 | ||||||||||||||||

Foreign office deposits | 171,048 | 257 | 0.20 | 121,212 | 175 | 0.19 | ||||||||||||||||

Total interest bearing deposits | 44,175,958 | 203,136 | 0.61 | 41,144,759 | 180,880 | 0.59 | ||||||||||||||||

FHLB and other borrowings | 5,742,906 | 67,068 | 1.56 | 4,070,692 | 48,947 | 1.61 | ||||||||||||||||

Federal funds purchased and securities sold under agreement to repurchase | 832,854 | 5,534 | 0.89 | 885,147 | 1,384 | 0.21 | ||||||||||||||||

Other short-term borrowings | 3,973,734 | 36,668 | 1.23 | 27,183 | 516 | 2.54 | ||||||||||||||||

Total interest bearing liabilities | 54,725,452 | 312,406 | 0.76 | 46,127,781 | 231,727 | 0.67 | ||||||||||||||||

Noninterest bearing deposits | 18,749,621 | 16,349,912 | ||||||||||||||||||||

Other noninterest bearing liabilities | 1,890,692 | 1,509,944 | ||||||||||||||||||||

Total liabilities | 75,365,765 | 63,987,637 | ||||||||||||||||||||

Shareholder's equity | 12,222,970 | 11,786,754 | ||||||||||||||||||||

Total liabilities and shareholder's equity | $ | 87,588,735 | $ | 75,774,391 | ||||||||||||||||||

Net interest income/ net interest spread | 1,565,157 | 2.56 | % | 1,529,991 | 3.00 | % | ||||||||||||||||

Net yield on earning assets | 2.77 | % | 3.18 | % | ||||||||||||||||||

Total taxable equivalent adjustment | 56,279 | 53,950 | ||||||||||||||||||||

Net interest income | $ | 1,508,878 | $ | 1,476,041 | ||||||||||||||||||

[a] Excludes adjustment for market valuation. | ||||||||||||||||||||||

9

BBVA COMPASS BANCSHARES, INC. (Unaudited) (Dollars in thousands) | |||||||||||||||||||||||||||||||

Nine Months | Three Months Ended | ||||||||||||||||||||||||||||||

Ended September 30, | % | 2015 | 2014 | ||||||||||||||||||||||||||||

2015 | 2014 | Change | September 30 | June 30 | March 31 | December 31 | September 30 | ||||||||||||||||||||||||

NONINTEREST INCOME | |||||||||||||||||||||||||||||||

Service charges on deposit accounts | $ | 161,891 | $ | 165,886 | (2 | ) | $ | 54,917 | $ | 53,690 | $ | 53,284 | $ | 56,799 | $ | 57,537 | |||||||||||||||

Card and merchant processing fees | 83,918 | 81,459 | 3 | 29,024 | 28,711 | 26,183 | 26,432 | 28,682 | |||||||||||||||||||||||

Retail investment sales | 77,574 | 83,053 | (7 | ) | 26,055 | 26,373 | 25,146 | 25,424 | 27,645 | ||||||||||||||||||||||

Investment banking and advisory fees | 84,975 | 63,226 | 34 | 17,842 | 36,799 | 30,334 | 24,229 | 18,750 | |||||||||||||||||||||||

Asset management fees | 24,449 | 31,959 | (23 | ) | 7,918 | 8,435 | 8,096 | 10,813 | 10,666 | ||||||||||||||||||||||

Corporate and correspondent investment sales | 20,290 | 22,016 | (8 | ) | 6,047 | 7,984 | 6,259 | 7,619 | 5,388 | ||||||||||||||||||||||

Mortgage banking income | 21,269 | 18,924 | 12 | 554 | 12,556 | 8,159 | 5,627 | 8,498 | |||||||||||||||||||||||

Bank owned life insurance | 13,527 | 12,807 | 6 | 4,345 | 4,394 | 4,788 | 5,809 | 4,603 | |||||||||||||||||||||||

Other | 192,473 | 154,581 | 25 | 79,938 | 55,797 | 56,738 | 68,032 | 54,809 | |||||||||||||||||||||||

680,366 | 633,911 | 7 | 226,640 | 234,739 | 218,987 | 230,784 | 216,578 | ||||||||||||||||||||||||

Investment securities gains, net | 66,967 | 47,608 | 41 | 6,736 | 27,399 | 32,832 | 5,434 | 9,710 | |||||||||||||||||||||||

Gain (loss) on prepayment of FHLB and other borrowings | (6,118 | ) | (315 | ) | NM | — | (3,569 | ) | (2,549 | ) | — | 143 | |||||||||||||||||||

Total noninterest income | $ | 741,215 | $ | 681,204 | 9 | $ | 233,376 | $ | 258,569 | $ | 249,270 | $ | 236,218 | $ | 226,431 | ||||||||||||||||

NONINTEREST EXPENSE | |||||||||||||||||||||||||||||||

Salaries, benefits and commissions | $ | 796,333 | $ | 791,204 | 1 | $ | 268,362 | $ | 268,709 | $ | 259,262 | $ | 281,065 | $ | 265,334 | ||||||||||||||||

FDIC indemnification expense | 49,669 | 80,736 | (38 | ) | 8,461 | 12,419 | 28,789 | 34,313 | 18,748 | ||||||||||||||||||||||

Professional services | 152,462 | 148,652 | 3 | 54,784 | 51,119 | 46,559 | 59,027 | 52,463 | |||||||||||||||||||||||

Equipment | 173,467 | 165,562 | 5 | 58,151 | 57,175 | 58,141 | 58,401 | 56,355 | |||||||||||||||||||||||

Net occupancy | 119,187 | 118,514 | 1 | 39,525 | 40,382 | 39,280 | 39,865 | 39,357 | |||||||||||||||||||||||

Marketing | 32,330 | 30,097 | 7 | 10,624 | 11,618 | 10,088 | 5,894 | 11,587 | |||||||||||||||||||||||

Communications | 16,694 | 18,605 | (10 | ) | 5,682 | 5,245 | 5,767 | 6,003 | 5,964 | ||||||||||||||||||||||

Amortization of intangibles | 30,083 | 38,800 | (22 | ) | 9,507 | 9,889 | 10,687 | 24,556 | 12,635 | ||||||||||||||||||||||

Other | 208,380 | 205,101 | 2 | 81,154 | 63,080 | 64,146 | 74,357 | 70,699 | |||||||||||||||||||||||

Total noninterest expense | $ | 1,578,605 | $ | 1,597,271 | (1 | ) | $ | 536,250 | $ | 519,636 | $ | 522,719 | $ | 583,481 | $ | 533,142 | |||||||||||||||

NM = Not meaningful | |||||||||||||||||||||||||||||||

10

BBVA COMPASS BANCSHARES, INC. (Unaudited) (Dollars in thousands) | |||||||||||||||

Three Months Ended September 30, | Nine Months Ended September 30, | ||||||||||||||

2015 | 2014 | 2015 | 2014 | ||||||||||||

NON-GAAP RECONCILIATION | |||||||||||||||

Computation of Average Tangible Equity: | |||||||||||||||

Total stockholder's equity (average) | $ | 12,317,150 | $ | 11,917,267 | $ | 12,222,970 | 11,786,754 | ||||||||

Less: Goodwill and other intangibles (average) | 5,147,993 | 5,198,332 | 5,148,781 | 5,176,840 | |||||||||||

Average tangible equity [B] | $ | 7,169,157 | $ | 6,718,935 | $ | 7,074,189 | 6,609,914 | ||||||||

Net income [A] | $ | 125,732 | $ | 143,618 | $ | 404,149 | 366,120 | ||||||||

Return on average tangible equity ([A]/[B], annualized) | 6.96 | % | 8.48 | % | 7.64 | % | 7.41 | % | |||||||

11

BBVA COMPASS BANCSHARES, INC SUPPLEMENTAL LOAN PORTFOLIO INFORMATION (Unaudited) (In Thousands) | |||||||||||||||||||||||||||||||

At or Quarter Ended September 30, 2015 | |||||||||||||||||||||||||||||||

30-59 Days Past Due | 60-89 Days Past Due | 90 Days or More Past Due | Nonaccrual | Accruing TDRs | Not Past Due or Impaired | Total | Net Charge Offs (Recoveries) | ||||||||||||||||||||||||

Commercial, financial and agricultural | $ | 15,300 | $ | 3,930 | $ | 5,202 | $ | 130,370 | $ | 9,635 | $ | 25,471,882 | $ | 25,636,319 | $ | 3,990 | |||||||||||||||

Real estate – construction | 1,565 | 117 | 426 | 5,712 | 2,247 | 2,305,284 | 2,315,351 | (426 | ) | ||||||||||||||||||||||

Commercial real estate – mortgage | 4,887 | 732 | 5,607 | 85,975 | 33,837 | 10,493,594 | 10,624,632 | 437 | |||||||||||||||||||||||

Residential real estate – mortgage | 47,936 | 15,450 | 1,230 | 103,492 | 71,102 | 13,658,513 | 13,897,723 | (299 | ) | ||||||||||||||||||||||

Equity lines of credit | 8,988 | 4,675 | 2,411 | 33,436 | — | 2,326,898 | 2,376,408 | 2,087 | |||||||||||||||||||||||

Equity loans | 6,485 | 1,807 | 985 | 15,104 | 37,785 | 549,982 | 612,148 | 384 | |||||||||||||||||||||||

Credit card | 5,949 | 3,621 | 8,322 | — | — | 592,090 | 609,982 | 6,675 | |||||||||||||||||||||||

Consumer – direct | 16,433 | 1,988 | 2,153 | 635 | 469 | 833,311 | 854,989 | 6,194 | |||||||||||||||||||||||

Consumer – indirect | 60,018 | 12,901 | 4,213 | 6,053 | — | 2,818,418 | 2,901,603 | 8,970 | |||||||||||||||||||||||

Covered loans | 4,303 | 3,347 | 43,039 | 153 | — | 407,224 | 458,066 | 488 | |||||||||||||||||||||||

Total loans | $ | 171,864 | $ | 48,568 | $ | 73,588 | $ | 380,930 | $ | 155,075 | $ | 59,457,196 | $ | 60,287,221 | $ | 28,500 | |||||||||||||||

Loans held for sale | $ | 416 | $ | 380 | $ | — | $ | — | $ | — | $ | 633,362 | $ | 634,158 | $ | — | |||||||||||||||

At or Quarter Ended June 30, 2015 | |||||||||||||||||||||||||||||||

30-59 Days Past Due | 60-89 Days Past Due | 90 Days or More Past Due | Nonaccrual | Accruing TDRs | Not Past Due or Impaired | Total | Net Charge Offs (Recoveries) | ||||||||||||||||||||||||

Commercial, financial and agricultural | $ | 18,524 | $ | 7,037 | $ | 3,149 | $ | 147,051 | $ | 9,693 | $ | 24,767,734 | $ | 24,953,188 | $ | 1,869 | |||||||||||||||

Real estate – construction | 148 | 512 | 1,157 | 7,777 | 2,212 | 2,425,025 | 2,436,831 | (2,106 | ) | ||||||||||||||||||||||

Commercial real estate – mortgage | 7,916 | 1,348 | 2,853 | 78,569 | 34,389 | 10,200,605 | 10,325,680 | 671 | |||||||||||||||||||||||

Residential real estate – mortgage | 45,487 | 14,926 | 1,703 | 106,179 | 71,357 | 13,963,891 | 14,203,543 | 1,487 | |||||||||||||||||||||||

Equity lines of credit | 7,833 | 4,370 | 2,515 | 33,757 | — | 2,304,225 | 2,352,700 | 3,608 | |||||||||||||||||||||||

Equity loans | 5,202 | 1,553 | 1,147 | 16,175 | 38,998 | 576,051 | 639,126 | (585 | ) | ||||||||||||||||||||||

Credit card | 4,840 | 3,361 | 7,672 | — | — | 576,496 | 592,369 | 7,542 | |||||||||||||||||||||||

Consumer – direct | 7,247 | 2,190 | 2,176 | 853 | 167 | 767,735 | 780,368 | 6,311 | |||||||||||||||||||||||

Consumer – indirect | 47,676 | 8,895 | 2,810 | 4,853 | — | 3,185,345 | 3,249,579 | 7,593 | |||||||||||||||||||||||

Covered loans | 5,930 | 3,640 | 44,528 | 136 | — | 419,608 | 473,842 | 152 | |||||||||||||||||||||||

Total loans | $ | 150,803 | $ | 47,832 | $ | 69,710 | $ | 395,350 | $ | 156,816 | $ | 59,186,715 | $ | 60,007,226 | $ | 26,542 | |||||||||||||||

Loans held for sale | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 195,616 | $ | 195,616 | $ | — | |||||||||||||||

12

At or Quarter Ended March 31, 2015 | |||||||||||||||||||||||||||||||

30-59 Days Past Due | 60-89 Days Past Due | 90 Days or More Past Due | Nonaccrual | Accruing TDRs | Not Past Due or Impaired | Total | Net Charge Offs (Recoveries) | ||||||||||||||||||||||||

Commercial, financial and agricultural | $ | 7,940 | $ | 3,981 | $ | 2,901 | $ | 95,318 | $ | 9,632 | $ | 24,329,192 | $ | 24,448,964 | $ | 4,437 | |||||||||||||||

Real estate – construction | 5,275 | 450 | 392 | 7,781 | 2,237 | 2,309,360 | 2,325,495 | (1,426 | ) | ||||||||||||||||||||||

Commercial real estate – mortgage | 6,346 | 3,629 | 2,542 | 87,931 | 35,292 | 9,784,843 | 9,920,583 | 203 | |||||||||||||||||||||||

Residential real estate – mortgage | 45,893 | 17,007 | 3,195 | 107,051 | 70,299 | 13,757,423 | 14,000,868 | 927 | |||||||||||||||||||||||

Equity lines of credit | 10,615 | 4,602 | 1,995 | 34,597 | — | 2,274,075 | 2,325,884 | 1,943 | |||||||||||||||||||||||

Equity loans | 5,387 | 1,728 | 703 | 18,313 | 40,432 | 568,732 | 635,295 | 371 | |||||||||||||||||||||||

Credit card | 5,004 | 3,441 | 8,618 | — | — | 582,967 | 600,030 | 7,834 | |||||||||||||||||||||||

Consumer – direct | 7,545 | 2,406 | 2,426 | 2,010 | 180 | 692,684 | 707,251 | 3,478 | |||||||||||||||||||||||

Consumer – indirect | 34,444 | 6,726 | 2,576 | 4,102 | — | 3,057,685 | 3,105,533 | 6,568 | |||||||||||||||||||||||

Covered loans | 6,582 | 3,872 | 45,402 | 179 | — | 432,525 | 488,560 | 873 | |||||||||||||||||||||||

Total loans | $ | 135,031 | $ | 47,842 | $ | 70,750 | $ | 357,282 | $ | 158,072 | $ | 57,789,486 | $ | 58,558,463 | $ | 25,208 | |||||||||||||||

Loans held for sale | $ | — | $ | — | $ | — | $ | 257 | $ | — | $ | 198,231 | $ | 198,488 | $ | — | |||||||||||||||

At or Quarter Ended December 31, 2014 | |||||||||||||||||||||||||||||||

30-59 Days Past Due | 60-89 Days Past Due | 90 Days or More Past Due | Nonaccrual | Accruing TDRs | Not Past Due or Impaired | Total | Net Charge Offs (Recoveries) | ||||||||||||||||||||||||

Commercial, financial and agricultural | $ | 10,829 | $ | 5,765 | $ | 1,610 | $ | 61,157 | $ | 10,127 | $ | 23,739,049 | $ | 23,828,537 | $ | 712 | |||||||||||||||

Real estate – construction | 1,954 | 994 | 477 | 7,964 | 2,112 | 2,141,151 | 2,154,652 | (1,539 | ) | ||||||||||||||||||||||

Commercial real estate – mortgage | 9,813 | 4,808 | 628 | 89,736 | 39,841 | 9,732,380 | 9,877,206 | 3,180 | |||||||||||||||||||||||

Residential real estate – mortgage | 45,279 | 16,510 | 2,598 | 108,357 | 69,408 | 13,680,504 | 13,922,656 | 3,848 | |||||||||||||||||||||||

Equity lines of credit | 9,929 | 4,395 | 2,679 | 32,874 | — | 2,254,907 | 2,304,784 | 2,128 | |||||||||||||||||||||||

Equity loans | 6,357 | 3,268 | 997 | 19,029 | 41,197 | 564,120 | 634,968 | 755 | |||||||||||||||||||||||

Credit card | 5,692 | 3,921 | 9,441 | — | — | 611,402 | 630,456 | 8,209 | |||||||||||||||||||||||

Consumer – direct | 9,542 | 1,826 | 2,296 | 799 | 298 | 638,166 | 652,927 | 4,756 | |||||||||||||||||||||||

Consumer – indirect | 35,366 | 7,935 | 2,771 | 2,624 | — | 2,821,712 | 2,870,408 | 8,367 | |||||||||||||||||||||||

Covered loans | 6,678 | 4,618 | 47,957 | 114 | — | 435,823 | 495,190 | 335 | |||||||||||||||||||||||

Total loans | $ | 141,439 | $ | 54,040 | $ | 71,454 | $ | 322,654 | $ | 162,983 | $ | 56,619,214 | $ | 57,371,784 | $ | 30,751 | |||||||||||||||

Loans held for sale | $ | 240 | $ | — | $ | — | $ | — | $ | — | $ | 154,576 | $ | 154,816 | $ | — | |||||||||||||||

13

At or Quarter Ended September 30, 2014 | |||||||||||||||||||||||||||||||

30-59 Days Past Due | 60-89 Days Past Due | 90 Days or More Past Due | Nonaccrual | Accruing TDRs | Not Past Due or Impaired | Total | Net Charge Offs (Recoveries) | ||||||||||||||||||||||||

Commercial, financial and agricultural | $ | 12,846 | $ | 3,261 | $ | 838 | $ | 79,577 | $ | 10,444 | $ | 22,403,990 | $ | 22,510,956 | $ | (414 | ) | ||||||||||||||

Real estate – construction | 526 | 109 | 464 | 9,928 | 672 | 1,966,085 | 1,977,784 | (977 | ) | ||||||||||||||||||||||

Commercial real estate – mortgage | 7,716 | 3,129 | 3,448 | 92,718 | 43,023 | 9,348,527 | 9,498,561 | 247 | |||||||||||||||||||||||

Residential real estate – mortgage | 37,711 | 20,447 | 2,474 | 104,192 | 72,590 | 13,369,402 | 13,606,816 | 3,223 | |||||||||||||||||||||||

Equity lines of credit | 8,046 | 3,966 | 3,308 | 34,115 | — | 2,210,126 | 2,259,561 | 2,221 | |||||||||||||||||||||||

Equity loans | 5,624 | 2,746 | 1,068 | 18,637 | 42,595 | 558,377 | 629,047 | 1,142 | |||||||||||||||||||||||

Credit card | 5,566 | 3,718 | 8,774 | — | — | 612,942 | 631,000 | 7,570 | |||||||||||||||||||||||

Consumer – direct | 7,751 | 1,678 | 1,984 | 402 | 57 | 598,108 | 609,980 | 4,482 | |||||||||||||||||||||||

Consumer – indirect | 30,348 | 6,379 | 1,389 | 1,596 | — | 2,665,060 | 2,704,772 | 4,553 | |||||||||||||||||||||||

Covered loans | 9,741 | 4,512 | 52,449 | 3,772 | 2,399 | 507,883 | 580,756 | 704 | |||||||||||||||||||||||

Total loans | $ | 125,875 | $ | 49,945 | $ | 76,196 | $ | 344,937 | $ | 171,780 | $ | 54,240,500 | $ | 55,009,233 | $ | 22,751 | |||||||||||||||

Loans held for sale | $ | — | $ | — | $ | — | $ | — | $ | — | $ | 190,882 | $ | 190,882 | $ | — | |||||||||||||||

14

BBVA COMPASS BANCSHARES, INC. BALANCE SHEET (Unaudited) (In Thousands) | |||||||||||||||||||

2015 | 2014 | ||||||||||||||||||

September 30 | June 30 | March 31 | December 31 | September 30 | |||||||||||||||

Assets: | |||||||||||||||||||

Cash and due from banks | $ | 3,898,257 | $ | 3,353,177 | $ | 3,664,182 | $ | 2,764,345 | $ | 4,643,636 | |||||||||

Federal funds sold, securities purchased under agreements to resell and interest bearing deposits | 479,207 | 512,244 | 300,175 | 624,060 | 271,898 | ||||||||||||||

Cash and cash equivalents | 4,377,464 | 3,865,421 | 3,964,357 | 3,388,405 | 4,915,534 | ||||||||||||||

Trading account assets | 4,193,506 | 4,879,125 | 3,680,427 | 2,834,397 | 515,136 | ||||||||||||||

Investment securities available for sale | 10,803,660 | 10,392,484 | 10,101,828 | 10,237,275 | 9,326,413 | ||||||||||||||

Investment securities held to maturity | 1,357,801 | 1,375,075 | 1,373,542 | 1,348,354 | 1,417,985 | ||||||||||||||

Loans held for sale | 634,158 | 195,616 | 198,488 | 154,816 | 190,882 | ||||||||||||||

Loans | 60,287,221 | 60,007,226 | 58,558,463 | 57,371,784 | 55,009,233 | ||||||||||||||

Allowance for loan losses | (722,122 | ) | (721,471 | ) | (701,864 | ) | (685,041 | ) | (695,878 | ) | |||||||||

Net loans | 59,565,099 | 59,285,755 | 57,856,599 | 56,686,743 | 54,313,355 | ||||||||||||||

Premises and equipment, net | 1,309,009 | 1,315,020 | 1,332,539 | 1,351,479 | 1,333,008 | ||||||||||||||

Bank owned life insurance | 697,023 | 698,773 | 694,370 | 694,335 | 695,842 | ||||||||||||||

Goodwill | 5,060,197 | 5,060,161 | 5,046,847 | 5,046,847 | 5,060,924 | ||||||||||||||

Other intangible assets | 40,701 | 50,208 | 60,097 | 70,784 | 82,840 | ||||||||||||||

Other real estate owned | 23,762 | 20,188 | 17,764 | 20,600 | 17,058 | ||||||||||||||

Other assets | 1,297,620 | 1,332,923 | 1,148,883 | 1,318,392 | 1,323,212 | ||||||||||||||

Total assets | $ | 89,360,000 | $ | 88,470,749 | $ | 85,475,741 | $ | 83,152,427 | $ | 79,192,189 | |||||||||

Liabilities: | |||||||||||||||||||

Deposits: | |||||||||||||||||||

Noninterest bearing | $ | 19,060,016 | $ | 19,048,273 | $ | 18,599,702 | $ | 17,169,412 | $ | 16,979,235 | |||||||||

Interest bearing | 45,432,380 | 43,451,096 | 44,300,979 | 44,020,304 | 43,291,723 | ||||||||||||||

Total deposits | 64,492,396 | 62,499,369 | 62,900,681 | 61,189,716 | 60,270,958 | ||||||||||||||

FHLB and other borrowings | 6,216,425 | 6,778,066 | 4,919,141 | 4,809,843 | 4,551,050 | ||||||||||||||

Federal funds purchased and securities sold under agreements to repurchase | 639,259 | 623,400 | 909,683 | 1,129,503 | 809,053 | ||||||||||||||

Other short-term borrowings | 4,167,897 | 4,982,154 | 3,377,694 | 2,545,724 | 246,835 | ||||||||||||||

Accrued expenses and other liabilities | 1,463,688 | 1,360,698 | 1,206,612 | 1,474,067 | 1,387,240 | ||||||||||||||

Total liabilities | 76,979,665 | 76,243,687 | 73,313,811 | 71,148,853 | 67,265,136 | ||||||||||||||

Shareholder’s Equity: | |||||||||||||||||||

Common stock — $0.01 par value | 2,230 | 2,230 | 2,230 | 2,230 | 2,230 | ||||||||||||||

Surplus | 15,246,072 | 15,245,414 | 15,278,877 | 15,285,991 | 15,333,316 | ||||||||||||||

Retained deficit | (2,859,770 | ) | (2,985,011 | ) | (3,121,071 | ) | (3,262,181 | ) | (3,364,389 | ) | |||||||||

Accumulated other comprehensive loss | (37,789 | ) | (64,672 | ) | (27,654 | ) | (51,357 | ) | (73,846 | ) | |||||||||

Total BBVA Compass Bancshares, Inc. shareholder’s equity | 12,350,743 | 12,197,961 | 12,132,382 | 11,974,683 | 11,897,311 | ||||||||||||||

Noncontrolling interests | 29,592 | 29,101 | 29,548 | 28,891 | 29,742 | ||||||||||||||

Total shareholder’s equity | 12,380,335 | 12,227,062 | 12,161,930 | 12,003,574 | 11,927,053 | ||||||||||||||

Total liabilities and shareholder’s equity | $ | 89,360,000 | $ | 88,470,749 | $ | 85,475,741 | $ | 83,152,427 | $ | 79,192,189 | |||||||||

15

BBVA COMPASS BANCSHARES, INC. INCOME STATEMENTS (Unaudited) (In Thousands) | |||||||||||||||||||

Three Months Ended | |||||||||||||||||||

2015 | 2014 | ||||||||||||||||||

September 30 | June 30 | March 31 | December 31 | September 30 | |||||||||||||||

Interest income: | |||||||||||||||||||

Interest and fees on loans | $ | 540,517 | $ | 531,394 | $ | 543,842 | $ | 547,309 | $ | 509,766 | |||||||||

Interest on investment securities available for sale | 46,646 | 48,204 | 48,208 | 45,786 | 48,363 | ||||||||||||||

Interest on investment securities held to maturity | 6,953 | 6,924 | 6,702 | 6,860 | 6,862 | ||||||||||||||

Interest on federal funds sold, securities purchased under agreements to resell and interest bearing deposits | 1,659 | 1,362 | 996 | 566 | 47 | ||||||||||||||

Interest on trading account assets | 14,431 | 13,832 | 9,614 | 5,696 | 933 | ||||||||||||||

Total interest income | 610,206 | 601,716 | 609,362 | 606,217 | 565,971 | ||||||||||||||

Interest expense: | |||||||||||||||||||

Interest on deposits | 68,282 | 65,201 | 69,653 | 71,034 | 66,763 | ||||||||||||||

Interest on FHLB and other borrowings | 20,422 | 27,540 | 19,106 | 20,010 | 16,399 | ||||||||||||||

Interest on federal funds purchased and securities sold under agreements to repurchase | 2,506 | 1,702 | 1,326 | 918 | 447 | ||||||||||||||

Interest on other short-term borrowings | 11,129 | 15,291 | 10,248 | 4,802 | 394 | ||||||||||||||

Total interest expense | 102,339 | 109,734 | 100,333 | 96,764 | 84,003 | ||||||||||||||

Net interest income | 507,867 | 491,982 | 509,029 | 509,453 | 481,968 | ||||||||||||||

Provision for loan losses | 29,151 | 46,149 | 42,031 | 19,914 | 3,869 | ||||||||||||||

Net interest income after provision for loan losses | 478,716 | 445,833 | 466,998 | 489,539 | 478,099 | ||||||||||||||

Noninterest income: | |||||||||||||||||||

Service charges on deposit accounts | 54,917 | 53,690 | 53,284 | 56,799 | 57,537 | ||||||||||||||

Card and merchant processing fees | 29,024 | 28,711 | 26,183 | 26,432 | 28,682 | ||||||||||||||

Retail investment sales | 26,055 | 26,373 | 25,146 | 25,424 | 27,645 | ||||||||||||||

Investment banking and advisory fees | 17,842 | 36,799 | 30,334 | 24,228 | 18,750 | ||||||||||||||

Asset management fees | 7,918 | 8,435 | 8,096 | 10,813 | 10,666 | ||||||||||||||

Corporate and correspondent investment sales | 6,047 | 7,984 | 6,259 | 7,619 | 5,388 | ||||||||||||||

Mortgage banking income | 554 | 12,556 | 8,159 | 5,627 | 8,498 | ||||||||||||||

Bank owned life insurance | 4,345 | 4,394 | 4,788 | 5,809 | 4,603 | ||||||||||||||

Investment securities gains, net | 6,736 | 27,399 | 32,832 | 5,434 | 9,710 | ||||||||||||||

Gain (loss) on prepayment of FHLB and other borrowings | — | (3,569 | ) | (2,549 | ) | — | 143 | ||||||||||||

Other | 79,938 | 55,797 | 56,738 | 68,033 | 54,809 | ||||||||||||||

Total noninterest income | 233,376 | 258,569 | 249,270 | 236,218 | 226,431 | ||||||||||||||

Noninterest expense: | |||||||||||||||||||

Salaries, benefits and commissions | 268,362 | 268,709 | 259,262 | 281,065 | 265,334 | ||||||||||||||

FDIC indemnification expense | 8,461 | 12,419 | 28,789 | 34,313 | 18,748 | ||||||||||||||

Professional services | 54,784 | 51,119 | 46,559 | 59,027 | 52,463 | ||||||||||||||

Equipment | 58,151 | 57,175 | 58,141 | 58,401 | 56,355 | ||||||||||||||

Net occupancy | 39,525 | 40,382 | 39,280 | 39,865 | 39,357 | ||||||||||||||

Marketing | 10,624 | 11,618 | 10,088 | 5,894 | 11,587 | ||||||||||||||

Communications | 5,682 | 5,245 | 5,767 | 6,003 | 5,964 | ||||||||||||||

Amortization of intangibles | 9,507 | 9,889 | 10,687 | 24,556 | 12,635 | ||||||||||||||

Other | 81,154 | 63,080 | 64,146 | 74,357 | 70,699 | ||||||||||||||

Total noninterest expense | 536,250 | 519,636 | 522,719 | 583,481 | 533,142 | ||||||||||||||

Net income before income tax expense | 175,842 | 184,766 | 193,549 | 142,276 | 171,388 | ||||||||||||||

Income tax expense | 50,110 | 48,116 | 51,782 | 39,864 | 27,770 | ||||||||||||||

Net income | 125,732 | 136,650 | 141,767 | 102,412 | 143,618 | ||||||||||||||

Less: net income attributable to noncontrolling interests | 491 | 590 | 657 | 204 | 815 | ||||||||||||||

Net income attributable to shareholder | $ | 125,241 | $ | 136,060 | $ | 141,110 | $ | 102,208 | $ | 142,803 | |||||||||

16