Attached files

| file | filename |

|---|---|

| 8-K - MIDSOUTH BANCORP FORM 8-K - MIDSOUTH BANCORP INC | form8-kxoctober27.htm |

| EX-99.1 - PRESS RELEASE - OCTOBER 27, 2015 - MIDSOUTH BANCORP INC | mslq309302015er-8kex991.htm |

3Q15 Supplemental Materials October 27, 2015 1NYSE: MSL

Energy Portfolio as of 09/30/2015 (*) *Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices 2NYSE: MSL Collateral Total $’s (Millions) % of Energy Portfolio # of Loans # of Relationships Avg $ per Relationship Wt'd Avg Maturity (Yrs) Oil & Gas Extraction $3.1 1.1% 48 43 $72,399 4.6 Account Receivables 44.4 15.0% 64 58 765,537 0.6 Barges, Crew Boats, Marine Vessel 75.4 25.6% 44 27 2,794,413 6.6 Equipment 96.2 32.5% 236 113 851,051 3.9 Commercial Real Estate 41.8 14.1% 65 50 836,206 12.3 Real Estate 7.6 2.6% 51 46 164,811 6.6 Inventory 1.7 0.6% 9 8 218,747 1.1 CD Secured 21.1 7.1% 13 11 1,916,650 0.1 All Other 4.3 1.4% 97 86 49,598 2.3 Total $295.6 100% 627 442 $668,829 5.0

Energy Lending Update (*) 3NYSE: MSL ▪ $296 million in energy loans to 442 customers ▪ Top 10 energy customers account for 41% of energy loans ▪ Energy loans increased $29.2 million during the quarter to $295.6 million at September 30, 2015 ▪ As of the date of this release, energy loans declined to $259.8 million, or $35.8 million during the month of October due to substantial paydown activity ▪ No energy related charge-offs during 3Q15; YTD energy charge-offs $557,000 ▪ There was only one energy-related impairment during the quarter of $1.1 million ▪ Energy reserve stands at 2.4% of energy loans at September 30, 2015 ▪ One energy loan relationship of $21.1 million moved from accruing Troubled Debt Restructure (TDR) to non-accruing TDR during 3Q15 ▪ Eight energy loan relationships had rating changes during the quarter ◦ Three loan relationships totaling $9.2 million were downgraded to Special Mention ◦ Four loan relationships totaling $13.7 million were downgraded to Substandard ◦ One loan relationship totaling $2.5 million was upgraded to Special Mention during the quarter *Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices

Past Due Energy Loans as of 09/30/15 (*) *Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices > 30 days + nonaccruals = 10.20% of energy loans 4 Collateral Total $’s (Millions) % of Energy Portfolio Total $’s (Millions) % of Energy Portfolio Accruing – Past Due ($millions) Non- Accruals0-29 30-59 60-89 90+ Oil & Gas Extraction $3.1 1.1% $0.02 —% $ — $ — $ 0.01 $ — $ 0.02 Account Receivables 44.4 15.0% 1.16 0.4% 0.44 0.62 — — 0.10 Barges, Crew Boats, Marine Vessel 75.4 25.5% 24.26 8.2% 1.79 0.24 — — 22.23 Equipment 96.2 32.6% 10.41 3.5% 7.78 0.61 — — 2.57 Commercial Real Estate 41.8 14.1% 2.97 1.0% 1.38 1.57 — — 0.02 Real Estate 7.6 2.6% — —% 0.13 — — — 2.15 Inventory 1.7 0.6% — —% — — — — — CD Secured 21.1 7.1% — —% 0.25 — — — — All Other 4.3 1.4% 3.16 1.1% 0.07 — — — — Total $295.6 100.0% $41.98 14.2% $ 11.84 $ 3.04 $ 0.01 $ — $ 27.09

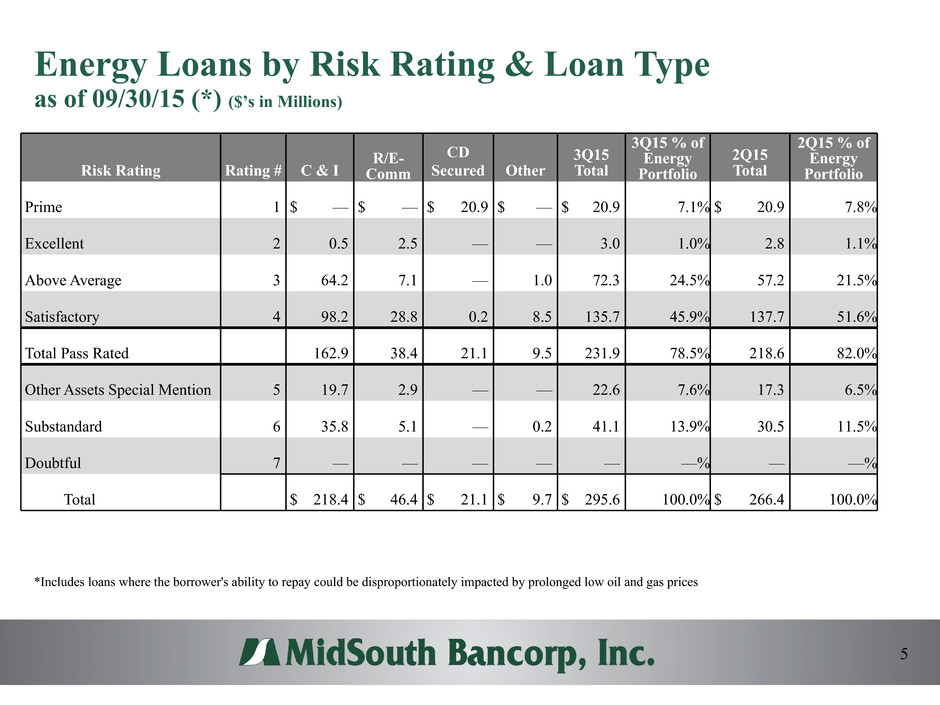

Energy Loans by Risk Rating & Loan Type as of 09/30/15 (*) ($’s in Millions) *Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices 5 Risk Rating Rating # C & I R/E- Comm CD Secured Other 3Q15 Total 3Q15 % of Energy Portfolio 2Q15 Total 2Q15 % of Energy Portfolio Prime 1 $ — $ — $ 20.9 $ — $ 20.9 7.1% $ 20.9 7.8% Excellent 2 0.5 2.5 — — 3.0 1.0% 2.8 1.1% Above Average 3 64.2 7.1 — 1.0 72.3 24.5% 57.2 21.5% Satisfactory 4 98.2 28.8 0.2 8.5 135.7 45.9% 137.7 51.6% Total Pass Rated 162.9 38.4 21.1 9.5 231.9 78.5% 218.6 82.0% Other Assets Special Mention 5 19.7 2.9 — — 22.6 7.6% 17.3 6.5% Substandard 6 35.8 5.1 — 0.2 41.1 13.9% 30.5 11.5% Doubtful 7 — — — — — —% — —% Total $ 218.4 $ 46.4 $ 21.1 $ 9.7 $ 295.6 100.0% $ 266.4 100.0%

Energy Loans by Risk Rating & Collateral as of 09/30/15 (*) ($’s in Millions) *Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices 6 Collateral Pass Other Assets Special Mention Substandard Doubtful 3Q15 Total 3Q15 % of Energy Portfolio 2Q15 Total 2Q15 % of Energy Portfolio Oil & Gas Extraction $ 3.1 $ — $ — $ — $ 3.1 1.1% $ 2.6 1.0% Account Receivables 38.8 3.6 2.0 — 44.4 15.0% 37.0 13.9% Barges, Crew Boats, Marine Vessel 43.3 8.0 24.1 — 75.4 25.5% 75.7 28.4% Equipment 78.5 8.1 9.6 — 96.2 32.6% 74.5 28.0% Commercial Real Estate 35.9 2.9 3.0 — 41.8 14.1% 38.0 14.3% Real Estate 5.3 — 2.3 — 7.6 2.6% 7.8 2.9% Inventory 1.7 — 0.1 — 1.7 0.6% 4.3 1.6% CD Secured 21.1 — — — 21.1 7.1% 21.2 7.9% All Other 4.2 — — — 4.3 1.4% 5.3 2.0% Total $231.9 $ 22.6 $ 41.1 $ — $ 295.6 100.0% $ 266.4 100.0% Energy Loans - Migration Summary – 3Q15 • Criticized Loans increased $15.9 million from $47.8 million to $63.7 • 3 Credits totaling $9.2 million downgraded to Special Mention • 4 Credits totaling $13.7 million downgraded to Substandard • 1 Credit totaling $2.5 million upgraded to Special Mention

Energy Loans by Type of Facility as of 09/30/15 (*) * Includes loans where the borrower's ability to repay could be disproportionately impacted by prolonged low oil and gas prices 7 Facility Type Bal 09.30.15 ($’s in Millions) % of Energy Portfolio Bal 06.30.15 ($’s in Millions) % of Energy Portfolio Net Change 3Q15 Revolving LOC $ 58.4 19.8% $ 41.4 15.5% $ 17.0 Closed-End LOC 220.8 74.7% 210.3 79.0% 10.6 Other 16.4 5.5% 14.7 5.5% 1.6 Grand Total $ 295.6 100.0% $ 266.4 100.0% $ 29.2