Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - FLAGSTAR BANCORP INC | pressrelease3q2015.htm |

| 8-K - 8-K - FLAGSTAR BANCORP INC | a8-kearningsrelease3q2015.htm |

3rd Quarter 2015 Flagstar Bancorp, Inc. (NYSE: FBC) Earnings Presentation 3rd Quarter 2015 October 27, 2015

3rd Quarter 2015 Cautionary statement This report contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Forward-looking statements are based on management’s current expectations and assumptions regarding the Company’s business and performance, the economy and other future conditions, and forecasts of future events, circumstances and results. However, they are not guarantees of future performance and are subject to known and unknown risks, uncertainties, contingencies and other factors. Words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates" and variations of such words and similar expressions are intended to identify such forward-looking statements. The Company’s actual results or outcomes may vary materially from those expressed or implied in a forward-looking statement. Accordingly, we cannot and do not provide you with any assurance that our expectations will in fact occur or that actual results will not differ materially from those expressed or implied by such forward-looking statements. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by us or any other person that the results or conditions described in such statements or our objectives and plans will be achieved. Factors that could cause future results to differ materially from historical performance and these forward-looking statements include, but are not limited to, the following items: 1. General business and economic conditions, including unemployment rates, movements in interest rates, the slope of the yield curve, any increase in mortgage fraud and other related activity and changes in asset values in certain geographic markets, that affect us or our counterparties; 2. Volatile interest rates and our ability to effectively hedge against them, which could affect, among other things, (i) the overall mortgage business, (ii) our ability to originate or acquire loans and to sell assets at a profit, (iii) prepayment speeds, (iv) our cost of funds and (v) investments in mortgage servicing rights; 3. The adequacy of our allowance for loan losses and our representation and warranty reserves; 4. Changes in accounting standards generally applicable to us and our application of such standards, including the calculation of the fair value of our assets and liabilities; 5. Our ability to borrow funds, maintain or increase deposits or raise capital on commercially reasonable terms or at all, and our ability to achieve or maintain desired capital ratios; 6. Changes in material factors affecting our loan portfolio, particularly our residential mortgage loans, and the market areas where our business is geographically concentrated or further loan portfolio or geographic concentration; 7. Changes in, or expansion of, the regulation of financial services companies and government-sponsored housing enterprises, including new legislation, regulations, rulemaking and interpretive guidance, enforcement actions, the imposition of fines and other penalties by our regulators, the impact of existing laws and regulations, new or changed roles or guidelines of government-sponsored entities, changes in regulatory capital ratios, increases in deposit insurance premiums, and special assessments of the Federal Deposit Insurance Corporation; 8. Our ability to comply with the terms and conditions of the Supervisory Agreement with the Board of Governors of the Federal Reserve and the Bank’s ability to comply with the Consent Order with the Office of Comptroller of the Currency and the Consent Order of the Consumer Financial Protection Bureau and our ability to address any further matters raised by these regulators, and other regulators or government bodies; 9. Our ability to comply with the terms and conditions of the agreement with the U.S. Department of Justice and the impact of compliance with that agreement and our ability to accurately estimate the financial impact of that agreement, including the fair value and timing of the future payments; 10. The Bank’s ability to make capital distributions and our ability to pay dividends on our capital stock or interest on our trust preferred securities; 11. Our ability to attract and retain senior management and other qualified personnel to execute our business strategy, including our entry into new lines of business, our introduction of new products and services and management of risks relating thereto, and our competing in the mortgage loan originations, mortgage servicing and commercial and retail banking lines of business; 12. Our ability to satisfy our mortgage servicing and subservicing obligations and manage repurchases and indemnity demands by mortgage loan purchasers, guarantors, and insurers; 13. The outcome and cost of defending current and future legal or regulatory litigation, proceedings, or investigations; 14. Our ability to create and maintain an effective risk management framework and effectively manage risk, including, among other things, market, interest rate, credit and liquidity risk, including risks relating to the cyclicality and seasonality of our mortgage banking business, litigation and regulatory risk, operational risk, counterparty risk, and reputational risk; 15. The control by, and influence of, the fund that is our majority stockholder, and any changes that may occur with respect to that fund or its ownership interest in us; 16. A failure of, interruption in or cybersecurity attack on our network or computer systems, which could impact our ability to properly collect, process, and maintain personal data, ensure ongoing mortgage and banking operations, or maintain system integrity with respect to funds settlement; and 17. Factors that may require us to establish a valuation allowance against our deferred tax asset or that impact our ability to maximize the tax benefit of our net operating losses. Factors that may cause future results to differ materially from historical performance and from forward-looking statements, including but not limited to the factors listed above, may be difficult to predict, may contain uncertainties that materially affect actual results, and may be beyond our control. Also, new factors emerge from time to time, and it is not possible for our management to predict the occurrence of all such factors or to assess the effect of each such factor, or the combined effect of several of the factors at one time, on our business. Any forward-looking statement speaks only as of the date on which it is made. Except to fulfill our obligations under the U.S. securities laws, we undertake no obligation to update any such statement to reflect events or circumstances after the date on which it is made.

3rd Quarter 2015 Executive Overview Sandro DiNello, CEO

3rd Quarter 2015 Progress on strategic initiatives Expand mortgage originations • Optimize fulfillment and secondary marketing to improve profitability • Accelerate retail & DTC distribution to boost purchase mortgage originations Grow community banking • Replace lower performing loans with higher quality assets • Refresh the Flagstar brand to build awareness and grow loans and deposits Enhance efficiency • Drive productivity and revenue improvements to maintain mid-60’s efficiency ratio • Position bank to generate positive operating leverage Sustain risk management • Continue to strengthen risk management practices • Exit regulatory orders (continue to make meaningful progress) Optimize capital structure • Redeem TARP (anticipated no later than 2nd half 2016) • Execute MSR reduction plan to meet Basel III phase-in target 4 Focus on growth and diversification of earnings

3rd Quarter 2015 Financial Overview Jim Ciroli, CFO

3rd Quarter 2015 3rd quarter key highlights Strong profitability • Net income of $47 million, or $0.69 per diluted share in 3Q15, up $1 million, or $0.01 per diluted share vs. 2Q15 • Positive operating leverage, resulting from a 1% increase in revenue and a 5% drop in expenses • Average interest earning assets increased 3%; residential first mortgages increased 16% Higher noninterest income • Noninterest income increased $2 million to $128 million, up 2% from 2Q15 - MSR return rose $3 million to $12 million - Other noninterest income increased $10 million to $9 million, led by favorable fair value adjustments - Net gain on loan sales decreased $15 million to $68 million on lower gain on sale margin and lock volumes Expense discipline • Noninterest expense decreased $7 million to $131 million, down 5% from 2Q15 - Asset resolution expense declined $5 million primarily benefitting from stronger balance sheet - Other noninterest expense fell $2 million on lower advertising costs and regulatory-related expense - Legal and professional expense rose $2 million due to higher non-agency loan sales expense and consulting fees Improved asset quality • Sold $233 million of interest-only (closed October 2015) and lower performing loans - Adjusted charge-offs were 61 bps - $8 million net allowance release, relating to transfer of interest-only and sale of lower performing loans - Allowance to loans held-for-investment remained strong at 3.7% Robust capital • Tier 1 leverage remains solid at 11.7% • On-balance sheet liquidity equal to 18.1% of total assets(1) 1) Liquid assets include interest earning deposits and investment securities; a 5% haircut is applied to investment securities to estimate liquidation costs. 6

3rd Quarter 2015 (Benefit) provision for loan losses • $9 million net allowance release related to interest-only and lower performing loan sales • NPAs decreased 5 bps to 0.64% compared to 0.69% of total assets; no commercial loan delinquencies B Quarterly income comparison $mm Observations 7 Noninterest income • Noninterest income increased 2% - Net gain on loan sales decreased 18% on lower gain on sale margin and lock volumes - Net return on MSR rose on lower transaction costs, partially offset by market-driven changes - Other noninterest income improved $10 million on favorable loan fair value adjustments C Net interest income • Net interest income stable despite loan sales - Modest interest-earning asset growth of 3% - Net interest margin decreased 4 bps to 2.75% A 1) Expressed as a percent of fallout-adjusted locks. Noninterest expense • Efficiency ratio improved to 65% - Lower variable expenses related to decreased mortgage closings - Lower asset resolution, advertising and regulatory-related expenses, partially offset by increased legal & professional fees D 3Q15 2Q15 $ Variance % Variance Net interest income $73 $73 $0 0% (Benefit) provision for loan losses ("PLL") (1) (13) 12 (92%) Net interest income after PLL 74 86 (12) (14%) Net gain on loan sales 68 83 (15) (18%) Loan fees and charges 17 19 (2) (11%) Loan administration income 8 7 1 14% Net return on the mortgage servicing asset 12 9 3 33% Representation and warranty benefit 6 5 1 20% Other noninterest income 17 3 14 N/M Total noninterest income 128 126 2 2% Gain sale / total revenue 34% 39% -5% Compensation and benefits 58 59 (1) (2%) Commissions and loan processing expense 24 25 (1) (4%) Other noninterest expenses 49 54 (5) (9%) Total noninterest expense 131 138 (7) (5%) Income before income taxes 71 74 (3) (4%) Provision for income taxes 24 28 (4) 14% Net income $47 $46 $1 2% Diluted earnings per share $0.69 $0.68 $0.01 1% Profitability Net interest margi 2.75% 2.79% -4 bps Mortgage rate lock ommitments, fallout adjusted $6,495 $6,804 ($309) (5%) Mortgage closings $7,876 $8,448 ($572) (7%) Gain on loan sale margin(1) 1.05% 1.21% -16 bps Efficiency ratio 65.0% 69.6% 460 bps A B C2 D C1 C3

3rd Quarter 2015 154 7 35 8 Pre-tax earnings bridge (3Q15 vs 2Q15) ($mm) 1) See non-GAAP reconciliations in the appendix for excluded items in Q3 2014. $74 $71 ($12) +$10 ($15) +$3 +$5 +$3 $3 2Q15 Δ Benefit for loan losses Δ Other Noninterest Income Δ Gain on loan sales Δ Net MSR return Δ Asset resolution Δ Gain on sale of assets Core improvement 3Q15 Balance sheet Operations

3rd Quarter 2015 Book value per share • Price to book ratio of 99% based on closing price as of October 26, 2015(3) 1) Other consumer loans include second mortgage, HELOC and other loans; commercial loans include commercial real estate, commercial & industrial and warehouse loans. 2) Ratios are calculated on the average balance sheet for the quarter. 3) Book value per share has not been reduced for $79 million of unpaid dividends on our perpetual preferred stock, which has been deferred. If these dividends were paid, book value per share would be reduced by $1.39 per share. 3Q15 2Q15 $ Variance % Variance Total Assets $12,305 $11,811 $494 4% Cash and cash equivalents $192 $200 ($8) (4%) Investment securities $2,313 $2,350 (37) (2%) Liquid assets $2,505 $2,550 ($45) (2%) Residential first mortgages $2,782 $2,408 $374 16% Other consumer loans(1) $586 $505 81 16% Commercial loans(1) $1,108 $1,054 54 5% Warehouse loans $936 $970 (34) (4%) Loans, held for investment $5,412 $4,938 $474 10% Loans held for sale $2,200 2,218 (18) (1%) Loans with government guarantees $547 630 (83) (13%) Total loans $8,159 $7,786 $373 5% Mortgage servicing rights $317 $271 $46 17% Book value per common share $21.91 $20.98 $0.93 4% Strong balance sheet(2) • Deposits are a significant portion of our funding - Total deposits equaled 77% of liabilities - Core deposits equaled 46% of liabilities • Common equity / assets of 10% Average balance sheet highlights $mm Observations Balance sheet growth • Average balance sheet grew $0.5 billion or 4% • Total average loans increased 5% - Loans HFI rose 10% with residential first mortgages up 16% - Other consumer loans increased 16% 9

3rd Quarter 2015 10 Asset quality Performing TDRs and NPLs ($mm) 366 362 112 108 97 107 120 83 65 63 $473 $482 $195 $173 $160 9/30/2014 12/31/2014 3/31/2015 6/30/2015 9/30/2015 Peforming TDRs NPLs 1) Excludes loans carried under the fair value option. Representation & warranty reserve ($mm) Allowance coverage¹ (% of loans HFI) 7.6% 7.0% 5.7% 4.3% 3.7% 11.1% 11.0% 9.5% 6.5% 5.2% 1.9% 1.7% 1.5% 1.4% 1.4% 9/30/2014 12/31/2014 3/31/2015 6/30/2015 9/30/2015 Total Consumer Commercial $57 $53 $53 $48 $45 9/30/2014 12/31/2014 3/31/2015 6/30/2015 9/30/2015 Net charge-offs ($mm) 7 6 5 3 8 $13 $9 $41 $18 $24 0.70% 0.60% 0.45% 0.26% 0.61%(1) 3Q14 4Q14 1Q15 2Q15 3Q15 Charge-offs excl. asset sales Charge-offs from asset sales Adjusted NCO % LHFI 1) 0.30% excluding charge-offs of $3mm for commercial loans and $1mm for consumer loans related to an operational change

3rd Quarter 2015 -96bps +46bps -105bps +50bps -43bps +61bps 12.5%(1) 12.0% 11.5% 11.7% 12/31/2014 Bal Sheet Growth Earnings 3/31/2015 Bal Sheet Growth Earnings 6/30/2015 Bal Sheet Growth Earnings 9/30/2015 Robust capital 11 Repayment of TARP (targeted 2nd half of 2016) • Flagstar has used excess capital to support balance sheet growth • Flagstar grows regulatory capital at a greater pace as it utilizes its NOL-related DTAs and scales back its concentration of MSRs • From Tier 1 capital we currently deduct: - $228mm of NOL-related DTAs - $79mm of MSRs at 40% partial phase-in • Excess capital would be available to repay TARP Regulatory capital ratios as of 9/30/15 vs 6/30/15(1) 11.5% 14.6% 20.0% 21.3% 11.7% 14.9% 20.3% 21.6% Tier 1 Leverage CET-1 to RWA Tier 1 to RWA Total RBC to RWA 6/30/2015 9/30/2015 Observations (Q3 2015) • Increase in regulatory ratios resulted from earnings retention and a lower deduction for NOL-related deferred assets, partially offset by earning asset growth • Utilization of NOL-related DTA has released regulatory capital to support balance sheet growth (9 mos. YTD) - Benefit of 0.4% to Tier 1 Leverage ratio - Supported earning asset growth of $2.2bn (26%) • Flagstar continues to maintain strong capital ratios with the partial phase-in of Basel III regulations 1) Pro-forma under Basel III partial phase-in requirements. Please see non-GAAP tables in the appendix. Tier 1 leverage - 12/31/14 to 9/30/15 1) Please see non-GAAP tables in the appendix.

3rd Quarter 2015 Business Segment Overview Lee Smith, COO

3rd Quarter 2015 • Flagstar is investing in its community banking franchise to diversify and grow its earnings stream Community banking 13 Average commercial loans ($bn) Commercial loan total commitments ($bn) Average consumer loans ($bn) Average deposit funding(1) ($bn) 0.4 0.4 0.4 0.4 0.4 0.6 0.6 0.6 0.6 0.7 0.6 0.5 0.6 1.0 0.9 $1.5 $1.5 $1.7 $2.0 $2.0 3Q14 4Q14 1Q15 2Q15 3Q15 Commercial and Industrial Commercial Real Estate Warehouse 0.6 0.7 0.7 0.7 0.8 0.7 0.8 0.8 0.8 1.2 1.4 1.6 1.7 1.9 2.1 $2.7 $3.1 $3.2 $3.4 $4.1 9/30/2014 12/31/2014 3/31/2015 6/30/2015 9/30/2015 Commercial and Industrial Commercial Real Estate Warehouse 2.3 2.2 2.2 2.4 2.8 0.4 0.4 0.4 0.5 0.6 $2.6 $2.5 $2.6 $2.9 $3.4 3Q14 4Q14 1Q15 2Q15 3Q15 Residential First Other Consumer 5.2 5.3 5.5 5.7 5.7 0.9 1.0 1.0 0.9 1.1 0.9 0.8 1.0 1.1 1.5 $7.0 $7.1 $7.4 $7.7 $8.3 3Q14 4Q14 1Q15 2Q15 3Q15 Retail Government Company-controlled deposits 1) Includes company controlled deposits which are included as part of mortgage servicing.

3rd Quarter 2015 4.4 4.1 4.6 5.2 4.5 1.9 1.6 1.4 1.7 1.9 1.3 1.6 1.5 $7.2 $6.6 $7.3 $8.5 $7.9 3Q14 4Q14 1Q15 2Q15 3Q15 Conventional Government Jumbo Mortgage originations 14 Closings by purpose ($bn) 4.5 3.5 2.6 3.8 4.4 2.7 3.1 4.6 4.6 3.5 $7.2 $6.6 $7.2 $8.4 $7.9 3Q14 4Q14 1Q15 2Q15 3Q15 Purchase originations Refinance originations Closings by mortgage type ($bn) 61% 62% 64% 61% 57% Conforming (%) Gain on loan sale(1) – revenue and margin $52 $53 $91 $83 $68 0.83% 0.87% 1.27% 1.21% 1.05% 0.00% 0.50% 1.00% 1.50% 2.00% $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 $100 3Q14 4Q14 1Q15 2Q15 3Q15 Fallout-adjusted locks ($bn) $6.3 $6.2 $7.2 $6.8 $6.5 3Q14 4Q14 1Q15 2Q15 3Q15 1) Based on fallout adjusted locks. • Flagstar has enhanced its mortgage originations business to improve customer service and profitability 15% 14% 12% 16% 20% FHA (%)

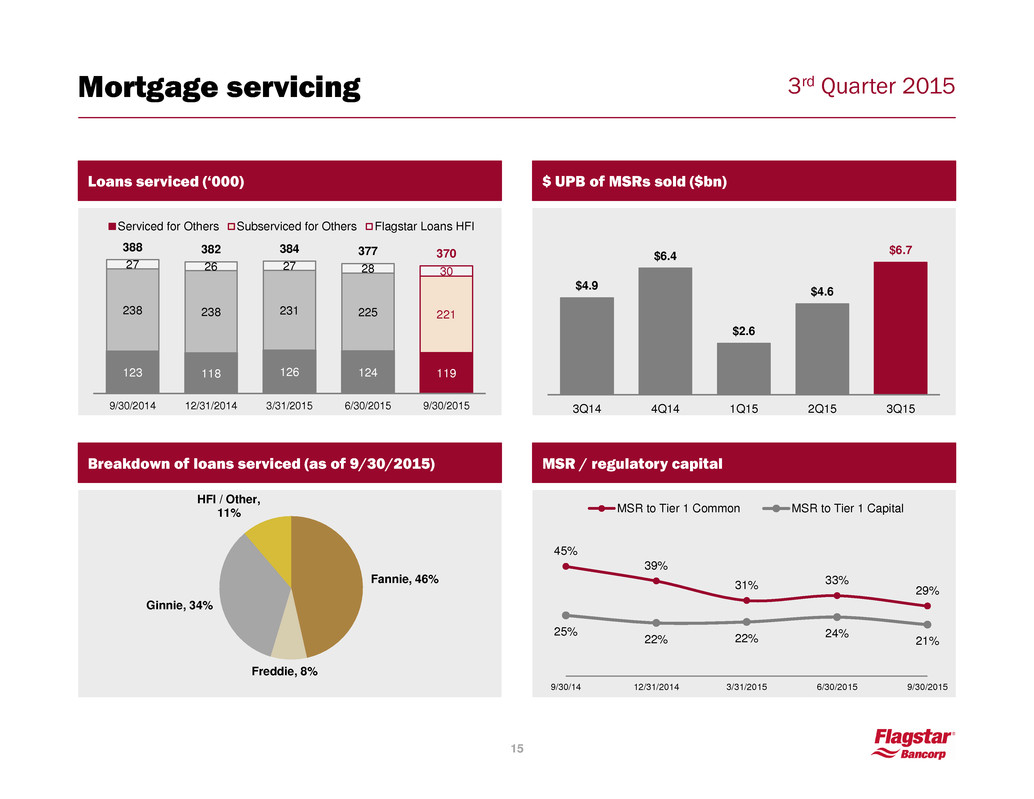

3rd Quarter 2015 15 Breakdown of loans serviced (as of 9/30/2015) MSR / regulatory capital Loans serviced (‘000) $ UPB of MSRs sold ($bn) $4.9 $6.4 $2.6 $4.6 $6.7 3Q14 4Q14 1Q15 2Q15 3Q15 123 118 126 124 119 238 238 231 225 221 27 26 27 28 30 388 382 384 377 370 9/30/2014 12/31/2014 3/31/2015 6/30/2015 9/30/2015 Serviced for Others Subserviced for Others Flagstar Loans HFI 45% 39% 31% 33% 29% 25% 22% 22% 24% 21% 9/30/14 12/31/2014 3/31/2015 6/30/2015 9/30/2015 MSR to Tier 1 Common MSR to Tier 1 Capital Mortgage servicing Fannie, 46% Freddie, 8% Ginnie, 34% HFI / Other, 11%

3rd Quarter 2015 Interest-only loan portfolio Overview 16 • Flagstar has materially eliminated risk associated with held-for-investment interest-only loans Subject to review HFI interest-only reset exposure (UPB $mm) Resolved, $1,432 Pre- reset, $97 Post- reset, $27 Remaining, $124 HFI interest-only portfolio at 12/31/2011 ($1,556) HFI interest-only portfolio at 9/30/2015 ($124)

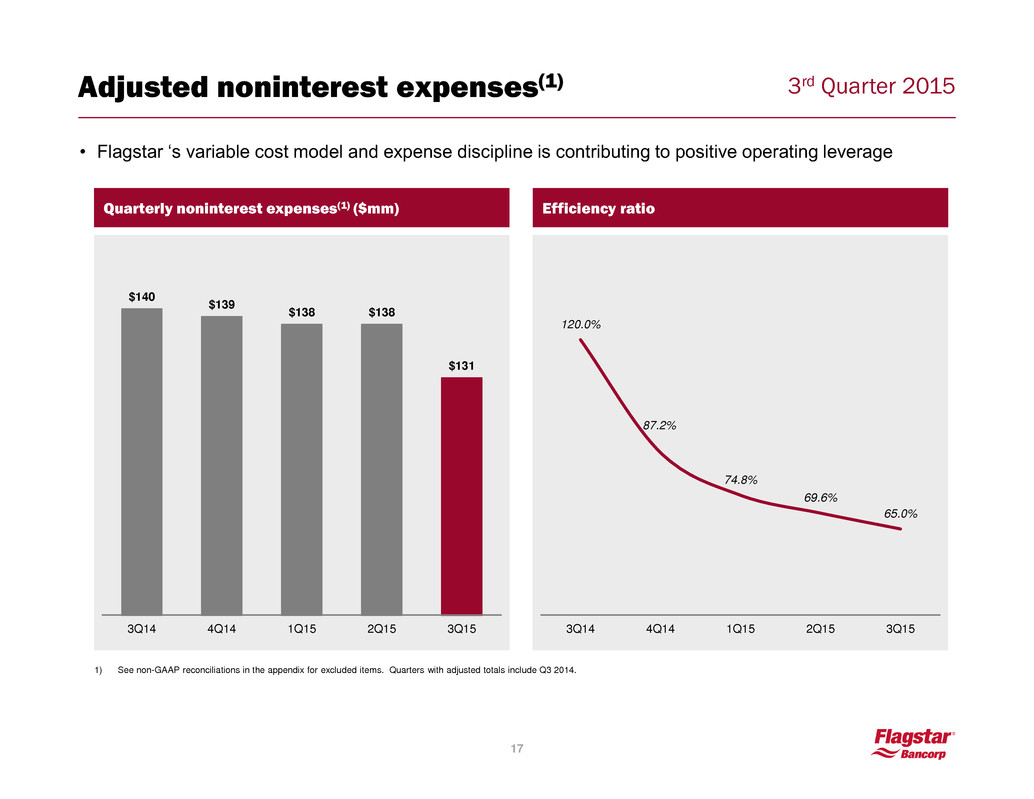

3rd Quarter 2015 Adjusted noninterest expenses(1) Efficiency ratio 120.0% 87.2% 74.8% 69.6% 65.0% 3Q14 4Q14 1Q15 2Q15 3Q15 Quarterly noninterest expenses(1) ($mm) $140 $139 $138 $138 $131 3Q14 4Q14 1Q15 2Q15 3Q15 1) See non-GAAP reconciliations in the appendix for excluded items. Quarters with adjusted totals include Q3 2014. 17 • Flagstar ‘s variable cost model and expense discipline is contributing to positive operating leverage

3rd Quarter 2015 Closing Remarks / Q&A Sandro DiNello, CEO

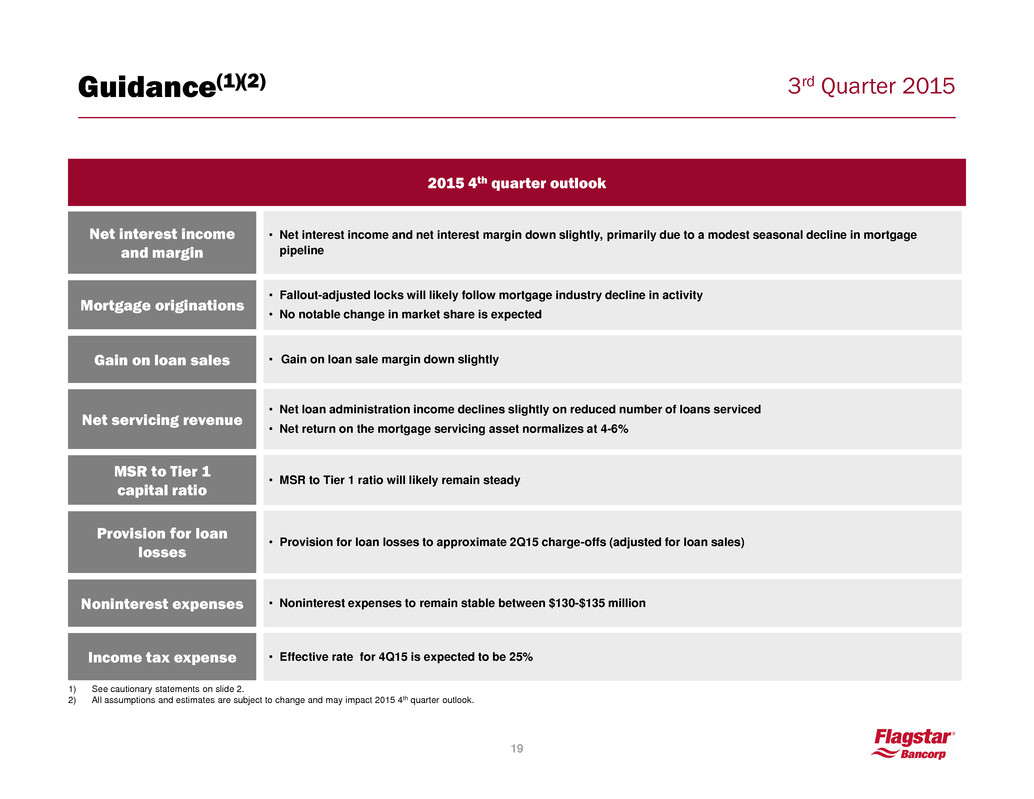

3rd Quarter 2015 Guidance(1)(2) 19 1) See cautionary statements on slide 2. 2) All assumptions and estimates are subject to change and may impact 2015 4th quarter outlook. Net interest income and margin • Net interest income and net interest margin down slightly, primarily due to a modest seasonal decline in mortgage pipeline Mortgage originations • Fallout-adjusted locks will likely follow mortgage industry decline in activity • No notable change in market share is expected Gain on loan sales • Gain on loan sale margin down slightly Net servicing revenue • Net loan administration income declines slightly on reduced number of loans serviced • Net return on the mortgage servicing asset normalizes at 4-6% MSR to Tier 1 capital ratio • MSR to Tier 1 ratio will likely remain steady Provision for loan losses • Provision for loan losses to approximate 2Q15 charge-offs (adjusted for loan sales) Noninterest expenses • Noninterest expenses to remain stable between $130-$135 million 2015 4th quarter outlook Income tax expense • Effective rate for 4Q15 is expected to be 25%

3rd Quarter 2015 Appendix Company overview 21 Financial performance 24 Community banking segment 27 Mortgage origination segment 33 Mortgage servicing segment 34 Capital and liquidity 35 Asset quality 38 Non-GAAP reconciliation 39

3rd Quarter 2015 Solid core franchise 21 3 Community bank • Largest Michigan based bank • #7 in deposit market share • $12.1bn of assets • $7.6bn of deposits • 99 branches Mortgage originator • 10th largest originator nationally • Originated more than $29bn of residential mortgage loans during the last 12 months Mortgage servicer • 7th largest sub-servicer of mortgage loans nationwide • Currently servicing nearly 370k loans • Scalable mortgage platform to service up to 1mm loans COMPANY OVERVIEW

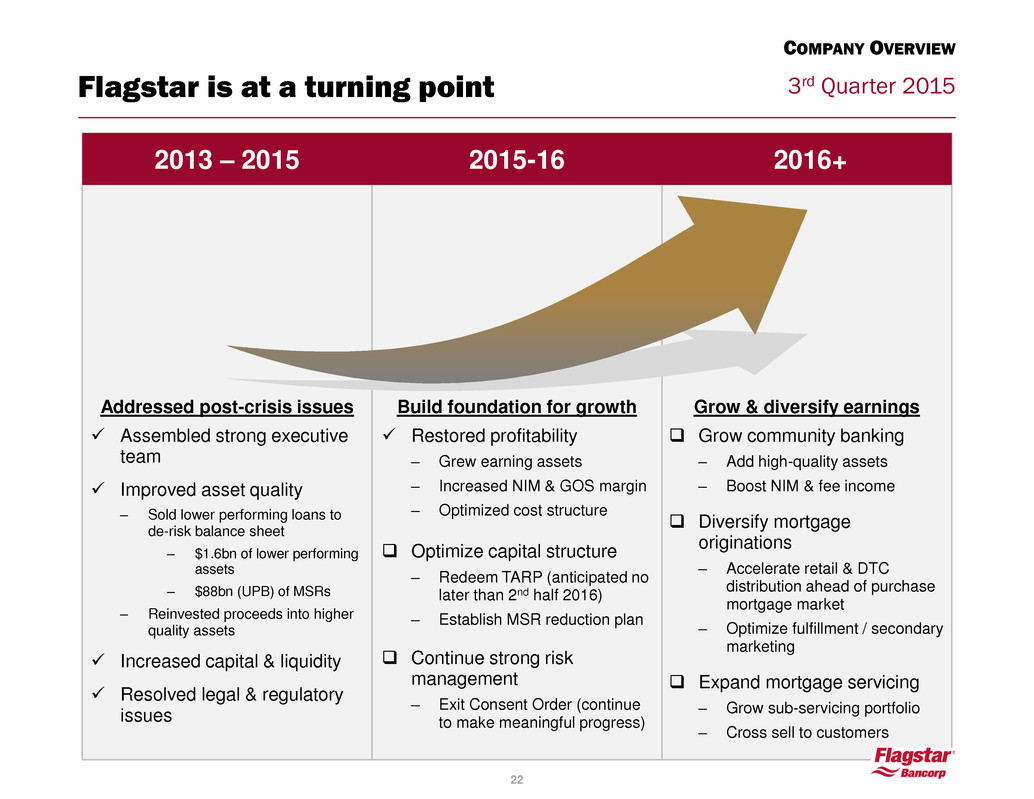

3rd Quarter 2015 Flagstar is at a turning point 2013 – 2015 2015-16 2016+ Addressed post-crisis issues Assembled strong executive team Improved asset quality – Sold lower performing loans to de-risk balance sheet – $1.6bn of lower performing assets – $88bn (UPB) of MSRs – Reinvested proceeds into higher quality assets Increased capital & liquidity Resolved legal & regulatory issues Build foundation for growth Restored profitability – Grew earning assets – Increased NIM & GOS margin – Optimized cost structure Optimize capital structure – Redeem TARP (anticipated no later than 2nd half 2016) – Establish MSR reduction plan Continue strong risk management – Exit Consent Order (continue to make meaningful progress) Grow & diversify earnings Grow community banking – Add high-quality assets – Boost NIM & fee income Diversify mortgage originations – Accelerate retail & DTC distribution ahead of purchase mortgage market – Optimize fulfillment / secondary marketing Expand mortgage servicing – Grow sub-servicing portfolio – Cross sell to customers 22 COMPANY OVERVIEW

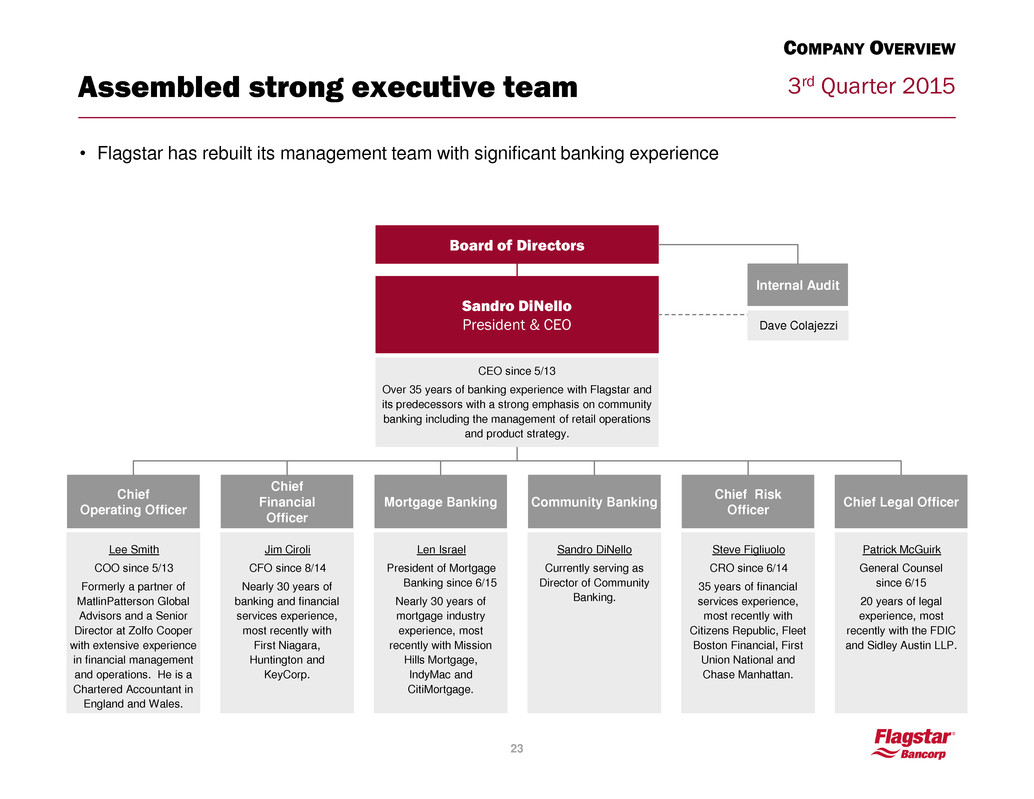

3rd Quarter 2015 Assembled strong executive team 23 • Flagstar has rebuilt its management team with significant banking experience Sandro DiNello President & CEO Board of Directors Community Banking Sandro DiNello Currently serving as Director of Community Banking. Chief Financial Officer Jim Ciroli CFO since 8/14 Nearly 30 years of banking and financial services experience, most recently with First Niagara, Huntington and KeyCorp. Chief Operating Officer Lee Smith COO since 5/13 Formerly a partner of MatlinPatterson Global Advisors and a Senior Director at Zolfo Cooper with extensive experience in financial management and operations. He is a Chartered Accountant in England and Wales. Chief Risk Officer Steve Figliuolo CRO since 6/14 35 years of financial services experience, most recently with Citizens Republic, Fleet Boston Financial, First Union National and Chase Manhattan. Mortgage Banking Len Israel President of Mortgage Banking since 6/15 Nearly 30 years of mortgage industry experience, most recently with Mission Hills Mortgage, IndyMac and CitiMortgage. Chief Legal Officer Patrick McGuirk General Counsel since 6/15 20 years of legal experience, most recently with the FDIC and Sidley Austin LLP. Internal Audit Dave Colajezzi COMPANY OVERVIEW CEO since 5/13 Over 35 years of banking experience with Flagstar and its predecessors with a strong emphasis on community banking including the management of retail operations and product strategy.

3rd Quarter 2015 Restored profitability 24 $mm (except per share data) Observations Increased net interest income • Net interest income bolstered by higher interest-earning assets, led by expansion of commercial banking platform and residential mortgage production A Higher noninterest income • Led by increased net gain on loan sales and improved returns on MSR asset • Net gain on loan sales improved by higher GOS margins C Improved operating leverage • Efficiently managed noninterest expense after implementing cost optimization efforts • Lower efficiency ratio led by higher revenues with stable expense base D Lower credit costs • Sale of TDRs, I/Os and lower performing loans during 1Q15 - 3Q15 resulted in reserve releases • Rotation into higher quality assets resulted in lower provision for loan losses B 9/30/15 6/30/15 3/31/15 12/31/14 9/30/14 9/30/15 9/30/14 Net interest income $73 $73 $65 $61 $64 $211 $185 (Benefit) provision for loan losses ("PLL") (1) (13) (4) 5 8 (18) 127 Net interest income (loss) after PLL 74 86 69 56 56 229 58 Net gain on loans sales 68 83 91 53 52 242 152 Loan fees and charges 17 19 17 17 19 53 56 Loan administration income 8 7 4 5 6 19 19 Other noninterest income 35 17 7 23 8 59 36 Total noninterest income 128 126 119 98 85 373 263 Compensation and benefits 58 59 61 59 54 178 174 Commissions and loan processing 24 25 22 20 20 71 52 Other noninterest expense 49 54 55 60 105 158 213 Total noninterest expense 131 138 138 139 179 407 439 Income (loss) before income taxes 71 74 50 15 (38) 195 (118) Provision (benefit) for income taxes 24 28 18 4 (10) 70 (38) Net income (loss) to common $47 $46 $32 $11 ($28) $125 ($81) Dilluted income (loss) per share $0.70 $0.68 $0.43 $0.07 ($0.61) $1.82 ($1.79) Profitability Net interest margin 2.56% 2.79% 2.75% 2.80% 2.91% 2.76% 2.95% Mortgage rate lock commitments, fallout adjusted $6,495 $6,804 $7,185 $6,156 $6,304 $20,484 $17,851 Mortgage closings $7,876 $8,448 $7,254 $6,603 $7,187 $23,578 $18,004 Gain on loan sale margin 1.05% 1.21% 1.27% 0.87% 0.83% 1.18% 0.85% Efficiency ratio 65.0% 69.6% 74.8% 87.2% 120.0% 69.6% 98.3% Three Months Ended Nine Months Ended B D2 C2 C1 A D1 FINANCIAL PERFORMANCE

3rd Quarter 2015 Consolidated financial highlights 25 FINANCIAL PERFORMANCE Quarterly results – $mm 3Q14 4Q14 1Q15 2Q15 3Q15 Balance Sheet Gross loans HFS $1,469 $1,244 $2,097 $2,038 $2,408 Gross loans HFI $4,185 $4,448 $4,631 $5,335 $5,514 Government guaranteed loans $1,192 $1,128 $704 $592 $509 MSR $285 $258 $279 $317 $294 Total assets $9,625 $9,840 $11,571 $12,139 $12,519 Deposits $7,234 $7,069 $7,549 $7,648 $8,136 FHLB borrowings $150 $514 $1,625 $2,198 $2,024 Trust preferred $247 $247 $247 $247 $247 Preferred equity $267 $267 $267 $267 $267 Common equity $1,085 $1,106 $1,153 $1,184 $1,237 % common equity of total assets 11.3% 11.2% 10.0% 9.8% 9.9% Income Statement Net interest income $64 $61 $65 $73 $73 Gain on loan sales $52 $53 $91 $83 $68 Other noninterest income $33 $45 $28 $43 $61 Noninterest expense ($179) ($139) ($138) ($138) ($131) Pre-provision net revenue (expense) ($30) $20 $46 $61 $71 Provision for loan losses ($8) ($5) $4 $13 $1 Income (loss) before taxes ($38) $15 $50 $74 $71 PPNR / average assets -1.2% 0.8% 1.7% 2.1% 2.3% Credit ALLL $301 $297 $253 $222 $197 ALLL as a % of loans HFI (excl FV) 7.6% 7.0% 5.7% 4.3% 3.7% NPAs to total assets 1.40% 1.40% 0.90% 0.70% 0.60% Operations Number of banking centers 106 107 107 100 99 Number of loan origination centers 32 16 16 13 14 # of employees 2,725 2,739 2,680 2,713 2,677

3rd Quarter 2015 Consolidated financial highlights 26 FINANCIAL PERFORMANCE Annual results – $mm 2010 2011 2012 2013 2014 Balance Sheet Gross loans HFS $2,585 $1,801 $3,940 $1,480 $1,244 Gross loans HFI $6,305 $7,039 $5,438 $4,056 $4,448 Government guaranteed loans $1,675 $1,899 $1,841 $1,308 $1,128 MSR $580 $511 $711 $285 $258 Total assets $13,644 $13,637 $14,082 $9,407 $9,840 Deposits $7,998 $7,690 $8,294 $6,140 $7,069 FHLB borrowings $3,725 $3,953 $3,180 $988 $514 Trust preferred $247 $247 $247 $247 $247 Preferred equity $249 $255 $260 $266 $267 Common equity $1,011 $825 $899 $1,160 $1,106 % common equity of total assets 7.4% 6.0% 6.4% 12.3% 11.2% Income Statement Net interest income $211 $245 $297 $186 $247 Gain on loan sales $297 $301 $991 $402 $206 Other noninterest income $157 $85 $30 $251 $155 Noninterest expense ($612) ($635) ($989) ($918) ($579) Pre-provision net revenue (expense) $53 ($4) $329 ($79) $29 Provision for loan losses ($426) ($177) ($276) ($70) ($132) Income (loss) before taxes ($373) ($181) $53 ($149) ($103) PPNR / average assets 0.4% 0.0% 2.4% -0.7% 0.3% Credit ALLL ($274) ($318) ($305) ($207) ($297) ALLL as a % of loans HFI (excl FV) 4.40% 4.50% 5.60% 5.40% 7.00% NPAs to total assets 4.40% 4.40% 3.70% 2.00% 1.40% Operations Number of banking centers 162 111 111 111 107 Number of loan origination centers 27 27 31 39 16 # of employees 3,279 3,136 3,662 3,253 2,739

3rd Quarter 2015 Deposits Portfolio and strategy overview 4.8 5.4 5.5 5.7 5.7 $7.0 $7.1 $7.4 $7.7 $8.3 3Q14 4Q14 1Q15 2Q15 3Q15 Retail deposits Other deposits Total average deposits ($bn) +17% YOY • Flagstar gathers deposits from consumers, small businesses and select governmental entities – Traditionally, CDs and savings accounts represented the bulk of our branch-based retail depository relationships – Today, we are focused on gathering core DDA deposits from small business and consumers, which represents nearly $20mm of the quarterly deposit growth – We additionally maintain depository relationships in connection with our mortgage origination and servicing businesses, and with predominately Michigan governmental entities – Cost of interest-bearing deposits equal to 0.70% DDA 11% Savings 45% MMDA 3% CD 10% Company- controlled 18% Government & other 13% 69% retail Total : $8.3bn 0.70% cost of interest-bearing deposits Q3 2015 total average deposits 27 COMMUNITY BANKING

3rd Quarter 2015 Focus on driving branch deposit growth Key consumer accomplishments • 3Q15 represented the 15th consecutive quarter with net growth in personal checking accounts, despite the Saginaw branch sale in 3Q15 • 6% growth in average time deposit balances during 3Q15 • 6% growth in deposit fee income over prior quarter and 22% higher than 2014 average Average deposits / branch ($mm)(1) $48 $48 $49 $54 $55 3Q14 4Q14 1Q15 2Q15 3Q15 28 Affinity Relationships COMMUNITY BANKING 1) Excludes commercial, government and company controlled deposits.

3rd Quarter 2015 Deposit channel overviews: Commercial, Company-controlled, government Average commercial ($mm) $175 $191 $214 $242 $280 3Q14 4Q14 1Q15 2Q15 3Q15 Average company-controlled ($mm) $865 $836 $952 $1,131 $1,490 3Q14 4Q14 1Q15 2Q15 3Q15 Average government ($mm) $944 $994 $962 $947 $1,069 3Q14 4Q14 1Q15 2Q15 3Q15 • Arise due to servicing of loans for others and represent the portion of the investor custodial accounts on deposit with the Bank • 3Q15 increase was driven by the return of all remaining mortgage escrow deposits • We call on local governmental agencies and other public units as an additional source for deposit funding • Cost of deposit 0.45% • Over the past year, treasury management services has driven: – 60% growth in commercial deposits – 24% YTD growth in fee income • Cost of deposit: 0.54% 29 COMMUNITY BANKING

3rd Quarter 2015 1.6 1.7 1.8 2.2 2.2 4.1 4.0 4.3 4.9 5.4 1.2 1.1 0.9 0.6 0.5 $6.9 $6.9 $7.0 $7.8 $8.2 3Q14 4Q14 1Q15 2Q15 3Q15 Loans HFS Gross Loans HFI Government Guaranteed Loans 1st Mortgage HFI 34% 2nds, HELOC & other 7% Warehouse 11% CRE and C&I 14% GNMA buyouts 7% 1st Mortgage HFS 27% Q3 2015 average gross loans Lending Portfolio and strategy overview Total average loans ($bn) • Flagstar’s largest category of earning assets consists of loans held-for-investment, currently $5.4bn, gross – Loans to consumers consist of residential first mortgage loans, HELOC and other – C&I / CRE lending is an important growth strategy, offering risk diversification and asset sensitivity – Warehouse loans are extended to other mortgage lenders, offering attractive risk-adjusted returns • Flagstar maintains a balance of mortgage loans held for sale of $2.4bn at 9/30/15 – Essentially all of our mortgage loans produced are sold into the secondary market on a whole loan basis or by securitizing the loans into MBS – Flagstar has the option to direct a portion of the mortgage loans it originates to its own balance sheet • Flagstar also has a portfolio of FHA-insured or guaranteed delinquent loans securitized in Ginnie Mae pools, which it repurchases from time to time 30 COMMUNITY BANKING

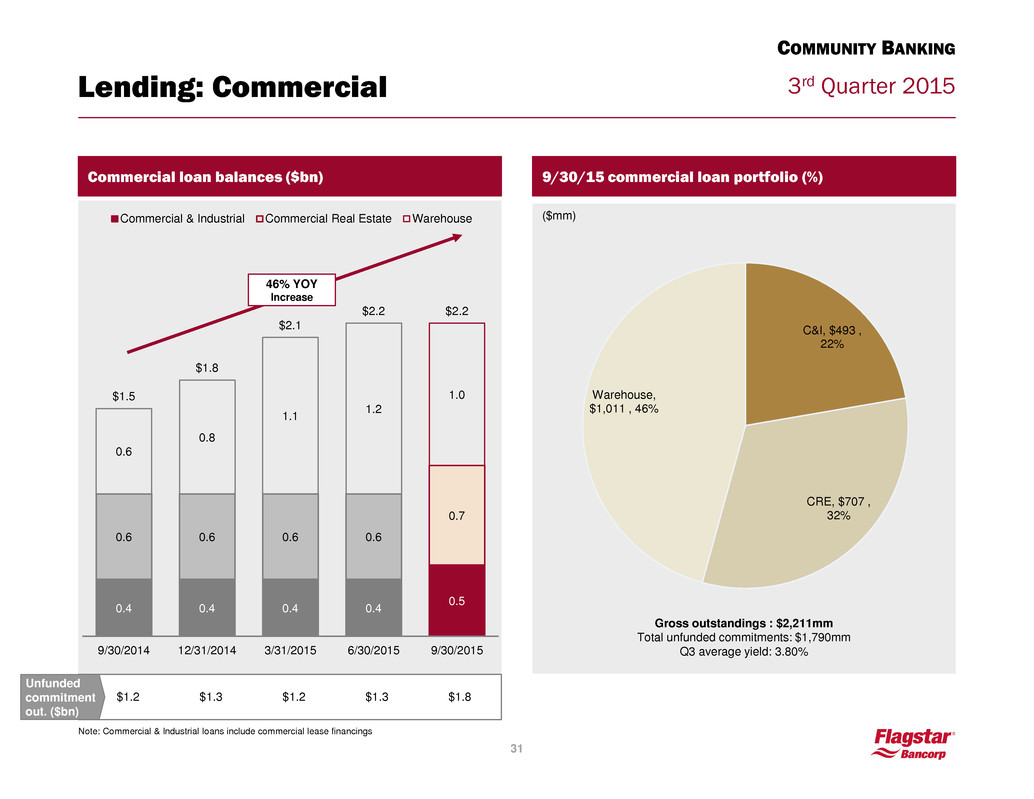

3rd Quarter 2015 $1.2 $1.3 $1.2 $1.3 $1.8 C&I, $493 , 22% CRE, $707 , 32% Warehouse, $1,011 , 46% Gross outstandings : $2,211mm Total unfunded commitments: $1,790mm Q3 average yield: 3.80% Commercial loan balances ($bn) 0.4 0.4 0.4 0.4 0.5 0.6 0.6 0.6 0.6 0.7 0.6 0.8 1.1 1.2 1.0 $1.5 $1.8 $2.1 $2.2 $2.2 9/30/2014 12/31/2014 3/31/2015 6/30/2015 9/30/2015 Commercial & Industrial Commercial Real Estate Warehouse 46% YOY Increase 9/30/15 commercial loan portfolio (%) Note: Commercial & Industrial loans include commercial lease financings Lending: Commercial 31 Unfunded commitment out. ($bn) COMMUNITY BANKING ($mm)

3rd Quarter 2015 Lending: Commercial C&I and CRE predominately in-footprint and well diversified 32 COMMUNITY BANKING MI 51% SC 12% NJ 10% MN 7% CA 7% All Other 13% Services 35% Financial / Insurance 45% Manufacturing, 11% Distribution 8% Govt & Educ. 1% MI 86% NC 2% NY 2% GA 2% KY 2% All Other 6% Office 21% Retail 22% Apartments 19% Industrial 7% Special Purpose 6% SFR Resi. & Land Devel. 5% Owner- Occupied 20% CRE as of 9/30/15 - $707mm Property type: C&I as of 9/30/15 - $493mm Property location: Borrower location: Borrower type:

3rd Quarter 2015 Mortgages are originated primarily through the correspondent channel 33 MORTGAGE ORIGINATIONS Residential mortgage originations by channel ($bn) $5.3 $4.8 $5.0 $5.8 $5.6 3Q14 4Q14 1Q15 2Q15 3Q15 Correspondent Broker Retail $1.5 $1.5 $1.8 $2.2 $1.9 3Q14 4Q14 1Q15 2Q15 3Q15 $0.3 $0.3 $0.4 $0.5 $0.4 3Q14 4Q14 1Q15 2Q15 3Q15 • Nearly 700 correspondent partners in 50 states in Q3 2015 • Top 10 relationships account for 14% of overall correspondent volume • Warehouse lines to over 250 correspondent relationships • Nearly 600 brokerage relationships in 50 states in Q3 2015 • Top 10 relationships account for 20% of overall brokerage volume • 14 standalone home loan centers in 10 states in Q3 2015 • Consumer direct is 32% of retail volume

3rd Quarter 2015 154 7 35 34 MSR portfolio as of 9/30/15 MSR portfolio characteristics (% UPB) MSR portfolio statistics Measure ($mm) 9/30/2015 6/30/2015 Δ Unpaid principal balance $26,308 $27,681 ($1,373) Fair value of MSR $294 $317 ($23) Capitalized rate 1.12% 1.15% -0.03% Multiple 3.990 4.209 (0.219) N te rate 4.108% 4.064% 0.044% Service fee 0.280% 0.272% 0.008% Average Measure ($000) UPB per loan $222 $223 ($1) FICO 727 734 (7) Loan to value 78.18% 76.71% 1.47% $ return – MSR asset $ Return 3Q14 4Q14 1Q15 2Q15 3Q15 Net hedged profit (loss) ($1) $0 ($4) $4 $1 Carry on asset 16 15 18 22 19 Run-off (9) (10) (15) (12) (8) Gr ss r turn on the mortgage servicing asset $6 $5 ($1) $14 $12 Sale transaction & P/L (2) (4) (2) (5) 3 Model Changes (3) - - - (3) Net return on the mortgage servicing asset $1 $2 ($2) $9 $12 Average mortgage servicing rights $295 $280 $265 $271 $317 2015, 56% 2014, 35% <=2013, 9% Vintage Fannie, 55% GNMA, 27% Freddie, 16% Private, 2% Investor MORTGAGE SERVICING

3rd Quarter 2015 Liquidity Gross loans/deposits Available liquidity/total assets(1) 23% 24% 24% 29% 27% 57% 57% 57% 65% 67% 17% 16% 11% 8% 7% 96% 97% 93% 102% 100% 9/30/2014 12/31/2014 3/31/2015 6/30/2015 9/30/2015 Gross loans HFS Gross loans HFI Gov. insured loans 35 CAPITAL AND LIQUIDITY 14% 17% 21% 19% 18% 29% 22% 13% 10% 13% 43% 39% 33% 29% 31% 9/30/2014 12/31/2014 3/31/2015 6/30/2015 9/30/2015 Cash + investment securities FHLB borrowing capacity / assets 1) Reclassification of certain Investment securities to held-to-maturity as of 9/30/15 have been included in available liquidity.

3rd Quarter 2015 Available liquidity and funding 36 CAPITAL AND LIQUIDITY Liquidity balances and ratios ($mm) Available liquidity 6/30/2014 9/30/2014 12/31/2014 3/31/2015 9/30/2015 Interest-earning deposits $63 $89 $198 $194 $130 Investment securites available-for-sale 1,378 1,672 2,295 2,272 1,150 Investment securites held-to-maturity (1) - - - - 1,108 Less: securities haircut (69) (84) (115) (114) (112) Less: pledged collateral (1) - - - (13) Liquid assets $1,371 $1,677 $2,378 $2,352 $2,263 FHLB borrowing capacity $2,775 $2,200 $1,476 $1,186 $1,569 Total available liquidity $4,146 $3,877 $3,854 $3,538 $3,832 Liquid assets as a % of total assets 14.2% 17.0% 20.6% 19.4% 18.1% FHLB Capacity as a % of total assets 28.8% 22.4% 12.8% 9.8% 12.5% Available liquidity as a % of total assets 43.1% 39.4% 33.3% 29.1% 30.6% Funding 9/30/2014 12/31/2014 3/31/2015 6/30/2015 9/30/2015 Brokered deposits $354 $392 $361 $328 $317 FHLB advances 150 514 1,625 2,198 2,024 Other debt 340 331 317 283 279 Total wholesale funding $844 $1,237 $2,303 $2,809 $2,620 Wholesale funding as a % of total assets 8.8% 12.6% 19.9% 23.1% 20.9% 1) Reclassification of certain Investment securities to held-to-maturity as of 9/30/15 have been included in available liquidity.

3rd Quarter 2015 Composition of liabilities 37 CAPITAL AND LIQUIDITY Quarter end liabilities ($mm) ($ in mm) Balance Mix Balance Mix Balance Mix Balance Mix Balance Mix Retail deposits Demand $685 8.3% $726 8.6% $751 7.4% $757 7.1% $746 6.8% Savings 3,311 40.0% 3,428 40.5% 3,643 35.9% 3,749 35.1% 3,671 33.3% Money market 220 2.7% 209 2.5% 196 1.9% 185 1.7% 176 1.6% Certificates of deposit 854 10.3% 807 9.5% 769 7.6% 765 7.2% 799 7.3% Total retail $5,070 61.3% $5,170 61.1% $5,359 52.8% $5,456 51.0% $5,392 49.0% Commercial deposits Demand $121 1.5% $133 1.6% $139 1.4% $161 1.5% $149 1.4% Savings 27 0.3% 27 0.3% 35 0.3% 39 0.4% 32 0.3% Money market 37 0.4% 43 0.5% 56 0.6% 96 0.9% 75 0.7% Certificates of deposit 1 0.0% 5 0.1% 6 0.1% 2 0.0% 14 0.1% Total commercial $186 2.2% $208 2.5% $236 2.3% $298 2.8% $270 2.5% Government deposits Demand $292 3.5% $246 2.9% $346 3.4% $254 2.4% $367 3.3% Savings 410 5.0% 317 3.7% 356 3.5% 403 3.8% 468 4.2% Certificates of deposit 376 4.5% 355 4.2% 240 2.4% 312 2.9% 372 3.4% Total government $1,078 13.0% $918 10.8% $942 9.3% $969 9.1% $1,207 11.0% Company controlled deposits $900 10.9% $773 9.1% $1,012 10.0% $925 8.7% $1,267 11.5% Total deposits $7,234 87.4% $7,069 83.5% $7,549 74.4% $7,648 71.6% $8,136 73.9% FHLB Advances 150 1.8% 514 6.1% 1,625 16.0% 2,198 20.6% 2,024 18.4% Other debt 340 4.1% 331 3.9% 317 3.1% 283 2.6% 279 2.5% Other liabilities 549 6.6% 553 6.5% 661 6.5% 559 5.2% 576 5.2% Total liabilities $8,273 100.0% $8,467 100.0% $10,152 100.0% $10,688 100.0% $11,015 100.0% 9/30/20156/30/20153/31/201512/31/20149/30/2014

3rd Quarter 2015 766 988 1,185 912 788 588 487 449 442 402 1,354 177 1,475 265 1,634 237 1,354 150 1,190 56 3Q 2014 4Q 2014 1Q 2015 2Q 2015 3Q 2015 Fannie Mae Freddie Mac Fannie Mae Freddie Mac Audit file pulls Repurchase demands Representation & Warranty reserve details (in millions) 9/30/14 12/31/14 3/31/15 6/30/15 9/30/15 Beginning balance $50) $57) $53) $53) $48) Additions 15) (4) 0) (3) (4) Net charge-offs (8) 0) (0) (2) 1) Ending Balance $57) $53) $53) $48) $45) Repurchase pipeline ($mm) Repurchase reserve ($mm) Repurchase activity with Fannie and Freddie Repurchase demands / file pulls 18% 15% 11% 13% 38 5% ASSET QUALITY $31 $43 $58 $46 $30 9/30/2014 12/31/2014 3/31/15 6/30/2015 9/30/2015

3rd Quarter 2015 Supplemental capital ratios 39 NON-GAAP RECONCILIATION $mm – Basel I to Basel III (transitional) as of 12/31/14 1) On January 1, 2015, the Basel III rules became effective, subject to transition provisions primarily related to regulatory deductions and adjustments impacting, risk weighted assets, adjusted tangible assets, common equity Tier 1 capital and Tier 1 capital. We reported under Basel I (which included the Market Risk Final Rules) at December 31, 2014. Flagstar Bancorp Common Equity Tier 1 (to Risk Weighted Assets) Tier 1 Leverage (to Adjusted Tangible Assets) Tier 1 Capital (to Risk Weighted Assets) Total Risk-Based Capital (to Risk Weighted Assets) Regulatory capital as of 12/31/14 Basel I capital N/A $1,184 $1,184 $1,252 Net change in capital N/A $37 $37 $37 Basel III capital(1) $876 $1,221 $1,221 $1,289 Risk-weighted assets as 12/31/14 Basel I assets N/A $9,403 $5,190 $5,190 Net change in assets N/A $351 $42 $42 Basel III assets(1) $5,232 $9,755 $5,232 $5,232 Capital ratios Basel I N/A 12.6% 22.8% 24.1% Basel III(1) 16.7% 12.5% 23.3% 24.6%

3rd Quarter 2015 Efficiency ratio and earnings per share 40 $mm 1) Reverse benefit for contract renegotiation. 2) Add back reserve increase related to indemnifications claims on government insured loans. 3) Negative fair value adjustment on repurchased performing loans and a benefit for contract renegotiation. 4) Adjust for legal expenses related to the litigation settlements during the respective periods. 5) Adjust for CFPB litigation settlement expense. NON-GAAP RECONCILIATION 3Q14 4Q14 1Q15 2Q15 3Q15 Net interest income (a) $64 $61 $65 $73 $73 Noninterest income (b) 85 98 119 126 128 Adjusting items: Loan fees and charges (1) - - - - - Representation and warranty reserve – change in estimate (2) 10 - - - - Other noninterest income (3) - - - - - Adjusted noninterest income $95 $98 $119 $126 $128 Adjusted income $159 $159 $184 $199 $201 Noninterest expense (c) $179 $139 $138 $138 $131 Adjusting items: Legal and professional expense (4) (1) - - - - Other noninterest expense (5) (38) - - - - Adjusted noninterest expense $140 $139 $138 $138 $131 Efficiency ratio (c/(a+b)) 120.1% 87.4% 75.0% 69.3% 65.2% Net (loss) income applicable to common stockholders ($28) $11 $32 $46 $47 Adjustment to remove adjusting items 49 - - - - Tax impact of adjusting items (17) - - - - Adjusting tax item - - - - - Adjusted net (loss) income applicable to common stockholders $4 $11 $32 $46 $47 Dilute (loss) income per share ($0.61) $0.07 $0.43 $0.68 $0.69 Adjustment to remove adjusting items 0.87 - - - - Tax impact of adjusting items (0.30) - - - - Adjusting tax item - - - - - Diluted adjusted (loss) income per share ($0.04) $0.07 $0.43 $0.68 $0.69 Weighted average shares outstanding Basic 56,249,300 56,310,858 56,385,454 56,436,026 56,436,026 Diluted 56,249,300 56,792,751 56,775,039 57,165,072 57,207,503