Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 PDF - UDR, Inc. | a3q15pressrelease.pdf |

| EX-99.2 - EXHIBIT 99.2 PDF - UDR, Inc. | a3q15supplement.pdf |

| 8-K - 8-K - UDR, Inc. | form8-kx09302015.htm |

| EX-99.1 - EXHIBIT 99.1 - UDR, Inc. | exhibit991-09302015.htm |

Exhibit 99.2

Financial Highlights | |||||||||||||

UDR, Inc. | |||||||||||||

As of End of Third Quarter 2015 (1) | |||||||||||||

(Unaudited) | |||||||||||||

Actual Results | Actual Results | Guidance as of September 30, 2015 | |||||||||||

Dollars in thousands, except per share | 3Q 2015 | YTD 2015 | 4Q 2015 | Full-Year 2015 | |||||||||

Per Share Metrics | |||||||||||||

FFO per common share and unit, diluted | $0.42 | $1.25 | $0.40 to $0.42 | $1.65 to $1.67 | |||||||||

FFO as Adjusted per common share and unit, diluted | $0.42 | $1.24 | $0.41 to $0.43 | $1.65 to $1.67 | |||||||||

Adjusted Funds from Operations ("AFFO") per common share and unit, diluted | $0.37 | $1.13 | $0.36 to $0.38 | $1.49 to $1.51 | |||||||||

Dividend declared per share and unit | $0.2775 | $0.8325 | $0.2775 | $1.11 (2) | |||||||||

Same-Store Operating Metrics | |||||||||||||

Revenue growth | 5.9% | 5.4% | -- | 5.25% to 5.50% | |||||||||

Expense growth | 2.7% | 2.3% | -- | 2.75% to 3.00% | |||||||||

NOI growth | 7.3% | 6.8% | -- | 6.25% to 6.75% | |||||||||

Physical Occupancy | 96.6% | 96.8% | -- | 96.5% | |||||||||

Property Metrics | Homes | Communities | % of Total NOI | ||||||||||

Same-Store | 34,774 | 119 | 74.5% | ||||||||||

Stabilized, Non-Mature | 1,847 | 6 | 6.2% | ||||||||||

Redevelopment | 328 | 1 | 1.6% | ||||||||||

Development, completed | 701 | 2 | 1.5% | ||||||||||

Non-Residential / Other | N/A | N/A | 3.1% | ||||||||||

Held for disposition | 1,755 | 8 | 2.7% | ||||||||||

Joint Venture (includes completed JV developments) (3) | 6,696 | 28 | 10.4% | ||||||||||

Sub-total, completed homes | 46,101 | 164 | 100% | ||||||||||

Under Development | 516 | 1 | - | ||||||||||

Joint Venture Development | 1,173 | 4 | - | ||||||||||

Preferred Equity Investments | 1,533 | 5 | - | ||||||||||

Total expected homes (3)(4) | 49,323 | 174 | 100% | ||||||||||

Balance Sheet Metrics (adjusted for non-recurring items) | Market Capitalization | ||||||||||||

3Q 2015 | 3Q 2014 | 3Q 2015 | % of Total | ||||||||||

Interest Coverage Ratio | 4.34x | 3.50x | Total debt | $ | 3,513,234 | 27.0% | |||||||

Fixed Charge Coverage Ratio | 4.22x | 3.42x | Common stock equivalents (5) | 9,483,523 | 73.0% | ||||||||

Leverage Ratio | 36.7% | 39.2% | Total market capitalization | $ | 12,996,757 | 100.0% | |||||||

Net Debt-to-EBITDA | 6.0x | 6.7x | |||||||||||

(1) See Attachment 16 for definitions and other terms. | ||||||||||||

(2) Annualized for 2015. | ||||||||||||

(3) Joint venture NOI is based on UDR's pro rata share. Homes and communities at 100%. | ||||||||||||

(4) Excludes 218 homes at Steele Creek where we have a participating loan investment as described in Attachment 9(B). | ||||||||||||

(5) Based on a common share price of $34.48 at September 30, 2015. | ||||||||||||

1

| |||||||||||||||||

Attachment 1 | |||||||||||||||||

UDR, Inc. | |||||||||||||||||

Consolidated Statements of Operations (1) | |||||||||||||||||

(Unaudited) | |||||||||||||||||

Three Months Ended | Nine Months Ended | ||||||||||||||||

September 30, | September 30, | ||||||||||||||||

In thousands, except per share amounts | 2015 | 2014 | 2015 | 2014 | |||||||||||||

REVENUES: | |||||||||||||||||

Rental income | $ | 217,765 | $ | 203,587 | $ | 637,576 | $ | 598,898 | |||||||||

Joint venture management and other fees (2) | 3,653 | 3,165 | 19,457 | 9,599 | |||||||||||||

Total revenues | 221,418 | 206,752 | 657,033 | 608,497 | |||||||||||||

OPERATING EXPENSES: | |||||||||||||||||

Property operating and maintenance | 39,478 | 39,086 | 113,922 | 112,646 | |||||||||||||

Real estate taxes and insurance | 24,722 | 24,697 | 76,082 | 73,844 | |||||||||||||

Property management | 5,988 | 5,598 | 17,533 | 16,470 | |||||||||||||

Other operating expenses | 2,639 | 2,009 | 6,174 | 6,097 | |||||||||||||

Real estate depreciation and amortization | 90,568 | 89,339 | 269,689 | 266,748 | |||||||||||||

Acquisition costs | 410 | 164 | 693 | 266 | |||||||||||||

General and administrative | 15,414 | 11,390 | 41,004 | 35,812 | |||||||||||||

Casualty-related (recoveries)/charges, net | 541 | — | 2,380 | 500 | |||||||||||||

Other depreciation and amortization | 1,457 | 1,385 | 4,780 | 3,658 | |||||||||||||

Total operating expenses | 181,217 | 173,668 | 532,257 | 516,041 | |||||||||||||

Operating income | 40,201 | 33,084 | 124,776 | 92,456 | |||||||||||||

Income/(loss) from unconsolidated entities (2) | 2,691 | (939 | ) | 61,277 | (4,932 | ) | |||||||||||

Interest expense | (30,232 | ) | (33,087 | ) | (88,705 | ) | (97,470 | ) | |||||||||

Other debt (charges)/benefits, net | — | — | — | (192 | ) | ||||||||||||

Total interest expense | (30,232 | ) | (33,087 | ) | (88,705 | ) | (97,662 | ) | |||||||||

Interest income and other income/(expense), net | 402 | 9,061 | 1,144 | 11,902 | |||||||||||||

Income/(loss) before income taxes, discontinued operations and gain/(loss) on sale of real estate | 13,062 | 8,119 | 98,492 | 1,764 | |||||||||||||

Tax benefit/(provision), net | 633 | 2,492 | 2,462 | 8,011 | |||||||||||||

Income/(loss) from continuing operations | 13,695 | 10,611 | 100,954 | 9,775 | |||||||||||||

Income/(loss) from discontinued operations, net of tax | — | 79 | — | 10 | |||||||||||||

Income/(loss) before gain/(loss) on sale of real estate owned | 13,695 | 10,690 | 100,954 | 9,785 | |||||||||||||

Gain/(loss) on sale of real estate owned, net of tax | — | 31,302 | 79,042 | 82,305 | |||||||||||||

Net income/(loss) | 13,695 | 41,992 | 179,996 | 92,090 | |||||||||||||

Net (income)/loss attributable to redeemable noncontrolling interests in the OP | (405 | ) | (1,447 | ) | (6,022 | ) | (3,171 | ) | |||||||||

Net (income)/loss attributable to noncontrolling interests | 1 | 4 | (6 | ) | (2 | ) | |||||||||||

Net income/(loss) attributable to UDR, Inc. | 13,291 | 40,549 | 173,968 | 88,917 | |||||||||||||

Distributions to preferred stockholders - Series E (Convertible) | (930 | ) | (931 | ) | (2,792 | ) | (2,793 | ) | |||||||||

Net income/(loss) attributable to common stockholders | $ | 12,361 | $ | 39,618 | $ | 171,176 | $ | 86,124 | |||||||||

Income/(loss) per weighted average common share - basic: | |||||||||||||||||

Income/(loss) from continuing operations attributable to common stockholders | $ | 0.05 | $ | 0.16 | $ | 0.66 | $ | 0.34 | |||||||||

Income/(loss) from discontinued operations attributable to common stockholders | $ | 0.00 | $ | 0.00 | $ | 0.00 | $ | 0.00 | |||||||||

Net income/(loss) attributable to common stockholders | $ | 0.05 | $ | 0.16 | $ | 0.66 | $ | 0.34 | |||||||||

Income/(loss) per weighted average common share - diluted: | |||||||||||||||||

Income/(loss) from continuing operations attributable to common stockholders | $ | 0.05 | $ | 0.16 | $ | 0.66 | $ | 0.34 | |||||||||

Income/(loss) from discontinued operations attributable to common stockholders | $ | 0.00 | $ | 0.00 | $ | 0.00 | $ | 0.00 | |||||||||

Net income/(loss) attributable to common stockholders | $ | 0.05 | $ | 0.16 | $ | 0.66 | $ | 0.34 | |||||||||

Common distributions declared per share | $ | 0.2775 | $ | 0.2600 | $ | 0.8325 | $ | 0.7800 | |||||||||

Weighted average number of common shares outstanding - basic | 259,114 | 251,655 | 257,940 | 250,701 | |||||||||||||

Weighted average number of common shares outstanding - diluted | 261,207 | 253,732 | 260,020 | 252,675 | |||||||||||||

(1) See Attachment 16 for definitions and other terms. | |||||||||||||||||

(2) In January 2015, the eight communities held by the Texas joint venture were sold, generating proceeds to UDR of $43.5 million. The Company recorded promote and disposition fee income of approximately $9.6 million and a gain of approximately $59.1 million in connection with the sale. | |||||||||||||||||

2

| |||||||||||||||||

Attachment 2 | |||||||||||||||||

UDR, Inc. | |||||||||||||||||

Funds From Operations (1) | |||||||||||||||||

(Unaudited) | |||||||||||||||||

Three Months Ended | Nine Months Ended | ||||||||||||||||

September 30, | September 30, | ||||||||||||||||

In thousands, except per share amounts | 2015 | 2014 | 2015 | 2014 | |||||||||||||

Net income/(loss) attributable to common stockholders | $ | 12,361 | $ | 39,618 | $ | 171,176 | $ | 86,124 | |||||||||

Real estate depreciation and amortization, including discontinued operations | 90,568 | 89,339 | 269,689 | 266,748 | |||||||||||||

Noncontrolling interests | 404 | 1,443 | 6,028 | 3,173 | |||||||||||||

Real estate depreciation and amortization on unconsolidated joint ventures | 9,396 | 10,398 | 29,263 | 29,926 | |||||||||||||

Net (gain)/loss on the sale of unconsolidated depreciable property (2) | — | — | (59,073 | ) | — | ||||||||||||

Net (gain)/loss on the sale of depreciable property, excluding TRS | — | (31,377 | ) | (79,042 | ) | (81,260 | ) | ||||||||||

Funds from operations ("FFO") attributable to common stockholders and unitholders, basic | $ | 112,729 | $ | 109,421 | $ | 338,041 | $ | 304,711 | |||||||||

Distributions to preferred stockholders - Series E (Convertible) (3) | 930 | 931 | 2,792 | 2,793 | |||||||||||||

FFO attributable to common stockholders and unitholders, diluted | $ | 113,659 | $ | 110,352 | $ | 340,833 | $ | 307,504 | |||||||||

FFO per common share and unit, basic | $ | 0.42 | $ | 0.42 | $ | 1.27 | $ | 1.17 | |||||||||

FFO per common share and unit, diluted | $ | 0.42 | $ | 0.41 | $ | 1.25 | $ | 1.16 | |||||||||

Weighted average number of common shares and OP Units outstanding - basic | 268,175 | 260,844 | 267,057 | 259,975 | |||||||||||||

Weighted average number of common shares, OP Units, and common stock | |||||||||||||||||

equivalents outstanding - diluted | 273,297 | 265,957 | 272,170 | 264,985 | |||||||||||||

Impact of adjustments to FFO: | |||||||||||||||||

Acquisition-related costs/(fees), including joint ventures (4) | $ | 410 | $ | 76 | $ | 2,153 | $ | 178 | |||||||||

Cost/(benefit) associated with debt extinguishment and other | — | — | — | 192 | |||||||||||||

Texas Joint Venture promote and disposition fee income (2) | — | — | (9,633 | ) | — | ||||||||||||

Long-term incentive plan transition costs | 791 | — | 2,653 | — | |||||||||||||

(Gain)/loss on sale of land | — | — | — | (1,120 | ) | ||||||||||||

Net gain on prepayment of note receivable | — | (8,411 | ) | — | (8,411 | ) | |||||||||||

Casualty-related (recoveries)/charges, including joint ventures, net (5) | 797 | — | 2,636 | 500 | |||||||||||||

$ | 1,998 | $ | (8,335 | ) | $ | (2,191 | ) | $ | (8,661 | ) | |||||||

FFO as Adjusted attributable to common stockholders and unitholders, diluted | $ | 115,657 | $ | 102,017 | $ | 338,642 | $ | 298,843 | |||||||||

FFO as Adjusted per common share and unit, diluted | $ | 0.42 | $ | 0.38 | $ | 1.24 | $ | 1.13 | |||||||||

Recurring capital expenditures | (13,694 | ) | (12,280 | ) | (31,048 | ) | (29,977 | ) | |||||||||

AFFO attributable to common stockholders and unitholders | $ | 101,963 | $ | 89,737 | $ | 307,594 | $ | 268,866 | |||||||||

AFFO per common share and unit, diluted | $ | 0.37 | $ | 0.34 | $ | 1.13 | $ | 1.01 | |||||||||

(1) See Attachment 16 for definitions and other terms. | |||||||||||||||||

(2) The Company recorded promote and disposition fee income of approximately $9.6 million and a gain of approximately $59.1 million in connection with the sale of eight communities held by the Texas Joint Venture in 1Q15. | |||||||||||||||||

(3) Series E preferred shares are dilutive for purposes of calcluating FFO per share. Consequently, distributions to Series E preferred shareholders are added to FFO and the weighted average number of shares are included in the denominator when calculating FFO per common share and unit, diluted. | |||||||||||||||||

(4) Nine months ended September 30, 2015 acquisition-related costs include $1.5 million related to UDR's share of the West Coast Development joint venture's transaction expenses, which are recorded as income/(loss) from unconsolidated entities in Attachment 1. | |||||||||||||||||

(5) 3Q15 Casualty-related charges include $256 thousand related to UDR's share of the 717 Olympic casualty, which is included in income/(loss) from unconsolidated entites in Attachment 1. | |||||||||||||||||

3

| |||||||||

Attachment 3 | |||||||||

UDR, Inc. | |||||||||

Consolidated Balance Sheets | |||||||||

September 30, | December 31, | ||||||||

In thousands, except share and per share amounts | 2015 | 2014 | |||||||

ASSETS | (unaudited) | (audited) | |||||||

Real estate owned: | |||||||||

Real estate held for investment | $ | 8,162,463 | $ | 8,205,627 | |||||

Less: accumulated depreciation | (2,557,490 | ) | (2,434,772 | ) | |||||

Real estate held for investment, net | 5,604,973 | 5,770,855 | |||||||

Real estate under development | |||||||||

(net of accumulated depreciation of $0 and $0) | 104,080 | 177,632 | |||||||

Real estate held for disposition | |||||||||

(net of accumulated depreciation of $90,014 and $0) | 116,420 | — | |||||||

Total real estate owned, net of accumulated depreciation | 5,825,473 | 5,948,487 | |||||||

Cash and cash equivalents | 1,321 | 15,224 | |||||||

Restricted cash | 23,722 | 22,340 | |||||||

Deferred financing costs, net | 20,206 | 22,686 | |||||||

Notes receivable, net | 15,494 | 14,369 | |||||||

Investment in and advances to unconsolidated joint ventures, net | 921,925 | 718,226 | |||||||

Other assets | 114,589 | 105,202 | |||||||

Total assets | $ | 6,922,730 | $ | 6,846,534 | |||||

LIABILITIES AND EQUITY | |||||||||

Liabilities: | |||||||||

Secured debt | $ | 1,346,992 | $ | 1,361,529 | |||||

Unsecured debt | 2,166,242 | 2,221,576 | |||||||

Real estate taxes payable | 32,326 | 15,978 | |||||||

Accrued interest payable | 23,577 | 34,215 | |||||||

Security deposits and prepaid rent | 33,879 | 34,064 | |||||||

Distributions payable | 75,937 | 69,460 | |||||||

Accounts payable, accrued expenses, and other liabilities | 56,401 | 91,282 | |||||||

Total liabilities | 3,735,354 | 3,828,104 | |||||||

Redeemable noncontrolling interests in the OP | 312,158 | 282,480 | |||||||

Equity: | |||||||||

Preferred stock, no par value; 50,000,000 shares authorized | |||||||||

2,796,903 shares of 8.00% Series E Cumulative Convertible issued | |||||||||

and outstanding (2,803,812 shares at December 31, 2014) | 46,457 | 46,571 | |||||||

Common stock, $0.01 par value; 350,000,000 shares authorized | |||||||||

262,015,237 shares issued and outstanding (255,114,603 shares at December 31, 2014) | 2,620 | 2,551 | |||||||

Additional paid-in capital | 4,449,555 | 4,223,747 | |||||||

Distributions in excess of net income | (1,610,086 | ) | (1,528,917 | ) | |||||

Accumulated other comprehensive income/(loss), net | (14,187 | ) | (8,855 | ) | |||||

Total stockholders' equity | 2,874,359 | 2,735,097 | |||||||

Noncontrolling interests | 859 | 853 | |||||||

Total equity | 2,875,218 | 2,735,950 | |||||||

Total liabilities and equity | $ | 6,922,730 | $ | 6,846,534 | |||||

4

| |||||||||||||||||||

Attachment 4(A) | |||||||||||||||||||

UDR, Inc. | |||||||||||||||||||

Selected Financial Information (1) | |||||||||||||||||||

(Unaudited) | |||||||||||||||||||

September 30, | December 31, | ||||||||||||||||||

Common Stock and Equivalents | 2015 | 2014 | |||||||||||||||||

Common shares (2) | 260,825,337 | 254,114,631 | |||||||||||||||||

Restricted shares | 1,189,900 | 999,972 | |||||||||||||||||

Total common stock | 262,015,237 | 255,114,603 | |||||||||||||||||

Stock options and restricted stock equivalents | 947,565 | 1,052,147 | |||||||||||||||||

Operating partnership units | 7,301,628 | 7,413,802 | |||||||||||||||||

Preferred OP units | 1,751,671 | 1,751,671 | |||||||||||||||||

Convertible preferred Series E stock (3) | 3,028,068 | 3,035,548 | |||||||||||||||||

Total common stock and equivalents | 275,044,169 | 268,367,771 | |||||||||||||||||

3Q 2015 Weighted | 3Q 2014 Weighted | ||||||||||||||||||

Weighted Average Number of Shares Outstanding | Average | Average | |||||||||||||||||

Weighted average number of common shares and OP Units outstanding - basic | 268,175,324 | 260,845,291 | |||||||||||||||||

Weighted average number of OP Units outstanding | (9,061,359 | ) | (9,189,987 | ) | |||||||||||||||

Weighted average number of common shares outstanding - basic per the Consolidated Statements of Operations | 259,113,965 | 251,655,304 | |||||||||||||||||

Weighted average number of common shares, OP units, and common stock equivalents outstanding - diluted | 273,297,571 | 265,957,136 | |||||||||||||||||

Weighted average number of OP Units outstanding | (9,061,359 | ) | (9,189,987 | ) | |||||||||||||||

Weight average number of Series E preferred shares outstanding | (3,029,206 | ) | (3,035,548 | ) | |||||||||||||||

Weighted average number of common shares outstanding - diluted per the Consolidated Statements of Operations | 261,207,006 | 253,731,601 | |||||||||||||||||

Year-to-Date | Year-to-Date | ||||||||||||||||||

Weighted Average | Weighted Average | ||||||||||||||||||

Weighted average number of common shares and OP Units outstanding - basic | 267,057,273 | 259,975,492 | |||||||||||||||||

Weighted average number of OP Units outstanding | (9,116,777 | ) | (9,274,401 | ) | |||||||||||||||

Weighted average number of common shares outstanding - basic per the Consolidated Statements of Operations | 257,940,496 | 250,701,091 | |||||||||||||||||

Weighted average number of common shares, OP units, and common stock equivalents outstanding - diluted | 272,170,517 | 264,985,065 | |||||||||||||||||

Weighted average number of OP Units outstanding | (9,116,777 | ) | (9,274,401 | ) | |||||||||||||||

Weight average number of Series E preferred shares outstanding | (3,033,411 | ) | (3,035,548 | ) | |||||||||||||||

Weighted average number of common shares outstanding - diluted per the Consolidated Statements of Operations | 260,020,329 | 252,675,116 | |||||||||||||||||

September 30, | December 31, | ||||||||||||||||||

Market Capitalization, In thousands | 2015 | % of Total | 2014 | % of Total | |||||||||||||||

Total debt | $ | 3,513,234 | 27.0 | % | $ | 3,583,105 | 30.2 | % | |||||||||||

Common stock and equivalents ($34.48 at 9/30/15 and $30.82 at 12/31/14) | 9,483,523 | 73.0 | % | 8,271,095 | 69.8 | % | |||||||||||||

Total market capitalization | $ | 12,996,757 | 100.0 | % | $ | 11,854,200 | 100.0 | % | |||||||||||

Gross | % of | ||||||||||||||||||

Number of | 3Q 2015 NOI (1) | Carrying Value | Total Gross | ||||||||||||||||

Asset Summary | Homes | ($000s) | % of NOI | ($000s) | Carrying Value | ||||||||||||||

Unencumbered assets | 26,812 | $ | 108,828 | 70.9 | % | $ | 6,222,771 | 73.4 | % | ||||||||||

Encumbered assets | 12,593 | 44,737 | 29.1 | % | 2,250,206 | 26.6 | % | ||||||||||||

39,405 | $ | 153,565 | 100.0 | % | $ | 8,472,977 | 100.0 | % | |||||||||||

(1) See Attachment 16 for definitions and other terms. | |||||||||||||||||||

(2) Includes the effect of the ATM issuance of 3.4 million and 3.4 million shares at an average price of $32.29 and $29.95 and a net price of $31.64 and $29.36 during the nine and twelve months ended September 30, 2015 and December 31, 2014. September 30, 2015 includes the effect of the $2.9 million shares issued at a net price of $35.00 per share during 3Q15. | |||||||||||||||||||

(3) At September 30, 2015 and December 31, 2014, a total of 2,796,903 and 2,803,812 shares of the Series E were outstanding, which is equivalent to 3,028,068 and 3,035,548 shares of common stock if converted (after adjusting for the special dividend paid in 2008). | |||||||||||||||||||

5

| ||||||||||||||||||||||

Attachment 4(B) | ||||||||||||||||||||||

UDR, Inc. | ||||||||||||||||||||||

Selected Financial Information | ||||||||||||||||||||||

(Unaudited) | ||||||||||||||||||||||

| Weighted | Weighted | ||||||||||||||||||||

Average | Average Years | |||||||||||||||||||||

Debt Structure, In thousands | Balance | % of Total | Interest Rate | to Maturity | ||||||||||||||||||

Secured | Fixed | $ | 971,577 | (1) | 27.7 | % | 5.3 | % | 2.3 | |||||||||||||

Floating | 375,415 | (2) | 10.7 | % | 1.5 | % | 5.0 | |||||||||||||||

Combined | 1,346,992 | 38.4 | % | 4.2 | % | 3.0 | ||||||||||||||||

Unsecured | Fixed | 2,021,242 | (3) | 57.5 | % | 3.9 | % | 5.7 | ||||||||||||||

Floating | 145,000 | 4.1 | % | 1.2 | % | 2.3 | ||||||||||||||||

Combined | 2,166,242 | 61.6 | % | 3.7 | % | 5.5 | ||||||||||||||||

Total Debt | Fixed | 2,992,819 | 85.2 | % | 4.4 | % | 4.6 | |||||||||||||||

Floating | 520,415 | 14.8 | % | 1.4 | % | 4.3 | ||||||||||||||||

Combined | $ | 3,513,234 | 100.0 | % | 3.9 | % | 4.5 | |||||||||||||||

Debt Maturities, In thousands | ||||||||||||||||||||||

Unsecured | Revolving | Weighted Average | ||||||||||||||||||||

Secured Debt | Debt | Credit Facility | Balance | % of Total | Interest Rate | |||||||||||||||||

2015 | $ | 185,926 | $ | — | $ | — | $ | 185,926 | 5.3 | % | 5.9 | % | ||||||||||

2016 | 142,627 | (4) | 95,611 | — | 238,238 | 6.8 | % | 5.1 | % | |||||||||||||

2017 | 278,218 | — | 110,000 | (5) (6) | 388,218 | 11.0 | % | 3.3 | % | |||||||||||||

2018 | 207,969 | 648,856 | — | 856,825 | 24.4 | % | 3.0 | % | ||||||||||||||

2019 | 318,843 | — | — | 318,843 | 9.1 | % | 4.4 | % | ||||||||||||||

2020 | 90,000 | 299,960 | — | 389,960 | 11.1 | % | 3.8 | % | ||||||||||||||

2021 | — | — | — | — | — | — | ||||||||||||||||

2022 | — | 397,746 | — | 397,746 | 11.3 | % | 4.7 | % | ||||||||||||||

2023 | 96,409 | — | — | 96,409 | 2.7 | % | 2.1 | % | ||||||||||||||

2024 | — | 314,732 | — | 314,732 | 9.0 | % | 4.0 | % | ||||||||||||||

Thereafter | 27,000 | 299,337 | — | 326,337 | 9.3 | % | 4.2 | % | ||||||||||||||

$ | 1,346,992 | $ | 2,056,242 | $ | 110,000 | $ | 3,513,234 | 100.0 | % | 3.9 | % | |||||||||||

Debt Maturities With Extensions, In thousands | ||||||||||||||||||||||

Unsecured | Revolving | Weighted Average | ||||||||||||||||||||

Secured Debt | Debt | Credit Facility | Balance | % of Total | Interest Rate | |||||||||||||||||

2015 | $ | 185,926 | $ | — | $ | — | $ | 185,926 | 5.3 | % | 5.9 | % | ||||||||||

2016 | 71,812 | 95,611 | — | 167,423 | 4.8 | % | 4.8 | % | ||||||||||||||

2017 | 349,033 | — | — | 349,033 | 9.9 | % | 4.5 | % | ||||||||||||||

2018 | 207,969 | 648,856 | 110,000 | (5) (6) | 966,825 | 27.5 | % | 2.8 | % | |||||||||||||

2019 | 318,843 | — | — | 318,843 | 9.1 | % | 4.4 | % | ||||||||||||||

2020 | 90,000 | 299,960 | — | 389,960 | 11.1 | % | 3.8 | % | ||||||||||||||

2021 | — | — | — | — | — | — | ||||||||||||||||

2022 | — | 397,746 | — | 397,746 | 11.3 | % | 4.7 | % | ||||||||||||||

2023 | 96,409 | — | — | 96,409 | 2.7 | % | 2.1 | % | ||||||||||||||

2024 | — | 314,732 | — | 314,732 | 9.0 | % | 4.0 | % | ||||||||||||||

Thereafter | 27,000 | 299,337 | — | 326,337 | 9.3 | % | 4.2 | % | ||||||||||||||

$ | 1,346,992 | $ | 2,056,242 | $ | 110,000 | $ | 3,513,234 | 100.0 | % | 3.9 | % | |||||||||||

(1) Includes $50.0 million of floating rate debt that has been fixed using interest rate swaps at a weighted average rate of 4.0%. | ||||||||||||||||||||||

(2) Includes $286.3 million of debt with a weighted average interest cap of 8.1% on the underlying index. | ||||||||||||||||||||||

(3) Includes $315.0 million of floating rate debt that has been fixed using interest rate swaps at a weighted average rate of 1.6%. | ||||||||||||||||||||||

(4) Includes $70.8 million of financing with a one year extension at UDR's option. | ||||||||||||||||||||||

(5) UDR's $900 million line of credit has a maturity date of December 2017, plus a six-month extension option and contains an accordion feature that allows UDR to increase the facility up to $1.45 billion assuming lender participation. The credit facility carries an interest rate equal to LIBOR plus a spread of 100 basis points and a facility fee of 15 basis points. | ||||||||||||||||||||||

(6) Subsequent to quarter end, the Company amended its unsecured revolving credit facility. The amendment increases the facility size from $900 million to $1.1 billion and extends the maturity date from December 2017 to January 2021, inclusive of a 1 year extension. Based on the Company’s current credit rating, the credit facility carries an interest rate equal to LIBOR plus a spread of 90 basis points and the facility fee remains at 15 basis points. In addition, the Company amended and consolidated its $350 million of term loans outstanding under the same facility. The loans were repriced to LIBOR plus 95 basis points and the maturity date was extended to January 2021 from June 2018. | ||||||||||||||||||||||

6

| ||||||||||||

Attachment 4(C) | ||||||||||||

UDR, Inc. | ||||||||||||

Selected Financial Information (1) | ||||||||||||

(Unaudited) | ||||||||||||

Quarter Ended | ||||||||||||

Coverage Ratios | September 30, 2015 | |||||||||||

Net income/(loss) attributable to UDR, Inc. | $ | 13,291 | ||||||||||

Adjustments (includes continuing and discontinued operations): | ||||||||||||

Interest expense | 30,232 | |||||||||||

Real estate depreciation and amortization | 90,568 | |||||||||||

Real estate depreciation and amortization on unconsolidated joint ventures | 9,396 | |||||||||||

Other depreciation and amortization | 1,457 | |||||||||||

Noncontrolling interests | 404 | |||||||||||

Income tax expense/(benefit) | (633 | ) | ||||||||||

EBITDA | $ | 144,715 | ||||||||||

Long-term incentive plan transition costs | 791 | |||||||||||

Acquisition-related costs/(fees), including joint ventures | 410 | |||||||||||

Casualty-related (recoveries)/charges, including joint ventures, net | 797 | |||||||||||

EBITDA - adjusted for non-recurring items | $ | 146,713 | ||||||||||

Annualized EBITDA - adjusted for non-recurring items | $ | 586,852 | ||||||||||

Interest expense | $ | 30,232 | ||||||||||

Capitalized interest expense | 3,572 | |||||||||||

Total interest | $ | 33,804 | ||||||||||

Preferred dividends | $ | 930 | ||||||||||

Total debt | $ | 3,513,234 | ||||||||||

Cash | 1,321 | |||||||||||

Net debt | $ | 3,511,913 | ||||||||||

Interest Coverage Ratio | 4.28 | x | ||||||||||

Fixed Charge Coverage Ratio | 4.17 | x | ||||||||||

Interest Coverage Ratio - adjusted for non-recurring items | 4.34 | x | ||||||||||

Fixed Charge Coverage Ratio - adjusted for non-recurring items | 4.22 | x | ||||||||||

Net Debt-to-EBITDA - adjusted for non-recurring items | 6.0 | x | ||||||||||

Debt Covenant Overview | ||||||||||||

Unsecured Line of Credit Covenants (2) | Required | Actual | Compliance | |||||||||

Maximum Leverage Ratio | ≤60.0% | 36.3% | Yes | |||||||||

Minimum Fixed Charge Coverage Ratio | ≥1.5 | 3.4 | Yes | |||||||||

Maximum Secured Debt Ratio | ≤40.0% | 18.1% | Yes | |||||||||

Minimum Unencumbered Pool Leverage Ratio | ≥150.0% | 345.3% | Yes | |||||||||

Senior Unsecured Note Covenants (3) | Required | Actual | Compliance | |||||||||

Debt as a percentage of Total Assets | ≤60.0% | 36.8% | Yes | |||||||||

Consolidated Income Available for Debt Service to Annual Service Charge | ≥1.5 | 3.9 | Yes | |||||||||

Secured Debt as a percentage of Total Assets | ≤40.0% | 14.1% | Yes | |||||||||

Total Unencumbered Assets to Unsecured Debt | ≥150.0% | 292.6% | Yes | |||||||||

Securities Ratings | Debt | Preferred | Outlook | |||||||||

Moody's Investors Service | Baa1 | Baa2 | Stable | |||||||||

Standard & Poor's | BBB+ | BB+ | Stable | |||||||||

(1) See Attachment 16 for definitions and other terms. | ||||||||||||

(2) As defined in our credit agreement dated October 25, 2011 as amended June 6, 2013. | ||||||||||||

(3) As defined in our indenture dated November 1, 1995 as amended, supplemented or modified from time to time. | ||||||||||||

7

| |||||||||||||||||||||||

Attachment 5 | |||||||||||||||||||||||

UDR, Inc. | |||||||||||||||||||||||

Operating Information (1) | |||||||||||||||||||||||

(Unaudited) | |||||||||||||||||||||||

Total | Quarter Ended | Quarter Ended | Quarter Ended | Quarter Ended | Quarter Ended | ||||||||||||||||||

Dollars in thousands | Homes | September 30, 2015 | June 30, 2015 | March 31, 2015 | December 31, 2014 | September 30, 2014 | |||||||||||||||||

Revenues | |||||||||||||||||||||||

Same-Store Communities | 34,774 | $ | 180,672 | $ | 177,392 | $ | 173,583 | $ | 171,005 | $ | 170,627 | ||||||||||||

Stabilized, Non-Mature Communities | 1,847 | 16,239 | 15,692 | 15,119 | 14,259 | 11,789 | |||||||||||||||||

Acquired Communities | — | — | — | — | — | — | |||||||||||||||||

Redevelopment Communities | 328 | 3,274 | 3,125 | 3,073 | 3,106 | 3,025 | |||||||||||||||||

Development Communities | 701 | 4,508 | 1,978 | 1,097 | 522 | 19 | |||||||||||||||||

Non-Residential / Other (2) | — | 6,149 | 5,632 | 4,656 | 4,634 | 4,776 | |||||||||||||||||

Total | 37,650 | $ | 210,842 | $ | 203,819 | $ | 197,528 | $ | 193,526 | $ | 190,236 | ||||||||||||

Expenses | |||||||||||||||||||||||

Same-Store Communities | $ | 52,916 | $ | 50,155 | $ | 50,740 | $ | 49,063 | $ | 51,535 | |||||||||||||

Stabilized, Non-Mature Communities | 5,595 | 5,474 | 5,635 | 5,371 | 4,869 | ||||||||||||||||||

Acquired Communities | — | — | — | — | — | ||||||||||||||||||

Redevelopment Communities | 625 | 575 | 578 | 570 | 564 | ||||||||||||||||||

Development Communities | 2,014 | 1,470 | 962 | 747 | 434 | ||||||||||||||||||

Non-Residential / Other (2) | 752 | 1,813 | 2,405 | 2,122 | 1,661 | ||||||||||||||||||

Total | $ | 61,902 | $ | 59,487 | $ | 60,320 | $ | 57,873 | $ | 59,063 | |||||||||||||

Net Operating Income | |||||||||||||||||||||||

Same-Store Communities | $ | 127,756 | $ | 127,237 | $ | 122,843 | $ | 121,942 | $ | 119,092 | |||||||||||||

Stabilized, Non-Mature Communities | 10,644 | 10,218 | 9,484 | 8,888 | 6,920 | ||||||||||||||||||

Acquired Communities | — | — | — | — | — | ||||||||||||||||||

Redevelopment Communities | 2,649 | 2,550 | 2,495 | 2,536 | 2,461 | ||||||||||||||||||

Development Communities | 2,494 | 508 | 135 | (225 | ) | (415 | ) | ||||||||||||||||

Non-Residential / Other (2) | 5,397 | 3,819 | 2,251 | 2,512 | 3,115 | ||||||||||||||||||

Total | $ | 148,940 | $ | 144,332 | $ | 137,208 | $ | 135,653 | $ | 131,173 | |||||||||||||

Operating Margin | |||||||||||||||||||||||

Same-Store Communities | 70.7 | % | 71.7 | % | 70.8 | % | 71.3 | % | 69.8 | % | |||||||||||||

Average Physical Occupancy | |||||||||||||||||||||||

Same-Store Communities | 96.6 | % | 96.9 | % | 96.7 | % | 96.7 | % | 96.9 | % | |||||||||||||

Stabilized, Non-Mature Communities | 95.8 | % | 95.9 | % | 92.7 | % | 90.2 | % | 89.9 | % | |||||||||||||

Acquired Communities | — | — | — | — | — | ||||||||||||||||||

Redevelopment Communities | 94.5 | % | 95.0 | % | 97.1 | % | 98.0 | % | 98.3 | % | |||||||||||||

Development Communities | 80.5 | % | 53.5 | % | 51.4 | % | 41.2 | % | 20.7 | % | |||||||||||||

Other (3) | 95.6 | % | 96.3 | % | 96.1 | % | 95.9 | % | 94.6 | % | |||||||||||||

Total | 96.2 | % | 96.2 | % | 96.2 | % | 95.6 | % | 96.3 | % | |||||||||||||

Return on Invested Capital | |||||||||||||||||||||||

Same-Store Communities | 7.5 | % | 7.5 | % | 7.4 | % | 7.1 | % | 7.0 | % | |||||||||||||

Sold and Held for Disposition Communities | 1,755 | ||||||||||||||||||||||

Revenues | $ | 6,923 | $ | 8,945 | $ | 9,519 | $ | 12,578 | $ | 13,351 | |||||||||||||

Expenses | 2,298 | 2,845 | 3,152 | 4,240 | 4,720 | ||||||||||||||||||

Net Operating Income/(loss) | $ | 4,625 | $ | 6,100 | $ | 6,367 | $ | 8,338 | $ | 8,631 | |||||||||||||

Total | 39,405 | $ | 153,565 | $ | 150,432 | $ | 143,575 | $ | 143,991 | $ | 139,804 | ||||||||||||

Discontinued Operations (4) | |||||||||||||||||||||||

Revenues | $ | — | $ | — | $ | — | $ | — | $ | 21 | |||||||||||||

Expenses | — | — | — | — | 11 | ||||||||||||||||||

Net Operating Income/(loss) | $ | — | $ | — | $ | — | $ | — | $ | 10 | |||||||||||||

(1) See Attachment 16 for definition and other terms. | |||||||||||||||||||||||

(2) Primarily non-residential revenue and expense and straight-line adjustment for concessions. | |||||||||||||||||||||||

(3) Includes occupancy of Sold and Held for Disposition Communities and Discontinued Operations. | |||||||||||||||||||||||

(4) Effective January 1, 2014, UDR prospectively adopted Accounting Standards Update (“ASU”) No. 2014-08, Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity, for all communities not previously sold or classified as held for sale. ASU 2014-08 incorporates into the definition of a discontinued operation a requirement that a disposition represent a strategic shift in an entity’s operations, which resulted in UDR no longer classifying the sale of communities as a discontinued operation. 2014 activity included in discontinued operations is related to Grandview, a commercial property classified as held for sale prior to the adoption of the new accounting standard, which was sold in July 2014. | |||||||||||||||||||||||

8

| |||||||||||||||

Attachment 6 | |||||||||||||||

UDR, Inc. | |||||||||||||||

Same-Store Operating Expense Information (1) | |||||||||||||||

(Dollars in Thousands) | |||||||||||||||

(Unaudited) | |||||||||||||||

% of 3Q 2015 | |||||||||||||||

SS Operating | |||||||||||||||

Year-Over-Year Comparison | Expenses | 3Q 2015 | 3Q 2014 | % Change | |||||||||||

Real estate taxes (2) | 32.3 | % | $ | 17,092 | $ | 16,889 | 1.2 | % | |||||||

Personnel | 24.4 | % | 12,898 | 13,042 | -1.1 | % | |||||||||

Utilities | 16.1 | % | 8,533 | 8,033 | 6.2 | % | |||||||||

Repair and maintenance | 14.5 | % | 7,666 | 7,375 | 3.9 | % | |||||||||

Administrative and marketing | 6.9 | % | 3,638 | 3,629 | 0.2 | % | |||||||||

Insurance | 5.8 | % | 3,089 | 2,567 | 20.4 | % | |||||||||

Same-Store operating expenses (2) | 100.0 | % | $ | 52,916 | $ | 51,535 | 2.7 | % | |||||||

Same-Store Homes | 34,774 | ||||||||||||||

% of 3Q 2015 | |||||||||||||||

SS Operating | |||||||||||||||

Sequential Comparison | Expenses | 3Q 2015 | 2Q 2015 | % Change | |||||||||||

Real estate taxes (2) | 32.3 | % | $ | 17,092 | $ | 17,596 | -2.9 | % | |||||||

Personnel | 24.4 | % | 12,898 | 12,540 | 2.9 | % | |||||||||

Utilities | 16.1 | % | 8,533 | 7,731 | 10.4 | % | |||||||||

Repair and maintenance | 14.5 | % | 7,666 | 6,906 | 11.0 | % | |||||||||

Administrative and marketing | 6.9 | % | 3,638 | 3,174 | 14.6 | % | |||||||||

Insurance | 5.8 | % | 3,089 | 2,208 | 39.9 | % | |||||||||

Same-Store operating expenses (2) | 100.0 | % | $ | 52,916 | $ | 50,155 | 5.5 | % | |||||||

Same-Store Homes | 34,774 | ||||||||||||||

% of YTD 2015 | |||||||||||||||

SS Operating | |||||||||||||||

Year-to-Date Comparison | Expenses | YTD 2015 | YTD 2014 | % Change | |||||||||||

Real estate taxes (2) | 33.8 | % | $ | 49,300 | $ | 48,229 | 2.2 | % | |||||||

Personnel | 24.5 | % | 35,750 | 35,105 | 1.8 | % | |||||||||

Utilities | 16.4 | % | 23,932 | 22,989 | 4.1 | % | |||||||||

Repair and maintenance | 13.9 | % | 20,270 | 20,108 | 0.8 | % | |||||||||

Administrative and marketing | 6.5 | % | 9,520 | 9,471 | 0.5 | % | |||||||||

Insurance | 4.9 | % | 7,193 | 6,764 | 6.3 | % | |||||||||

Same-Store operating expenses (2) | 100.0 | % | $ | 145,965 | $ | 142,666 | 2.3 | % | |||||||

Same-Store Homes | 33,495 | ||||||||||||||

(1) See Attachment 16 for definitions and other terms. | |||||||||||||||

(2) 3Q15 and YTD 2015 presented above includes $70 thousand of higher New York real estate taxes due to 421 exemption and abatement reductions. Had the Same Store Expense included 100% of the NY real estate taxes before 421 savings, in all periods presented, the percent change would have been as follows: | |||||||||||||||

3Q 2015 vs. 3Q 2014 | 3Q 2015 vs. 2Q 2015 | YTD 2015 vs. YTD 2014 | |||||||||||||

Real estate taxes | 0.7 | % | -2.8 | % | 1.8 | % | |||||||||

Same-Store operating expense | 2.4 | % | 5.1 | % | 2.1 | % | |||||||||

9

| ||||||||||||||||||

Attachment 7(A) | ||||||||||||||||||

UDR, Inc. | ||||||||||||||||||

Apartment Home Breakout (1) | ||||||||||||||||||

Portfolio Overview as of Quarter Ended | ||||||||||||||||||

September 30, 2015 | ||||||||||||||||||

(Unaudited) | ||||||||||||||||||

Non-Mature Homes | Unconsolidated | |||||||||||||||||

Total | Total | Joint Venture | Total | |||||||||||||||

Same-Store | Non- | Consolidated | Operating | Homes | ||||||||||||||

Homes | Stabilized (2) | Stabil. / Other (3) | Homes | Homes (4) | (incl. JV) (4) | |||||||||||||

West Region | ||||||||||||||||||

Orange County, CA | 4,321 | 493 | 400 | 5,214 | — | 5,214 | ||||||||||||

San Francisco, CA | 2,423 | — | 328 | 2,751 | — | 2,751 | ||||||||||||

Seattle, WA | 1,727 | 358 | — | 2,085 | 555 | 2,640 | ||||||||||||

Los Angeles, CA | 1,225 | — | — | 1,225 | 151 | 1,376 | ||||||||||||

Monterey Peninsula, CA | 1,565 | — | — | 1,565 | — | 1,565 | ||||||||||||

Other Southern CA | 756 | — | 119 | 875 | 571 | 1,446 | ||||||||||||

Portland, OR | 476 | — | — | 476 | — | 476 | ||||||||||||

12,493 | 851 | 847 | 14,191 | 1,277 | 15,468 | |||||||||||||

Mid-Atlantic Region | ||||||||||||||||||

Metropolitan DC | 4,568 | 256 | 332 | 5,156 | 874 | 6,030 | ||||||||||||

Baltimore, MD | 2,122 | — | 178 | 2,300 | 379 | 2,679 | ||||||||||||

Richmond, VA | 1,358 | — | — | 1,358 | — | 1,358 | ||||||||||||

Norfolk, VA | — | — | 846 | 846 | — | 846 | ||||||||||||

Other Mid-Atlantic | 168 | — | — | 168 | — | 168 | ||||||||||||

8,216 | 256 | 1,356 | 9,828 | 1,253 | 11,081 | |||||||||||||

Southeast Region | ||||||||||||||||||

Orlando, FL | 2,500 | — | — | 2,500 | — | 2,500 | ||||||||||||

Tampa, FL | 2,287 | — | 212 | 2,499 | — | 2,499 | ||||||||||||

Nashville, TN | 2,260 | — | — | 2,260 | — | 2,260 | ||||||||||||

Other Florida | 636 | — | — | 636 | — | 636 | ||||||||||||

7,683 | — | 212 | 7,895 | — | 7,895 | |||||||||||||

Northeast Region | ||||||||||||||||||

New York, NY | 1,205 | 740 | — | 1,945 | 710 | 2,655 | ||||||||||||

Boston, MA | 1,179 | — | 369 | 1,548 | 1,302 | 2,850 | ||||||||||||

Philadelphia, PA | — | — | — | — | 290 | 290 | ||||||||||||

2,384 | 740 | 369 | 3,493 | 2,302 | 5,795 | |||||||||||||

Southwest Region | ||||||||||||||||||

Dallas, TX | 2,725 | — | — | 2,725 | 1,382 | 4,107 | ||||||||||||

Austin, TX | 1,273 | — | — | 1,273 | 259 | 1,532 | ||||||||||||

Denver, CO | — | — | — | — | 223 | 223 | ||||||||||||

3,998 | — | — | 3,998 | 1,864 | 5,862 | |||||||||||||

Totals | 34,774 | 1,847 | 2,784 | 39,405 | 6,696 | 46,101 | ||||||||||||

Communities | 119 | 6 | 11 | 136 | 28 | 164 | ||||||||||||

Total Homes (incl. joint ventures) (4) | 46,101 | |||||||||||||||||

Homes in Development, Excluding Completed Homes (5) | ||||||||||||||||||

Current Pipeline Wholly-Owned | 516 | |||||||||||||||||

Current Pipeline Joint Venture (6) | 1,173 | |||||||||||||||||

Current Pipeline Preferred Equity Investments (6) | 1,533 | |||||||||||||||||

Total expected homes (including development) | 49,323 | |||||||||||||||||

(1) See Attachment 16 for definitions and other terms. | ||||||||||||||||||

(2) Represents homes included in Stabilized, Non-Mature category on Attachment 5. | ||||||||||||||||||

(3) Represents homes included in Acquired, Development, Redevelopment, Non-Residential/Other, Sold, and Held for Disposition categories on Attachment 5. Excludes development homes not yet completed. | ||||||||||||||||||

(4) Represents joint venture homes at 100 percent. See Attachment 12 for UDR's joint venture and partnership ownership interests. | ||||||||||||||||||

(5) See Attachments 9(A) and 9(B) for details of our development communities. | ||||||||||||||||||

(6) Represents joint venture and preferred equity investment homes at 100 percent. Excludes 218 homes at Steele Creek where we have a participating loan investment. See Attachments 9(A) and 9(B) for UDR's developments and ownership interests. | ||||||||||||||||||

10

| |||||||||||||||||||||

Attachment 7(B) | |||||||||||||||||||||

UDR, Inc. | |||||||||||||||||||||

Non-Mature Home Summary (1) | |||||||||||||||||||||

Portfolio Overview as of Quarter Ended | |||||||||||||||||||||

September 30, 2015 | |||||||||||||||||||||

(Unaudited) | |||||||||||||||||||||

Non-Mature Home Breakout - By Region (includes development homes that have been completed) | |||||||||||||||||||||

# of | Same-Store | # of | Same-Store | ||||||||||||||||||

Community | Category | Homes | Date (2) | Community | Category | Homes | Date (2) | ||||||||||||||

West Region | Mid-Atlantic Region | ||||||||||||||||||||

Orange County, CA | Metropolitan D.C. | ||||||||||||||||||||

Los Alisos | Stabilized, Non-Mature | 320 | 1Q16 | Domain College Park | Stabilized, Non-Mature | 256 | 4Q15 | ||||||||||||||

Beach & Ocean | Stabilized, Non-Mature | 173 | 4Q16 | DelRay Tower | Development | 332 | 1Q17 | ||||||||||||||

San Francisco, CA | Northeast Region | ||||||||||||||||||||

2000 Post | Redevelopment | 328 | 1Q17 | New York, NY | |||||||||||||||||

View 34 | Stabilized, Non-Mature | 740 | 1Q16 | ||||||||||||||||||

Seattle, WA | |||||||||||||||||||||

Lightbox | Stabilized, Non-Mature | 162 | 2Q16 | Boston, MA | |||||||||||||||||

Waterscape | Stabilized, Non-Mature | 196 | 1Q16 | 100 Pier 4 | Development | 369 | 1Q17 | ||||||||||||||

Total | 2,876 | ||||||||||||||||||||

Non-Mature Home Breakout - By Date (quarter indicates date of Same-Store inclusion) | |||||||||||||||||||||

# of | # of | ||||||||||||||||||||

Date & Community | Category | Homes | Date & Community | Category | Homes | ||||||||||||||||

4Q15 | 4Q16 | ||||||||||||||||||||

Domain College Park | Stabilized, Non-Mature | 256 | Beach & Ocean | Stabilized, Non-Mature | 173 | ||||||||||||||||

1Q16 | 1Q17 | ||||||||||||||||||||

Los Alisos | Stabilized, Non-Mature | 320 | 2000 Post | Redevelopment | 328 | ||||||||||||||||

Waterscape | Stabilized, Non-Mature | 196 | DelRay Tower | Development | 332 | ||||||||||||||||

View 34 | Stabilized, Non-Mature | 740 | 100 Pier 4 | Development | 369 | ||||||||||||||||

2Q16 | |||||||||||||||||||||

Lightbox | Stabilized, Non-Mature | 162 | |||||||||||||||||||

Total | 2,876 | ||||||||||||||||||||

Summary of Non-Mature Home Activity | |||||||||||||||||||||

Stabilized, Non-Mature | Acquired | Redevelopment | Development | Held for Disposition | Total | ||||||||||||||||

Non-Mature Homes at June 30, 2015 | 2,952 | — | 328 | 874 | — | 4,154 | |||||||||||||||

27 Seventy Five Mesa Verde | (964 | ) | — | — | — | — | (964 | ) | |||||||||||||

Channel @ Mission Bay | (315 | ) | — | — | — | — | (315 | ) | |||||||||||||

Beach & Ocean | 173 | — | — | (173 | ) | — | — | ||||||||||||||

View 34 | 1 | — | — | — | — | 1 | |||||||||||||||

Tamar Meadow | — | — | — | — | 178 | 178 | |||||||||||||||

Sugar Mill Creek | — | — | — | — | 212 | 212 | |||||||||||||||

Huntington Villas | — | — | — | — | 400 | 400 | |||||||||||||||

Ocean Villas | — | — | — | — | 119 | 119 | |||||||||||||||

Eastwind | — | — | — | — | 200 | 200 | |||||||||||||||

Dominion Waterside At Lynnhaven | — | — | — | — | 192 | 192 | |||||||||||||||

Heather Lake | — | — | — | — | 252 | 252 | |||||||||||||||

Dominion Yorkshire Downs | — | — | — | — | 202 | 202 | |||||||||||||||

Non-Mature Homes at September 30, 2015 | 1,847 | — | 328 | 701 | 1,755 | 4,631 | |||||||||||||||

(1) See Attachment 16 for definitions and other terms. | |||||||||||||||||||||

(2) Estimated Same-Store quarter represents the quarter UDR anticipates contributing the community to the QTD Same-Store pool. | |||||||||||||||||||||

11

| ||||||||||||||||||||||||

Attachment 7(C) | ||||||||||||||||||||||||

UDR, Inc. | ||||||||||||||||||||||||

Total Revenue Per Occupied Home Summary (1) | ||||||||||||||||||||||||

Portfolio Overview as of Quarter Ended | ||||||||||||||||||||||||

September 30, 2015 | ||||||||||||||||||||||||

(Unaudited) | ||||||||||||||||||||||||

Non-Mature Homes | Unconsolidated | |||||||||||||||||||||||

Total | Total | Joint Venture | Total | |||||||||||||||||||||

Same-Store | Non- | Consolidated | Operating | Homes | ||||||||||||||||||||

Homes | Stabilized (2) | Stabilized (3) (4) | Homes | Homes (5) | (incl. pro rata JV) (5) | |||||||||||||||||||

West Region | ||||||||||||||||||||||||

Orange County, CA | $ | 1,998 | $ | 2,132 | $ | 1,963 | $ | 2,007 | $ | — | $ | 2,007 | ||||||||||||

San Francisco, CA | 3,282 | — | 3,522 | 3,309 | — | 3,309 | ||||||||||||||||||

Seattle, WA | 1,902 | 1,962 | — | 1,913 | 3,494 | 2,098 | ||||||||||||||||||

Los Angeles, CA | 2,530 | — | — | 2,530 | 3,567 | 2,589 | ||||||||||||||||||

Monterey Peninsula, CA | 1,377 | — | — | 1,377 | — | 1,377 | ||||||||||||||||||

Other Southern CA | 1,644 | — | 1,727 | 1,656 | 2,950 | 1,975 | ||||||||||||||||||

Portland, OR | 1,337 | — | — | 1,337 | — | 1,337 | ||||||||||||||||||

Mid-Atlantic Region | ||||||||||||||||||||||||

Metropolitan DC | 1,924 | 1,999 | 1,962 | 1,929 | 2,730 | 1,974 | ||||||||||||||||||

Baltimore, MD | 1,489 | — | 1,584 | 1,496 | 1,775 | 1,518 | ||||||||||||||||||

Richmond, VA | 1,261 | — | — | 1,261 | — | 1,261 | ||||||||||||||||||

Norfolk, VA | — | — | 1,058 | 1,058 | — | 1,058 | ||||||||||||||||||

Other Mid-Atlantic | 1,034 | — | — | 1,034 | — | 1,034 | ||||||||||||||||||

Southeast Region | ||||||||||||||||||||||||

Orlando, FL | 1,118 | — | — | 1,118 | — | 1,118 | ||||||||||||||||||

Tampa, FL | 1,216 | — | 1,134 | 1,209 | — | 1,209 | ||||||||||||||||||

Nashville, TN | 1,124 | — | — | 1,124 | — | 1,124 | ||||||||||||||||||

Other Florida | 1,432 | — | — | 1,432 | — | 1,432 | ||||||||||||||||||

Northeast Region | ||||||||||||||||||||||||

New York, NY | 3,883 | 4,560 | — | 4,138 | 4,706 | 4,224 | ||||||||||||||||||

Boston, MA | 2,377 | — | 3,390 | 2,574 | 2,378 | 2,514 | ||||||||||||||||||

Philadelphia, PA | — | — | — | — | 3,259 | 3,259 | ||||||||||||||||||

Southwest Region | ||||||||||||||||||||||||

Dallas, TX | 1,207 | — | — | 1,207 | 1,842 | 1,334 | ||||||||||||||||||

Austin, TX | 1,350 | — | — | 1,350 | 4,331 | 1,618 | ||||||||||||||||||

Denver, CO | — | — | — | — | 3,147 | 3,147 | ||||||||||||||||||

Weighted Average | $ | 1,792 | $ | 3,062 | $ | 1,921 | $ | 1,860 | $ | 2,838 | $ | 1,933 | ||||||||||||

(1) See Attachment 16 for definitions and other terms. | ||||||||||||||||||||||||

(2) Represents homes included in Stabilized, Non-Mature category on Attachment 5. | ||||||||||||||||||||||||

(3) Represents homes included in Acquired, Development, Redevelopment, Non-Residential/Other and Sold and Held for Disposition communities categories on Attachment 5. | ||||||||||||||||||||||||

(4) Development revenue per occupied home can be affected by the timing of home deliveries during a quarter and the effects of upfront rental rate concessions on cash-based calculations. | ||||||||||||||||||||||||

(5) Represents joint ventures at UDR's pro-rata ownership interests. See Attachment 12 for UDR's joint venture and partnership ownership interests. | ||||||||||||||||||||||||

12

| ||||||||||||||

Attachment 7(D) | ||||||||||||||

UDR, Inc. | ||||||||||||||

Net Operating Income Breakout By Market (1) | ||||||||||||||

September 30, 2015 | ||||||||||||||

(Dollars in Thousands) | ||||||||||||||

(Unaudited) | ||||||||||||||

Three Months Ended September 30, 2015 | ||||||||||||||||||||

Pro-Rata | ||||||||||||||||||||

Same-Store | Non Same-Store (2) | Share of JVs (3) | Total | |||||||||||||||||

Net Operating Income | $ | 127,756 | $ | 21,184 | $ | 17,890 | $ | 166,830 | ||||||||||||

Three Months Ended September 30, 2015 | Three Months Ended September 30, 2015 | |||||||||||||||||||

As a % of NOI | As a % of NOI | |||||||||||||||||||

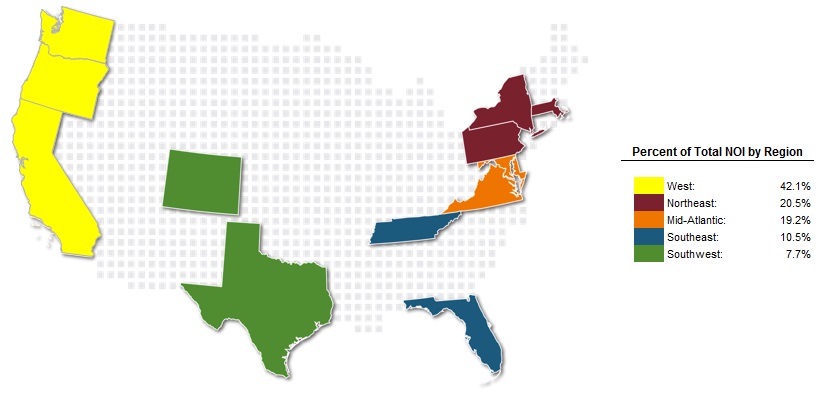

Region | Same-Store | Total | Region | Same-Store | Total | |||||||||||||||

West Region | Southeast Region | |||||||||||||||||||

Orange County, CA | 14.5 | % | 12.8 | % | Orlando, FL | 4.3 | % | 3.3 | % | |||||||||||

San Francisco, CA | 13.7 | % | 12.2 | % | Tampa, FL | 4.1 | % | 3.1 | % | |||||||||||

Seattle, WA | 5.4 | % | 6.8 | % | Nashville, TN | 4.0 | % | 3.1 | % | |||||||||||

Los Angeles, CA | 5.3 | % | 4.3 | % | Other Florida | 1.3 | % | 1.0 | % | |||||||||||

Monterey Peninsula, CA | 3.5 | % | 2.7 | % | 13.7 | % | 10.5 | % | ||||||||||||

Other Southern CA | 2.0 | % | 2.5 | % | Northeast Region | |||||||||||||||

Portland, OR | 1.1 | % | 0.8 | % | New York, NY | 8.2 | % | 13.1 | % | |||||||||||

45.5 | % | 42.1 | % | Boston, MA | 4.5 | % | 6.6 | % | ||||||||||||

Philadelphia, PA | 0.0 | % | 0.8 | % | ||||||||||||||||

Mid-Atlantic Region | 12.7 | % | 20.5 | % | ||||||||||||||||

Metropolitan DC | 13.3 | % | 12.7 | % | Southwest Region | |||||||||||||||

Baltimore, MD | 4.8 | % | 4.1 | % | Dallas, TX | 4.7 | % | 5.0 | % | |||||||||||

Richmond, VA | 2.8 | % | 2.2 | % | Austin, TX | 2.3 | % | 2.3 | % | |||||||||||

Other Mid-Atlantic | 0.2 | % | 0.2 | % | Denver, CO | 0.0 | % | 0.4 | % | |||||||||||

21.1 | % | 19.2 | % | 7.0 | % | 7.7 | % | |||||||||||||

Total | 100.0 | % | 100.0 | % | ||||||||||||||||

(1) See Attachment 16 for definitions and other terms. | ||||||||||||||||||||

(2) Excludes results from Sold and Held for Disposition Communities. | ||||||||||||||||||||

(3) Includes UDR's pro rata share of joint venture and partnership NOI. | ||||||||||||||||||||

13

| |||||||||||||||||||||

Attachment 8(A) | |||||||||||||||||||||

UDR, Inc. | |||||||||||||||||||||

Same-Store Operating Information By Major Market (1) | |||||||||||||||||||||

Current Quarter vs. Prior Year Quarter | |||||||||||||||||||||

September 30, 2015 | |||||||||||||||||||||

(Unaudited) | |||||||||||||||||||||

% of Same- | |||||||||||||||||||||

Total | Store Portfolio | Same-Store | |||||||||||||||||||

Same-Store | Based on | Physical Occupancy | Total Revenue per Occupied Home | ||||||||||||||||||

Homes | 3Q 2015 NOI | 3Q 15 | 3Q 14 | Change | 3Q 15 | 3Q 14 | Change | ||||||||||||||

West Region | |||||||||||||||||||||

Orange County, CA | 4,321 | 14.5 | % | 95.6 | % | 96.1 | % | -0.5 | % | $ | 1,998 | $ | 1,867 | 7.0 | % | ||||||

San Francisco, CA | 2,423 | 13.7 | % | 96.1 | % | 97.3 | % | -1.2 | % | 3,282 | 2,970 | 10.5 | % | ||||||||

Seattle, WA | 1,727 | 5.4 | % | 96.9 | % | 96.9 | % | 0.0 | % | 1,902 | 1,757 | 8.3 | % | ||||||||

Los Angeles, CA | 1,225 | 5.3 | % | 95.7 | % | 95.8 | % | -0.1 | % | 2,530 | 2,335 | 8.4 | % | ||||||||

Monterey Peninsula, CA | 1,565 | 3.5 | % | 97.2 | % | 97.6 | % | -0.4 | % | 1,377 | 1,230 | 12.0 | % | ||||||||

Other Southern CA | 756 | 2.0 | % | 95.6 | % | 96.4 | % | -0.8 | % | 1,644 | 1,566 | 5.0 | % | ||||||||

Portland, OR | 476 | 1.1 | % | 97.2 | % | 98.0 | % | -0.8 | % | 1,337 | 1,178 | 13.5 | % | ||||||||

12,493 | 45.5 | % | 96.2 | % | 96.7 | % | -0.5 | % | 2,158 | 1,987 | 8.6 | % | |||||||||

Mid-Atlantic Region | |||||||||||||||||||||

Metropolitan DC | 4,568 | 13.3 | % | 96.6 | % | 97.1 | % | -0.5 | % | 1,924 | 1,885 | 2.1 | % | ||||||||

Baltimore, MD | 2,122 | 4.8 | % | 96.3 | % | 96.4 | % | -0.1 | % | 1,489 | 1,459 | 2.1 | % | ||||||||

Richmond, VA | 1,358 | 2.8 | % | 95.9 | % | 96.7 | % | -0.8 | % | 1,261 | 1,224 | 3.0 | % | ||||||||

Other Mid-Atlantic | 168 | 0.2 | % | 97.1 | % | 96.2 | % | 0.9 | % | 1,034 | 1,029 | 0.5 | % | ||||||||

8,216 | 21.1 | % | 96.4 | % | 96.8 | % | -0.4 | % | 1,684 | 1,649 | 2.2 | % | |||||||||

Southeast Region | |||||||||||||||||||||

Orlando, FL | 2,500 | 4.3 | % | 97.0 | % | 96.7 | % | 0.3 | % | 1,118 | 1,051 | 6.4 | % | ||||||||

Tampa, FL | 2,287 | 4.1 | % | 97.0 | % | 96.5 | % | 0.5 | % | 1,216 | 1,138 | 6.9 | % | ||||||||

Nashville, TN | 2,260 | 4.0 | % | 97.4 | % | 97.5 | % | -0.1 | % | 1,124 | 1,062 | 5.8 | % | ||||||||

Other Florida | 636 | 1.3 | % | 96.7 | % | 96.5 | % | 0.2 | % | 1,432 | 1,358 | 5.4 | % | ||||||||

7,683 | 13.7 | % | 97.1 | % | 96.8 | % | 0.3 | % | 1,175 | 1,107 | 6.1 | % | |||||||||

Northeast Region | |||||||||||||||||||||

New York, NY | 1,205 | 8.2 | % | 98.0 | % | 98.0 | % | 0.0 | % | 3,883 | 3,672 | 5.7 | % | ||||||||

Boston, MA | 1,179 | 4.5 | % | 97.0 | % | 96.5 | % | 0.5 | % | 2,377 | 2,262 | 5.1 | % | ||||||||

2,384 | 12.7 | % | 97.5 | % | 97.2 | % | 0.3 | % | 3,142 | 2,982 | 5.4 | % | |||||||||

Southwest Region | |||||||||||||||||||||

Dallas, TX | 2,725 | 4.7 | % | 96.9 | % | 97.3 | % | -0.4 | % | 1,207 | 1,137 | 6.2 | % | ||||||||

Austin, TX | 1,273 | 2.3 | % | 97.7 | % | 97.2 | % | 0.5 | % | 1,350 | 1,296 | 4.2 | % | ||||||||

3,998 | 7.0 | % | 97.2 | % | 97.3 | % | -0.1 | % | 1,253 | 1,188 | 5.5 | % | |||||||||

Total/Weighted Avg. | 34,774 | 100.0 | % | 96.6 | % | 96.9 | % | -0.3 | % | $ | 1,792 | $ | 1,687 | 6.2 | % | ||||||

(1) See Attachment 16 for definitions and other terms. | |||||||||||||||||||||

14

| ||||||||||||||||||||||||||||||

Attachment 8(B) | ||||||||||||||||||||||||||||||

UDR, Inc. | ||||||||||||||||||||||||||||||

Same-Store Operating Information By Major Market (1) | ||||||||||||||||||||||||||||||

Current Quarter vs. Prior Year Quarter | ||||||||||||||||||||||||||||||

September 30, 2015 | ||||||||||||||||||||||||||||||

(Unaudited) | ||||||||||||||||||||||||||||||

Total | Same-Store ($000s) | |||||||||||||||||||||||||||||

Same-Store | Revenues | Expenses | Net Operating Income | |||||||||||||||||||||||||||

Homes | 3Q 15 | 3Q 14 | Change | 3Q 15 | 3Q 14 | Change | 3Q 15 | 3Q 14 | Change | |||||||||||||||||||||

West Region | ||||||||||||||||||||||||||||||

Orange County, CA | 4,321 | $ | 24,757 | $ | 23,264 | 6.4 | % | $ | 6,278 | $ | 6,148 | 2.1 | % | $ | 18,479 | $ | 17,116 | 8.0 | % | |||||||||||

San Francisco, CA | 2,423 | 22,927 | 21,004 | 9.2 | % | 5,386 | 5,323 | 1.2 | % | 17,541 | 15,681 | 11.9 | % | |||||||||||||||||

Seattle, WA | 1,727 | 9,550 | 8,819 | 8.3 | % | 2,667 | 2,634 | 1.2 | % | 6,883 | 6,185 | 11.3 | % | |||||||||||||||||

Los Angeles, CA | 1,225 | 8,898 | 8,221 | 8.2 | % | 2,107 | 2,448 | -13.9 | % | 6,791 | 5,773 | 17.6 | % | |||||||||||||||||

Monterey Peninsula, CA | 1,565 | 6,285 | 5,635 | 11.5 | % | 1,765 | 1,754 | 0.6 | % | 4,520 | 3,881 | 16.5 | % | |||||||||||||||||

Other Southern CA | 756 | 3,564 | 3,423 | 4.1 | % | 1,058 | 1,065 | -0.7 | % | 2,506 | 2,358 | 6.3 | % | |||||||||||||||||

Portland, OR | 476 | 1,856 | 1,648 | 12.7 | % | 505 | 514 | -1.9 | % | 1,351 | 1,134 | 19.2 | % | |||||||||||||||||

12,493 | 77,837 | 72,014 | 8.1 | % | 19,766 | 19,886 | -0.6 | % | 58,071 | 52,128 | 11.4 | % | ||||||||||||||||||

Mid-Atlantic Region | ||||||||||||||||||||||||||||||

Metropolitan DC | 4,568 | 25,470 | 25,077 | 1.6 | % | 8,475 | 7,990 | 6.1 | % | 16,995 | 17,087 | -0.5 | % | |||||||||||||||||

Baltimore, MD | 2,122 | 9,128 | 8,954 | 1.9 | % | 3,018 | 2,830 | 6.6 | % | 6,110 | 6,124 | -0.2 | % | |||||||||||||||||

Richmond, VA | 1,358 | 4,925 | 4,821 | 2.1 | % | 1,333 | 1,319 | 1.0 | % | 3,592 | 3,502 | 2.6 | % | |||||||||||||||||

Other Mid-Atlantic | 168 | 506 | 499 | 1.4 | % | 208 | 197 | 5.7 | % | 298 | 302 | -1.4 | % | |||||||||||||||||

8,216 | 40,029 | 39,351 | 1.7 | % | 13,034 | 12,336 | 5.7 | % | 26,995 | 27,015 | -0.1 | % | ||||||||||||||||||

Southeast Region | ||||||||||||||||||||||||||||||

Orlando, FL | 2,500 | 8,134 | 7,625 | 6.7 | % | 2,615 | 2,558 | 2.2 | % | 5,519 | 5,067 | 8.9 | % | |||||||||||||||||

Tampa, FL | 2,287 | 8,093 | 7,536 | 7.4 | % | 2,893 | 2,923 | -1.0 | % | 5,200 | 4,613 | 12.7 | % | |||||||||||||||||

Nashville, TN | 2,260 | 7,424 | 7,021 | 5.7 | % | 2,289 | 2,426 | -5.7 | % | 5,135 | 4,595 | 11.8 | % | |||||||||||||||||

Other Florida | 636 | 2,642 | 2,500 | 5.7 | % | 934 | 906 | 3.2 | % | 1,708 | 1,594 | 7.1 | % | |||||||||||||||||

7,683 | 26,293 | 24,682 | 6.5 | % | 8,731 | 8,813 | -0.9 | % | 17,562 | 15,869 | 10.7 | % | ||||||||||||||||||

Northeast Region | ||||||||||||||||||||||||||||||

New York, NY | 1,205 | 13,758 | 13,002 | 5.8 | % | 3,388 | 2,906 | 16.6 | % | (2) | 10,370 | 10,096 | 2.7 | % | (2) | |||||||||||||||

Boston, MA | 1,179 | 8,156 | 7,719 | 5.7 | % | 2,365 | 2,244 | 5.4 | % | 5,791 | 5,475 | 5.8 | % | |||||||||||||||||

2,384 | 21,914 | 20,721 | 5.8 | % | 5,753 | 5,150 | 11.7 | % | 16,161 | 15,571 | 3.8 | % | ||||||||||||||||||

Southwest Region | ||||||||||||||||||||||||||||||

Dallas, TX | 2,725 | 9,563 | 9,047 | 5.7 | % | 3,531 | 3,274 | 7.8 | % | 6,032 | 5,773 | 4.5 | % | |||||||||||||||||

Austin, TX | 1,273 | 5,036 | 4,812 | 4.7 | % | 2,101 | 2,076 | 1.1 | % | 2,935 | 2,736 | 7.3 | % | |||||||||||||||||

3,998 | 14,599 | 13,859 | 5.3 | % | 5,632 | 5,350 | 5.2 | % | 8,967 | 8,509 | 5.4 | % | ||||||||||||||||||

Totals | 34,774 | $ | 180,672 | $ | 170,627 | 5.9 | % | $ | 52,916 | $ | 51,535 | 2.7 | % | (2) | $ | 127,756 | $ | 119,092 | 7.3 | % | (2) | |||||||||

(1) See Attachment 16 for definitions and other terms. | ||||||||||||||||||||||||||||||

(2) 3Q15 presented above includes $70 thousand of higher New York real estate taxes due to 421 exemption and abatement reductions. Had the Same Store Expense included 100% of the NY real estate taxes before 421 savings, in all periods presented, the percent change in Total Same Store expense and NOI would have been 2.4% and 7.5%, respectively; and the percent change in New York expense and NOI would have been 7.0% and 4.8%, respectively. | ||||||||||||||||||||||||||||||

15

| |||||||||||||||||||

Attachment 8(C) | |||||||||||||||||||

UDR, Inc. | |||||||||||||||||||

Same-Store Operating Information By Major Market (1) | |||||||||||||||||||

Current Quarter vs. Last Quarter | |||||||||||||||||||

September 30, 2015 | |||||||||||||||||||

(Unaudited) | |||||||||||||||||||

Total | Same-Store | ||||||||||||||||||

Same-Store | Physical Occupancy | Total Revenue per Occupied Home | |||||||||||||||||

Homes | 3Q 15 | 2Q 15 | Change | 3Q 15 | 2Q 15 | Change | |||||||||||||

West Region | |||||||||||||||||||

Orange County, CA | 4,321 | 95.6 | % | 95.5 | % | 0.1 | % | $ | 1,998 | $ | 1,944 | 2.8 | % | ||||||

San Francisco, CA | 2,423 | 96.1 | % | 97.1 | % | -1.0 | % | 3,282 | 3,176 | 3.3 | % | ||||||||

Seattle, WA | 1,727 | 96.9 | % | 97.3 | % | -0.4 | % | 1,902 | 1,836 | 3.6 | % | ||||||||

Los Angeles, CA | 1,225 | 95.7 | % | 95.6 | % | 0.1 | % | 2,530 | 2,453 | 3.1 | % | ||||||||

Monterey Peninsula, CA | 1,565 | 97.2 | % | 97.5 | % | -0.3 | % | 1,377 | 1,311 | 5.0 | % | ||||||||

Other Southern CA | 756 | 95.6 | % | 96.4 | % | -0.8 | % | 1,644 | 1,622 | 1.4 | % | ||||||||

Portland, OR | 476 | 97.2 | % | 97.5 | % | -0.3 | % | 1,337 | 1,268 | 5.4 | % | ||||||||

12,493 | 96.2 | % | 96.4 | % | -0.2 | % | 2,160 | 2,093 | 3.2 | % | |||||||||

Mid-Atlantic Region | |||||||||||||||||||

Metropolitan DC | 4,568 | 96.6 | % | 96.8 | % | -0.2 | % | 1,924 | 1,924 | 0.0 | % | ||||||||

Baltimore, MD | 2,122 | 96.3 | % | 97.3 | % | -1.0 | % | 1,489 | 1,483 | 0.4 | % | ||||||||

Richmond, VA | 1,358 | 95.9 | % | 96.9 | % | -1.0 | % | 1,261 | 1,236 | 2.0 | % | ||||||||

Other Mid-Atlantic | 168 | 97.1 | % | 95.9 | % | 1.2 | % | 1,034 | 1,037 | -0.3 | % | ||||||||

8,216 | 96.4 | % | 96.9 | % | -0.5 | % | 1,684 | 1,678 | 0.4 | % | |||||||||

Southeast Region | |||||||||||||||||||

Orlando, FL | 2,500 | 97.0 | % | 97.0 | % | 0.0 | % | 1,118 | 1,098 | 1.8 | % | ||||||||

Tampa, FL | 2,287 | 97.0 | % | 97.0 | % | 0.0 | % | 1,216 | 1,194 | 1.8 | % | ||||||||

Nashville, TN | 2,260 | 97.4 | % | 97.3 | % | 0.1 | % | 1,124 | 1,103 | 1.9 | % | ||||||||

Other Florida | 636 | 96.7 | % | 96.6 | % | 0.1 | % | 1,432 | 1,427 | 0.4 | % | ||||||||

7,683 | 97.1 | % | 97.1 | % | 0.0 | % | 1,175 | 1,155 | 1.7 | % | |||||||||

Northeast Region | |||||||||||||||||||

New York, NY | 1,205 | 98.0 | % | 98.0 | % | 0.0 | % | 3,883 | 3,805 | 2.0 | % | ||||||||

Boston, MA | 1,179 | 97.0 | % | 97.1 | % | -0.1 | % | 2,377 | 2,316 | 2.6 | % | ||||||||

2,384 | 97.5 | % | 97.6 | % | 0.0 | % | 3,142 | 3,072 | 2.3 | % | |||||||||

Southwest Region | |||||||||||||||||||

Dallas, TX | 2,725 | 96.9 | % | 97.0 | % | -0.1 | % | 1,207 | 1,181 | 2.2 | % | ||||||||

Austin, TX | 1,273 | 97.7 | % | 97.3 | % | 0.4 | % | 1,350 | 1,345 | 0.4 | % | ||||||||

3,998 | 97.2 | % | 97.1 | % | 0.1 | % | 1,253 | 1,233 | 1.6 | % | |||||||||

Total/Weighted Avg. | 34,774 | 96.6 | % | 96.9 | % | -0.3 | % | $ | 1,792 | $ | 1,755 | 2.1 | % | ||||||

(1) See Attachment 16 for definitions and other terms. | |||||||||||||||||||

16

| ||||||||||||||||||||||||||||||

Attachment 8(D) | ||||||||||||||||||||||||||||||

UDR, Inc. | ||||||||||||||||||||||||||||||

Same-Store Operating Information By Major Market (1) | ||||||||||||||||||||||||||||||

Current Quarter vs. Last Quarter | ||||||||||||||||||||||||||||||

September 30, 2015 | ||||||||||||||||||||||||||||||

(Unaudited) | ||||||||||||||||||||||||||||||

Total | Same-Store ($000s) | |||||||||||||||||||||||||||||

Same-Store | Revenues | Expenses | Net Operating Income | |||||||||||||||||||||||||||

Homes | 3Q 15 | 2Q 15 | Change | 3Q 15 | 2Q 15 | Change | 3Q 15 | 2Q 15 | Change | |||||||||||||||||||||

West Region | ||||||||||||||||||||||||||||||

Orange County, CA | 4,321 | $ | 24,757 | $ | 24,060 | 2.9 | % | $ | 6,278 | $ | 5,926 | 5.9 | % | $ | 18,479 | $ | 18,134 | 1.9 | % | |||||||||||

San Francisco, CA | 2,423 | 22,927 | 22,420 | 2.3 | % | 5,386 | 5,200 | 3.6 | % | 17,541 | 17,220 | 1.9 | % | |||||||||||||||||

Seattle, WA | 1,727 | 9,550 | 9,253 | 3.2 | % | 2,667 | 2,613 | 2.1 | % | 6,883 | 6,640 | 3.7 | % | |||||||||||||||||

Los Angeles, CA | 1,225 | 8,898 | 8,617 | 3.3 | % | 2,107 | 2,267 | -7.1 | % | 6,791 | 6,350 | 6.9 | % | |||||||||||||||||

Monterey Peninsula, CA | 1,565 | 6,285 | 5,999 | 4.8 | % | 1,765 | 1,603 | 10.1 | % | 4,520 | 4,396 | 2.8 | % | |||||||||||||||||

Other Southern CA | 756 | 3,564 | 3,547 | 0.5 | % | 1,058 | 963 | 9.9 | % | 2,506 | 2,584 | -3.0 | % | |||||||||||||||||

Portland, OR | 476 | 1,856 | 1,766 | 5.1 | % | 505 | 511 | -1.3 | % | 1,351 | 1,255 | 7.7 | % | |||||||||||||||||

12,493 | 77,837 | 75,662 | 2.9 | % | 19,766 | 19,083 | 3.6 | % | 58,071 | 56,579 | 2.6 | % | ||||||||||||||||||

Mid-Atlantic Region | ||||||||||||||||||||||||||||||

Metropolitan DC | 4,568 | 25,470 | 25,523 | -0.2 | % | 8,475 | 8,091 | 4.7 | % | 16,995 | 17,432 | -2.5 | % | |||||||||||||||||

Baltimore, MD | 2,122 | 9,128 | 9,185 | -0.6 | % | 3,018 | 2,639 | 14.4 | % | 6,110 | 6,546 | -6.7 | % | |||||||||||||||||

Richmond, VA | 1,358 | 4,925 | 4,879 | 0.9 | % | 1,333 | 1,196 | 11.4 | % | 3,592 | 3,683 | -2.5 | % | |||||||||||||||||

Other Mid-Atlantic | 168 | 506 | 501 | 1.0 | % | 208 | 196 | 6.2 | % | 298 | 305 | -2.3 | % | |||||||||||||||||

8,216 | 40,029 | 40,088 | -0.2 | % | 13,034 | 12,122 | 7.5 | % | 26,995 | 27,966 | -3.5 | % | ||||||||||||||||||

Southeast Region | ||||||||||||||||||||||||||||||

Orlando, FL | 2,500 | 8,134 | 7,991 | 1.8 | % | 2,615 | 2,484 | 5.3 | % | 5,519 | 5,507 | 0.2 | % | |||||||||||||||||

Tampa, FL | 2,287 | 8,093 | 7,945 | 1.9 | % | 2,893 | 2,805 | 3.1 | % | 5,200 | 5,140 | 1.2 | % | |||||||||||||||||

Nashville, TN | 2,260 | 7,424 | 7,277 | 2.0 | % | 2,289 | 2,175 | 5.2 | % | 5,135 | 5,102 | 0.7 | % | |||||||||||||||||

Other Florida | 636 | 2,642 | 2,631 | 0.4 | % | 934 | 954 | -2.1 | % | 1,708 | 1,677 | 1.8 | % | |||||||||||||||||

7,683 | 26,293 | 25,844 | 1.7 | % | 8,731 | 8,418 | 3.7 | % | 17,562 | 17,426 | 0.8 | % | ||||||||||||||||||

Northeast Region | ||||||||||||||||||||||||||||||

New York, NY | 1,205 | 13,758 | 13,481 | 2.1 | % | 3,388 | 3,020 | 12.2 | % | (2) | 10,370 | 10,461 | -0.9 | % | (2) | |||||||||||||||

Boston, MA | 1,179 | 8,156 | 7,955 | 2.5 | % | 2,365 | 2,147 | 10.1 | % | 5,791 | 5,808 | -0.3 | % | |||||||||||||||||

2,384 | 21,914 | 21,436 | 2.2 | % | 5,753 | 5,167 | 11.3 | % | 16,161 | 16,269 | -0.7 | % | ||||||||||||||||||

Southwest Region | ||||||||||||||||||||||||||||||

Dallas, TX | 2,725 | 9,563 | 9,365 | 2.1 | % | 3,531 | 3,260 | 8.3 | % | 6,032 | 6,105 | -1.2 | % | |||||||||||||||||

Austin, TX | 1,273 | 5,036 | 4,997 | 0.8 | % | 2,101 | 2,105 | -0.2 | % | 2,935 | 2,892 | 1.5 | % | |||||||||||||||||

3,998 | 14,599 | 14,362 | 1.7 | % | 5,632 | 5,365 | 5.0 | % | 8,967 | 8,997 | -0.3 | % | ||||||||||||||||||

Total | 34,774 | $ | 180,672 | $ | 177,392 | 1.8 | % | $ | 52,916 | $ | 50,155 | 5.5 | % | (2) | $ | 127,756 | $ | 127,237 | 0.4 | % | (2) | |||||||||

(1) See Attachment 16 for definitions and other terms. | ||||||||||||||||||||||||||||||

(2) 3Q15 presented above includes $70 thousand of higher New York real estate taxes due to 421 exemption and abatement reductions. Had the Same Store Expense included 100% of the NY real estate taxes before 421 savings, in all periods presented, the percent change in Total Same Store expense and NOI would have been 5.1% and 0.5%, respectively; and the percent change in New York expense and NOI would have been 5.0% and -0.3%, respectively. | ||||||||||||||||||||||||||||||

17

| ||||||||||||||||||||||

Attachment 8(E) | ||||||||||||||||||||||

UDR, Inc. | ||||||||||||||||||||||

Same-Store Operating Information By Major Market (1) | ||||||||||||||||||||||

Current Year-to-Date vs. Prior Year-to-Date | ||||||||||||||||||||||

September 30, 2015 | ||||||||||||||||||||||

(Unaudited) | ||||||||||||||||||||||

% of Same- | ||||||||||||||||||||||

Total | Store Portfolio | Same-Store | ||||||||||||||||||||

Same-Store | Based on | Physical Occupancy | Total Revenue per Occupied Home | |||||||||||||||||||

Homes | YTD 2015 NOI | YTD 15 | YTD 14 | Change | YTD 15 | YTD 14 | Change | |||||||||||||||

West Region | ||||||||||||||||||||||

Orange County, CA | 3,357 | 11.7 | % | 95.9 | % | 95.2 | % | 0.7 | % | $ | 1,903 | $ | 1,809 | 5.2 | % | |||||||

San Francisco, CA | 2,108 | 11.9 | % | 96.9 | % | 97.2 | % | -0.3 | % | 2,990 | 2,732 | 9.4 | % | |||||||||

Seattle, WA | 1,727 | 5.6 | % | 97.2 | % | 97.2 | % | 0.0 | % | 1,842 | 1,723 | 6.9 | % | |||||||||

Los Angeles, CA | 1,225 | 5.4 | % | 95.4 | % | 95.5 | % | -0.1 | % | 2,460 | 2,317 | 6.2 | % | |||||||||

Monterey Peninsula, CA | 1,565 | 3.7 | % | 97.3 | % | 95.5 | % | 1.8 | % | 1,318 | 1,203 | 9.6 | % | |||||||||

Other Southern CA | 756 | 2.2 | % | 96.1 | % | 95.9 | % | 0.2 | % | 1,624 | 1,537 | 5.7 | % | |||||||||

Portland, OR | 476 | 1.1 | % | 97.7 | % | 97.8 | % | -0.1 | % | 1,277 | 1,152 | 10.9 | % | |||||||||

11,214 | 41.6 | % | 96.5 | % | 96.1 | % | 0.4 | % | 2,031 | 1,896 | 7.1 | % | ||||||||||

Mid-Atlantic Region | ||||||||||||||||||||||

Metropolitan DC | 4,568 | 14.4 | % | 96.7 | % | 96.9 | % | -0.2 | % | 1,914 | 1,875 | 2.1 | % | |||||||||

Baltimore, MD | 2,122 | 5.3 | % | 96.9 | % | 96.7 | % | 0.2 | % | 1,480 | 1,453 | 1.9 | % | |||||||||

Richmond, VA | 1,358 | 3.0 | % | 96.2 | % | 96.7 | % | -0.5 | % | 1,241 | 1,216 | 2.1 | % | |||||||||

Other Mid-Atlantic | 168 | 0.3 | % | 95.9 | % | 96.7 | % | -0.8 | % | 1,027 | 1,012 | 1.5 | % | |||||||||

8,216 | 23.0 | % | 96.7 | % | 96.8 | % | -0.1 | % | 1,673 | 1,640 | 2.0 | % | ||||||||||

Southeast Region | ||||||||||||||||||||||

Orlando, FL | 2,500 | 4.6 | % | 96.9 | % | 96.8 | % | 0.1 | % | 1,095 | 1,030 | 6.3 | % | |||||||||

Tampa, FL | 2,287 | 4.3 | % | 97.0 | % | 96.4 | % | 0.6 | % | 1,194 | 1,131 | 5.6 | % | |||||||||

Nashville, TN | 2,260 | 4.2 | % | 97.3 | % | 97.4 | % | -0.1 | % | 1,104 | 1,051 | 5.0 | % | |||||||||

Other Florida | 636 | 1.4 | % | 96.7 | % | 96.4 | % | 0.3 | % | 1,420 | 1,351 | 5.1 | % | |||||||||

7,683 | 14.5 | % | 97.0 | % | 96.8 | % | 0.2 | % | 1,154 | 1,093 | 5.6 | % | ||||||||||

Northeast Region | ||||||||||||||||||||||

New York, NY | 1,205 | 8.7 | % | 98.0 | % | 97.6 | % | 0.4 | % | 3,799 | 3,610 | 5.2 | % | |||||||||

Boston, MA | 1,179 | 4.8 | % | 96.7 | % | 96.4 | % | 0.3 | % | 2,326 | 2,210 | 5.2 | % | |||||||||

2,384 | 13.5 | % | 97.4 | % | 97.0 | % | 0.4 | % | 3,075 | 2,922 | 5.3 | % | ||||||||||

Southwest Region | ||||||||||||||||||||||

Dallas, TX | 2,725 | 5.0 | % | 97.0 | % | 97.1 | % | -0.1 | % | 1,183 | 1,127 | 5.0 | % | |||||||||

Austin, TX | 1,273 | 2.4 | % | 97.3 | % | 96.9 | % | 0.4 | % | 1,338 | 1,271 | 5.3 | % | |||||||||

3,998 | 7.4 | % | 97.1 | % | 97.1 | % | 0.0 | % | 1,233 | 1,172 | 5.2 | % | ||||||||||

Total/Weighted Avg. | 33,495 | 100.0 | % | 96.8 | % | 96.6 | % | 0.2 | % | $ | 1,721 | $ | 1,635 | 5.3 | % | |||||||

(1) See Attachment 16 for definitions and other terms. | ||||||||||||||||||||||

18

| ||||||||||||||||||||||||||||||

Attachment 8(F) | ||||||||||||||||||||||||||||||

UDR, Inc. | ||||||||||||||||||||||||||||||

Same-Store Operating Information By Major Market (1) | ||||||||||||||||||||||||||||||

Current Year-to-Date vs. Prior Year-to-Date | ||||||||||||||||||||||||||||||

September 30, 2015 | ||||||||||||||||||||||||||||||

(Unaudited) | ||||||||||||||||||||||||||||||

Total | Same-Store ($000s) | |||||||||||||||||||||||||||||

Same-Store | Revenues | Expenses | Net Operating Income | |||||||||||||||||||||||||||

Homes | YTD 15 | YTD 14 | Change | YTD 15 | YTD 14 | Change | YTD 15 | YTD 14 | Change | |||||||||||||||||||||

West Region | ||||||||||||||||||||||||||||||

Orange County, CA | 3,357 | $ | 55,136 | $ | 52,042 | 5.9 | % | $ | 13,463 | $ | 13,664 | -1.5 | % | $ | 41,673 | $ | 38,378 | 8.6 | % | |||||||||||

San Francisco, CA | 2,108 | 54,972 | 50,385 | 9.1 | % | 12,658 | 12,665 | -0.1 | % | 42,314 | 37,720 | 12.2 | % | |||||||||||||||||

Seattle, WA | 1,727 | 27,831 | 26,028 | 6.9 | % | 7,834 | 7,637 | 2.6 | % | 19,997 | 18,391 | 8.7 | % | |||||||||||||||||

Los Angeles, CA | 1,225 | 25,869 | 24,400 | 6.0 | % | 6,770 | 7,504 | -9.8 | % | 19,099 | 16,896 | 13.0 | % | |||||||||||||||||

Monterey Peninsula, CA | 1,565 | 18,056 | 16,180 | 11.6 | % | 5,018 | 4,901 | 2.4 | % | 13,038 | 11,279 | 15.6 | % | |||||||||||||||||

Other Southern CA | 756 | 10,622 | 10,026 | 5.9 | % | 2,908 | 3,035 | -4.2 | % | 7,714 | 6,991 | 10.4 | % | |||||||||||||||||

Portland, OR | 476 | 5,345 | 4,826 | 10.8 | % | 1,455 | 1,444 | 0.8 | % | 3,890 | 3,382 | 15.0 | % | |||||||||||||||||

11,214 | 197,831 | 183,887 | 7.6 | % | 50,106 | 50,850 | -1.5 | % | 147,725 | 133,037 | 11.0 | % | ||||||||||||||||||

Mid-Atlantic Region | ||||||||||||||||||||||||||||||

Metropolitan DC | 4,568 | 76,078 | 74,701 | 1.8 | % | 24,722 | 23,920 | 3.4 | % | 51,356 | 50,781 | 1.1 | % | |||||||||||||||||

Baltimore, MD | 2,122 | 27,392 | 26,833 | 2.1 | % | 8,364 | 7,920 | 5.6 | % | 19,028 | 18,913 | 0.6 | % | |||||||||||||||||

Richmond, VA | 1,358 | 14,587 | 14,370 | 1.5 | % | 3,820 | 3,702 | 3.1 | % | 10,767 | 10,668 | 0.9 | % | |||||||||||||||||

Other Mid-Atlantic | 168 | 1,489 | 1,480 | 0.6 | % | 594 | 557 | 6.8 | % | 895 | 923 | -3.1 | % | |||||||||||||||||

8,216 | 119,546 | 117,384 | 1.8 | % | 37,500 | 36,099 | 3.9 | % | 82,046 | 81,285 | 0.9 | % | ||||||||||||||||||

Southeast Region | ||||||||||||||||||||||||||||||

Orlando, FL | 2,500 | 23,876 | 22,434 | 6.4 | % | 7,534 | 7,237 | 4.1 | % | 16,342 | 15,197 | 7.5 | % | |||||||||||||||||

Tampa, FL | 2,287 | 23,838 | 22,449 | 6.2 | % | 8,457 | 8,187 | 3.3 | % | 15,381 | 14,262 | 7.9 | % | |||||||||||||||||

Nashville, TN | 2,260 | 21,846 | 20,813 | 5.0 | % | 6,780 | 6,626 | 2.3 | % | 15,066 | 14,187 | 6.2 | % | |||||||||||||||||

Other Florida | 636 | 7,860 | 7,455 | 5.4 | % | 2,774 | 2,607 | 6.5 | % | 5,086 | 4,848 | 4.9 | % | |||||||||||||||||

7,683 | 77,420 | 73,151 | 5.8 | % | 25,545 | 24,657 | 3.6 | % | 51,875 | 48,494 | 7.0 | % | ||||||||||||||||||

Northeast Region | ||||||||||||||||||||||||||||||

New York, NY | 1,205 | 40,377 | 38,214 | 5.7 | % | 9,332 | 8,740 | 6.8 | % | (2) | 31,045 | 29,474 | 5.3 | % | (2) | |||||||||||||||

Boston, MA | 1,179 | 23,865 | 22,603 | 5.6 | % | 6,914 | 6,501 | 6.4 | % | 16,951 | 16,102 | 5.3 | % | |||||||||||||||||

2,384 | 64,242 | 60,817 | 5.6 | % | 16,246 | 15,241 | 6.6 | % | 47,996 | 45,576 | 5.3 | % | ||||||||||||||||||

Southwest Region | ||||||||||||||||||||||||||||||

Dallas, TX | 2,725 | 28,151 | 26,836 | 4.9 | % | 10,258 | 9,908 | 3.5 | % | 17,893 | 16,928 | 5.7 | % | |||||||||||||||||

Austin, TX | 1,273 | 14,917 | 14,113 | 5.7 | % | 6,310 | 5,911 | 6.7 | % | 8,607 | 8,202 | 5.0 | % | |||||||||||||||||

3,998 | 43,068 | 40,949 | 5.2 | % | 16,568 | 15,819 | 4.7 | % | 26,500 | 25,130 | 5.5 | % | ||||||||||||||||||

Totals | 33,495 | $ | 502,107 | $ | 476,188 | 5.4 | % | $ | 145,965 | $ | 142,666 | 2.3 | % | (2) | $ | 356,142 | $ | 333,522 | 6.8 | % | (2) | |||||||||

(1) See Attachment 16 for definitions and other terms. | ||||||||||||||||||||||||||||||

(2) 2015 presented above includes $70 thousand of higher New York real estate taxes due to 421 exemption and abatement reductions. Had the Same Store Expense included 100% of the NY real estate taxes before 421 savings, in all periods presented, the percent change in Total Same Store expense and NOI would have been 2.1% and 7.0%, respectively; and the percent change in New York expense and NOI would have been 3.0% and 7.8%, respectively. | ||||||||||||||||||||||||||||||

19

| ||||||||||||||||

Attachment 8(G) | ||||||||||||||||

UDR, Inc. | ||||||||||||||||

Same-Store Operating Information By Major Market (1) | ||||||||||||||||

September 30, 2015 | ||||||||||||||||

(Unaudited) | ||||||||||||||||

Effective New Lease Rate Growth | Effective Renewal Lease Rate Growth | Annualized Turnover | ||||||||||||||

3Q 2015 | 3Q 2015 | 3Q 2015 | 3Q 2014 | YTD 2015 | YTD 2014 | |||||||||||

West Region | ||||||||||||||||

Orange County, CA | 8.0 | % | 7.6 | % | 71.5 | % | 66.9 | % | 61.4 | % | 60.0 | % | ||||

San Francisco, CA | 11.3 | % | 10.1 | % | 71.6 | % | 59.3 | % | 58.2 | % | 50.7 | % | ||||

Seattle, WA | 13.1 | % | 10.0 | % | 65.2 | % | 63.6 | % | 54.9 | % | 53.3 | % | ||||

Los Angeles, CA | 10.4 | % | 10.1 | % | 67.4 | % | 61.5 | % | 54.0 | % | 53.3 | % | ||||

Monterey Peninsula, CA | 18.1 | % | 14.0 | % | 68.7 | % | 60.1 | % | 55.2 | % | 48.3 | % | ||||

Other Southern CA | 3.5 | % | 5.6 | % | 77.7 | % | 67.7 | % | 63.8 | % | 61.2 | % | ||||

Portland, OR | 20.5 | % | 12.8 | % | 65.9 | % | 61.7 | % | 56.5 | % | 53.9 | % | ||||

Mid-Atlantic Region | ||||||||||||||||

Metropolitan DC | 0.8 | % | 4.1 | % | 57.8 | % | 55.0 | % | 47.2 | % | 45.2 | % | ||||

Baltimore, MD | -0.6 | % | 5.3 | % | 70.5 | % | 69.6 | % | 52.7 | % | 55.0 | % | ||||

Richmond, VA | 1.4 | % | 5.8 | % | 69.0 | % | 65.7 | % | 58.3 | % | 59.2 | % | ||||

Other Mid-Atlantic | 1.4 | % | 5.0 | % | 44.9 | % | 87.4 | % | 52.5 | % | 62.9 | % | ||||

Southeast Region | ||||||||||||||||

Tampa, FL | 8.2 | % | 7.6 | % | 63.8 | % | 66.1 | % | 57.1 | % | 56.6 | % | ||||

Orlando, FL | 11.5 | % | 7.2 | % | 61.3 | % | 72.2 | % | 53.8 | % | 56.4 | % | ||||

Nashville, TN | 9.3 | % | 6.3 | % | 64.6 | % | 64.1 | % | 57.2 | % | 57.0 | % | ||||

Other Florida | 4.1 | % | 5.6 | % | 48.0 | % | 53.0 | % | 46.5 | % | 50.5 | % | ||||

Northeast Region | ||||||||||||||||

New York, NY | 9.0 | % | 6.3 | % | 51.4 | % | 50.4 | % | 43.2 | % | 45.9 | % | ||||

Boston, MA | 6.1 | % | 6.6 | % | 56.9 | % | 61.2 | % | 48.5 | % | 47.5 | % | ||||

Southwest Region | ||||||||||||||||

Dallas, TX | 6.7 | % | 6.9 | % | 71.3 | % | 61.7 | % | 58.7 | % | 56.0 | % | ||||

Austin, TX | 6.3 | % | 6.1 | % | 58.9 | % | 63.9 | % | 50.3 | % | 54.2 | % | ||||

Total/Weighted Avg. | 7.6 | % | 7.3 | % | 65.1 | % | 62.9 | % | 54.7 | % | 53.6 | % | ||||