Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): October 20, 2015 (October 19, 2015)

WAVE SYNC CORP.

(Exact name of registrant as specified in its charter)

| Delaware | 001-34113 | 74-2559866 | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 40 Wall Street, 28th Floor, New York, NY 10005 |

| (Address of principal executive offices) |

Registrant’s telephone number, including area code: 646-512-5855

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information contained in this Current Report on Form 8-K include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. The statements herein which are not historical reflect our current expectations and projections about our future results, performance, liquidity, financial condition, prospects and opportunities and are based upon information currently available to us and our management and our management’s interpretation of what is believed to be significant factors affecting the business, including many assumptions regarding future events. Such forward-looking statements include statements regarding, among other things:

| ● | our ability to reach widespread commercial viability; |

| ● | our growth strategies; |

| ● | our anticipated future operation and profitability; |

| ● | our future financing capabilities and anticipated need for working capital; |

| ● | the anticipated trends in our industry; |

| ● | our ability to expand our marketing and sales capabilities; |

| ● | acquisitions of other companies or assets that we might undertake in the future; |

| ● | our operations in China and the regulatory, economic and political conditions in China; and |

| ● | current and future competition. |

Forward-looking statements, which involve assumptions and describe our future plans, strategies, and expectations, are generally identifiable by use of the words “may,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” or “project” or the negative of these words or other variations on these words or comparable terminology. Actual results, performance, liquidity, financial condition, prospects and opportunities could differ materially from those expressed in, or implied by, these forward-looking statements as a result of various risks, uncertainties and other factors, including the ability to raise sufficient capital to continue our operations. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Risk Factors” and matters described in this Current Report on Form 8-K generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained herein will in fact occur.

Potential purchasers of our common stock or other securities should not place undue reliance on any forward-looking statements. Except as expressly required by the federal securities laws, there is no undertaking to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason.

| 2 |

EXPLANATORY NOTE

This Current Report on Form 8-K being filed in connection with a series of transactions consummated by the Registrant, and certain related events and actions taken by the Registrant.

This Current Report on Form 8-K includes the following items on Form 8-K:

| Item 1.01 | Entry into a Material Definitive Agreement |

| Item 2.01 | Completion of Acquisition or Disposition of Assets |

| Item 3.02 | Unregistered Sale of Equity Securities |

| Item 5.01 | Changes in Control of Registrant |

| Item 5.02 | Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers |

| Item 5.03 | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year |

| Item 5.06 | Change in Shell Company Status |

| Item 9.01 | Financial Statements and Exhibits |

Certain Definitional Conventions Used in this Current Report

In this Current Report on Form 8-K, unless the context requires or is otherwise specified, references to the “Registrant,” “Company,” “we,” “us,” “our” and similar expressions include the following entities, after giving effect to the Acquisition (as defined herein):

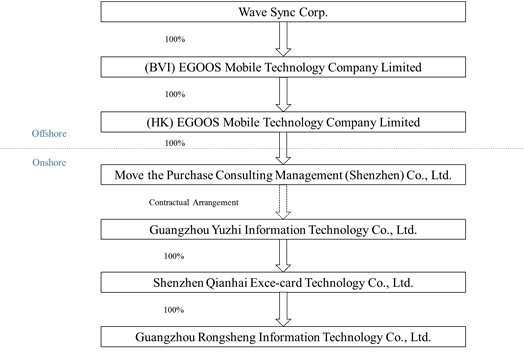

| (i) | Wave Sync Corp., formerly known as China Bio-Energy Corp., a Delaware company (most commonly referred to herein as the “Registrant” or “WAYS” as the context requires), which is our publicly traded parent company; | |

| (ii) | EGOOS Mobile Technology Company Limited, a British Virgin Islands company and a wholly-owned subsidiary of the Registrant (“EGOOS BVI”); | |

| (iii) | EGOOS Mobile Technology Company Limited, a Hong Kong company (“EGOOS HK”) and a wholly owned subsidiary of EGOOS BVI; | |

| (iv) | Move the Purchase Consulting Management (Shenzhen) Co., Ltd., a wholly owned subsidiary of EGOOS HK incorporated in the People’s Republic of China, or PRC, or China as a wholly foreign-owned enterprise (“WFOE” or “Yigou”); | |

| (v) | Guangzhou Yuzhi Information Technology Co., Ltd., our principal operating subsidiary, which is a Chinese variable interest entity that the WOFE controls through certain contractual arrangements (“Guangzhou Yuzhi”); | |

| (vi) | Shenzhen Qianhai Exce-card Technology Co., Ltd., a Chinese corporation and a wholly owned subsidiary of Guangzhou Yuzhi (“Shenzhen Exce-card”); and | |

| (vii) | Guangzhou Rongsheng Information Technology Co., Ltd., a Chinese corporation and a wholly owned subsidiary of Shenzhen Exce-card (“Guangzhou Rongsheng”, together with Guangzhou Yuzhi and Shenzhen Exce-card, is collectively referred to herein as “Guangzhou Yuzhi and its Subsidiaries”). |

Item 1.01 Entry into a Material Definitive Agreement

Share Purchase Agreement

Reference is made to Item 2.01 of this Current Report for a description of a Share Purchase Agreement, entered into on October 19, 2015 (the “Share Purchase Agreement”), and a related acquisition transaction (the “Acquisition”) by and between the Registrant, EGOOS BVI and the sole shareholder of EGOOS BVI.

As a result of the Acquisition, EGOOS BVI has become a wholly-owned subsidiary of the Registrant and business of the Registrant is now the business of EGOOS’ indirect, controlled subsidiaries Guangzhou Yuzhi, Shenzhen Exce-card and Guangzhou Rongsheng, corporations organized in the PRC.

Item 2.01 Completion of Acquisition or Disposition of Assets

On October 19, 2015, Wave Sync Corp., formerly known as China Bio-Energy Corp.(the “Registrant” or the “Company”) entered into a Share Purchase Agreement (the “Share Purchase Agreement”) with EGOOS Mobile Technology Company Limited, a British Virgin Islands holding company (“EGOOS BVI”), which owns 100% of EGOOS Mobile Technology Company Limited, a Hong Kong company (“EGOOS HK”), which owns 100% of Move the Purchase Consulting Management (Shenzhen) Co., Ltd. (“WOFE” or “Yigou”), a foreign investment enterprise organized under the laws of the PRC, and which has, through various contractual agreements, management control and the rights to the profits of Guangzhou Yuzhi Information Technology Co., Ltd., a corporation organized under the laws of the PRC as a variable interest entity(“Guangzhou Yuzhi”), which owns 100% of Shenzhen Qianhai Exce-card Technology Co., Ltd., a Chinese corporation (“Shenzhen Exce-card”), which owns 100% of Guangzhou Rongsheng Information Technology Co., Ltd., a Chinese corporation (“Guangzhou Rongsheng”, together with Guangzhou Yuzhi and Shenzhen Exce-card, is collectively referred to herein as “Guangzhou Yuzhi and its Subsidiaries”), and the sole shareholder of EGOOS BVI. Guangzhou Yuzhi and its Subsidiaries engage in research, development, marketing and distribution of audio bank card products.

| 3 |

The Share Purchase Agreement provides for an acquisition transaction (the “Acquisition”) in which the Registrant, through the issuance of a convertible note to EGOOS BVI’s sole shareholder, will acquire 100% of EGOOS BVI. Such note is convertible into 15,000,000 shares of the Company’s common stock, on a post Reverse Split (as defined below) basis, at noteholder’s election, at any time after 30 days following issuance of such note but prior to two year anniversary of the date of such note, provided that the Company has effectuated a reverse split of all of the issued and outstanding Common Stock as of the date of the issuance of the note (the “Reverse Split”). Upon conversion of the note, the existing shareholders of the Registrant will own an aggregate of 24.7% of the post-acquisition entity.

The closing of the Acquisition (the “Closing”) took place on October 19, 2015 (the “Closing Date”). On the Closing Date, pursuant to the terms of the Share Purchase Agreement, the Registrant acquired all of the outstanding equity securities of EGOOS BVI from the sole shareholder of EGOOS BVI; and the shareholder of EGOOS BVI transferred and contributed all of his issued and outstanding shares of EGOOS BVI to the Registrant. In exchange, the Registrant issued to the sole shareholder of EGOOS BVI a convertible note, which may be converted into an aggregate of 15,000,000 Post-Split Common Shares of the Registrant.

On August 5, 2015, Yigou entered into an Exclusive Service Agreement which entitles Yigou to substantially all of the economic benefits of Guangzhou Yuzhi and its Subsidiaries in consideration of services provided by Yigou to Guangzhou Yuzhi and its Subsidiaries. In addition, Yigou entered into certain agreements with each of Wenbin Yang, Ping Li, (collectively, the “Guangzhou Yuzhi shareholders”), as well as Guangzhou Yuzhi and its Subsidiaries, including (i) a Call Option Agreement allowing Yigou to acquire the shares of Guangzhou Yuzhi as permitted by PRC laws, (ii) a Voting Rights Proxy Agreement that provides Yigou with the voting rights of the Guangzhou Yuzhi shareholders and those of Guangzhou Yuzhi, and (iii) an Equity Pledge Agreement that pledges the shares in Guangzhou Yuzhi and its Subsidiaries to Yigou. This VIE structure provides Yigou, a wholly-owned subsidiary of EGOOS HK, with control over the operations and benefits of Guangzhou Yuzhi and its Subsidiaries without having a direct equity ownership in Guangzhou Yuzhi and its Subsidiaries (EGOOS BVI, EGOOS HK, Guangzhou Yuzhi, Shenzhen Exce-card, Guangzhou Rongsheng and Yigou are collectively referred to herein as the “Group”).

As all of the companies in the Group are under common control, this has been accounted for as a reorganization of entities and the financial statements have been prepared as if the reorganization had occurred retroactively. The Registrant has consolidated the operating results, assets and liabilities of Guangzhou Yuzhi and its Subsidiaries within its financial statements.

FORM 10 INFORMATION

Information in response to this Item 2.01 below is keyed to the item numbers of Form 10.

Part I

Item 1. Description of Business.

Overview

Wave Sync Corp. (“WAYS”) was incorporated on December 23, 1988 as a Delaware corporation. It became a shell company in July 2015 as a result of terminating its contractual relationship with its then existing “variable interest entity” subsidiaries. Through the Acquisition, the Registrant acquired EGOOS BVI and its principal operating subsidiaries, Guangzhou Yuzhi, Shenzhen Exce-card and Guangzhou Rongsheng (“Guangzhou Yuzhi and its Subsidiaries”). A summary of the business of Guangzhou Yuzhi and its Subsidiaries is described below.

| 4 |

General

EGOOS BVI, a British Virgin Islands business company, acts as a holding company and indirectly controls Guangzhou Yuzhi (a variable interest entity in China) and its Subsidiaries. EGOOS BVI’s sole source of income and operations is through its indirect, contractual control of Guangzhou Yuzhi and its Subsidiaries.

Based in the city of Guangzhou, Guangdong Province, China, Guangzhou Yuzhi and Guangzhou Rongsheng are principally engaged in software and information technology services and share full-time employees with Shenzhen Exce-card.

Shenzhen Exce-card is based in the city of Guangzhou, Guangdong Province, China, with branches in Beijing and Shanghai, and a business development department in New York. Additionally, Shenzhen Exce-card has entered into a partnership agreement with UINT France located in Saint Aubin, France (“UINT”), amended and supplemented by an amendment dated March 27, 2015 (as amended and supplemented, the “Partnership Agreement”), pursuant to which UINT is engaged by Shenzhen Exce-card to conduct product research and development (“R&D”) and other related services in connection with new audio signals, testing and producing new inlays for audio bank card and assisting the card manufacturers with lamination test, new generation of audio card, and assisting the card manufacturers with certification of the new audio card products.

For the production of the audio bank card end product, Shenzhen Exce-card partners with UINT and two card manufacturers in China, i.e., Hengbao Co., Ltd. (“Hengbao”) and Wuhan Tianyu Information Industry Co., Ltd. (“Tianyu”). Shenzhen Exce-card is principally engaged in the design and production of active smart cards and other products in the related technological field, which provide a comprehensive solution for mobile payment. As of the date of this Current Report, Shenzhen Exce-card has approximately 23 full-time employees. In February 2015, Shenzhen Exce-card developed an IC card product encrypted with innovative audio technology “audio bank card,” which was recognized and approved by UnionPay, the only domestic bank card organization in China as well as the only interbank network in mainland China. The audio bank card was then entitled “UnionPay Audio Bank Card” officially which resulted in UnionPay issuing a “technology white paper” titled “UnionPay Audio Bank Card Product Solutions” to all of its members. Generally speaking, a “technology white paper” refers to a report on a particular topic given by an individual or group with authority on the topic, typically to explain the results of a development effort.

Guangzhou Yuzhi and its Subsidiaries believe their growth in the coming years may be supported by the continuing expansion of the market for bank cards and electronic payment in the PRC. According to data compiled by the People’s Bank of China (the “PBOC”), by the end of 2014, the amount of bank cards issued in aggregate reached 5 billion in the PRC.

Guangzhou Yuzhi and its Subsidiaries are seeking to develop and maintain long-term relationships with major card issuers in China. Since 2014, they have been actively communicating with China Construction Bank (“CCB”), one of China’s four major banks, in the pursuit of promoting their new audio bank cards, which communications led to CCB’s desire to launch a pilot audio bank card program to be operated by its Guangdong branch offices (“CCB Guangdong”). Under this proposed program, 500,000 cards are expected to be manufactured by Tianyu, with flexible circuit boards supplied by Shenzhen Exce-card, and issued and distributed by CCB Guangdong to some of its 25 million customers. At a meeting among Shenzhen Exce-card, Tianyu, and CCB Guangdong in Guangzhou, Guangdong Province, PRC held on September 24, 2015, CCB Guangdong indicated that they would report to the individual finance department and procurement department of CCB’s headquarters for approval to start the procurement process regarding these 500,000 audio bank cards. As of the date of this Current Report, there is no definitive agreement entered into by CCB Guangdong and Shenzhen Exce-card, and there is no assurance that such agreement will be entered into or the pilot program will be launched. If this pilot program is launched and proved to be successful, CCB is expected to issue 4 million audio bank cards in various locations in China.

| 5 |

Guangzhou Yuzhi and its Subsidiaries also plan to develop relationships with the other three of China’s four major banks, i.e., China Industrial and Commercial Bank, Bank of China, and Agricultural Bank of China, with the goal of substituting 10% of their bank card issuance with audio bank cards, which represents up to 75 million audio bank cards annually.

Additionally, Guangzhou Yuzhi and its Subsidiaries supply and sell flexible circuit boards embedded with audio chips and other modules to card manufacturers, such as Tianyu and Hengbao, who have established relationships with major banks in China. Up to date in 2015, Guangzhou Yuzhi and its Subsidiaries generated revenue in the amount of RMB150,000 (approximately $23,602.72), from the aforementioned sales to Tianyu.

Other than the research, development, marketing and distribution of audio bank cards, Guangzhou Yuzhi and its Subsidiaries will seek to develop and expand its product and services to other fields, which may include providing business consulting services, solutions and software products, and system development services to card issuing banks, third party payment entities, and other card issuing entities, and may also include partnering with banks to issue co-branded cards in order to generate annual fees and transaction fees, and developing customers and commercial users via the operation of audio payment platform. Up to date in 2015, Guangzhou Yuzhi and its Subsidiaries generated revenue in the amount of RMB900,000 (approximately $141,616.31) from selling a set of audio payment platform software to Tianyu.

The executive office of the Company is located at 40 Wall Street, 28th Floor, New York, NY 10005.

Organization and Consolidated Subsidiaries

EGOOS BVI’s organizational structure was crafted to abide by the laws of the PRC and maintain tax benefits as well as internal organizational efficiencies. EGOOS BVI’s post–acquisition organization structure is summarized below:

Overview of the Audio Bank Card Market

The Global Bank Card Market

A report published by the Euromonitor International in March 2015 titled “Consumer Payments 2015: Trends, Developments and Prospects” indicates that the global consumer payment market has more than doubled over the last decade, to reach US$47 trillion in payment volume in 2014. American Express, Diners Club, JCB, MasterCard, UnionPay, and Visa brand cards generated 168.56 billion transactions at merchants in 2013, an increase of 19.17 billion or 12.8% over 2012, according to the Nilson Report on “Global Cards – 2013” published in July 2015. Credit, debit, and prepaid cards in circulation totaled 8.33 billion at the end of 2013, up 13.3% or 975.0 million cards over year-end 2012.

| 6 |

The Global Contactless Bank Card Market

Contactless bank cards are bank cards that allow holders to make a transaction without actually swiping or inserting the card into a payment terminal. Instead, at the point of transaction, the card holder taps or touches the contactless reader with their bank cards. The contactless reader then scans the payment information using radio frequency identification (RFID) technology for secure payments. An audio bank card, a type of contactless bank card, is an IC card embedded with active integrated circuit, which enable it to communicate via unique audio frequency with receiving devices without any physical contact (“audio chip”). Audio bank cards can be broadly used in electronic payment and card transactions, providing safer and more convenient card-using experience for cardholders in the internet era. Our audio bank cards with such innovative technology meet international standards of bank cards and are certified by MasterCard. Audio chips for bank cards are highly innovative and are new to the industry, world-wide and in the PRC.

The Chinese Bank Card Market

According to a report published by the PBOC, in 2014, an aggregate of 4.936 billion bank cards were issued in China, an increase of 17.13% over 2013; national cardholding per capita was 3.64, an increase of 17.04% over 2013. 59.573 billion transactions were made by bank cards in China in 2014, totaling 449.90 trillion renminbi or RMB. Furthermore, in 2014, electronic payment reached 1.4 quadrillion RMB, among which 22.59 trillion RMB was mobile payment, an increase of 134.3% over 2013; 6.04 trillion RMB was telephone payment, an increase of 27.41% over 2013; 1.376 quadrillion RMB was online payment, an increase of 30.65% over 2013. Additionally, with the promotion by the PBOC on upgrading magnetic stripe cards to IC cards with a statement that national commercial banks should no longer issue magnetic stripe bank cards after January 2015, leading banks in China have been making great efforts to such replacement.

The Chinese Contactless Bank Card Market

Audio bank cards enable a direct communication between bank cards and electronic devices (including telephones, cell phones, tablets, and computers), allowing electronic payment by bank cards. Audio bank cards can be used in swiped transactions (including point of sale payment and ATM deposit, withdrawal and transfer) as well as transactions via electronic payment which, according to the Payment and Settlement System Report published by the PBOC in April 2014, is a combined market of potentially up to 1.85 quadrillion RMB.

Supportive Government Policies and Legislation in the PRC

On January 1, 2008, the National People’s Congress of China passed “the Enterprise Income Tax Law of the People's Republic of China.” Accordingly, “the enterprise income tax on important high- and new-tech enterprises that are necessary to be supported by the state shall be levied at the reduced tax rate of 15%”, which applies to Guangzhou Yuzhi and its Subsidiaries. The regular enterprise income tax rate is 25% in China.

On July 18, 2015, the PBOC, the Ministry of Industry and Information Technology, the Ministry of Finance and 7 other state government authorities jointly issued the Guideline Opinions on Promoting the Healthy Development of Internet Finance (the “Guidelines”), which aim to encourage innovation and to support the steady development of internet finance.

In April 2005, the PBOC and other state departments jointly promulgated Certain Opinions on Promoting the Development of Bank Card Industry, which encouraged and promoted work emphasis of related government authorities on, among other things, meeting the demand and improving the varieties and functions of bank cards, promoting a fast and sound development of bank card handling market, enhancing the risk management of bank cards, and implementing industrial incentive policies to support the bank card industry.

| 7 |

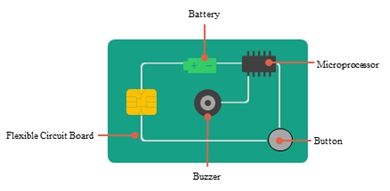

Technology and Product Description

An audio bank card is a dual interface card with financial IC module and audio IC module. Financial IC chip performs UnionPay standard functions such as debit and credit, and small amount payment transactions. It also supports communications with the audio IC chip. Moreover, the financial IC chip processes and modulates banking data to sound wave signal in order to communicate with cell phones, PCs, telephones and other audio receiving devices. The financial IC module may work independently from the audio IC module.

All of the components used in the core flexible circuit board of our audio bank card including PCB, paper battery, processor, buzzer, and button are bendable and can be integrated into an ISO7810 card. Our audio bank cards meet international standards of bank cards and are certified by MasterCard. An audio bank card can be used for 5 to 10 years and for 30,000 to 50,000 times. It is anti-bending, anti-embossment, anti-electromagic, anti-noise, and is adaptable to high and low temperature.

An Audio bank card operates as follows: first, personalized banking information, customer information and security verification information are stored in a chip embedded in the audio bank card; at point of transaction, a cardholder pushes the button on the bank card, which triggers the modulation of banking information and security information into sound wave; a receiving device recognizes this sound wave and completes the transaction by processing information received from the audio bank card. Information transmitted by audio bank card via such sound wave includes bank card number, dynamic expiration date, dynamic CVN2, dynamic password and encrypted verification information.

Compared with traditional magnetic stripe bank cards and bank cards only embedded with financial IC chips, audio bank cards are more secure, more convenient and enjoy wider applications. Data and programs stored in the audio IC chip are equipped with anti-tampering mechanism, guaranteeing the security of the data-storage key. Technology such as parity bit, cyclic redundancy check (CRC), and dynamic encryption ensures data security. When executing contactless communication, the sound wave emitted by our audio cards differ each time with different unique passwords, through hardware dynamic encryption; repetitive use by recording is prevented by event calculation; communication errors are avoided by CRC. Additionally, audio bank card holders can conduct transactions without binding devices or signing receipts. Our audio bank cards can be used in a wide range of areas such as electronic bank, mobile payment, telephone payment, online payment, industrial practice, and can also be used as a regular bank card.

R&D Partner

Shenzhen Exce-card entered into a partnership agreement with UINT France (“UINT”) located in Saint Aubin, France, which was amended and supplemented by an amendment dated March 27, 2015 (as amended and supplemented, the “Partnership Agreement”) with a term from May 1, 2014 to April 30, 2016 (the “Term”), to engage UINT in product research and development (R&D) of new audio wave emission device and new inlay for audio bank cards. Pursuant to the Partnership Agreement, Shenzhen Exce-card paid UINT €120,000 for R&D, and loaned €60,000 to UINT for operation costs, both of which will be refunded to Shenzhen Exce-card if Shenzhen Exce-card acquires UINT within 18 months after the date of execution, i.e., November 1, 2015. Both parties are currently negotiating on the details of such acquisition. However, if such acquisition does not occur within this time frame, UINT will repay the loan via fees charged on issuance of cards. Such repayment will be triggered after Shenzhen Exce-card has ordered 1 million audio bank cards from UINT. Further, the costs and rights of any patent related to the new audio bank card product arises during the Term are borne by and shared costs and rights of any patent by both parties.

Additionally, for five years from the date on which the first audio bank card is officially deployed by any commercial banks in China, which is expected to be in the first quarter of 2016, Shenzhen Exce-card will be the exclusive distributor of the audio card products within the territory of China, including Hong Kong, Macau and Taiwan (the “Greater China Area”), and the distributor of the audio card product within the United States territory. A €0.1 per audio card product will be paid by UINT to Shenzhen Exce-card as royalty in other areas the product is distributed, while no such royalty will be paid in the Greater China Area or the United States. In the event that Shenzhen Exce-card acquires 100% of UINT, UINT will cease to pay such royalty.

| 8 |

Manufacturing Partners

Currently, UINT manufactures the inlays for the audio bank cards and some of the 10,000 beta testing audio bank cards for Guangzhou Yuzhi and its Subsidiaries in its 9,000 square feet manufacturing facility (including a 5,000 square feet “clean room” in which the concentration of airborne particles is controlled to specified limits) located in Limoges, France. The plant is fully operational and has a production capacity of 6 million cards per year.

For the mass production of the audio bank card end product, Shenzhen Exce-card has entered into cooperation agreements on July 23, 2014 and July 7, 2014, respectively, to partner with two bank card manufacturers in China, Hengbao and Tianyu, both of which are publicly traded on China’s Shenzhen Stock Exchange and have established relationships with major commercial banks in China as their bank card providers, including Bank of China, Bank of Communications, CCB, Agricultural Bank of China, and Industrial and Commercial Bank of China.

Additionally, Shenzhen Exce-card and Tianyu signed a more detailed audio bank card production preparation service agreement, according to which, from May 1, 2015 to May 1, 2016, Shenzhen Exce-card is to provide inlays for testing, technology and support to Tianyu for the manufacturing of the audio bank card end product, and in return, Tianyu pays RMB150,000 (approximately $23,630.61) for Shenzhen Exce-card’s services. Tianyu, headquartered at Huazhong University of Science and Technology Science Park in Wuhan City, Hubei Province, China, is a high-tech enterprise focusing on the research and development, manufacturing, and sale of products and services related to data security, mobile internet, and payment services. It has an annual production capacity of 500 million IC cards, and an estimated annual production capacity of 10 million audio bank cards. At present, Tianyu is testing and digesting the technics for the lamination of audio bank cards, and thus, is manufacturing a portion of the 10,000 beta testing audio bank cards for Guangzhou Yuzhi and its Subsidiaries.

Shenzhen Exce-card has also entered into a cooperation agreement with Hengbao on September 28, 2015, according to which, for 10 years from the date of this agreement, Shenzhen Exce-card is to provide inlays, technology and support to Hengbao for the manufacturing of the audio card end product, and in return, Hengbao pays RMB200,000 (approximately $31,507.48) for Shenzhen Exce-card’s services. Shenzhen Exce-card and Hengbao also agree to cooperate and develop the market application and to gradually increase the market shares of audio bank cards. Hengbao, headquartered in Beijing, China, with a manufacturing facility in Danyang City, Jiangsu Province, China, is one of the largest card manufacturers and providers in China. Hengbao has recently started to test and adjust the technics for the lamination of audio bank cards according to the cooperation agreement between Shenzhen Exce-card and Hengbao.

The Manufacturing Process

Our audio bank cards are produced through the following process:

| 1. | Inlay production. Pieces of electro-circuit are tested, and then embedded in a flexible circuit board through fine technics to build up the “brain” of the card. Several functional modules including an audio IC chip, a paper battery, a button, and a buzzer which can generate unique audio wave are then installed onto this flexible circuit board. | |

| 2. | Lamination. The assembled inlay will be implanted into a card base laminated with multiple foils and the financial IC chip. |

| 9 |

Customers

Our audio bank cards are expected to be sold to the CCB Guangdong via its pilot program. In addition, we expect to develop and maintain our relationships with other banks throughout China.

Competition

We currently are not aware of any other companies in China which is producing or marketing the similar products as ours.

Our Growth Strategy

In the next five years, we seek to grow our business by pursuing the following strategies:

| ● | Focus on active smart cards, and research and develop active financial IC card products and applications that meet the market needs; |

| ● | Actively explore options in modern service industry, such as Internet finance and mobile payment services; |

| ● | Develop electronic payment channel of UnionPay audio bank cards, and to structure application environment for CCB UnionPay audio bank cards; and |

| ● | Strengthen and/or develop relationships with major banks. |

Our Strengths and Competitive Advantages

We believe we are well positioned to achieve our business objectives and to execute our strategies due to the following competitive strengths:

| ● | Our audio bank cards may solve the issues related to electronic payment security and terminal adaption problems pertaining to transactions by electronic devices; |

| ● | Compared to third party payment solutions, bank cards are accepted more by the general public as the regular and more secured payment method; |

| ● | Our audio bank cards support a wide range of transaction channels and can be adapted easily by retail clients in various sectors as well as clients with online payment options; | |

| ● | We have a team of management with ample experience in financial IC card technology, operation of banking systems, microwave photonics and software security, as well as business operation and management. |

| 10 |

Marketing

Since Guangzhou Yuzhi and its Subsidiaries supply audio chips for bank cards, have not engaged in direct advertising efforts for marketing our products to the mass bank card end users.

Our marketing strategy is to develop relationships with large banks in China, starting with the pilot program expected to launch the first quarter of 2016 when CCB will introduce the UnionPay audio bank cards embedded with our flexible circuit board with the audio chips to its customers. Along with and subsequent to such pilot program, we may seek to further develop relationships with China Industrial and Commercial Bank, Bank of China, Agricultural Bank of China, and Bank of Communications. Issuance of audio bank cards by these large banks may in turn encourage other smaller banks in China to work with us and market our products to their customers.

Pricing

At present, there are no similar products on the market. Taking into account the level of acceptance by the market and the negotiation with issuing banks, we suggest that the unit price of the audio bank cards to be set at 55 RMB, approximately $8.65, and inlay audio chip at 45 RMB, approximately $7.08. Price will be adjusted downwards upon the increase of volume issued and appearance of competitors.

R&D

Pursuant to the Partnership Agreement between Shenzhen Exce-card and UINT, for the period from May 1, 2014 to April 30, 2016, Shenzhen Exce-card paid UINT €120,000 for R&D services, €20,000 of which was for developing new audio signals of new audio card product, €30,000 of which was for the testing of new Inlay and assisting the card manufacturers with lamination test , €50,000 of which was for the conception of new generation audio cards, and the last €20,000 of which was for assisting the card manufacturers with certification of the new audio card product. Another €60,000 was loaned to UINT to cover its operation costs.

UINT currently have 12 employees for R&D. We expect to invest resources to retain more qualified employees and update our R&D equipment in China for our second generation audio bank cards with one chip of a combined function of audio chip and financial chip, and third generation audio bank cards with fingerprint sensor chips and other personalized functions.

Seasonality

We do not expect our operating results and operating cash flows to be subject to seasonal variations.

Employees

Substantially all of our employees are located in China. As of October 6, 2015, Guangzhou Yuzhi and its Subsidiaries had 23 employees. There are no collective bargaining contracts covering any of our employees. We believe our relationship with our employees is satisfactory.

We are required to contribute a portion of our employees’ total salaries to the Chinese government’s social insurance funds, including medical insurance, unemployment insurance and workers’ compensation insurance, and a housing assistance fund, in accordance with relevant regulations. Guangzhou Yuzhi and its Subsidiaries are currently paying social insurance for all of their 23 full-time employees through a third party agent. We expect the amount of contribution to the government’s social insurance funds to increase in the future as we expand our workforce and operations.

Insurance companies in China offer limited business insurance products. While business interruption insurance is available to a limited extent in China, we have determined that the risks of interruption, cost of such insurance and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to have such insurance. As a result, we could face liability from the interruption of our business.

| 11 |

Forward-Looking Statements

Forward-looking statements are subject to numerous risks and uncertainties that could cause actual results to differ materially from those anticipated and you should not rely on them as predictions of future events. Although information is based on our current estimates, forward-looking statements depend on assumptions, data or methods which may be incorrect or imprecise. You are cautioned not to place undue reliance on this information as we cannot guarantee that any future expectations and events described will happen as described or that they will happen at all. You can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “may,” “should,” “seeks,” “approximately,” “intends,” “plans,” “pro forma,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases. You can also identify forward-looking statements by discussions of strategy, plans or intentions.

Intellectual Property

Currently we have one granted patent and four pending patent applications in the PRC, all of which are related to the technology and design utilized in the audio bank card and its transaction system. We also have three pending trademark applications in the PRC, two of which are with respect to financial and monetary affairs and one is with respect to computer programs, magnetic data media and internet communication devices.

Pursuant to the Partnership Agreement, any background information and know-how used in connection with the agreement remain the property of the party introducing such background information. UINT’s know-how relating to the services it provides under this agreement remains the exclusive property of UINT and it may use such know-how for other clients. Additionally, the costs and rights of any patent related to the new audio bank card product arises during the Term are borne by and shared equally by both parties.

Government Regulation

We believe that we have been compliant to date with all requirements required by the applicable governing authorities in China for the research, development, production and distribution of our audio bank cards, and that such laws, rules and regulations do not currently have a material impact on our operations. However, it is possible that more stringent rules or regulations could be adopted, which may increase our operating costs and expenses.

Additionally, since 1997, the PBOC has issued several versions of Financial IC Card Specifications. On November 3, 2014, PBOC published a Notice on Further Application of Financial IC Card, proposing a time frame, i.e., from April 1, 2015, new financial IC cards issued by any issuing banks should comply with the PBOC Financial IC Card Specifications version 3.0. We believe that we are in compliance with these requirements by the PBOC.

Properties

Guangzhou Yuzhi’s office is located at Suite 1601-A, 437 Middle Dongfeng Road, Yuexiu District, Guangzhou City, Guangdong Province, China. We lease a total of approximately 40 square meters (approximately 431 square feet) of office space at the aforementioned address pursuant to one lease agreement. Pursuant to this agreement, which will expire on May 1, 2017, the monthly rent is approximately RMB 6,004 (approximately $941).

Shenzhen Exce-card’s corporate headquarters is located at Suite 1601-C, 437 Middle Dongfeng Road, Yuexiu District, Guangzhou City, Guangdong Province, China. We lease a total of approximately 126 square meters (approximately 1,356 square feet) of office space at the aforementioned address pursuant to one lease agreement. Pursuant to this agreement, which will expire on May 1, 2017, the monthly rent is approximately RMB 16,000 (approximately $2,508).

Current, we do not have our own manufacturing facility.

For more details please refer to the section titled “Risks Related to the Overall Business of Guangzhou Yuzhi and its Subsidiaries” included in “Item 1A Risk Factors” below.

| 12 |

Item 1A. Risk Factors.

Our business, operations and financial condition are subject to various risks. Some of these risks are described below and you should take these risks into account in making a decision to invest in our Common Stock. If any of the following risks actually occurs, we may not be able to conduct our business as currently planned and our financial condition and operating results could be seriously harmed. In that case, the market price of our Common Stock could decline and you could lose all or part of your investment in our Common Stock.

Risks Related to the Business and Operations of Guangzhou Yuzhi and its Subsidiaries

Risks Related to the Overall Business of Guangzhou Yuzhi and its Subsidiaries

Guangzhou Yuzhi and its Subsidiaries have a limited operating history, which makes it difficult to evaluate its financial position and future success.

Guangzhou Yuzhi and its Subsidiaries have had a limited prior operating history by which to evaluate the likelihood of success or its ability to continue as a going concern. Although Guangzhou Yuzhi and its Subsidiaries have been developing and producing audio bank cards, and may participate in a pilot program with China Construction Bank to launch 500,000 audio bank cards through the bank’s branches in Guangdong Province, China, there is no assurance our production capacity and sales will keep increasing in a profitable manner.

Guangzhou Yuzhi and its Subsidiaries are expected to be heavily dependent on sales of one key product, namely, audio bank cards.

Guangzhou Yuzhi and its Subsidiaries are expected to begin generating revenue in 2016 from the sale of audio bank cards, and are expected to continue to derive a significant portion of its future revenue from sales of audio bank cards.

Our audio bank cards are expected to be sold in the People’s Republic of China as a new generation of bank cards, seeking to substitute the traditional magnetic stripe bank cards. Demand for audio bank cards may not meet our expectation if audio bank cards do not gain broad market acceptance and build consumer confidence in their quality, security and availability, or if the technology in audio bank cards is replaced by a more innovative alternate, our prospects will be negatively impacted.

The results of operations, financial position and business outlook of Guangzhou Yuzhi and its Subsidiaries will be highly dependent on the market’s response.

Although the audio bank card is certified by Mastercard and recognized by UnionPay, CCB will only be testing the market’s response in Guangdong Province, China with the first 500,000 cards. In addition, bank cards with IC chips have just been popularized in China since January 1, 2015. The market may not respond immediately to another new bank card technology. Further, the market may perceive the traditional cash payment method or the cardless payment method (e.g., mobile wallet) to be more convenient or secured. If the market does not respond to the product as quickly or does not accept the product as widely as expected, the results of operations, financial position and business outlook of Guangzhou Yuzhi and its Subsidiaries will be negatively affected.

The results of operations, financial position and business outlook of Guangzhou Yuzhi and its Subsidiaries will be highly dependent on Shenzhen Exce-card being and remaining the exclusive distributor of audio chips and audio bank card products in the Greater China Area.

According to the Partnership Agreement with UINT, Shenzhen Exce-card will be the exclusive distributor in the Greater China Area for five years from the date on which the first audio bank card is officially deployed by any commercial banks in China, which is expected to be in the first quarter of 2016, and to keep its exclusivity status, Shenzhen Exec-card has to order 1 million audio card products from UINT annually. In the event that Shenzhen Exce-card does not meet this annual quota, it will lose its status of exclusive distributor in the Greater China Area, which may have an adverse effect on our results of operations, financial position and business outlook.

| 13 |

EGOOS BVI is a holding company and there are significant limitations on its ability to receive distributions from its subsidiaries.

EGOOS BVI conducts substantially all of its operations through subsidiaries and through contractual arrangements with Guangzhou Yuzhi, an affiliated variable interest entity (“VIE”) and Guangzhou Yuzhi’s subsidiaries Shenzhen Exce-card and Guangzhou Rongsheng, and is dependent on dividends and other intercompany transfers of funds from its subsidiaries and affiliated VIE to meet its financial obligations. EGOOS BVI’s subsidiaries have not made significant distributions to it and may not have funds legally available for dividends or distributions in the future. In addition, EGOOS BVI may enter into credit or other agreements that would contractually restrict its subsidiaries or affiliated VIE from paying dividends or making distributions. Any inability of EGOOS BVI to receive funds from its subsidiaries including Guangzhou Yuzhi can be expected to impair its ability to pay dividends on the Common Stock and may otherwise have an adverse effect on our future operating or growth prospects.

The research and development of audio chip and audio bank cards is entirely dependent on the partnership relationship between Guangzhou Yuzhi and UINT.

Shenzhen Exce-cardengaged UINT pursuant to the Partnership Agreement with a term from May 1, 2014 to April 30, 2016 to research and develop audio bank card technology. Although Guangzhou Yuzhi or its Subsidiaries intends to acquire UINT by November 1, 2015, there is no assurance that the transaction will be consummated, or that UINT will continue to develop any audio bank card technology for Guangzhou Yuzhi. In addition, pursuant to the Partnership Agreement, the know-how relating to the services provided by UINT will remain the exclusive property of UINT, and UINT may use such know-how for its other clients. Competitors of Guangzhou Yuzhi and its Subsidiaries may engage UINT to develop new technology and potentially compete with the audio bank card product of Guangzhou Yuzhi and its Subsidiaries. Any such incidents may harm the financial condition, results of operations and future growth prospects of Guangzhou Yuzhi and its Subsidiaries.

Currently, the production of inlays for audio bank cards is entirely dependent on the operations of UINT in Limoges, France and the production of audio bank card end product is entirely dependent on the operations of UINT and two bank card manufacturers Shenzhen Exce-card partners with in Beijing and Danyang, Hubei Province, China. An operational disruption at any of these locations could suspend or halt our manufacturing operations.

A significant portion of EGOOS BVI’s revenues will be derived from the sale of audio bank cards, the inlays production and some end product manufacturing of which is in Limoges, France and some of the end product manufacturing of which is in Beijing and Danyang, Hubei Province, China, although Guangzhou Yuzhi and its Subsidiaries will probably construct and operate production factories in China in the near future. Manufacturing operations are subject to inherent risks, all of which could have a material adverse effect on its financial condition or results of operations. Risks affecting operations include:

| ● | unexpected changes in regulatory requirements; |

| ● | political and economic instability; |

| ● | terrorism and civil unrest; |

| ● | equipment and machinery breakdowns; |

| ● | injuries or accidents at our facilities |

| ● | severe weather or other natural disasters; |

| ● | work stoppages or strikes; |

| ● | difficulties in staffing and managing operations; and |

| ● | variations in tariffs, quotas, taxes and other market barriers. |

| 14 |

Some of these hazards may cause severe damage to, or destruction of, property and equipment or environmental damage, and may result in suspension of operations and the imposition of civil or criminal penalties. Any such delay or disruption can be expected to harm EGOOS BVI’s financial condition, results of operations and future growth prospects.

Guangzhou Yuzhi and its Subsidiaries have not entered into and may not be able to enter into any enforceable agreement with CCB in connection with the pilot program in which CCB will distribute 500,000 of our audio bank cards.

As of the date of this Current Report, Guangzhou Yuzhi and its Subsidiaries have negotiated with CCB and have obtained an oral agreement from CCB Guangdong for CCB to issue 500,000 audio bank cards through its Guangdong branches. In the event that CCB partially or completely fails to implement the pilot program, such oral agreement is not enforceable against CCB. Moreover, there is no assurance that an enforceable agreement in writing between CCB and Guangzhou Yuzhi or its Subsidiaries will be entered into regarding this pilot program. Our future operating results and financial condition could be significantly disrupted if the pilot program is not implemented as planned.

In the near future, the distribution of our audio bank cards may be entirely dependent on the distribution of one proposed pilot program of the Guangdong branches of CCB in China.

In the near future, CCB may be the only distributor of the audio bank cards in China when CCB’s proposed pilot program is launched in the first quarter of 2016, if being launched at all. In the event that the CCB’s pilot program in Guangdong Province, China fails to gain positive market response as expected, CCB may elect to discontinue the distribution of audio bank card products. Although Guangzhou Yuzhi and its Subsidiaries are actively developing relationships with other major banks in China for the distribution of the audio bank cards, there is no assurance such efforts will be successful or will result in steady income cash flow for the Company. Therefore, the financial condition, results of operations and future growth prospects may be materially negatively affected in the event that CCB discontinues the distribution of the audio bank cards.

Currently, the mass production of our audio bank cards are entirely dependent on two card manufacturers that Shenzhen Exce-card partners with in China.

Although Shenzhen Exce-card partners with Hengbao and Tianyu to mass produce the audio bank cards, and such partnership relationships will expire by September 27, 2025 and May 1, 2016, respectively, there is no assurance that these agreements will be renewed or extended, or these agreements will not be terminated earlier, and Guangzhou Yuzhi and its Subsidiaries may not be able to recruit other card manufacturers to effectively replace the previous manufacturer. Any such incidents may harm the financial condition, results of operations and future growth prospects of Guangzhou Yuzhi and its Subsidiaries.

Gross margins are principally dependent on the spread between development and production cost and sale price. If the cost of development and production increases and sale price does not increase or if the sale price decreases and the cost of development and production does not decrease, gross margins will decrease and EGOOS BVI’s results of operations could be harmed should the sales volume of the product does not increase.

EGOOS BVI’s gross margins depend principally on the spread between development and production cost and sale price.

While moving the production from France to China could potentially decrease the cost of production, the sale price of audio bank cards and audio chips may decrease as well, as potential competitors start developing and producing like products, which may narrow the gross margins should the sales volume does not increase. Any event that tends to negatively impact the sales volume of audio bank cards and audio chips of Guangzhou Yuzhi and its Subsidiaries will potentially harm its financial condition and results of operation.

| 15 |

Consumer acceptance or rejection of audio bank cards will have a material impact on EGOOS BVI’s future prospects.

The market in China for audio bank cards has not developed. Therefore, widespread acceptance of audio bank cards is not assured and depends on market acceptance of audio bank cards as an addition, or an alternative, to traditional bank cards or other channels to bank or make payment. Because this market is new, it is difficult to predict its potential size or future growth rate. In addition, a long-term customer base has not been adequately defined. The success of Guangzhou Yuzhi and its Subsidiaries in generating revenue in this emerging market will depend, among other things, on its ability to educate potential customers and end-users about the practical benefits of audio bank cards. In the event a substantial market for audio bank cards fails to materialize, or if we fail to properly capitalize on such market, our growth and future operating prospects will be materially harmed.

Unanticipated problems or delays with product quality or product performance could result in a decrease in customers and revenue, unexpected expenses and loss of market share.

EGOOS BVI’s cash flow depends on the timely and economical operations of and its partnership with the R&D and production centers in France, manufacturing plants in Beijing and Danyang, Hubei Province, China, and potentially other production facilities in China.

The development and production of audio chips are complex, and the audio chips must meet detailed quality requirements in order to ensure the safety and efficiency of use. Concerns about audio chips quality may impact the ability of Guangzhou Yuzhi and its Subsidiaries to successfully market their audio chips and audio bank cards to a larger market. If the product does not meet its promised and marketed quality standards, its credibility and the market acceptance and sales volume could be negatively affected. In addition, actual or perceived problems with protection of user’s information in the industry generally may lead to a lack of consumer confidence in bank cards encrypted with chips of new technology. Prolonged problems may threaten the commercial viability of audio bank cards generally or the production and sale of the product specifically.

Guangzhou Yuzhi and its Subsidiaries plan to primarily sell their audio bank cards and audio chips through banks in China and if their relationships with one or more of these banks were to end, their operating results could be harmed.

Guangzhou Yuzhi and its Subsidiaries are expected to market and distribute a substantial portion of its audio bank cards and audio chips through major banks in China. Their future operating results and financial condition could be significantly disrupted by the loss of one or more of these banks with current or future relationships, order cancellations or the failure of the banks to successfully sell the products.

Financial instability in the Chinese financial markets could materially and adversely affect our results of operations and financial condition.

The Chinese financial markets and the Chinese economy are influenced by economic and market conditions in other countries, particularly in other Asian emerging market countries and the United States. Financial turmoil in Asia, Russia and elsewhere in the world in recent years has affected the Chinese economy. Although economic conditions are different in each country, investors’ reactions to developments in one country can have adverse effects on the securities of companies operating in other countries, including China. A loss in investor confidence in the financial systems of other countries may cause increased volatility in Chinese financial markets and, indirectly, in the Chinese economy in general. Financial disruptions could harm Guangzhou Yuzhi’s operation or its stock price, results of operations and financial condition.

Natural calamities could have a negative impact on the Chinese economy and harm the business of Guangzhou Yuzhi and its Subsidiaries.

China has experienced natural calamities such as earthquakes, floods, droughts and a tsunami in recent years. The extent and severity of these natural disasters determines their impact on the economies in the local communities that experience these calamities. Natural disasters could have an adverse impact on the economies in the geographic regions in which Guangzhou Yuzhi and its Subsidiaries operate, which could adversely affect their operating and growth prospects.

| 16 |

Growth may impose a significant burden on the administrative and operational resources of Guangzhou Yuzhi and its Subsidiaries which, if not effectively managed, could impair their growth.

The strategy of Guangzhou Yuzhi and its Subsidiaries envisions a period of rapid growth that may impose a significant burden on their administrative and operational resources. The growth of their business will require significant investments of capital and management’s close attention. Their ability to effectively manage their growth will require them to substantially expand the capabilities of their administrative and operational resources and to attract, train, manage and retain qualified management, technicians and other personnel. Failure to successfully manage their growth could result in their sales not increasing commensurately with capital investments. If Guangzhou Yuzhi and its Subsidiaries are unable to successfully manage their growth, they may be unable to achieve their growth goals.

Guangzhou Yuzhi and its Subsidiaries may be unable to protect their intellectual property, which could negatively affect its ability to compete.

Guangzhou Yuzhi and its Subsidiaries rely on a combination of patent, registered trademark, confidentiality agreements, and other contractual restrictions on disclosure to protect their intellectual property rights. They also enter into confidentiality agreements with their employees, consultants, and corporate partners, and control access to and distribution of their confidential information. These measures may not preclude the disclosure of their confidential or proprietary information. Despite efforts to protect their proprietary rights, unauthorized parties may attempt to copy or otherwise obtain and use their proprietary technologies and information. Monitoring unauthorized use of confidential information is difficult, and Guangzhou Yuzhi and its Subsidiaries cannot be certain that the steps they takes to prevent unauthorized use of its proprietary technologies and confidential information, particularly in foreign countries where the laws may not protect proprietary rights as fully as in the U.S., will be effective. Failure to protect our intellectual property rights can be expected to have a material, adverse impact on our competitive advantage and potentially on our financial condition, stock price and future growth prospects.

Guangzhou Yuzhi and its Subsidiaries will be required to hire and retain skilled technical and managerial personnel.

Personnel qualified to continue researching and developing, and to operate and manage production center and other facilities are in demand. The success of Guangzhou Yuzhi and its Subsidiaries depends in large part on their ability to attract, train, motivate and retain qualified management and highly-skilled employees, particularly managerial, technical, sales and marketing personnel, technicians, and other critical personnel. Any failure to attract and retain such personnel may have a negative impact on the operations of Guangzhou Yuzh and its Subsidiaries, which would have a negative impact on revenues.

Guangzhou Yuzhi and its Subsidiaries are dependent upon their officers and directors for management and direction and the loss of any of these persons could adversely affect their operations and results.

Guangzhou Yuzhi and its Subsidiaries are dependent upon their officers and directors for implementation and execution of their business plan. The loss of any of their officers or directors could have a material adverse effect upon their results of operations and financial position. Guangzhou Yuzhi and its Subsidiaries do not maintain “key person” life insurance for any of their officers. The loss of any of their officers or directors could delay or prevent the achievement of their business objectives.

EGOOS BVI’s lack of business diversification could result in the devaluation of its securities if it does not generate revenue from its primary products, or such revenues decrease.

The current business of Guangzhou Yuzhi and its Subsidiaries consists solely of the research and development, production and sale of audio chips and audio bank cards in China. Currently, sales of the products account for 100% of EGOOS BVI’s revenues. The lack of business diversification could cause you to lose all or some of your investment, since EGOOS BVI does not have any other lines of business or alternative revenue sources.

| 17 |

Failure to fully comply with PRC labor laws, including laws relating to social insurance, may expose Guangzhou Yuzhi and its Subsidiaries to potential liability and increased costs.

Companies operating in China must comply with a variety of labor laws, including certain pension, health insurance, unemployment insurance and other welfare-oriented payment obligations. Guangzhou Yuzhi and its Subsidiaries are currently paying social insurance for all of 23 of their full-time employees through a third party agent. If the PRC regulatory authorities take the view that payment of social insurance through a third party agent is invalid, the failure to comply may be in violation of applicable PRC labor laws and we cannot assure you that PRC governmental authorities will not impose penalties on Guangzhou Yuzhi and its Subsidiaries therefor, which could have a material adverse effect on the financial condition and results of operations of Guangzhou Yuzhi and its Subsidiaries.

In addition, the new PRC Labor Contract Law took effect January 1, 2008 and governs standard terms and conditions for employment, including termination and lay-off rights, contract requirements, compensation levels and consultation with labor unions, among other topics. In addition, the law limits non-competition agreements with senior management and other employees who have access to confidential information to two years and imposes restrictions or geographical limits. This new labor contract law will increase the labor costs of Guangzhou Yuzhi and its Subsidiaries, which could adversely impact the results of operations.

EGOOS BVI may have difficulty establishing adequate management, governance, legal and financial controls in the PRC.

The PRC historically has been deficient in western style management, governance and financial reporting concepts and practices, as well as in modern banking and other control systems. Our current management has little experience with western style management, governance and financial reporting concepts and practices, and we may have difficulty in hiring and retaining a sufficient number of qualified employees to work in the PRC. As a result of these factors, and especially given that we expect to be a publicly listed company in the U.S. and subject to regulation as such, we may experience difficulty in establishing management, governance legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet western standards. We may have difficulty establishing adequate management, governance, legal and financial controls in the PRC. Therefore, we may, in turn, experience difficulties in implementing and maintaining adequate internal controls as required under applicable U.S. laws, rules and regulations. This may result in significant deficiencies or material weaknesses in our internal controls which could impact the reliability of our financial statements and prevent us from complying with SEC rules and regulations. Any such deficiencies, weaknesses or lack of compliance could have a materially adverse effect on our business and the public announcement of such deficiencies could adversely impact our stock price.

The Company has not yet developed comprehensive independent corporate governance.

Although the Company has formed audit, compensation and nominating committees of its board of directors, it is inexperienced in formal U.S. corporate governance procedures. A lack of functioning independent controls over the Company’s corporate affairs may result in potential or actual conflicts of interest between controlling shareholders and other shareholders. It presently has no policy to resolve such conflicts. The absence of customary standards of corporate governance may leave its shareholders without protections against interested director transactions, conflicts of interest, if any, and similar matters and any potential investors may be reluctant to provide the Company with funds necessary to expand its operations.

| 18 |

Risks Related to the VIE Agreements

The PRC government may determine that the VIE Agreements are not in compliance with applicable PRC laws, rules and regulations.

EGOOS BVI manages and operates the business of Guangzhou Yuzhi and its Subsidiaries through Yigou pursuant to the rights it holds under the VIE Agreements. Almost all economic benefits and risks arising from the operations of Guangzhou Yuzhi and its Subsidiaries are transferred to EGOOS BVI under these agreements.

There are risks involved with the operation of the business of Guangzhou Yuzhi and its Subsidiaries in reliance on the VIE Agreements, including the risk that the VIE Agreements may be determined by PRC regulators or courts to be unenforceable. If the VIE Agreements were for any reason determined to be in breach of any existing or future PRC laws or regulations, the relevant regulatory authorities would have broad discretion in dealing with such breach, including:

| ● | imposing economic penalties; |

| ● | discontinuing or restricting the operations of Yigou or Guangzhou Yuzhi and its Subsidiaries; |

| ● | imposing conditions or requirements in respect of the VIE Agreements with which the Group may not be able to comply; |

| ● | requiring EGOOS BVI to restructure the relevant ownership structure or operations; |

| ● | taking other regulatory or enforcement actions that could adversely affect its business; and |

| ● | revoking the business licenses or certificates of Guangzhou Yuzhi and its Subsidiaries and/or voiding the VIE Agreements. |

Any of these actions could adversely affect EGOOS BVI’s ability to manage, operate and gain the financial benefits of Guangzhou Yuzhi and its Subsidiaries, which represents its sole operations, which would have a material adverse impact on its business, financial condition and results of operations.

EGOOS BVI’s ability to manage and operate Guangzhou Yuzhi and its Subsidiaries under the VIE Agreements may not be as effective as direct ownership.

EGOOS BVI’s plans for future growth are based substantially on growing the operations of Guangzhou Yuzhi and its Subsidiaries. However, the VIE Agreements may not be as effective in providing EGOOS BVI with control over Guangzhou Yuzhi and its Subsidiaries as direct ownership. Under the current VIE arrangements, as a legal matter, if Guangzhou Yuzhi and its Subsidiaries fail to perform their obligations, EGOOS BVI may have to (i) incur substantial costs and resources to enforce such arrangements, and (ii) rely on legal remedies under PRC law, which it cannot be sure would be effective. Therefore, if EGOOS BVI is unable to effectively control Guangzhou Yuzhi and its Subsidiaries, it may have an adverse effect on its ability to achieve its business objectives and grow its revenues.

| 19 |

Risks Related to Doing Business in the PRC

The Chinese government exerts substantial influence over the manner in which Guangzhou Yuzhi and its Subsidiaries must conduct their business activities.

Guangzhou Yuzhi and its Subsidiaries are dependent on its relationship with the local government in Guangdong province where they operate. The Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. The ability of Guangzhou Yuzhi and its Subsidiaries to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, environmental regulations, land use rights, property and other matters. The central or local governments of the PRC may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on Guangzhou Yuzhi and its Subsidiaries’ part to ensure compliance with such regulations or interpretations. Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy, or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China or particular regions thereof, and could require EGOOS BVI to divest itself of any interest it then holds in Chinese properties.

Future inflation in China may inhibit the ability of Guangzhou Yuzhi and its Subsidiaries to conduct business in China. In recent years, the Chinese economy has experienced periods of rapid expansion and high rates of inflation. Rapid economic growth can lead to growth in the money supply and rising inflation. If prices for the products of Guangzhou Yuzhi and its Subsidiaries rise at a rate or unchanged or even decrease so that they are insufficient to compensate for the rise in the costs of development and production, it may have an adverse effect on profitability. These factors have led to the adoption by the Chinese government, from time to time, of various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause Chinese government to impose controls on credit and/or prices, or to take other action which could inhibit economic activity in China, and thereby harm the market for audio chips and audio bank cards products.

The operations and assets of Guangzhou Yuzhi and its Subsidiaries in China are subject to significant political and economic uncertainties and EGOOS BVI may lose all of their assets and operations if the Chinese government alters its policies to further restrict foreign participation in business operating in the PRC.

Changes in PRC laws and regulations, or their interpretation, or the imposition of confiscatory taxation, restrictions on currency conversion, imports and sources of supply, devaluations of currency or the nationalization or other expropriation of private enterprises could have a material adverse effect on the business, results of operations and financial condition of. Under its current leadership, the Chinese government has been pursuing economic reform policies that encourage private economic activities and greater economic decentralization. There is no assurance, however, that the Chinese government will continue to pursue these policies, or that it will not significantly alter these policies from time to time without notice. EGOOS BVI may lose all of its assets and operations if the Chinese government alters its policies to further restrict foreign participation in business operating in the PRC.

EGOOS BVI derives all of its sales in China and a slowdown or other adverse development in the PRC economy may materially and adversely affect the customers and end-users of Guangzhou Yuzhi and its Subsidiaries, demand for their products and their business.

All of the sales of Guangzhou Yuzhi and its Subsidiaries are generated in China and they anticipates that sales of their audio bank cards and audio chips in China will continue to represent all of their total sales in the near future. Although the PRC economy has grown significantly in recent years, no assurances can be given that such growth will continue. The industry in which Guangzhou Yuzhi and its Subsidiaries is involved in the PRC is new and growing, but Guangzhou Yuzhi and its Subsidiaries do not know how sensitive this industry is to a slowdown in economic growth or other adverse changes in the PRC economy which may affect demand for audio chips and audio bank cards products. In addition, the Chinese government also exercises significant control over Chinese economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies. Efforts by the Chinese government to slow the pace of growth of the Chinese economy could result in reduced demand for biodiesel products. A slowdown in overall economic growth, an economic downturn or recession or other adverse economic developments in the PRC may materially reduce the demand for bank cards in general or audio bank cards in particular and materially and adversely affect the business, results of operations and future operating prospects of Guangzhou Yuzhi and its Subsidiaries.

| 20 |

Currency fluctuations and restrictions on currency exchange may adversely affect the business of Guangzhou Yuzhi and its Subsidiaries, including limiting the ability to convert Chinese Renminbi into foreign currencies and, if Chinese Renminbi were to decline in value, reducing EGOOS BVI’s financial results in U.S. dollar terms.

EGOOS BVI’s reporting currency is the U.S. dollar and the operations of Guangzhou Yuzhi and its Subsidiaries in China use China’s local currency as their functional currency. Substantially all of EGOOS BVI’s revenues and expenses are in the Chinese currency, the Renminbi, or RMB. EGOOS BVI is subject to the effects of exchange rate fluctuations with respect to both of these currencies. For example, the value of the Renminbi depends to a large extent on Chinese government policies and China’s domestic and international economic and political developments, as well as supply and demand in the local market. Since 1994, the official exchange rate for the conversion of the Renminbi to the U.S. dollar had generally been stable and the Renminbi had appreciated slightly against the U.S. dollar. In July 2005, the Chinese government changed its policy of pegging the value of the Renminbi to the U.S. dollar. Under this policy, which was halted in 2008 due to the worldwide financial crisis, the Renminbi was permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. In June 2010, the Chinese government announced its intention to again allow the Renminbi to fluctuate within the 2005 parameters. It is possible that the Chinese government could adopt an even more flexible currency policy, which could result in more significant fluctuation of Renminbi against the U.S. dollar, or it could adopt a more restrictive policy. Thus, no assurance can be given that the Renminbi will remain stable against the U.S. dollar or any other foreign currency.

EGOOS BVI’s financial statements are translated into U.S. dollars at the average exchange rates in each applicable period. To the extent the U.S. dollar strengthens against the RMB, the translation of RMB-denominated transactions will result in reduced revenue, operating expenses and net income. Similarly, to the extent the U.S. dollar weakens against the RMB, the translation of RMB-denominated transactions will result in increased revenue, operating expenses and net income. EGOOS BVI is also exposed to foreign exchange rate fluctuations as it converts the financial statements of its foreign consolidated subsidiaries into U.S. dollars in consolidation. If there is a change in RMB exchange rates, such conversion into U.S. dollars will lead to a translation gain or loss which is recorded as a component of other comprehensive income. EGOOS BVI has not entered into agreements or purchased instruments to hedge its exchange rate risks, although it may do so in the future. The availability and effectiveness of any hedging transaction may be limited and EGOOS BVI may not be able to effectively hedge its exchange rate risks.

The State Administration of Foreign Exchange (“SAFE”) restrictions on currency exchange may limit EGOOS BVI’s ability to receive and use its funds effectively and to pay dividends.