Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AMSURG CORP | d31686d8k.htm |

| EX-99.1 - EX-99.1 - AMSURG CORP | d31686dex991.htm |

| EX-99.3 - EX-99.3 - AMSURG CORP | d31686dex993.htm |

A Compelling Opportunity to Create Shareholder Value October 20, 2015 Exhibit 99.2 |

Forward-Looking Statements This presentation includes forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E

of the Securities Exchange Act of 1934, as amended. These forward-looking statements include, but are not limited to, statements regarding AmSurg’s proposed business combination

transaction with TeamHealth (including financing of the proposed transaction and the benefits, results, effects and timing of a transaction), all statements regarding AmSurg’s (and

AmSurg’s and TeamHealth’s combined) expected future financial position, results of operations, cash flows, financing plans, business strategy, budgets, capital expenditures, competitive positions,

growth opportunities, plans and objectives of management, and statements containing the words such as “anticipate,” “approximate,” “believe,” “plan,”

“estimate,” “expect,” “project,” “could,” “would,” “should,” “will,” “intend,” “may,” “potential,” and other similar

expressions. Statements in this presentation concerning the business

outlook or future economic performance, anticipated profitability, revenues, expenses or other financial items, and service line growth of AmSurg (and the combined businesses of AmSurg and TeamHealth), together with other statements that are not

historical facts, are forward-looking statements that are estimates reflecting the best judgment of AmSurg based upon currently available information. Such forward-looking statements are inherently uncertain, and shareholders and other potential investors must recognize that

actual results may differ materially from AmSurg’s expectations as a result of a variety of factors, including, without limitation, those discussed below. Such forward-looking statements are

based upon management’s current expectations and include known and unknown risks, uncertainties and other factors, many of which AmSurg is unable to predict or control, that may cause AmSurg’s

actual results, performance or plans with respect to TeamHealth, to differ materially from any future results, performance or plans expressed or implied by such forward-looking statements.

These statements involve risks, uncertainties and other factors discussed below and detailed from time to time in AmSurg’s filings with the Securities and Exchange Commission (the

“SEC”). Risks and uncertainties related to the proposed transaction with TeamHealth include, but are not limited to, uncertainty as to

whether AmSurg will further pursue, enter into or consummate the transaction on the terms set forth in the proposal or on other terms, potential adverse reactions or changes to business

relationships resulting from the announcement or completion of the transaction, uncertainties as to the timing of the transaction, adverse effects on AmSurg’s stock price resulting from the

announcement or consummation of the transaction or any failure to complete the transaction, competitive responses to the announcement or consummation of the transaction, the risk that regulatory,

licensure or other approvals and financing required for the

consummation of the transaction are not obtained or are obtained subject

to terms and conditions that are not anticipated, costs and difficulties related to the integration of TeamHealth’s businesses and operations with AmSurg’s businesses and operations, the inability to obtain, or delays in obtaining, cost

savings and synergies from the transaction, unexpected costs, liabilities, charges or expenses resulting from the transaction, litigation relating to the transaction, the inability to retain key personnel,

and any changes in general economic and/or industry specific

conditions. In addition to the factors set forth above, other factors that may affect AmSurg’s plans, results or stock price are set

forth in AmSurg’s Annual Report on Form 10-K and its reports on Forms 10-Q and 8-K. Consequently, actual results, performance or developments may differ materially from the forward-looking

statements included above. AmSurg disclaims any intent or obligation to update these forward-looking statements. Additional Information This presentation is provided for informational purposes only and does not constitute an offer to purchase or the solicitation of

an offer to sell any securities. Subject to future developments, AmSurg may file a registration statement and/or tender offer documents with the SEC in connection with a possible business

combination transaction with TeamHealth. AmSurg and TeamHealth shareholders should read those filings, and any other filings made by AmSurg with the SEC in connection with a possible business

combination, if any, as they will contain important information. Those documents, if and when filed, as well as AmSurg’s other public filings with the SEC, may be obtained without charge at

the SEC’s website at www.sec.gov and at AmSurg’s website at www.amsurg.com. |

Strategically & Financially Compelling Combination

1 Creates market leader in physician services, giving a voice to core constituency in healthcare

Leading national provider of outsourced physician services to health

systems Network of more than 1,200 healthcare facilities and

approximately 20,000 clinicians Breadth and depth of services accelerates

cross-sell and new contract wins Enhances relationships with health

insurers in the midst of increasing consolidation Financially compelling

transaction Provides 36% premium to TeamHealth shareholders at

current prices and implies a multiple of 15.2x 2016E EBITDA (for

combined TeamHealth and IPC) or 10.9x EBITDA inclusive of base case run

rate synergies of $200 million Expected to be immediately accretive to

earnings by greater than $0.35 assuming base case run rate

synergies Pro forma net leverage at closing of 5.1x, expected to be below 4.5x by end of first year

Led by experienced AmSurg management team with strong integration track

record Financial performance of AmSurg since closing Sheridan transaction

has exceeded initial public guidance on every metric

AmSurg successful integration track record serves as a roadmap for TeamHealth

transaction Ability to optimize financing of the AmSurg/TeamHealth and

TeamHealth/IPC transactions could decrease aggregate financing expense

by $100 to $150 million |

Summary

Terms of Proposal Merger

Consideration $11.49 per share in cash and fixed exchange ratio of 0.768x – Implies total value per share at offer of $71.47 per share including $59.98 per share in newly

issued common stock in the combined company – Structured to balance pro forma equity ownership to 50%/50% to enable both companies’

shareholders to share in upside of the combined company

–

Implies consideration mix of 16% cash and 84% stock to TeamHealth

shareholders Delivers

~22% of TeamHealth’s

current market capitalization in cash

Deal Value Total implied firm value of TeamHealth at offer of $7.8bn Social Issues Open to combined company retaining TeamHealth name or new mutually agreeable name

Openness to discuss social issues through constructive engagement

Financing Cash consideration funded with mix of new bank debt and publicly issued bonds Guggenheim Securities and J.P. Morgan are highly confident in ability to finance proposed

combination Synergies Base case assumes $200mm in annual synergies with opportunity for up to $290mm, subject to due diligence confirmation Approvals & Timing Shareholder vote required at both companies Regulatory approvals and customer closing conditions Anticipated closing by Q1 2016 if TeamHealth engages promptly Source: FactSet, ThomsonOne and public company filings as of 10/19/2015 2 |

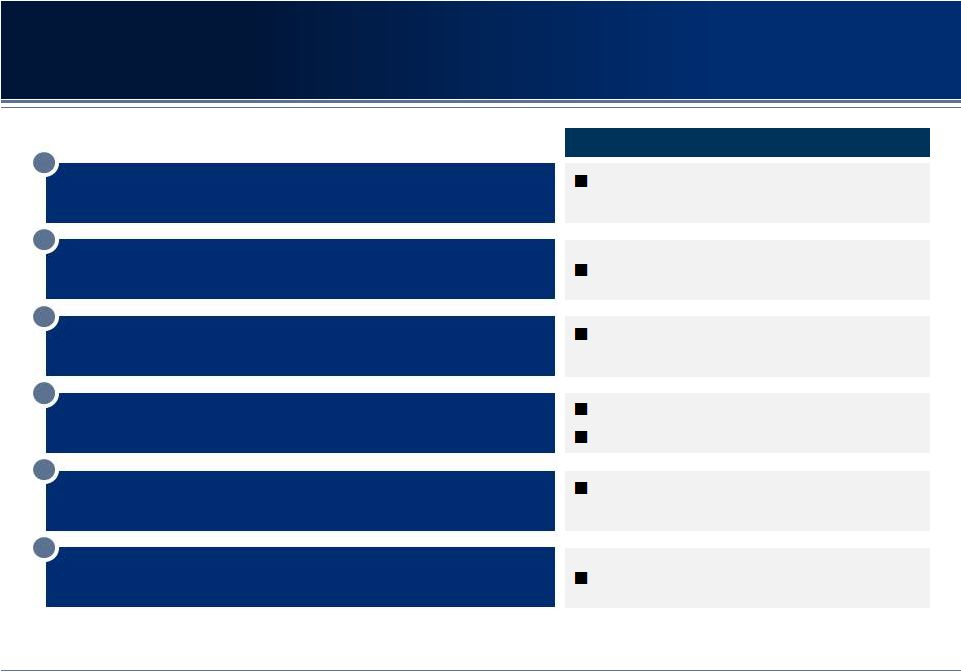

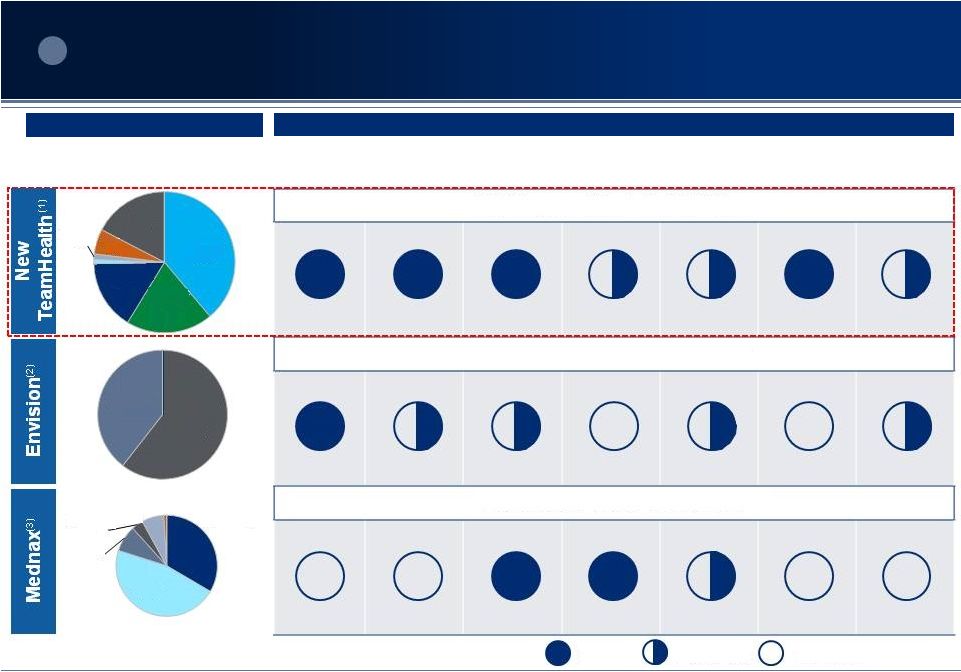

Creates a highly differentiated market leader Significant diversification Reduces risks of IPC integration New and expanded opportunities to accelerate growth Deal structure maintains upside opportunity Combined Company Controls its Destiny Physician Staffing ’15 EBITDA (1) $477mm Firm Value $6.1bn Health Insurers Significant consolidation 3 Large Players + Local Blues Hospitals Significant consolidation 4 Large Public Health Systems Supply Chain 1 Standalone PBM PBM / Retail Convergence Emergence of End Game Winners UnitedHealth CVS HCA Fresenius McKesson Express Scripts ’15 EBITDA $737mm Firm Value $9.8bn ’15 EBITDA $660mm Firm Value $8.9bn ’15 EBITDA $516mm Firm Value $6.3bn TeamHealth AmSurg Mednax Envision Race for Scale… …Creates Opportunities for New TeamHealth Source: FactSet, ThomsonOne and public company filings as of 10/19/2015 Note: TeamHealth includes IPC (with $60mm of synergies) (1) Assumes midpoint of AmSurg management guidance 3 |

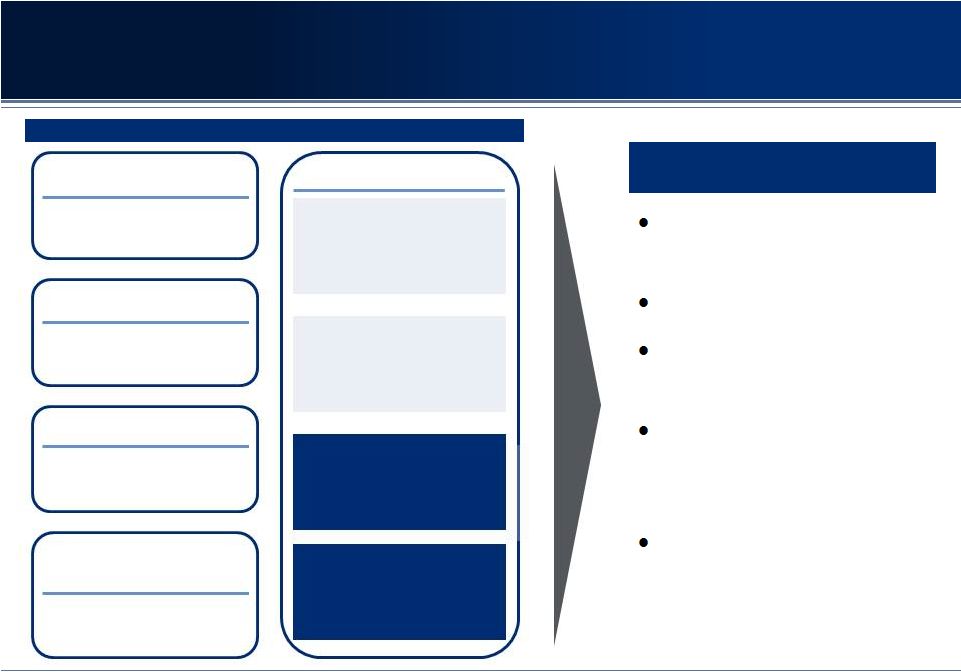

Combination has the Potential to Significantly Enhance

Shareholder Value Most Complete Platform of Outsourced Clinical Services Accelerates Multiple Avenues of Growth 1 Management has High Credibility, Proven Track Record, and Strong Cultural Fit 6 Largest National Provider with Highly Diversified Business Mix 2 Best Positioned for Evolving Payment Models and Enabling Providers to Better Coordinate Care 5 Opportunities for Meaningful Synergies 4 Delivers Immediate Financial Return at Modest Leverage 3 Catalytic to organic growth and M&A opportunities Value Driver Reduces risk Quantifiable impacts on immediate value Cost: increase base earnings Revenue: further accelerate growth Positioned for shift to value-based payments, bundling and risk Adds credibility to value story 4 |

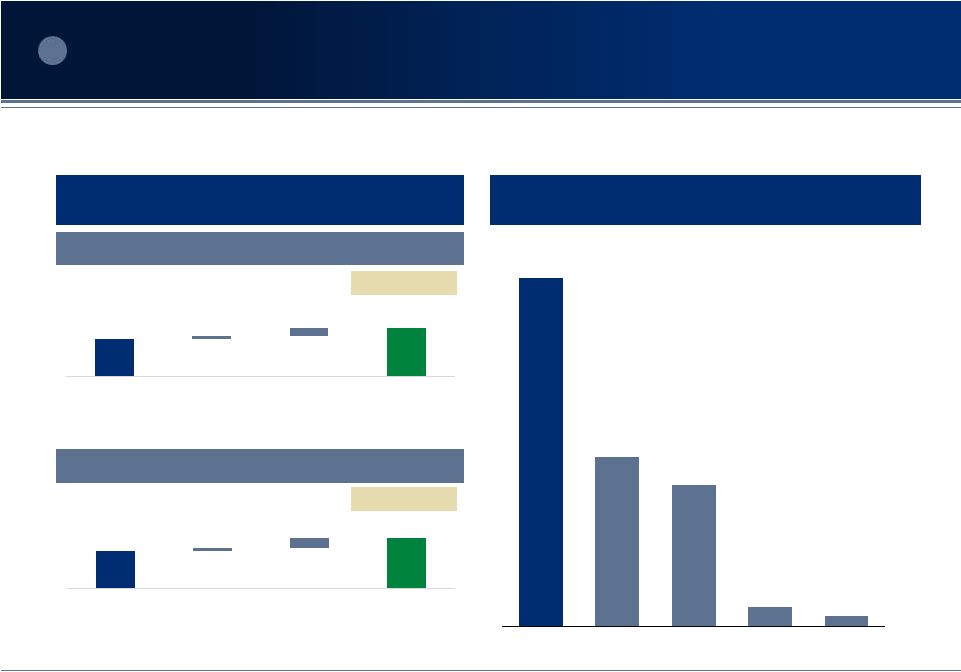

Core Presence Non-Core Clinical Service Offerings Business Mix Source: Company filings (1) Pro forma business mix calculated based on standalone business mix applied to 2014 revenue, as reported. AmSurg contribution of revenue assumes midpoint of 2015 guidance (2) Based on 6 months ending Q2 2015 results; pro forma for Rural/Metro

(3) Based on FY 2014 results; pro forma for vRad ED Hospitalist Anesthesiology Children’s Services Radiology Surgery Center Post-Acute 2015E Revenue: ~$7bn & ~20,000 Clinicians 2015E Revenue: ~$6bn & ~9,000 Clinicians 2015E Revenue: ~$3bn & ~3,000 Clinicians 1 Most Complete Platform of Outsourced Clinical Services Accelerates Growth 5 Emergency Department 39% Acute / PAC Hospitalists 20% Anesthesiology 16% Children's 1% Radiology 1% Other 6% ASC 17% Emergency Staffing & Other 61% Ambulance 39% Anesthesiology 33% Neonatal 46% Maternal 8% Pediatric Cardiology 4% Radiology 7% Other 1% |

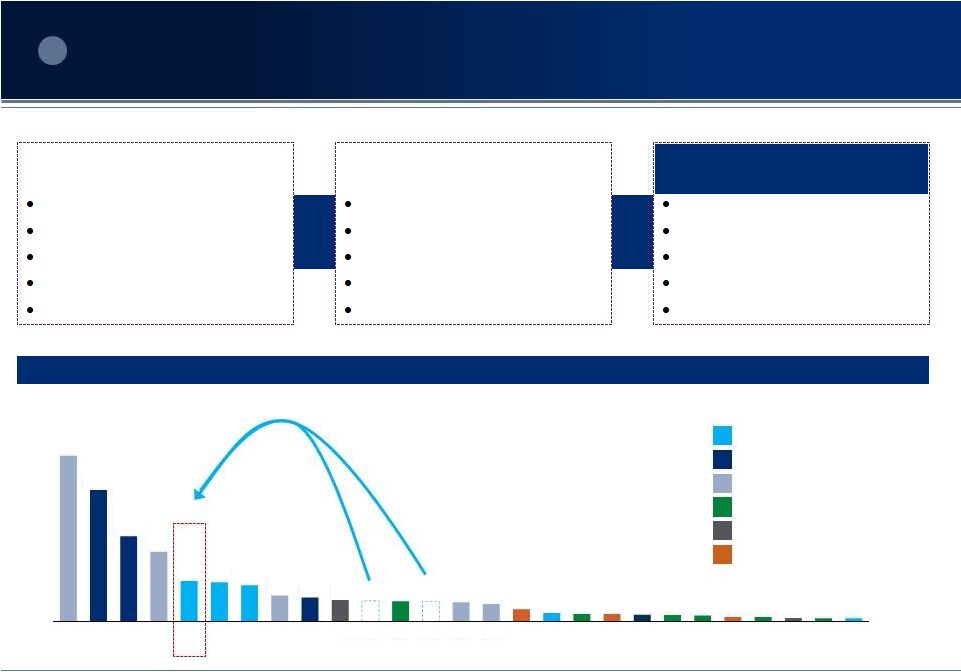

$ in millions Staffing Alternate Site Acute Care Post-Acute Home Health / Hospice Senior Housing Healthcare Services Provider Landscape: Market Capitalizations Source: FactSet and public company filings as of 10/19/2015 (1) Assumes midpoint of AmSurg management guidance (2) Includes IPC (with $60mm of synergies) (3) Includes $200mm of combined synergies AmSurg 2015E Revenue (1) $2.5bn 2015E Adj. EBITDA (1) $477mm States 38 Healthcare facilities 210 Clinicians 5,000+ TeamHealth (2) 2015E Revenue $4.3bn 2015E Adj. EBITDA $516mm States 47 Healthcare facilities 1,000+ Clinicians 16,000+ New TeamHealth (3) 2015E Revenue ~$7.0bn 2015E Adj. EBITDA $1.1bn States 48 Healthcare facilities 1,200+ Clinicians ~20,000 + = Leading National Physician Services Company with Complementary Service Offerings 2 6 $32.6 $25.9 $16.8 $13.7 $7.9 $7.7 $7.1 $5.1 $4.7 $4.3 $4.0 $3.9 $3.9 $3.8 $3.4 $2.4 $1.6 $1.5 $1.4 $1.3 $1.2 $1.2 $0.9 $0.9 $0.7 $0.6 $0.6 HCA FMS DVA UHS MD EVHC CYH ACHC BKD AMSG HLS TMH THC LPNT CHE AHS SEM AMED SCAI KND ENSG LHCG GEN CSU USPH CCRN New TMH |

5.1x

4.2x Pro Forma Net Leverage @ Close Net Leverage @ End of Year-1 $7.0 billion + Revenue $1.1 billion + EBITDA 20,000+ Healthcare Professionals Quickly Deleveraging (1) $450 million + Discretionary Free Cash Flow Year-1 Net Leverage 4.2x Source: FactSet and public company filings as of 10/19/2015 Note: Discretionary free cash flow calculated as cash flow from operations less capital expenditures, distributions to minority interests

and preferred dividends. Assumes $200mm of synergies.

(1) $75mm of synergies for leverage purposes Accelerates Growth 20% + EBITDA CAGR Delivers Immediate Financial Return at Modest Leverage $200 million + Combined Company Synergies 3 Immediately Accretive to Earnings and Value Year-1 Accretion in Excess of $0.35 Assuming Base Case Run-Rate Synergies 7 18% 23% TMH + IPC '15-'17 EBITDA CAGR PF AmSurg + TeamHealth '15-'17 EBITDA CAGR |

Opportunities for Meaningful Synergies

4 Preliminary synergy range of $200 – $290 million, including $40 – $60 million from IPC The analysis assumes $200mm as the Base Case Synergy Assumption Revenue Synergies Managed Care Opportunities for collaboration and enhanced relationships with managed care organizations Enterprise New Contract Growth Enterprise new contract growth rate increases by 1% due to enhanced portfolio and

cross selling opportunities

Sheridan Contract Growth Increases in Sheridan's growth rate to match TeamHealth new contract growth rate

leveraging their sales expertise and client base

IPC Synergies with TeamHealth Collections improvements, bundled services, post-acute service Incremental EBITDA from Revenue Synergies $130mm – $185mm Cost Synergies TeamHealth Cost Synergies Operations support, back office, public company costs incurred; potential group

purchasing on malpractice, benefits and other costs

IPC Synergies with TeamHealth Corporate and regional overhead; public company costs; operating, billing and purchasing savings Incremental EBITDA from Cost Synergies $70mm – $105mm 8 |

At the

forefront of key

fee-for-value

initiatives Participation in BPCI initiative provides early

experience with Medicare’s new reimbursement program

Healthcare system has ~$1.5bn of bundled payments in today’s program

Infrastructure in place through IPC

Magnitude of financial impact will only increase over time

Scale / Partner of choice:

in over 1,200 healthcare facilities and employs 20,000

clinicians who are best positioned to manage / coordinate care to drive cost

down Strategic Asset: Value of the hospitalist as care coordinator will only increase The transaction offers immediate and concrete strategic and financial return and better

positions the company for value based payments, bundling and risk sharing

arrangements Best Positioned for Evolving Payment Models and

Enabling Coordinated Care 5 9 |

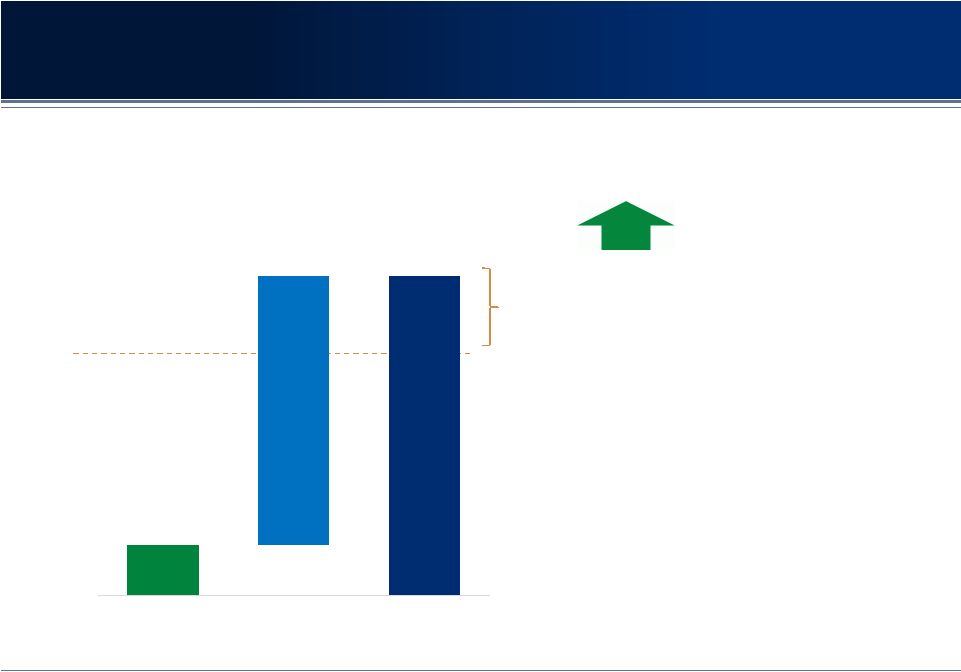

Management has High Credibility, Proven Track

Record, and Strong Cultural Fit

6 AmSurg management has been instrumental in driving long term shareholder appreciation

and has outperformed the peer group over the last three years

Source:

FactSet and public company filings as of 10/19/2015

Note: Current IPC shown as of unaffected price of $58.46 (1) Represents the day prior to AmSurg’s acquisition of Sheridan Share Price Performance Since May 28, 2014 (1) Recent Performance has Outpaced Expectations Mid-Point Adj. EBITDA Guidance ($ in millions) Mid-Point Adj. EPS Guidance ($ / share) $448 $9 $20 $477 6.5% Increase $3.28 $0.07 $0.21 8.5% Increase $3.56 10 FY2015 Guidance as of Q4 '14 Increase to FY2015 Guidance in Q1 '15 Increase to FY2015 Guidance in Q2 '15 Current FY 2015 Guidance FY2015 Guidance as of Q4 '14 Increase to FY2015 Guidance in Q1 '15 Increase to FY2015 Guidance in Q2 '15 Current FY 2015 Guidance 82% 40% 34% 5% 3% AMSG MD IPC TMH EVHC |

Combination Represents Significant Value Creation

Opportunity for TeamHealth Shareholders

Significant value creation to TeamHealth stockholders through initial premium as well

as continued upside and equal share of synergies

Current Price: $52.50 Source: FactSet and Company Filings as of 10/19/2015 Note: Assumes $200mm of run rate synergies. Peer group includes AmSurg, Envision, Mednax and TeamHealth. (1) Net of share of assumed transaction expenses 36% Premium Share of incremental synergies capitalized at peer NTM EBITDA multiple of ~12.3x (1) implies >$10.00 of additional upside, representing a >50% premium to current 11 $11.49 $59.98 $71.47 Cash Stock Total Value at Offer |

Shared

Vision for New TeamHealth Transformational Combination Aligned with the

Future of Healthcare New

Breadth

to TeamHealth Brand & Long-term Vision: Partner of choice for health systems Comprehensive Platform: Industry leading portfolio of outsourced physician services Multiple Levers of Growth: Built for the long-term with new and expanded growth opportunities Aligned with the Future: Best positioned to enable providers to move toward value-based care Best of Breed Management Team Full Suite of Solutions Care Coordination: Hospital to Home Platform to Manage Risk Post-Acute Coordination of Care Surgical Outpatient Largest by Revenue: ~$7.0bn Largest by Clinicians: 20,000 Leader in more sub-specialties than anyone Market Size Medical $20bn $19bn $19bn $14bn $15bn 12 New TeamHealth TeamHealth ED Sheridan Anesthesia / Neo IPC Hospitalist & Post-acute Radisphere Radiology AmSurg ASCs |

We

believe our proposal is compelling for TeamHealth Shareholders

MOE with a 36% “control premium”

$71.47 per share value at offer, above all-time high

15x+ TeamHealth EBITDA Valuation

50/50% ownership: “not truly selling”

Enormous value creation opportunity

$1.8bn value of capitalized synergies larger than the

$1.6bn IPC transaction

We have great respect for the value of the TeamHealth

Name for NewCo

Openness to discuss social issues through

constructive engagement

Concrete path to near-term value in excess of $80.00

per share

Share in upside equally with base case of $200mm of

synergies

Opportunity to avoid $100mm-$150mm of breakage

costs from IPC financing

AmSurg CEO/Management team

Continued financial outperformance

Stock up 82% since Sheridan

Integration experience

Synergies conservative and achievable

Opportunity to create the Best-In-Class Provider of Clinical

Outsourced Services …with meaningfully enhanced

outlook 13

Proposal delivers significant value today…

|

Next

Steps No expected financing contingency; JPM/Guggenheim

highly confident in AmSurg ability to finance merger

Proposal based on public information/internal estimates

Would conduct prompt due diligence to reach agreed upon

transaction Shareholder votes required for both

companies Do not anticipate significant regulatory

hurdles Look forward to engaging promptly with

TeamHealth’s Board to reach an agreement TeamHealth

Shareholders Must Urge Their Board of Directors to Engage

with AmSurg to Consummate Significant Value Creating Transaction 14 |

Financial

Information We have included certain financial measures in

this presentation, including Adjusted EBITDA and Adjusted EPS, which are “non-GAAP financial measures” as defined under the rules and regulations promulgated by the SEC. We define

Adjusted EBITDA as earnings before interest expense, net,

income taxes, depreciation, amortization, share-based

compensation, transaction costs, changes in contingent purchase price

consideration, gain or loss on deconsolidations and

discontinued operations. Adjusted EBITDA, as presented herein, is considered a supplemental measure of our performance and is not required by, or presented in accordance with, generally accepted accounting principles in the

United States (“GAAP”). Adjusted EBITDA is not a measure of

our financial performance under GAAP and should not be

considered as an alternative to net income or any other performance

measure derived in accordance with GAAP. We define

Adjusted EPS as net earnings per share, excluding discontinued operations, gains or loss from deconsolidations, which are non-cash in nature, transaction costs, including associated debt extinguishment costs and deferred financing

write-off, and acquisition-related amortization

expense (the majority of which relate to the Sheridan transaction and which are of a nature and significance not generally associated with our historical individual center acquisition activity), changes

in contingent purchase price consideration and

share-based compensation expense. Our measures of

Adjusted EBITDA and Adjusted EPS may not be comparable to similarly titled measures of other companies and are not measures of performance calculated in accordance with GAAP. We have included information

concerning Adjusted EBITDA and Adjusted EPS in this presentation because

we believe that such information is used by certain

investors as measures of a company’s historical performance. We believe these measures are frequently used by securities analysts, investors and other interested parties in the evaluation of issuers of equity securities, many of which

present EBITDA, Adjusted EBITDA, EPS and Adjusted EPS when

reporting their results. Our presentation of Adjusted

EBITDA and Adjusted EPS should not be construed as an inference that our

future results will be unaffected by unusual or

nonrecurring items. |