Attached files

| file | filename |

|---|---|

| EX-5.1 - EXHIBIT 5.1 - Optex Systems Holdings Inc | s102018_ex5-1.htm |

| EX-23.2 - EXHIBIT 23.2 - Optex Systems Holdings Inc | s102018_ex23-2.htm |

As filed with the Securities and Exchange Commission on October 15, 2015 |

Registration Statement No. 333-204955 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3

to

REGISTRATION STATEMENT

ON FORM S-1

UNDER

THE SECURITIES ACT OF 1933

OPTEX SYSTEMS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 3827 | 33-143215 |

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Identification Number) |

| incorporation or organization) | Classification Code Number) |

1420 Presidential Drive

Richardson, TX 75081

(972) 764-5700

(Address, including zip code, and telephone number, including

area code, of registrant’s principal executive offices)

Danny Schoening

Chief Executive Officer

1420 Presidential Drive

Richardson, TX 75081

(972) 764-5700

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

with copies to:

| Jolie Kahn, Esq. | Joseph A. Smith |

| 2 Liberty Place, Suite 3401 | Ellenoff Grossman & Schole, LLP |

| Philadelphia, PA 19102 | 1345 Avenue of the Americas |

| New York, New York 10105 | |

| Telephone (215) 253-6645 | Telephone (212) 370-1300 |

Approximate Date of Commencement of Proposed Sale to the Public: As soon as practicable after the effective date hereof.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “small reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o |

| Non-accelerated filer o | Smaller reporting company x |

| (Do not check if a smaller reporting company) |

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered | Proposed maximum aggregate offering price(1) | Amount of registration fee | ||||||

| Common stock, $.001 par value (2)(3) | $ | 13,800,000 | $ | 1,390 | ||||

| Warrants to purchase common stock(2) | — | (4) | — | (5) | ||||

| Shares of common stock underlying warrants (2)(3) | $ | 17,250,000 | $ | 1,738 | ||||

| Underwriters’ warrants | — | — | (6) | |||||

| Shares of common stock underlying Underwriters’ warrants (3) | $ | 1,725,000 | $ | 174 | ||||

| Total | $ | 32,775,000 | $ | 3,302 | ||||

| (1) | Estimated solely for the purpose of calculating the registration fee under Rule 457(o) of the Securities Act. The filing fee on the original 2,000,000 shares common stock was paid in conjunction with the filing of the Registration Statement on Form S-1, filed with the SEC on June 15, 2015, and we paid an additional filing fee for the shares of common stock offered as part of the “greenshoe” at 15% as well as the common stock underlying the warrants (including the “greenshoe”) with the filing of Amendment No. 2 to Registration Statement on Form S-1, which was filed with the SEC on October 9, 2015. With the filing of this Amendment No. 3 to Registration Statement on Form S-1, we have paid the filing fee on the additional 400,000 shares of stock being offered (and the additional common stock offered as part of the “greenshoe” on those additional 400,000 shares of common stock at 15%) and including the shares of common stock underlying the additional warrants being issued for the 400,000 additional shares of common stock being offered (and green shoe). We have also paid the filing fee with this Amendment No. 3 for the shares of stock underlying the underwriters’ warrants being offered hereunder. |

| (2) | Includes 1,800,000 shares of common stock and warrants to purchase up to 2,250,000 shares of common stock which may be issued upon exercise of a 45-day option granted to the underwriter to cover over-allotments, if any. The over-allotment option may be used to purchase common stock, warrants or any combination thereof as determined by the underwriters. |

| (3) | Pursuant to Rule 416 under the Securities Act, the securities being registered hereunder include such indeterminate number of additional shares of common stock as may be issued after the date hereof as a result of stock splits, stock dividends or similar transactions. |

| (4) | For purposes of the calculation of the Registration Fee, the warrants to be issued to investors hereunder are included in the price of the common stock above. The actual public offering price shall be allocated $_____ to the common stock and $_____ to each portion of a warrant representing warrant shares. |

| (5) | No separate registration fee is required pursuant to Rule 457(g) promulgated under the Securities Act. |

| (6) | Assumes the underwriter’s over-allotment is fully exercised for the maximum amount of common stock and warrants. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(a), MAY DETERMINE.

INFORMATION CONTAINED HEREIN IS SUBJECT TO COMPLETION OR AMENDMENT. A REGISTRATION STATEMENT RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION. THESE SECURITIES MAY NOT BE SOLD UNTIL THE REGISTRATION STATEMENT BECOMES EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL AND IS NOT A SOLICITATION OF AN OFFER TO BUY IN ANY STATE IN WHICH AN OFFER, SOLICITATION OR SALE IS NOT PERMITTED.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION, DATED OCTOBER 15, 2015 |

2,400,000 SHARES OF COMMON STOCK AND

WARRANTS TO PURCHASE 2,400,000 SHARES OF COMMON STOCK

OPTEX SYSTEMS HOLDINGS, INC.

We are offering 2,400,000 shares of our common stock, $.001 par value per share, together with warrants to purchase 2,400,000 shares of our common stock. Each warrant is immediately exercisable for one share of common stock at an exercise price of $ per share, which is 125% of the offering price per share, and will expire five years after the issuance date. The common stock and warrants will be separately issued.

Our common stock is currently traded on the OTCQB Marketplace, operated by OTC Markets Group, Inc. under the symbol “OPXSD”. We are applying to list our common stock and warrants on The NASDAQ Capital Market under the symbols “OPXS” and “OPXSW”, respectively. No assurance can be given that our application will be approved. On October 14, 2015, the last reported sales price for our common stock was $6.00 per share. On October 6, 2015, 20 calendar days had passed since the mailing to our shareholders of the Definitive Schedule 14C regarding the approval by our Board of Directors and shareholders of a reverse stock split of our common stock, in a ratio to be determined by our board of directors, of not less than 1-for-400 nor more than 1-for-1000 and on October 7, 2015, we effected a 1-for-1000 reverse split of our common stock. All warrant, option, share and per share information in this prospectus gives retroactive effect for a 1-for-1000 split.

INVESTING IN THE OFFERED SECURITIES INVOLVES RISKS, INCLUDING THOSE SET FORTH IN THE “RISK FACTORS” SECTION OF THIS PROSPECTUS BEGINNING ON PAGE 9. INVESTORS SHOULD ONLY CONSIDER AN INVESTMENT IN THESE SECURITIES IF THEY CAN AFFORD THE LOSS OF THEIR ENTIRE INVESTMENT.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

| Per Share | Per Warrant | Total | ||||||||||

| Public offering price | $ | $ | $ | |||||||||

| Underwriting discounts and commissions (1) | $ | $ | $ | |||||||||

| Proceeds, before expenses, to us | $ | $ | $ | |||||||||

| (1) | In addition to the underwriting discount, we have agreed to pay up to $50,000 of the fees and expenses of the representative of the underwriters in connection with this offering, which includes the fees and expenses of the representative’s counsel. We have agreed to issue warrants to the underwriters. See “Underwriting” on page 9 of this prospectus for a description of the compensation arrangements. |

We have granted the underwriters a 45-day option to purchase up to _______ additional shares of common stock and/or additional warrants to purchase up to ______ additional shares of common stock, in any combination thereof, from us at the offering price for each security, less underwriting discounts and commissions, to cover over-allotments, if any. The over-allotment option may be used to purchase shares of common stock, warrants, or any combination thereof, as determined by the representative of the underwriters. The shares and/or warrants issuable upon exercise of the over-allotment option are identical to those offered by this prospectus. If the underwriters exercise this option in full, the total underwriting discounts and commissions payable by us will be $_______________, and the total proceeds to us, before expenses, will be $__________________. We estimate the total expenses of this offering, excluding underwriting commissions and discounts, to be approximately $200,000.

The underwriters are offering the shares and warrants as set forth under the heading “Underwriting” beginning on page S-10. The underwriter expects to deliver our securities, against payment, on or about ______ __, 2015.

Chardan Capital Markets, LLC Joseph Gunnar & Co.

The date of this prospectus is __________, 2015.

| 3 |

| 4 |

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus and any related free writing prospectus that we may provide to you in connection with this offering. We have not, and the underwriter has not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriter is not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: neither we nor the underwriter have done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus and any such free writing prospectus outside of the United States.

| 5 |

This summary highlights important information about this offering and our business. It does not include all information you should consider before investing in our common stock. Please review this prospectus in its entirety, including the risk factors and our financial statements and the related notes, before you decide to invest.

References in this prospectus to “we,” “us,” and “our” refer to Optex Systems Holdings, Inc. and its subsidiaries.

Our Company

Our wholly owned subsidiary, Optex Systems, Inc., manufactures optical sighting systems and assemblies, primarily for Department of Defense applications. Our products are installed on various types of U.S. military land vehicles, such as the Abrams and Bradley fighting vehicles, light armored and armored security vehicles and have been selected for installation on the Stryker family of vehicles. Optex Systems, Inc. also manufactures and delivers numerous periscope configurations, rifle and surveillance sights and night vision optical assemblies. Optex Systems, Inc. products consist primarily of build-to-customer print products that are delivered both directly to the armed services and to other defense prime contractors. As a result of Optex Systems, Inc.’s November 2014 acquisition of L-3 Communications Inc.’s Applied Optics Products Line, we also manufacture highly specialized thin film coatings, primarily for use in the defense industry but also with potential commercial applications. Less than 1% of our current revenue is related to the resale of products substantially manufactured by others. In this case, the product would likely be a simple replacement part of a larger system previously produced by our predecessor, Optex Systems, Inc. (Texas).

Some of our contracts allow for government contract financing in the form of contract progress payments pursuant to Federal Acquisition Regulation 52.232-16, “Progress Payments”. As a small business, and subject to certain limitations, this clause provides for government payment of up to 90% of incurred program costs prior to product delivery. To the extent our contracts allow for progress payments, we intend to utilize this benefit, thereby minimizing the working capital impact on us for materials and labor required to complete the contracts.

Our contracts allow for Federal Acquisition Regulation 52.243-1 which entitles the contractor to an “equitable adjustment” to the contract if the contract changes result in a change in contract costs or time of performance. In essence, an equitable price adjustment request is a request for a contract price modification (generally an increase) which provides for the contractor to be “made whole” for additional costs incurred which were necessitated by some modification of the contract effort. This modification may come from an overt change in U.S. Government requirements or scope, or it may come from a change in the conditions surrounding the contract (e.g., differing site conditions or late delivery of U.S. Government-furnished property) which result in statement of work additions, deletions, part substitutions, schedule or other changes to the contract which impact the contractor’s overall cost to complete. We have requested an equitable adjustment on a previously completed Howitzer Aiming Circle program due to significant design issues that impacted the manufacturability of the product. On September 23, 2015 Optex Systems Inc. agreed to an $850,000 settlement on the Aiming Circle request for equitable adjustment on contract number W52H09-06-D-0229, in which shipments concluded in 2011. This settlement is the result of a negotiation and fact gathering process managed through the Armed Services Contract Board of Appeals. All of the incurred losses have been previously recognized through the completion of the program, thus the full settlement amount positively impacts the company’s working capital.

We also anticipate the opportunity to integrate some of our night vision and optical sights products into commercial applications.

| 6 |

Recent Events

Estimated Year End Revenue

Revenue for fiscal year ended September 27, 2015 is estimated to be $13.0 million, compared to $10.2 for the year ended September 28, 2014. This is a $2.8 million, or 27.5%, increase. The increase is directly attributable to the Applied Optics Center acquisition on November 3, 2014.

The above selected estimated result for fiscal 2015 is preliminary and is subject to the completion of our normal year-end closing procedures. Our actual results may differ from this estimates.

Approval of Reverse Stock Split

On August 31, 2015, our board of directors and the shareholders holding a majority of our issued and outstanding Common Stock approved an amendment to our Certificate of Incorporation to effect a reverse stock split which combines the outstanding shares of our common stock into a lesser number of outstanding shares. Our board of directors will have the sole discretion to effect the amendment and reverse stock split at any time prior to March 31, 2016, and to fix the specific ratio for the combination, provided that the ratio would be not less than 1-for-400 and not more than 1-for-1000. The 1-for-1000 reverse split is effected as of October 7, 2015, and the numbers in this prospectus are set forth on a post split basis except as otherwise indicated.

Election of New Board Members and Committees

On May 27, 2015, our board of directors and shareholders elected the following four individuals as directors to serve until their successors are elected and duly qualify: Kerry Craven, David Kittay, Owen Naccarato and Charles Trego. All four directors qualify as independent directors under the rules governing the NASDAQ Capital Market.

On July 14, 2015, our board of directors confirmed the appointment of the following independent directors to serve on the following committees of our board of directors:

Audit Committee: Charles Trego (Chair), Kerry Craven and David Kittay

Compensation Committee: Owen Naccarato (Chair), David Kittay and Kerry Craven

Nominating Committee: David Kittay (Chair), Kerry Craven, Owen Naccarato and Charles Trego.

The board also acknowledged the charters for each committee which are approved.

Mr. Trego has also been determined to be the Audit Committee’s financial expert, a position for which he qualifies as a long time chief financial officer of public reporting companies.

Applied Optics Product Line Contracts

On May 26, 2015, and effective as of May 21, 2015, we entered into a supply agreement with Nightforce Optics, Inc. for supply by us to Nightforce of certain critical optical assemblies through our Applied Optics Product Line division. The production rate and delivery schedule shall be agreed upon by the parties and are subject to aggregate annual minimum order values of $3,000,000 in 2015 and $3,900,000 in 2016. The initial term of the agreement is two years, and can be extended by Nightforce for an additional year. We are the primary supplier of the covered products to Nightforce as we agree to work exclusively with Nightforce on its markets of interest in commercial sporting optics and select military optics; however, our existing business arrangements with certain Department of Defense manufacturers are not subject to this exclusivity covenant.

On June 8, 2015, we announced that we have been awarded a purchase order from a customer for 11,200 ACOG Laser Filter units valued at $1.3 million through our Applied Optics Product Line division. This award also includes an option quantity up to an additional 11,200 units for up to an additional $1.3 million.

Purchase of Applied Optics Products Line

On November 3, 2014, we entered into a Purchase Agreement with L-3 Communications, Inc. pursuant to which we purchased the assets comprising L-3’s Applied Optics Products Line, which is engaged in the production and marketing and sales of precision optical assemblies utilizing thin film coating capabilities for optical systems and components primarily used for military purposes. The purchased assets consist of personal property, inventory, books and records, contracts, prepaid expenses and deposits, intellectual property, and governmental contracts and licenses utilized in the business comprised of the purchased assets.

The purchase price for the acquisition was $1,013,053, which was paid in full at closing, plus the assumption of certain liabilities associated with the Purchased Assets in the approximate amount of $271,000. The source of funds for the acquisition consisted of an advance of $800,000 from the November 2014 sale of our convertible notes to certain accredited investors in a transaction exempt from registration under Section 4(2) of the Securities Act, with the balance of the funds derived directly from working capital.

In conjunction with the acquisition of the assets comprising L-3’s Applied Optics Products Line, Optex Systems, Inc. assumed the obligations of L-3 pursuant to this certain Assignment to Lease and Consent of Landlord Agreement dated as of October 30, 2014, between L-3, as tenant, Optex Systems Inc., as assignee, and CABOT II TX1W04, LP, as landlord, with respect to those certain Leases dated as of August 27, 1996 covering Premises located at 9839 and 9827 Chartwell Drive, respectively, Dallas, Texas, as amended by First Amendments dated May 14, 2001, Second Amendments dated January 9, 2004, Third Amendments dated February 21, 2005 and the Fourth Amendment dated March 13, 2009. The leased premises under the lease consist of approximately 56,633 square feet of space at the premises, with a monthly rental of approximately $32,000 per month. The term of the lease expires September 30, 2016, and there are four renewal options available to the tenant, and each renewal option has a five year term.

Issuance of Convertible Notes and Conversion to Series B Preferred Stock

On November 17, 2014, we entered into a Subscription Agreement with certain accredited investors pursuant to which we sold to them $1.55 million principal amount convertible promissory notes in a private placement.

On March 26, 2015, we filed a Certificate of Designation with respect to our Certificate of Incorporation to authorize a series of preferred stock known as “Series B Preferred Stock” under Article FOURTH thereof, with 1010 shares of Series B preferred stock issuable thereunder. The amendment was approved by our Board of Directors under Article FOURTH of our Certificate of Incorporation. The stated value of each share of Series B preferred stock is $1,629.16, and each share of Series B preferred stock is convertible into shares of our common stock at a conversion price of $.0025. Holders of the Series B preferred stock receive preferential rights in the event of liquidation to other classes of preferred and common stock other than our Series A preferred stock. Additionally, the holders of the Series B preferred stock are entitled to vote together with the common stock and the Series A preferred stock on an “as-converted” basis.

On March 29, 2015, the holders of $1,560,000 in principal amount of convertible promissory notes issued in November 2014 converted the entire principal amount thereof and all accrued and unpaid interest thereon, into 1,000 shares of our Series B preferred stock.

Appointment of Chief Financial Officer, Resignation and Appointment of Chairman and Director

Effective November 19, 2014, Karen Hawkins, the Vice President of Finance and Controller, was appointed as our Chief Financial Officer.

| 7 |

Also effective November 19, 2014, Merrick Okamoto resigned as our Chairman of the Board and as a Director. In recognition of his service, all of his unvested stock options were deemed to vest immediately, and the termination date of all of his stock options was extended to December 31, 2018.

Also effective November 19, 2014, Peter Benz was appointed as a Director to our Board of Directors and was also elected as our Chairman of the Board of Directors.

New Product Development

During the first six months of 2015, we completed prototype development of a new digital spotting scope called Red Tail (patent pending). This device is targeted towards long range observation and image recording used by military, border patrol, and select consumer/commercial applications. The device is designed to deliver high definition images with military grade resolution, but at commercial “off the shelf” pricing. Using high grade optics to deliver a 45X magnified image onto a 5 megapixel CMOS sensor, the Red Tail device then transmits this image via Wi-Fi to the user’s smartphone or tablet. Digital still images or videos can then be captured and/or emailed using a custom Red Tail app available for either iOS or Android devices. We are presently in negotiations to make this device available via General Services Administration schedules for government personnel and through commercial websites for non-government procurement. We demonstrated this device in April 2015 at the Border Security Expo in Phoenix, Arizona and received positive feedback from U.S. border agents, police officers, and other Expo attendees.

Risk Factors

Investing in our common stock is a speculative proposition, and we encourage you to review our Risk Factors section commencing on p.10 of this prospectus.

These risks include, but are not limited to, the following:

| · | our lack of market saturation for our products and our ability to achieve full commercialization of our product ahead of our competitors; |

| · | our ability to achieve market acceptance and to become profitable; |

| · | our ability to engage and retain key personnel, for which we do not carry key man insurance; and |

| · | the dilutive nature of this offering and the potential need to raise further capital in the future, which will have a further dilutive effect on our shareholders. |

| 8 |

Corporate Information

On March 30, 2009, Optex Systems Holdings, Inc. (formerly known as Sustut Exploration, Inc.), a Delaware corporation, and Optex Systems, Inc., a privately held Delaware corporation, entered into a reorganization agreement, pursuant to which Optex Systems, Inc. was acquired by Optex Systems Holdings in a share exchange transaction. Optex Systems Holdings was the surviving corporation and Optex Systems, Inc. became our wholly-owned subsidiary. At the closing, we changed our name from Sustut Exploration, Inc. to Optex Systems Holdings, Inc., and our year end changed from December 31 to a fiscal year ending on the Sunday nearest September 30.

Our principal executive office is located at 1420 Presidential Drive, Richardson, TX 75081. Our telephone number is (972) 764-5700. Our website is www.optexsys.com. Our website and the information contained on, or that can be accessed through, our website will not be deemed to be incorporated by reference in, and are not considered part of, this prospectus. You should not rely on our website or any such information in making your decision whether to purchase our common stock.

We do not intend the use or display of other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

Summary of the Offering

| Securities offered: | 2,400,000 shares of our common stock together with warrants to purchase 2,400,000 shares of our common stock at an exercise price of $[*] per share. The warrants will be immediately exercisable and will expire five years after the issuance date. | |

| Common stock outstanding before the offering (*): | 179,572 shares | |

| Common stock to be outstanding after the offering (*): | 3,319,5812 shares (or ____________ shares if the underwriters exercise in full their option to purchase additional shares). | |

| Underwriters option | We have granted to the underwriters an option for a period of 45 days from the date of this prospectus supplement to purchase up to ____________ additional shares, in any combination thereof, and/or warrants to purchase up to _____________ additional shares to cover over-allotments. | |

| Estimate of Proceeds: | $12,000,000 | |

| Use of proceeds: | We intend to use the net proceeds from this offering for the following purposes: |

| Proceeds: | ||||

| Gross Proceeds | $ | 12,000,000 | ||

| Underwriter Discount, Fees and Expenses | (1,425,000 | ) | ||

| Net Proceeds | $ | 10,575,000 | ||

| Uses: | ||||

| Working Capital & Operating Expenses | 3,575,000 | |||

| Sales, Marketing & Business Development | 1,000,000 | |||

| Acquisitions | 6,000,000 | |||

| Total Uses | $ | 10,575,000 |

| (*) | The total number of shares of our common stock outstanding after this offering is based on 179,572 shares outstanding as of October 14, 2015 and excludes as of that date, the following: |

| · | 1,000 shares of common stock issuable upon exercise of the warrants issued in conjunction with the AvidBank Credit Facility with an exercise price of $100.00 per share. |

| · | 40,266 shares of common stock issuable upon the exercise of vested options outstanding as of October 14, 2015, at a weighted average exercise price of $18.65 per share; |

| · | 29,734 shares of common stock reserved for future grant or issuance as of October 14, 2015 under all of our 2009 Stock Option Plan; |

| · | 2,400,000 shares of common stock issuable upon exercise of the warrants issued to the public in connection with this offering; and |

| · | ___________ shares of common stock issuable upon exercise of the warrants to be received by the underwriter in connection with this offering. |

2 Includes conversion of 75.5 shares of Series A Preferred Stock and 993.9 shares of Series B Preferred Stock (less a portion owned by Alpha Capital Anstalt to keep their holdings at 9.9% of the issued and outstanding shares of common stock post closing) which adds an additional net 740,009 shares (854,825 less 114,816 shares to remain unconverted subject to a blocker Alpha Capital Anstalt so to equal 740,009 shares) shares of common stock outstanding. A total of 926 shares of Series A Preferred Stock (convertible into 2,541,070 common shares) which is beneficially held by Optex Systems Holdings officers and directors will not be converted.

| 9 |

| Risk Factors: | Investing in our securities involves substantial risks. You should carefully review and consider the “Risk Factors” section of this prospectus beginning on page 9 and the other information in this prospectus for a discussion of the factors you should consider before you decide to invest in this offering. | |

| Reverse Split: | All warrant, option, share and per share information in this prospectus gives retroactive effect for a 1-for-1000 split on October 7, 2015, except for certain historical information relating to our 2009 reverse merger and related information, as noted. |

Except as otherwise indicated herein, all information in this prospectus assumes the underwriter does not sell any common stock or warrants contained in the over-allotment option and the warrants offered hereby are not exercised.

Investing in our common stock involves a high degree of risk. Prospective investors should carefully consider the risks described below, together with all of the other information included or referred to in this annual report, before purchasing shares of our common stock. There are numerous and varied risks, known and unknown, that may prevent us from achieving our goals. The risks described below are not the only risks we will face. If any of these risks actually occurs, our business, financial condition or results of operations may be materially adversely affected. In such case, the trading price of our common stock could decline and investors in our common stock could lose all or part of their investment. The risks and uncertainties described below are not exclusive and are intended to reflect the material risks that are specific to us, material risks related to our industry and material risks related to companies that undertake a public offering or seek to maintain a class of securities that is registered or traded on any exchange or over-the-counter market.

Risks Related to our Business

We expect that we may need to raise additional capital in the future beyond any cash flow from our existing business; additional funds may not be available on terms that are acceptable to us, or at all.

We anticipate we may have to raise additional capital in the future to service our debt and to finance our future working capital needs. We cannot assure you that any additional capital will be available on a timely basis, on acceptable terms, or at all. Future equity or debt financings may be difficult to obtain. If we are not able to obtain additional capital as may be required, our business, financial condition and results of operations could be materially and adversely affected.

We anticipate that our capital requirements will depend on many factors, including:

| • | our ability to fulfill backlog; |

| 10 |

| • | our ability to procure additional production contracts; |

| • | our ability to control costs; |

| • | the timing of payments and reimbursements from government and other contracts, including but not limited to changes in federal government military spending and the federal government procurement process; |

| • | increased sales and marketing expenses; |

| • | technological advancements and competitors’ response to our products; |

| • | capital improvements to new and existing facilities; |

| • | our relationships with customers and suppliers; and |

| • | general economic conditions including the effects of future economic slowdowns, acts of war or terrorism and the current international conflicts. |

Even if available, financings may involve significant costs and expenses, such as legal and accounting fees, diversion of management’s time and efforts, and substantial transaction costs. If adequate funds are not available on acceptable terms, or at all, we may be unable to finance our operations, develop or enhance our products, expand our sales and marketing programs, take advantage of future opportunities or respond to competitive pressures.

Current economic conditions may adversely affect our ability to continue operations.

Current economic conditions may continue to cause a decline in business and consumer spending and capital market performance, which could adversely affect our business and financial performance. Our ability to raise funds, upon which we are fully dependent to continue to conduct and expand our operations, may be adversely affected by current and future economic conditions, such as a reduction in the availability of credit, financial market volatility and economic recession.

Our ability to fulfill our backlog may have an effect on our long term ability to procure contracts and fulfill current contracts.

Our ability to fulfill our backlog may be limited by our ability to devote sufficient financial and human capital resources and limited by available material supplies. If we do not fulfill our backlog in a timely manner, we may experience delays in product delivery which would postpone receipt of revenue from those delayed deliveries. Additionally, if we are consistently unable to fulfill our backlog, this may be a disincentive to customers to award large contracts to us in the future until they are comfortable that we can effectively manage our backlog.

Our historical operations depend on government contracts and subcontracts. We face risks related to contracting with the federal government, including federal budget issues and fixed price contracts.

Future general political and economic conditions, which cannot be accurately predicted, may directly and indirectly affect the quantity and allocation of expenditures by federal agencies. Even the timing of incremental funding commitments to existing, but partially funded, contracts can be affected by these factors. Therefore, cutbacks or re-allocations in the federal budget could have a material adverse impact on our results of operations. Given the continued adverse economic conditions, the federal government has slowed its pace with regard to the release of orders for the U.S. military. Since we depend on orders for equipment for the U.S. military for a significant portion of our revenues, this slower release of orders will continue to have a material adverse impact on our results of operations. Obtaining government contracts may also involve long purchase and payment cycles, competitive bidding, qualification requirements, delays or changes in funding, budgetary constraints, political agendas, extensive specification development, price negotiations and milestone requirements. In addition, our government contracts are primarily fixed price contracts, which may prevent us from recovering costs incurred in excess of budgeted costs. Fixed price contracts require us to estimate the total project cost based on preliminary projections of the project’s requirements. The financial viability of any given project depends in large part on our ability to estimate such costs accurately and complete the project on a timely basis. Some of those contracts are for products that are new to our business and are thus subject to unanticipated impacts to manufacturing costs. Given the current economic conditions, it is also possible that even if our estimates are reasonable at the time made, that prices of materials are subject to unanticipated adverse fluctuation. In the event our actual costs exceed fixed contractual costs of our product contracts, we will not be able to recover the excess costs which could have a material adverse effect on our business and results of operations. We examine these contracts on a regular basis and accrue for anticipated losses on these contracts, if necessary. As of September 28, 2014, we had a loss provision of $11 thousand accrued as a result of cost overruns on a contract that completed in the first quarter of fiscal year 2015.

| 11 |

Approximately 95% of our contracts contain termination clauses for convenience. In the event these clauses should be invoked by our customer, future revenues against these contracts could be affected, however these clauses allow for a full recovery of any incurred contract costs plus a reasonable fee up through and as a result of the contract termination. We are currently unaware of any pending terminations on our existing contracts.

In some cases, contract awards may be issued that are subject to renegotiation at a date (up to 180 days) subsequent to the initial award date. Generally, these subsequent negotiations have had an immaterial impact (zero to 5%) on the contract price of the affected contracts. Currently, none of our awarded contracts are subject to renegotiation.

We have sought to mitigate the adverse impact on our results of operations from U.S. military orders by seeking to obtain foreign military orders. In fiscal year 2012, we won a significant bid to secure an $8.0 million five year contact with a foreign military contractor and in the first quarter of fiscal year 2014, we received a quantity add on for an additional $1.0 million to the original contract; however, we do not expect to be awarded this contract, and our other efforts to completely mitigate the negative impact that the slower pace of U.S. military orders has had on our results from operations continue.

There is further uncertainty which arises from the sequestration in early 2013 which may continue to affect business opportunities at the federal government level.

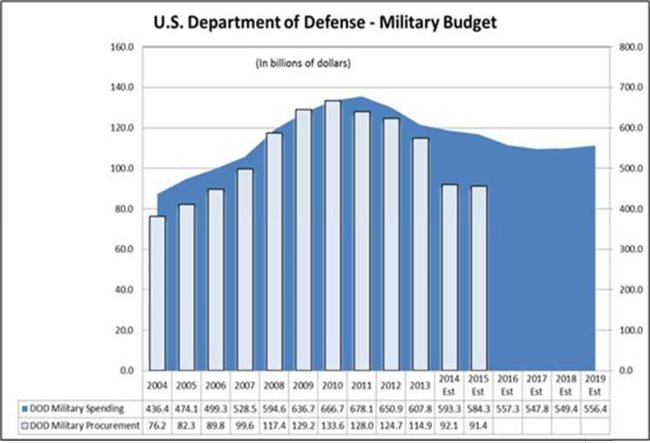

Military spending has been negatively impacted by the Budget Control Act of 2011, which was passed in August 2011. The Budget Control Act mandated a $917.0 billion reduction in discretionary spending over the next decade, and $1.2 trillion in automatic spending cuts over a nine-year period to be split between defense and non-defense programs beginning in January 2013.

In December 2013, the Bipartisan Budget Act of 2013 scaled back mandated reductions in discretionary spending in fiscal 2014 and 2015. Federal spending would thus be larger in these two years, but would be less in subsequent years until 2023. At the funding levels set forth in the Budget Control Act and Budget Bipartisan Act, the fourth brigade set of the Striker would not be funded, resulting in a significant decrease in plastic periscopes sold to GD-Canada starting in fiscal year 2016. The Budget Control Act cuts would potentially slow or stop the development of the follow-on Amphibious Combat Vehicle program to replace the 40-year old legacy Amphibious Assault Vehicles scheduled to start in fiscal year 2016.

On December 12, 2014, Congress passed the National Defense Authorization Act for fiscal year 2015, which is the comprehensive legislation to authorize the budget authority of the Department of Defense and the national security programs of the Department of Energy. The bill authorizes $584.2 billion in defense funding for fiscal year 2015, a decrease of 4% from the authorized funding of $607 billion in fiscal year 2014. Further, many of the funding and program provisions in the measure last only for one year, pushing long-term decisions off to the 2016 fiscal year. As the effect of the mandated budget reductions are scheduled to resume at an increased level starting in fiscal year 2016, the continued uncertainty surrounding the reductions have resulted in further reductions, delays or cancellations of these programs, which could have a further material adverse effect on our business, financial condition and results of operations.

| 12 |

If we fail to scale our operations appropriately in response to growth and changes in demand, we may be unable to meet competitive challenges or exploit potential market opportunities, and our business could be materially and adversely affected.

Our past growth has placed, and any future growth in our historical business is expected to continue to place, a significant strain on our management personnel, infrastructure and resources. To implement our current business and product plans, we will need to continue to expand, train, manage and motivate our workforce, and expand our operational and financial systems and our manufacturing and service capabilities. All of these endeavors will require substantial management effort and additional capital. If we are unable to effectively manage our expanding operations, we may be unable to scale our business quickly enough to meet competitive challenges or exploit potential market opportunities, and our current or future business could be materially and adversely affected.

We do not have employment agreements with our key personnel, other than our Chief Executive Officer, and our management has very minimal unencumbered equity ownership in us. If we are not able to retain our key personnel or attract additional key personnel as required, we may not be able to implement our business plan and our results of operations could be materially and adversely affected.

We depend to a large extent on the abilities and continued participation of our executive officers and other key employees. The loss of any key employee could have a material adverse effect on our business. We currently have only one employment agreement, with our Chief Executive Officer which renews on an annual basis and currently expires on December 1, 2015, and we do not presently maintain “key man” insurance on any key employees. Our management also has minimal unencumbered ownership interest in us, thus limiting their direct stake in our outcome. We believe that as our activities increase and change in character, additional, experienced personnel will be required to implement our business plan. Competition for such personnel is intense, and we cannot assure you that they will be available when required, or that we will have the ability to attract and retain them. In addition, due to our small size, we do not presently have depth of staffing in our executive, operational and financial management areas in order to have an effective succession plan should the need arise. Thus, in the event of the loss of one or more of our management employees, our results of operations could be vulnerable to challenges associated with recruiting additional key personnel, if such recruiting efforts are not successful in a timely manner.

Certain of our products are dependent on specialized sources of supply that are potentially subject to disruption which could have a material, adverse impact on our business.

We have selectively single-sourced some of our material components in order to mitigate excess procurement costs associated with significant tooling and startup costs. Furthermore, because of the nature of government contracts, we are often required to purchase selected items from U.S. government approved suppliers, which may further limit our ability to utilize multiple supply sources for these key components.

To the extent any of these single sourced or government approved suppliers may have disruptions in deliveries due to production, quality, or other issues, we may also experience related production delays or unfavorable cost increases associated with retooling and qualifying alternate suppliers. The impact of delays resulting from disruptions in supply for these items could negatively impact our revenue, our reputation with our customers, and our results of operations. In addition, significant price increases from single-source suppliers could have a negative impact on our profitability to the extent that we are unable to recover these cost increases on our fixed price contracts.

Each contract has a specific quantity of material which needs to be purchased, assembled, and shipped. Prior to bidding a contract, we contact potential sources of material and receive qualified quotations for this material. In some cases, the entire volume is given to a single supplier and in other cases; the volume might be split between several suppliers. If a contract has a single source supplier and that supplier fails to meet their obligations (e.g., quality, delivery), then we would find an alternate supplier and bring this information back to the final customer. Contractual deliverables would then be re-negotiated (e.g., specifications, delivery, price). As of October 14, 2015, approximately 75% of the costs of our material requirements are single-sourced across four suppliers representing approximately 11% of our active supplier orders . The percentage of single sourced materials increased significantly over prior periods due to lower overall purchase order commitments, combined with a change in product mix with a higher percentage of purchase orders in support of the Digital Day and Night program (DDAN) and a lower percentage in support of periscopes. Single-sourced component requirements span across all of our major product lines. The vast majority of these single-sourced components could be provided by another supplier with minimal interruption in schedule (supply delay of 3 months or less) or minimally increased costs. We do not believe these single sourced materials to pose any significant risk to us as other suppliers are capable of satisfying the purchase requirements in a reasonable time period with minimal increases in cost. Of these single sourced components, we have contracts (purchase orders) with firm pricing and delivery schedules in place with each of the suppliers to supply parts in satisfaction of our current contractual needs.

| 13 |

We consider only those specialized single source suppliers where a disruption in the supply chain would result in a period of three months or longer for us to identify and qualify a suitable replacement to present a material financial or schedule risk. In the table below, we identify only those specialized single source suppliers and the product lines supported by those materials utilized by us as of October 14, 2015.

| Product Line |

Supplier | Supply Item |

Risk | Purchase Orders | ||||

| M36 DDAN | Raytheon EO Innovations | Digital camera system | Alternative source would take in excess of six months to qualify | Current firm fixed price & quantity purchase orders are in place with the supplier to meet all contractual requirements. Supplier is on schedule. | ||||

| Periscopes | PolyOne Designed Structures and Solutions LLC | Cast acrylic | Alternative source would take in excess of six months to qualify | Current firm fixed price & quantity purchase orders are in place with the supplier to meet all contractual requirements. Supplier is on schedule. | ||||

| Vision Blocks | Lanzen Fab, Inc. | Steel cases for M88A2 Hercules VB | Alternative source would take in excess of six months to qualify | Current firm fixed price & quantity purchase orders are in place with the supplier to meet all contractual requirements. Supplier is on schedule. | ||||

| Periscopes | Harbor Castings | Steel castings | Alternative source would take in excess of six months to qualify | Current firm fixed price & quantity purchase orders are in place with the supplier to meet all contractual requirements. |

The defense technology supply industry is subject to technological change and if we are not able to keep up with our competitors and/or they develop advanced technology as response to our products, we may be at a competitive disadvantage.

The market for our products is generally characterized by technological developments, evolving industry standards, changes in customer requirements, frequent new product introductions and enhancements, short product life cycles and severe price competition. Our competitors could also develop new, more advanced technologies in reaction to our products. Currently accepted industry standards may change. Our success depends substantially on our ability, on a cost-effective and timely basis, to continue to enhance our existing products and to develop and introduce new products that take advantage of technological advances and adhere to evolving industry standards. An unexpected change in one or more of the technologies related to our products, in market demand for products based on a particular technology or of accepted industry standards could materially and adversely affect our business. We may or may not be able to develop new products in a timely and satisfactory manner to address new industry standards and technological changes, or to respond to new product announcements by others. In addition, new products may or may not achieve market acceptance.

As a result of our November 2014 acquisition of the Applied Optics Product Line line from L-3, we believe we have incurred the following additional risks, which may have a material adverse effect on our business results as we integrate the operations.

As a result of the purchase and integration of the Applied Optics Product Line Line from L-3 with our traditional business lines, the combined businesses are subject to some additional risks which were not formerly present.

| • | AOC has a substantial fixed cost base that is inflexible in the short term to changes in market conditions. This is due to the highly skilled and specialized workforce with established benefits for severance and vacation accruals that may exceed 6 months. In the short term, we may not be able to generate sufficient business revenue to cover these costs, so there will likely be increased cash flow requirements that exceed and would entail our raising additional funds to cover cash flow. |

| 14 |

| • | The manufacturing process entails use of coating equipment chambers which require utilization of higher than expected amounts of electrical power and are thus highly sensitive to changes in energy costs. Current energy rates are locked in for 18 months; however if energy costs increase significantly, it would have a material impact on future financials if AOC were unable to successfully incorporate the increases into priced contracts. |

| • | Above and beyond the normal risks to retain skilled personnel, there may be an inability to retain the specialized work force of AOC as a result of the changed corporate climate and the difference in corporate values of L-3 and us. A failure to retain such personnel could result in a material adverse ability to produce the traditional AOC products or cause delays and additional costs as we would need to train new personnel. |

Unexpected warranty and product liability claims could adversely affect our business and results of operations.

The possibility of future product failures could cause us to incur substantial expense to repair or replace defective products. Some of our customers require that we warrant the quality of our products to meet customer requirements and be free of defects for twelve to fifteen months subsequent to delivery. As of September 28, 2014, approximately 80% of our current contract deliveries were covered by these warranty clauses. We establish reserves for warranty claims based on our historical rate of less than one percent of returned shipments against these contracts. There can be no assurance that this reserve will be sufficient if we were to experience an unexpectedly high incidence of problems with our products. Significant increases in the incidence of such claims may adversely affect our sales and our reputation with consumers. Costs associated with warranty and product liability claims could materially affect our financial condition and results of operations.

We derive almost all of our revenue from three customers and the loss of any of these customers could have a material adverse effect on our revenues.

For the year ended September 28, 2014, we derived approximately 83% of our gross operating revenue from three customers: 44% from General Dynamics Land Systems Divisions, 32% from the U.S. Government (primarily DLA/Warren), and 7% from BAE Systems. Procuring new customers and contracts may partially mitigate this risk. In particular, a decision by either General Dynamics Land System Divisions or DLA/Warren to cease issuing contracts to us could have a significant material impact on our business and results of operations given that they represent 76% of our gross business revenue. There can be no assurance that we could replace these customers on a timely basis or at all.

We have approximately 75 discrete contracts with General Dynamics Land System Division and the U.S. Government (primarily DLA/Warren), and other prime contractors. If they choose to terminate these contracts, we are entitled to fully recover all contractual costs and reasonable profits incurred up to or as a result of the terminated contract.

We only possess two patents and rely primarily on trade secrets to protect our intellectual property.

We utilize several highly specialized and unique processes in the manufacture of our products, for which we rely solely on trade secrets to protect our innovations. We cannot assure you that we will be able to maintain the confidentiality of our trade secrets or that our non-disclosure agreements will provide meaningful protection of our trade secrets, know-how or other proprietary information in the event of any unauthorized use, misappropriation or other disclosure. The non-disclosure agreements that are designed to protect our trade secrets could be breached, and we might not have adequate remedies for the breach.

| 15 |

It is also possible that our trade secrets will otherwise become known or independently developed by our competitors, many of which have substantially greater resources than us, and these competitors may have applied for or obtained, or may in the future apply for or obtain, patents that will prevent, limit or interfere with our ability to make and sell some of our products. Although based upon our general knowledge (and we have not conducted patent searches), we believe that our products do not infringe on the patents or other proprietary rights of third parties; however, we cannot assure you that third parties will not assert infringement claims against us or that such claims will not be successful.

We have two outstanding patent applications. While we are optimistic that our applications will be approved, we cannot guarantee that these patent applications will ever result in actual patents being awarded. The applications were based on technology which is believed to be unique; however, there are many companies and many patents already awarded in this space. Further, the time frame for the US Patent and Trademark Office to review the patent application and engage in negotiations cannot be guaranteed.

In the future, we may look to acquire other businesses in our industry and the acquisitions will require us to use substantial resources.

In the future, we may decide to pursue acquisitions of other businesses in our industry. In order to successfully acquire other businesses, we would be forced to spend significant resources for both acquisition and transactional costs, which could divert substantial resources in terms of both financial and personnel capital from our current operations. Additionally, we might assume liabilities of the acquired business, and the repayment of those liabilities could have a material adverse impact on our cash flow. Furthermore, when a new business is integrated into our ongoing business, it is possible that there would be a period of integration and adjustment required which could divert resources from ongoing business operations.

Conversion of our Series A and Series B preferred stock could cause substantial dilution to our existing common stock holders, and certain other rights of the preferred stock holders present other risks to our existing common stock holders.

As of October 14, 2015, we had 179,572 shares of our common stock issued and outstanding. The outstanding shares of Series A preferred stock are currently convertible into 2,748,228 shares of our common stock, and the outstanding shares of Series B preferred stock are currently convertible into 647,667 shares of our common stock, which represents 95.1% of our outstanding common stock assuming a conversion of the Series A and Series B preferred stock into shares of our common stock. This would greatly dilute the holdings of our existing common stockholders. In addition, prior to any conversion, the preferred shareholders vote on an as-converted-to-common stock, one-to-one basis with our common shareholders.

Furthermore, in the event of liquidation, the holders of our Series A preferred stock and Series B preferred stock would receive priority liquidation payments before payments to common shareholders equal to the amount of the stated value of the preferred stock before any distributions would be made to our common shareholders. The total stated value of our preferred stock is $8,489,729, so the preferred shareholders would be entitled to receive the amount of the stated value before any distributions could be made to common shareholders. The liabilities on our balance sheet exceed the liquidation value of our assets; therefore, upon liquidation, there would be no assets remaining for distribution to common shareholders.

The preferred shareholders also have the right, by majority vote of the shares of preferred stock, to generally approve any issuances by us of equity and/or indebtedness, other than trade indebtedness in the ordinary course. Therefore, the preferred shareholders can effectively prevent us from entering into a transaction which they feel is not in their best interests, even if the transaction might otherwise be in the best interests of us and our common shareholders.

| 16 |

The Financial Industry Regulatory Authority, or FINRA, has adopted sales practice requirements which may also limit a shareholder’s ability to buy and sell our stock.

FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

| 17 |

The elimination of monetary liability against our directors, officers and employees under Delaware law and the existence of indemnification rights to our directors, officers and employees may result in substantial expenditures by us and may discourage lawsuits against our directors, officers and employees.

We provide indemnification to our directors and officers to the extent provided by Delaware law. The foregoing indemnification obligation could result in our incurring substantial expenditures to cover the cost of settlement or damage awards against directors and officers, which we may be unable to recoup. These provisions and resultant costs may also discourage us from bringing a lawsuit against directors and officers for breaches of their fiduciary duties and may similarly discourage the filing of derivative litigation by our stockholders against our directors and officers even though such actions, if successful, might otherwise benefit us and our stockholders.

RISKS RELATED TO THIS OFFERING

We may allocate net proceeds from this offering in ways which differ from our estimates based on our current plans and assumptions discussed in the section entitled “Use of Proceeds” and with which you may not agree.

The allocation of net proceeds of the offering set forth in the “Use of Proceeds” section below represents our estimates based upon our current plans and assumptions regarding industry and general economic conditions, our future revenues and expenditures. The amounts and timing of our actual expenditures will depend on numerous factors, including market conditions, cash generated by our operations and business developments. We may find it necessary or advisable to use portions of the proceeds from this offering for other purposes. Circumstances that may give rise to a change in the use of proceeds and the alternate purposes for which the proceeds may be used are discussed in the section entitled “Use of Proceeds” below. You may not have an opportunity to evaluate the economic, financial or other information on which we base our decisions on how to use the proceeds. As a result, you and other stockholders may not agree with our decisions. See “Use of Proceeds” section for additional information.

| 18 |

You will experience immediate and substantial dilution as a result of this offering and may experience additional dilution in the future.

You will incur immediate and substantial dilution as a result of this offering. After giving effect to the sale by us of up to ______ shares of common stock and corresponding warrants offered in this offering at a public offering price of $___ per share, and after deducting underwriter discounts and commissions and estimated offering expenses payable by us, investors in this offering can expect an immediate dilution of $___ per share, at the public offering price, assuming no exercise of the warrants. In addition, in the past, we issued options and warrants to acquire shares of common stock and may need to do so in the future to support our operations. To the extent these options and/or warrants are ultimately exercised, you will sustain future dilution.

Holders of warrants will have no rights as common stockholders until such holders exercise their warrants and acquire our common stock.

Until holders of warrants acquire shares of our common stock upon exercise of the warrants, holders of warrants will have no rights with respect to the shares of our common stock underlying such warrants. Upon exercise of the warrants, the holders will be entitled to exercise the rights of a common stockholder only as to matters for which the record date occurs after the exercise date.

RISKS RELATED TO OUR COMMON STOCK

We have issued a large number of shares of preferred stock, warrants and options, which if converted or exercised would substantially increase the number of common shares outstanding.

On October 14, 2015, we had 179,572 shares of common stock outstanding, and (a) we have warrants outstanding that, if fully exercised, would generate proceeds of $100,000, and cause us to issue up to an additional 1,000 shares of common stock, and (b) we have options outstanding to purchase common stock that, if fully exercised, would generate proceeds of $750,922 and result in the issuance of an additional 40,266 shares of common stock, and (c) we have 1001 shares of Series A preferred stock and 994 shares of Series B preferred stock that, if fully converted, would result in the issuance of an additional 3,395,895 shares of common stock. Future sales after this offering of our common stock, warrants, options and Series A and Series B preferred stock may also adversely affect our stock price and our ability to raise funds in new offerings.

As a key component of our growth strategy we have provided and intend to continue offering compensation packages to our management and employees that emphasize equity-based compensation and would thus cause further dilution.

Historically, we have not paid dividends on our common stock, and we do not anticipate paying any cash dividends in the foreseeable future.

We have never paid cash dividends on our common stock. We intend to retain our future earnings, if any, to fund operational and capital expenditure needs of our business, and we do not anticipate paying any cash dividends in the foreseeable future. As a result, capital appreciation, if any, of our common stock will be the sole source of gain for our common stockholders in the foreseeable future.

Our stock price is speculative and there is a risk of litigation.

The trading price of our common stock has in the past and may in the future be subject to wide fluctuations in response to factors such as the following:

| • | revenue or results of operations in any quarter failing to meet the expectations, published or otherwise, of the investment community; |

| • | speculation in the press or investment community; |

| • | wide fluctuations in stock prices, particularly with respect to the stock prices for other defense industry companies; |

| 19 |

| • | announcements of technological innovations by us or our competitors; |

| • | new products or the acquisition of significant customers by us or our competitors; |

| • | changes in investors’ beliefs as to the appropriate price-earnings ratios for us and our competitors; |

| • | changes in management; |

| • | sales of common stock by directors and executive officers; |

| • | rumors or dissemination of false or misleading information, particularly through Internet chat rooms, instant messaging, and other rapid-dissemination methods; |

| • | conditions and trends in the defense industry generally; |

| • | the announcement of acquisitions or other significant transactions by us or our competitors; |

| • | adoption of new accounting standards affecting our industry; |

| • | general market conditions; |

| • | domestic or international terrorism and other factors; and |

| • | the other factors described in this section. |

Fluctuations in the price of our common stock may expose us to the risk of securities class action lawsuits. Although no such lawsuits are currently pending against us and we are not aware that any such lawsuit is threatened to be filed in the future, there is no assurance that we will not be sued based on fluctuations in the price of our common stock. Defending against such suits could result in substantial cost and divert management’s attention and resources. In addition, any settlement or adverse determination of such lawsuits could subject us to significant liability.

Future sales of our common stock could depress our stock price.

Sales of a large number of shares of our common stock, or the availability of a large number for sale, could materially adversely affect the per share market price of our common stock and could impair our ability to raise funds in addition offering of our debt or equity securities. In the event that we propose to register shares of common stock under the Securities Act for our own account, certain shareholders are entitled to include their shares in the registration, subject to limitations described in the agreements granting these rights.

We are applying for listing of our common stock and the warrants issued in this offering on the NASDAQ Capital Market. If we fail to comply with the continuing listing standards of The NASDAQ Capital Market, our securities could be delisted.

We expect that our common stock and warrants will be eligible to be listed on the NASDAQ Capital Market. For our common stock and warrants to be listed on the NASDAQ Capital Market, we must meet the current NASDAQ Capital Market initial and continued listing requirements. If we were unable to meet these requirements, our common stock and warrants could be delisted from the NASDAQ Capital Market. If our common stock and warrants were to be delisted from the NASDAQ Capital Market, our common stock and warrants could continue to trade on the over-the-counter bulletin board following any delisting from the NASDAQ Capital Market. Any such delisting of our common stock and warrants could have an adverse effect on the market price of, and the efficiency of the trading market for, our common stock and warrants, not only in terms of the number of shares that can be bought and sold at a given price, but also through delays in the timing of transactions and less coverage of us by securities analysts, if any. Also, if in the future we were to determine that we need to seek additional equity capital, it could have an adverse effect on our ability to raise capital in the public or private equity markets.

| 20 |

Risks Associated with Our Reverse Stock Split

On October 7, 2015, we effected a one-for-1000 reverse stock split. However, the reverse stock split may not result in a proportionate increase in the price of our common stock, in which case we may not be able to list our common stock and the warrants sold in this offering on The NASDAQ Capital Market, in which case this offering will not be completed.

We expect that the one-for-1000 reverse stock split of our outstanding common stock will increase the market price of our common stock so that we will be able to meet the minimum bid price requirement of the listing rules of The NASDAQ Capital Market. However, the effect of a reverse stock split upon the market price of our common stock cannot be predicted with certainty. It is possible that the market price of our common stock following the reverse stock split will not increase sufficiently for us to be in compliance with the minimum bid price requirement. If we are unable meet the minimum bid price requirement, we may be unable to list our shares on The NASDAQ Capital Market, in which case this offering will not be completed.

Even if the reverse stock split increases the market price of our common stock, there can be no assurance that we will be able to comply with other continued listing standards of The NASDAQ Capital Market.

Even if the market price of our common stock increases sufficiently so that we comply with the minimum bid price requirement, we cannot assure you that we will be able to comply with the other standards that we are required to meet in order to maintain a listing of our common stock and/or warrants sold in this offering on The NASDAQ Capital Market. Our failure to meet these requirements may result in our common stock and/or warrants sold in this offering being delisted from The NASDAQ Capital Market, irrespective of our compliance with the minimum bid price requirement.

The reverse stock split may decrease the liquidity of the shares of our common stock.

The liquidity of the shares of our common stock may be affected adversely by the reverse stock split given the reduced number of shares that will be outstanding following the reverse stock split, especially if the market price of our common stock does not increase as a result of the reverse stock split.

| 21 |

Following the reverse stock split, the resulting market price of our common stock may not attract new investors, including institutional investors, and may not satisfy the investing requirements of those investors. Consequently, the trading liquidity of our common stock may not improve.

Although we believe that a higher market price of our common stock may help generate greater or broader investor interest, there can be no assurance that the reverse stock split will result in a market price that will attract new investors, including institutional investors. In addition, there can be no assurance that the market price of our common stock will satisfy the investing requirements of those investors. As a result, the trading liquidity of our common stock may not necessarily improve.

Cautionary Note Regarding Forward-Looking Information

This prospectus, in particular the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” appearing herein, contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”). These forward-looking statements represent our expectations, beliefs, intentions or strategies concerning future events, including, but not limited to, any statements regarding our assumptions about financial performance; the continuation of historical trends; the sufficiency of our cash balances for future liquidity and capital resource needs; the expected impact of changes in accounting policies on our results of operations, financial condition or cash flows; anticipated problems and our plans for future operations; and the economy in general or the future of the electrical storage device industry, all of which are subject to various risks and uncertainties.

When used in this prospectus as well as in reports, statements, and information we have filed with the Securities and Exchange Commission, in our press releases, presentations to securities analysts or investors, in oral statements made by or with the approval of an executive officer, the words or phrases “believes,” “may,” “will,” “expects,” “should,” “continue,” “anticipates,” “intends,” “will likely result,” “estimates,” “projects” or similar expressions and variations thereof are intended to identify such forward-looking statements. However, any statements contained in this prospectus that are not statements of historical fact may be deemed to be forward-looking statements. We caution that these statements by their nature involve risks and uncertainties, certain of which are beyond our control, and actual results may differ materially depending on a variety of important factors.

We estimate that we will receive up to $12,000,000 in gross proceeds from the sale of common stock (and a potential additional $1,800,000 if the entire overallotment is exercised) and corresponding warrants in this offering, based on a price of $5.00 per share of common stock, which is the closing price of our common stock on ____ __, 2015, and corresponding warrant and after deducting estimated underwriter fees and estimated offering expenses payable by us. If all of the warrants issued in this offering are exercised for cash, then we will receive an additional $___ of proceeds. It is possible that the warrants may be exercised on a cashless basis or expire prior to being exercised, in which case we will not receive any additional proceeds. If the underwriters exercise their over-allotment option in full, we estimate that the net proceeds from this offering will be approximately $10,575,000, excluding the proceeds, if any, from the exercise of any warrants issued in the over-allotment option. We cannot predict when or if any of the warrants will be exercised.

We intend to use the net proceeds from this offering for the following purposes:

| Proceeds: | ||||

| Gross Proceeds | $ | 12,000,000 | ||

| Underwriter Discount, Fees and Expenses | (1,425,000 | ) | ||

| Net Proceeds | $ | 10,575,000 | ||

| Uses: | ||||

| Working Capital & Operating Expenses | 3,575,000 | |||

| Sales, Marketing & Business Development | 1,000,000 | |||

| Acquisitions | 6,000,000 | |||

| Total Uses | $ | 10,575,000 |

| 22 |

The allocation of the net proceeds of the offering set forth above represents our estimates based upon our current plans and assumptions regarding industry and general economic conditions, our future revenues and expenditures.

With respect to the portion of the use of proceeds to be utilized for acquisitions, we have not yet identified specific businesses as potential acquisitions, thus we are not in negotiations regarding any such acquisitions, although we seek to commence active searches for such businesses in the fourth quarter of fiscal 2015. The nature of businesses sought are smaller divisions of major defense industry manufacturers which will provide accretive and compatible businesses to our core business, much as our Applied Optics Product Line acquisition in November 2014. We seek to acquire businesses which manufacture products which are compatible with our main night vision products for the defense and commercial industries to either or both provide supply of main components of our products and/or expand our product offerings.