Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - Hongli Clean Energy Technologies Corp. | v421762_ex31-1.htm |

| EX-99.9 - EXHIBIT 99.9 - Hongli Clean Energy Technologies Corp. | v421762_ex99-9.htm |

| EX-21 - EXHIBIT 21 - Hongli Clean Energy Technologies Corp. | v421762_ex21.htm |

| EX-4.1 - EXHIBIT 4.1 - Hongli Clean Energy Technologies Corp. | v421762_ex4-1.htm |

| EX-3.3 - EXHIBIT 3.3 - Hongli Clean Energy Technologies Corp. | v421762_ex3-3.htm |

| EX-3.4 - EXHIBIT 3.4 - Hongli Clean Energy Technologies Corp. | v421762_ex3-4.htm |

| EX-99.7 - EXHIBIT 99.7 - Hongli Clean Energy Technologies Corp. | v421762_ex99-7.htm |

| EX-31.2 - EXHIBIT 31.2 - Hongli Clean Energy Technologies Corp. | v421762_ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Hongli Clean Energy Technologies Corp. | v421762_ex32-1.htm |

| EX-99.8 - EXHIBIT 99.8 - Hongli Clean Energy Technologies Corp. | v421762_ex99-8.htm |

| EX-32.2 - EXHIBIT 32.2 - Hongli Clean Energy Technologies Corp. | v421762_ex32-2.htm |

| EX-10.45 - EXHIBIT 10.45 - Hongli Clean Energy Technologies Corp. | v421762_ex10-45.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

| þ | annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| For the fiscal year ended | June 30, 2015 |

or

| ¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| For the transition period from | __________________________________ to _________________________________ |

| Commission File Number: | 001-15931 |

| HONGLI CLEAN ENERGY TECHNOLOGIES CORP. |

| (Exact name of issuer as specified in its charter) |

| Florida | 98-0695811 | |

| (State or other jurisdiction of incorporation or | (I.R.S. employer identification number) | |

| organization) | ||

| Kuanggong Road and Tiyu Road 10th Floor | ||

| Chengshi Xin Yong She, Tiyu Road | ||

| Xinhua District | ||

| Pingdingshan, Henan Province | ||

| People’s Republic of China | 467000 | |

| (Address of principal executive offices) | (Zip Code) |

| Registrant’s telephone number, including area code | +86-3752882999 |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common stock, $0.001 par value | NASDAQ Capital Market |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every, Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Sec. 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

| Large Accelerated Filer o | Accelerated Filer o | |

| Non-accelerated filer o | Smaller reporting company þ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

As of December 31, 2014, the aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $45 million, based on a closing price of $2.81 per share of common stock as reported on the NASDAQ Stock Market on such date.

As of October 12, 2015, the registrant had 23,960,217 shares of common stock outstanding.

TABLE OF CONTENTS

TO ANNUAL REPORT ON FORM 10-K

FOR YEAR ENDED JUNE 30, 2015

| i |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K (the “Report”) and other reports (collectively the “Filings”) filed by the registrant from time to time with the Securities and Exchange Commission (the “SEC”) contain or may contain forward looking statements and information that are based upon beliefs of, and information currently available to, the registrant’s management as well as estimates and assumptions made by the registrant’s management. When used in the filings the words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan” or the negative of these terms and similar expressions as they relate to the registrant or the registrant’s management identify forward looking statements. Such statements reflect the current view of the registrant with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this Report entitled “Risk Factors”) relating to the registrant’s industry, the registrant’s operations and results of operations and any businesses that may be acquired by the registrant. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although the registrant believes that the expectations reflected in the forward looking statements are reasonable, the registrant cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, the registrant does not intend to update any of the forward-looking statements to conform these statements to actual results. The following discussion should be read in conjunction with the registrant’s financial statements and the related notes thereto included in this Report.

In this Report, “we,” “our,” “us,” “CETC” or the “Company” sometimes refers collectively to Hongli Clean Energy Technologies Corp. and its subsidiaries and affiliated companies.

| ii |

| ITEM 1. | Business. |

General Overview

We are a vertically-integrated coal and coke producer based in Henan Province, People’s Republic of China (“PRC” or “China”). Our products currently include washed coal, “medium” or mid-coal and coal slurries, coke, coke powder, coal tar and crude benzol, synthetic gas (“syngas”) and electricity. We generate synthetic gas (or “syngas”) which is converted from coke using our coke gasification facility since October 2014. We also generate electricity from gas emitted during the coking process, which we use primarily to power our operations. We anticipate continuing our efforts to reduce our reliance on coal products and expand into the clean energy industry.

In May 2014, we commenced plans to further extend our coal and coke operations into the clean-burning synthetic gas field. In July 2014, we started an investment plan of approximately $7.8 million or RMB 48 million to build a coke gasification facility for the conversion of coke into clean-burning syngas. The facility, termed our “Stage I facility,” was completed at the end of September 2014 and commenced its production in October 2014. The Stage I facility has a designed annual capacity of 219,000,000 cubic meters of syngas or 25,000 cubic meters of syngas per hour. In November 2014, with one month’s operating experience at running the Stage I facility, we conducted a technique upgrade on the Stage I facility to increase the designed capacity of the facility (a “Stage II facility”). The upgrade was fully completed in July 2015. With the completion of the technique upgrade, the Stage II facility’s designed annual coke gasification capacity was expanded to 438,000,000 cubic meters of syngas or 50,000 cubic meters of syngas per hour.

On August 28, 2014, we entered into a cooperative agreement with the North China Institute of Science and Technology regarding underground coal gasification technique (“UCG”) development to refine and implement advanced techniques to convert our coal into syngas. Our ultimate target is to build a UCG facility with an annual production capacity of 7,708,800,000 cubic meters of syngas or 880,000 cubic meters of syngas per hour in all four of our coal mines. The UCG project was approved by the Science and Technology Bureau of Baofeng County as a local Scientific and Technological Practical Project, and it was granted the privilege to refine the coal under Baofeng Coking Factory, which may have coal materials of approximately 216,200 tons shown on our primarily test, as a trial project for UCG technique development. We entered into a construction agreement on June 16, 2015 to build a UCG facility and commenced the construction of the trial project of the Scientific and Technological Practical Project at the end of June 2015. This UCG trial project is under the joint supervision of the Science and Technology Bureau of Baofeng County and North China Institute of Science and Technology (“Supervisors”) and requires further tests and approval from the Supervisors upon our completion of construction and equipment installation. As of June 30, 2015, we had invested $2,619,172 (RMB 16,000,000) in the construction of this UCG trial project. This UCG trial project is divided into several stages and each stage requires a periodical acceptance test conducted by the Supervisors. The first stage of the construction was completed in July 2015 and is in the process of the Supervisors’ examination. We expect the periodical acceptance test to be finished in October 2015. After the Supervisors provide their approval we would be able to proceed to our next stage of project development. It is anticipated that the construction of this trial project will be completed in March 2016, and is estimated to cost up to $5 million. Once the construction is completed, it requires another 6 months of preliminary operations for final testing which will be monitored by the Supervisors. With the final approval from the Supervisors, we will be able to implement our UCG techniques in our coal mines.

We also commenced our underground safety project in June 2015, which was for coal mining safety construction, in all of our existing coal mines to comply with legal safety requirements. We estimate such construction will be completed in December 2015. Once we obtain final approval from the Supervisors at Baofeng Scientific and Technological Practical Project, we would be able to implement our UCG techniques in our coal mines.

With the coke and coal gasification implementation plans, we are in the process of transforming from a producer of coal and coke products to a multifunctional energy company engaged in providing coal, coke, and clean-burning syngas.

Due to the continuing provincial-wide consolidation program in Henan, all small to mid-scale mines are required to be consolidated and undergo mandatory safety checks and inspections by relevant authorities before receiving clearance to resume coal mining operations. This requirement applies to all CETC mines. The Company is in the processing of seeking other ways to restructure or resume our coal mine operations. Our underground gasification project is one of the effective ways that the Company can resume its coal mine operations.

Our business operations are conducted by Henan Province Pingdingshan Hongli Coal & Coke Co., Ltd. (“Hongli”), which we control through contractual arrangements that Hongli and its owners have entered into with Pingdingshan Hongyuan Energy Science and Technology Development Co., Ltd. (“Hongyuan”), a wholly-owned subsidiary of Top Favour Limited (“Top Favour”), a British Virgin Island company and our wholly owned subsidiary. These contractual arrangements provide for management and control rights, and in addition entitle us to receive the earnings and control the assets of Hongli. Other than our interests in the contractual arrangements, we do not own any equity interests in Hongli.

Currently:

| · | Coking related operations, including coke gasification, are carried out by Hongli and its branch, Baofeng Coking Factory (“Baofeng Coking”), and a coking facility (the “Hongfeng plant”) we leased from Pingdingshan Hongfeng Coal Processing and Coking, Ltd. Starting in July 2014, the Baofeng plant has been temporarily closed as its old facilities cannot comply with the new Chinese coking industry entry standards. It is now pending for upgrade in order to better assist the UCG project development in the future. |

| · | Coal related operations, including underground coal gasification, are under the following three subsidiaries of Hongli, although all mining activities are currently on hold pending the ongoing mining moratorium (see “Our Products and Operations – Coal – Coal Mining Moratorium” below): |

| (1) | Baofeng Hongchang Coal Co., Ltd. (“Hongchang Coal”); |

| (2) | Baofeng Shuangrui Coal Mining Co., Ltd. (“Shuangrui Coal”), which is wholly owned by Hongchang Coal; and |

| (3) | Baofeng Xingsheng Coal Mining Co., Ltd. (“Xingsheng Coal”). |

| · | Electricity generation is carried out by Baofeng Hongguang Environment Protection Electricity Generating Co., Ltd. (“Hongguang Power”), also a wholly owned subsidiary of Hongli. As Hongguang Power mainly uses the gas produced during coking from our Baofeng plant to generate electricity, it has been temporarily closed following the Baofeng plant closing in July 2014. Thus, we did not generate any electricity in fiscal 2015, but plan to resume our Hongguang Power operations in the future when we are able to do so. |

We originally intended to transfer all coal mining operations from Hongli’s subsidiaries to a joint-venture established with Henan Province Coal Seam Gas Development and Utilization Co., Ltd. (“Henan Coal Seam Gas”), a state-owned enterprise and qualified provincial-level coal mine consolidator. The joint-venture, Henan Hongyuan Coal Seam Gas Engineering Technology Co., Ltd. (“Hongyuan CSG”), has been established, although our planned transfer of coal related activities to Hongyuan CSG has not been carried out as of the date of this Report. Our interests in Hongyuan CSG are held by Henan Zhonghong Energy Investment Co., Ltd. (“Zhonghong”), which equity interests are presently held on Hongli’s behalf and for its benefit by three nominees pursuant to share entrustment agreements. However, due to the imposition of the provincial-wide mining moratorium since June 2010, and the change of the Company’s original plan from developing coal mining operations to producing syngas, the plan to transfer the related operations was halted and we will decide whether to execute the original plan based on the mining moratorium status and syngas business development in the future. As of the date of this filing, our coal related operations have not been transferred to the joint-venture, and Shuangrui Coal and Xingsheng Coal have had no operations since their acquisitions by the Company.

| 2 |

In addition, once we complete construction of our new coking plant with an annual production capacity of 900,000 metric tons, we intend to operate the plant through Baofeng Hongrun Coal Chemical Co., Ltd. (“Hongrun Coking”), a wholly-owned subsidiary of Hongli. As of the date of this Report, however, construction is not actively proceeding (see “Our Products and Operations – Coke – New Coking Facility” below), and Hongrun Coking has not commenced operations.

On April 8, 2015, we renewed our lease of a coking facility (the “Hongfeng plant”) from Pingdingshan Hongfeng Coal Processing and Coking, Ltd. for an additional year. We began leasing the Hongfeng plant in April 2013. The Hongfeng plant has an annual capacity of 200,000 metric tons and is approximately 3 miles from our Baofeng plant. We believe that the skills we gain from operating such coke ovens will be invaluable for operating our 900,000 metric ton facility that is still under construction (the “new plant”).

In July 2014, we started construction to retrofit our existing coking facility to produce clean-burning syngas. The Stage I construction of this facility, which included the installation of gas furnaces, electrical equipment and consoles, as well as transporting system, dust removal system, and cooling and purification system was completed in September 2014. It commenced its production in October 2014. At full capacity, this facility could produce approximately 25,000 cubic meters of syngas per hour or 219,000,000 cubic meters of syngas a year. In November 2014, we conducted a technique upgrade on the Stage I facility to increase the designed capacity of the facility (Stage II facility). The upgrade project was started from November 2014 and fully completed in July 2015. With the completion of the technique upgrade, the Stage I facility’s designed annual coke gasification capacity was expanded to 438,000,000 cubic meters of syngas or 50,000 cubic meters of syngas per hour.

As of June 30, 2015, we have working capital of $25,400,753. On September 18, 2014, we sold 2,818,845 shares of our common stock for $14.3 million. However, our cash flow from operating activities during the year ended June 30, 2015 was an inflow of only $530,514 and our cash balance was $81,605 as of June 30, 2015, comparing to our short-term loans of $44.5 million which will due in the next 12 months. Our ability to continue as a going concern depends upon our expenditure requirements and repayments of our short-term and long-term loan facilities with Bairui Trust Co., Ltd. (“Bairui Trust”) as and when they fall due. See “Risk Factors – Risks Related to Our Business – If we cannot continue as a going concern, you will lose your entire investment” and “If we do not raise additional capital or refinance our debt, we will not be able to achieve our objectives and we may need to curtail or even discontinue operations”.

History and Corporate Structure

We were incorporated in Florida on September 30, 1996, originally under the name “J. B. Financial Services, Inc.” We changed our name to “Ableauctions.com, Inc.” on July 19, 1999.

On December 30, 2009, our shareholders approved a Plan and Agreement of Share Exchange, dated July 17, 2009, with Top Favour under which we agreed to acquire all of the outstanding capital stock of Top Favour in exchange for the issuance of 13,117,952 shares of our common stock to the shareholders of Top Favour (the “Share Exchange”). The Share Exchange was consummated on February 5, 2010.

On March 11, 2010, we completed two private placement financings, pursuant to exemptions under Regulation S and Regulation D, respectively, in which we sold and issued a total of 7,344,935 shares of common stock, and five-year warrants for the purchase of an additional 3,789,631 shares of common stock, resulting in aggregate proceeds of $44 million.

On September 24, 2014, we completed a registered sale of our common stock with two institutional investors under our shelf registration statement on Form S-3 pursuant to a Securities Purchase Agreement executed on September 18, 2014. Gross proceeds from the offering were approximately $14.3 million in exchange of 2,818,845 shares of the Company’s common stock.

Effective on July 13, 2015, we changed our name to “Hongli Clean Energy Technologies Corp.”, and we started trading in NASDAQ Capital Market under the aforesaid name and trading symbol of “CETC” on July 28, 2015.

| 3 |

Top Favour

Top Favour is a holding company incorporated in the British Virgin Islands on July 2, 2008. Top Favour was formed by the Owners (defined below) as a special vehicle for raising capital outside of the PRC. Other than holding 100% of the equity interests in Hongyuan and facilitating loan transactions for Hongli and its subsidiaries, Top Favour has no operations of its own.

Hongyuan

Hongyuan is a limited liability company organized in the PRC with registered capital of $3 million and is wholly-owned by Top Favour. Hongyuan was approved as a wholly foreign owned enterprise (“WFOE”) by the Henan government on February 26, 2009 and formally organized on March 18, 2009. Other than activities relating to its contractual arrangements with Hongli, Hongyuan has no separate operations of its own.

Hongli

Hongli is a limited liability company organized in the PRC on July 5, 1996, and held by four Chinese nationals (the “Owners”) initially as follows: 83.66% by Mr. Jianhua Lv, our Chairman and Chief Executive Officer, 6.44% by Ms. Xin Zheng, 4.95% by Mr. Wenqi Xu, and 4.95% by Mr. Guoxiang Song. In August 2010, the Pingdingshan government directed Hongli to increase its registered capital from 8,808,000 Renminbi (“RMB”) to RMB 28,080,000 in order to maintain its coal trading license. Accordingly, the Owners contributed the additional registered capital in full in August 2010, although not in proportion to their original ownership percentages: Mr. Lv and Ms. Zheng increased their holdings to 85.40% and 9.19%, respectively, while Mr. Xu and Mr. Song decreased their holdings to 3.99% and 1.42%, respectively. Registration of such additional contribution and change in ownership percentages with Pingdingshan’s Administration for Industry and Commerce (“AIC”) was completed in April 2011.

Currently, Hongli has a branch, six subsidiaries and a joint-venture as follows (each a “Hongli company,” and with Hongli collectively “Hongli Group”):

Branch:

| · | Baofeng Coking was established on May 31, 2002 as a branch of Hongli. |

Subsidiaries:

| · | Hongchang Coal is a limited liability company formed in the PRC on July 19, 2007 with registered capital of RMB 3 million. Hongchang Coal is wholly-owned by Hongli and holds the rights to mine Hongchang coal mine. Hongli also holds the rights to mine Shunli coal mine. |

| · | Hongguang Power is a limited liability company formed in the PRC on August 1, 2006 with registered capital of RMB 22 million. Hongguang Power is wholly owned by Hongli. |

| · | Hongrun Coking is a limited liability company formed in the PRC on May 17, 2011 with registered capital of RMB 30 million. Hongrun Coking is a wholly-owned subsidiary of Hongli. |

| · | Shuangrui Coal is a limited liability company formed in the PRC on March 17, 2009 with registered capital of RMB 4,029,960. Hongchang Coal currently holds 100% of the equity interests of Shuangrui Coal. Hongli initially acquired 60% of such interests on May 20, 2011, and when it acquired the remaining 40% on June 20, 2012, Hongli concurrently transferred all 100% of Shuangrui Coal to Hongchang Coal, which transfer has been registered with the Pingdingshan AIC. As of the date of this Report, Hongli has not yet paid any consideration for the 40% as negotiation with its seller remains ongoing, although we have accrued for such consideration of $4.7 million or RMB 29 million based on its fair market value. Shuangrui Coal holds the rights to mine the Shuangrui coal mine. We intend to dissolve Shuangrui Coal in the future and consolidate its mine assets under Hongchang Coal. |

| 4 |

| · | Xingsheng Coal is a limited liability company formed in the PRC on December 6, 2007 with registered capital of RMB 3,634,600. Hongli currently holds 60% of the equity interests of Xingsheng Coal. Xingsheng Coal holds the rights to mine the Xingsheng coal mine. |

| · | Zhonghong is a limited liability company formed in the PRC on December 30, 2010 with registered capital of RMB 10,010,000, which was increased to RMB 20 million on April 14, 2011, and to RMB 51 million on July 12, 2011. Zhonghong’s equity interests are presently held on Hongli’s behalf and for its benefit by three nominees pursuant to share entrustment agreements, namely, Messrs. Hui Zheng and Jiangong Fan, vice president of operations and a department manager at Hongli, respectively, and an unrelated party who also serves as Zhonghong’s general manager. Zhonghong holds our interests in Hongyuan CSG, our joint-venture with Henan Coal Seam Gas. |

Joint-Venture:

| · | Hongyuan CSG is a joint-venture established in the PRC on April 28, 2011 by Zhonghong (49%) and Henan Coal Seam Gas (51%). Hongli’s interests in the joint-venture are held by Zhonghong. |

We also acquired 100% of Baofeng Shunli Coal Co., Ltd. (“Shunli Coal”) on May 20, 2011. On July 4, 2012, Shunli Coal was dissolved, and we are in the process of applying to transfer its mine assets to, and consolidating them under, Hongchang Coal, which we currently expect to complete when the government has a new policy regarding coal mining. Shunli Coal’s mine assets consist of the rights to mine Shunli coal mine.

Contractual Arrangements with Hongli Group and its Owners

Our relationship with Hongli Group and the Owners are governed by a series of contractual arrangements, under which our subsidiary Hongyuan holds and exercises ownership and management rights over Hongli Group. While we do not own any equity interest in Hongli Group, the contractual arrangements are designed to provide us with rights equivalent in all material respects to those we would possess as its sole equity holder, including absolute control rights and the rights to assets, property and income. According to a legal opinion issued by our PRC counsel, the contractual arrangements constitute valid and binding obligations of the parties to such agreements, and are enforceable and valid in accordance with the laws of the PRC.

The contractual arrangements, entered into on March 18, 2009, consist of the following:

| · | Consulting Services Agreement: Hongyuan provides each Hongli company with general consulting services relating to its business management and operations on an exclusive basis. Additionally, Hongyuan owns any intellectual property rights that are developed during the course of providing such services. Each Hongli company pays a quarterly consulting service fee in RMB equal to its net income for such quarter to Hongyuan. This agreement is in effect unless and until terminated by written notice of either party if: (a) the other party causes a material breach of the agreement, provided that if the breach does not relate to a financial obligation, the breaching party has 14 days to cure following the receipt of written notice; (b) the other party becomes bankrupt, insolvent, is the subject of proceedings or arrangements for liquidation or dissolution, ceases to carry on business, or becomes unable to pay its debts as they become due; (c) Hongyuan terminates its operations; (d) a Hongli Group business license or any other approval for its business operations is terminated, cancelled or revoked; or (e) circumstances arise which would materially and adversely affect the performance or the objectives of this agreement. Additionally, Hongyuan may terminate the agreement without cause. |

| 5 |

| · | Operating Agreement*: Hongyuan provides guidance and instructions for each Hongli company’s daily operations, financial management and employment issues. In addition, Hongyuan agrees to guarantee the performance of each Hongli company under any agreements or arrangements relating to its business arrangements with any third party. In return, the Owners must designate Hongyuan’s designees as their representatives on each Hongli company’s board of directors, and Hongyuan has the right to appoint senior executives of each Hongli company. Additionally, each Hongli company agrees to pledge its accounts receivable and all of its assets to Hongyuan. Moreover, each Hongli company agrees not to engage in any transactions that could materially affect its assets, liabilities, rights or operations without Hongyuan’s prior consent, including without limitation, incurrence or assumption of any indebtedness, sale or purchase of any assets or rights, incurrence of any encumbrance on any of its assets or intellectual property rights in favor of a third party or transfer of any agreements relating to its business operation to any third party. The term of this agreement is the maximum period of time permitted by law unless sooner terminated by any other agreements reached by all parties or upon a 30-day written notice from Hongyuan. The term may be extended only upon Hongyuan’s written confirmation prior to the expiration of the agreement, with the extended term to be mutually agreed upon by the parties. Under current applicable PRC law, there is no limitation on the maximum term permitted by law for this agreement. |

| · | Equity Pledge Agreement*: The Owners pledged all of their equity interests in Hongli Group to Hongyuan to guarantee each Hongli company’s performance of the consulting services agreement. If a Hongli company or the owners breach their respective contractual obligations, Hongyuan, as pledgee, will be entitled to certain rights, including, but not limited to, the right to vote with, control and sell the pledged equity interests. The Owners also agreed that upon occurrence of any event of default, Hongyuan shall be granted an exclusive, irrevocable power of attorney to take actions in the place and stead of the owners to carry out the security provisions of the equity pledge agreement, and take any action and execute any instrument as required by Hongyuan to accomplish the purposes of the agreement. The Owners agreed not to dispose of the pledged equity interests or take any actions that would prejudice Hongyuan’s interest. This agreement will expire two years from the fulfillment of Hongli Group’s obligations under the consulting services agreement. |

| · | Option Agreement*: The Owners irrevocably granted Hongyuan an exclusive option to purchase, to the extent permitted under PRC law, all or part of their equity interests in Hongli Group at a price equal to their initial registered capital contributions or the minimum amount of consideration permitted under PRC law. Hongyuan has sole discretion to decide when to exercise the option, and whether in part or in full. The term of this agreement is ten years from January 1, 2006 and may be extended prior to its expiration by written agreement of the parties. |

| · | Voting Rights Proxy Agreement*: The Owners irrevocably granted a Hongyuan designee the right to exercise all their voting rights in accordance with PRC laws and each Hongli company’s governing charters. This agreement may not be terminated without the unanimous consent of all parties, except that Hongyuan may terminate the proxy agreement with or without cause upon 30-day written notice to the owners. |

| * | Re-executed on September 9, 2011, to reflect RMB 20 million of additional registered capital contributed by the Owners in August 2010, and the resulting change in ownership percentages. We were made a party to the re-executed agreements to acknowledge them. |

As a result of the foregoing contractual arrangements, we have the ability to effectively control Hongli Group’s daily operations and financial affairs, appoint senior executives and decide on all matters requiring the Owners’ approval. While the Owners continue to own 100% of equity interests, they have given us their rights attendant to such ownership through the contractual arrangements. Accordingly, we are considered the primary beneficiary of Hongli Group and each Hongli company is deemed our variable interest entity (“VIE”).

However, control based on contractual arrangements may ultimately not be as effective as direct ownership, as we will need to enforce our rights through quasi-judicial proceeding in the event Hongli Group fails to perform its contractual obligations. In the event the outcome of such proceeding is unfavorable to us, we may effectively lose control over Hongli Group. See “Risk Factors – Risks Related to Our Corporate Structure – Our contractual arrangements with Hongli and its owners as well as our ability to enforce our rights thereunder may not be as effective in providing control over Hongli as direct ownership.” As of October 12, 2015, Mr. Lv held approximately 33% of our issued and outstanding common stock, and 85.40% of the equity interests of Hongli. As such, we believe that our interests remain aligned with the Owners. However, we cannot give assurance that such interests will always be aligned, or that we can effectively control Hongli Group if and when such interests are no longer aligned. See “Risk Factors - Risks Related to Our Corporate Structure – Management members of Hongli have potential conflicts of interest with us, which may adversely affect our business and your ability for recourse.”

| 6 |

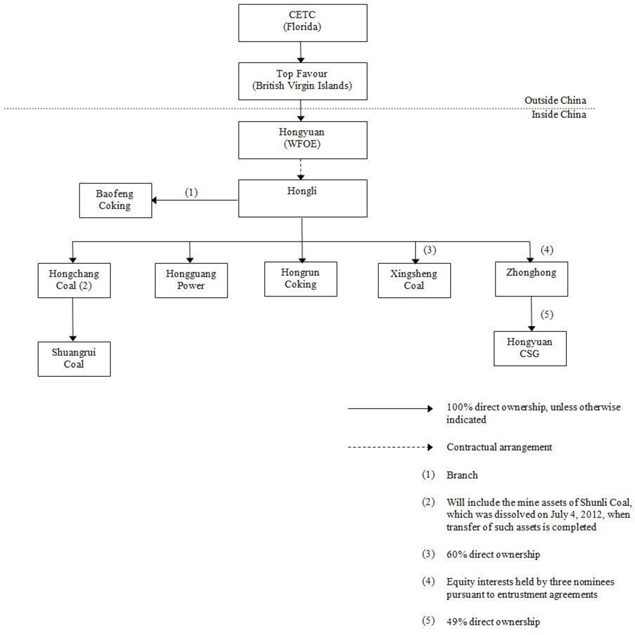

Our Current Corporate Structure

The following diagram illustrates our current corporate structure:

| 7 |

Our Products and Operations

Overview

We are based in Henan Province in the central part of China, known as a coal-rich region. Our current operations are located in West Baofeng County, a part of Pingdingshan Prefecture south of Zhengzhou, the provincial capital. Our principal products are coal, coke, syngas and electricity.

Coal

We sell coal, including washed coal, mid-coal and coal slurries (see “Coal Washing” below), and also use washed coal to make coke. We currently control four coal mines (see “Property, Plant and Equipment” below). Until June 2010, we largely extracted coal from Hongchang coal mine to meet our needs, although we also engaged in coal trading. As described under “Coal Mining Moratorium” below, however, we have been unable to extract coal since September 2011. We have instead been relying on coal purchased elsewhere, including from Shanxi, Shannxi, Henan, Qinghai and Inner Mongolia, to meet our requirements. Our coal purchases for the fiscal years ended June 30, 2015 and 2014 are as follows:

| Annual Purchases* | ||||

| Fiscal Year | (metric tons) | |||

| 2014 | 373,112 | |||

| 2015 | 291,328 | |||

* Including coal for washing, coking and trading.

Generally, if the coal that we purchase meets coking requirements, we will reserve it for that purpose. Occasionally, however, we sell the coal (also known as coal trading) when market conditions are favorable.

Coal Mining Moratorium

In December 2009, the Henan government issued a directive to consolidate coal mines with annual production capacity below 300,000 metric tons (each a “targeted mine” and collectively the “targeted mines”), spurred by the central government’s decision to consolidate China’s coal industry in order to improve production efficiency and reduce coal mine accidents. In March 2010, the Henan government directed all lower-level governments within the province to begin shutting down all targeted mines, and further designated six state-owned enterprises (“SOEs”) to consolidate the targeted mines. Once shut down, the targeted mines cannot resume operations until they are consolidated and their facilities satisfy certain safety requirements.

In February and April 2010, the Baofeng government and the Pingdingshan government designated Hongli to consolidate targeted mines within the county and municipality, respectively. Because the Henan government’s directive requires that safety responsibility at each targeted mine be borne by a designated SOE, we reached an arrangement with one of them, Henan Coal Seam Gas, to form a joint-venture that would allow us to comply with the Henan government’s directive while maintaining operational control over any targeted mine that we consolidate. Such joint-venture, Hongyuan CSG, was formed in April 2011.

In late June 2010, pursuant to the Henan government’s directive, the Pingdingshan government imposed a mining moratorium on all targeted mines within Pingdingshan. Nevertheless, we continued to operate our only mine at that time, Hongchang coal mine, at approximately 50% capacity until September 2011, when we halted operation in order to complete certain engineering and safety upgrades. Operations at our other three mines (Shuangrui, Xingsheng and Shunli) were already halted when we acquired controlling interests in them in May 2011 and have not resumed since.

| 8 |

In August 2011, Henan Coal Seam Gas, as a designated SOE consolidator, determined that Hongchang and Xingsheng coal mines were safe to resume operations and applied with the Henan government to confirm such determination and issue the necessary licenses and permits to resume operations at both mine sites. However, due to an accident in November 2011 at a mine owned by Yima Coal Group, another designated SOE consolidator, the Henan government ordered all targeted mines to undergo further safety inspections and upgrades. We have made approximately $3.2 million in prepayments for works to increase our mining capacity at Hongchang coal mine to 450,000 metric tons, as well as to upgrade the monitoring system (by installing additional detectors), automatic control system (including power controls and ventilation), and escape system (with additional refuge compartments) at Hongchang and Xingsheng coal mines. Although such works have not commenced, we have submitted the related engineering plans to Henan Coal Seam Gas for its approval and submission to the Henan government. Accordingly, the applications to resume operations at these two mines remain pending as of the date of this Report. As we are also in the process of consolidating Shunli coal mine under Hongchang Coal (see “History and Corporate Structure – Hongli” above), the application approval for Hongchang coal mine may be subject to additional delay.

Henan Coal Seam Gas has not yet made a determination as to the safety at Shuangrui and Shunli coal mines, and we do not know when such determination will be made, if at all. In addition, our objective in acquiring Shuangrui Coal, Xingsheng Coal and Shunli Coal is their mining rights, and their sellers were required to dispose of all other assets and liabilities before the transfer of equity interests to us is complete, and to assume all rights and obligations to such assets and liabilities until their disposal, which rights and obligations we would disclaim should any such asset or liability remains in the company after the transfer of equity interests to us is complete. The equity interests have been transferred to us, and the assets and liabilities have been disposed as of the date of this Report.

If all four mines can resume operations, it was our original intention to transfer our interests in the mines to, and to operate them through, Hongyuan CSG. Such transfer, if carried out, would have reduced any future revenue we would receive from these mines by 31%, or pro rata to the 49% of the joint-venture that we control. Nevertheless, we believed that such transfer would be in our best interests by reducing any risk of loss from potential future policy changes by the central and provincial governments through the presence and influence of Henan Coal Seam Gas, our joint-venture partner. However, due to the imposition of the provincial-wide mining moratorium since June 2010, and the change of the Company’s original plan from developing coal mining operations to producing syngas, the plan to transfer the related operations was halted and we will decide whether to execute the original plan based on the mining moratorium status and syngas business development in the future. As of the date of this filing, our coal related operations have not been transferred to the joint-venture, and Shuangrui Coal and Xingsheng Coal have had no operations since their acquisitions by the Company.

Coal Washing

At the Baofeng plant (see “Coke” below), we operate a coal-washing facility that is capable of processing up to 750,000 metric tons of coal per year. Under current Chinese coking industry standards, raw coal with no more than 1% sulfur content is deemed suitable for coking, although other factors are also considered. In addition to low sulfur content, the industry preference is for lower ash content and volatile matters. While much of the coal from our mines and that we purchase is generally suitable for coking based on these parameters, the coal must nevertheless be washed before it is ready for the coking ovens, in order to reduce ash and sulfur content, and to increase thermal value. We use a water-based jig washing process, which is prevalent in China, and use both underground and recycled water. Sorting machines that can process up to 600 metric tons per hour sort the washed coal according to size. Washed coal is also typically blended with other coal in order to achieve the proper chemical composition and thermal value for coking.

Approximately 1.33 - 1.38 metric tons of raw coal yield 1 metric ton of washed coal. The bulk of the washed coal we produce is intended for our coking needs, although we sell if the pricing is favorable. In addition to washed coal, the coal-washing process produces two byproducts:

| · | “Medium” coal (or “mid-coal”), a PRC coal industry classification, is coal that does not have sufficient thermal value for coking, and is mixed with raw coal and even coal slurries, then sold for electricity generation, and domestic and industrial heating applications. |

| 9 |

| · | Coal slurries (or “coal slime”) are the castoffs and debris from the washing process. Coal slurries can be used as a fuel with low thermal value, and are sold “as is” or mixed with mid-coal to produce a blended mixture. |

Our annual production volumes of washed coal, mid-coal and coal slurries for the fiscal years ended June 30, 2014 and 2015 are as follows:

| Annual Production | ||||||||||||

| (metric tons) | ||||||||||||

| Fiscal | Mid | Coal | ||||||||||

| Year | Washed Coal | Coal* | Slurries* | |||||||||

| 2014 | 99,164 | 33,051 | 16,450 | |||||||||

| 2015 | 102,776 | 38,382 | 3,674 | |||||||||

* Estimated based on amount of raw coal used.

Coke

Coke is a hardened, solid carbonaceous residue derived from low-ash, low-sulfur bituminous coal from which the volatile constituents are driven off by baking in an oven without oxygen at high temperatures so that the fixed carbon and residual ash are fused together. Volatile constituents of the coal include water, coal-gas, and coal-tar.

We currently produce metallurgical coke, which is primarily used for steel manufacturing. China has exacting national standards for coke, based upon a variety of metrics, including most importantly, ash content, volatilization, caking qualities, sulfur content, mechanical strength and abrasive resistance. Typically, metallurgical coke must have more than 80% fixed carbon, less than 15% ash content, less than 0.8% sulfur content and less than 1.9% volatile matter. Our metallurgical coke is typically 85% fixed carbon, less than 12% ash, less than 1.9% volatile matter and less than 0.7% sulfur.

According to national standards, metallurgical coke is classified into three grades – Grade I, Grade II and Grade III, with Grade I being the highest quality. Generally, our customers do not have specific content requirements, but we may make certain adjustments, such as to moisture content, upon request. The amount of each grade of coke that we produce is based on market demands, although historically our customers have mostly required Grade II coke which has higher profit margin than other types of coke. For the fiscal years ended June 30, 2014 and 2015, we only produced Grade II coke.

We currently have two plants: the Baofeng plant, which we own, and the Hongfeng plant, which we have leased from Pingdingshan Hongfeng Coal Processing and Coking, Ltd. since April 2013. At the Baofeng plant, we produce coke from a series of three WG-86 Type coke ovens lined up in a row with an annual capacity of 250,000 metric tons. Starting in July 2014, the Baofeng plant has been temporarily closed as its old facilities cannot comply with the new coking industry entry standards of the country. It is now pending for upgrade in order to better assist the UCG project development in the future. The Hongfeng plant has an annual capacity of 200,000 metric tons and is approximately 3 miles from the Baofeng plant. We commenced production in August 2013. We believe that the skills we gain from operating its ZN-43 type coke ovens will be invaluable for operating our 900,000 metric ton facility still under construction (see “New Coking Facility” below).

After being processed at our coal-washing facility, coal is sent to a coal blending room (either the Baofeng plant, which has been temporarily closed since July 2014, or the Hongfeng plant), where it is crushed and blended to achieve an optimal coking mixture. Samples are taken from the coal blend and tested for moisture, chemical composition and other properties. The crushed and blended coal is next tamped, or packed, prior to being transported by conveyor to a coal bin to be fed into the waiting oven below. This tamping process allows the use of lower quality washed coal without affecting the quality of the coke produced. After processing through temperature-controlled ovens at temperature of 1,200° C (2,192° F), hot coke is pushed out of the oven chamber onto a waiting coke cart, transported to an adjacent quench tower where it is cooled with water spray, and hauled to a platform area adjacent to our private rail line to be air-dried. Coke samples are taken at several stages during the process and analyzed in our testing facility, and data is recorded daily and kept by technicians. After drying, the coke is sorted according to size to meet customer requirements.

| 10 |

For the fiscal years ended June 30, 2014 and 2015, we produced the following volumes of metallurgical coke:

| Annual Production | ||||

| Fiscal Year | (metric tons) | |||

| 2014 | 226,944 | |||

| 2015 | 176,734 | |||

Since the mining moratorium and the cessation of our mining operations, we have largely relied on purchased coal to make coke.

Coke Emissions Recycling

In the coke oven, coal’s volatile contents, including water and coal tar, are driven off in gaseous forms, which we capture and recycle. We pipe coal gas into a cooling tower to separate coal tar by condensation, which we sell as a fuel byproduct (see “Coal Byproducts” below). We burn the remaining purified coal gas to generate steam that drives steam-powered turbines to produce electricity (see “Electricity Generation” below).

Coking Byproducts

Coal tar is an ingredient of coal tar pitch used in the aluminum industry, and can be further refined to create chemicals and additives such as fine phenol, fine naphthalene and modified pitch that can be used as raw material in making concrete sealant, wood treatment compounds, agricultural pesticides and other chemical products.

Our annual production volumes of coal tar for the years ended June 30, 2014 and 2015 are as follows:

| Annual Production | ||||

| Fiscal Year | (metric tons) | |||

| 2014 | 9,032 | |||

| 2015 | 6,909 | |||

Both the Baofeng and Hongfeng plants produce sulfur and ammonia sulfate, but only the Hongfeng plant produces other byproducts such as crude benzol, benzene, sulfur-based chemicals and methanol. Starting in July 2014, the Baofeng plant has been temporarily closed as its old facilities cannot comply with China’s new coking industry entry standards. It is now pending for upgrade in order to better assist the UCG project development in the future.

New Coking Facility

On March 3, 2010, we commenced construction of a new state-of-the-art coking plant on a 460,000 square meter site adjacent to the Baofeng plant. As of the date of this Report, we have completed construction of the shallow foundation, an underground workshop and the furnace and chimney rack, and are in the process of installing the coal preparation, cooling, recycling, and auxiliary systems, as well as framing the coal blending structure and coal yard. Originally anticipated to be completed at the end of December 2011, we have slowed down construction in light of ongoing weak demand for coke. We plan to complete the plant and commence operations once the coke market improves and stabilizes, which we currently expect to be some time in calendar 2016, although there is no guaranty that this will happen.

| 11 |

When completed as designed, this new plant is expected to have an estimated coke-producing capacity of up to 900,000 metric tons per year, as well as the ability to generate power, distill chemicals such as crude benzol, sulfur and ammonium sulfate from the coking process and produce purified coal gas. Our plans to provide the coal gas as a fuel source to local residents through the state-owned gas grid have received approval from the authorities of Daying County, and we currently plan to offer the coal gas at a price per thermal equivalent unit that is estimated to be 20% less than the current price of liquid natural gas, a competing alternative. Hongrun Coking will operate the new plant.

Electricity Generation

As Hongguang Power mainly uses the gas produced during coking from Baofeng plant to generate electricity, it has been temporarily closed when Baofeng plant closed in July 2014. There was no electricity generated for the fiscal year ended June 30, 2015. We will resume our operations in the future at Hongguang Power to generate electricity to better assist the UCG project.

Our annual amounts of electricity generated for the years ended June 30, 2014 and 2015 are as follows:

| Annual Generation | ||||

| Fiscal Year | (kilowatt) | |||

| 2014 | 5,834,093 | |||

| 2015 | - | |||

Synthetic Gas

New Synthetic Gas Facility

In May 2014, we commenced plans to further extend our coal and coke operations into the clean-burning synthetic gas field. In July 2014, we started an investment plan of approximately $7.8 million or RMB 48 million to build a coke gasification facility for the conversion of coke into a clean-burning syngas. The facility, termed our “Stage I facility,” was completed at the end of September 2014 and commenced its production in October 2014. The Stage I facility has a designed annual capacity of 219,000,000 cubic meters of syngas or 25,000 cubic meters of syngas per hour. In November 2014, with one month’s operating experience at running the Stage I facility, we conducted a technique upgrade on the Stage I facility to increase the designed capacity of the facility (a “Stage II facility”). The upgrade was fully completed in July 2015. With the completion of the technique upgrade, the Stage II facility’s designed annual coke gasification capacity was expanded to 438,000,000 cubic meters of syngas or 50,000 cubic meters of syngas per hour.

On August 28, 2014, we entered into a cooperative agreement with the North China Institute of Science and Technology regarding underground coal gasification technique (“UCG”) development to refine and implement advanced techniques to convert our coal into syngas. Our ultimate target is to build a UCG facility with an annual production capacity of 7,708,800,000 cubic meters of syngas or 880,000 cubic meters of syngas per hour in all four of our coal mines. The UCG project was approved by the Science and Technology Bureau of Baofeng County as a local Scientific and Technological Practical Project, and it was granted the privilege to refine the coal under Baofeng Coking Factory, which may have coal materials of approximately 216,200 tons shown on our primarily test, as a trial project for UCG technique development. We entered into a construction agreement on June 16, 2015 to build a UCG facility and commenced the construction of the trial project of the Scientific and Technological Practical Project at the end of June 2015. This UCG trial project is under the joint supervision of the Science and Technology Bureau of Baofeng County and North China Institute of Science and Technology (“Supervisors”) and requires further tests and approval from the Supervisors upon our completion of construction and equipment installation. As of June 30, 2015, we had invested $2,619,172 (RMB 16,000,000) in the construction of this UCG trial project. This UCG trial project is divided into several stages and each stage requires a periodical acceptance test conducted by the Supervisors. The first stage of the construction was completed in July 2015 and is in the process of the Supervisors’ examination. We expect the periodical acceptance test to be finished in October 2015. After the Supervisors provide their approval we would be able to proceed to our next stage of project development. It is anticipated that the construction of this trial project will be completed in March 2016, and is estimated to cost up to $5 million. Once the construction is completed, it requires another 6 months of preliminary operations for final testing which will be monitored by the Supervisors. With the final approval from the Supervisors, we will be able to implement our UCG techniques in our coal mines.

| 12 |

Syngas is a clean energy alternative which consists primarily of hydrogen and carbon monoxide. Syngas is usually a product of gasification and the main application is electrical generation. It can also be used as a fuel of internal combustion engines or used in the Fischer-Tropsch process to produce diesel or converted into methane, methanol and dimethyl ether in catalytic processes.

Sales and Marketing

We enter into non-binding annual letters of intent that set forth current year supply quantities, suggested pricing, and monthly delivery schedules with our customers for both coal and coke products at the beginning of each calendar year. The terms of the letters of intent are usually negotiated during the Annual National Coal Trading Convention organized by the China Coal Transport and Distribution Association. A significant portion of our sales are made through attendance at this convention. Changes in delivery quantity and pricing, which is based on open market pricing at the time of delivery, must be documented in a final written contract on a 30-day advance notice submitted by the party making the change and accepted by the other party. All of our current customers are generally required to make payment upon delivery of each shipment. In pricing our products, we consider factors such as the prices offered by competitors, the quality and grade of the product, the volume in national and regional coal inventory build-up and forecasted future trends for coal and coke prices. The remaining portion of our sales is derived from purchase orders placed by customers throughout the year when they require additional coal and coke products.

We have a flexible credit policy, and adjust credit terms for different types of customers. Depending on the customer, we may allow open accounts, or require acceptance bills or cash on delivery. We consider the creditworthiness and the requested credit amount of each customer when determining the appropriate payment arrangements and credit terms, which generally do not exceed a period over 90 days. We evaluate the creditworthiness of potential new customers before entering into sales contracts and reassesses customer creditworthiness on an annual basis. We require immediate settlement of accounts upon delivery for customers without an established history.

Generally, our selling prices are driven by a number of factors, including the particular composition and quality of the coal or coke we sell, their prevailing market prices locally and throughout China, as well as in the global marketplace, timing of sales, delivery terms, and our relationships with our customers and our negotiations of their purchase orders. The selling prices of all coke products and coal products decreased over fiscal years 2015 and 2014 resulting from the oversupply of coke and coal products through the whole year of 2015 in the market.

Coke Sales

Coke sales for the last two fiscal years in volume, dollar amount and as a percentage of our total revenue, and the weighted average selling price per metric ton for each fiscal year, are as follows:

| Coke Sales | ||||||||||||||||

| Weighted | ||||||||||||||||

| Average | ||||||||||||||||

| Annual Sales | Sale Price Per | |||||||||||||||

| Fiscal Year | (metric tons) | Annual Sales ($) | % of Revenue | Metric Ton ($) | ||||||||||||

| 2014 | 191,303 | $ | 38,917,211 | 77 | % | $ | 203 | |||||||||

| 2015 | 152,152 | $ | 25,902,868 | 57 | % | $ | 170 | |||||||||

| 13 |

The coke revenues decreased 33.44% resulting from a 20.47% decrease in the coke quantity and a 16.26% decrease in the coke average selling price. Due to demand structure and the price of the coke products, no coke powder was produced and sold in fiscal year 2015.

Because the coke market demand was still weak and we used coke to produce our new clean-burning syngas, our revenues from coke products decreased.

Coal Tar Sales

Coal tar sales for the last two completed fiscal years in volume, dollar amount and as a percentage of our total revenue, and the weighted average selling price per metric ton for each fiscal year, are as follows:

| Coal Tar Sales | ||||||||||||||||

| Fiscal Year |

Annual Sales (metric tons) |

Annual Sales ($) | % of Revenue |

Weighted Average Price Per Metric Ton ($) |

||||||||||||

| 2014 | 9,032 | $ | 2,884,303 | 6 | % | $ | 319 | |||||||||

| 2015 | 6,909 | $ | 1,818,648 | 4 | % | $ | 263 | |||||||||

Our byproduct revenues from coal tar decreased 36.95% resulting from a 23.51% decrease in the coal tar quantity and a 17.55% decrease from the coke tar average selling price and our revenues from crude benzol increased by 32.70% resulting from a 89.35% increase in the crude benzol quantity and offset by a 29.85% decreased in the crude benzol average selling price.

Raw Coal Sales

Our coal revenue continued to suffer from unstable and unpredictable raw coal supply from our coal mines affected by the ongoing mining moratorium. We are unable to anticipate when the moratorium or policy will change to allow us to reopen our mining activities. We had no raw coal revenues for fiscal years 2015 and 2014.

Washed Coal Sales

Washed coal sales for the last two fiscal years in volume, dollar amount and as a percentage of our total revenue, and the weighted average selling price per metric ton for each fiscal year, are as follows:

| Washed Coal Sales | ||||||||||||||||

| Weighted | ||||||||||||||||

| Average | ||||||||||||||||

| Annual Sales | Sale Price Per | |||||||||||||||

| Fiscal Year | (metric tons) | Annual Sales ($) | % of Revenue | Metric Ton ($) | ||||||||||||

| 2014 | 25,158 | $ | 4,201,698 | 8 | % | $ | 167 | |||||||||

| 2015 | 17,469 | $ | 2,765,054 | 6 | % | $ | 158 | |||||||||

We purchase raw coal from third parties and wash coal for our coking processing. In response to the higher price of raw coal used to make washed coal, we have adapted our coal washing process to increase washed coal yield. Doing so has also resulted in less coal slurries but more mid-coal being produced, which when combined with the effect of selling price changes, resulted in the revenue fluctuations for both mid-coal and coal slurries.

Our lower washed coal revenue for fiscal year 2015 resulted from the limited amount of washed coal sold to our customers due to the limited availability of raw coal which we use to produce washed coal.

| 14 |

Syngas Sales

Syngas sales for the last two fiscal years in volume, dollar amount and as a percentage of our total revenue, and the weighted average selling price per metric ton for each fiscal year, are as follows:

| Syngas Sales | ||||||||||||||||

| Weighted | ||||||||||||||||

| Average | ||||||||||||||||

| Annual Sales | Sale Price Per | |||||||||||||||

| Fiscal Year | (metric tons) | Annual Sales ($) | % of Revenue | Metric Ton ($) | ||||||||||||

| 2014 | - | $ | - | - | % | $ | - | |||||||||

| 2015 | 124,104,744 | $ | 12,443,527 | 27 | % | $ | 0.10 | |||||||||

Our syngas operation was launched in October 2014. Thus, we do not have historical data comparing the results of operations for fiscal year 2015 to fiscal year 2014. Our revenues from syngas have increased since commencement of those operations in October 2014. All sales of syngas were delivered by the pipeline and all syngas was delivered as it was generated in our conversion ovens. Our coke gasification capacity has increased month to month since October 2014 to June 30, 2015. We believe that revenues from syngas will continue to increase along with the improvement of our production techniques and the expansion of the production capacity.

Customers

We sell our products only in China. The following customers each accounted for 10% or more of our total revenue for fiscal 2015:

| Sales to Customer | Sales to Customer | |||||||

| Customer | ($) | as a % of Revenue | ||||||

| Wuhan Railway Zhongli Group | $ | 5,907,417 | 13.0 | % | ||||

| Ma’anshan Guofu Commercial and Trading Co., Ltd. | $ | 10,318,775 | 22.6 | % | ||||

| Baofeng County Fulong Industrial Co., Ltd. | $ | 4,613,384 | 10.1 | % | ||||

| Fujian San’an Steel Co., Ltd. | $ | 5,426,279 | 11.9 | % | ||||

The largest customer of each principal product for fiscal 2015 is as follows:

| % of Product Bought by | ||||||||

| Customer | Product | Customer | ||||||

| Wuhan Railway Zhongli Group | Coke | 22.8 | % | |||||

| Ma’anshan Guofu Commercial and Trading Co., Ltd. | Coke | 39.8 | % | |||||

| Baofeng County Fulong Industrial Co., Ltd. | Syngas | 37.0 | % | |||||

| Fujian San’an Steel Co., Ltd. | Coke | 21.0 | % | |||||

None of these customers is related to or affiliated with us. Our sales personnel conduct routine visits to our customers. We have long-standing relationships with our customers, and management believes that our relationships with them are stable.

| 15 |

Transportation and Distribution

We own and operate a private rail track of 4.5 kilometers in length that connects the Baofeng plant to the national railway system at both the East Pingdingshan Railway Station and the Baofeng Railway Station. Industrial loaders load coal and coke from our platform onto railcars to be transported to customers primarily in central and southeastern China in the provinces of Henan, Hubei, Hunan and Fujian. Our private railway affords us some measures of control over transportation cost and delivery execution. See also “Property, Plant and Equipment – Railway Assets” below.

We also truck coke from the Hongfeng plant (which is not directly connected by rail) to our platform for loading. Customers can also arrange for trucks to take delivery from both plants.

At the time of this filing, we have a gas pipeline network that extends 10 kilometers from our existing syngas facilities at the Hongfeng plant. Almost 80% of the pipelines came with the Hongfeng plant when we leased it, while 20% were built by us. All our customers in need of syngas have their own pipeline. We can connect our pipeline with our customers’ own pipeline to deliver syngas

Competitors

We compete primarily with coal and coke producers in the central, eastern and southern regions of China. Coke competitors range from Shanxi Coking Co., Ltd., a national coke producer, to local operations like Hongyue Coke Factory, Dongxin Coke Factory and Hongjiang Coke Factory. We also compete with China Pingmei Shenma Group (“China Pingmei”), a Pingdingshan-based state-owned coke and coal producer with a similar product-mix as us. China Pingmei is also the largest regional coal producer and one of Henan’s six SOE consolidators, all of whom are our competitors in the coal market. Competitive factors include geographic location, quality (i.e. thermal value, ash and sulfur content, washing and processing, and other characteristics), and reliability of delivery. The mining moratorium has also created a competitive advantage for the six SOE consolidators, as their mines are the only ones currently operating in Henan.

Suppliers

We purchase from various suppliers within China. The following suppliers each accounted for 10% or more our total purchases for fiscal 2015:

| Materials | Amount of Purchase | % of Total | ||||||||

| Supplier | Supplied | ($) | Purchases | |||||||

| Henan Shenhuo International Trade Ltd. | Washed Coal | 8,097,441 | 33.7 | % | ||||||

| Xiaotunjia Lingnan Coal Mine | Raw Coal | 4,470,515 | 18.6 | % | ||||||

None of these suppliers is related to or affiliated with us.

As with our coke and coal sales, we meet our washed coal needs by entering into non-binding annual letters of intent with suppliers that set forth supply quantities, proposed pricing and monthly delivery schedules at the beginning of the year. We generally make payment upon each delivery throughout the year, subject to changes in delivery quantity and pricing, which is based on the open market price of metallurgical coal at the time of delivery and agreed to by the parties.

We believe that we have established stable cooperative relationships with our suppliers. In light of the mining moratorium, we have been sourcing coal from third parties, both inside and outside Henan. During the 2015 fiscal year, about 18% of our coal purchases were from outside Henan, with the remaining from SOEs in Henan whose mining operations have not been affected by the ongoing mining moratorium and consolidation.

| 16 |

Our other principal raw materials include water and electricity. The Baofeng plant gets its water without charge in the form of treated underground water from the operator of the nearby Hangzhuang coal mines, and its electricity from our own power stations (see “Electricity Generation” above). Starting in July 2014, the Baofeng plant has been temporarily closed as its old facilities cannot comply with the new coking industry entry standards of the country. It is now pending for upgrade in order to better assist the UCG project development in the future. The Hongfeng plant, on the other hand, buys water on the market and electricity from a local state-owned utility. We also require wood and steel for our operations, and source these materials from nearby suppliers on a per purchase order basis. These materials are readily available and there is no shortage of suppliers to choose from.

Employees

The following table sets forth the number of our employees for each of our areas of operations and as a percentage of our total workforce as of June 30, 2015:

| Number of | % of | |||||||

| Employees | Employees | |||||||

| Coal-related operations | 19 | 10 | % | |||||

| Coke-related operations | 22 | 11 | % | |||||

| Syngas-related operations | 70 | 36 | % | |||||

| Sales and marketing | 4 | 2 | % | |||||

| Administrative (including management) | 78 | 41 | % | |||||

| TOTAL | 193 | 100 | % | |||||

Our Hongfeng plant operates year round in three shifts of eight hours per day. Although mining operations are currently shut down, we have staff at the mine sites for necessary maintenance and repairs during the moratorium. Once our coal mines can resume full operations, we anticipate operating in three shifts of eight hours per day. In compliance with the Employment Contract Law of PRC, we have written contracts with all of our employees. We consider our relationship with our employees to be good.

Research and Development

On June 18, 2013, the Pingdingshan Municipal Science and Technology Bureau issued us a “Certificate of Achievement” in connection with advances that we made in coke sintering. Sintering is the process of bonding small particles with heat that does not reach the melting point of such particles. We developed and completed initial testing of a new sintering fuel in November 2012, and commenced trial production in December 2012. After preliminary testing followed by a full evaluation, experts at Henan Province Science and Technology Bureau determined that our sintering fuel, when compared to conventional sintering fuel, can reduce dust and sulfur dioxide emissions at various stages of steel production. In connection with our Certificate of Achievement, we are also approved to commercially produce our sintering fuel, although we have not done so as of the date of this Report.

We are currently working with the Chinese Academy of Agricultural Sciences to evaluate the economic feasibility of extracting humic acid from mid-coal and coal slurries.

| 17 |

On August 28, 2014, we entered into a cooperative agreement with the North China Institute of Science and Technology regarding underground coal gasification technique (“UCG”) development to refine and implement advanced techniques to convert our coal into syngas. Our ultimate target is to build a UCG facility with an annual production capacity of 7,708,800,000 cubic meters of syngas or 880,000 cubic meters of syngas per hour in all four of our coal mines. The UCG project was approved by the Science and Technology Bureau of Baofeng County as a local Scientific and Technological Practical Project, and it was granted the privilege to refine the coal under Baofeng Coking Factory, which may have coal materials of approximately 216,200 tons shown on our primarily test, as a trial project for UCG technique development. We entered into a construction agreement on June 16, 2015 to build a UCG facility and commenced the construction of the trial project of the Scientific and Technological Practical Project at the end of June 2015. This UCG trial project is under the joint supervision of the Science and Technology Bureau of Baofeng County and North China Institute of Science and Technology (“Supervisors”) and requires further tests and approval from the Supervisors upon our completion of construction and equipment installation. As of June 30, 2015, we had invested $2,619,172 (RMB 16,000,000) in the construction of this UCG trial project. This UCG trial project is divided into several stages and each stage requires a periodical acceptance test conducted by the Supervisors. The first stage of the construction was completed in July 2015 and is in the process of the Supervisors’ examination. We expect the periodical acceptance test to be finished in October 2015. After the Supervisors provide their approval we would be able to proceed to our next stage of project development. It is anticipated that the construction of this trial project will be completed in March 2016, and is estimated to cost up to $5 million. Once the construction is completed, it requires another 6 months of preliminary operations for final testing which will be monitored by the Supervisors. With the final approval from the Supervisors, we will be able to implement our UCG techniques in our coal mines.

Intellectual Property

We have no patents, trademarks, licenses, franchises, or royalty arrangements.

Relevant PRC Regulations

We operate in an industry that is highly regulated by local, provincial and central government authorities in the PRC. Applicable regulations include those relating to safety, production, environmental, energy use and labor. While it is not practicable to summarize all applicable laws, the following is a list of names of significant laws and regulations that apply to our business:

Laws and regulations concerning safety of coal mines:

| · | Law of the People’s Republic of China on the Coal Industry |

| · | Regulation on Work Safety Licenses |

| · | Regulations on Administration of Village’s and County’s Coal Mines |

| · | Law of Mine Safety |

| · | Production Safety Law, which applies to production activities in general |

| · | Law of the Coal Industry |

| · | Regulations on Coal Mine Safety Supervision and Inspection |

| · | Regulations on Coal Mine Explosives Control |

| · | Special Provisions for the Prevention of Coal Mine Incidents |

| · | Requirements for Basic Production Conditions for Coal Mines |

| · | Penalties for Coal Mine Safety Violations |

| · | Penalties for Production Safety Violations |

| 18 |

Laws and regulations concerning environmental protection and energy conservation:

| · | Law of the Prevention and Control of Solid Waste Environmental Pollution, which applies to entities whose production activities may generate pollutive solid waste |

| · | Law of the Prevention and Control of Atmospheric Pollution, which set restrictions in coal burning and emissions that cause air pollution |

| · | Mineral Resources Law, which regulates the extraction of mineral resources including coal |

| · | Law Regarding the Prevention and Control of Water Pollution, which regulates pollution of underground water caused by mining activities |

| · | Land Administration Law, which restricts mining activities on agricultural land |

| · | Law of Prevention and Control of Radioactive Pollution, which regulates and prohibits the release of radioactive pollution caused by certain mining activities |

| · | Laws of Water and Soil Conservation, which regulates mining activities with the aim of preventing soil erosion |

| · | Environmental Protection Law, which contains certain general provisions that apply to the operation of coal mines |

Laws and regulations concerning labor:

| · | Labor Law, which protects workers, and contains provisions that apply to a broad range of industries including the mining industry |

| · | Labor Contract Law of the People’s Republic of China and its implementation, which protect workers, and contains laws that apply to a broad range of industries including the mining industry |

Environmental Protection Measures

We incorporate measures to reduce the environmental impact of our operations. Our large-sized furnace reduces the frequency of coal loading and trundling, thereby reducing the amount of dust and soot that is generated. We capture coal gas emitted during the coking process to generate electricity which we use in our operations. We also recycle water by treating the water that is used for coal washing to remove phenol and other contaminants, and then using this water in the coal washing operation. We also use recycled water, in the form of treated underground water, to quench coke and for our power stations, which is provided without cost by the nearby Hanzhuang coal mines, which mining rights are owned and operated by unrelated third parties. Additionally, we use sound insulation to reduce noise pollution, and we plant vegetation throughout our plant to help mitigate the environmental impact of our operations. Syngas, composed primarily of hydrogen and carbon monoxide, is a clean-burning fuel being increasingly utilized as a clean-energy alternative to burning coal. Our coke gasification projects use fixed-bed pure oxygen with a steam consecutive generation technique which causes no waste gas to be emitted. For our UCG project, we have designed the project to decrease the amount of hydrogen sulfide, the main pollutant in the waste gas, by almost 60%.

Safety

Under PRC law, companies with mining operations are required to report violations or mining incidents and casualties to the government authorities. Since inception, except for ordinary and minor injuries, we have suffered no major accidents and no casualties in connection with our mining operations, and have not suffered any reportable incident. In addition, mining companies are subject to random and periodic safety inspections by government mine regulators. Since inception, we have not been found to be in material violation of any mining regulations. As we have no record of violations or mining incidents, management considers our safety record to be excellent. See also “Our Products and Operations – Coal – Coal Mining Moratorium” above.

| 19 |

Property, Plant and Equipment

The location of Pingdingshan, where we are based, is illustrated below:

| 20 |

The locations of our executive office, current coking plant and coal mines, are all in and around Pingdingshan, and are illustrated below:

Coal Mines and Production Facilities

The description below is based on operations prior to the mining moratorium (see “Our Products and Operations – Coal – Coal Mining Moratorium” above):

All four coal mines that we currently control are located at Baofeng County in the central part of Henan Province and are in close proximity to one another as well as to roadways. All are underground mines, and the “room-and-pillar” method is used to extract coal. Under such method, a coal stratum is divided into horizontal planes and the coal is removed from each plane while leaving “pillars” of un-mined materials as supports, working from the uppermost plane down. Each plane is further divided into grids to determine the optimal pillar placements. Drilling and blasting techniques are used to extract the coal.

Raw coal would be loaded and transported by a chain conveyor into crates which are carried out to the surface by an electrical winch. Each crate carries approximately 2.5 metric tons, and approximately 400 crates would be carried to the surface during each 8-hour mining shift. Rock material is used for floor ballast with the excess sent to the surface for disposal. Air compressors would provide for underground air tool use. Electrical power comes from our own power stations as well as the state grid, and supplied down mineshafts through a double-circuit cable designed to mitigate and circumvent potential power disruptions.

Normal water inflow into the mines would be controlled by a system of ditches, sumps, pumps and drainpipes installed throughout the mine tunnels. Each mine’s ventilation system includes an exhaustive fan on the surface of the main incline. Auxiliary fans would be used as needed.

| 21 |