Attached files

| file | filename |

|---|---|

| EX-5.1 - EXHIBIT 5.1 - NowNews Digital Media Technology Co. Ltd. | v420404_ex5-1.htm |

| EX-23.1 - EXHIBIT 23.1 - NowNews Digital Media Technology Co. Ltd. | v420404_ex23-1.htm |

As filed with the Securities and Exchange Commission on September 29, 2015

Registration No. 333-

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| FORM S-1 |

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 |

| NOWNEWS DIGITAL MEDIA TECHNOLOGY CO. LTD. |

| (Exact name of Registrant as specified in its charter) |

| Nevada | 7310 | 36-4794119 |

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

| 4F, No. 32, Ln. 407, Sec. 2. Tiding Road, Neihu District, Taipei City 114, Taiwan |

| 886287978775 ext 507 |

| (Address, including zip code, and telephone number, |

| including area code, of Registrant’s principal executive offices) |

| Yih-Jong Shy |

| Chief Executive Officer |

| 4F, No. 32, Ln. 407, Sec. 2. Tiding Road, Neihu District, Taipei City 114, Taiwan |

| 886287978775 ext 500 |

| (Name, address, including zip code, and telephone number, including area code, of agent for service) |

Copies to:

Jay M. Kaplowitz, Esq.

Wei Wang, Esq.

Sichenzia Ross Friedman Ference LLP

61 Broadway, 32nd Floor

New York, NY 10006

(212) 930-9700

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | ||

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company x |

| CALCULATION OF REGISTRATION FEE |

| Title of Each Class of Securities to Be Registered | Amount to Be Registered | Proposed Maximum Offering Price Per Unit (1) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||||||||||

| Common Stock (2) | 3,990,950 | $ | 5.00 | $ | 19,954,750 | $ | 2,318.74 | |||||||||

| (1) | Pursuant to Rule 416 under the Securities Act of 1933, this Registration Statement also covers any additional securities that may be offered or issued in connection with any stock split, stock dividend or similar transaction. |

| (2) | Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933, as amended, using the average of the high and low prices as reported on the OTCBQ on September 28, 2015, which was $5.00 per share. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the Securities and Exchange Commission (the “SEC”) declares our registration statement effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated September 29, 2015

Prospectus

NowNews Digital Media Technology Co. Ltd.

3,990,950 Shares of Common Stock

This prospectus (“Prospectus”) relates to the sale of 3,990,950 shares (“Shares”) of common stock, par value $0.001 per share (“Common Stock”) of NOWnews Digital Media Technology Co. Ltd.(the “Company,” “we,” “us,” or “our”) by the selling stockholders identified herein (the “Selling Stockholders”).

The Selling Stockholders may offer to sell the Shares at fixed prices, at prevailing market prices at the time of sale, at varying prices or at negotiated prices, and will pay all brokerage commissions and discounts attributable to the sale of such shares. The Selling Shareholders will receive all of the net proceeds from the offering of their shares.

The Shares may be sold by the Selling Stockholders to or through underwriters or dealers, directly to purchasers or through agents designated from time to time. For additional information regarding the methods of sale you should refer to the section entitled “Plan of Distribution” in this Prospectus.

Our common stock is presently quoted on the OTCQB under the symbol “NDMT”. On September 16, 2015, the last reported sale price for our common stock on the OTCQB was $5 per share.

Investing in our Common Stock involves a high degree of risk. You may lose your entire investment. See “Risk Factors” beginning on page 2. You should read the entire prospectus before making an investment decision.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2015

TABLE OF CONTENTS

This summary highlights information contained in greater detail elsewhere in this prospectus. You should read the entire prospectus carefully before making an investment in our Common Stock. You should carefully consider, among other things, our consolidated financial statements and the related notes and the sections entitled “Risk Factors,” “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus. Unless the context otherwise requires, the terms “NOWnews,” “the Company,” “we,” “us” and “our” in this prospectus refer to NOWnews Digital Media Technology Co. Ltd., and its subsidiaries.

Overview

NOWnews Digital Media Technology Co. Ltd. (the “Company”, “NOWnews”, or “we”) is engaged in the business of creating, collecting and distributing news and information through its website http://www.nownews.com/ and its applications on mobile phones or tablets. We generate revenue primarily from online advertising and marketing services and news content licensing.

Company Information

We maintain our principal executive offices at 4F, No. 32, Ln. 407, Sec. 2, Tiding Road, Neihu District, Taipei City 114, Taiwan. Our telephone number is +886-287978775 ext. 500 and our website address is http://www.nownews.com/. The information contained in, or that can be accessed through, our website is not incorporated into and is not part of this prospectus. We were incorporated as Forever Zen Ltd. on March 20, 2010 under the laws of the State of Nevada. On December 13, 2013, we changed our name to NOWnews Digital Media Technology Co Ltd.

Going Concern

As described in auditor’s report on our financial statements, our auditors have included a “going concern” provision in their opinion on our financial statements, expressing substantial doubt that we can continue as an ongoing business for the next twelve months.

The Offering

| Common Stock offered by the selling stockholders | 3,990,950 shares of Common Stock of the Company | |

| Common Stock Outstanding before this offering | 22,412,000 shares | |

| Common stock to be outstanding after this offering | 22,412,000 shares | |

| Trading Market | OTCQB | |

| Ticker Symbol | NDMT | |

| Use of proceeds | We will not receive any of the proceeds from the sale of shares to be offered by the selling stockholders. See “Use of Proceeds.” | |

| Risk factors | You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 2 of this prospectus before deciding whether or not to invest in shares of our Common Stock. |

| 1 |

Investing in our Common Stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this prospectus, including our consolidated financial statements and related notes, before investing in our Common Stock. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that affect us. If any of the following risks occur, our business, financial condition, operating results, and prospects could be materially harmed. In that event, you could lose part or all of your investment.

Risks Related to Our Business and Our Industry

We are subject to the risks associated with operating in an evolving market.

As a company operating in the rapidly evolving online and digital communications market, we face numerous risks and uncertainties. Some of these risks relate to our ability to:

| · | continue to attract users to remain with us and use our website and mobile applications as the primary means of obtaining news information switches from personal computers to mobile phones or other portable devices; |

| · | continue to attract a larger audience to our matrices of Chinese-language content and services by expanding the type and technical sophistication of the content and services we offer; |

| · | develop a sufficiently large customer base for our content licensing as well as advertising and marketing services; |

| · | increase the revenues derived from our licensing, advertising and marketing businesses; |

| · | attract and retain qualified personnel; and |

| · | effectively control our increased costs and expenses as we expand our businesses. |

We are relying on advertising as a significant portion of our revenues, but the online advertising industry is subject to many uncertainties, which could cause our advertising revenues to decline.

The online advertising industry is rapidly evolving in Taiwan. Many of our current and potential advertisers have limited experience with the Internet as an advertising and marketing medium, have not traditionally devoted a significant portion of their advertising and marketing expenditures or other available funds to web-based advertising and marketing, and may not find the internet to be effective for promoting their products and services relative to traditional print and broadcast media. We may not be successful in attracting new advertisers, convincing our current and potential advertisers to increase their budgets for online advertising and marketing or securing a significant share of those budgets. If the internet does not become more widely accepted as a medium for advertising and marketing, our ability to generate additional revenues could be negatively affected. Our ability to generate significant advertising and marketing revenues will depend on a number of factors, many of which are beyond our control, including but not limited to:

| · | the development and retention of a large base of users possessing demographic characteristics attractive to advertisers; |

| · | the maintenance and enhancement of our brands in a cost-effective manner; |

| · | increased competition and potential downward pressure on online advertising and marketing prices and limitations on web page space; |

| · | changes in government policy that curtail or restrict our online advertising and marketing services or content offerings or increase our costs associated with policy compliance; |

| 2 |

| · | the acceptance of online advertising and marketing as an effective way for advertisers to market their businesses; |

| · | advertisers’ preferences for new online advertising and marketing formats, products or business models offered by other competitors and our ability to provide similar or competing new formats, products and solutions; |

| · | the development of independent and reliable means of verifying levels of online advertising and traffic; and |

| · | the effectiveness of our advertising delivery, tracking and reporting systems. |

If there is a downturn in advertising and marketing spending, especially in these sectors, our results of operations, cash flows and financial condition and our share price could suffer. Our growth in advertising and marketing revenues will also depend on our ability to increase our network and develop new offerings, such as those tied to video content, mobile environment and user-generated content in social media environments. If we fail to increase our advertising and marketing services, our growth in advertising and marketing revenues could be hampered and our share price may drop significantly.

We face intense competition that could reduce our market share and adversely affect our financial performance.

There are many companies that distribute online content and services targeting Internet users in Taiwan. We compete with such distributors for user traffic, advertising dollars, potential partners and mobile services. Competition is intense and expected to increase significantly in the future because there are no substantial barriers to entry in our market. Also, as internet usage in Greater China increases and the Greater China market becomes more attractive to online advertisers and for conducting fee-based services, large global competitors, such as Facebook, Twitter, Line, Kakao and WhatsApp, may increasingly focus their resources on the Greater China market.

We compete with our peers and competitors primarily on the following basis:

| · | technological advancements; |

| · | attractiveness of our website and mobile applications; |

| · | brand recognition; |

| · | volume of traffic and users; |

| · | quality of website, mobile applications and content; |

| · | strategic relationships; |

| · | quality of our advertising and marketing services; |

| · | talented staff; and |

| · | pricing. |

Many of our competitors in the online markets for advertising and marketing have certain competitive advantages over us including:

| · | greater brand recognition among Internet users and clients; |

| · | better products and services; |

| · | larger user and customer bases; |

| · | more extensive and well developed marketing and sales networks; and |

| · | substantially greater financial and technical resources. |

We cannot assure you that we will succeed in competing against the established and emerging competitors in the market. The increased competition could result in reduced traffic, loss of market share and revenues, and lower profit margins.

| 3 |

Failure to raise additional capital as needed could adversely affect the Company and its ability to grow.

The Company will need considerable amounts of capital to develop its business. It may raise funds through public or private equity offerings or debt financings. If the Company cannot raise funds on acceptable terms when needed, it may not be able to grow or maintain the business. Furthermore, such lack of funds may inhibit the Company’s ability to respond to competitive pressures or unanticipated capital needs, or may force the Company to reduce operating expenses, which could significantly harm the business and development of operations. Because the Company’s independent auditors have expressed doubt as to the Company’s ability to continue as a “going concern,” as reported in the financial statements of the Company, its ability to raise capital may be severely hampered. Similarly, the Company’s ability to borrow any such capital may be more expensive and difficult to obtain until this “going concern” issue is eliminated.

Our business is highly sensitive to the strength of our brands in the marketplace, and we may not be able to maintain current or attract new users, customers and strategic partners for our website and mobile applications as well as advertising and marketing services if we do not continue to increase the strength of our brands and develop new brands successfully in the marketplace.

Our operational and financial performance is highly dependent on our strong brands in the marketplace. Such dependency will increase further as the number of internet and mobile users as well as the number of market entrants in Greater China grows. In order to retain existing and attract new internet users, advertisers, mobile customers and strategic partners, we may need to substantially increase our expenditures to create and maintain brand awareness and brand loyalty. Consequently, we will need to grow our revenues at least in the same proportion as any increase in brand spending to maintain our current levels of profitability.

Increases in competition and market prices for professionally produced content may have an adverse impact on our financial condition and results of operations.

Competition for quality content for online advertising is intense in Taiwan and Greater China. Our competitors include well-capitalized companies, both private and newly listed companies, many of whom operate on a net-loss basis, as well as well-established companies that have user traffic greater than ours. If we are unable to secure a large portfolio of professionally produced quality content due to prohibitive cost, or if we are unable to manage our content acquisition costs effectively and generate sufficient revenues to outpace the increase in content spending, our website traffic, financial condition and results of operations may be adversely affected.

The expansion of advertisement blocking measures may result in a decrease of advertising revenues.

The development of software and mobile applications that block advertisements before they appear on a user’s screen may hinder the growth of online and digital advertising. Since our advertising revenues are generally based on user views, the expansion of advertisement blocking software and mobile applications may decrease our advertising revenues. As a result, such advertisements will not be tracked as a delivered advertisement. In addition, advertisers may choose not to advertise on the Internet, our websites or applications because of the expansion of advertisement blocking measures. In addition, increasing numbers of browsers include technical barriers designed to prevent consumer tracking such as trailing browsing history, which may also adversely affect the growth of online and digital advertising.

If we fail to detect significant fraudulent click-through, we could lose the confidence of our search customers and our search revenues could decline.

Our search business is exposed to the risk of click-through fraud on our paid search results. Click-through fraud occurs when a person clicks paid search results for a reason other than to view the underlying content of search results. If we fail to detect significant fraudulent clicks or otherwise are unable to prevent significant fraudulent activity, the affected search customers may experience a reduced return on their investment in our pay-for-click services and lose confidence in the integrity of our pay-for-click service systems, and we may have to issue refunds to our customers. If this happens, we may be unable to retain existing customers and attract new customers for our pay-for-click services, and our search revenues could decline. In addition, affected customers may also file legal actions against us claiming that we have over-charged or failed to refund them. Any such claims or similar claims, regardless of their merits, could be time-consuming and costly for us to defend against and could also adversely affect our search brand and our search customers’ confidence in the integrity of our pay-for-click service systems.

If we fail to establish and maintain relationships with content or infrastructure providers, we may not be able to attract and retain users.

In addition to reliance upon our reporters, editors and staff, we rely on a number of third party relationships to provide high-quality news, video, audio and text content in order to make our websites and mobile applications more attractive to users and advertisers. Our arrangements with content providers are usually short-term and our content providers may increase the fees they charge us for their content. This trend would increase our costs and operating expenses and could adversely affect our ability to obtain content at an economically acceptable cost. Except for the exclusive content, much of the third party content provided to our websites is also available from other sources or may be provided to other Internet companies. If other Internet companies present the same or similar content in a superior manner, it would adversely affect our user traffic.

| 4 |

Our business also depends significantly on relationships with infrastructure providers. Our competitors may establish the same relationships as we have, which may adversely affect us. We may not be able to maintain these relationships or replace them on commercially attractive terms.

Changes in technology may render our current technologies obsolete or require us to obtain licenses for introducing new services or make substantial capital investments, financing for which may not be available to us on favorable commercial terms or at all.

The Taiwan telecommunications industry has been characterized by rapid increases in the diversity and sophistication of the technologies and services offered. As a result, we expect that we will need to constantly upgrade our telecommunications technologies and services in order to respond to competitive industry conditions and customer requirements. Developments of new technologies have rendered some less advanced technologies unpopular or obsolete. If we fail to develop, or obtain timely access to, new technologies and equipment, or if we fail to obtain the necessary licenses to provide our content using these new technologies, we may lose our customers and market share and become less profitable.

In addition, the cost of implementing new technologies, upgrading our networks or expanding capacity could be significant. In particular, we have made and will continue to make substantial capital expenditures in the near future in order to effectively respond to technological changes, such as the continued expansion of our fiber optic networks. To the extent these expenditures exceed our cash resources, we will be required to seek additional debt or equity financing. Our ability to obtain additional financing on favorable commercial terms will depend on a number of factors. These factors include our financial condition, results of operations, cash flows and the prevailing market conditions in the domestic and international telecommunications industry, the cost of financing and conditions in the financial markets, and the issuance of relevant government and other regulatory approvals. Any inability to obtain funding for our capital expenditures on commercially acceptable terms could jeopardize our expansion plans and materially and adversely affect our business prospects and future results of operations.

If new technologies adopted by us do not perform as expected, or if we are unable to effectively integrate new technologies in a commercially viable manner, our revenue growth and profitability will decline.

We are constantly evaluating new growth opportunities in our industry. Some of these opportunities involve new digital platform technologies for which there are no proven markets, and may not develop as expected. These new technologies may not perform as expected or generate an acceptable rate of return. In addition, we may not be able to successfully develop new technologies to effectively and economically deliver our advertising or marketing services, or be able to compete successfully in the delivery of our news content based on or through new technologies. Furthermore, the success of our mobile applications is substantially dependent on the mobile applications developed by third-party developers. These applications may not be sufficiently developed to support our content and/or advertising and marketing services. If we are unable to deliver commercially viable services or applications based on the new technologies that we adopt, our financial condition and results of operations may be materially and adversely affected.

Our growth may cause significant pressures upon our operational, administrative and financial resources.

Our operational, administrative and financial resources may be inadequate to sustain the growth we want to achieve. As the demands of our users and the needs of our customers change, the number of our users and volume of online advertising increase, requirements for maintaining sufficient servers to provide high-definition online video and mobile activities increase, we will need to increase our investment in our network infrastructure, facilities and other areas of operations. If we are unable to manage our growth and expansion effectively, the quality of our advertising and marketing services could deteriorate and our business may suffer. Our future success will depend on, among other things, our ability to:

| · | adapt our services and maintain and improve the quality of our services; |

| · | protect our website from hackers and unauthorized access; |

| · | continue training, motivating and retaining our existing employees and attract and integrate new employees; and |

| · | develop and improve our operational, financial, accounting and other internal systems and controls. |

| 5 |

Our operating company maintains its books and records in accordance with the Taiwan GAAP and, as a result, it involves a risk of accuracy when our personnel convert the financial statements to U.S. GAAP.

Our operating company in Taiwan maintains its books and records in accordance with the generally accepted accounting principles in Taiwan (“Taiwan GAAP”). We do not retain an outside accounting firm or consultant to prepare our financial statements or to evaluate our internal controls over financial reporting. Our Financial Manager prepares the U.S. GAAP financial statements and converts the financial statements prepared under Taiwan GAAP into U.S. GAAP. Our CFO is responsible for supervising the preparation of our financial statements under Taiwan GAAP and for reviewing such financial statements to ensure their accuracy and completeness. In addition, he is responsible for reviewing the adjustments made to the financial statements to convert them into U.S. GAAP for SEC reporting requirements.

Our company is at the early stage of adopting necessary financial reporting concepts and practices, including strong corporate governance, internal controls and, computer, financial and other control systems. Most of our accounting and finance staff are not educated and trained in U.S. GAAP and SEC reporting requirements, and we may have difficulty hiring new employees in Taiwan with such training. As a result of these factors, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet SEC reporting requirements. Therefore, we may, in turn, experience difficulties in implementing and maintaining adequate internal controls as required under Section 404 of the Sarbanes-Oxley Act of 2002. This may result in significant deficiencies or material weaknesses in our internal controls, which could impact the reliability of our financial statements and prevent us from complying with SEC rules and regulations and the requirements of the Sarbanes-Oxley Act of 2002. Any such deficiencies, weaknesses or lack of compliance could have a materially adverse effect on our business.

Due to the rapidly evolving market in which we operate, we cannot predict whether we will meet internal or external expectations of future performance.

Our primary market is in Taiwan, where the internet industry is rapidly evolving and new products, new business models and new players emerge from time to time. In addition, regulatory changes can have an unexpected and significant impact on many aspects of our business. In the past, we have experienced high growth rates in our two main lines of business in advertising and marketing, and there may be expectations that these growth rates will continue.

We believe our future success depends on our ability to significantly grow our revenues from new and existing products, business models and sales channels. However, market data on our business, especially on new products, business models and sales channels, are often limited, unreliable or nonexistent. Accordingly, our prospects must be considered in light of the risks, expenses and difficulties frequently encountered by companies in a fast changing market where there are abundant private and public capital to support competing new product developments, new business models and new companies. These risks include our ability to:

| · | offer new and innovative mobile applications; |

| · | attract and retain users and advertisers; |

| · | react quickly and effectively to regulatory changes; |

| · | generate revenues from our advertising business; |

| · | respond effectively to competitive pressures and address the effects of strategic relationships or corporate combinations among our competitors; |

| · | attract customers to our advertising and marketing services; |

| · | maintain our current, and develop new, strategic relationships; |

| · | increase awareness of our brand and continue to build user loyalty; |

| · | attract and retain qualified managerial and other talented employees; |

| · | upgrade our technology to support increased traffic and expanded services; |

| · | expand the content and services on our network, secure premium content and increase network bandwidth in a cost-effective manner; and |

| 6 |

| · | develop a sufficiently large customer and user base and monetization models for our advertising and marketing services to recover its development costs, network expenditures and marketing expenses and eventually achieve profitability. |

We may not be able to adequately protect our intellectual properties, and we may be subject to intellectual property infringement claims or other allegations by third parties for services we provide or for information or content displayed on, retrieved from or linked to our websites, or distributed to our users, which may materially and adversely affect our business, financial condition and prospects.

We rely on a combination of copyright, patent and trademark laws and restrictions on disclosure to protect our intellectual property rights. Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy or otherwise obtain and use our intellectual properties. Monitoring unauthorized use of our products is difficult and costly, and we cannot be certain that the steps we have taken will prevent misappropriation of our intellectual properties, particularly in countries where the laws may not protect our proprietary rights as fully as in the United States. From time to time, we may have to resort to litigation to enforce our intellectual property rights, which could result in substantial costs and diversion of our resources.

Companies in the internet, technology, and media industries are frequently involved in litigation based on allegations of infringement of intellectual property rights, unfair competition, invasion of privacy, defamation and other violations of other parties’ rights. The validity, enforceability and scope of protection of intellectual property rights in internet-related industries are uncertain and still evolving. As we face increasing competition and as litigation becomes more common in our industry, we face a higher risk of being the subject of intellectual property infringement claims.

Defending patent and other intellectual property litigation is costly and can impose a significant burden on management and employees, and there can be no assurances that favorable final outcomes will be obtained in all cases. Such claims, even if they do not result in liability, may harm our reputation. Any resulting liability or expenses, or changes required to our websites to reduce the risk of future liability, may have a material adverse effect on our business, financial condition and prospects.

Privacy concerns may prevent us from selling demographically targeted advertising in the future and make us less attractive to advertisers.

We collect personal data from our user base in order to better understand our users and their needs and to help our advertisers target specific demographic groups. If privacy concerns or regulatory restrictions prevent us from selling demographically targeted advertising, we may become less attractive to advertisers. For example, as part of our future advertisement delivery system, we may integrate user information such as advertisement response rate, name, address, age or email address, with third-party databases to generate comprehensive demographic profiles for individual users.

We do not have business insurance coverage, including director and officer liability insurance.

We do not have any business liability or disruption insurance coverage for our operations, and we do not yet have director and officer liability insurance. Any business disruption, litigation or natural disaster may cause us to incur substantial costs and divert our resources.

Currency fluctuations and restrictions on currency exchange may adversely affect our business, including limiting our ability to convert NTD into foreign currencies and, if NTD were to decline in value, reducing our revenues and profits in U.S. dollar terms.

Our reporting currency is the U.S. dollar and our operations in Taiwan uses the New Taiwan Dollar as the functional currencies. The majority of our revenues derived and expenses incurred are in NTD with a relatively small amount in U.S. dollars. We are subject to the effects of exchange rate fluctuations with respect to any of these currencies. For example, the value of the NTD depends to a large extent on Taiwanese government policies, domestic and international economic and political developments as well as supply and demand in the local market.

| 7 |

We depend on select personnel and could be affected by the loss of their services.

We depend on the continued service of our executive officers, senior management and other key employees, many of whom are difficult to replace. The loss of the services of any of our executive officers or other key employees could harm our business. Competition for qualified talent in Taiwan is intense. Our future success is dependent on our ability to attract a significant number of qualified employees and retain existing key employees. If we are unable to do so, our business and growth may be materially and adversely affected and our share price could suffer. Our need to significantly increase the number of our qualified employees and retain key employees may cause us to materially increase compensation-related costs, including stock-based compensation.

Any further economic downturn or decline in the growth of the population in Taiwan may materially and adversely affect our financial condition, results of operations and prospects.

We conduct most of our operations and generate most of our revenues in Taiwan. As a result, any decline in the Taiwan economy or a decline in the growth of the population in Taiwan may materially and adversely affect our financial condition, results of operations and prospects. For example, the global slowdown in technology expenditures has from time to time adversely affected the Taiwan economy, which is highly dependent on the technology industry. There is considerable uncertainty over the long-term effects of the expansionary monetary and fiscal policies that have been adopted by the central banks and financial authorities of some of the world’s leading economies. There have also been concerns over unrest in the Middle East, Africa and Ukraine, which has resulted in higher oil prices and significant market volatility.

As our business is significantly dependent on economic growth, any uncertainty or further deterioration in economic conditions could have a material adverse effect on our financial condition and results of operations. We cannot assure you that economic conditions in Taiwan will continue to improve in the future or that our business and operations will not be materially and adversely affected by deterioration in the Taiwan economy.

We face substantial political risks associated with doing business in Taiwan, particularly due to domestic political events and the tense relationship between Taiwan and the People’s Republic of China, which could adversely affect our financial condition and results of operations.

Our principal executive offices and substantially all of our assets are located in Taiwan, and substantially all of our revenues are derived from our operations in Taiwan. Accordingly, our business, financial condition and results of operations and the market price of our common shares may be affected by changes in the PRC’s governmental policies, taxation, inflation or interest rates and by social instability and diplomatic and social developments in or affecting Taiwan which are outside of our control. Taiwan has a unique international political status. Since 1949, Taiwan and the Chinese mainland have been separately governed. The People’s Republic of China, or PRC, claims that it is the sole government in China and that Taiwan is part of China. Although significant economic and cultural relations have been established between the Republic of China and the PRC, such as the engagement of the Economic Cooperation Framework Agreement, or ECFA, in 2010, relations may become strained again. In June 2013, the Taiwan government and the PRC government entered into the Cross-Strait Agreement on Trade in Services pursuant to the ECFA. According to this agreement, both parties agreed to certain concessions on the telecommunication industries. As of March 31, 2014, the Cross-Strait Agreement on Trade in Services has not yet been ratified by the Legislation Yuan of Taiwan. If the agreement is unable to be ratified by the Legislation Yuan, our business operations in the PRC and our results of operation may be adversely affected. In addition, the PRC government has refused to renounce the use of military force to gain control over Taiwan. Past developments in relations between the Republic of China and the PRC have on occasion depressed the market prices of the securities of companies in the Republic of China. Relations between the Republic of China and the PRC and other factors affecting military, political or economic conditions in Taiwan could materially and adversely affect our financial condition and results of operations, as well as the market price and the liquidity of our securities. In addition, the complexities of the relationship between the ROC and PRC require companies involved in cross-strait business operations to carefully monitor their actions and manage their relationships with both Taiwan and PRC governments. In the past, companies in Taiwan, have received minor sanctions such as travel restrictions or minor monetary fines by Taiwan and/or PRC governments. We cannot assure you that we will be able to successfully manage our relationships with the ROC and PRC governments for our cross-strait business operations, which could have an adverse effect on our ability to expand our business and conduct cross-strait business operations.

| 8 |

You may have difficulty enforcing judgment against us or our directors and officers.

We are a Nevada holding company and most of our assets are located outside of the United States. In addition, all of our directors and executive officers are residents of Taiwan, and substantially all of their assets and our assets are located in Taiwan. As a result, investors may not be able to effect service of process upon us or our directors and executive officers, or to enforce against them judgments obtained in courts outside of Taiwan.

Any final judgment obtained against us in any court other than the courts of the Republic of China in connection with any legal suit or proceeding arising out of or relating to our securities will be enforced by the courts of the Republic of China without further review of the merits only if the court of the Republic of China in which enforcement is sought is satisfied that:

| • | the court rendering the judgment has jurisdiction over the subject matter according to the laws of the Republic of China; |

| • | the judgment and the court procedure resulting in the judgment are not contrary to the public order or good morals of the Republic of China; |

| • | if the judgment was rendered by default by the court rendering the judgment, we, or the above mentioned persons, were duly served within a reasonable period of time in accordance with the laws and regulations of the jurisdiction of the court or process was served on us with judicial assistance of the Republic of China; and |

| • | judgments at the courts of the Republic of China are recognized and enforceable in the court rendering the judgment on a reciprocal basis. |

If you fail to establish the foregoing to the satisfaction of the courts in the Republic of China, you may not be able to enforce a judgment against us rendered by a court in the United States.

Any future outbreak of contagious diseases may materially and adversely affect our business and operations, as well as our financial condition and results of operations.

Any future outbreak of contagious diseases, such as severe acute respiratory syndrome or avian influenza, may disrupt our ability to adequately staff our business and may generally disrupt our operations. If any of our employees is suspected of having contracted any contagious disease, we may under certain circumstances be required to quarantine such employees and the affected areas of our premises. As a result, we may have to temporarily suspend part or all of our operations. Furthermore, any future outbreak may restrict the level of economic activity in affected regions, including Taiwan, which may adversely affect our business and prospects. As a result, we cannot assure you that any future outbreak of contagious diseases would not have a material adverse effect on our financial condition and results of operations.

Risks Related to the Telecommunications Infrastructure

The telecommunications infrastructure in China and Taiwan, which are not as well developed as in the United States, may limit our growth.

The telecommunications infrastructure in China and Taiwan are not well developed. Our growth will depend on government and state-owned enterprises establishing and maintaining a reliable Internet and telecommunications infrastructure to reach a broader base of Internet users, especially in China. The Internet infrastructure, standards, protocols and complementary products, services and facilities necessary to support the demands associated with continued growth may not be developed on a timely basis or at all.

| 9 |

Our operations and ability to deliver services may be disrupted due to a systems failure, shutdown in our networks, earthquakes or other natural disasters.

Taiwan is susceptible to earthquakes and typhoons. However, we do not carry insurance to cover damage caused by earthquakes, typhoons or other natural disasters or any resulting business interruption. Our services are currently carried through our fixed and mobile communications networks, as well as through our transmission networks consisting of optical fiber cable, microwave, submarine cable and satellite transmission links, which could be vulnerable to damage or interruptions in operations due to natural disasters. The occurrence of natural disasters could impact our ability to deliver services and have a negative effect on our results of operations. Furthermore, we might also be liable for losses claimed from our customers that were incurred from our failure to deliver our services. These potential liabilities could also have a material adverse effect on our results of operations.

Our network operations may be vulnerable to hacking, viruses and other disruptions, which may make our website and mobile applications less attractive and reliable, and we may be susceptible to security breaches, which may damage our reputation and adversely affect our business.

As an internet-based news source delivering content through a website and mobile applications, our system is susceptible to cyber security risks, including hijack attacks, phishing attacks, hacker’s intrusions to steal customer’s information, including personal information, and distributed denial-of-service (DDoS) attacks. These attacks may disrupt our services and cause leakage of our customers’ personal information, which may result in significant damage and material adverse effect to our customers and our operations. We cannot assure you that our data protection measures are sufficient to prevent any data leakage or disruption of our service due to cyber attacks. We may suffer negative consequences, such as remedial costs, increased cyber security protection costs, lost revenues, litigation and reputational damage due to cyber attacks.

Internet use can decline if any well-publicized compromise of security occurs. “Hacking” involves efforts to gain unauthorized access to information or systems or to cause intentional malfunctions or loss or corruption of data, software, hardware or other computer equipment. Hackers, if successful, could misappropriate proprietary information or cause disruptions in our service. We may be required to expend capital and other resources to protect our website and mobile applications against hackers, and measures we may take may not be effective. In addition, the inadvertent transmission of computer viruses could expose us to a risk of loss or litigation and possible liability, as well as damage our reputation and decrease our user traffic.

Traffic growth and user engagement depend upon effective interoperation with operating systems, networks, devices, web browsers and standards that we do not control.

We make our websites and mobile applications available across a variety of operating systems. We are dependent on the interoperability of our websites and mobile applications with popular devices, desktop and mobile operating systems and web browsers that we do not control, such as Windows, Mac OS, Android, iOS, and others. Any changes in such systems, devices or web browsers that degrade the functionality of our websites and mobile applications or give preferential treatment to competitive websites and mobile applications could adversely affect us.

Further, if the number of platforms for which we develop our websites and mobile applications increases, it will result in an increase in our costs and expenses. In order to deliver high quality products and services, it is important that our websites and mobile applications work well with a range of operating systems, networks, devices, web browsers and standards that we do not control. In addition, because a large number of our users access our websites and mobile applications through mobile devices, we are particularly dependent on the interoperability of our websites and mobile applications with such devices and operating systems. In the event that it is difficult for our users to access and use our websites and mobile applications and services, particularly on their mobile devices, our user growth and user engagement could be harmed, and our business and operating results could be adversely affected.

Our business and operations results may be harmed by service disruptions, or by our failure to timely and effectively scale and adapt our existing technology and infrastructure.

The continual accessibility of our websites and the performance and reliability of our network infrastructure are critical to our reputation and our ability to attract and retain users, advertisers and merchants. Any system failure or performance inadequacy that causes interruptions in the availability of our services or increases the response time of our services could reduce our appeal to users and consumers. Factors that could significantly disrupt our operations include system failures and outages caused by fire, floods, earthquakes, power loss, telecommunications failures and similar events; software errors; computer viruses, break-ins and similar disruptions from unauthorized tampering with our computer systems; and security breaches related to the storage and transmission of proprietary information, such as credit card numbers or other personal information.

| 10 |

As the number of our users increases and our users generate more content, including photos and videos on our platform, we may be required to expand and adapt our technology and infrastructure to continue to reliably store and analyze this content. It may become increasingly difficult to maintain and improve the performance of our products and services, especially during peak usage times, as our products and services become more complex and our user traffic increases. We have limited backup systems and redundancy. Future disruptions or any of the foregoing factors could damage our reputation, require us to expend significant capital and other resources and expose us to a risk of loss or litigation and possible liability. We do not carry sufficient business interruption insurance to compensate for losses that may occur as a result of any of these events. Accordingly, our revenues and results of operations may be adversely affected if any of the above disruptions should occur.

If we fail to comply with the regulations of the ROC Fair Trade Act, we may be investigated and fined.

Our business operations are subject to the regulations of the ROC Fair Trade Act, or the FTA, which is administered and enforced by the ROC Fair Trade Commission, or the FTC. The FTA requires, among other things, that the marketing and promotional materials of a business to be true and not misleading. The FTA also prohibits a business from participating or engaging in a cartel or other anti-competitive conduct. The FTC has the authority under the FTA to investigate and, where appropriate, impose fines and penalties on a business that violates any regulations promulgated by the FTA. The consequences of any such violations could have a material adverse effect on our business and results of operations. As the FTA provides the FTC broad discretion to interpret anti-competition actions and enforce the relevant clauses under the FTA, we are unable to predict whether the FTC would initiate investigation on any of our daily business activities or find us liable for violating the FTA in the future. The investigations of and penalties imposed by the FTC could interrupt the operation of our website and mobile applications or advertising and marketing services, which would have a negative impact on our reputation, business operations and results of operations.

If we are unable to obtain and maintain the licenses to operate our business, our prospects and business may be adversely affected.

We currently possess a permit for (i) production and distribution of radio and TV programs and (ii) radio and TV advertisements. In order to retain the permit, we must maintain a minimum registered capital of NT$1,200,000 and a minimum office area of approximately 538 square feet. Although the Company may maintain such minimum regulatory requirements, we risk losing our permit if we do not update our information as to changes in the company name, management, registered capital and business address. If the permit is revoked, suspended or not renewed, or if we are unable to obtain any additional licenses that we may need to operate or expand our business in the manner we desire, then our prospects and business may be adversely affected.

The PRC allows our website and applications to operate in China, however, content on our website and mobile applications may be found objectionable by PRC regulatory authorities who may block users in China from accessing our website and/or mobile applications.

In addition to professionally produced content, we allow all of our users to upload content to our website. A percentage of our users access our website and mobile applications from within China. All of our users can upload all types of content, including user-created and professionally produced content. Although we have adopted internal procedures to monitor and review the content displayed on our website and mobile applications, we may not be able to identify all user content that may be objectionable in China.

The PRC government has adopted regulations governing Internet access and the distribution of videos over the Internet. To the extent that PRC regulatory authorities find any content displayed on our website or mobile applications objectionable, the PRC government may block users in China from accessing our website and/or mobile applications. Further, the PRC government may not provide us with advance notice that our website and/or mobile applications will be blocked in China. The websites of some competitors have been blocked in the past. Although we do not operate under the jurisdiction of the PRC government, our business may be adversely impacted if users in China are blocked from accessing our website or mobile applications.

| 11 |

Risks Related to our Stock and Becoming a Public Company

Our largest stockholder may take actions that conflict with our public stockholders’ best interests.

As of the date of this report, our largest stockholder, Alan Chen, owned approximately 27.94% of our outstanding common shares. Moreover, Mr. Chen is also stockholder and a control person of other entities affiliated with NOWnews. At times, the interests of such other entities may conflict with those of NOWnews. We cannot assure you that our largest shareholder will not take actions that impair our ability to conduct our business competitively or conflict with the best interests of our other stockholders.

You may experience dilution of your ownership interests because of the future issuance of additional ordinary shares.

In the future, we may issue additional authorized but previously unissued equity securities, resulting in the dilution of the ownership interests of our shareholders. We may also issue additional shares of our securities that are convertible into or exercisable for ordinary shares, as the case may be, in connection with hiring or retaining employees, future acquisitions, future sales of its securities for capital raising purposes, or for other business purposes. The future issuance of any such additional shares may create downward pressure on the value of our securities. There can be no assurance that we will not be required to issue additional shares, warrants or other convertible securities in the future in conjunction with any capital raising efforts, including at a price (or exercise prices) below the price at which our shares may be valued or are trading in a public market.

There is not an active liquid trading market for the Company’s Common Stock.

There is no regular active trading market in the Company’s Common Stock, and we cannot give an assurance that an active trading market will develop. If an active market for the Company’s Common Stock develops, there is a significant risk that the Company’s stock price may fluctuate dramatically in the future in response to any of the following factors, some of which are beyond our control:

| · | variations in our operating results; |

| · | announcements that our revenue or income are below expectations; |

| · | general economic slowdowns; |

| · | sales of large blocks of the Company’s Common Stock; and |

| · | announcements by us or our competitors of significant contracts, acquisitions, strategic partnerships, joint ventures or capital commitments. |

We will incur increased costs as a result of operating as a public company, and our management will be required to devote substantial time to new compliance initiatives.

As a public company, we will incur significant legal, accounting and other expenses that we did not incur as a private company. We will be subject to the reporting and other requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), and the Dodd-Frank Wall Street Reform and Protection Act (the “Dodd-Frank Act”). These rules and regulations will require, among other things, that we file annual, quarterly and current reports with respect to our business and financial condition and establish and maintain effective disclosure and financial controls and corporate governance practices. We expect these rules and regulations to substantially increase our legal and financial compliance costs and to make some activities more time-consuming and costly, particularly after we are no longer an "emerging growth company" as defined in the recently enacted Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). Our management and other personnel will need to devote a substantial amount of time to these compliance initiatives.

| 12 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, including the sections entitled “Prospectus Summary,” “Risk Factors,” “Use of Proceeds,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Business,” contains forward-looking statements. The words “believe,” “may,” “will,” “potentially,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “project,” “plan” “expect,” and similar expressions that convey uncertainty of future events or outcomes are intended to identify forward-looking statements.

These forward-looking statements include, but are not limited to, statements concerning the following:

| · | our ability to maintain an adequate rate of revenue growth; |

| · | our business plan and our ability to effectively manage our growth; |

| · | costs associated with defending intellectual property infringement and other claims; |

| · | our ability to attract and retain customers; |

| · | our ability to further penetrate our existing customer base; |

| · | our ability to timely and effectively scale and adapt our existing technology; |

| · | our ability to innovate new products and bring them to market in a timely manner; |

| · | our ability to expand internationally; |

| · | the effects of increased competition in our market and our ability to compete effectively; |

| · | the effects of seasonal trends on our results of operations; |

| · | our expectations concerning relationships with third parties; |

| · | the attraction and retention of qualified employees and key personnel; |

| · | our ability to maintain, protect, and enhance our brand and intellectual property; and |

| · | future acquisitions of or investments in complementary companies, products, services or technologies. |

These forward-looking statements are subject to a number of risks, uncertainties, and assumptions, including those described in “Risk Factors” and elsewhere in this prospectus. Moreover, we operate in a very competitive and rapidly changing environment, and new risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties, and assumptions, the forward-looking events and circumstances discussed in this prospectus may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this prospectus to conform these statements to actual results or to changes in our expectations, except as required by law.

You should read this prospectus and the documents that we reference in this prospectus and have filed with the SEC as exhibits to the registration statement of which this prospectus is a part with the understanding that our actual future results, levels of activity, performance, and events and circumstances may be materially different from what we expect.

MARKET AND INDUSTRY DATA

The industry and market data presented in this prospectus are inherently estimates and are based upon third-party data, information made public by online market research, brokerage analyst reports, internet companies and our own internal estimates. While we believe that this data is reasonable, in some cases this data is based on our own and others’ estimates. Accordingly, you are cautioned not to place undue reliance on the industry and market data included in this prospectus.

| 13 |

The net proceeds from any disposition of the shares covered hereby would be received by the Selling Stockholders. We will not receive any of the proceeds from any such sale of the Common Stock offered by this prospectus.

MARKET FOR COMMON EQUITY AND RELATED SHAREHOLDER MATTERS

Market for Common Equity and Related Stockholder Matters

Our common stock is currently quoted on the OTCQB under the symbol “NDMT.” There has not been any significant trading to date in the Company’s common stock. The table below presents the high and low bid for our common stock for each quarter for the years ended December 31, 2015 (until June 30, 2015), 2014 and 2013. These prices reflect inter-dealer prices, without retail markup, markdown, or commission, and may not represent actual transactions.

| High | Low | |||||||

| Year ended December 31, 2015 | ||||||||

| 1st Quarter | $ | * | $ | * | ||||

| 2nd Quarter | $ | * | $ | * | ||||

| Year ended December 31, 2014 | ||||||||

| 1st Quarter | $ | 1.50 | $ | 1.50 | ||||

| 2nd Quarter | $ | 1.50 | $ | 1.50 | ||||

| 3rd Quarter | $ | 6.10 | $ | 1.50 | ||||

| 4th Quarter | $ | 6.30 | $ | 5.00 | ||||

| Year ended December 31, 2013 | ||||||||

| 1st Quarter | $ | 1.50 | $ | 1.50 | ||||

| 2nd Quarter | $ | 1.50 | $ | 1.50 | ||||

| 3rd Quarter | $ | 1.50 | $ | 1.50 | ||||

| 4th Quarter | $ | 1.50 | $ | 1.50 | ||||

* There has been no trading in our commons stock since December 4, 2014.

As of September 16, 2015, we had 22,412,000 shares of common stock outstanding and held of record by 485 stockholders. Within the holders of record of our common stock are depositories such as Cede & Co. that hold shares of stock for brokerage firms, which, in turn, hold shares of stock for beneficial owners.

Securities Authorized for Issuance under Equity Compensation Plans.

None.

Stock Transfer Agent

Our stock transfer agent is Empire Stock Transfer, 1859 Whitney Mesa Dr., Henderson, NV 89014.

Dividends

The Company has never declared or paid any cash dividends on its common stock. The Company currently intends to retain future earnings, if any, to finance the expansion of its business. As a result, the Company does not anticipate paying any cash dividends in the foreseeable future.

Repurchase of Equity Securities

None.

Recent Sales of Unregistered Securities

None.

| 14 |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

This Management Discussion and Analysis (“MD&A”) contains “forward-looking statements”, which represent our projections, estimates, expectations or beliefs concerning among other things, financial items that relate to management’s future plans or objectives or to our future economic and financial performance. In some cases, you can identify these statements by terminology such as “may”, “should”, “plans”, “believe”, “will”, “anticipate”, “estimate”, “expect” “project”, or “intend”, including their opposites or similar phrases or expressions. You should be aware that these statements are projections or estimates as to future events and are subject to a number of factors that may tend to influence the accuracy of the statements. These forward-looking statements should not be regarded as a representation by the Company or any other person that the events or plans of the Company will be achieved. You should not unduly rely on these forward-looking statements, which speak only as of the date of this MD&A. Except as may be required under applicable securities laws, we undertake no obligation to publicly revise any forward-looking statement to reflect circumstances or events after the date of this MD&A or to reflect the occurrence of unanticipated events. You should, however, review the factors and risks we describe under “Risk Factors” in this Prospectus. Actual results may differ materially from any forward looking statement.

Overview

We were incorporated as Forever Zen Ltd. on March 20, 2010 under the laws of the State of Nevada. On December 13, 2013, we changed our name to NOWnews Digital Media Technology Co Ltd. and planned to enter into the business of internet media and news content. Prior to the Share Exchange, we were a development stage company and had not yet realized any revenues from our planned operations.

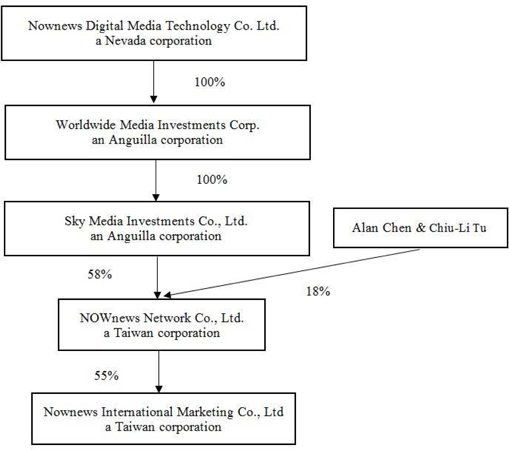

As a result of the consummation of the Share Exchange on November 14, 2014, NOWnews became, indirectly through Worldwide and Sky Media, a majority-owned subsidiary of the Company and the business of NOWnews became the business of the Company. We are now, through NOWnews, engaged in creating, collecting and distributing news and information through our website http://www.nownews.com/ and our applications on mobile phones or tablets.

We generate revenue primarily from online advertising and marketing services and news content licensing. In addition, we historically had revenues from online product sales in the E-commerce business and editing services for customers. Since our editing service was not profitable, we ceased this service in December 2013. In addition, we also suspended our E-commerce business in April 2014 due to the continuous loss from this business.

Results of Operations for the Year Ended December 31, 2014 as Compared to the Year Ended December 31, 2013:

| For The Years Ended | ||||||||||||||||

| December 31, | ||||||||||||||||

| 2014 | 2013 | Change | % | |||||||||||||

| Net revenue | $ | 2,932,751 | $ | 3,225,163 | (292,412 | ) | (9 | ) | ||||||||

| Cost of revenue | (1,819,883 | ) | (2,786,702 | ) | 966,819 | (35 | ) | |||||||||

| Gross Profit | 1,112,868 | 438,461 | 674,407 | 154 | ||||||||||||

| Selling expenses | (606,355 | ) | (998,148 | ) | 391,793 | (39 | ) | |||||||||

| General and administrative expenses | (1,384,823 | ) | (1,963,141 | ) | 578,318 | (29 | ) | |||||||||

| Total Operating Expense | (1,991,178 | ) | (2,961,289 | ) | 970,111 | (33 | ) | |||||||||

| Operating loss | (878,310 | ) | (2,522,828 | ) | 1,644,518 | (65 | ) | |||||||||

| Other income (expense) | ||||||||||||||||

| Interest income | 1,556 | 848 | 708 | 83 | ||||||||||||

| Interest expense | (25,103 | ) | (25,267 | ) | 164 | (1 | ) | |||||||||

| Other income, net | 2,664 | 7,930 | (5,266 | ) | (66 | ) | ||||||||||

| Total Other Expense | (20,883 | ) | (16,489 | ) | (4,394 | ) | 27 | |||||||||

| Loss from continuing operations before income taxes | (899,193 | ) | (2,539,317 | ) | 1,640,124 | (65 | ) | |||||||||

| Income taxes | - | - | - | 0 | ||||||||||||

| Loss from continuing operations | (899,193 | ) | (2,539,317 | ) | 1,640,124 | (65 | ) | |||||||||

| Loss from discontinued operations, net of income taxes | (8,604 | ) | (189,751 | ) | 181,147 | (95 | ) | |||||||||

| Net loss | (907,797 | ) | (2,729,068 | ) | 1,821,271 | (67 | ) | |||||||||

| Net loss attributable to noncontrolling interests: | ||||||||||||||||

| Net loss from continuing operations | 205,029 | 898,853 | (693,824 | ) | (77 | ) | ||||||||||

| Net loss from discontinued operations | 5,481 | 120,871 | (115,390 | ) | (95 | ) | ||||||||||

| Total net loss attributable to noncontrolling interest | 210,510 | 1,019,724 | (809,214 | ) | (79 | ) | ||||||||||

| Net loss attributable to NOWnews Digital Media Technology Co., Ltd. | $ | (697,287 | ) | $ | (1,709,344 | ) | $ | 1,012,057 | (59 | ) | ||||||

| 15 |

Net Revenue

Our net revenue for the year 2014 was $2.93 million, a decrease of $0.3 million or 9% from $3.23 million for the year 2013. The decrease was primarily due to the decrease in licensing revenue and E-commerce revenue, partially offset by the increase in advertisement revenue.

Advertising

Our advertising avenue was $2.36 million for the year ended December 31, 2014, an increase of $0.49 million, or 26%, from $1.87 million for the year ended December 31, 2013. The increase was because we focus on the more profitable internet advertising and marketing.

Licensing

Our revenue from content licensing was $0.30 million for the year ended December 31, 2014, a decrease of $0.27 million, or 47%, from $0.57 million for the year ended December 31, 2013. In 2014, we did not license as much content to Yahoo Taiwan, Inc., our top customers for the past two years (“Yahoo Taiwan”) during the year 2014 due to low gross profit margin. In addition, we terminated our low-profit news editing services to Yahoo Taiwan. Such services were supplementary to our licensing arrangements with them.

E-Commerce

Our E-commerce revenue was $0.25 million for the year ended December 31, 2014, a decrease of $0.46 million, or 65%, from $0.71 million for the year ended December 31, 2013. The decrease was primarily attributable to suspension of our E-Commerce business in April 2014 due to continuous losses. We are currently in the process of evaluating and adjusting this line of business.

Other

Other revenue includes revenue from film/video editing services and licensing copyrights to Chunghwa Wideband Best Network Co., Ltd. Other revenue was $0.02 million for the year ended December 31, 2014, a decrease of $0.06 million, or 75%, from $0.08 million for the year ended December 31, 2013. The decrease was primarily due to the termination of editing services and decrease in licensing copyrights charged to Chunghwa Wideband Best Network Co., Ltd.

| 16 |

Cost of Revenue

Cost of revenue mainly consists of advertisement costs, content licensing costs, E-commerce costs, copyright costs, website maintenance costs, and labor costs.

Cost of revenue was $1.82 million for the year ended December 31, 2014, compared to $2.79 million for the year ended December 31, 2013, a decrease of $0.97 million, or 35%. The decrease was mainly due to a decrease of $0.48 million in cost of goods sold in E-commerce, a decrease in labor costs of $0.42 million due to the decrease in the number of employees in the year 2014 as a result of our efforts to reduce our operating costs and expenses.

Gross Profit

Gross profit increased approximately $0.67 million, an increase of 154% as compared to last year due to the substantial decrease in cost of revenue. Gross margin was 38% for the year ended December 31, 2014 as compared to 14% for the prior year.

Selling Expenses

Total selling expenses consist primarily of payroll, labor and health insurance, and advertisement expenses. The amount decreased by $0.39 million or 39% from $1.0 million for the year ended December 31, 2013 to $0.61 million for the year ended December 31, 2014. The decrease in selling expenses was primarily due to the decrease in advertisement expenses related to E-commerce and the decrease in labor costs due to decrease in the number of salespersons.

General and Administrative Expenses

General and administrative expenses primarily consist of payroll, welfare, labor and health insurance, post-retirement benefits, office rent and management fees, depreciation & amortization expenses, professional services, litigation settlement payments, loss on film costs, and expenses for other general corporate activities. General and administrative expenses decreased by approximately $0.58 million or 29% from $1.96 million for the year ended December 31, 2013 to $1.38 million for the year ended December 31, 2014. The decrease in general and administration expenses was principally due to the decrease in payroll resulting from reduction in the number of employees.

Interest Expense

Interest expense for the year ended December 31, 2014 was $25,103 compared to $25,267 for the year ended December 31, 2013, a decrease of $164, or 1%. The decrease in interest expense was primarily due to reduced bank loans incurred for the year ended December 31, 2014 as compared with the year ended December 31, 2013. The loans were used for working capital and capital expenditures.

Net Loss

As a result of the above factors, we have net loss of approximately $0.70 million for the year ended December 31, 2014 as compared to net loss of approximately $1.71 million for the year ended December 31, 2013, representing a decrease of loss of approximately $1.01 million or approximately 59%.

| 17 |

Results of Operations for the Three Months Ended June 30, 2015 as Compared to the Three Months Ended June 30, 2014:

| For The Three Months Ended | ||||||||||||||||

| June 30, | Change in | |||||||||||||||

| 2015 | 2014 | $ | % | |||||||||||||

| Net revenue | $ | 522,222 | $ | 650,432 | $ | (128,210 | ) | (20 | ) | |||||||

| Cost of revenue | (332,815 | ) | (444,395 | ) | 111,580 | (25 | ) | |||||||||

| Gross profit | 189,407 | 206,037 | (16,630 | ) | (8 | ) | ||||||||||

| Selling expenses | (87,621 | ) | (164,430 | ) | 76,809 | (47 | ) | |||||||||

| General and administrative expenses | (253,336 | ) | (378,244 | ) | 124,908 | (33 | ) | |||||||||

| Total operating expense | (340,957 | ) | (542,674 | ) | 201,717 | (37 | ) | |||||||||

| Operating loss | (151,550 | ) | (336,637 | ) | 185,087 | (55 | ) | |||||||||

| Other income (expense) | ||||||||||||||||

| Interest income | 13 | 245 | (232 | ) | (95 | ) | ||||||||||

| Interest expense | (873 | ) | (6,223 | ) | 5,350 | (86 | ) | |||||||||

| Other income (expense), net | 511 | (2,042 | ) | 2,553 | (125 | ) | ||||||||||

| Total other expense | (349 | ) | (8,020 | ) | 7,671 | (96 | ) | |||||||||

| Loss from continuing operations before income taxes | (151,899 | ) | (344,657 | ) | 192,758 | (56 | ) | |||||||||

| Income taxes | - | - | - | - | ||||||||||||

| Loss from continuing operations | (151,899 | ) | (344,657 | ) | 192,758 | (56 | ) | |||||||||

| Loss from discontinued operations, net of income taxes | (54,589 | ) | (25 | ) | (54,564 | ) | 218,256 | |||||||||

| Net loss | (206,488 | ) | (344,682 | ) | 138,194 | (40 | ) | |||||||||

| Net loss attributable to noncontrolling interests: | ||||||||||||||||

| Net loss from continuing operations | 53,134 | 104,369 | (51,235 | ) | (49 | ) | ||||||||||

| Net loss from discontinued operations | 34,773 | 16 | 34,757 | 217,231 | ||||||||||||

| Total net loss attributable to noncontrolling interest | 87,907 | 104,385 | (16,478 | ) | (16 | ) | ||||||||||

| Net loss attributable to NOWnews Digital Media Technology Co., Ltd. | $ | (118,581 | ) | $ | (240,297 | ) | $ | 121,716 | (51 | ) | ||||||

Net Revenue

Our net revenue for the three months ended June 30, 2015 was $0.52 million, a decrease of $0.13 million or 20% from $0.65 million for the three months ended June 30, 2014. The decrease was primarily due to the decrease in advertisement revenue, licensing revenue, and E-commerce revenue.

Advertising

Our advertising avenue was $0.47 million for the three months ended June 30, 2015, a decrease of $0.06 million, or 12%, from $0.53 million for the three months ended June 30, 2014. During the three months ended June 30, 2015, our web server had experienced instability due to move of office and change of service vendor for our web maintenance. Such instability caused decrease in advertisement posted on our website, resulting in the decrease of advertisement revenue in the three months ended June 30, 2015.

| 18 |

Licensing and Services